Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Nos. 333-203320 and 333-203320-01

|

| | |

ENTERGY NEW ORLEANS STORM RECOVERY FUNDING I, L.L.C. | PRELIMINARY TERM SHEET | July 9, 2015 |

Entergy New Orleans Storm Recovery Funding I, L.L.C.

Issuing Entity

$98,730,000*

Senior Secured Storm Recovery Bonds

Transaction Summary

We, Entergy New Orleans Storm Recovery Funding I, L.L.C., are issuing $98,730,000* of Senior Secured Storm Recovery Bonds in a single tranche (the “bonds”). The bonds are our senior secured obligations secured primarily by storm recovery property, which includes the irrevocable right to impose, bill, charge, collect and receive a nonbypassable consumption-based charge, known as a storm recovery charge, paid by all existing and future customers receiving electric transmission or distribution retail electric service, or both, from Entergy New Orleans, Inc. (“ENO”) or its successors or assignees under rate schedules or special contracts approved by the Council (the “Council”) of the City of New Orleans (the “City”). As of December 31, 2014, ENO provided electric service to approximately 171,120 retail customers in Louisiana.

In May 2006, the Louisiana legislature enacted The Louisiana Electric Utility Storm Recovery Securitization Act, which authorized electric utilities to use securitization financing for storm recovery costs, including the funding and replenishment of storm reserves. This provision of Louisiana law, the Securitization Law, is codified at Louisiana Revised Statutes 45:1226-1236. The Securitization Law governs the application for, and the Council’s issuance of, a financing order allowing for the securitization of storm recovery costs and upfront financing costs. A Louisiana utility which furnishes electric service within the City must apply to the Council for a financing order under the Securitization Law to authorize the issuance of storm recovery bonds. ENO applied for a financing order under the Securitization Law, which was issued by the Council on May 14, 2015 and became final and non-appealable on June 16, 2015 (the “financing order”).

In the financing order, the Council authorized a storm recovery charge to be imposed on customers in an amount sufficient at all times to pay principal and interest on the bonds and other expenses. In the financing order, the Council requires that storm recovery charges be adjusted at least semi-annually (and quarterly following the last scheduled final payment date until all of the bonds and associated costs are paid in full), and authorizes more frequent adjustments as necessary to ensure the expected recovery of amounts sufficient to timely provide all scheduled payments of principal and interest on the bonds (the “true-up mechanism”). Through the true-up mechanism, customers cross share in the liabilities of other customers for the payment of storm recovery charges. Certain self-generation is exempted from the storm recovery charges under the financing order. ENO, as servicer, will collect storm recovery charges on our behalf and remit the estimated storm recovery charges daily to a trustee.

In the financing order, the Council has pledged that the financing order is irrevocable until the indefeasible (i.e., not voidable) payment in full of the bonds and the financing costs. Except in connection with a refinancing, or to implement any true-up mechanism authorized by the Securitization Law, the Council has pledged that it will not amend, modify, or terminate the financing order by any subsequent action or reduce, impair, postpone, terminate, or otherwise adjust the storm recovery charges or in any way reduce or impair the value of the storm recovery property.

The bonds are not a liability of ENO or any of its affiliates (other than us). The bonds are also not a debt or general obligation of the State of Louisiana (the “State”), the City, or any other agency, political subdivision or instrumentality of the State or the City. Except in their capacity as customers, neither the State, the City, nor any agency, political subdivision or instrumentality, nor any other public or private entity will be obligated to provide funds for the payment of the bonds. Neither the full faith and credit nor the taxing power of the State or the City are pledged to the payment of the principal of or interest on the bonds.

This Preliminary Term Sheet has been prepared solely for informational purposes and is not an offer to buy or sell or a solicitation of an offer to buy or sell any bonds in any jurisdiction where such offer or sale is prohibited. Please read the important information and qualifications on page 14 of this Preliminary Term Sheet.

_______________________

Citigroup

* Preliminary; subject to change

|

| | |

ENTERGY NEW ORLEANS STORM RECOVERY FUNDING I, L.L.C. | PRELIMINARY TERM SHEET | July 9, 2015 |

$98,730,000*

Entergy New Orleans Storm Recovery Funding I, L.L.C.

Senior Secured Storm Recovery Bonds

Summary of Terms

Anticipated Bond Structure*

|

| | | | | | |

| Tranche | Weighted Expected Average Life (Years) | Size ($) | Scheduled Final Payment Date | Final Maturity Date | Scheduled Sinking Fund Payments Begin | No. of Scheduled Semi-annual Sinking Fund Payments |

| Tranche A | 4.97 | $98,730,000 | June 2024 | June 2027 | June 2016 | 17 |

* Preliminary; subject to change.

|

| |

| Issuing Entity and Capital Structure | Entergy New Orleans Storm Recovery Funding I, L.L.C. We are a direct, wholly-owned subsidiary of ENO and a special purpose bankruptcy remote limited liability company formed under Louisiana law. We were formed solely to purchase and own storm recovery property (described below under “Credit/Security”), to issue storm recovery bonds secured by storm recovery property and to perform any activity incidental thereto. We have covenanted that the bonds offered hereby are the only storm recovery bonds we will issue. |

| | In addition to the storm recovery property, our assets include a capital investment by ENO in the amount of $2,961,900 (3.0% of the bonds’ principal amount issued). This capital contribution will be held in the capital subaccount. We have also created an excess funds subaccount to retain, until the next payment date, any amounts collected and remaining after all payments on the bonds have been made. |

| Securities Offered | Senior secured fixed-rate bonds, as listed above, scheduled to pay principal and interest semi-annually in accordance with the expected sinking fund schedule. See “Expected Sinking Fund Schedule.” |

| Expected Ratings | “AAA(sf)” / “Aa1(sf)” by S&P and Moody’s, respectively. |

| Payment Dates and Interest Accrual | Semi-annually, June 1st and December 1st. Interest will be calculated at a fixed rate on a 30/360 basis. The first scheduled payment date is June 1, 2016. If any interest payment date is not a business day, payments scheduled to be made on such date may be made on the next succeeding business day and no interest shall accrue upon such payment during the intervening period. |

| | Interest is due on each payment date and principal is due upon the final maturity date. |

| No Optional Redemption | Non-callable for the life of the bonds. |

| Average Life | Prepayment is not permitted. Extension risk is possible but the risk is expected to be statistically remote. |

|

| |

| Credit/Security | The bonds are primarily secured by storm recovery property, which includes our irrevocable right to impose, bill, charge, collect and receive a nonbypassable consumption-based storm recovery charge from all customers receiving transmission or distribution retail electric service, or both, from ENO or its successors or assignees. As of December 31, 2014, ENO provided electric service to approximately 171,120 retail customers in Louisiana. In the financing order, the Council requires that storm recovery charges be set and adjusted at least semi-annually (and quarterly following the last scheduled final payment date until all bonds and associated costs are paid in full) and authorizes more frequent adjustments as necessary to ensure the expected collection of amounts sufficient to pay principal of and interest on the bonds and ongoing financing costs on a timely basis. Funds on deposit in the collection account and related subaccounts and our rights under the various transaction documents are also pledged to secure the bonds. See also “Issuing Entity and Capital Structure” and “True-up Mechanism for Payment of Scheduled Principal and Interest.” |

| Storm Recovery Property/Cross Sharing of Liabilities | The storm recovery property consists of all of our rights and all of the rights of ENO under the Securitization Law and the financing order, including our irrevocable right to impose, bill, charge, collect and receive nonbypassable consumption based storm recovery charges and the right to implement the true-up mechanism (but excluding ENO’s rights to recover certain costs and expenses consistent with the terms of the bond indenture). Storm recovery property is a present contract right created under the Securitization Law by the financing order issued by the Council and protected by the State and Council pledges described below. Through the true-up mechanism, all customers cross share in the liabilities of all other customers for the payment of storm recovery charges. |

| Nonbypassable Storm Recovery Charges | The Securitization Law provides that the storm recovery charges are nonbypassable subject to the terms of the financing order. “Nonbypassable” means that ENO collects these charges from all retail electric customers; i.e. any existing or future customers receiving transmission or distribution retail electric service, or both, from ENO or its successors or assignees under rate schedules or special contracts approved by the Council, even if the customer elects to purchase electricity from an alternative electricity supplier as a result of a fundamental change in the manner of regulation of public utilities in Louisiana. Under current law, customers of Louisiana public utilities cannot buy their electricity from alternative electricity suppliers. Certain self-generation is excluded from the calculation of the storm recovery charges. |

| True-up Mechanism for Payment of Scheduled Principal and Interest | As authorized by the Securitization Law, the financing order requires that storm recovery charges be adjusted at least semi-annually (and quarterly following the last scheduled final payment date until all bonds and associated costs are paid in full) to correct any overcollections or undercollections and to ensure the projected recovery of amounts sufficient to provide for the timely payment of scheduled payments of principal, interest and other amounts in respect of the bonds during the subsequent twelve month period, except for the first true-up adjustment period, which may be longer or shorter than six months, but in any event no longer than nine months (or in the case of quarterly adjustments, the period ending on the next bond payment date). The financing order also authorizes the servicer to make more frequent interim true-up adjustments if the servicer forecasts that storm recovery charge collections will be insufficient to make on a timely basis all scheduled payments of principal, interest and other financing costs in respect of the bonds during the current or next succeeding semi-annual payment period and/or to replenish any draws upon the capital subaccount. Additionally, the financing order requires the servicer to request, subject to maintenance of the then current ratings of the bonds, approval from the Council of a non-standard true-up adjustment that the servicer deems necessary or appropriate to address any material deviations between storm recovery charge collections and amounts required to provide for the timely payment of scheduled payments of principal, interest and other amounts in respect of the bonds. These adjustments are intended to ensure the expected recovery of amounts sufficient to timely provide all payments of debt service and other required amounts and charges in connection with the bonds for the two payment dates next succeeding the adjustment. The Securitization Law does not cap the level of storm recovery charges that may be imposed on customers, as a result of the true-up process, to pay on a timely basis scheduled principal of and interest on the bonds. |

| Obligations of the State of Louisiana and the City | The financing order concludes that the true-up mechanism and all other obligations of the State and the City set forth in the financing order are direct, explicit, irrevocable and unconditional upon issuance of the bonds, and are legally enforceable against the State and the City. |

|

| |

| State Pledge | Under the Securitization Law, the State has pledged, for the benefit and protection of storm recovery bondholders and ENO, that (i) it will not alter the provisions of the Securitization Law which authorize the Council to create a contract right by the issuance of a financing order, to create storm recovery property and to make the storm recovery charges irrevocable, binding and nonbypassable charges, (ii) it will not take or permit any action that impairs or would impair the value of the storm recovery property, and (iii) except for the true-up mechanism, or for a refinancing or refunding, it will not reduce, alter, or impair the storm recovery charges that are to be imposed, collected and remitted to storm recovery bondholders until any and all principal, interest, premium, financing costs and other fees, expenses or charges incurred and any contracts to be performed in connection with the bonds have been paid and performed in full. However, nothing will preclude limitation or alteration if and when full compensation is made by law for the full protection of the storm recovery charges collected pursuant to the financing order and the full protection of the storm recovery bondholders and any assignee or financing party. |

| Council Pledge | Pursuant to state law, ENO is under the exclusive regulatory supervision of the Council (except only for public safety matters, which are under the supervision of the Louisiana Public Service Commission). In the financing order, the Council has pledged that the financing order is irrevocable until the indefeasible (i.e., not voidable) payment in full of the bonds and the financing costs. Except in connection with a refinancing or refunding, or to implement any true-up mechanism authorized by the Securitization Law and adopted by the Council, the Council further has pledged that it will not amend, modify, or terminate the financing order by any subsequent action or reduce, impair, postpone, terminate, or otherwise adjust the storm recovery charges or in any way reduce or impair the value of the storm recovery property until the indefeasible (i.e., not voidable) payment in full of the bonds and financing costs. However, nothing will preclude such limitation or alteration of the financing order if and when full compensation is made for the full protection of the storm recovery charges approved pursuant to the financing order and the full protection of the storm recovery bondholders and any assignee or financing party. |

| Tax Treatment | Bonds will be treated as debt for U.S. federal income tax purposes and Louisiana state income tax purposes. |

| Type of Offering | Securities and Exchange Commission (“SEC”) registered. |

| ERISA Eligible | Yes, as described in the base prospectus. |

| OTHER CONSIDERATIONS | |

| Seller/Sponsor/Servicer | ENO is a corporation organized under the laws of the State. ENO is an electric and gas public utility providing services to customers in the City since 1926. All of the common stock in ENO is held by Entergy Corporation, referred to as Entergy, a Delaware corporation based in New Orleans, Louisiana. Entergy is an integrated energy company engaged primarily in electric power production and retail distribution operations. Neither ENO nor Entergy nor any affiliate (other than us) is an obligor on the bonds. As of December 31, 2014, ENO provided electric service to approximately 171,120 retail customers in Louisiana. |

| Structuring Bookrunner | Citigroup Global Markets Inc. |

| | |

| SETTLEMENT | |

| Indenture Trustee | The Bank of New York Mellon, a New York banking corporation |

| Expected Settlement | The closing date will be on or about July [22], 2015, settling flat. DTC, Clearstream and Euroclear. |

| Use of Proceeds | We will use the net proceeds of the issuance of the bonds to pay the upfront financing costs of the bonds and to purchase the storm recovery property from ENO. In accordance with the financing order, ENO will apply the proceeds it receives from the sale of the storm recovery property, net of any upfront financing costs payable by ENO, as a reimbursement for previously-incurred storm recovery costs and to fund and replenish its storm recovery reserve. |

| More Information | For a complete discussion of the proposed transaction, please read the base prospectus and the accompanying prospectus supplement. |

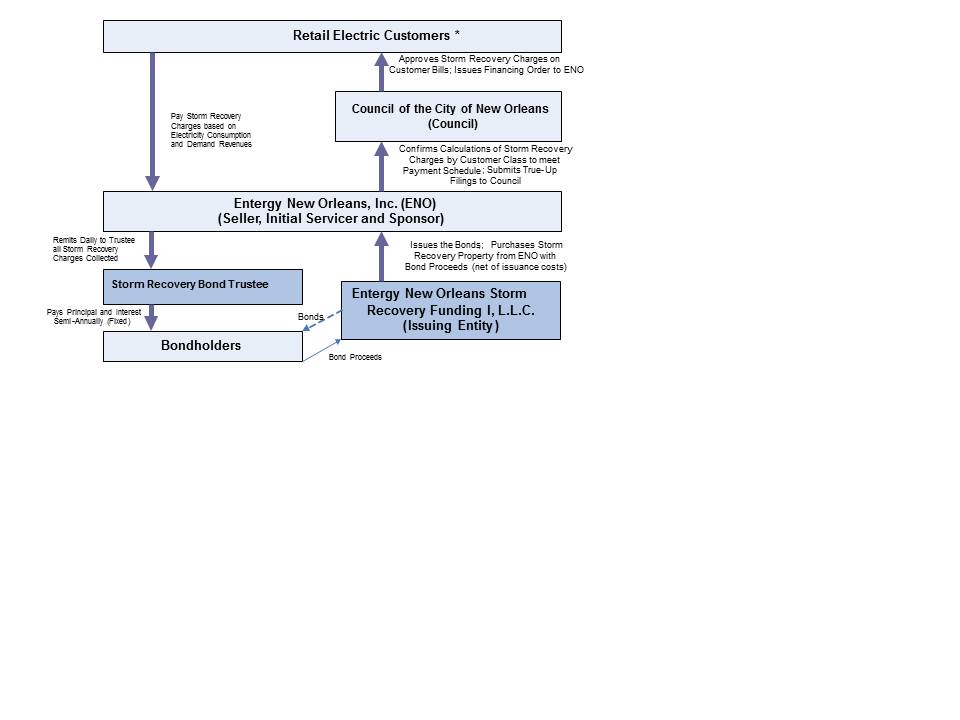

The following chart represents a general summary of the parties to the transactions underlying the offering of the bonds, their roles and their various relationships to the other parties:

Parties to Transaction and Responsibilities

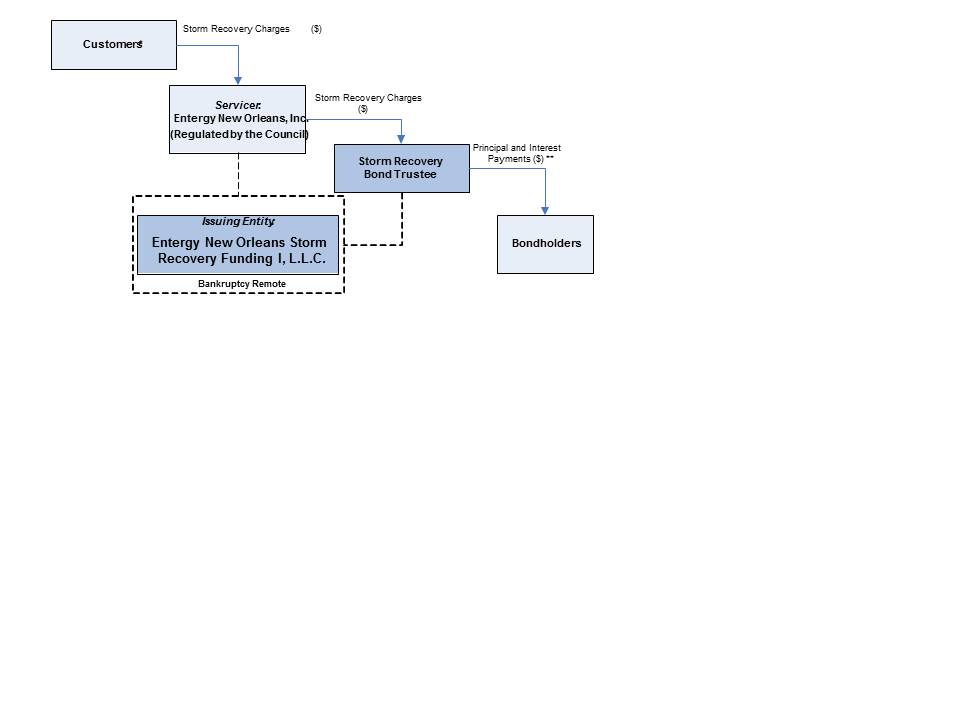

Flow of Funds

The following chart represents a general summary of the flow of funds following issuance of the bonds:

___________________________

| |

| * | As of December 31, 2014, ENO provided electric service to approximately 171,120 retail electric customers. |

| |

| ** | Payments of principal and interest will follow payment of certain fees and operating expenses. |

Key Questions and Answers on the Transaction

| |

| Q1: | Could the Financing Order be rescinded or altered? |

| |

| A: | No. The Securitization Law and the financing order provide that the financing order is irrevocable. |

| |

| Q2: | Are the Council’s obligations under the financing order, including its obligations to implement the true-up mechanism, enforceable by bondholders? |

| |

| A: | Yes. The financing order concludes that the true-up mechanism and all other obligations of the State and the Council set forth in the financing order are direct, explicit, irrevocable and unconditional upon issuance of the bonds, and are legally enforceable against the State and the Council. |

| |

| Q3: | Could the Securitization Law or the financing order be repealed or altered in a manner that will impair the value of the security or prevent timely repayment of the bonds? |

| |

| A: | Not without potentially violating the State pledge in the Securitization Law or the Council pledge in the financing order. Any such action by the State or the Council that impairs the value of the security or timely repayment of the bonds would violate the State’s pledge in the Securitization Law and/or the Council’s pledge in the financing order not to take such action, unless the State or the Council acts in a reasonable and necessary manner to serve a significant and legitimate public purpose, such as protecting the public health and safety or responding to a national or regional catastrophe affecting ENO’s service territory, or if the State or the Council otherwise acts in the valid exercise of the police power. Unlike in certain other states, the citizens of the State do not currently have the constitutional right to adopt or revise state laws by initiative or referendum. Under the Home Rule Charter, voters in the City have the right to amend the Home Rule Charter by referendum, but cannot amend or revise ordinances or resolutions adopted by the Council. Thus, absent an amendment to the Home Rule Charter, the financing order cannot be amended or repealed by direct action of the electorate. |

| |

| Q4: | Are there any reasonably foreseeable circumstances in which the true-up mechanism would not be required to be applied to customer bills, e.g., economic recession, temporary power shortages, blackouts, or bankruptcy of the parent company? |

| |

| A: | No. Once the bonds are issued, the provisions of the financing order (including the true-up mechanism) are unconditional. If collections differ or are projected to differ from forecasted revenues, regardless of the reason, ENO is required semiannually, quarterly following the last final scheduled payment date, and is authorized more frequently if determined necessary by ENO, to submit to the Council an adjustment to the storm recovery charges to ensure the imposition of charges projected to be sufficient to provide payment of principal and interest on the bonds and other costs in connection with the bonds on a timely basis. Under the financing order, the Council will confirm the mathematical accuracy of the adjustment to the storm recovery charges within 15 days. The adjusted storm recovery charges will be reflected on the customer’s bill in the next monthly billing cycle. Any errors identified by the Council will be corrected in the next true-up adjustment. Furthermore, any delinquencies or under-collections in one customer class will be taken into account in the true-up mechanism to adjust the storm recovery charge for all customers of ENO, not just the class of customers from which the delinquency or under-collection arose. |

| |

| Q5: | Can customers avoid paying storm recovery charges if, in the future, they are permitted to purchase electricity from alternative electricity providers? |

| |

| A: | No. The Securitization Law provides that the storm recovery charges are nonbypassable. This means that the storm recovery charges are applied to any existing or future retail electric customer who remains attached to ENO’s (or its successor’s or assignee’s) electric transmission or distribution lines, and who, via such lines, receives any type of service from ENO (or its successor or assignee) under rate schedules or special contracts approved by the Council. However, under current law customers of Louisiana public utilities cannot buy their electricity from alternative electricity providers. Any customer who completely severs interconnection with ENO would no longer be a customer and thus would be exempt from the storm recovery charge. |

| |

| Q6: | Can retail electric customers avoid paying storm recovery charges if the customers self-generate? |

| |

| A: | Under the financing order, certain self-generation is excluded from the calculation of the storm recovery charge. Generally, industrial/commercial-sized self-generation will be exempt if the customer had installed, or had made a substantial financial commitment to install, the self-generation facilities prior to June 1, 2015, or if the self generation serves new load. Net metered self-generation, which is limited to customers (currently, residential customers for self-generation of less than 25kW and commercial customers for self-generation of less than 300kW) using qualifying resources (such as solar) will also be exempt from the charge, but only to the extent that the net-metered customer uses self-generation in a manner that is not reflected on the meter (“behind the meter” usage). In such case the electricity is not delivered by ENO, and hence the usage will be excluded from the calculation of storm recovery charges. As of December 31, 2014, net metered self-generation capacity accounted for approximately 3% of ENO’s peak load. |

| |

| Q7 | Is there any cap or limit on the amount of the storm recovery charge for any customer? |

| |

| A: | No. There is no cap or any time limit on the imposition of storm recovery charges. |

| |

| Q8: | What happens if, for any reason, electricity usage and, as a result, related storm recovery charges, are less than projected at any time over the life of the bonds? |

| |

| A: | The storm recovery charges paid by all retail electric customers will be increased to ensure payment of the bonds pursuant to the true-up mechanism. |

| |

| Q9: | What if customers leave ENO’s service territory or fail to pay the storm recovery charges? |

| |

| A: | In the event customers leave ENO’s service territory or fail to pay the storm recovery charges, the true-up mechanism allows us to recalculate the storm recovery charges such that those ratepayers who do pay will make up the difference. |

Expected Sinking Fund Schedule*

|

| |

| Semi- Annual Payment Date | Principal Repayment |

| Initial Tranche Balance | $98,730,000.00 |

| 6/1/2016 | 6,057,482.72 |

| 12/1/2016 | 5,466,285.47 |

| 6/1/2017 | 5,070,896.75 |

| 12/1/2017 | 5,455,728.51 |

| 6/1/2018 | 5,363,076.82 |

| 12/1/2018 | 5,712,891.80 |

| 6/1/2019 | 5,398,646.66 |

| 12/1/2019 | 5,785,902.16 |

| 6/1/2020 | 5,623,734.99 |

| 12/1/2020 | 5,980,451.49 |

| 6/1/2021 | 5,736,880.48 |

| 12/1/2021 | 6,115,015.49 |

| 6/1/2022 | 5,917,437.05 |

| 12/1/2022 | 6,290,474.44 |

| 6/1/2023 | 6,066,071.77 |

| 12/1/2023 | 6,444,784.85 |

| 6/1/2024 | 6,244,238.54 |

| Number of Payments | 17 |

| |

| * | Preliminary; subject to change. May not total due to rounding. |

Expected Amortization Schedule*

Outstanding Principal Balance

|

| |

Semi-Annual Payment Date | Tranche A Balance |

| 7/[22]/15 Issuance Date | $98,730,000.00 |

| 6/1/2016 | 92,672,517.28 |

| 12/1/2016 | 87,206,231.81 |

| 6/1/2017 | 82,135,335.05 |

| 12/1/2017 | 76,679,606.54 |

| 6/1/2018 | 71,316,529.72 |

| 12/1/2018 | 65,603,637.92 |

| 6/1/2019 | 60,204,991.26 |

| 12/1/2019 | 54,419,089.10 |

| 6/1/2020 | 48,795,354.11 |

| 12/1/2020 | 42,814,902.62 |

| 6/1/2021 | 37,078,022.15 |

| 12/1/2021 | 30,963,006.65 |

| 6/1/2022 | 25,045,569.60 |

| 12/1/2022 | 18,755,095.16 |

| 6/1/2023 | 12,689,023.39 |

| 12/1/2023 | 6,244,238.54 |

| 6/1/2024 | 0 |

| |

| * | Preliminary; subject to change. May not total due to rounding. |

STABLE AVERAGE LIFE

Severe stress cases on electricity consumption result in no measurable changes in the weighted average life of the bonds.

For the purposes of preparing the table below, the following assumptions, among others, have been made: (i) the forecast error stays constant over the life of the bonds and is equal to an overestimate of electricity consumption of 5% (0.77 standard deviations from mean) or 15% (3.49 standard deviations from mean), (ii) ENO or a successor servicer makes timely and accurate filings to true-up the storm recovery charges semi-annually or otherwise, as required and (iii) retail electric customers remit all storm recovery charges 60 days after such charges are billed. There can be no assurance that the weighted average life of the bonds will be as shown.

Weighted Average Life Sensitivity

|

| | | | | |

| | Expected Weighted Avg. Life (“WAL”) (yrs) | WAL |

=-5%

(0.77 Standard Deviations from Mean) | =-15%

(3.49 Standard Deviations from Mean) |

WAL (yrs) | Change (days)* | WAL (yrs) | Change (days)* |

| Tranche A | 4.97 | 4.97 | 0 | 4.97 | 0 |

* Number is rounded to whole days.

True-up Mechanism for Payment of Scheduled Principal and Interest

The storm recovery charge will be calculated and included on each customer bill as a percentage of billed base rate revenues. The financing order requires the storm recovery charges to be adjusted semi-annually (and quarterly following the last scheduled final payment date), and authorizes more frequent adjustments as necessary, to ensure the projected recovery of amounts sufficient to provide timely payment of the scheduled principal, interest and other required amounts in connection with the bonds. Any delinquencies or under-collections in one customer class will be taken into account in the true-up mechanism to adjust the storm recovery charge for all customers of ENO, not just the class of customers from which the delinquency or under-collection arose.

The following describes the mechanics for implementing the true-up mechanism. (See also “Key Questions and Answers on the Transaction” on page 7.)

MANDATORY SEMI-ANNUAL TRUE-UPS

The financing order provides that storm recovery charges will be reviewed and adjusted semi-annually to:

| |

| • | correct, over a period of up to twelve months covering the next two succeeding payment dates, any under-collections or over-collections, for any reason, during the preceding six months, |

| |

| • | ensure the projected recovery of amounts sufficient to provide timely payment of the scheduled principal of and interest on the bonds and all other required amounts and charges in connection with the bonds during the subsequent twelve-month period, and |

| |

| • | to provide for the payment of all such bonds, including interest due thereon, by the next succeeding payment date if the bonds are outstanding after the last scheduled final payment date. |

| |

| STEP 1: | Each six months, ENO computes the total dollar requirement for the bonds for the next six-month and the next twelve-month periods, which includes scheduled principal and interest payments and all other permitted costs of the transaction, adjusted to correct for any prior undercollection or overcollection. |

| |

| STEP 2: | ENO divides the total dollar requirement for each of six and twelve month periods by the forecasted base rate revenues for each customer for such period. The quotient will determine the storm recovery charge (expressed as a percentage of base rate revenues) for the six-month and twelve-month period. |

| |

| STEP 3: | ENO then selects the larger of the two storm recovery charges for each period determined under Step 2, which charges will be requested in the true-up filing. |

| |

| STEP 4: | ENO must make a true-up filing with the Council, specifying such adjustments to the storm recovery charge. The Council will confirm the mathematical accuracy of the adjustment to the storm recovery charges within 15 days. The adjusted storm recovery charge will be implemented with the first billing cycle of ENO’s next billing month after the true-up adjustment is filed with the Council. Any errors identified by the Council will be corrected in the next true-up adjustment. |

INTERIM TRUE-UPS

In addition, the servicer may also make interim true-up adjustments more frequently at any time during the term of the bonds:

| |

| • | if the servicer forecasts that storm recovery charge collections will be insufficient to make on a timely basis all scheduled payments of interest and other financing costs in respect of the bonds during the current or next succeeding payment period or bring all principal payments on schedule over the next two succeeding payment dates, and/or |

| |

| • | to replenish any draws upon the capital subaccount. |

NON-STANDARD TRUE-UP MECHANISM

The financing order requires the servicer to request Council approval of an amendment to the true-up mechanism described above - a non-standard true-up (under such procedures as shall be proposed by the servicer and approved by the Council at the time) - that it deems necessary or appropriate to address any material deviations between storm recovery charge collections and the periodic revenue requirement. No such change shall cause any of the then-current credit ratings of the bonds to be suspended, withdrawn or downgraded.

INITIAL STORM RECOVERY AND OTHER SECURITIZATION CHARGES

The initial storm recovery charge (expressed as a percentage of base rate revenues-i.e., electricity and demand charges) for all customers is expected to be approximately 4.2948%. The initial storm recovery charge for a typical residential customer using 1,000kW of electricity will be approximately $2.92 per month.

Glossary

|

| |

| “Storm Recovery Charges” | Storm recovery charges means statutorily-created, nonbypassable charges that are charged as a percentage of billed base rate revenues. Storm recovery charges are irrevocable and payable by retail electric customers who consume electricity that is delivered through ENO’s transmission or distribution system, or both, or is produced in certain new on-site generation. There is no “cap” on the level of storm recovery charges that may be imposed on future customers as a result of the true-up mechanism. Through the true-up mechanism, all customers will cross share in the liabilities of all other customers for the payment of storm recovery charges. |

| “Security” | All assets held by the Indenture Trustee for the benefit of the holders of the bonds, including amounts deposited in the Capital Subaccount and collections of the storm recovery charges held by the Indenture Trustee. Our principal asset securing the bonds is the storm recovery property, which includes the irrevocable right to impose, bill, charge, collect and receive nonbypassable consumption-based storm recovery charges and to obtain adjustments of such charges from time to time through a true-up mechanism. Storm recovery property is a present contract right created by the Securitization Law and the financing order and is expressly protected by the State’s and the Council’s pledges not to take or permit any action that would impair its value or revise the storm recovery costs for which recovery is authorized under the financing order or, except for the specified true-up adjustments to correct any overcollections or undercollections, reduce, alter or impair the storm recovery charges until all principal and interest in respect of the bonds and all related financing costs are paid or performed in full. |

| “Principal Payments” | Principal will be paid on the bonds from available funds in accordance with the expected sinking fund schedule until paid in full unless there is an acceleration of the bonds following an event of default. Please see “Expected Sinking Fund Schedule.” |

| “Legal Structure” | The Securitization Law, among other things, authorizes the adoption of the irrevocable financing order by the Council, and provides for the State pledge and the Council pledge. In the financing order, the Council determined that ENO is entitled, pursuant to the Securitization Law, to finance, through the issuance of storm recovery bonds in the amount of up to approximately $99.0 million storm recovery costs (including financing costs). The financing order also authorized: (1) ENO’s proposed financing structure and issuance of the bonds; (2) creation of the storm recovery property, including the right to impose and collect storm recovery charges sufficient to pay the bonds and associated financing costs; and (3) a tariff to implement the storm recovery charges. |

| “Ratings” | A security rating is not a recommendation to buy, sell or hold securities and may be subject to revision or withdrawal at any time by the assigning rating agency. No person is obligated to maintain the rating on any bond, and, accordingly, there can be no assurance that the ratings assigned to the bonds upon initial issuance will not be revised or withdrawn by a rating agency at any time thereafter. |

We and ENO have filed a registration statement (including a prospectus and prospectus supplement) (Registration Nos. 333-203320 and 333-203320-01) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus and prospectus supplement in that registration statement and other documents we have filed with the SEC for more complete information about us and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. You can also obtain copies of the registration statement from the SEC upon payment of prescribed charges, or you can examine the registration statement free of charge at the SEC’s offices at 100 F Street, N.E., Washington, D.C. 20549. Alternatively, we, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling toll free at (1-800-831-9146).

This Preliminary Term Sheet is not required to contain all information that is required to be included in the prospectus and the prospectus supplement that will be prepared for the securities offering to which this Preliminary Term Sheet relates. The prospectus and the prospectus supplement contain material information not contained herein, and the prospective purchasers are referred to the prospectus and prospectus supplement, including the final prospectus and prospectus supplement. This Preliminary Term Sheet is not an offer to sell or a solicitation of an offer to buy these securities in any state where such offer, solicitation or sale is not permitted.

The information in this Preliminary Term Sheet is preliminary, and may be superseded by an additional term sheet provided to you prior to the time you enter into a contract of sale. This Preliminary Term Sheet is being delivered to you solely to provide you with information about the offering of the securities referred to herein. The securities are being offered when, as and if issued. In particular, you are advised that these securities, and the storm recovery charges securing them, are subject to modification or revision (including, among other things, the possibility that one or more tranches of securities may be split, combined or eliminated), at any time prior to issuance or availability of a final prospectus. As a result, you may commit to purchase securities that have characteristics that may change, and you are advised that all or a portion of the securities may not be issued with the characteristics described in these materials. Our obligation to sell securities to you is conditioned on the securities and the underlying transaction having the characteristics described in these materials.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this Preliminary Term Sheet is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential are not applicable to these materials and should be disregarded to the extent inconsistent with any legends or other information contained herein. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

Neither the SEC nor any state securities commission has approved or disapproved of the bonds or determined if this Preliminary Term Sheet is truthful or complete. Any representation to the contrary is a criminal offense.

Price and availability of the bonds are subject to change without notice.

Neither the State nor the Council is acting as an agent for the issuer or its affiliates in connection with the proposed transaction.

A contract of sale will come into being no sooner than the date on which the bonds have been priced and we have confirmed the allocation of securities to be made to you; and “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us. You may withdraw your offer to purchase securities at any time prior to our acceptance of your offer.

Any legends, disclaimers or other notices that may appear at the bottom of the email communication to which this Preliminary Term Sheet is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

OFFERING RESTRICTIONS IN CERTAIN JURISDICTIONS

Notice to Residents of Singapore

This Preliminary Term Sheet has not been registered and will not be registered as a Prospectus with the Monetary Authority of Singapore, and the bonds will be offered pursuant to exemptions under the Securities and Futures Act, Chapter 289 of Singapore (the “Securities and Futures Act”). Accordingly, the bonds may not be offered or sold or made the subject of an invitation for subscription or purchase nor may this Preliminary Term Sheet or any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of bonds be circulated or distributed whether directly or indirectly to any person in Singapore other than (i) to an institutional investor under Section 274 of the Securities and Futures Act, (ii) to a relevant person pursuant to Section 275(1) of the Securities and Futures Act, or any person pursuant to Section 275(1a) of the Securities and Futures Act, and in accordance with the conditions, specified in Section 275 of the Securities and Futures Act, or (iii) otherwise pursuant to, and in accordance with the conditions of, any other applicable provision of the Securities and Futures Act.

Where the bonds are subscribed or purchased under Section 275 of the Securities and Futures Act by a relevant person which is:

| |

| (a) | a corporation (which is not an “Accredited Investor” as defined in Section 4 of the Securities and Futures Act) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of whom is an Accredited Investor; or |

| |

| (b) | a trust (where the trustee is not an Accredited Investor) whose sole purpose is to hold investments and each beneficiary of the trust is an individual who is an Accredited Investor; |

Shares, debentures and units of shares and debentures of that corporation or the beneficiaries’ rights and interest however described, in that trust shall not be transferable within six months after that corporation or that trust has acquired the foregoing securities pursuant to offer made under Section 275 of the Securities and Futures Act except:

| |

| (1) | to an institutional investor (for corporations under Section 274 of the Securities and Futures Act) or to a relevant person defined in Section 275(2) of the Securities and Futures Act, or to any person pursuant to an offer that is made on terms that such securities of that corporation or such rights and interest in that trust are acquired at a consideration of not less than US$200,000 (or its equivalent in any foreign currency) for each transaction, whether such amount is to be paid for in cash or by exchange of securities or other assets, and further for corporations, in accordance with the conditions specified in Section 275 of the Securities and Futures Act; |

| |

| (2) | where no consideration is or will be given for the transfer; or |

| |

| (3) | where the transfer is by operation of law. |

Notice to Residents of the People’s Republic of China

The bonds shall not be offered or sold in the People’s Republic of China, excluding Hong Kong, Macau and Taiwan, (the “PRC”) as part of the initial distribution of the bonds.

This Preliminary Term Sheet does not constitute an offer to sell or the solicitation of an offer to buy any securities in the PRC to any person to whom it is unlawful to make the offer or solicitation in the PRC.

The PRC does not represent that this Preliminary Term Sheet may be lawfully distributed, or that any bonds may be lawfully offered, in compliance of any applicable registration or other requirements in the PRC, or pursuant to an exemption available thereunder, or assume any responsibility for facilitating any such distribution or offering. In particular, no action has been taken by the issuing entity which would permit a public offering of any bonds or the distribution of this Preliminary Term Sheet in the PRC. Accordingly, the bonds are not being offered or sold within the PRC by means of this Preliminary Term Sheet or any other document. Neither this Preliminary Term Sheet nor any advertisement or other offering material may be distributed or published in the PRC, except under circumstances that will result in compliance with any applicable laws and regulations. The state shall not be responsible or liable for any approvals, registration or filing procedures required by the PRC investors in connection with their subscriptions under this Preliminary Term Sheet under the laws of the PRC as well as any other requirements under other foreign laws.

Notice to Residents of Japan

The bonds have not been and will not be registered under the Financial Instruments and Exchange Act of Japan (Act No. 25 of 1948, as amended, the “Financial Instruments and Exchange Act”), and each underwriter has represented and agreed that it will not offer or sell any of the bonds, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan (which term as used herein means any person resident of Japan, including any corporation or other entity recognized under the laws of Japan) or to, or for the benefit of others for reoffering or resale, directly or indirectly, in Japan or to a resident of Japan, except pursuant to an exemption from the registration requirements of, and otherwise in compliance with the Financial Instruments and Exchange Act and any other applicable laws, regulations and ministerial guidelines and regulations of Japan.

Notice to Residents of Hong Kong

Each underwriter has represented and agreed that it has not offered or sold and will not offer or sell in Hong Kong, by means of any document, any Bonds other than (a) to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) of Hong Kong and any rules made under that Ordinance; or (b) in other circumstances which do not result in the document being a “prospectus” as defined in the Companies Ordinance (Cap. 32) of Hong Kong or which do not constitute an offer to the public within the meaning of that Ordinance; and it has not issued or had in its possession for the purposes of issue, and will not issue or have in its possession for the purposes of issue, whether in Hong Kong or elsewhere, any advertisement, invitation or document relating to the Bonds, which is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to Bonds which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” as defined in the Securities and Futures Ordinance (Cap. 571) and any rules made under that Ordinance.

Notice to Residents of the European Economic Area

In relation to each Member State of the European Economic Area which has implemented the Prospectus Directive (each, a “Relevant Member State”), each underwriter has represented and agreed that with effect from and including the date on which the Prospectus Directive is implemented in that Relevant Member State it has not made and will not make an offer of the bonds which are the subject of the offering contemplated by this Preliminary Term Sheet to the public in that Relevant Member State other than:

| |

| (a) | solely to qualified investors (as defined in the Prospectus Directive); |

(b) to fewer than 150 natural or legal persons (other than qualified investors as defined in the Prospectus Directive), subject to obtaining the prior consent of the relevant underwriters or underwriters nominated by the issuing entity for any such offer; or

(c) in any other circumstances falling within Article 3(2) of the Prospectus Directive,

provided that no such offer of the bonds shall require the state or any underwriter to publish a prospectus pursuant to Article 3 of the Prospectus Directive.

For purposes of this provision, the expression an “offer of the bonds to the public” in relation to any bonds in any Relevant Member State means the communication in any form and by any means of sufficient information on the terms of the offer and the bonds to be offered so as to enable an investor to decide to purchase or subscribe for the bonds, as the same may be varied in that Member State by any measure implementing the Prospectus Directive in that Member State, the expression “Prospectus Directive” means Directive 2003/71/EU (as amended, including by Directive 2010/73/EU), and includes any relevant implementing measure in the Relevant Member State.

Notice to Residents of United Kingdom

Each underwriter has represented and agreed that (i) it has only communicated or caused to be communicated and will only communicate or cause to be communicated an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the Financial Services and Markets Act 2000, as Amended (the “FSMA”)) received by it in connection with the issue or sale of the bonds in circumstances in which Section 21(1) of the FSMA does not apply to the issuing entity; and (ii) it has complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the storm recovery bonds in, from or otherwise involving the United Kingdom.