- HMC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Honda Motor (HMC) 6-KCurrent report (foreign)

Filed: 31 May 22, 6:18am

No.1-7628

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MAY 2022

COMMISSION FILE NUMBER: 1-07628

HONDA GIKEN KOGYO KABUSHIKI KAISHA

(Name of registrant)

HONDA MOTOR CO., LTD.

(Translation of registrant’s name into English)

1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo 107-8556, Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Notice of Convocation of the 98th Ordinary General Meeting of Shareholders of the Company has been uploaded to the Company’s website shown below.

https://global.honda/investors/stock_bond/meeting.html

The English translation of Report of Independent Directors of the Company.

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| HONDA GIKEN KOGYO KABUSHIKI KAISHA |

| (HONDA MOTOR CO., LTD.) |

/s/ Masaharu Hirose |

Masaharu Hirose |

| General Manager |

| Finance Division |

| Honda Motor Co., Ltd. |

Date: May 31, 2022

Securities Code Number: 7267

THE 98TH ORDINARY GENERAL MEETING OF SHAREHOLDERS

TO BE HELD AT GRAND NIKKO TOKYO DAIBA, TOKYO, JAPAN

ON JUNE 22, 2022 AT 10:00 A.M.

(This is an abridged translation of the original notice

in the Japanese language mailed on June 3, 2022

to shareholders in Japan, and is for reference purposes only.

In the event of any discrepancy between the translated document and the Japanese original,

the original shall prevail.

The Company assumes no responsibility for this translation

or for direct, indirect or any other forms of damage arising from the translations.)

HONDA MOTOR CO., LTD.

(HONDA GIKEN KOGYO KABUSHIKI KAISHA)

TOKYO, JAPAN

[Abridged Translation]

June 3, 2022

To Shareholders:

Notice of Convocation of the 98th

Ordinary General Meeting of Shareholders

Dear Shareholders:

You are hereby notified that the 98th Ordinary General Meeting of Shareholders will be held as stated below.

We have decided to hold this meeting after taking appropriate measures to prevent the spread of COVID-19.

For your health and safety, you are requested to exercise your voting rights via the Internet or by mail in advance if possible and to refrain from coming to the venue.

If you exercise your voting rights via the Internet or by mail, please review the reference materials for the general meeting of shareholders mentioned below, and exercise your voting rights no later than 6:00 p.m. on Tuesday, June 21, 2022.

This general meeting of shareholders will be streamed live via the Internet, from the opening to the closing of the meeting.

| Yours faithfully, |

| Toshihiro Mibe |

| Director, President and Representative Executive Officer |

| Honda Motor Co., Ltd. |

| 1-1, Minami-Aoyama, 2-chome |

| Minato-ku, Tokyo |

Particulars

| Time and Date | 10:00 a.m. on Wednesday, June 22, 2022 (registration desks to open at 9:00 a.m.) | |||

| Place | Grand Nikko Tokyo Daiba | |||

| Palais Royal ball room on the first basement level, at 2-6-1 Daiba, Minato-ku, Tokyo | ||||

Agenda

Matters to be reported |

1. The Business Report, Consolidated Financial Statements and Unconsolidated Financial Statements for the 98th Fiscal Year (from April 1, 2021 to March 31, 2022); | |||

2. The Results of the Audit of the Consolidated Financial Statements for the 98th Fiscal Year (from April 1, 2021 to March 31, 2022) by the Independent Auditors and the Audit Committee. | ||||

Matters to be resolved | Item | Election of Eleven (11) Directors | ||

2

Matters Posted on the Company’s Website

| ∎ | Regarding documents to be provided together with this Notice of Convocation, following items are posted on the Company’s website in accordance with provisions of laws and regulations and Article 15 of the Company’s Articles of Incorporation. |

• Business Report: | OUTLINE OF BUSINESS | |

Changes in Financial Position and Results of Operations of the Group and the Parent Company, Principal Business Activities, Principal Business Sites | ||

Employees of the Group and the Parent Company | ||

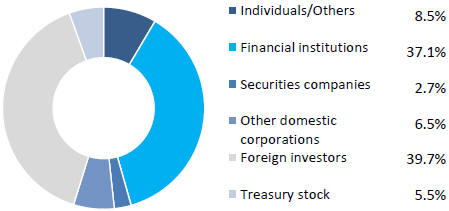

| COMMON STOCK | ||

Total Number of Shares Issued, Number of Shareholders, Major Shareholders | ||

| STOCK WARRANTS | ||

| CORPORATE OFFICERS | ||

Summary of Content of Liability Limitation Contracts | ||

| FINANCIAL AUDITOR | ||

| THE COMPANY’S SYSTEMS AND POLICIES | ||

Systems to Ensure the Appropriateness of Operations | ||

Overview of Operating Status for Systems to Ensure the Appropriateness of Operations | ||

• Consolidated Financial Statements: | Consolidated Statements of Changes in Equity | |

| The Notes to the Consolidated Statutory Report |

The Audit Committee and the financial auditor have audited documents that are subject to audit, including the above matters posted on the Company’s website. |

| ∎ | If any revision is made to the reference materials for the general meeting of shareholders or the attached materials, the revision will be posted on the Company’s website. |

| ∎ | The results of resolutions passed by the Ordinary General Meeting of Shareholders will be posted on the Company’s website, instead of sending the document by mail. |

Japanese https://www.honda.co.jp/investors/stock_bond/meeting.html | English https://global.honda/investors/stock_bond/meeting.html | |

3

Notes:

| (1) | If there is no indication of approval or disapproval on a voting right exercise form in relation to any matter proposed to be resolved, it will be treated as a vote of approval for such matter. |

| (2) | If voting rights are exercised both through indications on the voting right exercise form by mail and through voting via the Internet, causing voting rights to be exercised more than once, the votes submitted via the Internet will be regarded as the effective votes. |

| (3) | If voting rights are exercised more than once via the Internet, the most recent votes submitted via the Internet will be regarded as the effective votes. |

| (4) | If you wish to exercise your voting rights by proxy, one other shareholder holding a voting right of the Company may attend the meeting as proxy. In this case, please submit a document that certifies your power of representation, such as a letter of attorney, to the Company. A person who is not a shareholder, such as a proxy who is not a shareholder or an accompanying person of a shareholder, may not attend the meeting. |

| * | If you wish to exercise your voting rights via the Internet, please enter your vote for or against each of the proposals on the following voting rights exercise website. |

https://evote.tr.mufg.jp/

Request: We request that when arriving at the meeting you present the voting right exercise form enclosed herewith to the meeting hall receptionist.

4

REFERENCE MATERIALS FOR THE GENERAL MEETING OF SHAREHOLDERS

| ITEM | Election of Eleven (11) Directors |

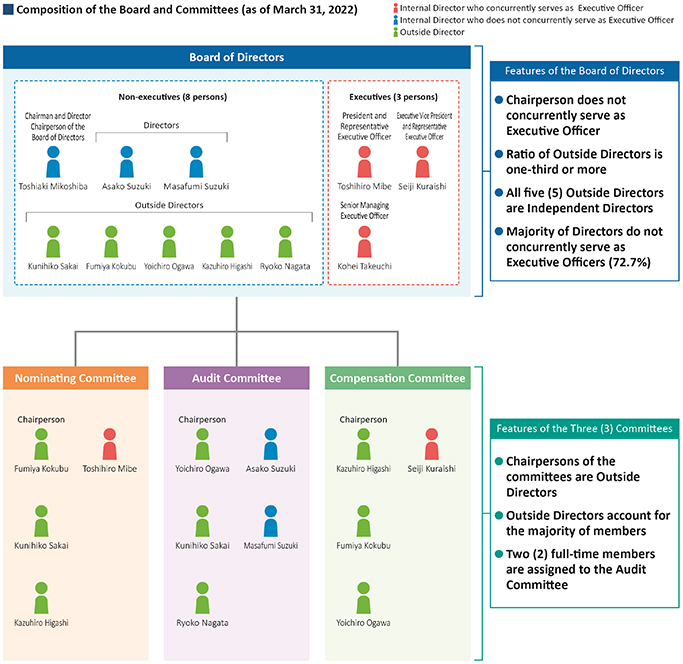

The term of office of each of the eleven (11) current Directors is due to expire at the close of this general meeting of shareholders.

It is proposed that the following eleven (11) Directors, including five (5) Outside Directors, be elected at this meeting.

The names and particulars of the candidates for the position of Directors are provided below.

| Candidate number | Name | Current position | Responsibilities | |||||

| 1 | Reappointment | Seiji Kuraishi | Chairman and Director | Chairman of the Board of Directors | ||||

| 2 | Reappointment | Toshihiro Mibe | Director, President and Representative Executive Officer | Member of the Nominating Committee Chief Executive Officer | ||||

| 3 | Reappointment | Kohei Takeuchi | Director, Executive Vice President and Representative Executive Officer | Member of the Compensation Committee Chief Financial Officer Risk Management Officer | ||||

| 4 | New appointment | Shinji Aoyama | Senior Managing Executive Officer | Chief Officer for Business Development Operations Chief Officer for Automobile Operations Corporate Brand Officer | ||||

| 5 | Reappointment | Asako Suzuki | Director | Member of the Audit Committee (Full-time) | ||||

| 6 | Reappointment | Masafumi Suzuki | Director | Member of the Audit Committee (Full-time) | ||||

| 7 | Reappointment | Kunihiko Sakai | Director | Member of the Nominating Committee Member of the Audit Committee | ||||

| 8 | Reappointment | Fumiya Kokubu | Director | Member of the Nominating Committee (Chairperson) Member of the Compensation Committee | ||||

| 9 | Reappointment | Yoichiro Ogawa | Director | Member of the Audit Committee (Chairperson) Member of the Compensation Committee | ||||

| 10 | Reappointment | Kazuhiro Higashi | Director | Member of the Nominating Committee Member of the Compensation Committee (Chairperson) | ||||

| 11 | Reappointment | Ryoko Nagata | Director | Member of the Audit Committee | ||||

5

Name | Attendance record for the fiscal year ended March 31, 2022 | |||||||

Board of Directors | Nominating Committee | Audit Committee | Compensation Committee | |||||

| Seiji Kuraishi | 10/10 100% | — | — | 5/5 100% | ||||

| Toshihiro Mibe | 10/10 100% | 7/7 100% | — | — | ||||

| Kohei Takeuchi | 10/10 100% | — | — | — | ||||

| Shinji Aoyama | — | — | — | — | ||||

| Asako Suzuki | 8/8 100% | — | 6/6 100% | — | ||||

| Masafumi Suzuki | 10/10 100% | — | 6/6 100% | — | ||||

| Kunihiko Sakai | 10/10 100% | 7/7 100% | 6/6 100% | — | ||||

| Fumiya Kokubu | 10/10 100% | 7/7 100% | — | 5/5 100% | ||||

| Yoichiro Ogawa | 8/8 100% | — | 6/6 100% | 5/5 100% | ||||

| Kazuhiro Higashi | 8/8 100% | 7/7 100% | — | 5/5 100% | ||||

| Ryoko Nagata | 8/8 100% | — | 6/6 100% | — | ||||

Notes: | 1. | As of June 23, 2021, the Company transitioned from a company with an audit and supervisory committee to a company with three committees. | ||

| 2. | The attendance record of the Board of Directors of Directors Asako Suzuki, Yoichiro Ogawa, Kazuhiro Higashi and Ryoko Nagata shows figures covering the meetings of the Board of Directors held after their assumption of office on June 23, 2021. | |||

| 3. | Directors Masafumi Suzuki and Kunihiko Sakai attended all of the four (4) meetings of the Audit and Supervisory Committee held during April to June 2021. | |||

| 4. | Two (2) of the eleven (11) candidates for Directors are female (18% of the candidates for Directors). | |||

6

| ∎ | (Reference) Nomination Policy of Director Candidates (from “Honda Corporate Governance Basic Policies”) |

| • | The Director candidates shall be exceptional persons who are familiar with corporate management or the Company Group’s business, and have superior character and insight, irrespective of gender, nationality, and other such individual attributes. In nominating such candidates, the Nominating Committee shall consider the balance of gender, internationality, and experience and specialization in each field. |

| • | The Outside Director candidates shall have abundant experience and deep insight in fields such as corporate management, the legal, public administration, accounting, or education, and shall be capable of overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint based on the standpoint independent from the Company Group. |

Name | Skills | Committee to be appointed | ||||||||||||||||||||||||||||||||||||

| Corporate management | Internationality | Industrial experience | New business strategies | HR | Accounting & finance | Legal & risk management | ESG & sustainability | Nominating | Audit | Compensation | ||||||||||||||||||||||||||||

Seiji Kuraishi | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||

Toshihiro Mibe | ● | ● | ● | ● | ● | ● | ● |  | ||||||||||||||||||||||||||||||

Kohei Takeuchi | ● | ● | ● | ● | ● | ● | ● |  | ||||||||||||||||||||||||||||||

Shinji Aoyama | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||

Asako Suzuki | ● | ● | ● | ● | ● |  | ||||||||||||||||||||||||||||||||

Masafumi Suzuki | ● | ● | ● |  | ||||||||||||||||||||||||||||||||||

Kunihiko Sakai | ● | ● |  |  | ||||||||||||||||||||||||||||||||||

Fumiya Kokubu | ● | ● | ● | ● |  |  | ||||||||||||||||||||||||||||||||

Yoichiro Ogawa | ● | ● | ● | ● |  |  | ||||||||||||||||||||||||||||||||

Kazuhiro Higashi | ● | ● | ● | ● | ● |  |  | |||||||||||||||||||||||||||||||

Ryoko Nagata | ● | ● | ● |  | ||||||||||||||||||||||||||||||||||

: Chairperson of the Committee : Chairperson of the Committee | ||||||||||||||||||||||||||||||||||||||

Please refer to the next page for the reasoning behind the selection of the skills.

7

| ∎ | Reasons for Selecting the Skills |

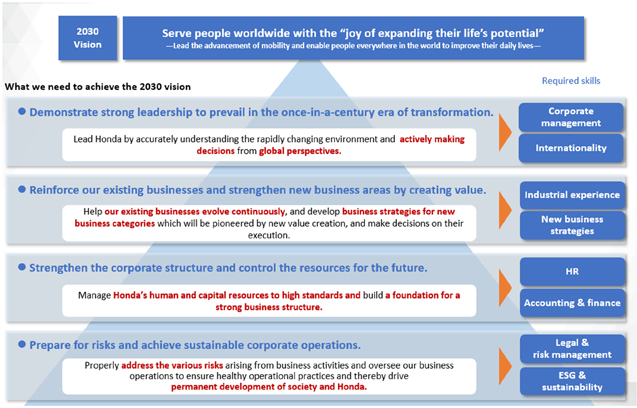

The Company has identified the following skills required for the Board of Directors to fulfill its role of making decisions with respect to the basic management policies of the Company Group and other equivalent matters and overseeing the performance by the Directors and Executive Officers of their duties, with the aim of achieving the “2030 Vision.”

8

1 | Seiji Kuraishi | Date of birth July 10, 1958 | Reappointment | |||

|

Current position

| Chairman and Director |

Responsibilities

| Chairman of the Board of Directors | ||||

● Number of shares of the Company held 43,000 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

| Board of Directors 10/10 (100%) Compensation Committee 5/5 (100%) | |||||||

● Term of office as Director (as of the close of this Meeting) 6 years

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1982 | Joined Honda Motor Co., Ltd. | Apr. 2017 | In Charge of Strategy, Business Operations and Regional Operations | |||

Jun. 2011 | Operating Officer | Jun. 2017 | Executive Vice President and Representative Director | |||

Nov. 2013 | President of Honda Motor (China) Technology Co., Ltd. | Apr. 2019 | Director in Charge of Strategy, Business Operations and Regional Operations | |||

Apr. 2014 | Managing Officer of the Company | Apr. 2019 | Chief Officer for Automobile Operations | |||

Apr. 2016 | Senior Managing Officer | Jun. 2021 | Director, Executive Vice President and Representative Executive Officer | |||

Jun. 2016 | Executive Vice President, Executive Officer and Representative Director | Jun. 2021 | Member of the Compensation Committee | |||

Jun. 2016 | Risk Management Officer | Apr. 2022 | Chairman and Director (present) | |||

Jun. 2016 | Corporate Brand Officer | Apr. 2022 | Chairman of the Board of Directors (present) | |||

Apr. 2017 | Chief Operating Officer | |||||

Reasons for nomination as a candidate for position of Director

Mr. Seiji Kuraishi has broad experience primarily in the areas of supply chain management and sales and marketing, as well as abundant international experience, and is familiar with the Company Group’s business including overseas operations.

In the fiscal year ended March 31, 2022, he has properly fulfilled his duties as Director, Executive Vice President and Representative Executive Officer, and Chief Operating Officer by demonstrating strong leadership and being responsible for business execution of the entire Company Group, as well as overseeing business execution.

He has been nominated as a candidate for Director again, given that he is particularly an exceptional person with both superior character and insight and is well qualified for assuming a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

9

2 | Toshihiro Mibe | Date of birth July 1, 1961 | Reappointment | |||

| Current position | Director, President and Representative Executive Officer | Responsibilities | Member of the Nominating Committee Chief Executive Officer | ||||

● Number of shares of the Company held 22,600 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

|

Board of Directors 10/10 (100%) Nominating Committee 7/7 (100%) | |||||||

● Term of office as Director (as of the close of this Meeting) 2 years

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1987 | Joined Honda Motor Co., Ltd. | Apr. 2019 | In Charge of Intellectual Property and Standardization of the Company | |||

Apr. 2012 | Managing Officer of Honda R&D Co., Ltd. | Apr. 2020 | Senior Managing Officer | |||

Apr. 2014 | Operating Officer of the Company | Apr. 2020 | In Charge of Mono-zukuri (Research & Development, Production, Purchasing, Quality, Parts, Service, Intellectual Property, Standardization and IT) | |||

Apr. 2014 | Executive in Charge of Powertrain Business for Automobile Operations | Apr. 2020 | Risk Management Officer | |||

Apr. 2014 | Head of Powertrain Production Supervisory Unit of Automobile Production for Automobile Operations | Jun. 2020 | Senior Managing Director | |||

Apr. 2015 | Executive in Charge of Powertrain Business and Drivetrain Business for Automobile Operations | Jun. 2020 | Director in Charge of Mono-zukuri (Research & Development, Production, Purchasing, Quality, Parts, Service, Intellectual Property, Standardization and IT) | |||

Apr. 2015 | Head of Drivetrain Business Unit in Automobile Production for Automobile Operations | Apr. 2021 | President and Representative Director | |||

Apr. 2016 | Senior Managing Officer and Director of Honda R&D Co., Ltd. | Apr. 2021 | Chief Executive Officer (present) | |||

Apr. 2018 | Managing Officer of the Company | Jun. 2021 | Director, President and Representative Executive Officer (present) | |||

Apr. 2018 | Executive Vice President and Director of Honda R&D Co., Ltd. | Jun. 2021 | Member of the Nominating Committee (present) | |||

Apr. 2019 | President and Representative Director of Honda R&D Co., Ltd. | |||||

Reasons for nomination as a candidate for position of Director

Mr. Toshihiro Mibe has broad experience primarily in the areas of R&D and production, and is familiar with the Company Group’s business including overseas operations.

In the fiscal year ended March 31, 2022, he has properly fulfilled his duties as Director, President and Representative Executive Officer, and Chief Executive Officer of the Company by demonstrating strong leadership and being responsible for the management of the entire Company Group, as well as overseeing business execution.

He has been nominated as a candidate for Director again, given that he is particularly an exceptional person with both superior character and insight and is well qualified for assuming a role in overseeing the entire business management of the Company in order to achieve the realization of 2030 Vision, 2050 carbon neutrality, and zero traffic collision fatalities.

After his appointment, he will serve as a Member of the Nominating Committee.

10

3 | Kohei Takeuchi | Date of birth February 10, 1960 | Reappointment | |||

| Current position | Director, Executive Vice President and Representative Executive Officer | Responsibilities | Member of the Compensation Committee Chief Financial Officer Risk Management Officer | ||||

● Number of shares of the Company held 31,700 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

|

Board of Directors 10/10 (100%) | |||||||

● Term of office as Director (as of the close of this Meeting) 9 years

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1982 | Joined Honda Motor Co., Ltd. | Apr. 2019 | Compliance Officer | |||

Apr. 2011 | Operating Officer | Apr. 2020 | Chief Financial Officer and Director in Charge of Finance and Administration (Accounting, Finance, Human Resources and Corporate Governance) | |||

Apr. 2013 | Chief Officer for Business Management Operations | Apr. 2021 | Chief Financial Officer (present) | |||

Jun. 2013 | Operating Officer and Director | Jun. 2021 | Director, Senior Managing Executive Officer | |||

Apr. 2015 | Managing Officer and Director | Apr. 2022 | Director, Executive Vice President and Representative Executive Officer (present) | |||

Apr. 2016 | Senior Managing Officer and Director | Apr. 2022 | Member of the Compensation Committee (present) | |||

Apr. 2016 | Chief Officer for Driving Safety Promotion Center | Apr. 2022 | Risk Management Officer (present) | |||

Apr. 2017 | Chief Financial Officer (Accounting, Finance, Human Resources, Corporate Governance and IT) | |||||

Jun. 2017 | Senior Managing Director | |||||

Apr. 2019 | Chief Financial Officer and Director in Charge of Finance and Administration (Accounting, Finance, Human Resources, Corporate Governance and IT) | |||||

Reasons for nomination as a candidate for position of Director

Mr. Kohei Takeuchi has broad experience primarily in the area of accounting and finance, as well as abundant international experience, and is familiar with the Company Group’s business including overseas operations.

In the fiscal year ended March 31, 2022, he has properly fulfilled his duties as Chief Financial Officer by demonstrating high degree of expertise and strong leadership, and being responsible for business execution of the entire Company Group, as well as overseeing business execution.

He has been nominated as a candidate for Director again, given that he is particularly an exceptional person with both superior character and insight and is well qualified for assuming a role in overseeing the entire business management of the Company in order to achieve the realization of 2030 Vision, 2050 carbon neutrality, and zero traffic collision fatalities.

After his appointment, he will serve as a Member of the Compensation Committee.

11

4 | Shinji Aoyama | Date of birth December 25, 1963 | New appointment | |||

| Current position | Senior Managing Executive Officer | Responsibilities | Chief Officer for Business Development Operations Chief Officer for Automobile Operations Corporate Brand Officer | ||||

● Number of shares of the Company held 35,900 shares

| ||||||||

● Special interest between the candidate and the Company None

| ||||||||

● Term of office as Director (as of the close of this Meeting) –

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1986 | Joined Honda Motor Co., Ltd. | Nov. 2018 | President, Chief Operating Officer and Director of Honda North America, Inc. | |||

Apr. 2012 | Operating Officer | Nov. 2018 | President, Chief Operating Officer and Director of American Honda Motor Co., Inc. | |||

Apr. 2013 | Chief Officer for Motorcycle Operations | Apr. 2019 | Chief Officer for Regional Operations (North America) of the Company | |||

Jun. 2013 | Operating Officer and Director | Apr. 2019 | President, Chief Executive Officer and Director of Honda North America, Inc. | |||

Apr. 2017 | Chief Officer for Regional Operations (Asia & Oceania) | Apr. 2019 | President, Chief Executive Officer and Director of American Honda Motor Co., Inc. | |||

Apr. 2017 | President, Chief Executive Officer and Director of Asian Honda Motor Co., Ltd. | Jul. 2021 | Managing Officer in Charge of Electrification of the Company | |||

Jun. 2017 | Operating Officer of the Company (resigned from position as Director) | Oct. 2021 | Managing Executive Officer | |||

Apr. 2018 | Managing Officer | Apr. 2022 | Senior Managing Executive Officer (present) | |||

Apr. 2018 | Vice Chief Officer for Regional Operations (North America) | Apr. 2022 | Chief Officer for Business Development Operations (present) | |||

Apr. 2018 | Senior Executive Vice President, Chief Operating Officer and Director of Honda North America, Inc. | Apr. 2022 | Corporate Brand Officer (present) | |||

Apr. 2018 | Senior Executive Vice President, Chief Operating Officer and Director of American Honda Motor Co., Inc.

| Jun. 2022 | Chief Officer for Automobile Operations (present) | |||

Reasons for nomination as a candidate for position of Director | ||||||

Mr. Shinji Aoyama has broad experience primarily in the area of sales and marketing in the Motorcycle Operations, as well as abundant international experience, and is familiar with the Company Group’s business including overseas operations.

In the first half of the fiscal year ended March 31, 2022, he demonstrated strong leadership to increase the joy of customers as an officer responsible for North America, while contributing to the business from a global perspective. Since July 2021, he has achieved satisfactory results as the person in Charge of Electrification for the entire Company by driving the acceleration of business development for electrification in order to achieve a carbon-free society.

He has been newly nominated as a candidate for Director, given that he is an exceptional person with both superior character and insight and is well qualified for assuming a role in overseeing the entire business management of the Company in order to achieve the realization of 2030 Vision, 2050 carbon neutrality, and zero traffic collision fatalities.

| ||||||

12

5 | Asako Suzuki | Date of birth January 28, 1964 | Reappointment | |||

| Current position |

Director

| Responsibilities | Member of the Audit Committee (Full-time)

| ||||

● Number of shares of the Company held

| ● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

| Board of Directors 8/8 (100%) Audit Committee 6/6 (100%) | |||||||

● Term of office as Director (as of the close of this Meeting) 1 year

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions

| ||||||

Apr. 1987 | Joined Honda Motor Co., Ltd. | Apr. 2019 | Chief Officer for Human Resources and Corporate Governance Operations | |||

Apr. 2014 | President of Dongfeng Honda Automobile Co., Ltd. | Apr. 2020 | Operating Executive | |||

Apr. 2016 | Operating Officer of the Company | Jun. 2021 | Director (present) | |||

Apr. 2018

| Vice Chief Officer for Regional Operations (Japan) | Jun. 2021 | Member of the Audit Committee (Full-time) (present) | |||

Reasons for nomination as a candidate for position of Director

Ms. Asako Suzuki has broad experience primarily in the area of sales and marketing, accounting and finance, human resources and corporate governance, as well as abundant international experience, and is familiar with the Company Group’s business including overseas operations.

In the fiscal year ended March 31, 2022, she has properly fulfilled her duties as Director and a Member of the Audit Committee by auditing and overseeing the execution of duties by Directors and Executive Officers.

She has been nominated as a candidate for Director again, given that she is an exceptional person with both superior character and insight and is well qualified for assuming a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

After her appointment, she will serve as a Member of the Audit Committee.

13

6 | Masafumi Suzuki | Date of birth April 23, 1964 | Reappointment | |||

| Current position | Director | Responsibilities | Member of the Audit Committee (Full-time) | ||||

● Number of shares of the Company held 58,520 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

|

Board of Directors 10/10 (100%) Audit Committee 6/6 (100%)

Note:Mr. Masafumi Suzuki attended all of the four (4) meetings of the Audit and Supervisory Committee held during April to June 2021. | |||||||

● Term of office as Director (as of the close of this Meeting) 5 years

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1987 | Joined Honda Motor Co., Ltd. | Jun. 2017 | Director (Full-time Audit and Supervisory Committee Member) | |||

Apr. 2012 | General Manager of Regional Operation Planning Office for Regional Operations (Europe, CIS, the Middle & Near East and Africa) | Jun. 2021 | Director (present) | |||

Apr. 2013 | General Manager of Accounting Division for Business Management Operations

| Jun. 2021 | Member of the Audit Committee (Full-time) (present) | |||

Reasons for nomination as a candidate for position of Director

|

Mr. Masafumi Suzuki held the position of General Manager of Accounting Division for Business Management Operations of the Company. He has high expertise and abundant experience in the areas of accounting and finance, and is familiar with the Company Group’s business including overseas operations.

In the fiscal year ended March 31, 2022, he has properly fulfilled his duties as Director and a Member of the Audit Committee by auditing and overseeing the execution of duties by Directors and Executive Officers.

He has been nominated as a candidate for Director again, given that he is an exceptional person with both superior character and insight and is well qualified for assuming a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

After his appointment, he will serve as a Member of the Audit Committee.

|

14

7 | Kunihiko Sakai | Date of birth March 4, 1954 | Reappointment Outside Independent Director | |||

| Current position | Director | Responsibilities | Member of the Nominating Committee Member of the Audit Committee | ||||

● Number of shares of the Company held 1,200 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

|

Board of Directors 10/10 (100%) Nominating Committee 7/7 (100%) Audit Committee 6/6 (100%) | |||||||

● Term of office as Outside Director (as of the close of this Meeting) 3 years

|

Note: Mr. Kunihiko Sakai attended all of the four (4) meetings of the Audit and Supervisory Committee held during April to June 2021. | |||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1979 | Public Prosecutor of Tokyo District Public Prosecutors’ Office | Jun. 2018 | Audit and Supervisory Board Member (Outside) of Furukawa Electric Co., Ltd. (present) | |||

Jun. 2012 | President of Research and Training Institute of Ministry of Justice | Jun. 2019 | Outside Director (Audit and Supervisory Committee Member) of the Company | |||

Jul. 2014 | Superintending Prosecutor of Takamatsu High Public Prosecutors’ Office | Jun. 2021 | Outside Director (present) | |||

Sep. 2016 | Superintending Prosecutor of Hiroshima High Public Prosecutors’ Office (resigned in March 2017) | Jun. 2021 | Member of the Nominating Committee (present) | |||

Apr. 2017 | Registered with the Dai-Ichi Tokyo Bar Association | Jun. 2021 | Member of the Audit Committee (present) | |||

Apr. 2017 | Advisor Attorney to TMI Associates (present) | |||||

(Significant concurrent positions) | ||||||

Lawyer, Advisor Attorney to TMI Associates, Audit and Supervisory Board Member (Outside) of Furukawa Electric Co., Ltd.

| ||||||

| 1. | Reasons for nomination as a candidate for position of Outside Director |

Mr. Kunihiko Sakai has high expertise and abundant experience as a legal affairs specialist having served as Public Prosecutor and a lawyer, including posts of Superintending Prosecutor at High Public Prosecutors’ Offices from July 2014 to March 2017.

He has properly fulfilled his duties as Outside Director who is an Audit and Supervisory Committee Member since June 2019, and as Outside Director and a Member of the Nominating Committee and the Audit Committee since June 2021, by auditing and overseeing the entire business management of the Company from an independent standpoint.

He has no experience in corporate management except serving as Outside Director or Outside Corporate Auditor. However, he has been nominated as a candidate for Outside Director again, given that he is an exceptional person with both superior character and insight, in order for him to continue to assume a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

| 2. | Roles expected to fulfill after appointment |

After his appointment, he is expected to contribute to strengthening the supervisory function of the Company’s management. He is also expected to fulfill a role in strengthening the transparency and objectivity of the process of selecting candidates for Directors, as well as strengthening the audit function, as a Member of the Nominating Committee and the Audit Committee.

| 3. | Other matters related to the Outside Director candidate |

| (1) | Mr. Kunihiko Sakai is a candidate for the position of Outside Director as defined in Article 2, Paragraph 3, Item 7 of the Enforcement Regulations of the Companies Act. |

| (2) | Mr. Kunihiko Sakai fulfills the “Honda Motor Co., Ltd. Criteria for Independence of Outside Directors.” The Company has appointed him as an Independent Outside Director as stipulated by the rules of the Tokyo Stock Exchange and reported his appointment to the Tokyo Stock Exchange. If he is re-elected and assumes the position of Director, the Company plans to continue his appointment as an Independent Outside Director. |

15

8 | Fumiya Kokubu | Date of birth October 6, 1952 | Reappointment Outside Independent Director | |||

| Current position | Director | Responsibilities | Member of the Nominating Committee (Chairperson) Member of the Compensation Committee | ||||

● Number of shares of the Company held 700 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

| Board of Directors 10/10 (100%) Nominating Committee 7/7 (100%) Compensation Committee 5/5 (100%) | |||||||

● Term of office as Outside Director (as of the close of this Meeting) 2 years

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1975 | Joined Marubeni Corporation | Jun. 2019 | Outside Director of Taisei Corporation (present) | |||

Apr. 2012 | Senior Executive Vice President of Marubeni Corporation | Jun. 2020 | Outside Director of the Company (present) | |||

Jun. 2012 | Senior Executive Vice President, Member of the Board of Marubeni Corporation | Jun. 2021 | Member of the Nominating Committee (Chairperson) (present) | |||

Apr. 2013 | President and CEO, Member of the Board of Marubeni Corporation | Jun. 2021 | Member of the Compensation Committee (present) | |||

Apr. 2019 | Chairman of the Board of Marubeni Corporation (present) | |||||

(Significant concurrent positions) Chairman of the Board of Marubeni Corporation, Outside Director of Taisei Corporation | ||||||

1. Reasons for nomination as a candidate for position of Outside Director

Mr. Fumiya Kokubu held positions of President and CEO, and Chairman of the Board of Marubeni Corporation from 2013, and has abundant experience and deep insight regarding corporate management.

He has properly fulfilled his duties as Outside Director since June 2020, and as Outside Director, the Chairperson of the Nominating Committee and a Member of the Compensation Committee since June 2021 by overseeing the entire business management of the Company from an independent standpoint.

He has been nominated as a candidate for Outside Director again, given that he is an exceptional person with both superior character and insight, in order for him to continue to assume a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

2. Roles expected to fulfill after appointment

After his appointment, he is expected to contribute to strengthening the supervisory function of the Company’s management. He is also expected to fulfill a role in strengthening the transparency and objectivity of the process of selecting candidates for Directors and the process of determining the compensation of Directors and Executive Officers, as the Chairperson of the Nominating Committee and a Member of the Compensation Committee.

3. Other matters related to the Outside Director candidate

| (1) | Mr. Fumiya Kokubu is a candidate for the position of Outside Director as defined in Article 2, Paragraph 3, Item 7 of the Enforcement Regulations of the Companies Act. |

| (2) | Marubeni Corporation, where Mr. Fumiya Kokubu currently holds the position of Chairman of the Board, the Company and their respective principal consolidated subsidiaries have business relationships. However, the amount of annual transactions between them is less than 1% of the consolidated sales revenue of the Company and the other party, and Mr. Fumiya Kokubu fulfills the “Honda Motor Co., Ltd. Criteria for Independence of Outside Directors.” The Company has appointed him as an Independent Outside Director as stipulated by the rules of the Tokyo Stock Exchange and reported his appointment to the Tokyo Stock Exchange. If he is re-elected and assumes the position of Director, the Company plans to continue his appointment as an Independent Outside Director. |

16

9 | Yoichiro Ogawa | Date of birth February 19, 1956 | Reappointment Outside Independent Director | |||

| Current position | Director | Responsibilities | Member of the Audit Committee (Chairperson) Member of the Compensation Committee | ||||

● Number of shares of the Company held 200 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None |

Board of Directors 8/8 (100%) Audit Committee 6/6 (100%) Compensation Committee 5/5 (100%)

| |||||||

● Term of office as Outside Director (as of the close of this Meeting) 1 year

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Oct. 1980 | Joined Tohmatsu & Aoki Audit Corporation (currently Deloitte Touche Tohmatsu LLC) | Jun. 2018 | Senior Advisor of Deloitte Tohmatsu Group (resigned in October 2018) | |||

Mar. 1984 | Registered as Japanese Certified Public Accountant | Nov. 2018 | Founder of Yoichiro Ogawa CPA Office (present) | |||

Oct. 2013 | Deputy CEO of Deloitte Touche Tohmatsu LLC | Jun. 2020 | Outside Audit & Supervisory Board Member of Recruit Holdings Co., Ltd. (present) | |||

Oct. 2013 | Deputy CEO of Tohmatsu Group (currently Deloitte Tohmatsu Group) | Jun. 2021 | Outside Director of the Company (present) | |||

Jun. 2015 | Global Managing Director for Asia Pacific of Deloitte Touche Tohmatsu Limited (United Kingdom) (resigned in May 2018) | Jun. 2021 | Member of the Audit Committee (Chairperson) (present) | |||

Jul. 2015 | CEO of Deloitte Tohmatsu Group | Jun. 2021 | Member of the Compensation Committee (present) | |||

(Significant concurrent positions) Certified Public Accountant, Founder of Yoichiro Ogawa CPA Office, Outside Audit & Supervisory Board Member of Recruit Holdings Co., Ltd. | ||||||

| 1. | Reasons for nomination as a candidate for position of Outside Director |

Mr. Yoichiro Ogawa has high expertise and abundant experience as an accounting specialist having served as a Certified Public Accountant for many years, including posts of CEO of Deloitte Tohmatsu Group from July 2015 to May 2018.

He has properly fulfilled his duties as Outside Director, the Chairperson of the Audit Committee and a Member of the Compensation Committee since June 2021 by auditing and overseeing the entire business management of the Company from an independent standpoint.

He has been nominated as a candidate for Outside Director again, given that he is an exceptional person with both superior character and insight, in order for him to continue to assume a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

| 2. | Roles expected to fulfill after appointment |

After his appointment, he is expected to contribute to strengthening the supervisory function of the Company’s management. He is also expected to fulfill a role in strengthening the audit function, as well as strengthening the transparency and objectivity of the process of determining the compensation of Directors and Executive Officers, as the Chairperson of the Audit Committee and a Member of the Compensation Committee.

| 3. | Other matters related to the Outside Director candidate |

| (1) | Mr. Yoichiro Ogawa is a candidate for the position of Outside Director as defined in Article 2, Paragraph 3, Item 7 of the Enforcement Regulations of the Companies Act. |

| (2) | Mr. Yoichiro Ogawa formerly belonged to Deloitte Tohmatsu Group, which has business relationships with the Company and its principal consolidated subsidiaries. However, he has no relationship with the Group since October 2018. Mr. Yoichiro Ogawa therefore fulfills the “Honda Motor Co., Ltd. Criteria for Independence of Outside Directors.” The amount of annual transactions between them is less than 1% of the consolidated sales revenue of the Company and the other party. The Company has appointed him as an Independent Outside Director as stipulated by the rules of the Tokyo Stock Exchange and reported his appointment to the Tokyo Stock Exchange. If he is re-elected and assumes the position of Director, the Company plans to continue his appointment as an Independent Outside Director. |

17

10 | Kazuhiro Higashi | Date of birth April 25, 1957 | Reappointment Outside Independent Director | |||

| Current position | Director | Responsibilities | Member of the Nominating Committee Member of the Compensation Committee (Chairperson) | ||||

● Number of shares of the Company held 200 shares

|

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

| Board of Directors 8/8 (100%) Nominating Committee 7/7 (100%) Compensation Committee 5/5 (100%) | |||||||

● Term of office as Outside Director (as of the close of this Meeting) 1 year

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions | ||||||

Apr. 1982 | Joined Resona Group | Jun. 2017 | Chairman of Osaka Bankers Association (resigned in June 2018) | |||

Apr. 2011 | Director, Deputy President and Representative Executive Officer of Resona Holdings, Inc. | Apr. 2018 | Chairman of the Board, President, Representative Director and Executive Officer of Resona Bank, Limited | |||

Apr. 2011 | Executive Officer of Resona Bank, Limited | Apr. 2020 | Chairman and Director of Resona Holdings, Inc. (present) | |||

Apr. 2012 | Representative Director, Deputy President and Executive Officer of Resona Bank, Limited | Apr. 2020 | Chairman and Director of Resona Bank, Limited (present) | |||

Apr. 2013 | Director, President and Representative, Executive Officer of Resona Holdings, Inc. | Jun. 2020 | Outside Director of Sompo Holdings, Inc. (present) | |||

Apr. 2013 | Representative Director, President and Executive Officer of Resona Bank, Limited | Jun. 2021 | Outside Director of the Company (present) | |||

Jun. 2013 | Chairman of Osaka Bankers Association (resigned in June 2014) | Jun. 2021 | Member of the Nominating Committee (present) | |||

Apr. 2017 | Chairman of the Board, President and Representative Director of Resona Bank, Limited | Jun. 2021 | Member of the Compensation Committee (Chairperson) (present) | |||

(Significant concurrent positions) Chairman and Director of Resona Holdings, Inc.*, Chairman and Director of Resona Bank, Limited*, Outside Director of Sompo Holdings, Inc. * Mr. Kazuhiro Higashi will retire from the office of Chairman and Director and assume the office of Senior Advisor at the Ordinary General Meeting of Shareholders of Resona Holdings, Inc. and Resona Bank, Limited to be held on June 24, 2022. | ||||||

| 1. | Reasons for nomination as a candidate for position of Outside Director |

Mr. Kazuhiro Higashi held positions of President and Chairman of Resona Holdings, Inc. from April 2013, and has abundant experience and deep insight regarding corporate management.

He has properly fulfilled his duties as Outside Director, the Chairperson of the Compensation Committee and a Member of the Nominating Committee since June 2021 by overseeing the entire business management of the Company from an independent standpoint.

He has been nominated as a candidate for Outside Director again, given that he is an exceptional person with both superior character and insight, in order for him to continue to assume a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint.

| 2. | Roles expected to fulfill after appointment |

After his appointment, he is expected to contribute to strengthening the supervisory function of the Company’s management. He is also expected to fulfill a role in strengthening the transparency and objectivity of the process of determining the compensation of Directors and Executive Officers and the process of selecting candidates for Directors, as the Chairperson of the Compensation Committee and a Member of the Nominating Committee.

| 3. | Other matters related to the Outside Director candidate |

| (1) | Mr. Kazuhiro Higashi is a candidate for the position of Outside Director as defined in Article 2, Paragraph 3, Item 7 of the Enforcement Regulations of the Companies Act. |

| (2) | The aggregate amount of the Company Group’s borrowings from Resona Holdings, Inc. and its subsidiaries, where Mr. Kazuhiro Higashi currently holds the position of Chairman and Director, in the past three fiscal years is less than 1% of the amount of consolidated total assets of either of the two companies. Accordingly, Mr. Kazuhiro Higashi fulfills the “Honda Motor Co., Ltd. Criteria for Independence of Outside Directors.” The Company has appointed him as an Independent Outside Director as stipulated by the rules of the Tokyo Stock Exchange and reported his appointment to the Tokyo Stock Exchange. If he is re-elected and assumes the position of Director, the Company plans to continue his appointment as an Independent Outside Director. |

18

11 | Ryoko Nagata | Date of birth July 14, 1963 | Reappointment Outside Independent Director | |||

|

Current position

| Director | Responsibilities | Member of the Audit Committee | ||||

● Number of shares of the Company held 200 shares |

● Attendance record of the Board of Directors, etc. (number of meetings attended/number of meetings held) | |||||||

● Special interest between the candidate and the Company None

|

Board of Directors 8/8 (100%) Audit Committee 6/6 (100%) | |||||||

● Term of office as Outside Director (as of the close of this Meeting) 1 year

| ||||||||

● Resume, current position, responsibilities and significant concurrent positions

| ||||||

Apr. 1987 | Joined Japan Tobacco Inc. | Jun. 2021 | Outside Director of the Company (present) | |||

June 2008 | Executive Officer of Japan Tobacco Inc. | Jun. 2021 | Member of the Audit Committee (present) | |||

Mar. 2018 | Standing Audit & Supervisory Board Member of Japan Tobacco Inc. (present) | |||||

(Significant concurrent positions) | ||||||

Standing Audit & Supervisory Board Member of Japan Tobacco Inc.

| ||||||

1. Reasons for nomination as a candidate for position of Outside Director | ||||

Ms. Ryoko Nagata held positions of Executive Officer and Audit & Supervisory Board Member of Japan Tobacco Inc. from 2008, and has abundant experience and deep insight regarding corporate management and audit. She has properly fulfilled her duties as Outside Director and a Member of the Audit Committee since June 2021 by auditing and overseeing the entire business management of the Company from an independent standpoint. | ||||

She has been nominated as a candidate for Outside Director again, given that she is an exceptional person with both superior character and insight, in order for her to continue to assume a role in overseeing the entire business management of the Company from an objective, highly sophisticated and broader viewpoint. | ||||

2. Roles expected to fulfill after appointment | ||||

After her appointment, she is expected to contribute to strengthening the supervisory function of the Company’s management. She is also expected to fulfill a role in strengthening the audit function, as a Member of the Audit Committee. | ||||

3. Other matters related to the Outside Director candidate | ||||

(1) Ms. Ryoko Nagata is a candidate for the position of Outside Director as defined in Article 2, Paragraph 3, Item 7 of the Enforcement Regulations of the Companies Act.

(2) Ms. Ryoko Nagata fulfills the “Honda Motor Co., Ltd. Criteria for Independence of Outside Directors.” The Company has appointed her as an Independent Outside Director as stipulated by the rules of the Tokyo Stock Exchange and reported her appointment to the Tokyo Stock Exchange. If she is re-elected and assumes the position of Director, the Company plans to continue her appointment as an Independent Outside Director.

| ||||

19

| Notes: | 1. | Summary of Content of Limited Liability Contract | ||

Based on Article 427, Paragraph 1 of the Companies Act and Article 27, Paragraph 2 of the Articles of Incorporation of the Company, the Company has entered into contracts with all Outside Directors, which limit their liability for damages as stipulated in Article 423, Paragraph 1 of the Companies Act, to the minimum liability amount that is stipulated in Article 425, Paragraph 1 of the Companies Act.

If Mr. Kunihiko Sakai, Mr. Fumiya Kokubu, Mr. Yoichiro Ogawa, Mr. Kazuhiro Higashi and Ms. Ryoko Nagata are re-elected and assume the positions of Director, the Company plans to continue such limited liability contract with each of them. | ||||

| 2. | Summary of Content of Indemnity Contract | |||

The Company has entered into indemnity contracts with all Directors and Executive Officers, in accordance with Article 430-2, Paragraph 1 of the Companies Act, and the Company indemnifies them for expenses set forth in Item 1 of the same Paragraph to the extent stipulated by laws.

If the eleven (11) candidates are re-elected or elected and assume the positions of Director, the Company plans to continue such indemnity contract with each of them. | ||||

| 3. | Summary of Content of Directors and Officers Liability Insurance Contract | |||

Based on Article 430-3, Paragraph 1 of the Companies Act, the Company has entered into a directors and officers liability insurance contract that includes all Directors and Executive Officers as the insured with an insurance company. The insurance contract covers legal damages and litigation expenses to be borne by the insured.

If the eleven (11) candidates are re-elected or elected and assume the positions of Director, each Director will be an insured in the insurance contract. The Company intends to renew the contract under the same conditions during the term of office. | ||||

∎ Criteria for Independence of Outside Directors |

The Company’s board of directors will determine that an outside director is sufficiently independent from the Company if it determines that the said outside director satisfies the independence criteria stipulated by the Tokyo Stock Exchange and the requirements set forth below:

| 1. | He/She is not, and has never been, any of the following during the last year: |

| 1) | a person who executes the business (*1) of a large shareholder (*2) of the Company; |

| 2) | a person who executes the business of (i) a major customer (*3) of the Company, or (ii) a company of which the Company is a major customer; |

| 3) | a person who executes the business of a major lender (*4) of the Company Group; |

| 4) | a person who executes the business of an audit corporation which conducts statutory audits for the Company or a person who handles the audit functions of the Company; |

| 5) | a consultant, an accounting specialist, or a legal expert (or, if the person in question is a corporation, an association, or any other similar organization, then a person who executes the business of that corporation, etc.) who receives a large amount (*5) of money, etc. from the Company, other than remuneration paid to directors of the Company; |

| 2. | No family member or close relative (*6) of the outside director currently falls or at any point of time during the last year fell under any of items 1) through 5) in paragraph 1 above. |

[End]

Established on May 15, 2015

Partly amended on June 15, 2017

Partly amended on February 9, 2021

| *1 | A “person who executes the business” means an executive director, an executive officer, or an important employee including operating officer. |

| *2 | A “large shareholder” means a shareholder who directly or indirectly holds shares representing 10% or more of the total number of voting rights of the Company as of the end of a fiscal year. |

| *3 | A “major customer” means a customer of the Company where the annual amount of transactions between the customer and the Company exceeds 2% of the consolidated sales revenue of the Company or the said customer. |

| *4 | A “major lender” means a financial institution from which the Company Group borrows, where the aggregate amount of such borrowings exceeds 2% of the amount of consolidated total assets of the Company or the financial institution as at the end of a fiscal year. |

| *5 | A person receives a “large amount” if he/she receives consideration from the Company in excess of 10 million yen per year. |

| *6 | A “family member or close relative” means a spouse or first or second degree relative of an outside director. |

20

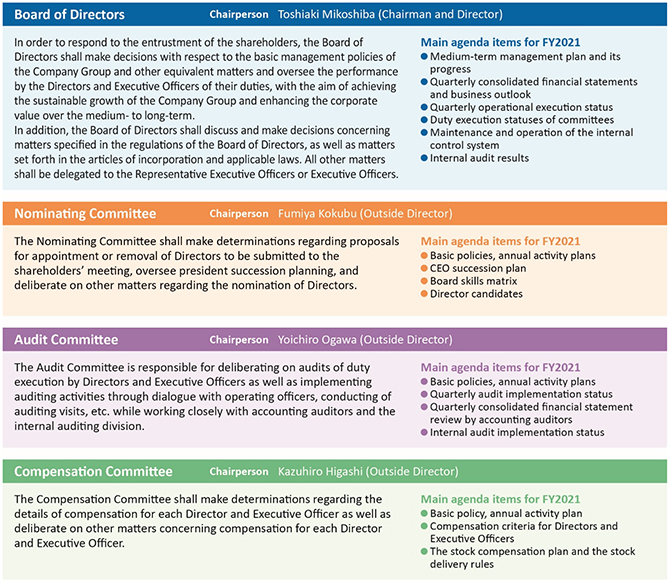

Corporate Governance Initiatives (reference)

∎ Basic Approach to Corporate Governance |

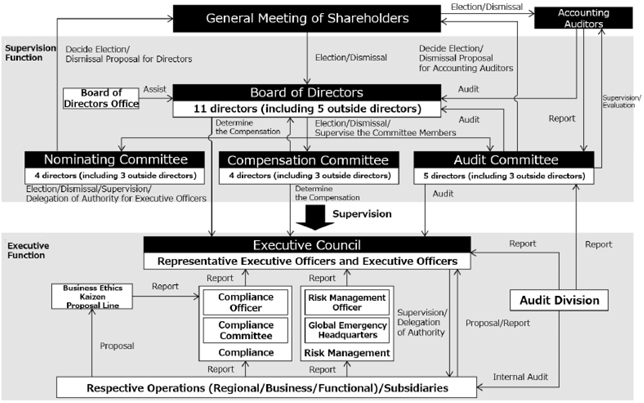

The Company strives to enhance corporate governance as one of the most important tasks for its management, based on the Company’s basic principle, in order to further strengthen the trust of our shareholders/investors and other stakeholders; encourage timely, decisive and risk-considered decision-making; seek sustainable growth and the enhancement of corporate value over the medium- to long-term; and become “a company that society wants to exist.”

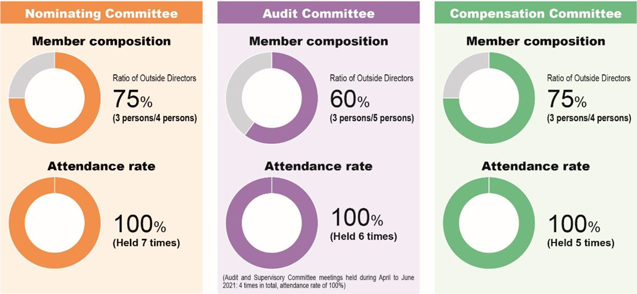

In order to clearly segregate the supervisory function and execution function of management and to strengthen the supervisory function and to enable prompt and flexible decisions, the Company has “Nominating Committee,” “Audit Committee,” and “Compensation Committee,” each of which is composed of more than one half of Outside Directors, and has adopted a company with three committees structure which allows broad delegation of the business execution authority from Board of Directors to the Executive Officers.

We are making efforts to appropriately disclose corporate information including the release and disclosure of quarterly financial results and management policies in a timely and accurate manner to bolster trust and appreciation from shareholders/investors and other stakeholders. Going forward, we will continue to strive to ensure the transparency of our management.

For the Company’s basic approach to corporate governance, please refer to “Honda Corporate Governance Basic Policies” (the URL below).

“Honda Corporate Governance Basic Policies”

https://global.honda/investors/policy/governance.html

∎ Corporate Governance System (as of March 31, 2022) |

21

22

23

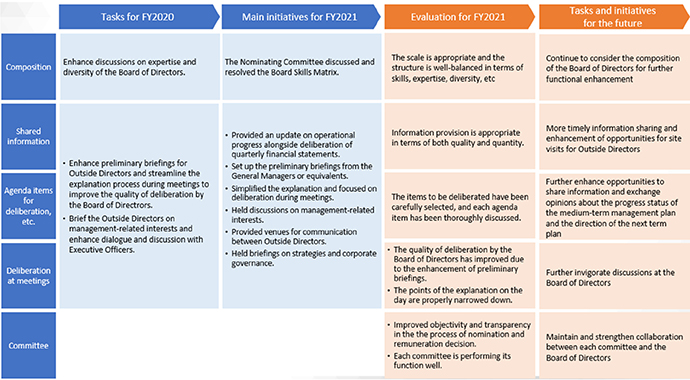

| ∎ | Activities of the Board and Committees (FY2021) |

24

| ∎ | Creating Environment for Maximizing Outside Directors’ Effectiveness |

Orientation for nominees

The Company provides Outside Director nominees with training on industrial trends, the company’s history, businesses, finances, organizations, internal control system, etc.

Preliminary briefings and information sessions

The Company holds a preliminary briefing before each Board meeting in order to provide Outside Directors with sufficient insights into the details and background of the agenda items to be escalated to the Board, their positions in medium-to-long-term management plan, and other basic prerequisites to ensure substantial discussions at Board meetings. In addition, we set up opportunities to share important information about our medium-term management plan and hold discussions among Directors.

Discussion on management-related interests

The Company held discussions on Directors’ interests to achieve alignment among the Outside Directors with respect to the Company Group’s long-term challenges and future direction and to help them better understand our management-related initiatives. We also aimed at incorporating their insights into discussions of our future management policies.

Dialogue with Executive Officers/among Outside Directors

The Company provides opportunities for dialogue between Outside Directors and Executive Officers/Internal Directors as well as among Outside Directors as needed in order to enhance communication among Directors.

Site visits

The Company held visits to our factories and other business locations to help Directors better understand our businesses.

| ||||

| Visit to Yorii Plant |

25

∎ Evaluation of the Effectiveness of the Board |

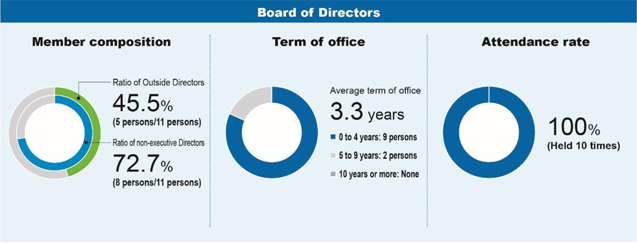

Each fiscal year, the Company conducts an evaluation of the overall effectiveness of the Board of Directors in order to confirm the current status of the Board’s functions, with the aim of further improving its effectiveness and promoting understanding among shareholders and stakeholders.

Evaluation process

Evaluation results

Summary of evaluation results

The evaluation confirmed that the effectiveness of the Board of Directors has been adequately ensured. This has been achieved by a number of changes made after the management approach was updated in response to the transition to a company with three committees. The evaluation confirmed improvements to the discussion of management policies from a medium- to long-term perspective and the provision of information relevant to these, and an improvement in the quality of deliberations and appropriate operation of the three committees.

The evaluation cited a need to provide more timely information to Outside Directors, to enhance opportunities for business site visits, and to enable more active discussions at Board of Directors meetings. We will address these issues to further enhance effectiveness as monitoring-type Board of Directors.

26

Business Report for the 98th Fiscal Year

For the Period From: April 1, 2021 To: March 31, 2022

| 1. | OUTLINE OF BUSINESS |

| (1) | Review of Operations |

Despite shifting to a recovery trend, the economic environment surrounding Honda, its consolidated subsidiaries and its affiliates accounted for under the equity method (hereinafter, the “Honda Group”) in the fiscal year ended March 31, 2022, continued to be difficult due to the spread of COVID-19, the impact of semiconductor supply shortages, and sharp increases in raw material prices, among other factors. In the United States, the economy picked up due to factors such as economic stimulus measures and improved consumer spending. In Europe and Asia, while there were signs of economic recovery, conditions were difficult, with some countries curtailing economic activities. In Japan, although the economy continued to pick up, there were signs of weakness in some areas, such as employment. During the fourth quarter of the fiscal year ended March 31, 2022, the global economy slowed down due to the worsening situation in Ukraine. A further downturn in the economy is expected in the near term.

In the Honda Group’s principal markets, the motorcycle market recovered substantially in Indonesia and Brazil, and moderately in Thailand compared to the previous fiscal year, but shrank in India and Vietnam. Compared to the previous fiscal year, the automobile market recovered substantially in Indonesia, and moderately in India, but shrank in Japan, China, Europe, Thailand, Brazil, and the United States.

In these circumstances, the Honda Group worked to strengthen its business structure in order to respond swiftly and accurately to the changing and varied needs of customers and society. We also continued to pursue our goals of achieving carbon neutrality and zero fatalities in traffic accidents. On the research and development front, we made proactive efforts to develop safety and environmental technologies and advanced technologies to enhance the attractiveness of our products and transform mobility, utilizing open innovation with external partners. With regard to production, we strengthened our production structure and further pressed ahead with optimizing the production allocation and production capability to deal with changes in demand on a global basis. As for sales, we worked to enhance our product lineup through measures such as aggressively launching products that offer new value and delivering products globally.

Honda’s consolidated sales revenue for the fiscal year ended March 31, 2022 increased by 10.5% from the fiscal year ended March 31, 2021 to JPY 14,552.6 billion, due mainly to increased sales revenue in the motorcycle business and financial services business operations as well as positive foreign currency translation effects.

Operating profit increased by 32.0%, to JPY 871.2 billion from the previous fiscal year, due mainly to an increase in profit attributable to sales impacts as well as positive foreign currency effects, which was partially offset by a decrease in profit attributable to sales price and cost impacts. Profit before income taxes increased by 17.1%, to JPY 1,070.1 billion from the previous fiscal year. Profit for the year attributable to owners of the parent increased by 7.6%, to JPY 707.0 billion from the previous fiscal year.

27

Motorcycle Business

Consolidated unit sales totaled 10,721 thousand, an increase of 4.5% from the previous fiscal year.

| Unit (Thousands) | ||||||||||||||||||||||||||||||||

| Honda Group Unit Sales | Consolidated Unit Sales | |||||||||||||||||||||||||||||||

| Year ended Mar. 31, 2021 | Year ended Mar. 31, 2022 | Year ended Mar. 31, 2021 | Year ended Mar. 31, 2022 | |||||||||||||||||||||||||||||

| Change | % | Change | % | |||||||||||||||||||||||||||||

Motorcycle business | 15,132 | 17,027 | 1,895 | 12.5 | 10,264 | 10,721 | 457 | 4.5 | ||||||||||||||||||||||||

Japan | 215 | 244 | 29 | 13.5 | 215 | 244 | 29 | 13.5 | ||||||||||||||||||||||||

North America | 332 | 437 | 105 | 31.6 | 332 | 437 | 105 | 31.6 | ||||||||||||||||||||||||

Europe | 234 | 317 | 83 | 35.5 | 234 | 317 | 83 | 35.5 | ||||||||||||||||||||||||

Asia | 13,319 | 14,589 | 1,270 | 9.5 | 8,451 | 8,283 | -168 | -2.0 | ||||||||||||||||||||||||

Other Regions | 1,032 | 1,440 | 408 | 39.5 | 1,032 | 1,440 | 408 | 39.5 | ||||||||||||||||||||||||

| Note: | Honda Group Unit Sales is the total unit sales of completed products of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method. Consolidated Unit Sales is the total unit sales of completed products corresponding to consolidated sales revenue to external customers, which consists of unit sales of completed products of Honda and its consolidated subsidiaries. |

With respect to Honda’s sales for the fiscal year by business segment, in motorcycle business operations, sales revenue from external customers increased by 22.3%, to JPY 2,185.2 billion from the previous fiscal year, due mainly to increased consolidated unit sales. Operating profit totaled JPY 311.4 billion, an increase of 38.7% from the previous fiscal year, due primarily to an increase in profit attributable to sales impacts as well as positive foreign currency effects, which was partially offset by higher overhead costs.

Automobile Business

Consolidated unit sales totaled 2,424 thousand, a decrease of 7.4% from the previous fiscal year.

| Unit (Thousands) | ||||||||||||||||||||||||||||||||

| Honda Group Unit Sales | Consolidated Unit Sales | |||||||||||||||||||||||||||||||

| Year ended Mar. 31, 2021 | Year ended Mar. 31, 2022 | Year ended Mar. 31, 2021 | Year ended Mar. 31, 2022 | |||||||||||||||||||||||||||||

| Change | % | Change | % | |||||||||||||||||||||||||||||

Automobile business | 4,546 | 4,074 | -472 | -10.4 | 2,617 | 2,424 | -193 | -7.4 | ||||||||||||||||||||||||

Japan | 592 | 547 | -45 | -7.6 | 520 | 476 | -44 | -8.5 | ||||||||||||||||||||||||

North America | 1,480 | 1,283 | -197 | -13.3 | 1,480 | 1,283 | -197 | -13.3 | ||||||||||||||||||||||||

Europe | 101 | 100 | -1 | -1.0 | 101 | 100 | -1 | -1.0 | ||||||||||||||||||||||||

Asia | 2,247 | 2,022 | -225 | -10.0 | 390 | 443 | 53 | 13.6 | ||||||||||||||||||||||||

Other Regions | 126 | 122 | -4 | -3.2 | 126 | 122 | -4 | -3.2 | ||||||||||||||||||||||||

| Note: | Honda Group Unit Sales is the total unit sales of completed products of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method. Consolidated Unit Sales is the total unit sales of completed products corresponding to consolidated sales revenue to external customers, which consists of unit sales of completed products of Honda and its consolidated subsidiaries. Certain sales of automobiles that are financed with residual value type auto loans, etc., by our Japanese finance subsidiaries and provided through our consolidated subsidiaries are accounted for as operating leases in conformity with IFRS and are not included in consolidated sales revenue to the external customers in our Automobile business. Accordingly, they are not included in Consolidated Unit Sales, but are included in Honda Group Unit Sales of our Automobile business. |

In the automobile business operations, sales revenue from external customers increased by 6.8%, to JPY 9,147.4 billion from the previous fiscal year due mainly to positive foreign currency translation effects, which were partially offset by a decrease in consolidated unit sales. Operating profit totaled JPY 236.2 billion, an increase of 161.7% from the previous fiscal year, due primarily to lower overhead expenses and positive foreign currency effects, which were partially offset by a decrease in profit attributable to sales price and cost impacts.

Financial Services Business

Sales revenue from external customers in the financial services business operations increased by 13.1%, to JPY 2,820.6 billion from the previous fiscal year due mainly to an increase in revenues on disposition of lease vehicles. Operating profit decreased by 6.7% to JPY 333.0 billion from the previous fiscal year, mainly due to the difference of the allowance for credit loss.

Life Creation and Other Businesses

Consolidated unit sales in the life creation and other businesses operations totaled 6,200 thousand, an increase of 10.3% from the previous fiscal year.

28

| Unit (Thousands) | ||||||||||||||||

| Honda Group Unit Sales/ Consolidated Unit Sales | ||||||||||||||||

| Year ended Mar. 31, 2021 | Year ended Mar. 31, 2022 | |||||||||||||||

| Change | % | |||||||||||||||

Life creation business | 5,623 | 6,200 | 577 | 10.3 | ||||||||||||

Japan | 336 | 353 | 17 | 5.1 | ||||||||||||

North America | 2,617 | 2,738 | 121 | 4.6 | ||||||||||||

Europe | 929 | 1,189 | 260 | 28.0 | ||||||||||||

Asia | 1,405 | 1,487 | 82 | 5.8 | ||||||||||||

Other Regions | 336 | 433 | 97 | 28.9 | ||||||||||||

| Note: | Honda Group Unit Sales is the total unit sales of completed products of Honda, its consolidated subsidiaries and its affiliates and joint ventures accounted for using the equity method. Consolidated Unit Sales is the total unit sales of completed products corresponding to consolidated sales revenue to external customers, which consists of unit sales of completed products of Honda and its consolidated subsidiaries. In life creation business, there is no discrepancy between Honda Group Unit Sales and Consolidated Unit Sales for the year ended March 31, 2021 and 2022, since no affiliates and joint ventures accounted for using the equity method were involved in the sale of Honda power products. |

Sales revenue from external customers in life creation and other businesses increased by 24.1%, to JPY 399.2 billion from the previous fiscal year, due mainly to an increase in consolidated unit sales in life creation and other businesses. Honda reported an operating loss of JPY 9.4 billion, an improvement of JPY 2.1 billion from the previous fiscal year, due mainly to an increase in profit from the impact of sales, despite increased overhead costs. Operating loss of aircraft and aircraft engines included in the life creation and other businesses segment was JPY 33.7 billion, a deterioration of JPY 1.4 billion from the previous fiscal year.

29

◾ Sales Revenue Breakdown

| Yen (millions) | ||||||||||||||||

| FY2021 From April 1, 2020 to March 31, 2021 (reference) | FY2022 From April 1, 2021 to March 31, 2022 | Change from the previous fiscal year (reference) | ||||||||||||||

| (%) | ||||||||||||||||

Grand Total | 13,170,519 | 14,552,696 | 1,382,177 | 10.5 | ||||||||||||

Japan | 1,849,268 | 1,943,649 | 94,381 | 5.1 | ||||||||||||

North America | 7,080,833 | 7,624,799 | 543,966 | 7.7 | ||||||||||||

Europe | 511,795 | 611,889 | 100,094 | 19.6 | ||||||||||||

Asia | 3,250,125 | 3,711,460 | 461,335 | 14.2 | ||||||||||||

Other Regions | 478,498 | 660,899 | 182,401 | 38.1 | ||||||||||||

Motorcycle Business | 1,787,283 | 2,185,253 | 397,970 | 22.3 | ||||||||||||

Japan | 88,129 | 105,023 | 16,894 | 19.2 | ||||||||||||

North America | 197,185 | 230,780 | 33,595 | 17.0 | ||||||||||||

Europe | 146,948 | 202,254 | 55,306 | 37.6 | ||||||||||||

Asia | 1,149,879 | 1,309,977 | 160,098 | 13.9 | ||||||||||||

Other Regions | 205,142 | 337,219 | 132,077 | 64.4 | ||||||||||||

Automobile Business | 8,567,205 | 9,147,498 | 580,293 | 6.8 | ||||||||||||

Japan | 1,321,487 | 1,340,775 | 19,288 | 1.5 | ||||||||||||

North America | 4,679,324 | 4,884,934 | 205,610 | 4.4 | ||||||||||||

Europe | 290,366 | 319,366 | 29,000 | 10.0 | ||||||||||||

Asia | 2,037,519 | 2,321,721 | 284,202 | 13.9 | ||||||||||||

Other Regions | 238,509 | 280,702 | 42,193 | 17.7 | ||||||||||||

Financial Services Business | 2,494,294 | 2,820,667 | 326,373 | 13.1 | ||||||||||||

Japan | 380,384 | 418,383 | 37,999 | 10.0 | ||||||||||||

North America | 2,070,569 | 2,356,978 | 286,409 | 13.8 | ||||||||||||

Europe | 11,219 | 10,876 | -343 | -3.1 | ||||||||||||

Asia | 15,060 | 15,757 | 697 | 4.6 | ||||||||||||

Other Regions | 17,062 | 18,673 | 1,611 | 9.4 | ||||||||||||

Life Creation & Other Businesses | 321,737 | 399,278 | 77,541 | 24.1 | ||||||||||||

Japan | 59,268 | 79,468 | 20,200 | 34.1 | ||||||||||||

North America | 133,755 | 152,107 | 18,352 | 13.7 | ||||||||||||

Europe | 63,262 | 79,393 | 16,131 | 25.5 | ||||||||||||

Asia | 47,667 | 64,005 | 16,338 | 34.3 | ||||||||||||

Other Regions | 17,785 | 24,305 | 6,520 | 36.7 | ||||||||||||

30

| (2) | Capital Expenditures |

Capital expenditures during the fiscal year ended March 31, 2022 totaled JPY 278,405 million. The breakdown of capital expenditures by business segment was as follows:

In addition to investments for new model introductions, Honda’s capital expenditure was predominantly utilized for expanding, rationalizing, and renovating manufacturing facilities as well as for expanding sales and R&D facilities.

| Yen (millions), % | ||||||||||||||||

Business Segment | FY2021 (reference) | FY2022 | Change in amount (reference) | Change (%) (reference) | ||||||||||||

Motorcycle Business | 30,483 | 36,754 | 6,271 | 20.6 | ||||||||||||

Automobile Business | 281,617 | 230,476 | -51,141 | -18.2 | ||||||||||||

Financial Services Business | 260 | 340 | 80 | 30.8 | ||||||||||||

Life Creation and Other Businesses | 8,934 | 10,835 | 1,901 | 21.3 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total | 321,294 | 278,405 | -42,889 | -13.3 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Equipment on operating leases | 2,001,898 | 2,026,098 | 24,200 | 1.2 | ||||||||||||

Note: Intangible assets are not included in the table above.

| (3) | Liquidity and Capital Resources |

Honda meets its working capital requirements primarily through cash generated by operations, bank loans and corporate bonds. The outstanding balance of liabilities for Honda’s manufacturing and sales businesses at the end of the fiscal year ended March 31, 2022 was JPY 836.8 billion.

In addition, the Company’s finance subsidiaries fund financial programs for customers and dealers primarily from medium-term notes, bank loans, securitization of finance receivables and equipment on operating leases, commercial paper and corporate bonds. The outstanding balance of liabilities for Honda’s financial services subsidiaries at the end of the fiscal year was JPY 7,269.9 billion.

| (4) | Preparing for the Future |

| 1) | Management Policies and Strategies |

The Honda Group has two Fundamental Beliefs: “Respect for the Individual,” and “The Three Joys” (the Joy of Buying, the Joy of Selling, and the Joy of Creating). “Respect for the Individual” calls on Honda to nurture and promote these characteristics in our company by respecting individual differences and trusting each other as equal partners. “The Three Joys” are based on “Respect for the Individual,” and is the philosophy of creating joy together with everyone involved in Honda’s activities, with the joy of its customers as the driving force.

Based on these Fundamental Beliefs, the Honda Group strives to improve its corporate value by sharing joy with all people, and with our shareholders in particular, by practicing its Mission Statement: “Maintaining a global viewpoint, we are dedicated to supplying products of the highest quality, yet at a reasonable price for worldwide customer satisfaction.”

The Honda Group has also defined its vision toward 2030 as “Serve people worldwide with the ‘joy of expanding their life’s potential,’” and will take initiatives in the following three directions.

1. Toward a clean and safe / secure society

2. Creating value for “mobility” and “daily lives”

3. Accommodate the different characteristics of people and society

The Honda Group is thoroughly committed to “eliminating the burden on the global environment” and “achieving safety that protects precious lives.” Specifically, in terms of the environment, the Honda Group aims to achieve carbon neutrality in 2050 across all of our products and business activities.

In terms of safety, the Honda Group will work toward the goal of zero traffic collision fatalities involving the Group’s motorcycles and automobiles globally by 2050.

| 1. | Toward a clean and safe / secure society |

| a. | Toward the realization of carbon neutrality |