- D Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-3ASR Filing

Dominion Energy (D) S-3ASRAutomatic shelf registration

Filed: 19 Dec 14, 12:00am

Exhibit 25.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY

UNDER THE TRUST INDENTURE ACT OF 1939

OF A CORPORATION DESIGNATED TO ACT AS TRUSTEE

| ¨ | CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE PURSUANT TO SECTION 305(b)(2) |

DEUTSCHE BANK TRUST COMPANY AMERICAS

(formerly BANKERS TRUST COMPANY)

(Exact name of trustee as specified in its charter)

| NEW YORK | 13-4941247 | |

(Jurisdiction of Incorporation or organization if not a U.S. national bank) | (I.R.S. Employer Identification no.) | |

60 WALL STREET NEW YORK, NEW YORK | 10005 | |

| (Address of principal executive offices) | (Zip Code) | |

Deutsche Bank Trust Company Americas

Attention: Lynne Malina

Legal Department

60 Wall Street, 37th Floor

New York, New York 10005

(212) 250 – 0677

(Name, address and telephone number of agent for service)

Dominion Resources, Inc.

(Exact name of obligor as specified in its charter)

| Virginia | 54-1229715 | |

(State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

120 Tredegar Street Richmond, Virginia | 23219 | |

| (Address of principal executive offices) | (Zip Code) | |

Senior Debt Securities

(Title of the Indenture securities)

Item 1. General Information.

Furnish the following information as to the trustee.

| (a) | Name and address of each examining or supervising authority to which it is subject. |

Name | Address | |

| Federal Reserve Bank (2nd District) | New York, NY | |

| Federal Deposit Insurance Corporation | Washington, D.C. | |

| New York State Banking Department | Albany, NY |

| (b) | Whether it is authorized to exercise corporate trust powers. |

Yes.

Item 2. Affiliations with Obligor.

If the obligor is an affiliate of the Trustee, describe each such affiliation.

None.

Item 3.-15. Not Applicable

Item 16. List of Exhibits.

| Exhibit 1 - | Restated Organization Certificate of Bankers Trust Company dated August 6, 1998, Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated September 25, 1998, Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated December 16, 1998, and Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated February 27, 2002 - Incorporated herein by reference to Exhibit 1 filed with Form T-1 Statement, Registration No. 333-157637-01. | |

| Exhibit 2 - | Certificate of Authority to commence business - Incorporated herein by reference to Exhibit 2 filed with Form T-1 Statement, Registration No. 333-157637-01. | |

| Exhibit 3 - | Authorization of the Trustee to exercise corporate trust powers - Incorporated herein by reference to Exhibit 3 filed with FormT-1 Statement, Registration No. 333-157637-01. | |

| Exhibit 4 - | Existing By-Laws of Deutsche Bank Trust Company Americas, as amended on April 15, 2002 business - Incorporated herein by reference to Exhibit 4 filed with Form T-1 Statement, Registration No.333-157637-01. | |

| Exhibit 5 - | Not applicable. | |

| Exhibit 6 - | Consent of Bankers Trust Company required by Section 321(b) of the Act. - business - Incorporated herein by reference to Exhibit 6 filed with Form T-1 Statement, Registration No. 333-157637-01. | |

| Exhibit 7 - | The latest report of condition of Deutsche Bank Trust Company Americas dated as of September 30, 2014. Copy attached. | |

| Exhibit 8 - | Not Applicable. | |

| Exhibit 9 - | Not Applicable. | |

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the trustee, Deutsche Bank Trust Company Americas, a corporation organized and existing under the laws of the State of New York, has duly caused this statement of eligibility to be signed on its behalf by the undersigned, thereunto duly authorized, all in The City of New York, and State of New York, on this 17th day of December, 2014.

DEUTSCHE BANK TRUST COMPANY AMERICAS | ||||||||

| By: | /s/ CAROL NG | |||||||

| CAROL NG | ||||||||

| VICE PRESIDENT | ||||||||

DEUTSCHE BANK TRUST COMPANY AMERICAS | ||||||

Legal Tide of Bank | ||||||

NEW YORK | FFIEC 031 | |||||

city | Page 16 of 79 | |||||

NY | 10005 | RC-1 | ||||

State | Zip Code | |||||

FDIC Certificate Number: 00623 | ||||||

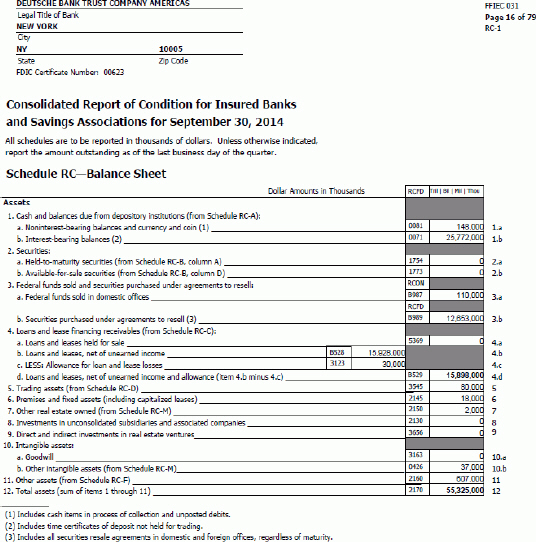

Consolidated Report of Condition for Insured Banks and Savings Associations for September 30, 2014

All schedules are to be reported in thousands of dollars. Unless otherwise indicated, report the amount outstanding as of the last business day of the quarter.

Schedule RC—Balance Sheet

Dollar Amounts in Thousands | RCFD | Trtl | Ell | Ml | Tticu | ||||||||||||||||||

Assets | ||||||||||||||||||||

1. Cash and balances due from depository institutions (from Schedule RC-A): |

| |||||||||||||||||||

a. Noninterest-bea’inq balances and currency and coin (1) |

|

| 0081 |

|

| 148.000 |

|

| 1.a |

| ||||||||||

b. Interest-bearing balances (2) |

|

| 0071 |

|

| 25.772.000 |

|

| 1.b |

| ||||||||||

2. Securities: | ||||||||||||||||||||

a. Held-to-maturity securities (from Schedule RC-B, column A) |

|

| 1754 |

|

| 2.a |

| |||||||||||||

b. Available-for-sale securities (from Schedule RC-B, column D) |

|

| 1773 |

|

| 2.b |

| |||||||||||||

3. Federal funds sold and securities purchased under agreements to resell: |

| RCON |

| |||||||||||||||||

a. Federal funds sold in domestic offices |

|

| B967 |

|

| 110.000 |

|

| 3.a |

| ||||||||||

| RCFD |

| ||||||||||||||||||

b. Securities purchased under agreements to resell (3) |

|

| B989 |

|

| 12.653.000 |

|

| 3.b |

| ||||||||||

4. Loans and lease financing receivables (from Schedule RC-C): a. Loans and leases held for sale |

| 5369 |

|

| 0 |

|

| 4.a |

| |||||||||||

b. Loans and leases, net of unearned income |

| B528 |

|

| 15.028.000 |

|

| 4.b |

| |||||||||||

c. LESS: Allowance for loan and lease losses |

| 3123 |

|

| 30.000 |

|

| 4.c |

| |||||||||||

d. Loans and leases, net of unearned income and allowance (item 4.b minus 4.c) |

| B529 |

|

| 15.898.000 |

|

| 4.d |

| |||||||||||

5. Trading assets (from Schedule RC-D) |

| 3545 |

|

| 80.000 |

|

| S |

| |||||||||||

6. Premises and fixed assets (including capitalized leases) |

| 2145 |

|

| 18.000 |

|

| 6 |

| |||||||||||

7. Other- real estate owned (from Schedule RC-M) |

| 2150 |

|

| 2.000 |

|

| 7 |

| |||||||||||

8. Investments in unconsolidated subsidiaries and associated companies |

| 2130 |

|

| 0 |

|

| 8 |

| |||||||||||

9. Direct and indirect investments in real estate ventures |

| 3656 |

|

| 0 |

|

| 9 |

| |||||||||||

10. Intangible assets: | ||||||||||||||||||||

a. Goodwill |

| 3163 |

|

| 0 |

|

| 10.a |

| |||||||||||

b. Other intangible assets (from Schedule RC-M) |

| 0426 |

|

| 37.000 |

|

| 10.b |

| |||||||||||

11. Other assets (from Schedule RC-F) |

| 2160 |

|

| 607.000 |

|

| 11 |

| |||||||||||

12. Total assets (sum of items 1 through 11) |

| 2170 |

|

| 55.325.000 |

|

| 12 |

| |||||||||||

(1) |

| Includes cash items in process of collection and unposted debits. |

(2) |

| Includes time certificates of deposit not held for trading. |

(3) |

| Includes all securities resale agreements in domestic and foreign offices, regardless of maturity. |

DEUTSCHE BANK TRUST COMPANY AMERICAS FIEC 03i

Legal Tide of Bank Page 16a of 79

FDIC Certificate Number: 00623 RC-la

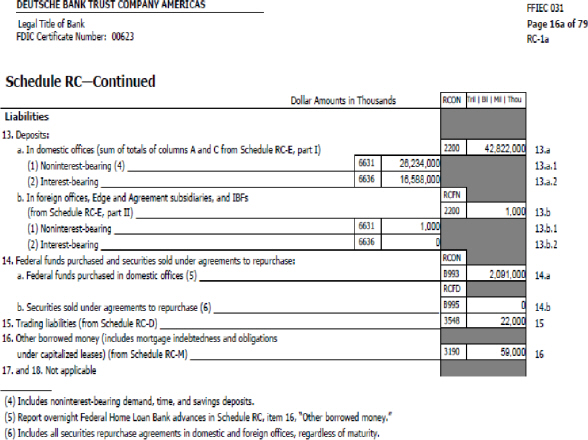

Schedule RC—Continued

Dollar Amounts in

Thousands

RCON

Iril | Ell | Ml | m-cu

13.a

13.d,l

13.a,2

13,b

Liabilities

13. Deposits:

a. In domestic offices (sum of totals of columns A and C from Schedule RC-E,- pat I)

2200

42.822,000

(1) Noninterest-bearing (4)

6631

26,234,000

(2) Interest-bearing

6636

16,588,000

b. In foreign offices, Edge and Agreement subsidiaries, and IBFs (from Schedule RC-E, pat n)

RCFN

2200

1,000

(1) Noninterest-bearing

6631

1,000

13.b.l

(2) Interest-bearing

6636

0

13.b,2

14, Federal funds purchased and securities sold under agreements to repurchase:

RCON

a, Federal funds purchased in domestic offices (5)

B993

2.091,000

14.a

RCFD

b, Securities sold under agreements to repurchase (6)

B995

0

14.b

15, Trading liabilities (from Schedule RC-D)

3546

22,000

15

16, Other borrowed money (includes mortgage ndebtedness and obligationsunder’ capitalized leases) (from Schedule RC-M)

3190

59,000

16

17. and 18. Not applicable

(4) Includes noninterest-bearing demand, time, and savings deposits,

(5} Report overnight Federal Home Loan Bank advances in Schedule RC, item 16, “Other borrowed money.”

(6) Includes all securities repurchase agreements in domestic and foreign offices,- regardless of maturity,

DEUTSCHE BANK TRUST COMPANY AMERICAS

FFIEC 031 Page 17 of 79

RC-2

Legal Tide of Bank

RCON

MM / DO

8678

N/A

M.2

FDIC Certificate Number: 00623

Dollar Amounts in Thousands

RCFD

Trll | Bll | Ml | TTicu

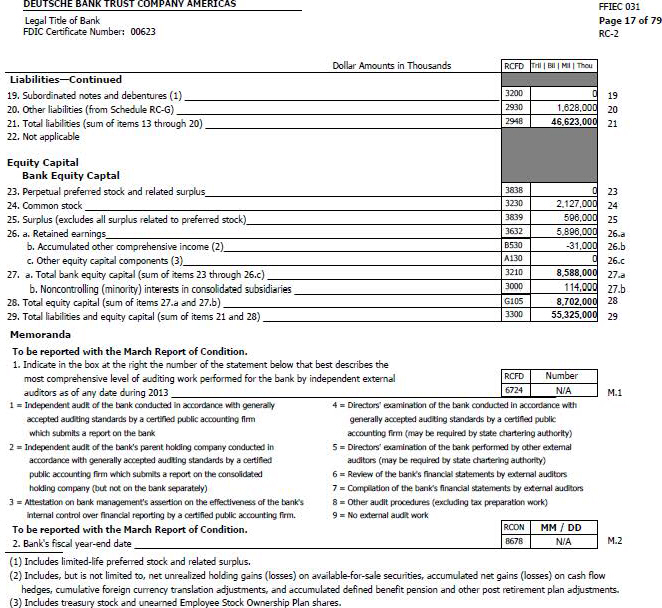

Liabilities—Continued

19. Subordinated notes and debentures (1)

3200

19

20. Other liabilities (from Schedule RC-G)

29301628.030

20

21. Total liabilities (sum of items 13 through 20)

2948

46.623.00C

21

22. Not applicable

Equity Capital

Bank Equity Capital

23. Perpetual preferred stock and related surplus

3838

a

23

24. Common stock

3230

2.127.00C

24

25. Surplus (excludes all surplus related to preferred stock)

3839

596.00C

25

26. a. Retained earnings

3632

5.896.00C

26.a

b. Accumulated other comprehensive income (2)

B530

-31.00C

26. b

c. Other equity Capital components (3)

A130

C

26.c

3210

8.588.000

27-a

b. Noncontrolling (minority) interests in consolidated subsidiaries

3000

114.0QC

27.b

28. Total equity capital (sum of items 27.a and 27.b)

G105

8.702.000

28

29. Total liabilities and equity capital (sum of items 21 and 28)

3300

55.325.000

29

MemorandaTo be reported with the March Report of Condition.1. Indicate in the box at the right the number of the statement below that best describes themost comprehensive level of auditing work performed for the bank by independent external

RCFD

Number

auditors as of any date during 2013

6724

N/A

M.1

= Directors’ examination of the bank conducted in accordance with

Generally accepted auditing standards by a certified public accounting firm (may be required by state chartering authority)

= Directors’ examination of the bank performed by other external

Auditors (may be required by state chartering authority)

? Review of the bank’s finance! statements by external auditors

= Compilation of the bank’s financial Statements by external auditors

= Other audit procedures (excluding tax preparation work)

9*No external audit work

To be reported with the March Report of Condition.

2. Bank’s fiscal year-end date

RCON

MM / DD

8678

N/A

(1) Includes limited-life preferred stock and related surplus.

(2) Includes, but is not limited to, net unrealized holding gains (losses) on available-for-sale securities, accumulated net gains (losses) on cash flow hedges, cumulative foreign currency translation adjustments, and accumulated defined benefit pension and other post retirement plan adjustments.

(3) Includes treasury stock and unearned Employee Stock Ownership Plan shares.