Yellow Corporation Third Quarter 2021 Earnings Conference Call EX 99.2

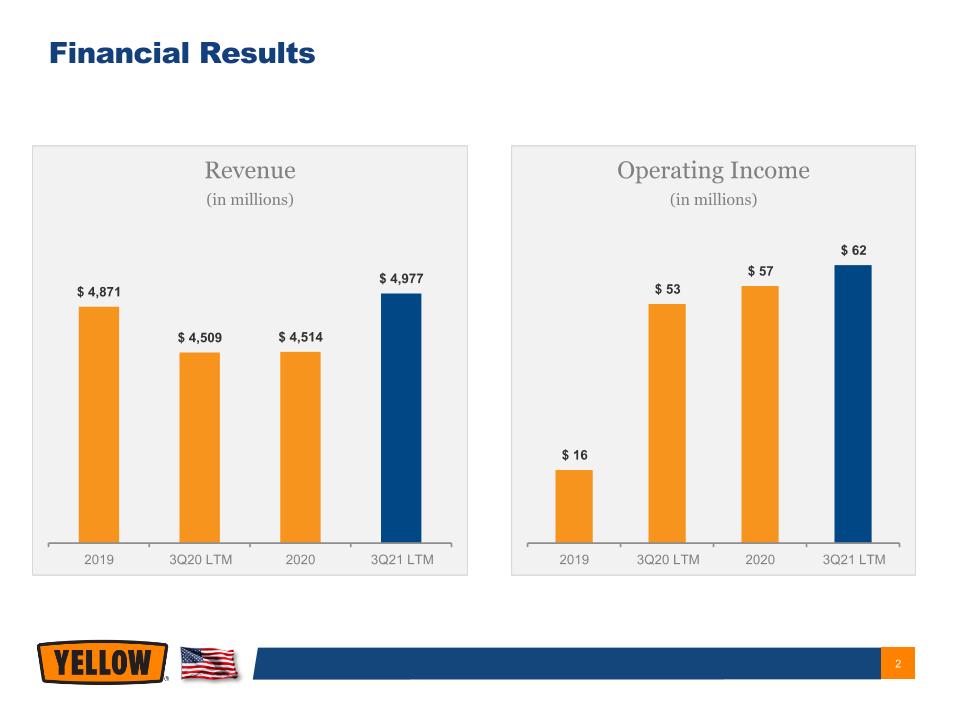

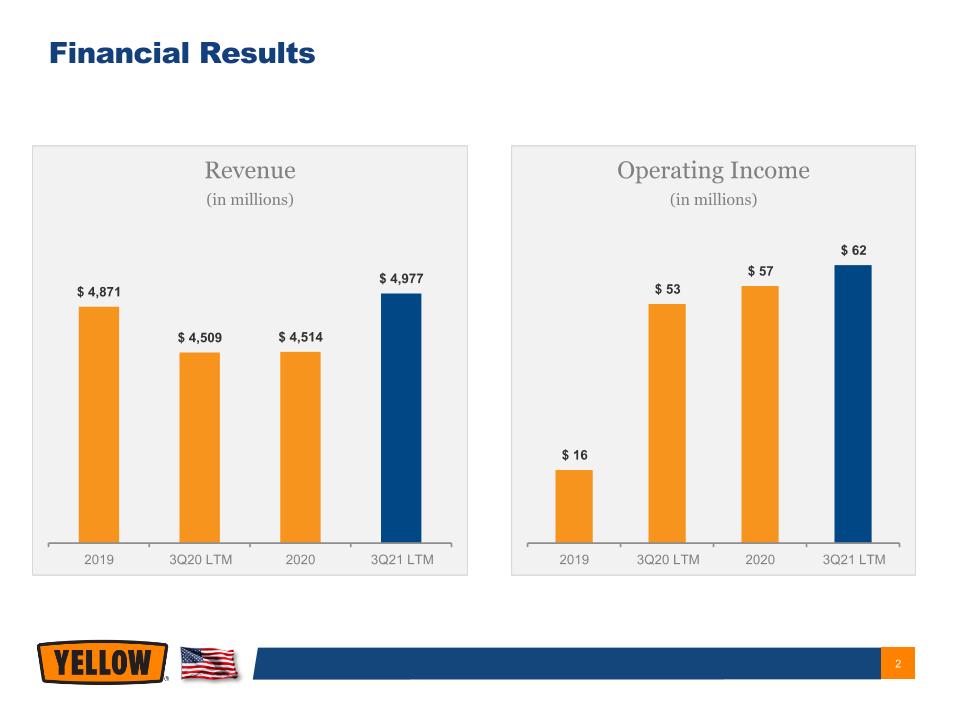

Financial Results

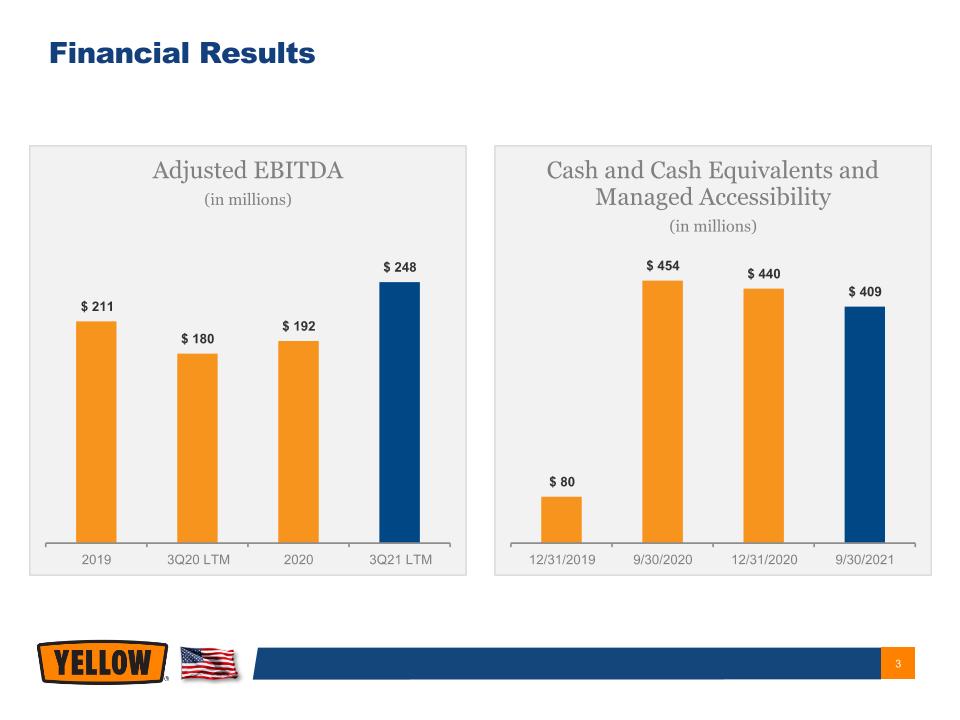

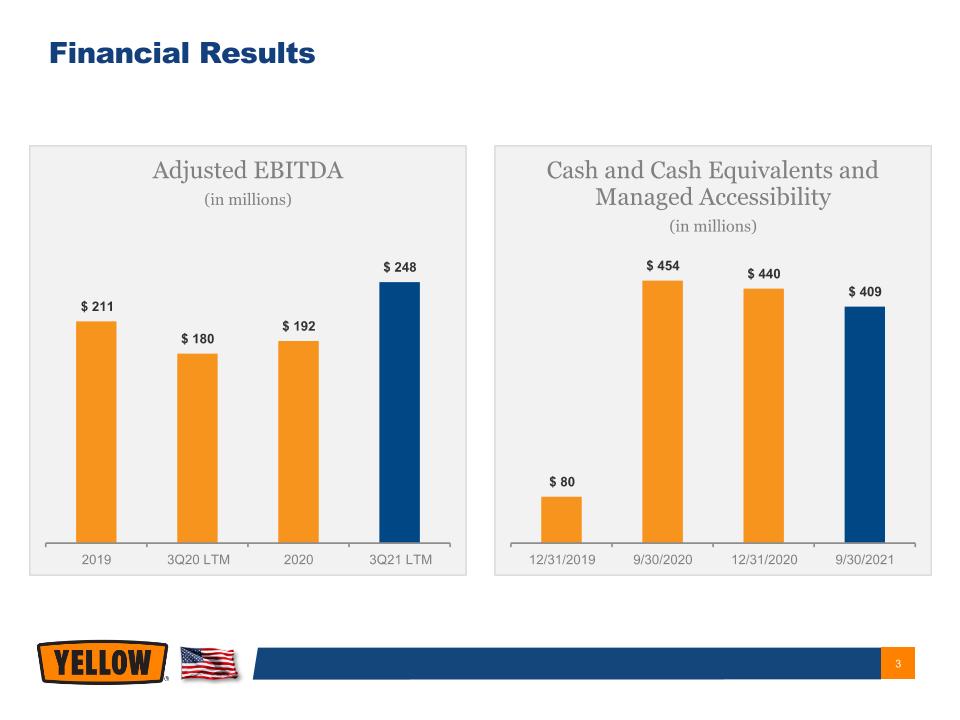

Financial Results

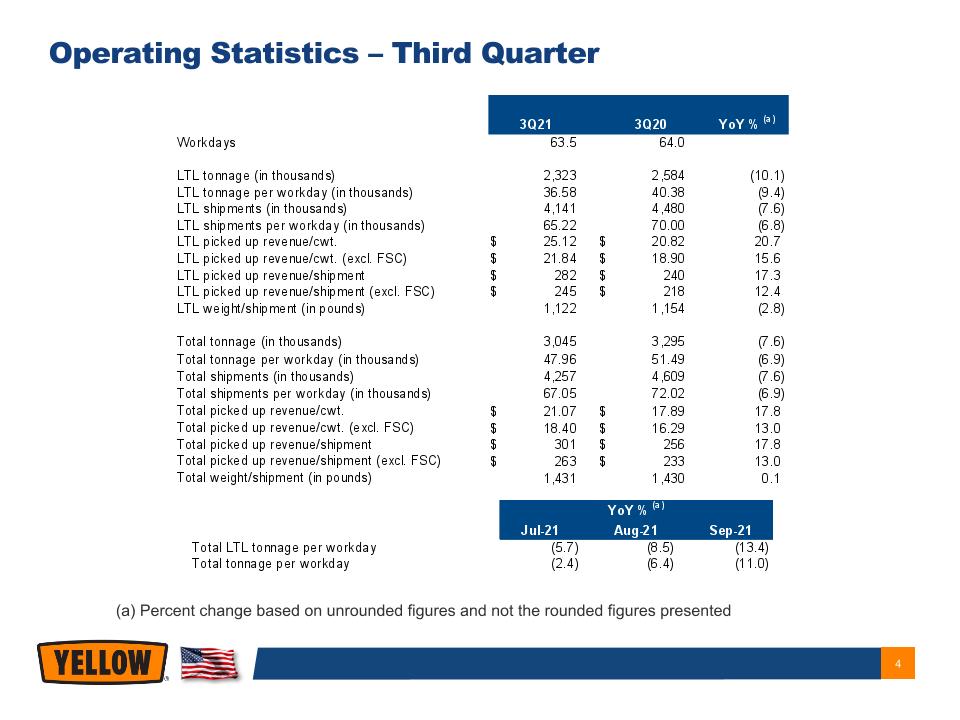

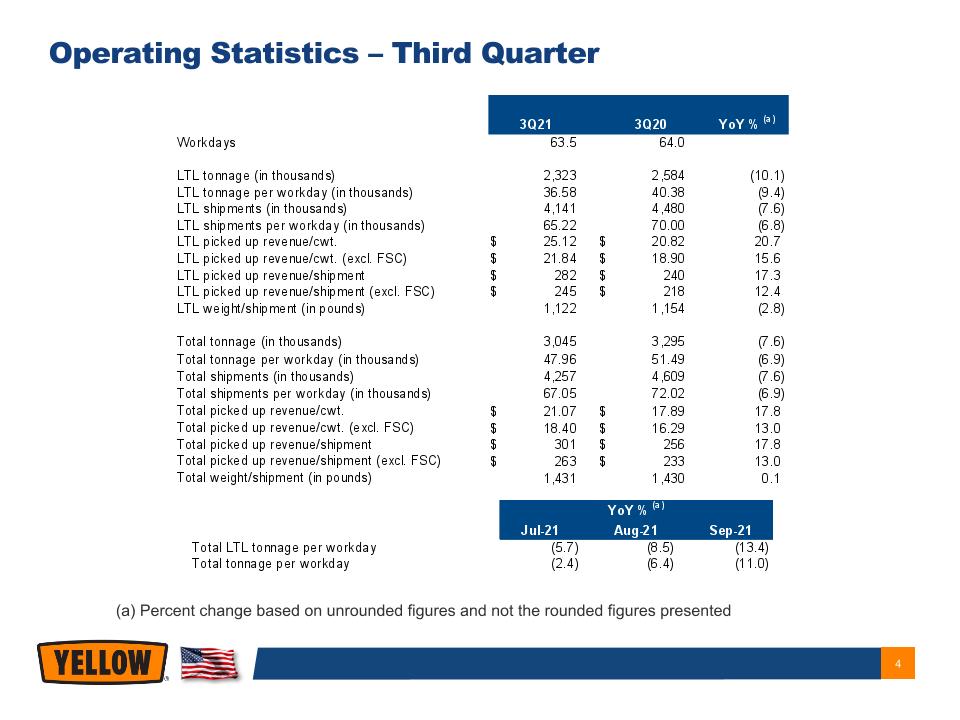

(a) Percent change based on unrounded figures and not the rounded figures presented Operating Statistics – Third Quarter

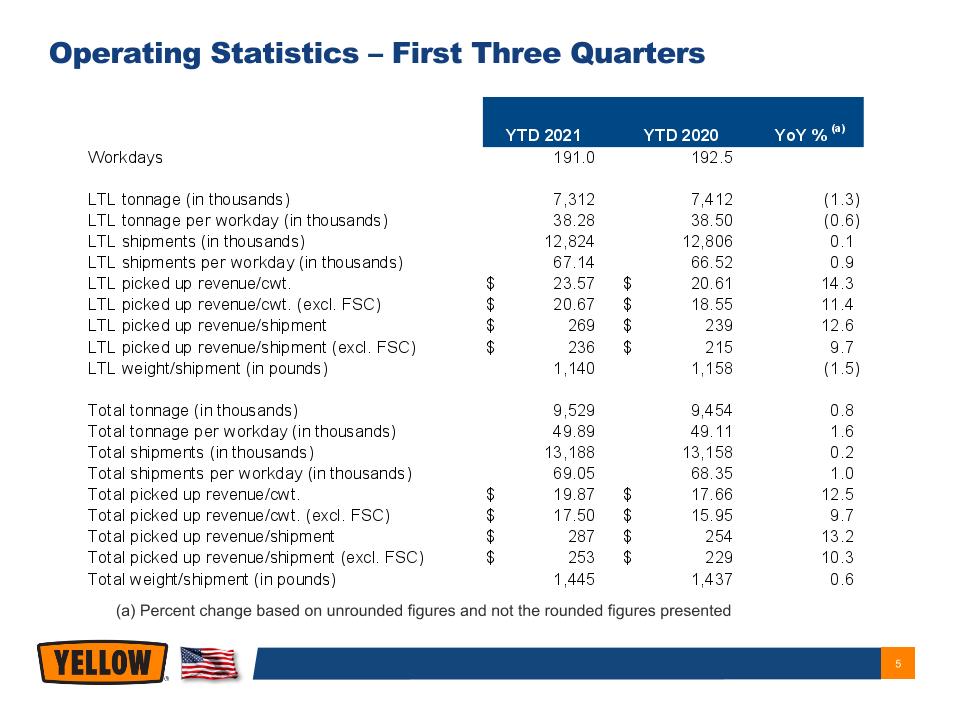

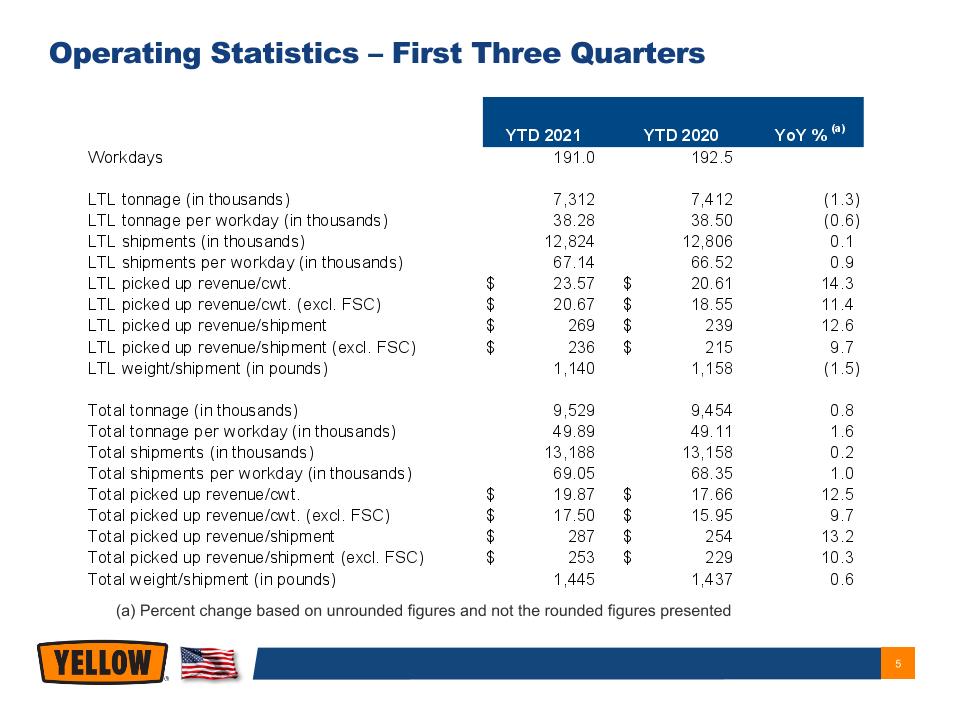

(a) Percent change based on unrounded figures and not the rounded figures presented Operating Statistics – First Three Quarters

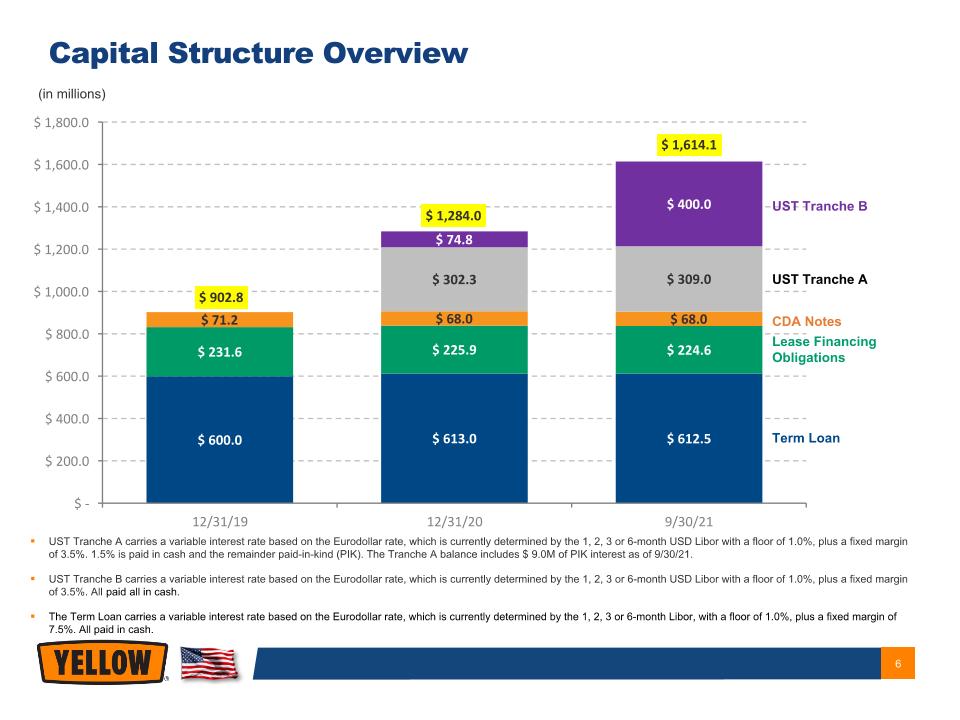

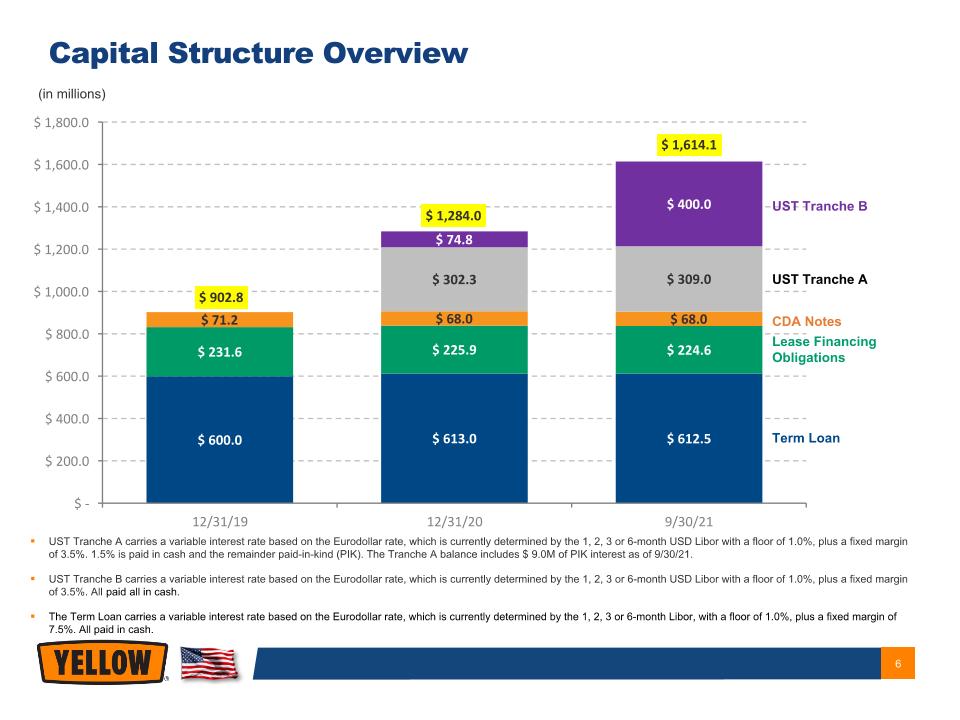

Term Loan Lease Financing Obligations CDA Notes UST Tranche A UST Tranche B (in millions) UST Tranche A carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month USD Libor with a floor of 1.0%, plus a fixed margin of 3.5%. 1.5% is paid in cash and the remainder paid-in-kind (PIK). The Tranche A balance includes $9.0M of PIK interest as of 9/30/21. UST Tranche B carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month USD Libor with a floor of 1.0%, plus a fixed margin of 3.5%. All paid all in cash. The Term Loan carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month Libor, with a floor of 1.0%, plus a fixed margin of 7.5%. All paid in cash. Capital Structure Overview

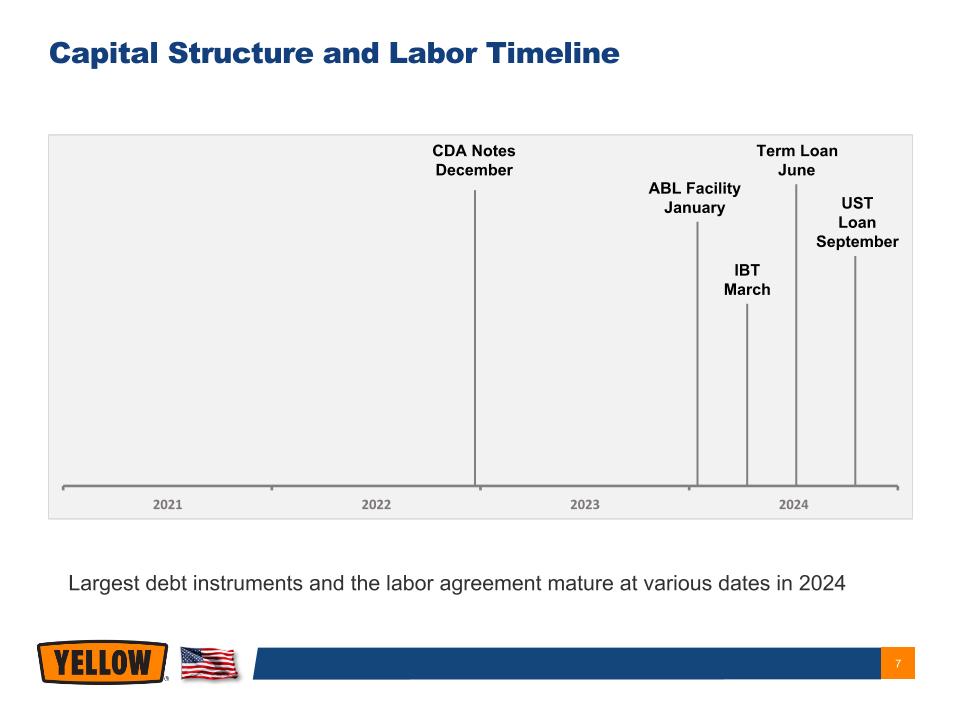

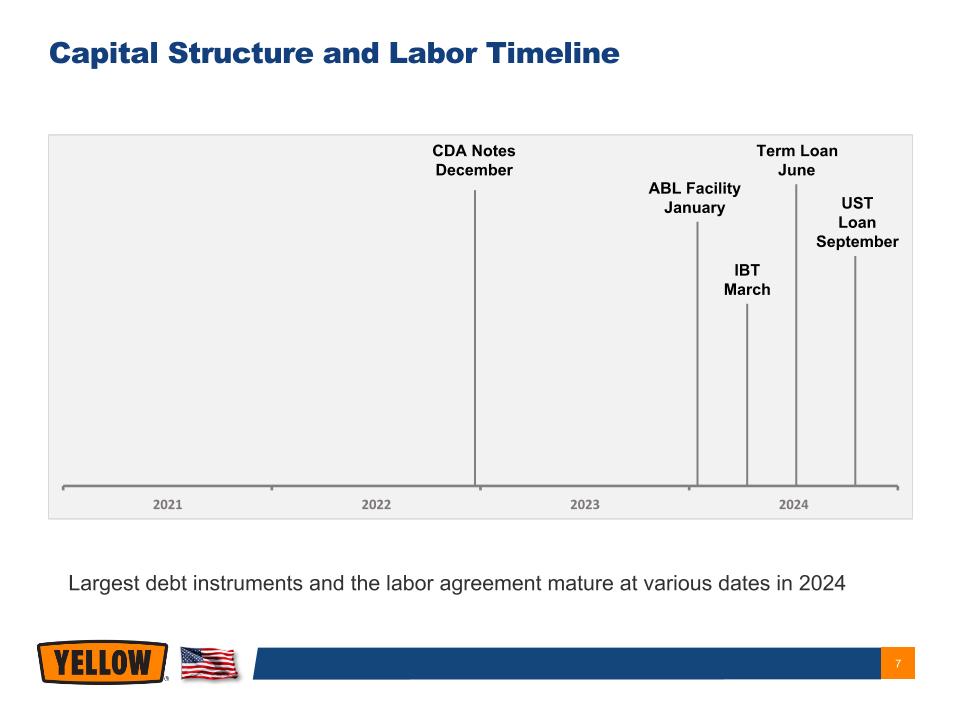

Largest debt instruments and the labor agreement mature at various dates in 2024 IBT March ABL Facility January Term Loan June CDA Notes December UST Loan�September Capital Structure and Labor Timeline

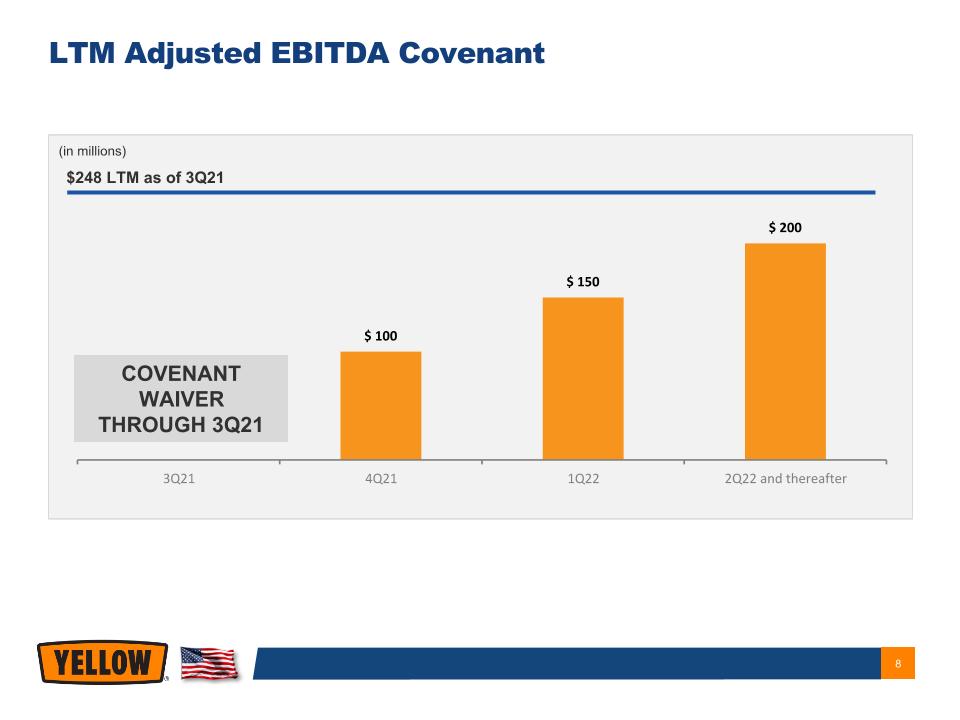

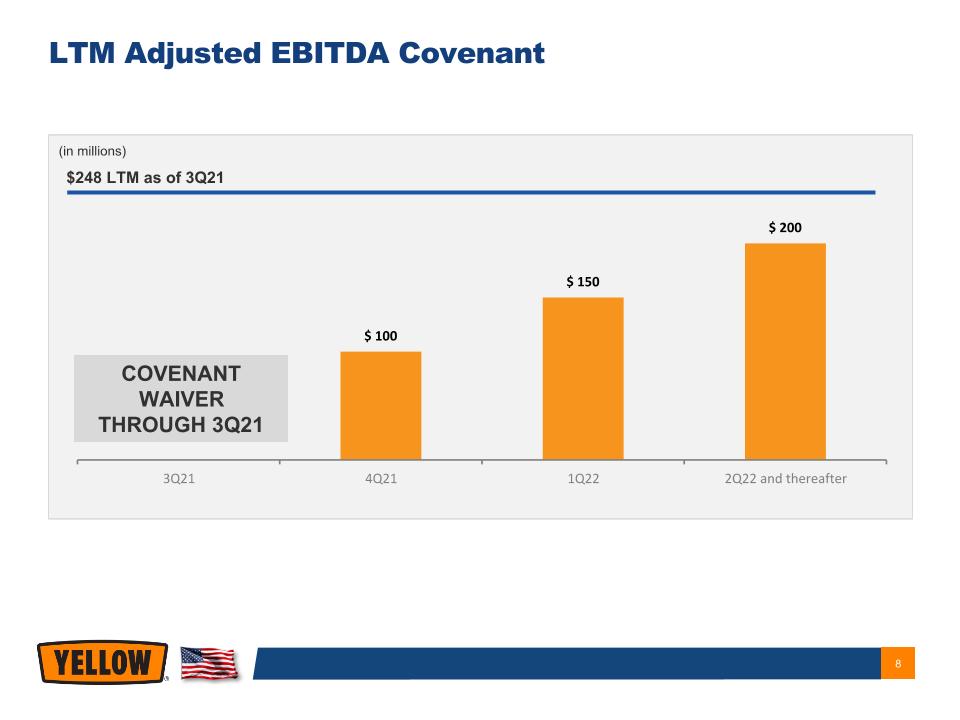

(in millions) LTM Adjusted EBITDA Covenant $248 LTM as of 3Q21 COVENANT WAIVER THROUGH 3Q21

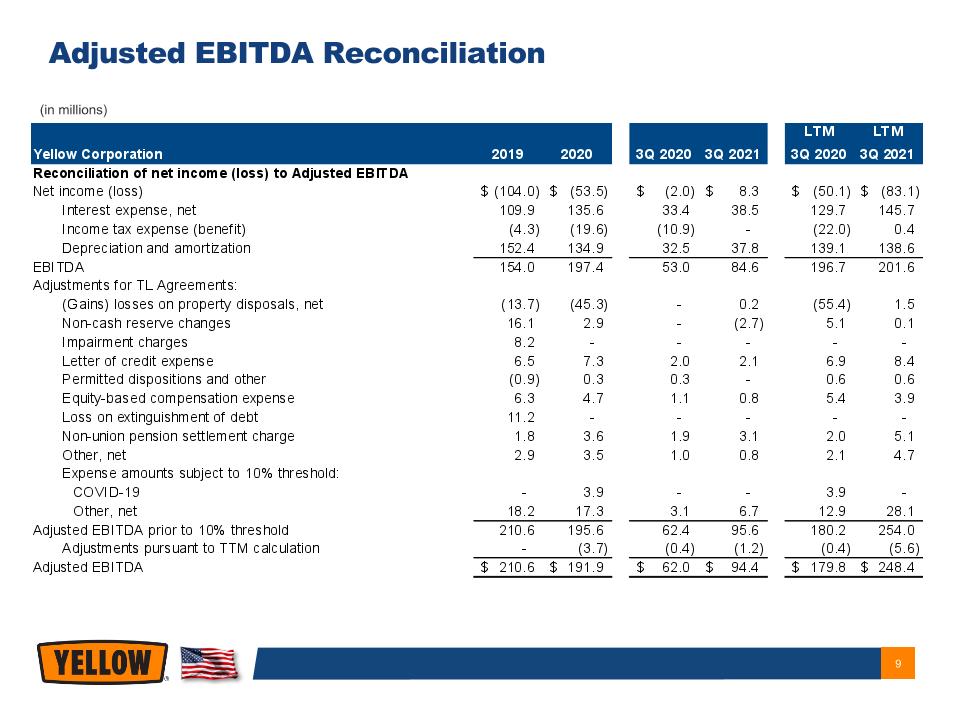

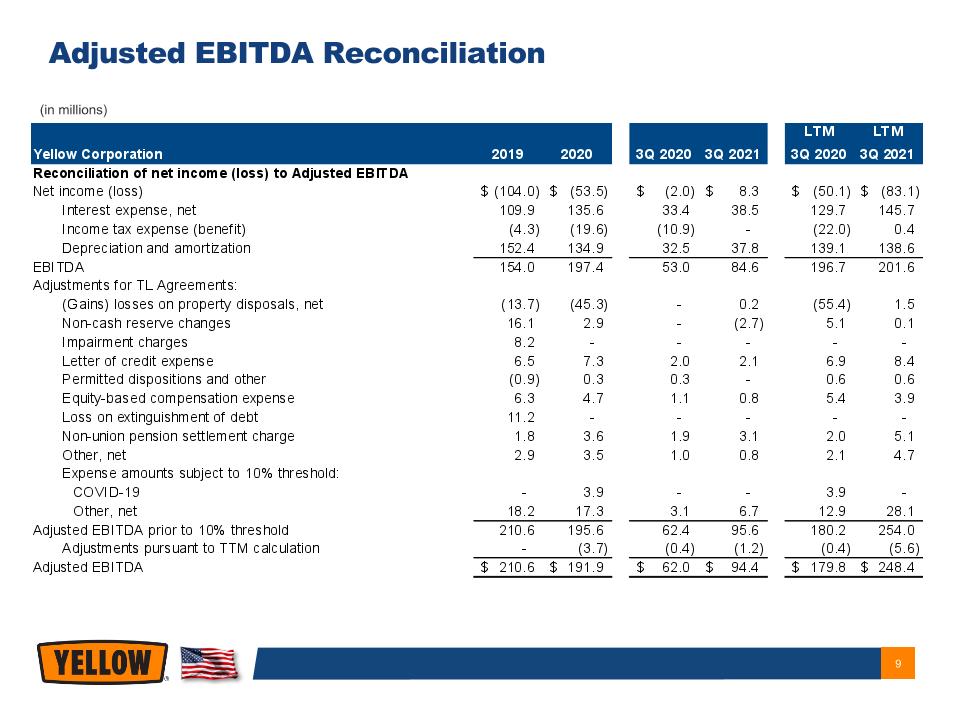

(in millions) Adjusted EBITDA Reconciliation