Annual Shareholders Meeting 2014

The presentation may contain “forward looking” information as defined by the Private Securities Litigation Reform Act of 1995 . When words such as “believes”, “expects”, “anticipates” or similar expressions are used in this release, Juniata Valley is making forward - looking statements . Such information is based on Juniata Valley’s current expectations, estimates and projections about future events and financial trends affecting the financial condition of its business . These statements are not historical facts or guarantees of future performance, events or results . Such statements involve potential risks and uncertainties and, accordingly, actual results may differ materially from this “forward looking” information . Many factors could affect future financial results . Juniata Valley undertakes no obligation to publicly update or revise forward looking information, whether as a result of new or updated information, future events, or otherwise . For a more complete discussion of certain risks and uncertainties affecting Juniata Valley, please see the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Forward - Looking Statements” set forth in the Juniata Valley’s filings with the Securities and Exchange Commission .

Chairman of the Board of Directors Timothy I. Havice

President and Chief Executive Officer Marcie A. Barber

Signs of Progress

Can we put the same picture of Water Street’s sign that is on the front cover of the report?

“It was the best of times, it was the worst of times….” Charles Dickens

Executive Vice President and Chief Financial Officer JoAnn N. McMinn

Key Financial Ratios For Year 2012 For Year 2013 Change Return on Average Assets 0.80% 0.89% 11.3% Return on Average Equity 7.33% 8.07% 10.1% Net Interest Margin (fully tax equivalent) 3.68% 3.53% (4.1)% Loan Loss Provision as % of Average Assets 0.31% 0.09% 71.0% Non - Interest Income (excludes securities gains) as % of Average Assets 1.00% 0.94% (6.0)% Non - Interest Expense (net of amortization of Low Income Housing Investment) as % of Average Assets 2.88% 2.82% 0.2% Low Income Housing Investment tax credit, net of after - tax amortization of investment as % of Average Assets 0.00% 0.05% Earnings per Share (Fully Diluted) $0.86 $0.95 10.5%

Balance Sheet More change than initially apparent Assets 12/31/13 12/31/12 Cash $8,613 $14,397 Investments 132,434 128,911 Loans (net) 275,511 274,219 OREO 281 428 Other 31,943 30,914 Total $448,782 $448,869 • Loans – Increase in commercial lending portfolio • 38.4% in 2012 • 43.3% in 2013 – Decrease in % of non - accrual loans • 3.2% in 2012 • 2.1% in 2013 • Deposits – Increase in non - interest bearing deposits • 18.4% in 2012 • 19.7% in 2013 Liabilities/Equity 12/31/13 12/31/12 Deposits $379,645 $386,751 Borrowings 19,153 6,741 Other liabilities 4,000 5,080 Equity 49,984 50,297 Total $448,782 $448,869

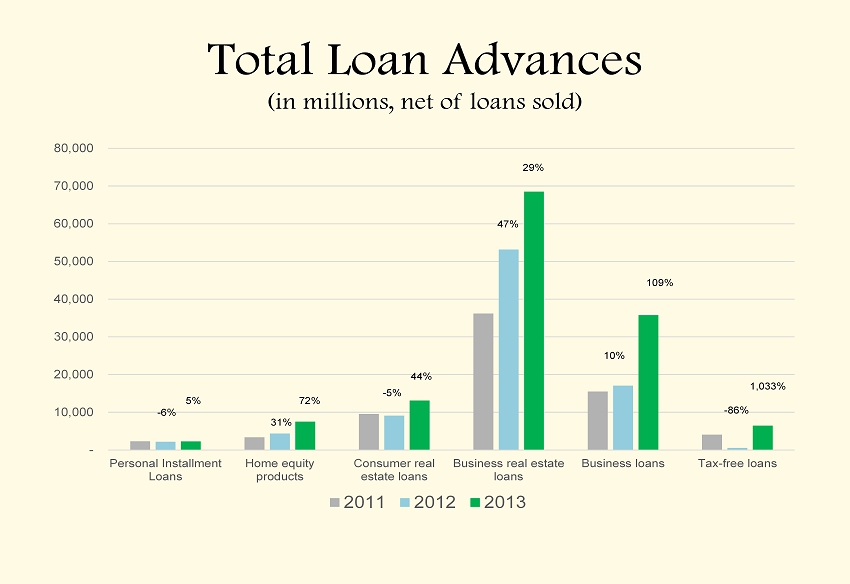

Total Loan Advances (in millions, net of loans sold) - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Personal Installment Loans Home equity products Consumer real estate loans Business real estate loans Business loans Tax-free loans 2011 2012 2013 31% 5% 72% - 6% - 5% 44% 47% 29% 10% 109% 1,033% - 86%

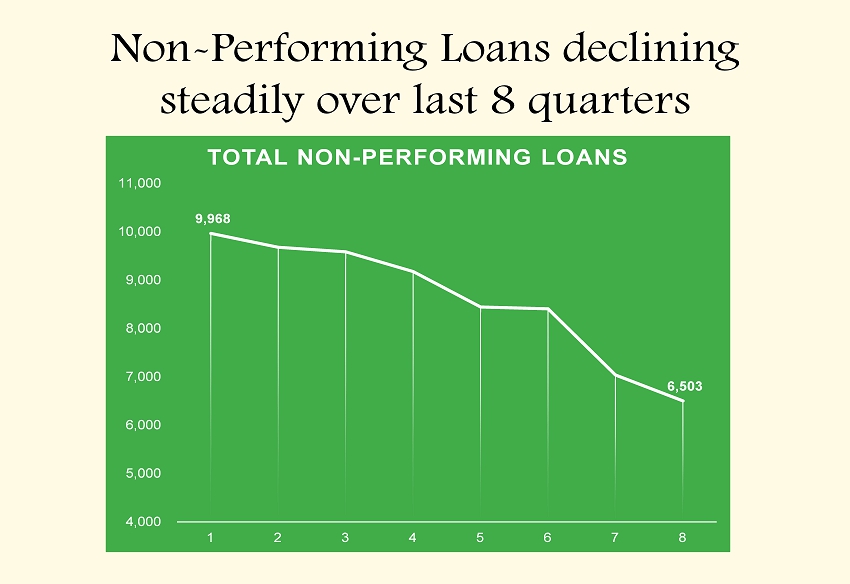

Signs of Improvement in Non - Performing Loans - 2,000 4,000 6,000 8,000 10,000 12,000 2008 2009 2010 2011 2012 2013 2014 Q1 1,919 3,998 6,971 10,690 9,588 6,978 6,503 Non - Performing Loan Balances, in Millions

Non - Performing Loans declining steadily over last 8 quarters 9,968 6,503 4,000 5,000 6,000 7,000 8,000 9,000 10,000 11,000 1 2 3 4 5 6 7 8 TOTAL NON - PERFORMING LOANS

Key Financial Ratios For Year 2013 Q1 2014 Change Return on Average Assets 0.89% 0.81% (9.0)% Return on Average Equity 8.07% 7.17% (11.2)% Net Interest Margin (fully tax equivalent) 3.53% 3.52% (0.3)% Loan Loss Provision as % of Average Assets 0.09% 0.02% 77.8% Non - Interest Income (excludes securities gains) as % of Average Assets 0.94% 0.82% (12.8)% Non - Interest Expense (net of amortization of Low Income Housing Investment) as % of Average Assets 2.82% 2.89% (2.5)% Low Income Housing Investment tax credit, net of after - tax amortization of investment as % of Average Assets 0.05% 0.12% 140.0% Earnings per Share (Fully Diluted) $0.95 $0.22

Performance Comparisons To Peer Groups Important to assess our performance against other financial institutions of our relative size who are experiencing similar regulatory and compliance governance.

Selected Local Peers Geographic Peers of similar size and complexity – CBTC - CBT Financial Corporation – CCFN – CCFNB Bancorp, Inc. – DIMC – Dimeco, Inc. – EMCF – Emclaire Financial Corp. – ENBP – ENB Financial Corp – FMFP – First Community Financial Corporation (* when possible ) – FRAF – Franklin Financial Services Corporation – KISB – Kish Bancorp, Inc. – MPB – Mid Penn Bancorp, Inc. – RIVE – Riverview Financial Corporation – Group of 10 – Average Asset Size: $602 million Broad Group of Similar Sized Banking Organizations All commercial banking organizations within the state of Pennsylvania whose asset sizes are between $300 million and $1 billion . – Group of 50 Peer Groups Selected for Performance Comparisons

Performance Comparison Return on Average Assets 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 1.10% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Performance Comparison Equity Ratios 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps 8.00% 8.50% 9.00% 9.50% 10.00% 10.50% 11.00% 11.50% 12.00% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps Return on Average Equity Equity /Asset Ratio

Performance Comparison Net Interest Margin (fully tax equivalent) 3.00% 3.20% 3.40% 3.60% 3.80% 4.00% 4.20% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Performance Comparison Loan Loss Provision as % of Average Assets 0.00% 0.05% 0.10% 0.15% 0.20% 0.25% 0.30% 0.35% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Performance Comparison Non - Interest Income as % of Average Assets 0.50% 0.60% 0.70% 0.80% 0.90% 1.00% 1.10% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Performance Comparison Non - Interest Expense as % of Average Assets 2.00% 2.20% 2.40% 2.60% 2.80% 3.00% 3.20% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Credit Quality Statistics • High Focus on Reduction and Prevention of Non - Performing Assets. • Definition of Non - Performing Asset – Loan that has been placed in non - accrual status. – Loan that is accruing but is more than 90 days delinquent in scheduled payments. – Performing loan that is a troubled - debt restructure (TDR). – Properties owned by the Bank as a result of loan foreclosures (Other Real Estate Owned – OREO).

Quarterly Comparison Non - Performing Assets as % of Equity (includes Non - Accrual, OREO, TDR and 90 Day Delinquencies still Accruing) 10.00% 12.00% 14.00% 16.00% 18.00% 20.00% 22.00% 24.00% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Capital Strength • Regulatory Measurement of Capital Adequacy • JUVF Capital levels support the level of dividends being maintained. The dividend yield is among the highest, as depicted on a slide to follow • Total Return on Investment continues to be strong in comparison to both peer groups.

Performance Comparison Risk - Based Capital Ratios 13.00% 14.00% 15.00% 16.00% 17.00% 18.00% 19.00% 20.00% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Stockholder Total Return – 5 Year Assumptions • Investment made on 03/31/2009 • Selected Local Peers Include: – CBTC - CBT Financial Corporation – CCFN – CCFNB Bancorp, Inc. – DIMC – Dimeco, Inc. – EMCF – Emclaire Financial Corp. – ENBP – ENB Financial Corp – FMFP – First Community Financial Corporation – FRAF – Franklin Financial Services Corporation – KISB – Kish Bancorp, Inc. – MPB – Mid Penn Bancorp, Inc. – RIVE – Riverview Financial Corporation Definition • Total return of a security over a period, including price appreciation and the reinvestment of dividends. Dividends are assumed to be reinvested at the closing price of the security on the ex - date of the dividend .

03/31/2009 – 03/31/2014 Stock – Five Year Total Return Performance Compared to National Index and Selected Local Peers

Performance Comparison Dividend Yield 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

President and Chief Executive Officer Marcie A. Barber

Signs of Progress

Business Lending

Total Loan Advances (in millions, net of loans sold) - 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Personal Installment Loans Home equity products Consumer real estate loans Business real estate loans Business loans Tax-free loans 2011 2012 2013

Loan Participations

. JVB Southwood Office Centre

Mortgage Lending

Consumer Lending

Enjoying Retirement – Living Well

Electronic Services

How many people know your Social Security number?

Francis J. Evanitsky

RESOLUTION The following resolution was adopted by the Board of Directors of The Juniata Valley Bank and Juniata Valley Financial Corp . at their April 15 , 2014 meetings : WHEREAS, Francis J . Evanitsky will retire as Director of The Juniata Valley Bank and Juniata Valley Financial Corp . effective May 20 , 2014 , and WHEREAS, it is fitting to be placed on record an appreciation of his sixteen ( 16 ) years of service to the Company, THEREFORE, BE IT RESOLVED, that we have enjoyed in Mr . Evanitsky a true and loyal friend and associate, who was always committed and dedicated to the best interest and welfare of the Company ; That we extend best wishes to Mr . Evanitsky on his retirement, and that a copy of this resolution be given to him, and further placed upon the records of this Company . BOARD OF DIRECTORS THE JUNIATA VALLEY BANK and JUNIATA VALLEY FINANCIAL CORP

Hurdles • Increasing costs of regulation • Limitations imposed by Consumer Protection • Increasing Financial Disclosures • Higher Capital Requirements • Weakened economy • Flat yield curve

From INC .

Capital Strength • Regulatory Measurement of Capital Adequacy • Necessary to support growth in Assets • Growth in Assets is necessary to support growth in earnings • Growth in Earnings is necessary to support growth in shareholder value.

Performance Comparison Risk - Based Capital Ratios 13.00% 14.00% 15.00% 16.00% 17.00% 18.00% 19.00% 20.00% 2011 Year 2012 Year 2013 Year 2014 Qtr 1 JUVF Selected Local Peers PA Banking Corps

Signs of Progress