Q2 2020 Investor Presentation

Forward-Looking Statements This presentation may contain various statements about Renasant Corporation (“Renasant,” “we,” “our,” or “us”) that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward-looking in nature and not historical facts. Forward-looking statements include information about our future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management. We believe these forward-looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions about future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements; such differences may be material. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date they are made. Currently, the most important factor that could cause Renasant’s actual results to differ materially from those in forward-looking statements is the continued impact of the COVID-19 pandemic and related governmental measures to respond to the pandemic on the U.S. economy and the economies of the markets in which we operate. In this presentation, we have addressed the historical impact of the pandemic on our operations and set forth certain expectations regarding the COVID-19 pandemic’s future impact on our business, financial condition, results of operations, liquidity, asset quality, capital, cash flows and prospects. We believe these statements about future events and conditions in light of the COVID-19 pandemic are reasonable, but these statements are based on assumptions regarding, among other things, how long the pandemic will continue, the duration, extent and effectiveness of the governmental measures implemented to contain the pandemic and ameliorate its impact on businesses and individuals throughout the United States, and the impact of the pandemic and the government’s virus containment measures on national and local economies, all of which are out of our control. If the assumptions underlying these statements about future events prove to be incorrect, Renasant’s business, financial condition, results of operations, liquidity, asset quality, capital, cash flows and prospects may be materially different from what is presented in our forward-looking statements. Important factors other than the COVID-19 pandemic currently known to us that could cause actual results to differ materially from those in forward-looking statements include the following: (i) our ability to efficiently integrate acquisitions into operations, retain the customers of these businesses, grow the acquired operations and realize the cost savings expected from an acquisition to the extent and in the timeframe management anticipated; (ii) the effect of economic conditions and interest rates on a national, regional or international basis; (iii) timing and success of the implementation of changes in operations to achieve enhanced earnings or effect cost savings; (iv) competitive pressures in the consumer finance, commercial finance, insurance, financial services, asset management, retail banking, mortgage lending and auto lending industries; (v) the financial resources of, and products available from, competitors; (vi) changes in laws and regulations as well as changes in accounting standards, such as the adoption of the CECL model on January 1, 2020; (vii) changes in policy by regulatory agencies; (viii) changes in the securities and foreign exchange markets; (ix) our potential growth, including our entrance or expansion into new markets, and the need for sufficient capital to support that growth; (x) changes in the quality or composition of our loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers; (xi) an insufficient allowance for credit losses as a result of inaccurate assumptions; (xii) general economic, market or business conditions, including the impact of inflation; (xiii) changes in demand for loan products and financial services; (xiv) concentration of credit exposure; (xv) changes or the lack of changes in interest rates, yield curves and interest rate spread relationships; (xvi) increased cybersecurity risk, including potential network breaches, business disruptions or financial losses; (xvii) natural disasters, epidemics and other catastrophic events in our geographic area; (xviii) the impact, extent and timing of technological changes; and (xix) other circumstances, many of which are beyond our control. The COVID-19 pandemic has exacerbated, and is likely to continue to exacerbate, the impact of any of these factors on us. Management believes that the assumptions underlying our forward-looking statements are reasonable, but any of the assumptions could prove to be inaccurate. Investors are urged to carefully consider the risks described in Renasant’s filings with the Securities and Exchange Commission from time to time, which are available at www.renasant.com and the SEC’s website at www.sec.gov. We undertake no obligation, and specifically disclaim any obligation, to update or revise our forward-looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws. 2

Current Footprint More than 200 banking, lending, wealth management and insurance offices Destin 3

Four Key Strategic Initiatives • Focus on highly-accretive acquisition opportunities Capitalize on • Leverage existing markets Opportunities • Seek new markets • New lines of business • Superior returns • Revenue growth / Expense control Enhance Profitability • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth • Enhance credit process, policies and personnel Focus on Risk • Aggressively identify and manage problem credits Management • Board focus on Enterprise Risk Management • Selective balance sheet growth Build Capital Ratios • Maintain dividend • Prudently manage capital 4

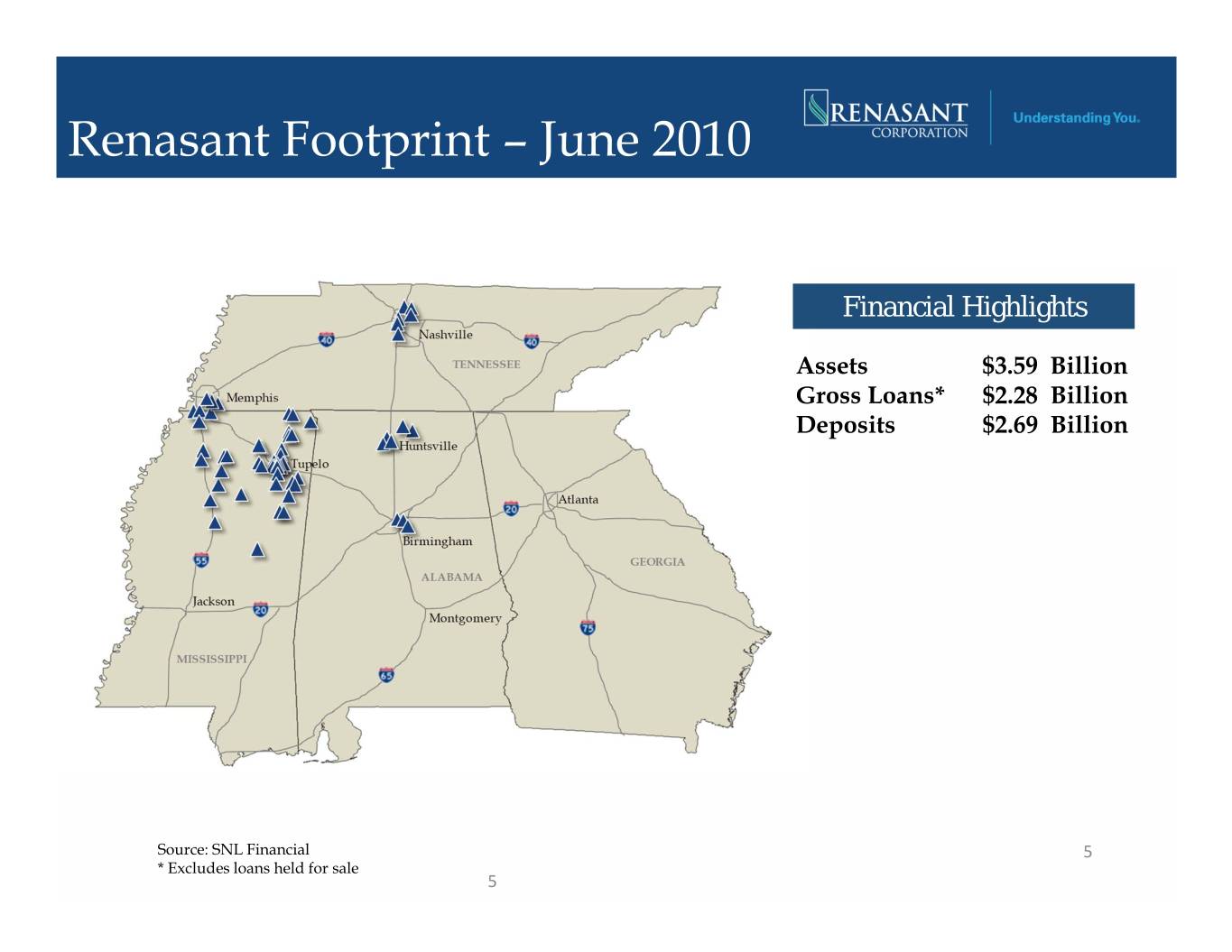

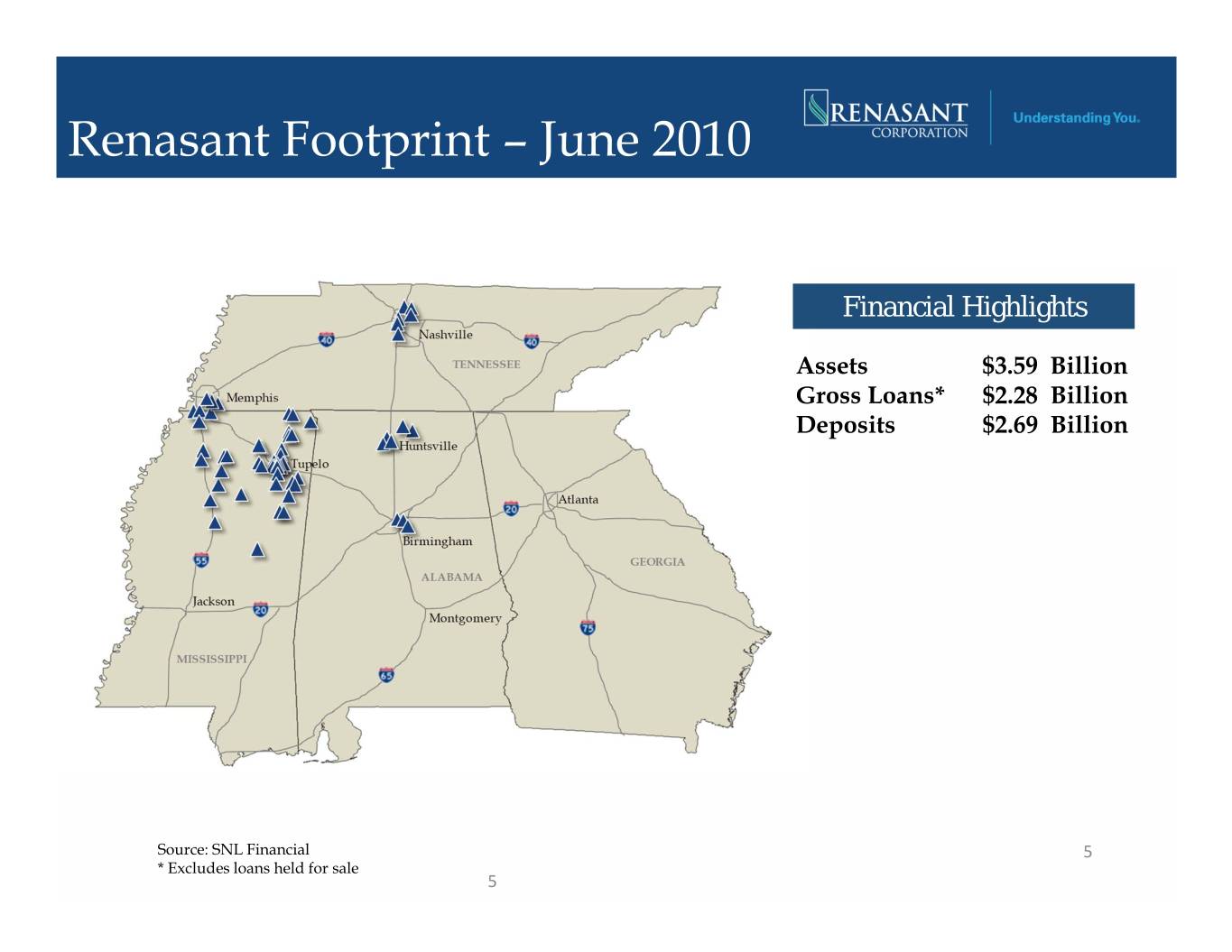

Renasant Footprint – June 2010 Financial Highlights Assets $3.59 Billion Gross Loans* $2.28 Billion Deposits $2.69 Billion Source: SNL Financial 5 * Excludes loans held for sale 5

Market Expansion Since 2010 2018 Whole Bank Transaction: Brand Group Holdings, Inc. | Lawrenceville, GA | Assets: $2.3 billion Whole Bank Transaction: Metropolitan BancGroup, Inc. | Ridgeland, MS | Assets: $1.2 billion 2017 De novo expansion: Mobile, AL 2016 Whole Bank Transaction: KeyWorth Bank | Atlanta, GA | Assets: $399 million 2015 Whole Bank Transaction: Heritage Financial Group, Inc. | Albany, GA | Assets: $1.9 billion Whole Bank Transaction: First M&F Corporation | Kosciusko, MS | Assets: $1.5 billion 2013 De novo expansion: Bristol, TN | Johnson City, TN 2012 De novo expansion: Maryville, TN | Jonesborough, TN FDIC-Assisted Transaction: American Trust Bank | Roswell, GA | Assets: $145 million 2011 Trust Acquisition: RBC (USA) Trust Unit | Birmingham, AL | Assets: $680 million De novo expansion: Montgomery, AL | Starkville, MS | Tuscaloosa, AL FDIC-Assisted Transaction: Crescent Bank and Trust | Jasper, GA | Assets: $1.0 billion 2010 De novo expansion: Columbus, MS 6

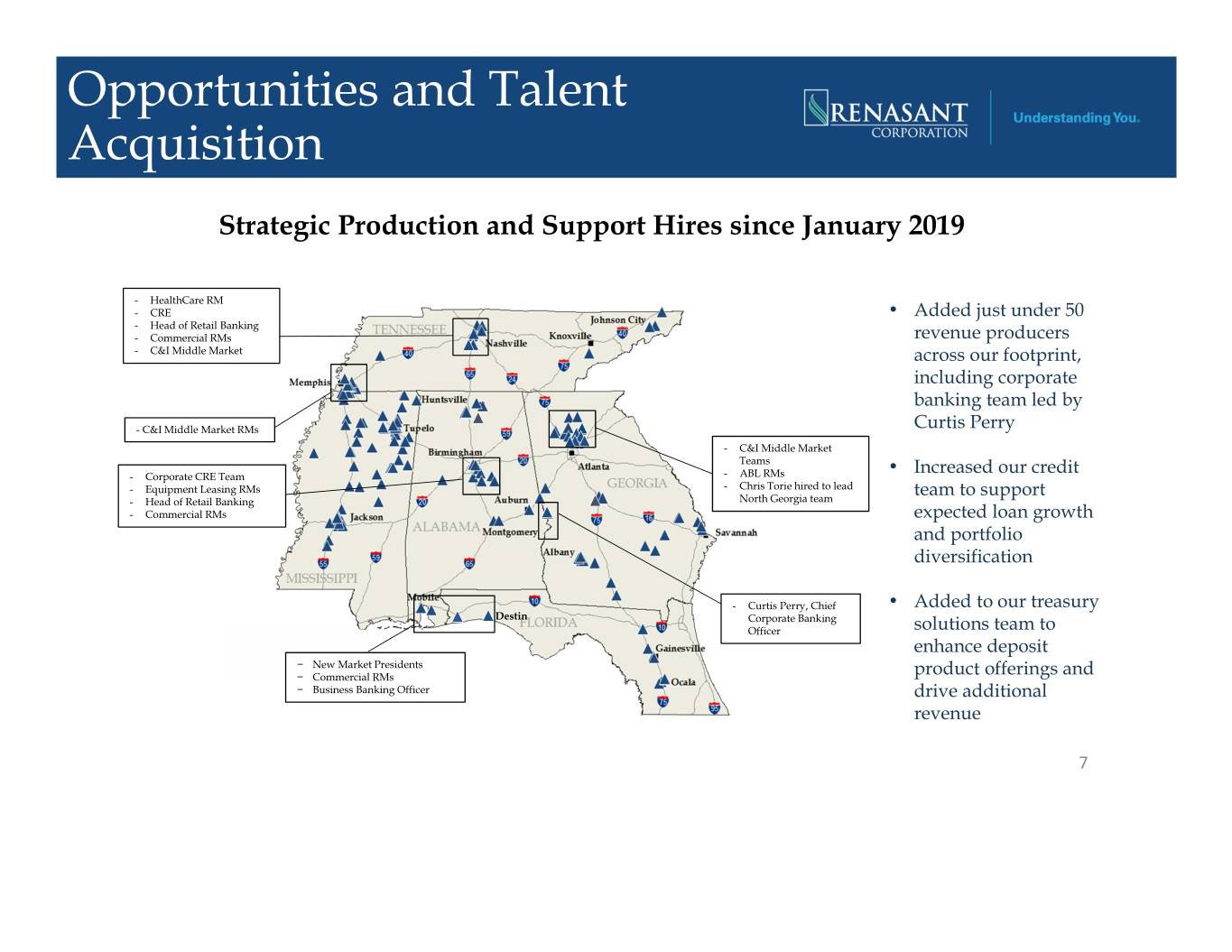

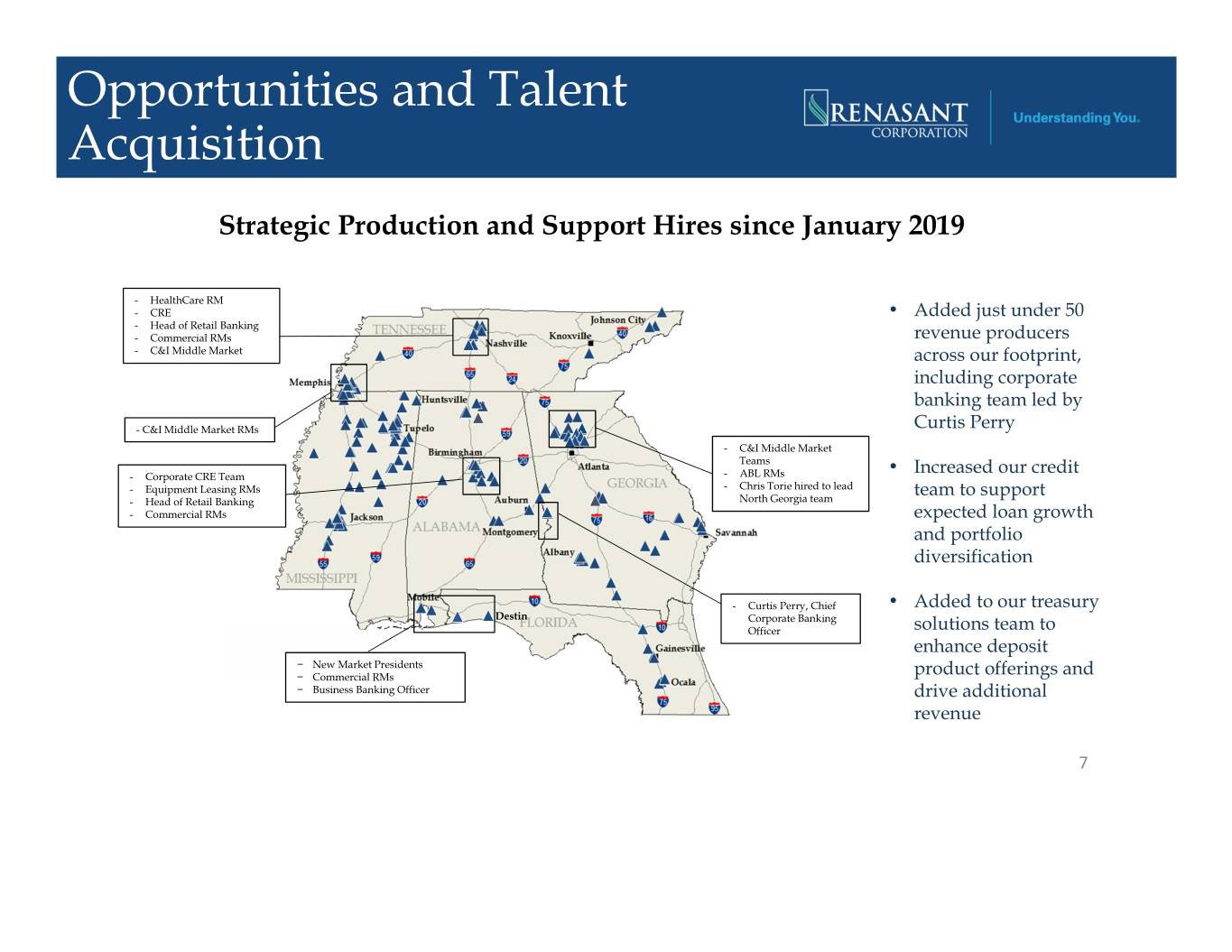

Opportunities and Talent Acquisition Strategic Production and Support Hires since January 2019 - HealthCare RM -CRE • Added just under 50 - Head of Retail Banking - Commercial RMs revenue producers - C&I Middle Market across our footprint, including corporate banking team led by - C&I Middle Market RMs Curtis Perry - C&I Middle Market Teams • -Corporate CRE Team - ABL RMs Increased our credit - Equipment Leasing RMs - Chris Torie hired to lead team to support - Head of Retail Banking North Georgia team - Commercial RMs expected loan growth and portfolio diversification - Curtis Perry, Chief • Added to our treasury Destin Corporate Banking Officer solutions team to enhance deposit − New Market Presidents − Commercial RMs product offerings and − Business Banking Officer drive additional revenue 7

Current Footprint Over 200 banking, lending, wealth management and insurance offices Highlights1 Assets $14.90 Billion Gross Loans2,3 $11.00 Billion Deposits $11.85 Billion Destin 1 As of June 30, 2020 2 Excludes loans held for sale 3 Includes $1.3 billion in PPP loans 8

Four Key Strategic Initiatives • Focus on highly-accretive acquisition opportunities Capitalize on • Leverage existing markets Opportunities • Seek new markets • New lines of business • Superior returns • Revenue growth / Expense control Enhance Profitability • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth • Enhance credit process, policies and personnel Focus on Risk • Aggressively identify and manage problem credits Management • Board focus on Enterprise Risk Management • Selective balance sheet growth Build Capital Ratios • Maintain dividend • Prudently manage capital 9

Total Assets $16,000 $14,897 $13,901 $14,000 $13,401 $12,935 $12,000 $9,830 $10,000 $8,670 $7,936 $8,000 $5,805 $6,000 $4,000 $2,000 $0 2014 2015 2016 2017 2018 2019 1Q20 2Q20 (In millions) Total Assets Deposits 10

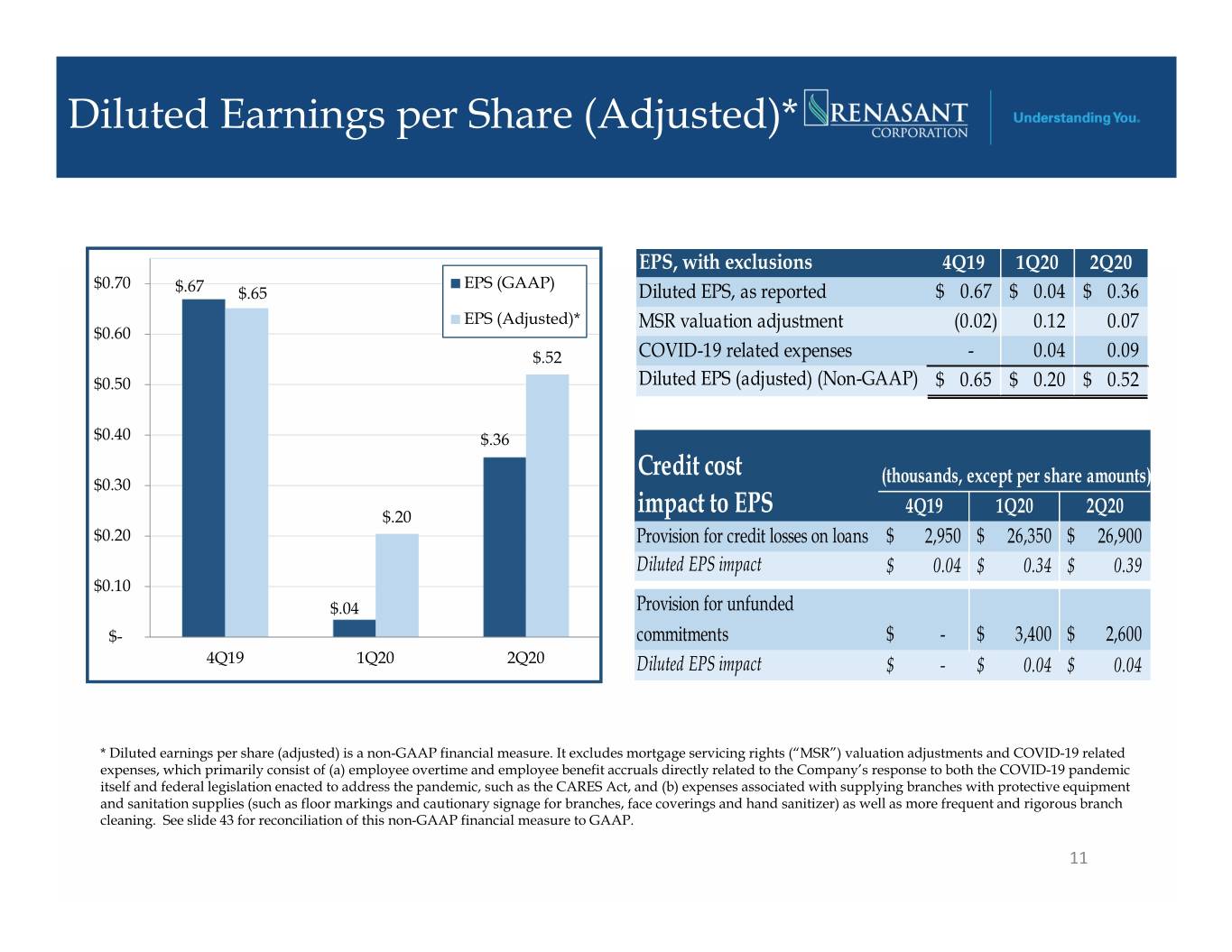

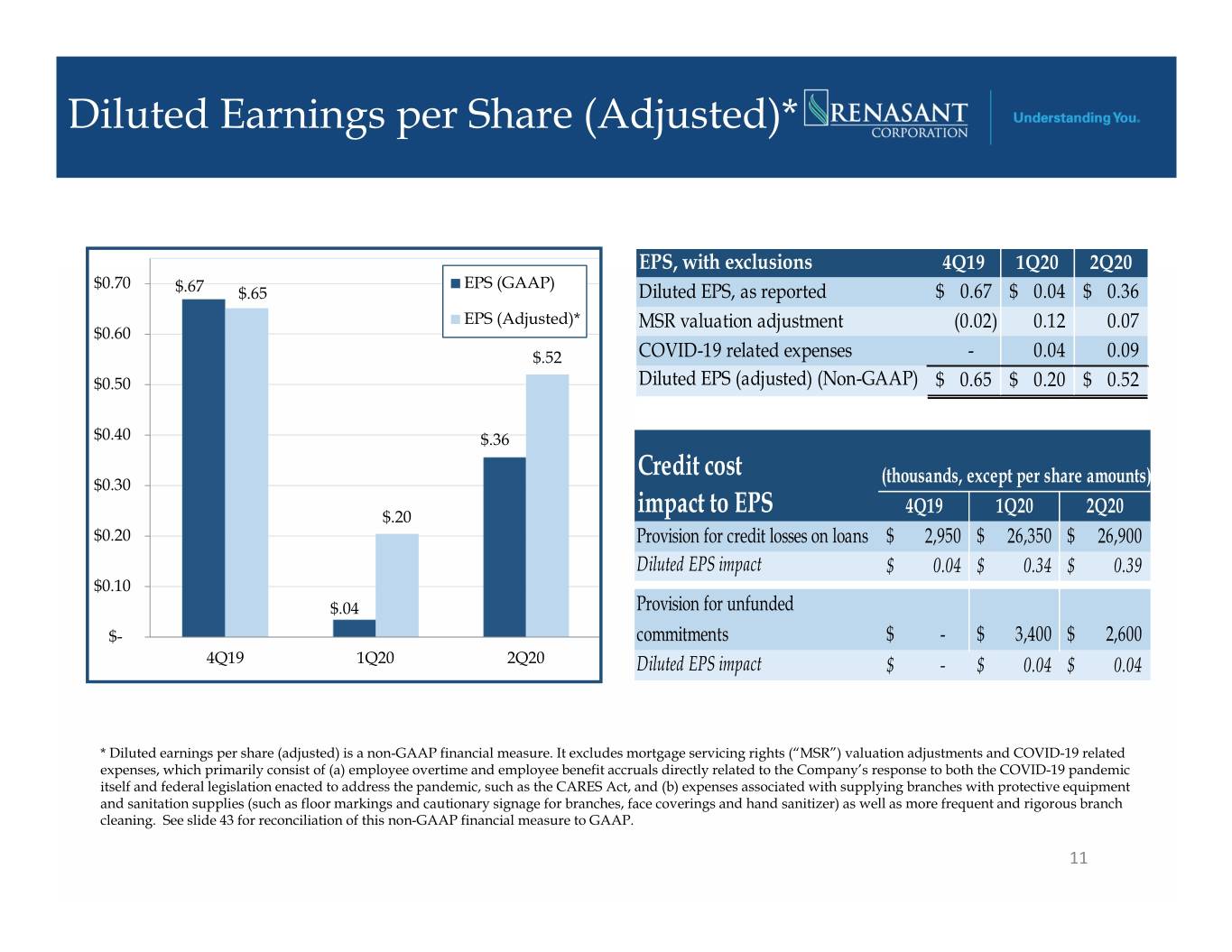

Diluted Earnings per Share (Adjusted)* EPS, with exclusions 4Q19 1Q20 2Q20 $0.70 EPS (GAAP) $.67 $.65 Diluted EPS, as reported$ 0.67 $ 0.04 $ 0.36 EPS (Adjusted)* MSR valuation adjustment (0.02) 0.12 0.07 $0.60 $.52 COVID-19 related expenses - 0.04 0.09 $0.50 Diluted EPS (adjusted) (Non-GAAP) $ 0.65 $ 0.20 $ 0.52 $0.40 $.36 Credit cost $0.30 (thousands, except per share amounts) $.20 impact to EPS 4Q19 1Q20 2Q20 $0.20 Provision for credit losses on loans$ 2,950 $ 26,350 $ 26,900 Diluted EPS impact $ 0.04 $ 0.34 $ 0.39 $0.10 $.04 Provision for unfunded $- commitments$ - $ 3,400 $ 2,600 4Q19 1Q20 2Q20 Diluted EPS impact $ - $ 0.04 $ 0.04 * Diluted earnings per share (adjusted) is a non-GAAP financial measure. It excludes mortgage servicing rights (“MSR”) valuation adjustments and COVID-19 related expenses, which primarily consist of (a) employee overtime and employee benefit accruals directly related to the Company’s response to both the COVID-19 pandemic itself and federal legislation enacted to address the pandemic, such as the CARES Act, and (b) expenses associated with supplying branches with protective equipment and sanitation supplies (such as floor markings and cautionary signage for branches, face coverings and hand sanitizer) as well as more frequent and rigorous branch cleaning. See slide 43 for reconciliation of this non-GAAP financial measure to GAAP. 11

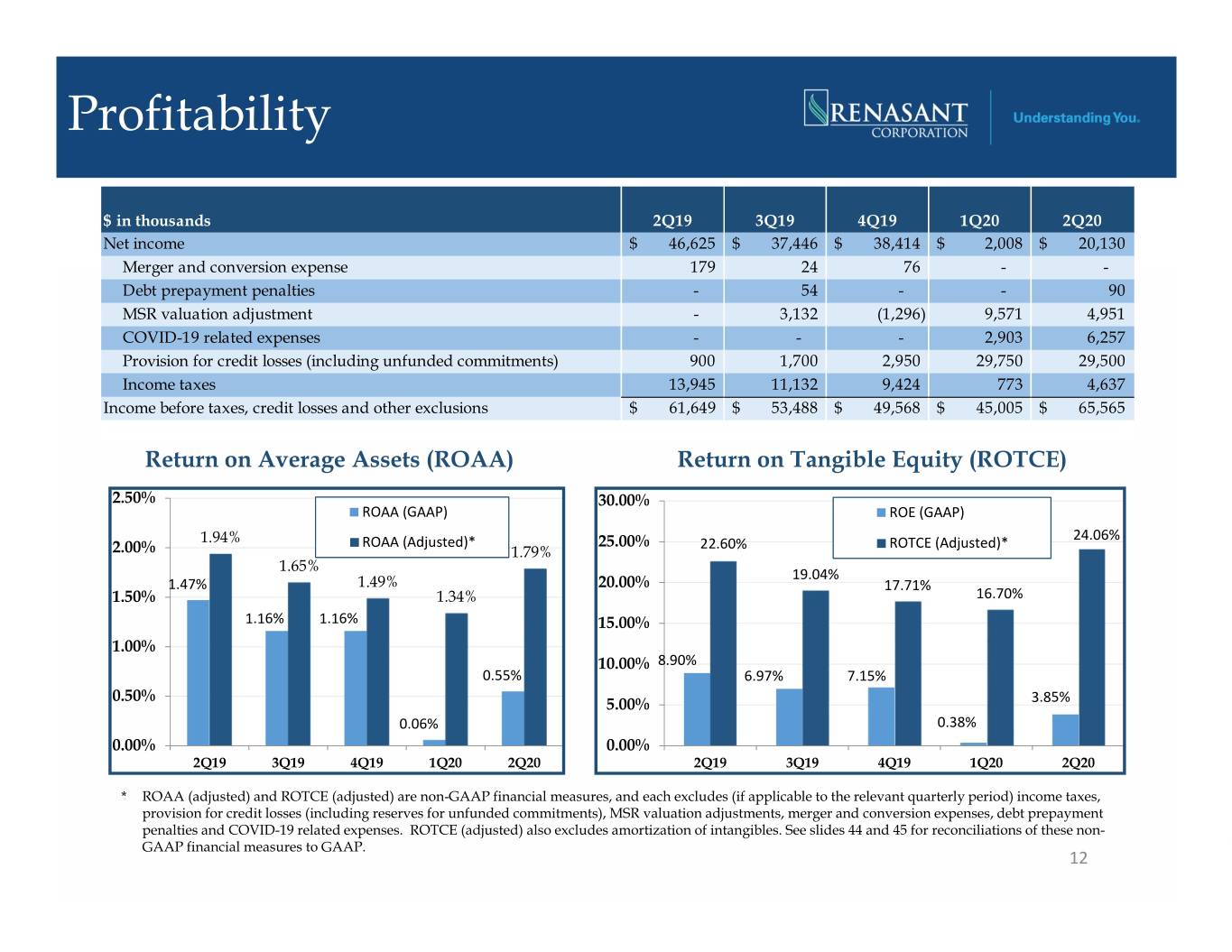

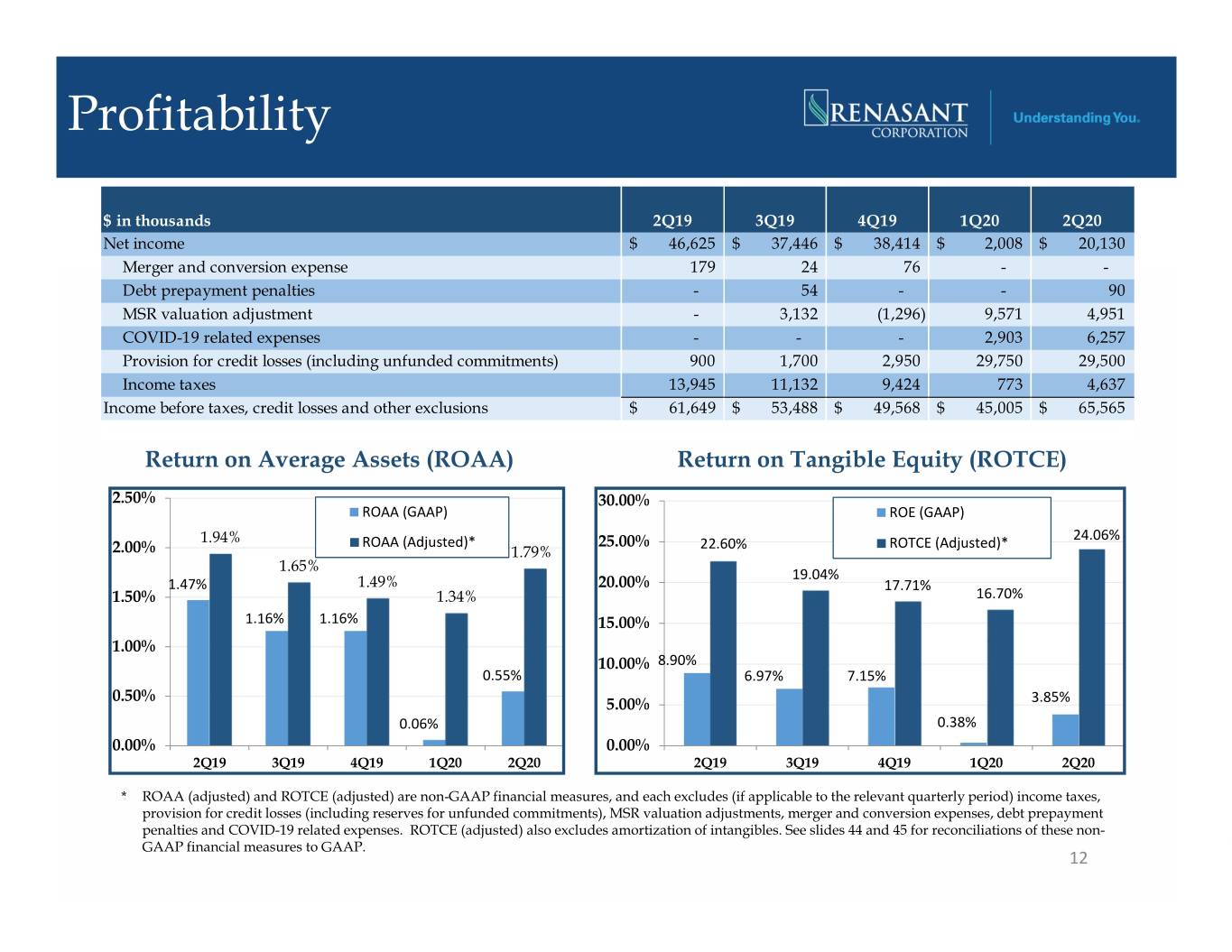

Profitability $ in thousands 2Q19 3Q19 4Q19 1Q20 2Q20 Net income$ 46,625 $ 37,446 $ 38,414 $ 2,008 $ 20,130 Merger and conversion expense 179 24 76 - - Debt prepayment penalties - 54 - - 90 MSR valuation adjustment - 3,132 (1,296) 9,571 4,951 COVID-19 related expenses - - - 2,903 6,257 Provision for credit losses (including unfunded commitments) 900 1,700 2,950 29,750 29,500 Income taxes 13,945 11,132 9,424 773 4,637 Income before taxes, credit losses and other exclusions$ 61,649 $ 53,488 $ 49,568 $ 45,005 $ 65,565 Return on Average Assets (ROAA) Return on Tangible Equity (ROTCE) 2.50% 30.00% ROAA (GAAP) ROE (GAAP) 24.06% 1.94% ROAA (Adjusted)* 25.00% 22.60% ROTCE (Adjusted)* 2.00% 1.79% 1.65% 19.04% 1.47% 1.49% 20.00% 17.71% 1.50% 1.34% 16.70% 1.16% 1.16% 15.00% 1.00% 10.00% 8.90% 0.55% 6.97% 7.15% 0.50% 3.85% 5.00% 0.06% 0.38% 0.00% 0.00% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 * ROAA (adjusted) and ROTCE (adjusted) are non-GAAP financial measures, and each excludes (if applicable to the relevant quarterly period) income taxes, provision for credit losses (including reserves for unfunded commitments), MSR valuation adjustments, merger and conversion expenses, debt prepayment penalties and COVID-19 related expenses. ROTCE (adjusted) also excludes amortization of intangibles. See slides 44 and 45 for reconciliations of these non- GAAP financial measures to GAAP. 12

Profitability, cont. Efficiency Ratio (Adjusted)1 80.00% 75.00% 68.7% 70.00% 63.8% 63.7% 65.00% 63.0% 60.4% 60.9% 59.6% 59.2% 60.00% 55.00% 50.00% 45.00% 40.00% 2014 2015 2016 2017 2018 2019 1Q20 2Q20 1 Efficiency Ratio (adjusted) is a non-GAAP financial measure and excludes (if applicable to the relevant time period) profit (loss) on sales of securities and MSR valuation adjustments from noninterest income and excludes amortization of intangibles, merger and conversion related expenses, debt prepayment penalties, loss share termination, provision for unfunded commitments and COVID-19 related expenses from noninterest expense. See slide 41 for reconciliation of this non-GAAP financial measure to GAAP. 13

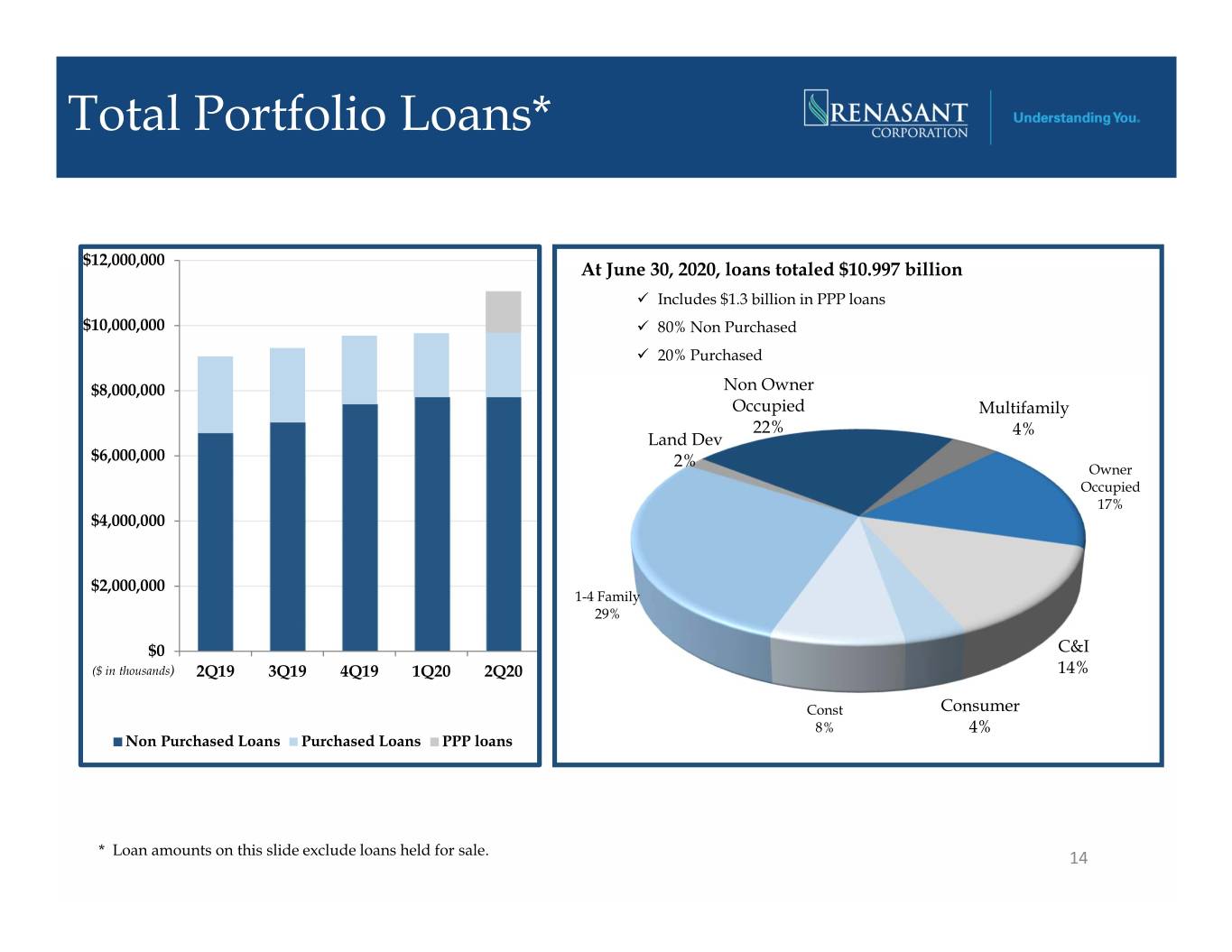

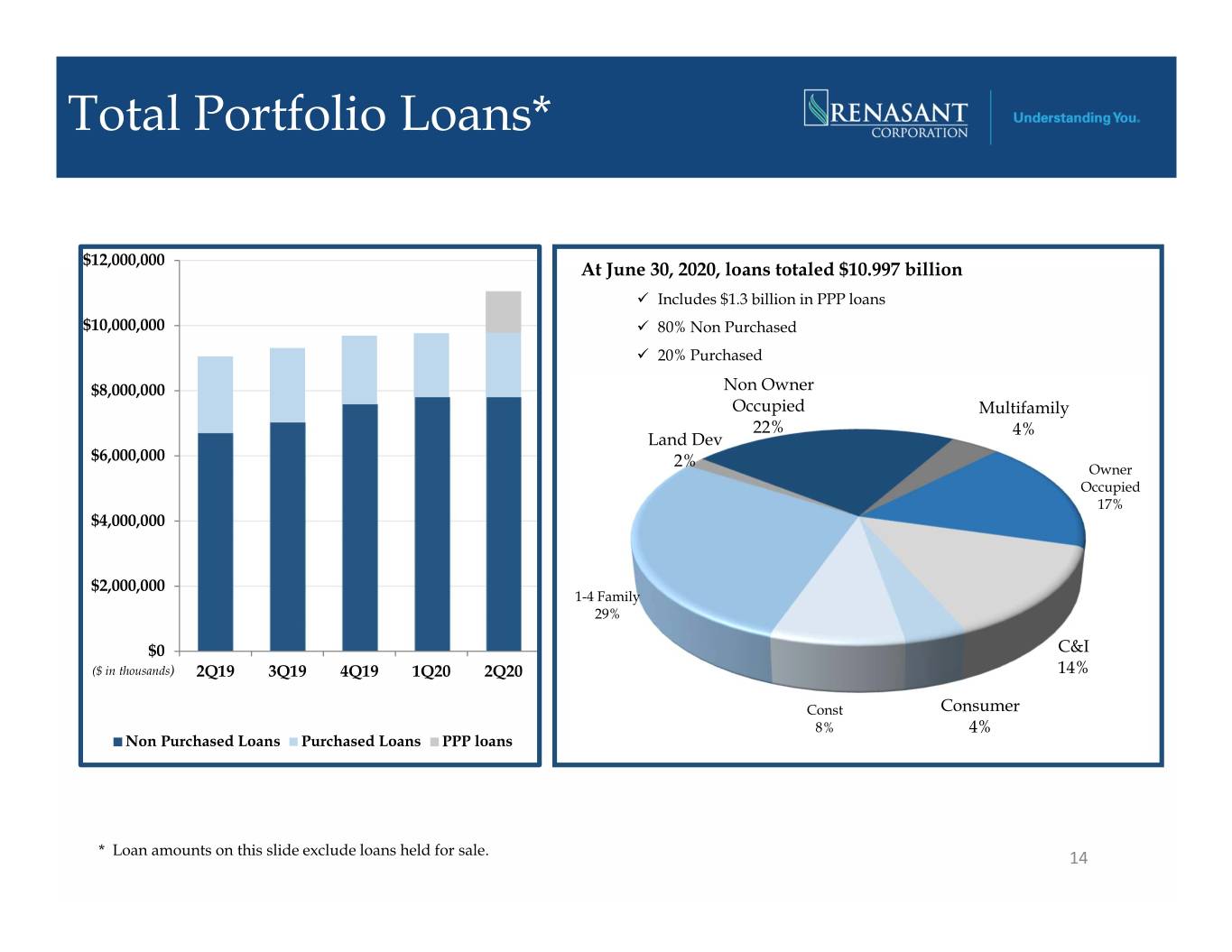

Total Portfolio Loans* $12,000,000 At June 30, 2020, loans totaled $10.997 billion Includes $1.3 billion in PPP loans $10,000,000 80% Non Purchased 20% Purchased $8,000,000 Non Owner Occupied Multifamily 22% 4% Land Dev $6,000,000 2% Owner Occupied 17% $4,000,000 $2,000,000 1-4 Family 29% $0 C&I ($ in thousands) 2Q19 3Q19 4Q19 1Q20 2Q20 14% Const Consumer 8% 4% Non Purchased Loans Purchased Loans PPP loans * Loan amounts on this slide exclude loans held for sale. 14

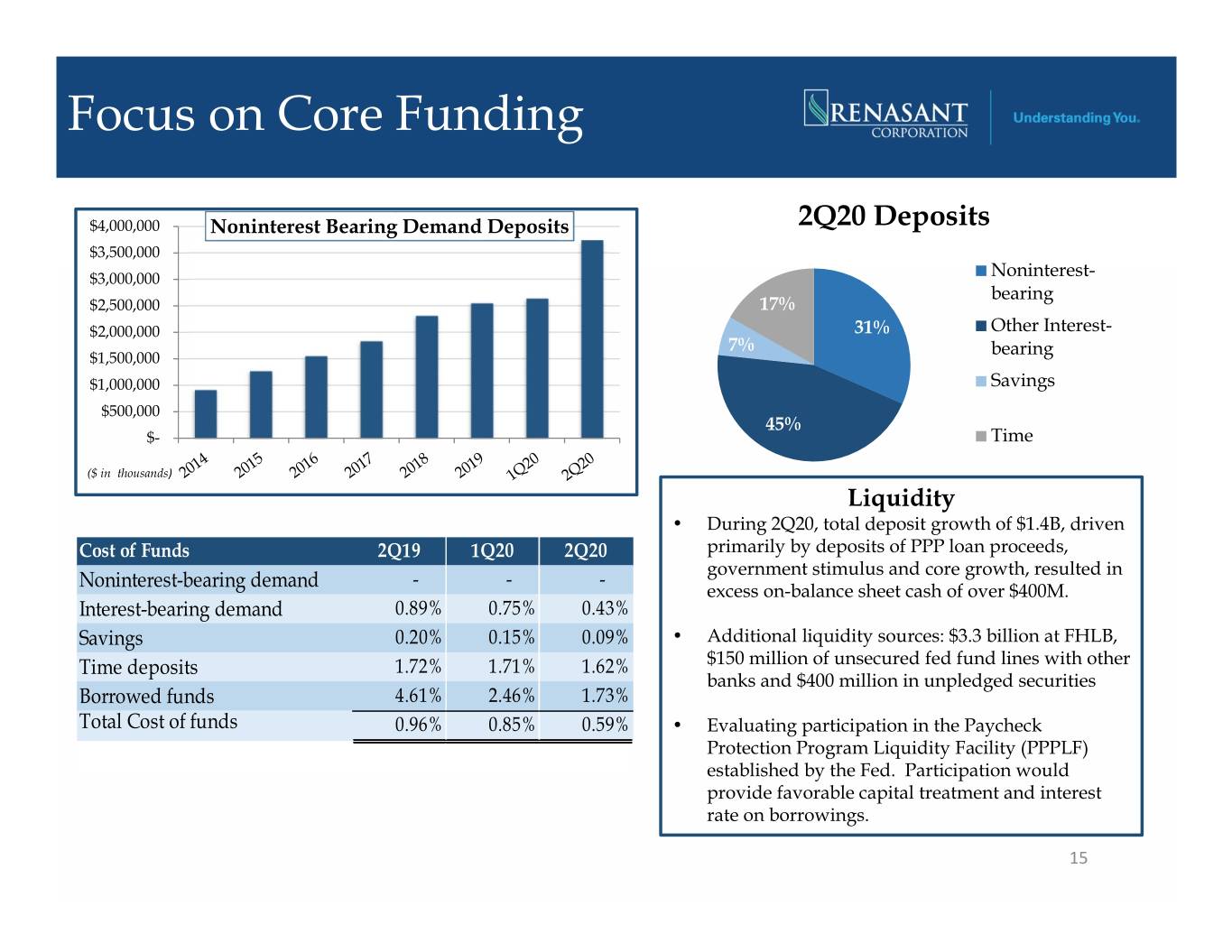

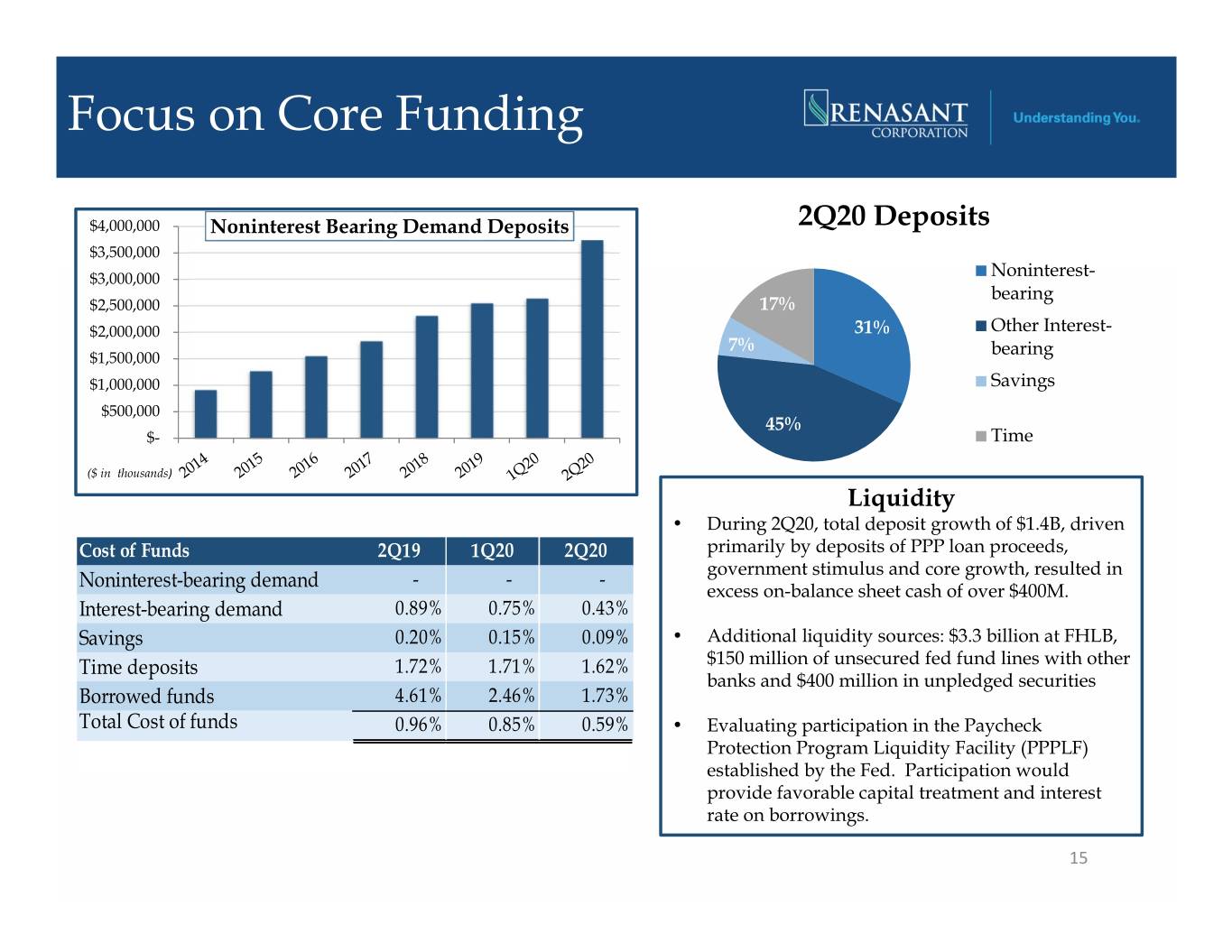

Focus on Core Funding $4,000,000 Noninterest Bearing Demand Deposits 2Q20 Deposits $3,500,000 $3,000,000 Noninterest- bearing $2,500,000 17% $2,000,000 31% Other Interest- 7% bearing $1,500,000 $1,000,000 Savings $500,000 45% $- Time ($ in thousands) Liquidity • During 2Q20, total deposit growth of $1.4B, driven Cost of Funds 2Q19 1Q20 2Q20 primarily by deposits of PPP loan proceeds, government stimulus and core growth, resulted in Noninterest-bearing demand - - - excess on-balance sheet cash of over $400M. Interest-bearing demand 0.89% 0.75% 0.43% Savings 0.20% 0.15% 0.09% • Additional liquidity sources: $3.3 billion at FHLB, $150 million of unsecured fed fund lines with other Time deposits 1.72% 1.71% 1.62% banks and $400 million in unpledged securities Borrowed funds 4.61% 2.46% 1.73% Total Cost of funds 0.96% 0.85% 0.59% • Evaluating participation in the Paycheck Protection Program Liquidity Facility (PPPLF) established by the Fed. Participation would provide favorable capital treatment and interest rate on borrowings. 15

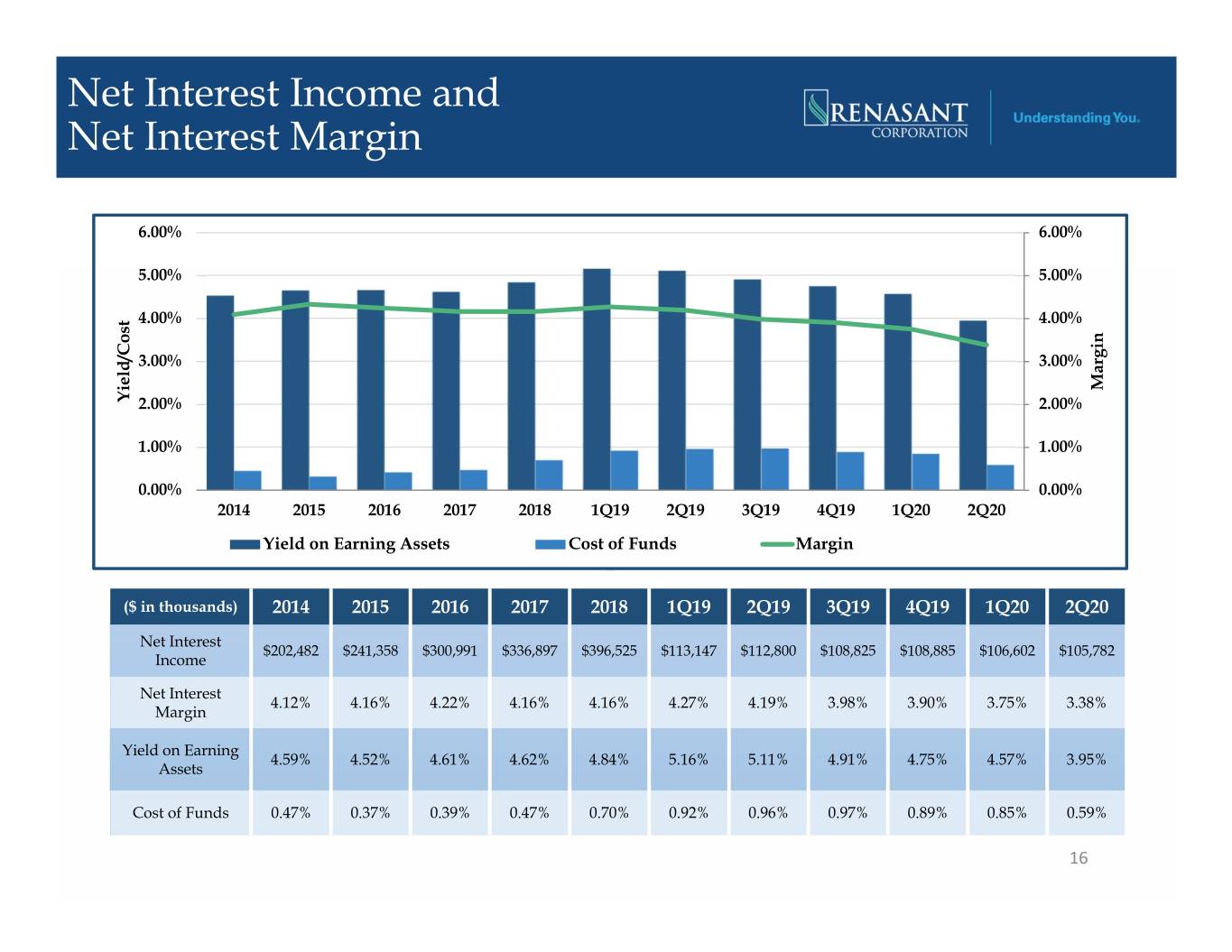

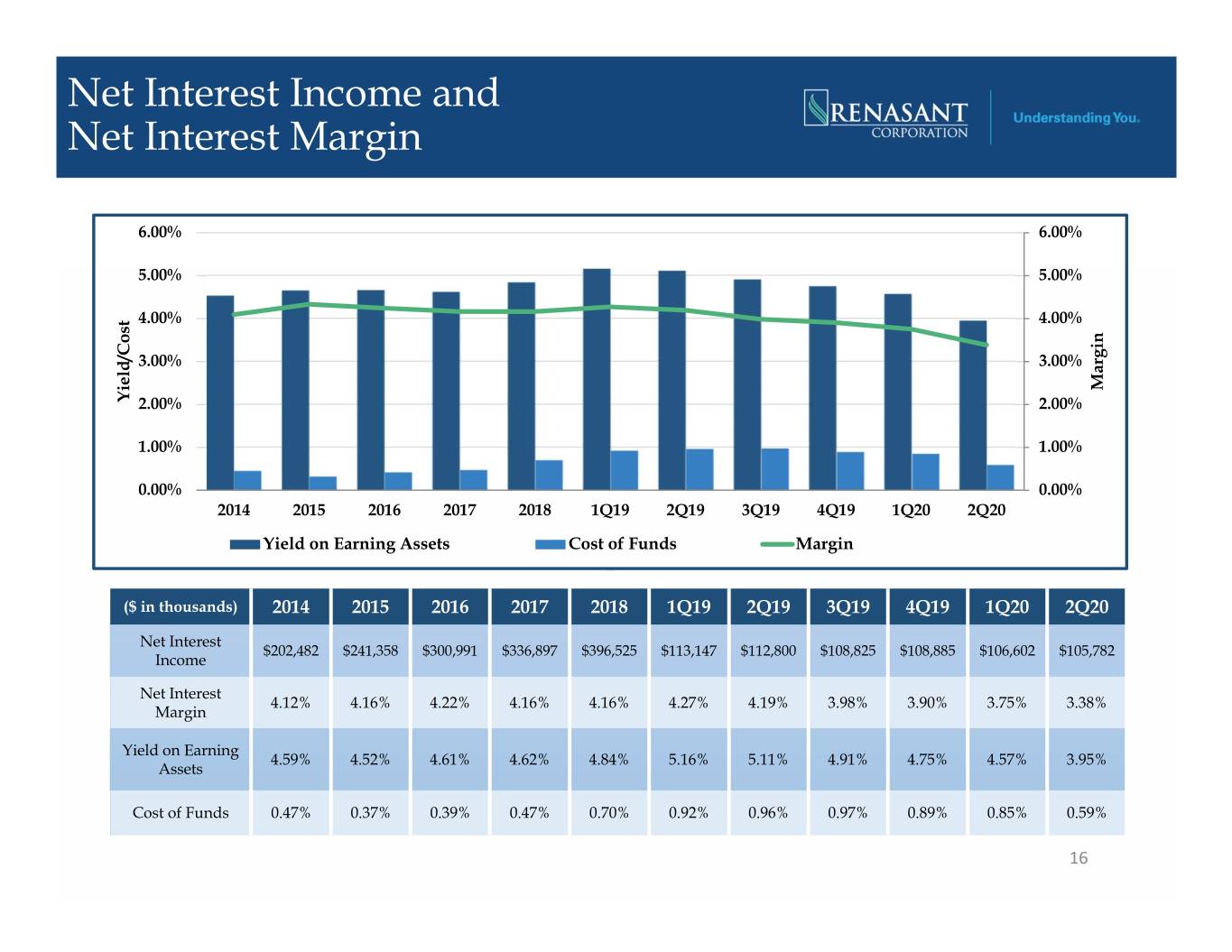

Net Interest Income and Net Interest Margin 6.00% 6.00% 5.00% 5.00% 4.00% 4.00% 3.00% 3.00% Margin Yield/Cost 2.00% 2.00% 1.00% 1.00% 0.00% 0.00% 2014 2015 2016 2017 2018 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Yield on Earning Assets Cost of Funds Margin ($ in thousands) 2014 2015 2016 2017 2018 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Net Interest $202,482 $241,358 $300,991 $336,897 $396,525 $113,147 $112,800 $108,825 $108,885 $106,602 $105,782 Income Net Interest 4.12% 4.16% 4.22% 4.16% 4.16% 4.27% 4.19% 3.98% 3.90% 3.75% 3.38% Margin Yield on Earning 4.59% 4.52% 4.61% 4.62% 4.84% 5.16% 5.11% 4.91% 4.75% 4.57% 3.95% Assets Cost of Funds 0.47% 0.37% 0.39% 0.47% 0.70% 0.92% 0.96% 0.97% 0.89% 0.85% 0.59% 16

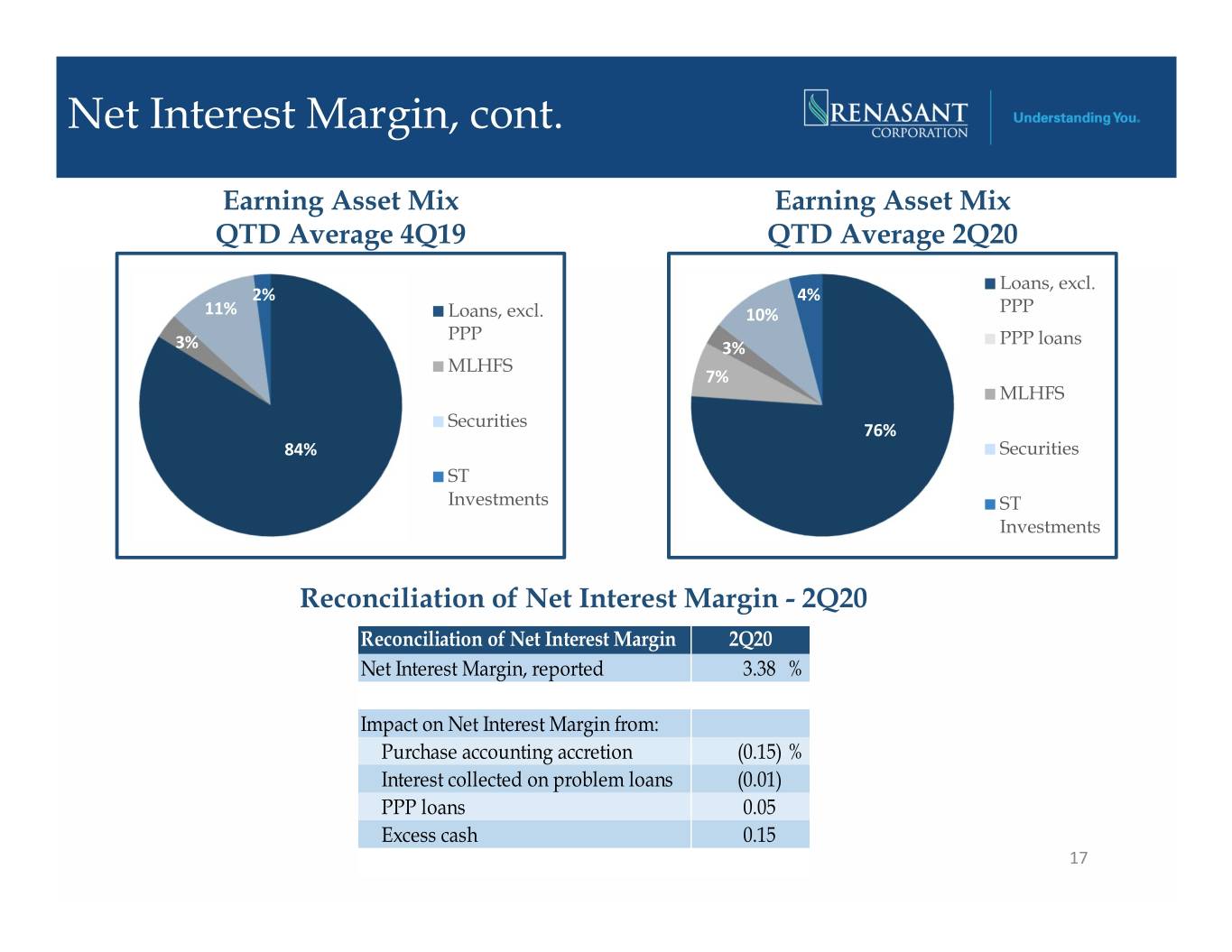

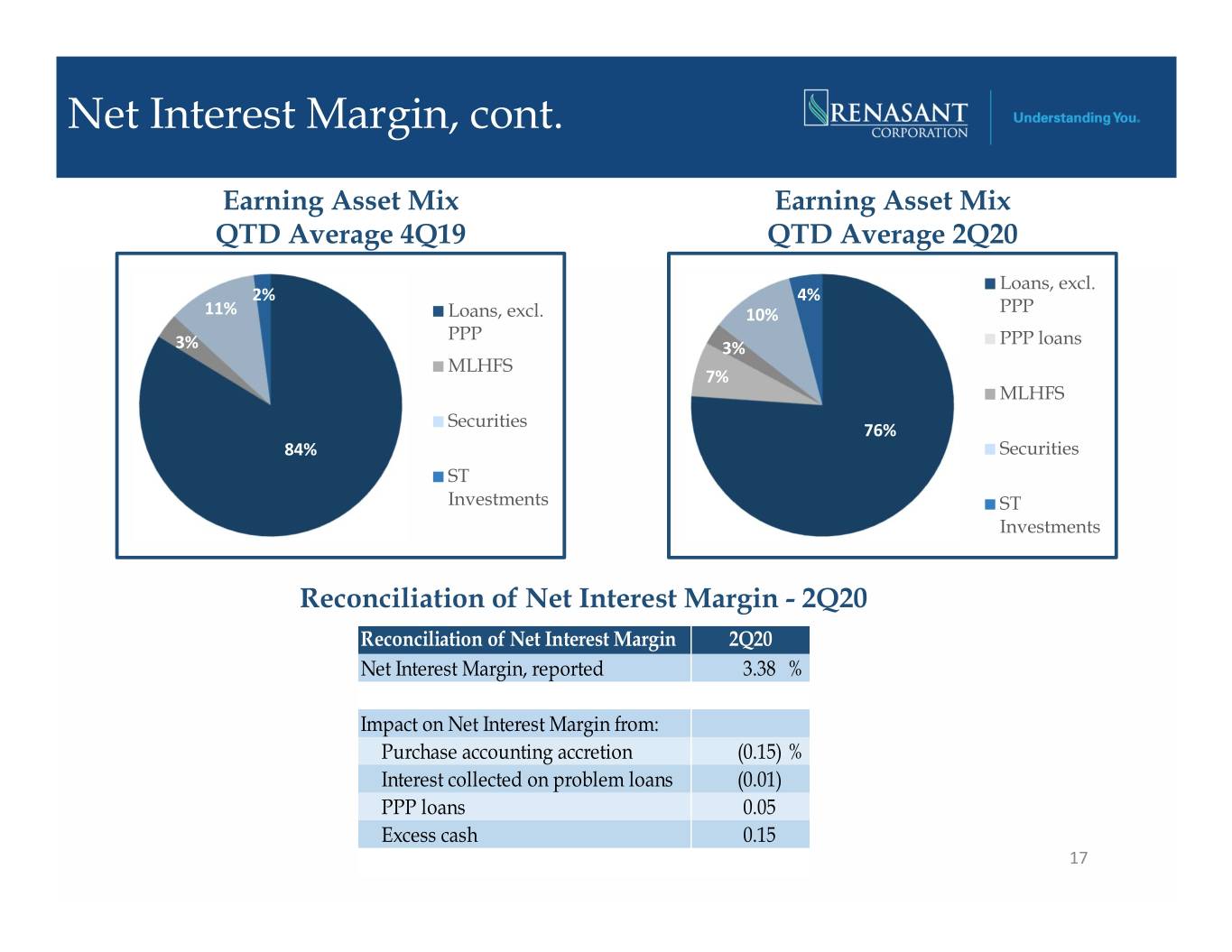

Net Interest Margin, cont. Earning Asset Mix Earning Asset Mix QTD Average 4Q19 QTD Average 2Q20 Loans, excl. 2% 4% 11% Loans, excl. 10% PPP PPP 3% 3% PPP loans MLHFS 7% MLHFS Securities 76% 84% Securities ST Investments ST Investments Reconciliation of Net Interest Margin - 2Q20 Reconciliation of Net Interest Margin 2Q20 Net Interest Margin, reported 3.38 % Impact on Net Interest Margin from: Purchase accounting accretion (0.15) % Interest collected on problem loans (0.01) PPP loans 0.05 Excess cash 0.15 17

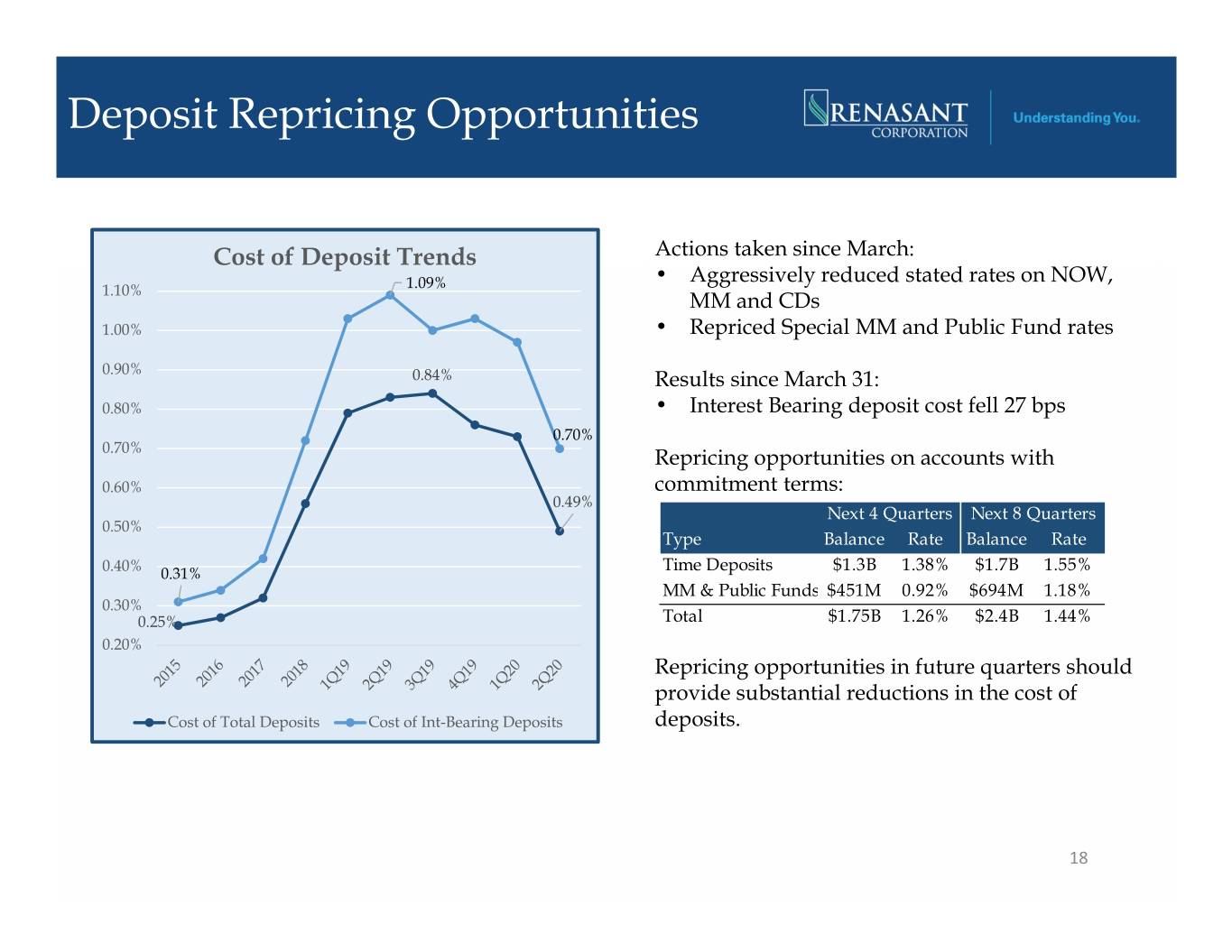

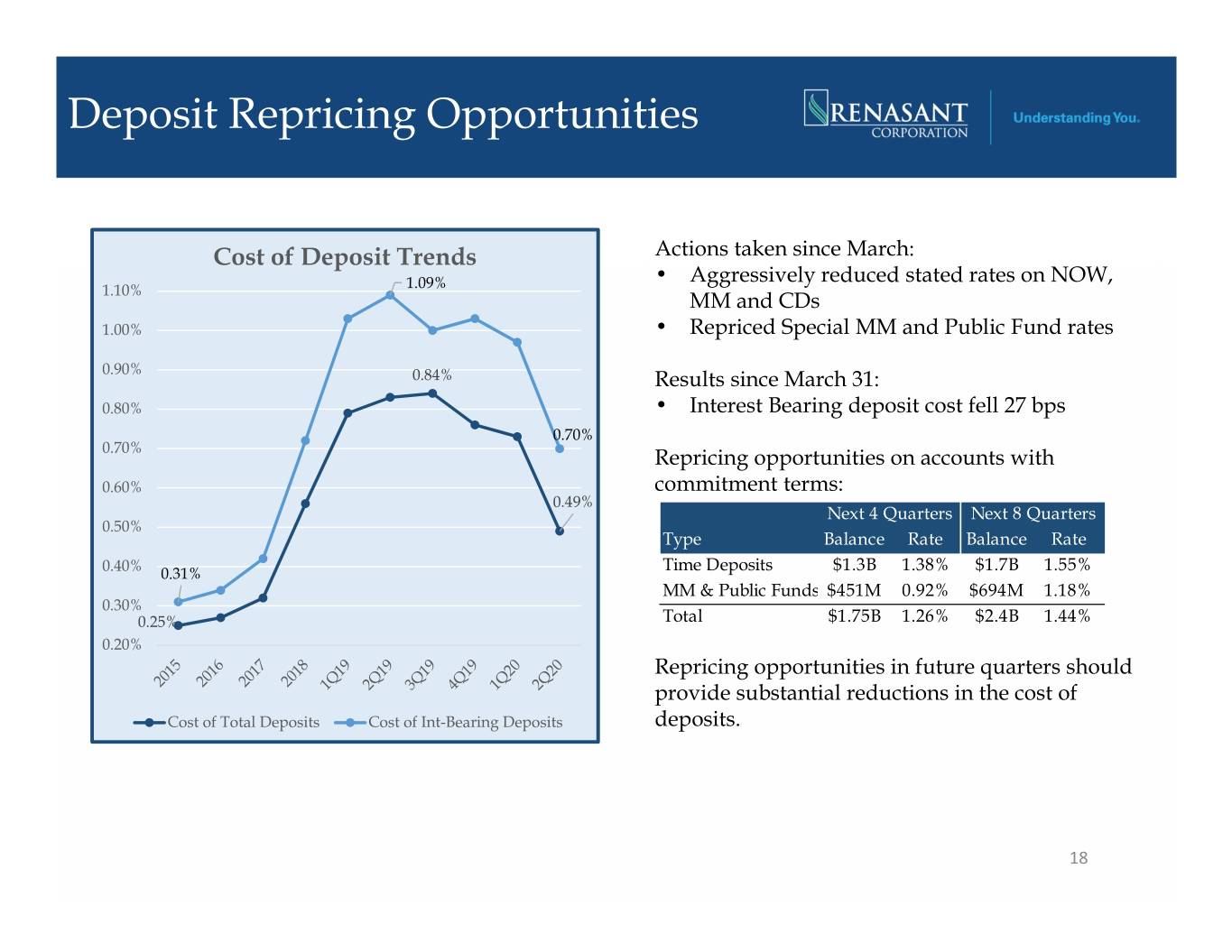

Deposit Repricing Opportunities Cost of Deposit Trends Actions taken since March: • Aggressively reduced stated rates on NOW, 1.10% 1.09% MM and CDs 1.00% • Repriced Special MM and Public Fund rates 0.90% 0.84% Results since March 31: 0.80% • Interest Bearing deposit cost fell 27 bps 0.70% 0.70% Repricing opportunities on accounts with 0.60% commitment terms: 0.49% Next 4 Quarters Next 8 Quarters 0.50% Type Balance Rate Balance Rate 0.40% Time Deposits $1.3B 1.38% $1.7B 1.55% 0.31% MM & Public Funds $451M 0.92% $694M 1.18% 0.30% 0.25% Total $1.75B 1.26% $2.4B 1.44% 0.20% Repricing opportunities in future quarters should provide substantial reductions in the cost of Cost of Total Deposits Cost of Int-Bearing Deposits deposits. 18

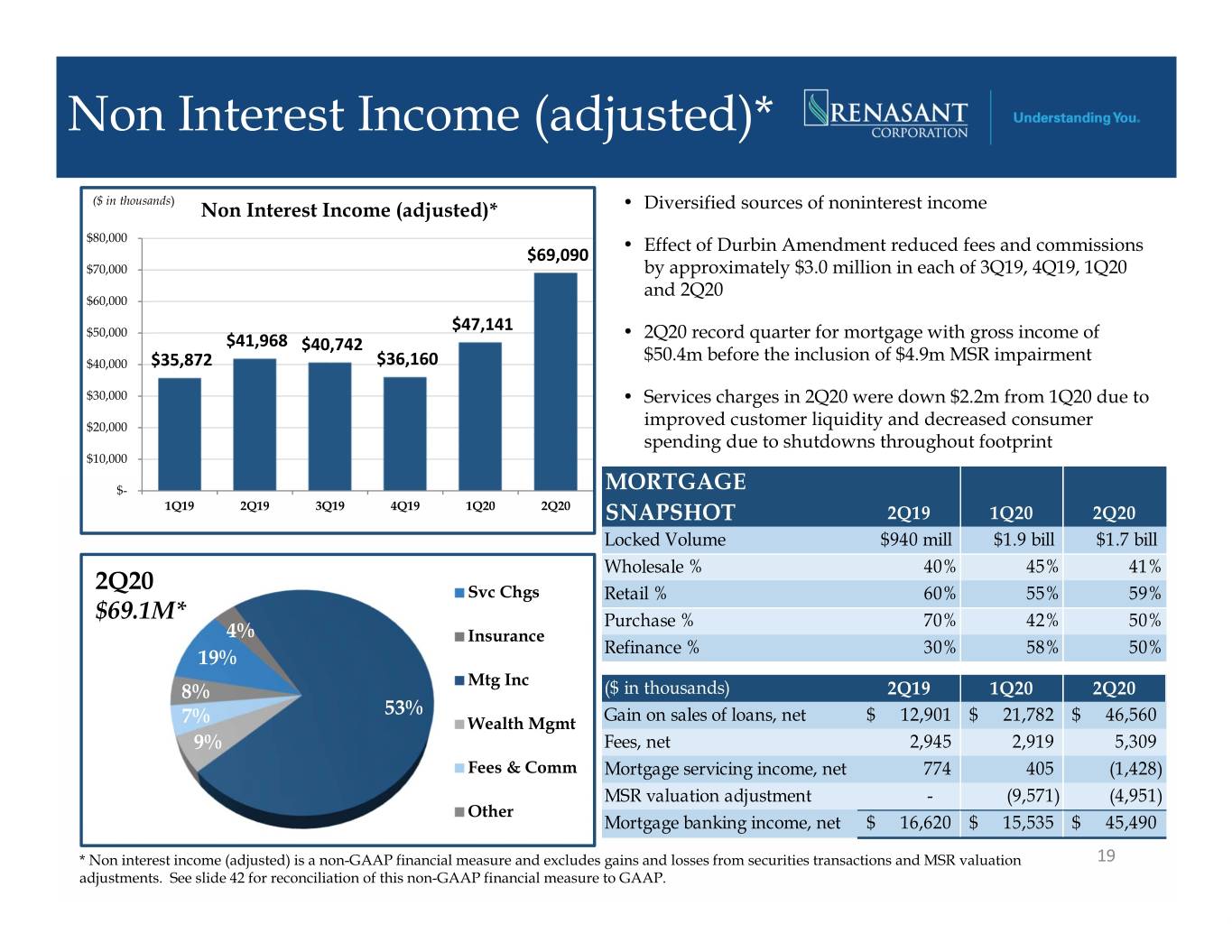

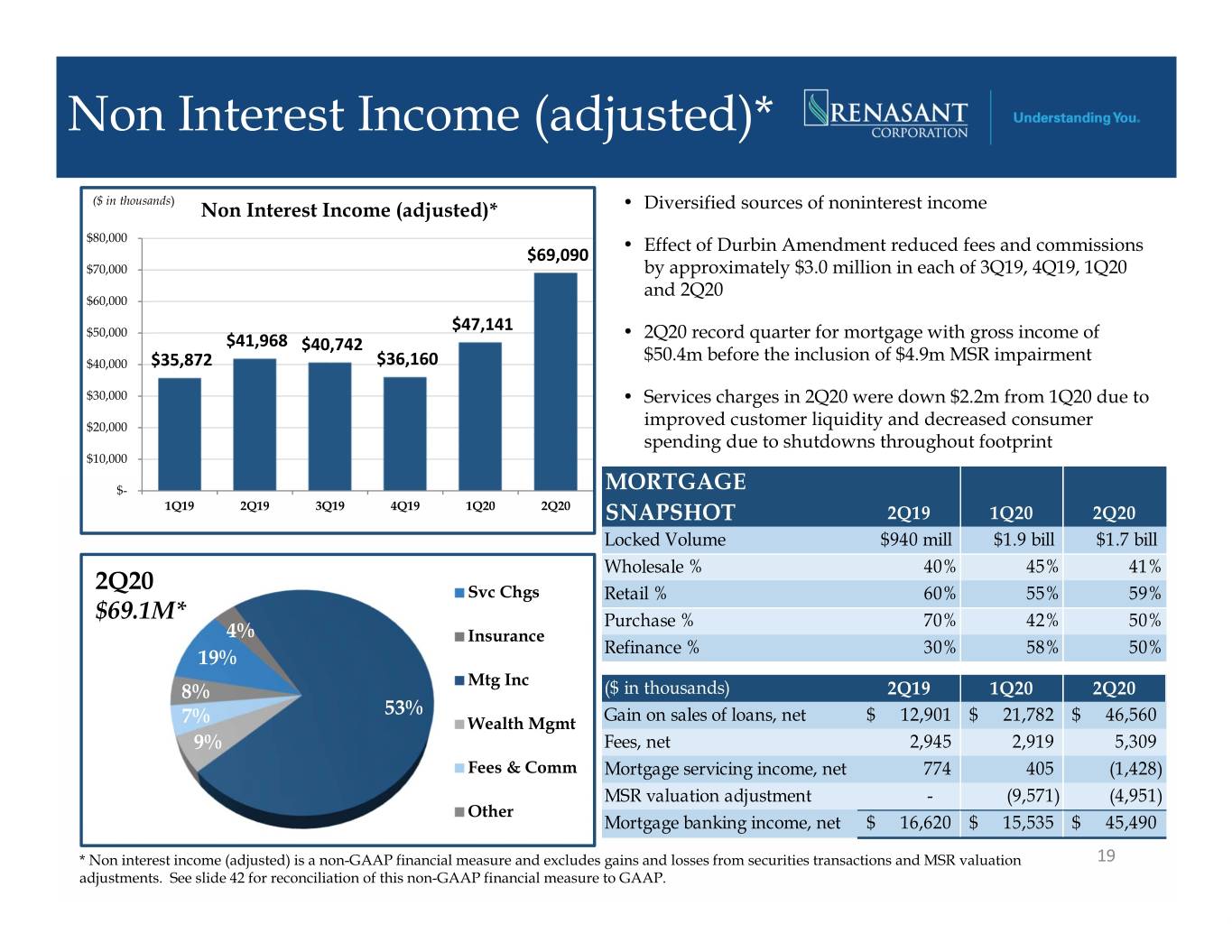

Non Interest Income (adjusted)* ($ in thousands) Non Interest Income (adjusted)* • Diversified sources of noninterest income $80,000 • $69,090 Effect of Durbin Amendment reduced fees and commissions $70,000 by approximately $3.0 million in each of 3Q19, 4Q19, 1Q20 and 2Q20 $60,000 $47,141 $50,000 • 2Q20 record quarter for mortgage with gross income of $41,968 $40,742 $40,000 $35,872 $36,160 $50.4m before the inclusion of $4.9m MSR impairment $30,000 • Services charges in 2Q20 were down $2.2m from 1Q20 due to $20,000 improved customer liquidity and decreased consumer spending due to shutdowns throughout footprint $10,000 $- MORTGAGE 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 SNAPSHOT 2Q19 1Q20 2Q20 Locked Volume $940 mill $1.9 bill $1.7 bill Wholesale % 40% 45% 41% 2Q20 Svc Chgs Retail % 60% 55% 59% $69.1M* Purchase % 70% 42% 50% 4% Insurance 19% Refinance % 30% 58% 50% Mtg Inc 8% ($ in thousands) 2Q19 1Q20 2Q20 53% 7% Wealth Mgmt Gain on sales of loans, net$ 12,901 $ 21,782 $ 46,560 9% Fees, net 2,945 2,919 5,309 Fees & Comm Mortgage servicing income, net 774 405 (1,428) MSR valuation adjustment - (9,571) (4,951) Other Mortgage banking income, net$ 16,620 $ 15,535 $ 45,490 * Non interest income (adjusted) is a non-GAAP financial measure and excludes gains and losses from securities transactions and MSR valuation 19 adjustments. See slide 42 for reconciliation of this non-GAAP financial measure to GAAP.

Four Key Strategic Initiatives • Focus on highly-accretive acquisition opportunities Capitalize on • Leverage existing markets Opportunities • Seek new markets • New lines of business • Superior returns • Revenue growth / Expense control Enhance Profitability • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth • Enhance credit process, policies and personnel Focus on Risk • Aggressively identify and manage problem credits Management • Board focus on Enterprise Risk Management • Selective balance sheet growth Build Capital Ratios • Maintain dividend • Prudently manage capital 20

Asset Quality Metrics Loans 30-89 Days Past Due/ Classified Loans/Total Loans(1) (1) Total Loans $180,000 2.00% $50,000 0.60% $160,000 1.80% $140,000 1.60% 0.50% $40,000 $120,000 1.40% 1.20% 0.40% $100,000 $30,000 1.00% $80,000 0.30% 0.80% $20,000 $60,000 0.20% 0.60% $40,000 0.40% $10,000 0.10% $20,000 0.20% $- 0.00% $- 0.00% ($ in thousands) ($ in thousands) 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 30-89 DPD % of Total Loans, excl. PPP Classified Loans % of Total Loans, excl PPP (1) PPP loans excluded from the balance of “Total Loans” 21

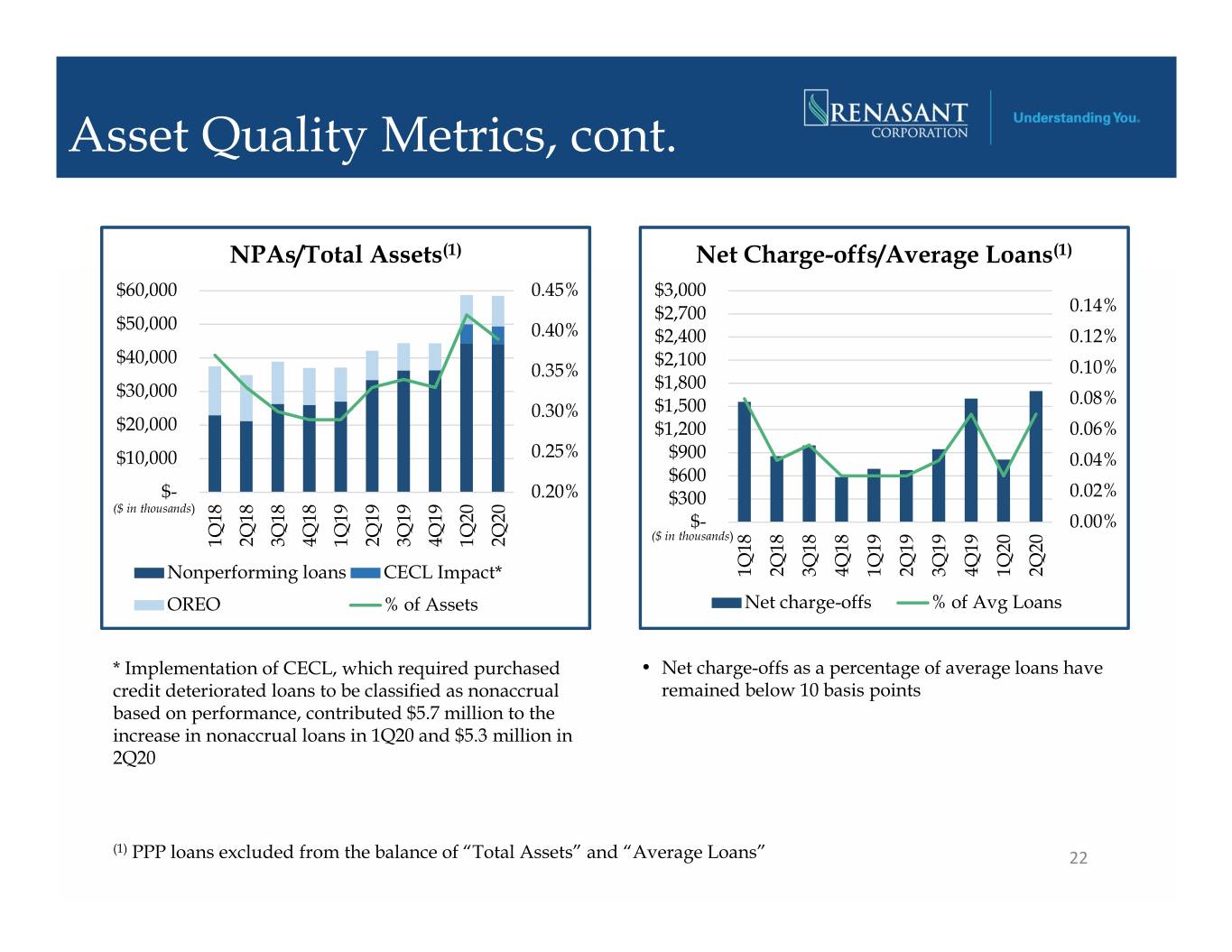

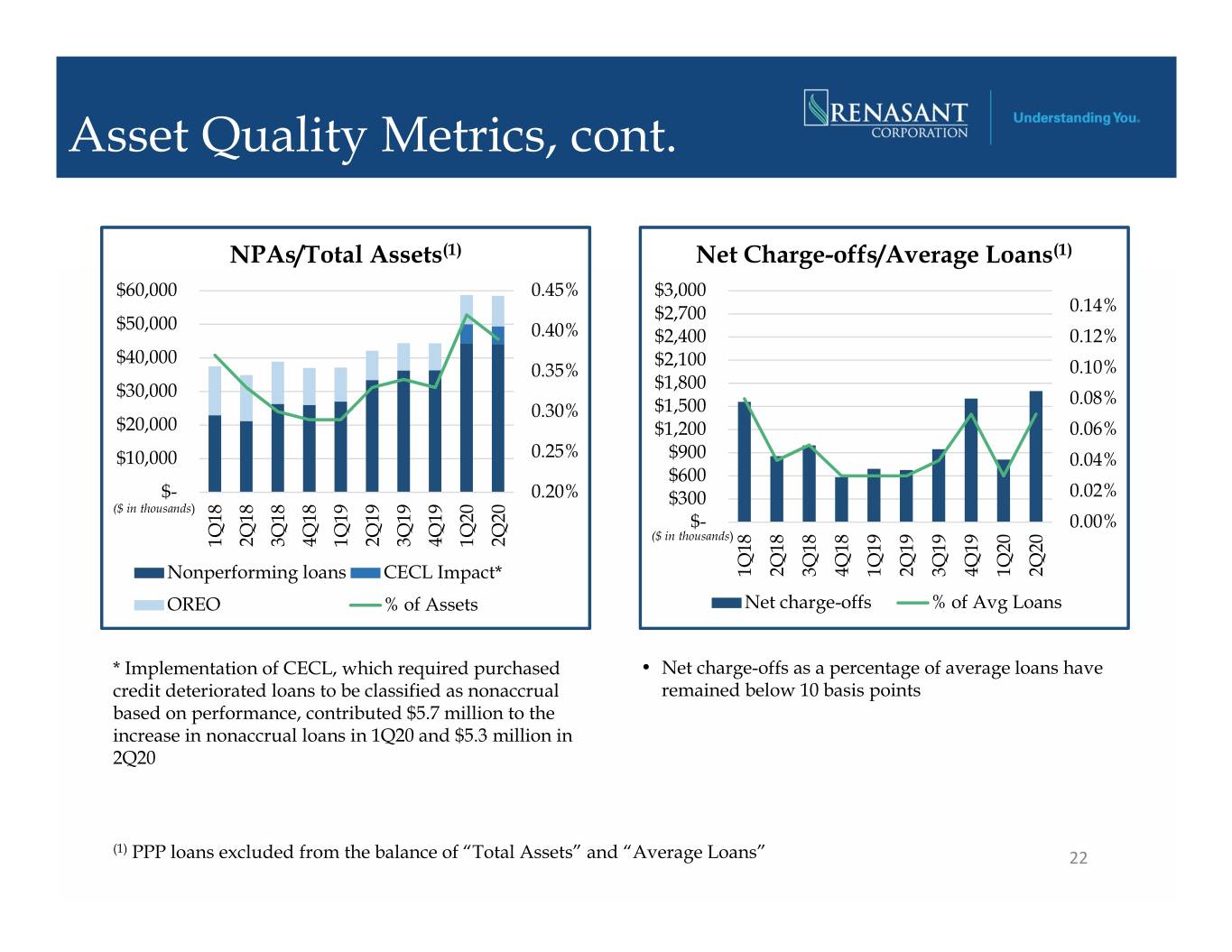

Asset Quality Metrics, cont. NPAs/Total Assets(1) Net Charge-offs/Average Loans(1) $60,000 0.45% $3,000 $2,700 0.14% $50,000 0.40% $2,400 0.12% $40,000 $2,100 0.35% 0.10% $1,800 $30,000 0.08% 0.30% $1,500 $20,000 $1,200 0.06% $10,000 0.25% $900 0.04% $600 $- 0.20% $300 0.02% ($ in thousands) $- 0.00% ($ in thousands) 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Nonperforming loans CECL Impact* 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 OREO % of Assets Net charge-offs % of Avg Loans * Implementation of CECL, which required purchased • Net charge-offs as a percentage of average loans have credit deteriorated loans to be classified as nonaccrual remained below 10 basis points based on performance, contributed $5.7 million to the increase in nonaccrual loans in 1Q20 and $5.3 million in 2Q20 (1) PPP loans excluded from the balance of “Total Assets” and “Average Loans” 22

Asset Quality Metrics, cont. Allowance/Total Loans Allowance/Nonperforming Loans $140,000 1.60% $140,000 700.00% 1.40% $120,000 $120,000 600.00% 1.20% $100,000 $100,000 500.00% 1.00% $80,000 $80,000 400.00% 0.80% $60,000 300.00% $60,000 0.60% 200.00% $40,000 0.40% $40,000 $20,000 0.20% $20,000 100.00% $- 0.00% $- 0.00% ($ in thousands) ($ in thousands) 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Allowance % of Total Loans, excl. PPP Allowance % of Total NPLs • Adopted CECL effective January 1, 2020 23

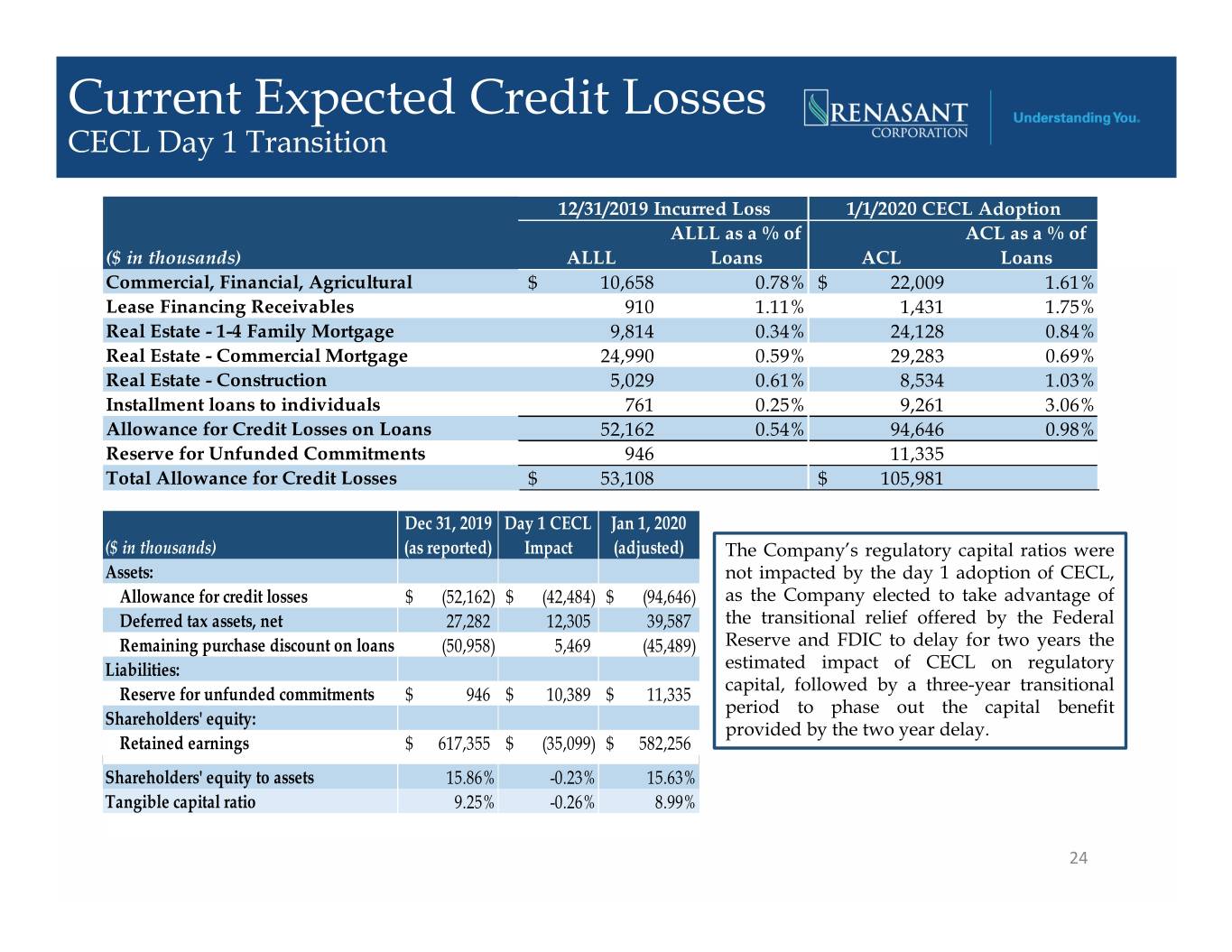

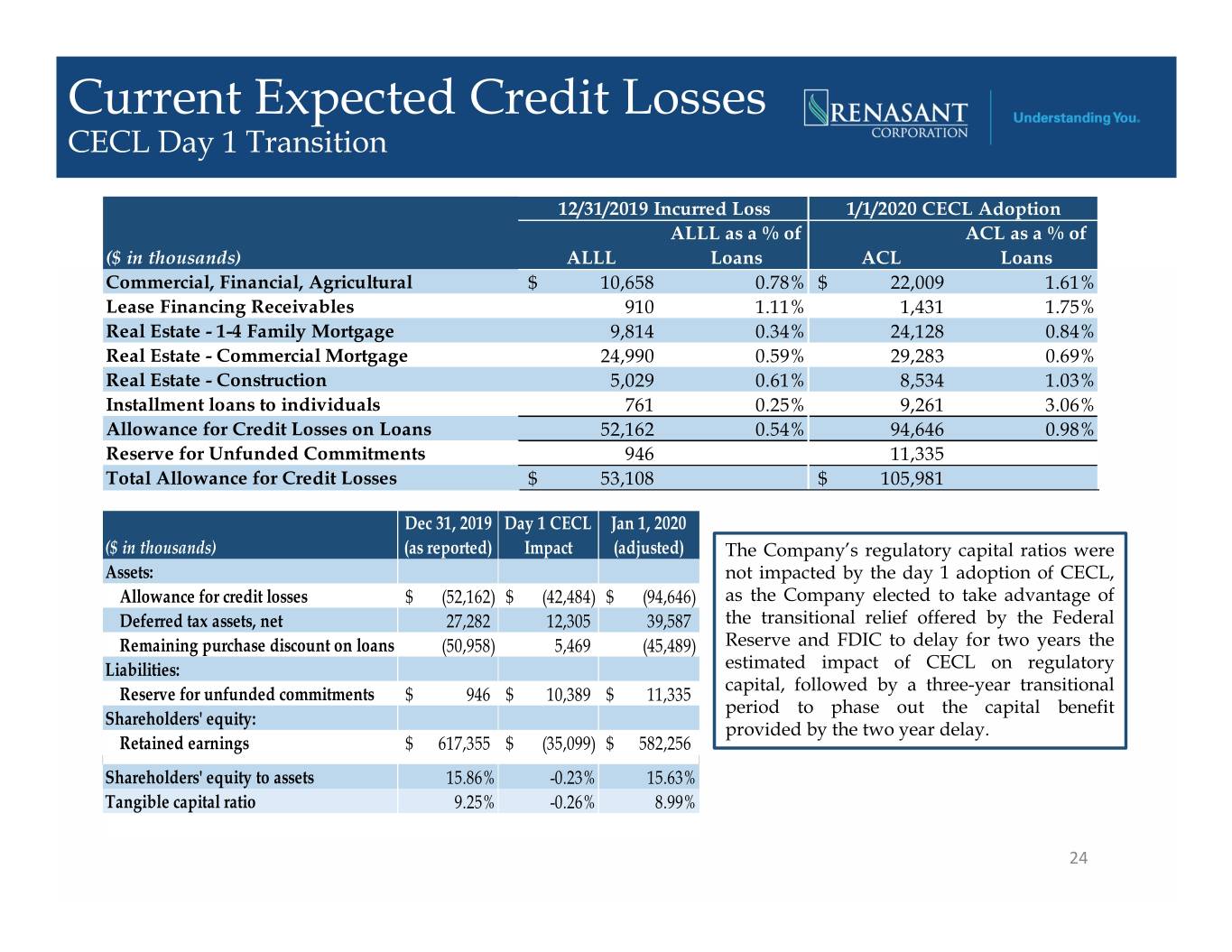

Current Expected Credit Losses CECL Day 1 Transition 12/31/2019 Incurred Loss 1/1/2020 CECL Adoption ALLL as a % of ACL as a % of ($ in thousands) ALLL Loans ACL Loans Commercial, Financial, Agricultural $ 10,658 0.78%$ 22,009 1.61% Lease Financing Receivables 910 1.11% 1,431 1.75% Real Estate - 1-4 Family Mortgage 9,814 0.34% 24,128 0.84% Real Estate - Commercial Mortgage 24,990 0.59% 29,283 0.69% Real Estate - Construction 5,029 0.61% 8,534 1.03% Installment loans to individuals 761 0.25% 9,261 3.06% Allowance for Credit Losses on Loans 52,162 0.54% 94,646 0.98% Reserve for Unfunded Commitments 946 11,335 Total Allowance for Credit Losses $ 53,108 $ 105,981 Dec 31, 2019 Day 1 CECL Jan 1, 2020 ($ in thousands) (as reported) Impact (adjusted) The Company’s regulatory capital ratios were Assets: not impacted by the day 1 adoption of CECL, Allowance for credit losses $ (52,162) $ (42,484) $ (94,646) as the Company elected to take advantage of Deferred tax assets, net 27,282 12,305 39,587 the transitional relief offered by the Federal Remaining purchase discount on loans (50,958) 5,469 (45,489) Reserve and FDIC to delay for two years the Liabilities: estimated impact of CECL on regulatory capital, followed by a three-year transitional Reserve for unfunded commitments $ 946 $ 10,389 $ 11,335 period to phase out the capital benefit Shareholders' equity: provided by the two year delay. Retained earnings $ 617,355 $ (35,099) $ 582,256 Shareholders' equity to assets 15.86% -0.23% 15.63% Tangible capital ratio 9.25% -0.26% 8.99% 24

CECL 2020 Reserve Build 1/1/2020 CECL Adoption 3/31/2020 CECL 6/30/2020 CECL ACL as a % of ACL as a % of ACL as a % of ($ in thousands) ACL Loans ACL Loans ACL Loans SBA Paycheck Protection Program - - - - $ - 0.00% Commercial, Financial, Agricultural $ 22,009 1.61%$ 25,937 1.82% 30,685 2.26% Lease Financing Receivables 1,431 1.75% 1,588 1.88% 1,812 2.24% Real Estate - 1-4 Family Mortgage 24,128 0.84% 27,320 0.96% 29,401 1.05% Real Estate - Commercial Mortgage 29,283 0.69% 44,237 1.03% 60,061 1.36% Real Estate - Construction 8,534 1.03% 10,924 1.39% 12,538 1.58% Installment loans to individuals 9,261 3.06% 10,179 3.21% 10,890 3.83% Allowance for Credit Losses on Loans 94,646 0.98% 120,185 1.23% 145,387 1.32% Reserve for Unfunded Commitments 11,335 14,735 17,335 Total Allowance for Credit Losses $ 105,981 $ 134,920 $ 162,722 ACL on Total Loans excluding PPP loans 0.98% 1.23% 1.50% (in thousands) 2020 Highlights: Credit Cost • Elevated provision during the year is qualitatively driven Provision for Credit Losses Reserve for Unfunded Cmmt related to the uncertainty around the COVID-19 pandemic with forecasted negative GDP growth and high $26,900 $26,350 unemployment rates throughout 2020 and into 2021 and a potential prolonged economic recovery • The potential benefits of the CARES Act stimulus package (i.e. PPP loan program, stimulus checks to individual $3,400 $2,600 householdsandenhancedunemployment benefits) as well as internal programs implemented to assist customers were 1Q20 2Q20 also considered when developing the estimate 25

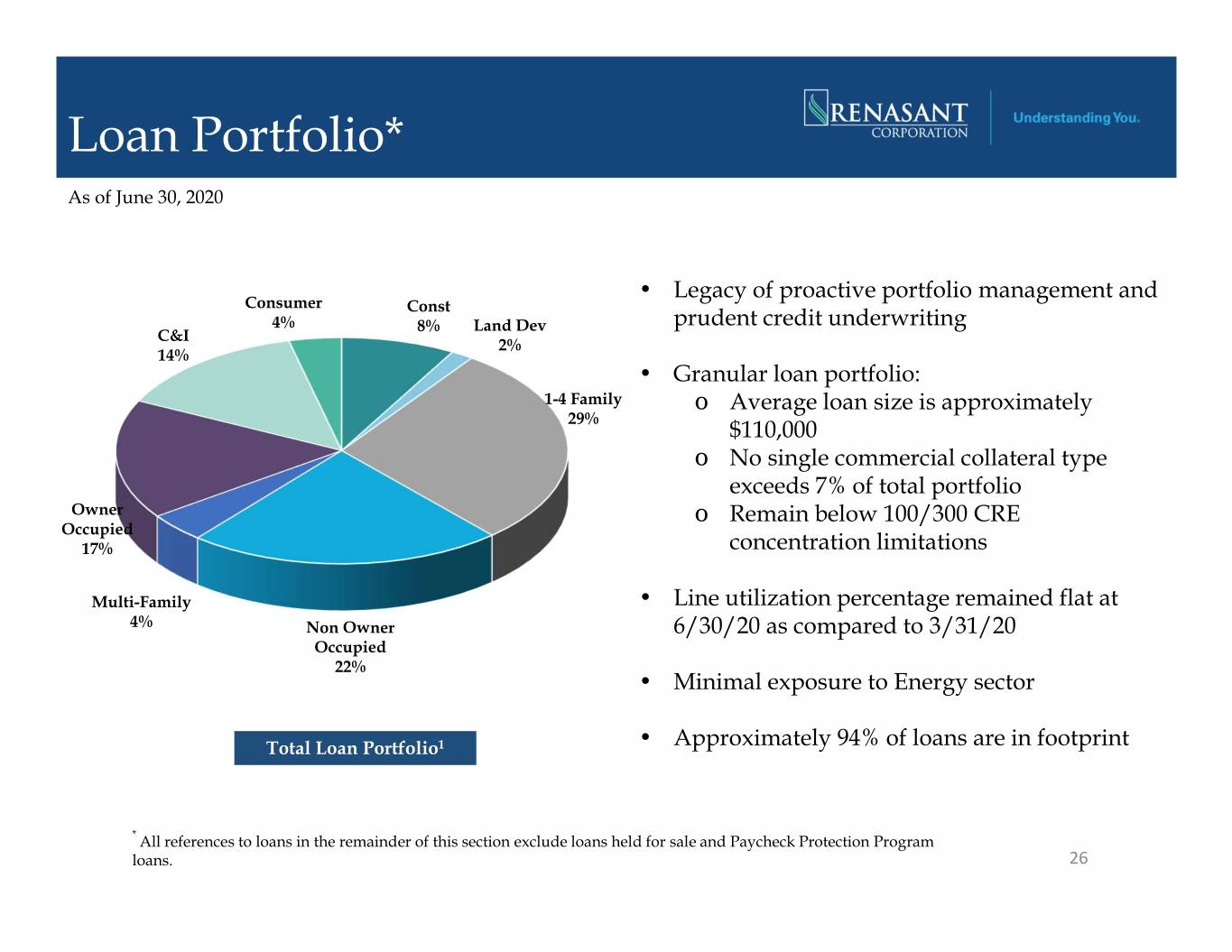

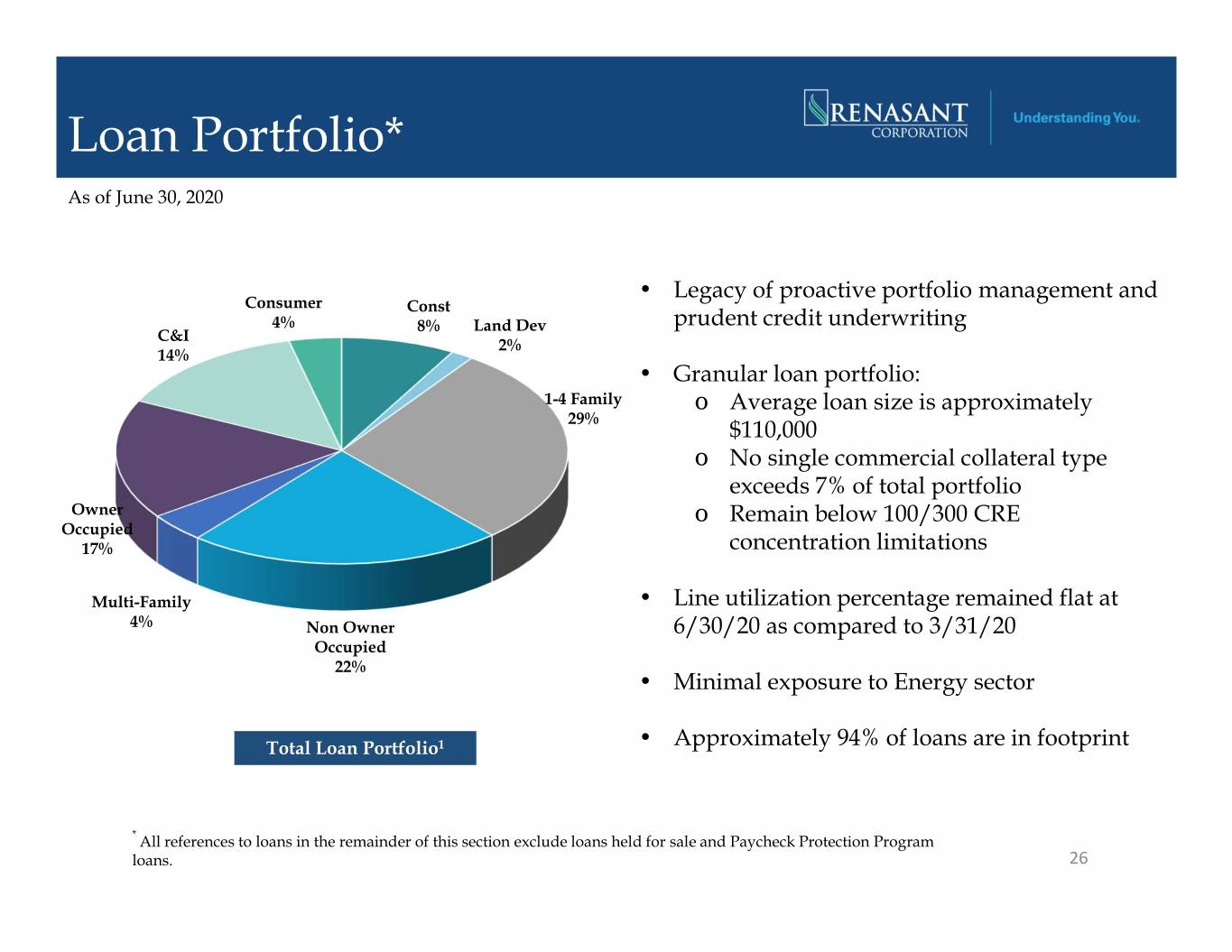

Loan Portfolio* As of June 30, 2020 • Legacy of proactive portfolio management and Consumer Const 4% 8% Land Dev prudent credit underwriting C&I 2% 14% • Granular loan portfolio: 1-4 Family o Average loan size is approximately 29% $110,000 o No single commercial collateral type exceeds 7% of total portfolio Owner o Remain below 100/300 CRE Occupied 17% concentration limitations Multi-Family • Line utilization percentage remained flat at 4% Non Owner 6/30/20 as compared to 3/31/20 Occupied 22% • Minimal exposure to Energy sector Total Loan Portfolio1 • Approximately 94% of loans are in footprint * All references to loans in the remainder of this section exclude loans held for sale and Paycheck Protection Program loans. 26

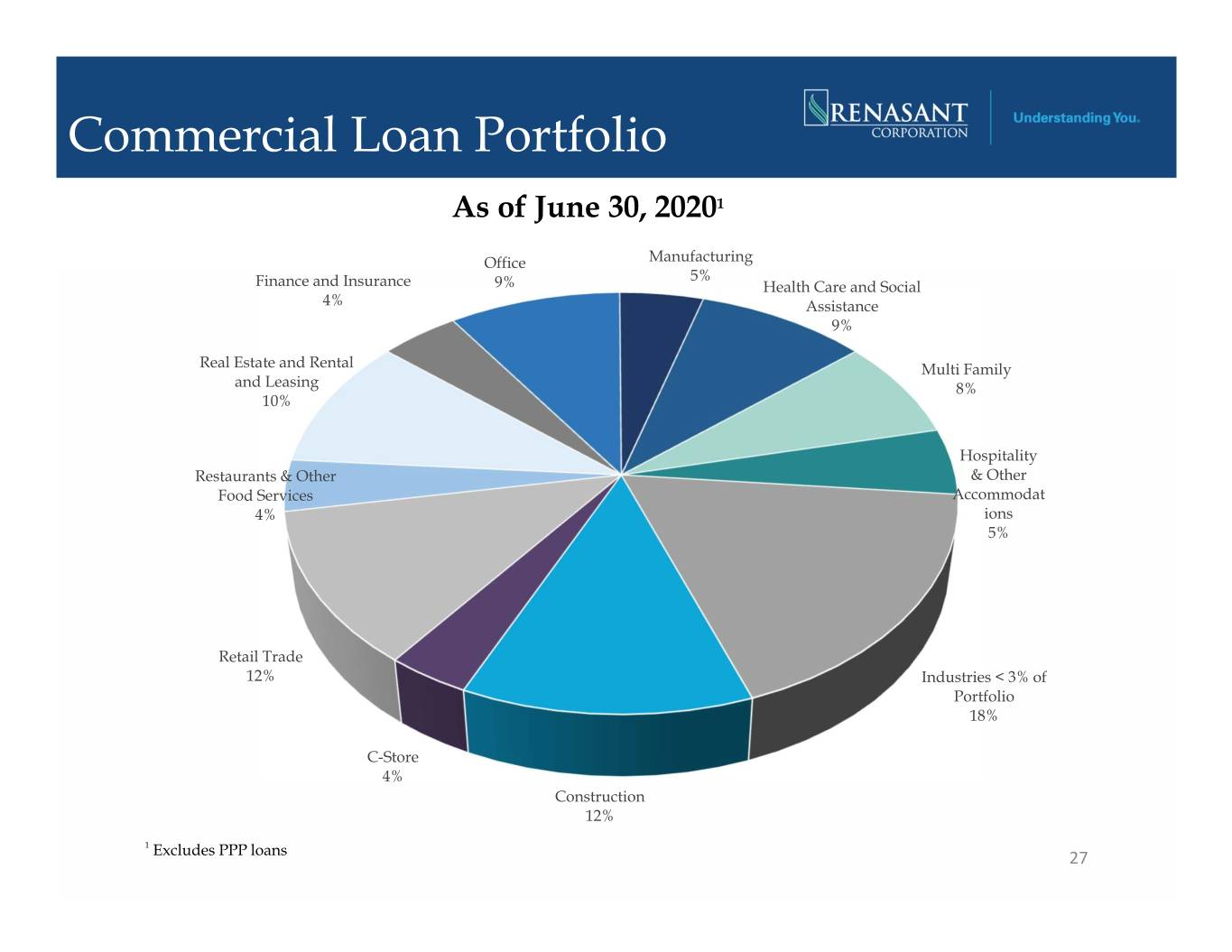

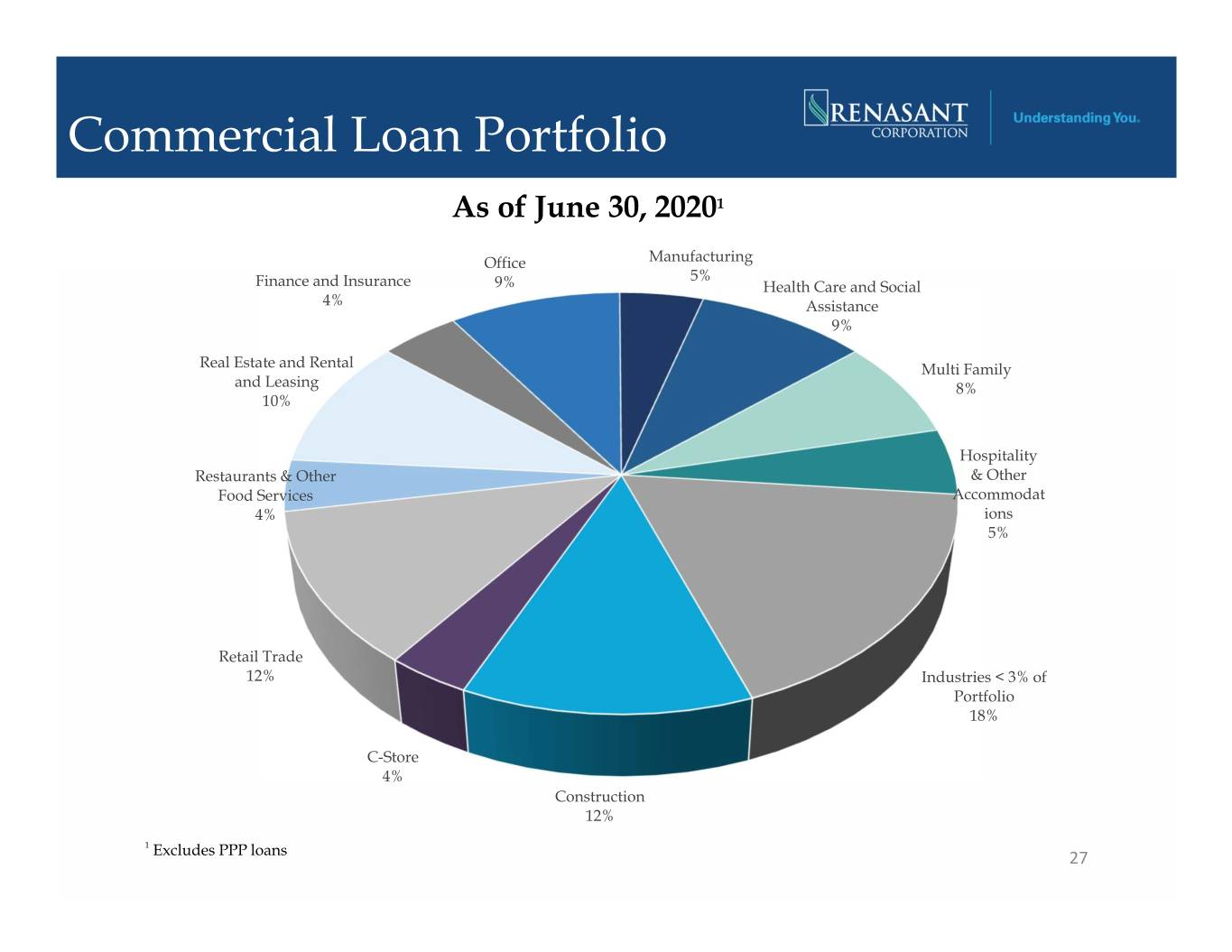

Commercial Loan Portfolio As of June 30, 20201 Office Manufacturing 5% Finance and Insurance 9% Health Care and Social 4% Assistance 9% Real Estate and Rental Multi Family and Leasing 8% 10% Hospitality Restaurants & Other & Other Food Services Accommodat 4% ions 5% Retail Trade 12% Industries < 3% of Portfolio 18% C-Store 4% Construction 12% 1 Excludes PPP loans 27

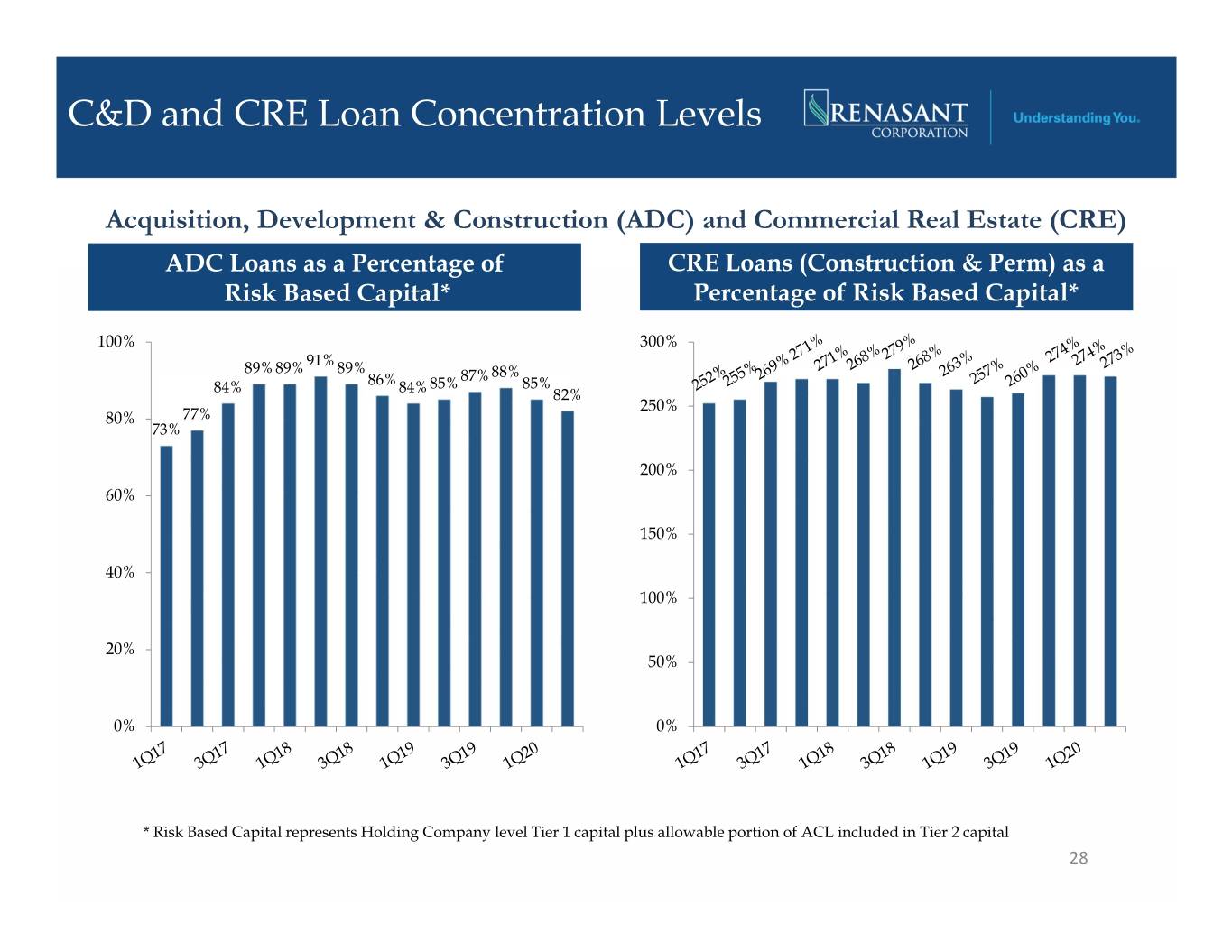

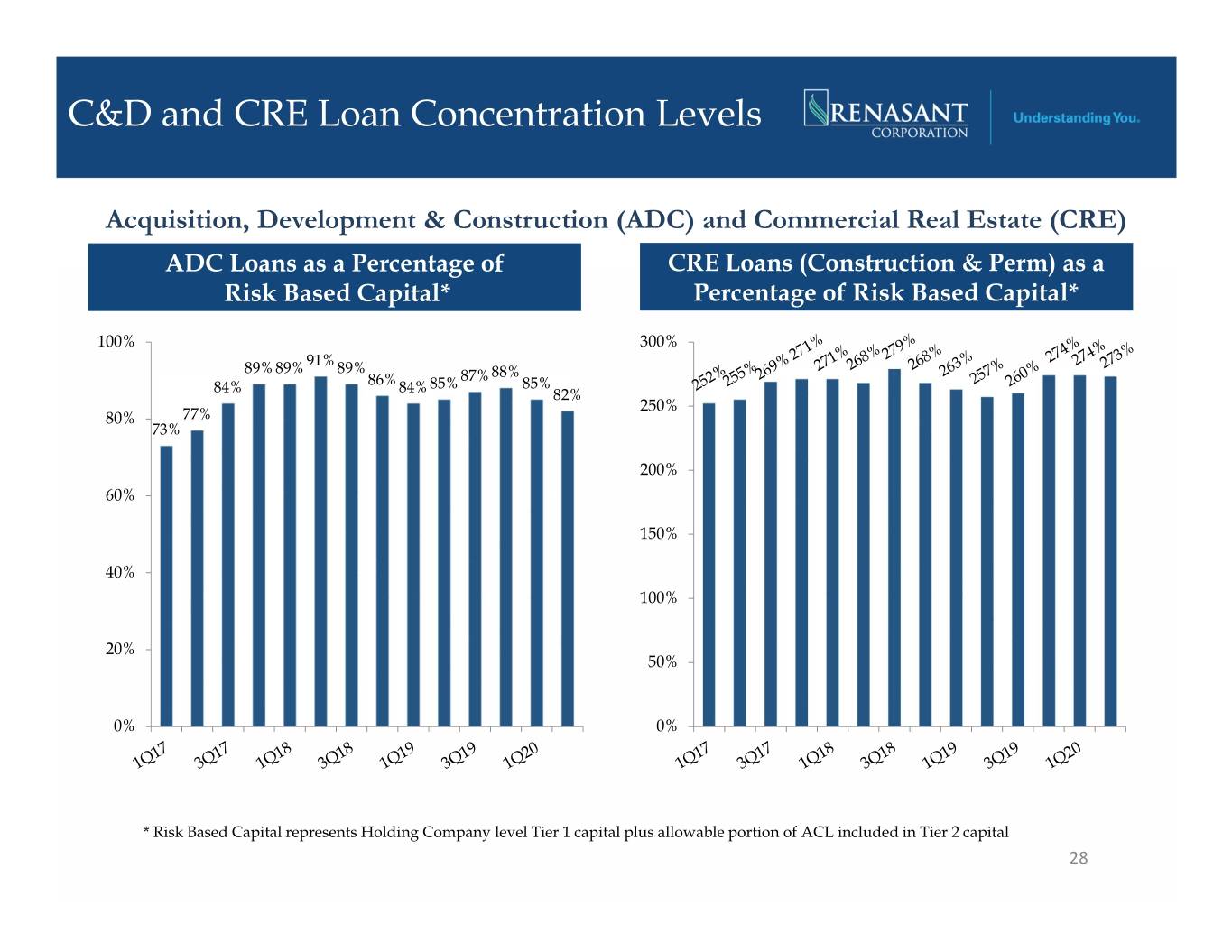

C&D and CRE Loan Concentration Levels Acquisition, Development & Construction (ADC) and Commercial Real Estate (CRE) ADC Loans as a Percentage of CRE Loans (Construction & Perm) as a Risk Based Capital* Percentage of Risk Based Capital* 100% 300% 91% 89% 89% 89% 88% 86% 85% 87% 85% 84% 84% 82% 250% 80% 77% 73% 200% 60% 150% 40% 100% 20% 50% 0% 0% * Risk Based Capital represents Holding Company level Tier 1 capital plus allowable portion of ACL included in Tier 2 capital 28

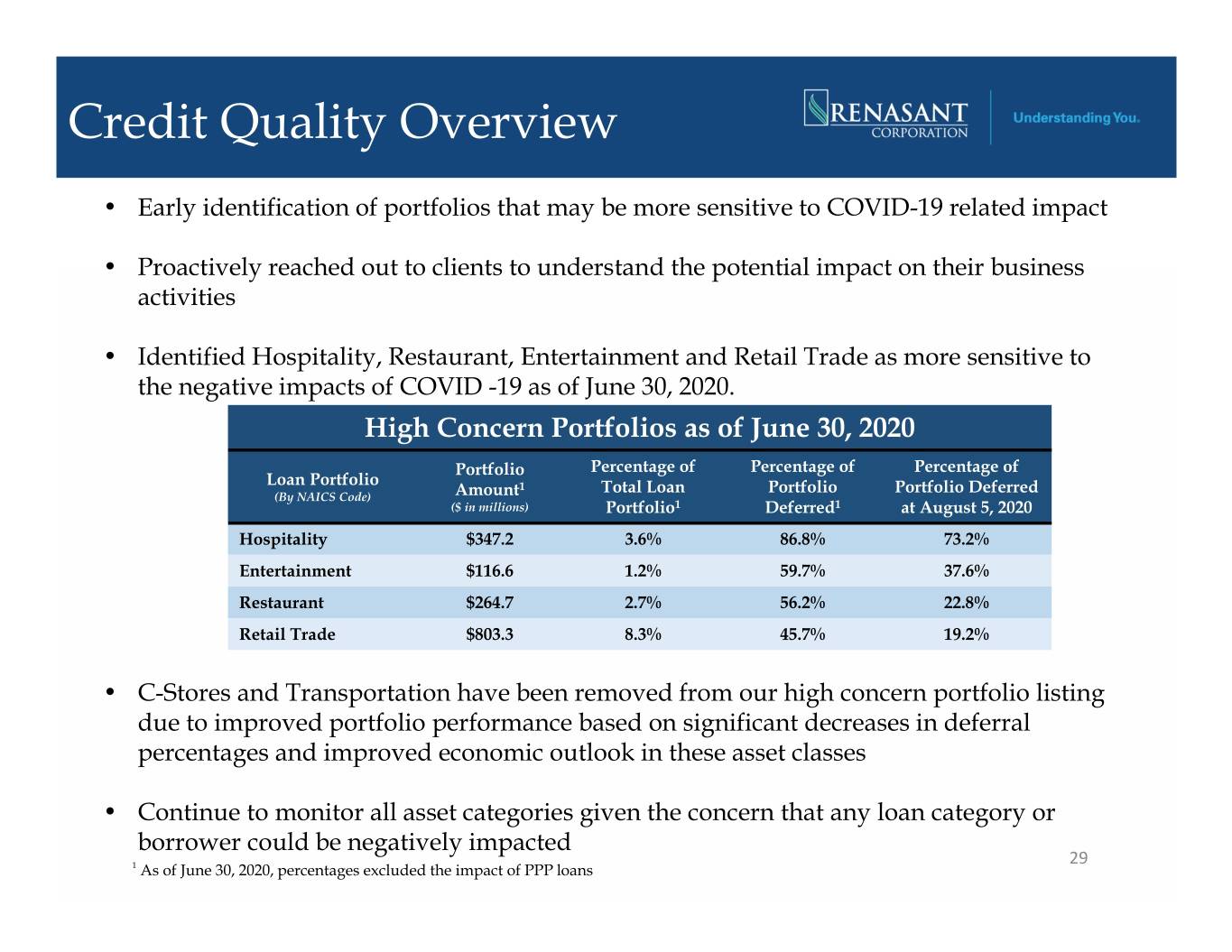

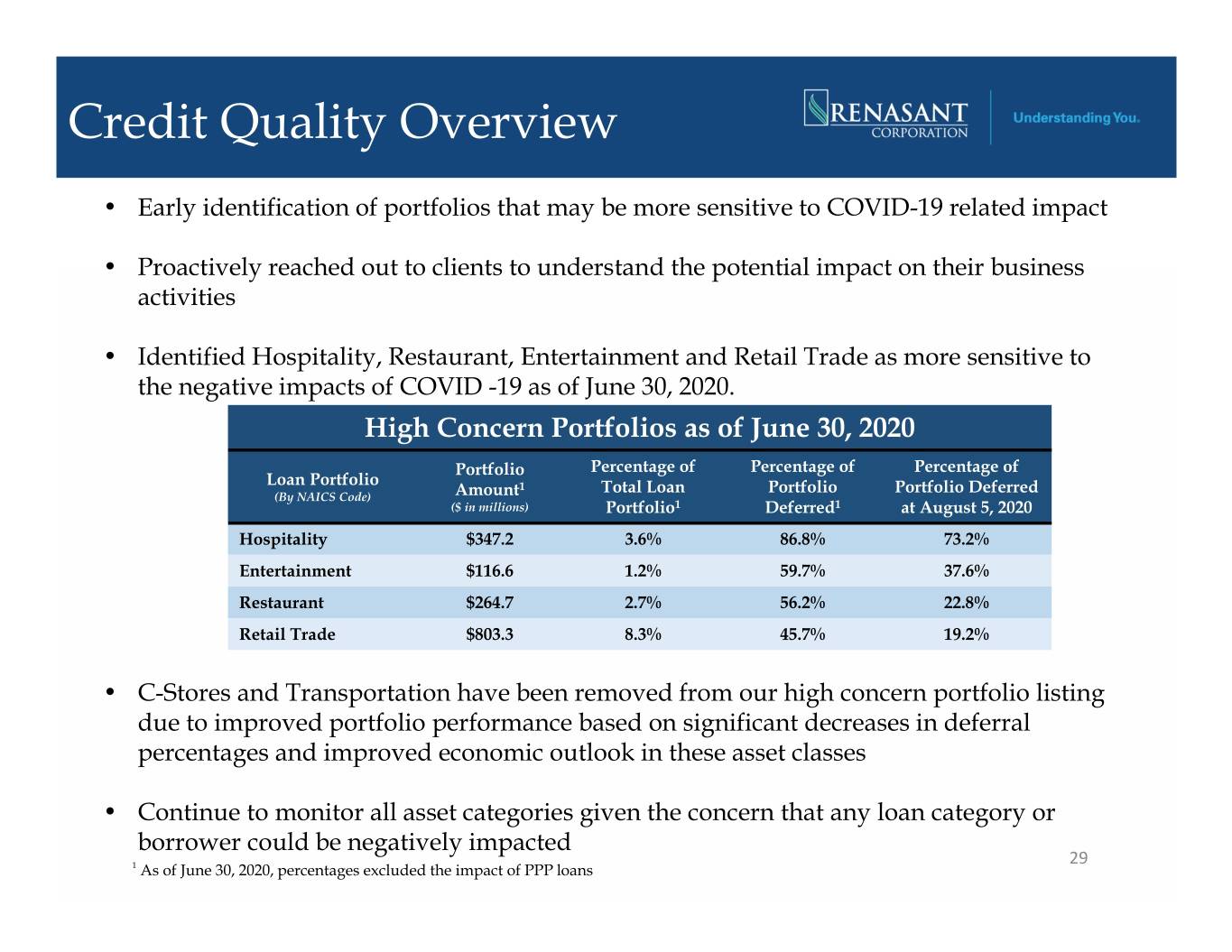

Credit Quality Overview • Early identification of portfolios that may be more sensitive to COVID-19 related impact • Proactively reached out to clients to understand the potential impact on their business activities • Identified Hospitality, Restaurant, Entertainment and Retail Trade as more sensitive to the negative impacts of COVID -19 as of June 30, 2020. High Concern Portfolios as of June 30, 2020 Portfolio Percentage of Percentage of Percentage of Loan Portfolio 1 Total Loan Portfolio Portfolio Deferred (By NAICS Code) Amount ($ in millions) Portfolio1 Deferred1 at August 5, 2020 Hospitality $347.2 3.6% 86.8% 73.2% Entertainment $116.6 1.2% 59.7% 37.6% Restaurant $264.7 2.7% 56.2% 22.8% Retail Trade $803.3 8.3% 45.7% 19.2% • C-Stores and Transportation have been removed from our high concern portfolio listing due to improved portfolio performance based on significant decreases in deferral percentages and improved economic outlook in these asset classes • Continue to monitor all asset categories given the concern that any loan category or borrower could be negatively impacted 29 1 As of June 30, 2020, percentages excluded the impact of PPP loans

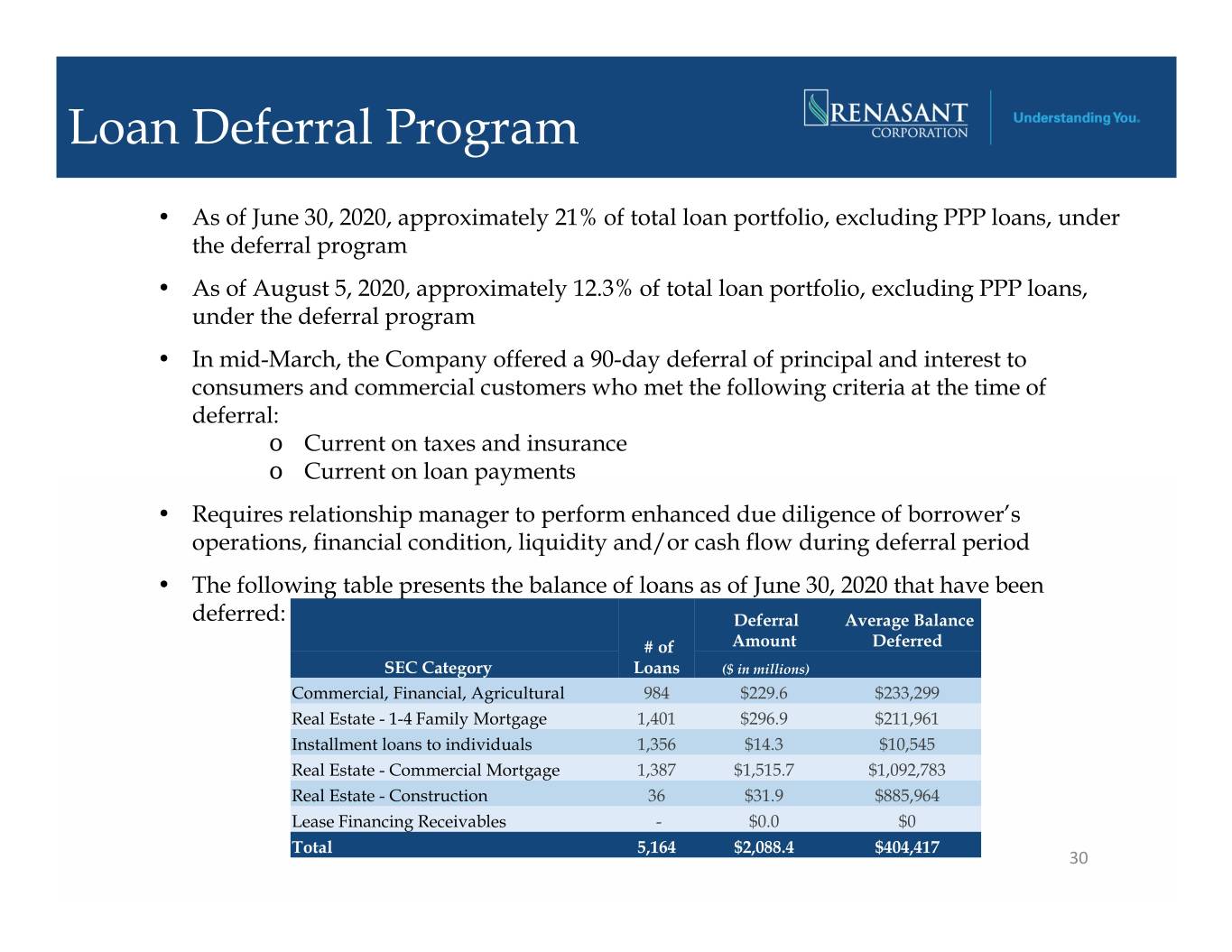

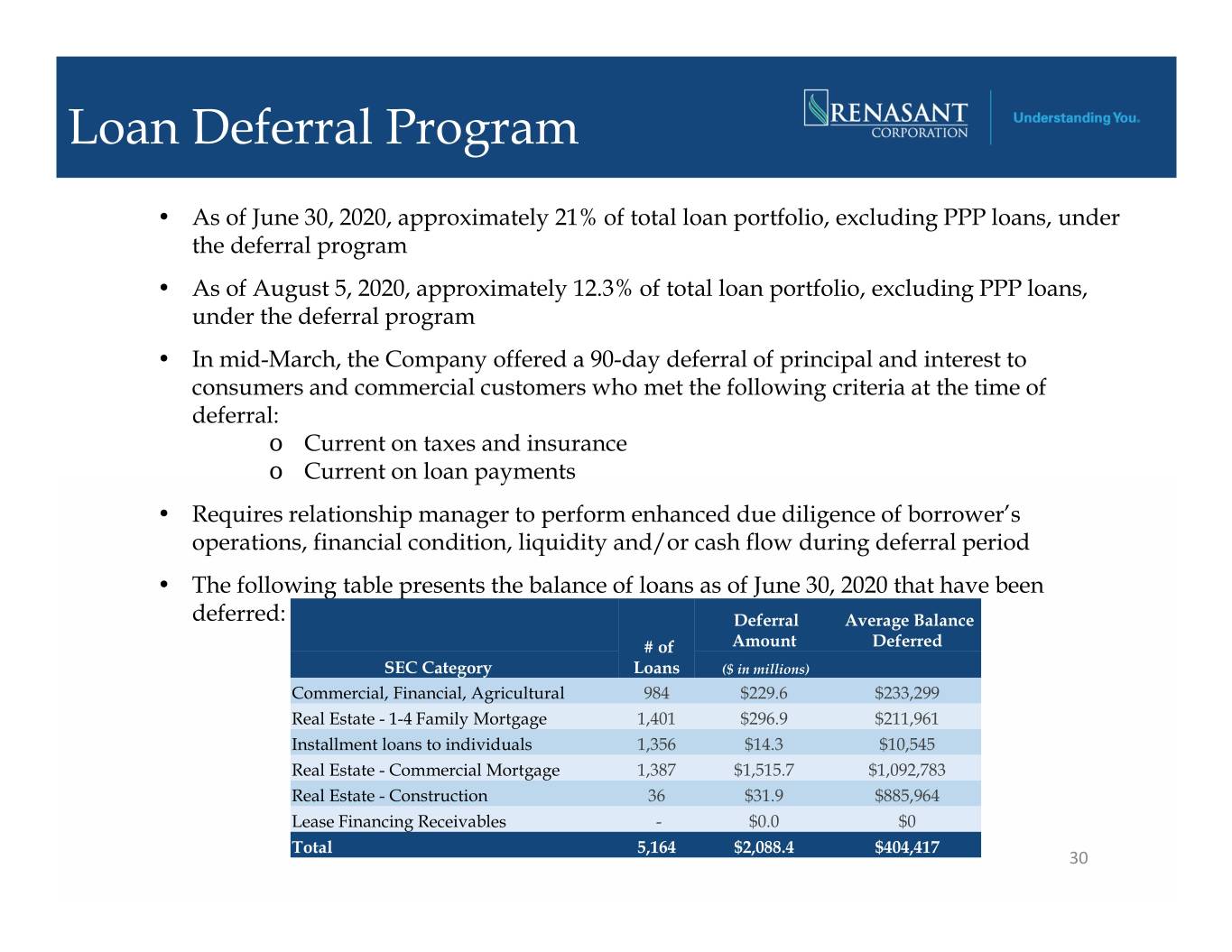

Loan Deferral Program • As of June 30, 2020, approximately 21% of total loan portfolio, excluding PPP loans, under the deferral program • As of August 5, 2020, approximately 12.3% of total loan portfolio, excluding PPP loans, under the deferral program • In mid-March, the Company offered a 90-day deferral of principal and interest to consumers and commercial customers who met the following criteria at the time of deferral: o Current on taxes and insurance o Current on loan payments • Requires relationship manager to perform enhanced due diligence of borrower’s operations, financial condition, liquidity and/or cash flow during deferral period • The following table presents the balance of loans as of June 30, 2020 that have been deferred: Deferral Average Balance # of Amount Deferred SEC Category Loans ($ in millions) Commercial, Financial, Agricultural 984 $229.6 $233,299 Real Estate - 1-4 Family Mortgage 1,401 $296.9 $211,961 Installment loans to individuals 1,356 $14.3 $10,545 Real Estate - Commercial Mortgage 1,387 $1,515.7 $1,092,783 Real Estate - Construction 36 $31.9 $885,964 Lease Financing Receivables - $0.0 $0 Total 5,164 $2,088.4 $404,417 30

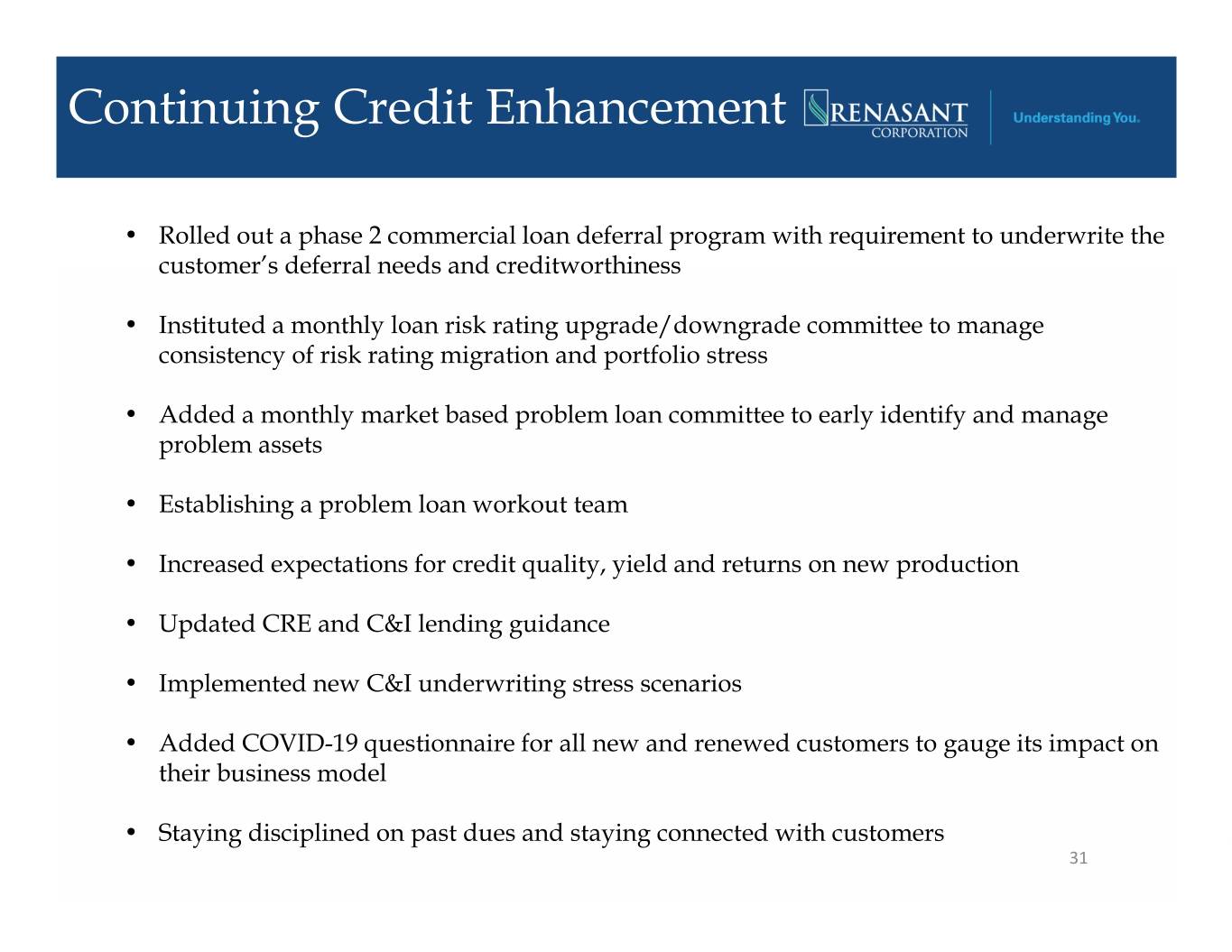

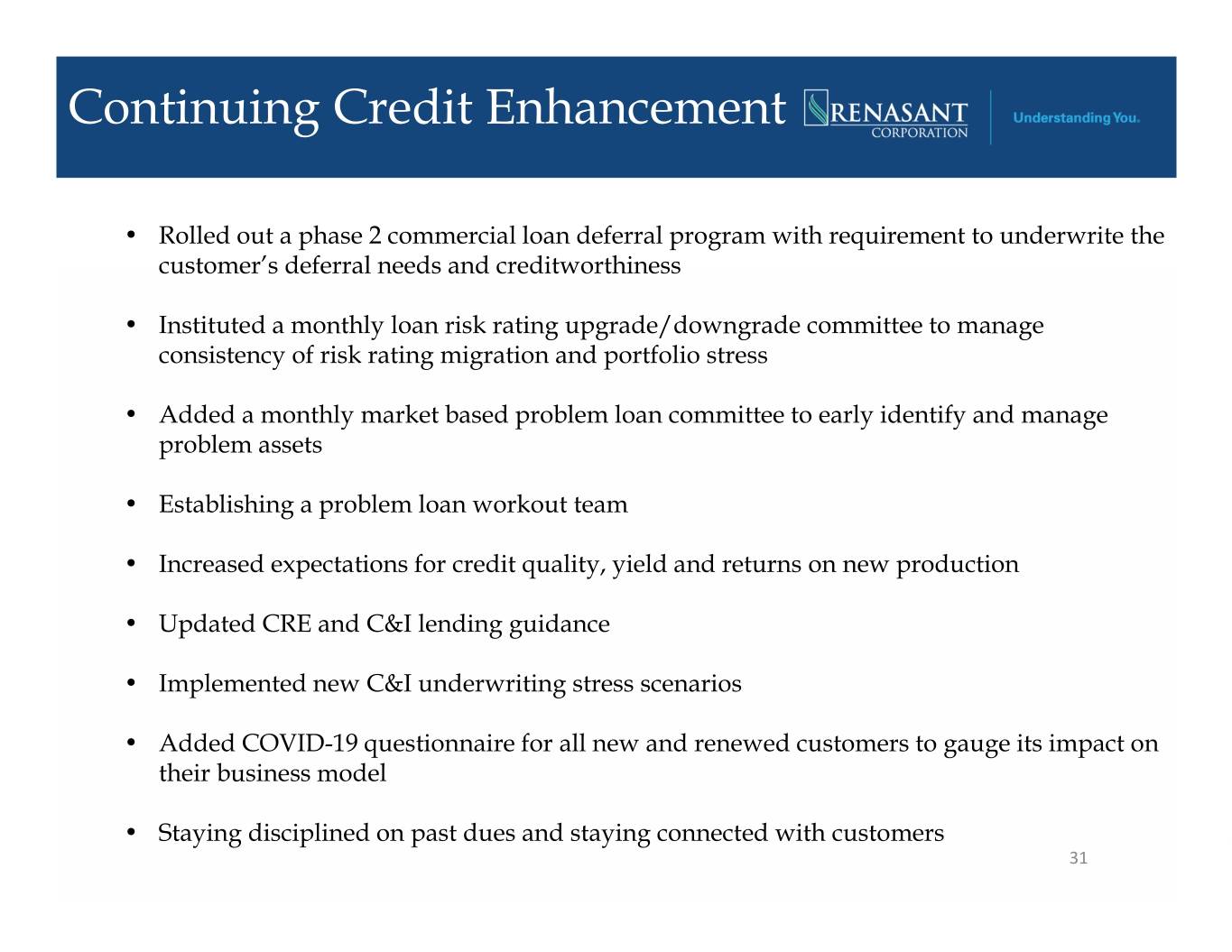

Continuing Credit Enhancement • Rolled out a phase 2 commercial loan deferral program with requirement to underwrite the customer’s deferral needs and creditworthiness • Instituted a monthly loan risk rating upgrade/downgrade committee to manage consistency of risk rating migration and portfolio stress • Added a monthly market based problem loan committee to early identify and manage problem assets • Establishing a problem loan workout team • Increased expectations for credit quality, yield and returns on new production • Updated CRE and C&I lending guidance • Implemented new C&I underwriting stress scenarios • Added COVID-19 questionnaire for all new and renewed customers to gauge its impact on their business model • Staying disciplined on past dues and staying connected with customers 31

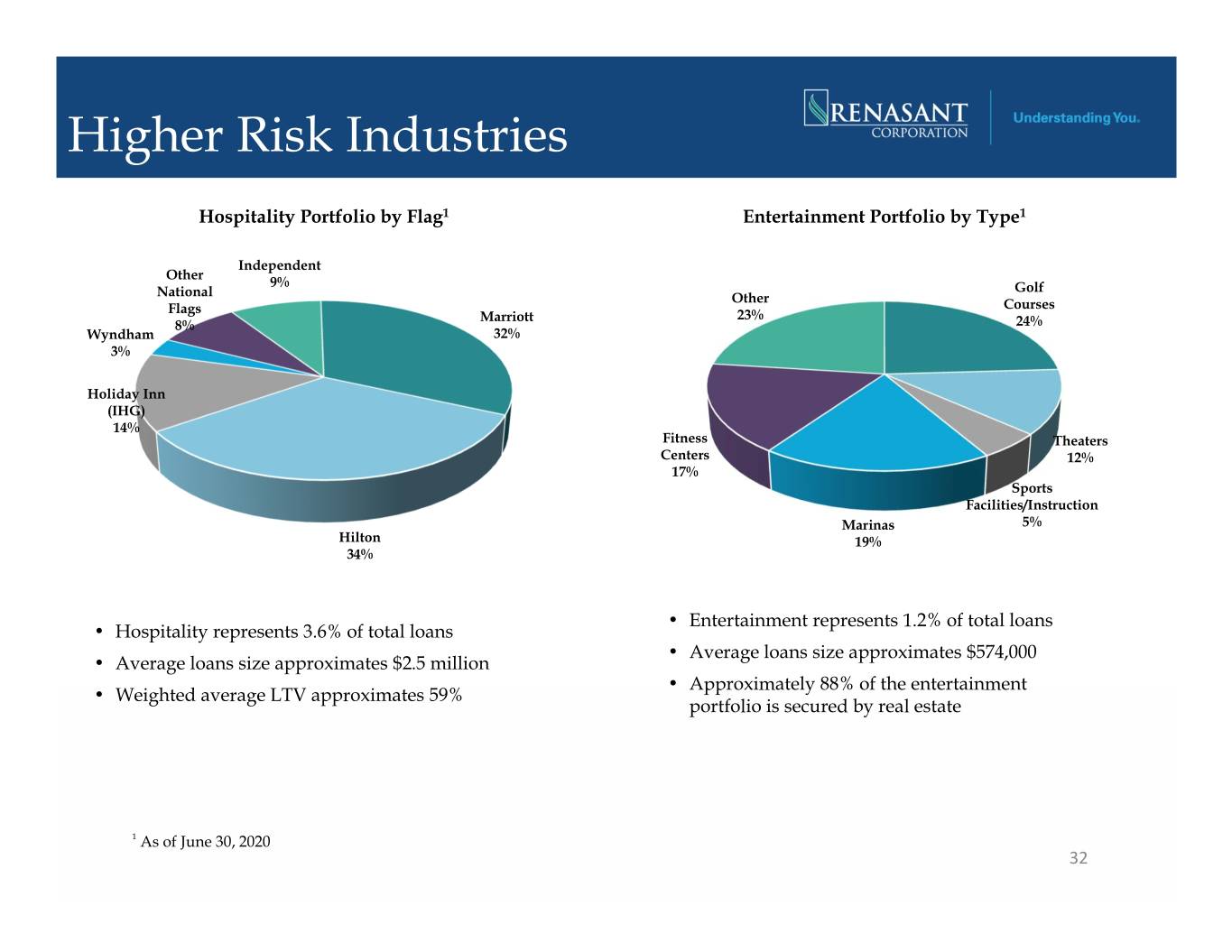

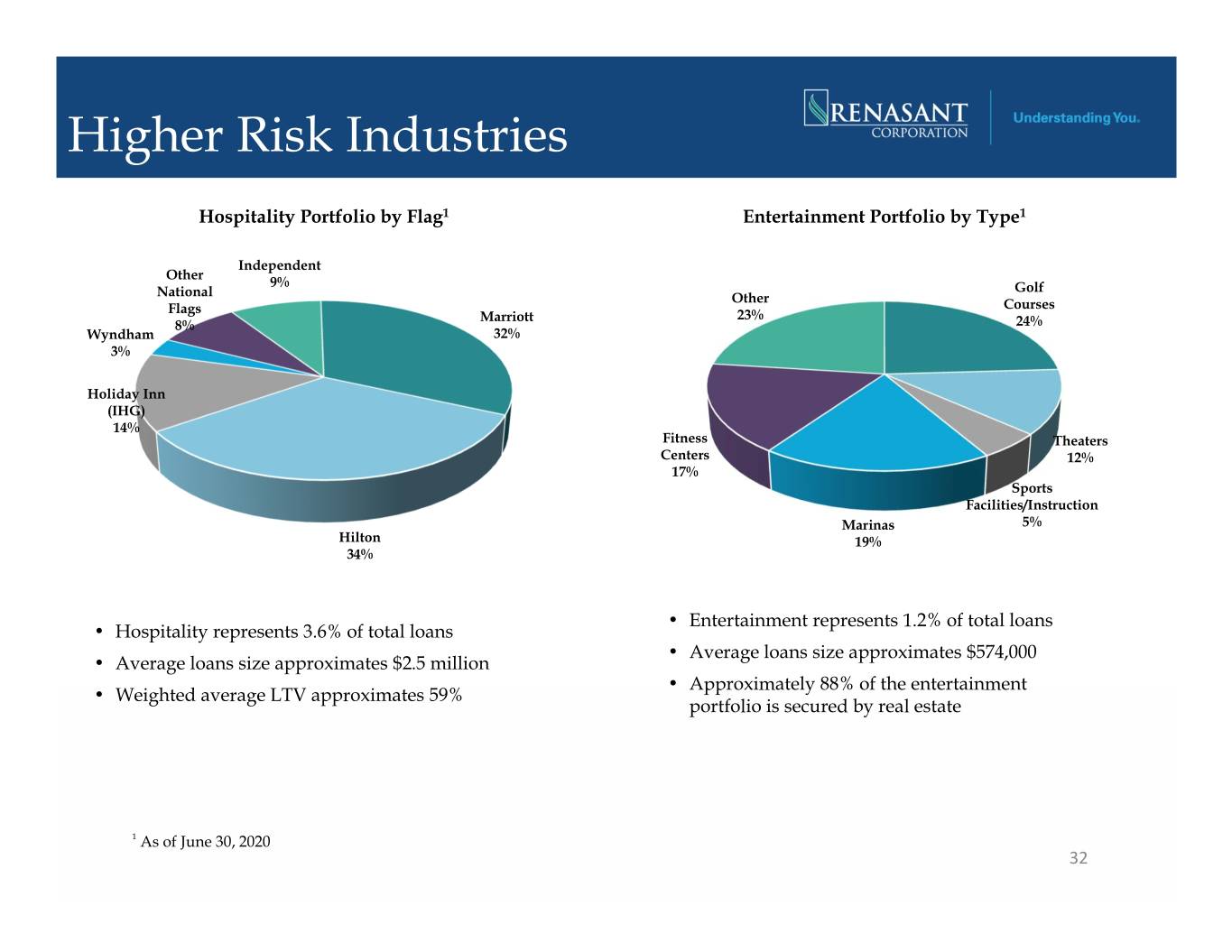

Higher Risk Industries Hospitality Portfolio by Flag1 Entertainment Portfolio by Type1 Independent Other 9% Golf National Other Flags Courses Marriott 23% 8% 24% Wyndham 32% 3% Holiday Inn (IHG) 14% Fitness Theaters Centers 12% 17% Sports Facilities/Instruction Marinas 5% Hilton 19% 34% • Entertainment represents 1.2% of total loans • Hospitality represents 3.6% of total loans • Average loans size approximates $574,000 • Average loans size approximates $2.5 million • Approximately 88% of the entertainment • Weighted average LTV approximates 59% portfolio is secured by real estate 1 As of June 30, 2020 32

Higher Risk Industries, cont. Restaurant Portfolio by Type1 Retail Trade Portfolio by Type1 Other Other Auto Dealers 4% 15% 13% Full-Service 45% Single Tenant 19% Grocery Limited- Anchored Service Unanchored 4% 51% Multi- Tenant Other 34% Anchored 15% • Restaurant represents 2.7% of total loans • Retail Trade represents 8.3% of total loans • Average loans size approximates $394,000 • Average loans size approximates $612,000 • Approximately 80% of the restaurant portfolio is • Weighted average LTV of approximately 57% secured by real estate • Approximately 93% of the retail trade portfolio is secured by real estate 1 As of June 30, 2020 33

CARES Act and Paycheck Protection Program (PPP) • Our approach • Lenders were hands on with the customers – not an online application portal • Credit was included in approval process to verify PPP underwriting requirements were satisfied • Utilized technology to improve efficiency • Offered to clients and non-clients, gained media recognition and loyal new clients • 30% of PPP loans were to new customers • Closed over 11,200 loans, funded $1.3 billion through August 5, 2020 and generated over $45 million in gross fees • Utilizing on-balance sheet liquidity for current funding needs • Prepared to participate in the Paycheck Protection Program Liquidity Facility (PPPLF) but currently using excess balance sheet liquidity to fund PPP loans 34

Four Key Strategic Initiatives • Focus on highly-accretive acquisition opportunities Capitalize on • Leverage existing markets Opportunities • Seek new markets • New lines of business • Superior returns • Revenue growth / Expense control Enhance Profitability • Net interest margin expansion / mitigate interest rate risk • Loan growth • Core deposit growth • Enhance credit process, policies and personnel Focus on Risk • Aggressively identify and manage problem credits Management • Board focus on Enterprise Risk Management • Selective balance sheet growth Build Capital Ratios • Maintain dividend • Prudently manage capital 35

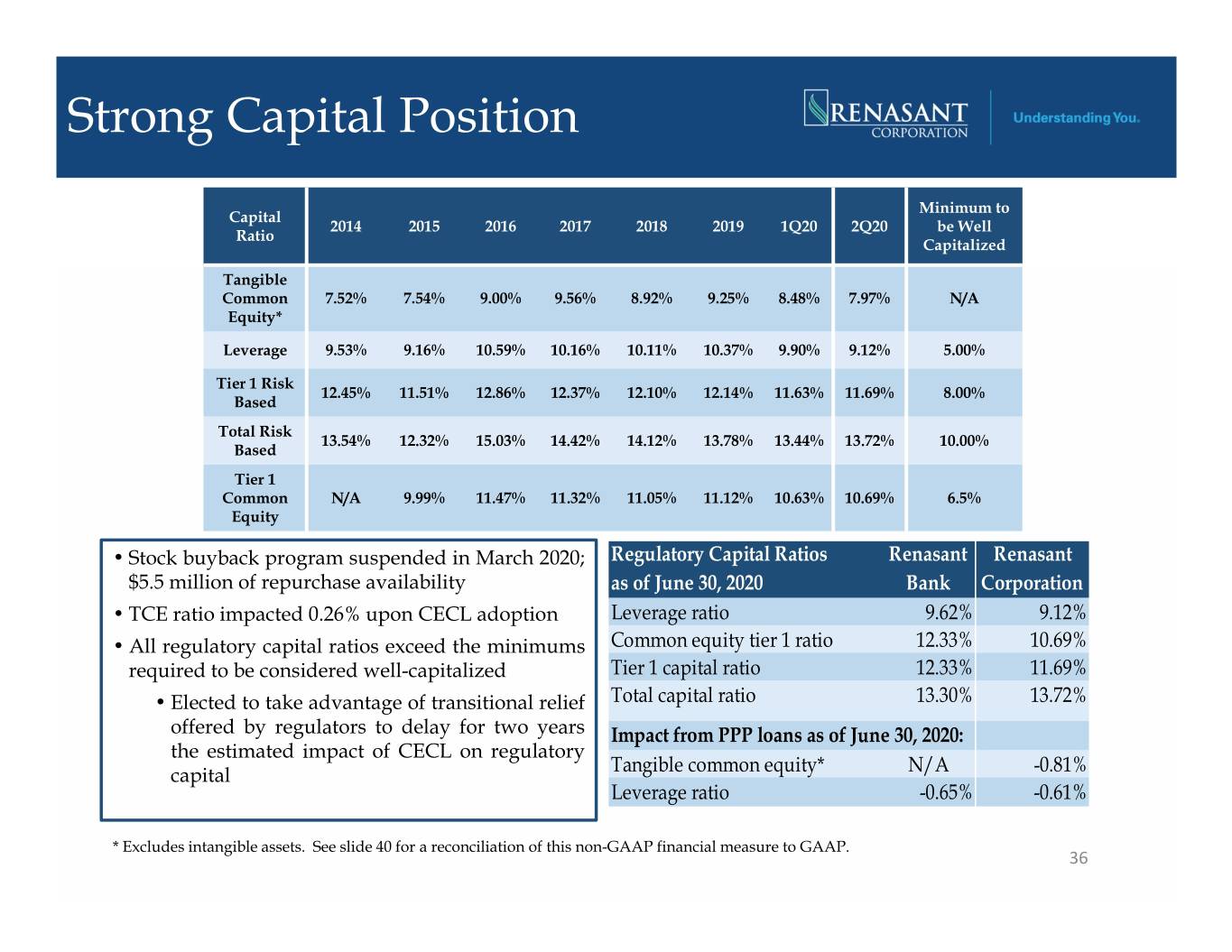

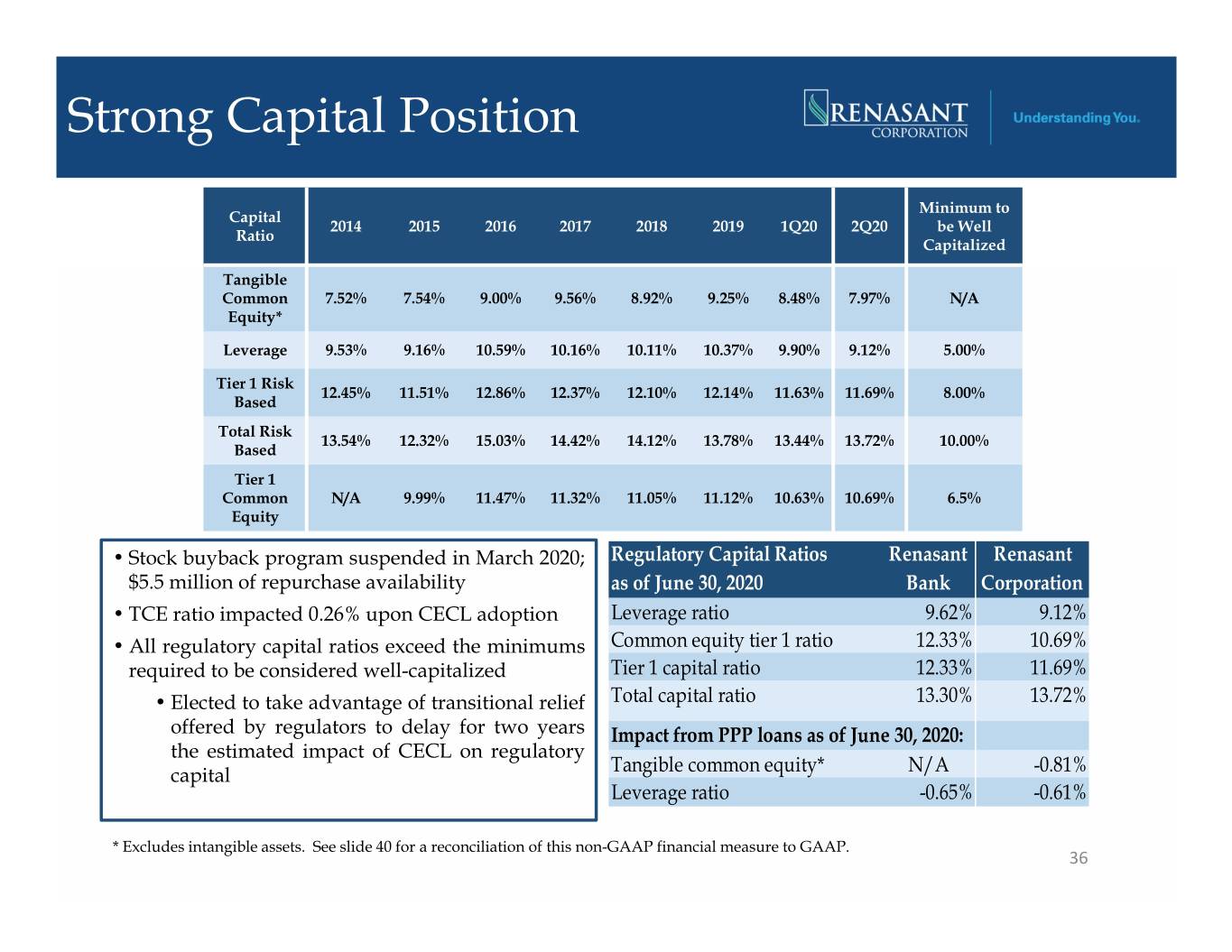

Strong Capital Position Minimum to Capital Strong Capital2014 2015 Position 2016 2017 2018 2019 1Q20 2Q20 be Well Ratio Capitalized Tangible Common 7.52% 7.54% 9.00% 9.56% 8.92% 9.25% 8.48% 7.97% N/A Equity* Leverage 9.53% 9.16% 10.59% 10.16% 10.11% 10.37% 9.90% 9.12% 5.00% Tier 1 Risk 12.45% 11.51% 12.86% 12.37% 12.10% 12.14% 11.63% 11.69% 8.00% Based Total Risk 13.54% 12.32% 15.03% 14.42% 14.12% 13.78% 13.44% 13.72% 10.00% Based Tier 1 Common N/A 9.99% 11.47% 11.32% 11.05% 11.12% 10.63% 10.69% 6.5% Equity • Stock buyback program suspended in March 2020; Regulatory Capital Ratios Renasant Renasant $5.5 million of repurchase availability as of June 30, 2020 Bank Corporation • TCE ratio impacted 0.26% upon CECL adoption Leverage ratio 9.62% 9.12% • All regulatory capital ratios exceed the minimums Common equity tier 1 ratio 12.33% 10.69% required to be considered well-capitalized Tier 1 capital ratio 12.33% 11.69% • Elected to take advantage of transitional relief Total capital ratio 13.30% 13.72% offered by regulators to delay for two years Impact from PPP loans as of June 30, 2020: the estimated impact of CECL on regulatory capital Tangible common equity* N/A -0.81% Leverage ratio -0.65% -0.61% * Excludes intangible assets. See slide 40 for a reconciliation of this non-GAAP financial measure to GAAP. 36

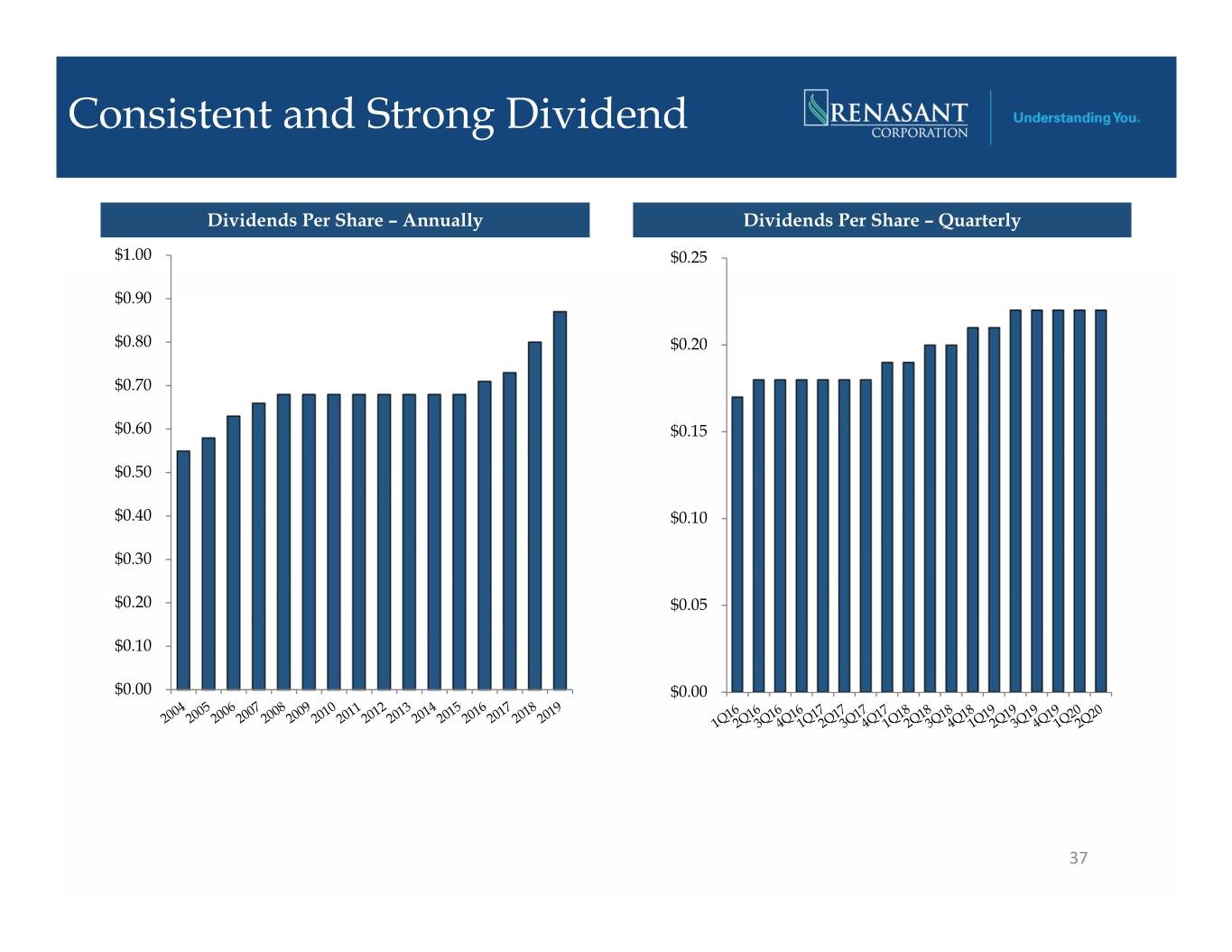

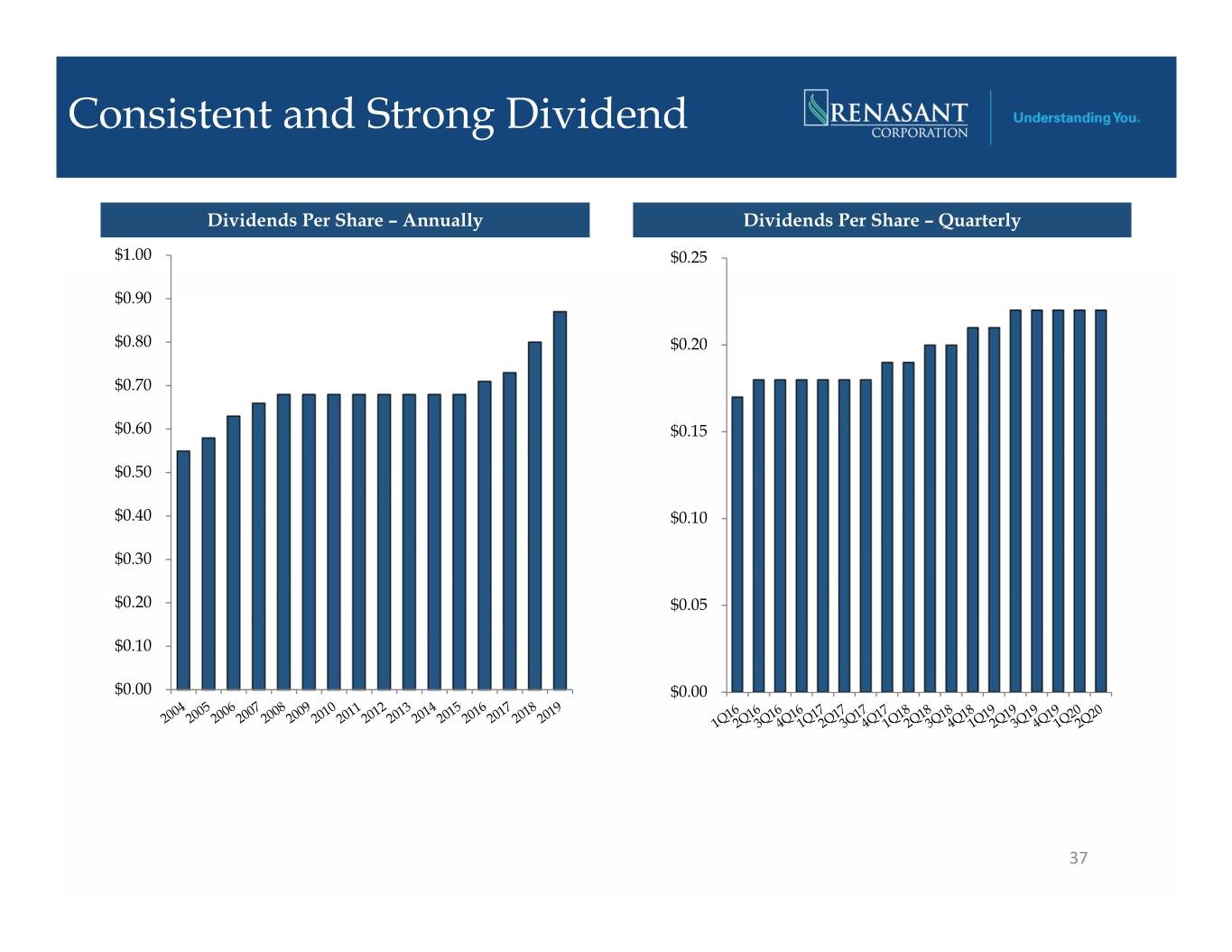

Consistent and Strong Dividend Dividends Per Share – Annually Dividends Per Share – Quarterly $1.00 $0.25 $0.90 $0.80 $0.20 $0.70 $0.60 $0.15 $0.50 $0.40 $0.10 $0.30 $0.20 $0.05 $0.10 $0.00 $0.00 37

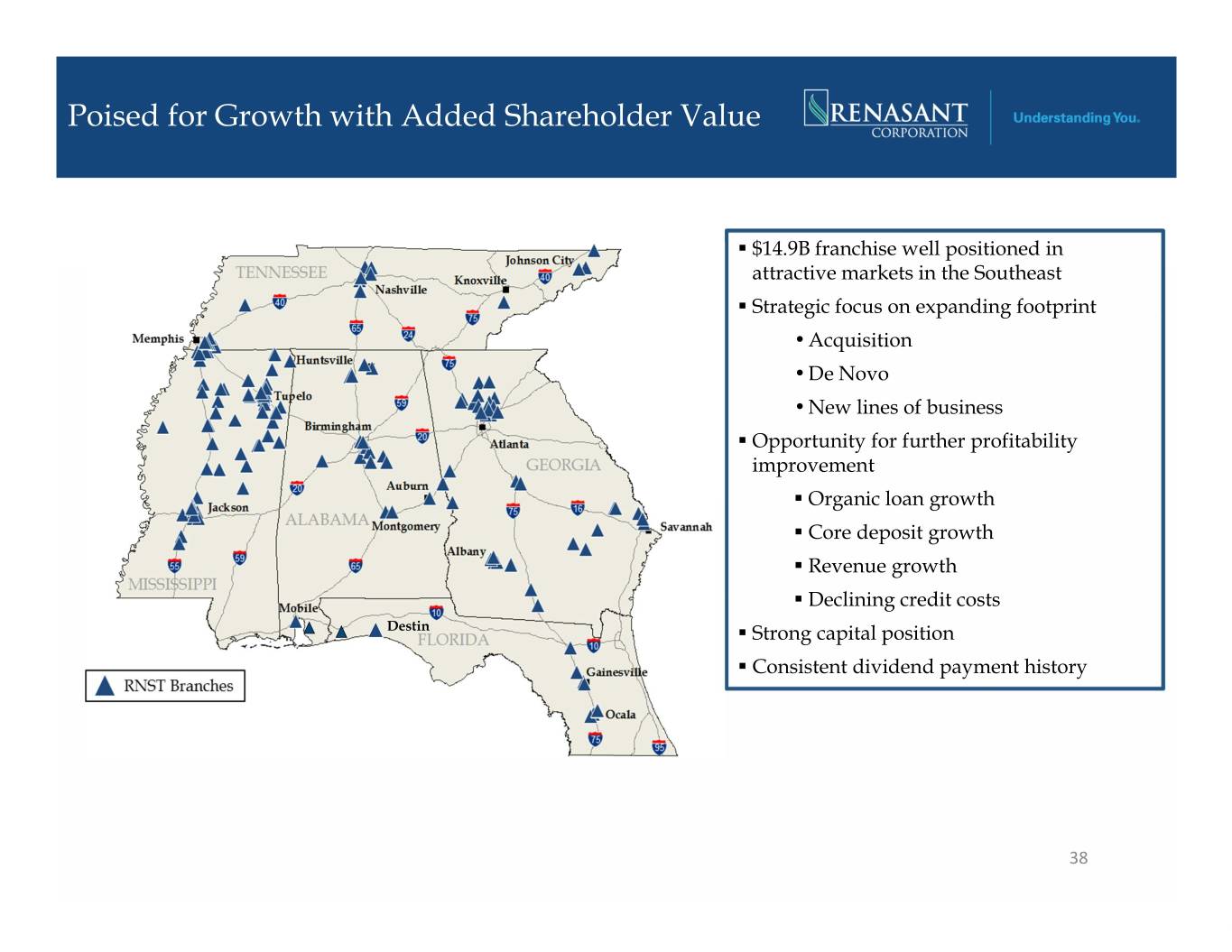

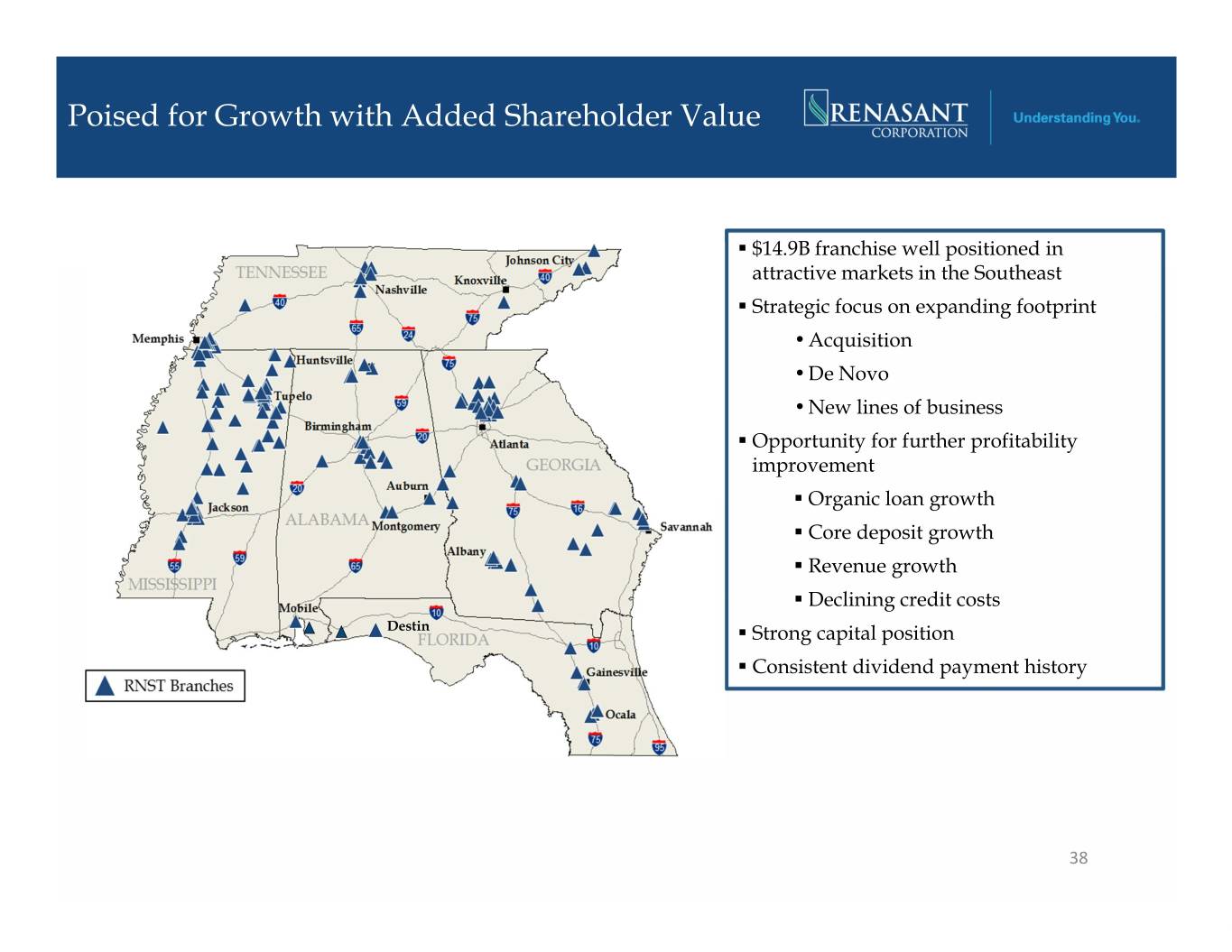

Poised for Growth with Added Shareholder Value . $14.9B franchise well positioned in attractive markets in the Southeast . Strategic focus on expanding footprint • Acquisition • De Novo • New lines of business . Opportunity for further profitability improvement . Organic loan growth . Core deposit growth . Revenue growth . Declining credit costs Destin . Strong capital position . Consistent dividend payment history 38

Appendix 39

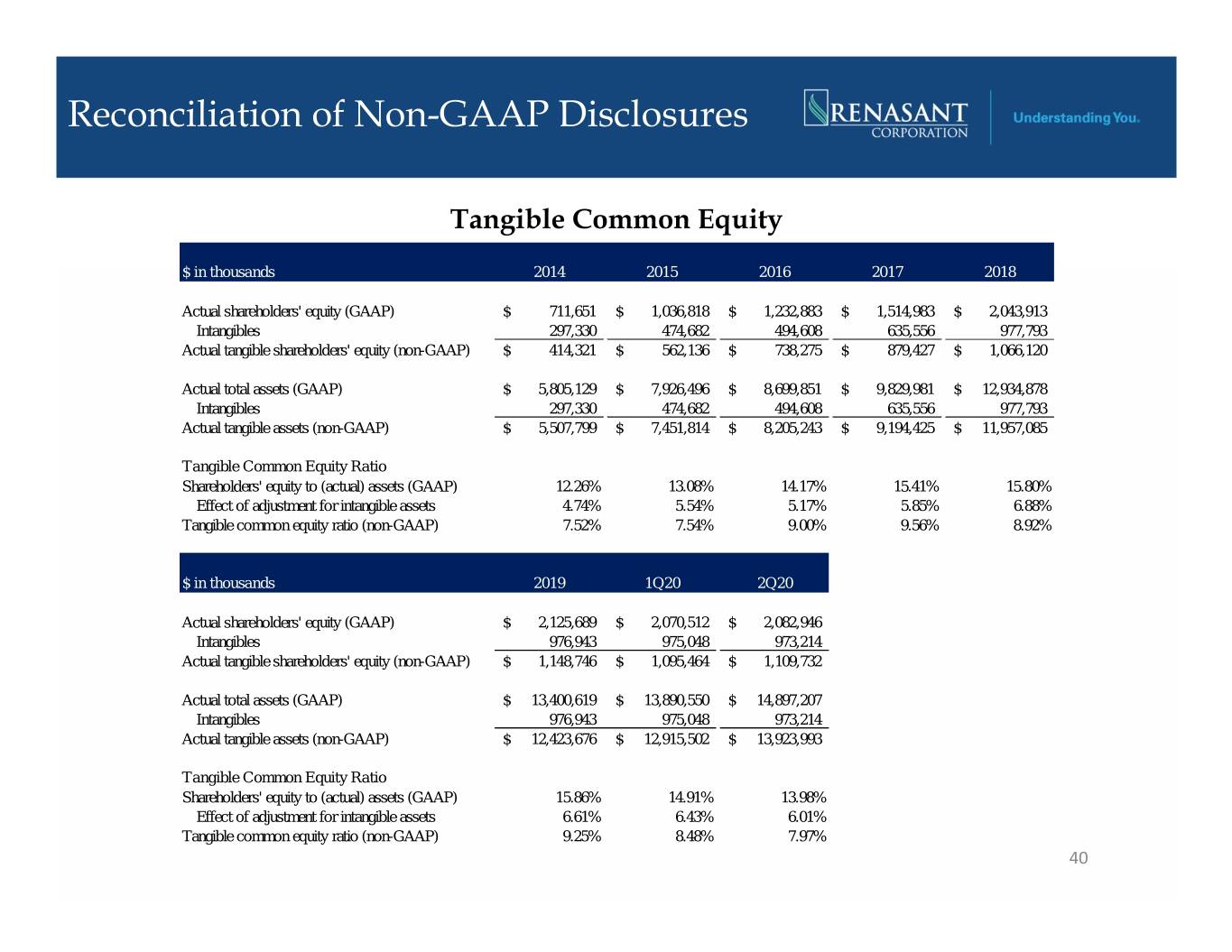

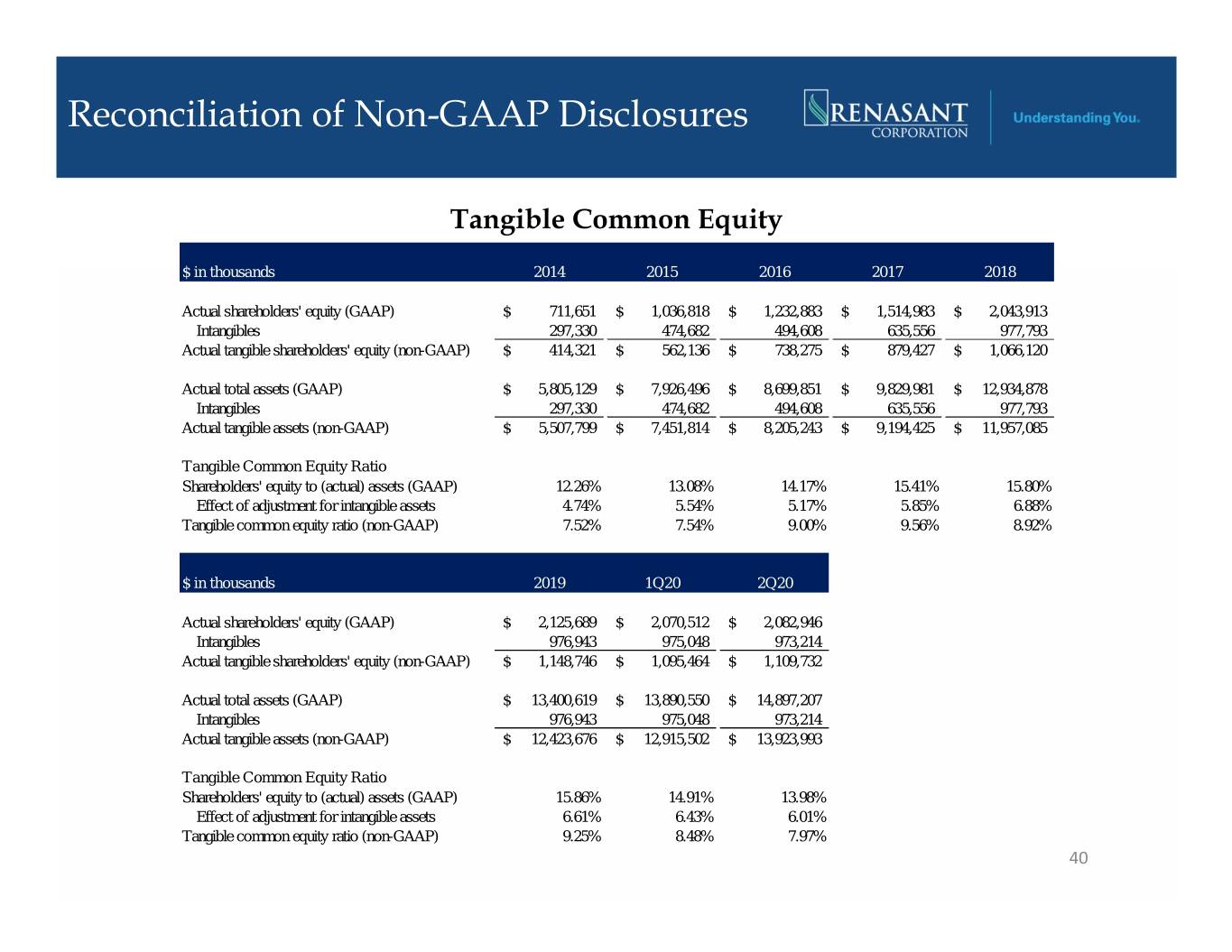

Reconciliation of Non-GAAP Disclosures Tangible Common Equity $ in thousands 2014 2015 2016 2017 2018 Actual shareholders' equity (GAAP)$ 711,651 $ 1,036,818 $ 1,232,883 $ 1,514,983 $ 2,043,913 Intangibles 297,330 474,682 494,608 635,556 977,793 Actual tangible shareholders' equity (non-GAAP)$ 414,321 $ 562,136 $ 738,275 $ 879,427 $ 1,066,120 Actual total assets (GAAP)$ 5,805,129 $ 7,926,496 $ 8,699,851 $ 9,829,981 $ 12,934,878 Intangibles 297,330 474,682 494,608 635,556 977,793 Actual tangible assets (non-GAAP)$ 5,507,799 $ 7,451,814 $ 8,205,243 $ 9,194,425 $ 11,957,085 Tangible Common Equity Ratio Shareholders' equity to (actual) assets (GAAP) 12.26% 13.08% 14.17% 15.41% 15.80% Effect of adjustment for intangible assets 4.74% 5.54% 5.17% 5.85% 6.88% Tangible common equity ratio (non-GAAP) 7.52% 7.54% 9.00% 9.56% 8.92% $ in thousands 2019 1Q20 2Q20 Actual shareholders' equity (GAAP)$ 2,125,689 $ 2,070,512 $ 2,082,946 Intangibles 976,943 975,048 973,214 Actual tangible shareholders' equity (non-GAAP)$ 1,148,746 $ 1,095,464 $ 1,109,732 Actual total assets (GAAP)$ 13,400,619 $ 13,890,550 $ 14,897,207 Intangibles 976,943 975,048 973,214 Actual tangible assets (non-GAAP)$ 12,423,676 $ 12,915,502 $ 13,923,993 Tangible Common Equity Ratio Shareholders' equity to (actual) assets (GAAP) 15.86% 14.91% 13.98% Effect of adjustment for intangible assets 6.61% 6.43% 6.01% Tangible common equity ratio (non-GAAP) 9.25% 8.48% 7.97% 40

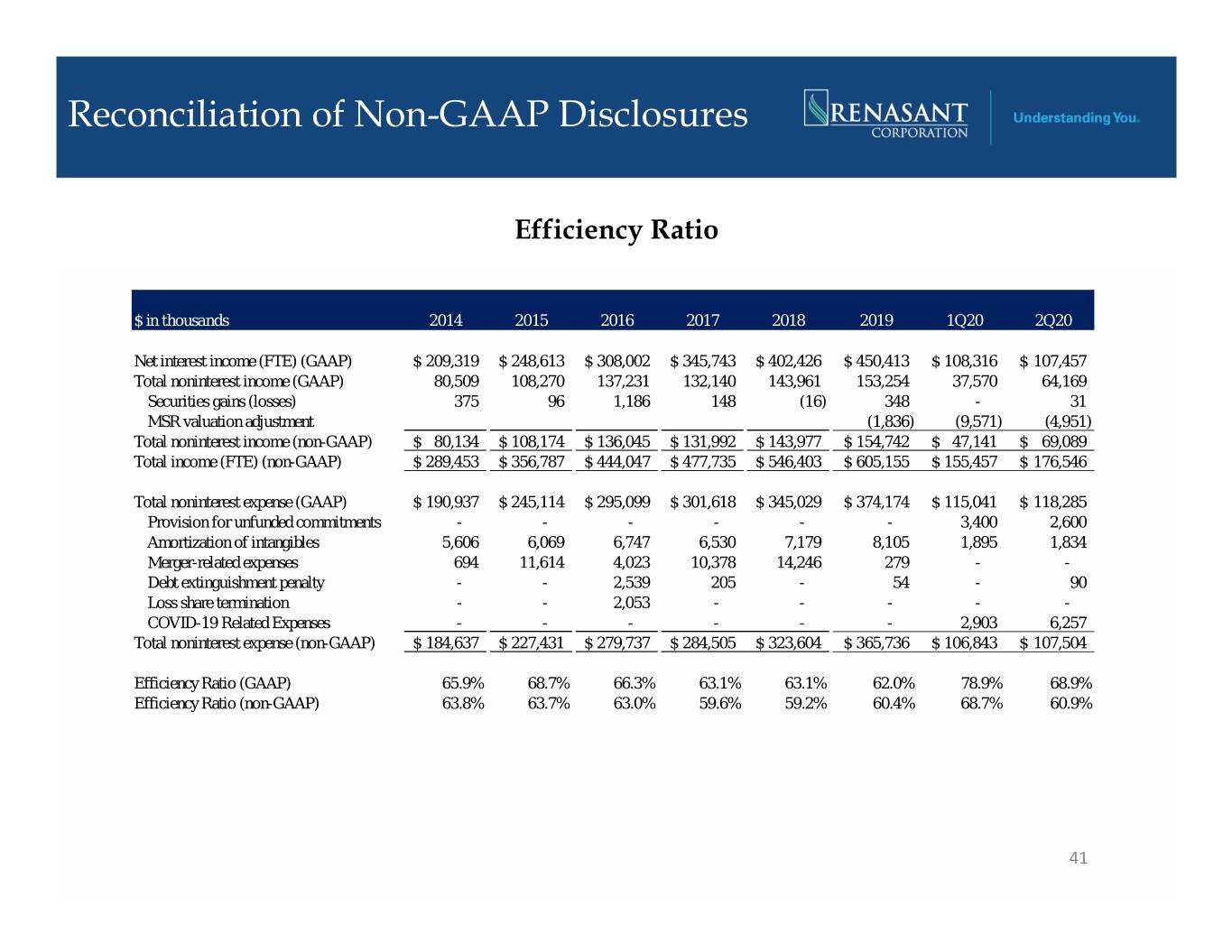

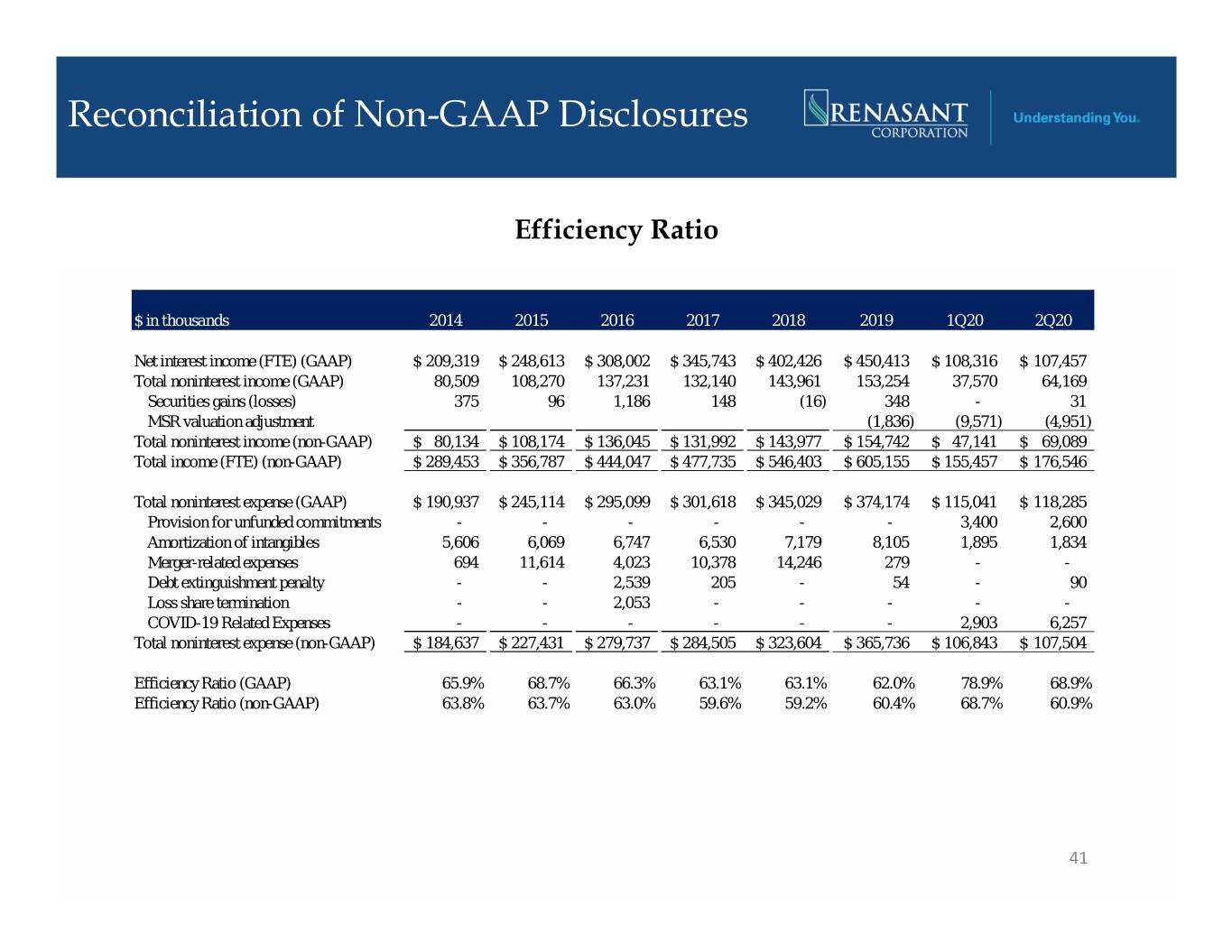

Reconciliation of Non-GAAP Disclosures Efficiency Ratio $ in thousands 2014 2015 2016 2017 2018 2019 1Q20 2Q20 Net interest income (FTE) (GAAP)$ 209,319 $ 248,613 $ 308,002 $ 345,743 $ 402,426 $ 450,413 $ 108,316 $ 107,457 Total noninterest income (GAAP) 80,509 108,270 137,231 132,140 143,961 153,254 37,570 64,169 Securities gains (losses) 375 96 1,186 148 (16) 348 - 31 MSR valuation adjustment (1,836) (9,571) (4,951) Total noninterest income (non-GAAP)$ 80,134 $ 108,174 $ 136,045 $ 131,992 $ 143,977 $ 154,742 $ 47,141 $ 69,089 Total income (FTE) (non-GAAP)$ 289,453 $ 356,787 $ 444,047 $ 477,735 $ 546,403 $ 605,155 $ 155,457 $ 176,546 Total noninterest expense (GAAP)$ 190,937 $ 245,114 $ 295,099 $ 301,618 $ 345,029 $ 374,174 $ 115,041 $ 118,285 Provision for unfunded commitments - - - - - - 3,400 2,600 Amortization of intangibles 5,606 6,069 6,747 6,530 7,179 8,105 1,895 1,834 Merger-related expenses 694 11,614 4,023 10,378 14,246 279 - - Debt extinguishment penalty - - 2,539 205 - 54 - 90 Loss share termination - - 2,053 - - - - - COVID-19 Related Expenses - - - - - - 2,903 6,257 Total noninterest expense (non-GAAP)$ 184,637 $ 227,431 $ 279,737 $ 284,505 $ 323,604 $ 365,736 $ 106,843 $ 107,504 Efficiency Ratio (GAAP) 65.9% 68.7% 66.3% 63.1% 63.1% 62.0% 78.9% 68.9% Efficiency Ratio (non-GAAP) 63.8% 63.7% 63.0% 59.6% 59.2% 60.4% 68.7% 60.9% 41

Reconciliation of Non-GAAP Disclosures Non Interest Income (adjusted) $ in thousands 1Q19 2Q19 3Q19 4Q19 1Q20 2Q20 Actual non interest income (GAAP)$ 35,885 $ 41,960 $ 37,953 $ 37,456 $ 37,570 $ 64,170 Securities gains (losses) 13 (8) 343 - - 31 MSR valuation adjustment - - (3,132) 1,296 (9,571) (4,951) Adjusted non interest income (non-GAAP)$ 35,872 $ 41,968 $ 40,742 $ 36,160 $ 47,141 $ 69,090 42

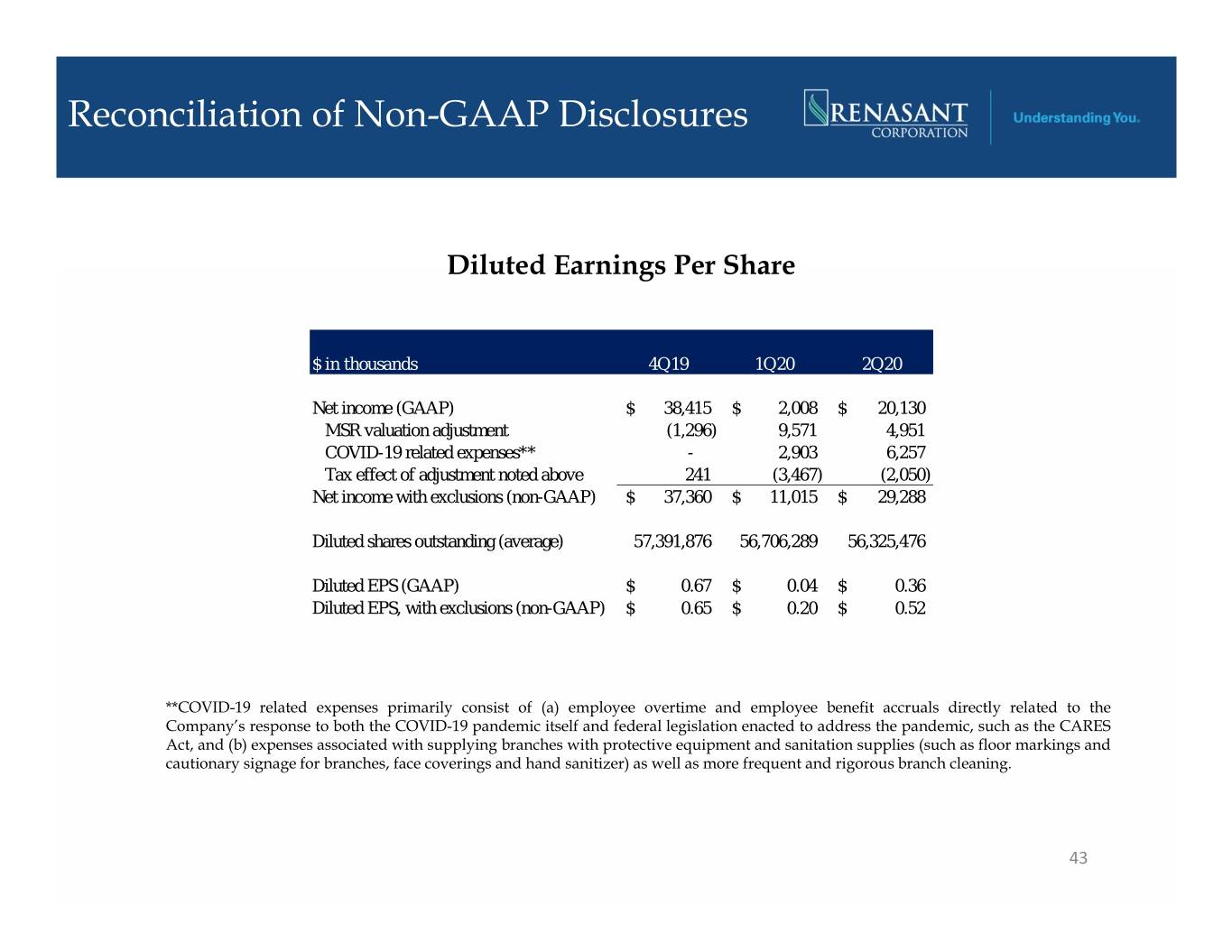

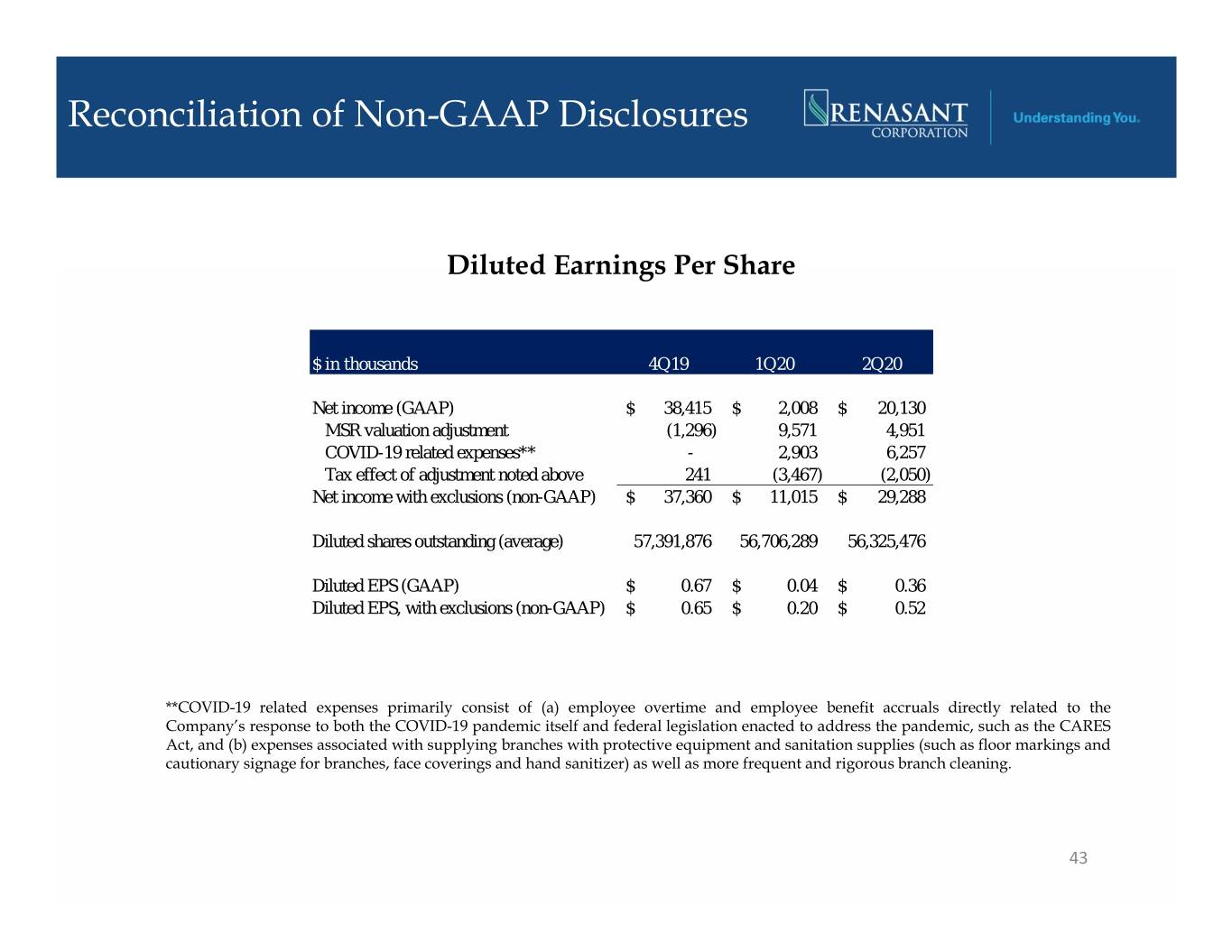

Reconciliation of Non-GAAP Disclosures Diluted Earnings Per Share $ in thousands 4Q19 1Q20 2Q20 Net income (GAAP)$ 38,415 $ 2,008 $ 20,130 MSR valuation adjustment (1,296) 9,571 4,951 COVID-19 related expenses** - 2,903 6,257 Tax effect of adjustment noted above 241 (3,467) (2,050) Net income with exclusions (non-GAAP)$ 37,360 $ 11,015 $ 29,288 Diluted shares outstanding (average) 57,391,876 56,706,289 56,325,476 Diluted EPS (GAAP)$ 0.67 $ 0.04 $ 0.36 Diluted EPS, with exclusions (non-GAAP)$ 0.65 $ 0.20 $ 0.52 **COVID-19 related expenses primarily consist of (a) employee overtime and employee benefit accruals directly related to the Company’s response to both the COVID-19 pandemic itself and federal legislation enacted to address the pandemic, such as the CARES Act, and (b) expenses associated with supplying branches with protective equipment and sanitation supplies (such as floor markings and cautionary signage for branches, face coverings and hand sanitizer) as well as more frequent and rigorous branch cleaning. 43

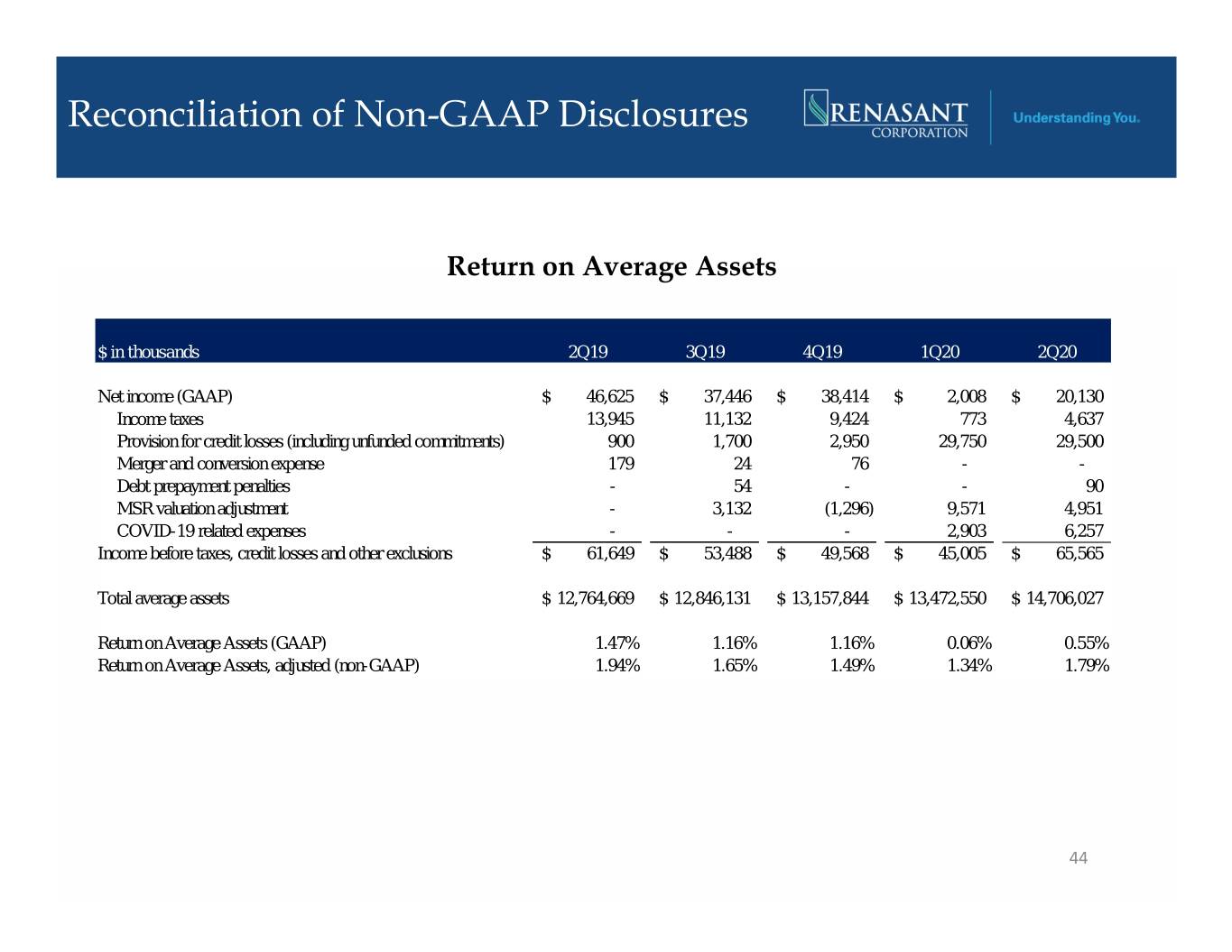

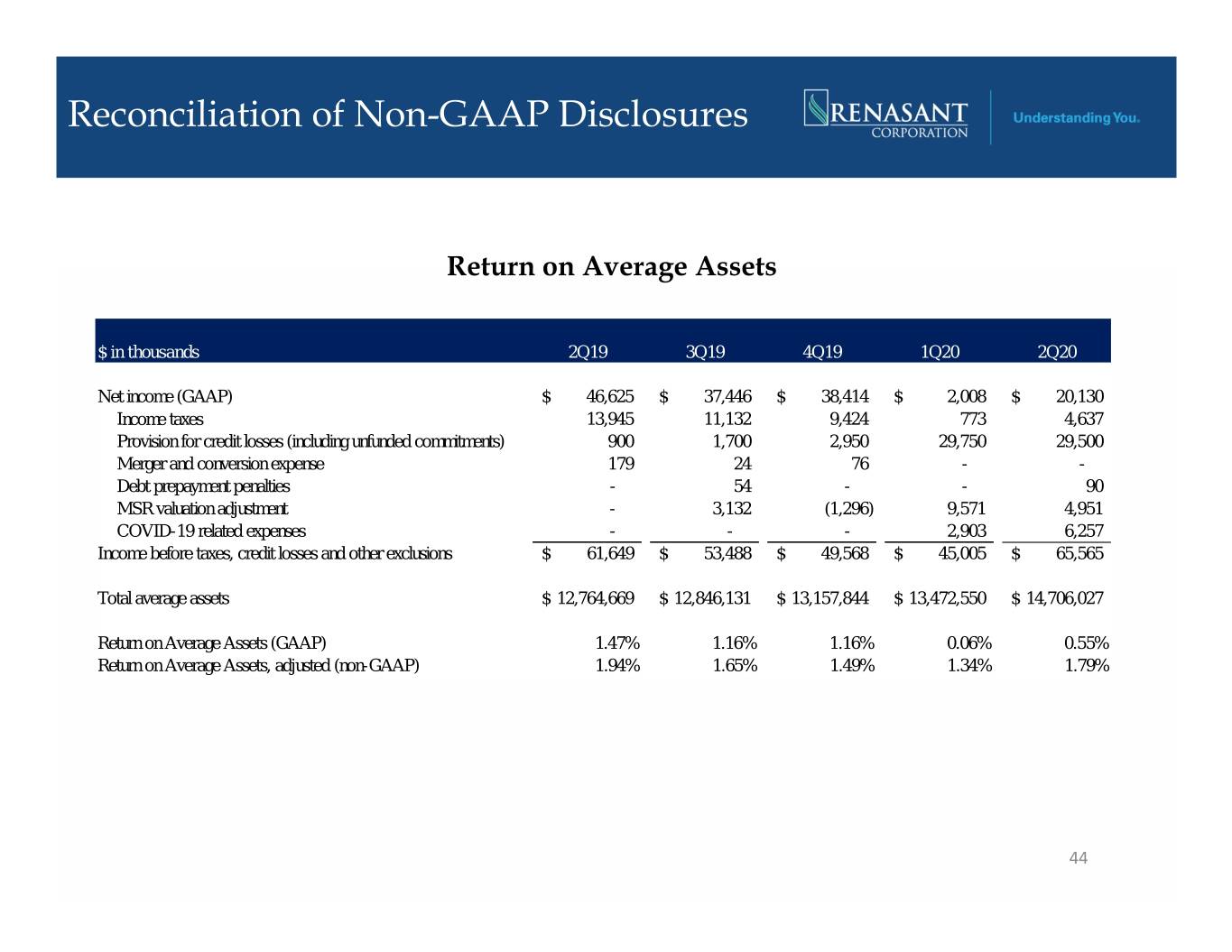

Reconciliation of Non-GAAP Disclosures Return on Average Assets $ in thousands 2Q19 3Q19 4Q19 1Q20 2Q20 Net income (GAAP)$ 46,625 $ 37,446 $ 38,414 $ 2,008 $ 20,130 Income taxes 13,945 11,132 9,424 773 4,637 Provision for credit losses (including unfunded commitments) 900 1,700 2,950 29,750 29,500 Merger and conversion expense 179 24 76 - - Debt prepayment penalties - 54 - - 90 MSR valuation adjustment - 3,132 (1,296) 9,571 4,951 COVID-19 related expenses - - - 2,903 6,257 Income before taxes, credit losses and other exclusions$ 61,649 $ 53,488 $ 49,568 $ 45,005 $ 65,565 Total average assets$ 12,764,669 $ 12,846,131 $ 13,157,844 $ 13,472,550 $ 14,706,027 Return on Average Assets (GAAP) 1.47% 1.16% 1.16% 0.06% 0.55% Return on Average Assets, adjusted (non-GAAP) 1.94% 1.65% 1.49% 1.34% 1.79% 44

Reconciliation of Non-GAAP Disclosures Return on Average Tangible Equity $ in thousands 2Q19 3Q19 4Q19 1Q20 2Q20 Net income (GAAP)$ 46,625 $ 37,446 $ 38,414 $ 2,008 $ 20,130 Income taxes 13,945 11,132 9,424 773 4,637 Provision for credit losses (including unfunded commitments) 900 1,700 2,950 29,750 29,500 Merger and conversion expense 179 24 76 - - Debt prepayment penalties - 54 - - 90 MSR valuation adjustment - 3,132 (1,296) 9,571 4,951 COVID-19 related expenses - - - 2,903 6,257 Income before taxes, credit losses and other exclusions$ 61,649 $ 53,488 $ 49,568 $ 45,005 $ 65,565 Amortization of intangibles 2,053 1,996 1,946 1,895 1,834 Tangible income before taxes, credit losses and other exclusions 63,702 55,484 51,514 46,900 67,399 Average shareholders' equity (GAAP)$ 2,102,093 $ 2,131,537 $ 2,131,342 $ 2,105,143 $ 2,101,092 Intangibles 974,628 975,306 977,506 975,933 974,237 Average tangible shareholders' equity (non-GAAP)$ 1,127,465 $ 1,156,231 $ 1,153,836 $ 1,129,210 $ 1,126,855 Return on Average Equity (GAAP) 8.90% 6.97% 7.15% 0.38% 3.85% Return on Average Tangible Equity (non-GAAP) 22.66% 19.04% 17.71% 16.70% 24.06% 45

Investor Inquiries C. Mitchell Waycaster President and Chief Executive Officer 209 TROY STREET TUPELO, MS 38804-4827 Kevin D. Chapman Senior Executive Vice President, PHONE: 1-800-680-1601 Chief Operating Officer FACSIMILE: 1-662-680-1234 WWW.RENASANT.COM James C. Mabry, IV WWW.RENASANTBANK.COM Senior Executive Vice President, Chief Financial Officer 46