Back to Contents

| 132 | The BOC Group plc Annual report and accounts 2005 | Notes to the financial statements |

30. US accounting information

a) Summary of differences between UK and US generally accepted accounting principles and other US accounting information

The financial statements of The BOC Group plc are prepared in accordance with accounting principles generally accepted in the UK (UK GAAP), which differ in certain significant respects from accounting principles generally accepted in the US (US GAAP).

Set out below is a summary of the more significant adjustments which would be required if US GAAP had been applied, together with reconciliations of net profit and shareholders’ funds from a UK GAAP to a US GAAP basis. Also presented on a US GAAP basis are a movement in shareholders’ funds, a consolidated cash flow statement, information on earnings per share, information on stock based compensation and details of recently issued US accounting pronouncements.

Goodwill and other intangible assets

Under UK GAAP, goodwill arising on acquisitions before 1998 accounted for under the purchase method has been eliminated against shareholders’ funds. Additionally, UK GAAP requires that on subsequent disposal or closure of a business, any goodwill previously taken directly to shareholders’ funds is then charged against income. The Group adopted FRS10 in 1999, which requires goodwill on subsequent acquisitions to be capitalised and amortised over a period not exceeding 20 years.

Under UK GAAP the Group has recognised negative goodwill on certain acquisitions. Under US GAAP, the excess of the amounts assigned to the assets acquired and liabilities assumed over the acquisition cost is adjusted against the values of the acquired long-lived assets in accordance with SFAS 141. This does not result in a difference between the shareholders’ funds under UK GAAP and US GAAP, although there is a difference in the classification between tangible and intangible assets.

Under US GAAP (SFAS142) goodwill continues to be capitalised, although no amortisation is charged to the income statement. Instead, an annual impairment test is carried out, with any identified impairment loss recorded in the income statement.

Other intangible assets with a finite life continue to be amortised under both UK and US GAAP. UK GAAP is highly prescriptive with regard to the recognition of intangible assets, although US GAAP rules result in the recognition of a greater amount of intangible assets. Therefore, differences arise in the classification of some intangible assets and goodwill between UK and US GAAP. Amortisation that has been charged against goodwill under UK GAAP is added back in the reconciliation to net income on a US GAAP basis.

The average life of other intangible assets is ten years and the annual amortisation charge under US GAAP is expected to be approximately £1 million.

Impairment of goodwill

Under UK GAAP, goodwill impairment reviews are carried out at the end of the first financial year following an acquisition, and also when an indicator of impairment exists. The impairment is measured by comparing the carrying value of the goodwill with the higher of the net realisable value and the value in use.

Under US GAAP, goodwill impairment reviews are also conducted when an indicator of impairment exists, in addition to an annual goodwill impairment test, as required by SFAS142. The impairment is measured by comparing the carrying value of a reporting unit to its fair value. Where the carrying value is greater than the fair value, the impairment loss is based on the excess of the carrying value of goodwill in the reporting unit over the implied fair value of the goodwill.

Profit or loss on the partial disposal of Group companies

Under UK GAAP (UITF 31), gains on the partial disposal of Group companies involving non-monetary consideration are recorded in the statement of total recognised gains and losses. Under US GAAP, such gains and losses are recorded in the income statement.

Deferred tax

Under UK GAAP, full provision for deferred tax is recognised in the financial statements. Under US GAAP, deferred tax is recognised on a similar basis. In addition, however, US GAAP requires provision for deferred tax on the unremitted earnings of overseas businesses that are not deemed to be permanently reinvested. This is not permitted under UK GAAP except in respect of any dividends that have been accrued as receivable.

Revaluation of fixed assets

UK GAAP allowed for the periodic revaluation of land and buildings with depreciation then being calculated on the revalued amount. Any surplus or deficit (to the extent that the revaluation reserve was in surplus) on the revaluation was then taken directly to shareholders’ funds. With the Group’s adoption of FRS15 in 2000, the Group no longer revalues fixed assets. Under US GAAP, revaluations of fixed assets are not permitted and, as a result, the reconciliation restates fixed assets to historical cost. The depreciation charge and any write downs of previously revalued assets are adjusted accordingly.

Impairment of tangible fixed assets

Under UK GAAP, a tangible fixed asset is reviewed for impairment if an indication exists that the asset may be impaired. If necessary, an impairment loss is recorded. A value in use calculation is carried out, based on discounted pre-tax future cash flows from the asset (or income generating unit to which the asset belongs).

Under US GAAP, a preliminary review of the tangible fixed asset is carried out using undiscounted future cash flows. If the undiscounted future cash flows are less than the asset’s carrying value, an impairment loss is required. The impairment loss will be calculated using discounted future cash flows, or the asset’s market value.

Under US GAAP, the reversal of previously recognised impairment losses is not permitted.

Provisions

Under UK GAAP, general requirements for liabilities and charges are contained in FRS 12 which states that provisions are made when a present obligation exists in respect of a past event, where it is probable that a transfer of economic benefits will be required and where the amount of the obligation can be reliably estimated. Under US GAAP the general requirements for loss contingencies of SFAS 5 require that, a provision is made when it is probable that an asset has been impaired or a liability has been incurred and the amount of loss can be reasonably estimated. The UK GAAP policy is substantially the same as the US GAAP policy and no adjustment is required.

Restructuring costs

Under UK GAAP, when a decision has been taken to restructure, supported by a detailed formal plan and the creation of a valid expectation in those affected that the restructuring will take place, the necessary provisions are made for impairment of asset values together with severance and other costs.

Under US GAAP (SFAS146), the requirements for charging restructuring costs to income are more prescriptive and all significant actions arising from the restructuring plan and their completion dates must be identified by the balance sheet date.

Pensions

For UK GAAP reporting (FRS17 – Retirement benefits), the pension asset or liability in the balance sheet represents the difference between the market value of pension scheme assets at the balance sheet date and the present value of pension scheme liabilities at that date, net of deferred tax.

Under US GAAP (SFAS87), plan assets are valued by reference to market-related value at the date of the financial statements. Liabilities are assessed using the rate of return obtainable on fixed or inflation-linked bonds.

FRS17 requires that past service costs are recognised in full in the period in which they become vested. SFAS87 requires past service costs to be amortised over the remaining service lives of the employees to whom the amendments relate.

Back to Contents

| | Notes to the financial statements | 133 |

30. US accounting information continued

There is a significant difference in the treatment of actuarial gains and losses arising during the accounting period. UK GAAP recognises the actuarial gains and losses in full in the year in which they arise in the statement of total recognised gains and losses. Under US GAAP, the actuarial gains and losses which exceed ten per cent of the value of the assets or liabilities at the start of the accounting period are amortised over the remaining service lives of scheme members.

Where an additional minimum liability exists under US GAAP, (ie where the amount provided for any scheme does not cover the unfunded accumulated benefit obligation for that scheme), this must be recognised in the balance sheet under SFAS87. The adjustment resulting from the recognition of an additional minimum liability is reported as an intangible asset to the extent of the unrecognised prior service cost, after eliminating amounts previously shown as a prepaid benefit cost. Any excess above these amounts is reported in comprehensive income.

Where surpluses exist in pension schemes under UK GAAP, a company should recognise the associated asset only to the extent that it is able to recover that surplus either through reduced contributions or through refunds from the scheme. Regulations in South Africa concerning surpluses (as set out in the Pension Funds Second Amendment Act 2001) specify that recognition of any surpluses in a retirement fund cannot be made by a company unless it is either as a result of a surplus apportionment exercise, or if a fund‘s rules allow it. As a result, any surpluses in South Africa are not recognised under UK GAAP and are written off in the statement of total recognised gains and losses.

There is no specific requirement under US GAAP relating to the treatment of irrecoverable surpluses. As a result, the associated surplus is retained under US GAAP in line with SFAS 87.

Post retirement medical costs

For UK GAAP reporting (FRS17 – Retirement benefits), the post retirement medical liability is discounted using the bond yield on suitable high quality corporate bonds, and disclosed net of related deferred tax.

For US GAAP (SFAS106), the liabilities are assessed and discounted using the rates of return obtainable on high quality fixed income investments.

Differences between the UK and US GAAP figures arise largely from the treatment of actuarial gains and losses.

Securities investments

Under UK GAAP, current asset investments (of all types) are stated at the lower of cost and net realisable value. Fixed asset investments are stated at cost, or alternatively, at market value or at directors’ valuation.

Under US GAAP, securities which are determined to be ‘available-for-sale’ are stated at fair value and any unrealised gains or losses included as a separate component of shareholders’ funds. The deferred tax consequences of unrealised gains or losses are also charged or credited to shareholders’ funds.

Contingent consideration

Under UK GAAP, contingent consideration is provided for as a liability when the likelihood of payment is considered to be probable.

Under US GAAP, contingent consideration is not recognised until the liability is determined beyond reasonable doubt. The elimination of contingent consideration for US GAAP purposes also impacts on the value of goodwill arising on acquisitions, therefore there is no net impact on shareholders’ funds.

Financial instruments

The Group enters into a number of currency swaps, interest rate swaps and forward foreign exchange contracts to hedge its exposure to currency and interest rate risks. Under UK GAAP, such instruments are shown at their carrying value.

Under US GAAP, these instruments are marked to market and any change in value is recognised in either the income statement or through comprehensive income in accordance with SFAS133 depending on whether a derivative is designated as part of a hedge transaction, and if it is, the type of hedge transaction.

Accounting for swaps

Under UK GAAP, gains or losses on closing out interest rate swap contracts taken to hedge the Group’s fixed/floating interest rate position can be taken to profit immediately.

US GAAP requires any gain or loss to be deferred over the remaining hedge period.

Share of results and net assets of joint ventures and associates

The Group’s share of the results and net assets of its joint ventures and associates (as calculated under UK GAAP) is shown within fixed asset investments. For the purposes of the reconciliations set out below, the Group’s share of the results and net assets of its joint ventures and associates has been adjusted to recognise a difference in the method of reporting profits under US GAAP.

Leasing

Under US GAAP (EITF 01–8) certain arrangements with customers (modified or entered into since 1 October 2003) concerning the use of some items of the Group’s plant and machinery are deemed to contain leases. Where such arrangements qualify as finance leases under SFAS13, an appropriate adjustment is made to net income and shareholders’ funds under US GAAP. UK GAAP does not contain this same requirement.

Sale and leaseback transactions

Under UK GAAP, any profit or loss on the sale and operating leaseback of fixed assets can generally be taken to profit immediately.

US GAAP requires any gain or loss to be deferred over the contract lease period.

Comprehensive income

Under US GAAP, SFAS130 establishes requirements for the reporting of comprehensive income and its components (revenue, expenses, gains and losses) in a full set of general purpose financial statements. Components of comprehensive income for the Group determined on a UK GAAP basis include profit for the financial year, pension actuarial gains and losses, and foreign currency translation gains and losses. Information regarding the Group’s foreign currency translation gains and losses is included in the statement of total recognised gains and losses under UK GAAP on page 89.

b) Selected financial information under US GAAP

In addition to the Group five year record on page 12, for SEC reporting the Group is required to disclose, on a US GAAP basis, certain key selected financial information under item 3.A.2. of form 20–F. |

|

|

|

|

|

|

|

|

|

|

| |

| | | 2005

£ million | | 2004

£ million | | 2003

£ million | | 2002

£ million | | 2001

£ million | |

| |

| |

| |

| |

| |

| |

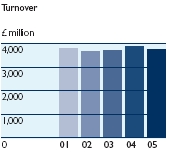

| Revenue | | 3,916.9 | | 3,885.4 | | 3,718.3 | | 3,657.7 | | 3,772.9 | |

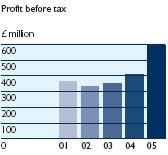

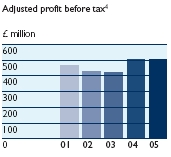

| Net operating income | | 652.9 | | 547.4 | | 512.3 | | 515.1 | | 497.4 | |

| Net income | | 326.7 | | 297.7 | | 264.3 | | 255.4 | | 234.2 | |

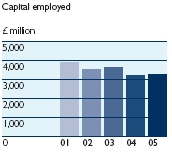

| Total assets | | 5,241.7 | | 5,333.2 | | 5,046.2 | | 5,126.9 | | 5,118.5 | |

| Net assets | | 2,122.2 | | 1,920.1 | | 1,872.5 | | 2,061.0 | | 2,138.9 | |

| |

| |

| |

| |

| |

| |

Back to Contents

| 134 | The BOC Group plc Annual report and accounts 2005 | Notes to the financial statements |

30. US accounting information continued

|

|

|

|

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| | | pence | | pence | | pence | | pence | | pence | |

| |

| |

| |

| |

| |

| |

| Earnings per share – basic | | 66.0 | | 60.4 | | 53.7 | | 52.1 | | 48.1 | |

| Earnings per share – diluted | | 65.8 | | 60.3 | | 53.6 | | 51.9 | | 47.9 | |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 | |

| | | million | | million | | million | | million | | million | |

| |

| |

| |

| |

| |

| |

| Weighted average ordinary shares – basic | | 495.0 | | 493.0 | | 492.5 | | 490.4 | | 486.9 | |

| Weighted average ordinary shares – diluted | | 496.6 | | 493.8 | | 492.7 | | 492.2 | | 488.6 | |

| |

| |

| |

| |

| |

| |

c) Income statement in US GAAP format

The Group profit and loss account on page 86 complies with UK GAAP. For SEC reporting purposes this presentation would be considered ‘non GAAP’ and therefore disclosed below is the income statement which meets the SEC reporting format set forth in Item 10 of Regulation S-X. The financial numbers disclosed within the income statement below are prepared under UK GAAP.

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | |

| | | £ million | | £ million | | £ million | |

| |

| |

| |

| |

| Revenue | | 3,754.7 | | 3,885.4 | | 3,718.3 | |

| Operating expenses | | | | | | | |

| Payroll costs | | (951.9 | ) | (1,015.6 | ) | (1,037.8 | ) |

| Depreciation and amortisation | | (301.9 | ) | (324.0 | ) | (333.4 | ) |

| Other operating expenses | | (1,848.8 | ) | (2,060.9 | ) | (1,908.5 | ) |

| |

| |

| |

| |

| Total operating expenses | | (3,102.6 | ) | (3,400.5 | ) | (3,279.7 | ) |

| |

| |

| |

| |

| Net operating income | | 652.1 | | 484.9 | | 438.6 | |

| Other income, net | | 18.2 | | 15.8 | | 9.4 | |

| Net interest expense | | (76.7 | ) | (88.4 | ) | (96.1 | ) |

| Income taxes | | (159.9 | ) | (101.7 | ) | (96.4 | ) |

| Minority interests | | (66.7 | ) | (46.6 | ) | (36.4 | ) |

| |

| |

| |

| |

| Net income | | 367.0 | | 264.0 | | 219.1 | |

| |

| |

| |

| |

| Earnings per share – basic | | 74.1 | p | 53.5 | p | 44.5 | p |

| Earnings per share – diluted | | 73.9 | p | 53.5 | p | 44.5 | p |

| |

| |

| |

| |

| | | | | | | | | |

| d) Reconciliation of net profit | | | | | | | | |

|

|

|

|

|

|

|

| |

| | | | 2005 | | 2004 | | 2003 | |

| Years ended 30 September | Notes | | £ million | | £ million | | £ million | |

|

| |

| |

| |

| |

| Net profit as reported in the Group profit and loss account under UK GAAP | | | 367.0 | | 264.0 | | 219.1 | |

| Pensions | | | (0.8 | ) | 7.5 | | 62.5 | |

| Post retirement medical costs | | | 0.1 | | (2.4 | ) | – | |

| Revaluations realised on asset disposals | | | 7.2 | | – | | 1.1 | |

| Depreciation of revalued fixed assets | | | 0.5 | | 0.2 | | 0.1 | |

| Non-amortisation of goodwill under SFAS142 | | | 12.6 | | 14.0 | | 13.9 | |

| Goodwill adjustment relating to disposals | | | (3.4 | ) | – | | – | |

| Consolidation of variable interest entity under FIN46 | | | 0.5 | | – | | – | |

| Amortisation of other intangibles | | | (0.6 | ) | (0.5 | ) | (0.5 | ) |

| Unrealised profit on disposal of subsidiary | | | – | | – | | 8.2 | |

| Other adjustments on profit on disposal of subsidiary | 1 | | – | | – | | (20.7 | ) |

| Share of results of joint ventures and associates | | | (3.5 | ) | 0.3 | | 0.6 | |

| Termination of interest rate swaps | | | 1.5 | | 1.6 | | 1.7 | |

| Financial and other derivative instruments | | | (1.1 | ) | (15.7 | ) | (2.8 | ) |

| Adjustment on disposal of the US packaged gas business | 2 | | (9.6 | ) | 39.9 | | – | |

| ESOPs and other share options | | | (1.5 | ) | 3.5 | | 1.7 | |

| Sale and leaseback | | | 0.1 | | 0.1 | | 0.1 | |

| Restructuring provisions | | | 1.0 | | – | | – | |

| Goodwill impairments | | | (16.3 | ) | – | | – | |

| Taxation adjustments | 3 | | (27.0 | ) | (14.8 | ) | (20.7 | ) |

|

| |

| |

| |

| |

| Net income under US GAAP | | | 326.7 | | 297.7 | | 264.3 | |

|

| |

| |

| |

| |

| 1. | The adjustment on profit of disposal of subsidiary of £(20.7) million in 2003 relates to differences relating to the combination of the Group’s Japanese gases business with part of Air Liquide Japan. It comprises £(11.7) million relating to the difference in the net book value of tangible assets and £(9.0) million relating to the difference in the net book value of intangible assets recognised in the Group’s Japanese business. |

| 2. | The adjustment on disposal of the US packaged gas business of £39.9 million in 2004 comprised £13.4 million relating to asset impairments, £19.9 million relating to goodwill and £6.6 million relating to restructuring provisions. In 2005, the adjustment relates to timing differences on restructuring provisions and expenses between UK GAAP and US GAAP. |

| 3. | During 2005 the deferred tax provision in respect of undistributed earnings of subsidiaries and joint ventures was reviewed. In connection with this, the amount of taxation adjustments includes a charge of £28.5 million (2004: £nil, 2003: £nil). |

| 4. | All net income arose from continuing operations. |

Back to Contents

| | Notes to the financial statements | 135 |

30. US accounting information continued

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | |

| Average number of 25p Ordinary shares | | million | | million | | million | |

| |

| |

| |

| |

| Basic | | 495.0 | | 493.0 | | 492.5 | |

| Diluted | | 496.6 | | 493.8 | | 492.7 | |

| |

| |

| |

| |

| | | | | | | | |

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | |

| | | pence | | pence | | pence | |

| |

| |

| |

| |

| Earnings per share | | | | | | | |

| Basic | | 66.0 | | 60.4 | | 53.7 | |

| Diluted | | 65.8 | | 60.3 | | 53.6 | |

| |

| |

| |

| |

| | | | | | |

| e) Reconciliation of shareholders’ funds | | | | | |

|

|

|

|

| |

| | | 2005 | | 2004 | |

| At 30 September | | £ million | | £ million | |

| |

| |

| |

| Shareholders’ funds reported in the Group balance sheet under UK GAAP | | 1,942.0 | | 1,675.3 | |

| UK minority interests | | 111.1 | | 202.8 | |

| |

| |

| |

| | | 2,053.1 | | 1,878.1 | |

| Pensions | | 107.8 | | 154.7 | |

| Post retirement medical costs | | (16.8 | ) | (12.2 | ) |

| Revaluations of fixed assets | | (30.3 | ) | (36.8 | ) |

| Goodwill previously charged to reserves | | 64.1 | | 62.7 | |

| Non-amortisation of goodwill under SFAS142 | | 40.1 | | 31.4 | |

| Amortisation of other intangibles | | (1.1 | ) | (1.0 | ) |

| Interest rate swaps | | (1.2 | ) | (2.7 | ) |

| Share of net assets of joint ventures and associates | | 14.1 | | 17.6 | |

| Securities investments | | – | | 7.3 | |

| Consolidation of variable interest entity under FIN46 | | (12.8 | ) | (29.7 | ) |

| Goodwill on disposal of subsidiary | | 5.5 | | 4.4 | |

| Fixed asset impairments | | 8.1 | | 13.3 | |

| Restructuring provisions | | 4.0 | | 6.5 | |

| Financial and other derivative instruments | | (3.1 | ) | (2.0 | ) |

| Provision for executive share schemes | | 0.5 | | 0.9 | |

| Sale and leaseback | | (1.8 | ) | (1.9 | ) |

| Goodwill impairments | | (16.3 | ) | – | |

| Deferred tax | | 6.2 | | 10.2 | |

| Minority interests | | (97.9 | ) | (180.7 | ) |

| |

| |

| |

| Shareholders’ funds under US GAAP | | 2,122.2 | | 1,920.1 | |

| |

| |

| |

| | | | | | |

| f) Movements in shareholders’ funds on a US GAAP basis | | | | | |

| Shareholders’ funds at 1 October | | 1,920.1 | | 1,872.5 | |

| Net income for the year | | 326.7 | | 297.7 | |

| Dividends | | (204.1 | ) | (197.3 | ) |

| Shares issued | | 32.6 | | 8.7 | |

| Movement in treasury stock | | (4.2 | ) | 2.5 | |

| Pensions | | (54.5 | ) | 53.3 | |

| Exchange adjustment | | 99.3 | | (98.1 | ) |

| Other movements | | 6.3 | | (19.2 | ) |

| |

| |

| |

| Shareholders’ funds at 30 September | | 2,122.2 | | 1,920.1 | |

| |

| |

| |

g) Consolidated cash flow statement

The Group cash flow statement on page 88 has been prepared in accordance with UK accounting standard FRS1, the objectives and principles of which are similar to those set out in US accounting principle SFAS95, Statement of Cash Flows. The principal differences between the standards relate to classification of items within the cash flow statement and with regard to the definition of cash and cash equivalents.

Under FRS1, cash flows are presented separately for: a) operating activities; b) dividends from joint ventures and associates; c) returns on investments and servicing of finance; d) tax paid; e) capital expenditure and financial investment; f) acquisitions and disposals; g) equity dividends paid; h) management of liquid resources; and i) financing. Under SFAS95, however, only three categories of cash flow activity are reported: a) operating activities; b) investing activities; and c) financing activities. Dividends from joint ventures and associates, cash flows from returns on investments and servicing of finance (excluding dividends paid to minorities) and tax paid under FRS1 would be included in operating activities under SFAS95; capital expenditure and acquisitions and disposals would be included in investing activities under SFAS95; equity dividends would be included as a financing activity under SFAS95.

Under FRS1, cash is defined as cash in hand and deposits repayable on demand with any qualifying financial institution, less overdrafts from any qualifying financial institution repayable on demand. Under SFAS95, cash is defined as cash in hand and deposits but also includes cash equivalents which are short-term, highly liquid investments. Generally only investments with original maturities of three months or less come within this definition.

Back to Contents

| 136 | The BOC Group plc Annual report and accounts 2005 | Notes to the financial statements |

30. US accounting information continued

Set out below, for illustrative purposes, is a summary consolidated statement of cash flows under SFAS95.

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | |

| | | £ million | | £ million | | £ million | |

| |

| |

| |

| |

| Net cash provided by operating activities | | 577.7 | | 673.5 | | 562.4 | |

| Net cash used by investing activities | | (235.2 | ) | (45.2 | ) | (389.2 | ) |

| Net cash used by financing activities | | (405.7 | ) | (413.0 | ) | (292.7 | ) |

| |

| |

| |

| |

| Net (decrease)/increase in cash and cash equivalents | | (63.2 | ) | 215.3 | | (119.5 | ) |

| Cash and cash equivalents at 1 October | | 289.7 | | 76.4 | | 181.9 | |

| Exchange and other movements | | (1.4 | ) | (2.0 | ) | 14.0 | |

| |

| |

| |

| |

| Cash and cash equivalents at 30 September | | 225.1 | | 289.7 | | 76.4 | |

| |

| |

| |

| |

h) Stock-based compensation

For US reporting purposes the company applies APB Opinion 25,Accounting for Stock Issued to Employees and related interpretations, in accounting for its share option plans.

Prior to 2005, by applying this statement, the employee share schemes were deemed non-compensatory since share options were granted at a discount of ten per cent to market price. Accordingly, grants under these schemes did not result in an expense under US GAAP. In 2005, share options under the company’s employee share schemes were granted at a discount of 20 per cent to the market price. Accordingly, they are deemed compensatory, which has resulted in a charge of £0.2 million (£0.1 million net of related tax) in 2005 (2004: £nil, 2003: £nil).

Grants of executive share options are made at the market price of the company’s shares at the time of grant and are therefore deemed non-compensatory.

The Long-Term Incentive Plan schemes are deemed compensatory and a charge is recognised when certain performance conditions are met. This has resulted in a charge of £6.1 million (£4.3 million net of related tax) in 2005 (2004: £nil, 2003: £nil).

If compensation cost for the Group’s share option plans had been determined based on the fair value at the grant dates for awards under those plans consistent with the method of SFAS123,Accounting for Stock-Based Compensation, the Group’s net income under US GAAP would have been:

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | |

| | | £ million | | £ million | | £ million | |

| |

| |

| |

| |

| Reported net income | | 326.7 | | 297.7 | | 264.3 | |

| Add stock compensation expense recognised in accordance with APB25 (net of related tax) | | 4.4 | | – | | – | |

| Deduct stock compensation expense determined in accordance with SFAS123 (net of related tax) | | (9.7 | ) | (5.7 | ) | (7.1 | ) |

| |

| |

| |

| |

| Pro forma net income | | 321.4 | | 292.0 | | 257.2 | |

| |

| |

| |

| |

| | | | | | | | |

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | |

| | | pence | | pence | | pence | |

| |

| |

| |

| |

| Earnings per share: | | | | | | | |

| Basic – as reported | | 66.0 | | 60.4 | | 53.7 | |

| Basic – pro forma | | 64.9 | | 59.2 | | 52.2 | |

| |

| |

| |

| |

| Diluted – as reported | | 65.8 | | 60.3 | | 53.6 | |

| Diluted – pro forma | | 64.7 | | 59.1 | | 52.2 | |

| |

| |

| |

| |

The Black-Scholes model was used to measure the compensation expense under SFAS123. The assumptions used for grants in 2005 included a dividend yield of 4.5 per cent (2004: 4.5 per cent, 2003: 4.5 per cent), expected share price volatility of 27.2 per cent (2004: 29.5 per cent, 2003: 30.6 per cent), a weighted average expected life of 4.9 years (2004: 4.9 years, 2003: 5.0 years) and a weighted average interest rate of 4.6 per cent (2004: 4.8 per cent, 2003: 4.0 per cent). The weighted average interest rate is based on UK Gilts on the date of grant with a maturity similar to the related options.

i) Goodwill

For US reporting purposes the company applies SFAS142 in accounting for goodwill. The changes in the carrying value of goodwill for the year ended 30 September 2005 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | Industrial | | | | | | | | | | | |

| | | Process | | and Special | | BOC | | Afrox | | | | | | | |

| | | Gas Solutions | | Products | | Edwards | | hospitals | | Gist | | Corporate | | Total | |

| | | £ million | | £ million | | £ million | | £ million | | £ million | | £ million | | £ million | |

| |

| |

| |

| |

| |

| |

| |

| |

| Balance at 1 October | | 55.8 | | 79.1 | | 109.0 | | 15.0 | | 0.7 | | 2.5 | | 262.1 | |

| Acquired during year | | 1.0 | | 2.6 | | – | | 0.5 | | 5.1 | | – | | 9.2 | |

| Disposals during year | | (0.6 | ) | (15.7 | ) | – | | (14.5 | ) | – | | – | | (30.8 | ) |

| Impairments in year | | – | | – | | (31.1 | ) | – | | – | | – | | (31.1 | ) |

| Exchange adjustment | | 3.6 | | 5.2 | | (0.2 | ) | (1.0 | ) | 0.3 | | – | | 7.9 | |

| |

| |

| |

| |

| |

| |

| |

| |

| Balance at 30 September | | 59.8 | | 71.2 | | 77.7 | | – | | 6.1 | | 2.5 | | 217.3 | |

| |

| |

| |

| |

| |

| |

| |

| |

Under US GAAP the fair values of the business for impairment testing purposes have been calculated using a discounted cash flow method. See note 2 b) for further information.

j) Operating leases – lessors

The following table provides information required in respect of owned assets which qualify as operating leases under SFAS13.

|

|

| |

| | | £ million | |

| |

| |

| At 30 September 2005 | | | |

| Gross book value | | 138.7 | |

| Accumulated depreciation | | (81.1 | ) |

| |

| |

| Net book value | | 57.6 | |

| |

| |

Back to Contents

| | Notes to the financial statements | 137 |

30. US accounting information continued

|

|

| |

| | | £ million | |

|

|

| |

| Revenue recognised in 2005 | | 31.2 | |

| | |

| |

| Contractually receivable amounts: | | | |

| Year to 30 September 2006 | | 32.5 | |

| Year to 30 September 2007 | | 33.7 | |

| Year to 30 September 2008 | | 30.8 | |

| Year to 30 September 2009 | | 28.5 | |

| Year to 30 September 2010 | | 27.3 | |

| Thereafter | | 4.1 | |

| |

| |

| Minimum future rentals | | 156.9 | |

| |

| |

| 1. | Contractually receivable amounts include amounts in respect of maintenance, safety and other operational costs. |

k) Recently issued accounting pronouncements implemented in the year

EITF04–1 – Accounting for Pre-existing relationships between the Parties to a Business Combination

In October 2004, the Emerging Issues Task Force (EITF) reached a consensus on EITF issue 04–1. Issue 04–1 applies when two parties that have a pre-existing contractual relationship enter into a business combination. If it is determined that assets of an acquired entity are related to a pre-existing contractual relationship, thus requiring accounting separate from the business combination, management will evaluate whether the acquiring entity of the Group should recognise contractual relationships as assets separate from goodwill in that business combination. EITF 04–1 did not have a material impact on the Group’s results and financial position in the year.

l) Recently issued accounting pronouncements not yet implemented

SFAS151 – Inventory costs

SFAS151 was issued in November 2004 and is effective for all inventory costs incurred during fiscal years beginning after 15 June 2005. This statement amends ARB 43 and requires all idle facility expense, excessive spoilage, double freight and re-handling costs to be recognised as current-period charges regardless of whether they meet the criterion of “so abnormal” (as previously stated in ARB 43). In addition, ARB 43 requires that the allocation of fixed production overheads to the costs of conversion be based on the normal capacity of the production facilities. Unallocated overheads are recognised as an expense in the period in which they are incurred. Management does not believe that this statement will have a material effect on the Group’s results and financial position under US GAAP in future periods.

SFAS153 – Exchanges of non-monetary assets

SFAS153 was issued in December 2004 and is effective for all non-monetary asset exchanges occurring in fiscal periods beginning after15 June 2005. This statement amends APB Opinion 29, which is based on the principle that exchanges of non-monetary assets should be measured based on the fair value of the assets exchanged. SFAS153 provides a general exception for exchange transactions that do not have commercial substance – that is, transactions that are not expected to result in significant changes in the cash flows of the reporting entity. Management does not believe that this statement will have a material effect on the Group’s results and financial position under US GAAP in future periods.

SFAS123(R) – Share-based payment (revised 2004)

SFAS123(R) was issued in December 2004 and is effective for the first annual reporting period that starts after 15 June 2005. It supersedes APB Opinion 25,Accounting for Stock Issued to Employees. SFAS123(R) is concerned with how to account for transactions in which an entity exchanges its equity instruments for goods or services. It also addresses transactions in which an entity incurs liabilities in exchange for goods or services that are based on the fair value of the entity’s equity instruments or that may be settled by the issuance of those equity instruments. The main effect of this revised standard is a move from an intrinsic value method to a fair value based method. It will therefore result in an additional charge relating to the fair value of share options in the Group’s income statement. Management does not believe that this will have a material effect on the Group’s results and financial position under US GAAP in future periods.

SFAS154 – Accounting changes and error corrections – a replacement of APB Opinion No. 20 and FASB Statement No. 3.

SFAS154 was issued in May 2005 and is effective for fiscal years beginning after 15 December 2005. This statement replaces APB Opinion 20,Accounting Changes, and SFAS 3, Reporting Accounting Changes in Interim Financial Statements. This Statement requires voluntary changes in accounting principles to be reported via retrospective application, unless impracticable. Previous guidance given in APB Opinion 20 for reporting the correction of an error in previously issued financial statements or a change in accounting estimates is unchanged in SFAS154. Management does not believe that this statement will have a material effect on the Group’s results and financial position under US GAAP in future periods.

FIN47 – Accounting for conditional asset retirement obligations

FIN47 was issued in August 2005 and is effective for fiscal years ending after 15 December 2005. This interpretation clarifies the term ‘conditional asset retirement obligation’ as used in SFAS143,Accounting for asset retirement obligations. FIN47 requires an entity to recognise a liability for the fair value of a conditional asset retirement obligation if the fair value of the liability can be reasonably estimated. The fair value of a liability for the conditional asset retirement obligation should be recognised when incurred - generally upon acquisition, construction, or development and/or through the normal operation of the asset. Uncertainty about the timing and/or method of settlement of a conditional asset retirement obligation should be factored into the measurement of the liability when sufficient information exists. Management does not believe that this interpretation will have a material effect on the Group’s results and financial position under US GAAP in future periods.

m) Other information

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make significant estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Back to Contents

| 138 | The BOC Group plc Annual report and accounts 2005 |

Group undertakings

A list of the Group’s major operating undertakings, certain financing undertakings and undertakings in which the Group has a material interest is detailed below. All holdings shown are Ordinary shares. Undertakings are held either by The BOC Group plc directly (where indicated by*) or through other operating undertakings or through undertakings formed for the convenient holding of shares in certain subsidiaries, joint ventures or associates. The Group holding percentages shown below represent the ultimate interest of The BOC Group plc. All companies are incorporated and registered in the country in which they operate as listed below.

|

|

|

| |

| | Principal | | Group holding | |

| | activity | | % | |

|

|

|

| |

| Aruba | | | | |

| BOC Gases Aruba NV |  | | 100 | |

|

|

|

| |

| Australia | | | | |

| BOC Ltd3 |    | | 100 | |

| Elgas Ltd5 |  | | 50 | |

|

|

|

| |

| Bangladesh | | | | |

| BOC Bangladesh Ltd |  | | 60 | * |

|

|

|

| |

| Belgium | | | | |

| SA BOC Edwards NV |  | | 100 | |

|

|

|

| |

| Bermuda | | | | |

| Priestley Company Ltd |  | | 100 | |

| The Hydrogen Company of Paraguana Ltd |  | | 100 | |

|

|

|

| |

| Brazil | | | | |

| BOC Edwards Brasil Ltda |   | | 100 | |

| BOC Gases do Brasil Ltda |  | | 100 | |

|

|

|

| |

| Brunei | | | | |

| Brunei Oxygen Sdn Bhd(a),5 |  | | 25 | |

|

|

|

| |

| Canada | | | | |

| BOC Canada Ltd3 |  | | 100 | |

| Hibon Inc |  | | 100 | |

|

|

|

| |

| Chile | | | | |

| Compania de Hidrogeno de Talcahuano Ltda5 |  | | 100 | |

| Indura S.A., Industriay Comercio5 |   | | 41 | |

|

|

|

| |

| Colombia | | | | |

| Gases Industriales de Colombia SA5 |   | | 74 | |

|

|

|

| |

| Czech Republic | | | | |

| BOC Edwards s.r.o. |  | | 100 | |

| Gist Czech Republic s.r.o. |  | | 100 | |

|

|

|

| |

| England | | | | |

| BOC Edwards Chemical | | | | |

| Management Europe Ltd |  | | 100 | * |

| BOC Holdings1, 3 |  | | 100 | * |

| BOC Ltd |     | | 100 | |

| BOC Netherlands Holdings Ltd |  | | 100 | * |

| BOC Overseas Finance Ltd |  | | 100 | * |

| Edwards High Vacuum International Ltd |  | | 100 | |

| Fluorogas Ltd |  | | 100 | * |

| Gist Ltd |  | | 100 | |

| Leengate Welding Group Ltd |  | | 100 | |

| Welding Products Holdings Ltd |   | | 100 | * |

|

|

|

| |

| Fiji | | | | |

| BOC Fiji Ltd |  | | 90 | |

|

|

|

| |

|

|

|

| |

| | Principal | | Group holding | |

| | activity | | % | |

|

|

|

| |

| France | | | | |

| Cryostar SAS |  | | 100 | |

| Edwards SAS |  | | 100 | |

| Hibon International SA |  | | 100 | |

| Hibon SAS |  | | 100 | |

| Société de Mécanique Magnétique |  | | 87 | |

|

|

|

| |

| Germany | | | | |

| BOC Edwards GmbH |  | | 100 | |

| BOC Gase Deutschland GmbH |  | | 100 | |

| Wilhelm Klein GmbH |  | | 100 | |

|

|

|

| |

| Guernsey | | | | |

| BOC No 1 Ltd |  | | 100 | |

| BOC No 2 Ltd |  | | 100 | |

|

|

|

| |

| Hong Kong | | | | |

| Hong Kong Oxygen & Acetylene Co Ltd |   | | 50 | |

| The BOC Group Ltd |  | | 100 | |

|

|

|

| |

| India | | | | |

| BOC India Ltd5 |   | | 55 | * |

|

|

|

| |

| Indonesia | | | | |

| PT BOC Gases Indonesia |   | | 100 | |

| PT Gresik Gases Indonesia |  | | 90 | |

| PT Gresik Power Indonesia |  | | 90 | |

|

|

|

| |

| Ireland | | | | |

| BOC Gases Ireland Ltd |   | | 100 | |

| Priestley Dublin Reinsurance Company Ltd |  | | 100 | |

|

|

|

| |

| Italy | | | | |

| BOC Edwards SpA |  | | 100 | |

|

|

|

| |

| Japan | | | | |

| BOC Japan Ltd |  | | 99 | |

| BOC Edwards Japan Ltd |  | | 100 | |

| Japan Air Gases Ltd5,8 |    | | 44 | |

|

|

|

| |

| Kenya | | | | |

| BOC Kenya Ltd |  | | 65 | |

|

|

|

| |

| Korea | | | | |

| BOC Gases Korea Co Ltd |  | | 100 | |

| Songwon Edwards Ltd |  | | 97 | |

|

|

|

| |

| Malawi | | | | |

| BOC Malawi Ltd(c) |  | | 42 | |

|

|

|

| |

| Malaysia | | | | |

| Malaysian Oxygen Bhd(a),4 |    | | 23 | |

| MOX Gases Sdn Bhd |  | | 23 | |

|

|

|

| |

| Mauritius | | | | |

| Les Gaz Industriels Ltee(b) |  | | 21 | |

|

|

|

| |

| Mexico | | | | |

| BOC Gases de Mexico, SA de CV5 |  | | 100 | |

| Compania de Nitrogeno de Cantarell, | | | | |

| SA de CV5,9 |  | | 65 | |

|

|

|

| |

Back to Contents

|

|

|

| |

| | Principal | | Group holding | |

| | activity | | % | |

|

|

|

| |

| Mozambique | | | | |

| Petrogas Ltda |  | | 27 | |

|

|

|

| |

| Namibia | | | | |

| IGL Properties (Pty) Ltd |  | | 56 | |

|

|

|

| |

| Netherlands | | | | |

| BOC Edwards Pharmaceutical Systems BV |  | | 100 | |

| Gist BV |  | | 100 | |

| G Van Dongen Holding BV |  | | 100 | |

| The BOC Group BV3 |  | | 100 | |

|

|

|

| |

| Netherlands Antilles | | | | |

| BOC Gases Curaçao NV |  | | 100 | |

|

|

|

| |

| New Zealand | | | | |

| BOC Ltd3 |   | | 100 | |

| South Pacific Welding Group (NZ) Ltd |  | | 100 | |

|

|

|

| |

| Nigeria | | | | |

| BOC Gases Nigeria plc |  | | 60 | |

|

|

|

| |

| Pakistan | | | | |

| BOC Pakistan Ltd |   | | 60 | * |

|

|

|

| |

| Papua New Guinea | | | | |

| BOC Papua New Guinea Pty Ltd |  | | 74 | |

|

|

|

| |

| Peoples’ Republic of China | | | | |

| BOC (China) Holdings Co Ltd3,5 |  | | 100 | |

| BOC Gases (North) Co Ltd5 |  | | 100 | |

| BOC Gases (Shanghai) Corporation Ltd5 |  | | 100 | |

| BOC Gases (Suzhou) Co Ltd5 |  | | 100 | |

| BOC Gases (Tianjin) Co Ltd5 |  | | 100 | * |

| BOC Gases (Wuhan) Co Ltd5 |  | | 100 | |

| BOC TISCO Gases Co Ltd5 |  | | 50 | * |

| BOC Trading (Shanghai) Co Ltd5 |  | | 100 | |

| EdwardsTianli (Beijing) | | | | |

| Pharmaceutical Systems Co Ltd5 |  | | 50 | |

| Maanshan BOC-Ma Steel Gases Co Ltd5 |  | | 50 | |

| Nanjing BOC-YPC Gases Co Ltd5 |  | | 50 | |

| Shanghai BOC Industrial Gases Co Ltd5 |  | | 100 | * |

|

|

|

| |

| Philippines | | | | |

| Consolidated Industrial Gases Inc |    | | 100 | |

| Southern Industrial Gases Philippines Inc |  | | 100 | |

|

|

|

| |

| Poland | | | | |

| BOC Gazy Sp. z o.o. |   | | 98 | |

|

|

|

| |

| Samoa | | | | |

| BOC Samoa Ltd |  | | 96 | |

|

|

|

| |

| Singapore | | | | |

| BOC Gases Pte Ltd |  | | 100 | * |

| Singapore Oxygen Air Liquide Pte Ltd |    | | 50 | |

|

|

|

| |

| Solomon Islands | | | | |

| BOC Gases Solomon Islands Ltd |  | | 100 | |

|

|

|

| |

|

|

|

|

| | Principal | | Group holding |

| | activity | | % |

|

|

|

|

| South Africa | | | |

| African Oxygen Ltd3 |   | | 56 |

| Afrox Ltd |   | | 56 |

| BOC Edwards South Africa (Pty) Ltd |  | | 100 |

| Life Healthcare Group (Pty) Ltd |  | | 11 |

|

|

|

|

| Spain | | | |

| Logistica Dotra S.L.5 |  | | 100 |

| Logistica van Trans S.L.5 |  | | 100 |

| Trans Fresca S.L.5 |  | | 100 |

|

|

|

|

| Switzerland | | | |

| BOC AG |  | | 100 |

|

|

|

|

| Taiwan | | | |

| Asia Union Electronic Chemical Corporation5 |  | | 50 |

| BOC Edwards HTC Ltd |  | | 50 |

| BOC Lienhwa Industrial Gases Co Ltd |    | | 50 |

|

|

|

|

| Thailand | | | |

| MIG Production Company Ltd |  | | 54 |

| Thai Industrial Gases Public Co Ltd3 |    | | 99 |

| TIG HyCO Ltd |  | | 99 |

|

|

|

|

| United Arab Emirates | | | |

| BOC Helium M.E. FZCO |  | | 100 |

|

|

|

|

| US | | | |

| BOC Americas(PGS), Inc |  | | 100 |

| BOC Energy Services, Inc |  | | 100 |

| BOC Global Helium, Inc |  | | 100 |

| BOC Hydrogen, Inc |  | | 100 |

| BOC, Inc |  | | 100 |

| Environmental Management Corporation |  | | 100 |

| Linde BOC Process Plants LLC(a), 5 |  | | 30 |

| The BOC Group, Inc3 |     | | 100 |

|

|

|

|

| US Virgin Islands | | | |

| BOC Gases Virgin Islands Inc5 |  | | 100 |

|

|

|

|

| Venezuela | | | |

| BOC Gases de Venezuela, C.A. |   | | 100 |

|

|

|

|

| Vietnam | | | |

| North Vietnam Industrial Gases Ltd5 |  | | 40 |

|

|

|

|

| Zambia | | | |

| BOC Gases Zambia plc(c) |  | | 39 |

|

|

|

|

| Zimbabwe | | | |

| BOC Zimbabwe (Pvt) Ltd |  | | 100 |

|

|

|

|

| | |

| 1. | Unlimited company having share capital with registered office at the same address as The BOC Group plc. |

| 2. | Businesses where the Group percentage ownership is 50 per cent or less are accounted for as joint ventures, except as follows: (a) accounted for as associates, (b) accounted for as investment or (c) accounted for as subsidiary (controlled through partly owned intermediate undertaking). See also accounting policies on pages 91 and 92. |

| 3. | Group undertakings which made acquisitions or investments during the year. |

| 4. | Group holding for dividend purposes is 28 per cent. |

| 5. | Group undertakings with financial year ends other than 30 September. |

| 6. | The principal activity of each undertaking is indicated as follows: |

| |  | Process Gas Solutions |

| |  | Industrial and Special Products |

| |  | BOC Edwards |

| |  | Afrox hospitals |

| |  | Gist |

| |  | Corporate/holding company |

| 7. | * | Indicates where investment is held directly byThe BOC Group plc. |

| 8. | BOC Japan Ltd holds 45 per cent of Japan Air Gases Ltd. |

| 9. | Accounted for as joint venture. |

Back to Contents

140 The BOC Group plc Annual report and accounts 2005

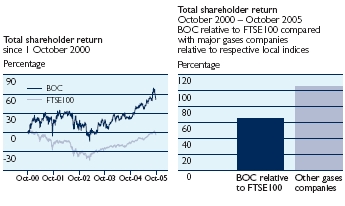

Shareholder information

Dividends

Ordinary shares

The company has paid cash dividends on its Ordinary shares in every year since 1899. Since 1988, the dividend policy has been to pay two interim dividends, one in February and one in August. The dividends are reported in the accounts in the year in which they are paid.

Two dividends were paid in 2005. A first interim dividend of 15.9p per share was paid in February and a second interim dividend of 25.3p per share was paid in August. Future dividends of the company will be dependent upon future earnings, the financial position of the company and other factors. A first interim dividend of 16.3p per share has been declared for payment on 1 February 2006.

| The table below sets out, in UK pence, the total of the cash amounts of the dividends per share. | |

|

|

|

|

|

| | Pence per Ordinary share | | |

|

|

|

|

| $ per |

| First | | Second | | | Ordinary1 |

| interim paid | interim paid | Total | share total |

| |

| |

| |

| |

| |

| 2001 | | 15.50 | | 21.50 | | 37.00 | | 0.53 | |

| 2002 | | 15.50 | | 22.50 | | 38.00 | | 0.57 | |

| 2003 | | 15.50 | | 23.50 | | 39.00 | | 0.63 | |

| 2004 | | 15.50 | | 24.50 | | 40.00 | | 0.73 | |

| 2005 | | 15.90 | | 25.30 | | 41.20 | | 0.74 | |

| |

| |

| |

| |

| |

| 1. | The dollar equivalents of the dividend per Ordinary share are based on the exchange rate at the date of payment of the dividend. |

12 1 /4 % Unsecured Loan Stock 2012/2017

Interest payments are made twice each year on 2 April and 2 October at such amounts as will result in an annual rate of 121 /4 per cent.

American Depositary Shares

The cash amount of the dividends applicable to an American Depositary Share representing two Ordinary shares, is set out below:

|

|

|

|

|

|

|

|

|

|

| |

| | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

| $ | $ | $ | $ | $ |

| |

| |

| |

| |

| |

| |

| First interim | | 0.60 | | 0.56 | | 0.51 | | 0.44 | | 0.45 | |

| Second interim | | 0.89 | | 0.89 | | 0.75 | | 0.70 | | 0.61 | |

| |

| |

| |

| |

| |

| |

Nature of trading market

The company’s Ordinary shares and 121 /4 % Unsecured Loan Stock 2012/2017 are listed on the London Stock Exchange.

The company listed American Depositary Shares (ADS) on the New York Stock Exchange (NYSE) on 18 September 1996 trading under the symbol BOX. Each ADS represents two Ordinary shares and is evidenced by an American Depositary Receipt (ADR). The ADR depositary, JPMorgan Chase Bank N.A., holds Ordinary shares in the company through Guaranty Nominees Limited.

At 12 November 2005, there were 242 US registered holders who held 160,480 of the company’s Ordinary shares and 67 registered ADS holders representing 39,122 ADSs. In addition, 3,400,742 ADSs were held by and through the Depository Trust Company.

The table below sets out the reported highest and lowest middle market quotations for the company’s Ordinary shares on the London Stock Exchange as notified by the company’s stockbrokers for the periods indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financial year | High | | Low | High | | Low | High | | Low | High | | Low | High | | Low |

| quarter | pence | pence | pence | pence | pence | pence | pence | pence | pence | pence |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| First quarter | 995.0 | | 870.0 | | 906.5 | | 791.5 | | 947.0 | | 818.0 | | 1108.0 | | 907.0 | | 1050.0 | | 850.5 | |

| Second quarter | 1035.0 | | 969.0 | | 948.0 | | 841.0 | | 904.0 | | 670.0 | | 1100.0 | | 988.0 | | 1076.0 | | 909.0 | |

| Third quarter | 1073.0 | | 965.0 | | 949.0 | | 875.5 | | 828.5 | | 755.0 | | 1088.0 | | 999.0 | | 1114.0 | | 928.0 | |

| Fourth quarter | 1173.0 | | 1025.0 | | 943.0 | | 867.0 | | 912.5 | | 767.5 | | 1035.0 | | 836.0 | | 1060.0 | | 780.0 | |

|

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | | | | | | | | | | | | | | | | |

| 2005 | | | | | | | | | May | | June | | July | | August | | September | | October | |

|

|

|

|

|

|

|

| |

| |

| |

| |

| |

| |

| |

| High pence | | | | | | | | | 1010.0 | | 1073.0 | | 1082.0 | | 1074.0 | | 1173.0 | | 1160.0 | |

| Low pence | | | | | | | | | 965.0 | | 1004.0 | | 1025.0 | | 1036.0 | | 1084.0 | | 1045.0 | |

|

|

|

|

|

|

|

| |

| |

| |

| |

| |

| |

| |

Back to Contents

| Shareholder information | 141 |

The table below sets out the highest and lowest reported sales prices for the company’s ADSs as reported on the NYSE as notified by the depositary for the periods indicated.

|

|

|

|

|

|

|

|

|

|

| |

| | | 2005 | | 2004 | | 2003 | | 2002 | | 2001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial year

| | | | | | | | | | | | | | | |

| quarter | High $ | Low $ | High $ | Low $ | High $ | Low $ | High $ | Low $ | High $ | Low $ |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| First quarter | | 38.80 | | 31.34 | | 31.09 | | 27.60 | | 29.11 | | 25.69 | | 31.76 | | 26.60 | | 31.25 | | 24.31 | |

| Second quarter | | 39.95 | | 36.40 | | 36.15 | | 31.00 | | 29.31 | | 22.00 | | 31.60 | | 27.83 | | 32.75 | | 26.70 | |

| Third quarter | | 39.40 | | 36.21 | | 35.13 | | 31.15 | | 27.30 | | 24.19 | | 31.74 | | 29.75 | | 31.50 | | 26.05 | |

| Fourth quarter | | 42.72 | | 35.80 | | 34.95 | | 31.67 | | 29.63 | | 25.86 | | 31.80 | | 26.02 | | 30.24 | | 22.50 | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 2005 | | | | | | | | | | May | | June | | July | | August | | September | | October | |

|

|

|

|

|

|

|

|

| |

| |

| |

| |

| |

| |

| |

| High $ | | | | | | | | | | 38.11 | | 39.40 | | 38.45 | | 38.80 | | 42.72 | | 40.79 | |

| Low $ | | | | | | | | | | 36.55 | | 36.21 | | 35.80 | | 37.20 | | 39.31 | | 37.10 | |

|

|

|

|

|

|

|

|

| |

| |

| |

| |

| |

| |

| |

Analysis of shareholdings

a) Substantial holdings – at 12 November 2005

|

|

|

|

| |

| | | Number | | |

| of shares | % of issued |

| million | capital |

| |

| |

| |

| Ordinary shares of 25p each | | | | | |

| Barclays PLC | | 15.70 | | 3.14 | |

| Legal & General Investment Management Limited | | 15.00 | | 3.02 | |

| UBS AG | | 17.50 | | 3.49 | |

| |

| |

| |

At 12 November 2005 no person or company is known to hold more than five per cent of the Ordinary shares.

The company is not directly or indirectly owned or controlled by any other company or any government.

b) By size of holding – at 30 September 2005

|

|

|

|

|

|

|

|

| |

Number of

accounts | | % of | | Size of holding 25p shares | | Number of | | % |

| total number | 25p shares | of ordinary |

| of accounts | million | capital |

| |

| |

| |

| |

| |

| 17,338 | | 46 | | 1 – 500 | | 4.3 | | 1 | |

| 9,556 | | 26 | | 501 – 1,000 | | 7.1 | | 1 | |

| 8,995 | | 24 | | 1,001 – 5,000 | | 17.7 | | 4 | |

| 1,107 | | 3 | | 5,001 – 50,000 | | 15.5 | | 3 | |

| 478 | | 1 | | 50,001 – 1,000,000 | | 120.4 | | 24 | |

| 88 | | 0 | | Over 1,000,000 | | 337.5 | | 67 | |

| |

| | | |

| |

| |

| 37,562 | | 100 | | | | 502.5 | | 100 | |

| |

| | | |

| |

| |

c) By investor type – at 30 September 2005

|

|

|

|

|

|

|

|

| |

Number of

accounts | | % of | | | | Number of | | % |

| total number | 25p shares | of ordinary |

| of accounts | Type of investor | million | capital |

| |

| |

| |

| |

| |

| 29,683 | | 79 | | Individuals | | 26.2 | | 5 | |

| 6,966 | | 19 | | Institutional investors | | 467.3 | | 93 | |

| 913 | | 2 | | Other corporate investors | | 9.0 | | 2 | |

| |

| | | |

| |

| |

| 37,562 | | 100 | | | | 502.5 | | 100 | |

| |

| | | |

| |

| |

d) Close company status

The company is not a close company within the meaning of the Income and Corporation Taxes Act 1988. There has been no change in that status since 30 September 2005.

e) Stock ownership of management

The interests of the directors and officers of the company in the shares and options of the company are given in the report on remuneration on pages 79 to 82.

Back to Contents

| 142 | The BOC Group plc Annual report and accounts 2005 | Shareholder information |

Taxation

A summary of the principal tax consequences for certain beneficial holders of Ordinary shares of BOC and ADSs representing Ordinary shares is set out below. This summary applies to citizens or residents of the UK or US, or otherwise who are subject to UK tax or US federal income tax on a net income basis in respect of such securities. It is not intended to be a comprehensive analysis of all of the potential tax consequences of holding Ordinary shares or ADSs and does not purport to deal with persons who hold their Ordinary shares or ADSs in special circumstances, such as financial institutions, tax exempt organisations, insurance companies, dealers in securities, persons who own, directly or indirectly or by attribution, ten per cent or more of the outstanding share capital or voting stock of BOC, persons holding Ordinary shares or ADSs as part of a ‘hedge’,‘straddle’ or other risk reduction transaction, or who acquired such Ordinary shares or ADSs through the exercise of an employee stock option or otherwise as compensation. All holders and investors are advised to consult their tax advisors on the tax implications of their particular holdings, including the consequences under applicable state and local law.

The statements of tax laws set out below are based on the laws in force at the date of this report unless otherwise noted, and are subject to any subsequent changes in UK and US law, or in any double tax convention between the UK and the US.

UK shareholders

The following information applies to individuals who hold Ordinary shares and who are resident or ordinarily resident in the UK for UK tax purposes (UK resident holders).

Taxation of capital gains

A UK resident holder will be liable to UK tax on the gain from the disposal of Ordinary shares. For the purposes of calculating the gain from the disposal of Ordinary shares, a UK resident holder who held Ordinary shares prior to 31 March 1982 may substitute the market value of such shares as at that date for the original cost of such shares. The market value of Ordinary shares on 31 March 1982 was 168.75p per Ordinary share.

A UK resident holder may also be entitled to indexation relief and taper relief when selling shares. Indexation relief is calculated on the market value of shares held at 31 March 1982 and on the cost of any subsequent purchases from that date. Indexation relief is not available for periods after 1 April 1998. Taper relief provides UK resident holders with relief from tax on gains accrued on the disposal of Ordinary shares held or acquired after 5 April 1998. The amount of taper relief available depends on the length of time such shares have been held and on the UK resident holder’s individual facts and circumstances.

Taxation of dividends

A UK resident holder is entitled to a tax credit on receipt of a cash dividend. The tax credit is a fixed proportion of the dividend and is currently 1 /9 th of the cash dividend received.

The income subject to UK income tax is the sum of the dividend and the attached tax credit, with the tax credit being available as a deduction against any resulting tax liability.

Special rates of tax apply to dividend income: the ‘ordinary rate’ is ten per cent and applies to individuals liable to tax at the basic or lower rates of tax; the ‘upper rate’ is 32.5 per cent which applies to the extent that income exceeds the basic rate band.

For a UK resident holder liable to income tax only at the basic or lower rates of tax, there will thus be no further tax liability in respect of the dividend received. If, however, the UK resident holder is subject to income tax at the higher rate there will be a further tax liability on the sum of the cash dividend received and the associated tax credit. Where a UK resident holder’s tax liability is less than the associated tax credit, no refund is available.

By way of example, the payment by BOC of a cash dividend of £90 would have an associated tax credit of £10 and a UK resident holder is treated as receiving a gross dividend of £100. The upper rate tax of 32.5 per cent on the gross dividend is £32.50. Therefore the UK resident holder liable to tax at the upper rate will have a tax liability of £22.50, being the tax liability on the gross dividend of £32.50 less the tax credit of £10.

Stamp duty

Stamp duty or stamp duty reserve tax at the rate of 0.5 per cent of consideration payable is normally payable on the purchase price of shares.

Inheritance tax

Individual shareholders may be liable to inheritance tax on the transfer of Ordinary shares. Inheritance tax may be charged on the amount by which the value of a shareholder’s estate is reduced as a result of any transfer by way of gift or other gratuitous transaction made by them or treated as made by them.

US holders

For the purposes of this summary, a US holder is a beneficial owner of ADSs who is an individual citizen or resident of the US, a corporation or other entity organised under the laws of the US or any state thereof, an estate the income of which is subject to US federal income taxation regardless of its source, or a trust if a court within the US is able to exercise primary supervision over the administration of the trust and one or more US persons have the authority to control all substantial decisions of the trust.

US holders of ADSs are treated as owners of underlying Ordinary shares for the purposes of the convention relating to estate and gift tax (the Estate Tax Convention) and for the purposes of the US Internal Revenue Code of 1986, as amended (the Code).

Back to Contents

| | Shareholder information | 143 |

| | | |

Taxation of dividends

Under current UK tax legislation, no tax will be withheld from dividend payments made by BOC.

Dividends received by a US holder will be foreign source income for US federal income tax purposes in the amount equal to the US dollar value of the dividend on the date of such payment. Generally, dividends will not be eligible for the ‘dividends received’ deduction allowed to US corporations under the Code.

The US dollar amount of any dividends received by a non-corporate US holder prior to 1 January 2009 that constitute qualified dividends will be taxable to the holder at a maximum rate of 15 per cent, provided that certain holding periods are met. BOC currently believes that dividends paid with respect to its ADSs should be treated as qualified dividends for the 2005 taxable year and BOC intends to report its dividends as qualified dividends on Forms 1099-DIV delivered to US holders. US holders are urged to consult their own tax advisers regarding the availability of the reduced dividend tax rate in light of their own particular situations.

The US Treasury has expressed concern that parties to whom ADSs are released may be taking actions that are inconsistent with the claiming of deductions in respect of qualified dividends by US holders of ADSs. Accordingly, the analysis of the availability of qualified dividend treatment could be affected by future actions that may be taken by the US Treasury with respect to ADSs.

Taxation of capital gains

Generally, a US holder who is not resident or ordinarily resident in the UK for tax purposes should not be subject to UK tax on any gain from the disposal of ADSs, but will be subject to US tax on any capital gain realised on the sale or other disposal of ADSs.

US information reporting and backup withholding

Dividend payments made with respect to ADSs and proceeds from the sale or other disposal of ADSs may be subject to information reporting to the US Internal Revenue Service and backup withholding at a current rate of 28 per cent. Holders should consult their own advisors as to the application to them of the information reporting and backup withholding rules.

Stamp duty

In practice no UK stamp duty is payable on the transfer of an ADS, provided that the separate instrument of transfer is not executed in, and always remains outside of, the UK. No stamp duty reserve tax is payable on an agreement to transfer ADSs.

Estate and gift tax

Under the Estate Tax Convention, a US holder generally is not subject to UK inheritance tax.

Exchange controls and other limitations affecting security holders

There are currently no exchange controls or other limitations in the UK affecting security holders.

Back to Contents

| 144 | The BOC Group plc Annual report and accounts 2005 | Shareholder information |

| Financial calendar | | | | | | | | | |

| |

| | | | | Ordinary Shares/

American Depositary Shares | | 121 /4 % Unsecured Loan Stock

2012/2017 | |

| | | | |

| |

| |

| | | | | First

interim | | Second

interim1 | | Half year | | Half year | |

| |

| |

| |

| |

| |

| Ex-dividend | | | | 4 Jan 2006 | | 28 Jun 2006 | | 1 Mar 2006 | | 30 Aug 2006 | |

| Record date | | | | 6 Jan 2006 | | 30 Jun 2006 | | 3 Mar 2006 | | 1 Sep 2006 | |

| DRIP notice date | | | | 11 Jan 2006 | | 11 Jul 2006 | | – | | – | |

| Payment date – UK | | | | 1 Feb 2006 | | 1 Aug 2006 | | 2 Apr 2006 | | 2 Oct 2006 | |

| – US | | | | 8 Feb 2006 | | 8 Aug 2006 | | – | | – | |

| |

| |

| |

| |

| |

| | | | | | | | | | | | |

|

|

|

|

|

|

|

|

|

|

| |

| | | Three months | | Half year | | Nine months | | Preliminary | | Report and

accounts | |

| |

| |

| |

| |

| |

| |

| Group results | | 8 Feb 2006 | | 11 May 2006 | | 2 Aug 2006 | | 23 Nov 2006 | | Dec 2006 | |

| |

| |

| |

| |

| |

| |

Key contacts information

Shareholder enquiries

Shareholders who have questions relating to the Group’s business or wish to receive copies of the interim statements should write to:

Director – Investor Relations

The BOC Group plc, Chertsey Road,Windlesham, Surrey GU20 6HJ, England

Telephone: 01276 477222

E-mail: ir@boc.com

Registrar

Administrative enquiries concerning shareholdings in the company such as the loss of share certificates, change of address, dividend payment arrangements, amalgamation of multiple accounts, or requests for the full report and accounts should be sent directly to:

LloydsTSB Registrars

The Causeway,Worthing,West Sussex BN99 6DA, England

Teltex for shareholders with hearing difficulties: 0870 600 3950

Telephone: 0870 600 3958 Fax: 0870 600 3980

If telephoning from outside the UK: +44 121 415 7035 or Fax: +44 1903 702424

Website: www.lloydstsb-registrars.co.uk

Correspondence should refer to The BOC Group plc, stating clearly the registered name and address and, if available, the full account number which starts with 0385.

Shareholding information

To view up-to-date information about your shareholding, change your address details, set up a new, or change an existing, dividend mandate, visit the Lloyds TSB Registrars shareview website at www.shareview.co.uk

The portfolio service provides access to more information on your investments including balance movements, indicative share prices and details of recent dividend payments. To register with Lloyds TSB Registrars as a user of the portfolio service and for more information visit the website at www.shareview.co.uk

Electronic shareholder communications

Shareholders can now elect to receive shareholder documents, such as annual and interim reports and notices of general meetings, electronically from the company’s website rather than in hard copy through the mail. This has the advantage of improving the speed of communications and reducing administrative costs of printing and postage. The terms on which this electronic facility is provided can be found on the company’s website (www.boc.com) or on request from the registered office. Any shareholder wishing to take advantage of this free service may do so by registering their details on the Lloyds TSB Registrars shareview website at www.shareview.co.uk

Dividend reinvestment plan

A dividend reinvestment plan (DRIP), through which Ordinary shareholders may invest the whole of their cash dividends in additional shares in the company, is available. Ordinary shareholders on the register at the record date may participate in the plan provided their application forms are received by the DRIP notice date shown in the financial calendar above. Copies of the explanatory brochure and application form are available on the company’s website (www.boc.com) or from Lloyds TSB Registrars whose details appear above.

Back to Contents

| | Shareholder information | 145 |

Payment of dividends

Ordinary shareholders and loan stock holders may arrange to have their dividends or interest paid directly into a bank or building society account through the Bankers Automated Clearing System (BACS). Mandate forms are available on the company’s website (www.boc.com) or from Lloyds TSB Registrars whose details appear on the previous page. Alternatively you can set up a new, or change an existing, dividend mandate via the Lloyds TSB Registrars shareview website at www.shareview.co.uk In February of each year a consolidated tax voucher relating to Ordinary dividend payments made via BACS during the financial year, will be mailed to the registered address of the shareholder. Loan stock holders will receive tax vouchers at the time of each interest payment in April and October, mailed directly to their registered address.

Overseas dividend payments

Private shareholders in 36 countries may now have their dividends paid directly into their local bank accounts in their local currency. There is a small fixed fee for the service, currently £2.50 per dividend. The dividend payment, less the fee, is normally received within five working days of the dividend payment date. For more information, please contact Lloyds TSB Registrars whose details appear on the previous page or visit the company’s website (www.boc.com).

Share dealing services

For Internet and telephone share dealing services contact Lloyds TSB Registrars by either logging on to www.shareview.co.uk/dealing or by calling 0870 850 0852 between 8.30 am and 4.30 pm on any business day (excluding bank holidays).You will need your shareholder reference number shown on your share certificate.

Lloyds TSB Registrars also offer a postal share dealing service. For further information contact:

Share Dealing Services

Lloyds TSB Registrars

PO Box 1357

The Causeway,Worthing

West Sussex, BN99 6UB

England

American Depositary Shares

The BOC Group plc American Depositary Shares (ADS) are listed on the New York Stock Exchange and trade under the symbol BOX. One ADS represents two The BOC Group plc Ordinary shares. JPMorgan Chase Bank N.A. is the depositary and their address for enquiries is:

JPMorgan Chase Bank N.A.

JPMorgan Service Center,

PO Box 3408, South Hackensack, NJ 07606-3408, USA

Telephone, toll free: US and Canada +1 800 990 1135 or from outside the US +1 201 680 6630

Website: www.adr.com/shareholder

A dividend reinvestment plan is available through JPMorgan Chase Bank N.A. as depositary for holders of ADSs. All enquiries regarding this plan should be addressed to:

Global Invest Direct,

JPMorgan Chase Bank N.A.

PO Box 3408, South Hackensack, NJ 07606-3408, USA

Telephone, toll free: JPMorgan Service Center on +1 800 428 4237 or from outside the US +1 201 680 6630

US report filings

All reports and other information filed with the US Securities and Exchange Commission (SEC) may be inspected at the public reference facilities maintained by the SEC at 100 F Street, NE,Washington DC 20549, USA. These reports may also be accessed via the SEC’s website at www.sec.gov

Agent in the US

CT Corporation System

111 Eighth Avenue, NewYork, NewYork 10011, USA

ShareGift

Shareholders with a small number of shares, the value of which makes it uneconomic to sell them, may wish to consider donating them to the charity ShareGift (registered charity number 1052686). A ShareGift donation form can be obtained from Lloyds TSB Registrars whose details appear on the previous page. Further information about ShareGift is available at www.sharegift.org or by writing to: ShareGift,The Orr Mackintosh Foundation, 46 Grosvenor Street, London W1K 3HN, England. Telephone: 020 7337 0501.

Unsolicited mail

The company is obliged by law to make its share register publicly available and as a consequence some shareholders may receive unsolicited mail. If you wish to limit the amount of unsolicited mail you receive, contact:The Mailing Preference Service, FREEPOST 29 (LON.20771), London W1E 0ZT, England. Telephone: 0845 703 4599 or register on-line at www.mpsonline.org.uk

The Mailing Preference Service is an independent organisation which offers a free service to the public. Registering with them will reduce most unsolicited consumer advertising material.

Special needs

If you would like to receive this report in an appropriate alternative format, such as large print, Braille, or audio cassette, please contact Lloyds TSB Registrars on 0870 600 3958 or for shareholders with hearing difficulties on Teltex 0870 600 3950.

Back to Contents

| 146 | The BOC Group plc Annual report and accounts 2005 |

| Cross reference to Form 20-F |

The information in this document that is referred to in the following table shall be deemed to be filed with the US Securities and Exchange Commission for all purposes.

|