Exhibit 99.2

Merger of Renasant Corporation (RNST)

and Heritage Financial Group, Inc. (HBOS)

December 10, 2014

Forward Looking Statement

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Congress passed the Private Securities Litigation Act of 1995 in an effort to encourage companies to provide information about their anticipated future financial performance. This act provides a safe harbor for such disclosure, which protects a company from unwarranted litigation if actual results are different from management expectations. This presentation reflects current views and estimates of the respective management of Renasant Corporation (“Renasant” or “RNST”) and Heritage Financial Group, Inc. (“Heritage” or “HBOS”) regarding future economic circumstances, industry conditions, company performance, and financial results. These forward looking statements are subject to a number of factors and uncertainties which could cause Renasant, Heritage, or the combined company’s actual results and experience to differ from the anticipated results and expectations expressed in such forward looking statements. Forward looking statements speak only as of the date they are made and neither Renasant nor Heritage assumes any duty to update forward looking statements. In addition to factors previously disclosed in Renasant’s and Heritage’s reports filed with the SEC and those identified elsewhere in this presentation, these forward-looking statements include, but are not limited to, statements about (i) the expected benefits of the transaction between Renasant and Heritage and between Renasant Bank and HeritageBank of the South, including future financial and operating results, cost savings, enhanced revenues and the expected market position of the combined company that may be realized from the transaction, and (ii) Renasant and Heritage’s plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts. Other statements identified by words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects” or words of similar meaning generally are intended to identify forward-looking statements. These statements are based upon the current beliefs and expectations of Renasant’s and Heritage’s management and are inherently subject to significant business, economic and competitive risks and uncertainties, many of which are beyond their respective control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from those indicated or implied in the forward-looking statements.

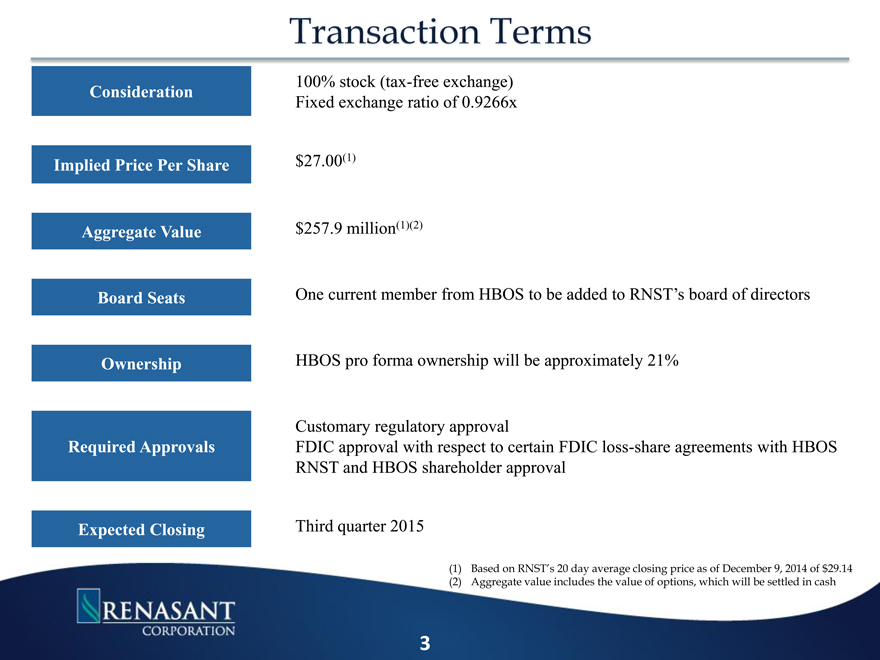

Transaction Terms

Consideration 100% stock (tax-free exchange) Fixed exchange ratio of 0.9266x

Implied Price Per Share $27.00(1)

Aggregate Value $257.9 million(1)(2)

Board Seats One current member from HBOS to be added to RNST’s board of directors

Ownership HBOS pro forma ownership will be approximately 21%

Required Approvals

Customary regulatory approval

FDIC approval with respect to certain FDIC loss-share agreements with HBOS RNST and HBOS shareholder approval

Expected Closing Third quarter 2015

(1) Based on RNST’s 20 day average closing price as of December 9, 2014 of $29.14 (2) Aggregate value includes the value of options, which will be settled in cash

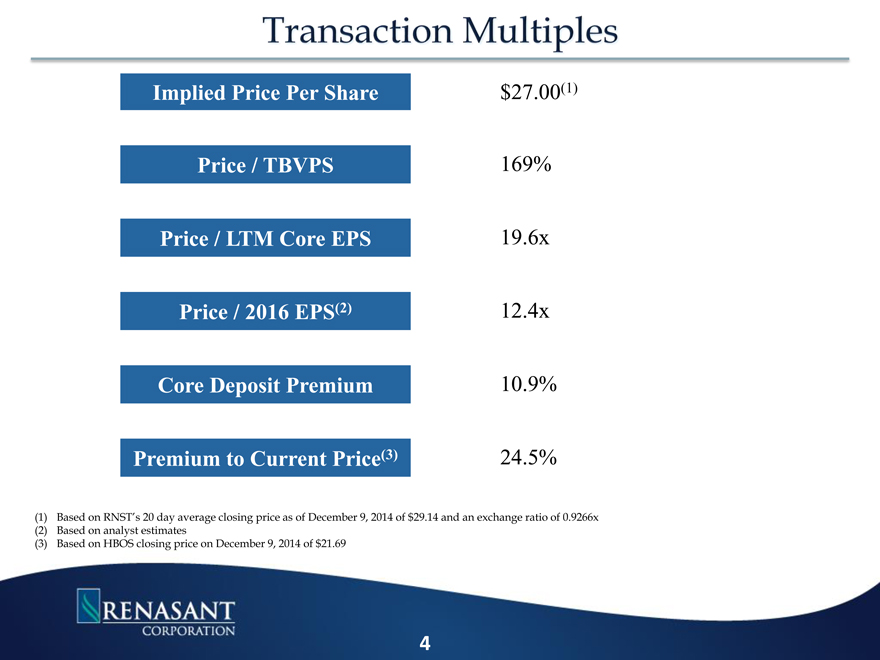

Transaction Multiples

Implied Price Per Share $27.00(1)

Price / TBVPS 169% Price / LTM Core EPS 19.6x Price / 2016 EPS(2) 12.4x Core Deposit Premium 10.9%

Premium to Current Price(3) 24.5%

(1) | | Based on RNST’s 20 day average closing price as of December 9, 2014 of $29.14 and an exchange ratio of 0.9266x |

(2) | | Based on analyst estimates |

(3) | | Based on HBOS closing price on December 9, 2014 of $21.69 |

Transaction Rationale

Strategically Advantageous

Provides additional scale with $1.9 billion in quality assets and a strong core deposit base

Complementary cultures and strong ties to the community consistent with Renasant

Banking, mortgage and investment offices enhance existing footprint and provide initial entry point into several attractive markets

Ability to increase non-interest income through the enhancement of fee-based services

Financially Attractive

Immediately accretive to EPS, double-digit EPS accretion projected in 2016

Tangible book value dilution expected to be earned back in under two (2) years(1)

Estimated IRR of 20%

Anticipated realization of significant expense synergies (20% of noninterest expense)

Pro forma TCE ratio of approximately 6.8%

Pro forma regulatory ratios remain above “well capitalized” guidelines

Lower risk opportunity

Extensive due diligence process completed

Comprehensive review of loan and OREO portfolios

Conservative credit mark coupled with large portion of previously acquired assets at fair value

Unique acquisition of an acquisitive institution

(1) Tangible book value earn back utilizes the “crossover” or “standalone vs. pro forma” methodology (assumes all merger-related expenses are recognized at close)

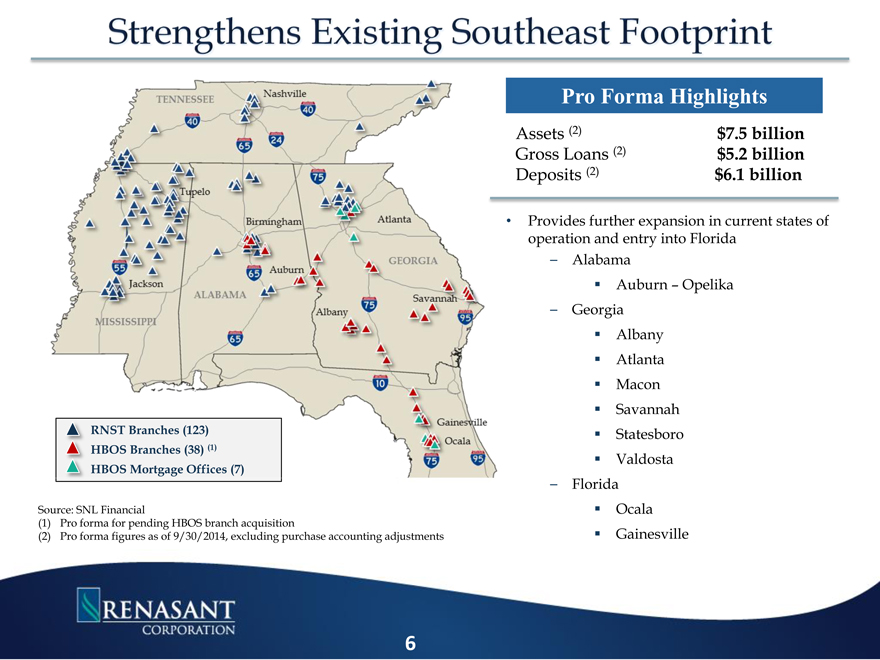

Strengthens Existing Southeast Footprint

RNST Branches (123) HBOS Branches (38) (1) HBOS Mortgage Offices (7)

Pro Forma Highlights

Assets (2) $7.5 billion Gross Loans (2) $5.2 billion Deposits (2) $6.1 billion

Source: SNL Financial

(1) | | Pro forma for pending HBOS branch acquisition |

(2) | | Pro forma figures as of 9/30/2014, excluding purchase accounting adjustments |

Provides further expansion in current states of operation and entry into Florida

Alabama

Auburn Opelika

Georgia

Albany

Atlanta

Macon

Savannah

Statesboro

Valdosta

Florida

Ocala

Gainesville

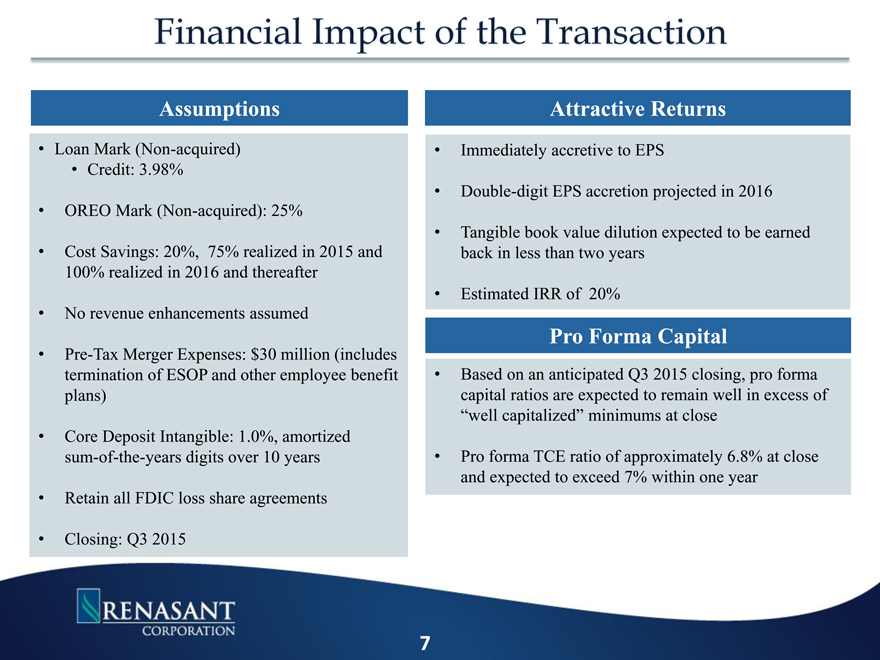

Financial Impact of the Transaction

Assumptions

Attractive Returns

Loan Mark (Non-acquired)

Credit: 3.98%

OREO Mark (Non-acquired): 25%

Cost Savings: 20%, 75% realized in 2015 and 100% realized in 2016 and thereafter

No revenue enhancements assumed

Pre-Tax Merger Expenses: $30 million (includes termination of ESOP and other employee benefit plans)

Core Deposit Intangible: 1.0%, amortized sum-of-the-years digits over 10 years

Retain all FDIC loss share agreements

Closing: Q3 2015

Immediately accretive to EPS

Double-digit EPS accretion projected in 2016

Tangible book value dilution expected to be earned back in less than two years

Estimated IRR of 20%

Pro Forma Capital

Based on an anticipated Q3 2015 closing, pro forma capital ratios are expected to remain well in excess of “well capitalized” minimums at close

Pro forma TCE ratio of approximately 6.8% at close and expected to exceed 7% within one year

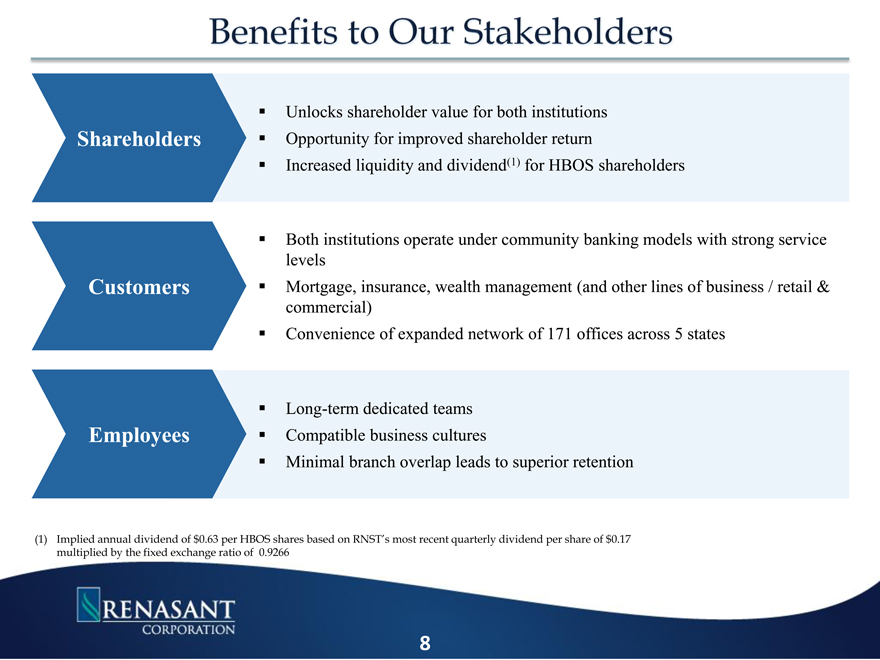

Benefits to Our Stakeholders

Shareholders

Unlocks shareholder value for both institutions

Opportunity for improved shareholder return

Increased liquidity and dividend(1) for HBOS shareholders Customers

Both institutions operate under community banking models with strong service levels

Mortgage, insurance, wealth management (and other lines of business / retail & commercial)

Convenience of expanded network of 171 offices across 5 states Employees

Long-term dedicated teams

Compatible business cultures

Minimal branch overlap leads to superior retention

(1) Implied annual dividend of $0.63 per HBOS shares based on RNST’s most recent quarterly dividend per share of $0.17 multiplied by the fixed exchange ratio of 0.9266

Appendix

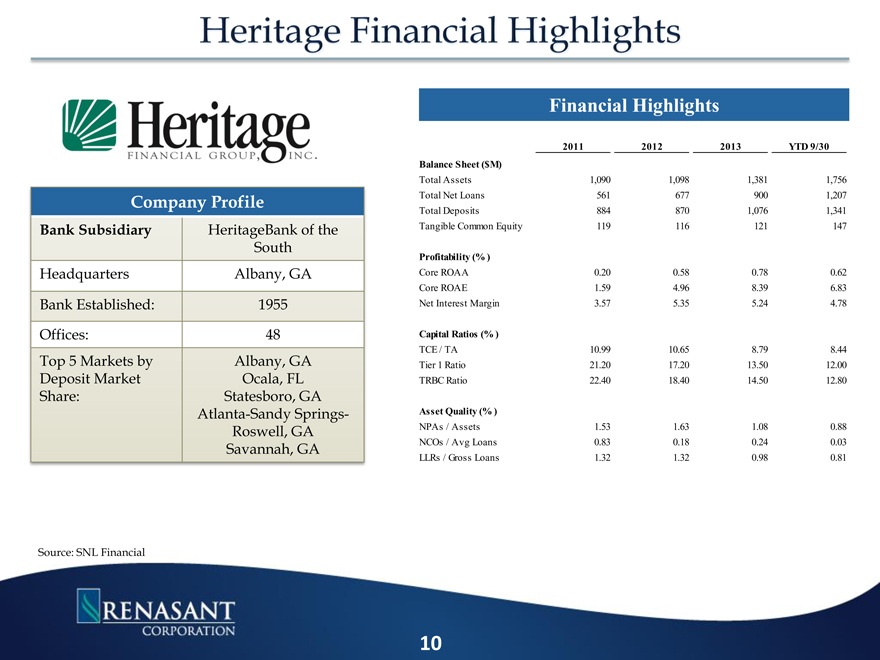

Heritage Financial Highlights

Financial Highlights

2011 2012 2013 YTD 9/30

Company Profile

Bank Subsidiary HeritageBank of the

South

Headquarters Albany, GA Bank Established: 1955

Offices: 48

Top 5 Markets by Deposit Market Share:

Albany, GA Ocala, FL Statesboro, GA

Atlanta-Sandy Springs- Roswell, GA Savannah, GA

Balance Sheet ($M)’ Total As s ets

1,090

1,098

1,381

1,756

Total Net Loans 561 677 900 1,207

Total Depos its 884 870 1,076 1,341

Tangible Common Equity 119 116 121 147

Profitability (% )’ Core ROAA

0.20

0.58

0.78

0.62

Core ROAE 1.59 4.96 8.39 6.83

Net Interes t Margin 3.57 5.35 5.24 4.78

Capital Ratios (% )

TCE / TA

10.99

10.65

8.79

8.44

Tier 1 Ratio 21.20 17.20 13.50 12.00

TRBC Ratio 22.40 18.40 14.50 12.80

As s et Quality (% )’ NPAs / As s ets

1.53

1.63

1.08

0.88

NCOs / Avg Loans 0.83 0.18 0.24 0.03

LLRs / Gros s Loans 1.32 1.32 0.98 0.81

Source: SNL Financial

10

HBOS Deposit Market Share(1)

Albany, GA MSA Statesboro, GA MSA

2014

2013

Deposits

Market

2014

2013

Deposits

Market

Rank Rank Institution Names Branches ($000’s) Share (%)

1 | | 1 Heritage Financial Group Inc. (GA) 5 408,108 19.38 |

2 | | 2 SunTrust Banks Inc. (GA) 5 274,378 13.03 |

3 | | 3 Synovus Financial Corp. (GA) 5 228,830 10.86 |

4 | | 4 Regions Financial Corp. (AL) 5 203,212 9.65 |

5 | | 6 Bank of America Corp. (NC) 3 144,920 6.88 |

6 | | 5 Flint Community Bcshs Inc. (GA) 1 140,739 6.68 |

7 | | 7 Colony Bankcorp Inc. (GA) 4 132,231 6.28 |

8 | | 8 Georgia Community Bancorp Inc. (GA) 3 125,306 5.95 |

9 9 Community Capital Bancshares (GA) 3 107,065 5.08

10 10 Dawson Bancshares Inc. (GA) 1 97,095 4.61

Top Ten 35 1,861,884 88.40

Market Total 43 2,106,228 100.00

Rank Rank Institution Names Branches ($000’s) Share (%)

1 | | 1 Synovus Financial Corp. (GA) 4 302,134 29.89 |

2 | | 2 BB&T Corp. (NC) 2 238,497 23.59 |

3 | | 4 Heritage Financial Group Inc. (GA) 2 152,699 15.11 |

4 | | 3 FMB Equibanc Inc. (GA) 3 149,121 14.75 |

5 | | 5 Wells Fargo & Co. (CA) 1 91,474 9.05 |

6 | | 6 Citizens Bk of Washington Cnty (GA) 1 44,251 4.38 |

7 | | 7 Queensborough Co. (GA) 1 22,768 2.25 |

8 | | 8 Liberty Shares Inc. (GA) 1 9,928 0.98 |

Market Total 15 1,010,872 100.00

2014

2013

Ocala, FL MSA

Deposits

Market

2014

2013

Savannah, GA MSA

Deposits

Market

Rank Rank Institution Names Branches ($000’s) Share (%)

1 | | 1 SunTrust Banks Inc. (GA) 13 1,070,982 19.27 |

2 | | 2 Regions Financial Corp. (AL) 12 899,716 16.19 |

3 | | 3 Wells Fargo & Co. (CA) 11 720,899 12.97 |

4 | | 4 Bank of America Corp. (NC) 9 675,501 12.15 |

6 | | 5 Florida Community Bkshs Inc. (FL) 7 461,339 8.30 |

7 | | 8 Heritage Financial Group Inc. (GA) 5 268,278 4.83 |

8 | | 7 CenterState Banks (FL) 5 193,121 3.47 |

9 10 BB&T Corp. (NC) 4 133,138 2.40

10 11 Villages Bancorp. Inc. (FL) 1 105,361 1.90

Top Ten 70 5,016,027 90.25

Market Total 86 5,558,563 100.00

Rank Rank Institution Names Branches ($000’s) Share (%)

1 | | 2 SunTrust Banks Inc. (GA) 12 1,300,931 22.79 |

2 | | 1 Wells Fargo & Co. (CA) 16 1,225,597 21.47 |

3 | | 3 Bank of America Corp. (NC) 11 713,818 12.50 |

4 | | 4 South State Corporation (SC) 7 546,007 9.56 |

5 | | 5 Ameris Bancorp (GA) 10 402,058 7.04 |

6 | | 6 BB&T Corp. (NC) 8 377,759 6.62 |

7 | | 7 FCB Financial Corp. (GA) 6 317,825 5.57 |

8 | | 8 Synovus Financial Corp. (GA) 4 209,763 3.67 |

9 9 Heritage Financial Group Inc. (GA) 3 139,638 2.45

10 10 Putnam-Greene Financial Corp. (GA) 2 102,471 1.80

Top Ten 79 5,335,867 93.47

Market Total 102 5,708,387 100.00

(1) | | Includes top four MSAs where Heritage was ranked within the top ten based on deposits |

Source: SNL Financial; Deposit market share data as of 6/30/2014

11

HBOS Mortgage Production

Mortgage team started in 2012 and currently consists of more than 70 bankers

Headquartered in the attractive Buckhead market

Total Production ($mm) Refinance vs. Purchases (% of Total Production)

$800.0

$678.0

100.0%

$600.0

75.0%

46.8%

$400.0

$407.4

$546.5

50.0%

70.8%

80.6%

$200.0

$0.0

$99.3

$46.5

$52.8

$288.3

$119.2 $131.5

25.0%

0.0%

53.2%

29.2%

19.4%

H2 ‘12 2013 ‘14 YTD

Refinanced Purchased

H2 ‘12 2013 ‘14 YTD

Refinanced Purchased

12

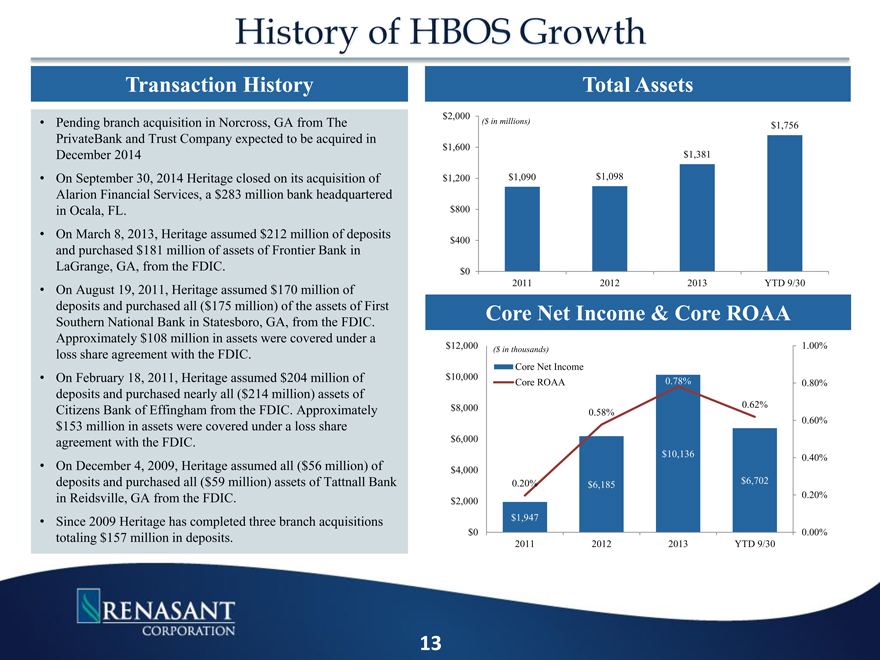

History of HBOS Growth

Transaction History

Pending branch acquisition in Norcross, GA from The PrivateBank and Trust Company expected to be acquired in December 2014

$2,000

$1,600

($ in millions)

Total Assets

$1,381

$1,756

On September 30, 2014 Heritage closed on its acquisition of Alarion Financial Services, a $283 million bank headquartered in Ocala, FL.

On March 8, 2013, Heritage assumed $212 million of deposits and purchased $181 million of assets of Frontier Bank in LaGrange, GA, from the FDIC.

On August 19, 2011, Heritage assumed $170 million of deposits and purchased all ($175 million) of the assets of First Southern National Bank in Statesboro, GA, from the FDIC. Approximately $108 million in assets were covered under a

$1,200

$800

$400

$0

$1,090 $1,098

2011 2012 2013 YTD 9/30

Core Net Income & Core ROAA

loss share agreement with the FDIC.

On February 18, 2011, Heritage assumed $204 million of deposits and purchased nearly all ($214 million) assets of Citizens Bank of Effingham from the FDIC. Approximately

$153 million in assets were covered under a loss share agreement with the FDIC.

On December 4, 2009, Heritage assumed all ($56 million) of deposits and purchased all ($59 million) assets of Tattnall Bank in Reidsville, GA from the FDIC.

Since 2009 Heritage has completed three branch acquisitions totaling $157 million in deposits.

$12,000

$10,000

$8,000

$6,000

$4,000

$2,000

$0

($ in thousands)

Core Net Income

Core ROAA

0.20%

$1,947

0.58%

$6,185

0.78%

$10,136

0.62%

$6, 02

1.00%

0.80%

0.60%

0.40%

0.20%

0.00%

2011 2012 2013 YTD 9/30

13

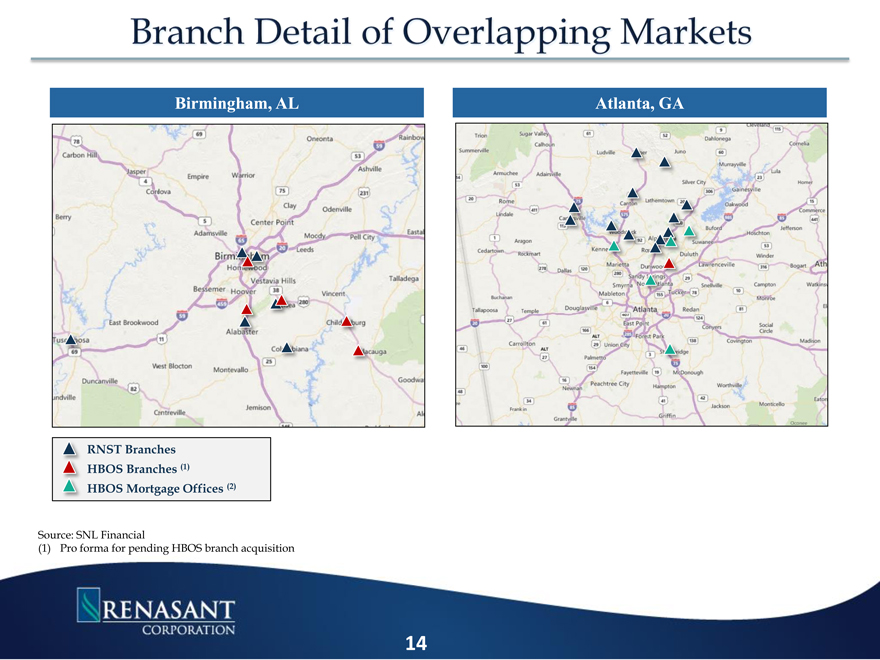

Branch Detail of Overlapping Markets

Birmingham, AL Atlanta, GA

RNST Branches

HBOS Branches (1)

HBOS Mortgage Offices (2)

Source: SNL Financial

(1) | | Pro forma for pending HBOS branch acquisition |

14

Additional Information

Renasant and Heritage will be filing a joint proxy statement/prospectus, and other relevant documents concerning the merger with the Securities and Exchange Commission (the “SEC”). This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE IN THE JOINT PROXY STATEMENT/PROSPECTUS BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RENASANT, HERITAGE AND THE PROPOSED MERGER. When available, the joint proxy statement/prospectus will be mailed to shareholders of both Renasant and Heritage. Investors will also be able to obtain copies of the joint proxy statement/prospectus and other relevant documents (when they become available) free of charge at the SEC’s Web site (www.sec.gov). In addition, documents filed with the SEC by Renasant will be available free of charge from Kevin Chapman, Chief Financial Officer, Renasant Corporation, 209 Troy Street, Tupelo, Mississippi 38804-4827, telephone: (662) 680-1450.

Renasant, Heritage and certain of their directors, executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from the shareholders of Renasant and Heritage in connection with the proposed merger. Information about the directors and executive officers of Renasant is included in the proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on March 11, 2014. Information about the directors and executive officers of Heritage is included in the proxy statement for its 2014 annual meeting of shareholders, which was filed with the SEC on April 25, 2014. Additional information regarding the interests of such participants and other persons who may be deemed participants in the transaction will be included in the joint proxy statement/prospectus and the other relevant documents filed with the SEC when they become available.

15

Investor Inquiries

209 TROY STREET TUPELO, MS 38804-4827

PHONE: 1-800-680-1601

FACSIMILE: 1-662-680-1234

WWW.RENASANT.COM

WWW.RENASANTBANK.COM

E. Robinson McGraw

Chairman

President and Chief Executive Officer

Kevin D. Chapman

Senior Executive Vice President and

Chief Financial Officer

16