SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission |

| | Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to 240.14a-12 |

WEGENER CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

WEGENER CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD TUESDAY, JANUARY 31, 2006

To Our Stockholders:

The Annual Meeting of Stockholders of WEGENER CORPORATION, a Delaware corporation, will be held at its home office at 11350 Technology Circle, Duluth, Georgia 30097, on Tuesday, January 31, 2006 at 7:00 p.m., Eastern Standard Time, for the following purposes:

| | 1) | Election of two Class II directors to hold office until the 2009 Annual Meeting of Stockholders or until their successors shall have been elected and qualified. The Board of Directors recommends that stockholders voteFor its nominees. |

| | 2) | Ratification of the appointment of BDO Seidman, LLP to serve as the independent registered public accounting firm for the Company for fiscal 2006. The Board of Directors recommends that stockholders voteFor the ratification of the appointment of BDO Seidman, LLP. |

| | 3) | Approval of a stockholder proposal (if such proposal is properly presented) requesting the Board of Directors to redeem or rescind the Company’s Stockholder Rights Agreement, which the Board of Directors opposes and recommends that stockholders voteAgainst. |

| | 4) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has fixed December 16, 2005 as the record date for the determination of stockholders entitled to vote at the Annual Meeting of Stockholders. Only stockholders of record at the close of business on that date will be entitled to notice of and to vote at the meeting. The stock transfer records of Wegener Corporation will not be closed.

A proxy statement and a proxy solicited by the Board of Directors, together with a copy of the 2005 Annual Report to Stockholders, are enclosed herewith. Stockholders are cordially invited to attend the Annual Meeting. Whether or not you expect to attend the meeting in person, you are requested to sign and date the enclosed WHITE proxy card and return it as promptly as possible in the accompanying envelope. If you attend the meeting, you may, if you wish, withdraw your proxy and vote in person.

| | |

| By Order of the Board of Directors |

| |

| | | J. ELAINE MILLER |

| | | Secretary |

Duluth, Georgia

December 29, 2005

PLEASE PROMPTLY COMPLETE AND RETURN THE

ENCLOSED WHITE PROXY CARD IN THE ENVELOPE PROVIDED.

WEGENER CORPORATION

11350 Technology Circle

Duluth, Georgia 30097

PROXY STATEMENT

For the Annual Meeting of Stockholders to be Held on January 31, 2006

General

This Proxy Statement and the accompanying form of Proxy are being furnished to the stockholders of Wegener Corporation (the “Company” or “Wegener”) on or about December 29, 2005 in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Stockholders to be held on Tuesday, January 31, 2006 at its home office at 11350 Technology Circle, Duluth, Georgia 30097 at 7:00 p.m. local time and any postponement or adjournment thereof. Any stockholder who executes and delivers a proxy may revoke it at any time prior to its use by (i) giving written notice of revocation to the Secretary of the Company; (ii) executing a proxy bearing a later date; or (iii) appearing at the Annual Meeting and voting in person.

Unless otherwise specified, all shares represented by effective proxies will be voted (i) in favor of election of the two individuals nominated by the Company’s independent directors as directors; (ii) in favor of the ratification of the selection of BDO Seidman, LLP to serve as the independent registered public accounting firm for the Company for fiscal 2006; and (iii) against the stockholder proposal requesting the Board of Directors to redeem or rescind the Company’s Stockholder Rights Agreement. The Board of Directors does not know of any other business to be brought before the meeting, but as to any such other business, proxies will be voted upon any such matters in accordance with the best judgment of the person or persons acting thereunder as to what is in the best interests of the Company.

The cost of soliciting proxies will be borne by the Company. In addition to use of the mails, proxies may be solicited in person or by telephone by directors, officers or regular employees of the Company who will not receive additional compensation for such services. In addition, the Company has engaged Innisfree M&A Incorporated (“Innisfree”) to provide proxy solicitation services on behalf of the Company in connection with the Annual Meeting. The Company has agreed to pay Innisfree a fee of not more than $40,000, and will reimburse Innisfree for certain reasonable out-of-pocket expenses. The Company has also agreed to indemnify Innisfree against certain liabilities and expenses. Innisfree will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. It is anticipated that Innisfree will employ approximately 25 people to solicit proxies on behalf of the Company. Brokerage houses, nominees, custodians and fiduciaries will be requested to forward soliciting material to beneficial owners of stock held of record by them, and the Company will reimburse such persons for their reasonable expenses in doing so. The total amount estimated to be spent for, in furtherance of, or in connection with the solicitation of proxies is $90,000. The total expenditures to the approximate date of the mailing of this proxy statement are approximately $48,000.

Holders of record of outstanding shares of the common stock of the Company at the close of business on December 16, 2005 are entitled to notice of and to vote at the meeting. As of December 16, 2005, there were approximately 12,579,051 shares of common stock outstanding. A majority of the shares entitled to vote, present in person or by proxy, shall constitute a quorum. Each outstanding share of common stock is entitled to one vote.

When a quorum is present at the meeting, the affirmative vote of the holders of a majority of the shares having voting power present in person or by proxy shall decide the action proposed in each matter listed in the accompanying Notice of Annual Meeting of Stockholders, except for the election of directors. The directors are elected by a plurality of the votes cast by the holders of shares present in person or by proxy and entitled to vote at a meeting of stockholders at which a quorum is present. Abstentions and broker “non-votes” will be counted as present in determining whether the quorum requirement is satisfied. A “non-vote” occurs when a nominee holding shares for a beneficial owner votes on one proposal pursuant to discretionary authority or instructions from the beneficial owner, but does not vote on another proposal because the nominee has not received instructions from the beneficial owner, and does not have discretionary power. An abstention from voting by a

stockholder on proposals other than the election of directors and ratification of accountants will have the same effect as a vote against such proposal. Broker “non-votes” are not counted for purposes of determining whether proposals other than the election of directors and ratification of accountants have been approved, which will also have the same effect as a vote against such proposals.

Questions and Answers About the 2006 Annual Meeting of Stockholders

How do I vote in person?

If you owned shares of our common stock on the record date, December 16, 2005, you may attend the 2006 Annual Meeting of Stockholders and vote in person. If you are not the record holder of your shares, please refer to the discussion following the question “What if I am not the record holder of my shares?”. If you hold your shares in the name of a bank or broker, you will not be able to vote in person at the 2006 Annual Meeting of Stockholders, unless you have previously specially requested and obtained a “legal proxy” from your bank or broker and present it at the 2006 Annual Meeting of Stockholders.

How do I vote by proxy?

To vote by proxy, you should complete, sign and date the enclosed proxy card and return it promptly in the enclosed postage-paid envelope. To be able to vote your shares in accordance with your instructions at the 2006 Annual Meeting of Stockholders, we must receive your proxy as soon as possible but in any event prior to the 2006 Annual Meeting of Stockholders. If you hold your shares through a bank or brokerage firm, you may have the option to provide your voting instructions via the Internet or telephone. Please review the enclosed voting form to determine if these voting options are available to you.

What if I am not the record holder of my shares?

If your shares are held in the name of a brokerage firm, bank nominee or other institution, only it can sign a proxy card with respect to your shares and only after receiving your specific instructions.

If I plan to attend the 2006 Annual Meeting of Stockholders, should I still submit a proxy?

Whether you plan to attend the 2006 Annual Meeting of Stockholders or not, we urge you to submit a proxy card. Returning the enclosed proxy card will not affect your right to attend the 2006 Annual Meeting of Stockholders and vote.

How will my shares be voted?

If you give a proxy on the accompanying proxy card, your shares will be voted as you direct. If you submit a proxy to us without instructions, our representatives will vote your shares. Therefore, unless otherwise specified, all shares represented by effective proxies will be voted in accordance with the description on page 1 of this proxy statement. Submitting a proxy card will entitle our representatives to vote your shares in accordance with their discretion on matters not described in this proxy statement that may arise at the 2006 Annual Meeting of Stockholders.

Unless a proxy specifies otherwise, it will be presumed to relate to all shares held of record on the record date by the person who submitted it.

How can I receive more information?

If you have any questions about giving your proxy or about our solicitation, or if you require assistance, please contact our proxy solicitor, Innisfree M&A Incorporated, toll free, at 1-888-750-5834.

2

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information as of December 5, 2005 with respect to ownership of the outstanding common stock of the Company by: (i) all persons known to the Company to own beneficially more than five percent (5%) of the outstanding common stock of the Company, including their addresses; (ii) each director, director nominee and executive officer of the Company; and (iii) all directors and executive officers of the Company as a group:

| | | | | | | | |

Name

| | Director Since

| | Amount and Nature of Beneficial Ownership(1)

| | | Percent of Class

| |

Robert A. Placek | | 1987 | | 2,017,727 | (2) | | 15.7 | % |

C. Troy Woodbury, Jr. | | 1989 | | 243,834 | (3) | | 1.9 | % |

Joe K. Parks | | 1992 | | 34,900 | (4) | | * | |

Thomas G. Elliot | | 1998 | | 36,800 | (5) | | * | |

Wendell H. Bailey | | 2003 | | 16,000 | (5) | | * | |

Ned L. Mountain | | 2003 | | 95,436 | (6) | | * | |

Phylis A. Eagle-Oldson | | 2004 | | 13,000 | (5) | | * | |

David E. Chymiak | | N/A | | 1,115,845 | (7) | | 8.9 | % |

Henry Partners, L.P., et al. (8) | | N/A | | 919,000 | (8) | | 7.3 | % |

Footprints Asset Management & Research | | N/A | | 902,073 | (9) | | 7.2 | % |

All executive officers and directors as a group (7 persons) | | | | 2,457,697 | (10) | | 18.6 | % |

| (1) | Includes stock options currently exercisable or exercisable within 60 days of the record date. Unless otherwise indicated, the person possesses sole voting and investment powers with respect to such shares. |

| (2) | Includes 29,267 shares held in a 401(k) plan and stock options to purchase 287,150 shares. Mr. Placek’s business address is 11350 Technology Circle, Duluth, Georgia 30097. |

| (3) | Includes 22,759 shares held in a 401(k) plan and 184,575 shares subject to stock options. |

| (4) | Includes stock options to purchase 29,900 shares. |

| (5) | Represents stock options to purchase common stock. |

| (6) | Includes 6,389 shares held in a 401(k) plan and 70,000 shares subject to stock options. |

| (7) | The information regarding Mr. Chymiak is based solely on a Schedule 13G/A dated October 13, 2003 filed by Mr. Chymiak with the Securities and Exchange Commission on October 14, 2003. Mr. Chymiak’s address is 1605 E. Iola, Broken Arrow, Oklahoma 74102. |

| (8) | All information is based solely upon a Schedule 13D/A dated October 20, 2005 filed with the Securities and Exchange Commission on October 24, 2005 by a group of reporting persons comprised of Henry Partners, L.P., Matthew Partners, L.P., Henry Investment Trust, L.P. (“HIT”), David W. Wright and Jeffrey H. Haas. According to the Schedule 13D/A, Henry Partners, L.P. possesses sole voting and dispositive powers with respect to 678,000 shares, or 5.4% of the outstanding common stock and Matthew Partners, L.P. possesses sole voting and dispositive powers with respect to 241,000 shares, or 1.9% of the outstanding common stock. David W. Wright is the President of Canine Partners, LLC, which is the sole general partner of HIT. HIT is the sole general partner of each of Henry Partners, L.P. and Matthew Partners, L.P. The business address of Henry Partners, L.P. is 255 South 17th Street, Suite 2501, Philadelphia, Pennsylvania 19103. |

| (9) | All information is based solely upon a Schedule 13G/A dated December 31, 2004 filed by Footprints Asset Management and Research (“FAMR”) filed with the Securities and Exchange Commission on September 16, 2005. According to the Schedule 13G/A, FAMR possesses sole voting and dispositive powers with respect to 902,073 shares, or 7.2% of the outstanding common stock. The address of FAMR’s principal business office is 11422 Miracle Hills Drive, Suite 208, Omaha, Nebraska 68154. |

3

| (10) | Includes 58,415 shares held in a 401(k) plan and 637,425 shares subject to stock options. |

No director owns (beneficially, directly or indirectly) any securities of any class of any parent or subsidiary of the Company.

The table below provides information related to directors’ purchases and sales of the Company’s common stock within the past two years :

| | | | | | |

Director

| | Purchase/Sale

| | Transaction Date

| | Shares of

Common Stock

|

Ned L. Mountain | | Purchase | | April 16, 2004 | | 10,000 |

C. Troy Woodbury, Jr. | | Purchase | | October 18, 2004 | | 20,000 |

Joe K. Parks | | Purchase | | August 22, 2005 | | 4,000 |

4

AGENDA ITEM ONE

ELECTION OF DIRECTORS

The Company’s Board of Directors presently consists of seven directors, elected to staggered three-year terms.

The terms of Robert A. Placek and Wendell H. Bailey will expire at the upcoming 2006 Annual Meeting of Stockholders. The independent directors of the Company have nominated Messrs. Placek and Bailey for reelection as Class II directors of the Company to serve for a term of three years, expiring in January 2009. Unless otherwise directed, the proxies will be voted at the meeting for the election of the foregoing nominees or, in the event of any unforeseen contingency, for a different person as substitute. Directors are elected by a plurality of the votes cast by the holders of shares entitled to vote in the election of directors at a meeting of stockholders at which a quorum is present.

Robert A. Placek, age 67, Class II director, has served as a director of the Company since 1987 and is Chief Executive Officer, Chairman of the Board, and co-founder of Wegener. He has served as President and Chief Executive Officer of Wegener since August 1987 and as Chairman since May 1994. He has served as Chairman of the Board and Chief Executive Officer of Wegener Communications, Inc. (WCI) since its founding in 1979. His career spans over forty years in the satellite communications industry. Prior to co-founding Wegener, Mr. Placek started and managed the Satellite Communications Product Line at Scientific Atlanta, Inc. Mr. Placek received a Bachelor of Science degree in Electrical Engineering from University of Florida. Mr. Placek’s business address is 11350 Technology Circle, Duluth, Georgia 30097.

Wendell H. Bailey, age 59, Class II director, has served as a director of the Company since February 2003. Since 1998, Mr. Bailey has served as Chief Technologist, Advanced Broadband Technology, of National Broadcasting Company, Inc. (NBC). From 1981 through 1997, Mr. Bailey served as Vice President, Science and Technology, of National Cable Television Association. Mr. Wendell is a graduate of the University of Maryland – UC with a Bachelor of Science degree in Business and a Master of Science in Technology Management. Mr. Bailey is a member of the Society of Telecommunications Engineers, the Society of Industry Leaders, Leaders in Technology and the Academy of Digital Pioneers. Mr. Bailey’s business address is 1305 Swan Harbour Road, Fort Washington, Maryland 20744.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF THE FOREGOING NOMINEES.

The directors whose terms do not expire at the upcoming Annual Meeting are as follows:

Phylis A. Eagle-Oldson, age 56, Class I director, has served as a director of the Company since January 2004. Since 1999, Ms. Eagle-Oldson has served as President and Chief Executive Officer of the Emma L. Bowen Foundation, a media industry-sponsored initiative to develop diversity within the telecommunications industry. From 1980 to 1999, Ms. Eagle-Oldson was employed by National Cable and Telecommunications Association, serving as its Vice President, Administration and Finance, from 1985 to 1999. Ms. Eagle-Oldson graduated from The George Washington University with a Bachelor of Accountancy degree, cum laude. Her term of office expires in January 2008. Ms. Eagle-Oldson’s business address is 1299 Pennsylvania Avenue, N.W., 11th Floor, Washington, District of Columbia 20004.

C. Troy Woodbury, Jr., age 58, Class I director, has served as Treasurer and Chief Financial Officer of Wegener since June 1988, and as a director of Wegener since December 1989. He also has served as Treasurer and Chief Financial Officer of WCI since September 1992, and as Senior Vice President of Finance since March 2002. Mr. Woodbury served as Executive Vice President of WCI from July 1995 to March 2002 and as Chief Operating Officer of WCI from September 1992 to June 1998. Prior to joining Wegener in 1988, Mr. Woodbury served as Group Controller for Scientific-Atlanta, Inc., from March 1975 to June 1988. Mr. Woodbury is a

5

Certified Public Accountant and graduated from Bob Jones University with a Bachelor of Science degree in Accounting. His term of office expires in January 2008. Mr. Woodbury’s business address is 11350 Technology Circle, Duluth, Georgia 30097.

Joe K. Parks, age 70, retired, Class I director, has served as a director of the Company since May 1992. He served as Laboratory Director, Threat Systems Development Laboratory of the Georgia Tech Research Institute, a department of the Georgia Institute of Technology, from 1978 to 1995. The principal business of the Threat Systems Development Laboratory is to design and manufacture radar systems which simulate enemy threats. From 1967 until he left to join the Georgia Tech Research Institute in 1978, Mr. Parks was employed by Scientific Atlanta, Inc., where he served as manager of the MARISAT Program. From 1962 to 1967, Mr. Parks was employed by Sperry Rand, where he worked with the design and production of traveling wave tubes and ferrite phase shifters. Mr. Parks graduated from the Georgia Institute of Technology in 1961 with a Bachelor of Science degree in physics. Mr. Parks received his Juris Doctor from Woodrow Wilson Law School in 1973 and has been a member of the State Bar of Georgia since 1973. His term of office expires in January 2008. Mr. Parks’ address is 130 Amsterdam, Lilburn, Georgia 30047.

Thomas G. Elliot, age 63, Class III director, has served as a director of the Company since September 1998. Mr. Elliot is a consultant and the principal of TGE & Associates, which was formed in 1997. Mr. Elliot engages in engineering and management consulting, among other activities. Mr. Elliot was previously employed by Telecommunications, Inc. (TCI) beginning in 1964 most recently as Senior Vice President of Engineering and Technical Services for TCI Cable Management, Inc. (from 1993 to 1997). Between 1989 and 1991, Mr. Elliot took a sabbatical from TCI to help form Cable Television Laboratories, Inc., a research and development consortium of cable television system operators representing most of the cable subscribers in North America, where he served as Vice President of Science and Technology. Mr. Elliot graduated from Colorado Technical Institute with an Associate of Science degree in Industrial Electronics Technology. Mr. Elliot is past-chairman and at-large director of the Society of Cable Telecommunications Engineers (SCTE), founder of the SCTE Interface Practices Committee, serves on the NCTA Engineering Committee and on the Education and Training Committee of the CATV Center and Museum. Mr. Elliot was named 1992 CED Man of the Year for his efforts on digital television, received the 1993 NCTA Vanguard Award for Science and Technology and was inducted into the SCTE Hall of Fame in 1998. His term of office expires in January 2007. Mr. Elliot’s business address is 5997 South Lakeview, Littleton, Colorado 80120.

Ned L. Mountain, age 57, Class III director, has served as a director of the Company since May 2003. Mr. Mountain has served as President and Chief Operating Officer of WCI since January 2005, and served as Executive Vice President of WCI from March 2002 to January 2005. He served as Senior Vice President of WCI from 1996 to March 2002. Mr. Mountain has been with Wegener for the past 24 years serving in numerous domestic and international sales, marketing, and management positions. He is a member of the NCTA engineering committee and serves as co-chair of the Quality Sound subcommittee. He has been involved in numerous cable-related projects including the satellite digital network control system currently in use by major programmers as well as the satellite system used by most of the Fox Sports Networks. Prior to joining Wegener, Mr. Mountain was a corporate Senior Engineer with the former UA-Columbia Cablevision. Mr. Mountain graduated from the University of Pittsburgh with a Bachelor of Science degree in Electrical Engineering. His term of office expires in January 2007. Mr. Mountain’s business address is 11350 Technology Circle, Duluth, Georgia 30097.

Other than the understanding of the nominees that they will serve as directors of the Company when elected, there are no arrangements or understandings between any director and any other person with regard to any future employment by the Company or its affiliates or with respect to any future transactions to which the Company or any of its affiliates may be a party.

Other than any interest that exists by virtue of (i) any position(s) he or she may hold with the Company or its affiliates as described in this document, and (ii) his or her status as a stockholder of the Company, no director has any interest, direct or indirect, in the matters to be acted upon at the 2006 Annual Meeting.

6

Henry Partners, L.P.

The Company has been notified that Henry Partners, L.P., a Delaware limited partnership (“Henry”), intends to nominate two individuals for election as directors at the 2006 Annual Meeting of Stockholders, and intends to solicit proxies from stockholders to vote in favor of Henry’s nominees. The Board of Directors urges you NOT to vote for any individuals that have been or may be nominated by Henry and NOT to execute any proxy card sent to you by Henry.

AGENDA ITEM TWO

APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The firm of BDO Seidman, LLP, independent registered public accountants, audited the financial statements of the Company for the fiscal year ended September 2, 2005. The Audit Committee of the Board of Directors has selected this same firm to audit the financial statements of the Company for the current fiscal year and proposes that the stockholders ratify this selection at the Annual Meeting. Neither such firm nor any of its members or associates has or has had during the past year any financial interest in the Company, direct or indirect, or any relationship with the Company other than in connection with their professional engagement.

Stockholder ratification of this appointment is not required. Management has submitted this matter to the stockholders because it believes the stockholders’ views on the matter should be considered, and if the proposal is not approved, management may reconsider the appointment. Representatives of BDO Seidman, LLP are expected to be present at the Annual Meeting to respond to stockholders’ questions and will have an opportunity to make any statements they consider appropriate.

Principal Accountant Fees and Services. The following is a summary of the fees and expenses billed to the Company by BDO Seidman, LLP for professional services rendered for the fiscal years ended September 2, 2005 and September 2, 2004, all of which were approved by the Audit Committee:

| | | | | | |

Fee Category

| | Fiscal 2005 Fees

| | Fiscal 2004 Fees

|

Audit Fees | | $ | 171,775 | | $ | 169,438 |

Audit-Related Fees | | $ | 29,950 | | $ | 3,000 |

Tax Fees | | $ | 14,698 | | $ | 15,000 |

All Other Fees | | | — | | | — |

| | |

|

| |

|

|

Total Fees | | $ | 216,423 | | $ | 187,438 |

Audit Fees. Consists of fees billed for professional services rendered for the audit of the Company’s consolidated financial statements and review of the interim consolidated financial statements included in quarterly reports and services that are normally provided by BDO Seidman, LLP in connection with statutory and regulatory filings or engagements. These services include meetings and consultation on various accounting matters ($5,200) in 2005; and meetings and consultation on various accounting matters ($9,538) in 2004.

Audit-Related Fees. Consists of fees billed for assurance and related services that are reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and are not reported under “Audit Fees.” These services include a special assignment related to an internal control review ($24,950) and progress billing on audit of employee benefit plan ($5,000) in 2005; and audit of employee benefit plan ($3,000) in 2004.

Tax Fees. Consists of fees billed for professional services for tax compliance, tax advice and tax planning.

All Other Fees. None.

7

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has developed a pre-approval policy for the audit and permissible non-audit services to be provided by the independent auditors. These services may include audit services, audit-related services, tax services and other services. The pre-approval policy is detailed as to the particular service or category of services and is generally subject to a specific budget. The independent auditors and management are required periodically to report to the Audit Committee regarding the extent of services provided by the independent auditors in accordance with this pre-approval, and the fees for the services performed to date. The Audit Committee can also pre-approve particular services on a case-by-case basis.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE RATIFICATION OF THE APPOINTMENT OF BDO SEIDMAN, LLP TO SERVE AS THE COMPANY’S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING SEPTEMBER 1, 2006.

AGENDA ITEM THREE

STOCKHOLDER PROPOSAL REQUESTING THE BOARD OF DIRECTORS TO REDEEM

OR RESCIND THE COMPANY’S STOCKHOLDER RIGHTS AGREEMENT

Henry Partners, L.P., 255 South 17th Street, Suite 2501, Philadelphia, Pennsylvania 19103, has advised the Company that it beneficially owns 919,000 shares of the Company’s common stock and that it intends to present the following proposal for consideration at the Annual Meeting.

Stockholder Proposal

RESOLVED: The stockholders of Wegener Corporation (the “Company”) request that the Board of Directors take such actions as necessary to promptly redeem, terminate or otherwise rescind the rights previously issued pursuant to the Company’s Stockholders’ Rights Agreement (the “Plan”), adopted by the Board of Directors without prior stockholder approval on May 1, 2003, and to refrain from adopting in the future any similar Plan without the prior approval by a majority vote of the stockholders.

Supporting Statement

A stockholder rights plan, commonly known as a “poison pill plan,” is an anti-takeover device that is designed to prevent a change in control of a company without the prior approval of its board. Such plans are intended to force potential acquirers to negotiate an acquisition with the board, instead of presenting an offer directly to the stockholders.

By forcing potential acquirers to negotiate exclusively with the board, however, we believe that poison pill plans generally tend to promote the entrenchment of management and the board by allowing them to substitute stockholders’ judgment with their own with respect to an offer for the stockholders’ shares.

For example, the Company announced the adoption of the Plan in a press release dated May 6, 2003, in which it stated that its Board had rejected as “grossly inadequate” a $1.55 per share cash offer from Raydne ComStream Inc. The same release also stated that after the Board determined to reject the Radyne offer on May 1, 2003, “Wegener’s board of directors adopted a stockholder rights agreement as a step to help preserve for Wegener stockholders the long-term value of the Company.”

Although an often cited reason for adoption of shareholder rights plans is to force potential acquirers to negotiate directly with the board, the Company had decided by May 9, 2003 that “there is no need to hold a meeting with Radyne to discuss a grossly inadequate cash offer price.”

8

As of August 17, 2005, we note that the price of Wegener shares is approximately 20% lower than the “grossly inadequate” cash offer from Radyne over two years ago. Because the Company never met with Radyne to attempt to negotiate a better offer after it adopted the Plan, we find it difficult to see how the Plan has in any way benefited stockholders or preserved the long-term value of the Company.

We believe that this type of anti-takeover defense can adversely impact stockholder value because it takes away from the stockholders the choice of whether or not to sell on the presumption that the board knows best. In our opinion, the Plan should be eliminated.

While the Company’s Board has an obligation to ensure that all stockholders benefit from any future proposal to acquire the Company, it is our belief that adequate protections to achieve that end already exist in the Company’s charter and By-Laws and under Delaware corporate law.

Accordingly, we urge a vote FOR this resolution to repeal the Plan.

Board of Directors Statement in Opposition to the Stockholder Proposal

The Company’s Board of Directors believes that (1) the Plan serves an important corporate purpose and (2) independent research has shown that rights plans enhance value for stockholders.

For these reasons, the Board of Directors unanimously recommends a vote AGAINST this stockholder proposal.

The Plan Serves an Important Purpose

The purpose of the Plan is to protect stockholders against potential abuses during a takeover attempt. The Company believes the Plan would allow the Board of Directors to review a takeover proposal in a careful and rational manner in order to determine whether the Board of Directors believes the proposal adequately reflects the value of the Company and is in the best interests of all of our stockholders. The Plan does not prevent potential purchasers from making offers, nor is it a deterrent to a stockholder’s initiation of a proxy contest. Instead, it encourages any potential purchaser to negotiate directly with the Board of Directors. The Board of Directors has concluded that the Plan helps protect the stability of the Company during a period of change and is therefore an important part of our plan to increase stockholder value.

The Board of Directors also does not believe that submitting the Plan to a stockholder vote would be in the best interest of all of the Company’s stockholders. Such action could allow potential purchasers or short term investors to influence the outcome of the vote in a manner that would benefit their interests at the expense of other stockholders. In contrast, the Board of Directors has the responsibility to take the interests of all stockholders into account.

Rights Agreements Enhance Value for Stockholders

In addition, independent evidence suggests that rights plans actually enhance value for stockholders. Institutional Shareholder Services, Inc. (ISS), an independent advocate for good corporate governance, provided data for a study, conducted by Dr. Lawrence D. Brown and Marcus L. Caylor of Georgia State University, released in December 2004, that was designed to test the correlation between corporate governance and firm performance. Among other things, the study’s authors noted that “firms with poison pills have higher returns on equity, higher net profit margins, higher dividend yields, and more share repurchases.”Corporate Governance and Firm Performance, Lawrence D. Brown and Marcus L. Caylor, December 7, 2004.

Other studies have reached similar conclusions. Georgeson Shareholder Communications Inc., a nationally recognized proxy solicitor and investor relations firm, analyzed takeover data between 1992 and 1996 to determine whether rights plans had any measurable impact on stockholder value. Georgeson concluded that:

| | • | | Premiums paid to acquire companies with rights plans were an average of eight percentage points higher than premiums paid to companies without rights plans; |

9

| | • | | Rights plans contributed an additional $13 billion in stockholder value in takeover situations over the study period, and stockholders of acquired companies without rights plans gave up $14.5 billion in potential premiums over the same period; |

| | • | | The presence of a rights plan did not increase the likelihood of withdrawal of a friendly takeover bid or the defeat of a hostile one; and |

| | • | | Rights plans did not reduce the likelihood of a company becoming a takeover target. |

Mergers & Acquisitions, Poison Pills and Shareholder Value / 1992-1996, Georgeson Shareholder, available at www.georgesonshareholder.com.

The Director of Corporate Programs at ISS has conceded that rights plans work, noting “companies with poison pills in place tend to get higher premiums paid on average than companies that don’t have pills.”Stealthy Takeover of Gucci Makes Poison Pill Look Good, The Wall Street Journal, January 29, 1999.

That rights plans increase stockholder returns is not merely an academic subject. The value of a rights plan in practice was on prominent display in Oracle Corp.’s 2003-2004 attempted hostile takeover of PeopleSoft, Inc. Oracle’s original bid for PeopleSoft, $5.1 billion, was initially rejected by the PeopleSoft board. Armed with their full complement of anti-takeover devices, PeopleSoft ultimately was able to resist Oracle’s lower bids until PeopleSoft finally accepted a $10.3 billion offer from Oracle in December 2004, resulting in significantly increased stockholder value.

For these reasons, rights plans have been adopted by a majority of the companies in the S&P 500 Index.

Conclusion

For the foregoing reasons, the Board of Directors continues to believe that the Plan helps ensure that the best interests of all stockholders are protected and that our Plan should be retained.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE AGAINST AGENDA ITEM THREE: STOCKHOLDER PROPOSAL REQUESTING THE BOARD OF DIRECTORS TO REDEEM OR RESCIND THE COMPANY’S STOCKHOLDER RIGHTS AGREEMENT.

10

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Independence

The Board of Directors presently consists of seven members. The Board of Directors has determined that Ms. Eagle-Oldson and Messrs. Bailey, Elliot and Parks have no relationship with the Company that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that such individuals are independent under the rules and listing standards of the Nasdaq Stock Market (“NASDAQ”).

Committees of the Board of Directors

The Board of Directors has a standing Audit Committee and a standing Compensation and Incentive Plan Committee. The Board of Directors does not have a standing nominating committee. See “Nomination of Directors.”

The Audit Committee is composed of Ms. Eagle-Oldson and Messrs. Elliot, Parks and Bailey and held four meetings during the fiscal year ended September 2, 2005. The members of the Audit Committee are independent, as such term is defined by NASDAQ listing standards. The function of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company, and to perform such other functions as described in the Audit Committee Charter of the Company. The Audit Committee considers the scope, approach, effectiveness and recommendations of the audit performed by the independent registered public accountants; determines and prescribes limits upon the types of non-audit professional services that may be provided by the independent accountants without adverse effect on the independence of such accountants; recommends the appointment of independent registered public accountants; and considers significant accounting methods adopted or proposed to be adopted.

The Compensation and Incentive Plan Committee is composed of Ms. Eagle-Oldson and Messrs. Bailey and Elliot and met two times during the fiscal year ended September 2, 2005. The functions of the Compensation and Incentive Plan Committee are to consider and approve compensation arrangements for the Company’s senior management and the adoption of any benefit plans in which officers and directors are eligible to participate, and to recommend the key employees who will receive awards under the 1988 Incentive Plan, the 1989 Directors’ Incentive Plan and the 1998 Incentive Plan (collectively, the “Incentive Plans”), the award amount or number of shares of stock to be granted, and the terms and conditions of each award.

Audit Committee Financial Expert

The Board of Directors of the Company has determined that Phylis Eagle-Oldson qualifies as an “audit committee financial expert,” as such term is currently defined by the Securities and Exchange Commission (“SEC”). Ms. Eagle-Oldson is “independent” as that term is defined under the rules and listing standards of NASDAQ. The Board of Directors has also determined that each current member of the Audit Committee has past employment experience or background which results in such individual’s financial sophistication as required by NASDAQ, including, but not limited to, the ability to understand generally accepted accounting principles (“GAAP”), financial statements and internal controls and procedures, as well as the ability to assess the general application of GAAP. Each member of the Audit Committee understands Audit Committee functions, and the Board of Directors believes that the members of the Audit Committee possess the requisite knowledge and experience to adequately perform their duties under the Audit Committee Charter.

Meetings of the Board of Directors

The Board of Directors of the Company held four meetings and acted one time by unanimous written consent during the fiscal year ended September 2, 2005. During fiscal 2005, each director attended at least 75% of all meetings of the Board of Directors and Committee(s) on which he or she served.

11

Compensation of Directors

Each non-employee director is paid an annual retainer of $5,000, and for each meeting of the Board of Directors or any committee of the Board on which a non-employee director serves, such director is paid $1,000 for attendance in person and $300 for attendance by telephone conference. Directors are also reimbursed for reasonable out-of-pocket expenses. Pursuant to the Company’s 1998 Incentive Plan, on November 23, 2004, Ms. Eagle-Oldson was granted an option to purchase 10,000 shares at an exercise price of $1.38. In addition, pursuant to the Company’s 1998 Incentive Plan, each non-employee director receives an option to purchase 3,000 shares of Common Stock on the last day of December of each year at an exercise price equal to the fair market value on such date. These options are exercisable for ten years. On December 30, 2004, each of Ms. Eagle-Oldson and Messrs. Bailey, Elliot and Parks was granted an option to purchase 3,000 shares, respectively, at an exercise price of $2.50.

Compensation Committee Interlocks and Insider Participation in Compensation Decisions

None of the members of our Compensation and Incentive Plan Committee is or has been one of our officers or employees. There are no compensation committee interlocks and no insider participation in compensation decisions that are required to be disclosed in this proxy statement.

Nomination of Directors

The Board of Directors does not have a separately constituted Nominating Committee and, consequently, has no Nominating Committee Charter. The Board of Directors is presently comprised of seven members, four of whom are “independent” within the meaning of the Nasdaq Director Independence Standards. The Board believes that it is appropriate under circumstances where the Board is comprised of only seven members not to have a separate Nominating Committee. Only the independent members of the Board of Directors participate in the consideration of director nominees for election to the Board of Directors of the Company and director nominees are nominated by a majority vote of the independent directors. Generally, director nominees shall be persons of sound ethical character, be able to represent all stockholders fairly, have no material conflicts of interest, have demonstrated professional achievement, have meaningful business experience and an understanding and appreciation of the major business issues facing the Company. The Board of Directors does not have a formal process for identifying and evaluating nominees for director, but will assess the composition of the Board on a regular and continuing basis and utilize both internal and external resources as it deems necessary or desirable to identify and evaluate potential nominees. Absent special circumstances, the independent members of the Board of Directors will continue to nominate qualified incumbent directors whom the independent directors believe will continue to make important contributions to the Board of Directors.

The Board of Directors will consider for possible nomination qualified nominees recommended by stockholders. Stockholders who wish to propose a qualified nominee for consideration shall submit complete information as to the identity and qualifications of that person to the Secretary of the Company at 11350 Technology Circle, Duluth, Georgia 30097. The Bylaws of the Company provide that no nomination submitted by a stockholder will be submitted to a stockholder vote at an annual meeting unless the Secretary of the Company has received written notice of the nomination on or prior to the date which is 60 days prior to the first anniversary of the date on which the Company first mailed proxy materials for the prior year’s annual meeting. Such notice must include the following:

| | (i) | the name and address of the nominating stockholder; |

| | (ii) | a representation that the stockholder is a stockholder of the Company and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; |

12

| | (iii) | such information regarding each nominee as would have been required to be included in a proxy statement filed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (or pursuant to any successor act or regulation) had proxies been solicited with respect to such nominee by the Board; |

| | (iv) | a description of all arrangements or understandings among the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder; |

| | (v) | the written consent of each nominee to serve as a director of the Company if so elected; and |

| | (vi) | such other information as may be required by applicable law or regulation. |

The independent members of the Board of Directors have unanimously nominated Messrs. Placek and Bailey for election at the 2006 Annual Meeting.

Stockholder Communications with the Board

The Board of Directors has implemented a process for stockholders to send communications to the Board. Any stockholder desiring to communicate with the Board, or with specific individual directors, may do so by writing to the Secretary of the Company at 11350 Technology Circle, Duluth, Georgia 30097. The Secretary of the Company shall promptly forward all such communications to the Board or such individual directors.

Although the Company does not have a formal policy with regard to Board members’ attendance at Annual Meetings, it is the Company’s practice historically to hold a meeting of the Board of Directors prior to each year’s Annual Meeting of Stockholders, and therefore the Company’s directors generally attend the Annual Meeting of Stockholders following the Board meeting. All directors of the Company attended the 2005 Annual Meeting of Stockholders.

Code of Ethics

The Company has adopted a Code of Business Conduct and Ethics which is applicable to all directors, officers and employees of the Company and its subsidiaries. A copy of the Company’s Code of Business Conduct and Ethics has been filed with the Securities and Exchange Commission as an exhibit to its Annual Report on Form 10-K for the year ended August 29, 2003 and such code is posted on the Company’s website at www.wegener.com.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, certain officers and persons who own more than 10% of the outstanding common stock of the Company to file with the Securities and Exchange Commission reports of changes in ownership of the common stock of the Company held by such persons. Officers, directors and greater than 10% stockholders are also required to furnish the Company with copies of all forms they file under this regulation. To the Company’s knowledge, based solely on a review of copies of such reports furnished to the Company and representations that no other reports were required, during fiscal 2005, all Section 16(a) filing requirements were complied with by its officers, directors and greater than 10% stockholders.

13

EXECUTIVE COMPENSATION

The following table provides certain summary information concerning compensation paid or accrued by the Company to or on behalf of the Company’s Chief Executive Officer and each other executive officer of the Company or WCI whose total annual salary and bonus exceeded $100,000 (the “Named Executive Officers”) for the fiscal years ended September 2, 2005, September 3, 2004 and August 29, 2003.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | |

| | | Annual Compensation

| | Long Term Compensation

| | |

| | | Awards

| | |

Name

and

Principal

Position

| | Fiscal

Year

| | Salary ($)(a)

| | Bonus ($)

| | Other Annual Compensation ($)

| | Restricted Stock Award(s) ($)

| | Securities Underlying Options/ SARs (#)

| | All Other Compensation ($)(b)

|

Robert A. Placek Chairman of the Board, President and Chief Executive Officer; Director | | 2005

2004

2003 | | $

| 179,078

182,522

179,078 | | 500

500

500 | | -0-

-0-

-0- | | -0-

-0-

-0- | | 153,000

50,000

-0- | | $

| 25,747

25,017

23,428 |

| | | | | | | |

C. Troy Woodbury, Jr. Treasurer and Chief Financial Officer; Director | | 2005

2004

2003 | |

| 131,424

133,951

131,424 | | 500

500

500 | | -0-

-0-

-0- | | -0-

-0-

-0- | | -0-

25,000

-0- | |

| 8,692

7,962

6,373 |

| | | | | | | |

Ned L. Mountain President and Chief Operating Officer of WCI; Director | | 2005

2004

2003 | |

| 140,000

142,692

138,269 | | 500

500

500 | | -0-

-0-

-0- | | -0-

-0-

-0- | | -0-

50,000

-0- | |

| 7,449

5,088

3,830 |

| (a) | Salary for fiscal 2004 reflects a 53-week fiscal year, compared to a 52-week year in fiscal 2005 and 2003. |

| (b) | Represents amounts contributed by the Company pursuant to the Company’s 401(k) plan and life insurance premiums paid by the Company, as follows: |

| | | | | | | | |

Name

| | Fiscal

Year

| | Insurance

Premiums

| | 401(k)

Contributions

|

Robert A. Placek | | 2005

2004

2003 | | $17,055

17,055

17,055 | | $8,692

7,962

6,373 |

| | | |

C. Troy Woodbury, Jr. | | 2005

2004

2003 | | -0-

-0-

-0- | | 8,692

7,962

6,373 |

| | | |

Ned L. Mountain | | 2005

2004

2003 | | -0-

-0-

-0- | | 7,449

5,088

3,830 |

14

Stock Option Plans

The following options were granted to the Named Executive Officers during the fiscal year ended September 2, 2005 under the Company’s Incentive Plans:

Option Grants in Last Fiscal Year

| | | | | | | | | | | | | | | | |

| | | | | Individual Grants

| | | | | | |

Name

| | Shares

Underlying

Options

Granted(1)

| | % of Total

Options

Granted to

Employees in

Fiscal Year

| | | Exercise

Price Per Share

| | Expiration Date

| | Potential Realizable

Value at Assumed

Annual Rates of Stock

Price Appreciation for Option Term(2)

|

| | | | | | 5%

| | 10%

|

Robert A. Placek | | 153,000 | | 100 | % | | $ | 1.29 | | 7/23/2015 | | $ | 124,125 | | $ | 314,557 |

C. Troy Woodbury, Jr. | | 0 | | 0 | % | | | N/A | | N/A | | | 0 | | | 0 |

Ned L. Mountain | | 0 | | 0 | % | | | N/A | | N/A | | | 0 | | | 0 |

| (1) | These options are immediately exercisable. |

| (2) | The dollar amounts under these columns represent the potential realizable value of each grant of option assuming that the market price of the Company’s Common Stock appreciates in value from the date of grant at the 5% and 10% annual rates prescribed by the Securities and Exchange Commission and are not intended to forecast possible future appreciation, if any, of the price of the Company’s common stock. |

The following table provides certain information concerning each exercise of stock options under the Company’s Incentive Plans during the fiscal year ended September 2, 2005, by the Named Executive Officers and the fiscal year end value of unexercised options held by such persons:

Aggregated Option Exercises in Last Fiscal Year

and Fiscal Year End Option Values

| | | | | | | | | |

Name

| | Shares

Acquired on

Exercise

(#)

| | Value

Realized

($)

| | | Number of

Securities

Underlying

Unexercised

Options at Fiscal

Year End

Exercisable/

Unexercisable

| | Value ($) of

Unexercised

In-the-Money

Options at

Fiscal

Year End

Exercisable/

Unexercisable(1)

|

Robert A. Placek | | 0 | | 0 | | | 287,150 / 0 | | 21,8790 /0 |

C. Troy Woodbury, Jr. | | 20,000 | | (3,750 | ) | | 184,575 / 0 | | 26,490 /0 |

Ned L. Mountain | | 0 | | 0 | | | 70,000 / 0 | | 8,400 / 0 |

| (1) | The market value of the Company’s common stock on September 2, 2005 was $1.26 per share. The actual value, if any, an executive may realize will depend upon the amount by which the market price of the Company’s common stock exceeds the exercise price when the options are exercised. |

15

Equity Compensation Plan Information

The following table summarizes information as of September 2, 2005 regarding the Company’s common stock reserved for issuance under the Company’s equity compensation plans.

| | | | | | | |

Plan Category

| | Number of Securities to

be Issued Upon

Exercise of Outstanding

Options (a)

| | Weighted-

Average

Exercise Price

of Outstanding

Options (b)

| | Number of Securities

Remaining Available for

Future Issuance Under

the Plans (Excluding

Securities Reflected in

Column (a)) (c)

|

Equity Compensation Plans Approved by Security Holders | | 1,313,531 | | $ | 1.58 | | 510,669 |

Equity Compensation Plans Not Approved by Security Holders | | - 0 - | | | N/A | | - 0 - |

| | |

| |

|

| |

|

TOTAL | | 1,313,531 | | $ | 1.58 | | 510,669 |

| | |

| |

|

| |

|

Retention Agreements

On May 2, 2003, following the approval and recommendation of a committee of the Board of Directors consisting solely of independent directors, Wegener entered into retention agreements with each of the Named Executive Officers and certain of its other key employees. Under the agreements with the Named Executive Officers, in the event of a change in control of Wegener, each such officer will be entitled to receive a cash payment of 2.5 times his annual salary and continued insurance benefits for a period of 30 months.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

David M. Placek is a Senior Software Engineer employed by Wegener Communications, Inc., a subsidiary of the Company (“WCI”). David M. Placek is the son of Robert A. Placek, Chairman of the Board, President and Chief Executive Officer of the Company. During the fiscal year ended September 2, 2005, David M. Placek received the following compensation from WCI: base annual salary of $70,555 (which is David M. Placek’s current annual salary); cash bonus of $500; and Company 401(k) Plan matching contributions of $8,455.

Notwithstanding anything to the contrary set forth in any of the Company’s previous filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, that might incorporate future filings, including this proxy statement, in whole or in part, the Audit Committee Report, the Report of the Compensation and Incentive Plan Committee on Executive Compensation and the Stockholder Return Performance Graph shall not be incorporated by reference into any such filings.

AUDIT COMMITTEE REPORT

For the fiscal year ended September 2, 2005, the Audit Committee has reviewed and discussed the audited financial statements with management, has discussed with the independent registered public accountants the matters required to be discussed by SAS 61 and has received the written disclosures and a letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). The Audit Committee has discussed with the independent accountants the independence of the independent registered public accountants. Based on the foregoing meetings, reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for fiscal 2005 be included in the Company’s Annual Report on Form 10-K for filing with the Securities and Exchange Commission.

This report is submitted by each member of the Company’s Audit Committee, as follows:

| | |

Phylis A. Eagle-Oldson, Chairperson Wendell H. Bailey | | Thomas G. Elliot Joe K. Parks |

16

The Board of Directors of the Company has adopted a written charter for the Audit Committee, a copy of which was included as an appendix to the Company’s Proxy Statement for the 2004 Annual Meeting. The members of the Audit Committee are independent, as such term is defined by Rule 4200(a)(14) of the National Association of Securities Dealers’ listing standards.

REPORT OF THE COMPENSATION AND INCENTIVE PLAN COMMITTEE

ON EXECUTIVE COMPENSATION

The Compensation and Incentive Plan Committee (“Committee”) is comprised of three non-employee directors of the Company, and is responsible for the review and determination of the compensation of the Chief Executive Officer and the other executive officers of the Company.

Compensation Policies

The performance of the Chief Executive Officer and the other executive officers of the Company is reviewed by the Committee in light of the performance of the Company and the Company’s working capital position and prospects. The Committee does not assign relative weights to the factors considered in setting compensation, but rather considers all factors as a whole. It is the Committee’s policy that the compensation paid to executive officers qualify for deductibility under Section 162(m) of the Internal Revenue Code. Future compensation policies will be developed in light of the Company’s profitability and with the goal of rewarding members of management for their contributions to the Company’s success.

Components of Executive Officer Compensation

Executive officer compensation consists of an annual base salary, a possible annual cash bonus, and incentive compensation awards under the Company’s 1998 Incentive Plan. Perquisites and other personal benefits for executives consist only of Company contributions to its 401(k) Plan on behalf of all participants, including the executive officers, automobiles and insurance premium payments for certain life insurance benefits for the Chief Executive Officer. There have been modest increases in Company contributions to all participant accounts in the 401(k) Plan in the past three years.

The Company has entered into retention agreements with each of the Named Executive Officers (and certain of its other employees) pursuant to which each Named Executive Officer will be entitled to receive a cash payment of 2.5 times his annual salary and continued insurance benefits for a period of 30 months in the event of a change in control of the Company.

The Company maintains the 1998 Incentive Plan for the purpose of awarding options and making other compensatory awards to directors, executive officers and other key employees. The Committee authorized the award of a stock option to the Chief Executive Officer to purchase 153,000 shares during fiscal 2005. See “Stock Option Plans.”

How Base Salaries for Executive Officers are Determined

The base salaries of the Company’s executive officers are set at levels intended to be competitive with comparable companies in the satellite telecommunications industry. In past years, the Committee and the Board of Directors have reviewed, to the extent such information was available, the compensation paid to the chief executive officer and other executive officers of those companies. Such information has indicated that the compensation levels of the Company’s Chief Executive Officer and other executive officers are in the lower range of compensation paid by comparably situated companies. There have been no material changes in salary or bonus paid to the Named Executive Officers, including the Chief Executive Officer, in the past three fiscal years; there was a modest decrease in their annual salaries in fiscal 2005.

17

Compensation of the Chief Executive Officer and Other Executive Officers

The Committee has reviewed the components of the Chief Executive Officer’s compensation, including salary, bonus, equity incentive compensation, unrealized stock option gains (if any), the dollar value to the Executive and costs to the Company of any perquisites and personal benefits, payments made on behalf of the Executive under the Company’s 401(k) Plan and potential obligations under the Retention Agreement. Based on this review, the Committee finds the Chief Executive Officer’s total compensation (and, in the case of the Retention Agreement, the potential payout), and the mix of components of compensation, to be reasonable and not excessive.

Likewise, based upon a similar review, the Committee finds the total compensation of the other executive officers (and, in the case of the Retention Agreements, the potential payouts), and the mix of components of compensation, to be reasonable and not excessive.

Thomas G. Elliot, Chairman Wendell H. Bailey Phylis A. Eagle-Oldson

18

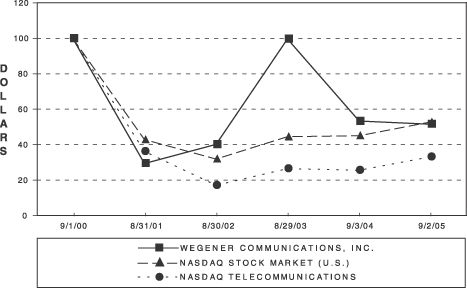

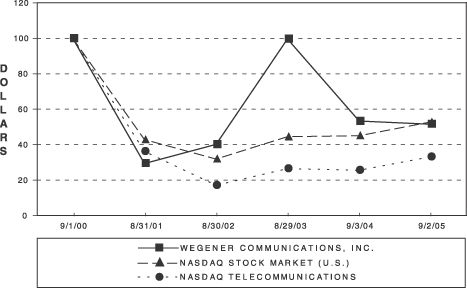

STOCKHOLDER RETURN PERFORMANCE GRAPH

Set forth below is a line graph comparing the yearly percentage change in the cumulative total stockholder return on the Company’s common stock against the cumulative total return of the Nasdaq Stock Market (U.S. Companies) and the Index for the Nasdaq Telecommunications Stocks for the period of five fiscal years commencing September 1, 2000 and ending September 2, 2005. The graph assumes that the value of the investment in the Company’s common stock and each index was $100 on September 1, 2000.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG WEGENER COMMUNICATIONS, INC., THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ TELECOMMUNICATIONS INDEX

| | | | | | | | | | | | | | | | | | |

| | | Cumulative Total Return

|

| | | 9/1/00 | | 8/31/01 | | 8/30/02 | | 8/29/03 | | 9/3/04 | | 9/2/05 |

WEGENER CORPORATION | | $ | 100.00 | | $ | 29.53 | | $ | 40.20 | | $ | 99.67 | | $ | 53.32 | | $ | 51.68 |

NASDAQ STOCK MARKET (U.S.) | | | 100.00 | | | 42.91 | | | 32.05 | | | 44.54 | | | 45.16 | | | 52.80 |

NASDAQ TELECOMMUNICATIONS | | | 100.00 | | | 36.25 | | | 17.11 | | | 26.53 | | | 25.63 | | | 33.18 |

19

AVAILABILITY OF ANNUAL REPORT TO STOCKHOLDERS AND

REPORT ON FORM 10-K

Additional information concerning the Company, including financial statements of the Company, is provided in the Company’s 2005 Annual Report to Stockholders (which includes the Annual Report on Form 10-K) that accompanies this proxy statement. The Company’s Annual Report on Form 10-K for the year ended September 2, 2005, as filed with the Securities and Exchange Commission, is available to stockholders who make a written request therefor to Mr. James T. Traicoff, Controller, at the offices of the Company, 11350 Technology Circle, Duluth, Georgia 30097. Copies of exhibits filed with that report or referenced therein will be furnished to stockholders of record upon request and payment of the Company’s expenses in furnishing such documents. These documents and other information may also be accessed from the Company’s website at www.wegener.com.

STOCKHOLDERS’ PROPOSALS FOR 2007 ANNUAL MEETING

Stockholders may submit proposals appropriate for stockholder action at the Company’s Annual Meeting consistent with the regulations of the Securities and Exchange Commission. Proposals by stockholders intended to be presented at the 2007 Annual Meeting must be received by the Company no later than August 29, 2006 in order to be included in the Company’s proxy materials for that meeting. Such proposals should be directed to Wegener Corporation, Attention: Corporate Secretary, 11350 Technology Circle, Duluth, Georgia 30097. In connection with the Company’s Annual Meeting of Stockholders to be held in 2007, if the Company does not receive notice of a matter or proposal to be considered by November 6, 2006, then the persons appointed by the Board of Directors to act as the proxies for such Annual Meeting (named in the form of proxy) will be allowed to use their discretionary voting authority with respect to any such matter or proposal at the Annual Meeting, if such matter or proposal is raised at that Annual Meeting. Any such proposals must comply in all respects with the rules and regulations of the Securities and Exchange Commission.

GENERAL

The cost of this proxy solicitation will be paid by the Company. Solicitations will be made by mail but in some cases may also be made by telephone or personal call of officers, directors or regular employees of the Company who will not be specially compensated for such solicitation. In addition, the Company has engaged Innisfree M&A Incorporated (“Innisfree”) to provide proxy solicitation services on behalf of the Company in connection with the Annual Meeting. The Company has agreed to pay Innisfree a fee of not more than $40,000, and will reimburse Innisfree for certain reasonable out-of-pocket expenses. The Company has also agreed to indemnify Innisfree against certain liabilities and expenses. Innisfree will solicit proxies from individuals, brokers, banks, bank nominees and other institutional holders. It is anticipated that Innisfree will employ approximately 25 people to solicit proxies on behalf of the Company.The Company will also pay the cost of supplying necessary additional copies of the solicitation material and the Company’s Annual Report to Stockholders for beneficial owners of shares held of record by brokers, dealers, banks and voting trustees and their nominees, and upon request, the Company will pay the reasonable expenses of record holders for mailing such materials to the beneficial owners. The total amount estimated to be spent for, in furtherance of, or in connection with the solicitation of proxies is $90,000. The total expenditures to the approximate date of the mailing of this proxy statement are approximately $48,000.

Management knows of no other matters to be acted upon at the meeting. However, if any other matter is lawfully brought before the meeting, the shares covered by your proxy will be voted thereon in accordance with the best judgment of the persons acting under such proxy.

20

In order that your shares may be represented if you do not plan to attend the meeting, and in order to assure a required quorum, please sign, date and return your proxy promptly. In the event you are able to attend, we will, if you request, cancel the proxy.

By Order of the Board of Directors,

J. Elaine Miller

Secretary

December 29, 2005

21

Ú TO VOTE BY MAIL PLEASE DETACH PROXY CARD HERE AND RETURN IN THE ENVELOPE PROVIDEDÚ

WEGENER CORPORATION

This Proxy is solicited on behalf of the Board of Directors for use at the 2006 Annual Meeting of Stockholders to be held on January 31, 2006 at 7:00 p.m., Eastern Standard Time.

The undersigned hereby appoints Robert A. Placek and C. Troy Woodbury, Jr. and each of them, attorneys and proxies with full power to each of substitution, to vote in the name of and as proxy for the undersigned at the Annual Meeting of Stockholders of Wegener Corporation (the “Company”) to be held on Tuesday, January 31, 2006 at 7:00 p.m., local time, at the offices of the Company, 11350 Technology Circle, Duluth, Georgia 30097, and at any adjournments or postponements thereof, according to the number of votes that the undersigned would be entitled to cast if personally present.

PROPERLY EXECUTED PROXIES WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED. IF NO SUCH DIRECTIONS ARE GIVEN, SUCH PROXIES WILL BE VOTED FOR THE NOMINEES REFERRED TO IN PROPOSAL (1), FOR THE PROPOSITION REFERRED TO IN PROPOSAL (2), AGAINST THE PROPOSITION REFERRED TO IN PROPOSAL (3), AND IN THE DISCRETION OF THE PROXIES WITH RESPECT TO ANY SUCH MATTERS THAT MAY PROPERLY COME BEFORE THE ANNUAL MEETING OR ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF.

(Continued and to be signed and dated on reverse side)

| | |

| x | | Please mark your vote as in this example |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR PROPOSALS 1 AND 2, AND AGAINST PROPOSAL 3.

| (1) | Election of the following nominees as Class II directors to serve until the 2009 Annual Meeting of Stockholders and until their successors are elected and qualified: |

Robert A. Placek Wendell H. Bailey

| | |

¨ FOR the nominees listed above (except as indicated to the contrary below) | | ¨ WITHHOLD AUTHORITY to vote for the nominees |

(To withhold authority to vote for any individual nominee(s), write that nominee’s name(s) on the line below:)

| (2) | Ratification of the appointment of BDO Seidman, LLP as the Independent Registered Public Accounting Firm for the Company and its subsidiaries for fiscal 2006; and |

¨ FOR ¨ AGAINST ¨ ABSTAIN

| (3) | Approval of a stockholder proposal requesting the Board of Directors to redeem or rescind the Company’s Stockholder Rights Agreement. |

¨ FOR ¨ AGAINST ¨ ABSTAIN

The undersigned revokes all prior proxies to vote the shares covered by this proxy.

Signature

Signature

Date:

(When signing as attorney, executor, administrator, trustee or guardian, please give title as such. If stockholder is a corporation, corporate name should be signed by an authorized officer and the corporate seal affixed. For joint accounts, each joint owner should sign.)

PLEASE SIGN, DATE AND MAIL THIS PROXY PROMPTLY IN THE ENCLOSED POSTAGE-PAID REPLY ENVELOPE.