Annual

Meeting

May 19,

2009

President and CEO – Francis J. Evanitsky

Juniata Valley Financial Corp.

Stability and Strength

Through Superior Performance

Our Message is Simple and Clear

No neon lights.

No loss-leader promotions.

Competent and caring professionals.

Broad array of products and services suited to the

needs of our customers.

Carefully designed to be offered with pride.

We listen, then act.

This has been our way for 141 years.

Results

Strong, stable financial condition.

Performance consistently exceeding peers.

Capital Strength - Risk-based capital more

than twice regulatory requirements for

“well-capitalized” category.

Liquidity more than double policy minimums.

No need for “help” from our government.

Profitability among highest in industry.

2008 Improvements over 2007

Increase in net income: 5.3%

Increase in fully diluted earnings per share: 7.4%

Increase in return on average equity: 3.1%

Increase in return on average assets: 4.7%

Increase in fully tax-equivalent net interest

margin: 4.1%

Reduction in noninterest expense: 1.6%

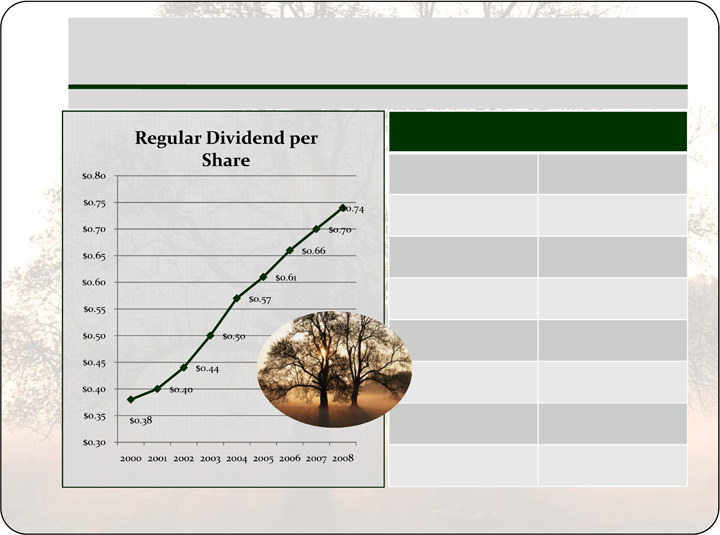

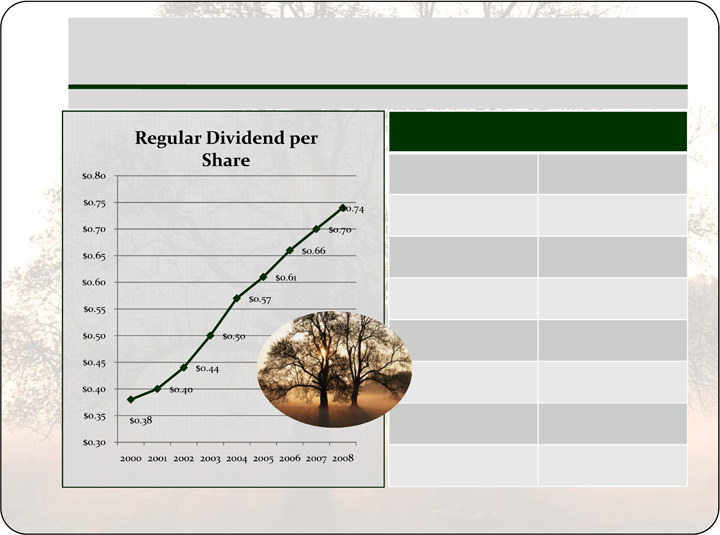

Strong Capacity to Pay Dividends

While many financial services companies have

decreased or eliminated dividends to shareholders

because of capital and liquidity concerns, we

increased our regular dividend again in 2008.

On April 21, our Board of Directors has declared a

regular quarterly dividend in the amount of $0.19

per share.

Year to date in 2009, the dividend is 5.5%

higher than in 2008.

Historical Regular Dividend Activity

Annual Percentage Increase

2001

5.3%

2002

10.0%

2003

13.6%

2004

14.0%

2005

7.0%

2006

8.2%

2007

6.1%

2008

5.7%

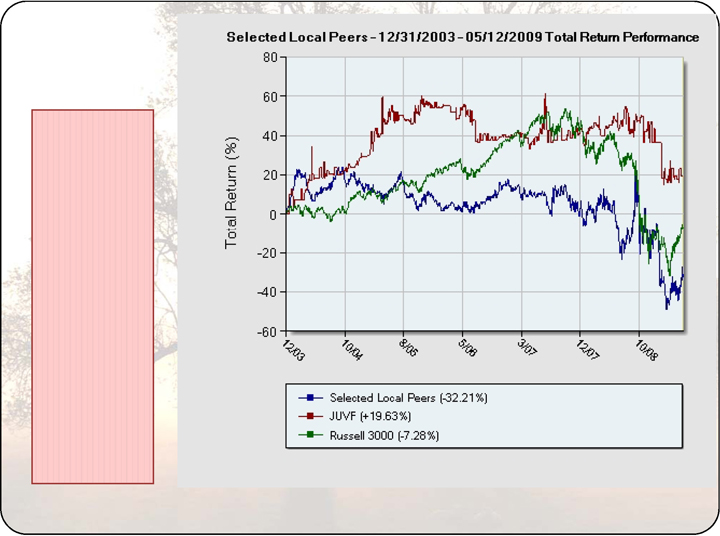

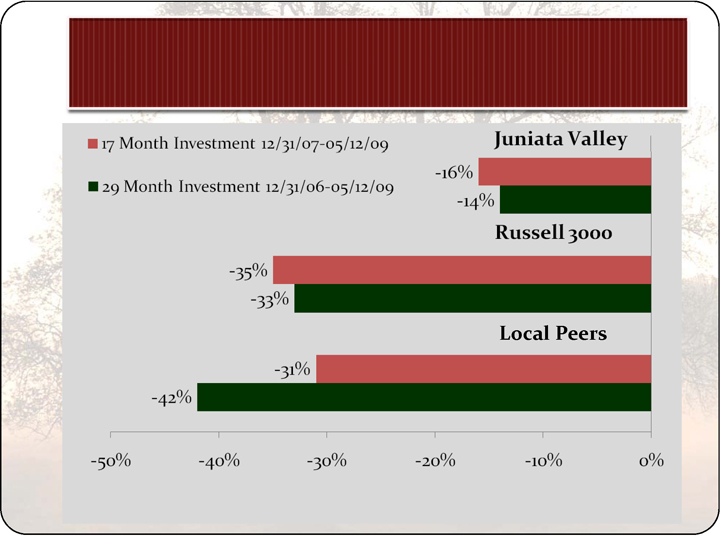

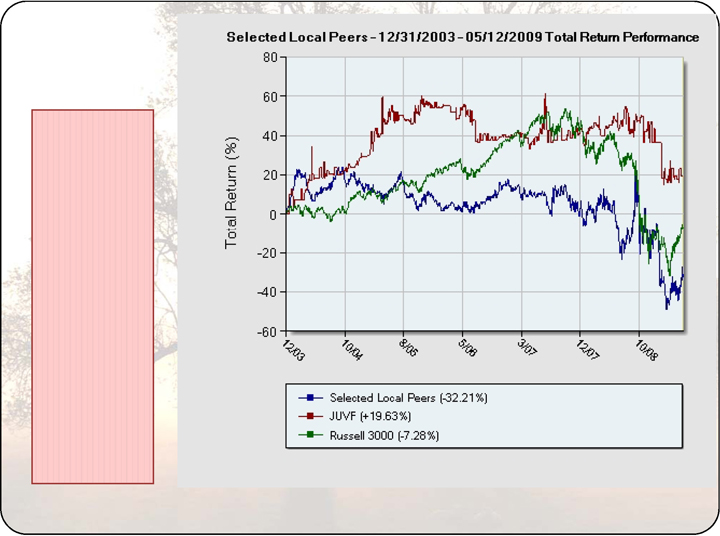

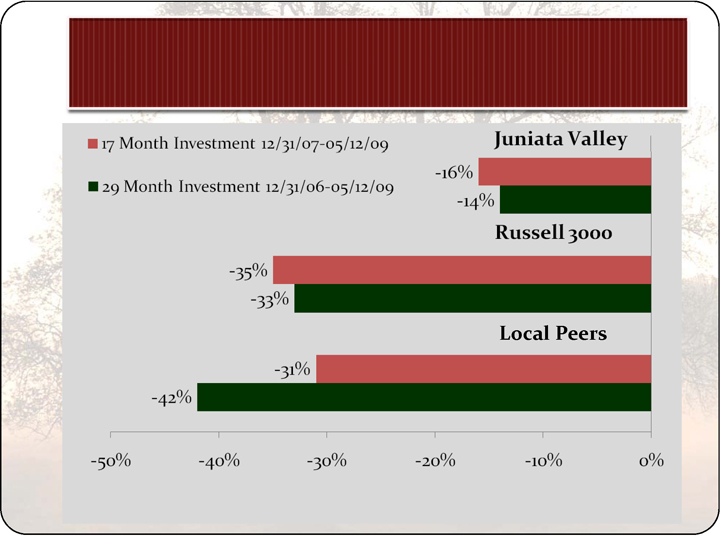

Juniata Valley Stock Trades

In spite of performance, stock has been trading at lower

levels than in the past.

General disfavor of financial institutions has affected the

perceived value of our stock, but not to the same degree

as our peers.

Have withstood negative industry trends better than

many others in our sector.

Current market values do not reflect our strong financial

accomplishments.

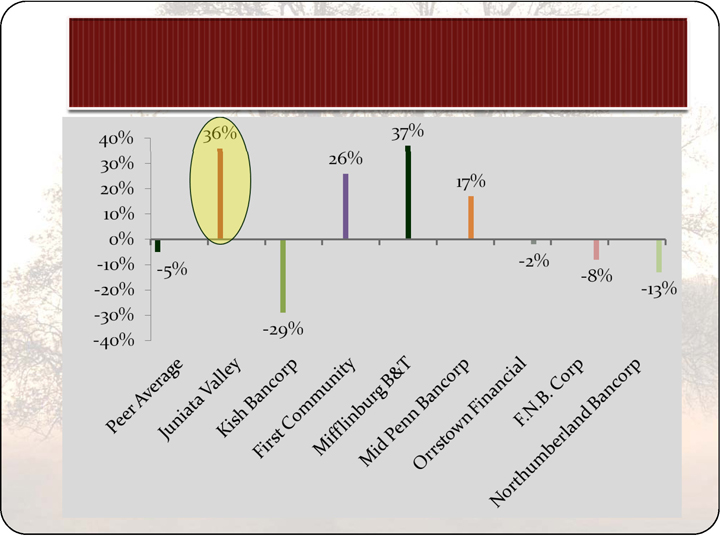

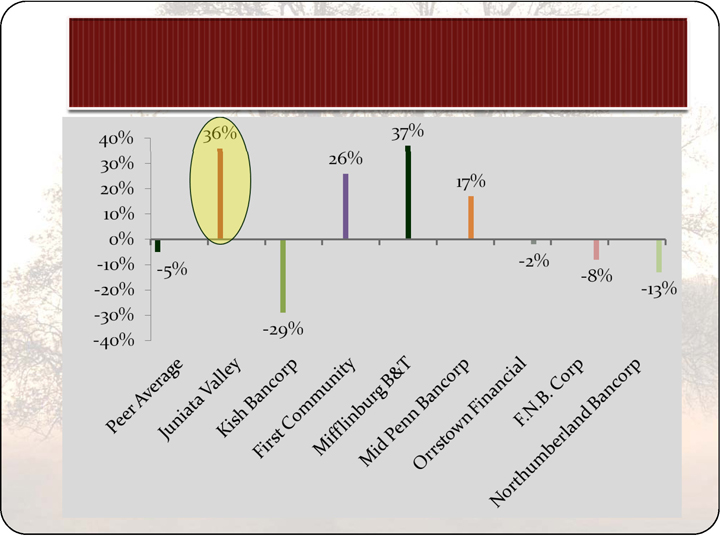

Comparison to Local Peers

Stock Value

Shareholder Return

Stockholder Total Return – 5 Year

Assumptions

Investment made on 12/31/2003

Selected Local Peers

FMFP – First Community

Financial Corp.

KISB – Kish Bancorp

MPB – Mid Penn Bancorp

MIFF – Mifflinburg B&T

NUBC – Northumberland

Bancorp

ORRF – Orrstown Financial

Services

FNB – FNB of Pennsylvania

Definition

Total return of a security

over a period, including

price appreciation and

the reinvestment of

dividends. Dividends are

assumed to be

reinvested at the closing

price of the security on

the ex-date of the

dividend.

Juniata

Valley

Vs.

Composite of

Selected

Peers

and

National

Index

Total Return Performance – 5 Year

Initial Investment 12/31/03 to 12/31/08

Total Return

in Shortened Investment Period

Independent Performance Analysis

Pennsylvania Bank Performance Report 2008

Analysis by FMC (Financial Management Consulting

Group) from Kentucky.

Ranks 143 banks in Pennsylvania on all major

performance components.

Juniata Valley Bank ranks 6th in the state for

overall performance in 2008.

Our Record

Speaks for itself.

Our People

Dedicated to our success.

Team of experienced senior officers.

Backed up by devoted middle managers.

Supported by competent staff.

Oversight by seasoned board of directors.

Assuring our

Customers

Firmly planted in Central Pennsylvania

Rural Central Pennsylvania

Serving the Juniata Valley

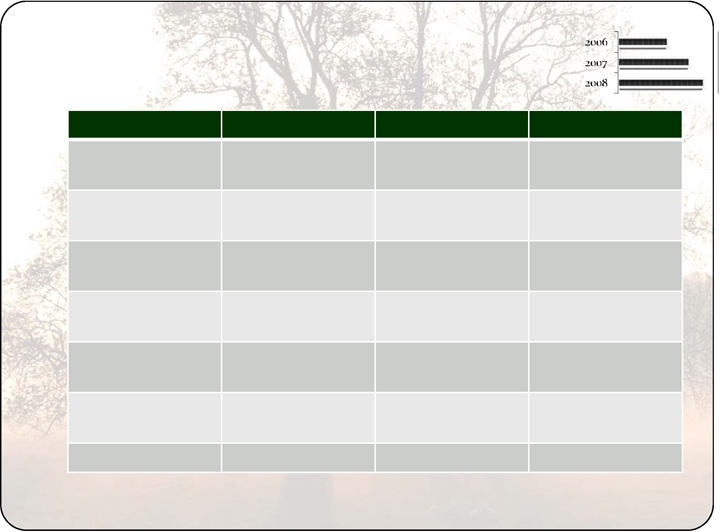

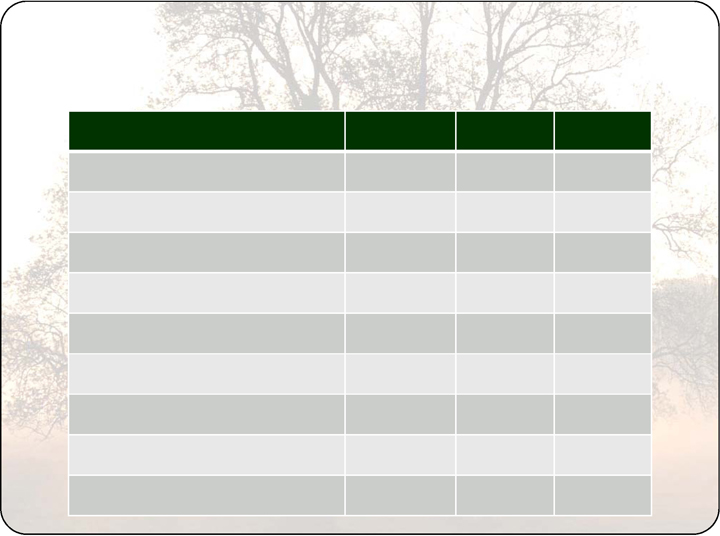

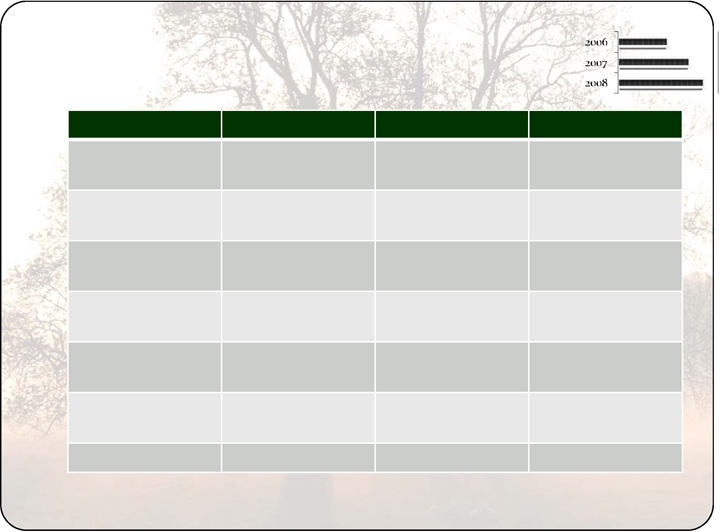

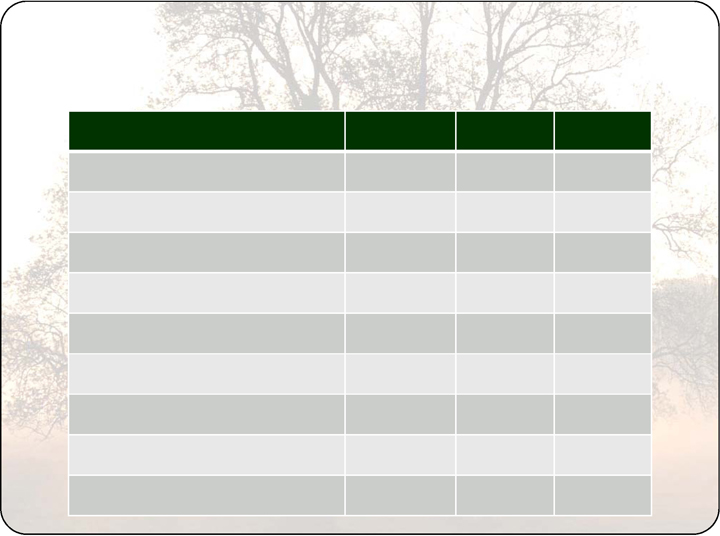

Financial Performance

Presented by JoAnn McMinn, Chief Financial Officer

Juniata Valley Financial Corp.

2008

2007

2006

Net interest

income

$16,173,000

$15,663,000

$14,552,000

Loan loss

provision

(421,000)

(120,000)

(54,000)

Non-interest

income

4,558,000

4,218,000

3,649,000

Security

transactions

(521,000)

(19,000)

181,000

Non-interest

expense

(12,008,000)

(12,209,000)

(11,245,000)

Income tax

expense

(2,057,000)

(2,099,000)

(2,081,000)

Net income

$5,724,000

$5,434,000

$5,002,000

Juniata Valley Financial Corp.

2008

2007

Change

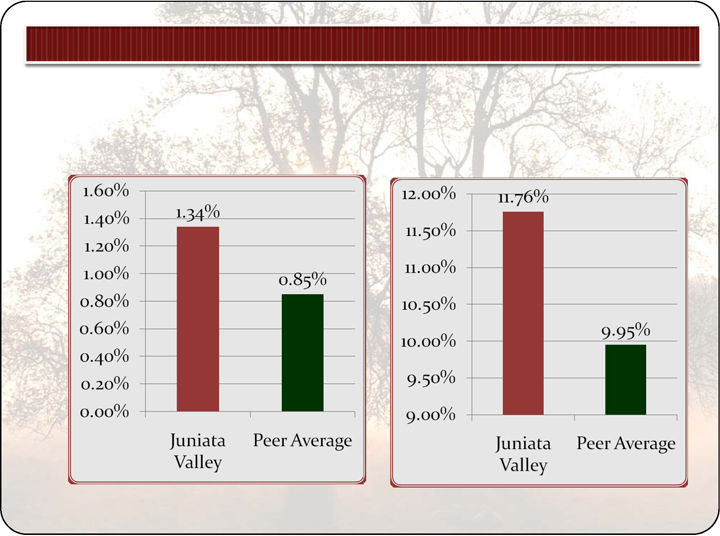

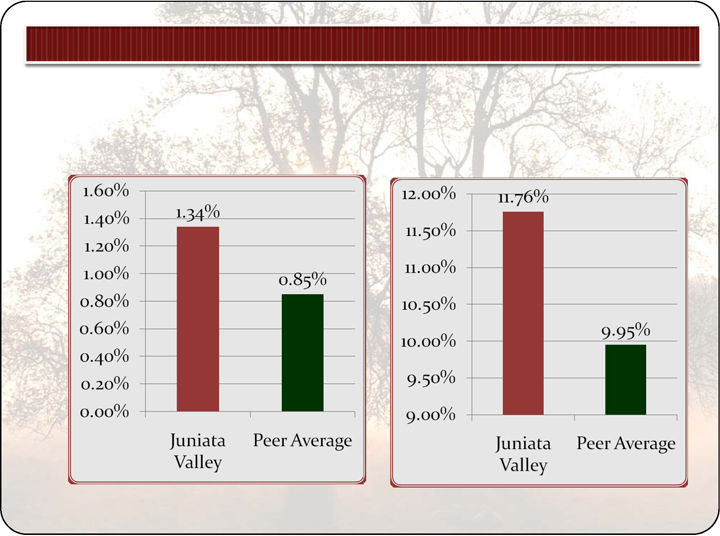

ROAA

1.34%

1.28%

4.7%

ROAE

11.76%

11.41%

3.1%

Yield on Earning Assets

6.48%

6.88%

(5.8)%

Cost of Funding

2.33%

2.85%

(18.2)%

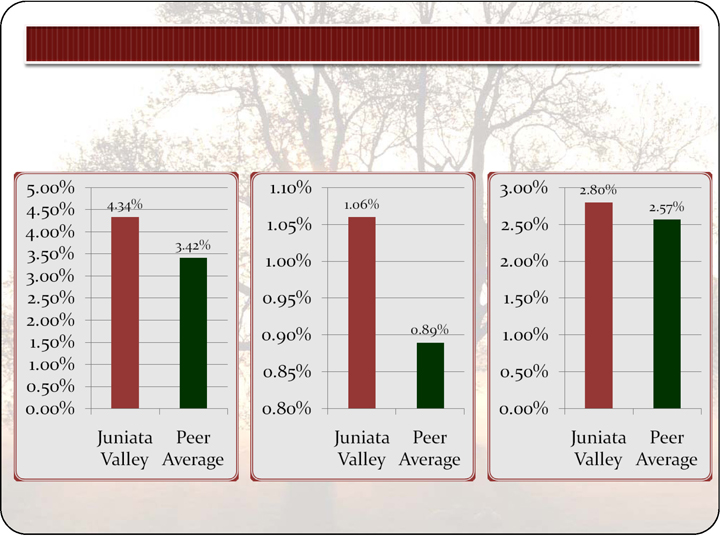

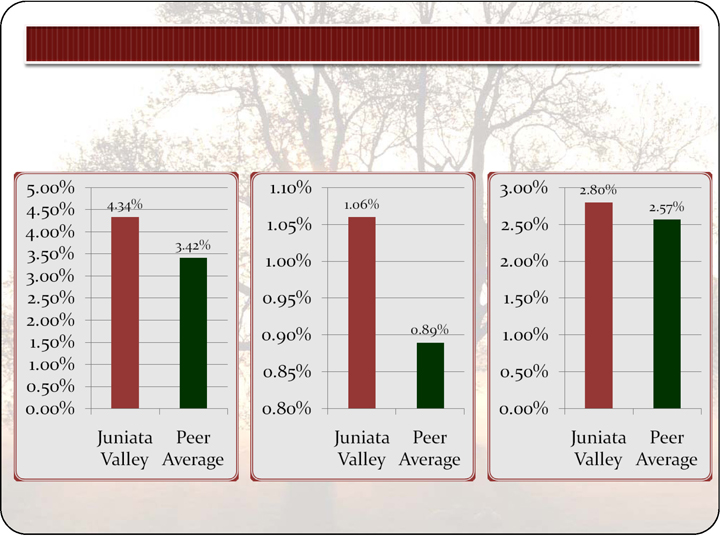

Net Interest Margin (tax equivalent)

4.34%

4.17%

4.1%

Non-interest income /AA

1.06%

0.99%

7.1%

Non-interest expense/AA

2.80%

2.87%

(2.4)%

Net non-interest expense/AA

1.74%

1.88%

(7.4)%

Earnings per share (FD)

$1.31

$1.22

7.4%

Key Factors Affecting 2008 Results

Interest rate environment – an increase in the net interest margin during

swiftly changing rate environment

Loan growth

- Increased $17 million, or 5.7% from year-end 2007 at year-end 2008

Allowance for Loan Loss adequacy

Changes in depositor preferences

- Shift from interest-bearing transaction accounts to term Certificates of Deposit

Other-than-temporary impairment charges on equities portfolio

Staffing turnover

Non-interest income improvement

Non-interest expense reduction

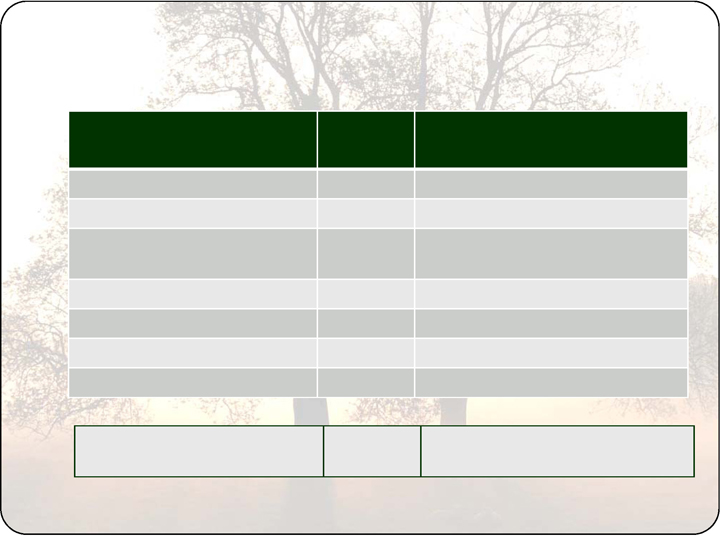

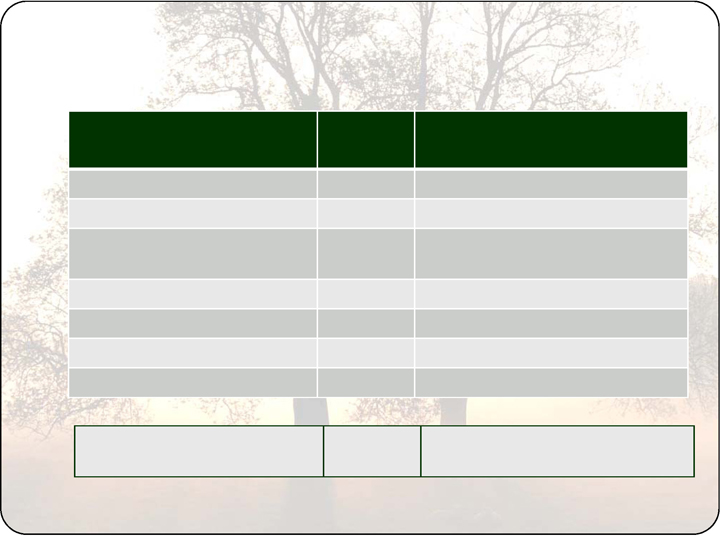

Comparison to Local Peers

Financial Performance

Local Peer Group

Corporation

Assets at

12/31/08

(in millions)

Principal Bank

Mid Penn Bancorp

$572

Mid Penn Bank

Kish Bancorp

$473

Kish Bank

First Community Financial

Corporation

$326

FNB Mifflintown

Mifflinburg Bancorp, Inc

$275

Mifflinburg Bank & Trust

Orrstown Financial Services

$1,052

Orrstown Bank

Northumberland Bancorp

$369

Northumberland National Bank

F.N.B. Corporation

$8,365

First National Bank of PA

Juniata Valley Financial

Corp

$428

Juniata Valley Bank

Sources for all Peer Data: SNL Financial and Company Annual Reports

For the Year 2008

Corporation

ROA

ROE

Net

Interest

Margin

Non-

Interest

Income to

Average

Assets

Non-

Interest

Expense to

Average

Assets

Mid Penn

0.67%

8.83%

3.50%

0.68%

2.74%

Kish

0.84%

12.75%

3.37%

0.81%

2.73%

First Community

0.73%

10.52%

3.20%

0.72%

2.50%

Mifflinburg

1.15 %

10.84%

3.62%

0.60%

2.35%

Orrstown

1.38%

13.20%

3.93%

1.63%

2.98%

F.N.B. Corp

0.46%

4.20%

3.88%

1.33%

2.89%

Northumberland

0.71%

9.32%

2.46%

0.46%

1.79%

Juniata Valley

1.34%

11.76%

4.34%

1.06%

2.80%

Peer Average

0.85%

9.95%

3.42%

0.89%

2.57%

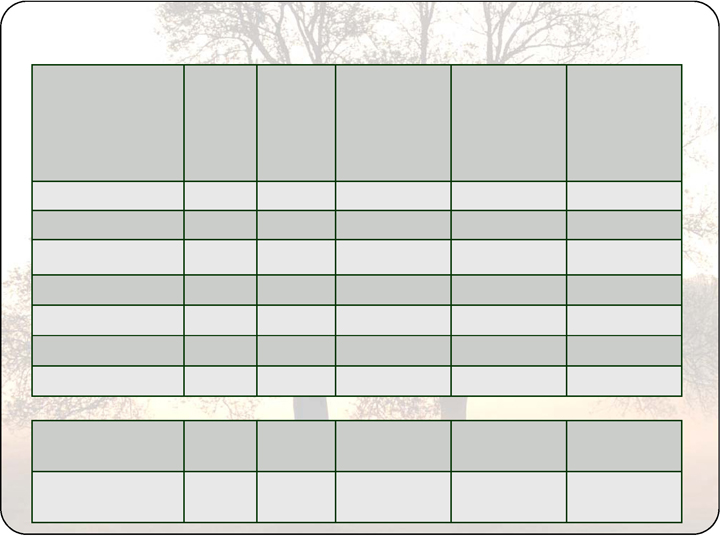

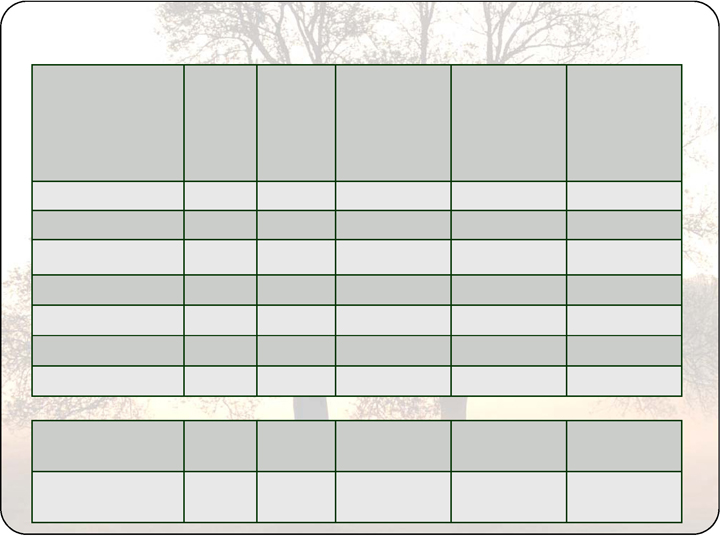

Return on Average

Assets

Return on Average

Equity

2008 Key Performance Ratio Comparisons to Local Peer Group

Net Interest Margin

Non-Interest Income /

Average Assets

2008 Key Performance Ratio Comparisons to Local Peer Group

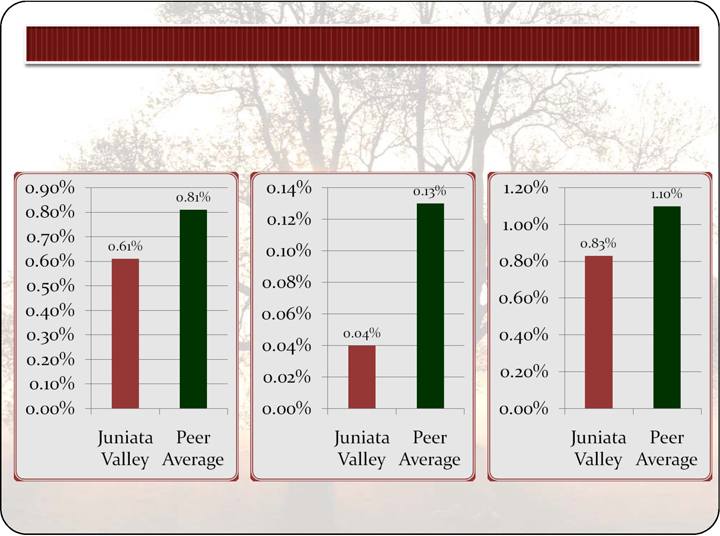

Non-Interest Expense/

Average Assets

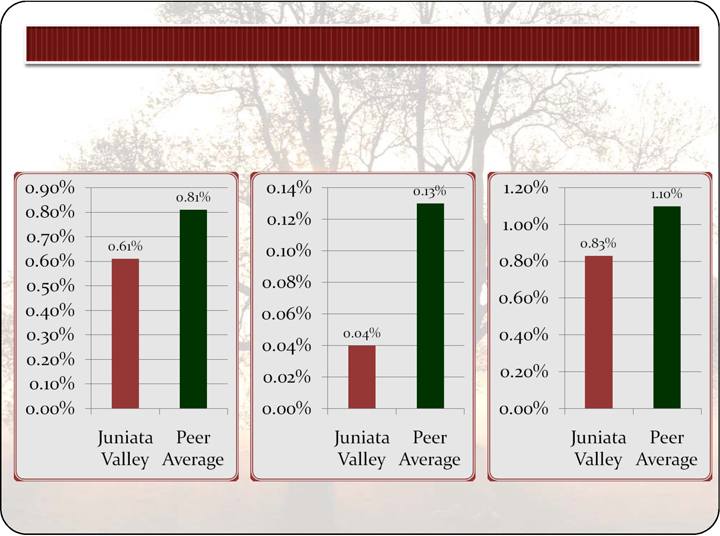

Non-Performing Loans

/ Total Loans

Net Charge-Offs to

Average Loans

2008 Key Performance Ratio Comparisons to Local Peer Group

Loan Loss Reserve /

Total Loans

Risk-Based Capital

Ratio (8% Minimum)

Tier 1 Risk Based

Capital Ratio (4% Minimum)

2008 Capital Ratio Comparisons to Local Peer Group

Leverage Ratio

(4% Minimum)

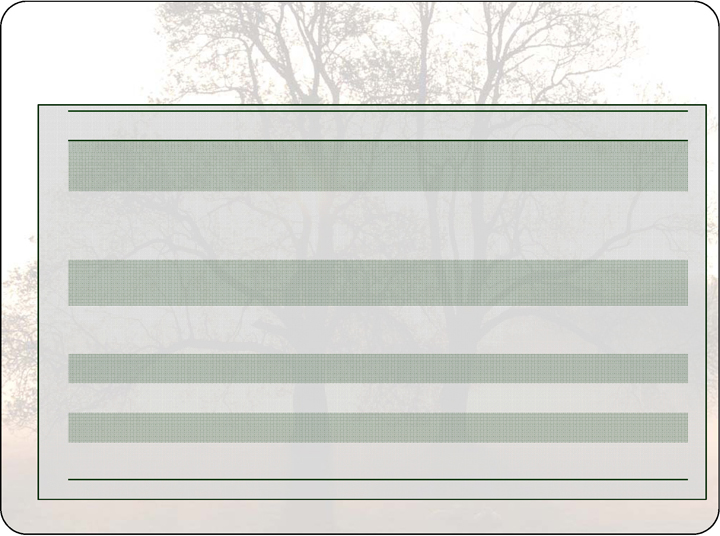

2009– Moving Ahead

Facing challenges

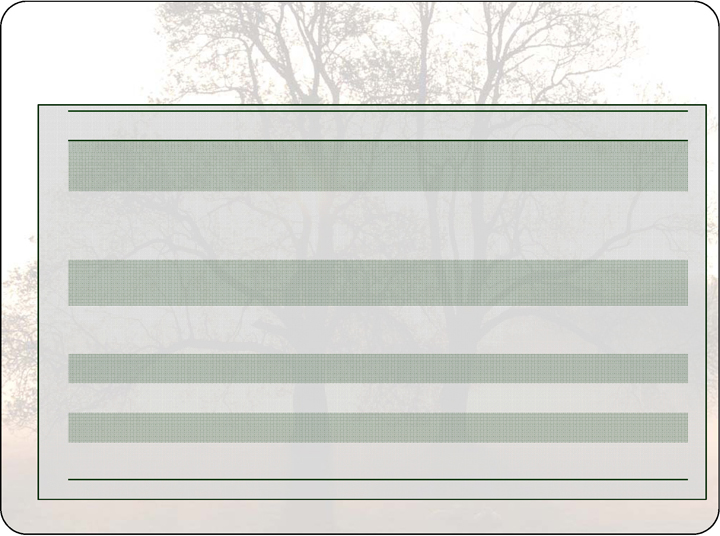

Q1 2009 vs. Q1 2008 Results

Q1 2009

Change from Q1 2008

Net Income

$1,410,000

0.6% Increase

Earnings per Share

$0.32

0.00% Increase

Total Assets (since year end)

$429,542,000

0.3% Increase

Net Interest Income

$4,017,000

3.5% Increase

Net Interest Margin

4.35%

2.4% Increase – 10 bp

Non-Interest Income/AA

1.16%

8.4% Increase – 9 bp

Non-Interest Expense/AA

3.00%

3.4% Increase – 10 bp

Return on Assets

1.32%

1.5% Decrease – 2 bp

Return on Equity

11.59%

0.0% Decrease – 1 bp

Juniata Valley Financial Corp.

Strategic Plan

Presented by Marcie Barber, Chief Operating Officer

Juniata Valley Bank

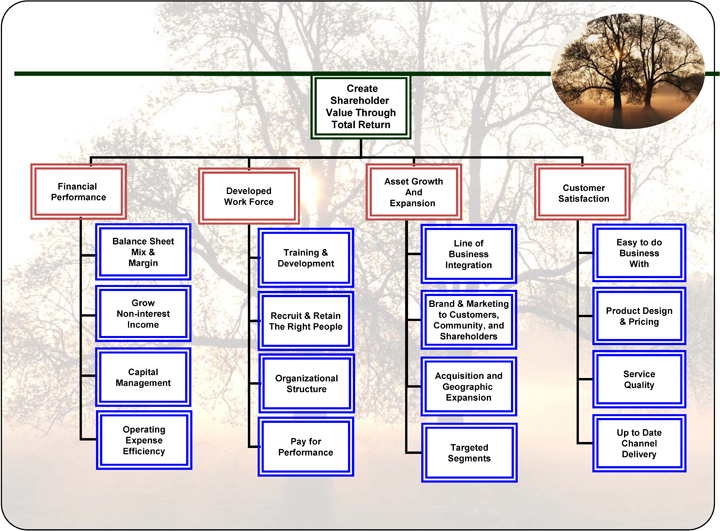

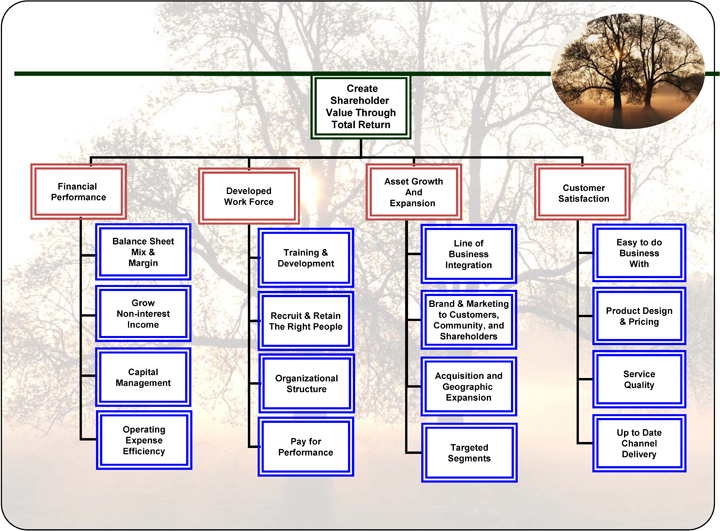

Strategy Map – Prioritized

Create Shareholder

Value Through

Total Return

Dividends

Financial Performance

Appreciation

Market Dynamics

Industry Perception

Image and Reputation

Financial Performance

Manage the Margin – Buy Low – Sell High

Trust - Deposit fee income – Alternative Investments

Protect and Share Responsibly

Controllable - And not…..

Financial

Performance

Balance Sheet

Mix &

Margin

Grow

Non-interest

Income

Capital

Management

Operating

Expense

Efficiency

Developed Workforce

Developed

Workforce

Training &

Development

Recruit & Retain

The Right People

Organizational

Structure

Pay for

Performance

Loan Training

Compliance Training

Changing Roles

Community Office

Incentive program

Credit – Compliance - Security

Asset Growth and Expansion

Asset Growth

and

Expansion

Line of

Business

Integration

Brand & Marketing

to Customers,

Community, and

Shareholders

Acquisition and

Geographic

Expansion

Targeted

Segments

.

Build the Team – Integrate Lines of Business

Stable and strong

Compatible markets and culture

Bloom where you’re planted

Integration of Business

Lines

Customer Satisfaction

Customer

Satisfaction

Easy to Do

Business

With

Product Design

& Pricing

Service

Quality

Up to Date

Channel

Delivery

Convenience

Progressive Internet and

Bill pay services

Remote Capture

One size does not fit all

An Enduring Strategy

3 Year Plan

Grow the Earnings

Grow the People

Grow the Bank – Profitably through new markets

and business integration

Grow the Base – Serve customers –Enhance Image

Maximize Shareholder Value

Presented by Fran Evanitsky, CEO

Juniata Valley Financial Corp.

In Summary

Outlook for 2009

Out of our control.

FDIC deposit insurance assessments.

Potential for further declines in fair values of

equities investments leading to other-than-

temporary impairment charges.

Development of financial problems among

borrowers that may lead to loan defaults.

Juniata Valley Financial Corp.

Outlook for 2009

In our control.

Maintaining traditional sound business practices.

Supplying the members of our community with the

financial services they need.

Adhering to our basic philosophies.

Juniata Valley Financial Corp.

Our long-standing philosophies have the greatest

impact during economic conditions like those we now

face:

Juniata Valley Financial Corp.

Higher value in strong net interest margin than

in high growth rates.

Solid, repeatable non-interest revenues result

from service-focused strategies.

Continued cost controls are imperative.

An inheritance of 5 shares of Lewistown Trust Co. stock

in 1922, with a basis of $500, has grown to 5,148 shares,

valued at $85,000 today.

Another inheritance of 6,388 shares of Juniata Valley

stock was valued at $243,000 in 1993. 1,500 of those

shares were sold in 1994 for $58,500. Through stock

dividends and splits, the remaining shares have grown to

21,000 and are valued today at $346,500.

Juniata Valley Financial Corp.

Long-Term Returns on Capital and Shareholder Value

We’re

Strong,

We’re

Healthy,

We’re Here

for You

Firmly planted in Central Pennsylvania – 141 Years