< ENTERGY >

Statistical Report

&

Investor Guide

2005

In 2005, two storms unprecedented in strength and size tested Entergy and its employees to their very limits. Entergy comes out of the tests of 2005 more determined than ever to be the best-in-class at safely providing clean, reliable, and affordable power to its customers. We have assembled the statistics and facts in this report to support your review and analysis of Entergy’s results over the last five years. This information is available in electronic form, with Excel spreadsheets, on our website at www.entergy.com/investor_relations, in order to facilitate easier access and analysis.

Entergy Investor Relations

ENTERGY CORPORATION is an integrated energy company engaged primarily in electric power production and retail distribution operations. Entergy owns and operates power plants with approximately 30,000 megawatts of electric generating capacity, and it is the second–largest nuclear generator in the United States. Entergy delivers electricity to 2.7 million utility customers in Arkansas, Louisiana, Mississippi, and Texas. Entergy has annual revenues of more than $10 billion and approximately 14,000 employees.

| 2 | ||

| 2 | ||

| 2 | ||

| 3 – 4 | ||

| 5 – 6 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 9 | ||

| 10 | ||

| 11 | ||

| 12 | ||

| 13 | ||

| 14 | ||

| 15 | ||

| 16 – 17 | ||

| 18 – 19 | ||

| 20 – 21 | ||

| 21 | ||

Consolidated Statements of Retained Earnings, Comprehensive Income and Paid–In Capital | 22 | |

| 23 | ||

| 23 | ||

| 23 | ||

| 23 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 24 | ||

| 25 | ||

| 25 | ||

| 26 – 27 | ||

| 28 – 29 | ||

| 30 | ||

| 30 | ||

| 30 | ||

| 31 | ||

| 32 | ||

| 32 | ||

| 33 | ||

| 34 | ||

| 34 | ||

| 35 | ||

| 35 | ||

| 35 | ||

| 36 | ||

| 37 – 38 | ||

| 39 – 40 | ||

| 41 – 42 | ||

| 43 – 44 | ||

| 45 – 46 | ||

| 46 | ||

| 47 | ||

| 48 | ||

| 48 | ||

| 48 | ||

| 49 | ||

| 50 | ||

| 51 | ||

| 51 | ||

| 51 | ||

| 51 | ||

| 51 | ||

| 52 | ||

| 52 | ||

| 53 | ||

| 53 | ||

| 53 | ||

| 54 | ||

| 55 – 58 | ||

| 59 – 67 | ||

| 68 | ||

1

This publication is unaudited and should be used in conjunction with Entergy’s 2005 Annual Report to Shareholders and Form 10-K filed with the Securities and Exchange Commission. It has been prepared for information purposes and is not intended for use in connection with any sale or purchase of, or any offer to buy, any securities of Entergy Corporation or its subsidiaries.

In this report and from time to time, Entergy makes statements concerning its expectations, beliefs, plans, objectives, goals, strategies, and future events or performance. Such statements are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Although Entergy believes that these forward-looking statements and the underlying assumptions are reasonable, it cannot provide assurance that they will prove correct. Except to the extent required by the federal securities laws, Entergy undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Forward-looking statements involve a number of risks and uncertainties, and there are factors that could cause actual results to differ materially from those expressed or implied in the statements. Some of those factors (in addition to others described elsewhere in this report, the Form 10-K, and in subsequent securities filings) include:

| • | resolution of pending and future rate cases and negotiations, including various performance-based rate discussions and implementation of new Texas legislation, and other regulatory proceedings, including those related to Entergy’s System Agreement and Entergy’s utility supply plan |

| • | Entergy’s ability to manage its operation and maintenance costs |

| • | the performance of Entergy’s generating plants, and particularly the capacity factors at its nuclear generating facilities |

| • | prices for power generated by Entergy’s unregulated generating facilities, the ability to hedge, sell power forward or otherwise reduce the market price risk associated with those facilities, including the Non-Utility Nuclear plants, the ability to meet credit support requirements, and the prices and availability of power Entergy must purchase for its utility customers |

| • | Entergy’s ability to develop and execute on a point of view regarding prices of electricity, natural gas, and other energy-related commodities |

| • | changes in the financial markets, particularly those affecting the availability of capital and Entergy’s ability to refinance existing debt, execute its share repurchase program, and fund investments and acquisitions |

| • | actions of rating agencies, including changes in the ratings of debt and preferred stock, changes in general corporate ratings, and changes in the rating agencies’ ratings criteria |

| • | changes in inflation, interest rates, and foreign currency exchange rates |

| • | Entergy’s ability to purchase and sell assets at attractive prices and on other attractive terms |

| • | volatility and changes in markets for electricity, natural gas, uranium, and other energy-related commodities |

| • | changes in utility regulation, including the beginning or end of retail and wholesale competition, the ability to recover net utility assets and other potential stranded costs, the establishment of a regional transmission organization that includes Entergy’s utility service territory, and the application of market power criteria by the FERC |

| • | changes in regulation of nuclear generating facilities and nuclear materials and fuel, including possible shutdown of nuclear generating facilities, particularly those in the northeastern United States |

| • | uncertainty regarding the establishment of interim or permanent sites for spent nuclear fuel storage and disposal |

| • | resolution of pending or future applications for license extensions or modifications of nuclear generating facilities |

| • | changes in law resulting from the new federal energy legislation, including the effects of PUHCA repeal |

| • | changes in environmental, tax, and other laws, including requirements for reduced emissions of sulfur, nitrogen, carbon, mercury, and other substances |

| • | the economic climate, and particularly growth in Entergy’s service territory |

| • | variations in weather and the occurrence of hurricanes and other storms and disasters, including uncertainties associated with efforts to remediate the effects of Hurricanes Katrina and Rita and recovery of costs associated with restoration including Entergy’s ability to obtain financial assistance from governmental authorities in connection with these storms |

| • | the outcome of the Chapter 11 bankruptcy proceeding of Entergy New Orleans, and the impact of this proceeding on other Entergy companies |

| • | the potential effects of threatened or actual terrorism and war |

| • | the effects of Entergy’s strategies to reduce tax payments |

| • | the effects of litigation and government investigations |

| • | changes in accounting standards, corporate governance, and securities law requirements |

| • | Entergy’s ability to attract and retain talented management and directors |

Financial performance measures shown in this report include those calculated and presented in accordance with generally accepted accounting principles (GAAP), as well as those that are considered non-GAAP measures. This report includes non-GAAP measures of operational earnings, operational return on average invested capital, operational return on average common or members’ equity, operational net margin, operational price to earnings ratio and operational common dividend payout ratio, as well as gross liquidity, net debt to net capital, net debt to net capital with off-balance sheet liabilities and pro forma financial results reflecting deconsolidation of Entergy New Orleans, Inc., when describing Entergy’s results of operations and financial performance. We have prepared reconciliations of these measures to the most directly comparable GAAP measures. Reconciliations can be found on pages 9, 11, and 55-67.

2

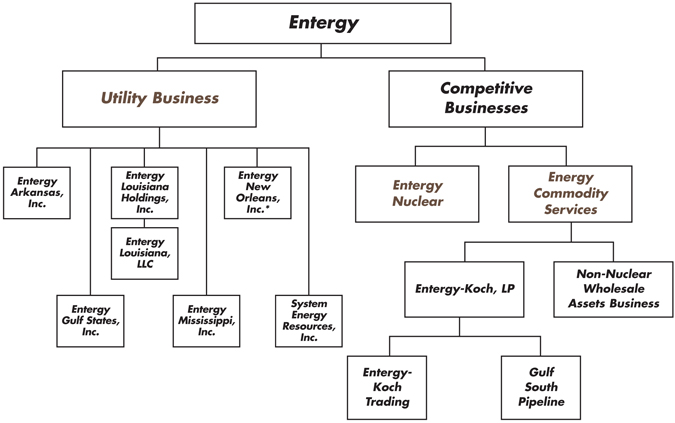

CORPORATE STRUCTURE

| * | Debtor-in-Possession |

CORPORATE PROFILE

Entergy Corporation is a Fortune 500 integrated energy company engaged primarily in electric power production and retail distribution operations.

| • | Approximately 30,000 MW electric generating capacity |

| • | 2nd-largest U.S. nuclear generator |

| • | 2.7 million utility customers |

| • | More than $10 billion annual revenues |

| • | Approximately 14,000 employees |

| • | 95 electric generating units operated |

BUSINESS SEGMENTS

Entergy’s five year results in this report are presented in three business segments:

| • | Utility |

| • | Entergy Nuclear (non-utility nuclear business) |

| • | Energy Commodity Services |

Entergy Nuclear and Energy Commodity Services are referred to as Entergy’s Competitive Businesses.

Entergy-Koch, LP sold Entergy-Koch Trading and Gulf South Pipeline in the fourth quarter of 2004, and Entergy-Koch is no longer an operating entity.

3

BUSINESS SEGMENTS (CONTINUED)

UTILITY

Entergy’s utility companies generate, transmit, distribute, and sell electric power, with a small amount of natural gas distribution.

| • | Five electric utilities with 2.7 million customers |

| • | Four states – Arkansas, Louisiana, Mississippi, Texas |

| • | 22,000 MW generating capacity |

| • | Two gas utilities with 219,000 customers |

ENTERGY ARKANSAS, INC. (EAI)

Entergy Arkansas generates, transmits, distributes, and sells electric power to 675,000 retail customers in portions of Arkansas.

ENTERGY GULF STATES, INC. (EGSI)

Entergy Gulf States generates, transmits, distributes, and sells electric power to 740,000 retail customers in portions of Texas and Louisiana. Entergy Gulf States also provides natural gas utility service to 89,000 customers in the Baton Rouge, Louisiana area.

ENTERGY LOUISIANA, LLC (ELL)

Entergy Louisiana generates, transmits, distributes, and sells electric power to 618,000 retail customers in portions of Louisiana.

ENTERGY MISSISSIPPI, INC. (EMI)

Entergy Mississippi generates, transmits, distributes, and sells electric power to 427,000 retail customers in portions of Mississippi.

ENTERGY NEW ORLEANS, INC. (ENOI)(a)

Entergy New Orleans generates, transmits, distributes, and sells electric power to 169,000 retail customers in the city of New Orleans, Louisiana. Entergy New Orleans also provides natural gas utility service to 130,000 customers in the City of New Orleans.

SYSTEM ENERGY RESOURCES, INC. (SERI)

System Energy owns and leases 90 percent of the Grand Gulf 1 nuclear generating facility. System Energy sells power and capacity from Grand Gulf 1 at wholesale to Entergy Arkansas, Entergy Louisiana, Entergy Mississippi, and Entergy New Orleans.

UTILITY NUCLEAR PLANTS

Entergy owns and operates five nuclear units at four plant sites to serve its regulated utility business: Arkansas Nuclear One (ANO) Units 1 and 2 near Russelville, Arkansas; Grand Gulf Nuclear Station in Port Gibson, Mississippi; River Bend Station in St. Francisville, Louisiana; and Waterford 3 in Taft, Louisiana.

ENTERGY NUCLEAR

Entergy’s non-utility nuclear business owns and operates five nuclear power plants in the northeastern United States. This business is primarily focused on selling power produced by those plants to wholesale customers. This business also provides operations and management services to nuclear power plants owned by other utilities in the United States.

| • | Five plants in northeastern U.S. |

| • | Pilgrim Nuclear Station in Plymouth, Massachusetts |

| • | James A. FitzPatrick in Oswego, New York |

| • | Indian Point Units 2 and 3 in Westchester County, New York |

| • | Vermont Yankee in Vernon, Vermont |

| • | 4,135 MW owned generating capacity (as of 3/31/06) |

| • | 800 MW under management services contract |

| • | Cooper Nuclear Station located near Brownville, Nebraska |

| • | Contracts (ongoing and completed) with other nuclear owners to manage decommissioning for 2 plants and license renewal (in partnership with Areva) for 3 plants |

ENERGY COMMODITY SERVICES

The energy commodity services business includes Entergy-Koch and Entergy’s Non-Nuclear Wholesale Assets business. Entergy-Koch engaged in two major businesses: energy commodity marketing and trading through Entergy-Koch Trading, and gas transportation and storage through Gulf South Pipeline. Entergy-Koch sold both of these businesses in the fourth quarter of 2004, and Entergy-Koch is no longer an operating entity.

NON-NUCLEAR WHOLESALE ASSETS BUSINESS

Entergy’s Non-Nuclear Wholesale Assets business sells to wholesale customers the electric power produced by power plants that it owns or controls (1,578 net MW generating capacity) while it focuses on improving performance and exploring sales or restructuring opportunities for its power plants. Such opportunities are evaluated consistent with Entergy’s market-based point-of-view.

| (a) | On September 23, 2005, Entergy New Orleans filed a voluntary petition for reorganization under Chapter 11 of the U.S. Bankruptcy Code to protect its customers and ensure continued progress in restoring power and gas service to New Orleans after Hurricane Katrina. As a result of the bankruptcy filing, Entergy discontinued the consolidation of Entergy New Orleans retroactive to January 1, 2005. |

4

WAYNE LEONARD – CHIEF EXECUTIVE OFFICER

Wayne Leonard became Entergy’s chief executive officer on January 1, 1999. He joined Entergy in April 1998 as president and chief operating officer of the company’s domestic business, and he assumed additional responsibility for international operations in August 1998. In 2005, Entergy was honored to receive the electric power industry’s highest honor, the Edison Award, from the Edison Electric Institute. Entergy also won this award in 2002. The Platts Global Energy Awards named Leonard 2003 CEO of the Year and Leonard has been a CEO of the Year finalist for the past five consecutive years. Prior to joining Entergy, Leonard was president of Cinergy’s Energy Commodities Strategic Business Unit and president of Cinergy Capital Trading.

LEO DENAULT – EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER

Leo Denault was named executive vice president and chief financial officer in February 2004. He was previously vice president of corporate development and strategic planning. He also held the position of vice president, corporate development, since joining the company in March 1999. Denault assumed responsibility for the areas of strategic planning, the Office of the Chief Risk Officer, and strategic pricing and transmission services in 2002. Prior to joining Entergy, Denault was vice president of corporate development at Cinergy Corporation, where he reviewed every major investment transaction, including the acquisition of generation, distribution and trading businesses in the United States and abroad.

RICHARD SMITH – GROUP PRESIDENT, UTILITY OPERATIONS

Rick Smith was named group president, utility operations in January 2002. He is responsible for the regulated utility financial results, along with operations of electric and natural gas distribution and customer service. In addition, Smith oversees utility regulatory support and regulated retail activities. He joined Entergy in September 1999 as senior vice president, transition management and later served as president of retail operations. Prior to joining Entergy, Smith was president of Cinergy Resources Inc, a non-regulated retail supply business. Prior to that, he served for three years as vice president of finance for Cinergy’s Energy Services business unit.

GARY TAYLOR – CHIEF EXECUTIVE OFFICER, ENTERGY NUCLEAR

Gary Taylor was named chief executive officer of Entergy’s nuclear businesses in April 2003. He joined Entergy in March 2000 as chief operating officer of its South region. Entergy operates five nuclear units in its retail electric service area and has acquired five nuclear plants in the northeast. Prior to joining Entergy, Taylor had been vice president of nuclear operations at South Carolina Electric & Gas Company, a subsidiary of SCANA Corporation, since 1995.

CURT HÉBERT – EXECUTIVE VICE PRESIDENT, EXTERNAL AFFAIRS

Curt Hébert joined Entergy as executive vice president, external affairs in September 2001 after a lengthy career as a government energy regulator at both the federal and state levels. His responsibilities include supervision of the company’s system and federal government relations, system regulatory affairs, external and internal communications, and corporate contribution functions. Prior to joining Entergy, Hébert was chairman of the Federal Energy Regulatory Commission. During Hébert’s four years of service as a member and later chairman, FERC was active in the restructuring of the electric utility and natural gas pipeline industries to promote competition.

MARK SAVOFF – EXECUTIVE VICE PRESIDENT, OPERATIONS

Mark Savoff was named executive vice president, operations in December 2003. He is responsible for fossil plant operations, transmission and distribution operations, system environmental and safety, system planning, compliance and performance management. Prior to joining Entergy, Savoff was vice president and corporate officer at GE Power Systems, Nuclear Energy. Before assuming his role as vice president, Nuclear Energy, he was General Manager of GE’s global nuclear fuel business and led the turnaround of GE’s global nuclear services business. He also served as president, Reuter-Stokes, a GE subsidiary.

MICHAEL KANSLER – PRESIDENT, ENTERGY NUCLEAR NORTHEAST

Michael Kansler was named president of Entergy Nuclear Northeast in January 2003 and has served as chief operating officer of Entergy Nuclear Northeast since January 2000. He is responsible for all of Entergy’s nuclear plants in the Northeast region and all other nuclear plants that the company may purchase or operate outside its traditional electric service territory. Kansler joined Entergy in 1998 as vice president of operations support, overseeing consolidated support functions for all five of Entergy’s regulated nuclear power units. Prior to joining Entergy, Kansler spent more than 20 years at Virginia Power (now Dominion Resources).

JOHN McGAHA – PRESIDENT, ENTERGY NUCLEAR SOUTH

John McGaha was named president of Entergy Nuclear South in March 2000. He is responsible for Entergy’s five nuclear units in its retail electric service area. McGaha started his Entergy career in 1978 at the Waterford 3 plant, where he advanced to the position of general manager of plant operations. Since 1991, he has held numerous management positions, including vice president of operations support for Entergy Nuclear South, vice president of River Bend Station, and executive vice president and chief operating officer of Entergy Nuclear South. Prior to joining Entergy, McGaha was an electrical design engineer for Brown & Root, Inc. for three years, and he served in the U.S. Navy nuclear submarine program for five years.

5

UTILITY OPERATING COMPANY PRESIDENTS

RENAE CONLEY – PRESIDENT & CEO, ENTERGY LOUISIANA AND ENTERGY GULF STATES – LOUISIANA

Renae Conley was named president and CEO of Entergy Louisiana and Entergy Gulf States – Louisiana in mid-2000. She is responsible for the Louisiana utilities’ electric and gas distribution systems, customer service, economic development, regulatory and governmental affairs. Prior to joining Entergy in 1999 as vice president of investor relations, Conley was president of The Cincinnati Gas & Electric Company, a subsidiary of Cinergy Corp. Conley also served as president and CEO of Cadence, a joint venture of Cinergy and other utilities that provides energy management services. At Cinergy, Conley was also general manager of corporate communications and investor relations.

JOE DOMINO – PRESIDENT & CEO, ENTERGY GULF STATES – TEXAS

Joe Domino was named president and CEO of Entergy Texas in 1998. He is responsible for Entergy Texas’ electric distribution system, customer service, economic development, regulatory and governmental affairs. Prior to being named president, he served as director of Entergy’s distribution operations in Texas and Southwest Louisiana. Domino joined Gulf States Utilities in 1970 as a planning engineer and was appointed director of Southern Region fossil plants in 1994.

HUGH McDONALD – PRESIDENT & CEO, ENTERGY ARKANSAS

Hugh McDonald was named president and CEO of Entergy Arkansas in spring 2000. He is responsible for Entergy Arkansas’ electric distribution system, customer service, economic development, regulatory and governmental affairs. Prior to becoming Entergy Arkansas’ president, he led Entergy’s Retail Operations. McDonald joined Entergy in 1982 at the Waterford 3 nuclear plant. In 1989, he became executive assistant to the chairman of Entergy Louisiana/Entergy New Orleans and then led Entergy Louisiana’s Total Quality initiative until 1993. During Entergy’s merger with Gulf States Utilities, McDonald served as the special projects director for the functional integration of the transmission, distribution, and customer service organizations. McDonald has also held the positions of division manager for Entergy Mississippi and director of regulatory affairs, Entergy Gulf States – Texas.

DAN PACKER – PRESIDENT & CEO, ENTERGY NEW ORLEANS

Dan Packer was named president of Entergy New Orleans in 1996 and CEO in 1998. He is responsible for Entergy New Orleans’ electric distribution system, customer service, economic development, regulatory and governmental affairs. Packer joined Entergy in 1982 as training manager at the Waterford 3 nuclear plant and later served as Waterford’s plant manager – the first African American in the United States to manage a nuclear plant. Prior to joining Entergy, Packer was a senior engineer with General Physics Corporation, worked for six years as training coordinator with Connecticut Yankee Atomic Power Company, and served in the U.S. Nuclear Navy Program from 1969 to 1975.

CAROLYN SHANKS – PRESIDENT & CEO, ENTERGY MISSISSIPPI

Carolyn Shanks was named president and CEO of Entergy Mississippi in July 1999. She is responsible for Entergy Mississippi’s electric distribution system, customer service, economic development, regulatory and governmental affairs. Shanks joined Entergy in 1983 as an accountant with Entergy Mississippi and later transferred to System Energy Resources, Inc., the subsidiary responsible for the operations of Grand Gulf Nuclear Station. In 1994, she was named director of business services for Entergy Operations, Inc., the subsidiary that manages Entergy’s five nuclear power plants in its retail electric service area. Shanks became vice president, finance and administration of Entergy Nuclear in February 1997.

6

CONSOLIDATED SELECTED DATA

CONSOLIDATED ENTERGY CORPORATION AND SUBSIDIARIES DATA

SELECTED FINANCIAL AND OPERATING DATA

| 2005(a) | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||

| (In millions, except percentages, per share amounts, and ratios) | ||||||||||||||||||||

GAAP MEASURES | ||||||||||||||||||||

Operating Revenues | $ | 10,106 | $ | 9,686 | $ | 9,033 | $ | 8,299 | $ | 9,621 | ||||||||||

As-Reported Earnings | $ | 898 | $ | 910 | $ | 927 | $ | 599 | $ | 726 | ||||||||||

As-Reported Earnings Per Share | $ | 4.19 | $ | 3.93 | $ | 4.01 | $ | 2.64 | $ | 3.23 | ||||||||||

Shares of Common Stock Outstanding: | ||||||||||||||||||||

End of Year | 207.5 | 216.8 | 228.9 | 222.4 | 220.7 | |||||||||||||||

Weighted Average – Diluted | 214.4 | 231.2 | 231.1 | 227.3 | 224.7 | |||||||||||||||

Return on Average Invested Capital – As-Reported | 7.2 | % | 7.3 | % | 7.4 | % | 5.8 | % | 7.2 | % | ||||||||||

Return on Average Common Equity – As-Reported | 11.2 | % | 10.7 | % | 11.2 | % | 7.8 | % | 10.0 | % | ||||||||||

Net Cash Flow Provided by Operating Activities | $ | 1,468 | $ | 2,929 | $ | 2,006 | $ | 2,182 | $ | 2,216 | ||||||||||

Year-End Closing Market Price Per Share of Common Stock | $ | 68.65 | $ | 67.59 | $ | 57.13 | $ | 45.59 | $ | 39.11 | ||||||||||

Book Value Per Share at End of Year | $ | 37.31 | $ | 38.25 | $ | 38.02 | $ | 35.24 | $ | 33.78 | ||||||||||

Market Value of Equity at End of Year | $ | 14,247 | $ | 14,655 | $ | 13,077 | $ | 10,140 | $ | 8,633 | ||||||||||

Price to Earnings Ratio – As-Reported | 16.39 | 17.18 | 14.25 | 17.29 | 12.10 | |||||||||||||||

Common Dividend Paid Per Share | $ | 2.16 | $ | 1.89 | $ | 1.60 | $ | 1.34 | $ | 1.28 | ||||||||||

Common Dividend Payout Ratio – As-Reported | 52 | % | 48 | % | 40 | % | 51 | % | 39 | % | ||||||||||

NON-GAAP MEASURES | ||||||||||||||||||||

Operational Earnings | $ | 943 | $ | 880 | $ | 982 | $ | 866 | $ | 726 | ||||||||||

Operational Earnings Per Share | $ | 4.40 | $ | 3.80 | $ | 4.25 | $ | 3.81 | $ | 3.23 | ||||||||||

Special Items Per Share | $ | (0.21 | ) | $ | 0.13 | $ | (0.24 | ) | $ | (1.17 | ) | $ | — | |||||||

Return on Average Invested Capital – Operational | 7.5 | % | 7.1 | % | 7.7 | % | 7.4 | % | 7.2 | % | ||||||||||

Return on Average Common Equity – Operational | 11.8 | % | 10.4 | % | 11.9 | % | 11.3 | % | 10.0 | % | ||||||||||

Price to Earnings Ratio – Operational | 15.61 | 17.77 | 13.45 | 11.96 | 12.10 | |||||||||||||||

Common Dividend Payout Ratio – Operational | 49 | % | 50 | % | 38 | % | 35 | % | 39 | % | ||||||||||

(a) 2005 reflects deconsolidation of Entergy New Orleans, Inc. | ||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||

Retail Kilowatt-Hour Sales (millions) | 99,865 | 102,225 | 99,968 | 101,631 | 99,956 | |||||||||||||||

Peak Demand (megawatts) | 21,391 | 21,174 | 20,162 | 20,419 | 20,257 | |||||||||||||||

Retail Customers – Year End (thousands) | 2,629 | 2,662 | 2,631 | 2,597 | 2,574 | |||||||||||||||

(a) Includes Entergy New Orleans, Inc. | ||||||||||||||||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | ||||||||||||||||

Total Employees – Year End | 14,136 | 14,425 | 14,773 | 15,601 | 15,054 | |||||||||||||||

OWNED AND LEASED CAPABILITY (MW)(a)

As of March 31, 2006

| Entergy Arkansas | Entergy Gulf States | Entergy Louisiana | Entergy Mississippi | Entergy New Orleans | System Energy | Entergy Nuclear(c) | Non- Nuclear Wholesale(d) | Total | ||||||||||

Gas/Oil | 1,601 | 4,890 | 4,991 | 2,945 | 876 | — | — | 1,317 | 16,620 | |||||||||

Coal | 1,190 | 627 | — | 416 | — | — | — | 181 | 2,414 | |||||||||

Total Fossil | 2,791 | 5,517 | 4,991 | 3,361 | 876 | — | — | 1,498 | 19,034 | |||||||||

Nuclear | 1,843 | 977 | 1,157 | — | — | 1,143 | 4,135 | — | 9,255 | |||||||||

Other(b) | 70 | — | — | — | — | — | — | 80 | 150 | |||||||||

Total | 4,704 | 6,494 | 6,148 | 3,361 | 876 | 1,143 | 4,135 | 1,578 | 28,439 |

| (a) | Owned and Leased Capability is the dependable load carrying capability as demonstrated under actual operating conditions based on the primary fuel (assuming no curtailments) that each station was designed to utilize. |

| (b) | Other includes Hydro and Wind. |

| (c) | Reflects maximum capacity of generating units. Vermont Yankee’s 95 MW uprate was approved in early March 2006. Maximum capacity reflects power ascension as of end of first quarter 2006. |

| (d) | Reflects nameplate rating of generating unit. |

7

CONSOLIDATED SELECTED DATA

CONSOLIDATED ENTERGY CORPORATION AND SUBSIDIARIES DATA

CONSOLIDATED QUARTERLY FINANCIAL METRICS

| 2005(a) | 2004 | YTD % CHANGE | |||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | ||||||||||||||

GAAP MEASURES | |||||||||||||||||||||||

As-Reported Earnings ($ millions) | 172.0 | 286.2 | 350.0 | 90.2 | 898.3 | 207.2 | 265.2 | 282.2 | 154.9 | 909.5 | (1 | ) | |||||||||||

Return on Average Invested Capital – As-Reported (%)* | 7.0 | 7.1 | 7.5 | 7.2 | 7.2 | 6.2 | 6.4 | 5.9 | 7.3 | 7.3 | (1 | ) | |||||||||||

Return on Average Common Equity – As-Reported (%)* | 10.3 | 10.7 | 11.5 | 11.2 | 11.2 | 8.6 | 9.3 | 8.1 | 10.7 | 10.7 | 5 | ||||||||||||

Net Margin – As-Reported (%)* | 9.4 | 9.5 | 10.0 | 8.9 | 8.9 | 8.1 | 8.7 | 7.6 | 9.4 | 9.4 | (5 | ) | |||||||||||

Cash Flow Interest Coverage (# times)* | 7.55 | 7.07 | 5.93 | 4.01 | 4.01 | 5.78 | 5.98 | 6.41 | 7.13 | 7.13 | (44 | ) | |||||||||||

Revolver Capacity ($ millions) | 1,070 | 1,407 | 791 | 2,545 | 2,545 | 1,553 | 1,280 | 1,310 | 1,490 | 1,490 | 71 | ||||||||||||

Total Debt ($ millions) | 8,033 | 8,283 | 8,865 | 9,288 | 9,288 | 8,282 | 8,173 | 8,070 | 7,807 | 7,807 | 19 | ||||||||||||

Debt to Capital Ratio (%) | 49.0 | 49.9 | 51.9 | 53.1 | 53.1 | 47.3 | 47.4 | 46.8 | 47.4 | 47.4 | 12 | ||||||||||||

Off-Balance Sheet Liabilities ($ millions) | 771 | 780 | 779 | 778 | 778 | 1,029 | 1,037 | 1,030 | 769 | 769 | 1 | ||||||||||||

NON-GAAP MEASURES | |||||||||||||||||||||||

Operational Earnings ($ millions) | 173.4 | 289.0 | 357.1 | 123.6 | 943.0 | 192.1 | 252.2 | 321.7 | 113.6 | 879.5 | 7 | ||||||||||||

Return on Average Invested Capital – Operational (%)* | 6.9 | 7.2 | 7.3 | 7.5 | 7.5 | 7.2 | 6.9 | 6.7 | 7.1 | 7.1 | 6 | ||||||||||||

Return on Average Common Equity – Operational (%)* | 10.2 | 10.8 | 11.2 | 11.8 | 11.8 | 10.7 | 10.4 | 9.7 | 10.4 | 10.4 | 13 | ||||||||||||

Net Margin – Operational (%)* | 9.3 | 9.5 | 9.7 | 9.3 | 9.3 | 10.0 | 9.7 | 9.1 | 9.1 | 9.1 | 2 | ||||||||||||

Total Gross Liquidity ($ millions) | 1,547 | 2,014 | 1,389 | 3,128 | 3,128 | 2,361 | 1,838 | 1,851 | 2,110 | 2,110 | 48 | ||||||||||||

Net Debt to Net Capital Ratio (%) | 47.5 | 48.0 | 50.2 | 51.5 | 51.5 | 44.8 | 45.6 | 45.1 | 45.3 | 45.3 | 14 | ||||||||||||

Net Debt Ratio Including Off-Balance Sheet Liabilities (%) | 49.9 | 50.4 | 52.4 | 53.7 | 53.7 | 48.0 | 48.8 | 48.3 | 47.9 | 47.9 | 12 | ||||||||||||

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

| * | Trailing twelve months. Totals may not foot due to rounding. |

CONSOLIDATED ANNUAL FINANCIAL METRICS

| 2005(a) | 2004 | 2003 | 2002 | 2001 | ||||||

GAAP MEASURES | ||||||||||

As-Reported Earnings ($ millions) | 898 | 910 | 927 | 599 | 726 | |||||

Return on Average Invested Capital – As-Reported (%) | 7.2 | 7.3 | 7.4 | 5.8 | 7.2 | |||||

Return on Average Common Equity – As-Reported (%) | 11.2 | 10.7 | 11.2 | 7.8 | 10.0 | |||||

Net Margin – As-Reported (%) | 8.9 | 9.4 | 10.3 | 7.2 | 7.5 | |||||

Cash Flow Interest Coverage (# times) | 4.01 | 7.13 | 5.05 | 4.92 | 4.09 | |||||

Revolver Capacity ($ millions) | 2,545 | 1,490 | 1,553 | 1,018 | 1,210 | |||||

Total Debt ($ millions) | 9,288 | 7,807 | 8,182 | 8,810 | 8,900 | |||||

Debt to Capital Ratio (%) | 53.1 | 47.4 | 47.5 | 51.8 | 53.2 | |||||

Off-Balance Sheet Liabilities ($ millions) | ||||||||||

Project Debt | — | — | — | — | 265 | |||||

Debt of Joint Ventures – Entergy’s Share | 214 | 173 | 414 | 409 | 347 | |||||

Leases – Entergy’s Share | 564 | 596 | 501 | 395 | 343 | |||||

Total | 778 | 769 | 915 | 804 | 955 | |||||

NON-GAAP MEASURES | ||||||||||

Operational Earnings ($ millions) | 943 | 880 | 982 | 866 | 726 | |||||

Return on Average Invested Capital – Operational (%) | 7.5 | 7.1 | 7.7 | 7.4 | 7.2 | |||||

Return on Average Common Equity – Operational (%) | 11.8 | 10.4 | 11.9 | 11.3 | 10.0 | |||||

Net Margin – Operational (%) | 9.3 | 9.1 | 10.9 | 10.4 | 7.5 | |||||

Total Gross Liquidity ($ millions) | 3,128 | 2,110 | 2,060 | 2,353 | 1,962 | |||||

Net Debt to Net Capital Ratio (%) | 51.5 | 45.3 | 45.9 | 47.7 | 51.0 | |||||

Net Debt Ratio Including Off-Balance Sheet Liabilities (%) | 53.7 | 47.9 | 48.7 | 50.3 | 53.8 |

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

8

CONSOLIDATED FINANCIAL RESULTS

ENTERGY CORPORATION CONSOLIDATED QUARTERLY RESULTS – GAAP TO NON-GAAP RECONCILIATION

| 2005 | 2004 | YTD Change | |||||||||||||||||||||||||||||||

| 1Q(a) | 2Q(a) | 3Q(a) | 4Q | YTD | 1Q(b) | 2Q(b) | 3Q | 4Q | YTD | ||||||||||||||||||||||||

| ($/share) | |||||||||||||||||||||||||||||||||

AS-REPORTED | |||||||||||||||||||||||||||||||||

Utility/Parent/Other | 0.42 | 1.05 | 1.35 | — | 2.82 | 0.55 | 0.83 | 1.11 | 0.36 | 2.86 | (0.04 | ) | |||||||||||||||||||||

Competitive Businesses | |||||||||||||||||||||||||||||||||

Entergy Nuclear | 0.36 | 0.27 | 0.33 | 0.37 | 1.32 | 0.29 | 0.27 | 0.28 | 0.22 | 1.06 | 0.26 | ||||||||||||||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||||

Non-Nuclear Wholesale Assets | 0.01 | 0.01 | (0.03 | ) | 0.06 | 0.05 | (0.03 | ) | (0.02 | ) | 0.02 | 0.25 | 0.23 | (0.18 | ) | ||||||||||||||||||

Entergy-Koch Trading | — | — | — | — | — | 0.03 | 0.05 | (0.21 | ) | (0.21 | ) | (0.35 | ) | 0.35 | |||||||||||||||||||

Gulf South Pipeline | — | — | — | — | — | 0.04 | 0.01 | 0.02 | 0.06 | 0.13 | (0.13 | ) | |||||||||||||||||||||

Total Energy Commodity Services | 0.01 | 0.01 | (0.03 | ) | 0.06 | 0.05 | 0.04 | 0.04 | (0.17 | ) | 0.10 | 0.01 | 0.04 | ||||||||||||||||||||

Total Competitive Businesses | 0.37 | 0.28 | 0.30 | 0.43 | 1.37 | 0.33 | 0.31 | 0.11 | 0.32 | 1.07 | 0.30 | ||||||||||||||||||||||

Consolidated As-Reported Earnings | 0.79 | 1.33 | 1.65 | 0.43 | 4.19 | 0.88 | 1.14 | 1.22 | 0.68 | 3.93 | 0.26 | ||||||||||||||||||||||

LESS SPECIAL ITEMS | |||||||||||||||||||||||||||||||||

Utility/Parent/Other | (0.01 | ) | (0.01 | ) | (0.03 | ) | (0.16 | ) | (0.21 | ) | — | — | — | 0.07 | 0.07 | (0.28 | ) | ||||||||||||||||

Competitive Businesses | |||||||||||||||||||||||||||||||||

Entergy Nuclear | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||||

Non-Nuclear Wholesale Assets | — | — | — | — | — | — | — | 0.02 | 0.26 | 0.28 | (0.28 | ) | |||||||||||||||||||||

Entergy-Koch Trading | — | — | — | — | — | 0.03 | 0.05 | (0.21 | ) | (0.21 | ) | (0.35 | ) | 0.35 | |||||||||||||||||||

Gulf South Pipeline | — | — | — | — | — | 0.04 | 0.01 | 0.02 | 0.06 | 0.13 | (0.13 | ) | |||||||||||||||||||||

Total Energy Commodity Services | — | — | — | — | — | 0.07 | 0.06 | (0.17 | ) | 0.11 | 0.06 | (0.06 | ) | ||||||||||||||||||||

Total Competitive Businesses | — | — | — | — | — | 0.07 | 0.06 | (0.17 | ) | 0.11 | 0.06 | (0.06 | ) | ||||||||||||||||||||

Total Special Items | (0.01 | ) | (0.01 | ) | (0.03 | ) | (0.16 | ) | (0.21 | ) | 0.07 | 0.06 | (0.17 | ) | 0.18 | 0.13 | (0.34 | ) | |||||||||||||||

OPERATIONAL | |||||||||||||||||||||||||||||||||

Utility/Parent/Other | 0.43 | 1.06 | 1.38 | 0.16 | 3.03 | 0.55 | 0.83 | 1.11 | 0.29 | 2.79 | 0.24 | ||||||||||||||||||||||

Competitive Businesses | |||||||||||||||||||||||||||||||||

Entergy Nuclear | 0.36 | 0.27 | 0.33 | 0.37 | 1.32 | 0.29 | 0.27 | 0.28 | 0.22 | 1.06 | 0.26 | ||||||||||||||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||||

Non-Nuclear Wholesale Assets | 0.01 | 0.01 | (0.03 | ) | 0.06 | 0.05 | (0.03 | ) | (0.02 | ) | — | (0.01 | ) | (0.05 | ) | 0.10 | |||||||||||||||||

Entergy-Koch Trading | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||

Gulf South Pipeline | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||

Total Energy Commodity Services | 0.01 | 0.01 | (0.03 | ) | 0.06 | 0.05 | (0.03 | ) | (0.02 | ) | — | (0.01 | ) | (0.05 | ) | 0.10 | |||||||||||||||||

Total Competitive Businesses | 0.37 | 0.28 | 0.30 | 0.43 | 1.37 | 0.26 | 0.25 | 0.28 | 0.21 | 1.01 | 0.36 | ||||||||||||||||||||||

Consolidated Operational Earnings | 0.80 | 1.34 | 1.68 | 0.59 | 4.40 | 0.81 | 1.08 | 1.39 | 0.50 | 3.80 | 0.60 | ||||||||||||||||||||||

Weather Impact | (0.01 | ) | — | 0.06 | 0.05 | 0.10 | (0.02 | ) | (0.01 | ) | (0.10 | ) | — | (0.11 | ) | 0.21 | |||||||||||||||||

SHARES OF COMMON STOCK OUTSTANDING(in millions) | |||||||||||||||||||||||||||||||||

End of Period | 212.8 | 209.9 | 207.4 | 207.5 | 207.5 | 231.0 | 226.8 | 225.2 | 216.8 | 216.8 | (9.3 | ) | |||||||||||||||||||||

Weighted Average - Diluted | 218.6 | 215.6 | 212.3 | 211.3 | 214.4 | 235.0 | 232.8 | 231.1 | 226.2 | 231.2 | (16.8 | ) | |||||||||||||||||||||

| (a) | Operational earnings for first, second, and third quarter 2005 were originally reported as $0.79 per share, $1.33 per share, and $1.65 per share respectively. Following the planned sale of the competitive retail business in Texas announced in fourth quarter 2005, Entergy began treating earnings from this business as a special item, which revises previously reported operational earnings. |

| (b) | Operational earnings for first quarter and second quarter 2004 were originally reported as $0.88 per share and $1.14 per share, respectively. Following the sales of Entergy-Koch, LP’s trading and pipeline businesses, Entergy began treating earnings from Entergy-Koch as a special item, which revises previously reported operational earnings. |

Totals may not foot due to rounding and accretion from share repurchase program.

9

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

ENTERGY CORPORATION CONSOLIDATED QUARTERLY SPECIAL ITEMS (Shown as Positive/(Negative) Impact on Earnings)

| 2005 | 2004 | YTD Change | |||||||||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | ||||||||||||||||||||||

| ($/share) | |||||||||||||||||||||||||||||||

UTILITY/PARENT/OTHER | |||||||||||||||||||||||||||||||

SPECIAL ITEMS | |||||||||||||||||||||||||||||||

Retail business impairment reserve | — | — | — | (0.12 | ) | (0.12 | ) | — | — | — | — | — | (0.12 | ) | |||||||||||||||||

Retail business discontinued operations | (0.01 | ) | (0.01 | ) | (0.03 | ) | (0.04 | ) | (0.09 | ) | — | — | — | — | — | (0.09 | ) | ||||||||||||||

Tax benefits – Entergy-Koch investment | — | — | — | — | — | — | — | — | 0.07 | 0.07 | (0.07 | ) | |||||||||||||||||||

Total | (0.01 | ) | (0.01 | ) | (0.03 | ) | (0.16 | ) | (0.21 | ) | — | — | — | 0.07 | 0.07 | (0.28 | ) | ||||||||||||||

COMPETITIVE BUSINESSES SPECIAL ITEMS | |||||||||||||||||||||||||||||||

Entergy Nuclear | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||

Entergy-Koch Trading earnings | — | — | — | — | — | 0.03 | 0.05 | (0.21 | ) | (0.21 | ) | (0.35 | ) | 0.35 | |||||||||||||||||

Gulf South Pipeline earnings | — | — | — | — | — | 0.04 | 0.01 | 0.02 | 0.06 | 0.13 | (0.13 | ) | |||||||||||||||||||

Tax benefits on restructuring | — | — | — | — | — | — | — | — | 0.42 | 0.41 | (0.41 | ) | |||||||||||||||||||

Asset impairment reserve | — | — | — | — | — | — | — | — | (0.16 | ) | (0.15 | ) | 0.15 | ||||||||||||||||||

Reduction in asset sale reserves | — | — | — | — | — | — | — | 0.02 | — | 0.02 | (0.02 | ) | |||||||||||||||||||

Total | — | — | — | — | — | 0.07 | 0.06 | (0.17 | ) | 0.11 | 0.06 | (0.06 | ) | ||||||||||||||||||

TOTAL SPECIAL ITEMS | (0.01 | ) | (0.01 | ) | (0.03 | ) | (0.16 | ) | (0.21 | ) | 0.07 | 0.06 | (0.17 | ) | 0.18 | 0.13 | (0.34 | ) | |||||||||||||

| 2005 | 2004 | YTD Change | |||||||||||||||||||||||||||||

| 1Q | 2Q | 3Q | 4Q | YTD | 1Q | 2Q | 3Q | 4Q | YTD | ||||||||||||||||||||||

| ($ millions) | |||||||||||||||||||||||||||||||

UTILITY/PARENT/OTHER | |||||||||||||||||||||||||||||||

SPECIAL ITEMS | |||||||||||||||||||||||||||||||

Retail business impairment reserve | — | — | — | (25.8 | ) | (25.8 | ) | — | — | — | — | — | (25.8 | ) | |||||||||||||||||

Retail business discontinued operations | (1.4 | ) | (2.8 | ) | (7.1 | ) | (7.6 | ) | (18.9 | ) | — | — | — | — | — | (18.9 | ) | ||||||||||||||

Tax benefits – Entergy-Koch investment | — | — | — | — | — | — | — | — | 16.7 | 16.7 | (16.7 | ) | |||||||||||||||||||

Total | (1.4 | ) | (2.8 | ) | (7.1 | ) | (33.4 | ) | (44.7 | ) | — | — | — | 16.7 | 16.7 | (61.4 | ) | ||||||||||||||

COMPETITIVE BUSINESSES SPECIAL ITEMS | |||||||||||||||||||||||||||||||

Entergy Nuclear | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||

Energy Commodity Services | |||||||||||||||||||||||||||||||

Entergy-Koch Trading earnings | — | — | — | — | — | 6.4 | 10.1 | (48.4 | ) | (47.4 | ) | (79.4 | ) | 79.4 | |||||||||||||||||

Gulf South Pipeline earnings | — | — | — | — | — | 8.7 | 2.9 | 3.3 | 14.3 | 29.3 | (29.3 | ) | |||||||||||||||||||

Tax benefits on restructuring | — | — | — | — | — | — | — | — | 93.6 | 93.6 | (93.6 | ) | |||||||||||||||||||

Asset impairment reserve | — | — | — | — | — | — | — | — | (35.8 | ) | (35.8 | ) | 35.8 | ||||||||||||||||||

Reduction in asset sale reserves | — | — | — | — | — | — | — | 5.6 | — | 5.6 | (5.6 | ) | |||||||||||||||||||

Total | — | — | — | — | — | 15.1 | 13.0 | (39.5 | ) | 24.7 | 13.3 | (13.3 | ) | ||||||||||||||||||

TOTAL SPECIAL ITEMS | (1.4 | ) | (2.8 | ) | (7.1 | ) | (33.4 | ) | (44.7 | ) | 15.1 | 13.0 | (39.5 | ) | 41.3 | 30.0 | (74.7 | ) | |||||||||||||

Totals may not foot due to rounding and accretion from share repurchase program.

10

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

ENTERGY CORPORATION CONSOLIDATED ANNUAL RESULTS – GAAP TO NON-GAAP RECONCILIATION

| 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||

| ($/share) | |||||||||||||||

AS-REPORTED | |||||||||||||||

Utility/Parent/Other | 2.82 | 2.86 | 1.93 | 2.40 | 2.19 | ||||||||||

Competitive Businesses | |||||||||||||||

Entergy Nuclear | 1.32 | 1.06 | 1.30 | 0.88 | 0.57 | ||||||||||

Energy Commodity Services | |||||||||||||||

Non-Nuclear Wholesale Assets | 0.05 | 0.23 | (0.10 | ) | (1.22 | ) | — | ||||||||

Entergy-Koch Trading | — | (0.35 | ) | 0.80 | 0.36 | 0.34 | |||||||||

Gulf South Pipeline | — | 0.13 | 0.08 | 0.22 | 0.13 | ||||||||||

Total Energy Commodity Services | 0.05 | 0.01 | 0.78 | (0.64 | ) | 0.47 | |||||||||

Total Competitive Businesses | 1.37 | 1.07 | 2.08 | 0.24 | 1.04 | ||||||||||

Consolidated As-Reported Earnings | 4.19 | 3.93 | 4.01 | 2.64 | 3.23 | ||||||||||

LESS SPECIAL ITEMS | |||||||||||||||

Utility/Parent/Other | (0.21 | ) | 0.07 | (0.69 | ) | — | (0.09 | ) | |||||||

Competitive Businesses | |||||||||||||||

Entergy Nuclear | — | — | 0.45 | — | — | ||||||||||

Energy Commodity Services | |||||||||||||||

Non-Nuclear Wholesale Assets | — | 0.28 | — | (1.17 | ) | 0.09 | |||||||||

Entergy-Koch Trading | — | (0.35 | ) | — | — | — | |||||||||

Gulf South Pipeline | — | 0.13 | — | — | — | ||||||||||

Total Energy Commodity Services | — | 0.06 | — | (1.17 | ) | 0.09 | |||||||||

Total Competitive Businesses | — | 0.06 | 0.45 | (1.17 | ) | 0.09 | |||||||||

Total Special Items | (0.21 | ) | 0.13 | (0.24 | ) | (1.17 | ) | — | |||||||

OPERATIONAL | |||||||||||||||

Utility/Parent/Other | 3.03 | 2.79 | 2.62 | 2.40 | 2.28 | ||||||||||

Competitive Businesses | |||||||||||||||

Entergy Nuclear | 1.32 | 1.06 | 0.85 | 0.88 | 0.57 | ||||||||||

Energy Commodity Services | |||||||||||||||

Non-Nuclear Wholesale Assets | 0.05 | (0.05 | ) | (0.10 | ) | (0.05 | ) | (0.09 | ) | ||||||

Entergy-Koch Trading | — | — | 0.80 | 0.36 | 0.34 | ||||||||||

Gulf South Pipeline | — | — | 0.08 | 0.22 | 0.13 | ||||||||||

Total Energy Commodity Services | 0.05 | (0.05 | ) | 0.78 | 0.53 | 0.38 | |||||||||

Total Competitive Businesses | 1.37 | 1.01 | 1.63 | 1.41 | 0.95 | ||||||||||

Consolidated Operational Earnings | 4.40 | 3.80 | 4.25 | 3.81 | 3.23 | ||||||||||

Weather Impact | 0.10 | (0.11 | ) | (0.05 | ) | (0.01 | ) | (0.01 | ) | ||||||

11

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

ENTERGY CORPORATION CONSOLIDATED ANNUAL SPECIAL ITEMS (Shown as Positive/(Negative) Impact on Earnings)

| 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||

| ($/share) | |||||||||||||||

UTILITY/PARENT/OTHER SPECIAL ITEMS | |||||||||||||||

Retail business impairment reserve | (0.12 | ) | — | — | — | — | |||||||||

Retail business discontinued operations | (0.09 | ) | — | — | — | — | |||||||||

Tax benefits – Entergy-Koch investment | — | 0.07 | — | — | — | ||||||||||

River Bend loss provision | — | — | (0.29 | ) | — | — | |||||||||

SFAS 143 implementation | — | — | (0.09 | ) | — | — | |||||||||

Voluntary severance plan | — | — | (0.31 | ) | — | — | |||||||||

Merger expenses | — | — | — | — | (0.06 | ) | |||||||||

Write-down of MyHomeKey investment | — | — | — | — | (0.03 | ) | |||||||||

Total | (0.21 | ) | 0.07 | (0.69 | ) | — | (0.09 | ) | |||||||

COMPETITIVE BUSINESSES SPECIAL ITEMS | |||||||||||||||

Entergy Nuclear | |||||||||||||||

SFAS 143 implementation | — | — | 0.67 | — | — | ||||||||||

Voluntary severance plan | — | — | (0.22 | ) | — | — | |||||||||

Energy Commodity Services | |||||||||||||||

Entergy-Koch Trading earnings | — | (0.35 | ) | — | — | — | |||||||||

Gulf South Pipeline earnings | — | 0.13 | — | — | — | ||||||||||

Tax benefits on restructuring | — | 0.41 | — | — | — | ||||||||||

Asset impairment reserve | — | (0.15 | ) | — | — | — | |||||||||

Reduction in asset sale reserves | — | 0.02 | — | — | — | ||||||||||

Gain (loss) on disposition of assets | — | — | — | 0.23 | 0.01 | ||||||||||

Asset and contract impairments | — | — | — | (0.62 | ) | — | |||||||||

Turbine commitment | — | — | — | (0.52 | ) | — | |||||||||

Development costs | — | — | — | (0.09 | ) | — | |||||||||

Restructuring costs | — | — | — | (0.17 | ) | (0.02 | ) | ||||||||

Damhead Creek mark-to-market gas contract | — | — | — | — | 0.10 | ||||||||||

Total | — | 0.06 | 0.45 | (1.17 | ) | 0.09 | |||||||||

TOTAL SPECIAL ITEMS | (0.21 | ) | 0.13 | (0.24 | ) | (1.17 | ) | — | |||||||

| 2005 | 2004 | 2003 | 2002 | 2001 | |||||||||||

| ($ millions) | |||||||||||||||

UTILITY/PARENT/OTHER SPECIAL ITEMS | |||||||||||||||

Retail business impairment reserve | (25.8 | ) | — | — | — | — | |||||||||

Retail business discontinued operations | (18.9 | ) | — | — | — | — | |||||||||

Tax benefits – Entergy-Koch investment | — | 16.7 | — | — | — | ||||||||||

River Bend loss provision | — | — | (65.6 | ) | — | — | |||||||||

SFAS 143 implementation | — | — | (21.3 | ) | — | — | |||||||||

Voluntary severance plan | — | — | (71.0 | ) | — | — | |||||||||

Merger expenses | — | — | — | — | (14.1 | ) | |||||||||

Write-down of MyHomeKey investment | — | — | — | — | (6.8 | ) | |||||||||

Total | (44.7 | ) | 16.7 | (157.9 | ) | — | (20.9 | ) | |||||||

COMPETITIVE BUSINESSES SPECIAL ITEMS | |||||||||||||||

Entergy Nuclear | |||||||||||||||

SFAS 143 implementation | — | — | 154.4 | — | — | ||||||||||

Voluntary severance plan | — | — | (51.8 | ) | — | — | |||||||||

Energy Commodity Services | |||||||||||||||

Entergy-Koch Trading earnings | — | (79.4 | ) | — | — | — | |||||||||

Gulf South Pipeline earnings | — | 29.3 | — | — | — | ||||||||||

Tax benefits on restructuring | — | 93.6 | — | — | — | ||||||||||

Asset impairment reserve | — | (35.8 | ) | — | — | — | |||||||||

Reduction in asset sale reserves | — | 5.6 | — | — | — | ||||||||||

Gain (loss) on disposition of assets | — | — | 0.7 | 52.3 | 1.4 | ||||||||||

Asset and contract impairments | — | — | — | (141.9 | ) | — | |||||||||

Turbine commitment | — | — | — | (117.2 | ) | — | |||||||||

Development costs | — | — | — | (21.3 | ) | — | |||||||||

Restructuring costs | — | — | — | (39.0 | ) | (3.5 | ) | ||||||||

Damhead Creek mark-to-market gas contract | — | — | — | — | 23.5 | ||||||||||

Total | — | 13.3 | 103.3 | (267.1 | ) | 21.4 | |||||||||

TOTAL SPECIAL ITEMS | (44.7 | ) | 30.0 | (54.6 | ) | (267.1 | ) | 0.5 | |||||||

12

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

DESCRIPTION OF ENTERGY CORPORATION CONSOLIDATED SPECIAL ITEMS

UTILITY/PARENT/OTHER SPECIAL ITEMS | Main Earnings Category | |

Retail business impairment reserve | Discontinued operations | |

Retail business discontinued operations | Discontinued operations | |

Tax benefits – Entergy-Koch investment | Income taxes | |

River Bend loss provision | Other income: miscellaneous-net | |

SFAS 143 implementation | Cumulative effect of accounting changes | |

Voluntary severance plan | Operating expenses: Other operation and maintenance | |

Merger expenses | Operating expenses: Other operation and maintenance | |

Write-down of MyHomeKey investment | Operating expenses: Other operation and maintenance | |

COMPETITIVE BUSINESSES SPECIAL ITEMS | ||

Entergy Nuclear | ||

SFAS 143 implementation | Cumulative effect of accounting changes | |

Voluntary severance plan | Operating expenses: Other operation and maintenance | |

Energy Commodity Services | ||

Entergy-Koch Trading earnings | Other income: equity in earnings (loss) of unconsolidated equity affiliates | |

Gulf South Pipeline earnings | Other income: equity in earnings (loss) of unconsolidated equity affiliates | |

Tax benefits on restructuring | Income taxes | |

Asset impairment reserve | Operating expenses: Provision for turbine commitments, asset impairments and restructuring charges | |

Reduction in asset sale reserves | Operating expenses: Provision for turbine commitments, asset impairments and restructuring charges | |

Gain (loss) on disposition of assets | Operating expenses: Provision for turbine commitments, asset impairments and restructuring charges | |

Asset and contract impairments | Operating expenses: Provision for turbine commitments, asset impairments and restructuring charges | |

Turbine commitment | Operating expenses: Provision for turbine commitments, asset impairments and restructuring charges | |

Development costs | Operating expenses: Provision for turbine commitments, asset impairments and restructuring charges | |

Restructuring costs | Operating expenses: Provision for turbine commitments, asset impairments and restructuring charges | |

Damhead Creek mark-to-market gas contract | Cumulative effect of accounting changes | |

13

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

CONSOLIDATED STATEMENTS OF INCOME

| 2005(a) | 2004(b) | 2003 | 2002 | 2001 | ||||||||||||||||

| In thousands, except share data, for the years ended December 31, | ||||||||||||||||||||

OPERATING REVENUES: | ||||||||||||||||||||

Domestic electric | $ | 8,446,830 | $ | 7,932,577 | $ | 7,397,175 | $ | 6,646,414 | $ | 7,244,827 | ||||||||||

Natural gas | 77,660 | 208,499 | 186,176 | 125,353 | 185,902 | |||||||||||||||

Competitive businesses | 1,581,757 | 1,544,445 | 1,449,363 | 1,527,285 | 2,189,832 | |||||||||||||||

Total | 10,106,247 | 9,685,521 | 9,032,714 | 8,299,052 | 9,620,561 | |||||||||||||||

OPERATING EXPENSES: | ||||||||||||||||||||

Operating and maintenance: | ||||||||||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale | 2,176,015 | 2,488,208 | 1,987,217 | 2,154,596 | 3,681,677 | |||||||||||||||

Purchased power | 2,521,247 | 1,701,610 | 1,579,057 | 829,995 | 1,021,388 | |||||||||||||||

Nuclear refueling outage expenses | 162,653 | 166,072 | 159,995 | 105,592 | 89,145 | |||||||||||||||

Provision for turbine commitments, asset impairments, and restructuring charges | — | 55,000 | (7,743 | ) | 428,456 | — | ||||||||||||||

Other operation and maintenance | 2,122,206 | 2,268,332 | 2,423,951 | 2,468,551 | 2,133,468 | |||||||||||||||

Decommissioning | 143,121 | 149,529 | 146,100 | 76,417 | 28,586 | |||||||||||||||

Taxes other than income taxes | 382,521 | 403,635 | 402,571 | 379,967 | 399,364 | |||||||||||||||

Depreciation and amortization | 856,377 | 893,574 | 849,771 | 838,472 | 720,878 | |||||||||||||||

Other regulatory credits - net | (49,882 | ) | (90,611 | ) | (13,761 | ) | (141,836 | ) | (20,510 | ) | ||||||||||

Total | 8,314,258 | 8,035,349 | 7,527,158 | 7,140,210 | 8,053,996 | |||||||||||||||

OPERATING INCOME | 1,791,989 | 1,650,172 | 1,505,556 | 1,158,842 | 1,566,565 | |||||||||||||||

OTHER INCOME: | ||||||||||||||||||||

Allowance for equity funds used during construction | 45,736 | 39,582 | 42,710 | 31,658 | 26,209 | |||||||||||||||

Interest and dividend income | 150,479 | 109,635 | 87,334 | 118,282 | 159,696 | |||||||||||||||

Equity in earnings (loss) of unconsolidated equity affiliates | 985 | (78,727 | ) | 271,647 | 183,878 | 162,882 | ||||||||||||||

Miscellaneous – net | 14,251 | 55,509 | (76,376 | ) | 13,864 | 332 | ||||||||||||||

Total | 211,451 | 125,999 | 325,315 | 347,682 | 349,119 | |||||||||||||||

INTEREST AND OTHER CHARGES: | ||||||||||||||||||||

Interest on long-term debt | 440,334 | 463,384 | 485,964 | 526,442 | 563,758 | |||||||||||||||

Other interest – net | 64,646 | 40,133 | 52,868 | 70,401 | 172,118 | |||||||||||||||

Allowance for borrowed funds used during construction | (29,376 | ) | (25,741 | ) | (33,191 | ) | (24,538 | ) | (21,419 | ) | ||||||||||

Total | 475,604 | 477,776 | 505,641 | 572,305 | 714,457 | |||||||||||||||

INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES AND CUMULATIVE EFFECT OF ACCOUNTING CHANGES | 1,527,836 | 1,298,395 | 1,325,230 | 934,219 | 1,201,227 | |||||||||||||||

Income taxes | 559,284 | 365,305 | 497,433 | 300,592 | 462,165 | |||||||||||||||

INCOME FROM CONTINUING OPERATIONS BEFORE CUMULATIVE EFFECT OF ACCOUNTING CHANGES | 968,552 | 933,090 | 827,797 | 633,627 | 739,062 | |||||||||||||||

LOSS FROM DISCONTINUED OPERATIONS (net of income tax expense (benefit) of $(24,051), $603, $(7,359), $(6,654), $(6,472) respectively) | (44,794 | ) | (41 | ) | (14,404 | ) | (10,555 | ) | (12,037 | ) | ||||||||||

CUMULATIVE EFFECT OF ACCOUNTING CHANGES (net of income taxes of $ 89,925 in 2003 and $10,064 in 2001) | — | — | 137,074 | — | 23,482 | |||||||||||||||

CONSOLIDATED NET INCOME | 923,758 | 933,049 | 950,467 | 623,072 | 750,507 | |||||||||||||||

Preferred dividend requirements and other | 25,427 | 23,525 | 23,524 | 23,712 | 24,311 | |||||||||||||||

EARNINGS APPLICABLE TO COMMON STOCK | $ | 898,331 | $ | 909,524 | $ | 926,943 | $ | 599,360 | $ | 726,196 | ||||||||||

Basic earnings (loss) per average common share: | ||||||||||||||||||||

Continuing operations | $ | 4.49 | $ | 4.01 | $ | 3.55 | $ | 2.73 | $ | 3.23 | ||||||||||

Discontinued operations | $ | (0.21 | ) | – | $ | (0.06 | ) | $ | (0.04 | ) | $ | (0.05 | ) | |||||||

Cumulative effect of accounting changes | – | – | $ | 0.60 | – | $ | 0.11 | |||||||||||||

Basic earnings (loss) per average common share | $ | 4.27 | $ | 4.01 | $ | 4.09 | $ | 2.69 | $ | 3.29 | ||||||||||

Diluted earnings (loss) per average common share: | ||||||||||||||||||||

Continuing operations | $ | 4.40 | $ | 3.93 | $ | 3.48 | $ | 2.68 | $ | 3.18 | ||||||||||

Discontinued operations | $ | (0.21 | ) | – | $ | (0.06 | ) | $ | (0.04 | ) | $ | (0.05 | ) | |||||||

Cumulative effect of accounting changes | – | – | $ | 0.59 | – | $ | 0.10 | |||||||||||||

Diluted earnings (loss) per average common share | $ | 4.19 | $ | 3.93 | $ | 4.01 | $ | 2.64 | $ | 3.23 | ||||||||||

Dividends declared per common share | $ | 2.16 | $ | 1.89 | $ | 1.60 | $ | 1.34 | $ | 1.28 | ||||||||||

Average number of common shares outstanding: | ||||||||||||||||||||

Basic | 210,141,887 | 226,863,758 | 226,804,370 | 223,047,431 | 220,944,270 | |||||||||||||||

Diluted | 214,441,362 | 231,193,686 | 231,146,040 | 227,303,103 | 224,733,662 | |||||||||||||||

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

| (b) | Pro Forma Income Statement reflecting deconsolidation of Entergy New Orleans, Inc. can be found on page 55. |

Certain prior year data has been reclassified to conform with current year presentation.

14

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

2005 CONSOLIDATING INCOME STATEMENT (unaudited)(a)

| Utility/ Parent/ Other | Competitive Businesses | Eliminations | Consolidated | |||||||||||||

| In thousands, except share data, for the year ended December 31, 2005. | ||||||||||||||||

OPERATING REVENUES: | ||||||||||||||||

Domestic electric | $ | 8,449,281 | $ | — | $ | (2,452 | ) | $ | 8,446,830 | |||||||

Natural gas | 77,660 | — | — | 77,660 | ||||||||||||

Competitive businesses | 46,003 | 1,613,280 | (77,526 | ) | 1,581,757 | |||||||||||

Total | 8,572,944 | 1,613,280 | (79,978 | ) | 10,106,247 | |||||||||||

OPERATING EXPENSES: | ||||||||||||||||

Operating and Maintenance: | ||||||||||||||||

Fuel, fuel-related expenses, and gas purchased for resale | 1,941,887 | 234,128 | — | 2,176,015 | ||||||||||||

Purchased power | 2,559,536 | 40,092 | (78,382 | ) | 2,521,247 | |||||||||||

Nuclear refueling outage expenses | 73,966 | 88,688 | — | 162,653 | ||||||||||||

Other operation and maintenance | 1,458,596 | 665,660 | (2,051 | ) | 2,122,206 | |||||||||||

Decommissioning | 83,910 | 59,212 | — | 143,121 | ||||||||||||

Taxes other than income taxes | 325,766 | 56,756 | — | 382,521 | ||||||||||||

Depreciation and amortization | 789,654 | 66,723 | — | 856,377 | ||||||||||||

Other regulatory credits – net | (49,882 | ) | — | — | (49,882 | ) | ||||||||||

Total | 7,183,433 | 1,211,259 | (80,433 | ) | 8,314,258 | |||||||||||

OPERATING INCOME | 1,389,511 | 402,021 | 455 | 1,791,989 | ||||||||||||

OTHER INCOME: | ||||||||||||||||

Allowance for equity funds used during construction | 45,736 | — | — | 45,736 | ||||||||||||

Interest and dividend income | 125,237 | 95,520 | (70,279 | ) | 150,479 | |||||||||||

Equity in earnings (loss) of unconsolidated equity affiliates | 10,462 | (9,477 | ) | — | 985 | |||||||||||

Miscellaneous– net | (19,030 | ) | 33,740 | (456 | ) | 14,251 | ||||||||||

Total | 162,405 | 119,783 | (70,734 | ) | 211,451 | |||||||||||

INTEREST AND OTHER CHARGES: | ||||||||||||||||

Interest on long-term debt | 427,055 | 13,279 | — | 440,334 | ||||||||||||

Other interest – net | 79,612 | 55,259 | (70,224 | ) | 64,646 | |||||||||||

Allowance for borrowed funds used during construction | (29,376 | ) | — | — | (29,376 | ) | ||||||||||

Total | 477,291 | 68,538 | (70,224 | ) | 475,604 | |||||||||||

INCOME FROM CONTINUING OPERATIONS BEFORE INCOME TAXES | 1,074,625 | 453,266 | (55 | ) | 1,527,836 | |||||||||||

Income taxes | 403,671 | 155,613 | — | 559,284 | ||||||||||||

INCOME FROM CONTINUING OPERATIONS | 670,954 | 297,653 | (55 | ) | 968,552 | |||||||||||

LOSS FROM DISCONTINUED OPERATIONS (net of income tax expense (benefit) of $(24,051)) | (44,794 | ) | — | — | (44,794 | ) | ||||||||||

CONSOLIDATED NET INCOME | 626,160 | 297,653 | (55 | ) | 923,758 | |||||||||||

Preferred dividend requirements and other | 22,007 | 3,475 | (55 | ) | 25,427 | |||||||||||

EARNINGS APPLICABLE TO COMMON STOCK | $ | 604,153 | $ | 294,178 | $ | — | $ | 898,331 | ||||||||

Earnings Per Average Common Share (from continuing operations): | ||||||||||||||||

Basic | $ | 3.09 | $ | 1.40 | $ | — | $ | 4.49 | ||||||||

Diluted | $ | 3.03 | $ | 1.37 | $ | — | $ | 4.40 | ||||||||

Loss Per Average Common Share (from discontinued operations): | ||||||||||||||||

Basic | $ | (0.21 | ) | $ | — | $ | — | $ | (0.21 | ) | ||||||

Diluted | $ | (0.21 | ) | $ | — | $ | — | $ | (0.21 | ) | ||||||

Earnings Per Average Common Share: | ||||||||||||||||

Basic | $ | 2.87 | $ | 1.40 | $ | — | $ | 4.27 | ||||||||

Diluted | $ | 2.82 | $ | 1.37 | $ | — | $ | 4.19 | ||||||||

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

Totals may not foot due to rounding.

15

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

| 2005(a) | 2004(b) | 2003 | 2002 | 2001 | ||||||||||||||||

| In thousands, as of December 31, | ||||||||||||||||||||

ASSETS | ||||||||||||||||||||

CURRENT ASSETS: | ||||||||||||||||||||

Cash and cash equivalents: | ||||||||||||||||||||

Cash | $ | 221,773 | $ | 79,136 | $ | 115,112 | $ | 169,788 | $ | 129,866 | ||||||||||

Temporary cash investments - at cost,which approximates market | 361,047 | 540,650 | 392,013 | 1,165,260 | 618,327 | |||||||||||||||

Special deposits | — | — | 308 | 280 | 3,380 | |||||||||||||||

Total cash and cash equivalents | 582,820 | 619,786 | 507,433 | 1,335,328 | 751,573 | |||||||||||||||

Other temporary investments | — | 187,950 | 234,800 | — | 150,000 | |||||||||||||||

Notes receivable - Entergy New Orleans DIP loan | 90,000 | — | — | — | — | |||||||||||||||

Notes receivable | 3,227 | 3,092 | 1,730 | 2,078 | 2,137 | |||||||||||||||

Accounts receivable: | ||||||||||||||||||||

Customer | 732,455 | 435,191 | 398,091 | 323,215 | 294,799 | |||||||||||||||

Allowance for doubtful accounts | (30,805 | ) | (23,758 | ) | (25,976 | ) | (27,285 | ) | (28,355 | ) | ||||||||||

Other | 356,414 | 342,289 | 246,824 | 244,621 | 295,771 | |||||||||||||||

Accrued unbilled revenues | 477,570 | 460,039 | 384,860 | 319,133 | 268,680 | |||||||||||||||

Total receivables | 1,535,634 | 1,213,761 | 1,003,799 | 859,684 | 830,895 | |||||||||||||||

Deferred fuel costs | 543,927 | 55,069 | 245,973 | 55,653 | 172,444 | |||||||||||||||

Accumulated deferred income taxes | — | 76,899 | — | — | 6,488 | |||||||||||||||

Fuel inventory - at average cost | 206,195 | 127,251 | 110,482 | 96,467 | 97,497 | |||||||||||||||

Materials and supplies - at average cost | 610,932 | 569,407 | 548,921 | 525,900 | 460,644 | |||||||||||||||

Deferred nuclear refueling outage costs | 157,764 | 107,782 | 138,836 | 163,646 | 79,755 | |||||||||||||||

Prepayments and other | 325,795 | 116,279 | 127,270 | 166,827 | 205,097 | |||||||||||||||

Total | 4,056,294 | 3,077,276 | 2,919,244 | 3,205,583 | 2,756,530 | |||||||||||||||

OTHER PROPERTY AND INVESTMENTS: | ||||||||||||||||||||

Investment in affiliates - at equity | 296,784 | 231,779 | 1,053,328 | 824,209 | 766,103 | |||||||||||||||

Decommissioning trust funds | 2,606,765 | 2,453,406 | 2,278,533 | 2,069,198 | 1,775,950 | |||||||||||||||

Non-utility property - at cost (less accumulated depreciation) | 228,833 | 219,717 | 262,384 | 297,294 | 295,616 | |||||||||||||||

Other | 81,535 | 90,992 | 152,681 | 277,539 | 495,542 | |||||||||||||||

Total | 3,213,917 | 2,995,894 | 3,746,926 | 3,468,240 | 3,333,211 | |||||||||||||||

PROPERTY, PLANT AND EQUIPMENT: | ||||||||||||||||||||

Electric | 29,161,027 | 29,053,340 | 28,035,899 | 26,789,538 | 26,359,676 | |||||||||||||||

Property under capital lease | 727,565 | 738,554 | 751,815 | 746,624 | 753,310 | |||||||||||||||

Natural gas | 86,794 | 262,787 | 236,622 | 209,969 | 201,841 | |||||||||||||||

Construction work in progress | 1,524,085 | 1,197,551 | 1,380,982 | 1,232,891 | 882,829 | |||||||||||||||

Nuclear fuel under capital lease | 271,615 | 262,469 | 278,683 | 259,433 | 265,464 | |||||||||||||||

Nuclear fuel | 436,646 | 320,813 | 234,421 | 263,609 | 232,387 | |||||||||||||||

Total property, plant and equipment | 32,207,732 | 31,835,514 | 30,918,422 | 29,502,064 | 28,695,507 | |||||||||||||||

Less - accumulated depreciation and amortization | 13,010,687 | 13,139,883 | 12,619,625 | 11,837,061 | 11,805,578 | |||||||||||||||

Property, plant and equipment - net | 19,197,045 | 18,695,631 | 18,298,797 | 17,665,003 | 16,889,929 | |||||||||||||||

DEFERRED DEBITS AND OTHER ASSETS: | ||||||||||||||||||||

Regulatory assets: | ||||||||||||||||||||

SFAS 109 regulatory asset – net | 735,221 | 746,413 | 830,539 | 844,105 | 946,126 | |||||||||||||||

Other regulatory assets | 2,133,724 | 1,429,261 | 1,398,323 | 973,185 | 873,985 | |||||||||||||||

Deferred fuel costs | 120,489 | 30,842 | — | — | — | |||||||||||||||

Long-term receivables | 25,572 | 39,417 | 20,886 | 24,703 | 28,083 | |||||||||||||||

Goodwill | 377,172 | 377,172 | 377,172 | 377,172 | 377,172 | |||||||||||||||

Other | 991,835 | 918,871 | 935,501 | 946,375 | 705,275 | |||||||||||||||

Total | 4,384,013 | 3,541,976 | 3,562,421 | 3,165,540 | 2,930,641 | |||||||||||||||

TOTAL ASSETS | $ | 30,851,269 | $ | 28,310,777 | $ | 28,527,388 | $ | 27,504,366 | $ | 25,910,311 | ||||||||||

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

| (b) | Pro Forma Balance Sheet reflecting deconsolidation of Entergy New Orleans, Inc. can be found on pages 56 – 57. |

Certain prior year data has been reclassified to conform with current year presentation.

16

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

CONSOLIDATED BALANCE SHEETS

| 2005(a) | 2004(b) | 2003 | 2002 | 2001 | ||||||||||||||||

| In thousands, as of December 31, | ||||||||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||

CURRENT LIABILITIES: | ||||||||||||||||||||

Currently maturing long-term debt | $ | 103,517 | $ | 492,564 | $ | 524,372 | $ | 1,191,320 | $ | 682,771 | ||||||||||

Notes payable | 40,041 | 193 | 351 | 351 | 351,018 | |||||||||||||||

Accounts payable | 1,655,787 | 896,528 | 796,572 | 855,446 | 592,529 | |||||||||||||||

Customer deposits | 222,206 | 222,320 | 199,620 | 198,442 | 188,230 | |||||||||||||||

Taxes accrued | 188,159 | 224,011 | 224,926 | 385,315 | 550,133 | |||||||||||||||

Accumulated deferred income taxes | 143,409 | — | 22,963 | 26,468 | — | |||||||||||||||

Nuclear refueling outage costs | 15,548 | — | 8,238 | 14,244 | 2,080 | |||||||||||||||

Interest accrued | 154,855 | 144,478 | 139,603 | 175,440 | 192,420 | |||||||||||||||

Obligations under capital leases | 130,882 | 133,847 | �� | 159,978 | 153,822 | 149,352 | ||||||||||||||

Other | 473,510 | 218,442 | 145,453 | 171,341 | 396,616 | |||||||||||||||

Total | 3,127,914 | 2,332,383 | 2,222,076 | 3,172,189 | 3,105,149 | |||||||||||||||

NON-CURRENT LIABILITIES: | ||||||||||||||||||||

Accumulated deferred income taxes and taxes accrued | 5,279,228 | 5,067,381 | 4,779,513 | 4,250,800 | 3,974,664 | |||||||||||||||

Accumulated deferred investment tax credits | 376,550 | 399,228 | 420,248 | 447,925 | 471,090 | |||||||||||||||

Obligations under capital leases | 175,005 | 146,060 | 153,898 | 155,943 | 181,085 | |||||||||||||||

Other regulatory liabilities | 408,667 | 329,767 | 291,239 | 185,579 | 135,878 | |||||||||||||||

Decommissioning and retirement cost liabilities | 1,923,971 | 2,066,277 | 2,215,490 | 2,115,744 | 1,194,333 | |||||||||||||||

Transition to competition | 79,101 | 79,101 | 79,098 | 79,098 | 231,512 | |||||||||||||||

Regulatory reserves | 18,624 | 103,061 | 69,528 | 56,438 | 37,591 | |||||||||||||||

Accumulated provisions | 556,028 | 549,914 | 506,960 | 389,868 | 425,399 | |||||||||||||||

Long-term debt | 8,824,493 | 7,016,831 | 7,322,940 | 7,308,649 | 7,536,028 | |||||||||||||||

Preferred stock with sinking fund | 13,950 | 17,400 | 20,852 | — | — | |||||||||||||||

Other | 1,879,017 | 1,541,331 | 1,407,551 | 1,145,232 | 801,040 | |||||||||||||||

Total | 19,534,634 | 17,316,351 | 17,267,317 | 16,135,276 | 14,988,620 | |||||||||||||||

Preferred stock with sinking fund | — | — | — | 24,327 | 26,185 | |||||||||||||||

Preferred stock without sinking fund | 445,974 | 365,356 | 334,337 | 334,337 | 334,337 | |||||||||||||||

SHAREHOLDERS’ EQUITY: | ||||||||||||||||||||

Common stock, $.01 par value, authorized 500,000,000 shares; issued 248,174,087 shares in 2005, 2004, 2003, 2002 and 2001 | 2,482 | 2,482 | 2,482 | 2,482 | 2,482 | |||||||||||||||

Paid-in capital | 4,817,637 | 4,835,375 | 4,767,615 | 4,666,753 | 4,662,704 | |||||||||||||||

Retained earnings | 5,428,407 | 4,984,302 | 4,502,508 | 3,938,693 | 3,638,448 | |||||||||||||||

Accumulated other comprehensive loss | (343,819 | ) | (93,453 | ) | (7,795 | ) | (22,360 | ) | (88,794 | ) | ||||||||||

Less – treasury stock, at cost (40,644,602 shares in 2005; 31,345,028 shares in 2004; 19,276,445 shares in 2003; 25,752,410 shares in 2002; 27,441,384 shares in 2001) | 2,161,960 | 1,432,019 | 561,152 | 747,331 | 758,820 | |||||||||||||||

Total | 7,742,747 | 8,296,687 | 8,703,658 | 7,838,237 | 7,456,020 | |||||||||||||||

Commitments and Contingencies | ||||||||||||||||||||

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 30,851,269 | $ | 28,310,777 | $ | 28,527,388 | $ | 27,504,366 | $ | 25,910,311 | ||||||||||

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

| (b) | Pro Forma Balance Sheet reflecting deconsolidation of Entergy New Orleans, Inc. can be found on pages 56 – 57. |

Certain prior year data has been reclassified to conform with current year presentation.

17

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

2005 CONSOLIDATING BALANCE SHEET (unaudited)(a)

Utility/ Other | Competitive Businesses | Eliminations | Consolidated | |||||||||||||

| In thousands, as of December 31, 2005. | ||||||||||||||||

ASSETS | ||||||||||||||||

CURRENT ASSETS: | ||||||||||||||||

Cash and cash equivalents: | ||||||||||||||||

Cash | $ | 207,135 | $ | 14,638 | $ | — | $ | 221,773 | ||||||||

Temporary cash investments - at cost, which approximates market | 127,786 | 233,261 | — | 361,047 | ||||||||||||

Total cash and cash equivalents | 334,921 | 247,899 | — | 582,820 | ||||||||||||

Notes receivable - Entergy New Orleans DIP loan | 90,000 | 90,000 | ||||||||||||||

Notes receivable | 575,873 | 1,144,505 | (1,717,151 | ) | 3,227 | |||||||||||

Accounts receivable: | ||||||||||||||||

Customer | 732,455 | — | — | 732,455 | ||||||||||||

Allowance for doubtful accounts | (28,635 | ) | (2,170 | ) | — | (30,805 | ) | |||||||||

Associated companies | 33,851 | 69,719 | (103,570 | ) | — | |||||||||||

Other | 193,548 | 162,866 | — | 356,414 | ||||||||||||

Accrued unbilled revenues | 477,570 | — | — | 477,570 | ||||||||||||

Total receivables | 1,408,789 | 230,415 | (103,570 | ) | 1,535,634 | |||||||||||

Deferred fuel costs | 543,927 | — | — | 543,927 | ||||||||||||

Accumulated deferred income taxes | — | — | — | — | ||||||||||||

Fuel inventory - at average cost | 204,382 | 1,813 | — | 206,195 | ||||||||||||

Materials and supplies - at average cost | 369,397 | 241,535 | — | 610,932 | ||||||||||||

Deferred nuclear refueling outage costs | 64,157 | 93,607 | — | 157,764 | ||||||||||||

Prepayments and other | 301,387 | 24,408 | — | 325,795 | ||||||||||||

Total | 3,892,833 | 1,984,182 | (1,820,721 | ) | 4,056,294 | |||||||||||

OTHER PROPERTY AND INVESTMENTS: | ||||||||||||||||

Investment in affiliates - at equity | 8,198,240 | 428,006 | (8,329,462 | ) | 296,784 | |||||||||||

Decommissioning trust funds | 1,136,006 | 1,470,759 | — | 2,606,765 | ||||||||||||

Non-utility property - at cost (less accumulated depreciation) | 226,264 | 2,569 | — | 228,833 | ||||||||||||

Other | 35,594 | 45,941 | — | 81,535 | ||||||||||||

Total | 9,596,104 | 1,947,275 | (8,329,462 | ) | 3,213,917 | |||||||||||

PROPERTY, PLANT AND EQUIPMENT: | ||||||||||||||||

Electric | 27,176,956 | 1,987,079 | (3,008 | ) | 29,161,027 | |||||||||||

Property under capital lease | 727,565 | — | — | 727,565 | ||||||||||||

Natural gas | 86,794 | — | — | 86,794 | ||||||||||||

Construction work in progress | 1,291,374 | 232,711 | — | 1,524,085 | ||||||||||||

Nuclear fuel under capital lease | 271,615 | — | — | 271,615 | ||||||||||||

Nuclear fuel | 101,403 | 335,243 | — | 436,646 | ||||||||||||

Total property, plant and equipment | 29,655,707 | 2,555,033 | (3,008 | ) | 32,207,732 | |||||||||||

Less - accumulated depreciation and amortization | 12,730,545 | 280,142 | — | 13,010,687 | ||||||||||||

Property, plant and equipment - net | 16,925,162 | 2,274,891 | (3,008 | ) | 19,197,045 | |||||||||||

DEFERRED DEBITS AND OTHER ASSETS: | ||||||||||||||||

Regulatory assets: | ||||||||||||||||

SFAS 109 regulatory asset - net | 735,221 | — | — | 735,221 | ||||||||||||

Other regulatory assets | 2,133,724 | — | — | 2,133,724 | ||||||||||||

Deferred fuel costs | 120,489 | — | — | 120,489 | ||||||||||||

Long-term receivables | 25,572 | — | — | 25,572 | ||||||||||||

Goodwill | 374,099 | 3,073 | — | 377,172 | ||||||||||||

Other | 841,068 | 801,587 | (650,820 | ) | 991,835 | |||||||||||

Total | 4,230,173 | 804,660 | (650,820 | ) | 4,384,013 | |||||||||||

TOTAL ASSETS | $ | 34,644,272 | $ | 7,011,008 | $ | (10,804,011 | ) | $ | 30,851,269 | |||||||

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

Totals may not foot due to rounding.

18

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

2005 CONSOLIDATING BALANCE SHEET (unaudited)(a)

Utility/ Other | Competitive Businesses | Eliminations | Consolidated | |||||||||||||

| In thousands, as of December 31, 2005. | ||||||||||||||||

LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||

CURRENT LIABILITIES: | ||||||||||||||||

Currently maturing long-term debt | $ | 22,989 | $ | 80,528 | $ | — | $ | 103,517 | ||||||||

Notes payable: | ||||||||||||||||

Associated companies | 926,271 | 530,880 | (1,457,151 | ) | — | |||||||||||

Other | 40,041 | — | — | 40,041 | ||||||||||||

Accounts payable: | ||||||||||||||||

Associated companies | 77,793 | 23,393 | (101,186 | ) | — | |||||||||||

Other | 1,494,385 | 161,402 | — | 1,655,787 | ||||||||||||

Customer deposits | 222,044 | 162 | — | 222,206 | ||||||||||||

Taxes accrued | 316,659 | (128,500 | ) | — | 188,159 | |||||||||||

Accumulated deferred income taxes | 143,409 | — | — | 143,409 | ||||||||||||

Nuclear refueling outage costs | 15,548 | — | — | 15,548 | ||||||||||||

Interest accrued | 153,269 | 1,586 | — | 154,855 | ||||||||||||

Obligations under capital leases | 130,882 | — | — | 130,882 | ||||||||||||

Other | 66,367 | 407,143 | — | 473,510 | ||||||||||||

Total | 3,609,657 | 1,076,594 | (1,558,337 | ) | 3,127,914 | |||||||||||

NON-CURRENT LIABILITIES: | ||||||||||||||||

Accumulated deferred income taxes and taxes accrued | 5,245,208 | 34,020 | — | 5,279,228 | ||||||||||||

Accumulated deferred investment tax credits | 376,550 | — | — | 376,550 | ||||||||||||

Obligations under capital leases | 175,005 | — | — | 175,005 | ||||||||||||

Other regulatory liabilities | 408,667 | — | — | 408,667 | ||||||||||||

Decommissioning and retirement cost liabilities | 1,161,830 | 762,141 | — | 1,923,971 | ||||||||||||

Transition to competition | 79,101 | — | — | 79,101 | ||||||||||||

Regulatory reserves | 18,624 | — | — | 18,624 | ||||||||||||

Accumulated provisions | 350,265 | 205,763 | — | 556,028 | ||||||||||||

Long-term debt | 8,791,811 | 349,073 | (316,391 | ) | 8,824,493 | |||||||||||

Preferred stock with sinking fund | 13,950 | — | — | 13,950 | ||||||||||||

Other | 1,729,076 | 749,961 | (600,021 | ) | 1,879,017 | |||||||||||

Total | 18,350,087 | 2,100,958 | (916,412 | ) | 19,534,634 | |||||||||||

Preferred stock without sinking fund | 411,321 | 426,590 | (391,937 | ) | 445,974 | |||||||||||

SHAREHOLDERS’ EQUITY: | ||||||||||||||||

Common stock, $.01 par value, authorized 500,000,000 shares; issued 248,174,087 shares in 2005 | 2,205,192 | 1,091,856 | (3,294,566 | ) | 2,482 | |||||||||||

Paid-in capital | 6,653,879 | 1,565,320 | (3,401,562 | ) | 4,817,637 | |||||||||||

Retained earnings | 5,712,395 | 1,121,151 | (1,405,139 | ) | 5,428,407 | |||||||||||

Accumulated other comprehensive income (loss) | (16,300 | ) | (328,145 | ) | 626 | (343,819 | ) | |||||||||

Less – treasury stock, at cost (40,644,602 shares in 2005) | 2,281,960 | 43,316 | (163,316 | ) | 2,161,960 | |||||||||||

Total | 12,273,206 | 3,406,866 | (7,937,325 | ) | 7,742,747 | |||||||||||

Commitments and Contingencies | ||||||||||||||||

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 34,644,272 | $ | 7,011,008 | $ | (10,804,011 | ) | $ | 30,851,269 | |||||||

| (a) | 2005 reflects deconsolidation of Entergy New Orleans, Inc. |

Totals may not foot due to rounding.

19

CONSOLIDATED FINANCIAL RESULTS

FINANCIAL RESULTS

CONSOLIDATED STATEMENTS OF CASH FLOW

| 2005(a) | 2004(b) | 2003 | 2002 | 2001 | ||||||||||||||||

| In thousands, for the years ended December 31, | ||||||||||||||||||||

OPERATING ACTIVITIES: | ||||||||||||||||||||

Consolidated net income | $ | 923,758 | $ | 933,049 | $ | 950,467 | $ | 623,072 | $ | 750,507 | ||||||||||

Adjustments to reconcile consolidated net income to net cash flow provided by operating activities: | ||||||||||||||||||||

Reserve for regulatory adjustments | (82,033 | ) | 33,533 | 13,090 | 18,848 | (359,199 | ) | |||||||||||||

Other regulatory credits - net | (49,882 | ) | (90,611 | ) | (13,761 | ) | (141,836 | ) | (20,510 | ) | ||||||||||