- HMC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Honda Motor (HMC) 6-KCurrent report (foreign)

Filed: 10 May 24, 6:04am

No.1-7628

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MAY 2024

COMMISSION FILE NUMBER: 1-07628

HONDA GIKEN KOGYO KABUSHIKI KAISHA

(Name of registrant)

HONDA MOTOR CO., LTD.

(Translation of registrant’s name into English)

1-1, Minami-Aoyama 2-chome, Minato-ku, Tokyo 107-8556, Japan

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Exhibit 1:

Exhibit 2:

Exhibit 3:

Exhibit 4:

Notice Regarding Stock Compensation Scheme for Executive Officers Etc.

Exhibit 5:

Notice Regarding Stock Compensation Scheme for Operating Executive

Exhibit 6:

Notice Concerning Recording of Extraordinary Losses in Non-Consolidated Financial Results

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| HONDA GIKEN KOGYO KABUSHIKI KAISHA (HONDA MOTOR CO., LTD.) |

/s/ Sumihiro Takahashi |

| Sumihiro Takahashi |

| General Manager |

| Finance Division |

| Honda Motor Co., Ltd. |

Date: May 10, 2024

HONDA MOTOR CO., LTD. REPORTS

CONSOLIDATED FINANCIAL RESULTS

FOR THE FISCAL YEAR ENDED MARCH 31, 2024

Tokyo, May 10, 2024 — Honda Motor Co., Ltd. today announced its consolidated financial results for the fiscal year ended March 31, 2024.

Fiscal Year Results

Honda’s consolidated sales revenue for the fiscal year ended March 31, 2024 increased by 20.8%, to JPY 20,428.8 billion from the fiscal year ended March 31, 2023, due mainly to increased sales revenue in Automobile business as well as positive foreign currency translation effects. Operating profit increased by 77.0%, to JPY 1,381.9 billion from the previous fiscal year, due mainly to an increase in profit attributable to price and cost impacts as well as sales impacts, which was partially offset by increased expenses. Profit before income taxes increased by 86.7%, to JPY 1,642.3 billion from the previous fiscal year. Profit for the year attributable to owners of the parent increased by 70.0%, to JPY 1,107.1 billion from the previous fiscal year.

Earnings per share attributable to owners of the parent for the year amounted to JPY 225.88, an increase of JPY 97.87 from the previous fiscal year. One Honda American Depository Share represents one common share.

Note: As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the record date of September 30, 2023. Earnings per share attributable to owners of the parent are calculated based on the assumption that the stock split had been implemented at the beginning of the year ended March 31, 2023.

—1—

Consolidated Statements of Financial Position for the Fiscal Year Ended March 31, 2024

Total assets increased by JPY 5,104.0 billion, to JPY 29,774.1 billion from March 31, 2023 due mainly to an increase in receivables from financial services, cash and cash equivalents as well as positive foreign currency translation effects. Total liabilities increased by JPY 3,600.5 billion, to JPY 16,768.2 billion from March 31, 2023 due mainly to increased financing liabilities as well as positive foreign currency translation effects. Total equity increased by JPY 1,503.5 billion, to JPY 13,005.8 billion from March 31, 2023 due mainly to increased retained earnings attributable to profit for the year as well as positive foreign currency translation effects.

Consolidated Statements of Cash Flows for the Fiscal Year Ended March 31, 2024

Consolidated cash and cash equivalents on March 31, 2024 increased by JPY 1,151.5 billion from March 31, 2023, to JPY 4,954.5 billion. The reasons for the increases or decreases for each cash flow activity, when compared with the previous fiscal year, are as follows:

Net cash provided by operating activities amounted to JPY 747.2 billion of cash inflows. Cash inflows from operating activities decreased by JPY 1,381.7 billion compared with the previous fiscal year, due mainly to an increase in payments for parts and raw materials as well as in receivables from financial services, which was partially offset by increased cash received from customers.

Net cash used in investing activities amounted to JPY 867.2 billion of cash outflows. Cash outflows from investing activities increased by JPY 189.2 billion compared with the previous fiscal year, due mainly to increased payments for acquisitions of investments accounted for using the equity method.

Net cash provided by financing activities amounted to JPY 918.6 billion of cash inflows. Cash inflows from financing activities increased by JPY 2,387.0 billion compared with the previous fiscal year, due mainly to increased proceeds from financing liabilities.

—2—

Forecasts for the Fiscal Year Ending March 31, 2025

In regard to the forecasts of the financial results for the fiscal year ending March 31, 2025, Honda projects consolidated results to be as shown below:

Fiscal year ending March 31, 2025

| Yen (billions) | Changes from FY 2024 | |||||||

Sales revenue | 20,300.0 | - 0.6 | % | |||||

Operating profit | 1,420.0 | + 2.8 | % | |||||

Profit before income taxes | 1,500.0 | - 8.7 | % | |||||

Profit for the year | 1,070.0 | - 9.5 | % | |||||

Profit for the year attributable to owners of the parent | 1,000.0 | - 9.7 | % | |||||

| Yen | ||||||||

Earnings per share attributable to owners of the parent | ||||||||

Basic and diluted | 210.23 | |||||||

Note: The forecasts are based on the assumption that the average exchange rates for the Japanese yen to the U.S. dollar will be JPY 140 for the full year ending March 31, 2025.

The reasons for the increases or decreases in the forecasts of the operating profit, and profit before income taxes for the fiscal year ending March 31, 2025 from the previous year are as follows.

| Yen (billions) | ||||

Sales impacts | - 71.0 | |||

Price and cost impacts | + 502.0 | |||

Expenses | - 71.0 | |||

R&D expenses | - 121.0 | |||

Currency effect | - 201.0 | |||

|

| |||

Operating profit compared with fiscal year ended March 31, 2024 | + 38.0 | |||

|

| |||

Profit of equity method | - 100.8 | |||

Other | - 79.5 | |||

|

| |||

Profit before income taxes compared with fiscal year ended March 31, 2024 | - 142.3 | |||

|

| |||

—3—

Dividend per Share of Common Stock

| Yen | ||||||||||||

| FY 2023 results | FY 2024 results | FY 2025 forecasts | ||||||||||

Interim dividend | 60.00 | 87.00 | 34.00 | |||||||||

Year-end dividend | 60.00 | 39.00 | 34.00 | |||||||||

Total annual dividend | 120.00 | — | 68.00 | |||||||||

Explanatory note:

As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the record date of September 30, 2023. The year-end dividend per share for the fiscal year ended March 31, 2024 is based on the number of shares after the stock split and the total annual dividend is disclosed as “ — ”. Based on the number of shares prior to the stock split, the year-end dividend and the total annual dividend for the fiscal year ended March 31, 2024 are expected to be JPY 117.00 per share and JPY 204.00 per share, respectively.

This announcement contains “forward-looking statements” as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements are based on management’s assumptions and beliefs taking into account information currently available to it. Therefore, please be advised that the actual results of the Company could differ materially from those described in these forward-looking statements as a result of numerous factors, including general economic conditions in the principal markets of the Company, its consolidated subsidiaries and its affiliates accounted for by the equity-method, and fluctuation of foreign exchange rates, as well as other factors detailed from time to time. The various factors for increases and decreases in profit have been classified in accordance with a method that Honda considers reasonable.

Basic Rationale for Selection of Accounting Standards

The Company adopted IFRS for the Company’s consolidated financial statements from the year ended March 31, 2015 which have been included in the annual securities report (to be submitted to the Financial Services Agency of Japan) and Form 20-F (to be submitted to the U.S. Securities and Exchange Commission), aiming at improving comparability of financial information across international capital markets as well as standardization of financial information and enhancing efficiency of financial reporting of the Company and its consolidated subsidiaries.

—4—

[1] Consolidated Statements of Financial Position

March 31, 2023 and 2024

| Yen (millions) | ||||||||

| Mar. 31, 2023 | Mar. 31, 2024 | |||||||

Assets | ||||||||

Current assets: | ||||||||

Cash and cash equivalents | 3,803,014 | 4,954,565 | ||||||

Trade receivables | 1,060,271 | 1,240,090 | ||||||

Receivables from financial services | 1,899,493 | 2,558,594 | ||||||

Other financial assets | 263,892 | 229,583 | ||||||

Inventories | 2,167,184 | 2,442,969 | ||||||

Other current assets | 384,494 | 446,763 | ||||||

|

|

|

| |||||

Total current assets | 9,578,348 | 11,872,564 | ||||||

|

|

|

| |||||

Non-current assets: | ||||||||

Investments accounted for using the equity method | 915,946 | 1,206,968 | ||||||

Receivables from financial services | 3,995,259 | 5,616,676 | ||||||

Other financial assets | 855,070 | 968,142 | ||||||

Equipment on operating leases | 4,726,292 | 5,202,768 | ||||||

Property, plant and equipment | 3,168,109 | 3,234,413 | ||||||

Intangible assets | 870,900 | 999,689 | ||||||

Deferred tax assets | 105,792 | 170,856 | ||||||

Other non-current assets | 454,351 | 502,074 | ||||||

|

|

|

| |||||

Total non-current assets | 15,091,719 | 17,901,586 | ||||||

|

|

|

| |||||

Total assets | 24,670,067 | 29,774,150 | ||||||

|

|

|

| |||||

Liabilities and Equity | ||||||||

Current liabilities: | ||||||||

Trade payables | 1,426,333 | 1,609,836 | ||||||

Financing liabilities | 3,291,195 | 4,105,590 | ||||||

Accrued expenses | 419,570 | 638,319 | ||||||

Other financial liabilities | 324,110 | 340,858 | ||||||

Income taxes payable | 86,252 | 157,410 | ||||||

Provisions | 362,701 | 566,722 | ||||||

Other current liabilities | 741,963 | 904,757 | ||||||

|

|

|

| |||||

Total current liabilities | 6,652,124 | 8,323,492 | ||||||

|

|

|

| |||||

Non-current liabilities: | ||||||||

Financing liabilities | 4,373,973 | 6,057,967 | ||||||

Other financial liabilities | 288,736 | 316,919 | ||||||

Retirement benefit liabilities | 255,852 | 284,844 | ||||||

Provisions | 270,169 | 385,001 | ||||||

Deferred tax liabilities | 877,300 | 855,067 | ||||||

Other non-current liabilities | 449,622 | 544,988 | ||||||

|

|

|

| |||||

Total non-current liabilities | 6,515,652 | 8,444,786 | ||||||

|

|

|

| |||||

Total liabilities | 13,167,776 | 16,768,278 | ||||||

|

|

|

| |||||

Equity: | ||||||||

Common stock | 86,067 | 86,067 | ||||||

Capital surplus | 185,589 | 205,073 | ||||||

Treasury stock | (484,931 | ) | (550,808 | ) | ||||

Retained earnings | 9,980,128 | 10,644,213 | ||||||

Other components of equity | 1,417,397 | 2,312,450 | ||||||

|

|

|

| |||||

Equity attributable to owners of the parent | 11,184,250 | 12,696,995 | ||||||

Non-controlling interests | 318,041 | 308,877 | ||||||

|

|

|

| |||||

Total equity | 11,502,291 | 13,005,872 | ||||||

|

|

|

| |||||

Total liabilities and equity | 24,670,067 | 29,774,150 | ||||||

|

|

|

| |||||

—5—

[2] Consolidated Statements of Income and Consolidated Statements of Comprehensive Income

Consolidated Statements of Income

For the years ended March 31, 2023 and 2024

| Yen (millions) | ||||||||

| Year ended Mar. 31, 2023 | Year ended Mar. 31, 2024 | |||||||

Sales revenue | 16,907,725 | 20,428,802 | ||||||

Operating costs and expenses: | ||||||||

Cost of sales | (13,576,133 | ) | (16,016,659 | ) | ||||

Selling, general and administrative | (1,669,908 | ) | (2,106,539 | ) | ||||

Research and development | (880,915 | ) | (923,627 | ) | ||||

|

|

|

| |||||

Total operating costs and expenses | (16,126,956 | ) | (19,046,825 | ) | ||||

|

|

|

| |||||

Operating profit | 780,769 | 1,381,977 | ||||||

|

|

|

| |||||

Share of profit of investments accounted for using the equity method | 117,445 | 110,817 | ||||||

Finance income and finance costs: | ||||||||

Interest income | 73,071 | 173,695 | ||||||

Interest expense | (36,112 | ) | (59,631 | ) | ||||

Other, net | (55,608 | ) | 35,526 | |||||

|

|

|

| |||||

Total finance income and finance costs | (18,649 | ) | 149,590 | |||||

|

|

|

| |||||

Profit before income taxes | 879,565 | 1,642,384 | ||||||

Income tax expense | (162,256 | ) | (459,794 | ) | ||||

|

|

|

| |||||

Profit for the year | 717,309 | 1,182,590 | ||||||

|

|

|

| |||||

Profit for the year attributable to: | ||||||||

Owners of the parent | 651,416 | 1,107,174 | ||||||

Non-controlling interests | 65,893 | 75,416 | ||||||

| Yen | ||||||||

Earnings per share attributable to owners of the parent | ||||||||

Basic and diluted | 128.01 | 225.88 | ||||||

—6—

Consolidated Statements of Comprehensive Income

For the years ended March 31, 2023 and 2024

| Yen (millions) | ||||||||

| Year ended Mar. 31, 2023 | Year ended Mar. 31, 2024 | |||||||

Profit for the year | 717,309 | 1,182,590 | ||||||

Other comprehensive income, net of tax: | ||||||||

Items that will not be reclassified to profit or loss | ||||||||

Remeasurements of defined benefit plans | 3,350 | (18,931 | ) | |||||

Net changes in revaluation of financial assets measured at fair value through other comprehensive income | (18,465 | ) | (25,469 | ) | ||||

Share of other comprehensive income of investments accounted for using the equity method | 292 | 8,300 | ||||||

Items that may be reclassified subsequently to profit or loss | ||||||||

Net changes in revaluation of financial assets measured at fair value through other comprehensive income | (474 | ) | 56 | |||||

Exchange differences on translating foreign operations | 422,960 | 875,050 | ||||||

Share of other comprehensive income of investments accounted for using the equity method | 30,429 | 54,353 | ||||||

|

|

|

| |||||

Total other comprehensive income, net of tax | 438,092 | 893,359 | ||||||

|

|

|

| |||||

Comprehensive income for the year | 1,155,401 | 2,075,949 | ||||||

|

|

|

| |||||

Comprehensive income for the year attributable to: | ||||||||

Owners of the parent | 1,081,429 | 1,981,448 | ||||||

Non-controlling interests | 73,972 | 94,501 | ||||||

—7—

[3] Consolidated Statements of Changes in Equity

For the years ended March 31, 2023 and 2024

| Yen (millions) | ||||||||||||||||||||||||||||||||

| Equity attributable to owners of the parent | Non-controlling interests | Total equity | ||||||||||||||||||||||||||||||

| Common stock | Capital surplus | Treasury stock | Retained earnings | Other components of equity | Total | |||||||||||||||||||||||||||

Balance as of April 1, 2022 | 86,067 | 185,495 | (328,309 | ) | 9,539,133 | 990,438 | 10,472,824 | 299,722 | 10,772,546 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Comprehensive income for the year | ||||||||||||||||||||||||||||||||

Profit for the year | 651,416 | 651,416 | 65,893 | 717,309 | ||||||||||||||||||||||||||||

Other comprehensive income, net of tax | 430,013 | 430,013 | 8,079 | 438,092 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income for the year | 651,416 | 430,013 | 1,081,429 | 73,972 | 1,155,401 | |||||||||||||||||||||||||||

Reclassification to retained earnings | 3,054 | (3,054 | ) | — | — | |||||||||||||||||||||||||||

Transactions with owners and other | ||||||||||||||||||||||||||||||||

Dividends paid | (213,475 | ) | (213,475 | ) | (51,601 | ) | (265,076 | ) | ||||||||||||||||||||||||

Purchases of treasury stock | (157,001 | ) | (157,001 | ) | (157,001 | ) | ||||||||||||||||||||||||||

Disposal of treasury stock | 379 | 379 | 379 | |||||||||||||||||||||||||||||

Share-based payment transactions | 94 | 94 | 94 | |||||||||||||||||||||||||||||

Equity transactions and others | (4,052 | ) | (4,052 | ) | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total transactions with owners and other | 94 | (156,622 | ) | (213,475 | ) | (370,003 | ) | (55,653 | ) | (425,656 | ) | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Balance as of March 31, 2023 | 86,067 | 185,589 | (484,931 | ) | 9,980,128 | 1,417,397 | 11,184,250 | 318,041 | 11,502,291 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Comprehensive income for the year | ||||||||||||||||||||||||||||||||

Profit for the year | 1,107,174 | 1,107,174 | 75,416 | 1,182,590 | ||||||||||||||||||||||||||||

Other comprehensive income, net of tax | 874,274 | 874,274 | 19,085 | 893,359 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income for the year | 1,107,174 | 874,274 | 1,981,448 | 94,501 | 2,075,949 | |||||||||||||||||||||||||||

Reclassification to retained earnings | (17,715 | ) | 17,715 | — | — | |||||||||||||||||||||||||||

Transactions with owners and other | ||||||||||||||||||||||||||||||||

Dividends paid | (241,865 | ) | (241,865 | ) | (63,895 | ) | (305,760 | ) | ||||||||||||||||||||||||

Purchases of treasury stock | (250,513 | ) | (250,513 | ) | (250,513 | ) | ||||||||||||||||||||||||||

Disposal of treasury stock | 504 | 504 | 504 | |||||||||||||||||||||||||||||

Cancellation of treasury stock | (623 | ) | 184,132 | (183,509 | ) | — | — | |||||||||||||||||||||||||

Share-based payment transactions | 3 | 3 | 3 | |||||||||||||||||||||||||||||

Equity transactions and others | 20,104 | 3,064 | 23,168 | (39,770 | ) | (16,602 | ) | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Total transactions with owners and other | 19,484 | (65,877 | ) | (425,374 | ) | 3,064 | (468,703 | ) | (103,665 | ) | (572,368 | ) | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

Balance as of March 31, 2024 | 86,067 | 205,073 | (550,808 | ) | 10,644,213 | 2,312,450 | 12,696,995 | 308,877 | 13,005,872 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||

—8—

[4] Consolidated Statements of Cash Flows

For the years ended March 31, 2023 and 2024

| Yen (millions) | ||||||||

| Year ended Mar. 31, 2023 | Year ended Mar. 31, 2024 | |||||||

Cash flows from operating activities: | ||||||||

Profit before income taxes | 879,565 | 1,642,384 | ||||||

Depreciation, amortization and impairment losses excluding equipment on operating leases | 721,630 | 794,366 | ||||||

Share of profit of investments accounted for using the equity method | (117,445 | ) | (110,817 | ) | ||||

Finance income and finance costs, net | (71,661 | ) | (141,250 | ) | ||||

Interest income and interest costs from financial services, net | (146,461 | ) | (152,041 | ) | ||||

Changes in assets and liabilities | ||||||||

Trade receivables | (155,924 | ) | (138,323 | ) | ||||

Inventories | (171,467 | ) | (67,833 | ) | ||||

Trade payables | 105,272 | 36,516 | ||||||

Accrued expenses | 42,122 | 157,582 | ||||||

Provisions and retirement benefit liabilities | 90,880 | 263,593 | ||||||

Receivables from financial services | (41,480 | ) | (1,454,357 | ) | ||||

Equipment on operating leases | 768,070 | 12,661 | ||||||

Other assets and liabilities | 218,369 | 58,325 | ||||||

Other, net | (1,222 | ) | (48,219 | ) | ||||

Dividends received | 244,902 | 158,092 | ||||||

Interest received | 324,234 | 560,709 | ||||||

Interest paid | (159,020 | ) | (283,447 | ) | ||||

Income taxes paid, net of refunds | (401,342 | ) | (540,663 | ) | ||||

|

|

|

| |||||

Net cash provided by operating activities | 2,129,022 | 747,278 | ||||||

Cash flows from investing activities: | ||||||||

Payments for additions to property, plant and equipment | (475,048 | ) | (348,680 | ) | ||||

Payments for additions to and internally developed intangible assets | (157,440 | ) | (259,985 | ) | ||||

Proceeds from sales of property, plant and equipment and intangible assets | 16,206 | 14,418 | ||||||

Proceeds from sales of subsidiaries, net of cash and cash equivalents disposed of | 740 | (18,544 | ) | |||||

Payments for acquisitions of investments accounted for using the equity method | (23,826 | ) | (173,767 | ) | ||||

Payments for acquisitions of other financial assets | (527,334 | ) | (282,076 | ) | ||||

Proceeds from sales and redemptions of other financial assets | 488,642 | 201,367 | ||||||

|

|

|

| |||||

Net cash used in investing activities | (678,060 | ) | (867,267 | ) | ||||

Cash flows from financing activities: | ||||||||

Proceeds from short-term financing liabilities | 9,127,333 | 10,020,736 | ||||||

Repayments of short-term financing liabilities | (8,684,799 | ) | (10,045,118 | ) | ||||

Proceeds from long-term financing liabilities | 971,067 | 3,654,964 | ||||||

Repayments of long-term financing liabilities | (2,382,190 | ) | (2,056,083 | ) | ||||

Dividends paid to owners of the parent | (213,475 | ) | (241,865 | ) | ||||

Dividends paid to non-controlling interests | (51,376 | ) | (66,855 | ) | ||||

Purchases and sales of treasury stock, net | (156,622 | ) | (250,009 | ) | ||||

Repayments of lease liabilities | (78,297 | ) | (80,513 | ) | ||||

Other, net | — | (16,611 | ) | |||||

|

|

|

| |||||

Net cash provided by (used in) financing activities | (1,468,359 | ) | 918,646 | |||||

Effect of exchange rate changes on cash and cash equivalents | 145,480 | 352,894 | ||||||

|

|

|

| |||||

Net change in cash and cash equivalents | 128,083 | 1,151,551 | ||||||

Cash and cash equivalents at beginning of year | 3,674,931 | 3,803,014 | ||||||

|

|

|

| |||||

Cash and cash equivalents at end of year | 3,803,014 | 4,954,565 | ||||||

|

|

|

| |||||

—9—

[5] Assumptions for Going Concern

None

—10—

[6] Notes to Consolidated Financial Statements

[A] Segment Information

Based on Honda’s organizational structure and characteristics of products and services, Honda discloses segment information in four categories: Reportable segments of Motorcycle business, Automobile business and Financial services business, and other segments that are not reportable. The other segments are combined and disclosed in Power products and other businesses. Segment information is based on the components of Honda for which separate financial information is available that is evaluated regularly by the chief operating decision maker in deciding how to allocate resources and in assessing performance. The accounting policies used for segment information are consistent with the accounting policies used in the Company’s consolidated financial statements.

Principal products and services, and functions of each segment are as follows:

Segment | Principal products and services | Functions | ||

Motorcycle Business | Motorcycles, all-terrain vehicles (ATVs), side-by-sides (SxS) and relevant parts | Research and development Manufacturing Sales and related services | ||

Automobile Business | Automobiles and relevant parts | Research and development Manufacturing Sales and related services | ||

Financial Services Business | Financial services | Retail loan and lease related to Honda products Others | ||

Power Products and Other Businesses | Power products and relevant parts, and others | Research and development Manufacturing Others | ||

Segment information based on products and services

As of and for the year ended March 31, 2023

| Yen (millions) | ||||||||||||||||||||||||||||

| Motorcycle Business | Automobile Business | Financial Services Business | Power Products and Other Businesses | Segment Total | Reconciling Items | Consolidated | ||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||

External customers | 2,908,983 | 10,593,519 | 2,954,098 | 451,125 | 16,907,725 | — | 16,907,725 | |||||||||||||||||||||

Intersegment | — | 188,198 | 2,046 | 25,307 | 215,551 | (215,551 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 2,908,983 | 10,781,717 | 2,956,144 | 476,432 | 17,123,276 | (215,551 | ) | 16,907,725 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment profit (loss) | 488,709 | (16,629 | ) | 285,857 | 22,832 | 780,769 | — | 780,769 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment assets | 1,580,521 | 10,082,519 | 11,197,017 | 480,166 | 23,340,223 | 1,329,844 | 24,670,067 | |||||||||||||||||||||

Depreciation and amortization | 65,746 | 600,617 | 908,942 | 21,571 | 1,596,876 | — | 1,596,876 | |||||||||||||||||||||

Capital expenditures | 59,101 | 613,351 | 1,546,683 | 14,386 | 2,233,521 | — | 2,233,521 | |||||||||||||||||||||

As of and for the year ended March 31, 2024

| Yen (millions) | ||||||||||||||||||||||||||||

| Motorcycle Business | Automobile Business | Financial Services Business | Power Products and Other Businesses | Segment Total | Reconciling Items | Consolidated | ||||||||||||||||||||||

Sales revenue: | ||||||||||||||||||||||||||||

External customers | 3,220,168 | 13,567,565 | 3,248,808 | 392,261 | 20,428,802 | — | 20,428,802 | |||||||||||||||||||||

Intersegment | — | 223,950 | 2,976 | 30,068 | 256,994 | (256,994 | ) | — | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Total | 3,220,168 | 13,791,515 | 3,251,784 | 422,329 | 20,685,796 | (256,994 | ) | 20,428,802 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment profit (loss) | 556,232 | 560,649 | 273,978 | (8,882 | ) | 1,381,977 | — | 1,381,977 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Segment assets | 2,047,270 | 11,690,446 | 14,118,371 | 585,301 | 28,441,388 | 1,332,762 | 29,774,150 | |||||||||||||||||||||

Depreciation and amortization | 72,590 | 655,250 | 834,246 | 17,400 | 1,579,486 | — | 1,579,486 | |||||||||||||||||||||

Capital expenditures | 74,006 | 598,475 | 2,451,930 | 16,768 | 3,141,179 | — | 3,141,179 | |||||||||||||||||||||

Explanatory notes:

| 1. | Intersegment sales revenues are generally made at values that approximate arm’s-length prices. |

| 2. | Reconciling items include elimination of intersegment transactions and balances as well as unallocated corporate assets. Unallocated corporate assets, included in reconciling items as of March 31, 2023 and 2024 amounted to JPY 1,462,656 million and JPY 1,573,834 million, respectively, which consist primarily of the Company’s cash and cash equivalents and financial assets measured at fair value through other comprehensive income. |

—11—

[B] Information about per common share

Equity per share attributable to owners of the parent as of March 31, 2023 and 2024 are calculated based on the following information.

| 2023 | 2024 | |||||||

Equity attributable to owners of the parent (millions of yen) | 11,184,250 | 12,696,995 | ||||||

The number of shares outstanding at the end of the year (excluding treasury stock) (shares) | 4,993,021,767 | 4,828,907,376 | ||||||

Equity per share attributable to owners of the parent (yen) | 2,239.98 | 2,629.37 | ||||||

Explanatory note:

| * | As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the record date of September 30, 2023. Equity per share attributable to owners of the parent is calculated based on the assumption that the stock split had been implemented at the beginning of the year ended March 31, 2023. |

Earnings per share attributable to owners of the parent for the years ended March 31, 2023 and 2024 are calculated based on the following information. There were no significant potentially dilutive common shares outstanding for the years ended March 31, 2023 and 2024.

| 2023 | 2024 | |||||||

Profit for the year attributable to owners of the parent (millions of yen) | 651,416 | 1,107,174 | ||||||

Weighted average number of common shares outstanding, basic (shares) | 5,088,921,345 | 4,901,560,332 | ||||||

Basic earnings per share attributable to owners of the parent (yen) | 128.01 | 225.88 | ||||||

Explanatory note:

| * | As of the effective date of October 1, 2023, the Company implemented a three-for-one stock split of its common stock to shareholders as of the record date of September 30, 2023. Basic earnings per share attributable to owners of the parent are calculated based on the assumption that the stock split had been implemented at the beginning of the year ended March 31, 2023. |

—12—

[C] Subsequent Event

Acquisition of the Company’s Own Shares

The Board of Directors of the Company, at its meeting held on May 10, 2024, resolved that the Company will acquire its own shares pursuant to Article 459, Paragraph 1 of the Company Law and Article 36 of the Company’s Articles of Incorporation.

| 1. | Reason for acquisition of own shares |

The Company will acquire its own shares for the purpose, among others, of improving efficiency of its capital structure and implementing a flexible capital strategy.

| 2. | Details of the acquisition |

| (1) | Class of shares to be acquired: |

Shares of common stock

| (2) | Total number of shares to be acquired: |

Up to 180,000,000 shares (3.7 % of total number of issued shares (excluding treasury stock))

| (3) | Total amount of shares to be acquired: |

Up to 300,000 million yen

| (4) | Period of acquisition: |

Starting on May 13, 2024 and ending on March 31, 2025

| (5) | Method of acquisition: |

Market purchases on the Tokyo Stock Exchange

| 1. | Purchases through the Tokyo Stock Exchange Trading Network Off-Auction Own Share Repurchase Trading System (ToSTNeT-3) |

| 2. | Market purchases based on a discretionary trading contract regarding acquisition of own shares |

[D] Other

Loss related to airbag inflators

Honda has been conducting market-based measures in relation to airbag inflators. Honda recognizes a provision for specific warranty costs when it is probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and a reliable estimate can be made of the amount of the obligation. There is a possibility that Honda will need to recognize additional provisions when new evidence related to the product recalls arise, however, it is not possible for Honda to reasonably estimate the amount and timing of potential future losses as of the date of this report.

—13—

May 10, 2024

| To: | Shareholders of Honda Motor Co., Ltd. |

| From: | Honda Motor Co., Ltd. |

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo, 107-8556

Toshihiro Mibe

Director, President and Representative Executive Officer

Notice of Resolution by the Board of Directors

Concerning Distribution of Surplus

for the Fiscal Year Ending March 31, 2024

The Board of Directors of Honda Motor Co., Ltd. (the “Company”), at its meeting held on May 10, 2024, resolved to make a distribution of surplus, the record date of which is March 31, 2024 as follows:

Particulars

| 1. | Details of Distribution of Surplus |

| Resolution | Previous Dividends Forecast (Announced on February 8, 2024) | Dividends Paid for the Fiscal Year-end in Fiscal 2023 | ||||

| Record Date | March 31, 2024 | March 31, 2024 | March 31, 2023 | |||

Dividends per Share of Common Stock (Conversion to the pre-split basis) | 39 yen (117 yen) | 29 yen (87 yen) | 60 yen | |||

Total Amount of Dividends | 188,418 million yen | — | 99,915 million yen | |||

| Effective Date | June 4, 2024 | — | June 6, 2023 | |||

Source of Funds for Dividends | Retained Earnings | — | Retained Earnings |

| 2. | Basis of the Distribution of Surplus |

The Company considers the redistribution of profits to its shareholders to be one of its most important management issues, and makes distributions after taking into account, among others, its retained earnings for future growth and consolidated earnings performance based on a long-term perspective. The Company resolved that a fiscal year-end dividend payment of 39 yen per share of common stock is to be paid considering its consolidated financial results for the fiscal year ending March 31, 2024.

Reference: Details of Annual Dividends

| Annual Dividend per share(yen) | ||||||

Interim (End of 2nd quarter) | Year-end | Total | ||||

Actual dividend issued (Conversion to the pre-split basis) | 87 | 39 (117) | — (204) | |||

| Results in the year ended March 31, 2023 | 60 | 60 | 120 | |||

(Notes)

| 1. | The company implemented the stock split into 3 shares per share with the effective date of October 1, 2023. The interim dividend for the fiscal year ending March 31, 2024, which has a dividend record date of September 30, 2023, is paid based on the shares before the stock split. |

| 2. | The full-year dividend per share is not presented because simple comparisons are not possible due to the implementation of the stock split. However, the full-year dividend per share based on the pre-stock split is 84 yen increase per share from the result in the year ended March 31, 2023. |

May 10, 2024

| To: | Shareholders of Honda Motor Co., Ltd. |

| From: | Honda Motor Co., Ltd. |

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo, 107-8556

Toshihiro Mibe

Director, President and Representative Executive Officer

Notice Concerning Acquisition of the Company’s Own Shares

(Acquisition of the Company’s own shares pursuant to the Articles of Incorporation of the Company

in accordance with Article 459, Paragraph 1 of the Company Law)

The Board of Directors of Honda Motor Co., Ltd. (the “Company”), at its meeting held on May 10, 2024, resolved that the Company will acquire its own shares pursuant to Article 459, Paragraph 1 of the Company Law and Article 36 of the Company’s Articles of Incorporation.

Particulars

| 1. | Reason for acquisition of own shares |

The Company will acquire its own shares for the purpose, among others, of improving efficiency of its capital structure and implementing a flexible capital strategy.

| 2. | Details of the acquisition |

| (1) | Class of shares to be acquired: |

Shares of common stock

| (2) | Total number of shares to be acquired: |

Up to 180,000,000 shares (3.7 % of total number of issued shares (excluding treasury stock))

| (3) | Total amount of shares to be acquired: |

Up to 300 billion yen

| (4) | Period of acquisition: |

Starting on May 13, 2024 and ending on March 31, 2025

| (5) | Method of acquisition: |

Market purchases on the Tokyo Stock Exchange

| 1. | Purchases through the Tokyo Stock Exchange Trading Network Off-Auction Own Share Repurchase Trading System (ToSTNeT-3) |

| 2. | Market purchases based on a discretionary trading contract regarding acquisition of own shares |

| Reference: | The Company’s treasury stock held as of March 31, 2024 |

| Total number of issued shares (excluding treasury stock): | 4,828,907,376 shares | |||||

| Total number of treasury stock: | 451,092,624 shares |

May 10, 2024

| To: | Shareholders of Honda Motor Co., Ltd. |

| From: | Honda Motor Co., Ltd. |

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo, 107-8556

Toshihiro Mibe

Director, President and Representative Executive Officer

Notice Regarding Stock Compensation Scheme for Executive Officers Etc.

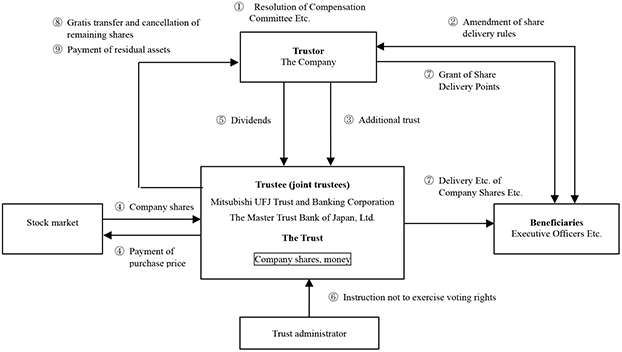

Honda Motor Co., Ltd. (the “Company”) passed a resolution approving the content of the stock compensation scheme for Executive Officers, and a part of Operating Executives of the Company who are residents of Japan (collectively, “Executive Officers Etc.”) and the continuation of the stock compensation scheme which uses a trust (the “Scheme”), with revisions as below.

Particulars

| 1. | Continuation of the Scheme |

| (1) | The Company made a decision to continue with the Scheme for Executive Officers Etc., which was introduced in the fiscal year ended March 31, 2019, for the purpose of further enhancing their attitude of contributing toward the sustained improvement of corporate value of the Company in the medium to long term as well as seeking for the sharing of common interests with shareholders. |

| (2) | The Scheme adopts a system called the “BIP (Board Incentive Plan) trust” (a “BIP Trust”). To continue with the Scheme in the fiscal year ending March 31, 2024, and onward, the Company will make a partial amendment to the Scheme and extend the trust period of the BIP Trust which has already been set. |

| (3) | The continuation of the Scheme was approved by the Company’s Compensation Committee, which consists of a majority of Outside Directors and is chaired by an Outside Director, and Board of Directors. The Compensation Committee will fairly evaluate the appropriateness of the performance targets and the level of achievement of such targets, and will ensure the transparency and objectivity of the decision-making process and results related to the compensation scheme for the officers. |

| 2. | Partial amendment of the Scheme |

Company has organized the 2030 Vision, which includes important themes (“Environment,” “Safety,” “People,” “Technology,” “Brand”) and materialities that we will particularly focus on in the future to create the joy of free movement. In line with stakeholders’ perspectives, including shareholders, we have decided to revise certain performance evaluation methods in this scheme to accelerate initiatives related to important themes and further support the creation of both social and economic value. Specifically, we will evaluate key financial indicators (such as consolidated operating profit margin, net income attributable to owners of the parent company) that should be addressed to achieve the ROIC target set for 2030, as

1

well as non-financial indicators directly related to the five important themes (brand value, total product CO2 emissions, employee engagement scores, etc.), and market valuation reflecting the creation of social and economic value (relative TSR, etc.) on an annual basis.

In the revised System, points corresponding to the criteria for each position will be granted annually in April, and shares equivalent to the points linked to the performance of the fiscal year will be issued, with transfer restrictions generally set until retirement from any position of director or executive officer of our company. These shares will be issued one year after the points are granted. The content of performance evaluation indicators is as follows.

| KPIs | Evaluation method | Weight | Fluctuation | |||||

Financial indicators | Consolidated operating profit margin | Evaluated based on degree of achievement of targets | 60% | 40 to 240% | ||||

| Profit for the year attributable to owners of the parent | ||||||||

Non-financial indicators | Brand value | 20% | ||||||

| Total CO2 emissions | ||||||||

| Associate engagement | ||||||||

Stock indicators | Total Shareholder Return | Evaluation based on relative comparison with the dividend-inclusive TOPIX growth rate for the fiscal year | 20% | |||||

| 3. | Structure of BIP Trust |

2

| j | At its Compensation Committee meeting the Company passed a resolution to continue with the Scheme. |

| k | For the continuation of the Scheme, the Company will make a partial amendment to share delivery rules. |

| l | Based on the resolution specified in j, the Company will extend the trust period of a trust whose beneficiaries are Executive Officers Etc. who satisfy the beneficiary requirements (the “Trust”) and entrust trustees with additional money. |

| m | In accordance with the instructions of the trust administrator, the Trust will acquire Company shares from the stock market using the additional money entrusted as specified in l and the money remaining in the Trust as the source of funds. |

| n | Dividends on Company shares held by the Trust shall be paid in the same manner as for other Company shares. |

| o | For the duration of the trust period, voting rights may not be exercised in respect of the Company shares held by the Trust. |

| p | During the trust period, the beneficiaries (i) shall, in accordance with the share delivery rules of the Company, be granted a certain number of points and, in principle one year after such granting of points, receive delivery of Company shares accordance with the provisions of the trust agreement, with restriction period on transfer until the time of retirement from both of the Company’s Director and Executive Officer. |

Also, any dividends paid in respect of the Company shares held by the Trust shall be paid to the beneficiaries in proportion to the number of Company shares (including shares that will be subject to conversion) that were Delivered Etc. by the Trust.

| q | If the Trust will continue to be used for the Scheme or for a stock compensation scheme similar to the Scheme, any remaining shares at the time of expiration of the trust period will be Delivered Etc. to Executive Officers Etc. by amending the trust agreement and entrusting additional amounts to the Trust. If the Trust will be terminated due to expiration of the trust period, as a measure of returning value to shareholders, the Trust will transfer such remaining shares to the Company for no consideration and the Company will cancel such shares by a resolution of the Board of Directors. |

| r | If the Trust will continue to be used after the expiration of the trust period, any remaining amounts of dividends pertaining to the Company shares held by the Trust at the time of such expiration shall be utilized as funds for acquiring Company shares, and if the Trust will be terminated due to expiration of the trust period, any portion of such remaining amounts of dividends that exceeds the trust expenses reserve (meaning the reserve for the trust fees and trust expenses, etc., which is the amount obtained after deducting the share acquisition funds from the trust money; the same applies hereinafter) is planned to be donated to organizations in which the Company and Executive Officers Etc. do not have any interests. |

| Note: | During the trust period, in the event of a shortage of company shares held within this trust or a shortfall of funds in the trust property for payment of trust fees or expenses, there is a possibility of additional funds being entrusted to this trust. |

3

Reference information

Content of trust agreement

| (1) | Type of trust | An individually-operated specified trust of money other than cash trust (third party beneficiary trust) | ||

| (2) | Purpose of trust | To further enhance the attitude of Executive Officers Etc. of contributing toward the sustained improvement of corporate value of the Company in the medium to long term | ||

| (3) | Trustor | The Company | ||

| (4) | Trustee | Mitsubishi UFJ Trust and Banking Corporation (Joint trustee: The Master Trust Bank of Japan, Ltd. | ||

| (5) | Beneficiaries | Executive Officers Etc. who satisfy the beneficiary requirements | ||

| (6) | Trust administrator | A third party which has no interests in the Company (a certified public accountant) | ||

| (7) | Date of trust agreement | August 20, 2018 (scheduled to be changed by August 31, 2024) | ||

| (8) | Period of trust | From August 20, 2018 to August 31, 2024 (scheduled to be extended until August 31, 2027 based on the changes to be made to the trust agreement by August 31, 2024) | ||

| (9) | Exercise of voting rights of Company shares | None | ||

| (10) | Class of shares acquired | Common shares of the Company | ||

| (11) | Amount of additional trust money | 1,940 million yen (scheduled) (including trust fees and trust expenses) | ||

| (12) | Timing of acquisition of shares | By August 31, 2024 (scheduled) (excluding the period from the fifth business day before the last day of each accounting period (including fiscal quarters) to the last day of such accounting period) | ||

| (13) | Method of acquisition of shares | Acquisition from stock market | ||

| (14) | Holder of vested rights | The Company | ||

| (15) | Residual assets | The residual assets able to be received by the Company as holder of vested rights shall be within the scope of the trust expenses reserve |

- End -

4

May 10, 2024

| To: | Shareholders of Honda Motor Co., Ltd. |

| From: | Honda Motor Co., Ltd. |

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo, 107-8556

Toshihiro Mibe

Director, President and Representative Executive Officer

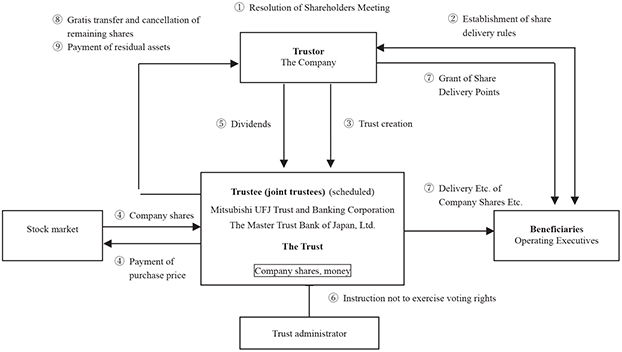

Notice Regarding Stock Compensation Scheme for Operating Executive

Honda Motor Co., Ltd. (the “Company”) passed a resolution approving the introduction of stock compensation scheme utilizing the Employee Stock Ownership Plan (ESOP) Trust for Operating Executive positions, who are employees of the company (hereinafter referred to as the “System”).

Particulars

| 1. | Purpose, etc. of introduction of the Scheme |

| (1) | We have organized our 2030 Vision, which includes important themes, materialities, and associated goals that our entire company will focus on, particularly aimed at creating “the joy of free movement.” These important themes were selected by systematically extracting societal issues from a sustainability perspective, aligning them with the direction our company aims for, and prioritizing them. Specifically, in addition to the traditionally emphasized management themes of “Environment” and “Safety,” we have also identified “People” and “Technology” as the driving forces behind our company’s growth, along with “Brand,” which encompasses all corporate activities, as five key non-financial areas. By aligning these with our financial strategy, we aim to realize the creation of social and economic value. We are introducing this program with the purpose of accelerating efforts towards these important themes, with both Executive Officers and Operating Executives working together to further support the creation of social and economic value. |

| (2) | The Scheme is a stock compensation scheme that uses a “ESOP (Employee Stock Ownership Plan) trust” (a “ESOP Trust”). The ESOP Trust is an incentive plan for employees, modeled after the ESOP system in the United States. Under this plan, the ESOP Trust acquires shares of our company, which are then allocated to executive positions in accordance with the stock grant regulations. For the acquisition of company shares by the ESOP Trust is provided by company, and there is no financial burden on the Operating Executives. |

| 2. | Structure of ESOP Trust |

| j | The Company will introduce the Scheme on the condition that a resolution approving the amount and details of the compensation for Operating Executives pertaining to the Scheme is passed at the Executive Council. |

| k | The company will establish the Stock Grant Regulations as an internal regulation concerning this program. |

| l | The Company will entrust money and create a ESOP trust whose beneficiaries are Operating Executives who satisfy the beneficiary requirements. |

| m | In accordance with the instructions of the trust administrator, the Trust will acquire Company shares from the stock market using the money entrusted in l above as the source of funds. |

| n | Dividends on Company shares held by the Trust shall be paid in the same manner as for other Company shares. |

| o | For the duration of the trust period, voting rights may not be exercised in respect of the Company shares held by the Trust. |

| p | During the trust period, the beneficiaries in accordance with the s Stock Grant Regulations of the Company, be granted a certain number of points and, in principle one year after such granting of points, receive delivery of Company shares. Also, any dividends paid in respect of the Company shares held by the Trust shall be paid to the beneficiaries in proportion to the number of Company shares (including shares that will be subject to conversion) that were delivered by the Trust. |

| q | If the Trust will continue to be used for the Scheme or for a stock compensation scheme similar to the Scheme, any remaining shares at the time of expiration of the trust period will |

be delivered to the Operating Executive by amending the trust agreement and entrusting additional amounts to the Trust. If the Trust will be terminated due to expiration of the trust period, as a measure of returning value to shareholders, the Trust will transfer such remaining shares to the Company for no consideration and the Company will cancel such shares by a resolution of the Board of Directors. |

| r | If the Trust will continue to be used after the expiration of the trust period, any remaining amounts of dividends pertaining to the Company shares held by the Trust at the time of such expiration shall be utilized as funds for acquiring Company shares, and if the Trust will be terminated due to expiration of the trust period, any portion of such remaining amounts of dividends that exceeds the trust expenses reserve (meaning the reserve for the trust fees and trust expenses, etc., which is the amount obtained after deducting the share acquisition funds from the trust money; the same applies hereinafter) is planned to be donated to organizations in which the Company and the Operating Executive do not have any interests. |

| Note: | During the trust period, in the event of a shortage of company shares held within this trust or a shortfall of funds in the trust property for payment of trust fees or expenses, there is a possibility of additional funds being entrusted to this trust. |

Content of trust agreement

| (1) | Type of trust | An individually-operated specified trust of money other than cash trust (third party beneficiary trust) | ||

| (2) | Purpose of trust | To further enhance the attitude of Operating Executive of contributing toward the sustained improvement of corporate value of the Company in the medium to long term | ||

| (3) | Trustor | The Company | ||

| (4) | Trustee | Mitsubishi UFJ Trust and Banking Corporation (Joint trustee: The Master Trust Bank of Japan, Ltd. | ||

| (5) | Beneficiaries | Employee who satisfy the beneficiary requirements | ||

| (6) | Trust administrator | A third party which has no interests in the Company (a certified public accountant) | ||

| (7) | Date of trust agreement | By August 31, 2024 (scheduled) | ||

| (8) | Period of trust | From the date of trust agreement to August 31, 2027 (scheduled) | ||

| (9) | Exercise of voting rights of Company shares | None | ||

| (10) | Class of shares acquired | Common shares of the Company | ||

| (11) | Amount of additional trust money | 2,940 million yen (scheduled) (including trust fees and trust expenses) | ||

| (12) | Timing of acquisition of shares | By August 31, 2024 (scheduled) (excluding the period from the fifth business day before the last day of each accounting period (including fiscal quarters) to the last day of such accounting period) | ||

| (13) | Method of acquisition of shares | Acquisition from stock market | ||

| (14) | Holder of vested rights | The Company | ||

| (15) | Residual assets | The residual assets able to be received by the Company as holder of vested rights shall be within the scope of the trust expenses reserve |

- End -

May 10, 2024

| To: | Shareholders of Honda Motor Co., Ltd. |

| From: | Honda Motor Co., Ltd. |

1-1, Minami-Aoyama 2-chome,

Minato-ku, Tokyo, 107-8556

Toshihiro Mibe

Director, President and Representative Executive Officer

Notice Concerning Recording of Extraordinary Losses in Non-Consolidated Financial Results

Honda Motor Co., Ltd. (the “Company”) hereby announces the recording of extraordinary losses in unconsolidated financial results for the fiscal year ended March 31, 2024.

The tax authorities have reached an agreement in principle on the mutual agreement procedure that was requested by the Company and its subsidiaries in North America and are expected to execute an agreement on the Advance Pricing Arrangement (“APA”) allocating income among related parties. Pursuant to the expected agreement, the Company has recorded an extraordinary loss of 99.7 billion yen as a transfer pricing adjustment in unconsolidated financial results for the fiscal year ended March 31, 2024. Since the subsidiaries in North America are consolidated subsidiaries, the impact on consolidated financial results for the fiscal year ended March 31, 2024, is immaterial.

- End -

—1—