Exhibit 99.1

Interface, Inc .Investor Presentation February 2007

This presentation contains forward-looking statements, including, in particular, statements about Interface’s plans, strategies and prospects. These are based on the Company’s current assumptions, expectations and projections about future events. Although Interface believes that the expectations reflected in these forward-looking statements are reasonable, the Company can give no assurance that these expectations will prove to be correct or that savings or other benefits anticipated in the forward-looking statements will be achieved. Important factors, some of which may be beyond the company’s control, that could cause actual results to differ materially from management’s expectations are discussed under the heading “Risk Factors” included in the Company’s Prospectus Supplement dated November 6, 2006 and filed with the Securities and Exchange Commission, which discussion is hereby incorporated by reference. Forward-looking statements speak only as of the date made. The Company assumes no responsibility to update or revise forward-looking statements and cautions listeners and conference attendees not to place undue reliance on any such statements. Forward Looking Statements

Daniel Hendrix • President and Chief Executive Officer Patrick Lynch •Vice President and Chief Financial Officer Management Team

Investment Thesis, Why Interface …?Carpet Tile has reached the “tipping point” in the commercial market as acceptance has increased in ALL segments and Interface is the largest modular player globally … A secular shift is happening. The U.S. and Europe office market has begun to rebound-Indications are that we are in the early days (second year) of the recovery with tremendous pent-up demand, which is creating a robust office market Interface continues to achieve record levels of profitability in it’s worldwide modular businesses despite a modestly recovering office market in the U.S. and Europe Interface is in the early stages of realizing momentum in the Bentley Prince Street and Fabrics businesses sand expectations are for a continued improvement in profitability Interface’s “first mover” status in the emerging markets positions us to benefit from growth in India, China, Eastern Europe, Middle East and South America The marketplace is rewarding our position on sustainability as companies in many industries scramble to become “greener”123456

The Office Market Rebound Continues … 5in ppt 0 2000 4000 6000 8000 10000 12000 14000 16000 80 82 84 86 88 90 92 94 96 98 00 02 04 06 Corporate Office (1990 - 2006) 0 300 600 900 1200 1500 1800 90 92 94 96 98 00 02 04 06- 20%- 10% 0% 10% 20% 30% Offices 50 125 200 275 350 425 80 82 84 86 88 90 92 94 96 98 00 02 04 06 Millions of Square Feet U.S. Office Construction 1980 -2006 05 10 15 20 25 84 86 88 90 92 94 96 98 00 02 04 06 Downtown Suburban U.S. Office Vacancy Rates CB Richard Ellis U.S. Office Vacancy Rates1984 -2006 Source: U.S. Census Bureau, CB Richard Ellis, BIFMA.U.S. Office Furniture Market TTM Shipments 1995 -2007 FU.S. Corporate Profits & Growth 1990 -Present 08F 06F

6Interface Brands • Largest U.S. commercial contract fabrics manufacturer • Market share leader in the panel fabrics market and upholstery market • Received first automotive adoption in the Ford Expo hybrid • Largest commercial carpet manufacturer located on the West Coast -Full-service floorcovering provider • Leading brand at the high-end of the commercial specified broadloom and modular markets • Fastest growth area is in Modular carpet • The most recognized brand in Modular Flooring -Only global manufacturer of carpet tile • Worldwide leader in design and manufacturing of carpet tile -Only global manufacturer of carpet tile • Emerging Markets Focus-China, India, South America, Middle East and Eastern Europe • Launched in 2003 -Modular carpet for the home • Offers modular flooring solutions to the residential and soft commercial markets through catalogs and retail partnerships

Interface Strategic Platforms MODULAR Centric SEGMENTED Market Approach • 74% of sales are Modular • Modular is becoming the flooring of choice (secular shift) • Strong U.S. and European corporate office market • Becoming the standard in Asia • Modular carpet is expanding into other non-office segments • Strong trends in Healthcare, Education Hospitality and Retail • First mover to introduce carpet tile into the home Innovation & Design Leader Unique Global Manufacturing Mode Operating Leverage First Mover in Sustainability • Recognized as the market leader • Leading market positions with pre-eminent brands • Leader in innovation and design • Only global manufacturer of carpet tile -4 continents • Unique make-to-order philosophy • Global reach with local service • Low cost manufacturer drives operating leverage • Ability to increase production without significant investment • High priced debt available for pay-down • Recognized leader in sustainability • Encourages innovative process • Winning business everyday • Sustainability is becoming mainstream

Over the Past Three Years, Interface Has Focused on its Core Modular Businesses … 2006 Portfolio Mix Core Focused 2002 Portfolio Mix Modular Centric 54% 26% 74% 46% Modular Floorcovering Other (Fabrics, Broadloom, Service, Specialty) 99% Commercial 1% Residential 68% Corporate Office 32% Non-Corporate Office 90% Refurbishment 10% New Construction Interface Portfolio (2002) 90% Commercial 10% Residential50% Corporate Office 50% Non-Corporate Office90% Refurbishment 10% New Construction Overall TARGET Portfolio

Modular Centric Why MODULAR … ? “Becoming the Flooring of Choice…” MODULAR Carpet means NO Glue, NO Pad 1 MODULAR Lowers the Cost of Change 2 MODULAR Produces Less Waste 3 MODULAR Means faster Installations 4 MODULAR is Easier to Reconfigure and Maintain 5 MODULAR Means Creative Freedom6

10 Functionality and Design Create a Secular Move to Modular Carpe Modular Centric1970 2005 2000 1995 1990 1985 1980 1975 0 1,000 250 500 100 U.S. Modular Carpet Sales Specified Commercial Market Source: Invista, Carpet and Rug Institute, Catalina Research, Inc., and management estimates. • Preferred interior design element • “Becoming the Flooring of Choice” -Secular shift • Random products merge Design with Function • Celebrating the square •Sustainability Is introduced • Pattern by Tile • Stressed the functionality of Modular Carpet • Exploited the benefits of Modular vs. Broadloom • Limited application and design • Open office plans emerge Secular Shift ($US -Millions) 2006 Pioneering Stage Functionality Stage Liberation of Design “Tipping Point”Proliferation Stage

Modular Centric Corporate Office Segment

Interface Changed “The Game” Driving the Acceptance of Modular Carpet into ALL Segments MARKET SIZECURRENT MODULAR PENETRATION 50% 0% $2B Specified Corporate Office Segment Specified Non-Corporate Office Market $ 800M $ 25B Specified Commercial Soft Floorcovering Market -ALL Segments Total Residential Floorcovering Market TOTAL Floorcovering Market $8BTotal Hard Surface Floorcovering Market $3B $11B $1B $22B Interface U.S. Market Opportunity Expansion Source: Invista, Carpet and Rug Institute, Catalina Research, Inc., and management expectations. Segmented Approach

Corporate Office Non-Corporate Office Modular Carpet is The “Hot Product” for the Commercial Market For The 8thYear in a Row !Modular carpet is at the Tipping Point -Becoming the flooring of choiceSource: 2006 Floor Focus Magazine. 2006 2005 2004 2003 2002 1Carpet Tiles 74% 67% 58% 56% 55% 2 Cork 55% 24% 19% 14% 17% 3 Stone 43% 45% 31% 29% 47% 4 Area Rugs 42% 30% 20% 28% 34% 5 Bamboo 39% 30% 16% 21% 23% 6 Ceramic / Porcelin 38% 39% 31% 33% 41% Rubber 38% 33% 30% 27% 30% 7 Hardwood 34% 31% 24% 17% 30% 8 Linoleum 32% 31% 40% 30% 24% 9 Viny l17% 17% 30% 25% 31% 10 Broadloom 19% 17% 11% 12% 15% 116' Rolls 9% 11% 12% 14% 13% 12 Laminate 7% 19% 21% 10% 17% 1 Nylon 15% 25% 19% 20% 18% 2 Wool 22% 8% 4% 11% 13% Carpet Tile has remained the most often specified product over the last several years, and is growing. Figures reflect the number of designers who are specifying more of the products below. FibersHot Products U.S. Floorcovering Opportunity Specified Commercial MarketSource: Invista, Carpet and Rug Institute, Catalina Research, Inc., BMW Associates and Management estimates. 21% $US 50% 20% $1.1 B $2.2B Segmented Approach Carpet Tile Penetration % $1.7B Opportunity $550M Opportunity

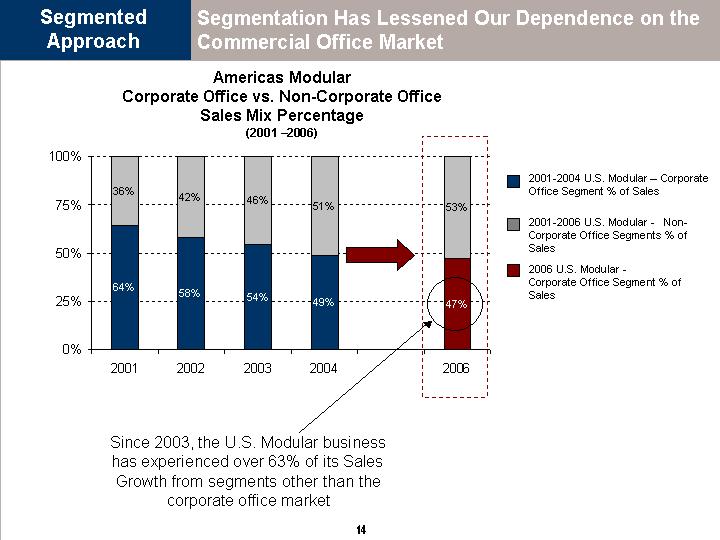

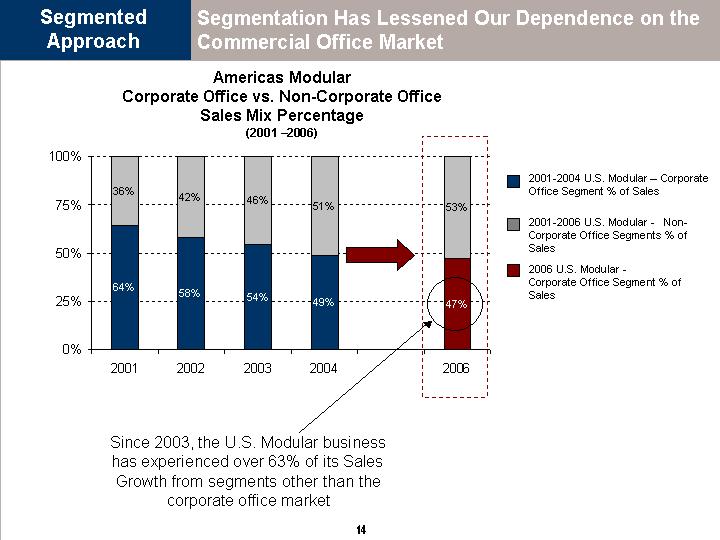

64%58%54%49%47%36%42%46%51%53%0%25%50%75%100%20012002200320042006Segmentation Has Lessened Our Dependence on the Commercial Office MarketAmericas Modular Corporate Office vs. Non-Corporate Office Sales Mix Percentage(2001 -2006)2001-2004 U.S. Modular -Corporate Office Segment % of Sales2006 U.S. Modular -Corporate Office Segment % of SalesSegmented Approach2001-2006 U.S. Modular -Non-Corporate Office Segments % of Sales Since 2003, the U.S. Modular business has experienced over 63% of its Sales Growth from segments other than the corporate office market

Education Segment -$400M+ U.S. OpportunityDorm RoomK-12 EducationSegmented Approach

Segmented Approach Hospitality -$250M+ U.S. OpportunityHotel Monaco -Room and Common Area

Segmented Approach Entertainment Movie Theatre

Segmented Approach Healthcare -$450M+ U.S. OpportunityParker Adventist Hospital and Clarian Healthcare

Segmented Approach Retail -$400M+ U.S. OpportunityIn-Store Retail and Shopping Mall Applications

Segmented Approach Institutional Segment -$250M+ U.S. OpportunityGovernment and Religious Establishments Government Religious Establishments

Specified Commercial"Soft" CommercialOther (Residential)Interface Introduces Modular Into the Home … Segmented ApproachU.S. Specified Commercial and Residential MarketsCarpet Tile Penetration33%<1%$3.3B$10BCarpet Tile Penetration %$12$10$8$6$4$2$0$US B$1B>10% With the introduction of FLOR, Interface has expanded its reach and opportunities into the “soft” commercial and the $10 billion residential markets

Recent AccomplishmentsFLOR is Creating a Category“Modular Carpet for the Home”Segmented Approach•Launched FLOR (residential brand) in Q1 2003•1,100 Lowe’s Stores•5.5 million Catalogs•250+ Target Stores -(2/07)•Martha Stewart Collection (6/07)•Disney Alliance (3/07)•KB Homes -Builder Direct (3/07)•Design Within Reach Catalog2003 -YTD 200652 Week Rolling Order TrendYTD 2007$20mmYE 2003 52 Week Rolling Orders: Weeks 1-52 2003 through YTD 2007

Segmented Approach Modular Goes in the Home …

Segmented Approach FLOR is Expanding its Retail Presence

Interface Continues to be the FIRST in Innovation …1.INVENTEDcarpet tile in Europe -1950s2.PIONEEREDthe modular concept In the U.S. -1970s 3.FIRSTto move away from the monolithic broadloom look for carpet tile4.FIRST to introduce a make-to-order offering 5.FIRST in the industry to recognize the importance of sustainability 6.FIRST to introduce PLA (bio-based) 7.FIRST to introduce “random” modular products with the i2collection8.FIRSTto introduce the modular product into ALL commercial segments9.EARLYadopter in the residential market 10.FIRSTto introduce a “Glueless” installation -TacTilesInterface INNOVATIONInnovation and Design Leader

Innovation and Design Leader …and the Market Leader in Product DESIGN and FASHION

SERVICEQUALITYDESIGNPERFORMANCEVALUE1. INTERFACEFLOR1. BPS (Interface)1. ATLAS1. LEES1. SHAW SHAW CONTRACT2. INTERFACEFLOR2. INTERFACEFLOR2. C&A2. INTERFACEFLOR2. BPS (Interface) LEES3. BPS (Interface) SHAW3. PATCRAFT LEES3. KARASTAN SHAW CONTRACT BPS (Interface)4. LEES3. MASLAND ATLAS MONTEREY3. KARASTAN5. BPS (Interface)4. ATLAS SHAW CONTRACT4. CONSTANTINE ATLAS ATLAS MOHAWK4. DURKAN DURKAN MANNINGTON6. MOHAWK5. MANNINGTON5. MANNINGTON MASLAND MASLAND DURKAN DURKAN MILLIKEN5. PATCRAFT4. MOHAWK J&J6. J&J MONTEREY LEES PATCRAFT C&A INVISION C&A C&A MILLIKEN MASLAND MILLIKEN6. PATCRAFT MILLIKEN INTERFACEFLOR7. PATCRAFT MASLAND INVISION MONTEREY MONTEREY6. MANNINGTON BLUE RIDGE KARASTANFAVORITE CARPET MANUFACTURERS… by Establishing Brands That Deliver Our Promise of High End Functionality, Quality and DesignU.S Market -2006 Floor Focus MagazineInnovation and Design LeaderArchitects and Designers rated Interface First or Second ALL categories of the 2006 Floor Focus magazine surveyRated the “Best Overall Experience” for the 3rdYear in a Row

Global Make-to-Order Model Interface Maintains a Strong Competitive Advantage Through its Made-to-Order Philosophy 1.Increases speed to market2.Promotes innovation3.Offers unique custom product capabilities4.Supports a constant flow ofnew products5.Offers sales force the opportunity to visit the customer with new products6.Decreases lead timeto customers7.Increases inventory turnsThe Made-to-Order ADVANTAGE Americas ModularAsia Pacific ModularEurope ModularInterface Modular Businesses Percentage Make-to-Order Actual vs. TARGETInterface is the ONLY company with a “make-to-order” approach to the market75% TARGET Level

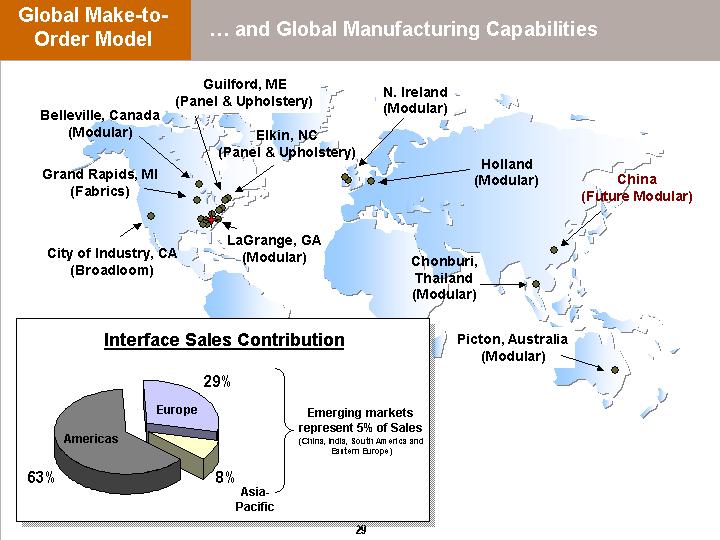

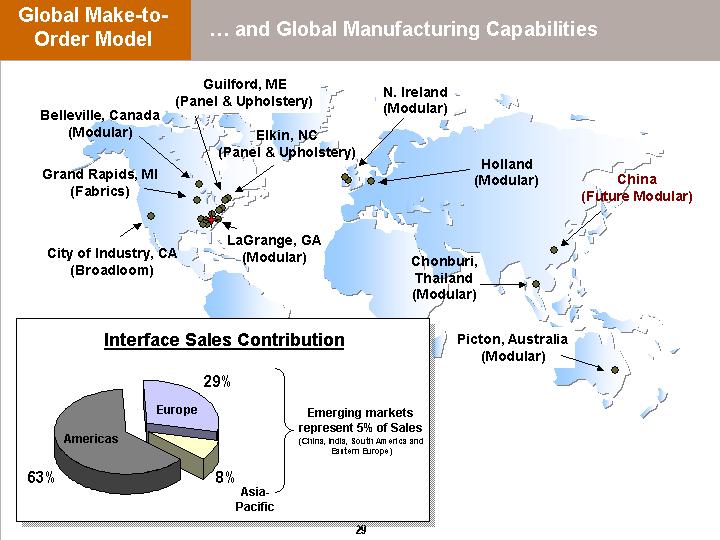

Global Make-to-Order Model … and Global Manufacturing Capabilities Guilford, ME(Panel & Upholstery)LaGrange, GA(Modular)Picton, Australia(Modular)Belleville, Canada(Modular)Chonburi, Thailand(Modular)City of Industry, CA(Broadloom)Holland(Modular)China(Future Modular)Elkin, NC(Panel & Upholstery)Grand Rapids, MI(Fabrics)N. Ireland(Modular)63%8%29%AmericasEuropeAsia-PacificInterface Sales ContributionEmerging markets represent 5% of Sales(China, India, South America and Eastern Europe)

IMPACT to Interface•Random Carpet Tile Patent•Terratex Products•Cool Blue•ReEntry Process•Landfill Gas Project•Recycled Backing Technology (GlasBacRE)•Cool CarpetInterface Continues to be Recognized as the Leader in Sustainability Zero Footprint by the Year 2020 is the Goal …First Mover in Sustainability TotalCorp.Gov'tVol.Inst.Serv.West. EUU.S.A/POther1Interface 14 12 15 17 12 18 52 31672Toyota12187151081114973BP11127911141481844Dupont 9 16 10 4 5 8 4 13 11 45 General Electric 8 9 10 11 5 6 3 12 5 7 6 Shell 8 12 12 6 7 3 8 7 5 18 7 Novo Nordisk7706614162208Unilever7721178134549Alcan567626190710IKEA4229516320SectorRegion2006 Globescan Survey The Globescan Survey of Sustainability Experts is a syndicated service for organizations that are looking to keep abreast of the sustainable development trends affecting their mandate. Begun the 1994, the reports are published twice a year. Each Report is based on the strategic insights and predictions provided by a selected panel of experts representing all sectors and regions.

We Are Executing on Our GROWTH Strategy Maintain CompetitivePosition in Core Markets•Invest in capacity additions to keep up with growth in core markets•Over $30 million spent over last eighteen months to increase capacity Expand Production into Market Segments•Segmentation strategy in Americas is well underway•Europe and Asia segmentation is progressing nicely Grow Emerging Markets•Interface “first mover” status in the emerging markets•Significant growth potential in China, India, Eastern Europe and South America regions•Global manufacturing platform creates a competitive advantage After several years of focus on portfolio and plant rationalization,Interface is poised for accelerated growth by leading the modular acceptance on a global platform

Interface, Inc. Financials

33 $24.9 $60.7 $82.0 $72.4 $31.4 $6.2 $22.4 $20.7 6.9% 8.3% 9.1% 6.3% 4.9% $0 $20 $40 $60 $80 $100200220032004200520064.0% 6.0% 8.0% 10.0% $223 $223 $265 $305 $340 31.6% 30.9% 30.1% 29.1% 29.9% $0 $100 $200 $300 $4002002200320042005200620.0% 25.0% 30.0% 35.0% 40.0% 45.0% 50.0% $176 $186 $204 $223 $24223.6% 24.3% 23.2% 22.6% 22.5% $0 $100 $200 $3002002200320042005200610.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% $745 $767 $881 $986 $1,076 $0 $200 $400 $600 $800 $1,000 $1,20020022003200420052006Interface Net Sales Revenue 2002 -200610% CAGRInterface Financial Results(mm)(1)(mm)Interface SG&A Totals and SG&A % of Net SalesInterface Gross Profit and Gross Profit % of Net SalesInterface Operating Income2002 -2006(1) 2006 figures include ONLY one quarter of input from EuropeanFabrics division (Cambourne LTD), which was divested on April 21, 2006.(1)33% TARGET Gross Profit % 21% TARGET SG&A % (mm)(mm)Operating Income % Gross Profit % SGA % Reported Operating IncomeRestructuring Charges ( $3.3m in 2006)Impairment of GoodwillLoss on Disposal ( $1.7m) $47.3 $37.6 $60.7 $98.1 $82.0(1)(1)

34 $162 $129 $117 $127 $135 $144020406080100120140160180200120022003200420052006-15% -10% -5% 0% 5% 10% 15% $115 $110 $119 $125 $13802040608010012014016020022003200420052006-10% -5% 0% 5% 10% 15% $442 $473 $563 $646 $7640100200300400500600700800900200220032004200520060% 5% 10% 15% 20% Segment Financial PerformanceWorldwide Modular(1)TARGET OperatingIncome Percentage at 8% % Operating Profit MarginTARGET OperatingIncome Percentage at 15% $mm% Operating Profit Margin(1) Figures adjusted to exclude European Fabrics division (Cambourne LTD), which was divested in April 2006. $mmTARGET OperatingIncome Percentage at 5% $mm% Operating Profit Margin15% CAGRBentley Prince StreetFabrics

The Interface OpportunitySecular shift to carpet tileEarly stages of cyclical upturn in office market in United States and EuropePositioned to take advantage of emerging markets: China, India, Eastern Europe, Middle East and South AmericaStrong operating leverageUnique global make-to-order manufacturing capabilityInterface is the largest modular carpet manufacturer on a globalbasis by more than a factor of two123456