Filed by Susquehanna Bancshares, Inc.

Pursuant to Rule 425 under the Securities Act of 1933, as amended

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Community Banks, Inc.

Commission File No.: 001-11663

The following is a slide presentation in connection with an investors and analyst teleconference call hosted by Susquehanna Bancshares, Inc. and Community Banks, Inc. on May 1, 2007.

May 1, 2007 “ The Power of Local Knowledge with Regional Scale” & |

2 Forward Looking Statements Forward Looking Statements During the course of this presentation, management may make projections and other forward-looking statements regarding events or the future financial performance of Susquehanna and Community Banks. We wish to caution you that these forward-looking statements may differ materially from actual results due to a number of risks and uncertainties. For a more detailed description of the factors that may affect Susquehanna’s and Community’s operating results, we refer you to our filings with the Securities & Exchange Commission, including our quarterly reports on Form 10-Q for the quarter ended September 30, 2006, and our annual reports on Form 10-K for the year ended December 31, 2006. Susquehanna and Community assume no obligation to update the forward- looking statements made during this presentation. For more information, please visit our Web sites at: www.susquehanna.net www.communitybanks.com |

3 Introductions Introductions William J. Reuter Chairman, President & CEO Eddie L. Dunklebarger Chairman, President & CEO Drew K. Hostetter EVP, Chief Financial Officer |

4 Combination Highlights Combination Highlights Franchise Enhancing Strong Strategic Fit Financially compelling Low execution risk |

5 Transaction Summary Transaction Summary 1. Based on SUSQ share price of $22.97 Transaction Value: (1) Consideration Mix: Implied Value per CMTY Share: (1) Exchange Ratio: (1) Holding Company Board Representation: Walk Away: $858.4 million 90% stock / 10% cash $34.00 per share Six (6) Community directors (including Eddie L. Dunklebarger) Standard “Double Trigger” walk-away provision Required Approvals: Susquehanna shareholders; Community Shareholders Customary regulatory approvals Expected Closing: November 2007 1.48 SUSQ shares for each CMTY share Break-up Fee: $30 million (3.5% of deal value) Management: Eddie L. Dunklebarger - Vice Chairman of Susquehanna Bancshares, Inc. Jeffrey M. Seibert – Chief Operating Officer of Susquehanna Bank, PA Due Diligence: Completed |

6 Comparables Pricing Consistent with Recent Transactions Pricing Consistent with Recent Transactions Price / LTM Earnings Price / 2007 Consensus EPS (1) Price / Book Value Price / Tangible Book Value Core Deposit Premium (2) 48.0 x 36.9 360 % 451 48.3 SUSQ / CMTY High Median Low 10.6 x 15.4 148 % 175 10.0 21.0 x 19.7 250 % 319 24.7 20.0 x 20.1 163 % 343 25.8 Select Mid-Atlantic, New England, Southeast (excluding Florida) and Ohio bank transactions since January 1, 2003 with transaction values between $250 million and $7.5 billion Source: SNL Financial and company filings Comparable transactions do not include merger of equals Financial data as of or for the quarter ended March 31, 2007 (1) Forward earnings estimates per First Call (2) Excludes CDs greater than $100,000 |

7 Community Banks, Inc. Overview Community Banks, Inc. Overview Headquartered in Harrisburg, PA Serving the communities of southeastern PA for over 135 years Assets of $3.8 billion 13 acquisitions since 2001 PennRock, BUCS, and East Prospect Business lines: Community Banking, Insurance, Investment Management/Trust |

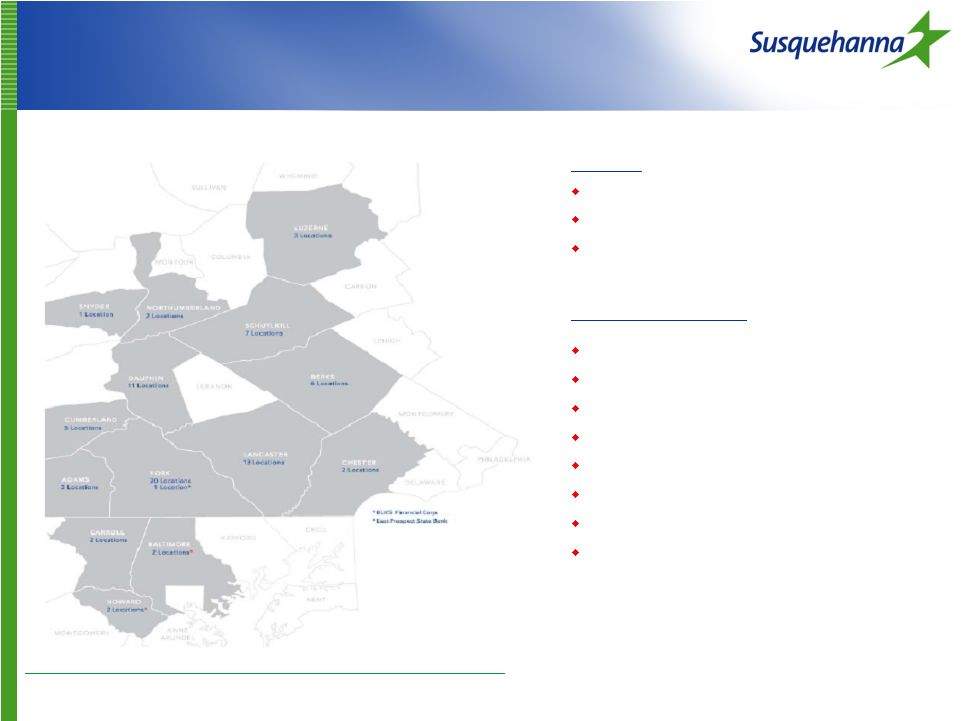

8 Community Banks Overview Community Banks Overview Source: Microsoft MapPoint and SNL Financial Note: Loans, deposits, and capital ratios pro forma for BUCS and East Prospect acquisitions Financial highlights as of or for the period ending March 31, 2007 Markets 80 branches over 14 counties Central PA; Poconos to Maryland Key MSAs: Hanover/York; Lancaster Financial Highlights $2.6 $2.7 1.10% 17.8% 0.43% 1.00% 0.09% 6.86% Loans ($B) Deposits ($B) ROAA: ROATE: NPAs/Assets: Reserves / Loans: NCO’s / Avg. Loans: Tang. Equity / Tang. Assets: |

9 Transaction Rationale Transaction Rationale Increases presence in key MSAs Top 10 deposit market share in Pennsylvania Top 5 in Assets in Mid-Atlantic (1) Franchise Enhancing Identified, achievable cost savings Accretive to GAAP and Cash EPS in the first full year of operations Attractive internal rate of return (1) Banks headquartered in PA, NJ, DE, VA, WV, MD, and DC In-market transaction; similar demographic markets Both companies have a proven track-record of integrating acquisitions Both companies use the same operating system Similar community banking philosophy and culture Increased scale will enhance lending capabilities Significant opportunity to leverage Susquehanna’s wealth management platform to Community’s customers Strong Strategic Fit Compelling Transaction Economics Low Execution Risk |

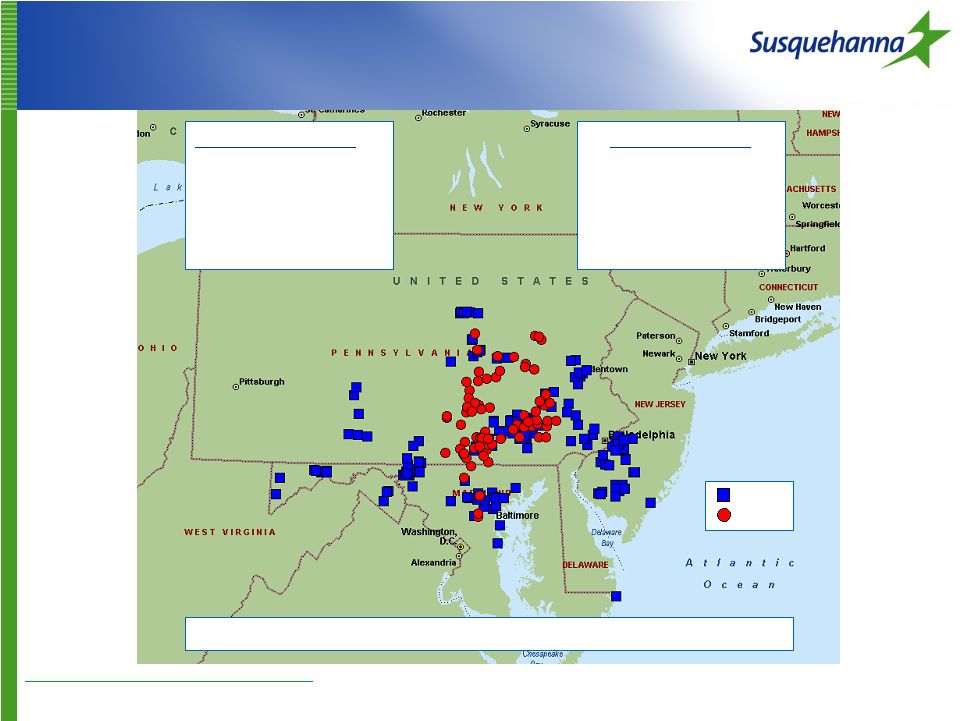

10 Creates a Powerful Mid-Atlantic Franchise Creates a Powerful Mid-Atlantic Franchise Source: Microsoft MapPoint and SNL Financial (1) Counties with projected population growth from 2006 to 2011 in excess of 5.0% Approximately half of the Company will be in high growth markets (1) Financial Highlights Assets: Deposits: Market Cap: $2.0 Billion 246 Branches SUSQ CMTY Branch Proximity 1/2 Mile: 1 Mile: 8 Branches 2 Mile: 4 Branches 22 Branches $12.3 Billion $8.7 Billion |

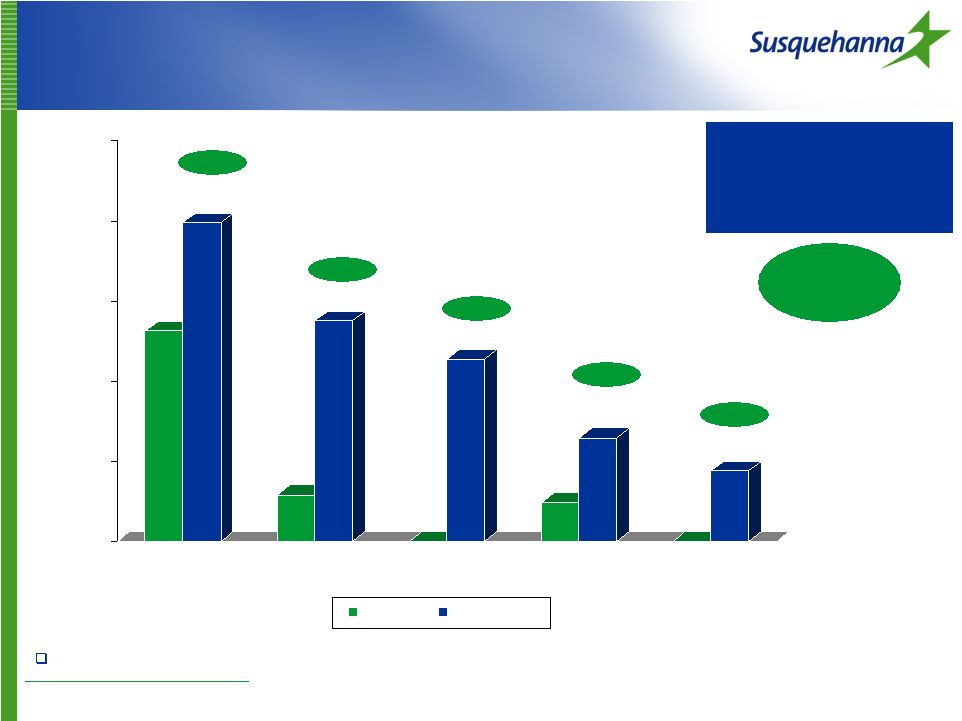

11 Market Leadership Market Leadership 13.1 19.9 2.9 13.8 0.0 11.4 2.5 6.4 0.0 4.4 0.0 5.0 10.0 15.0 20.0 25.0 Lancaster York-Hanover Gettysburg Reading Harrisburg- Carlisle SUSQ Pro Forma Significantly Fills Branch Footprint In Strategic MSAs Pro Forma Rank 1 2 4 7 9 The combined company will rank #1 or #2 in market share in 6 of its pro forma MSAs of operation Source: SNL Financial Market share data as of June 30, 2006 |

12 Meaningful Market Share Gain Meaningful Market Share Gain Source: SNL Financial Deposit data as of June 30, 2006; pro forma for pending acquisitions Note: Deposit market share excludes Bank of New York and General Motors Corp. STATE: Pennsylvania Total Total Deposits Market Branch in Market Share Rank Institution Count ($000) (%) 1 PNC Financial Services Group (PA) 351 33,505,542 14.20 2 Wachovia Corp. (NC) 316 28,077,374 11.90 3 Royal Bank of Scotland Group 398 25,884,973 10.97 4 Sovereign Bancorp Inc. (PA) 202 15,772,092 6.68 5 National City Corp. (OH) 208 12,807,290 5.43 7 M&T Bank Corp. (NY) 228 7,485,359 3.17 8 Commerce Bancorp Inc. (NJ) 85 7,083,035 3.00 9 Fulton Financial Corp. (PA) 138 5,317,187 2.25 10 Pro Forma 165 5,269,809 2.23 10 Northwest Bancorp Inc. (MHC) (PA) 141 4,753,421 2.01 11 Bank of America Corp. (NC) 117 4,741,560 2.01 12 First Commonwealth Financial (PA) 111 4,293,414 1.82 13 F.N.B. Corp. (PA) 149 4,136,201 1.75 14 National Penn Bancshares Inc. (PA) 85 3,775,887 1.60 15 Susquehanna Bancshares Inc. (PA) 93 2,838,126 1.20 16 Dollar Bank FSB (PA) 30 2,777,276 1.18 17 Huntington Bancshares Inc. (OH) 66 2,551,519 1.08 18 S&T Bancorp Inc. (PA) 51 2,498,002 1.06 19 Community Banks Inc. (PA) 72 2,431,683 1.03 20 Harleysville National Corp. (PA) 44 2,410,835 1.02 Top 10 2,067 140,686,273 59.62 Totals 4,720 235,972,241 100.00 |

13 Creates Substantial Scale in Pennsylvania Creates Substantial Scale in Pennsylvania Source: SNL Financial Financial data as of most recent available quarter Note: Pro Forma includes merger related adjustments Total Assets Company Name ($M) 1 PNC Financial Services Group, Inc. 122,563.0 $ 2 Sovereign Bancorp, Inc. 82,193.6 3 Fulton Financial Corporation 14,670.3 4 Pro Forma 12,319.1 4 Susquehanna Bancshares, Inc. 8,159.2 5 Northwest Bancorp, Inc. (MHC) 6,975.9 6 F.N.B. Corporation 6,015.8 7 First Commonwealth Financial Corporation 5,861.2 8 National Penn Bancshares, Inc. 5,520.1 9 Community Banks, Inc. 3,854.7 10 S&T Bancorp, Inc. 3,376.6 11 Harleysville National Corporation 3,325.0 12 Sterling Financial Corporation 3,279.8 13 KNBT Bancorp, Inc. 2,906.8 14 Univest Corporation of Pennsylvania 1,935.9 15 ESB Financial Corporation 1,905.1 16 Pennsylvania Commerce Bancorp, Inc. 1,898.6 17 Parkvale Financial Corporation 1,825.3 18 Omega Financial Corporation 1,803.6 19 Willow Financial Bancorp, Inc. 1,539.5 20 Royal Bancshares of Pennsylvania, Inc. 1,339.3 |

14 Financial Impact - Overview Financial Impact - Overview Extensive due diligence completed Achievable cost savings identified Revenue opportunities identified but not assumed Commercial Banking Insurance Investment Management / Trust |

15 Financial Impact – Synergies Financial Impact – Synergies Cost savings are approximately 35% of non-interest expense No branch closures are assumed in cost savings ($ in millions) Compensation and Benefits $18.9 Occupancy 2.4 Software, Systems and Processing 2.7 Professional Fees and Governance 2.3 Advertising, Marketing & PR 1.0 Other 5.7 Total $33.0 |

16 Financial Impact – Per Share Financial Impact – Per Share ($ in millions) 2008 Susquehanna Earnings (1) $86.1 Community Earnings (2) 46.9 Anticpated After-tax cost savings (3) 22.3 After-tax Financing Costs (4) (4.8) After-tax Core Deposit Amortization Expense (5) (2.8) Pro Forma Net Income $147.7 Pro Forma GAAP EPS $1.72 GAAP Impact to Susquehanna ($) $0.07 GAAP Impact to Susquehanna (%) 4.19 % Cash Impact to Susquehanna (%) 5.34 % (1) Based on First Call estimate of $1.65 per share (2) Based on First Call estimate of $1.81; eliminates Community’s existing CDI amortization (3) Based on pre-tax cost savings of $33 million (4) Includes trust preferred financing costs related to the cash portion of the transaction at a rate of 7.00%; includes cash portion of deal charge at an opportunity cost of cash of 5.25% (5) Assumes 3.25% pre-tax core deposit intangible, 10 year straight-line amortization |

17 Financial Impact – Capital Financial Impact – Capital Source: SNL Financial Assumes dividend payout ratio of 60% and balance sheet growth of 6% Actual 3/31/2007 12/31/2007 12/31/2008 Tangible Equity / Tangible Assets 7.61% 6.25% 6.39% Leverage Ratio 8.67 8.39 8.40 Tier 1 Ratio 9.53 9.37 9.43 Total Capital Ratio 12.50 11.61 11.59 Pro Forma (1) |

18 Financial Impact – 2006 Pro Forma Financial Impact – 2006 Pro Forma 66.4 57.2 50 56 62 68 74 80 Stand Alone Pro Forma Efficiency Ratio 1.05 1.20 1.00 1.10 1.20 1.30 Stand Alone Pro Forma Return on Average Assets 15.4 17.2 12.0 14.0 16.0 18.0 20.0 Stand Alone Pro Forma Return on Average Tang. Equity Transaction IRR of 13.0% with a terminal multiple of 14.5x |

19 Low Execution Risk Low Execution Risk Consistent with Susquehanna expansion strategy Similar markets and operations Shared community banking philosophy and culture Proven track-record integrating acquisitions |

20 Compelling Combination Compelling Combination Broad Business Lines + Strong Earnings Growth / Shareholder Value Market Share Leadership + Financial Strength |

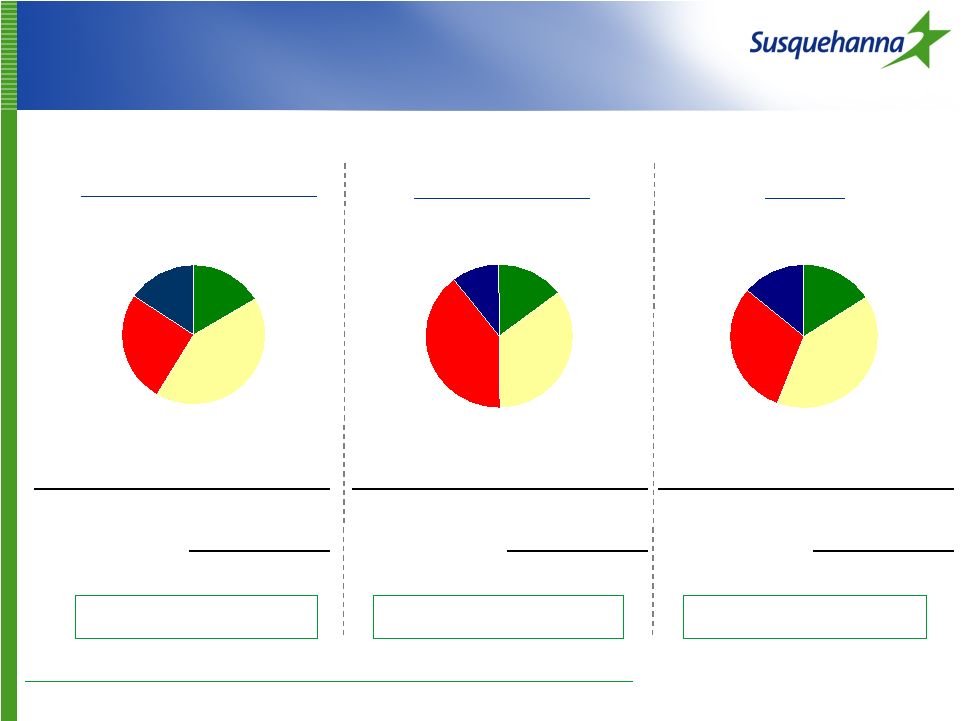

22 Residential R.E. 16.3% Construction 13.5% Commercial R.E. 30.2% Commercial 23.2% Leases 6.0% Consumer & Other 10.8% Dollars in thousands Source: SUSQ and CMTY loans per 12/31/2006 10-K; CMTY loans not pro forma for pending acquisitions SUSQ and CMTY loan yields per 10-K for the year ended 12/31/2006 Average Yield: 7.37% Average Yield: 7.23% Average Yield: 7.33% Residential R.E. 20.6% Construction 19.1% Commerical R.E. 28.4% Commerical 17.6% Leases 8.6% Consumer & Other 5.6% Pro Forma Susquehanna Bancshares, Inc. Community Banks, Inc. Loan Portfolio ($000) Amount % of Total Residential R.E. 1,147,741 $ 20.6% Commercial R.E. 1,577,534 28.4% Construction 1,064,452 19.1% Commercial 978,522 17.6% Leases 478,900 8.6% Consumer & Other 313,848 5.6% Gross Loans & Leases 5,560,997 $ 100.0% Residential R.E. 6.0% Construction 0.3% Commercial R.E. 34.4% Commercial 36.5% Consumer & Other 22.8% Loan Portfolio ($000) Amount % of Total Residential R.E. 141,826 $ 6.0% Commercial R.E. 815,028 34.4% Construction 7,290 0.3% Commercial 865,355 36.5% Leases - 0.0% Consumer & Other 541,390 22.8% Gross Loans & Leases 2,370,889 $ 100.0% Loan Portfolio ($000) Amount % of Total Residential R.E. 1,289,567 $ 16.3% Commercial R.E. 2,392,562 30.2% Construction 1,071,742 13.5% Commercial 1,843,877 23.2% Leases 478,900 6.0% Consumer & Other 855,238 10.8% Gross Loans & Leases 7,931,886 $ 100.0% Comparable Loan Mix Comparable Loan Mix |

23 CDs > $100K 15.4% NOW, Savings & MMDA 42.2% CDs < $100K 26.0% Demand Deposits 16.3% CDs > $100K 10.6% NOW, Savings & MMDA 35.0% CDs < $100K 39.7% Demand Deposits 14.7% CDs > $100K 14.0% NOW, Savin MMDA 40.1% CDs < $100K 30.1% Demand Deposits 15.8% Attractive Funding Base Attractive Funding Base Pro Forma Dollars in thousands Source: SUSQ and CMTY deposit data per 10-K as of 12/31/2006; CMTY not pro forma for pending acquisitions SUSQ and CMTY deposit costs per 10-K for the year ended 12/31/2006 Cost of Interest-bearing Deposits: 3.27% Cost of Deposits (including Demand): 2.73% Cost of Interest-bearing Deposits: 3.25% Cost of Deposits (including Demand): 2.77% Cost of Interest-bearing Deposits: 3.27% Cost of Deposits (including Demand): 2.74% Susquehanna Bancshares, Inc. Community Banks, Inc. Deposit Portfolio ($000) Amount % of Total Demand Deposits 959,654 $ 16.3% NOW, Savings & MMDA 2,482,043 42.2% CDs < $100K 1,528,298 26.0% CDs > $100K 907,594 15.4% Total Deposits 5,877,589 $ 100.0% Deposit Portfolio ($000) Amount % of Total Demand Deposits 368,329 $ 14.7% NOW, Savings & MMDA 879,343 35.0% CDs < $100K 998,510 39.7% CDs > $100K 267,000 10.6% Total Deposits 2,513,182 $ 100.0% Deposit Portfolio ($000) Amount % of Total Demand Deposits 1,327,983 $ 15.8% NOW, Savings & MMDA 3,361,386 40.1% CDs < $100K 2,526,808 30.1% CDs > $100K 1,174,594 14.0% Total Deposits 8,390,771 $ 100.0% |

24 Financial Impact – One Time Costs Financial Impact – One Time Costs ($ in millions) Compensation Costs $22.0 Fixed Asset Write - Offs 9.6 Professional Fee / Transactions Costs 13.4 Other 11.2 Total One - Time Costs $56.2 Tax Effect 15.0 Total After - Tax Costs $41.2 |

The following is an internal announcement and Q&A that was posted on the intranet of Susquehanna Bancshares, Inc. on May 1, 2007.

Susquehanna Announces Agreement to Acquire Community Banks, Inc.

Susquehanna Bancshares, Inc. and Community Banks, Inc. jointly announced the signing of a definitive merger agreement in which Susquehanna will acquire Community Banks. The combined company will have over $12 billion in assets and approximately $2 billion in market capitalization, making Susquehanna the 45th largest bank holding company in the United States. The acquisition ranks as the largest in Susquehanna’s history, and as Pennsylvania’s third-largest in-state bank transaction. Check out this article for a full copy of the acquisition news release and initial Q&As.

NEWS RELEASE

For Immediate Release

| | |

CONTACT: | | |

Alison van Harskamp Susquehanna Bancshares, Inc. (717) 625-6260 alison.vanharskamp@susquehanna.net | | Patricia E. Hoch Community Banks, Inc. (866) 255-2580 phoch@communitybanks.com |

Susquehanna Bancshares Inc. and Community Banks Inc.

Announce Definitive Merger Agreement

Lititz, PA & Harrisburg, PA—(BUSINESS WIRE)—May 1, 2007—Susquehanna Bancshares, Inc. (“Susquehanna”) (NASDAQ:SUSQ) and Community Banks, Inc. (“Community”) (NASDAQ:CMTY) today jointly announced the signing of a definitive merger agreement pursuant to which Susquehanna will acquire Community in a stock and cash transaction valued at approximately $860 million.

The transaction, unanimously approved by the boards of directors of both companies, will consolidate the companies’ presence in southeastern Pennsylvania and the Mid-Atlantic region, particularly in the attractive York and Lancaster markets. The combined company will have over $12 billion in assets and approximately $2 billion in market capitalization, making it the 45th largest bank holding company in the United States. The acquisition ranks as the largest in Susquehanna’s history, and as Pennsylvania’s third-largest in-state bank transaction.

William J. Reuter, Susquehanna’s Chairman, President and Chief Executive Officer, said, “Community’s core markets, particularly in the York/Hanover and greater Harrisburg area, have long been at the forefront of our targeted expansion strategy. Additionally, Community’s locations in the attractive markets of Lancaster, York and Berks counties in Pennsylvania complement our existing franchise.” Reuter continued, “The combination of Susquehanna and Community’s branches will create a comprehensive network of banking offices to serve customers throughout central Pennsylvania and will give us market leadership in six of our key markets. We look forward to working with Community’s experienced management team, which has demonstrated its ability to drive growth and profitability over the years.”

Under the terms of the merger agreement, shareholders of Community will be entitled to elect to receive for each share of Community common stock they own, either $34.00 in cash or 1.48 shares of Susquehanna common stock. Community shareholders may elect to receive cash for some shares and stock for others, but all shareholder elections will be subject to allocation procedures that will result in the exchange of 90 percent of Community’s common shares outstanding for shares of Susquehanna common stock and the remaining 10 percent of Community common shares outstanding for cash. Based upon the stated value of $34.00 per share, the transaction price represents 20.1 times Community’s 2007 earnings per share estimate as reported by First Call.

Eddie L. Dunklebarger, Chairman, President and Chief Executive Officer of Community, and five independent Community directors will be appointed to the Susquehanna Bancshares Board of Directors upon consummation of the merger. Dunklebarger will become Vice Chairman of Susquehanna Bancshares’ Board of Directors and Co-Chair of the Transition Team. Jeffrey M. Seibert will join Susquehanna Bank PA as Chief Operating Officer.

“Susquehanna’s similar focus on community banking and its wealth management business complement Community’s strategy and will enable us to leverage our platform to better serve our combined customer base. We believe that this combination will provide tremendous opportunities to create value for our combined shareholders, customers, employees and communities,” said Eddie L. Dunklebarger.

Susquehanna expects to achieve approximately 35 percent cost savings, or approximately $33 million, through the reduction of administrative and operational redundancies. It is anticipated that the transaction will be completed during the fourth quarter of 2007, pending regulatory approvals, the approval of the shareholders of both Community and Susquehanna, and the satisfaction of other closing conditions. The transaction is expected to be accretive to earnings per share in the first full year after closing.

Susquehanna Bancshares, Inc., is a financial services holding company with assets of $8.2 billion. It includes three commercial banks that provide financial services at 163 branch locations in the mid-Atlantic region. Through Susquehanna Wealth Management, the company offers investment, fiduciary, brokerage, insurance, retirement planning, and private banking services. Susquehanna also operates an insurance and employee benefits company, a commercial finance company, and a vehicle leasing company. For more information, please visitwww.susquehanna.net.

Community Banks, Inc., a financial holding company with approximately $3.8 billion in assets and 80 banking offices throughout central and eastern Pennsylvania and northern Maryland, is headquartered in Harrisburg, Pennsylvania.

This press release contains “forward-looking” statements as defined in the Private Securities Litigation Reform Act of 1995, which are based on Susquehanna’s and Community’s current expectations, estimates and projections about future events. This may include statements regarding the timing of the transaction, the timing and success of business plans and integration efforts once the transaction is complete, Susquehanna’s expectations or ability to realize growth and efficiencies through the acquisition of Community and the impact of the transaction on Susquehanna, and its business and financial operations. These statements are not historical facts or guarantees of future performance, events or results. Such statements involve potential risks and uncertainties, such as whether the merger will be approved by the shareholders of Susquehanna and Community or by regulatory authorities, whether each of the other conditions to closing set forth in the merger agreement will be met and the general effects of financial, economic, regulatory and political conditions affecting the banking and financial services industries. Accordingly, actual results may differ materially. Susquehanna undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Note: A conference call to discuss the transaction will be held on Tuesday, May 1, 2007, at 10:00 AM EST. A live audio Webcast of the call as well as a slide presentation will be available online at Susquehanna’s Web site at www.susquehanna.net. You may access the Webcast at www.susquehanna.net by selecting “Investor Relations” at on the home page and clicking the “Live Webcast” link. To listen to the live presentation, please go to the Web site at least fifteen minutes early to download and install any necessary audio software. For those who cannot listen to the live presentation, a replay will be available from one hour after the call’s conclusion through August 1, 2007.

ADDITIONAL INFORMATION ABOUT THE MERGER AND WHERE TO FIND IT

Susquehanna and Community intend to file with the SEC a proxy statement/prospectus and other relevant materials in connection with the merger. The proxy statement/prospectus will be mailed to the shareholders of Susquehanna and Community. Investors and security holders of Susquehanna and Community are urged to read the proxy statement/prospectus and the other relevant materials when they become available because they will contain important information about Community, Susquehanna and the merger.

The proxy statement/prospectus and other relevant materials (when they become available), and any other documents filed by Susquehanna or Community with the SEC, may be obtained free of charge at the SEC’s Web site at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by Community by contacting Eddie L. Dunklebarger, Community Banks, Inc., 777 East Park Drive, Harrisburg, PA 17111, telephone 717-920-5800 or from Community’s Web site at www.communitybanks.com. Investors and security holders may obtain free copies of the documents filed with the SEC by Susquehanna by contacting Drew K. Hostetter, Susquehanna Bancshares, Inc., 26 North Cedar Street, Lititz, PA 17543, telephone: 717-626-4721.

Investors and security holders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the merger.

Susquehanna Bancshares, Inc./Community Banks

Acquisition Q&As

Q: Who is Community Banks, Inc. and why are we acquiring them?

A: Community Banks, Inc. is a financial holding company whose wholly-owned subsidiaries include CommunityBanks, CommunityBanks Investments, Inc., and CommunityBanks Life Insurance Company. The Corporation operates through its executive office in Harrisburg, Pennsylvania, and 80 branches located in Adams, Berks, Chester, Cumberland, Dauphin, Lancaster, Luzerne, Northumberland, Schuylkill, Snyder, and York Counties in Pennsylvania and Carroll, Baltimore and Howard Counties in Maryland. Community Banks provides a wide range of services through its network of offices. Lending services include secured and unsecured commercial loans, residential and commercial mortgages and various forms of consumer lending. Deposit services include a variety of checking, savings, time and money market deposits. In addition to traditional banking services, Community Banks offers complete trust and investment services, as well as personal and commercial insurance through Community Banks Insurance Services LLC and real estate settlement services through CommunitySettlement LLC.

Community Banks At-A-Glance

Headquarters: Harrisburg, PA

Assets: $3.8 billion

Deposits: $2.7 billion

Loans: $2.6 billion

Business Lines: Community banking, insurance, investment management/trust

Community Banks Market Map

By acquiring Community Banks, Susquehanna will be able to significantly increase its presence in Lancaster and York markets, as well as enter the Pennsylvania counties of Adams, Cumberland, Dauphin, Luzerne and Schuylkill. It could take us several years to enter these markets outside of an acquisition.

Q: When will the acquisition take place?

A: Pending approvals, it is scheduled to take place in the fourth quarter of 2007.

Q: Will Community Banks become another bank affiliate of Susquehanna Bancshares?

A: No. Community Banks will be merged into Susquehanna’s existing bank affiliate network and marketed under the Susquehanna brand. The bulk of Community Banks’ branches will be incorporated into Susquehanna Bank PA.

Q: How will this merger affect our customers?

A: Our customers will have access to a significantly expanded network of branches and ATMs.

Q: What operating system(s) does Community Banks use?

A: Like Susquehanna, Community Banks uses the Jack Henry/Silverlake system for its core banking operations. They currently use Vertex, Net Teller, and Yellowhammer (fraud detection). They will begin to use Argo for platform and consumer loans after the merger.

Q: Where can I find up-to-date information about the merger?

A: We understand that you may have additional questions about this merger. There are several issues that need to be reviewed before we can communicate accurate information. We will communicate additional information as it becomes available.

A “Susquehanna/Community Banks Merger” icon will be posted on Web1 in the very near future. All communication regarding the merger will be posted and archived in this area. Initial postings will appear in the Corporate News section of Web1.

Additional Information and Where to Find It

Susquehanna Bancshares, Inc. and Community Banks, Inc. anticipate filing a Registration Statement on Form S-4 and joint proxy statement/prospectus with the Securities and Exchange Commission (the “Commission”) shortly. THE DEFINITIVE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS SHOULD BE READ CAREFULLY BEFORE MAKING A DECISION CONCERNING THE MERGER. IN SUCH EVENT, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ SUSQUEHANNA BANCSHARES’ REGISTRATION STATEMENT ON FORM S-4 AND THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS RELATING TO THE MERGER TRANSACTION DESCRIBED ABOVE, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The final joint proxy/prospectus will be mailed to shareholders of Susquehanna Bancshares, Inc. and Community Banks, Inc.. Investors and shareholders will be able to obtain a free copy of such documents when they become available at the Commission’s web site at www.sec.gov, from Susquehanna Bancshares, Inc. by directing a written request to Susquehanna Bancshares, Inc., 26 North Cedar Street, Lititz, PA 17543, Attention: Abram G. Koser, Vice President - Investor Relations or from Community Banks, Inc. by directing a written request to Community Banks, Inc., 777 East Park Drive, Harrisburg, PA 17111, Attention: Patricia E. Hoch. Certain of these documents may also be accessed on the web sites of Susquehanna Bancshares, Inc. (www.susquehanna.net) and Community Banks, Inc. (www.communitybanks.com) when they become available.

Participants in Solicitation

Susquehanna Bancshares, Inc., Community Banks, Inc. and their directors and executive officers and other members of their management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the participants and their interests in the solicitation may be found in the joint proxy statement/prospectus, when it becomes available.