NOVEMBER 12, 2019 Investor Presentation

Forward Looking Statements and Non-GAAP Measures This presentation contains forward-looking statements, including, in particular, statements about Interface’s plans, strategies and prospects. These are based on the Company’s current assumptions, expectations and projections about future events. Although Interface believes that the expectations reflected in these forward-looking statements are reasonable, the Company can give no assurance that these expectations will prove to be correct or that savings or other benefits anticipated in the forward-looking statements will be achieved. Important factors, some of which may be beyond the Company’s control, that could cause actual results to differ materially from management’s expectations include the matters discussed under the heading “Risk Factors” included in the Company’s Quarterly Report on Form 10-Q for the period ended March 31, 2019 and its most recent Annual Report on Form 10-K, which discussions are hereby incorporated by reference. Forward-looking statements in this presentation include, without limitation, the information set forth on the slide titled “Growth and Value Creation Strategy”, the section of this presentation titled “Growth and Value Creation” and the slide titled “Investment Thesis”. Other forward-looking statements can be identified by words such as “may,” “expect,” “forecast,” “anticipate,” “intend,” “plan,” “believe,” “could,” “seek,” “project,” “estimate,” “target,” and similar expressions. Forward-looking statements speak only as of the date made. The Company assumes no responsibility to update or revise forward-looking statements and cautions listeners and meeting attendees not to place undue reliance on any such statements. This presentation includes certain financial measures not calculated in accordance with U.S. GAAP. They may be different from similarly titled non-GAAP measures used by other companies, and should not be used as a substitute for, or considered superior to, GAAP measures. Reconciliations to the most directly comparable GAAP measures appear in the Appendix. page 2

Interface at a Glance Interface is a global leader of commercial flooring solutions including carpet tile, luxury vinyl tile (LVT) and rubber flooring. ($ in millions, except EPS) LTM Headquartered in Atlanta, GA Q3 2019 7 manufacturing locations on 4 continents Net Sales $1,341 4,100 global employees Adj Operating Income* $146 Adj EPS (Diluted)* $1.54 Sales in over 110 countries Net Debt* $541 New Product Vitality Index** of 37% LTM Adj EBITDA* $200 Net Debt / LTM Adj EBITDA* 2.7x All products are Carbon Neutral ROIC* 13% * See Appendix for a reconciliation of Non-GAAP figures APAC Corporate Americas Office 15% 47% 30% 55% 53% EMEA Non-Office ** New Product Vitality represents products launched in the past three years and custom products page 3 Note: Geographic breakdown and segment figures represent proforma FYE 2018 sales for Interface and nora combined

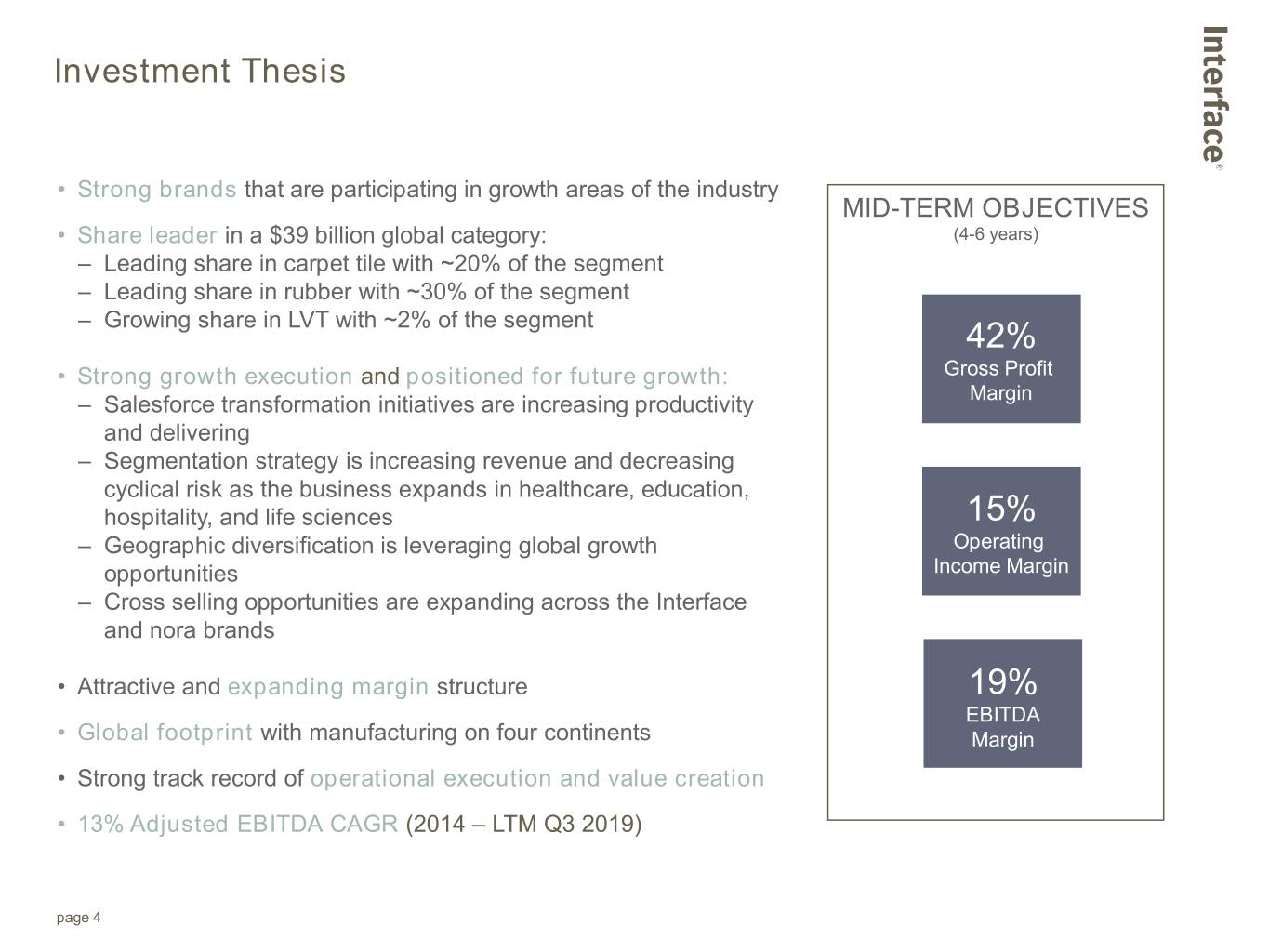

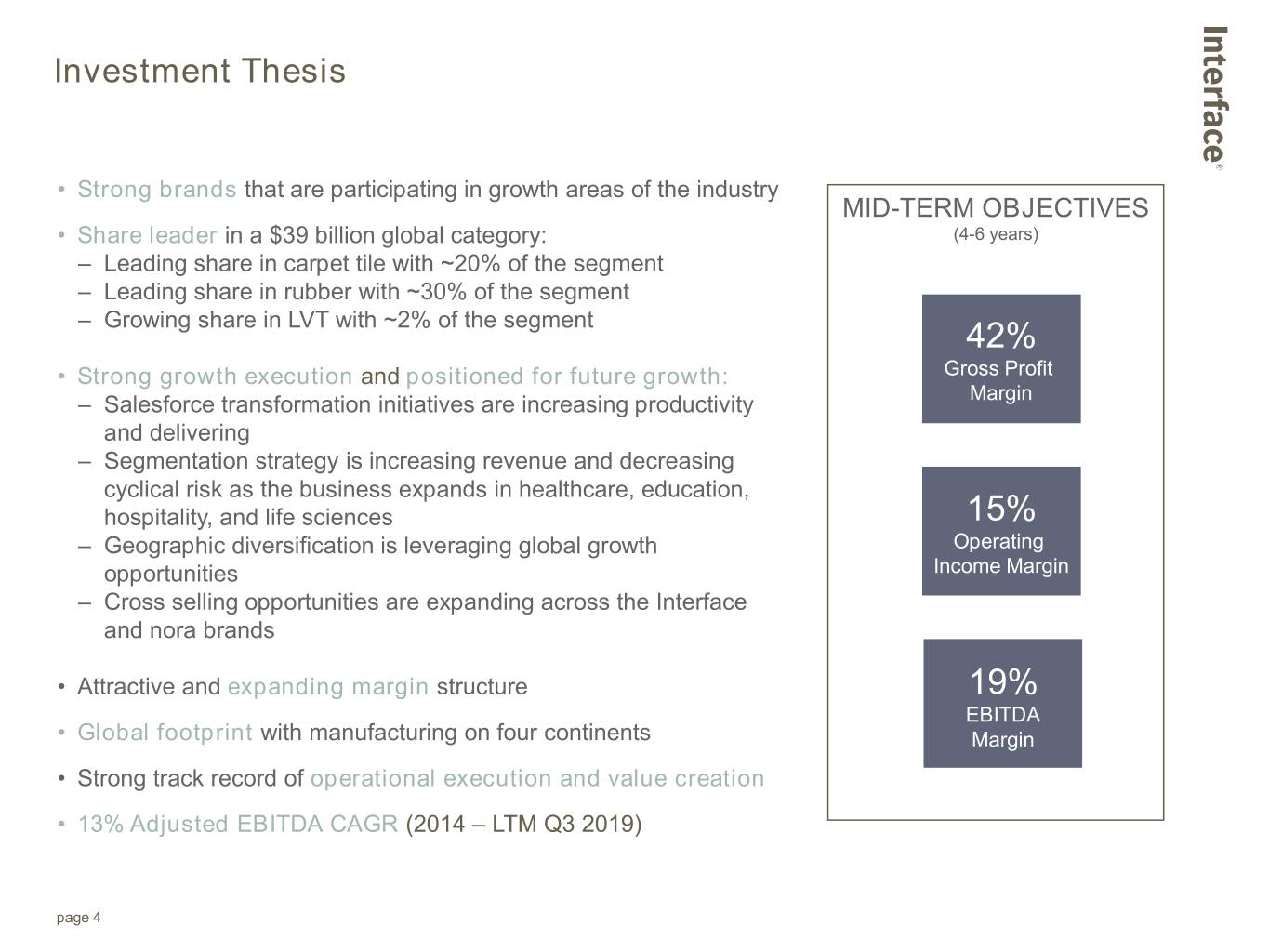

Investment Thesis • Strong brands that are participating in growth areas of the industry MID-TERM OBJECTIVES • Share leader in a $39 billion global category: (4-6 years) – Leading share in carpet tile with ~20% of the segment – Leading share in rubber with ~30% of the segment – Growing share in LVT with ~2% of the segment 42% • Strong growth execution and positioned for future growth: Gross Profit – Salesforce transformation initiatives are increasing productivity Margin and delivering – Segmentation strategy is increasing revenue and decreasing cyclical risk as the business expands in healthcare, education, hospitality, and life sciences 15% – Geographic diversification is leveraging global growth Operating opportunities Income Margin – Cross selling opportunities are expanding across the Interface and nora brands • Attractive and expanding margin structure 19% EBITDA • Global footprint with manufacturing on four continents Margin • Strong track record of operational execution and value creation • 13% Adjusted EBITDA CAGR (2014 – LTM Q3 2019) page 4

Investment Highlights: Who We Are leading most valuable strongest global global engaged, global provider brand sales & manufacturing customer-centric of commercial in the flooring marketing footprint and culture, focused flooring solutions category capabilities industry-leading on performance gross margins and galvanized around our sustainability mission page 5

Growth and Value Creation Strategy Interface’s vision is to become the world’s most valuable interior products & services company Build Grow the Core Execute a Resilient Optimize SG&A Carpet Tile Supply Chain Flooring Resources Business Productivity Business Lead a World-Changing Sustainability Movement Centered Around Mission Zero and Climate Take Back. page 6

Interface Positioning

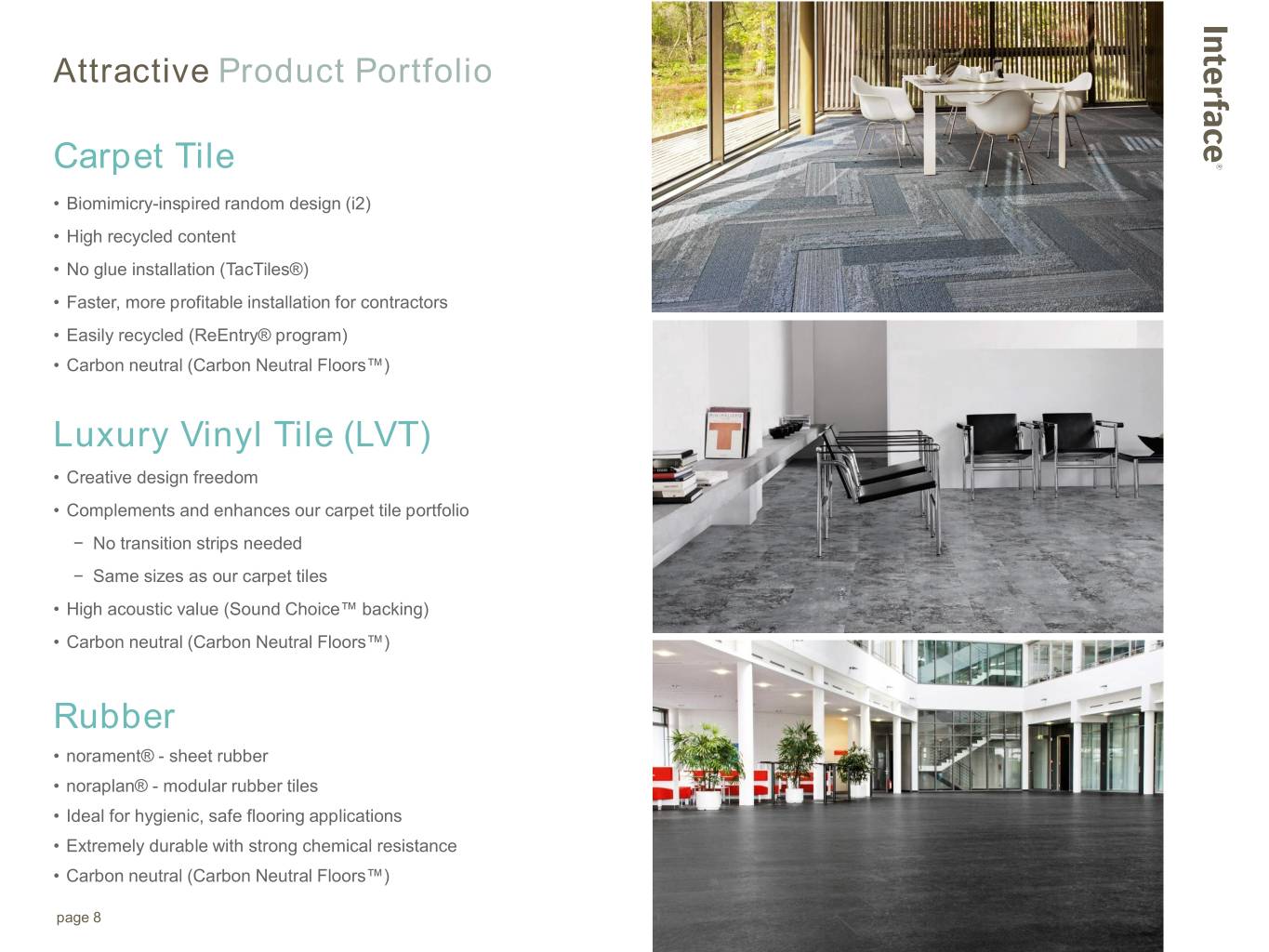

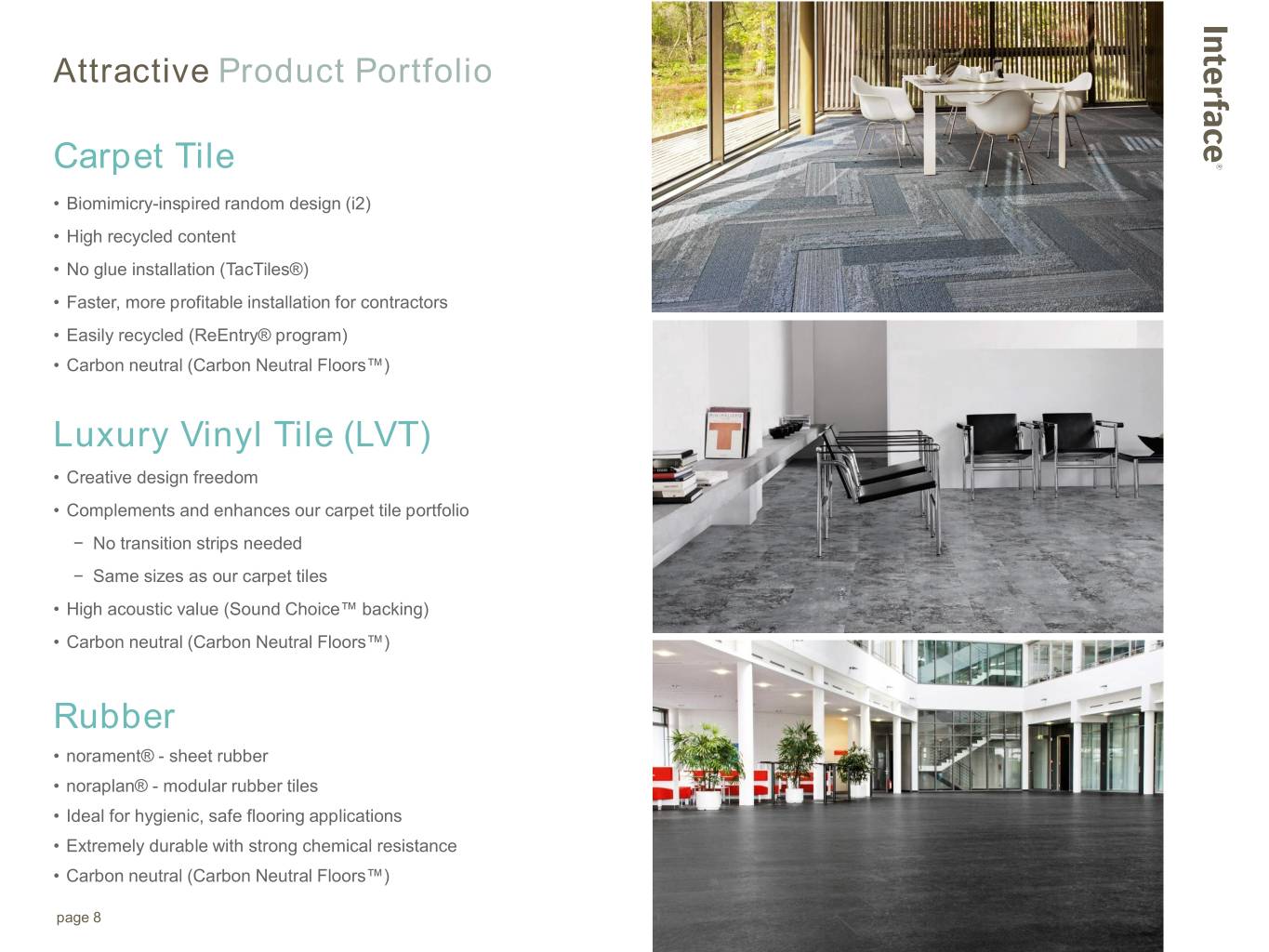

Attractive Product Portfolio Carpet Tile • Biomimicry-inspired random design (i2) • High recycled content • No glue installation (TacTiles®) • Faster, more profitable installation for contractors • Easily recycled (ReEntry® program) • Carbon neutral (Carbon Neutral Floors™) Luxury Vinyl Tile (LVT) • Creative design freedom • Complements and enhances our carpet tile portfolio − No transition strips needed − Same sizes as our carpet tiles • High acoustic value (Sound Choice™ backing) • Carbon neutral (Carbon Neutral Floors™) Rubber • norament® - sheet rubber • noraplan® - modular rubber tiles • Ideal for hygienic, safe flooring applications • Extremely durable with strong chemical resistance • Carbon neutral (Carbon Neutral Floors™) page 8

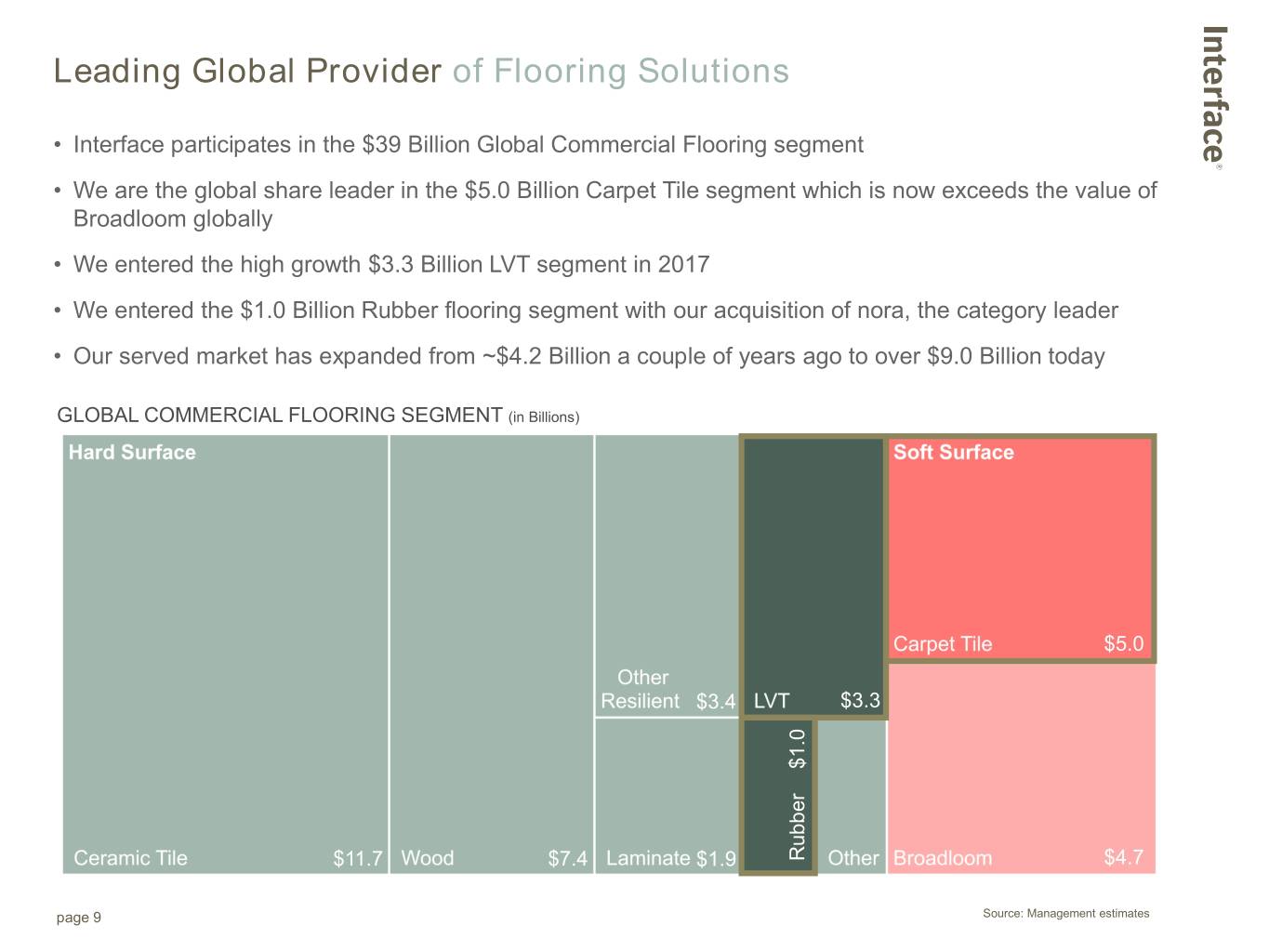

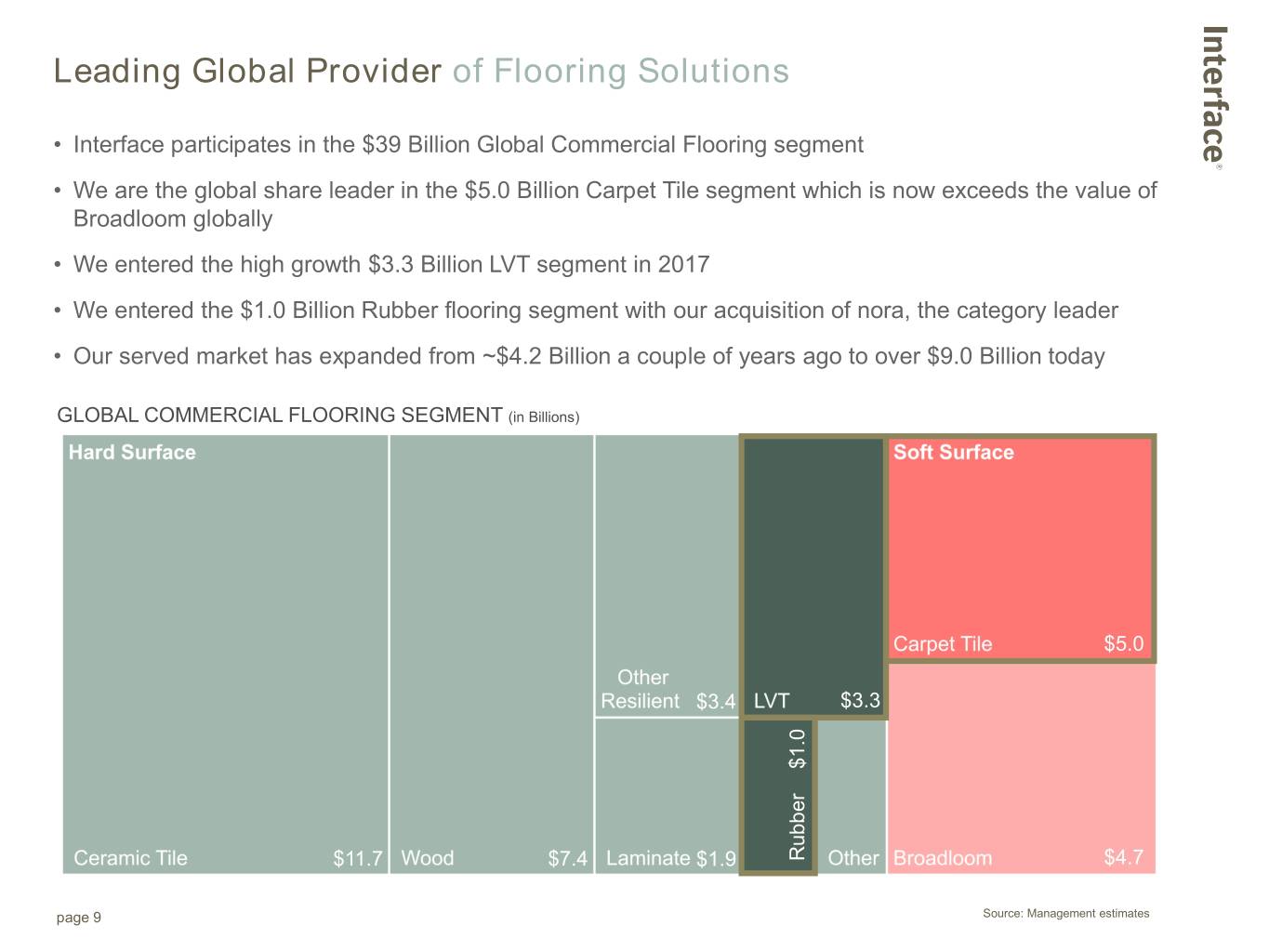

Leading Global Provider of Flooring Solutions • Interface participates in the $39 Billion Global Commercial Flooring segment • We are the global share leader in the $5.0 Billion Carpet Tile segment which is now exceeds the value of Broadloom globally • We entered the high growth $3.3 Billion LVT segment in 2017 • We entered the $1.0 Billion Rubber flooring segment with our acquisition of nora, the category leader • Our served market has expanded from ~$4.2 Billion a couple of years ago to over $9.0 Billion today GLOBAL COMMERCIAL FLOORING SEGMENT (in Billions) $5.0 $3.4 $3.3 $1.0 $11.7 $7.4 $1.9 Rubber $4.7 page 9 Source: Management estimates

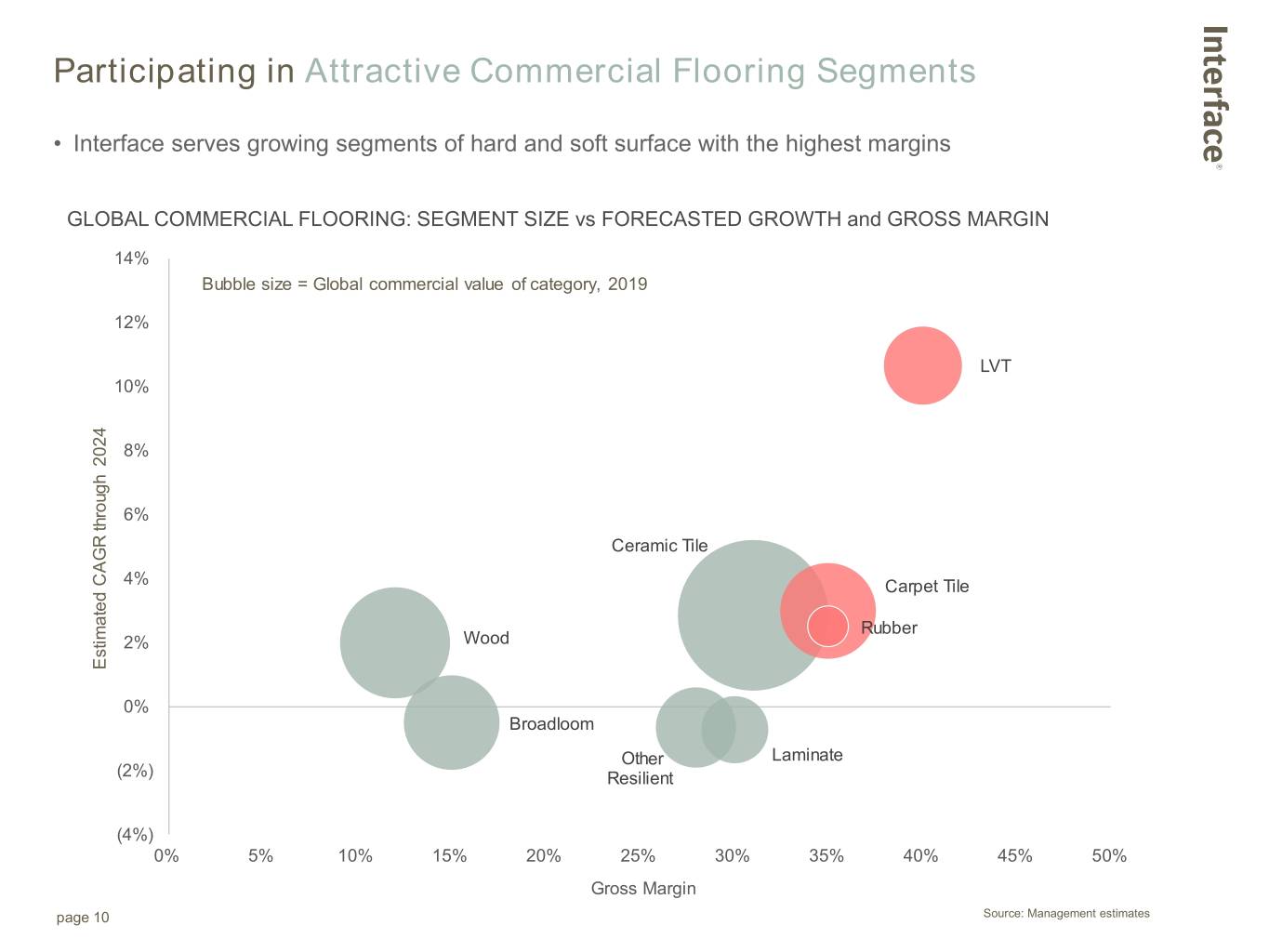

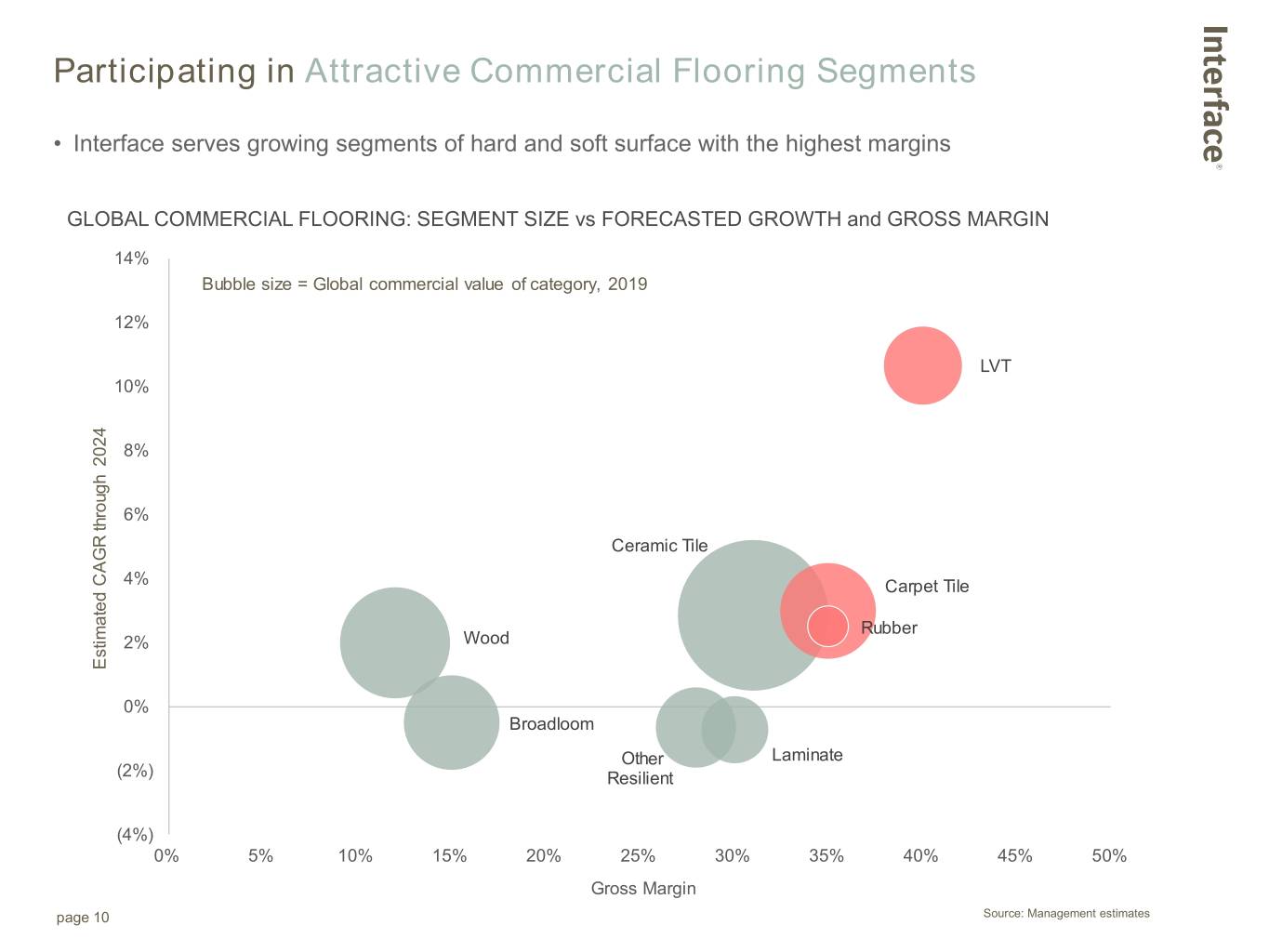

Participating in Attractive Commercial Flooring Segments • Interface serves growing segments of hard and soft surface with the highest margins GLOBAL COMMERCIAL FLOORING: SEGMENT SIZE vs FORECASTED GROWTH and GROSS MARGIN 14% Bubble size = Global commercial value of category, 2019 12% LVT 10% 8% 6% Ceramic Tile 4% Carpet Tile Rubber 2% Wood Estimated CAGR through through 2024 Estimated CAGR 0% Broadloom Other Laminate (2%) Resilient (4%) 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% Gross Margin page 10 Source: Management estimates

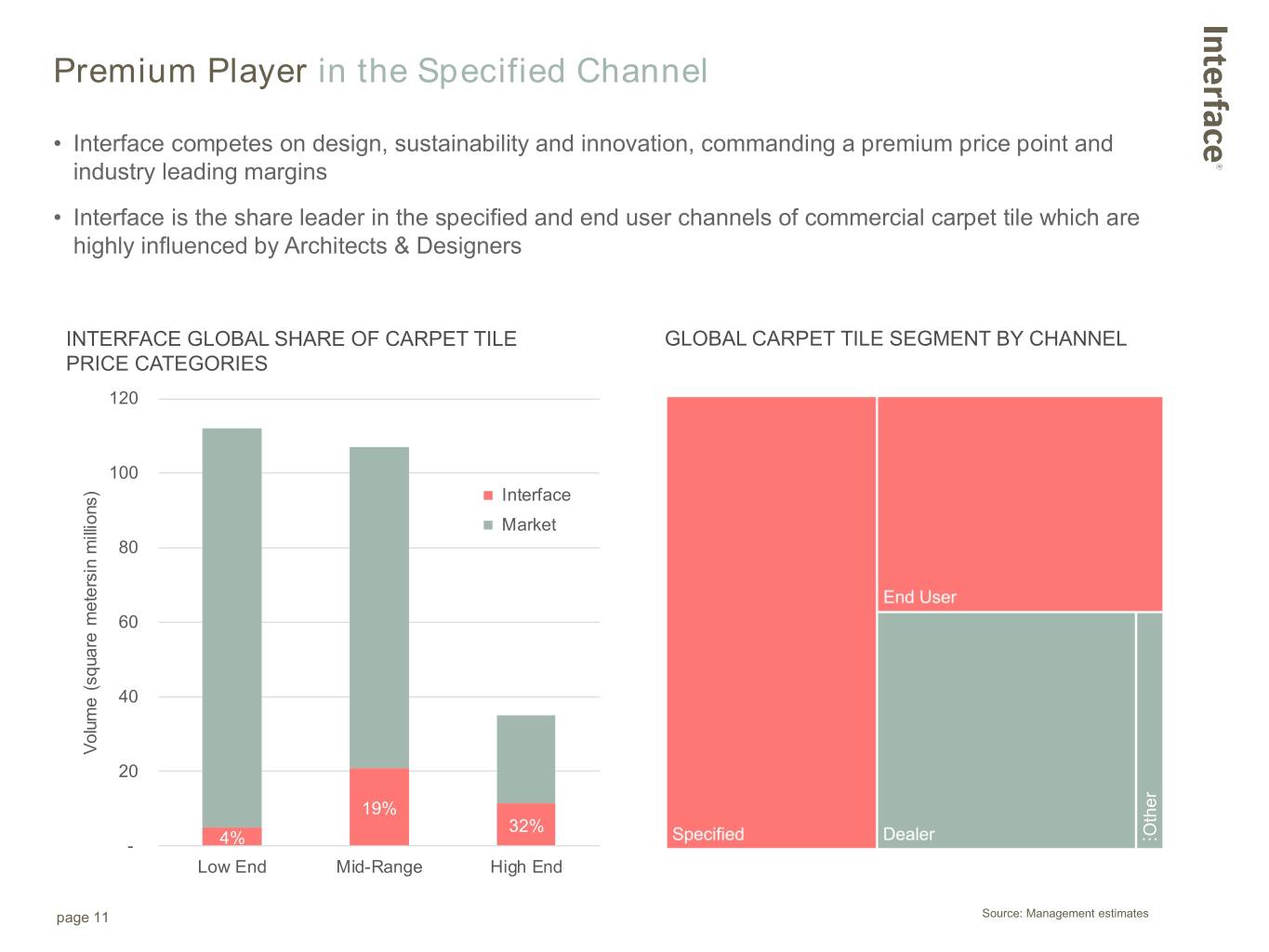

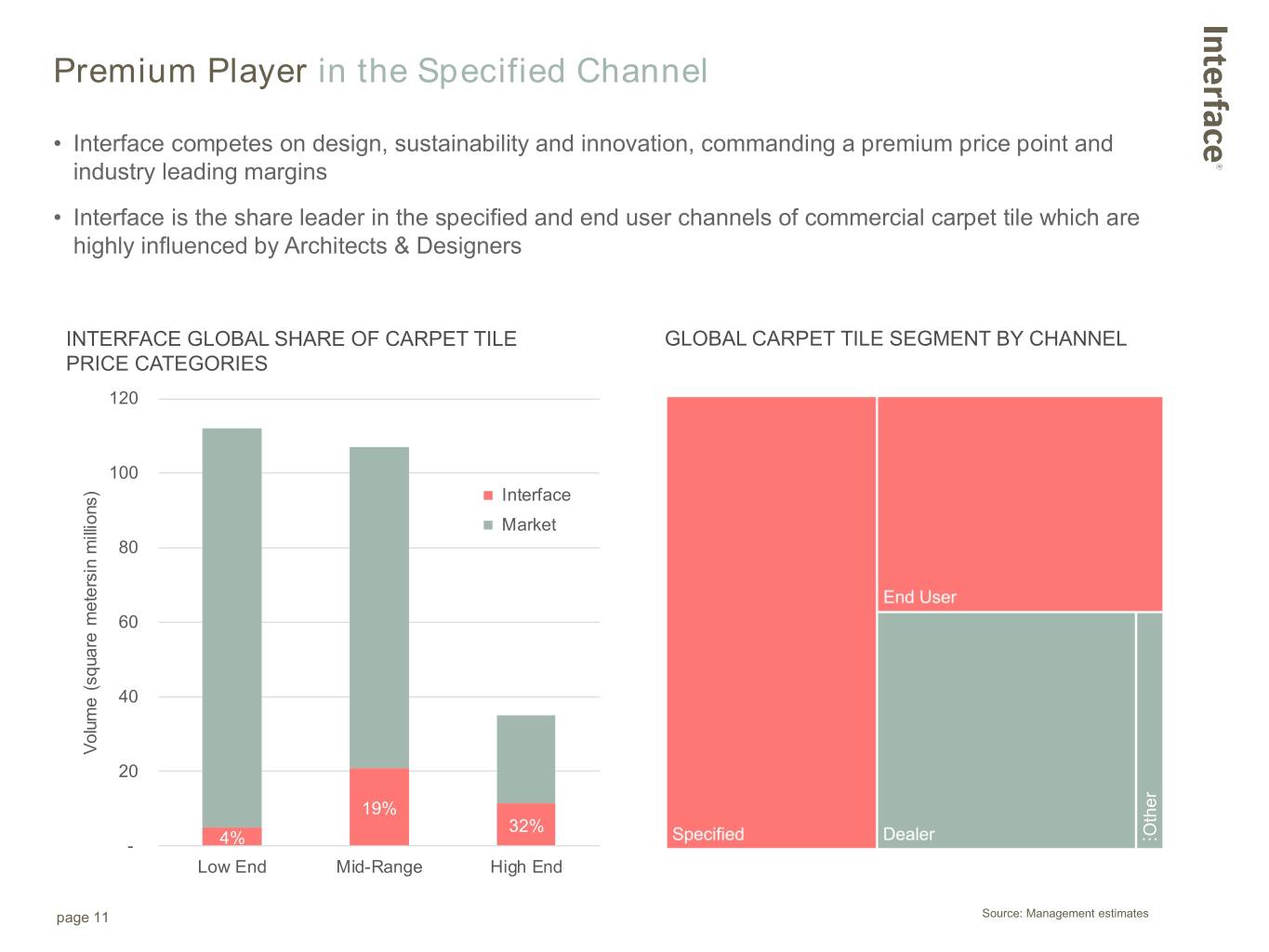

Premium Player in the Specified Channel • Interface competes on design, sustainability and innovation, commanding a premium price point and industry leading margins • Interface is the share leader in the specified and end user channels of commercial carpet tile which are highly influenced by Architects & Designers INTERFACE GLOBAL SHARE OF CARPET TILE GLOBAL CARPET TILE SEGMENT BY CHANNEL PRICE CATEGORIES 120 100 Interface Market 80 60 40 Volume millions) (square metersin Volume 20 19% 32% Other - 4% Low End Mid-Range High End page 11 Source: Management estimates

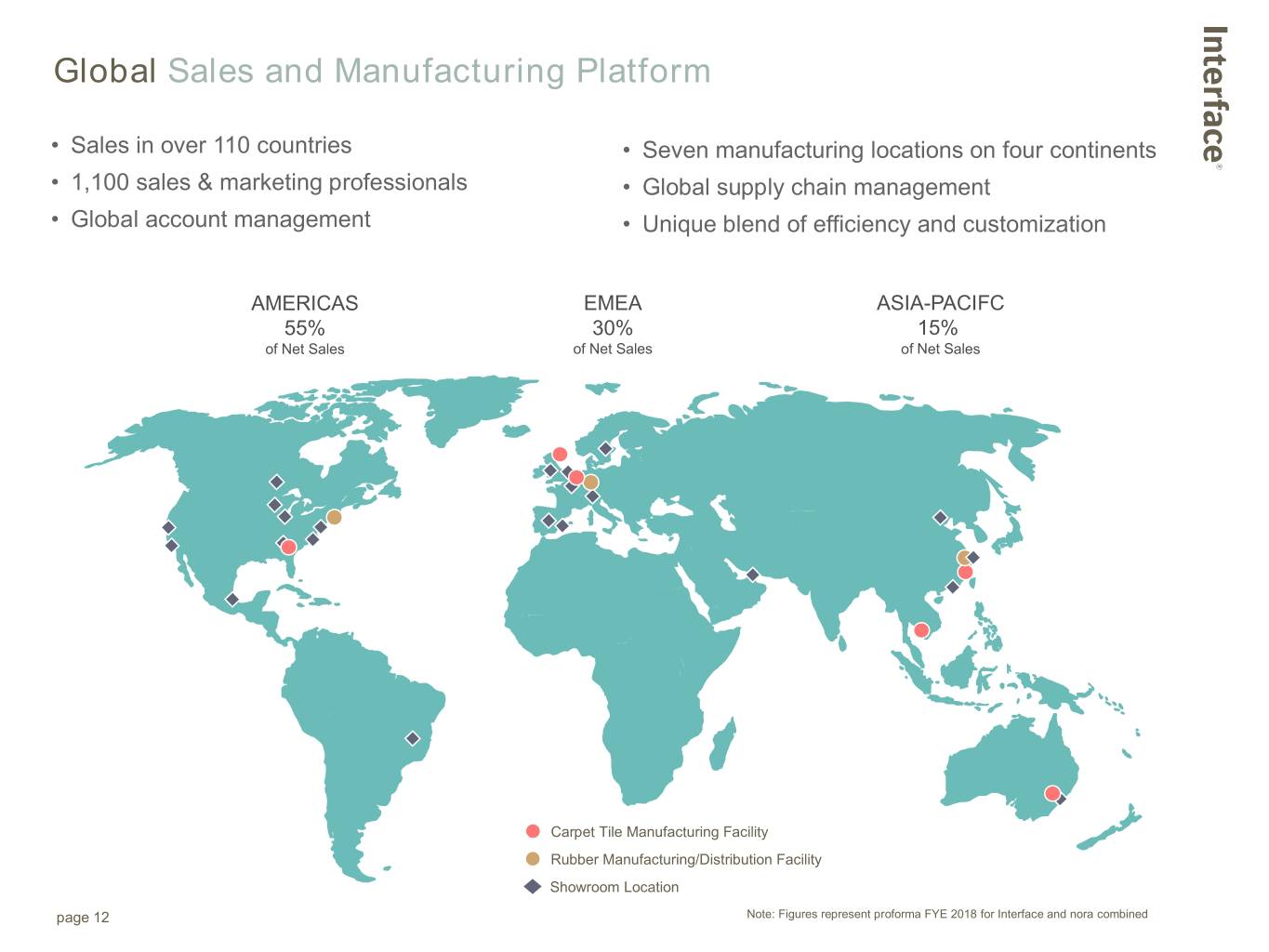

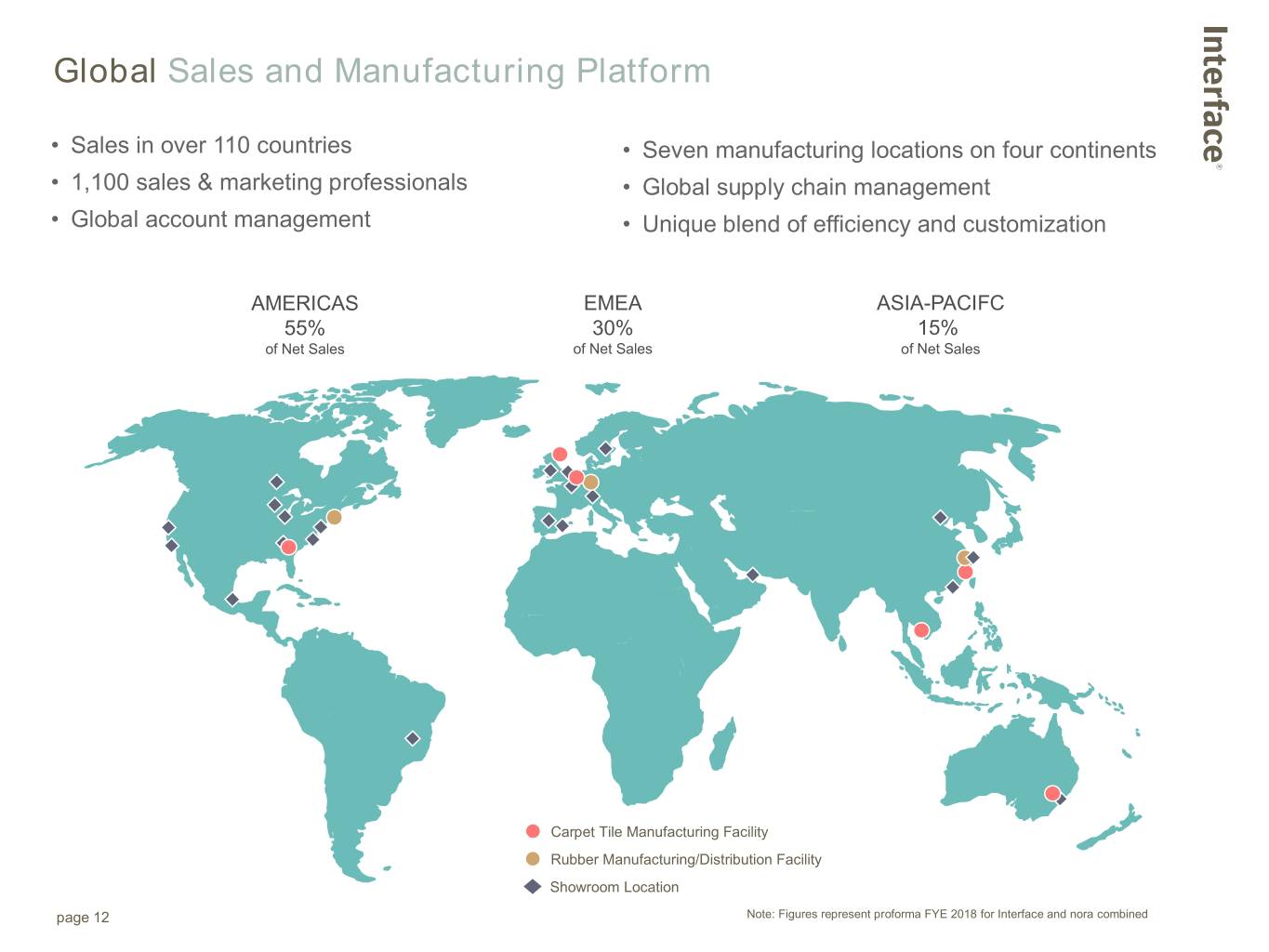

Global Sales and Manufacturing Platform • Sales in over 110 countries • Seven manufacturing locations on four continents • 1,100 sales & marketing professionals • Global supply chain management • Global account management • Unique blend of efficiency and customization AMERICAS EMEA ASIA-PACIFC 55% 30% 15% of Net Sales of Net Sales of Net Sales Carpet Tile Manufacturing Facility Rubber Manufacturing/Distribution Facility Showroom Location page 12 Note: Figures represent proforma FYE 2018 for Interface and nora combined

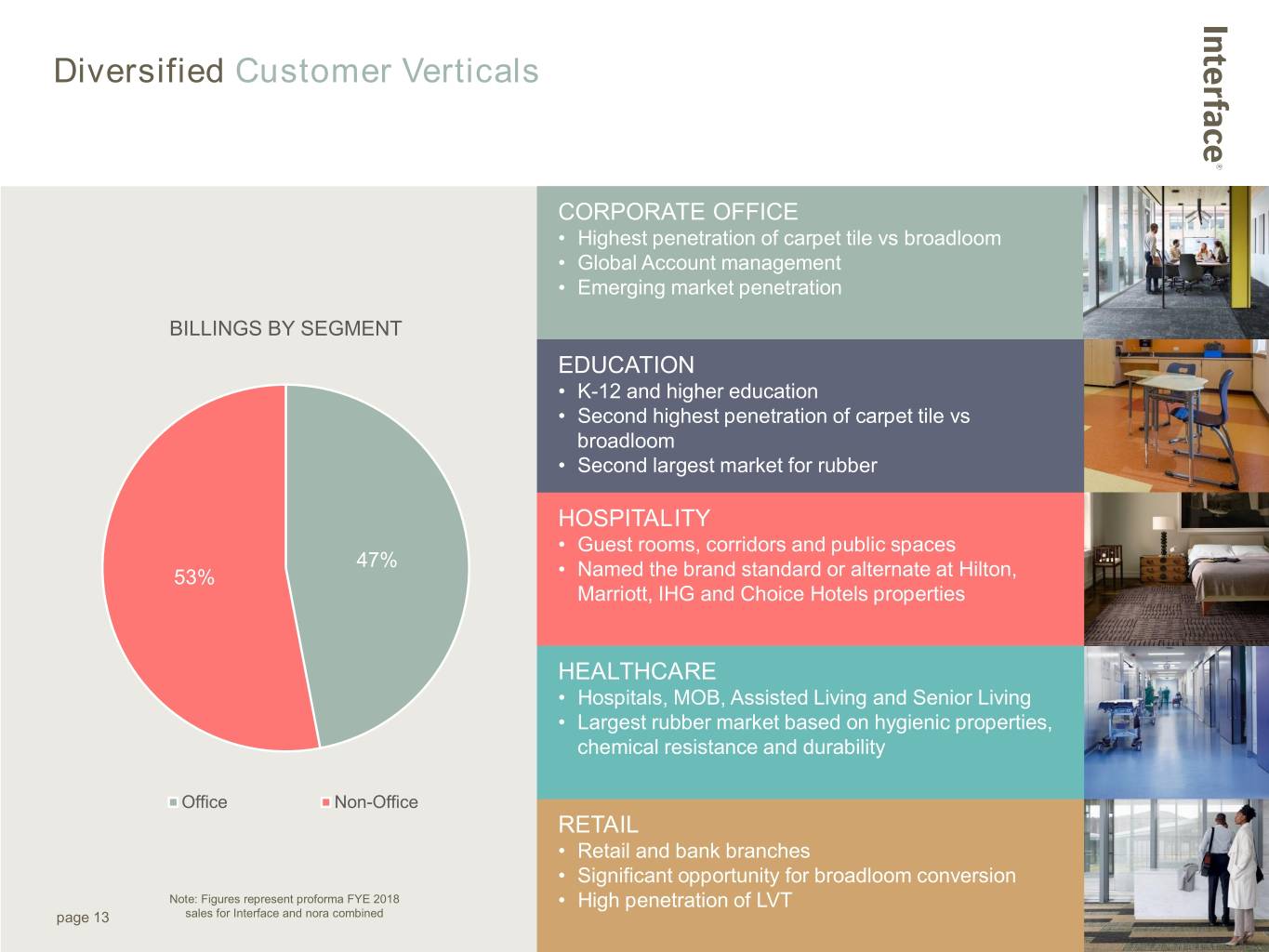

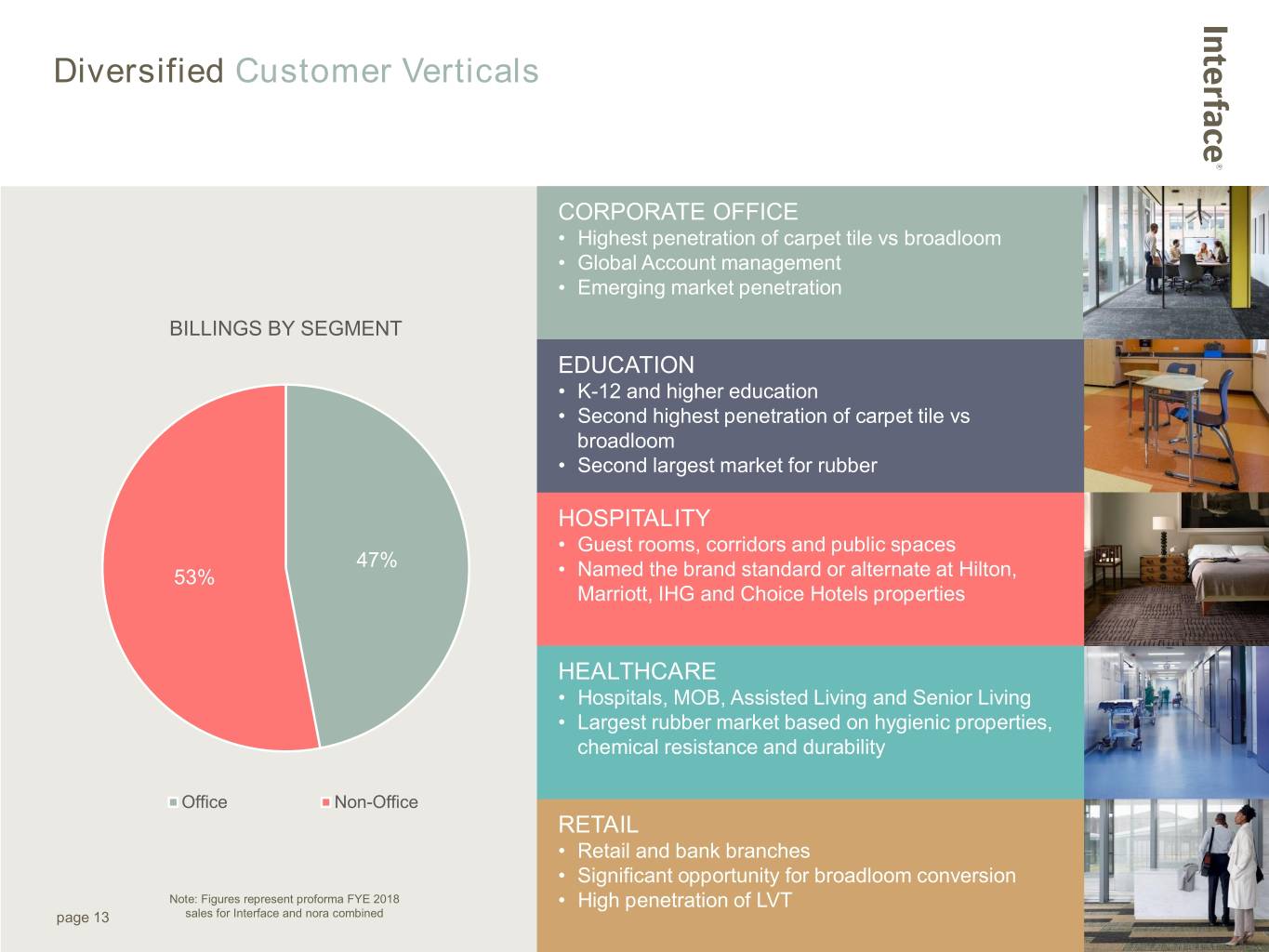

Diversified Customer Verticals CORPORATE OFFICE • Highest penetration of carpet tile vs broadloom • Global Account management • Emerging market penetration BILLINGS BY SEGMENT EDUCATION • K-12 and higher education • Second highest penetration of carpet tile vs broadloom • Second largest market for rubber HOSPITALITY • Guest rooms, corridors and public spaces 47% 53% • Named the brand standard or alternate at Hilton, Marriott, IHG and Choice Hotels properties HEALTHCARE • Hospitals, MOB, Assisted Living and Senior Living • Largest rubber market based on hygienic properties, chemical resistance and durability Office Non-Office RETAIL • Retail and bank branches • Significant opportunity for broadloom conversion Note: Figures represent proforma FYE 2018 • High penetration of LVT page 13 sales for Interface and nora combined

Growth and Value Creation

Growth and Value Creation Strategy Interface’s vision is to become the world’s most valuable interior products & services company Build Grow the Core Execute a Resilient Optimize SG&A Carpet Tile Supply Chain Flooring Resources Business Productivity Business Lead a World-Changing Sustainability Movement Centered Around Mission Zero and Climate Take Back. page 15

Grow the Core Carpet Tile Business • Enhance salesforce productivity – Execute on selling system transformation including reorganization, training and technology tools • Elevate and grow segments – Drive growth in priority segments including Corporate Office, Hospitality, Living and Education • Optimize product portfolio – Expand our portfolio to increase the addressable market • Lead the market in design and innovation – Continue to introduce innovative new products that energize and inspire • Continue to develop brand love, commanding the strongest Net Promoter Score among A&D and End Users page 16

Build a Resilient Flooring Business • Continue penetrating the high growth LVT segment, building on successful global LVT launch • Integrate nora® rubber flooring into our product portfolio • Leverage innovation pipeline • Expand global participation • Strategically expand product portfolio page 17

Resilient Flooring: nora Acquisition nora is a leading global manufacturer of commercial rubber floorcovering systems for healthcare, education, life sciences, public buildings and other end markets page 18

Interface and nora Together + excluding nora APAC APAC 15% 15% Americas Americas 25% 55% 59% 30% EMEA EMEA Geographic Reach Non-office 40% Non-office 47% 53% 60% Office Office Segmentation Americas EMEA APAC Americas EMEA APAC 15% 25% 38% 37% 55% 45% 43% 62% 57% 63% 85% 75% page 19 Note: Figures represent proforma FYE 2018 sales for Interface and nora combined

Execute Supply Chain Productivity • Continue to benefit from Troup County Optimization • Implement a dynamic yarn strategy • Continue to deliver on productivity pipeline initiatives page 20

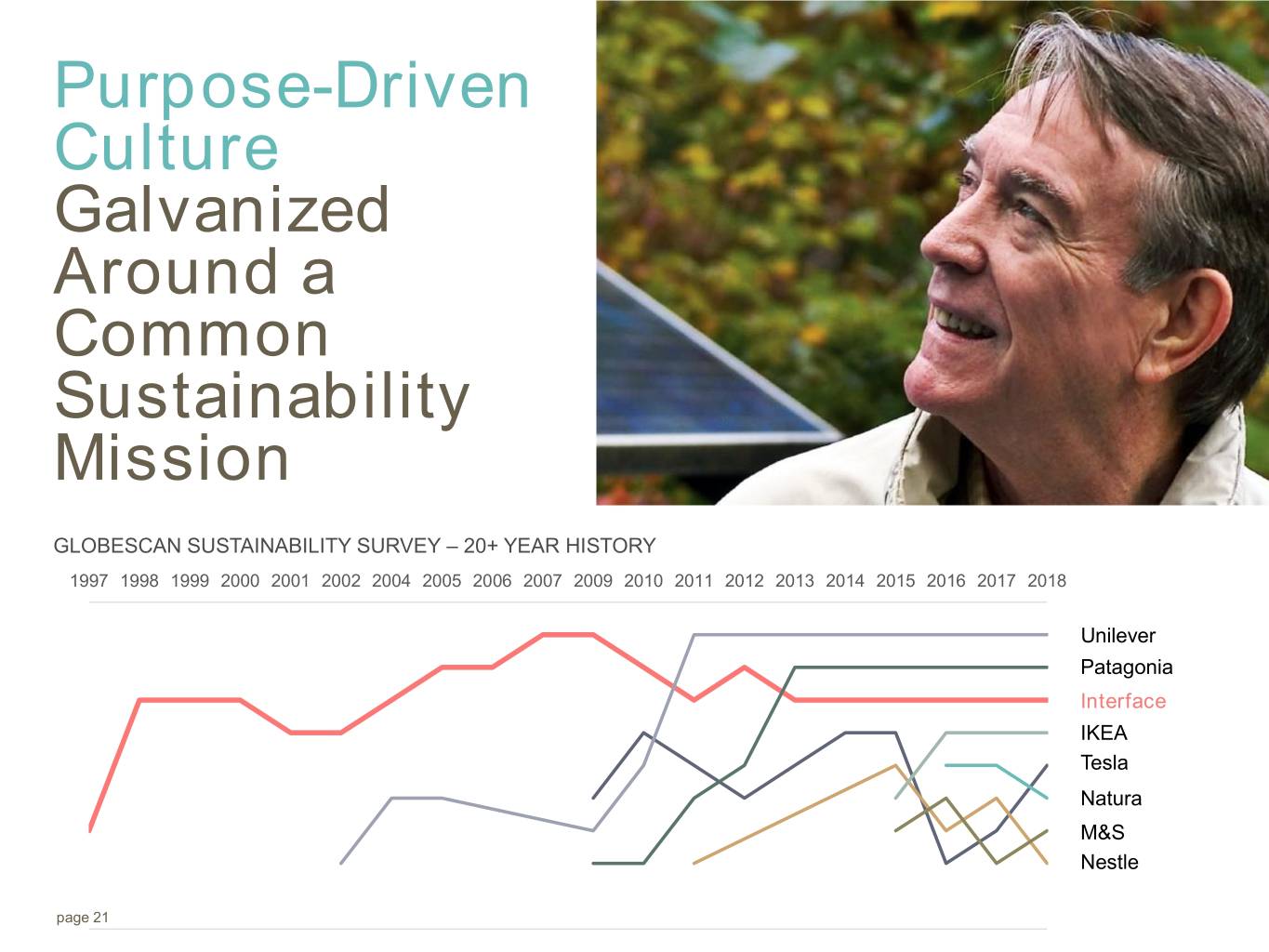

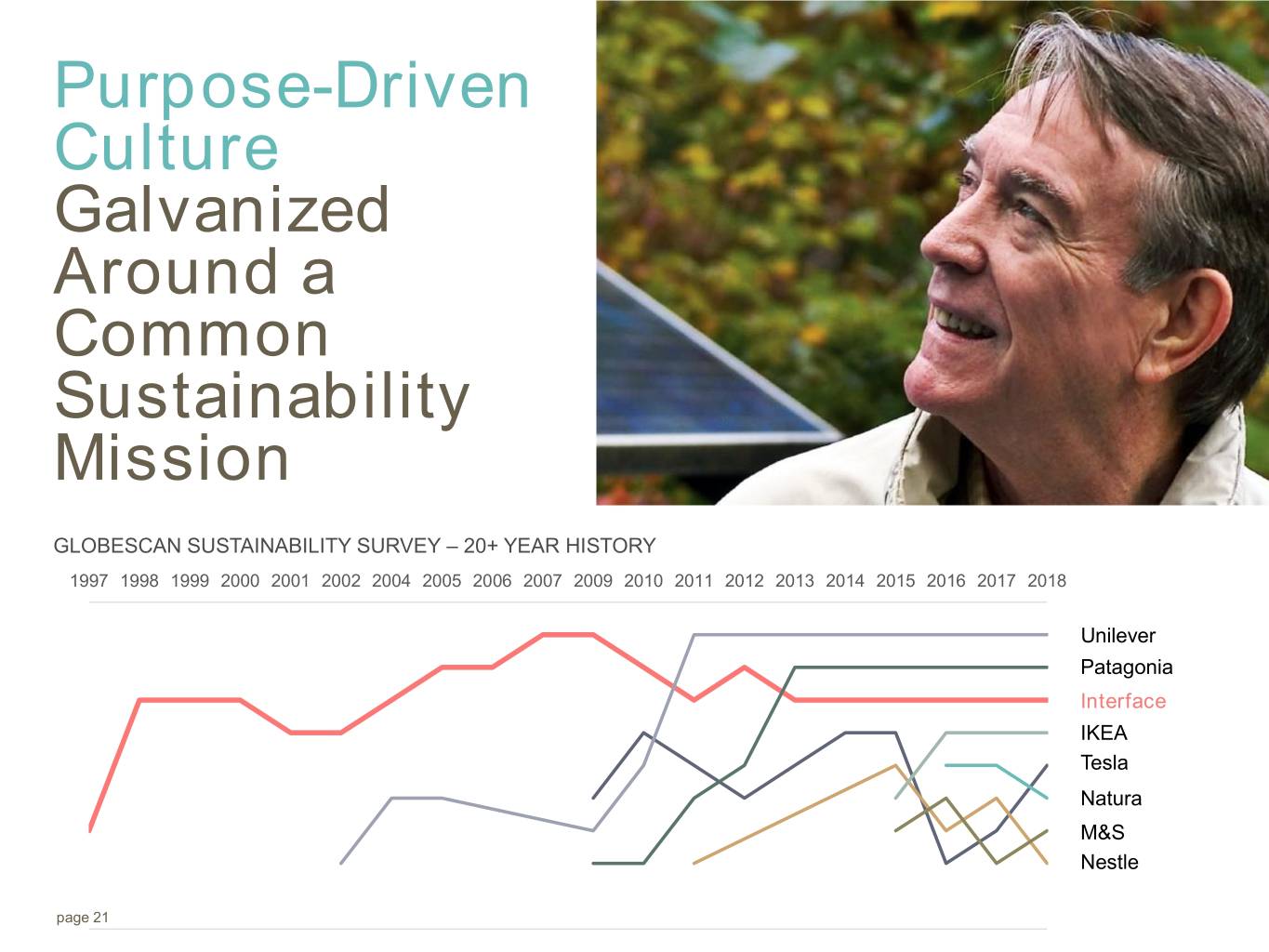

Purpose-Driven Culture Galvanized Around a Common Sustainability Mission GLOBESCAN SUSTAINABILITY SURVEY – 20+ YEAR HISTORY 1997 1998 1999 2000 2001 2002 2004 2005 2006 2007 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 Unilever Patagonia Interface IKEA Tesla Natura M&S Nestle page 21

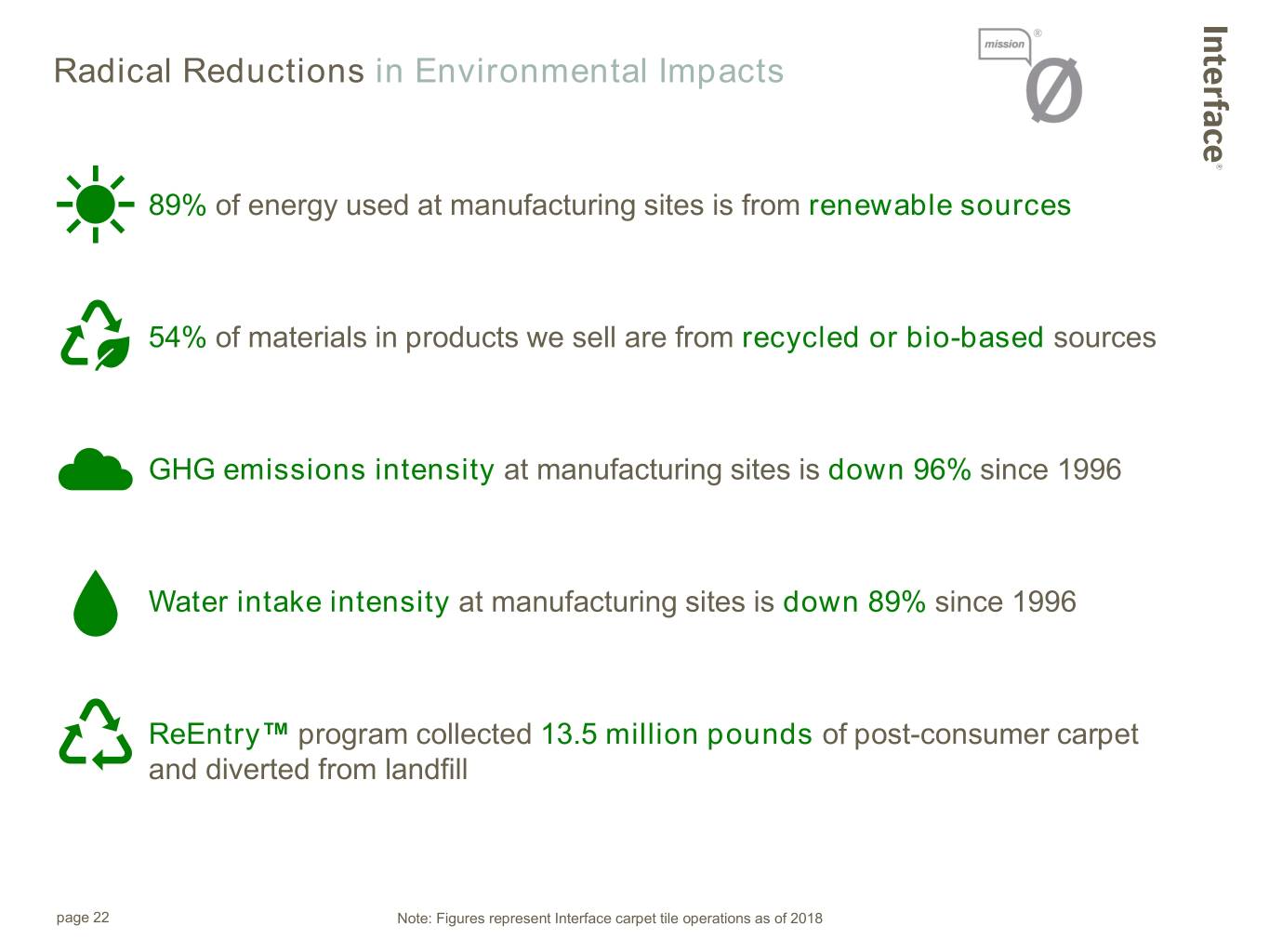

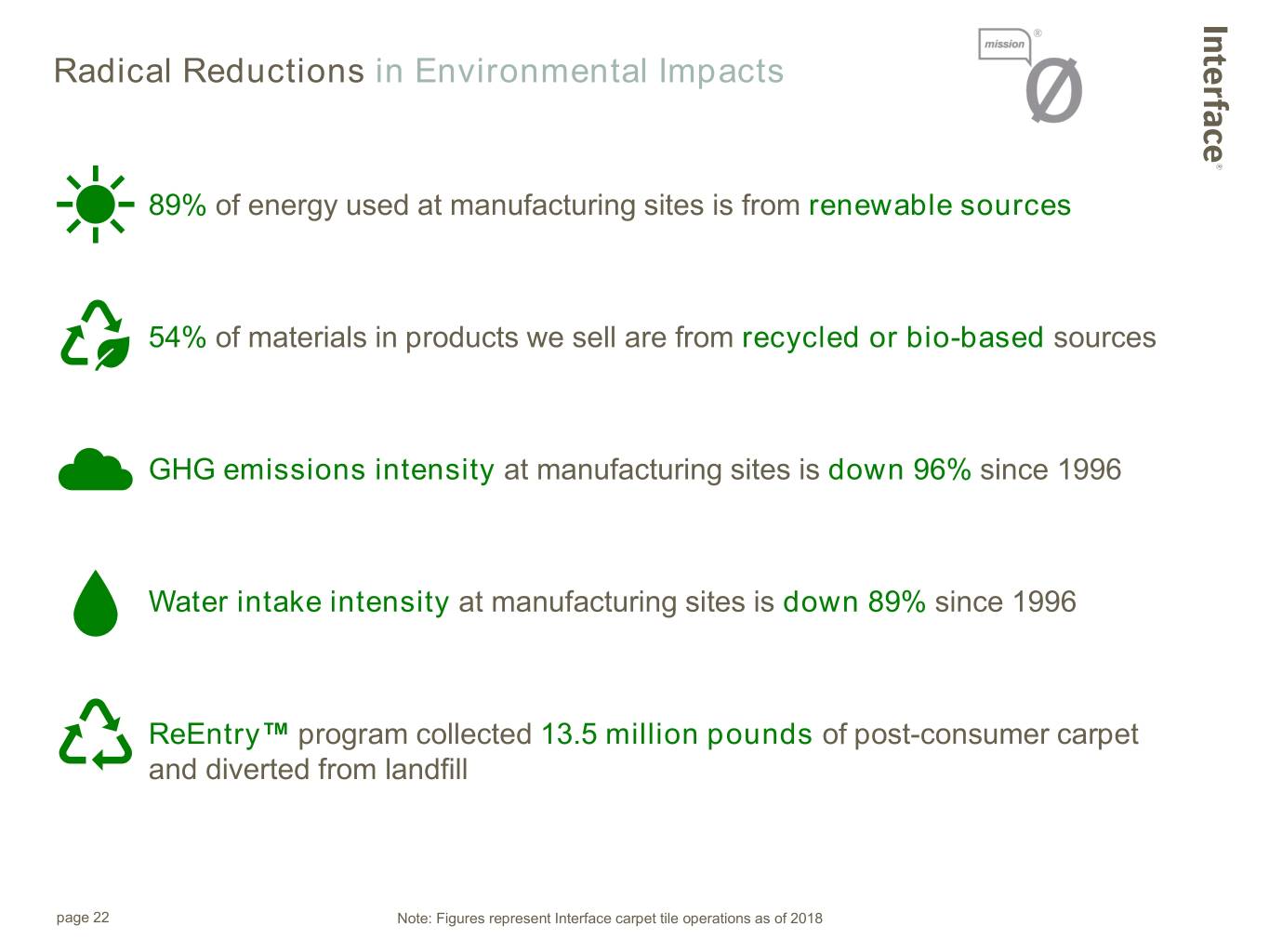

Radical Reductions in Environmental Impacts 89% of energy used at manufacturing sites is from renewable sources 54% of materials in products we sell are from recycled or bio-based sources GHG emissions intensity at manufacturing sites is down 96% since 1996 Water intake intensity at manufacturing sites is down 89% since 1996 ReEntry™ program collected 13.5 million pounds of post-consumer carpet and diverted from landfill page 22 Note: Figures represent Interface carpet tile operations as of 2018

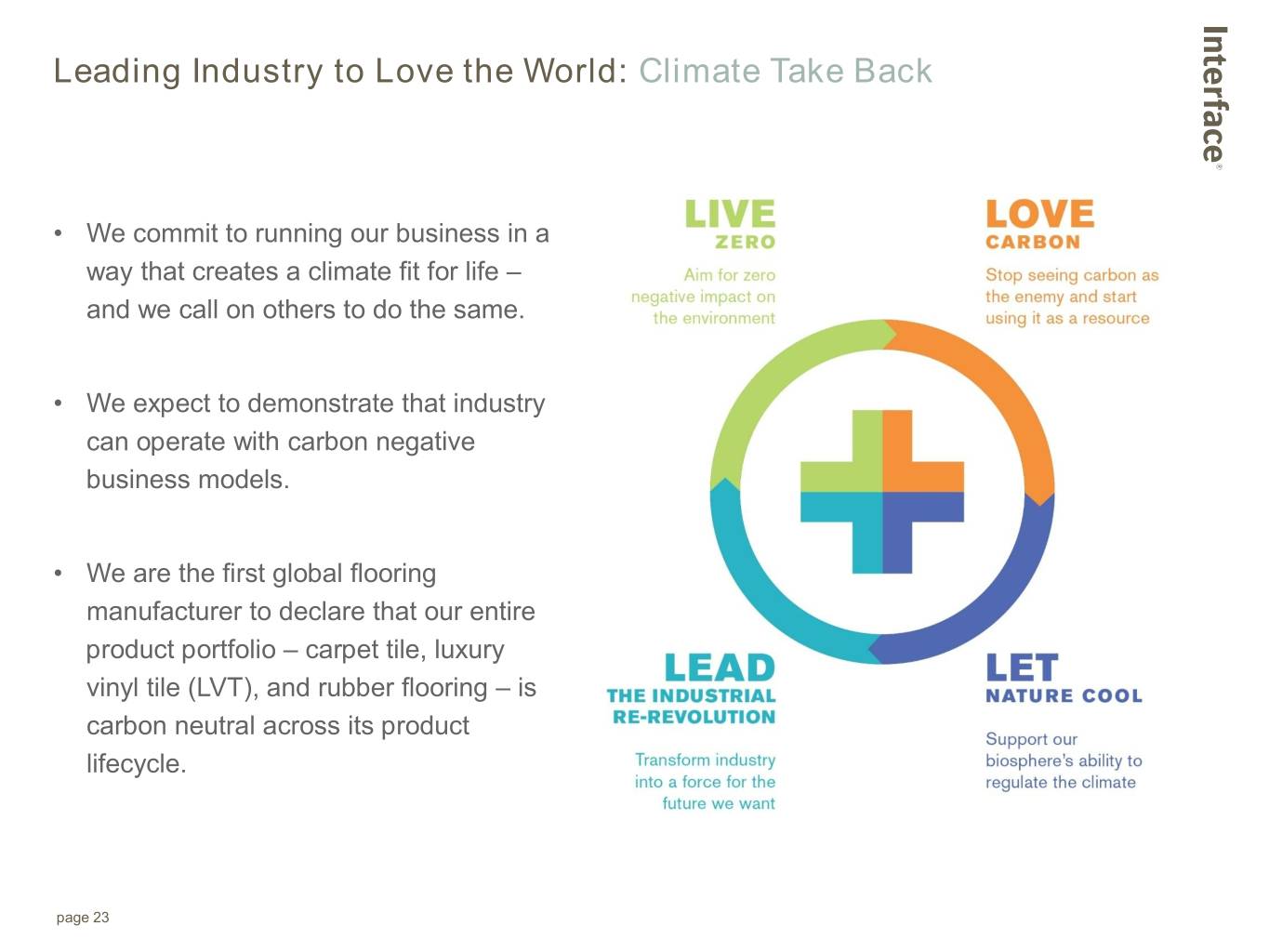

Leading Industry to Love the World: Climate Take Back • We commit to running our business in a way that creates a climate fit for life – and we call on others to do the same. • We expect to demonstrate that industry can operate with carbon negative business models. • We are the first global flooring manufacturer to declare that our entire product portfolio – carpet tile, luxury vinyl tile (LVT), and rubber flooring – is carbon neutral across its product lifecycle. page 23

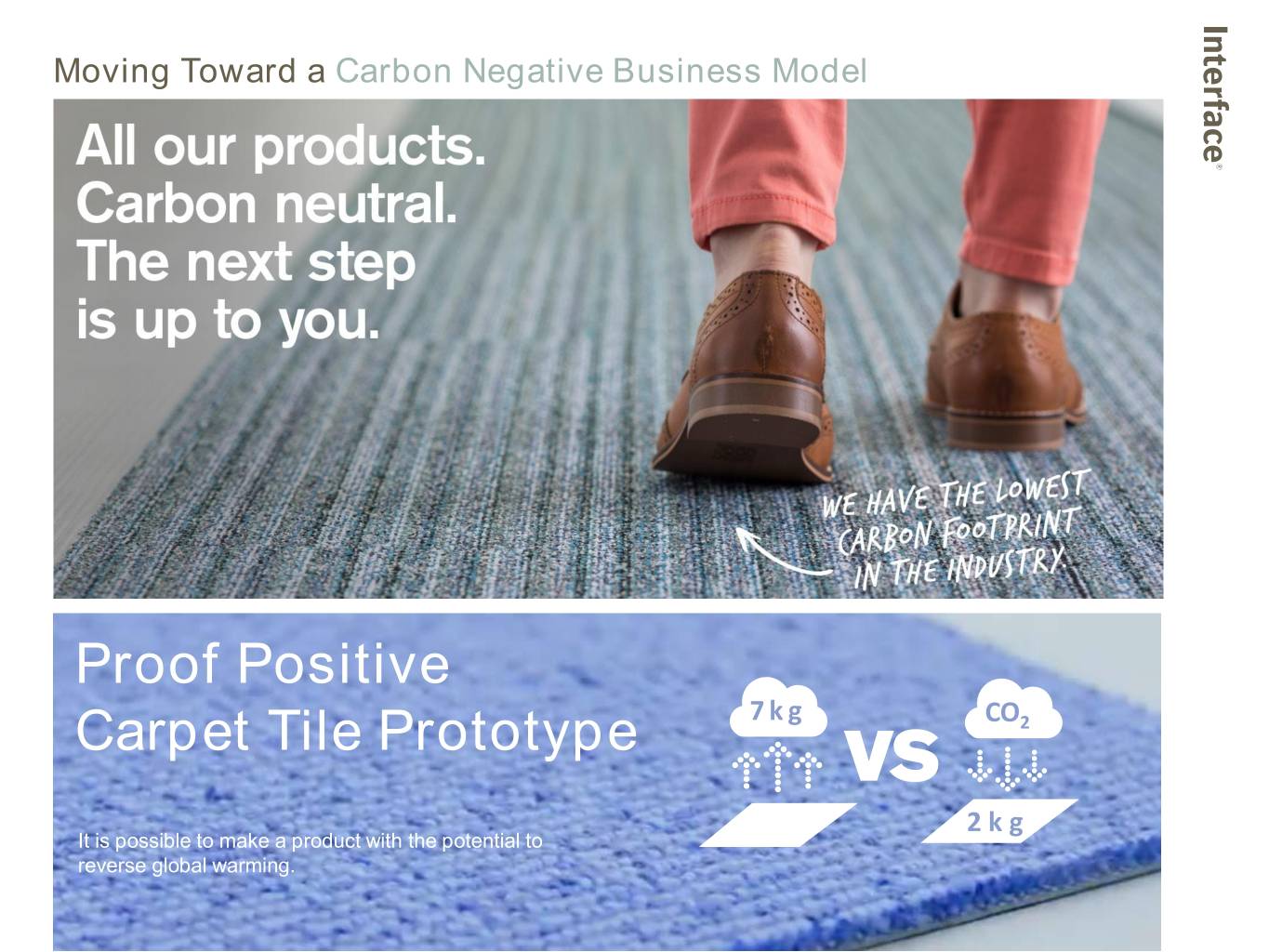

Moving Toward a Carbon Negative Business Model Proof Positive 7 k g Carpet Tile Prototype CO2 2 k g It is possible to make a product with the potential to reverse global warming. page 24

Financial Performance

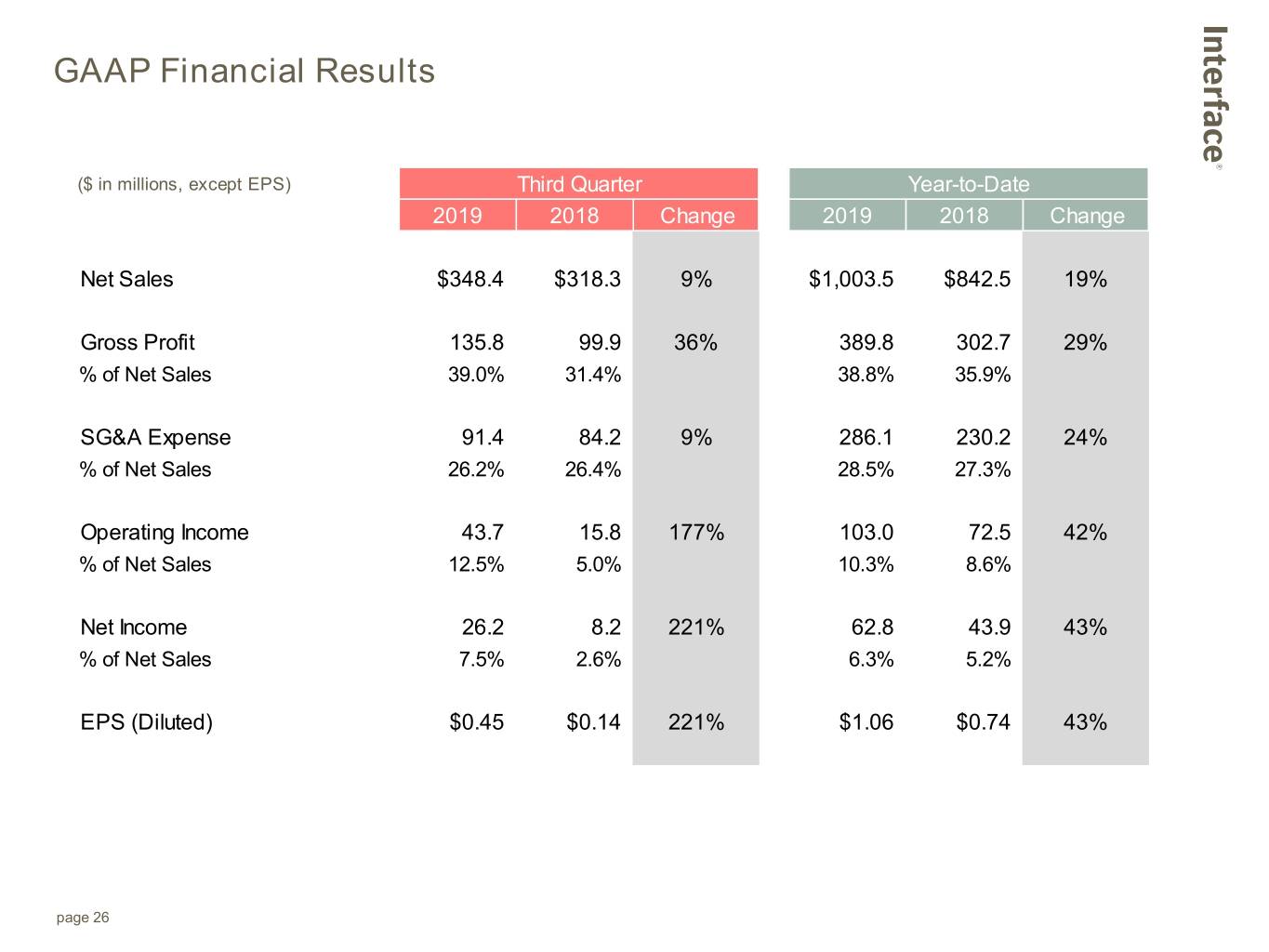

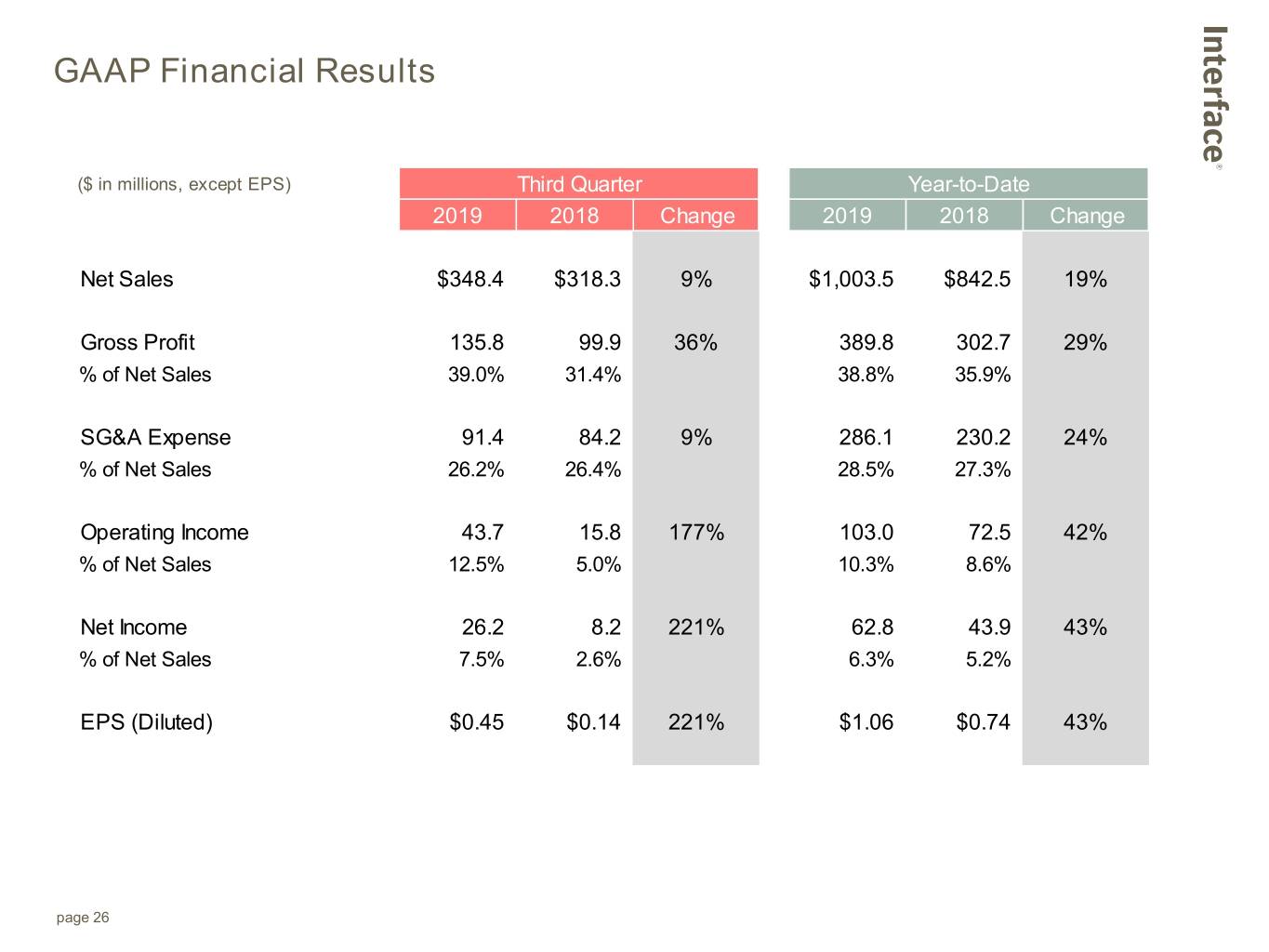

GAAP Financial Results ($ in millions, except EPS) Third Quarter Year-to-Date 2019 2018 Change 2019 2018 Change Net Sales $348.4 $318.3 9% $1,003.5 $842.5 19% Gross Profit 135.8 99.9 36% 389.8 302.7 29% % of Net Sales 39.0% 31.4% 38.8% 35.9% SG&A Expense 91.4 84.2 9% 286.1 230.2 24% % of Net Sales 26.2% 26.4% 28.5% 27.3% Operating Income 43.7 15.8 177% 103.0 72.5 42% % of Net Sales 12.5% 5.0% 10.3% 8.6% Net Income 26.2 8.2 221% 62.8 43.9 43% % of Net Sales 7.5% 2.6% 6.3% 5.2% EPS (Diluted) $0.45 $0.14 221% $1.06 $0.74 43% page 26

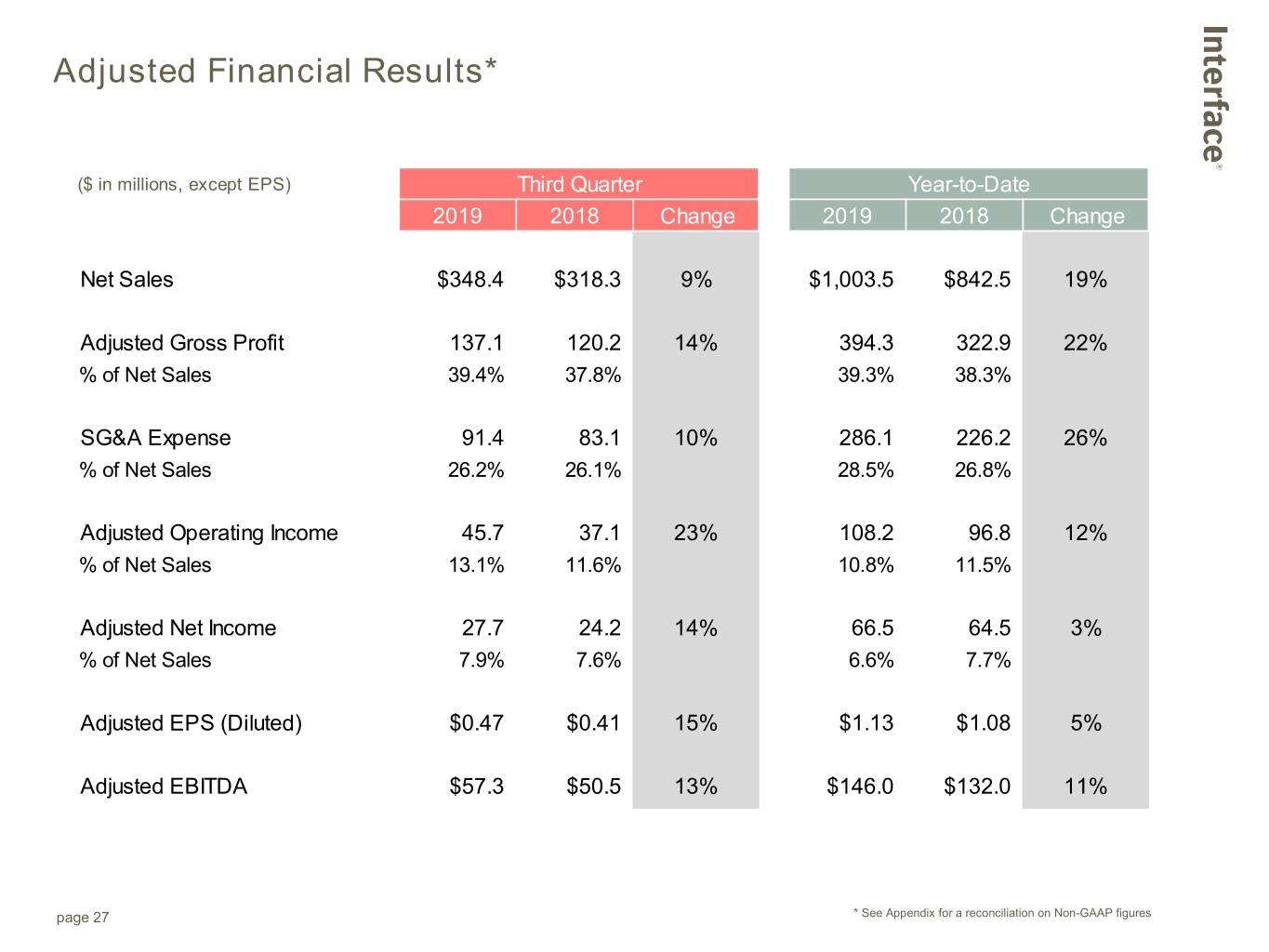

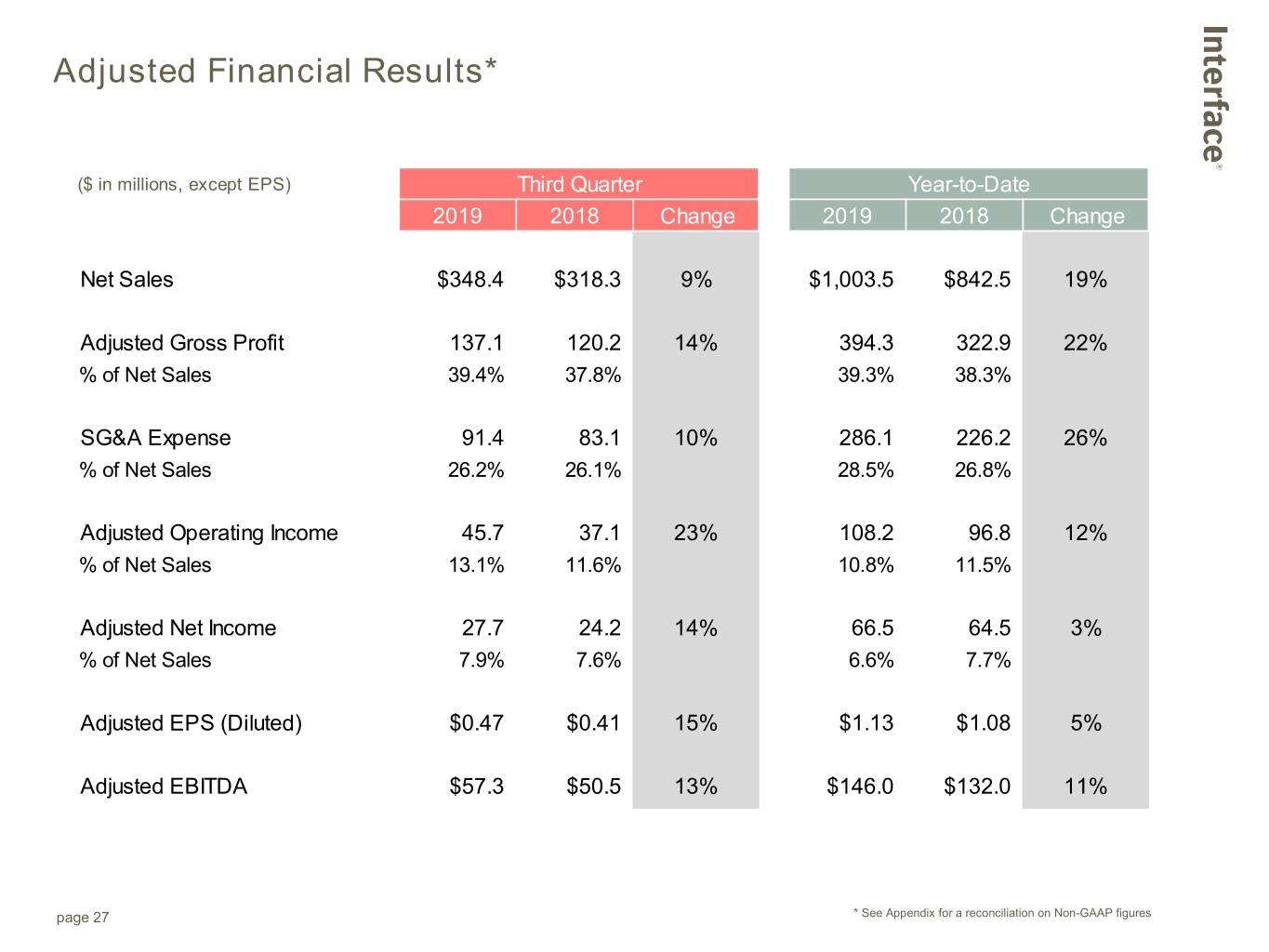

Adjusted Financial Results* ($ in millions, except EPS) Third Quarter Year-to-Date 2019 2018 Change 2019 2018 Change Net Sales $348.4 $318.3 9% $1,003.5 $842.5 19% Adjusted Gross Profit 137.1 120.2 14% 394.3 322.9 22% % of Net Sales 39.4% 37.8% 39.3% 38.3% SG&A Expense 91.4 83.1 10% 286.1 226.2 26% % of Net Sales 26.2% 26.1% 28.5% 26.8% Adjusted Operating Income 45.7 37.1 23% 108.2 96.8 12% % of Net Sales 13.1% 11.6% 10.8% 11.5% Adjusted Net Income 27.7 24.2 14% 66.5 64.5 3% % of Net Sales 7.9% 7.6% 6.6% 7.7% Adjusted EPS (Diluted) $0.47 $0.41 15% $1.13 $1.08 5% Adjusted EBITDA $57.3 $50.5 13% $146.0 $132.0 11% page 27 * See Appendix for a reconciliation on Non-GAAP figures

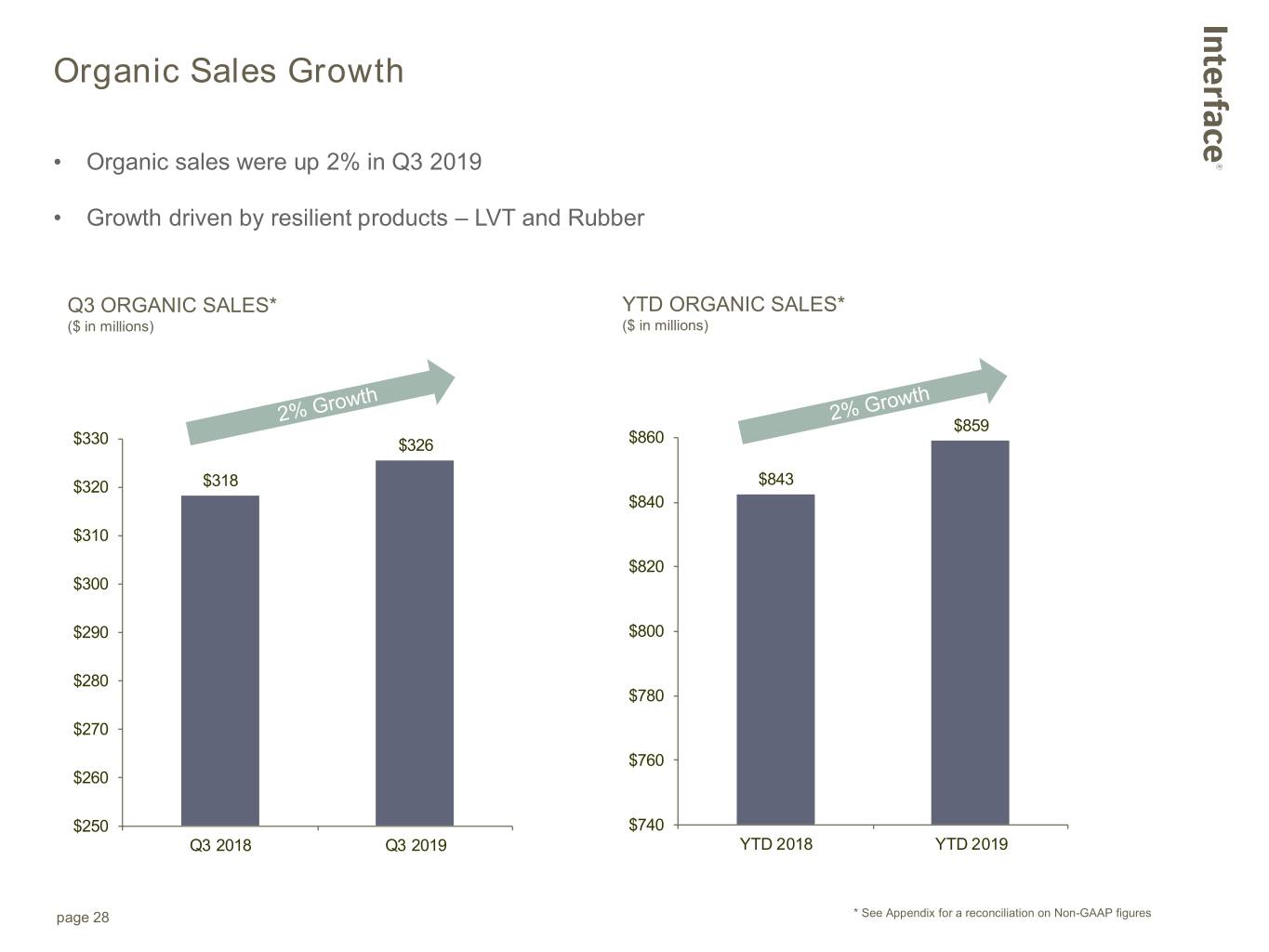

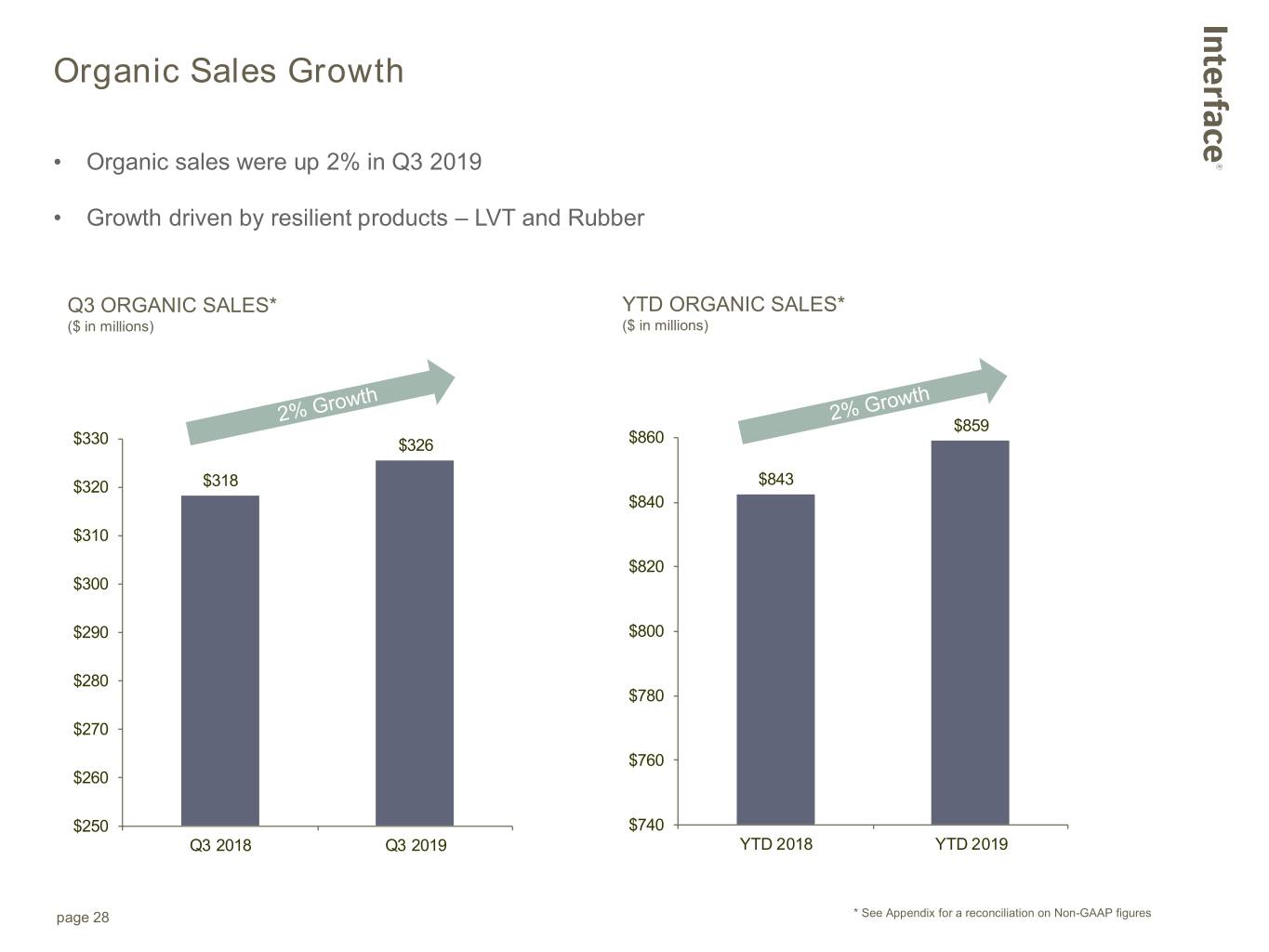

Organic Sales Growth • Organic sales were up 2% in Q3 2019 • Growth driven by resilient products – LVT and Rubber Q3 ORGANIC SALES* YTD ORGANIC SALES* ($ in millions) ($ in millions) $859 $330 $326 $860 $320 $318 $843 $840 $310 $820 $300 $290 $800 $280 $780 $270 $760 $260 $250 $740 Q3 2018 Q3 2019 YTD 2018 YTD 2019 page 28 * See Appendix for a reconciliation on Non-GAAP figures

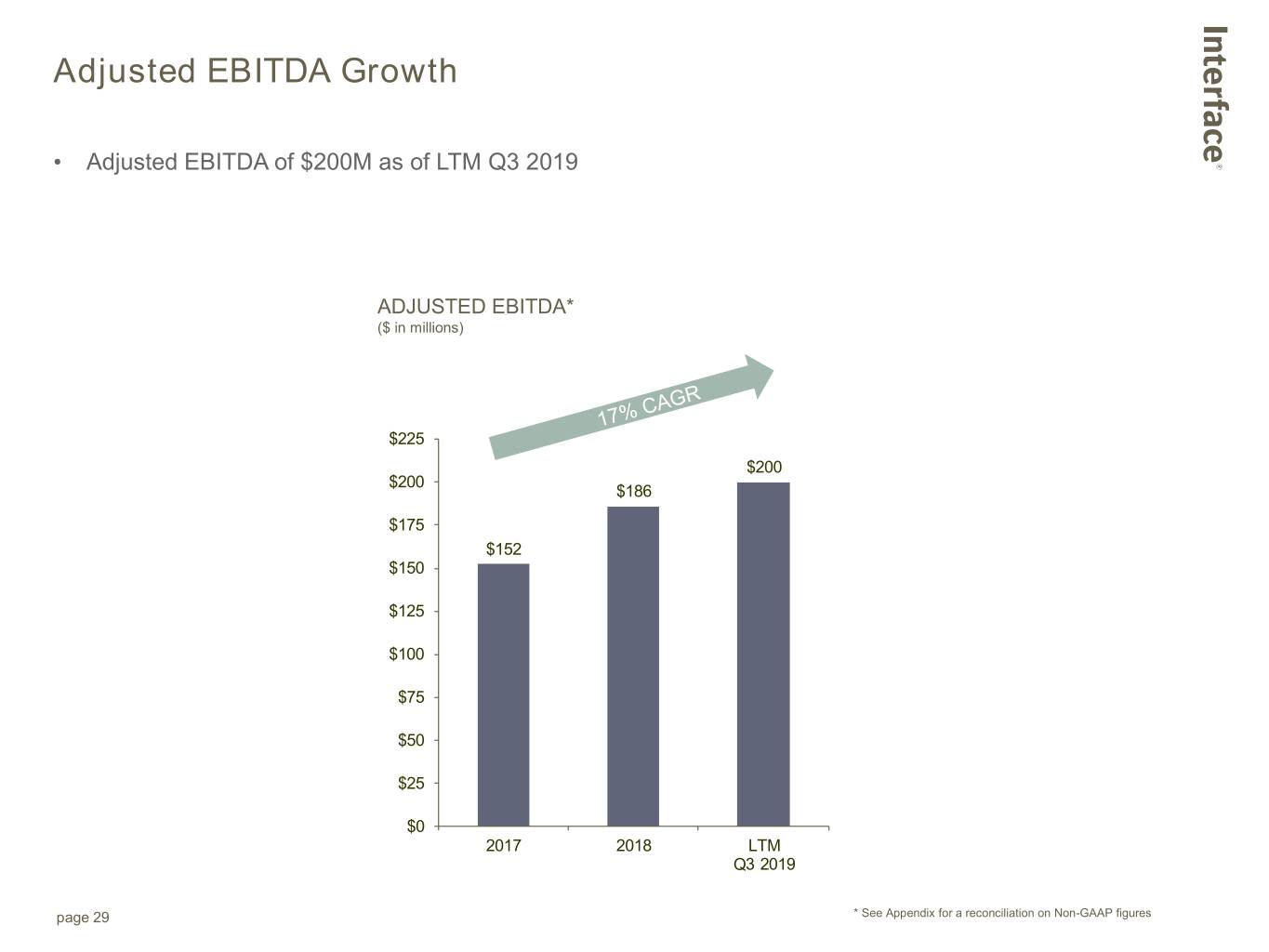

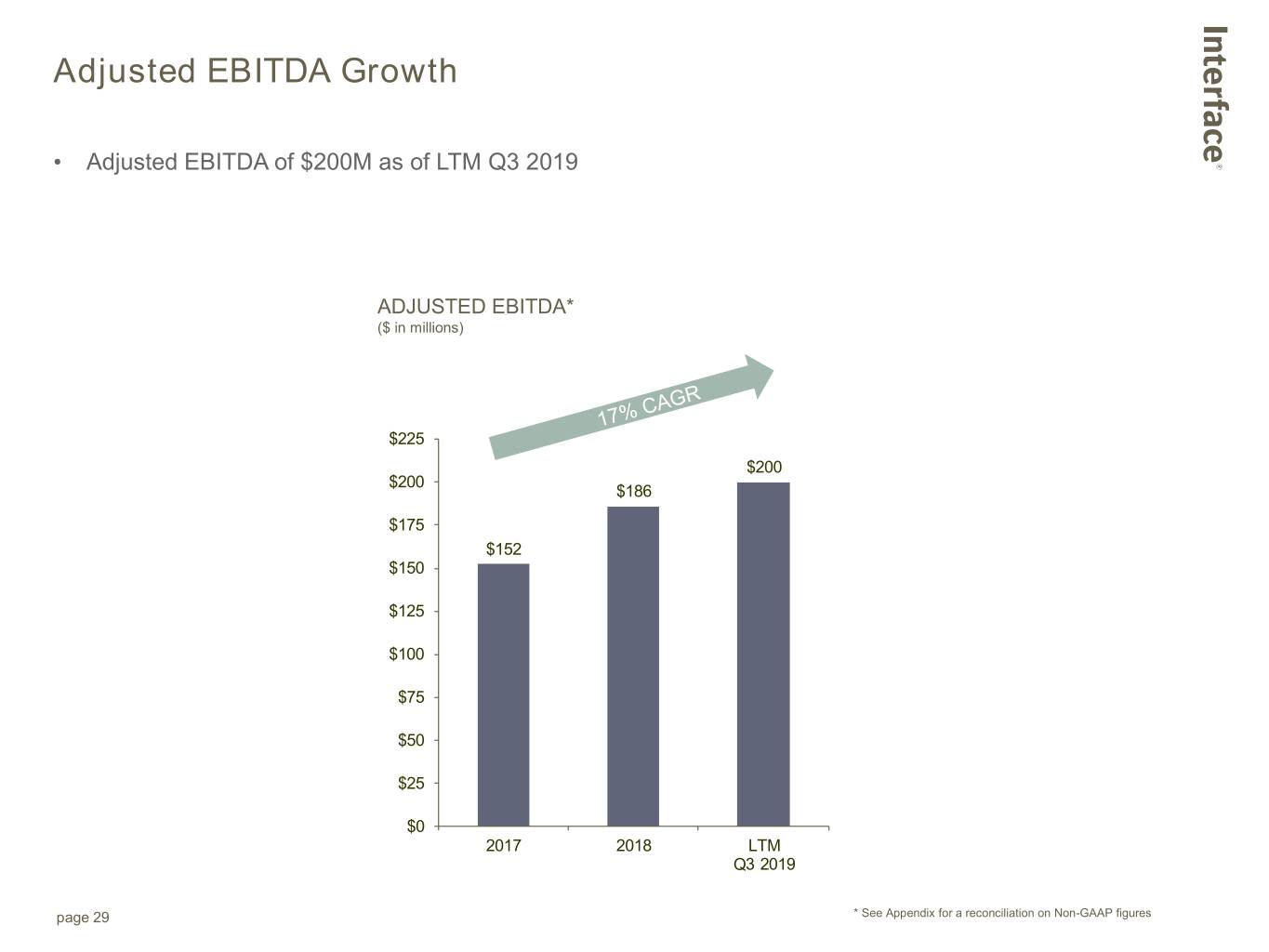

Adjusted EBITDA Growth • Adjusted EBITDA of $200M as of LTM Q3 2019 ADJUSTED EBITDA* ($ in millions) $225 $200 $200 $186 $175 $152 $150 $125 $100 $75 $50 $25 $0 2017 2018 LTM Q3 2019 page 29 * See Appendix for a reconciliation on Non-GAAP figures

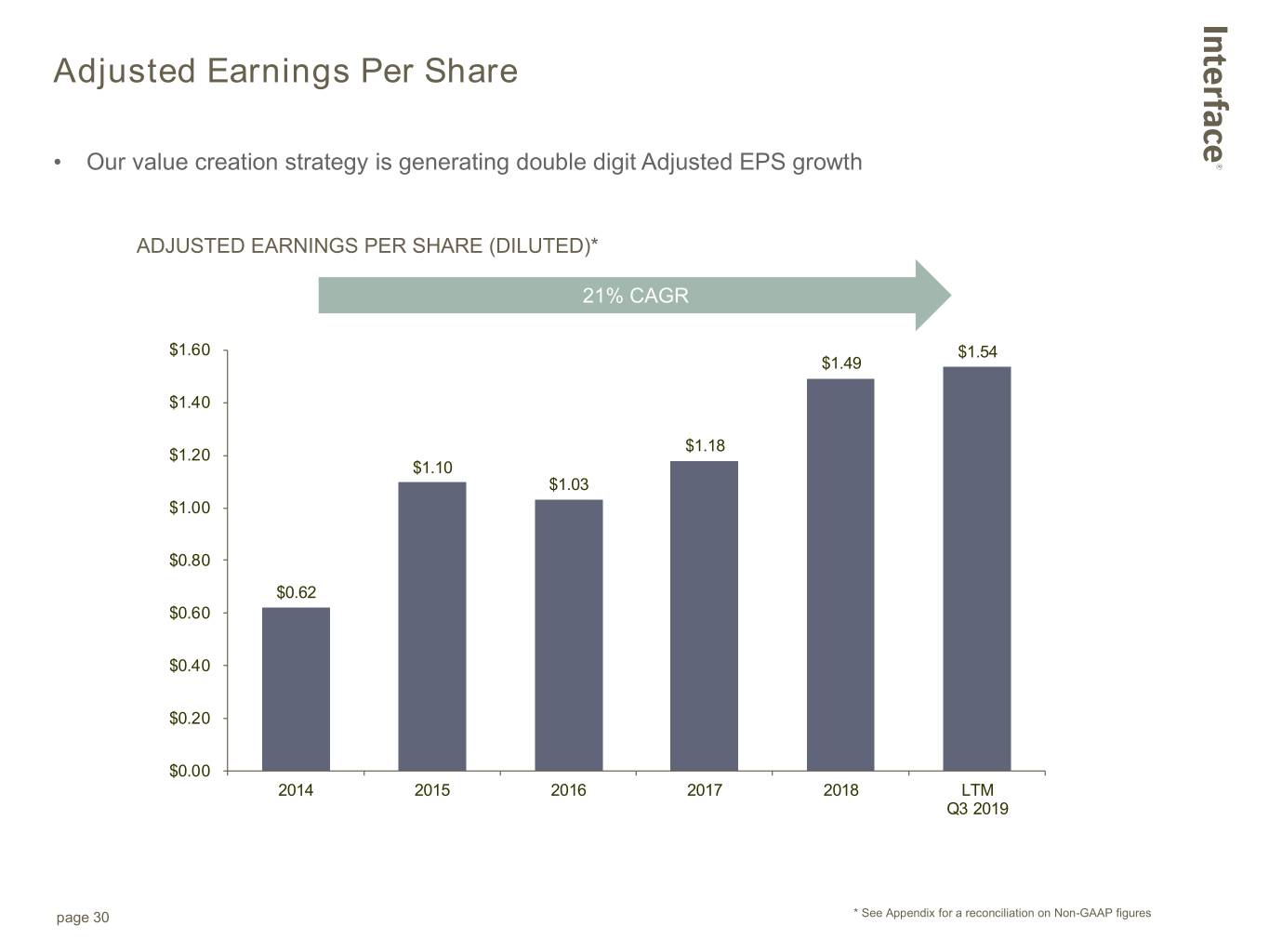

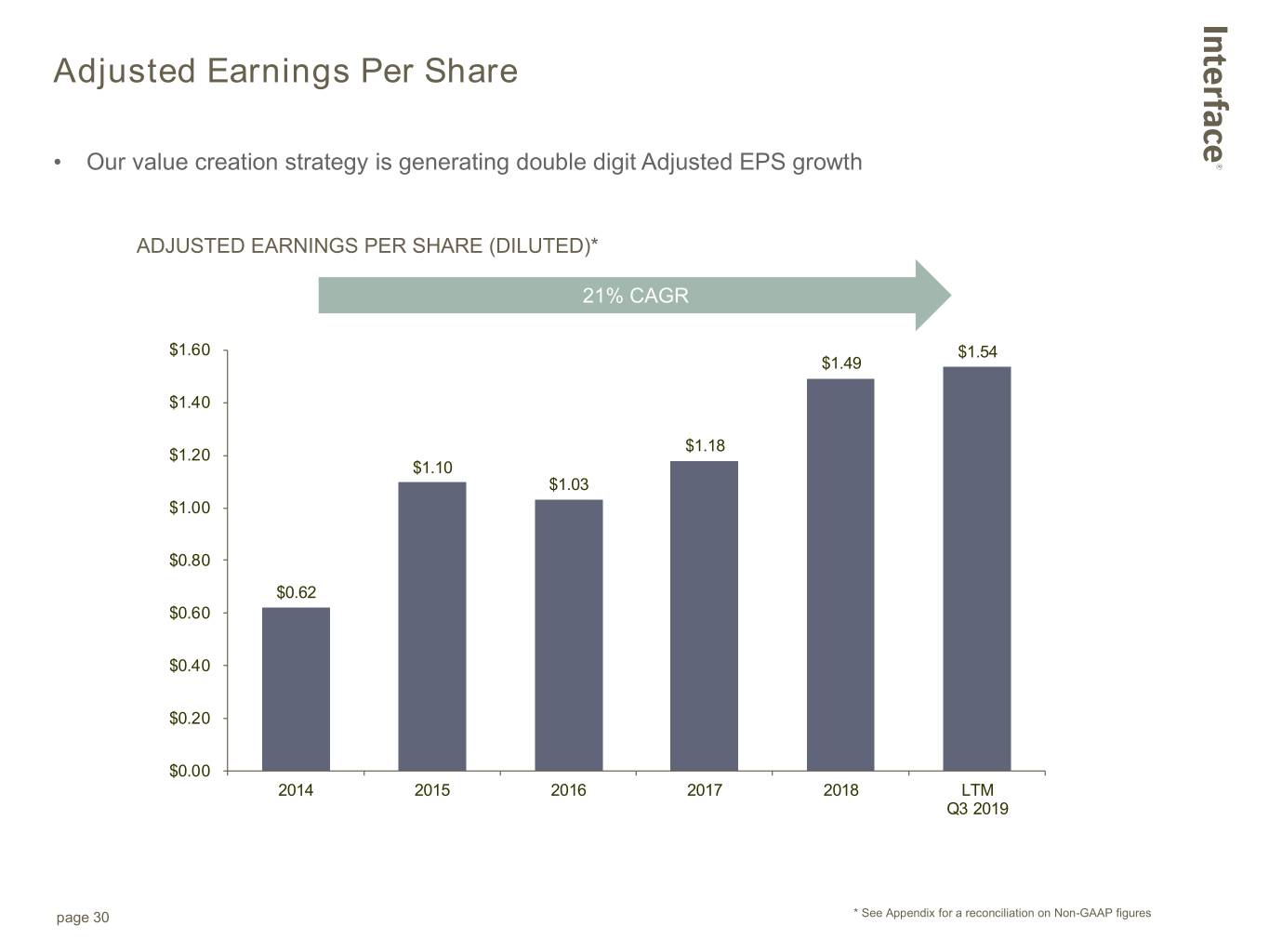

Adjusted Earnings Per Share • Our value creation strategy is generating double digit Adjusted EPS growth ADJUSTED EARNINGS PER SHARE (DILUTED)* 21% CAGR $1.60 $1.54 $1.49 $1.40 $1.18 $1.20 $1.10 $1.03 $1.00 $0.80 $0.62 $0.60 $0.40 $0.20 $0.00 2014 2015 2016 2017 2018 LTM Q3 2019 page 30 * See Appendix for a reconciliation on Non-GAAP figures

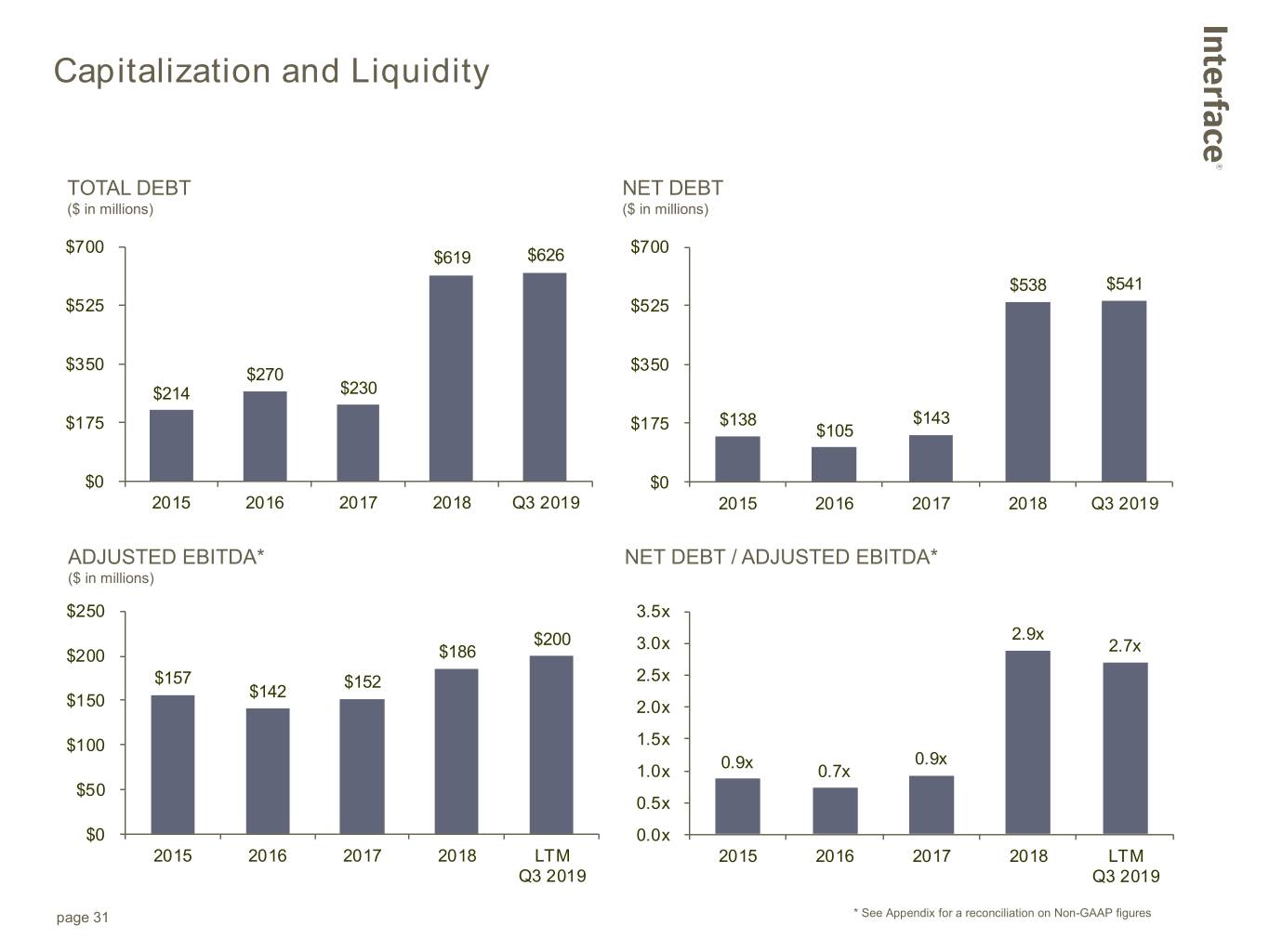

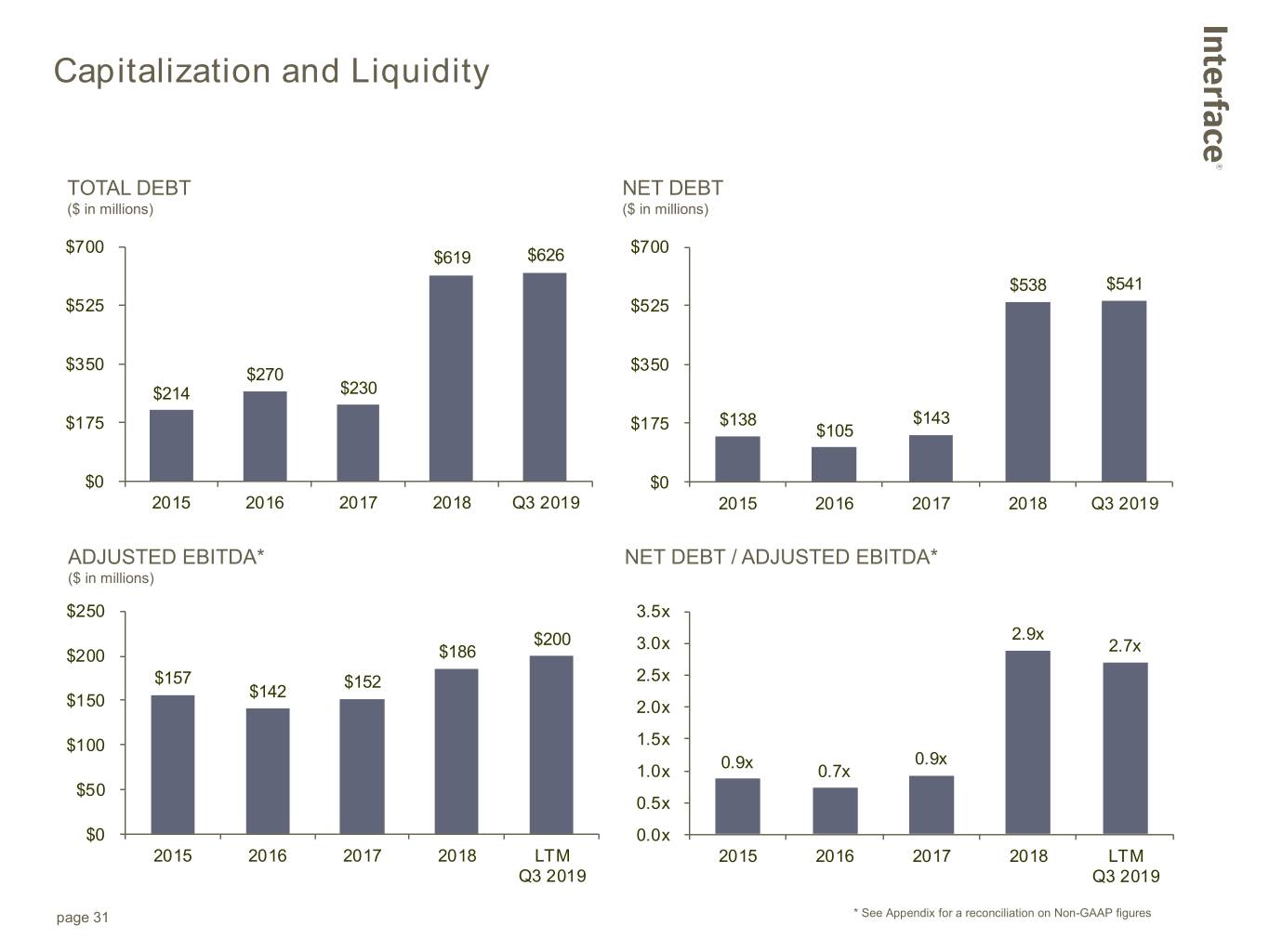

Capitalization and Liquidity TOTAL DEBT NET DEBT ($ in millions) ($ in millions) $700 $700 $619 $626 $538 $541 $525 $525 $350 $350 $270 $214 $230 $138 $143 $175 $175 $105 $0 $0 2015 2016 2017 2018 Q3 2019 2015 2016 2017 2018 Q3 2019 ADJUSTED EBITDA* NET DEBT / ADJUSTED EBITDA* ($ in millions) $250 3.5x 2.9x $200 3.0x 2.7x $200 $186 $157 $152 2.5x $142 $150 2.0x $100 1.5x 0.9x 0.9x 1.0x 0.7x $50 0.5x $0 0.0x 2015 2016 2017 2018 LTM 2015 2016 2017 2018 LTM Q3 2019 Q3 2019 page 31 * See Appendix for a reconciliation on Non-GAAP figures

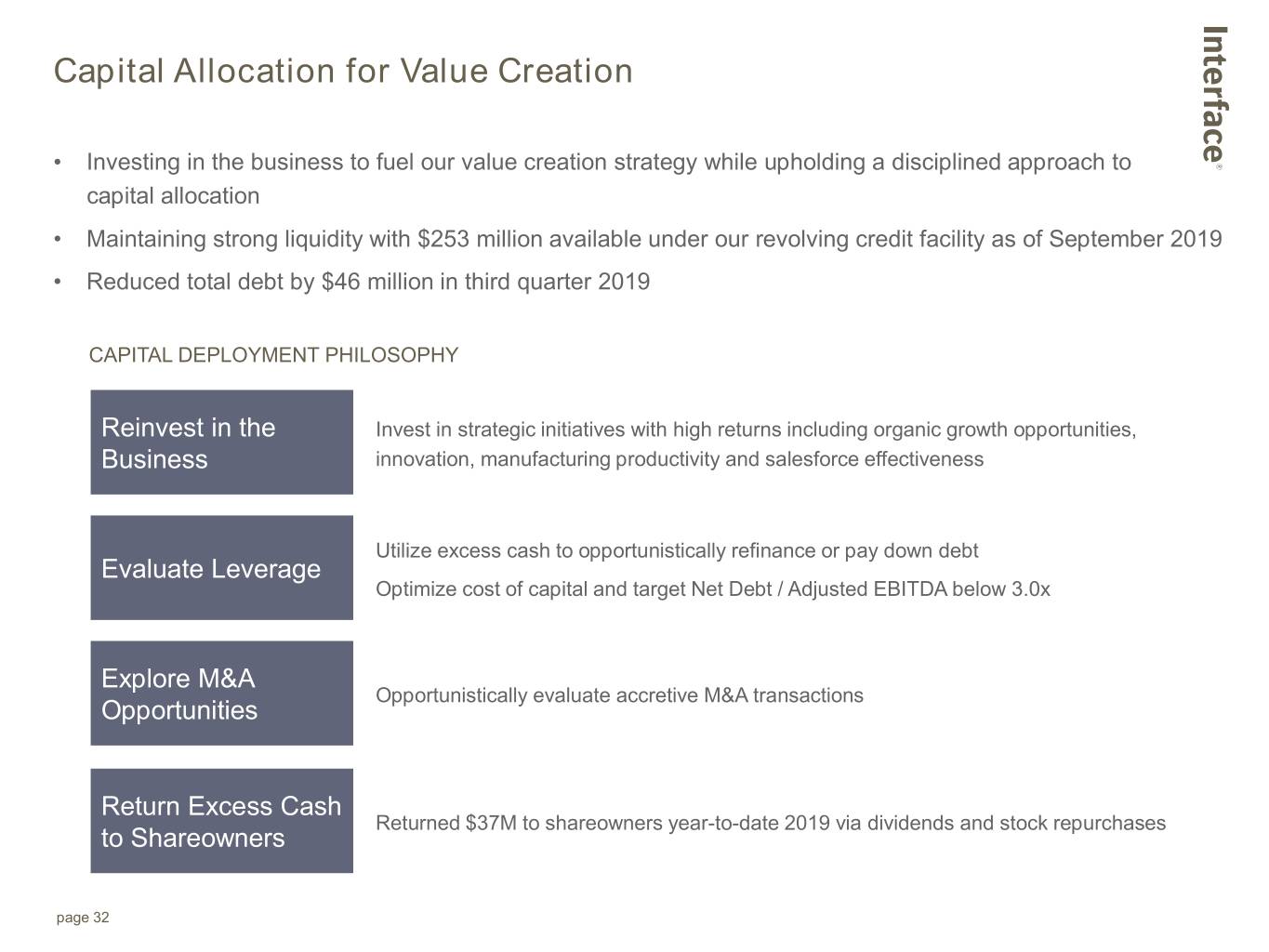

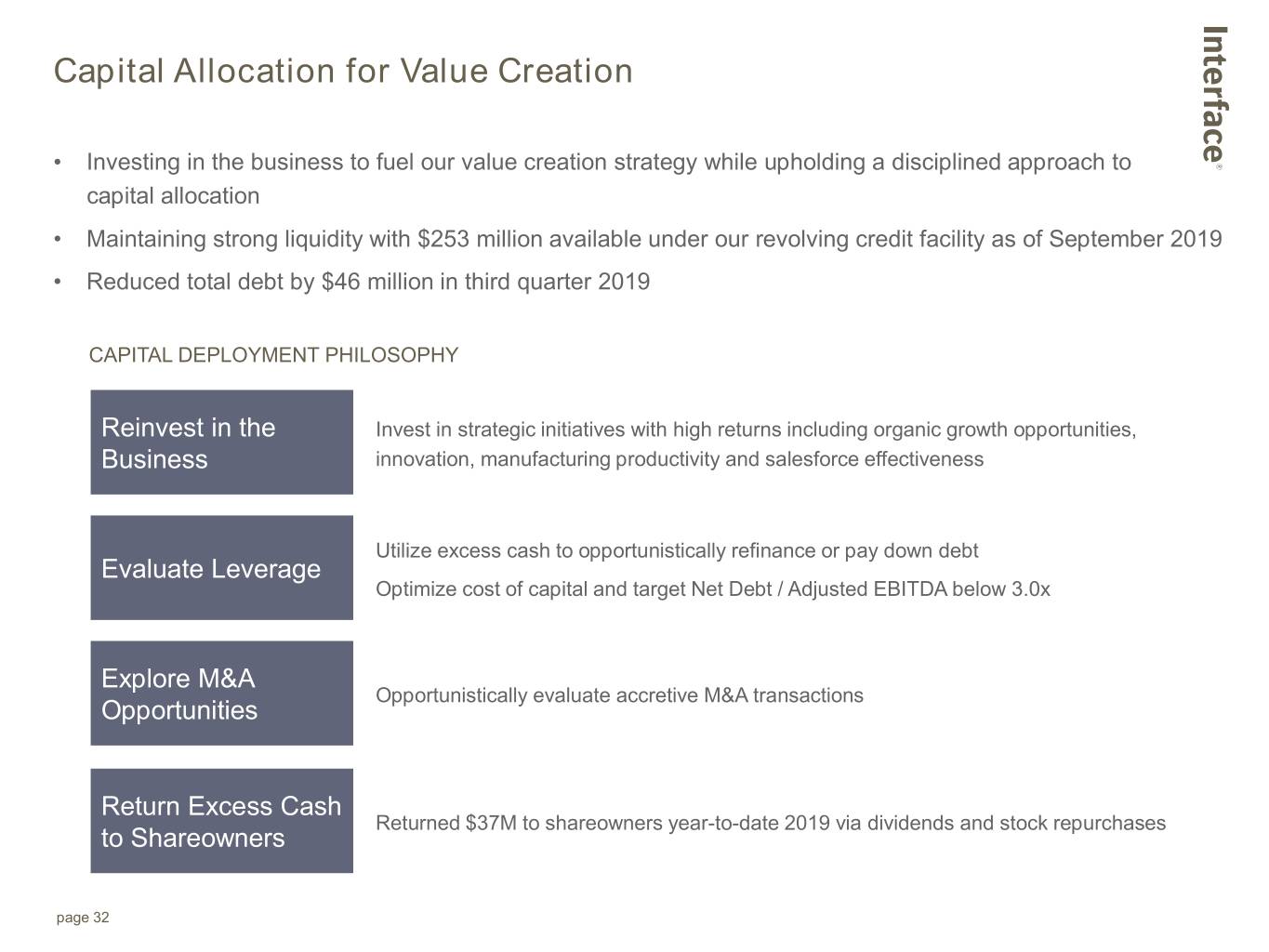

Capital Allocation for Value Creation • Investing in the business to fuel our value creation strategy while upholding a disciplined approach to capital allocation • Maintaining strong liquidity with $253 million available under our revolving credit facility as of September 2019 • Reduced total debt by $46 million in third quarter 2019 CAPITAL DEPLOYMENT PHILOSOPHY Reinvest in the Invest in strategic initiatives with high returns including organic growth opportunities, Business innovation, manufacturing productivity and salesforce effectiveness Utilize excess cash to opportunistically refinance or pay down debt Evaluate Leverage Optimize cost of capital and target Net Debt / Adjusted EBITDA below 3.0x Explore M&A Opportunistically evaluate accretive M&A transactions Opportunities Return Excess Cash Returned $37M to shareowners year-to-date 2019 via dividends and stock repurchases to Shareowners page 32

Investment Highlights: Who We Are leading most valuable strongest global global engaged, global provider brand sales & manufacturing customer-centric of commercial in the flooring marketing footprint and culture, focused flooring solutions category capabilities industry-leading on performance gross margins and galvanized around our sustainability mission page 33

AppendixAppendix

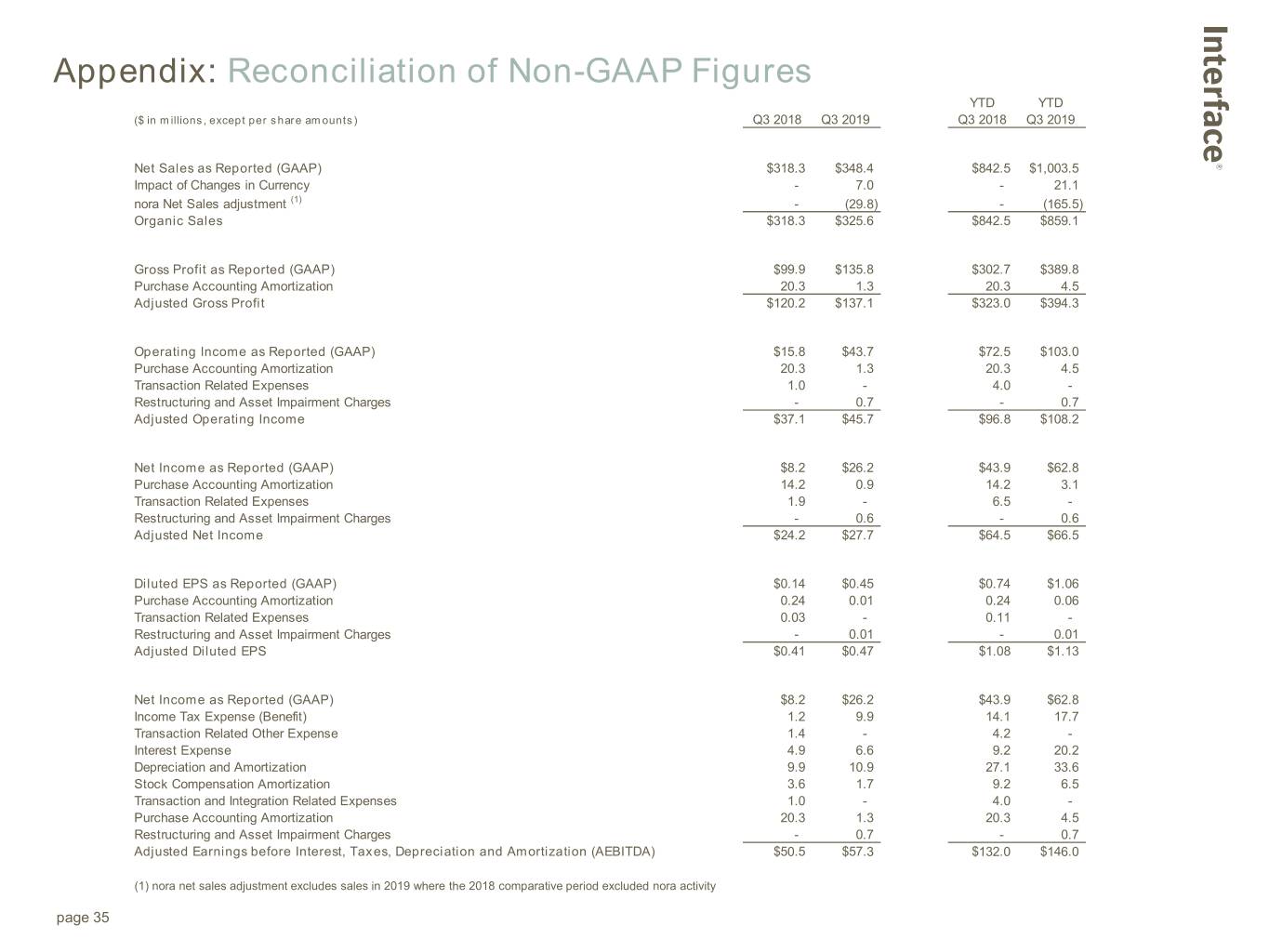

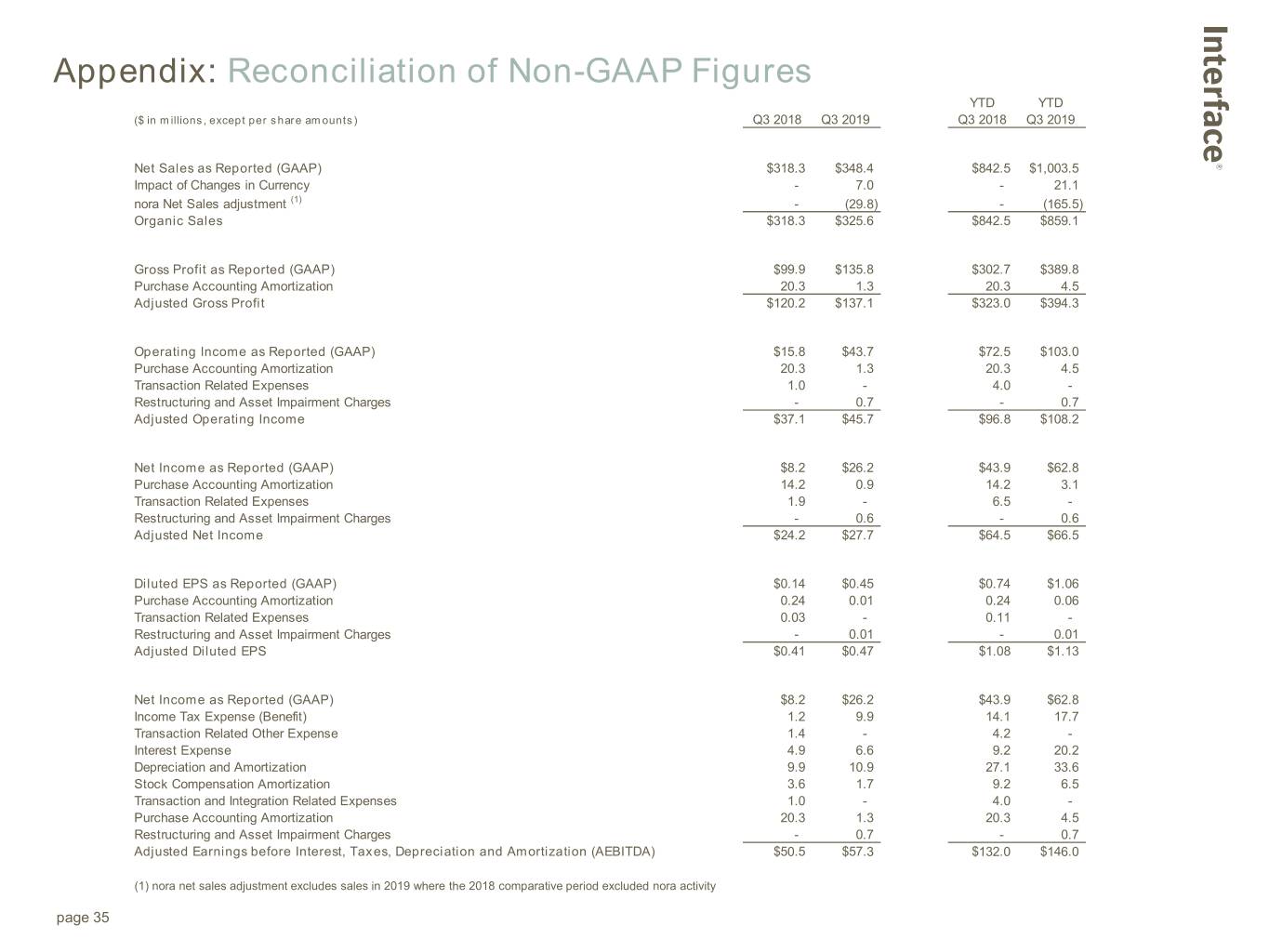

Appendix: Reconciliation of Non-GAAP Figures YTD YTD ($ in millions, except per share amounts) Q3 2018 Q3 2019 Q3 2018 Q3 2019 Net Sales as Reported (GAAP) $318.3 $348.4 $842.5 $1,003.5 Impact of Changes in Currency - 7.0 - 21.1 nora Net Sales adjustment (1) - (29.8) - (165.5) Organic Sales $318.3 $325.6 $842.5 $859.1 Gross Profit as Reported (GAAP) $99.9 $135.8 $302.7 $389.8 Purchase Accounting Amortization 20.3 1.3 20.3 4.5 Adjusted Gross Profit $120.2 $137.1 $323.0 $394.3 Operating Income as Reported (GAAP) $15.8 $43.7 $72.5 $103.0 Purchase Accounting Amortization 20.3 1.3 20.3 4.5 Transaction Related Expenses 1.0 - 4.0 - Restructuring and Asset Impairment Charges - 0.7 - 0.7 Adjusted Operating Income $37.1 $45.7 $96.8 $108.2 Net Income as Reported (GAAP) $8.2 $26.2 $43.9 $62.8 Purchase Accounting Amortization 14.2 0.9 14.2 3.1 Transaction Related Expenses 1.9 - 6.5 - Restructuring and Asset Impairment Charges - 0.6 - 0.6 Adjusted Net Income $24.2 $27.7 $64.5 $66.5 Diluted EPS as Reported (GAAP) $0.14 $0.45 $0.74 $1.06 Purchase Accounting Amortization 0.24 0.01 0.24 0.06 Transaction Related Expenses 0.03 - 0.11 - Restructuring and Asset Impairment Charges - 0.01 - 0.01 Adjusted Diluted EPS $0.41 $0.47 $1.08 $1.13 Net Income as Reported (GAAP) $8.2 $26.2 $43.9 $62.8 Income Tax Expense (Benefit) 1.2 9.9 14.1 17.7 Transaction Related Other Expense 1.4 - 4.2 - Interest Expense 4.9 6.6 9.2 20.2 Depreciation and Amortization 9.9 10.9 27.1 33.6 Stock Compensation Amortization 3.6 1.7 9.2 6.5 Transaction and Integration Related Expenses 1.0 - 4.0 - Purchase Accounting Amortization 20.3 1.3 20.3 4.5 Restructuring and Asset Impairment Charges - 0.7 - 0.7 Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (AEBITDA) $50.5 $57.3 $132.0 $146.0 (1) nora net sales adjustment excludes sales in 2019 where the 2018 comparative period excluded nora activity page 35

Appendix: Reconciliation of Non-GAAP Figures LTM 2014 2015 2016 2017 2018 Q3 2019 Diluted EPS as Reported (GAAP) $0.37 $1.10 $0.83 $0.86 $0.84 $1.16 Purchase Accounting - - - - 0.38 0.20 Transaction Related Expenses - - - - 0.12 0.01 Tax Act Expense (Benefit) - - - 0.25 (0.11) (0.11) Restructuring and Asset Impairment Charges 0.13 - 0.20 0.08 0.26 0.27 Debt Retirement Expenses 0.12 - - - - - Adjusted Diluted EPS $0.62 $1.10 $1.03 $1.18 $1.49 $1.54 ($ in millions) 2014 2015 2016 2017 2018 Q3 2019 Total Debt $263 $214 $270 $230 $619 $626 Less: Cash (55) (76) (166) (87) (81) (85) Net Debt $208 $138 $105 $143 $538 $541 LTM ($ in millions) 2014 2015 2016 2017 2018 Q3 2019 Net Income as Reported (GAAP) $25 $72 $54 $53 $50 $69 Taxes on Income 11 33 25 47 5 8 Transaction Related Other Expense - - - - 4 - Interest Expense 21 6 6 7 15 26 Depreciation & Amortization 31 31 31 30 39 46 Stock Compensation Amortization 4 14 6 7 15 12 Transaction Related Expenses - - - - 5 1 Purchase Accounting Amortization - - - - 32 16 Restructuring and Asset Impairment Charges 12 - 20 7 21 21 Debt Retirement Expenses 12 - - - - - Adjusted EBITDA $116 $157 $142 $152 $186 $200 Total Debt / Net Income 10.6x 2.9x 5.0x 4.3x 12.3x 9.1x Net Debt / Adjusted EBITDA 1.8x 0.9x 0.7x 0.9x 2.9x 2.7x page 36

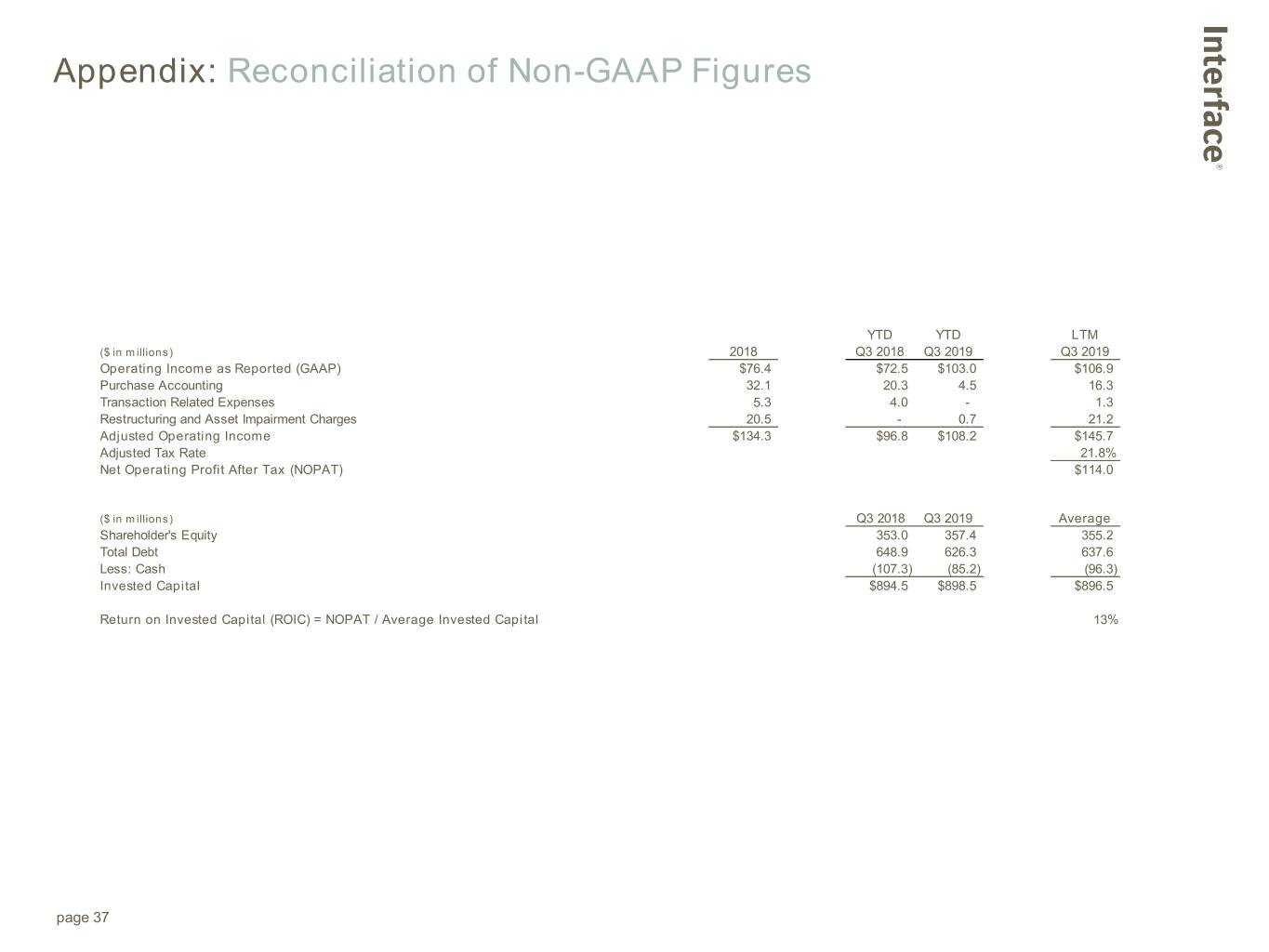

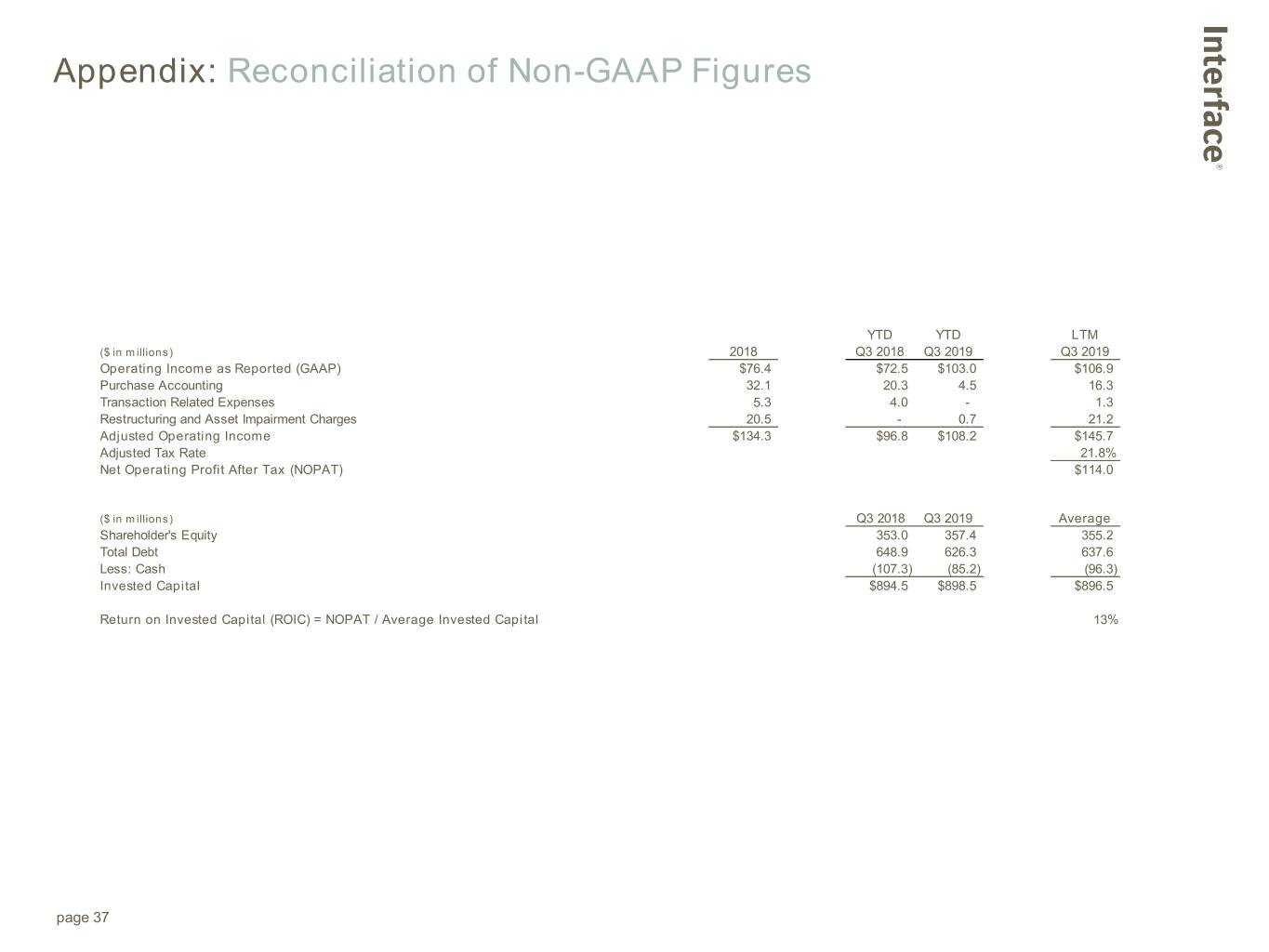

Appendix: Reconciliation of Non-GAAP Figures YTD YTD LTM ($ in millions) 2018 Q3 2018 Q3 2019 Q3 2019 Operating Income as Reported (GAAP) $76.4 $72.5 $103.0 $106.9 Purchase Accounting 32.1 20.3 4.5 16.3 Transaction Related Expenses 5.3 4.0 - 1.3 Restructuring and Asset Impairment Charges 20.5 - 0.7 21.2 Adjusted Operating Income $134.3 $96.8 $108.2 $145.7 Adjusted Tax Rate 21.8% Net Operating Profit After Tax (NOPAT) $114.0 ($ in millions) Q3 2018 Q3 2019 Average Shareholder's Equity 353.0 357.4 355.2 Total Debt 648.9 626.3 637.6 Less: Cash (107.3) (85.2) (96.3) Invested Capital $894.5 $898.5 $896.5 Return on Invested Capital (ROIC) = NOPAT / Average Invested Capital 13% page 37