UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| S | Definitive Proxy Statement | | |

| ¨ | Definitive Additional Materials | | |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 | | |

CITY NATIONAL BANCSHARES CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| £ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| £ | Fee paid previously with preliminary materials. |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement no.: |

CITY NATIONAL BANCSHARES CORPORATION

900 Broad Street

Newark, New Jersey 07102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To be held on Thursday, June 28, 2012

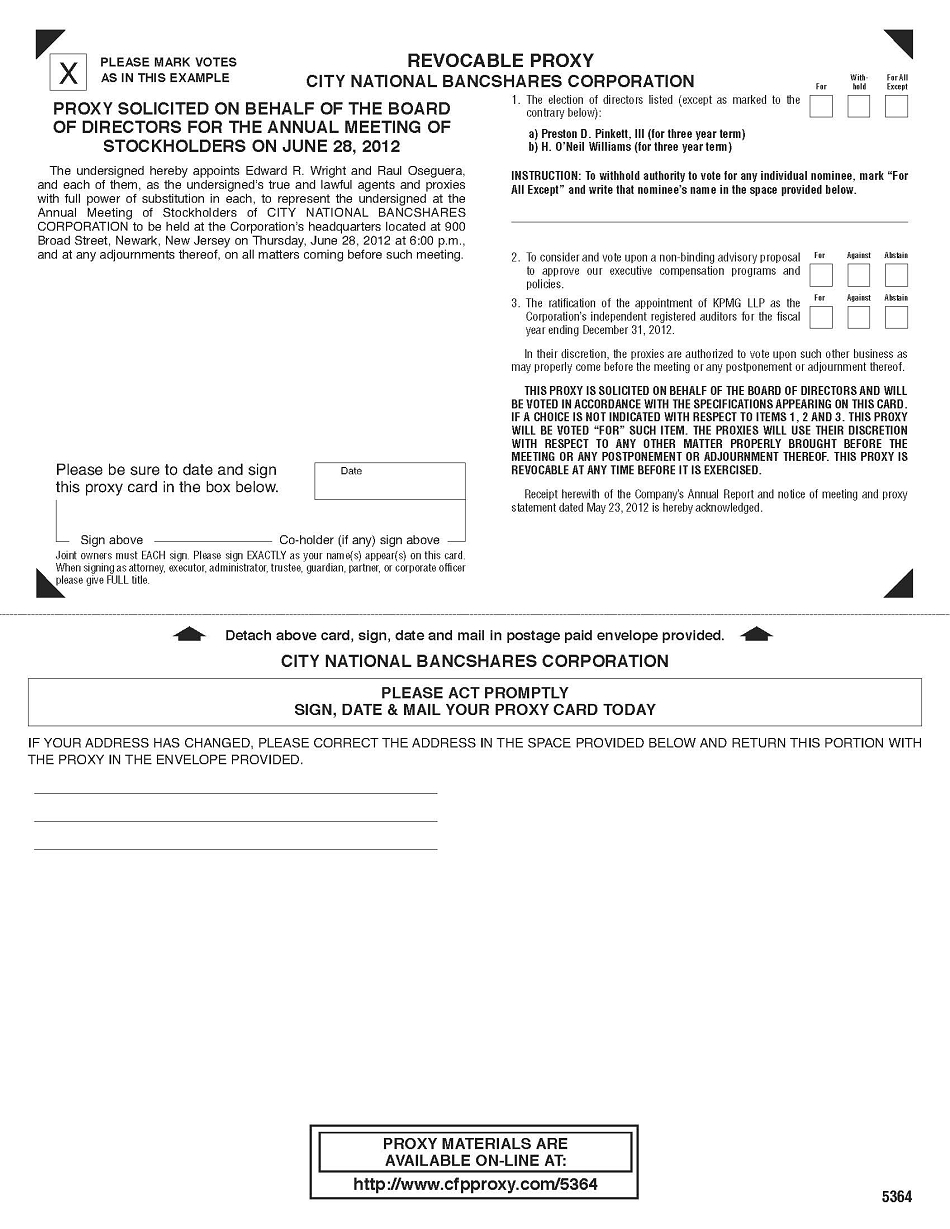

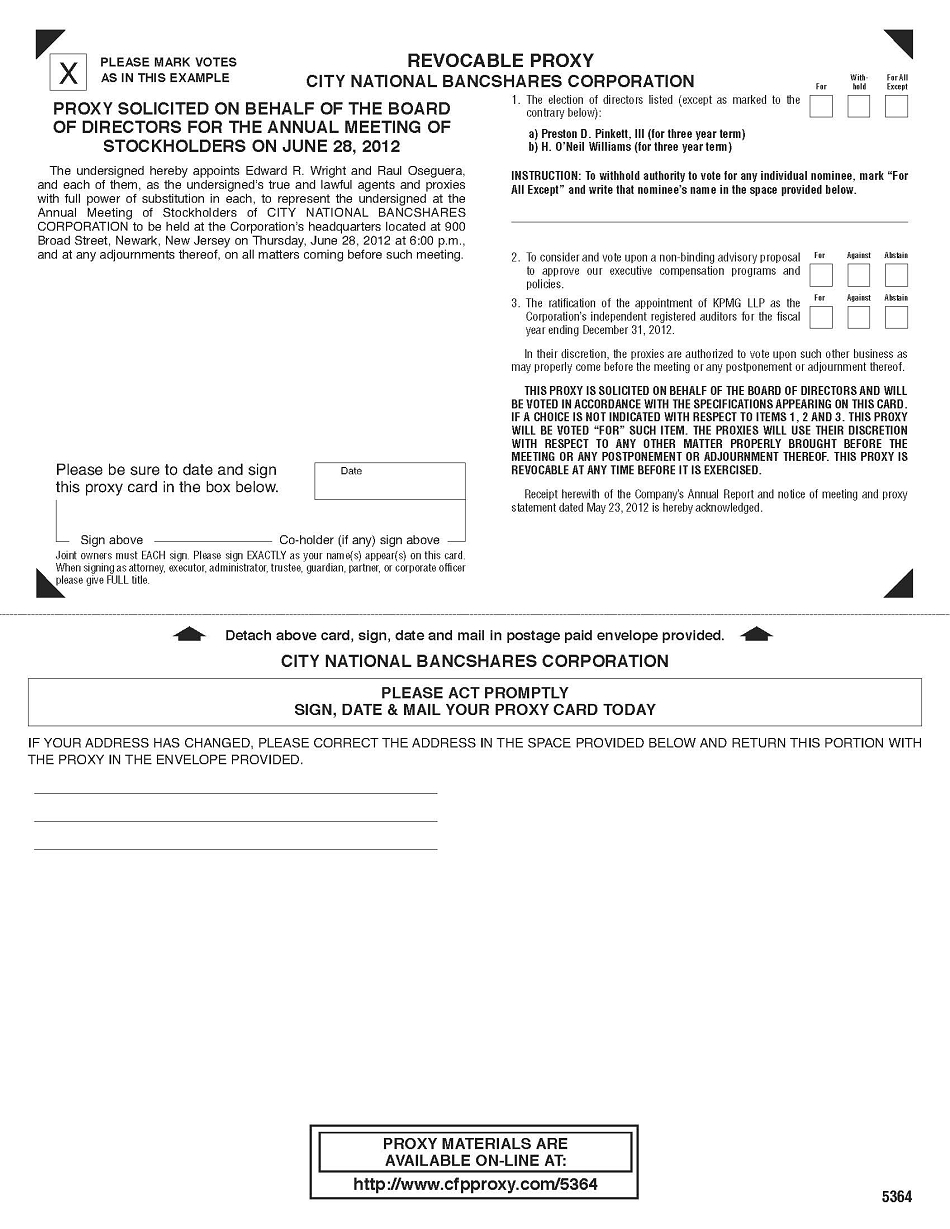

Notice is hereby given that the Annual Meeting of Stockholders of City National Bancshares Corporation (the "Corporation", “we” or “us”) will be held at City National Bank of New Jersey located at 900 Broad Street, Newark, New Jersey, on Thursday, June 28, 2012, at 6:00 p.m. for the following purposes:

| 1. | To elect two (2) directors for a term of three (3) years, or until their successors are elected and qualified; |

| 2. | To consider and vote upon a non-binding advisory proposal to approve our executive compensation programs and procedures; and |

| 3. | To ratify the appointment of KPMG LLP as our registered independent public accountants for the fiscal year ending December 31, 2012. |

Stockholders of record at the close of business on May 16, 2012 are entitled to notice of and to vote at the meeting.

Our Proxy Statement and its 2011 Annual Report to Stockholders accompany this Notice.

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING. IT IS IMPORTANT THAT YOUR SHARES ARE REPRESENTED AT THE MEETING. ACCORDINGLY, PLEASE SIGN, DATE AND MAIL THE ENCLOSED PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING. IF YOU DO ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS. FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 28, 2012 THIS PROXY STATEMENT AND OUR 2011 ANNUAL REPORT ON FORM 10-K FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011, AS FILED WITH THE SEC, WILL BE AVAILABLE AT WWW.CFPPROXY.COM/5364 ON OR ABOUT MAY 29, 2012. DIRECTIONS TO THE ANNUAL MEETING MAY BE OBTAINED BY CALLING US AT (973) 624-0865.

| | By order of the Board of Directors |

| | |

| | /s/ Lemar C. Whigham |

| | Lemar C. Whigham |

| | Secretary |

Newark, New Jersey

May 23, 2012

CITY NATIONAL BANCSHARES CORPORATION

900 Broad Street

Newark, New Jersey 07102

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 28, 2012

Introduction

The enclosed proxy is solicited by and on behalf of the Board of Directors of City National Bancshares Corporation (the "Corporation", “we” or “us”) for use at the Annual Meeting of Stockholders to be held on Thursday, June 28, 2012, at 6:00 p.m., at City National Bank of New Jersey located at 900 Broad Street, Newark, New Jersey or at any adjournment thereof.

Voting and Revocability of Proxy

The enclosed proxy is for use at the meeting if you do not attend the meeting, or if you wish to vote your shares by proxy even if you attend the meeting. You may revoke your proxy anytime before its exercise by (i) giving written notice to the Secretary of the Corporation, (ii) submitting a proxy having a later date, or (iii) appearing at the meeting and requesting to vote in person. Where a choice or abstention is specified in the form of proxy with respect to a matter being voted upon, the shares represented by proxy will be voted in accordance with such specification. If a proxy is signed but no specification is given, the shares will be voted for the director nominees named herein and in favor of the other proposal described below.

This Proxy Statement and the enclosed proxy and 2011 Annual Report to Stockholders are being first mailed to our stockholders on or about May 30, 2012. We will bear the cost of preparing this Proxy Statement and of soliciting proxies in the enclosed form. Proxies may be solicited by our employees, either personally, by letter or by telephone. Such employees will not be specifically compensated for soliciting said proxies.

Only holders of record of our common stock at the close of business on May 16, 2012 (the "Record Date"), are entitled to notice of, and to vote at, the meeting. At the close of business on the Record Date, there were outstanding and entitled to vote, 142,842 shares of common stock, each of which is entitled to one vote. The presence in person or by proxy of a majority of the outstanding shares of common stock will constitute a quorum for the purposes of the meeting.

The proposals to approve the appointment of independent auditors are considered “discretionary” items. This means that brokerage firms may vote in their discretion on such matters on behalf of clients who have not furnished voting instructions at least 10 days before the date of the annual meeting. In contrast, the election of Directors and the non-binding advisory resolutions regarding the compensation of the Corporation’s executives are “non-discretionary” items. This means brokerage firms that have not received voting instructions from their clients on this proposal may not vote on it.

For purposes of counting votes, abstentions and broker non-votes (i.e., shares held by brokers that they can't vote because they haven't received voting instructions from their customers with respect to matters voted on) will be treated asshares that are present and entitled to vote for purposes of determining the presence of a quorum, but will not be considered in determining the number of votes necessary for approval and will have no effect on the outcome of the vote for election of directors. For purposes of determining the votes cast on any matter at the meeting, only "FOR" and "AGAINST" votes are included.

We bear the cost of preparing, printing, assembling and mailing all proxy materials that may be sent to shareholders in connection with this solicitation. We will reimburse brokerage firms and other custodians, nominees and fiduciaries for their expense incurred in sending proxies and proxy materials to beneficial owners of our common stock.

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes of approximately equal size. Directors are elected for three-year terms on a staggered basis, so that the term of office of one class will expire each year at the annual meeting of stockholders when a successor is elected and qualified and terms of office of the other classes will continue for additional periods of one and two years, respectively. The Corporation’s failure to pay dividends for more than five (5) consecutive dividend periods has triggered the right of the holders of the Series F preferred stock to appoint two (2) additional directors, and the Corporation’s failure to pay dividends for more than six (6) consecutive dividend periods with respect to the Series G preferred stock has triggered the right of the holders of Series G preferred stock and Series F preferred stock to appoint two (2) additional directors.

Voting Procedures

Directors are elected by a plurality of votes cast. Shares cannot be voted for a greater number of persons than the number of nominees named herein. Should any nominee be unavailable for election by reason of death or other unexpected occurrence, the enclosed proxy, to the extent permitted by applicable law, may be voted with discretionary authority in connection with the nomination by the Board and the election of any substitute nominee.PROXIES, UNLESS INDICATED TO THE CONTRARY, WILL BE VOTED "FOR" THE ELECTION OF THE NOMINEES NAMED BELOW TO SERVE FOR THE TERMS SET FORTH BELOW.

Preston D. Pinkett, III and H. O’Neil Williams, currently serving as directors of the Corporation, are being nominated by non-management directors to serve as directors with terms expiring at the 2015 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified.

Information is presented below relating to the principal occupation, the business experience and the period during which each director has served on the Board of Directors of the Corporation and the Board of Directors of City National Bank of New Jersey (the "Bank").

The Board has nominated and recommends a vote “FOR” the election of the nominated slate of directors.

| Name of Director | Age | Director Since | Term

Ends | Principal Occupations |

| Alfonso L. Carney, Jr. | 63 | 2010 | 2013 | Chairman of the Board, Dormitory Authority of the State of New York and New Jersey; Principal, Rockwood Partners, LLC (providers of medical and legal consulting services)

|

| Eugene Giscombe | 71 | 1991 | 2014 | President, Giscombe Realty, LLC (real estate brokerage, leasing and management firm); President, 103 East 125th Street Corporation (real estate holding company)

|

| Preston D. Pinkett, III | 49 | 2010 | 2012 | President and Chief Executive Officer, City National Bank of New Jersey and City National Bancshares Corporation (effective March 1, 2011)

|

| Louis E. Prezeau | 69 | 1989 | 2014 | Retired President and Chief Executive Officer, City National Bank of New Jersey and City National Bancshares Corporation

|

| Lemar C. Whigham | 68 | 1989 | 2013 | President, L & W Enterprises (vending machine operations)

|

| H. O’Neil Williams | 65 | 2009 | 2012 | Retired Managing Partner, Mitchell & Titus, LLP (CPA Firm) |

Alfonso L. Carney, Jr.has been Chairman of the Dormitory Authority of the State New York (DASNY) which provides low-cost capital financing and manages public construction projects since May 2009. Mr. Carney is also a member of the Water Board of the City of New York. Since 2005, Mr. Carney has also been a principal in Rockwood Partners LLC, a medical and legal consulting firm. For the prior 30 years, he held senior legal and executive positions at major organizations and their affiliates, including Goldman Sachs Foundation, Altria Group, Inc., Philip Morris Companies, and Kraft Foods. From 2008 to the present, Mr. Carney has served as a trustee of Trinity College, Riverdale Country School, the University of Virginia School of Law Foundation, The Thomas Jefferson Foundation, and Veritas, Inc. He is an attorney with broad experience in the fields of corporate governance, social responsibility, compliance, technology and government relations, which are qualifications that make him desirable for Board membership.

Eugene Giscombe has been President of Giscombe Realty Group, LLC, a commercial real estate brokerage, leasing and management firm located in New York City since 1972, as well as President of 103 East 125th Street Corporation, a commercial real estate holding company also located in New York City since 1979, and a member of TAP TAP LLC, a commercial real estate holding company also located in New York City. Mr. Giscombe’s firm has provided real estate services to major banks and insurance companies for a period of 38 years. Mr. Giscombe currently serves as a director of the YMCA of Greater New York, Greater Harlem Nursing Home and formerly chaired the 125th Street Business Improvement District. Mr. Giscombe has served on several committees of the Real Estate Board of New York Inc. Mr. Giscombe’s extensive experience in commercial real estate in the Bank’s market area provides extensive insight into the management of the Bank’s commercial real estate loan portfolio. Mr. Giscombe has been Chairman of our Board of Directors since May 1997.

Preston D. Pinkett, III has been serving as the President and Chief Executive Officer of the Bank and the Corporation since March 1, 2011. Prior to his employment at the Bank he was a Vice President at Prudential Financial Corporation since September 2007. Prior to his employment at Prudential, Mr. Pinkett had been the Senior Vice President at New Jersey Economic Development Authority (“NJEDA”) from 2003 to 2007. Prior to his employment at the NJEDA, Mr. Pinkett served as a Senior Vice President of PNC Bank where he managed a network of retail branches serving disinvested neighborhoods throughout New Jersey and Pennsylvania from 1995 to 2003. Prior to his employment at PNC Bank, Mr. Pinkett served as Senior Vice President of Chemical Bank, New Jersey, where he managed its community development activities within New Jersey from 1988 to 1995. Mr. Pinkett also serves on the board of University Ventures, Inc. a specialized small business investment company, Montclair State University, the National Bankers Association, Global Impact Investment Network, Gate Impact, LLC and Cityworks. He also services as Vice Chairperson of the Geraldine R. Dodge Foundation. Mr. Pinkett has developed a strong reputation as a creative, socially-conscious lender in many of the same communities currently served by the Bank, which are qualifications that make him desirable for Board membership.

Louis E. Prezeau has been the President and Chief Executive Officer of the Corporation and the Bank, serving in those capacities since 1989 until his retirement, effective March 1, 2011. He also serves on the boards of the Bank and the Corporation and boards of several nonprofit organizations located in the Bank’s market area. Mr. Prezeau’s direct experience in managing the operations and employees of the Bank provides the Board of Directors with insight into its operations, and his position on the Board of Directors provides a clear and direct channel of communication from senior management to the full Board and alignment on corporate strategy.

Lemar C. Whigham has been Secretary of the Board of the Corporation and the Bank, serving in this capacity since 1989. Mr. Whigham has also been President and owner of L&W Enterprises since May 1992, a company that places vending machines in small businesses in Newark, New Jersey, and surrounding areas, where Mr. Whigham has significant community ties near the Bank’s locations. He was also the Chairman and Commissioner of the Parking Authority of the City of Newark, New Jersey from 2004 to 2008. Mr. Whigham has also been a New Jersey licensed funeral director since 1967. This knowledge provides him with valuable insights, particularly into portfolio loans and customer relationships in the Newark area. He is also the son of the founder of the Bank.

H. O’Neil Williams was a managing partner with the CPA firm of Mitchell & Titus, a member firm of Ernst & Young Global Limited, from 1981 until 2010. He is a CPA with over 35 years of diversified auditing and financial accounting experience with extensive insight into the financial aspects of the financial services industry. He currently serves as a trustee of on the New Jersey Teachers Pension and annuity Fund and on the board of the Cerebral Palsy of New Jersey. Mr. Williams has been designated as our audit committee “financial expert.”

Executive Officers

Listed below is certain information concerning the current executive officers of the Corporation.

Name |

Age | In Office

Since |

Office and Business Experience |

| Preston D. Pinkett III | 49 | 2011 | President and Chief Executive Officer, City National Bancshares Corporation and City National Bank of New Jersey

|

| Edward R. Wright | 66 | 1994 | Senior Vice President and Chief Financial Officer, City National Bancshares Corporation and City National Bank of New Jersey; Partner, Tap Tap LLC and Tap Tap Investments; 1978-1994, Executive Vice President and Chief Financial Officer, Rock Financial Corporation |

| Raul Oseguera | 46 | 1990 | Senior Vice President, City National Bank of New Jersey; Assistant Secretary, City National Bancshares Corporation |

| Walter T. Bond | 54 | 11/2011 | Senior Vice President and Chief Administration Officer, City National Bank of New Jersey; 2002-2011, Manager, The Bond Consulting Group |

| Carlton R. West | 49 | 10/2011 | Senior Vice President and Chief Information Officer, City National Bank of New Jersey; 2010-2011, Manager, New Trend Consulting; 2008-2010, Senior Vice President and Chief Information and Operations Officer, Orion Bank; 2005-2008, Chief Information Officer, Boca Developers/In Touch Communications |

Corporate Governance

General

Our business and affairs are managed under the direction of the Board of Directors. Board members are kept informed of our business by participating in meetings of the Board and its committees and through discussions with corporate officers. All members also served as members of our subsidiary bank, City National Bank of New Jersey, during 2011. It is our policy that all directors attend the annual meeting, absent extenuating circumstances. All members of the Board attended the 2011 annual meeting.

Meetings of the Board of Directors and Committees

During 2011, the Board of Directors held ten meetings. A quorum was present at all meetings and no director attended fewer than 75% of the meetings held by the Board and committees of which such director was a member.

All of our directors are also directors of the Bank. Regular meetings of our and the Bank’s Boards of Directors are held monthly. Additional meetings are held when deemed necessary. In addition to meeting as a group to review our business, certain members of the Board also serve on certain standing committees of the Bank’s Board of Directors. These committees, which are described below, serve similar functions for the Corporation.

Because of the relatively small size of our Board, there is no standingNominating Committee or nominating committee charter. The individual members of the entire Board, exclusive of interested directors, make the specific recommendations for Board nominees. Qualifications for prospective directors are reviewed by the entire Board. Messrs. Prezeau and Pinkett would not be considered independent under relevant SEC and NASDAQ rules.

The Board has not formulated specific criteria for nominees, but it considers qualifications that include, but are not limited to, ability to serve, conflicts of interest, and other relevant factors. In consideration of the fiduciary requirements of a Board member, and our relationship and our subsidiaries’ relationship to the communities they serve, the Committee places emphasis on character, ethics, financial stability, business acumen, and community involvement among other criteria it may consider. In addition, as a bank holding company, we are regulated by the Federal Reserve Board (“FRB”) and the Bank, as a national banking association, is regulated by the Office of the Comptroller of the Currency (“OCC”). Directors and director-nominees are subject to various laws and regulations pertaining to bank holding companies and national banks, including a minimum stock ownership requirement. The Board may consider recommendations from shareholders nominated in accordance with our bylaws by submitting such nominations to the President of the Corporation and the Bank, the Office of the Comptroller of the Currency and the Federal Reserve. For additional information regarding the requirements for shareholder nominations of director nominees, see the Corporation’s by-laws, copies of which are available upon request. We have not paid a third party to assist in identifying, evaluating, or otherwise assisting in the nomination process. The Board of Directors does not have a policy regarding diversity in identifying nominees for director.

TheAudit and Examining Committee reviews significant auditing and accounting matters, the adequacy of the system of internal controls and examination reports of the internal auditor, regulatory agencies and independent public accountants. Messrs. Carney, Williams and Whigham currently serve as members of the Committee. Ms. Barbara Bell Coleman served on the Committee in 2011 until her resignation on June 30, 2011. Mr. Williams serves as Chairperson of the Committee. All directors currently on the Audit and Examining Committee are and Ms. Coleman was considered independent under SEC and NASDAQ rules applicable to audit committees. Mr. Williams is our audit committee financial expert. The Committee met four times during 2011.

The Audit and Examining Committee operates pursuant to a charter, which gives the Committee the authority and responsibility for the appointment, retention, compensation and oversight of the Corporation’s independent registered public accounting firm, including pre-approval of all audit and non-audit services to be performed by our independent registered public accounting firm (See “Proposal 3 - Appointment of Independent Registered Public Accounting Firm”). The Audit and Examining Committee acts as an intermediary between the independent auditor and the Corporation and reviews the reports of the independent auditor. A copy of the charter may be accessed on our website located atwww.citynatbank.com by clicking on the “Security & Disclosures” link at the bottom of the web site.

TheLoan and Discount Committee reviews all (a) loan policy changes, (b) requests for policy exceptions, and (c) loans approved by management. Messrs. Carney, Pinkett, Prezeau, Williams, and Whigham currently serve as members of the Committee. Mr. Giscombe serves as Chairperson of this Committee. The Committee met 12 times during 2011. Ms. Coleman served on the Committee in 2011 until her resignation on June 30, 2011.

TheInvestment Committee reviews overall interest rate risk management and all investment policy changes, along with purchases and sales of investments. Messrs. Carney, Pinkett, Prezeau and Williams currently serve as members of this Committee. Mr. Prezeau serves as Chairperson of this Committee. The Committee met four times during 2011.

ThePersonnel/Director and Management Review Committee oversees personnel matters and reviews director and executive officer compensation, and serves as the “Compensation Committee.” Messrs. Carney and Williams currently serve as members of the Committee. Mr. Carney serves as Chairperson of the Committee. Ms. Coleman served as Chairperson of the Committee in 2011 until her resignation on June 30, 2011. This Committee addresses issues related to attracting, retaining, and measuring employee performance. The Committee recommends to the Board of Directors the annual salary levels and any bonuses to be paid to all Corporation and Bank executive officers. The Committee also makes recommendations regarding other compensation related matters. The Committee has not delegated this authority. The Committee has not historically engaged consultants, although the Committee continued its 2010 engagement of the services of an independent executive compensation consultant, I.F.M. Group, Inc., to assist it in carrying out certain responsibilities with respect to executive and employee compensation. Such consultant has provided no other services. In addition, the Committee requested Sandler O’Neil Partners, who has been engaged to assist us with matters relating to capital raising, to provide assistance in valuing shares of our common stock that are being issued to Mr. Pinkett pursuant to his November 2011 employment agreement. The Committee has a charter, which may be accessed on our website located atwww.citynatbank.com by clicking on the “Security & Disclosures” link at the bottom of the web site.

The executive officers do not play a role in the compensation process, except for the former chief executive officer Mr. Prezeau, who during his tenure in office presented information regarding the other executive officers to the Committee for its consideration, but he was not present while the Committee deliberated on his compensation package. All members of the Committee are independent (and Ms. Coleman was independent when she served) under NASDAQ independence standards. The Committee met four times during 2011. See “Executive Compensation-- Compensation Discussion and Analysis” for more information regarding the role of this Committee. Notwithstanding the foregoing, for purposes of making the assessments and reviews required to comply with TARP (as defined below), the entire Board carries out the duties and functions of a compensation committee under TARP.

TheCompliance Committee was formed as a result of the Formal Agreement, dated June 29, 2009 (the “Agreement”), between the OCC and the Bank, to oversee compliance with the terms of the Agreement and the Consent Order, dated December 22, 2010, between the OCC and the Bank. The entire Board serves as the Compliance Committee. Ms. Coleman served on the Committee in 2011 until her resignation from the Board. Director Williams chairs this Committee. The Committee held eighteen meetings during 2011.

As Chairman of the Board, Mr. Giscombe currently serves on all committees, with the exception of the Audit and Examining Committee.

Separation of Roles of Chairman and CEO

Mr. Giscombe serves as the Chairman of our Board of Directors and Mr. Prezeau served as Chief Executive Officer until March 1, 2011 and Mr. Pinkett began service as Chief Executive Officer thereafter. We believe the separation of offices is beneficial because a separate chairman (i) can provide the Chief Executive Officer with guidance and feedback on his performance; (ii) provides a more effective channel for the Board of Directors to express its view on management; and (iii) allows the Chairman to focus on stockholder interest and corporate governance while the Chief Executive Officer manages our operations.

Board’s Role in Risk Assessment

The Board of Directors is actively involved in oversight of risks that could affect the Corporation and the Bank. This oversight is conducted in part through committees of the Board of Directors, but the full Board of Directors has retained responsibility for general oversight of risks. The Board of Directors satisfies this responsibility through oral and written reports by each committee regarding its considerations and actions, as well as through oral and written reports directly from officers responsible for oversight of particular risks. Further, the Board of Directors oversees risks through the establishment of policies and procedures that are designed to guide daily operations in a manner consistent with applicable laws, regulations and risks acceptable to the Corporation and the Bank.

Code of Ethics and Conduct

The Corporation has adopted a Code of Ethics and Conduct which applies to all our officers and employees. Interested parties may obtain a copy of such Code of Ethics and Conduct, without charge, by written request to the Corporation c/o Assistant Secretary, City National Bank of New Jersey, 900 Broad Street, Newark, New Jersey 07102.

DIRECTOR COMPENSATION

Director Compensation

The following describes the provisions of our Director compensation plan. Under the plan, each of our directors receives an annual retainer of $4,000 (with the exception of Messrs. Carney and Pinkett with respect to such retainer), and a $600 fee for each board meeting attended except for the chairperson, who receives $700, and the secretary, who receives $650. Committee chairpersons receive $350 for each meeting attended other than the chairperson of the Loan and Discount Committee who receives $400 per meeting. Other committee members receive $300 for each meeting attended. Directors are eligible to receive bonuses based on our overall earnings performance for the previous fiscal year as determined by our chief executive officer. Directors received no fees or other compensation under the plan in 2011 as stipulated by the Consent Order.

Director’s Retirement Plan

Effective January 1, 1997, we instituted a director retirement plan (“Director’s Retirement Plan”). Under this plan, a director who attains the age of at least 65 and has completed five years of service on the Board, shall receive a lump sum benefit equal to 50% of the aggregate amount of the director’s fees paid to such director during the then last full fiscal year of the Corporation (the “normal retirement benefit”). If the director ceases service on the Board prior to attaining the age of 65 but after completing at least five years of service on the Board, the director shall receive an annual benefit equal to the normal retirement benefit payable over the same period of time multiplied by a fraction the numerator of which is the director’s years of service prior to termination of employment and the denominator of which is the years of service the director would have had the director remained employed until age 65.

Upon a change in control of the Corporation (which is defined in the director retirement plan as the acquisition by a non-affiliate of the Corporation of 30% or more of our outstanding common stock which is followed by (a) the termination of a director for any reason, or (b) the failure of such director to be elected, for whatever reason, for an immediately succeeding term upon the natural expiration of his/her term) followed by a termination of the director’s status as a member of the Board for any reason or a failure for whatever reason for the director to be nominated and elected to an immediately succeeding term, the director shall receive a benefit equal to the present value (discounted at the rate of 4%) of a theoretical series of 120 monthly payments, with each payment equal to 1/12 of the normal retirement benefit without regard as to whether the director otherwise qualified for the normal retirement benefit.

If a director dies while in active service on the Board, the designated beneficiary of such director shall receive the greater of the normal retirement benefit accrued by us for such director as of the date of such director’s death or the normal retirement benefit described above.

We may amend or terminate this plan at any time prior to termination of service by the director, provided that all benefits accrued by us as of the date of such termination or amendment shall be fully vested; and, provided further, that the plan may not be amended or terminated after a change in control (as defined) unless the director consents thereto.

We terminated the plan as of June 30, 2010, at which time all benefits accrued as of such date became fully vested.

Director Compensation Table

Messrs Pinkett, Giscombe, Williams, Whigham, Carney and Prezeau and Ms. Coleman served as directors in 2011. There was no reportable compensation to any person who served as director in 2011 , and as a result the Director Compensation Table is omitted. Compensation for Messrs. Pinkett and Prezeau for their service as officer is set forth in the Summary Compensation Table.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Board of Directors, through its Personnel/Director and Management Review Committee, is responsible for establishing and monitoring compensation levels. The primary factors that affect compensation are our operating results, the individual’s job performance and peer group compensation comparisons. The key components of executive compensation are base salary and annual bonuses, which are performance based, and retirement and welfare benefits, which are non-performance based. The Committee monitors the results of the annual advisory “say-on-pay” proposal and incorporates such results as one of many factors considered in connection with the discharge of its responsibilities, although no such factor is assigned a quantitative weighting. Because a substantial majority (99.2%) of our stockholders approved the compensation program described in our proxy statement in 2011, the Committee did not implement changes to our executive compensation program as a result of the stockholder advisory vote.

Salary

The primary factors that affect the compensation of Messrs. Pinkett, Prezeau, Wright and Oseguera (the “named executive officers”) are the responsibilities of the position, the individual’s job performance, our operating results and peer group compensation comparisons. Salary levels are reviewed annually and adjustments are made in the year following the year being reviewed.

Cash Bonus

As a recipient of TARP funds that have not been repaid, the Corporation may no longer pay a bonus to the President and CEO. Cash bonuses for other named executive officers are based on their job performances, the performance of their particular areas of responsibility and the overall performance of the Corporation compared to budgeted projections.

Non-performance Based Compensation Elements

The Corporation maintains a supplemental employee retirement plan (the “SERP”) implemented by salary continuation agreements with all of our named executive officers other than Mr. Pinkett. This provides benefits upon retirement, death and change of control. This part of our compensation package encourages executives to remain employed by us for the long term. However, the SERP was terminated and the accrued benefits frozen as of June 30, 2010. See “Executive Compensation—Supplemental Executive Retirement Plan,” below.

TARP/CPP Executive Compensation Compliance and Restrictions

As part of our participation in the Capital Purchase Program (“CPP”) of the Troubled Assets Relief Program (“TARP”) and our acceptance of a $9.4 million investment from the U.S. Treasury Department (“Treasury”) in April 2009, we agreed to adhere to several restrictions relative to compensation for our five senior executive officers (“SEOs”), which include the executives listed in our Summary Compensation Table below during the time in which the Treasury holds any equity or debt securities of the Corporation acquired through the CPP. At the time of our acceptance into the CPP, the restrictions and requirements included:

| • | A provision to recover any bonus or incentive compensation paid to an SEO that was based on financial statements deemed materially inaccurate; |

| • | A prohibition on any golden parachute payments to our SEOs; |

| • | A prohibition on receiving any tax gross-up from the Corporation or its subsidiaries; |

| • | A limitation on the deductibility of compensation to $500,000 (instead of $1,000,000), without exceptions for performance-based compensation; and |

| • | A requirement to ensure that our incentive compensation programs are structured to prevent SEOs from taking inappropriate risks that threaten the value of the institution. |

At the time that we entered the CPP, our SEOs understood that these restrictions or requirements might change and waived any claim against the United States or us and our subsidiaries for any changes to compensation or benefits that are required to comply with the regulations issued by the Treasury, as published in the Federal Register on October 20, 2008, notwithstanding the terms of his/her employment arrangements with the Corporation or its subsidiaries or other benefit plans, whether or not in writing.

In February 2009, TARP was amended by the American Recovery and Reinvestment Act of 2009 (the “ARRA”). Treasury issued final interim rules on June 15, 2009 to implement the ARRA standards. Such amendments further restrict our ability to pay executive compensation. Specifically, under such prohibitions, since we received less than $25 million of financial assistance, we are prohibited from paying or accruing any bonus, retention award, or incentive compensation to our most highly-compensated employee during the period that we have an outstanding obligation to the Treasury arising from the financial assistance provided under CPP. This restriction continues until repayment of the Treasury’s investment. This restriction does not apply to payment of a portion of salary in stock. This restriction also does not apply to our issuance of incentive compensation in the form of restricted stock to our most highly-compensated employee so long as such restricted stock: (i) does not fully vest during the CPP obligation period; (ii) has a value no greater than one-third of the total amount of “annual compensation” of the executive receiving the restricted stock; and (iii) is subject to such other terms as the Treasury determines to be in the public interest. No restricted stock was awarded or issued in 2011 other than as part of salary.

In addition, the new legislation expands the prohibition against paying golden parachute payments by defining a golden parachute payment as any payment to an SEO or any of the next five most highly compensated employees for departure from the Corporation for any reason, except for payments for (a) services performed or benefits accrued, (b) death and disability and/or (c) qualified plans. Accordingly, for as long as we participate in the CPP, our SEOs will not be entitled to any payments upon departure from us other than payments for (i) services performed or which were accrued at the time of departure, (ii) death and disability at the time of such death or disability, and/or (c) pursuant to qualified plans at the time of departure. Regulatory guidance has not yet been issued on the restrictions set forth in the new legislation. Such guidance, when issued, may change the manner in which such restrictions are applied. The Corporation believes this would restrict its ability to make change of control payments under the Director’s Retirement Plan (as defined below) with respect to executive officers that are also directors and the SERP.

Pinkett Compensation and Employment Agreement

Effective March 1, 2011, the Bank and the Corporation entered into an employment agreement, as amended (the “Original Agreement”), with Mr. Pinkett to serve as the President and Chief Executive Officer of both entities. The Original Agreement was for a term of six months. Under the Original Agreement, Mr. Pinkett received a salary of $150,000 consisting of $125,000 in cash and 667 shares of the Corporation’s common stock, valued at $37.50 per share or $25,000 in the aggregate.

On October 31, 2011, the Bank and the Company entered into a new one year employment agreement (the “Current Agreement”) effective as of November 1, 2011 with Mr. Pinkett to serve as President and Chief Executive Officer at an annual salary of $395,000 per year, consisting of $335,000 in cash and $60,000 in stock (20,000 shares of common stock valued at $3.00 each). Mr. Pinkett is also entitled to a $1,200 per month auto allowance.

In the Current Agreement, Mr. Pinkett has agreed that following (i) voluntary termination by him of his employment for any reason other than as a result of a material breach of his employment agreement by us, (ii) termination of his employment by us for cause, or (iii) expiration of his employment agreement as a result of his failure to accept our offer of a renewal of the employment agreement, he will not compete with us or any of our affiliates for a period of one (1) year following such termination within a 30 mile radius from the Bank’s main office located at 900 Broad Street, Newark, New Jersey or within a three mile radius from the location of any branch of the Bank existing as of the date of such termination.

In addition, the Current Agreement provides that its terms are subject to the laws, rules, and guidance of the U.S. Department of Treasury’s Troubled Asset Relief (“TARP”) Program Capital Purchase Program and that until we are no longer a participant in and subject to the TARP Capital Purchase Program rules and guidance the Board of Directors of the Bank and CNBC (collectively, the “Board”) can unilaterally and without Mr. Pinkett’s consent amend any of the provisions of his Current Agreement, including, but not limited to, reducing the amount of compensation and benefits provided therein, if in the Board’s sole judgment the modification is necessary to comply with the mandatory application of the U.S. Department of Treasury’s rules and guidance governing executive compensation of participants of the TARP Capital Purchase Program.

In connection with the Original Agreement, Mr. Pinkett was required to execute a waiver, which remains in effect, disclaiming any rights to payment of a bonus as well as any severance or change of control benefits, if any, for as long as the TARP preferred stock is outstanding.

Mr. Pinkett is also entitled to fringe, medical, health and life insurance benefits comparable to those received by other full-time Bank employees. Mr. Pinkett is currently eligible to participate in the Bank’s 401(k) plan.

Mr. Prezeau Employment & Trust Agreements

Prezeau Employment Agreement

On May 18, 2010, the Corporation and Bank entered into an employment agreement with Mr. Prezeau (the “Agreement”) to serve as the President and Chief Executive Officer of both entities. The Agreement was for a term of one year and was scheduled to automatically renew for successive one-year terms unless six months notice was given prior to the expiration of the Agreement. Under the Agreement, Mr. Prezeau was entitled to an annual salary of $268,000, which could be increased annually at the discretion of the Board.

Upon termination of the Agreement with or without cause, or upon death or disability, Mr. Prezeau was entitled to receive accrued and unpaid salary and benefits thereunder as of such termination date. In addition, solely upon (a) death while employed, we were required to continue health benefits for Mr. Prezeau’s family members for one year after death, and (b) disability, we were required to provide long-term disability benefits for Mr. Prezeau, including an additional long-term disability policy providing a disability benefit of an amount equal to two-thirds of Mr. Prezeau’s annual base salary in effect at the time of disability.

Mr. Prezeau was also entitled to fringe, medical, health and life insurance benefits, including life insurance for an amount of up to three times his base salary then in effect and a $1,200 per month car allowance.

Mr. Prezeau retired effective as of March 1, 2011.

Prezeau Trust Agreement

In the past, Mr. Prezeau has deferred portions of his salary under a deferred compensation arrangement (often called a “rabbi trust arrangement”) set up by the Corporation. All deferrals of Mr. Prezeau's salary were deposited by us into a trust (the "Trust") established for Mr. Prezeau's benefit pursuant to an irrevocable trust agreement (the "Trust Agreement”) The assets of the trust were paid to Mr. Prezeau after termination of his employment.

Messrs. Wright and Oseguera

Other named executive officers are not parties to employment agreements with the Corporation. Messrs. Wright and Oseguera receive annual salaries of $131,500 and $130,000, and monthly automobile allowances of $333 and $250, respectively. The Corporation also makes 401(k) contributions on their behalf. They also receive medical and dental benefits and participate in the SERP.

Supplemental Employee Retirement Plan

Certain executive officers participate in the SERP. Upon reaching normal retirement age of 65 while employed by us (“normal retirement”), executives will receive a lump sum payment based on an annual benefit equal to 40% of the annual base salary received by the executive during the last complete fiscal year of his or her service as an employee (the “normal retirement benefit”) except in the case of Mr. Prezeau, who will receive 60%. If the executive dies while in our active service, the beneficiary of the executive will receive an amount equal to the greater of that part of the normal retirement benefit accrued by us for the executive as of the date of the executive’s death or the projected retirement benefit calculated based on the executive’s age and other assumptions regarding increases in base salary. This death benefit is payable to the beneficiary in equal monthly installments over 15 years.

If the executive’s employment with us is terminated for any reason (other than death) between the age of 60 and 65 (“early retirement”), the executive shall receive the same benefit payable over the same period of time multiplied by a fraction the numerator of which is the executive’s years of service prior to termination of employment and the denominator of which is the years of service the executive would have had if the executive’s employment terminated when he was 65.

Upon a change in control of the Corporation (which is defined in the SERP as a change in the ownership or effective control of the Corporation, as defined in Internal Revenue Code Section 409A) followed at any time during the succeeding 12 months by a cessation in the executive’s employment for reasons other than death, disability or retirement, the executive shall receive (the “change of control benefit”) a lump sum payment equal to the present value of the stream of payments the executive would have received had he qualified for the normal retirement benefit.

If an executive’s employment with us is terminated for cause (as defined in the SERP) an executive is not entitled to any benefit under the SERP.

Under the SERP, an executive will receive only one of the normal retirement benefit, the early retirement benefit or the change of control benefit.

Under TARP, certain payments (that relate to unvested benefits to be received such as a result of a change of control) under the SERP are prohibited, see “Executive Compensation--TARP/CPP Executive Compensation Compliance and Restrictions”, above. Messrs. Pinkett, Wright and Oseguera have waived any rights to prohibited payments under TARP.

We terminated the SERP as of June 30, 2010, at which time all accrued benefits as of such date were frozen.

Other Benefits and Perquisites

Executive officers are eligible to participate (as are all officers and employees who meet service requirements under the several plans) in other components of the benefit package described below.

| • | Medical and dental health insurance plans; and |

We also provide automobile allowances to certain executive officers. No individual named executive officer received a total value of perquisites in excess of $25,000 during 2011. Additional details on perquisites are provided in the Summary Compensation Table included in this Proxy Statement. We view certain perquisites as being beneficial to the Corporation and the Bank, in addition to being directly compensatory to the executive officers. In addition, these perquisites, as a minor expense to the Company and the Bank, provide a useful benefit in our efforts to recruit, attract and retain top executive talent.

Executive Compensation Tables

Summary Compensation Table

Name and Principal Position | Year | Salary | Stock Awards ($) | Change in

Pension Value

and Non- Qualified Deferred

Compensation

Earnings | All Other

Compensation | Total |

Preston D. Pinkett, III, President and Chief Executive Officer, City National Bancshares Corporation and City National Bank of New Jersey | 2011 | $218,519 | (2) | $85,013 (2) | --- | | $ --- | (2) | $303,532 |

Louis E. Prezeau President and Chief Executive Officer, City National Bancshares Corporation and City National Bank of New Jersey (retired March 1, 2011) | 2009 2010 2011 | $268,000 $268,000 $ 90,728 | (7) | --- --- --- | $44,247 $83,205 $1,759 | (6) (6) (6) | $42,404 $49,178 $2,164 | (3) (3) (3) | $354,651 $400,383 $94,651 |

Edward R. Wright Senior Vice President and Chief Financial Officer, City National Bancshares Corporation and City National Bank of New Jersey | 2009 2010 2011 | $131,500 $131,500 $131,500 | | --- --- --- | $68,928 $36,772 $0 | (1) (1) (1) | $9,944 $9,944 $9,944 | (4) (4) (4) | $210,370 $178,216 $141,444 |

Raul Oseguera Senior Vice President, City National of Bank New Jersey and Assistant Secretary of City National Bancshares Corporation | 2009 2010 2011 | $111,500 $125,730 $133,000 | | --- --- --- | $22,609 $13,759 $0 | (1) (1) (1) | $6,345 $6,772 $6,990 | (5) (5) (5) | $140,454 $146,261 $139,990 |

The following table summarizes compensation in 2011 for services to the Corporation and the Bank paid to the Chief Executive Officers, Chief Financial Officer and to the only other two executive officers of the Corporation whose compensation exceeded $100,000 (“named executive officers”).

| (1) | Represents the change in the net present value of benefits from the taking into consideration each executive’s age, an interest rate discount factor and their remaining time until retirement (“Change in Pension Value”) with respect to the SERP. |

| (2) | All amounts reported in the “stock awards” column were an integral part of salary which had a cash component and stock component. The cash component is reported in the salary column and the stock component is reported under “stock awards.” Amounts reported in the “stock awards” column includes 667 shares valued at $37.50 per share for the period from March 1, 2011 through August 31, 2011 and 20,000 shares valued at $3.00 per share issued or to be issued for the period from November 1, 2011 through October 31, 2012. Mr. Pinkett received no compensation for services as a director in 2011. |

| (3) | Includes payments made under our profit sharing plan of $8,040, $8,040 and $2,164 in 2009, 2010, and 2011, respectively. Also includes $10,164, $11,988 and $0 in 2009, 2010 and 2011 representing Mr. Prezeau’s use of a Bank-leased automobile in such years. Includes Director Fees paid in cash of $24,200, and $29,150 in 2009 and 2010, respectively. Also includes contributions to a trust created pursuant to a Trust Agreement (see section below titled “Prezeau Trust Agreement”) of $6,694, $0 and $0 in 2009, 2010 and 2011, respectively, to reimburse the trust for payment of life insurance premiums on the life of Mr. Prezeau. Does not include $1,464,955 paid under the SERP or $85,000 withdrawn by Mr. Prezeau from the aforementioned trust in 2011. Mr. Prezeau received no compensation for services as a director in 2011. |

| (4) | Includes payments made under our profit sharing plan of $$3,944, $3,944 and $3,944 in 2009, 2010 and 2011, respectively, and automobile allowance payments of $6,000, $6,000 and $6,000 in 2009, 2010 and 2011, respectively. |

| (5) | Includes payments made under our profit sharing plan of $3,345, $3,772 and $3,990 in 2009, 2010, and 2011, respectively, and automobile allowance payments of $3,000, $3,000 and $3,000, in 2009 2010 and 2011, respectively. |

| (6) | Includes Changes in Pension Value of $1,716, $9,991 and $0 in 2009, 2010 and 2011, respectively, from the Director’s Retirement Plan, Changes in Pension Value of $24,471, $73,214 and $0 in 2009, 2010 and 2011, respectively, from the SERP and $18,080 and $1,759 of the above market return from the trust created pursuant to the Trust Agreement in 2009, and 2011, respectively. There was no above market return for such trust in 2010. |

| (7) | Includes amounts for unused 2011 vacation that Mr. Prezeau received upon retirement |

Pension Benefits Table

The following table provides information for the named executive officers for the year ended December 31, 2011

| Name | Plan name | Number of Years of Credited Service | Present Value of Accumulated Benefits (Accrued 12-31-11) | Payments During Last Fiscal Year |

| Preston D. Pinkett, III | --- | --- | $--- | --- |

| Louis E. Prezeau(1) | SERP | 21 | $--- | $1,464,955 |

| Louis E. Prezeau(2) | Director's

Retirement | 21 | $ 64,102 | $— |

| Edward R. Wright (3) | SERP | 16 | $ 450,001 | $— |

| Raul Oseguera | SERP | 20 | $ 84,457 | $— |

| (1) | Mr. Prezeau received a lump sum-payment of $1,465,000 on his retirement date of March 1, 2011. See “Executive Compensation--Supplemental Employee Retirement Plan.” |

| (2) | Mr. Prezeau is currently eligible for normal retirement under the Director’s Retirement Plan. See “ Executive Compensation—Director Compensation--Director’s Retirement Plan.” |

| (3) | Mr. Wright is currently eligible for normal retirement under the SERP. See “Executive Compensation-- Supplemental Employee Retirement Plan.” |

Grants of Plan Based Awards in 2011

The following table presents information regarding the grant of awards made to Mr. Pinkett, the only named executive officer to receive such awards under his employment agreements in 2011. All stock was issued to Mr. Pinkett under his employment agreements that mandated that part of his salary consist of cash and part of his salary consist of stock.

Grants of Plan-Based Awards

Name | Grant Date | All other

stock awards:

Number of

shares of

stock or units

(#) | Grant date fair

value of stock

and option

awards |

| Preston D. Pinkett, III | 3/1/2011 11/1/2011 | 667 20,000 | $25,013 $60,000 |

| Louis E. Prezeau | --- | --- | --- |

| Edward R. Wright | --- | --- | --- |

| Raul Oseguera | --- | --- | --- |

Option Exercises and Stock Vested in 2011

The following table presents information regarding the vesting of awards made to a 2011 named executive officer that occurred in our last completed fiscal year

Option Exercises and Stock Vested In Fiscal Year 2011

| | Option awards | Stock awards |

Name | Number of

shares

acquired on

exercise

| Value

realized on

exercise($)

| Number of

Shares Vested

(#) | Value

Realized on

Vesting ($)(1) |

| Preston D. Pinkett, III | --- | --- | 4,009 | $23,533 |

| Louis E. Prezeau | --- | --- | --- | --- |

| Edward R. Wright | --- | --- | --- | --- |

| Raul Oseguera | --- | --- | --- | --- |

| (1) | The shares are not traded on the market. Shares have been valued at $3.00 per share for the 3,342 shares granted at November 1, 2011 that vested in 2011. For the 667 shares granted at March 1, 2011 we have used an average value of $20.25, as we assumed that the shares declined in value from $37.50 to $3 over the six month course of issuance. |

Outstanding Equity Awards at 2011 Year End

The following table presents information regarding outstanding stock awards at December 31, 2011 for each of the 2011 named executive officers who has such awards outstanding:

Outstanding Equity Awards at 2011 Year-End

| | Stock Awards |

Name | Number of shares or units of

stock that have not vested

(#) | Market value of shares or units

of stock that have not vested

($) |

| Preston D. Pinkett, III | 16,658 | 49,974(1) |

| Louis E. Prezeau | --- | --- |

| Edward R. Wright | --- | --- |

| Raul Oseguera | --- | --- |

(1) Based on $3 per share valuation

Payments upon Separation of Service and Change of Control

The following table sets forth the severance amounts and benefits that would be paid to each of our named executive officers if employment with the Bank had been terminated on December 31, 2011, except Mr. Prezeau’s amounts include amounts actually paid (as opposed to estimated) to Mr. Prezeau as a result of his retirement.

Name | Retirement | Dismissal Without Cause (No Change in Control) | Termination

for Cause | Payments Upon

a Change-in-

Control | Death |

| Preston D. Pinkett III | --- | --- | --- | --- | $530,000(1) |

| Louis Prezeau | $1,464,955(2) | --- | --- | --- | --- |

| Edward R. Wright | $450,001(3) | $450,001(4) | --- | ---(4) | $713,001(1) |

| Raul Oseguera | --- | --- | --- | ---(4) | $344,457(1) |

| (1) | Includes life insurance of $530,000, $263,000 and $260,000 for Messrs. Pinkett, Wright and Osegura. Messrs. Wright’s and Oseguera’s figures also include the value of their SERP benefit of $450,001 and $84,457, respectively. |

| (2) | Mr. Prezeau retired on March 1, 2011. Entry represents withdrawal from SERP of $1,464,955 but does not include payment for unused 2011 vacation which is included in salary in the Summary Compensation Table. |

(3) Mr. Wright has reached normal retirement age.

| (4) | Gives effect to TARP’s elimination of change-in-control payments. All executive officers have executed waivers disclaiming rights to payments prohibited by TARP. All payments represent payments from the SERP. |

Non-Qualified Deferred Compensation Table

The following table lists certain information with respect to the Trust Agreement established with respect to Mr. Prezeau:

| Name | Executive contributions in 2011 ($) | Registrant contributions in 2011 ($) | Aggregate earnings in 2011 ($) | Aggregate withdrawals/distributions in 2011 ($) | Aggregate balance at 2011 year end ($) |

| Louis E. Prezeau | $0 | $0 | 6,753 | 109,235(1) | $133,731 |

(1) Includes $85,000 in withdrawals, $24,151 in insurance premiums and $84 in other charges.

STOCK OWNERSHIP OF MANAGEMENT AND PRINCIPAL SHAREHOLDERS

The following table presents information about the beneficial ownership of our common stock at April 1, 2012 by each person who is known by us to beneficially own more than five percent (5%) of the issued and outstanding common stock, each director and each of our executive officers for whom individual information is required to be set forth in this proxy statement under rules of the Securities and Exchange Commission, and by directors and all executive officers as a group.

COMMON STOCK Name of Beneficial Owner | Number of

Shares

Beneficially

Owned | Percent of

Class |

| Alfonso L. Carney, Jr., Director | 30 | | | | * |

| | | | | | |

Eugene Giscombe, Director c/o City National Bancshares Corporation 900 Broad Street Newark, New Jersey 07102 | 11,246 | (1) | | | 8.0% |

| | | | | | |

Preston D. Pinkett, III, President and CEO and Director c/o City National Bancshares Corporation 900 Broad Street Newark, New Jersey 07102 | 14,366 | (2) | | | 8.6% |

| | | | | | |

Louis E. Prezeau, Director, Retired President and CEO c/o City National Bancshares Corporation 900 Broad Street Newark, New Jersey 07102 | 25,216 | (3) | | | 17.5% |

| | | | | | |

Lemar C. Whigham, Director c/o City National Bancshares Corporation 900 Broad Street Newark, New Jersey 07102 | 9,624 | (4) | | | 6.9% |

| | | | | | |

| H. O’Neil Williams, Director | 773 | | | | * |

| | | | | | |

| Raul Oseguera, Senior Vice President and Assistant Secretary | 750 | | | | * |

| | | | | | |

| Edward R. Wright, Senior Vice President and CFO | 5,000 | | | | 3.6% |

| | | | | | |

| Directors and named executive officers as a group (8 persons) | 64,977 | (5) | | | 44.6% |

| | | | | | |

Carolyn M. Whigham, 5% stockholder 580 Dr. Martin Luther King Jr. Blvd., Newark, NJ 07102 | 8,495 | | | | 6.1% |

(1) Includes 780 shares of common stock held by his wife. Also includes 333 shares of common stock and 333 shares of common stock issuable to Mr. Giscombe and his spouse, respectively, upon conversion of Series E Preferred Stock.

(2) Includes 3,288 shares of common stock vesting within 60 days of April 1 , 2012.

(3) Includes 2,375 shares of common stock held by his sons, 110 shares of common stock held by his daughter and 1,402 shares held by his wife. Also includes 1,332 shares of common stock and 666 shares of common stock issuable to Mr. Prezeau and his spouse, respectively, upon conversion of Series E Preferred. Stock.

(4) Includes 1,064 shares of common stock held by his wife.

(5) Includes 2,664 shares of common stock issuable upon conversion of Series E Preferred Stock.

* Less than 1%

The following table presents information about the beneficial ownership of each series of preferred stock in which any named executive officer or director had any ownership interest at April 1, 2012 by each director and each of our executive officers for whom individual information is required to be set forth in this Proxy Statement under rules of the Securities and Exchange Commission, and by directors and all executive officers as a group. “Series E” means the 6% Non-Cumulative Perpetual Preferred Stock, Series E and “Series F” means the Series F Non-cumulative Redeemable Preferred Stock.

PREFERRED STOCK Name of Beneficial Owner | Series E | Series E% | Series F (1) | Series F %(1) |

| Alfonso L. Carney, Jr., Director | - - - | - - - | 636.4 | 9.1% |

| | | | | |

Eugene Giscombe, Director | 2(2) | 4.1% | 636.4 | 9.1% |

| | | | | |

| Preston D. Pinkett, III, President, CEO and Director | - - - | - - - | 636.4 | 9.1% |

| | | | | |

Louis E. Prezeau, Director, Retired CEO and President | 6(3) | 12.2% | 636.4 | 9.1% |

| | | | | |

Lemar C. Whigham, Director | - - - | - - - | 636.4 | 9.1% |

| | | | | |

| H. O’Neil Williams, Director | - - - | - - - | 636.4 | 9.1% |

| | | | | |

Raul Oseguera, Senior Vice President and Assistant Secretary | - - - | - - - | 636.4 | 9.1% |

| | | | | |

| Edward R. Wright, Senior Vice President and CFO | - - - | - - - | 636.4 | 9.1% |

| | | | | |

Directors and all executive officers as a group (10 persons) | - - - | - - - | 6,364 | 90.9% |

| (1) | In December 2011, all of the individuals in the above named table and three other persons formed Greene Street Enterprises, LLC (“Greene Street”) and acquired all 7,000 outstanding shares of Series F Preferred Stock from a third party. Mr. Pinkett is the managing member of such entity, but does not have the power to vote the shares of preferred stock which can only be exercised by the members of Greene Street. The percentages and amounts reported are the economic interests of each of the above in such entity. Greene Street as holder of the Series F Preferred Stock, together with the U.S. Department of Treasury as the holder of all Series G Preferred Stock of the Corporation, have the right to appoint 2 directors as a result of the deferral of dividends, which director appointment rights have not been exercised. |

| (2) | Includes one share held by spouse. |

| (3) | Includes two shares held by spouse. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Certain members of the Personnel/Director and Management Review Committee or their affiliates, engaged in loan transactions with the Bank during 2011. All such loans were made in the ordinary course of business on substantially the same terms including interest rates and collateral, as those prevailing at the time for comparable loans with others and did not involve more than the normal risk of collectability or present other unfavorable features. As noted above, Messrs. Carney, Giscombe, and Williams are members of the Personnel/Director and Management Review Committee, although, as noted above, for purposes of making the assessments and reviews required to comply with TARP (as defined below), the entire Board carries out the duties and functions of a compensation committee under TARP.

COMPENSATION COMMITTEE REPORT

A discussion of the principles, objectives, components, analyses and determinations of the Personnel/Director and Management Review Committee with respect to executive compensation is included in the Compensation Discussion and Analysis above. The Compensation Discussion and Analysis also includes commentary with respect to the Committee’s review of officer and employee compensation plans and more specifically any features of those places that may encourage employees to take unnecessary and excessive risks. None of the plans identified is of a nature or magnitude that could be expected reasonably to encourage any employee, particularly executives, to take any unnecessary and/or excessive risk. In fact our supplemental employee retirement plan, prior to termination, encouraged employees to stay with the Corporation for the long term. The specific decisions of the Committee regarding the compensation of the named executive officers are reflected in the compensation tables and narrative above that follow the Compensation Discussions and Analysis.

In 2011, no incentive compensation was paid to any employee. Salaries remained constant for fiscal year 2011, with the exception of the salary approved by the Committee for the CEO. That salary, discussed in greater detail above, consisted of both cash and common stock, as reflected in the tables above. Because the Corporation’s common stock is not traded publically, it was necessary for the committee to determine a value for the stock which the Committee required constitute a part of the CEO’s salary. The common stock component was assigned a value with the assistance of an independent third party reviewer. Both the total salary and the common stock component and its proposed valuation were submitted to and approved by the appropriate federal regulators, as the Committee deemed this to be a necessary prerequisite to the salary decision. As a result, the Committee certifies that: (a) it has reviewed with our Senior Risk Officer the SEO compensation plans and has made reasonable efforts to ensure that such plans do not encourage SEOs to take unnecessary and excessive risks that could threaten the value of the Corporation and its subsidiaries; (b) it has reviewed with our Senior Risk Officer the employee compensation plans and has made all reasonable efforts to limit any unnecessary risks these plans pose to the Corporation and its subsidiaries; and (c) it has reviewed the employee compensation plans to eliminate any features of these plans that would encourage the manipulation of reported earnings of the Corporation and its subsidiaries to enhance the compensation of any employee.

We have reviewed and discussed the Compensation Discussion and Analysis with management and, based upon that review and discussion, we recommend that the section be included in our annual report on Form 10-K for the year-ended December 31, 2011 and the 2012 proxy statement.

Alfonso L. Carney, Jr., Chairman Eugene Giscombe

H. O’Neil Williams

PROPOSAL 2

ADVISORY, NON-BNIDING PROPOSAL TO APPROVE

OUR EXECUTIVE COMPENSATION PROGRAMS AND POLICIES

In February 2009, the American Recovery and Reinvestment Act of 2009 (“ARRA”) was enacted and the U.S. Department of Treasury issued final interim rules on June 15, 2009 to implement the ARRA standards. ARRA revised Section 111(e) of the Emergency Economic Stabilization Act to require any recipient of funds in the TARP to permit a separate stockholder vote to approve the compensation of executives, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission. Under this legislation, the stockholder vote is not binding on the board of directors of the TARP participant, and may not be construed as overruling any decision by the participant’s board of directors. Therefore, in order to comply with ARRA as a recipient of TARP funds, the Board of Directors of City National Bancshares Corporation is providing stockholders with the opportunity to cast an advisory (non-binding) vote to approve at the Annual Meeting the compensation program and policies of City National Bancshares Corporation. City National Bancshares Corporation is exempt from the new requirements of the Dodd-Frank Wall Street Reform and Consumer Protection Act to conduct an advisory vote on the frequency of stockholders’ advisory votes on executive compensation until all outstanding indebtedness under TARP is repaid.

This proposal to approve an advisory (non-binding) vote on executive compensation and policies, commonly known as a “Say-on-Pay” proposal, gives you as a stockholder the opportunity to vote on our executive pay program through the following resolution:

“Resolved, that the compensation paid to the named executive officers, as described in this proxy statement under Executive Compensation, including the Compensation Discussion and Analysis, compensation tables and narrative discussion is hereby APPROVED.”

Because your vote is advisory, it will not be binding upon the Board of Directors. However, the Personnel/Director and Management Review Committee, which serves as our compensation committee, will take into account the outcome of the vote when considering future executive compensation arrangements.

The Board recommends a vote "FOR" approval of the executive compensation policies and procedures employed by the Personnel/Director and Management Review Committee.

PROPOSAL 3

APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The accounting firm of KPMG LLP served as the independent registered public accountants for the Corporation for the year ended December 31, 2011. Services provided included the examination of the consolidated financial statements and preparation of the tax returns.

The Board has appointed KPMG LLP as the independent registered public accountants for the Corporation and the Bank for 2012. Stockholder ratification of the appointment is not required under the laws of the State of New Jersey, but the Board has decided to ascertain the position of the stockholders on the appointment. The Board may reconsider the appointment if it is not ratified. The affirmative vote of a majority of the shares voted at the meeting is required for ratification.

Representatives of KPMG LLP are expected to be present at the meeting and will be allowed to make a statement if they so desire. Additionally, they will be available to respond to appropriate questions from stockholders during the meeting.

The Corporation incurred the following fees for services provided by KPMG LLP:

| | | 2011 | | | 2010 | |

| Audit fees | | $ | 300,000 | | | $ | 250,000 | |

| Audit-Related Fees | | | 0 | | | | 0 | |

| Tax fees | | | 52,300 | | | | 38,000 | |

| All Other Fees | | | 0 | | | | 0 | |

| | | $ | 352,300 | | | $ | 363,000 | |

All audit, as well as non-audit, services to be performed by the independent accountants to the Corporation must be pre-approved by the Audit Committee in order to assure that the provision of such services does not impair the auditor’s independence. During 2011 and 2010, the Audit Committee pre-approved all of the services provided by KPMG LLP. The Audit Committee has considered the provisions of these services by KPMG LLP and has determined that the services are compatible with maintaining KPMG LLP’s independence.

REPORT OF THE AUDIT COMMITTEE

In connection with the December 31, 2011 financial statements, the Audit Committee: (1) reviewed and discussed the audited financial statements with management; and (2) discussed with the independent public accountants the matters required by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vo. 11, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. Our independent public accountants also provided to the Audit Committee the written disclosures required by PCAOB Rule 3526, and the Audit Committee discussed with the independent registered public accountants that firm's independence. The Audit Committee has also considered whether the independent auditors' provision of non-audit services to us is compatible with the auditor's independence.

Based upon these reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Annual Report on Form 10-K filed with the Securities Exchange Committee.

Alfonso L. Carney, Jr.

H. O’Neil Williams, Chairperson

Lemar C. Whigham

The Board recommends a vote "FOR" ratification of the selection of KPMG LLP as independent registered public accountants for 2012.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Bank has made loans to its directors and executive officers and their associates, and assuming continued compliance with generally applicable credit standards, it expects to continue to make such loans. These loans were made in the ordinary course of business on substantially the same terms including interest rates and collateral, as those prevailing at the time for comparable loans with others and did not involve more than the normal risk of collectability or present other unfavorable features.

On December 16, 2011, Mr. Pinkett and all directors of the Corporation (including Messrs. Eugene Giscombe, Lemar Whigham, H. O’Neil Williams, Alfonso Carney Jr.), Mr. Edward Wright, its Chief Financial Officer and Mr. Oseguera, a Senior Vice President, Walter Bond and Carlton West, officers of the Bank, and David Scheck, formed Greene Street Enterprises LLC (“Greene Street”) pursuant to an Operating Agreement and contributed $35,000 each in capital for equal membership interests. The purpose of Greene Street was to purchase all of outstanding shares the Multimode Series F Noncumulative Redeemable Preferred Stock (“Series F Preferred Stock”) of the Corporation from a third party and to attempt to exchange such non-voting non-convertible preferred stock with the Corporation for common stock on terms to be negotiated and then to distribute the common stock to members of Greene Street. On December 29, 2011, Greene Street acquired all of the Series F Preferred Stock from a third party. Greene Street as holder of the Series F Preferred Stock, together with the U.S. Department of Treasury as the holder of all Series G Preferred Stock of the Corporation, have the right to appoint 2 directors as a result of the deferral of dividends, which director appointment rights have not been exercised. Greene Street has not yet exchanged such preferred stock for common stock, and there are no currently proposed terms for the exchange. The Board has not yet reviewed and determined how it would view such an exchange.

The Board, as a whole, reviews related party transactions, but there is no written policy or procedure with respect thereto and such reviews are conducted on a transaction by transaction basis. Under the Audit Committee charter, the Audit Committee may also review summary of directors’ and officers’ related party transactions and potential conflicts of interest.

DIRECTOR INDEPENDENCE

The Board has determined that all the directors, with the exception of Louis E. Prezeau and Preston D. Pinkett, III (upon commencement of service as President and Chief Executive Officer of the Corporation), are “independent” within the meaning of the NASDAQ listing standards, the exchange whose standards we use in determining director independence. In reviewing the independence of these directors, the Board considered that transactions with the Bank were made in the ordinary course of business, including loans that were made in accordance with Federal Reserve Regulation O.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our executive officers and directors, and any persons owning ten percent or more of our common stock, to file in their personal capacities initial statements of beneficial ownership, statements of changes in beneficial ownership and annual statements of beneficial ownership with the SEC. Copies of all filed reports are required to be furnished to us pursuant to Section 16(a). Based solely on the reports received by us and on written representations from reporting persons, we believe that our executive officers and directors, and any persons owning ten percent or more of our common stock complied with all Section 16(a) filing requirements during the year ended December 31, 2011, with the exception that (i) a Form 4 was not timely filed with respect to one transaction for Mr. Carney, (ii) separate Form 4s were not timely filed with respect to Mr. Pinkett's acquisition of 667 shares in connection with his initial employment agreement and 20,000 shares (which will vest ratably during the term of his current employment agreement) in connection with his current employment agreement, and (iii) separate Form 3s were not timely filed with respect to Messrs. Bond and West’s employment as senior executive officers.

STOCKHOLDER PROPOSALS

Stockholders who intend to present proposals at the 2013 Annual Meeting of Stockholders must present a written proposal to the Corporation by January 23, 2013 (in accordance with the section titled “Stockholder Communications with Directors” contained elsewhere in this Proxy Statement), for inclusion in our proxy statement. In addition, if a stockholder gives notice of a proposal to be raised at the 2013 Annual Meeting of Stockholders (without inclusion in the proxy statement for such meeting) before April 8, 2013, and our proxy statement gives advice on the nature of the matter, and how our proxy holders intend to exercise discretionary authority with respect thereto, then with certain exceptions our proxy holders may exercise discretionary authority on such matter, and otherwise they may not exercise discretionary authority. If a stockholder gives notice of such a proposal after this deadline, our proxy holders will be allowed to use their discretionary authority to vote against the stockholder proposal when and if the proposal is raised at our 2013 Annual Meeting of Stockholders.

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON JUNE 9, 2011