| Investment Objectives | inside front | | |

| Letter to Shareholders (Unaudited) | 2 | | |

| Management Discussion (Unaudited) | 4 | | |

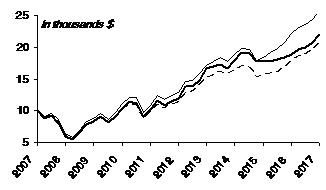

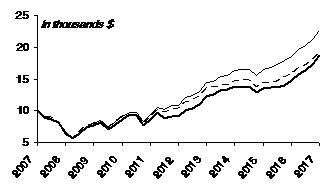

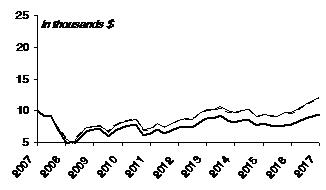

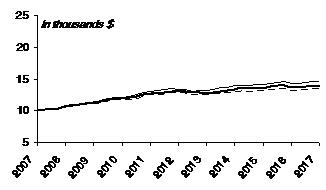

| Performance Summaries (Unaudited) | 8 | | |

| Fund Expenses (Unaudited) | 16 | | |

| Management and Organization (Unaudited) | 56 | | |

| Important Notices Regarding Delivery of Shareholder Documents, Portfolio Holdings and Proxy Voting (Unaudited) | 58 | | |

| | | | |

| | | | |

| FINANCIAL STATEMENTS | | | |

| | | | |

| | | | |

| | | | |

| The Wright Managed Equity Trust | | The Wright Managed Income Trust | |

| | | | |

| Wright Selected Blue Chip Equities Fund | | Wright Current Income Fund | |

| Portfolio of Investments | 18 | Portfolio of Investments | 41 |

| Statement of Assets and Liabilities | 20 | Statement of Assets and Liabilities | 45 |

| Statement of Operations | 20 | Statement of Operations | 45 |

| Statements of Changes in Net Assets | 21 | Statements of Changes in Net Assets | 46 |

| Financial Highlights | 22 | Financial Highlights | 47 |

| | | | |

| Wright Major Blue Chip Equities Fund | | Notes to Financial Statements | 48 |

| Portfolio of Investments | 23 | | |

| Statement of Assets and Liabilities | 24 | Report of Independent Registered Public Accounting Firm | 54 |

| Statement of Operations | 24 | | |

| Statements of Changes in Net Assets | 25 | Federal Tax Information (Unaudited) | 55 |

| Financial Highlights | 26 | | |

| | | | |

| Wright International Blue Chip Equities Fund | | | |

| Portfolio of Investments | 27 | | |

| Statement of Assets and Liabilities | 29 | | |

| Statement of Operations | 29 | | |

| Statements of Changes in Net Assets | 30 | | |

| Financial Highlights | 31 | | |

| | | | |

| Notes to Financial Statements | 32 | | |

| | | | |

| Report of Independent Registered Public Accounting Firm | 39 | | |

| | | | |

| Federal Tax Information (Unaudited) | 40 | | |

| | | | |

Dear Shareholder:

SUMMARY: Global stocks had a terrific year in 2017 as the worldwide economy finally started to pull itself out of its nearly decade-long lethargy. U.S. equities had their best performance since 2013, with all three of the major indexes returning well over 20%, much of it in anticipation of a major corporate tax cut that takes effect this year. Foreign stocks also did well, in many cases outperforming their American counterparts, with some additional help from a weak dollar. Bonds had modestly positive returns as short-term interest rates rose sharply but long-term yields fell or held steady. The outlook for 2018 remains positive, as lower tax rates promise to continue to boost the economy and improve corporate earnings results.

It was a banner year for stocks in 2017, with the major equity averages around the world boasting returns of 20% or more and in many cases closing at or near record highs. In the U.S., NASDAQ was the top performer, finishing with a 29.6% return, including dividends. But the Dow Jones Industrial Average nearly caught up to it at the end, finishing with a 28.1% return. The S&P 500 gained 21.8%. The catalyst for the advances was an improving economy and the potential of further gains from President Trump's big tax reform legislation cutting corporate income taxes to 21%.

Foreign stocks met or surpassed the gains in U.S. equities, with some of the increases coming from the weaker dollar overseas. The best-performing market was China, where stocks returned 54.1% in U.S. dollar terms. Emerging markets also outpaced the U.S., returning 37.3%. Japanese stocks gained an even 24%, while Pacific-area stocks outside Japan rose nearly 26%. Eurozone stocks increased 26.8% in dollar terms, with much of the gain coming from the dollar's 12.4% decline against the euro.

Bonds also had positive returns, but they paled in comparison to equities. In the U.S., the Bloomberg Barclays U.S. Bond Market Aggregate, which is heavily weighted with U.S. government securities, returned 3.5% in 2017, as short-term interest rates jumped sharply while long-term rates held steady or actually fell. Corporate and high-yield bonds did better, returning 6.2% and 7.5%, respectively. Still, returns on U.S. fixed-income instruments trailed foreign bonds, again because of the weak dollar, which boosted their returns.

One of the reasons for the big jump in stock prices, of course, was U.S. economic performance, which continued to exceed expectations, even before the tax package kicked in. GDP grew by more than 3% on an annualized basis in both the second and third quarters, and the Federal Reserve Bank of Atlanta's GDPNow forecaster is predicting 3.2% growth in the fourth quarter; if that happens, it would mark the first time since 2004 that GDP has grown by more than 3% in three straight quarters. Retail sales jumped an unexpectedly sharp 0.8% in November while consumer spending, a broader category, rose a better-than-expected 0.6%. Auto sales fell 1.7% last year, the first annual decline since the financial crisis, but sales still made it over the 17 million mark for the third straight year, the first time that's happened in the industry's history. The Conference Board's consumer confidence index climbed to 17-year highs in both October and November before easing a bit in December. Certainly, a big reason for the optimism is the jobs market. Nonfarm payrolls increased by a stronger-than-expected 228,000 in November while the unemployment rate held steady at a 17-year low of 4.1%.

The bar was set pretty high in 2017, so even approaching last year's stock market returns will be difficult to do. Nevertheless, we're optimistic that 2018 will be another good year for stocks. Chief among the reasons is the Tax Cuts and Jobs Act, which President Trump signed into law at the end of December. The centerpiece of the act is a reduction in corporate income taxes to 21% from 35%, which should boost profits and therefore equity prices. But as we saw in 2017, the economy started to surge long before tax reform became reality, not just in anticipation of it becoming law but also due to the many actions taken by the administration to ease the regulatory burdens on businesses. Clearly, they have had a major positive effect already, as evidenced by the economic data, and can be expected to deliver more dividends going forward.

Letter to Shareholders (Unaudited)

So, as we enter 2018, there are many reasons to remain upbeat. The U.S. economy finally appears to be firing on all cylinders after nearly a decade of subpar growth. The same thing is going on in Europe and to a lesser extent in Japan. We can expect the momentum to continue this year. Of course, investors must always be wary of the unexpected. That's why we believe holding a well-diversified portfolio of high-quality domestic and foreign financial assets remains the best investment approach.

Sincerely,

Amit S. Khandwala

Co-Chief Executive Officer

After mostly falling during the first eight months of 2017, interest rates rose sharply in the last four months of the year, mainly due to a strengthening U.S. economy. In response, the Federal Reserve raised the federal funds rate three times and signaled at least three more rate hikes in 2018. It also announced its intention to begin unwinding its $4.5 trillion bond portfolio, allowing it to gradually run off as the securities mature. The December passage of the Tax Cuts and Jobs Act promises to add to federal deficit spending, which puts further upward pressure on interest rates, especially if the Fed reduces or eliminates its purchases of new government debt issues. At the end of December 2017, the yield on the benchmark 10-year Treasury note – on which long-term mortgage rates are based – was at 2.41%, nearly 40 basis points higher than where it was in early September, its low point of the year. Higher rates on mortgages discourage homeowners from refinancing, which means existing mortgages can be expected to stay on lenders' books longer than historical norms.