Second Quarter 2022 Earnings Call

2 Forward-Looking Statements This presentation may contain various statements about Renasant Corporation (“Renasant,” “we,” “our,” or “us”) that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Statements preceded by, followed by or that otherwise include the words “believes,” “expects,” “projects,” “anticipates,” “intends,” “estimates,” “plans,” “potential,” “focus,” “possible,” “may increase,” “may fluctuate,” “will likely result,” and similar expressions, or future or conditional verbs such as “will,” “should,” “would” and “could,” are generally forward-looking in nature and not historical facts. Forward-looking statements include information about our future financial performance, business strategy, projected plans and objectives and are based on the current beliefs and expectations of management. We believe these forward-looking statements are reasonable, but they are all inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions about future business strategies and decisions that are subject to change. Actual results may differ from those indicated or implied in the forward-looking statements; such differences may be material. Prospective investors are cautioned that any forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date they are made. Important factors currently known to management that could cause our actual results to differ materially from those in forward-looking statements include the following: (i) the Company’s ability to efficiently integrate acquisitions into its operations, retain the customers of these businesses, grow the acquired operations and realize the cost savings expected from an acquisition to the extent and in the timeframe anticipated by management; (ii) the effect of economic conditions and interest rates on a national, regional or international basis; (iii) timing and success of the implementation of changes in operations to achieve enhanced earnings or effect cost savings; (iv) competitive pressures in the consumer finance, commercial finance, insurance, financial services, asset management, retail banking, mortgage lending and auto lending industries; (v) the financial resources of, and products available from, competitors; (vi) changes in laws and regulations as well as changes in accounting standards; (vii) changes in policy by regulatory agencies; (viii) changes in the securities and foreign exchange markets; (ix) the Company’s potential growth, including its entrance or expansion into new markets, and the need for sufficient capital to support that growth; (x) changes in the quality or composition of the Company’s loan or investment portfolios, including adverse developments in borrower industries or in the repayment ability of individual borrowers; (xi) an insufficient allowance for credit losses as a result of inaccurate assumptions; (xii) general economic, market or business conditions, including the impact of inflation; (xiii) changes in demand for loan products and financial services; (xiv) concentration of credit exposure; (xv) changes or the lack of changes in interest rates, yield curves and interest rate spread relationships; (xvi) increased cybersecurity risk, including potential network breaches, business disruptions or financial losses; (xvii) civil unrest, natural disasters, epidemics (including the re-emergence of the COVID-19 pandemic) and other catastrophic events in the Company’s geographic area; (xviii) the impact, extent and timing of technological changes; and (xix) other circumstances, many of which are beyond management’s control. Management believes that the assumptions underlying our forward-looking statements are reasonable, but any of the assumptions could prove to be inaccurate. Investors are urged to carefully consider the risks described in Renasant’s filings with the Securities and Exchange Commission (“SEC”) from time to time, including its most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are available at www.renasant.com and the SEC’s website at www.sec.gov. We undertake no obligation, and specifically disclaim any obligation, to update or revise our forward-looking statements, whether as a result of new information or to reflect changed assumptions, the occurrence of unanticipated events or changes to future operating results over time, except as required by federal securities laws.

Overview Note: Financial data as of June 30, 2022 (1) Total revenue is calculated as net interest income plus noninterest income. Company Snapshot Loans and Deposits by State Assets: $16.6 billion Loans: 10.6 Deposits: 13.8 Equity: 2.1 3 MS 23% AL 24% FL 6% GA 30% TN 17% Loans MS 36% AL 14%FL 3% GA 34% TN 13% Deposits 86% 5% 7% 2% YTD Total Revenue(1) Community Banking Wealth Management Mortgage Insurance

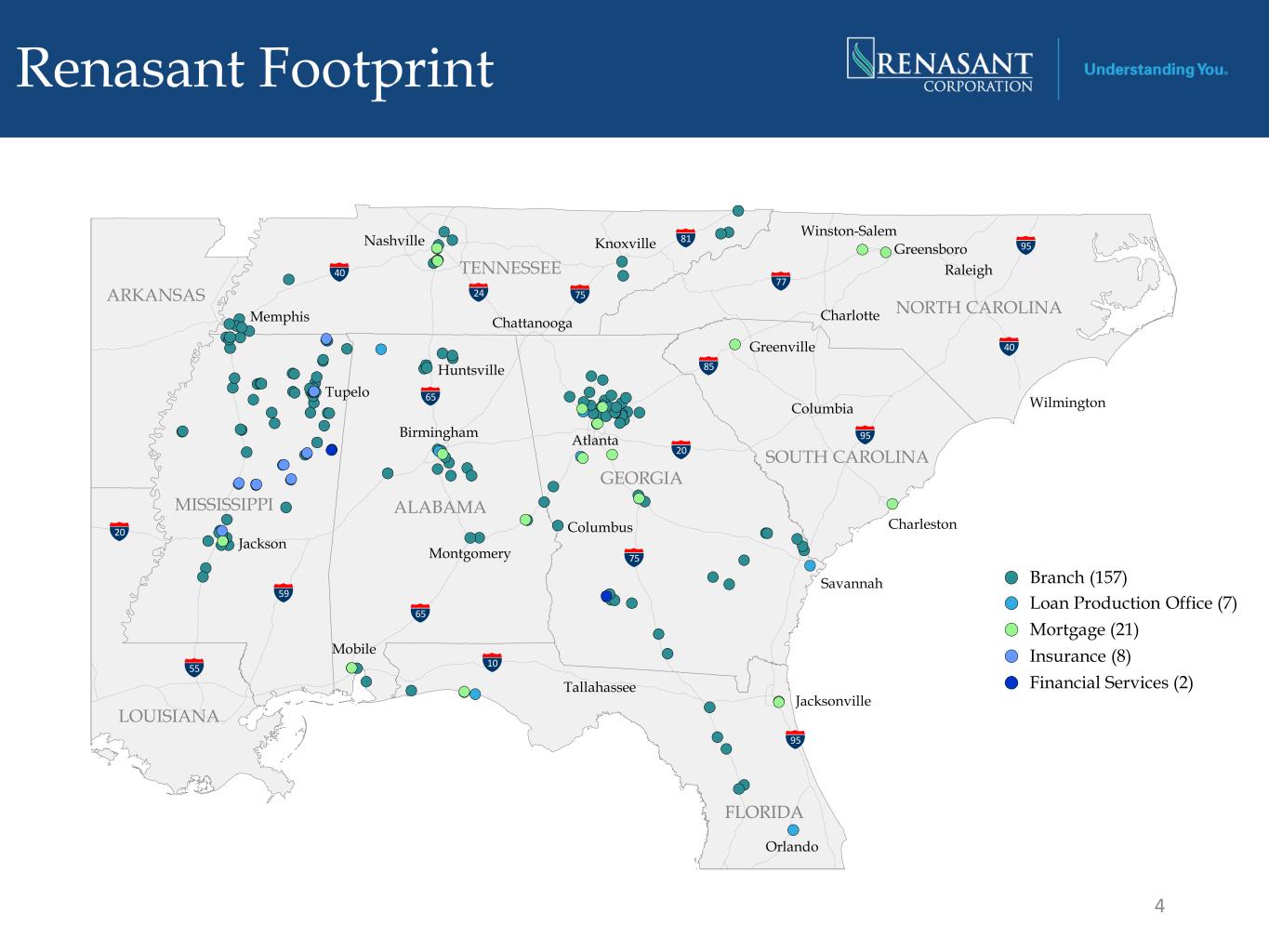

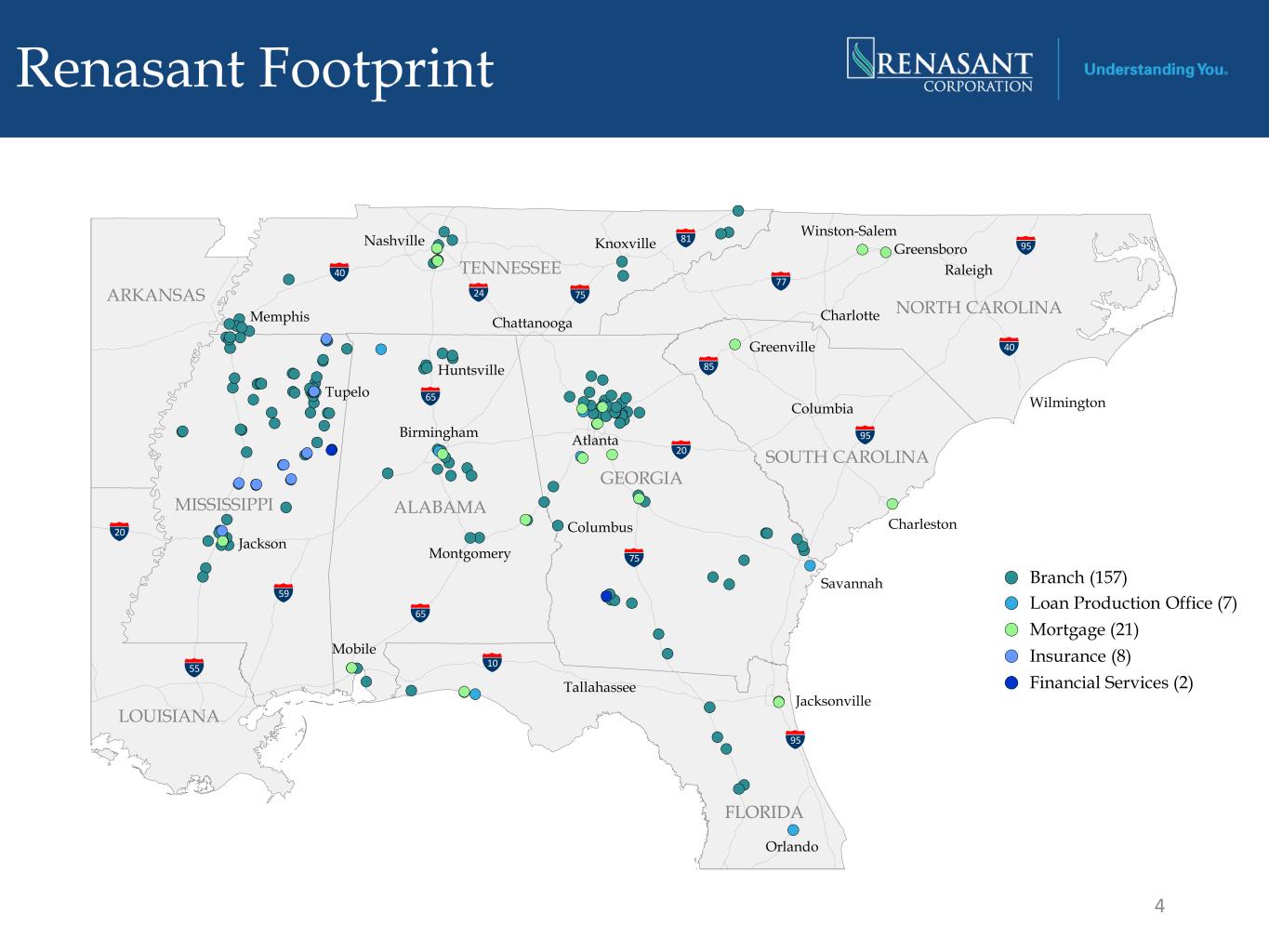

55 20 65 10 65 75 20 95 95 85 77 95 81 7524 40 59 40 FLORIDA Jackson Mobile Knoxville Chattanooga Greensboro Raleigh Columbia Nashville Winston-Salem Montgomery Birmingham Columbus Charlotte Jacksonville Memphis Orlando Huntsville Tallahassee Atlanta Wilmington Charleston Savannah Tupelo Greenville MISSISSIPPI ALABAMA TENNESSEE GEORGIA SOUTH CAROLINA NORTH CAROLINA ARKANSAS LOUISIANA Branch (157) Loan Production Office (7) Mortgage (21) Insurance (8) Financial Services (2) 4 Renasant Footprint

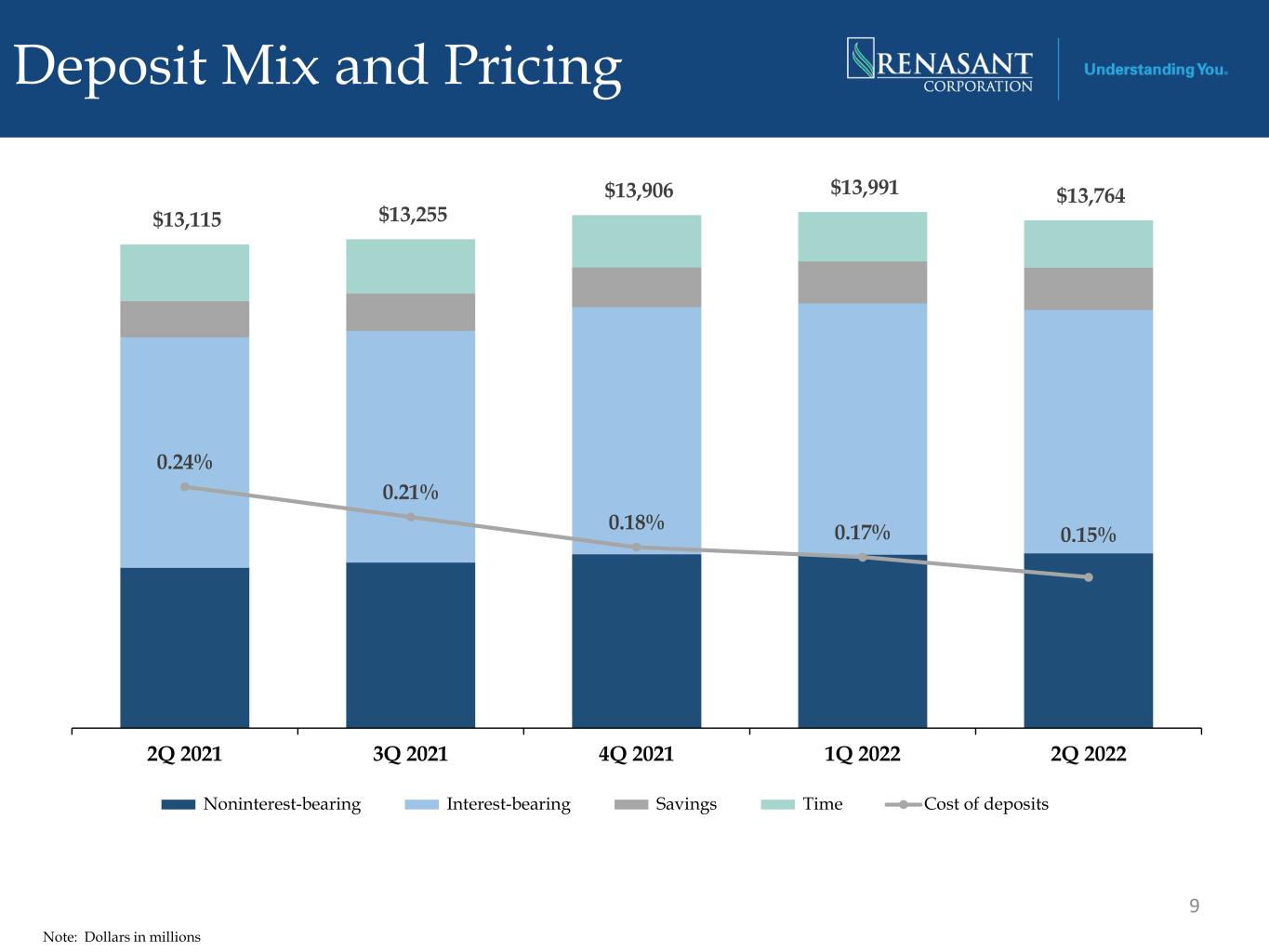

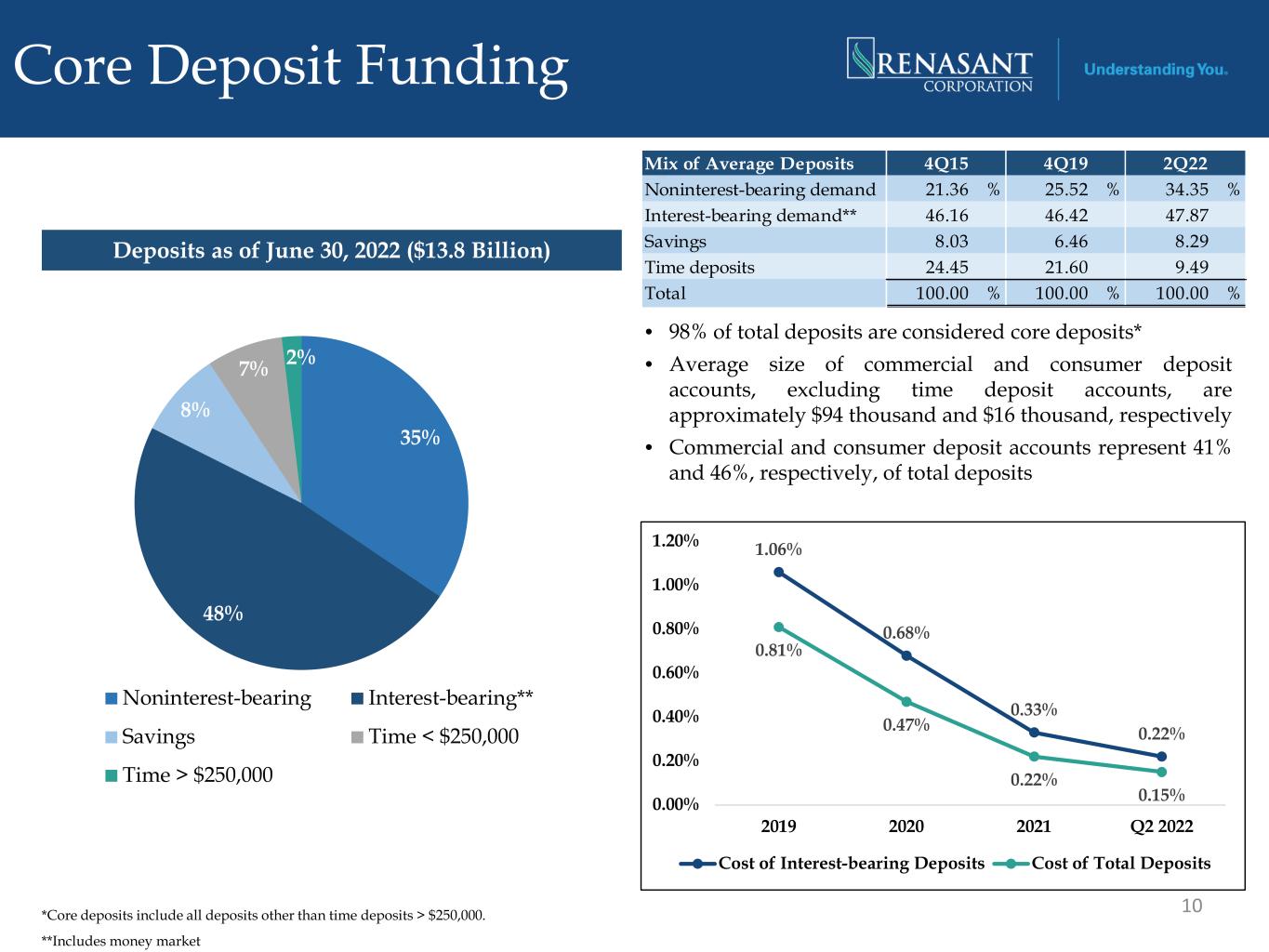

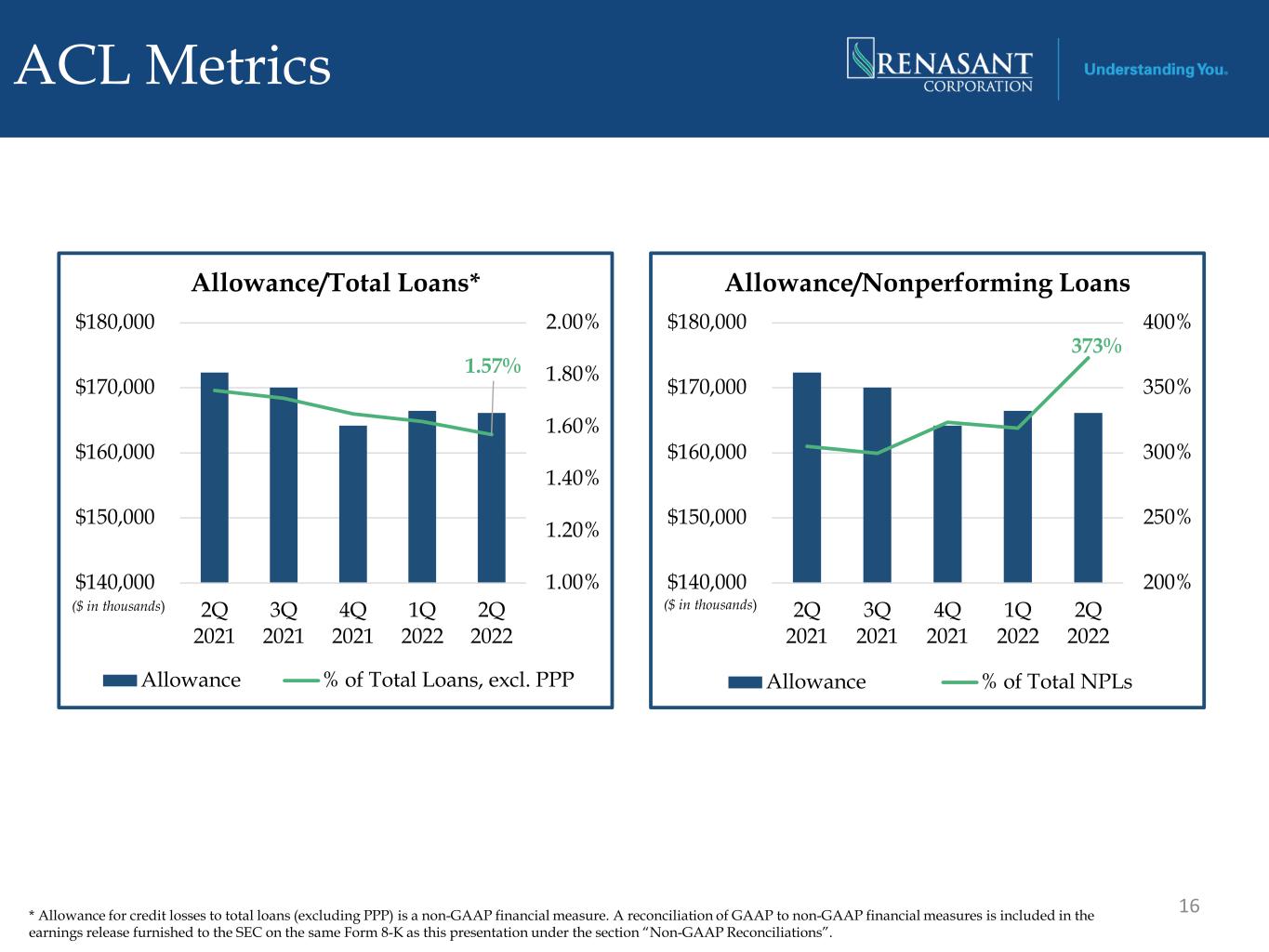

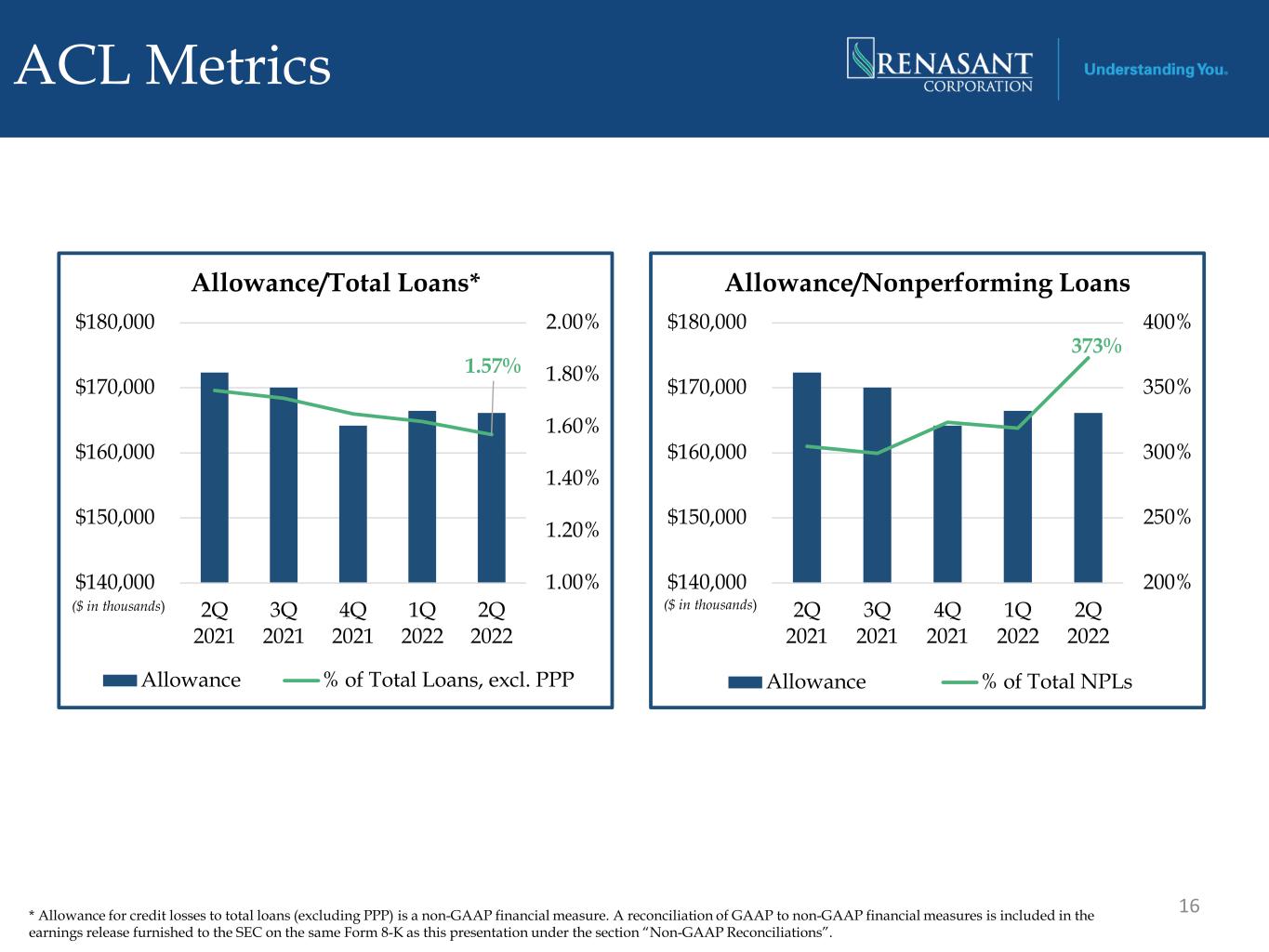

Second Quarter Highlights 5 • Net income of $39.7 million with diluted EPS of $0.71 • Net interest margin increased 35 basis points to 3.11% • Loans increased $290.3 million which represents 11.29% annualized net loan growth • Cost of deposits decreased 2 basis points on a linked quarter basis to 0.15%, and noninterest-bearing deposits now represent 34.35% of total deposits • The ratio of allowance for credit losses on loans to total loans decreased to 1.57% • Credit metrics remained stable with nonperforming loans to total loans decreasing to 0.42%

Financial Condition

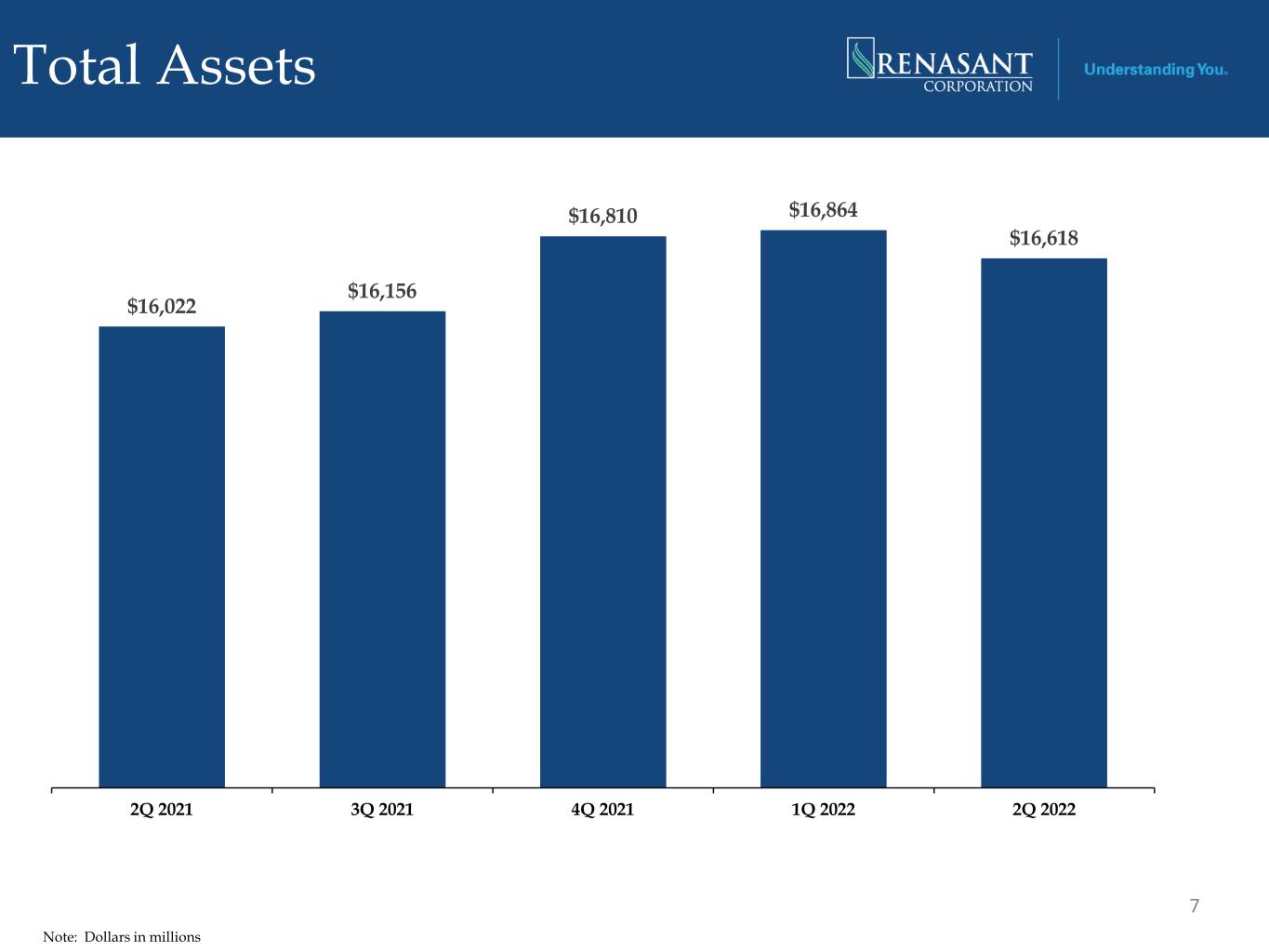

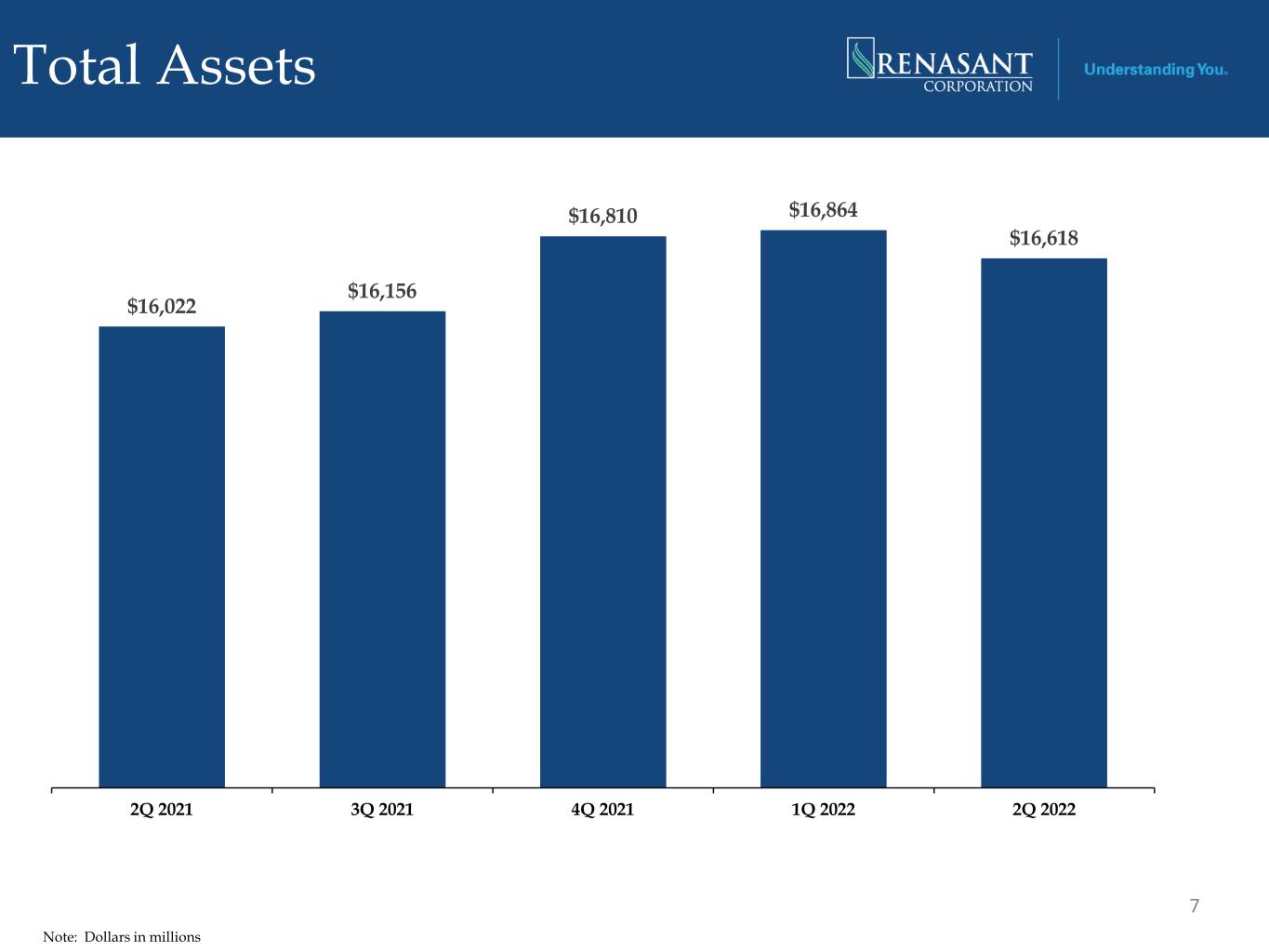

Total Assets 7 Note: Dollars in millions $16,022 $16,156 $16,810 $16,864 $16,618 $12 ,000 $12 ,500 $13 ,000 $13 ,500 $14 ,000 $14 ,500 $15 ,000 $15 ,500 $16 ,000 $16 ,500 $17 ,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022

Loans and Yields 8 Note: Dollars in millions * Other loans are comprised of installment loans to individuals and lease financing, which both have historically constituted less than 5% of the total loan portfolio. ** Core Loan Yield is a non-GAAP financial measure. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”. $10,149 $10,017 $10,021 $10,313 $10,604 4.24% 4.11% 3.98% 3.88% 4.12% 3.94% 3.89% 3.87% 3.82% 3.96% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 1-4 Family Mortgage Commercial Mortgage Construction Other* C&I Paycheck Protection Program ("PPP") Loan Yield Core Loan Yield**

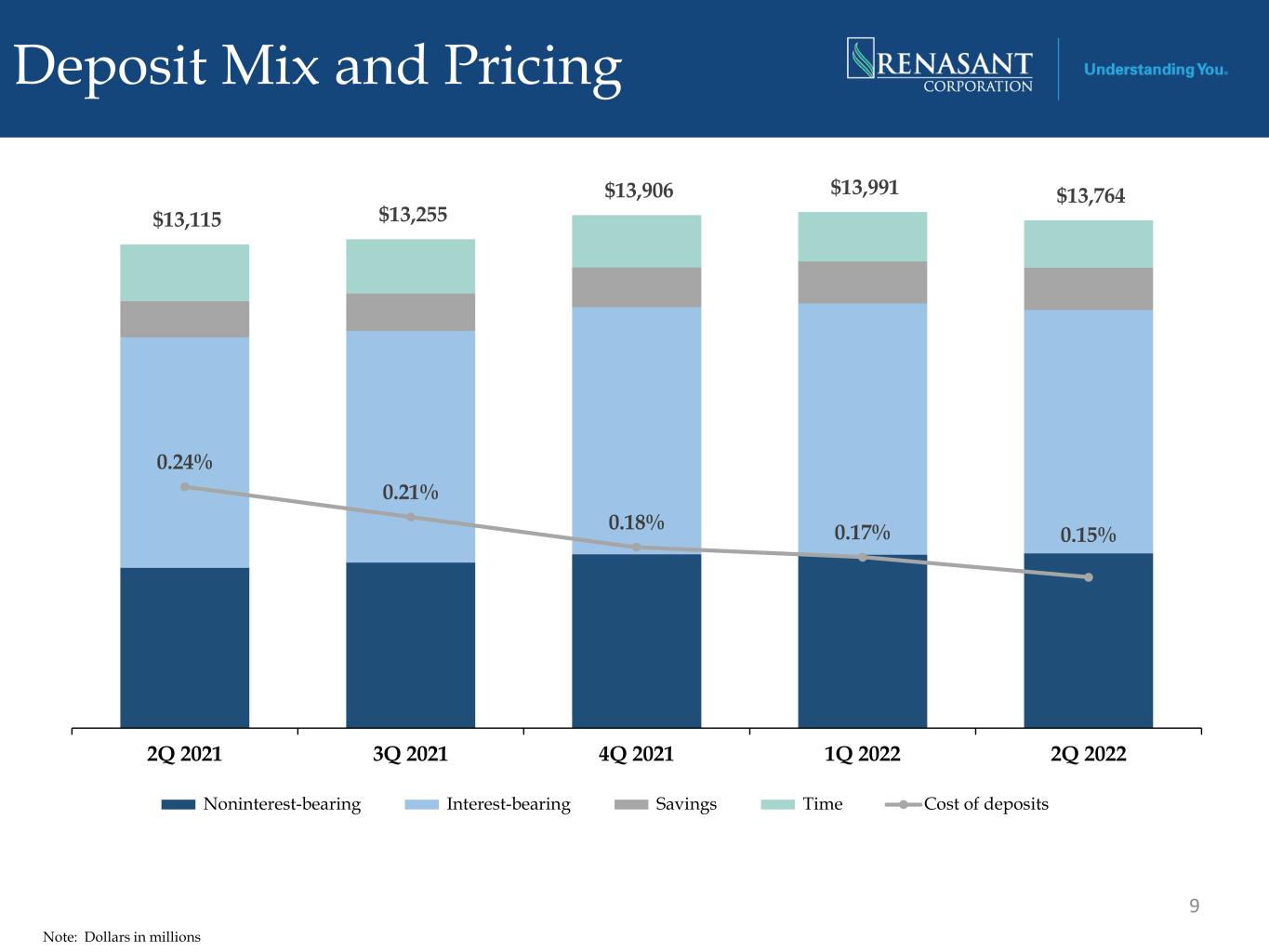

Deposit Mix and Pricing 9 Note: Dollars in millions $13,115 $13,255 $13,906 $13,991 $13,764 0.24% 0.21% 0.18% 0.17% 0.15% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Noninterest-bearing Interest-bearing Savings Time Cost of deposits

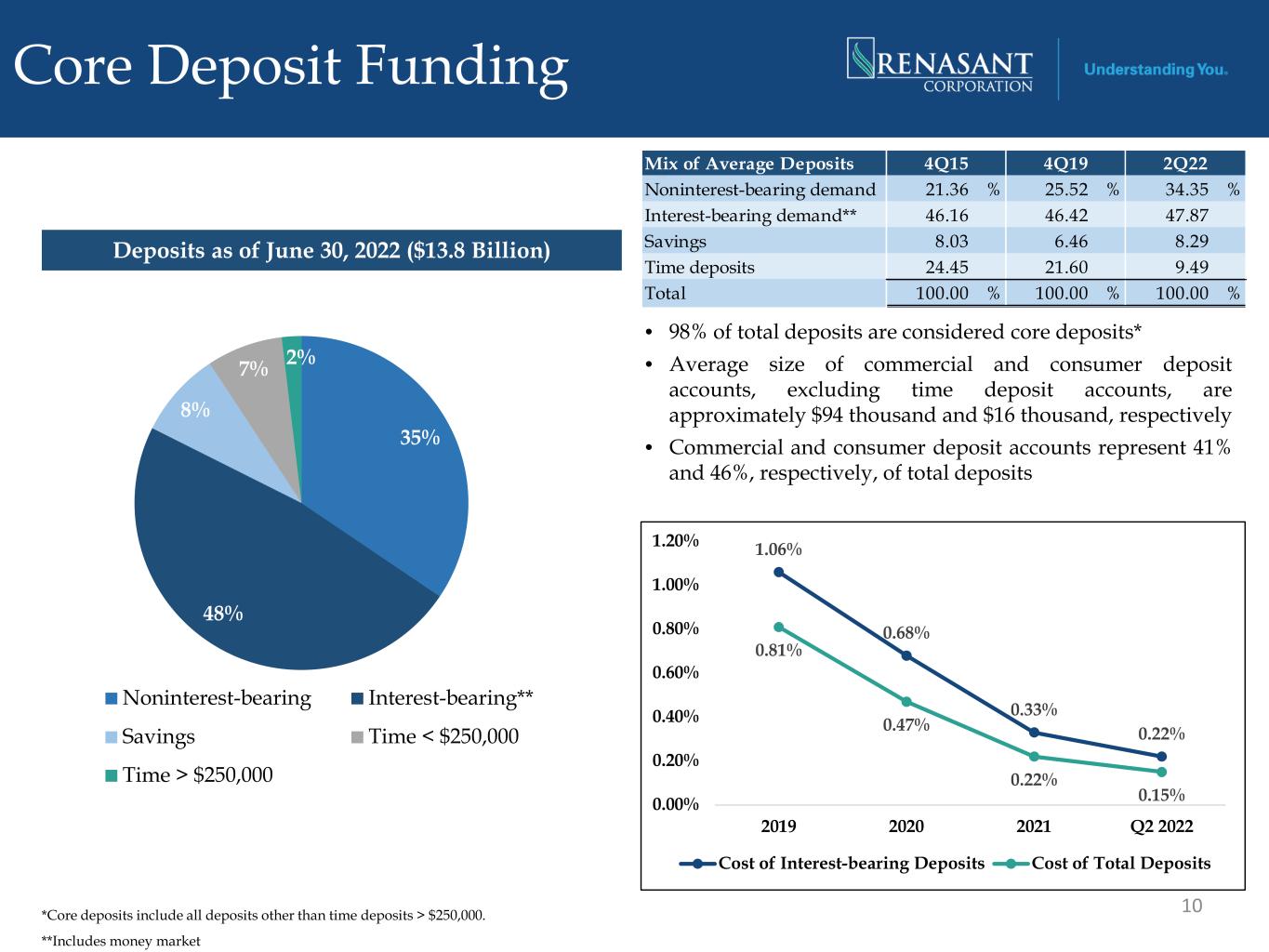

Core Deposit Funding 35% 48% 8% 7% 2% Noninterest-bearing Interest-bearing** Savings Time < $250,000 Time > $250,000 • 98% of total deposits are considered core deposits* • Average size of commercial and consumer deposit accounts, excluding time deposit accounts, are approximately $94 thousand and $16 thousand, respectively • Commercial and consumer deposit accounts represent 41% and 46%, respectively, of total deposits 10 Deposits as of June 30, 2022 ($13.8 Billion) Mix of Average Deposits Noninterest-bearing demand 21.36 % 25.52 % 34.35 % Interest-bearing demand** 46.16 46.42 47.87 Savings 8.03 6.46 8.29 Time deposits 24.45 21.60 9.49 Total 100.00 % 100.00 % 100.00 % 4Q19 2Q224Q15 *Core deposits include all deposits other than time deposits > $250,000. **Includes money market 1.06% 0.68% 0.33% 0.22% 0.81% 0.47% 0.22% 0.15%0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 2019 2020 2021 Q2 2022 Cost of Interest-bearing Deposits Cost of Total Deposits

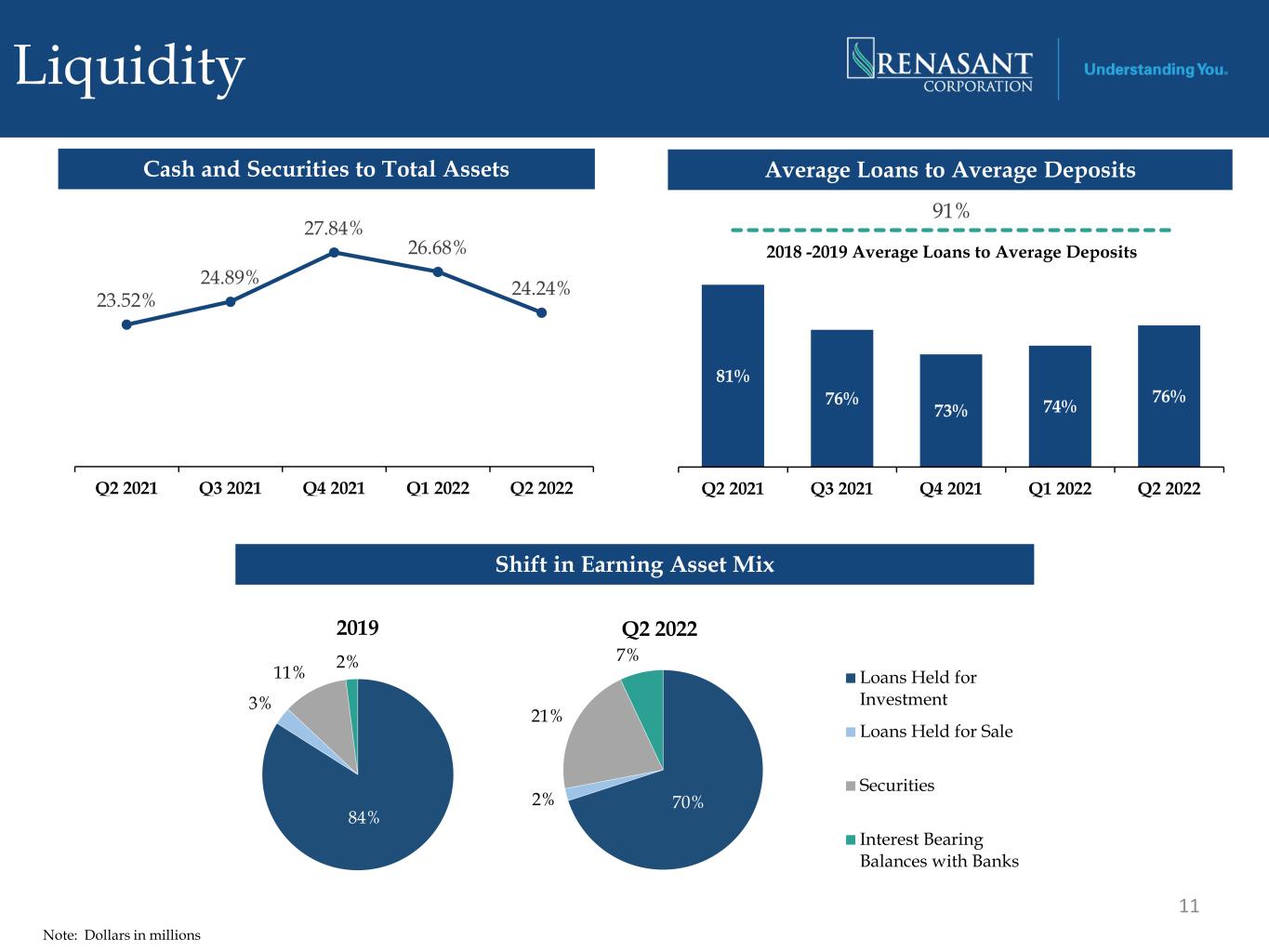

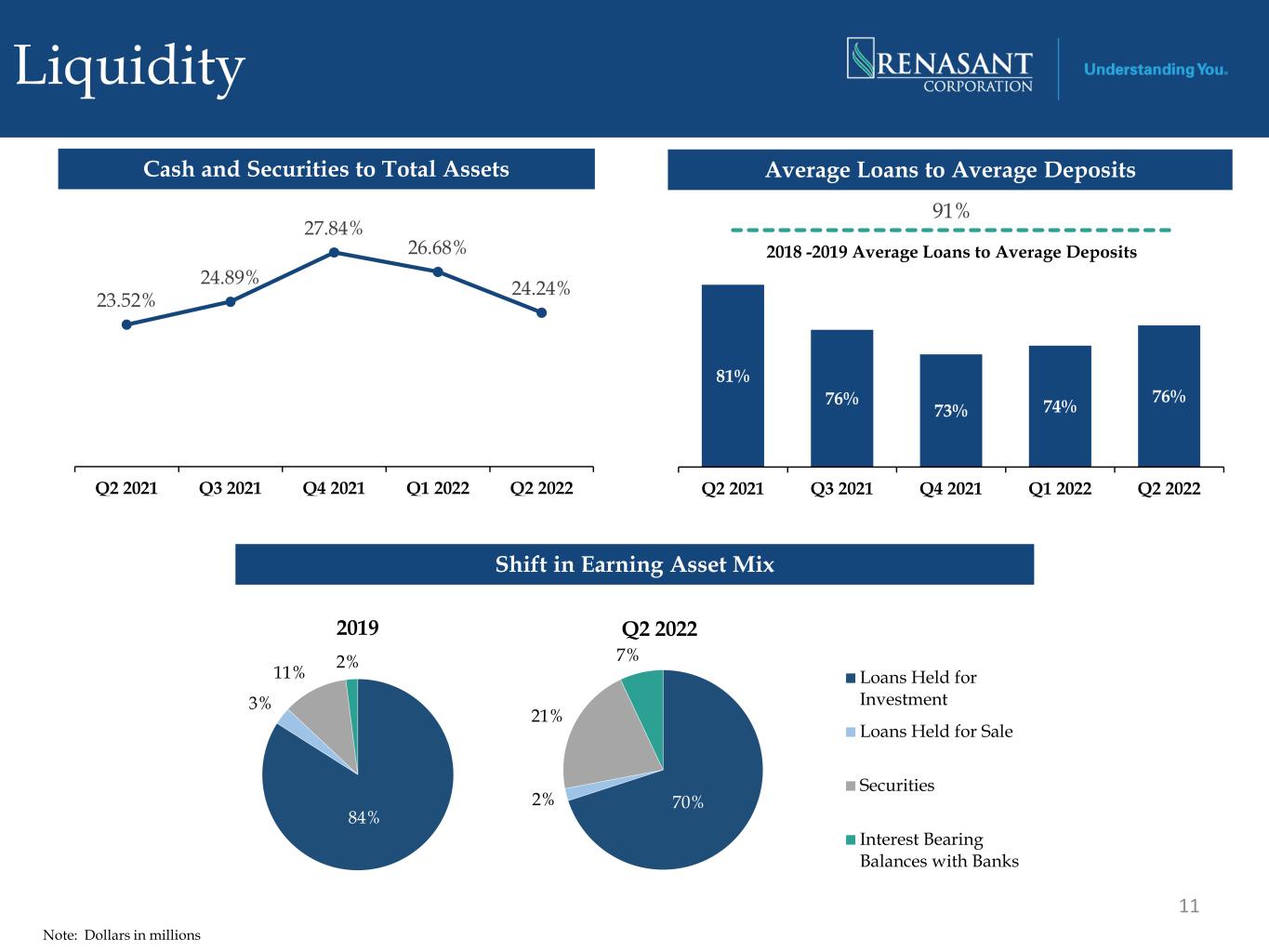

Liquidity 11 Note: Dollars in millions 81% 76% 73% 74% 76% 91% $1 $1 $1 $1 $1 $1 $1 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 2018 -2019 Average Loans to Average Deposits Average Loans to Average Deposits 23.52% 24.89% 27.84% 26.68% 24.24% $0 $0 $0 $0 $0 $0 $0 $0 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Cash and Securities to Total Assets 84% 3% 11% 2% 2019 70%2% 21% 7% Q2 2022 Loans Held for Investment Loans Held for Sale Securities Interest Bearing Balances with Banks Shift in Earning Asset Mix

Subordinated Notes $335,451 ACL $133,987 Trust Preferred $108,071 Common Equity Tier 1 $1,347,681 1 Capital Position 12 Tier 1 $1,456 Tier 2 $469 Regulatory Capital as of June 30, 2022 • $50 million stock repurchase program will remain in effect through October 2022; however, there was no buyback activity in the second quarter of 2022 • Consistent dividend payment history, including through the 2008 financial crisis Capital Highlights Note: Dollars in millions * Tangible Common Equity is a non-GAAP financial measure. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”. Ratio Tangible Common Equity* 7.35 % 7.34 % Leverage 9.00 9.16 Tier 1 Risk Based 11.67 11.60 Total Risk Based 15.51 15.34 Tier 1 Common Equity 10.78 10.74 1Q 2022 2Q 2022

Asset Quality

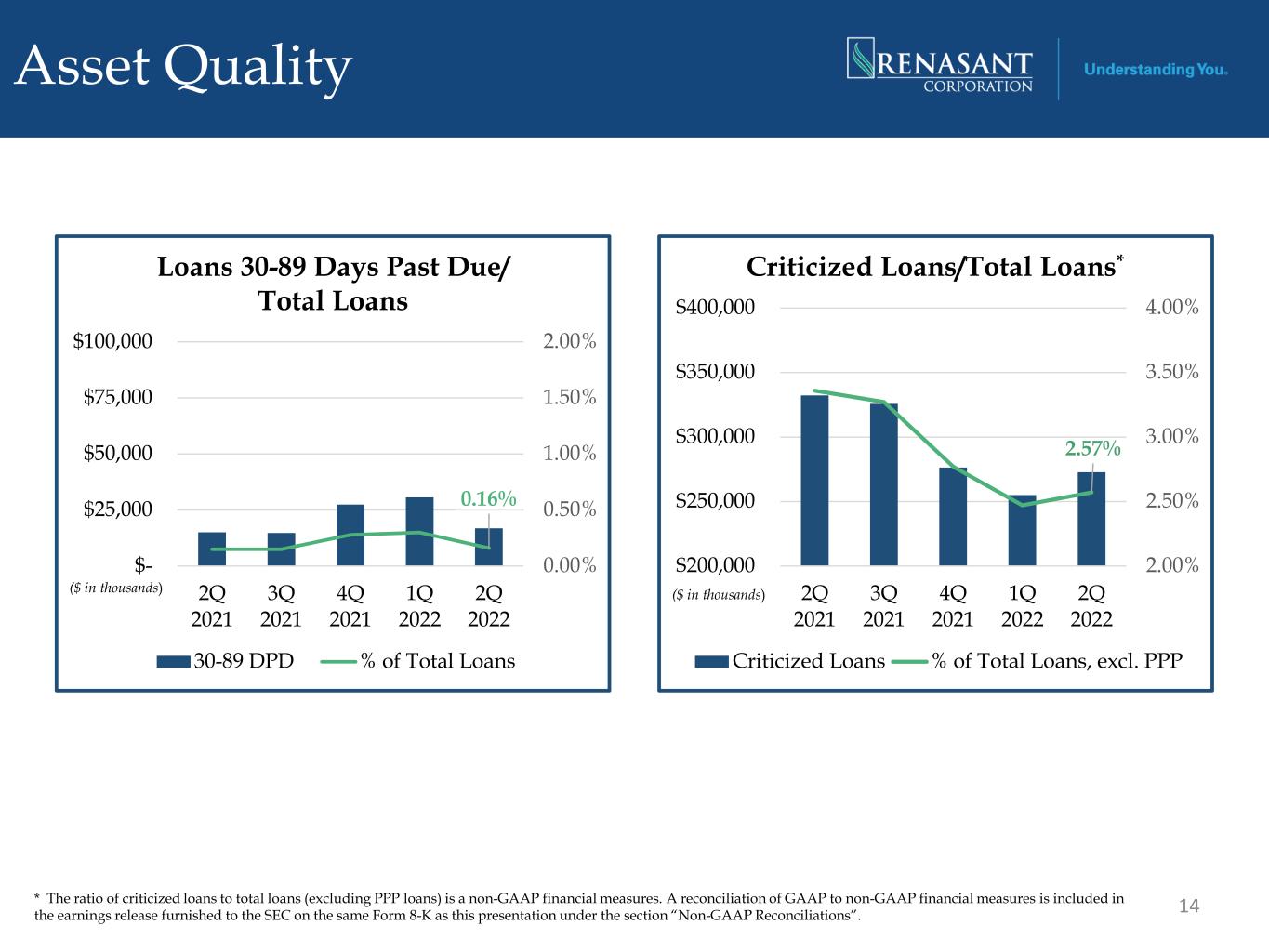

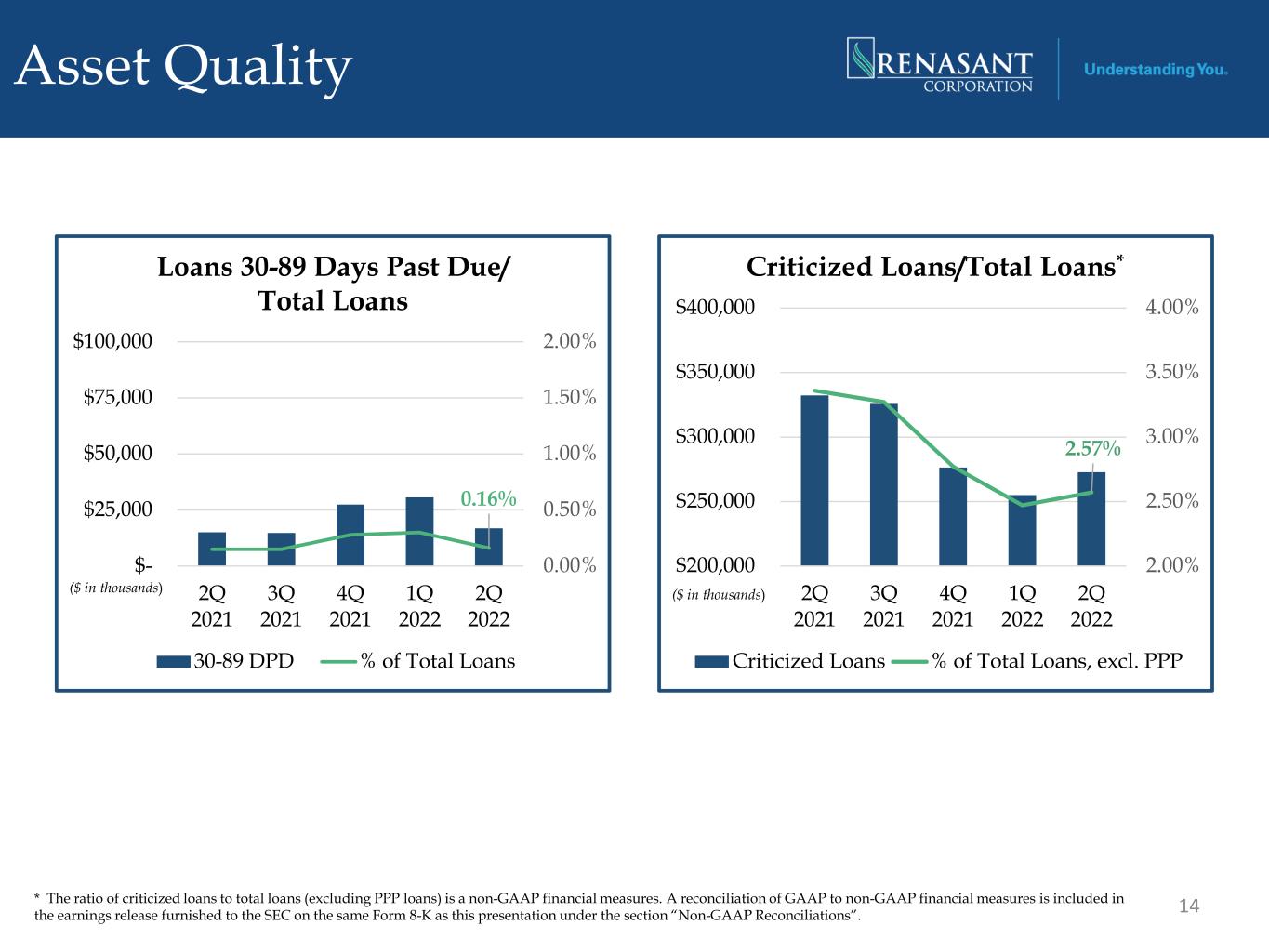

2.57% 2.00% 2.50% 3.00% 3.50% 4.00% $200,000 $250,000 $300,000 $350,000 $400,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Criticized Loans/Total Loans* Criticized Loans % of Total Loans, excl. PPP ($ in thousands) 0.16% 0.00% 0.50% 1.00% 1.50% 2.00% $- $25,000 $50,000 $75,000 $100,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Loans 30-89 Days Past Due/ Total Loans 30-89 DPD % of Total Loans ($ in thousands) Asset Quality 14* The ratio of criticized loans to total loans (excluding PPP loans) is a non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”.

0.28% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% $- $25,000 $50,000 $75,000 $100,000 $125,000 $150,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 NPAs/Total Assets* Nonperforming loans OREO % of Assets, excl. PPP ($ in thousands) 0.09% 0.00% 0.20% 0.40% 0.60% 0.80% $- $5,000 $10,000 $15,000 $20,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Net Charge-offs/Average Loans* Net charge-offs % of Avg Loans, excl. PPP ($ in thousands) Asset Quality 15* Nonperforming assets to total assets (excluding PPP loans) and net charge-offs to average loans (excluding PPP loans) are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”.

1.57% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% $140,000 $150,000 $160,000 $170,000 $180,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Allowance/Total Loans* Allowance % of Total Loans, excl. PPP ($ in thousands) 373% 200% 250% 300% 350% 400% $140,000 $150,000 $160,000 $170,000 $180,000 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Allowance/Nonperforming Loans Allowance % of Total NPLs ($ in thousands) ACL Metrics 16* Allowance for credit losses to total loans (excluding PPP) is a non-GAAP financial measure. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”.

ACL Summary ($ in thousands) ACL ACL as a % of Loans ACL ACL as a % of Loans SBA Paycheck Protection Program - - - - Commercial, Financial, Agricultural 33,606$ 2.32 30,192$ 2.02 Lease Financing Receivables 1,582 1.76 1,802 1.78 Real Estate - 1-4 Family Mortgage 36,848 1.30 41,910 1.38 Real Estate - Commercial Mortgage 65,231 1.42 64,373 1.36 Real Estate - Construction 18,411 1.51 17,290 1.54 Installment loans to individuals 10,790 7.87 10,564 8.05 Allowance for Credit Losses on Loans 166,468 1.61 166,131 1.57 Allowance for Credit Losses on Deferred Interest 1,266 1,263 Reserve for Unfunded Commitments 19,485 19,935 Total Reserves 187,219$ 187,329$ 6/30/20223/31/2022 17

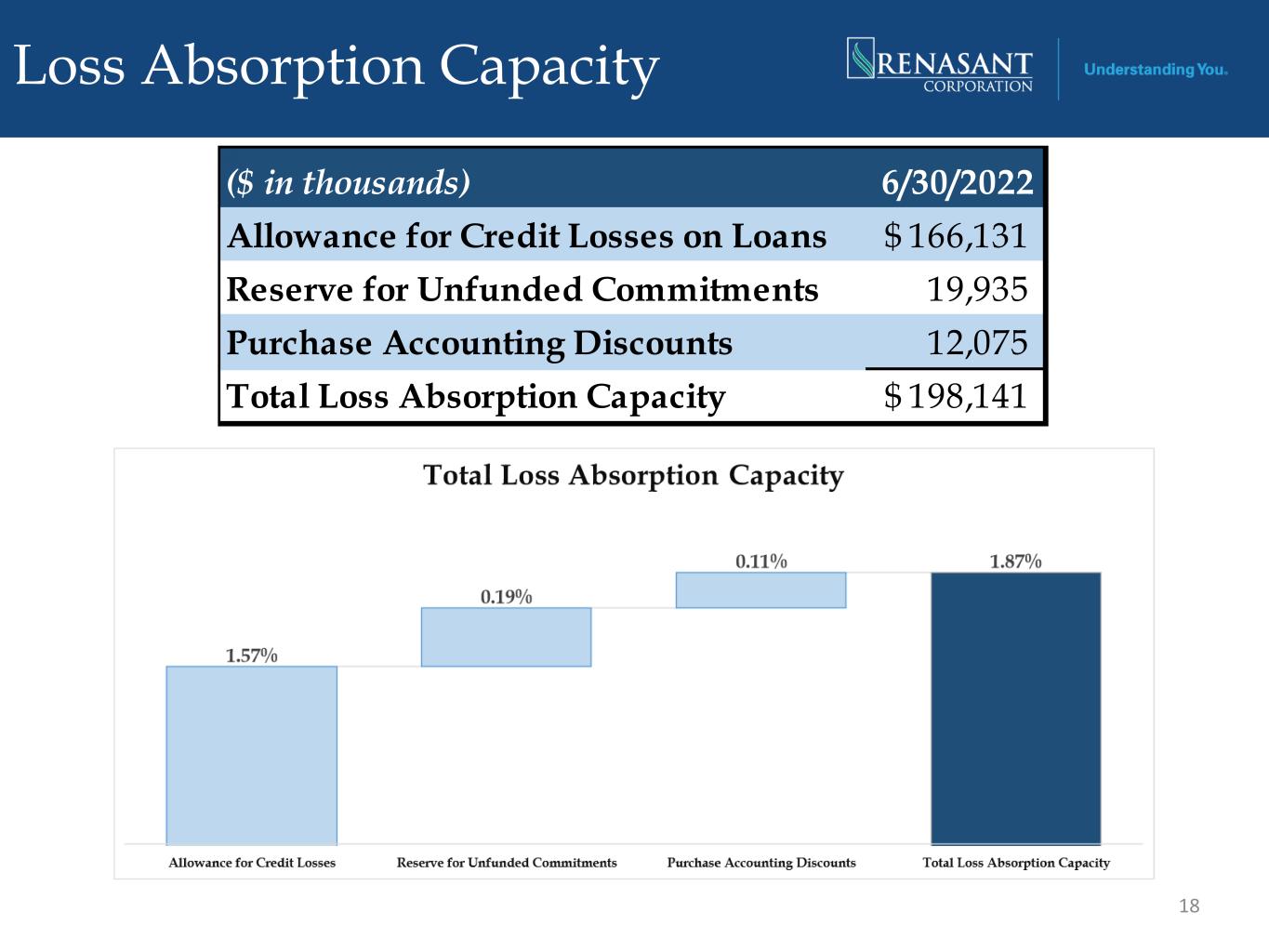

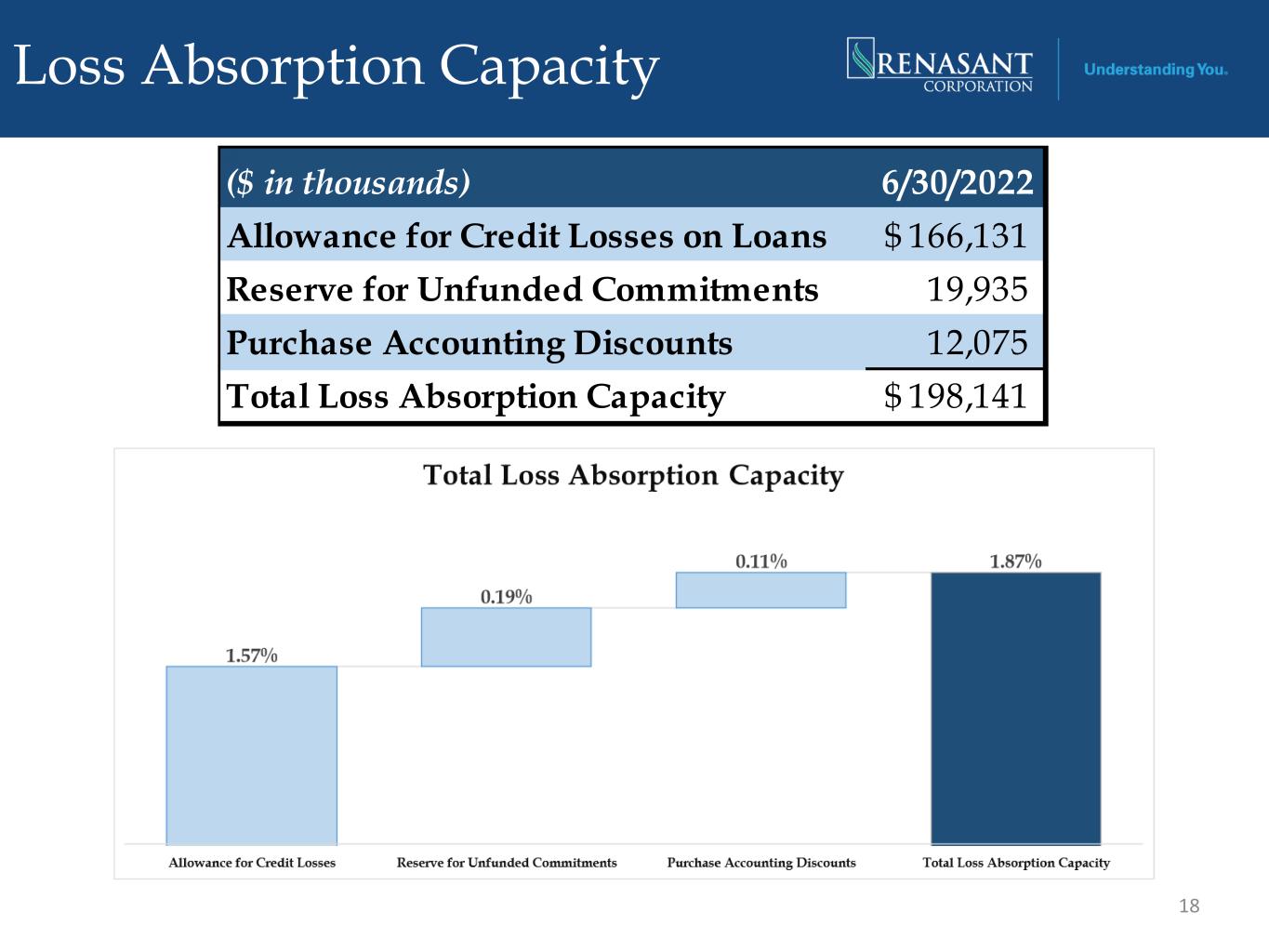

Loss Absorption Capacity 18 ($ in thousands) 6/30/2022 Allowance for Credit Losses on Loans 166,131$ Reserve for Unfunded Commitments 19,935 Purchase Accounting Discounts 12,075 Total Loss Absorption Capacity 198,141$

Profitability

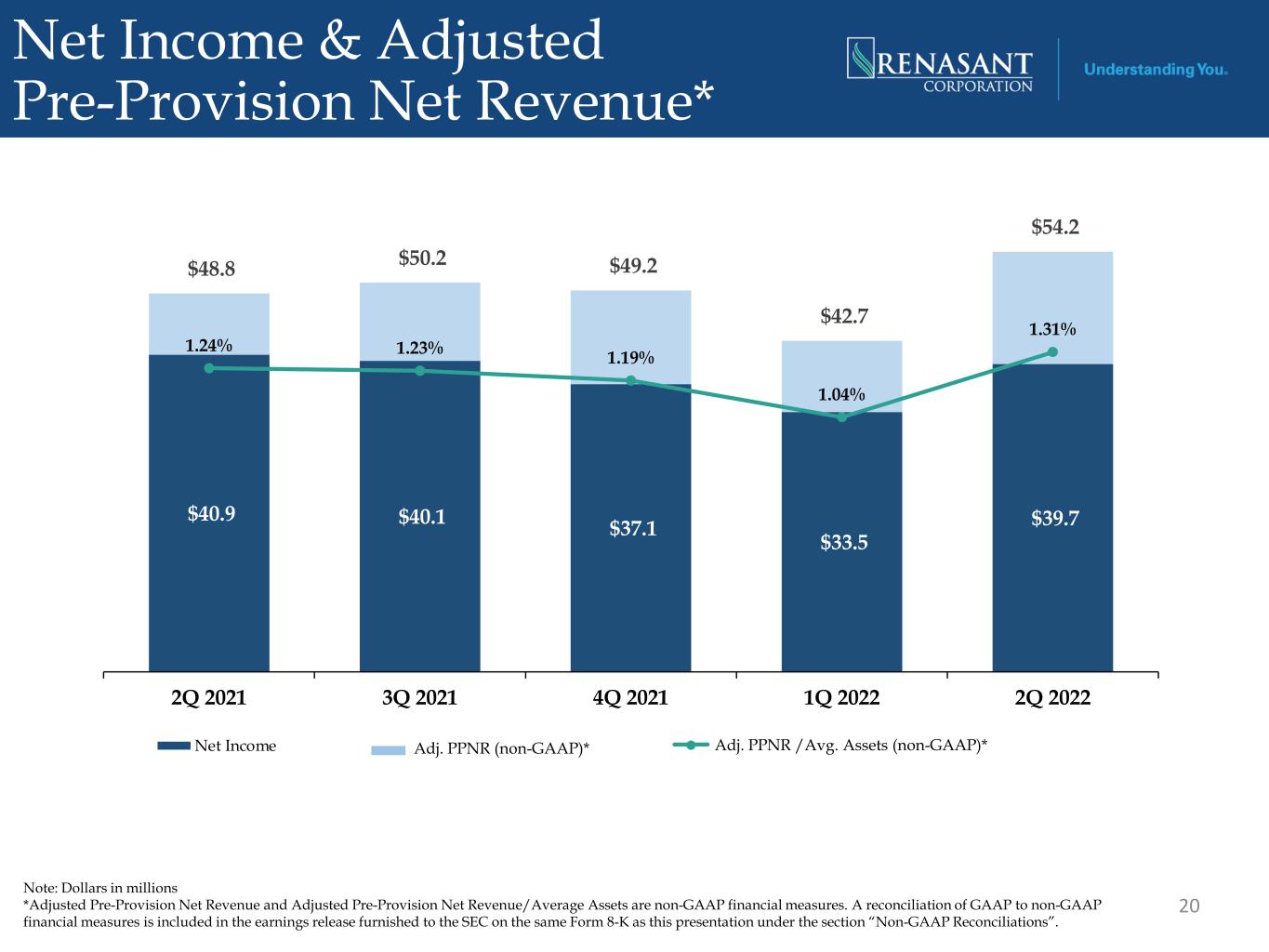

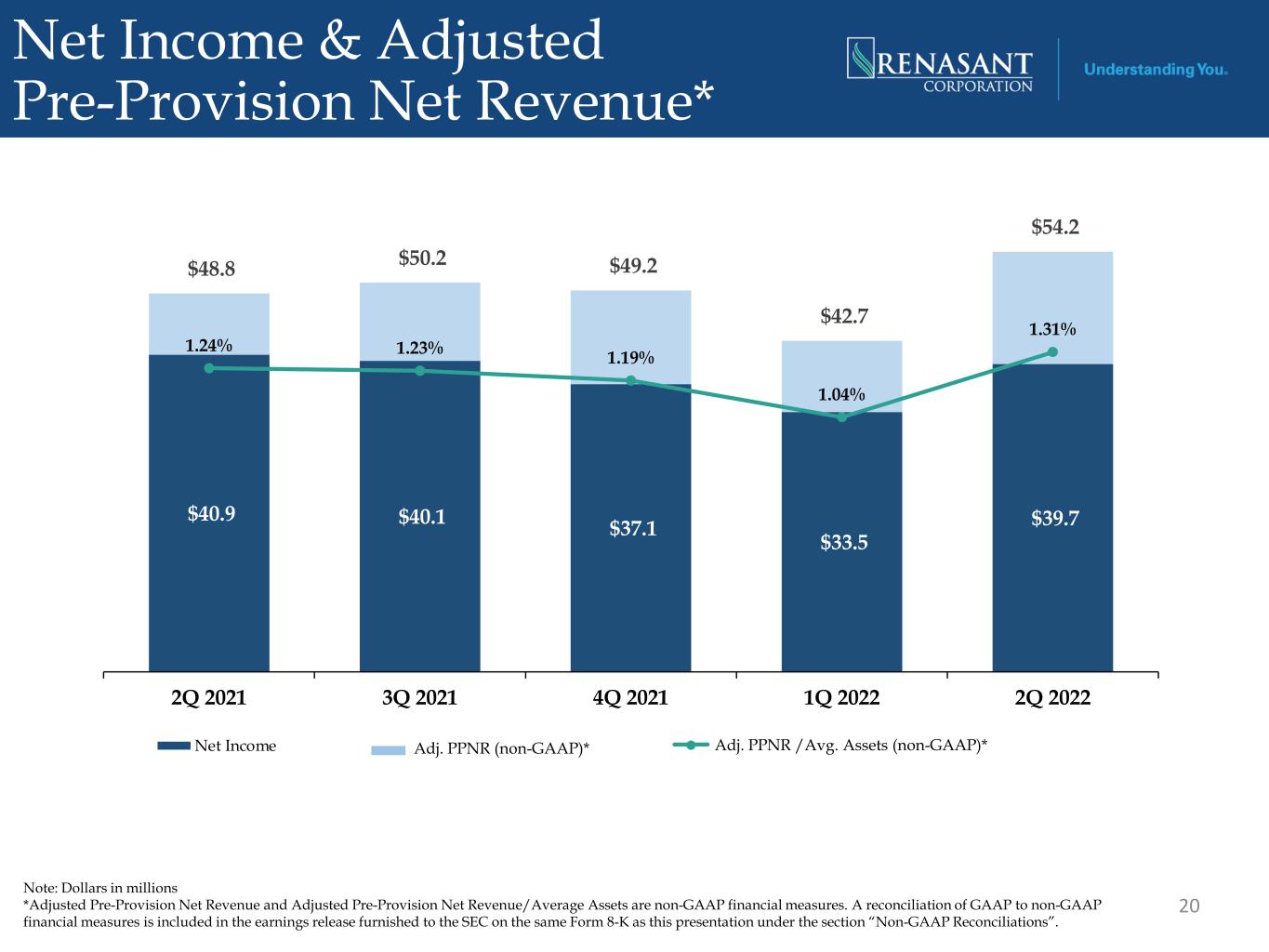

Net Income & Adjusted Pre-Provision Net Revenue* 20 $40.9 $40.1 $37.1 $33.5 $39.7 $48.8 $50.2 $49.2 $42.7 $54.2 1.24% 1.23% 1.19% 1.04% 1.31% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Net Income P Adj. PPNR (non-GAAP)* Adj. PPNR /Avg. Assets (non-GAAP)* Note: Dollars in millions *Adjusted Pre-Provision Net Revenue and Adjusted Pre-Provision Net Revenue/Average Assets are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”.

Diluted Earnings per Share Reported and Adjusted* 21 $.72 $.71 $.66 $.60 $.71 $.73 $.71 $.68 $.60 $.72 $- $0.10 $0.20 $0.30 $0.40 $0.50 $0.60 $0.70 $0.80 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Diluted EPS (GAAP) Diluted EPS Adjusted (non-GAAP)* * Diluted earnings per share (adjusted) is a non-GAAP financial measure. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”.

Profitability Ratios 22 7.40% 7.16% 6.59% 6.05% 7.31% 13.64% 13.13% 12.31% 10.99% 13.81% 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% 12.00% 14.00% 16.00% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 ROE (GAAP) ROTCE (Adjusted) (non-GAAP)* *ROAA (Adjusted) and ROTCE (Adjusted) are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”. 1.04% 0.99% 0.89% 0.81% 0.96% 1.04% 0.99% 0.92% 0.82% 0.98% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% 1.20% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 ROAA (GAAP) ROAA (Adjusted) (non-GAAP)* Return on Average Equity (ROE)Return on Average Assets (ROAA)

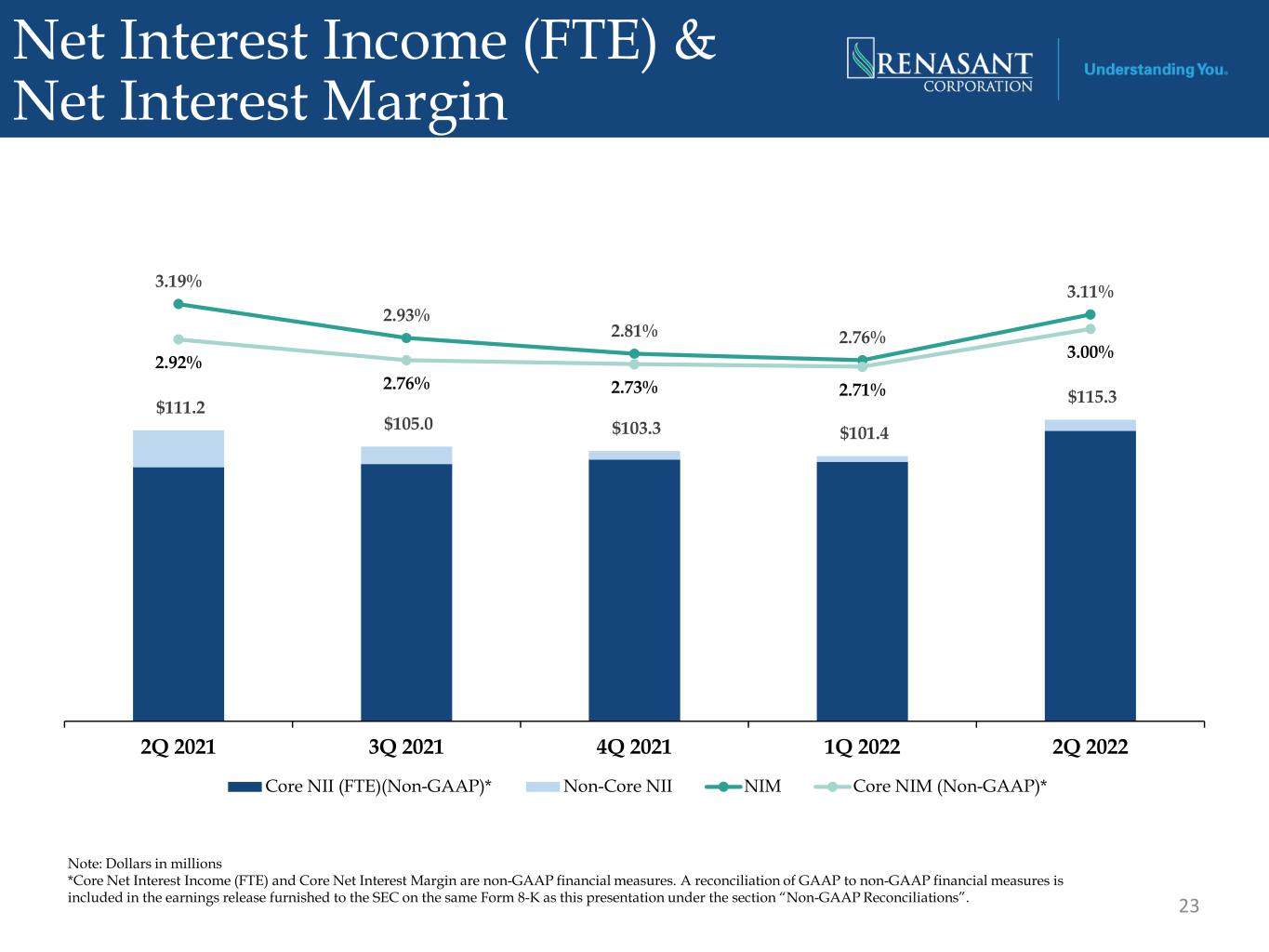

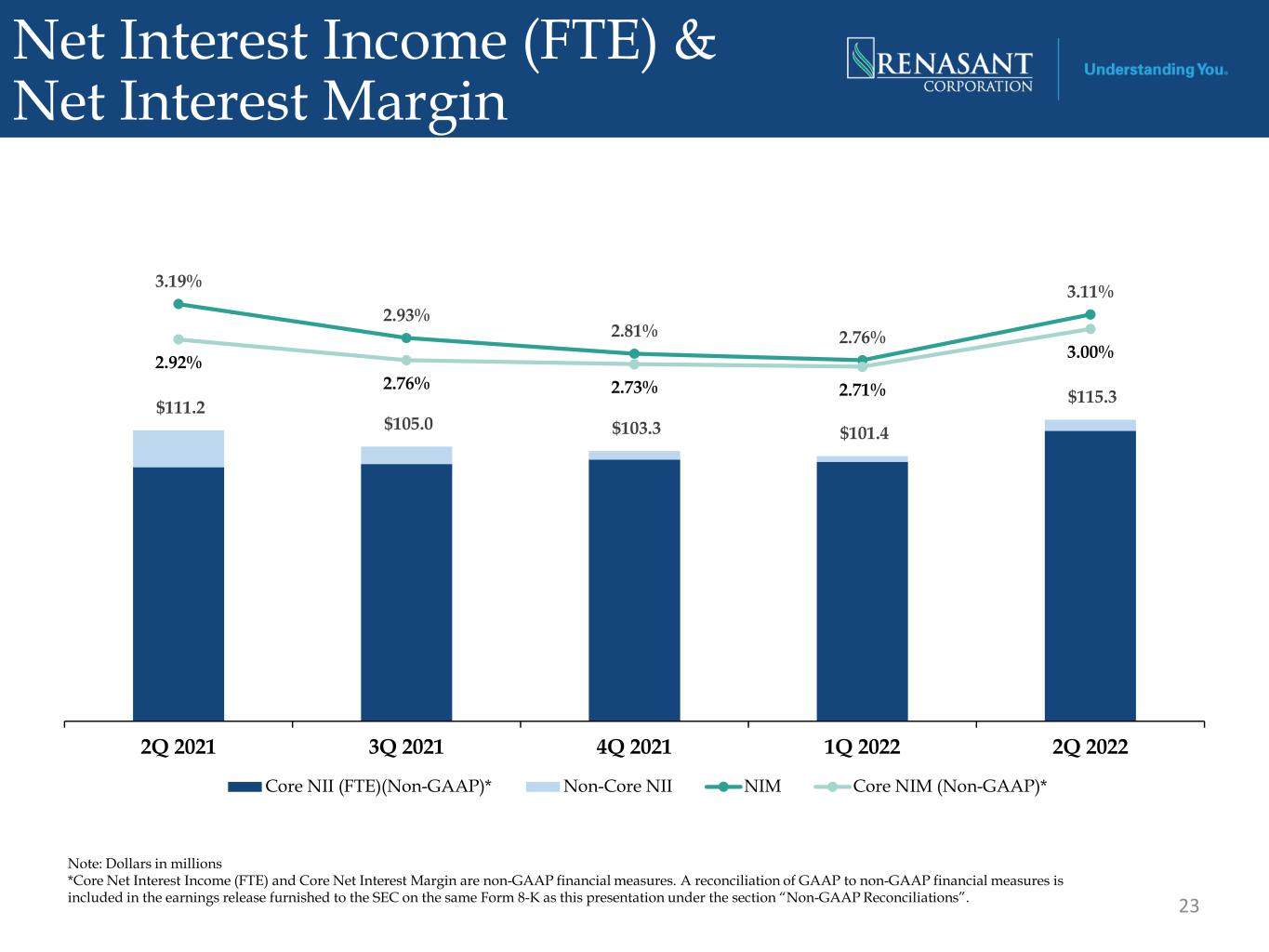

Net Interest Income (FTE) & Net Interest Margin 23 $111.2 $105.0 $103.3 $101.4 $115.3 3.19% 2.93% 2.81% 2.76% 3.11% 2.92% 2.76% 2.73% 2.71% 3.00% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Core NII (FTE)(Non-GAAP)* Non-Core NII NIM Core NIM (Non-GAAP)* Note: Dollars in millions *Core Net Interest Income (FTE) and Core Net Interest Margin are non-GAAP financial measures. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”.

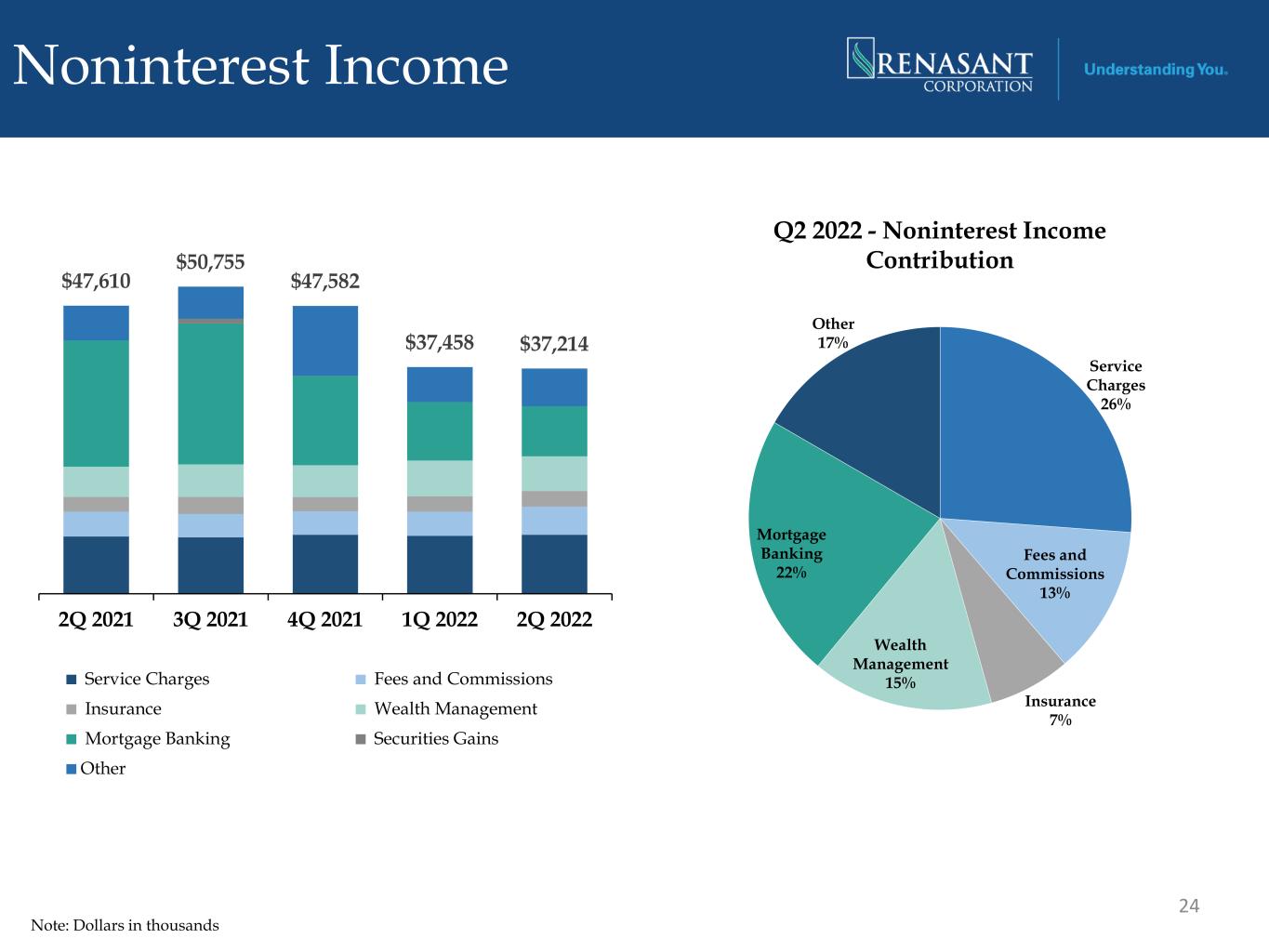

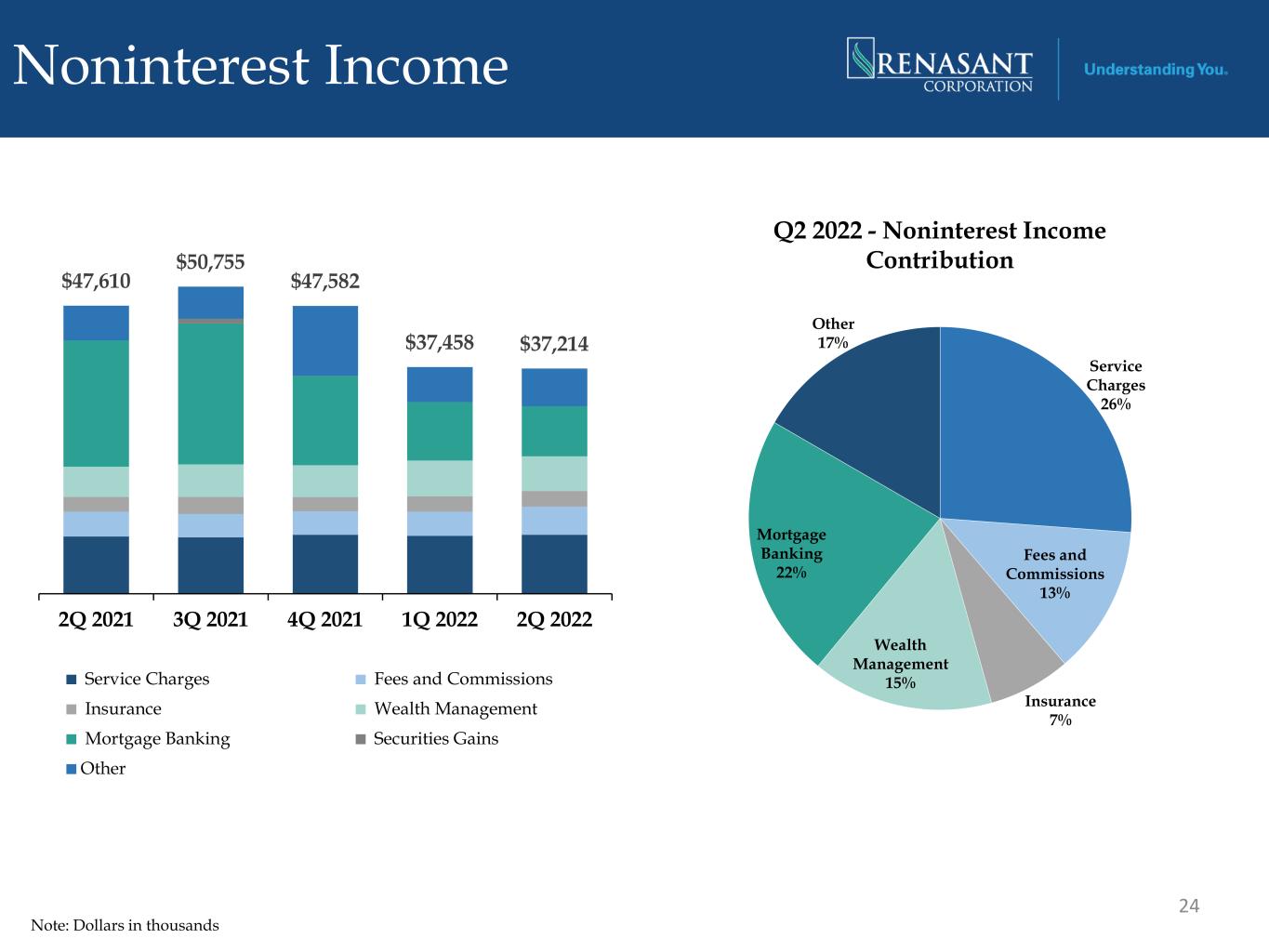

Note: Dollars in thousands $47,610 $50,755 $47,582 $37,458 $37,214 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Service Charges Fees and Commissions Insurance Wealth Management Mortgage Banking Securities Gains Other Noninterest Income 24 Service Charges 26% Fees and Commissions 13% Insurance 7% Wealth Management 15% Mortgage Banking 22% Other 17% Q2 2022 - Noninterest Income Contribution

Mortgage Banking 25 Mortgage MixMortgage banking income Gain on sale margin* *Gain on sale margin excludes pipeline fair value adjustments included in “Gain on sales of loans, net” in the table above. ($ in thousands) 2Q21 1Q22 2Q22 Gain on sales of loans, net 17,581$ 6,047$ 3,490$ Fees, net 4,519 3,053 3,064 Mortgage servicing (loss) income, net (1,247) 533 1,762 MSR valuation adjustment - - - Mortgage banking income, net 20,853$ 9,633$ 8,316$ 2.73% 2.23% 2.01% 1.81% 1.27% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 $1.5 $1.4 $1.2 $1.2 $0.9 $- $0 $0 $1 $1 $1 $1 $1 $2 $2 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Locked Volume (in billions) (in %) 2Q21 1Q22 2Q22 Wholesale 40 38 39 Retail 60 62 61 Purchase 67 73 80 Refinance 33 27 20

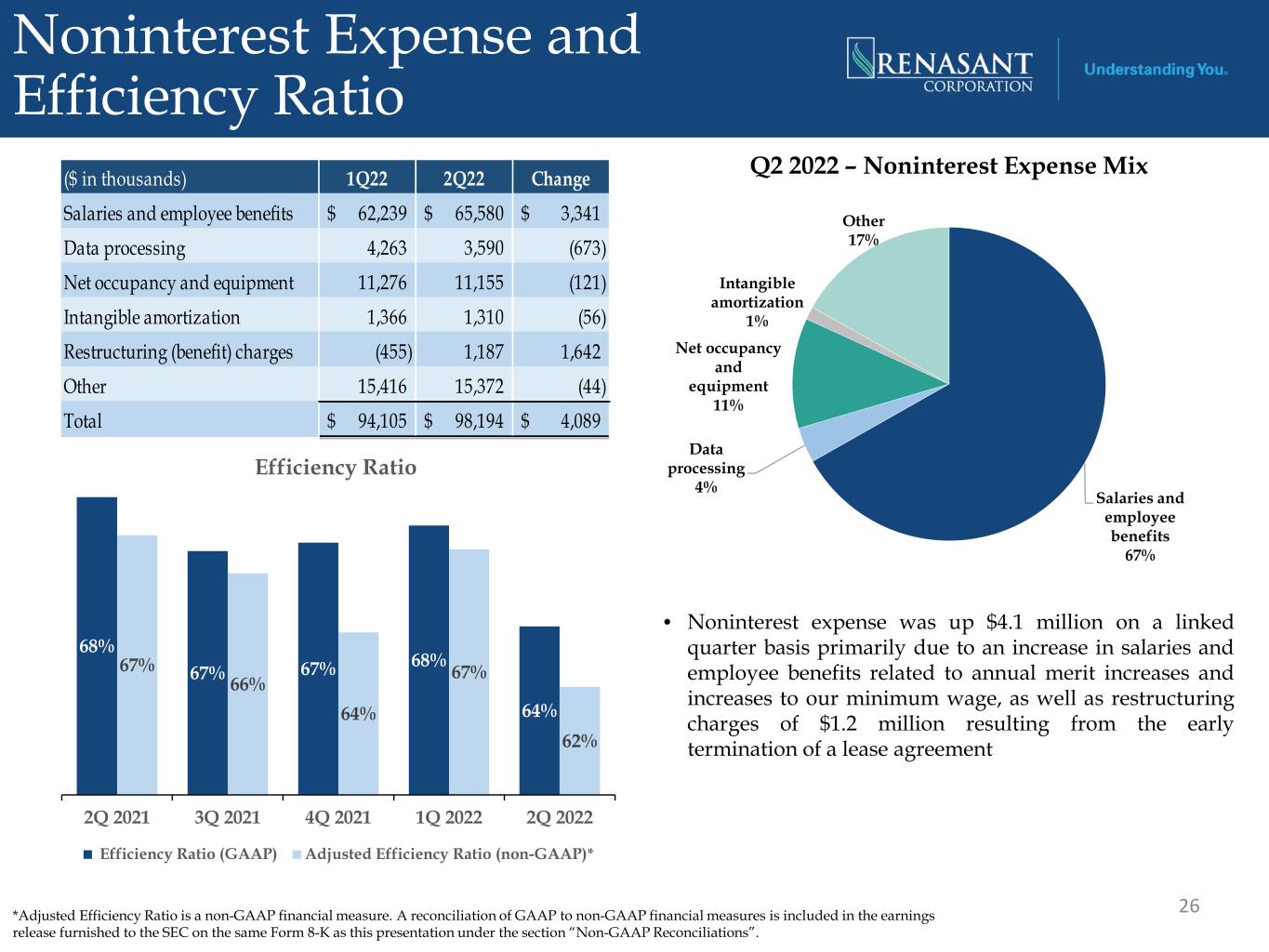

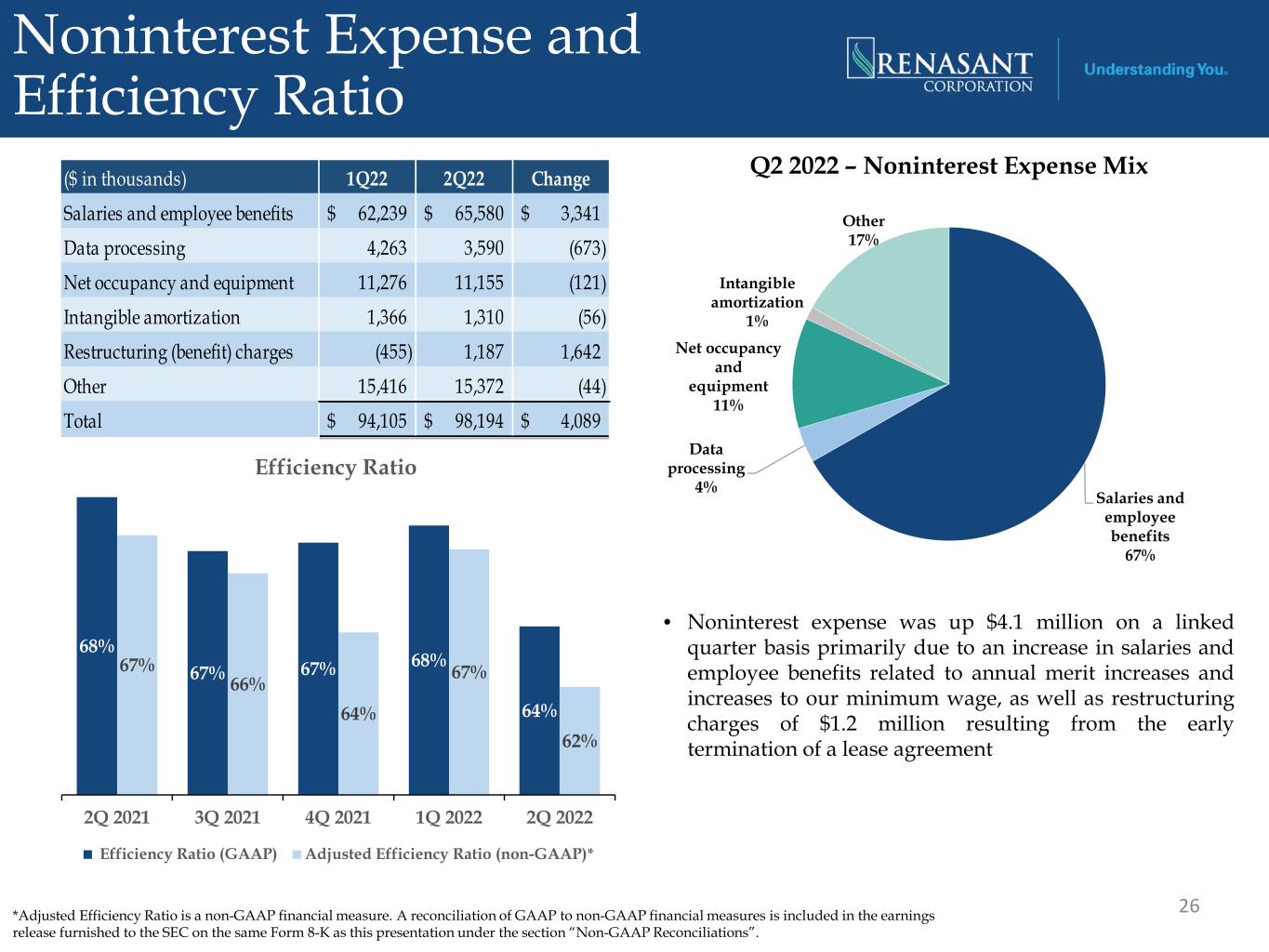

Noninterest Expense and Efficiency Ratio 26 Salaries and employee benefits 67% Data processing 4% Net occupancy and equipment 11% Intangible amortization 1% Other 17% Q2 2022 – Noninterest Expense Mix($ in thousands) 1Q22 2Q22 Change Salaries and employee benefits 62,239$ 65,580$ 3,341$ Data processing 4,263 3,590 (673) Net occupancy and equipment 11,276 11,155 (121) Intangible amortization 1,366 1,310 (56) Restructuring (benefit) charges (455) 1,187 1,642 Other 15,416 15,372 (44) Total 94,105$ 98,194$ 4,089$ 68% 67% 67% 68% 64% 67% 66% 64% 67% 62% 2Q 2021 3Q 2021 4Q 2021 1Q 2022 2Q 2022 Efficiency Ratio Efficiency Ratio (GAAP) Adjusted Efficiency Ratio (non-GAAP)* *Adjusted Efficiency Ratio is a non-GAAP financial measure. A reconciliation of GAAP to non-GAAP financial measures is included in the earnings release furnished to the SEC on the same Form 8-K as this presentation under the section “Non-GAAP Reconciliations”. • Noninterest expense was up $4.1 million on a linked quarter basis primarily due to an increase in salaries and employee benefits related to annual merit increases and increases to our minimum wage, as well as restructuring charges of $1.2 million resulting from the early termination of a lease agreement

27