As filed with the Securities and Exchange Commission on March 2, 2010

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-3668

THE WRIGHT MANAGED INCOME TRUST

440 Wheelers Farm Road

Milford, Connecticut 06461

Christopher A. Madden

Three Canal Plaza, Suite 600

Portland, ME 04101

207-347-2000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2009 – December 31, 2009

ITEM 1. REPORT TO STOCKHOLDERS.

The Wright Managed Blue Chip Investment Funds

ANNUAL REPORT

DECEMBER 31, 2009

THE WRIGHT MANAGED EQUITY TRUST

•Wright Selected Blue Chip Equities Fund

•Wright Major Blue Chip Equities Fund

•Wright International Blue Chip Equities Fund

THE WRIGHT MANAGED INCOME TRUST

•Wright Total Return Bond Fund

•Wright Current Income Fund

The Wright Managed Blue Chip Investment Funds

The Wright Managed Blue Chip Investment Funds consist of three equity funds from The Wright Managed Equity Trust and two fixed income funds from The Wright Managed Income Trust. Each of the five funds have distinct investment objectives and policies. They can be used individually or in combination to achieve virtually any objective. Further, as they are all “no-load” funds (no commissions or sales charges), portfolio allocation strategies can be altered as desired to meet changing market conditions or changing requirements without incurring any sales charges.

Approved Wright Investment List

Securities selected for investment in these funds are chosen mainly from a list of “investment grade” companies maintained by Wright Investors’ Service (“Wright” or the “Adviser”). Over 31,000 global companies (covering 63 countries) in Wright’s database are screened as new data becomes available to determine any eligible additions or deletions to the list. The qualifications for inclusion as “investment grade” are companies that meet Wright’s Quality Rating criteria. This rating includes fundamental criteria for investment acceptance, financial strength, profitability & stability and growth. In addition, securities, which are not included in Wright’s “investment grade” list, may also be selected from companies in the fund’s specific benchmark (up to 20% of the market value of the portfolio) in order to achieve broad diversification. Different quality criteria may apply for the different funds. For example, the companies in the Major Blue Chip Fund would require a higher Investment Acceptance rating than the companies in the Selected Blue Chip Fund.

Three Equity Funds

Wright Selected Blue Chip Equities Fund (WSBC) (the Fund) seeks to enhance total investment return through price appreciation plus income. The Fund’s portfolio is characterized as a blend of growth and value stocks. The market capitalization of the companies is typically between $1-$10 billion at the time of the Fund’s investment. The Adviser seeks to outperform the Standard & Poor’s 400 Index (S&P 400) by selecting stocks using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright Major Blue Chip Equities Fund (WMBC) (the Fund) seeks to enhance total investment return through price appreciation plus income by providing a broadly diversified portfolio of equities of larger well-established companies with market values of $10 billion or more. The Adviser seeks to outperform the Standard & Poor’s 500 Index (S&P 500) by selecting stocks, using fundamental company analysis and company specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries and sectors.

Wright International Blue Chip Equities Fund (WIBC) (the Fund) seeks total return consisting of price appreciation plus income by investing in a broadly diversified portfolio of equities of well-established, non-U.S. companies. The Fund may buy common stocks traded on the securities exchange of the country in which the company is based or it may purchase American Depositary Receipts (ADR’s) traded in the United States. The portfolio is denominated in U.S. dollars and investors should understand that fluctuations in foreign exchange rates may impact the value of their investment. The Adviser seeks to outperform the MSCI Developed World ex U.S. Index by selecting stocks using fundamental company analysis and company-specific criteria such as valuation and earnings trends. The portfolio is then diversified across industries, sectors and countries.

(continued on inside back cover)

Letter to Shareholders (unaudited) | | | 2 | |

Management Discussion (unaudited) | | | 4 | |

Performance Summaries (unaudited) | | | 10 | |

Fund Expenses (unaudited) | | | 15 | |

Management and Organization | | | 67 | |

Board of Trustees Annual Approval of the Investment Advisory Agreement | | | 69 | |

Important Notices Regarding Privacy, Delivery of Shareholder Documents,Portfolio Holdings and Proxy Voting | | | 70 | |

FINANCIAL STATEMENTS

The Wright Managed Equity Trust

Wright Selected Blue Chip Equities Fund | | | |

| Portfolio of Investments | | | 17 | |

| Statement of Assets & Liabilities | | | 20 | |

| Statement of Operations | | | 20 | |

| Statements of Changes in Net Assets | | | 21 | |

| Financial Highlights | | | 22 | |

| Wright Major Blue Chip Equities Fund | | | | |

| Portfolio of Investments | | | 23 | |

| Statement of Assets & Liabilities | | | 25 | |

| Statement of Operations | | | 25 | |

| Statements of Changes in Net Assets | | | 26 | |

| Financial Highlights | | | 27 | |

| Wright International Blue Chip Equities Fund | | | | |

| Portfolio of Investments | | | 28 | |

| Statement of Assets & Liabilities | | | 31 | |

| Statement of Operations | | | 31 | |

| Statements of Changes in Net Assets | | | 32 | |

| Financial Highlights | | | 33 | |

| Notes to Financial Statements | | | 34 | |

| Report of Independent Registered Public Accounting Firm | | | 42 | |

| Federal Tax Information | | | 43 | |

The Wright Managed Income Trust

| Wright Total Return Bond Fund | | | |

| Portfolio of Investments | | | 44 | |

| Statement of Assets & Liabilities | | | 49 | |

| Statement of Operations | | | 49 | |

| Statements of Changes in Net Assets | | | 50 | |

| Financial Highlights | | | 51 | |

| Wright Current Income Fund | | | | |

| Portfolio of Investments | | | 52 | |

| Statement of Assets & Liabilities | | | 56 | |

| Statement of Operations | | | 56 | |

| Statements of Changes in Net Assets | | | 57 | |

| Financial Highlights | | | 58 | |

| Notes to Financial Statements | | | 59 | |

| Report of Independent Registered Public Accounting Firm | | | 65 | |

| Federal Tax Information | | | 66 | |

The Wright Managed Blue Chip Investment Funds 1

Letter to Shareholders (unaudited)

January 2010

Dear Shareholders:

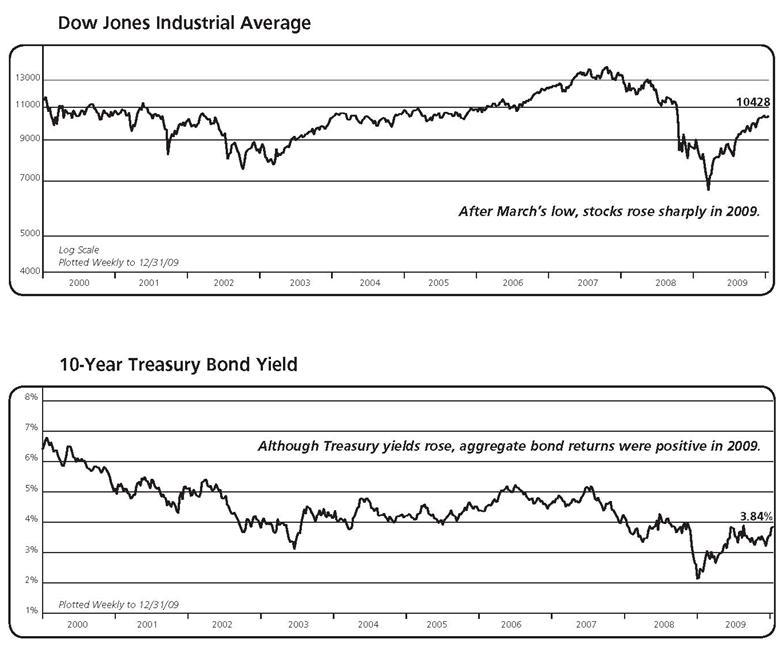

In summing up 2009, one is tempted to quote Charles Dickens from The Tale of Two Cities: It was the best of times, it was the worst – but that’s not quite right. The year certainly began as the worst in a long time, but the past year was not the best of anything, although for investors it was a whole lot better than 2008 and certainly better than most people thought possible 10 months ago. At the market low last March, the S&P 500 was down roughly 25% for the year, makings its 65% rise over the balance of the year – and its 26% total return for the entire year – highly improbable. That said, it is clear that 2010 is starting off with the financial markets and the global economy on much firmer footing than they were a year ago.

With the help of Federal Reserve liquidity injections and bailouts engineered by Congress and the Obama Administration, investors were coaxed into taking on more risk over the course of 2009, an inversion of 2008’s risk-averting behavior. Higher risk stocks, both those with smaller capitalizations and those with lower quality ratings, outperformed their bigger, more established counterparts. Emerging markets easily topped developed markets. High yield bonds averaged excess returns on the order of 60% for the year. The U.S. dollar lost 5% against a broad basket of foreign currencies. We expect investors will be far more discriminating in 2010, in at least a partial repudiation of the biggest “rubbish rally” in modern times that was 2009. The stock market’s rally lost some steam during the fourth quarter – the S&P 500’s Q4 return was only about 40% of its Q3 return – but that result (6.0% with income) was twice the market’s long-term average return for a three-month period.

For consumers and workers, 2009 was hardly the best of times, although conditions got better as the year progressed. Stimulus-related tax cuts helped to turn a roughly 3% decline in real wages and salaries for the year into an estimated 1.5% expansion in disposable personal income. At this time last year, consumer spending was declining at around a 4% annual rate, as the national mood was one of fear and despair. Consumer sentiment improved in a step-wise manner this past year, in part as a result of rebounding stock prices and, later in the year, on signs that jobs might be somewhat less hard to find in 2010. Despite the efforts of the Federal Reserve, however, credit conditions for many consumers, homeowners, municipalities and small businesses remain strained.

The Great Recession of 2008-09, as some have dubbed our recent economic troubles, appears of a piece with the 1958, 1974 and 1982 recessions as opposed to the deeper, longer economic declines (depressions) of the 1930s. True, the 18-20 months that the U.S. spent in recession from December 2007 through last summer exceeded the length of the 1957-58 (8 months), 1973-75 (16 months) and 1981-82 (16 months) declines. But its 3.7% peak-to-trough decline in real GDP matched the magnitude of the drop seen in 1958 and was not materially greater than the 3.2% decline in 1975 or the 2.9% decline in 1982. Unlike those earlier recessions, which were followed by GDP rebounds averaging more than 5.5% in the four quarters subsequent to recession’s end, the recovery we expect in 2010 is more likely to be in the 3%-3.5% range. That’s certainly better than we saw in 2006-09 (average GDP growth = 0.7%), but not sufficient to raise all boats, so to speak – particularly if U.S. economic growth disappoints later in 2010.

2 The Wright Managed Blue Chip Investment Funds

Letter to Shareholders (unaudited) - continued

In our view, investing in quality stocks makes sense throughout the economic cycle – despite the occasional year, such as 2009, when markets are topsy-turvy. Assuming that one could time such market turns with a reasonable degree of accuracy, then a policy of swapping in and out of quality sectors might be worth the risk. But market timing is difficult to start with, and timing the ins and outs of quality might leave you with a portfolio of losers – that is, low quality stocks – if you get the timing wrong. Wright’s investment philosophy is grounded in the observation that if you invest in quality stocks and you get the timing wrong, at least you end up with shares of high-quality, profitable companies that over the longer term will reward you through the sheer persistence of their earnings power. By contrast, if you chase junk stocks and your timing is poor, the risk is that you will end up with a portfolio of highly leveraged, low growth, low ROE stocks – not the sort of portfolio that long-term investors should want to hold.

December’s disappointing jobs losses aside, the 208,000 decline in employment over the final three months of 2009 is a good number when compared to the roughly one million lost per quarter during the recession. Still, the fact that firms have been slow to add workers, suggests that there may be a limit to how much can be accomplished though the credit easing efforts of policy makers when the essential problem of this recession has been the financial system’s excessive debt. Nonetheless, based on expected corporate earnings growth of more than 25% in the year ahead and 10% in 2011, the bull market in stocks that began in March 2009 has a good chance of extending into 2010. Corporate profits are a key driver of stock prices in the long run. Quality stocks are expected to outdistance more speculative issues as investor focus shifts from the magnitude of earning growth to the persistence of earning growth. In the bond market, 2010 is likely to see somewhat higher Treasury yields and modest additional tightening in yield spreads on non-Treasury securities. While bond returns are seen keeping ahead of inflation in 2010, it probably won’t be by much.

Last year’s March-December recovery in stock prices has the major stock market averages up more than 60% off their lows, a tough act to follow in 2010. Within the context of the past decade, with its two major bear markets, stock prices are not at levels we would describe as a bubble. Clearly, the earnings support for current stock pricing is much more constructive than was seen at the dot.com highs 10 years ago. At the same time, credit conditions and market liquidity, while far from perfect, are much improved over the levels seen in the housing bubble. If you have any questions or suggestions on how we can better serve your investment and wealth management needs, please let us know.

Sincerely,

Peter M. Donovan

Chairman & CEO

The Wright Managed Blue Chip Investment Funds 3

Management Discussion (unaudited)

EQUITY FUNDS

The second decade of the 21st century is starting off with the financial markets and the global economy on firmer footing than they were a year ago. March 2009 marked the start of one of the steepest bull markets since the 1930s. After the S&P 500 earned the best quarterly returns in a decade in the second and third quarters of 2009, the continuation of the rally through the fourth quarter, even at a slower pace, was impressive. The market’s move wasn’t based just on hopes for better times ahead. This past summer, the combined efforts of aggressive fiscal and monetary stimulus brought to an end the worst recession since the 1930s (although the National Bureau of Economic Research, the official arbiter of business cycles, had not yet made that call as this was written). Banks are regaining their financial health and credit markets are returning to normal although credit conditions remain tight for some would-be borrowers. Improvement in the developing economies of China and India will have a beneficial impact around the globe. The worst also appears to be over for corporate profits, which in Q4 rose for the first time on a year-over-year basis since Q2 2007.

The S&P 500’s return of 6.0% in the fourth quarter brought its full-year return for 2009 to 26.5%, its best year since 2003. The S&P 500’s rally in 2009, which took it up 65% in price in 10 months, recouped about half of its 2007-09 losses. The Dow Jones Industrials’ 8.1% return in the fourth quarter gave it a 22.7% return for the year. With technology stocks leading the market in the fourth quarter and the year, Nasdaq was the star of the major market averages in 2009, returning 45.4% for the year and 7.2% in the fourth quarter. Midcap stocks also had a stellar showing in 2009; the S&P MidCap 400 returned 37.4%, including 5.6% in the fourth quarter. The S&P SmallCap 600 returned 5.1% in Q4 and 25.6% for the year. As signs of economic recovery appeared, there was a cyclical bias to the market in both the fourth quarter and the year, with the S&P 500 led by strong showings in consumer discretionary and materials stocks as well as technology for both periods. In addition, smaller, lower-quality stocks tended to outperform more substantial, higher-quality issues, which is not unusual in the early stages of a market rally, though this trend showed signs of changing in the fourth quarter. International stocks outperformed the U.S. in 2009, with the MSCI World ex U.S. index of developed markets returning 33.7% in dollar terms for the year. For the year, the dollar declined in value compared to the currencies in the index, giving a boost to the dollar return. In Q4, international stock markets lagged U.S. equities, with the MSCI World ex U.S. index returning 2.4% in dollars; the dollar appreciated compared to the euro and the yen in Q4, reversing some of its March-September losses. Local currency returns also lagged in Q4 as economic data indicated the recovery in the European and Japanese economies may lag that of the U.S.

At the start of 2010, the near and long-term outlooks for the financial markets and the economy appear brighter than they were a year ago. Nevertheless, we don’t underestimate difficulties ahead. As stimulus is gradually withdrawn, the private sector will have to step up its investment and consumption spending to keep the recovery going beyond 2010. We expect that consumers will save more and spend less for an extended period, good for the economy in the long run but a constraint on growth in the near to intermediate term. Despite the relatively subdued recovery expected over the coming year and into 2011, we still expect corporate profits to move higher. At its level at year-end 2009, the stock market had priced in a substantial profit increase in 2010, and we expect that to be realized. Although sales growth may be tepid early in the recovery, cost cuts and productivity improvements are likely to take profit margins higher. Investors will also be able to look ahead to further profit growth in 2011. In the short run, we would not be surprised to see a pause in the market’s rally or even some giveback, given the magnitude of recent gains. We also expect that investor preference will shift toward high-quality issues, with most of the easy gains in riskier issues already made. Even with some fits and starts, stocks have the potential to generate a double-digit return over the coming 12 months, in our view. We note, however, that the current investment environment has more than the usual amount of risk; moreover, international tensions and war on two fronts add to the uncertainty. We recommend holding high-quality securities and a mix of asset classes as a prudent policy for long-term investors.

| Total Return | | 2009 Year | | | 2008 Year | | | 2007 Year | | | 2006 Year | | | 2005 Year | | | 2004 Year | | | 2003 Year | | | 2002 Year | | | 2001 Year | | | 2000 Year | |

| Wright Selected Blue Chip Equities Fund (WSBC) | | | 38.6 | % | | | -39.8 | % | | | 11.6 | % | | | 3.8 | % | | | 11.1 | % | | | 15.7 | % | | | 30.1 | % | | | -17.0 | % | | | -10.2 | % | | | 10.8 | % |

| Wright Major Blue Chip Equities Fund (WMBC) | | | 17.8 | % | | | -34.9 | % | | | 6.0 | % | | | 11.6 | % | | | 6.2 | % | | | 12.4 | % | | | 23.2 | % | | | -24.5 | % | | | -16.9 | % | | | -12.5 | % |

| Wright International Blue Chip Equities Fund (WIBC) | | | 33.8 | % | | | -47.7 | % | | | 5.5 | % | | | 28.5 | % | | | 21.1 | % | | | 17.7 | % | | | 32.0 | % | | | -14.5 | % | | | -24.2 | % | | | -17.6 | % |

4 The Wright Managed Blue Chip Investment Funds

Management Discussion (unaudited) - continued

WRIGHT SELECTED BLUE CHIP EQUITIES FUND

The S&P MidCap 400 outperformed the S&P 500 in 2009 with a 37.4% gain compared to 26.5% for the S&P 500. The MidCaps lagged slightly in the fourth quarter – an indication that investors may be shifting toward larger issues. The Wright Selected Blue Chip Fund (WSBC) outperformed the S&P MidCap 400 benchmark in three of the four quarters of 2009, including the fourth quarter, when it returned 5.8% compared to 5.6% for the benchmark. For the year, WSBC returned 38.6% compared to the S&P MidCap’s 37.4%. In all of 2009, including the fourth quarter, a key factor in WSBC’s outperformance relative to the mid-cap benchmark was its positioning in the technology sector. WSBC was overweight in technology, one of the best-performing sectors in the index for the quarter and the year, and its stock selection in this sector was superior. An overweight position and strong stock selection in health care also helped the Fund for the quarter and the year. The Fund’s positioning in the financial sector was also positive for the year, though in the fourth quarter its financial holdings did not perform as well as the benchmark’s. Among the individual securities that contributed to the Fund’s outperformance in 2009 were Western Digital (+286%) Health Management Associates (+306%) and Priceline (+197%), while two airlines, JetBlue (-21%) and Alaska Air (-40%), both sold before year-end, were detractors. For the fourth quarter, WellCare Group (+49%), Acxiom (+42%) and Cliffs Natural Resources (+43%) were among the contributors, while Aeropostale and Protective Life, both down 22%, were among the laggards. The WSBC Fund is well positioned to benefit from the shift toward quality stocks that we anticipate for 2010. In the aggregate, WSBC companies had lower current and forward P/E multiples than those in the MidCap 400 with similar expected earnings growth as 2010 began. WSBC continues to be biased to the larger companies in the index and its holdings have better historic earnings growth than the index constituents. WIS continues to advise diversity in investment portfolios as the best way to navigate difficult economic times.

WRIGHT MAJOR BLUE CHIP EQUITIES FUND

The Wright Major Blue Chip Fund (WMBC) is managed as a blend of the large-cap growth and value stocks in the S&P 500 Composite, selected with a bias toward the higher-quality issues in the index. The WMBC Fund lagged the S&P 500 in 2009, losing a bit more in the first quarter and not rebounding quite as strongly for the rest of the year. For 2009, WMBC returned 17.8% compared to 26.5% for the S&P 500. In the fourth quarter, WMBC returned 5.2% compared to 6.0% for the benchmark. In the first quarter of 2009, the main reason for the WMBC’s underperformance compared to the benchmark was its relative overweight position in financial stocks, which were the worst-performing group in the index for the period. The overweight position in financials was a plus for the second and third quarters. But for the last three quarters of the year, the Fund’s holdings in most sectors did not recover as much as some of the lower-quality issues (based on the Wright Quality Rating and Standard & Poor’s Quality Rating) in the S&P 500 as investors took on more risk. The preference of investors for the smaller stocks in the index in 2009 also worked against the Fund, which is weighted toward the more substantial holdings in the S&P 500. At year end, the median market cap of Fund holdings was twice that of the S&P 500. This low-quality, low-price preference was most pronounced in the second and third quarters of 2009. There were some signs that this focus on riskier issues was abating in the fourth quarter, as WMBC’s holdings in the financial, health care, and information technology sectors outperformed those in the S&P 500. For the full year, health care was the only sector where WMBC outperformed the benchmark. In terms of specific issues, for all of 2009, positive contributors to WMBC’s results included Apple computer (+147%), American Express (+126%) and National-Oilwell (+85%), while detractors included Lexmark (-37%), Xerox (-42%) and Integrys Energy (-38%), all of which have been sold. For the fourth quarter, positive contributors included health care issues Medtronic (+20%) and Wellpoint (+23%), and tech stocks Microsoft (+18%), Harris Corp. (+27%) and Oracle (+18%). Apollo Group (-18%), Jacobs Engineering (-18%, sold) and Citigroup (-15%, sold) detracted from results. The recovery in stocks since March has been driven by rising P/E multiples. In our view, the firm prospect of improving earnings growth will be necessary to take stocks much higher; in the fourth quarter of 2009 and early 2010 there were signs of this transition taking place. WMBC is well positioned to take advantage of an environment in which stock performance is driven by fundamentals, with its bias toward the higher-quality issues in the S&P 500 and an attractive valuation. At year-end 2009, WMBC holdings in the aggregate were priced at lower current and forward P/E multiples than the S&P 500 despite better historic earnings growth and similar forecast earnings growth.

The Wright Managed Blue Chip Investment Funds 5

Management Discussion (unaudited) - continued

WRIGHT INTERNATIONAL BLUE CHIP EQUITIES FUND

The MSCI World ex U.S. Index outperformed the S&P 500 in 2009 with a 33.7% return in dollars, with the dollar’s depreciation against the currencies in the index accounting for the advantage. In local currencies, the MSCI index’s 25.3% was comparable to the 26.5% for the S&P 500. In the fourth quarter of 2009, the MSCI World ex U.S. index returned 2.4% in dollars, behind the S&P 500’s 6.0%. In Q4, an appreciating dollar detracted from the MSCI’s dollar return. The Wright International Blue Chip Fund (WIBC) edged ahead of the MSCI’s performance in 2009 with a 33.8% return. For the fourth quarter, WIBC returned 2.7% compared to 2.4% for the MSCI Index. As in the U.S., international stock markets generally saw lower quality and smaller stocks outperform bigger, stronger companies, though there was some reversal in the fourth quarter. Among the factors that helped WIBC overcome this for the year was its overweight position in financial stocks in the second and third quarters of 2009 when they were strong, and an underweight position in Q4 when the financial sector of the MSCI had a negative return. Strong stock selection in the consumer discretionary, financial and telecom also helped, while weakness in consumer staples and technology detracted from performance. In the fourth quarter, strong stock selection in industrials as well as the WIBC’s positioning in financials contributed to the outperformance. The Fund also got a good contribution from its holdings in Japan. Among individual issues, Swiss Re (+216%), Jardine Cycle & Carriage (+203%) and Rio Tinto (+217%) were among the top contributors for the year, while several financial stocks such as Lloyds Banking Group (-65%, sold), National Bank of Greece (-37%) and Royal Bank of Scotland (-79%, sold) lagged. In the fourth quarter, miners Anglo American (+42%), Rio Tinto (+28%) and BHP Billiton (+18%) were strong contributors, while financials again detracted: Barclays (-24%), ING (-28%), National Bank of Greece (-27%). Moving into 2010, one of WIBC’s main themes in positioning was to focus on companies in Europe and Japan that will benefit from exports to the emerging markets of China and India, which are expected to grow significantly this year. WIBC is well positioned to benefit from a trend back toward quality and also offers attractive value. Its holdings are priced at significant discounts to the MSCI World ex U.S. index in terms of current and forward price/earnings ratios and price/cash flow ratio. We continue to see the inclusion of international stocks as likely to enhance returns in diversified investment portfolios.

6 The Wright Managed Blue Chip Investment Funds

Management Discussion (unaudited) - continued

FIXED-INCOME FUNDS

The Barclays U.S. Aggregate bond index returned 5.9% in 2009, with its strongest showing in the middle two quarters of the year. After giving a mixed signal in the third quarter, the bond market’s action in the fourth quarter of 2009 appeared to confirm the upbeat economic signal of stocks, with rising Treasury yields, tighter spreads on non-Treasury products and a steepening yield curve. As signs that the economy was pulling out of recession became more numerous later in the year, investors moved away from Treasury securities to take on more risk. Although inflation remained subdued in 2009, inflation expectations as measured by the difference between nominal Treasury bonds and Treasury Inflation-Protected Securities (TIPS) yields rose as investors looked ahead to stronger economic conditions and the eventual inflationary impact of the liquidity that policy makers poured into the economic system to help bring the economy out of its slump. While long-term yields rose for the year and the fourth quarter, the yield on the three month Treasury bill continued to hover around 0.1% as the Fed kept its fed funds rate target near zero. In the statement released after its December 16 policy meeting, the Federal Open Market Committee said that economic activity has picked up and conditions in the financial markets have become more supportive of economic growth. But the Fed still expects that slack resource use will help keep inflation subdued for some time; it therefore plans to maintain the fed funds target near zero for an extended period.

The 10-year Treasury bond yield rose about 160 basis points for all of 2009 and 50 basis points in the fourth quarter. Two-year Treasury bond yields rose about 40 basis points for the year, with about half of that in the fourth quarter. The essentially flat showing of the Barclays U.S. Aggregate bond index in Q4 was due to the 1.3% loss in Treasury bonds as their yields rose. Treasurys were the worst-performing sector of the bond market in Q4 as spreads on non-Treasury sectors continued to tighten on increasing confidence in the recovery. Treasurys lost 3.6% for the full year. Agencys were essentially flat for the fourth quarter and returned 1.9% for the year. Mortgage-backed issues returned 0.6% for the quarter and 5.9% for the year. Investment-grade corporate bonds overall outperformed Treasurys and the Barclays Aggregate by a wide margin in Q4 (returning 1.4%) and year (18.7%). Commercial mortgages were the best performing investment grade fixed-income sector in 2009: up 3.3% for the last quarter and 28.4% for all of 2009 despite concerns about the health of the commercial real estate market. Asset-backed issues had a 1.3% return for the fourth quarter and nearly 25% for the year.

The Fed is winding down some of the programs that helped keep the credit markets functioning during the financial crisis. Nevertheless, we don’t expect a change from its near-zero interest rate policy until late in 2010. Eventually, the flood of liquidity provided by policy makers around the globe and the better growth this stimulation produces will put some upward pressure on inflation, but we don’t expect to see much evidence of this until 2011; in 2010, excess global production and labor capacity is likely to keep inflation tame. As we move through 2010, inflation could be pushing toward 2% – though core inflation should be lower. Bond yields are expected to rise over the coming year, but not to levels that will inhibit economic growth. The Aggregate bond return is expected to be positive over the coming 12 months, reflecting coupon income and more spread tightening on non-Treasury sectors, which will offset rising yields on Treasurys. However, the coming year’s return on the Barclays Aggregate may be quite meager and is unlikely to match that of the last 12 months. We continue to recommend holding a mix of asset classes in long-term investment portfolios. Although bonds lagged stocks in 2009, they significantly outperformed in 2008 with a 5.2% positive return for the Barclays Aggregate compared to a 37% loss for the S&P 500, evidence of the benefits of diversification.

| Total Return | | 2009 Year | | | 2008 Year | | | 2007 Year | | | 2006 Year | | | 2005 Year | | | 2004 Year | | | 2003 Year | | | 2002 Year | | | 2001 Year | | | 2000 Year | |

| Wright Total Return Bond Fund (WTRB) | | | 10.5 | % | | | 1.7 | % | | | 5.6 | % | | | 3.3 | % | | | 1.5 | % | | | 3.5 | % | | | 3.3 | % | | | 9.0 | % | | | 5.0 | % | | | 10.6 | % |

| Wright Current Income Fund (WCIF) | | | 6.2 | % | | | 6.1 | % | | | 5.8 | % | | | 3.9 | % | | | 1.8 | % | | | 3.3 | % | | | 1.7 | % | | | 7.7 | % | | | 7.2 | % | | | 10.3 | % |

The Wright Managed Blue Chip Investment Funds 7

Management Discussion (unaudited) - continued

In 2009, the return on the Barclays Capital U.S. Aggregate bond index was 5.9%. The gains in bonds slowed in the fourth quarter of the year as the index returned 0.2%. The Wright Total Return Bond Fund (WTRB), a diversified bond fund, outperformed the Barclays Aggregate in each quarter of 2009. For the year, WTRB returned 10.5% compared to the benchmark’s 5.9% return. In the fourth quarter of 2009, WTRB returned 0.7% compared to 0.2% for the Barclays benchmark. WTRB had a yield of 4.5% for December 2009 calculated according to SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield. WTRB’s duration position, which was short compared to the Barclays Aggregate for most of 2009, had a positive impact on performance for the year. In the first half of 2009, the short duration helped as interest rates moved higher. In the third quarter, this short duration worked against the Fund as yields declined, but in Q4 the Fund benefitted from its duration position as rates turned higher again. Towards the end of the year, WTRB’s duration position was moved closer to neutral, based on the view that yields had moved up too fast in Q4, making an interim pullback in yields possible. We expect, however, that rates will move higher by the end of 2010. For the first half of 2009, the WTRB Fund benefitted from being positioned to take advantage of the steepening yield curve. In Q3, the Fund became more neutral to the yield curve, where it remained at the end of the year; a flattening of the yield curve, which would dictate a move from the neutral positioning, is not anticipated in the near term. Most of the WTRB Fund’s 2009 outperformance compared to the Barclays Aggregate resulted from its sector allocation. Being overweight in mortgage-backed and asset-backed securities helped Fund performance during the first quarter since both of these sectors outperformed the Barclays Aggregate index and Treasury bonds for the period. In the remainder of the year, overweight positions in corporate bonds, commercial mortgages, and asset-backed securities gave a significant boost to performance as these sectors significantly outperformed the Aggregate as well as Treasurys and Agencys, where WTRB was underweighted. In the third quarter, WTRB moved to an underweight position in mortgages, which also helped Fund performance since mortgages lagged the Aggregate in the second half of the year. As 2010 got underway, WTRB was maintaining its second-half positioning of being overweight in corporate bonds, commercial mortgage and asset-backed securities. We believe there is room for more spread tightening in these sectors in 2010 as the recovery proceeds and corporate profits improve; however, after the broad-based spread tightening in 2009, more care in the selection of specific issues will be required to generate superior performance in 2010.

WRIGHT CURRENT INCOME FUND

In 2009, the mortgage-backed sector of the bond market outperformed Treasury bonds with a return of 5.9%, just about matching the return of the Barclays Capital U.S. Aggregate bond index. In the fourth quarter, the MBS sector returned 0.6% compared to a return of 0.2% for the Barclays Aggregate. The Wright Current Income Fund (WCIF) is managed to be primarily invested in GNMA issues (mortgage-based securities, known as Ginnie Maes, guaranteed by the full faith and credit of the U.S. government) and other mortgage-based securities. The WCIF Fund is actively managed to maximize income and minimize principal fluctuation. In the fourth quarter of 2009, WCIF returned 0.6% compared to 0.4% for the GNMA bond index. For all of 2009, WCIF returned 6.2% compared to 5.4% for the GNMA index. For December 2009, the WCIF Fund had a yield of 4.8% as calculated by SEC guidelines. Dividends paid by this Fund may be more or less than implied by this yield. In addition to its holdings in Ginnie Maes (about 60% of assets at year end), WCIF also held MBS securities backed by Fannie Mae (FNMA) and Freddie Mac (FHLMC). These issues slightly outperformed Ginnie Maes in the fourth quarter and full year of 2009, contributing to WCIF’s outperformance relative to the GNMA benchmark. At year-end, about 3% of the WCIF portfolio was invested in non-Agency mortgages. The Fund’s selection of mortgages had a slightly longer duration than the GNMA index during the first nine months of the year. This had little impact on first-half performance and was positive in the third quarter when mortgage rates declined. In Q4, the Fund’s duration moved to slightly shorter than the index, which was positive as mortgage rates rose. Through 2009, the WCIF Fund was overweight in higher coupon issues (average coupon of 6.0% at year end vs 5.3% for the GNMA index) to generate more income. The Fund’s holdings of higher-coupon, well-seasoned bonds contributed to the Fund’s having less negative convexity that the Barclays benchmark, which contributes to a more stable performance when interest rates are volatile.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any of the Wright Managed Investment Funds.

8 The Wright Managed Blue Chip Investment Funds

Management Discussion (unaudited) - continued

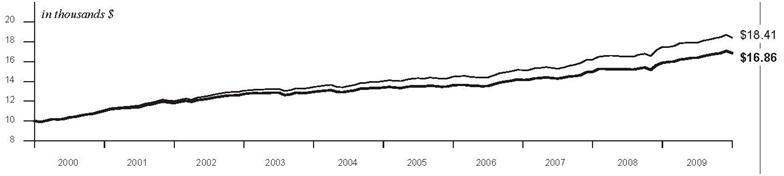

THE U.S. SECURITIES MARKET

The Wright Managed Blue Chip Investment Funds 9

Performance Summaries (unaudited)

Important

The Total Investment Return is the percent return of an initial $10,000 investment made at the beginning of the period to the ending redeemable value assuming all dividends and distributions are reinvested. After-tax returns are calculated using the historical highest individual federal marginal income tax rates, and do not reflect the impact of state and local taxes. Actual after-tax returns depend on the investor’s tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. Past performance is not predictive of future performance.

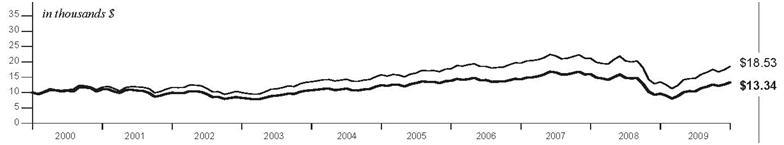

WRIGHT SELECTED BLUE CHIP EQUITIES FUND

Growth of $10,000 Invested 1/1/00 Through 12/31/09

| Average Annual Total Return | |

| | | | | | Last 1 Yr | | | Last 5 Yrs | | | Last 10 Yrs | |

| | - | | WSBC | | | | | | | | | | |

| | | | | - Return before taxes | | | 38.61 | % | | | 1.42 | % | | | 2.93 | % |

| | | | | - Return after taxes on distributions | | | 38.61 | % | | | -0.11 | % | | | 1.40 | % |

| | | | | - Return after taxes on distributions and sales of fund shares | | | 32.82 | % | | | -0.11 | % | | | 1.40 | % |

| | - | | S&P MidCap 400* | | | | 37.38 | % | | | 3.27 | % | | | 6.36 | % |

* The Fund’s average annual return is compared with that of the S&P MidCap 400, an unmanaged index of stocks in a broad range of industries with market capitalizations of a few billion or less. The performance of the S&P MidCap 400, unlike that of the Fund, reflects no deductions for fees, expenses, or taxes.

| Industry Weightings | |

| % of net assets @ 12/31/09 | |

| Health Care Equipment & Services | | | 10.8 | % |

| Software & Services | | | 9.3 | % |

| Materials | | | 9.1 | % |

| Electronic Equipment & Instruments | | | 8.5 | % |

| Retailing | | | 8.3 | % |

| Insurance | | | 7.9 | % |

| Energy | | | 7.3 | % |

| Real Estate | | | 6.0 | % |

| Commercial Services & Supplies | | | 4.6 | % |

| Utilities | | | 3.3 | % |

| Diversified Financials | | | 3.2 | % |

| Banks | | | 2.8 | % |

| Capital Goods | | | 2.8 | % |

| Oil & Gas | | | 2.2 | % |

| Pharmaceuticals & Biotechnology | | | 1.9 | % |

| Food, Beverage & Tobacco | | | 1.4 | % |

| Chemicals | | | 1.3 | % |

| Household & Personal Products | | | 1.3 | % |

| Consumer Products | | | 1.2 | % |

| Machinery | | | 1.0 | % |

| Aerospace & Defense | | | 0.8 | % |

| Consumer Durables & Apparel | | | 0.8 | % |

| Education | | | 0.8 | % |

| Telecommunication Services | | | 0.7 | % |

| Commercial & Professional Svcs. | | | 0.6 | % |

| Computers & Peripherals | | | 0.5 | % |

| Communications Equipment | | | 0.3 | % |

| Ten Largest Stock Holdings | |

| % of net assets @ 12/31/09 | |

| Lincare Holdings, Inc. | | | 2.9 | % |

| Sybase, Inc. | | | 2.4 | % |

| HCC Insurance Holdings, Inc. | | | 2.0 | % |

| MDU Resources Group, Inc. | | | 2.0 | % |

| Ross Stores, Inc. | | | 1.9 | % |

| Avnet, Inc. | | | 1.9 | % |

| Dick’s Sporting Goods, Inc. | | | 1.9 | % |

| Energen Corp. | | | 1.8 | % |

| NVR, Inc. | | | 1.6 | % |

| W.R. Berkley Corp. | | | 1.6 | % |

10 The Wright Managed Blue Chip Investment Funds

Performance Summaries (unaudited) - continued

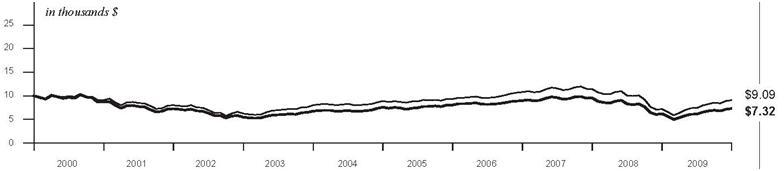

WRIGHT MAJOR BLUE CHIP EQUITIES FUND

Growth of $10,000 Invested 1/1/00 Through 12/31/09

| Average Annual Total Return | |

| | | | | | Last 1 Yr | | | Last 5 Yrs | | | Last 10 Yrs | |

| | - | | WMBC | | | | | | | | | | |

| | | | | - Return before taxes | | | 17.83 | % | | | -0.74 | % | | | -3.07 | % |

| | | | | - Return after taxes on distributions | | | 17.32 | % | | | -1.04 | % | | | -3.35 | % |

| | | | | - Return after taxes on distributions and sales of fund shares | | | 14.86 | % | | | -1.04 | % | | | -3.35 | % |

| | - | | S&P 500* | | | | 26.46 | % | | | 0.42 | % | | | -0.95 | % |

* The Fund’s average annual return is compared with that of the S&P 500, an unmanaged index of 500 widely held common stocks that generally indicates the performance of the market. The performance of the S&P 500, unlike that of the Fund, reflects no deductions for fees, expenses, or taxes.

| Industry Weightings | |

| % of net assets @ 12/31/09 | |

| | | | | | | |

| Pharmaceuticals & Biotechnology | | 10.2 | % | | Food, Beverage & Tobacco | | 3.3 | % |

| Computers & Peripherals | | 10.0 | % | | Communications Equipment | | 2.8 | % |

| Energy | | 9.3 | % | | Media | | 2.6 | % |

| Software & Services | | 8.5 | % | | Household Durables | | 2.2 | % |

| Insurance | | 5.8 | % | | Materials | | 2.2 | % |

| Diversified Financials | | 5.3 | % | | Hotels, Restaurants & Leisure | | 1.5 | % |

| Aerospace | | 5.1 | % | | Consumer Products | | 1.4 | % |

| Health Care Equipment & Services | | 5.1 | % | | Consumer Durables & Apparel | | 1.1 | % |

| Retailing | | 5.0 | % | | Education | | 0.8 | % |

| Telecommunication Services | | 4.0 | % | | Oil & Gas | | 0.8 | % |

| Capital Goods | | 3.7 | % | | Automobiles & Components | | 0.5 | % |

| Banks | | 3.7 | % | | Heavy Machinery | | 0.4 | % |

| Utilities | | 3.6 | % | | Commercial Services & Supplies | | 0.3 | % |

| Ten Largest Stock Holdings |

| % of net assets @ 12/31/09 |

| | | | |

| | | | |

| International Business Machines Corp. | | | 4.2 | % |

| Hewlett-Packard Co. | | | 3.9 | % |

| Chevron Corp. | | | 3.7 | % |

| Exxon Mobil Corp. | | | 2.9 | % |

| Oracle Corp. | | | 2.9 | % |

| Johnson & Johnson | | | 2.8 | % |

| Pfizer, Inc. | | | 2.7 | % |

| Procter & Gamble Co. (The) | | | 2.2 | % |

| Exelon Corp. | | | 2.2 | % |

| Apple, Inc. | | | 1.9 | % |

The Wright Managed Blue Chip Investment Funds 9

Performance Summaries (unaudited) - continued

WRIGHT INTERNATIONAL BLUE CHIP EQUITIES FUND

Growth of $10,000 Invested 1/1/00 Through 12/31/09

| | Average Annual Total Return |

| | | | | Last 1 Yr | | | Last 5 Yrs | | | Last 10 Yrs | |

| | −−−−−− | | WIBC | | | | | | | | | |

| | | | - Return before taxes | | | 33.77 | % | | | 2.80 | % | | | -0.48 | % |

| | | | - Return after taxes on distributions | | | 33.77 | % | | | 1.84 | % | | | -1.05 | % |

| | | | - Return after taxes on distributions and sales of fund shares | | | 28.70 | % | | | 1.84 | % | | | -1.05 | % |

| | --------- | | MSCI World ex U.S. Index* | | | 33.67 | % | | | 4.07 | % | | | 1.62 | % |

* The Fund’s average annual return is compared with that of the MSCI World ex U.S. Index. While the Fund does not seek to match the returns of this index, this unmanaged index generally indicates foreign stock market performance. The performance of the MSCI World ex U.S. Index, unlike that of the Fund, reflects no deductions for fees, expenses, or taxes.

| Country Weightings |

| % of net assets @ 12/31/09 |

| | | | | | | |

| | | | | | | |

| United Kingdom | | 17.2 | % | | Sweden | | 1.9 | % |

| Japan | | 16.8 | % | | Australia | | 1.5 | % |

| France | | 14.4 | % | | Denmark | | 0.9 | % |

| Switzerland | | 9.3 | % | | India | | 0.6 | % |

| Spain | | 7.6 | % | | Norway | | 0.6 | % |

| Canada | | 7.1 | % | | Austria | | 0.5 | % |

| Germany | | 5.0 | % | | China | | 0.5 | % |

| Hong Kong | | 4.5 | % | | Greece | | 0.5 | % |

| Italy | | 4.0 | % | | Ireland | | 0.5 | % |

| Netherlands | | 3.4 | % | | Russia | | 0.5 | % |

| Singapore | | 2.0 | % | | United Arab Emirates | | 0.4 | % |

| Ten Largest Stock Holdings |

| % of net assets @ 12/31/09 | |

| | | | |

| | | | |

| Telefonica SA | | | 3.1 | % |

| ENI SpA (Azioni Ordinarie) | | | 2.6 | % |

| AstraZeneca PLC | | | 2.6 | % |

| Banco Santander SA | | | 2.3 | % |

| HSBC Holdings PLC | | | 2.2 | % |

| Barclays PLC (Ordinary) | | | 2.0 | % |

| Swiss Reinsurance Co., Ltd. | | | 1.9 | % |

| Toronto-Dominion Bank (The) | | | 1.9 | % |

| Nestle SA | | | 1.8 | % |

| Total SA | | | 1.7 | % |

12 The Wright Managed Blue Chip Investment Funds

Performance Summaries (unaudited) - continued

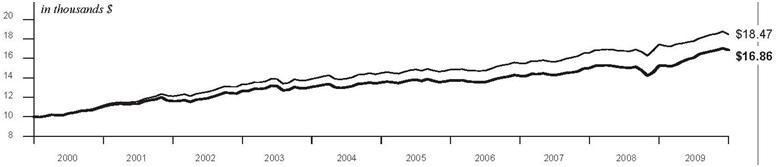

WRIGHT TOTAL RETURN BOND FUND

Growth of $10,000 Invested 1/1/00 Through 12/31/09

| Average Annual Total Return |

| | Last 1 Yr | | | Last 5 Yrs | | | Last 10 Yrs | |

| | −−−−−− | | WTRB | | | | | | | | | |

| | | | - Return before taxes | | | 10.53 | % | | | 4.50 | % | | | 5.36 | % |

| | | | - Return after taxes on distributions | | | 8.65 | % | | | 2.82 | % | | | 3.54 | % |

| | | | - Return after taxes on distributions and sales of fund shares | | | 7.86 | % | | | 2.82 | % | | | 3.48 | % |

| | --------- | | Barclays Capital U.S. Aggregate Bond Index* | | | 5.93 | % | | | 4.97 | % | | | 6.33 | % |

* The Fund’s average annual return is compared with that of the Barclays Capital U.S. Aggregate Bond Index, an unmanaged index that is a broad representation of the investment-grade fixed income market in the U.S. The Barclays Capital U.S. Aggregate Bond Index, unlike the Fund, reflects no deductions for fees, expenses, or taxes.

| Holdings by Sector | |

| % of net assets @ 12/31/09 | | | | |

| | | | | |

| Asset-Backed Securities | | | | 3.3 | % |

| Convertible Bonds | | | | 0.8 | % |

| Corporate Bonds | | | | 38.5 | % |

| Mortgage-Backed Securities | | | | 37.0 | % |

| U.S. Government Agencies | | | | 3.3 | % |

| U.S. Treasuries | | | | 15.3 | % |

| | | | | | |

| Holdings by Credit Quality | |

| % of net assets @ 12/31/09 | | | | | |

| | | | | | |

| AA | | | | 4 | % |

| A | | | | | 22 | % |

| BBB | | | | 14 | % |

| Agency-Backed Securities | | | | 3 | % |

| Mortgage-Backed Securities | | | | 37 | % |

| U.S. Government Agencies | | | | 3 | % |

| U.S. Treasuries | | | | 15 | % |

| Five Largest Bond Holdings | |

| % of net assets @ 12/31/09 | |

| | | | | | | | |

| U.S. Treasury Notes | | | 4.38 | % | 12/15/10 | | | 5.1 | % |

| U.S. Treasury Notes | | | 4.00 | % | 11/15/12 | | | 4.6 | % |

| U.S. Treasury Notes | | | 3.88 | % | 05/15/18 | | | 2.4 | % |

| FNMA Pool #781893 | | | 4.50 | % | 11/01/31 | | | 2.4 | % |

| FNMA Pool #745755 | | | 5.00 | % | 12/01/35 | | | 2.0 | % |

| Weighted Average Maturity | | | | |

| @ 12/31/09 | | | 5.8 | | years |

The Wright Managed Blue Chip Investment Funds 13

Performance Summaries (unaudited) - continued

WRIGHT CURRENT INCOME FUND

Growth of $10,000 Invested 1/1/00 Through 12/31/09

| Average Annual Total Return |

| | Last 1 Yr | | | Last 5 Yrs | | | Last 10 Yrs | |

| | −−−−−− | | WCIF | | | | | | | | | |

| | | | - Return before taxes | | | 6.20 | % | | | 4.74 | % | | | 5.36 | % |

| | | | - Return after taxes on distributions | | | 4.47 | % | | | 3.03 | % | | | 3.39 | % |

| | | | - Return after taxes on distributions and sales of fund shares | | | 4.27 | % | | | 3.03 | % | | | 3.39 | % |

| | --------- | | Barclays Capital GNMA Backed Bond Index* | | | 5.37 | % | | | 5.59 | % | | | 6.30 | % |

*The Fund’s average annual return is compared with that of the Barclays Capital GNMA Backed Bond Index. While the Fund does not seek to match the returns of the Barclays Capital GNMA Backed Bond Index, Wright believes that this unmanaged index generally indicates the performance of government and corporate mortgage-backed bond markets. The Barclays Capital GNMA Backed Bond Index, unlike the Fund, reflects no deductions for fees, expenses, or taxes.

| Holdings by Sector | | | |

| % of net assets @ 12/31/09 | | | |

| Mortgage-Backed Securities | | | 97.3 | % |

| |

| Weighted Average Maturity | | | | |

| @ 12/31/09 | | 4.1 years | |

| Five Largest Bond Holdings |

| % of net assets @ 12/31/09 | | | | | | | |

| GNMA Series 2002-47, Class PG | | | 6.50 | % | 07/16/32 | | | 4.5 | % |

| GNMA I Pool #697850 | | | 5.00 | % | 02/15/39 | | | 4.2 | % |

| GNMA I Pool #711286 | | | 6.50 | % | 10/15/32 | | | 3.9 | % |

| FNMA Pool #725027 | | | 5.00 | % | 11/01/33 | | | 3.9 | % |

| GNMA Series 1998-21, Class ZB | | | 6.50 | % | 09/20/28 | | | 3.6 | % |

14 The Wright Managed Blue Chip Investment Funds

Fund Expenses (unaudited)

Example:

As a shareholder of a fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchases and redemption fees (if applicable); and (2) ongoing costs including management fees; distribution or service fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2009 – December 31, 2009).

Actual Expenses:

The first line of the tables shown on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes:

The second line of the tables provides information about hypothetical account values and hypothetical expenses based on the actual Fund expense ratio and an assumed rate of return of 5% per year (before expenses), which is not the actual return of the Fund. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption fees (if payable). Therefore, the second line of the tables is useful in comparing ongoing costs only, and will help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

The Wright Managed Blue Chip Investment Funds 15

Fund Expenses (unaudited) - continued

EQUITY FUNDS

Wright Selected Blue Chip Equities Fund

| | | Beginning Account Value (7/1/09) | | | Ending Account Value (12/31/09) | | | Expenses Paid During Period* (7/1/09-12/31/09) | |

| Actual Fund Shares | | $ | 1,000.00 | | | $ | 1,284.40 | | | $ | 8.06 | |

| Hypothetical (5% return per year before expenses) | |

| Fund Shares | | $ | 1,000.00 | | | $ | 1,018.15 | | | $ | 7.12 | |

| | *Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2009. |

Wright Major Blue Chip Equities Fund

| | | Beginning Account Value (7/1/09) | | | Ending Account Value (12/31/09) | | | Expenses Paid During Period* (7/1/09-12/31/09) | |

| Actual Fund Shares | | $ | 1,000.00 | | | $ | 1,178.96 | | | $ | 7.69 | |

| Hypothetical (5% return per year before expenses) | |

| Fund Shares | | $ | 1,000.00 | | | $ | 1,018.15 | | | $ | 7.12 | |

| | *Expenses are equal to the Fund’s annualized expense ratio of 1.40% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2009. |

Wright International Blue Chip Equities Fund

| | | Beginning Account Value (7/1/09) | | | Ending Account Value (12/31/09) | | | Expenses Paid During Period* (7/1/09-12/31/09) | |

| Actual Fund Shares | | $ | 1,000.00 | | | $ | 1,225.43 | | | $ | 9.65 | |

| Hypothetical (5% return per year before expenses) | |

| Fund Shares | | $ | 1,000.00 | | | $ | 1,016.53 | | | $ | 8.74 | |

| | *Expenses are equal to the Fund’s annualized expense ratio of 1.72% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2009. |

FIXED INCOME FUNDS

Wright Total Return Bond Fund

| | | Beginning Account Value (7/1/09) | | | Ending Account Value (12/31/09) | | | Expenses Paid During Period* (7/1/09-12/31/09) | |

| Actual Fund Shares | | $ | 1,000.00 | | | $ | 1,049.80 | | | $ | 3.62 | |

| Hypothetical (5% return per year before expenses) | |

| Fund Shares | | $ | 1,000.00 | | | $ | 1,021.70 | | | $ | 3.57 | |

| | *Expenses are equal to the Fund’s annualized expense ratio of 0.70% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2009. |

Wright Current Income Fund

| | | Beginning Account Value (7/1/09) | | | Ending Account Value (12/31/09) | | | Expenses Paid During Period* (7/1/09-12/31/09) | |

| Actual Fund Shares | | $ | 1,000.00 | | | $ | 1,029.60 | | | $ | 4.60 | |

| Hypothetical (5% return per year before expenses) | |

| Fund Shares | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 4.58 | |

| | *Expenses are equal to the Fund’s annualized expense ratio of 0.90% multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). The example assumes that the $1,000 was invested at the net asset value per share determined at the close of business on June 30, 2009. |

16 The Wright Managed Blue Chip Investment Funds

Wright Selected Blue Chip Equities Fund (WSBC)

Portfolio of Investments – As of December 31, 2009

| | | Shares | | | Value | |

| EQUITY INTERESTS - 98.7% | | | | | | |

| AEROSPACE & DEFENSE - 0.8% | | | | | | |

| Alliant Techsystems, Inc. * | | | 1,605 | | | $ | 141,673 | |

| | | | | | | | | |

| BANKS - 2.8% | | | | | | | | |

| Bank of Hawaii Corp. | | | 3,125 | | | $ | 147,063 | |

| Commerce Bancshares, Inc. | | | 2,140 | | | | 82,861 | |

| SVB Financial Group * | | | 5,760 | | | | 240,134 | |

| | | | | | | $ | 470,058 | |

| | | | | | | | | |

| CAPITAL GOODS - 2.8% | | | | | | | | |

| SPX Corp. | | | 4,225 | | | $ | 231,108 | |

| Thomas & Betts Corp. * | | | 6,875 | | | | 246,056 | |

| | | | | | | $ | 477,164 | |

| | | | | | | | | |

| CHEMICALS - 1.3% | | | | | | | | |

| Ashland, Inc. | | | 1,665 | | | $ | 65,967 | |

| Cytec Industries, Inc. | | | 2,085 | | | | 75,936 | |

| Olin Corp. | | | 4,105 | | | | 71,920 | |

| | | | | | | $ | 213,823 | |

| | | | | | | | | |

| | | | | | | | | |

| COMMERCIAL & PROFESSIONAL SERVICES - 0.6% | | | | | | | | |

| Watson Wyatt Worldwide, Inc. - Class A | | | 1,955 | | | $ | 92,902 | |

| | | | | | | | | |

| COMMERCIAL SERVICES & SUPPLIES - 4.6% | | | | | | | | |

| Global Payments, Inc. | | | 4,170 | | | $ | 224,596 | |

| Harsco Corp. | | | 3,070 | | | | 98,946 | |

| Manpower, Inc. | | | 3,565 | | | | 194,578 | |

| Navigant Consulting, Inc.* | | | 6,745 | | | | 100,231 | |

| Teleflex, Inc. | | | 2,680 | | | | 144,425 | |

| | | | | | | $ | 762,776 | |

| | | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 0.3% | | | | | | | | |

| CommScope, Inc.* | | | 2,120 | | | $ | 56,244 | |

| | | | | | | | | |

| COMPUTERS & PERIPHERALS - 0.5% | | | | | | | | |

| Western Digital Corp.* | | | 1,965 | | | $ | 86,755 | |

| | | | | | | | | |

| CONSUMER DURABLES & APPAREL - 0.8% | | | | | | | | |

| Herman Miller, Inc. | | | 8,725 | | | $ | 139,426 | |

| | | | | | | | | |

| CONSUMER PRODUCTS - 1.2% | | | | | | | | |

| 99 Cents Only Stores* | | | 6,030 | | | $ | 78,812 | |

| Priceline.com, Inc.* | | | 540 | | | | 117,990 | |

| | | | | | | $ | 196,802 | |

| | | | | | | | | |

| | | | | | | | | |

| DIVERSIFIED FINANCIALS - 3.2% | | | | | | | | |

| Affiliated Managers Group, Inc.* | | | 2,065 | | | $ | 139,078 | |

| Astoria Finanical Corp. | | | 3,315 | | | | 41,205 | |

| Lender Processing Services, Inc. | | | 2,120 | | | | 86,199 | |

| Raymond James Financial, Inc. | | | 6,932 | | | | 164,774 | |

| SEI Investments Co. | | | 6,085 | | | | 106,609 | |

| | | | | | | $ | 537,865 | |

| | | | | | | | | |

| | | | | | | | | |

| EDUCATION - 0.8% | | | | | | | | |

| ITT Educational Services, Inc.* | | | 1,450 | | | $ | 139,142 | |

| | | | | | | | | |

| ELECTRONIC EQUIPMENT & INSTRUMENTS - 8.5% | | | | | | | | |

| AMETEK, Inc. | | | 3,260 | | | $ | 124,662 | |

| Arrow Electronics, Inc.* | | | 7,460 | | | | 220,891 | |

| Avnet, Inc.* | | | 10,620 | | | | 320,299 | |

| Hubbell, Inc. - Class B | | | 4,280 | | | | 202,444 | |

| Lincoln Electric Holdings, Inc. | | | 2,360 | | | | 126,166 | |

| Pentair, Inc. | | | 4,715 | | | | 152,295 | |

| Synopsys, Inc.* | | | 2,730 | | | | 60,824 | |

| Tech Data Corp.* | | | 2,195 | | | | 102,419 | |

| Vishay Intertechnology, Inc.* | | | 13,990 | | | | 116,817 | |

| | | | | | | $ | 1,426,817 | |

| | | | | | | | | |

| ENERGY - 7.3% | | | | | | | | |

| Cimarex Energy Co. | | | 3,620 | | | $ | 191,751 | |

| Cliffs Natural Resources, Inc. | | | 1,785 | | | | 82,271 | |

| Comstock Resources, Inc.* | | | 2,275 | | | | 92,297 | |

| Energen Corp. | | | 6,475 | | | | 303,030 | |

| FMC Technologies, Inc.* | | | 3,605 | | | | 208,513 | |

| Helmerich & Payne, Inc. | | | 3,125 | | | | 124,625 | |

| Patterson-UTI Energy, Inc. | | | 5,705 | | | | 87,572 | |

| Superior Energy Services, Inc.* | | | 2,490 | | | | 60,482 | |

| Tidewater, Inc. | | | 1,625 | | | | 77,919 | |

| | | | | | | $ | 1,228,460 | |

| FOOD, BEVERAGE & TOBACCO - 1.4% | | | | | | | | |

| PepsiAmericas, Inc. | | | 4,280 | | | $ | 125,233 | |

| Ralcorp Holdings, Inc.* | | | 1,330 | | | | 79,414 | |

| Universal Corp. | | | 780 | | | | 35,576 | |

| | | | | | | $ | 240,223 | |

See notes to financial statements.

The Wright Managed Blue Chip Investment Funds 17

Wright Selected Blue Chip Equities Fund (WSBC)

Portfolio of Investments – As of December 31, 2009 - continued

| | | | Shares | | | | Value | |

| HEALTH CARE EQUIPMENT & SERVICES - 10.8% | | | | | | | | |

| Community Health Systems, Inc.* | | | 5,120 | | | $ | 182,272 | |

| Health Management Associates, Inc. - Class A* | | | 16,235 | | | | 118,028 | |

| Henry Schein, Inc.* | | | 2,740 | | | | 144,124 | |

| Kindred Healthcare, Inc.* | | | 5,000 | | | | 92,300 | |

| Kinetic Concepts, Inc.* | | | 4,500 | | | | 169,425 | |

| LifePoint Hospitals, Inc.* | | | 7,295 | | | | 237,160 | |

| Lincare Holdings, Inc.* | | | 13,270 | | | | 492,582 | |

| Service Corp. International | | | 10,770 | | | | 88,206 | |

| STERIS Corp. | | | 3,785 | | | | 105,866 | |

| WellCare Health Plans, Inc.* | | | 4,805 | | | | 176,632 | |

| | | | | | | $ | 1,806,595 | |

| | | | | | | | | |

| HOUSEHOLD & PERSONAL PRODUCTS - 1.3% | | | | | | | | |

| Church & Dwight Co., Inc. | | | 1,165 | | | $ | 70,424 | |

| Tupperware Brands Corp. | | | 3,290 | | | | 153,215 | |

| | | | | | | $ | 223,639 | |

| | | | | | | | | |

| INSURANCE - 7.9% | | | | | | | | |

| American Financial Group, Inc. | | | 4,960 | | | $ | 123,752 | |

| Everest Re Group, Ltd. | | | 1,645 | | | | 140,944 | |

| HCC Insurance Holdings, Inc. | | | 11,850 | | | | 331,445 | |

| Protective Life Corp. | | | 6,420 | | | | 106,251 | |

| Reinsurance Group of America, Inc. | | | 2,360 | | | | 112,454 | |

| StanCorp Financial Group, Inc. | | | 5,980 | | | | 239,320 | |

| W.R. Berkley Corp. | | | 10,752 | | | | 264,929 | |

| | | | | | | $ | 1,319,095 | |

| | | | | | | | | |

| MACHINERY - 1.0% | | | | | | | | |

| IDEX Corp. | | | 1,370 | | | $ | 42,676 | |

| Wabtec Corp. | | | 3,020 | | | | 123,337 | |

| | | | | | | $ | 166,013 | |

| | | | | | | | | |

| MATERIALS - 9.1% | | | | | | | | |

| Airgas, Inc. | | | 3,180 | | | $ | 151,368 | |

| Crane Co. | | | 2,910 | | | | 89,104 | |

| FMC Corp. | | | 1,590 | | | | 88,658 | |

| Joy Global, Inc. | | | 3,840 | | | | 198,106 | |

| Lubrizol Corp. | | | 3,400 | | | | 248,030 | |

| Matthews International Corp. - Class A | | | 1,700 | | | | 60,231 | |

| Minerals Technologies, Inc. | | | 1,285 | | | | 69,994 | |

| Reliance Steel & Aluminum Co. | | | 2,520 | | | | 108,914 | |

| Sonoco Products Co. | | | 3,785 | | | | 110,711 | |

| Steel Dynamics, Inc. | | | 5,470 | | | | 96,928 | |

| Terra Industries, Inc. | | | 4,060 | | | | 130,691 | |

| Timken Co. (The) | | | 5,705 | | | | 135,266 | |

| Worthington Industries, Inc. | | | 2,735 | | | | 35,746 | |

| | | | | | | $ | 1,523,747 | |

| | | | | | | | | |

| OIL & GAS - 2.2% | | | | | | | | |

| Newfield Exploration Co.* | | | 2,800 | | | $ | 135,044 | |

| Plains Exploration & Production Co.* | | | 2,975 | | | | 82,289 | |

| Pride International, Inc.* | | | 1,700 | | | | 54,247 | |

| Unit Corp.* | | | 2,090 | | | | 88,825 | |

| | | | | | | $ | 360,405 | |

| | | | | | | | | |

| PHARMACEUTICALS & BIOTECHNOLOGY - 1.9% | | | | | | | | |

| Endo Pharmaceuticals Holdings, Inc.* | | | 9,710 | | | $ | 199,152 | |

| Perrigo Co. | | | 2,810 | | | | 111,950 | |

| | | | | | | $ | 311,102 | |

| | | | | | | | | |

| REAL ESTATE - 6.0% | | | | | | | | |

| Duke Realty Corp. | | | 5,070 | | | $ | 61,702 | |

| Federal Realty Investment Trust (REIT) | | | 1,260 | | | | 85,327 | |

| Hospitality Properties Trust (REIT) | | | 5,750 | | | | 136,333 | |

| Jones Lang LaSalle, Inc. | | | 2,140 | | | | 129,256 | |

| NVR, Inc.* | | | 385 | | | | 273,623 | |

| SL Green Realty Corp. (REIT) | | | 1,880 | | | | 94,451 | |

| Toll Brothers, Inc.* | | | 3,625 | | | | 68,186 | |

| UDR, Inc. | | | 9,821 | | | | 161,457 | |

| | | | | | | $ | 1,010,335 | |

| | | | | | | | | |

| RETAILING - 8.3% | | | | | | | | |

| Aeropostale, Inc.* | | | 4,847 | | | $ | 165,040 | |

| Dick’s Sporting Goods, Inc.* | | | 12,595 | | | | 313,238 | |

| Dollar Tree, Inc.* | | | 4,850 | | | | 234,255 | |

| Guess?, Inc. | | | 3,840 | | | | 162,431 | |

| Phillips-Van Heusen Corp. | | | 3,785 | | | | 153,974 | |

| Rent-A-Center, Inc.* | | | 2,345 | | | | 41,553 | |

| Ross Stores, Inc. | | | 7,535 | | | | 321,820 | |

| | | | | | | $ | 1,392,311 | |

| | | | | | | | | |

| SOFTWARE & SERVICES - 9.3% | | | | | | | | |

| Acxiom Corp.* | | | 10,260 | | | $ | 137,689 | |

| Alliance Data Systems Corp.* | | | 1,605 | | | | 103,667 | |

| ANSYS, Inc.* | | | 4,495 | | | | 195,353 | |

| DST Systems, Inc.* | | | 1,965 | | | | 85,576 | |

| F5 Networks, Inc.* | | | 2,580 | | | | 136,688 | |

| Factset Research Systems, Inc. | | | 1,370 | | | | 90,242 | |

| Fair Isaac Corp. | | | 3,550 | | | | 75,650 | |

| Mantech International Corp. - Class A* | | | 1,555 | | | | 75,075 | |

| McAfee, Inc.* | | | 2,015 | | | | 81,749 | |

| Parametric Technology Corp.* | | | 10,805 | | | | 176,554 | |

| Sybase, Inc.* | | | 9,160 | | | | 397,544 | |

| | | | | | | $ | 1,555,787 | |

| | | | | | | | | |

See notes to financial statements.

18 The Wright Managed Blue Chip Investment Funds

Wright Selected Blue Chip Equities Fund (WSBC)

Portfolio of Investments – As of December 31, 2009 - continued

| | | | | | | | | |

| TELECOMMUNICATION SERVICES - 0.7% | | | | | | | | |

| NeuStar, Inc. - Class A* | | | 2,265 | | | $ | 52,186 | |

| Syniverse Holdings, Inc.* | | | 3,685 | | | | 64,414 | |

| | | | | | | $ | 116,600 | |

| | | | | | | | | |

| | | | | | | | | |

| UTILITIES - 3.3% | | | | | | | | |

| MDU Resources Group, Inc. | | | 13,878 | | | $ | 327,521 | |

| ONEOK, Inc. | | | 5,165 | | | | 230,204 | |

| | | | | | | $ | 557,725 | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL EQUITY INTERESTS - 98.7% | | | | | | | | |

| (identified cost, $14,420,794) | | | | | | $ | 16,553,484 | |

| | | | | | | | | |

| OTHER ASSETS, LESS LIABILITIES - 1.3% | | | | | | | 209,503 | |

| | | | | | | | | |

| NET ASSETS - 100.0% | | | | | | $ | 16,762,987 | |

REIT - - Real Estate Investment Trust

* Non-income producing security.

See notes to financial statements.

The Wright Managed Blue Chip Investment Funds 19

Wright Selected Blue Chip Equities Fund (WSBC)

STATEMENT OF ASSETS AND LIABILITIES

| ASSETS: | | | |

| Investments, at value (identified cost $14,420,794) (Note 1A) | | $ | 16,553,484 | |

| Cash | | | 202,938 | |

| Receivable for fund shares sold | | | 16,677 | |

| Dividends receivable | | | 12,597 | |

| Prepaid expenses | | | 2,804 | |

| | | | | |

| Total assets | | $ | 16,788,500 | |

| | | | | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for fund shares reacquired | | | 3,250 | |

| Payable to affiliate for investment adviser fee | | | 4,523 | |

| Accrued expenses and other liabilities | | | 17,740 | |

| | | | | |

| Total liabilities | | $ | 25,513 | |

| NET ASSETS | | $ | 16,762,987 | |

| | | | | |

| | | | | |

| NET ASSETS CONSIST OF: | | | | |

| Paid-in capital | | $ | 16,846,689 | |

| Accumulated net realized loss on investments | | | (2,233,544 | ) |

| Accumulated undistributed net investment income | | | 17,152 | |

| Unrealized appreciation of investments | | | 2,132,690 | |

| | | | | |

| Net assets applicable to outstanding shares | | $ | 16,762,987 | |

| | | | | |

| SHARES OF BENEFICIAL INTEREST OUTSTANDING | | | 1,995,085 | |

| NET ASSET VALUE, OFFERING PRICE, AND REDEMPTION PRICE PER SHARE | | | | |

| OF BENEFICIAL INTEREST | | $ | 8.40 | |

STATEMENT OF OPERATIONS

For the Year Ended December 31, 2009

| INVESTMENT INCOME (Note 1C) | | | |

| Dividend income | | $ | 205,473 | |

| Other Income | | | 7,617 | |

| Total investment income | | $ | 213,090 | |

| | | | | |

| Expenses - | | | | |

| Investment adviser fee (Note 3) | | $ | 84,577 | |

| Administrator fee (Note 3) | | | 16,915 | |

| | | | | |

| Compensation of Trustees who are not employees of the investment adviser or administrator | | | 13,001 | |

| Custodian fee (Note 1F) | | | 57,353 | |

| Distribution expenses (Note 4) | | | 35,240 | |

| Transfer and dividend disbursing agent fees | | | 25,361 | |

| Printing | | | 2,630 | |

| Shareholder communications | | | 4,037 | |

| Audit services | | | 32,115 | |

| Legal services | | | 3,953 | |

| Registration costs | | | 20,212 | |

| Miscellaneous | | | 7,737 | |

| Total expenses | | $ | 303,131 | |

| Deduct - | | | | |

| Waiver and/or reimbursement by the principal underwriter and/or investment adviser (Note 3 and 4) | | $ | (111,824 | ) |

| Reduction of custodian fee (Note 1F) | | | (12 | ) |

| Total deductions | | $ | (111,836 | ) |

| Net expenses | | $ | 191,295 | |

| Net investment income | | $ | 21,795 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS: | | | | |

| Net realized loss on investment transactions | | $ | (818,298 | ) |

| Net change in unrealized appreciation on investments | | | 5,533,574 | |

| Net realized and unrealized gain on investments | | $ | 4,715,276 | |

| Net increase in net assets from operations | | $ | 4,737,071 | |

See notes to financial statements.

20 The Wright Managed Blue Chip Investment Funds

Wright Selected Blue Chip Equities Fund (WSBC)

| | | Year Ended December 31, | |

| STATEMENTS OF CHANGES IN NET ASSETS | | 2009 | | | 2008 | |

| INCREASE (DECREASE) IN NET ASSETS: | | | | | | |

| From operations - | | | | | | |

| Net investment income (loss) | | $ | 21,795 | | | $ | (27,533 | ) |

| Net realized loss on investment transactions | | | (818,298 | ) | | | (1,371,940 | ) |

| Net change in unrealized appreciation (depreciation) on investments | | | 5,533,574 | | | | (6,810,349 | ) |

| Net increase (decrease) in net assets from operations | | $ | 4,737,071 | | | $ | (8,209,822 | ) |

| | | | | | | | | |

| Distributions to shareholders (Note 2) - | | | | | | | | |

| From net realized gains | | $ | — | | | $ | (1,863,251 | ) |

| Total distributions | | $ | — | | | $ | (1,863,251 | ) |

| Net decrease in net assets from fund share transactions (Note 6) | | $ | (1,337,892 | ) | | $ | (486,111 | ) |

| Net increase (decrease) in net assets | | $ | 3,399,179 | | | $ | (10,559,184 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| At beginning of year | | | 13,363,808 | | | | 23,922,992 | |

| At end of year | | $ | 16,762,987 | | | $ | 13,363,808 | |

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME INCLUDED IN NET ASSETS AT END OF PERIOD | | $ | 17,152 | | | $ | - | |

See notes to financial statements.

The Wright Managed Blue Chip Investment Funds 21

Wright Selected Blue Chip Equities Fund (WSBC)

| | | Year Ended December 31, | |

| | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 6.060 | | | $ | 11.100 | | | $ | 12.270 | | | $ | 13.030 | | | $ | 13.226 | |

| | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | |

Net investment income (loss) (1)(3) | | $ | 0.011 | | | $ | (0.013 | ) | | $ | (0.013 | ) | | $ | (0.034 | ) | | $ | (0.053 | ) |

| Net realized and unrealized gain (loss) | | | 2.331 | | | | (4.121 | ) | | | 1.340 | | | | 0.529 | | | | 1.476 | |

| Total income (loss) from investment operations | | $ | 2.342 | | | $ | (4.134 | ) | | $ | 1.327 | | | $ | 0.495 | | | $ | 1.423 | |

| | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | $ | - | | | $ | - | | | $ | (0.016 | ) | | $ | - | | | $ | - | |

| From net realized gains | | | - | | | | (0.906 | ) | | | (2.481 | ) | | | (1.255 | ) | | | (1.619 | ) |

| Total distributions | | $ | - | | | $ | (0.906 | ) | | $ | (2.497 | ) | | $ | (1.255 | ) | | $ | (1.619 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of year | | $ | 8.402 | | | $ | 6.060 | | | $ | 11.100 | | | $ | 12.270 | | | $ | 13.030 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return (2) | | | 38.61 | % | | | (39.81 | )% | | | 11.59 | % | | | 3.77 | % | | | 11.09 | % |

| | | | | | | | | | | | | | | | | | | | | |

Ratios/Supplemental Data (1): | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 16,763 | | | $ | 13,364 | | | $ | 23,923 | | | $ | 38,352 | | | $ | 47,652 | |

| Ratios (As a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 1.36 | % | | | 1.26 | % | | | 1.26 | % | | | 1.26 | % | | | 1.27 | % |

| Net expenses after custodian fee reduction | | | 1.36 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

| Net investment income (loss) | | | 0.15 | % | | | (0.15 | )% | | | (0.10 | )% | | | (0.27 | )% | | | (0.18 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 40 | % | | | 72 | % | | | 67 | % | | | 66 | % | | | 110 | % |

| | (1)For the years ended December 31, 2009, 2008, 2007, 2006, and 2005, the operating expenses of the Fund were reduced by a waiver of fees and/or an allocation of expenses to the principal underwriter and/or investment adviser. Had such action not been undertaken, net investment loss per share and the ratios would have been as follows: |

| | | 2009 | | | 2008 | | | 2007 | | | 2006 | | | 2005 | |

| | | | | | | | | | | | | | | | |

Net investment loss per share(3) | | $ | (0.043 | ) | | $ | (0.068 | ) | | $ | (0.064 | ) | | $ | (0.058 | ) | | $ | (0.111 | ) |

| Ratios (As a percentage of average daily net assets): | | | | | | | | | | | | | | | | | | | | |

| Expenses | | | 2.15 | % | | | 1.90 | % | | | 1.66 | % | | | 1.46 | % | | | 1.45 | % |

| Expenses after custodian fee reduction | | | 2.15 | % | | | 1.89 | % | | | 1.66 | % | | | 1.44 | % | | | 1.43 | % |

| Net investment loss | | | (0.64 | )% | | | (0.79 | )% | | | (0.51 | )% | | | (0.46 | )% | | | (0.38 | )% |

| | (2)Total return is calculated assuming a purchase at the net asset value on the first day and a sale at the net asset value on the last day of each period reported. Dividends and distributions, if any, are assumed to be reinvested at the net asset value on the reinvestment date. |

| (3)Computed using average shares outstanding. |

See notes to financial statements.

22 The Wright Managed Blue Chip Investment Funds

Wright Major Blue Chip Equities Fund (WMBC)

Portfolio of Investments – As of December 31, 2009

| AEROSPACE - 5.1% | | | | | | |

| General Dynamics Corp. | | | 5,205 | | | $ | 354,825 | |

| Honeywell International, Inc. | | | 5,950 | | | | 233,240 | |

| Northrop Grumman Corp. | | | 8,055 | | | | 449,872 | |

| Raytheon Co. | | | 3,655 | | | | 188,306 | |

| United Technologies Corp. | | | 2,495 | | | | 173,178 | |

| | | | | | | $ | 1,399,421 | |

| AUTOMOBILES & COMPONENTS - 0.5% | | | | | | | | |

| Ford Motor Co.* | | | 14,780 | | | $ | 147,800 | |

| | | | | | | | | |

| BANKS - 3.7% | | | | | | | | |

| Bank of America Corp. | | | 23,580 | | | $ | 355,115 | |

| Bank of New York Mellon Corp. (The) | | | 4,525 | | | | 126,564 | |

| Hudson City Bancorp, Inc. | | | 10,055 | | | | 138,055 | |

| Wells Fargo & Co. | | | 14,580 | | | | 393,514 | |

| | | | | | | $ | 1,013,248 | |

| CAPITAL GOODS - 3.7% | | | | | | | | |

| General Electric Co. | | | 33,140 | | | $ | 501,408 | |

| Lockheed Martin Corp. | | | 6,950 | | | | 523,683 | |

| | | | | | | $ | 1,025,091 | |

| COMMERCIAL SERVICES & SUPPLIES - 0.3% | | | | | | | | |

| RR Donnelley & Sons Co. | | | 3,665 | | | $ | 81,620 | |

| | | | | | | | | |

| COMMUNICATIONS EQUIPMENT - 2.8% | | | | | | | | |

| Cisco Systems, Inc.* | | | 4,525 | | | $ | 108,329 | |

| Harris Corp. | | | 7,245 | | | | 344,500 | |

| L-3 Communications Holdings, Inc. | | | 2,355 | | | | 204,767 | |

| QUALCOMM, Inc. | | | 2,235 | | | | 103,391 | |

| | | | | | | $ | 760,987 | |

| COMPUTERS & PERIPHERALS - 10.0% | | | | | | | | |

| Apple, Inc.* | | | 2,495 | | | $ | 526,096 | |

| Hewlett-Packard Co. | | | 20,615 | | | | 1,061,879 | |