Yellow Corporation Third Quarter 2022 Earnings Conference Call EX 99.2

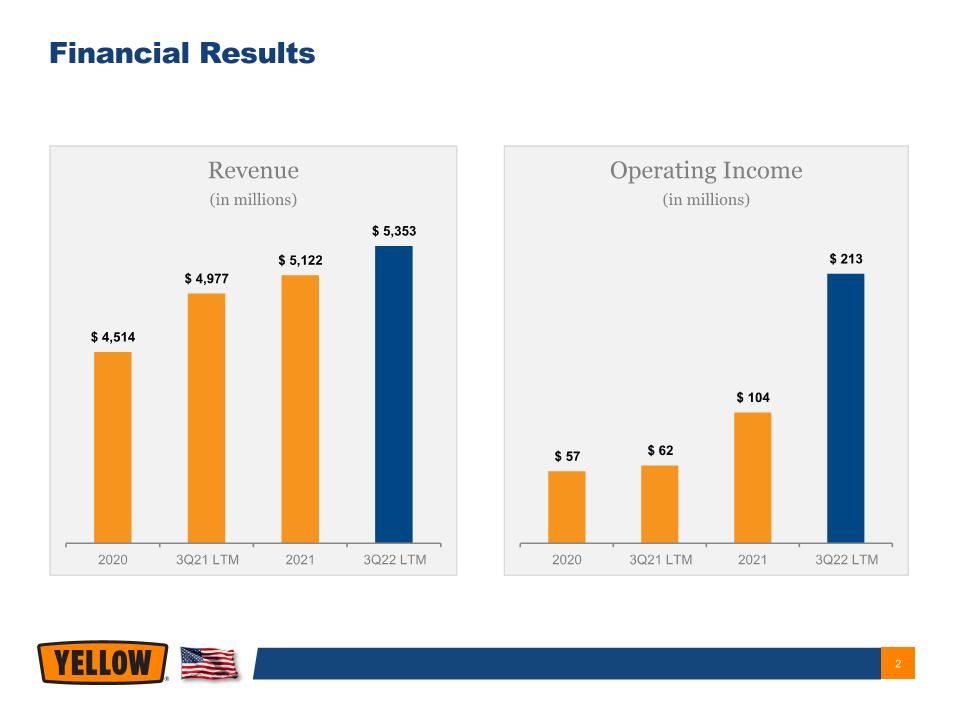

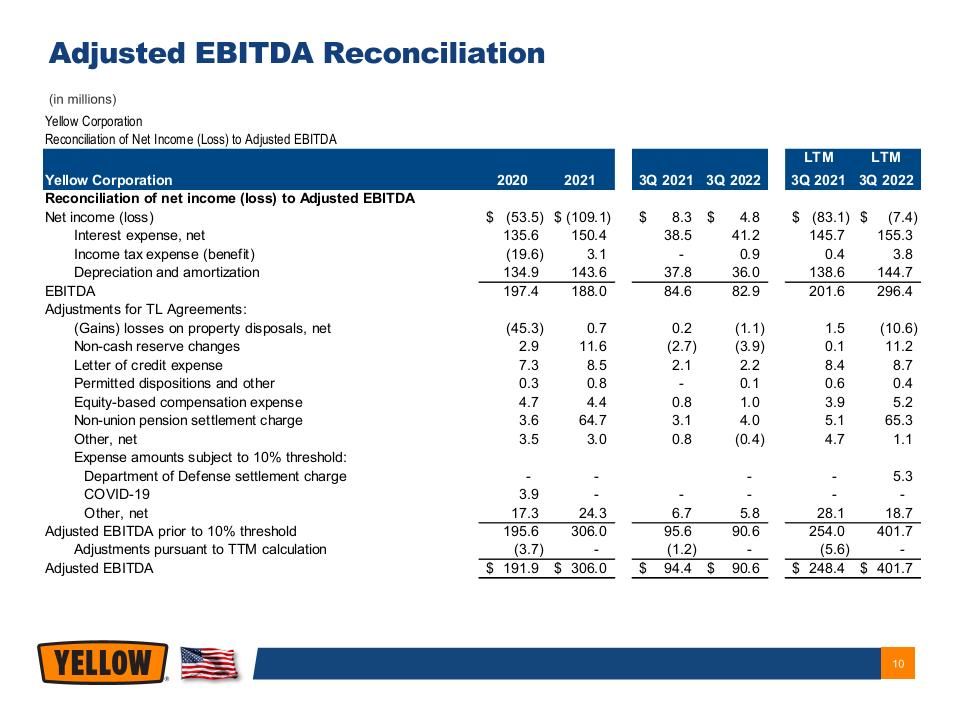

Financial Results

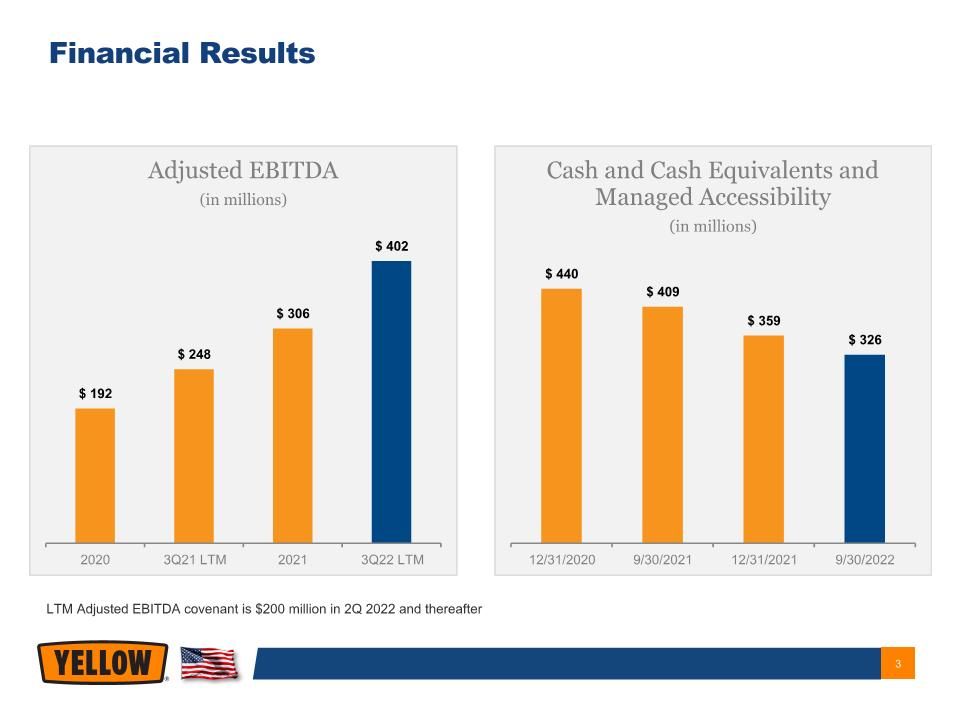

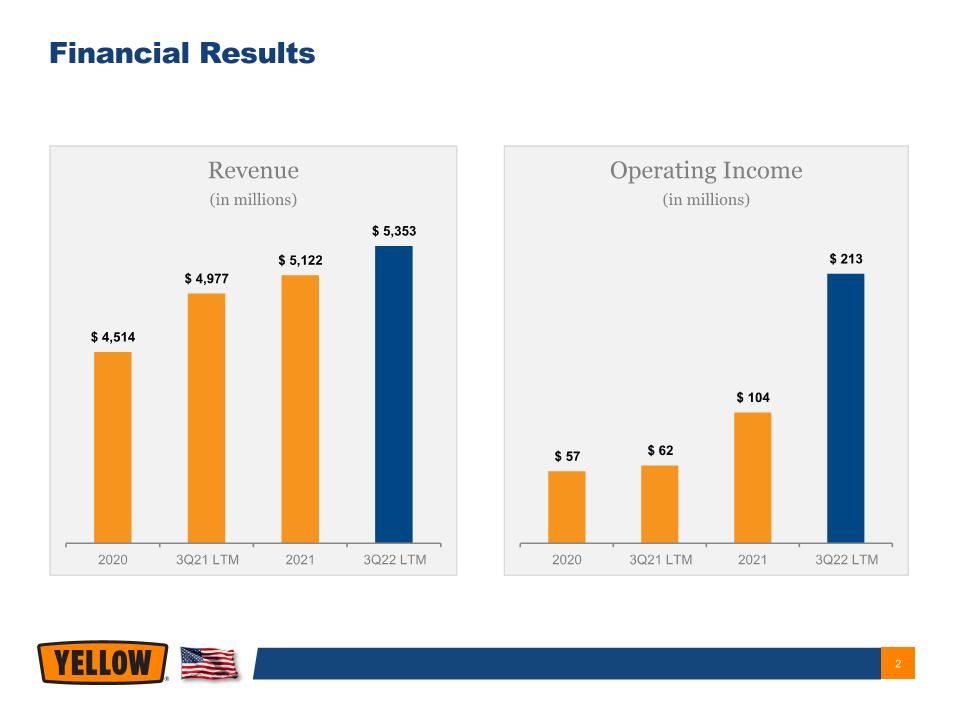

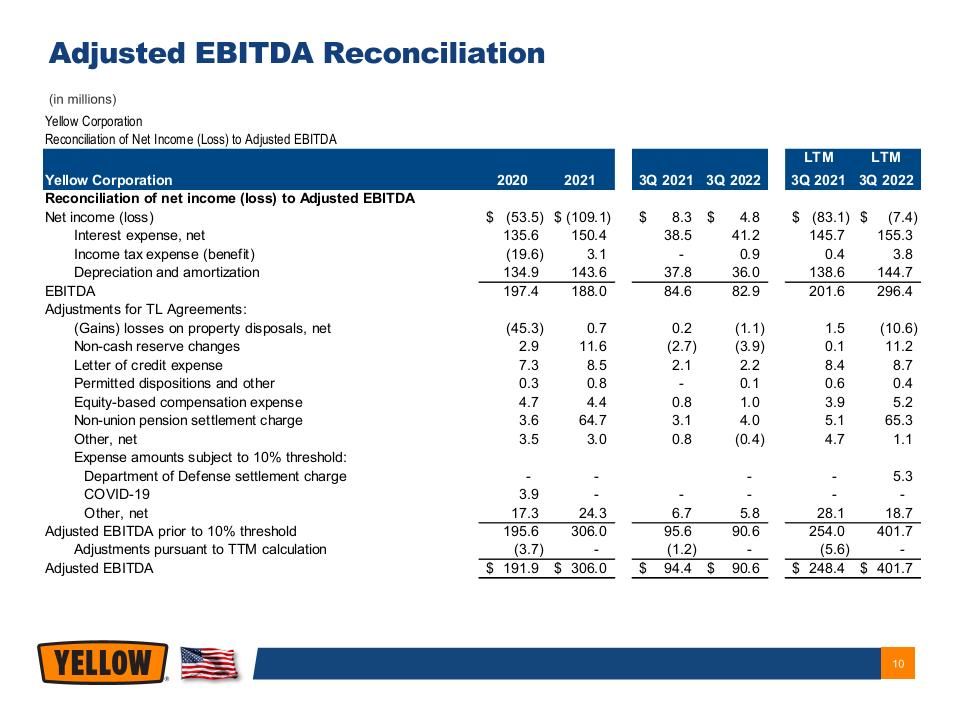

Financial Results LTM Adjusted EBITDA covenant is $200 million in 2Q 2022 and thereafter

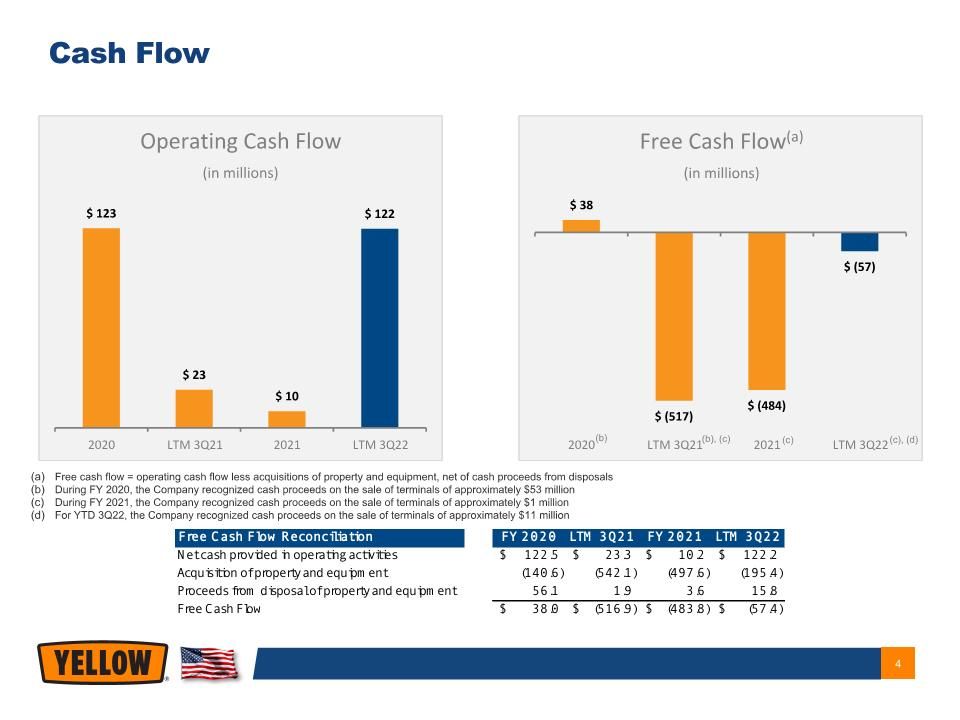

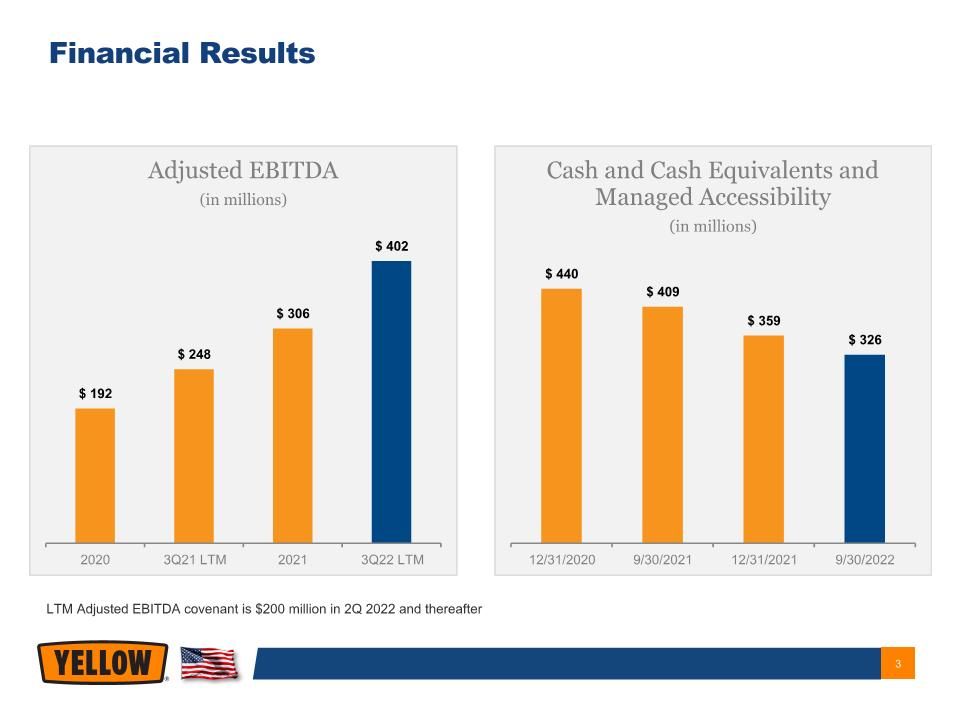

(b) (c) Free cash flow = operating cash flow less acquisitions of property and equipment, net of cash proceeds from disposals During FY 2020, the Company recognized cash proceeds on the sale of terminals of approximately $53 million During FY 2021, the Company recognized cash proceeds on the sale of terminals of approximately $1 million For YTD 3Q22, the Company recognized cash proceeds on the sale of terminals of approximately $11 million Cash Flow (b), (c) (c), (d)

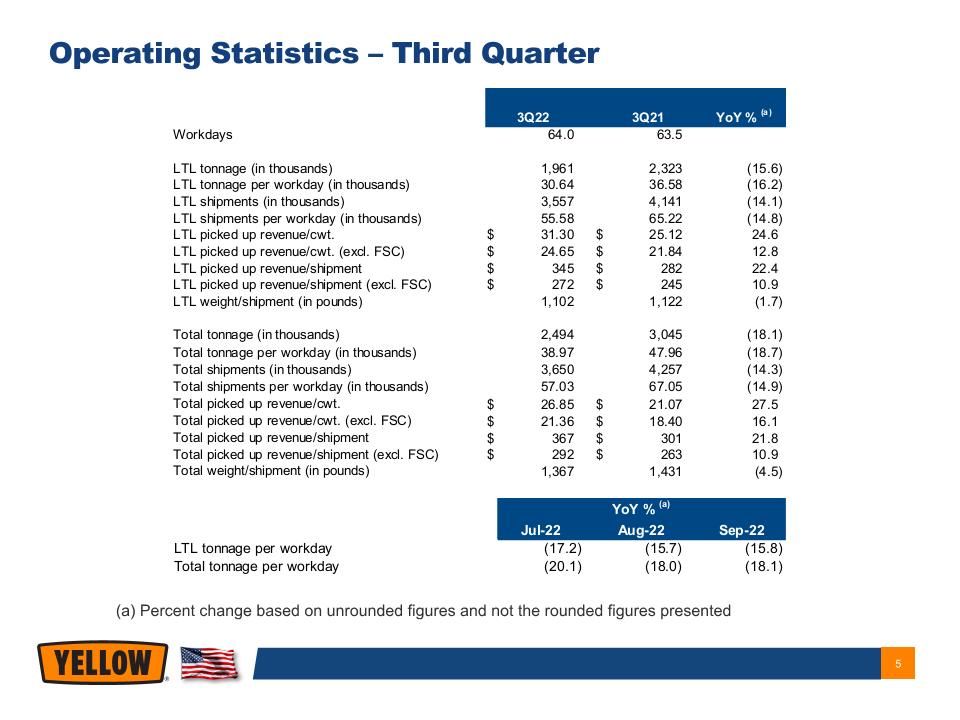

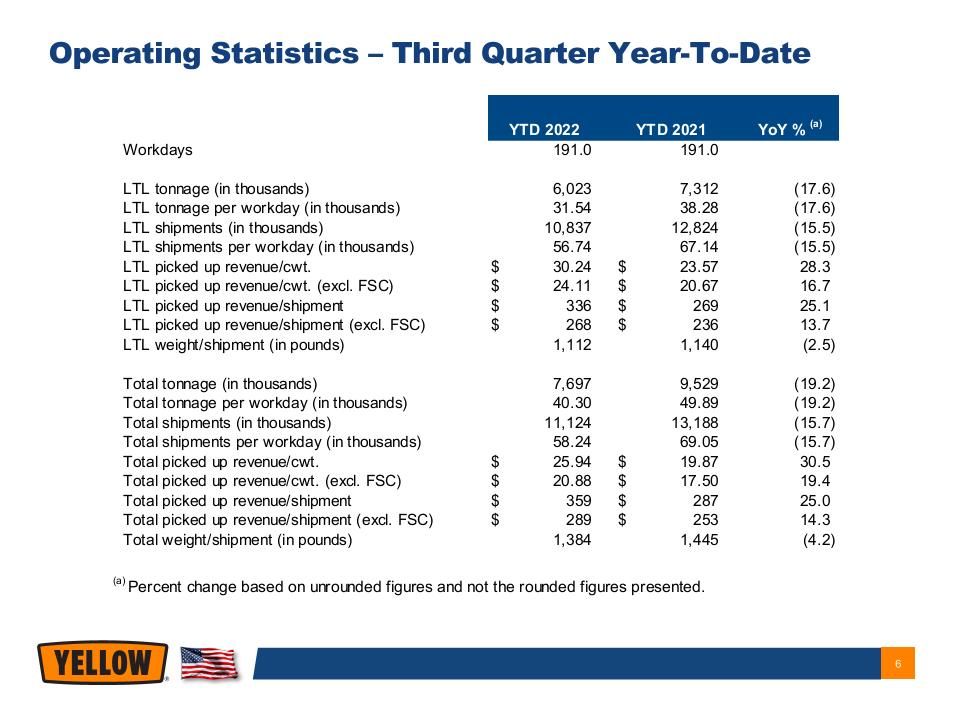

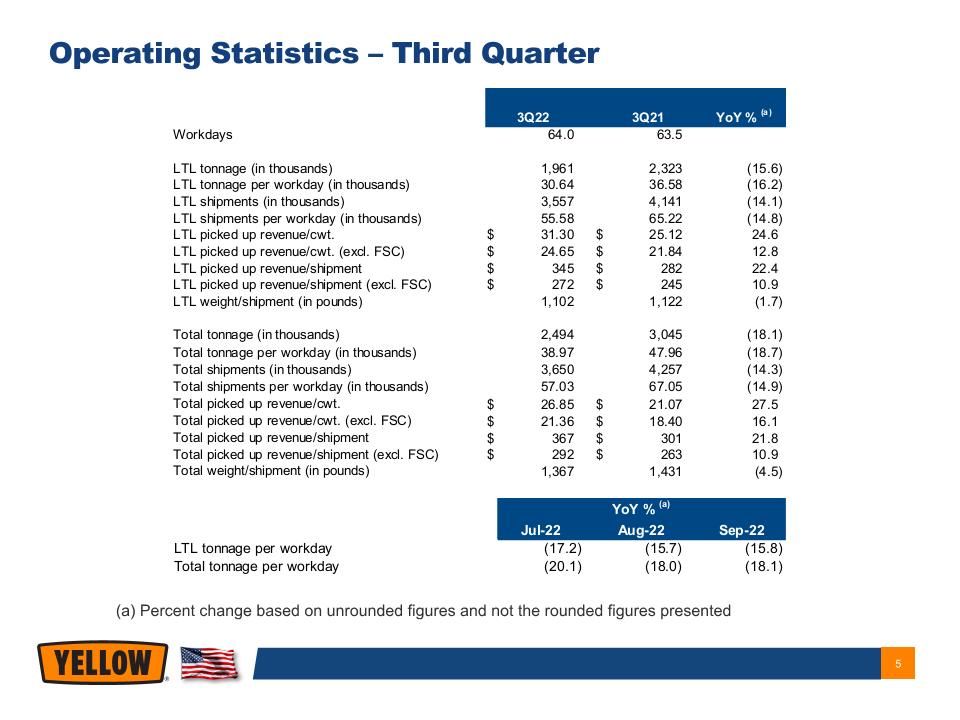

(a) Percent change based on unrounded figures and not the rounded figures presented Operating Statistics – Third Quarter

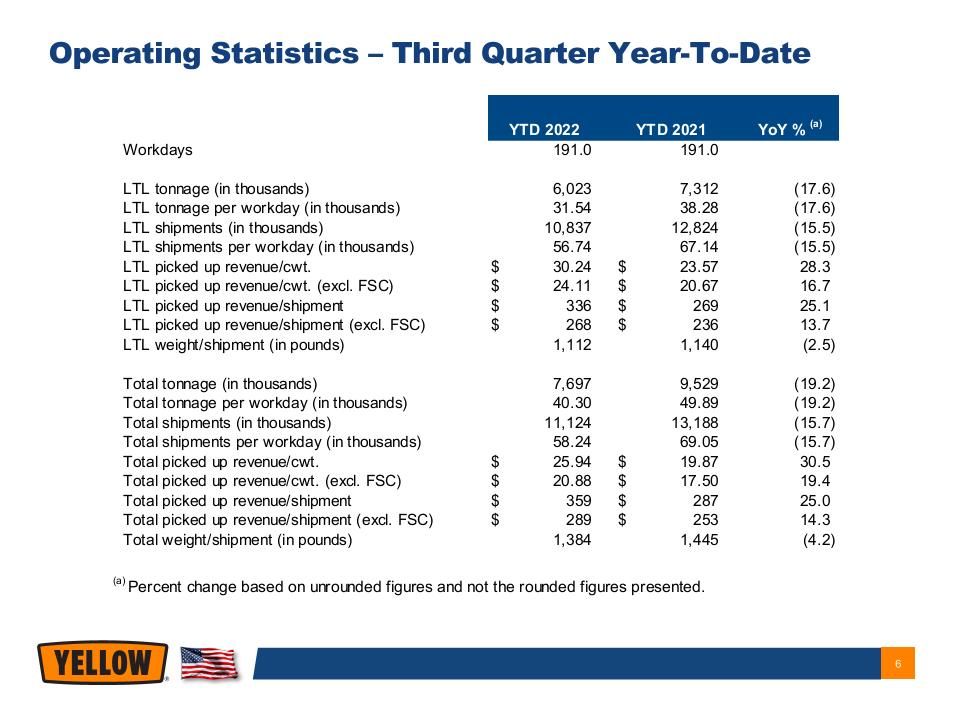

Operating Statistics – Third Quarter Year-To-Date

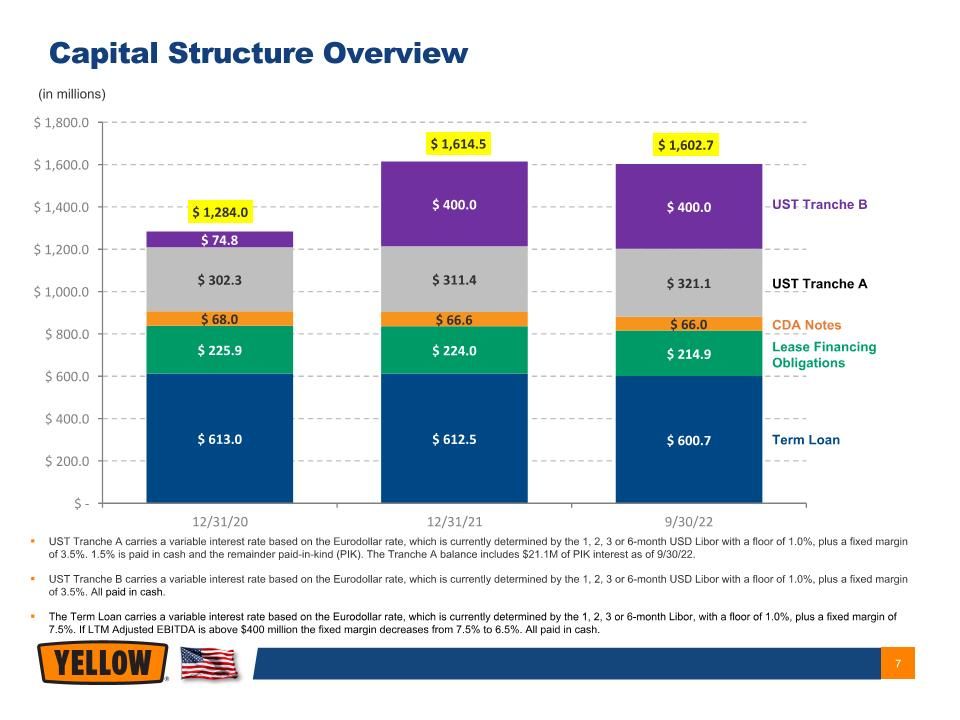

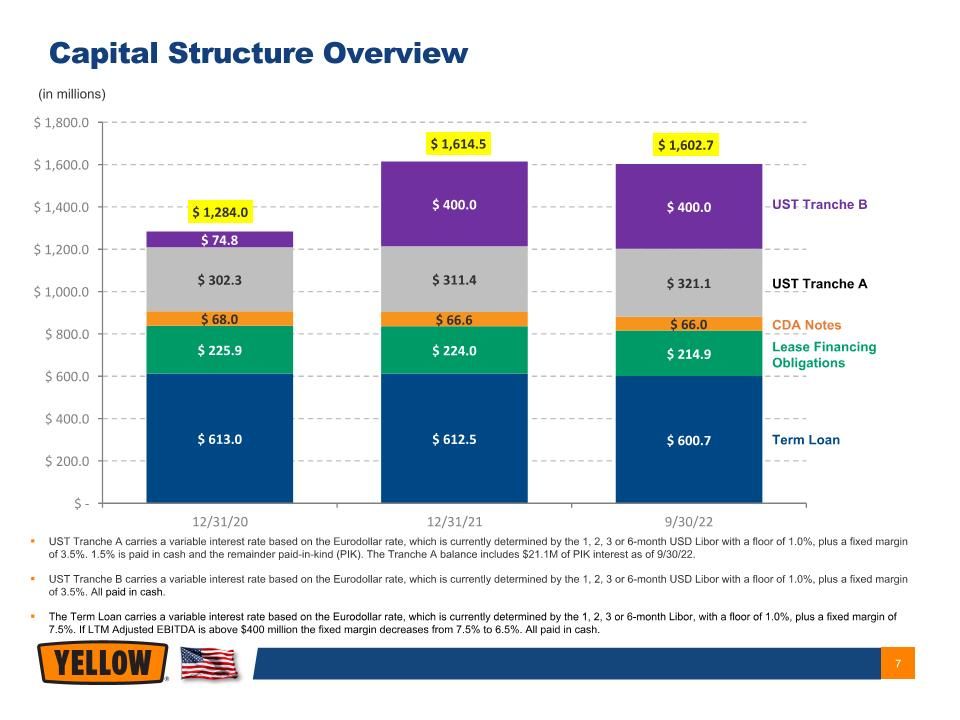

Term Loan Lease Financing Obligations CDA Notes UST Tranche A UST Tranche B (in millions) UST Tranche A carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month USD Libor with a floor of 1.0%, plus a fixed margin of 3.5%. 1.5% is paid in cash and the remainder paid-in-kind (PIK). The Tranche A balance includes $21.1M of PIK interest as of 9/30/22. UST Tranche B carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month USD Libor with a floor of 1.0%, plus a fixed margin of 3.5%. All paid in cash. The Term Loan carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month Libor, with a floor of 1.0%, plus a fixed margin of 7.5%. If LTM Adjusted EBITDA is above $400 million the fixed margin decreases from 7.5% to 6.5%. All paid in cash. Capital Structure Overview

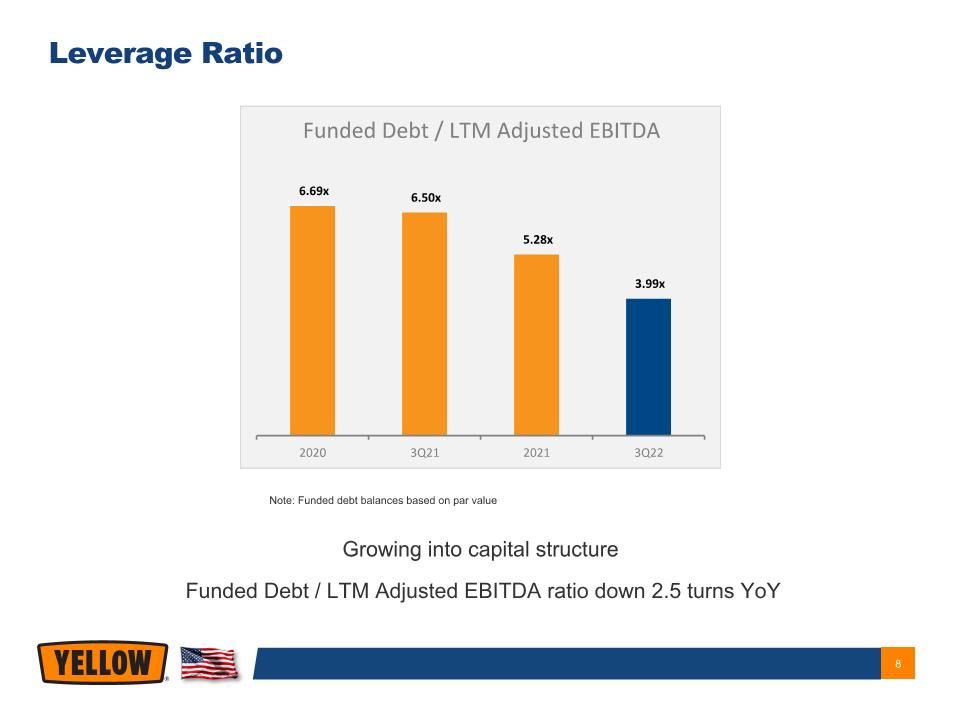

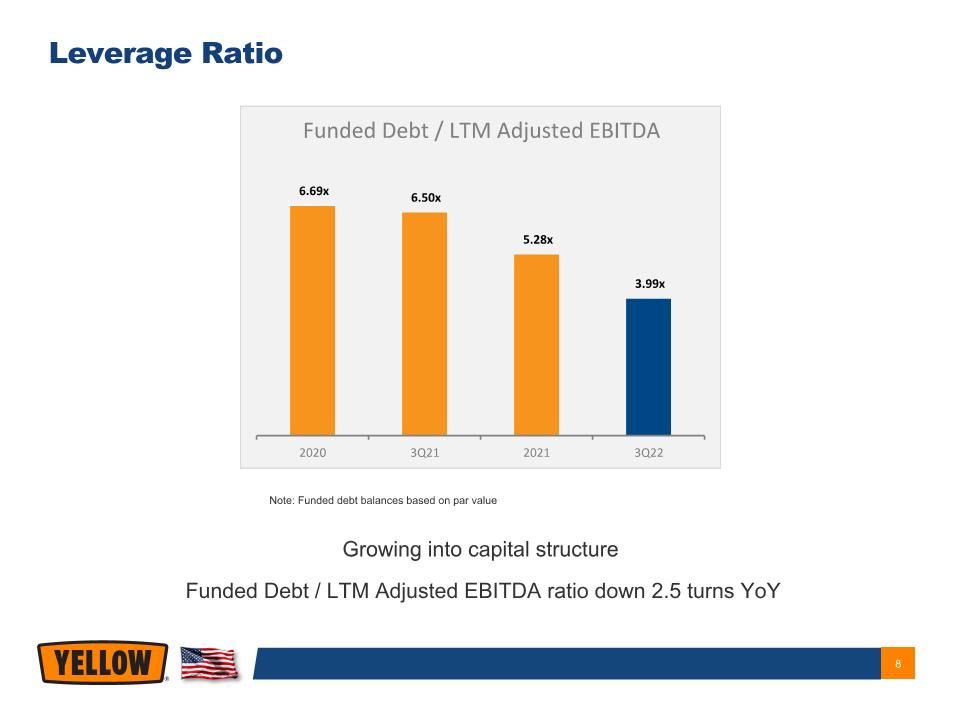

Leverage Ratio Note: Funded debt balances based on par value Growing into capital structure Funded Debt / LTM Adjusted EBITDA ratio down 2.5 turns YoY

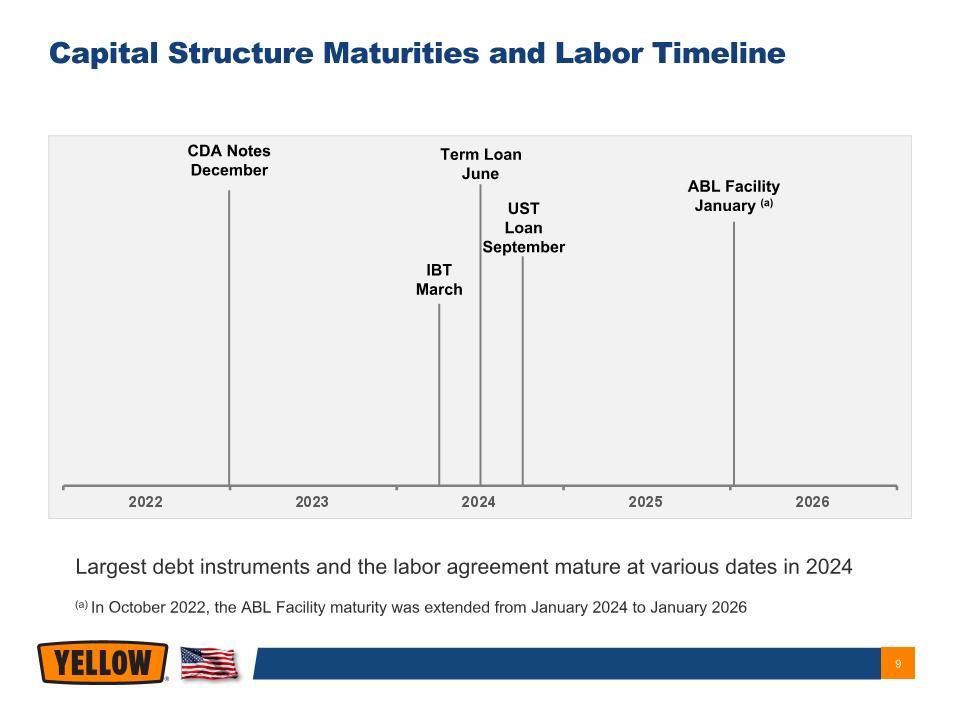

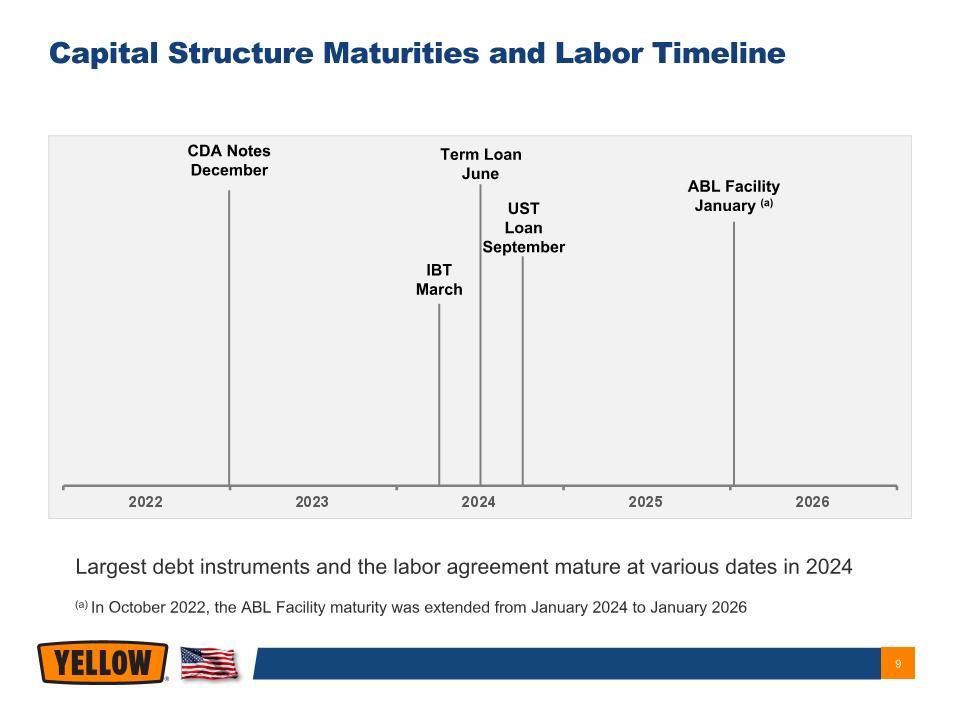

Largest debt instruments and the labor agreement mature at various dates in 2024 IBT March ABL Facility January (a) Term Loan June CDA Notes December UST Loan�September Capital Structure Maturities and Labor Timeline (a) In October 2022, the ABL Facility maturity was extended from January 2024 to January 2026

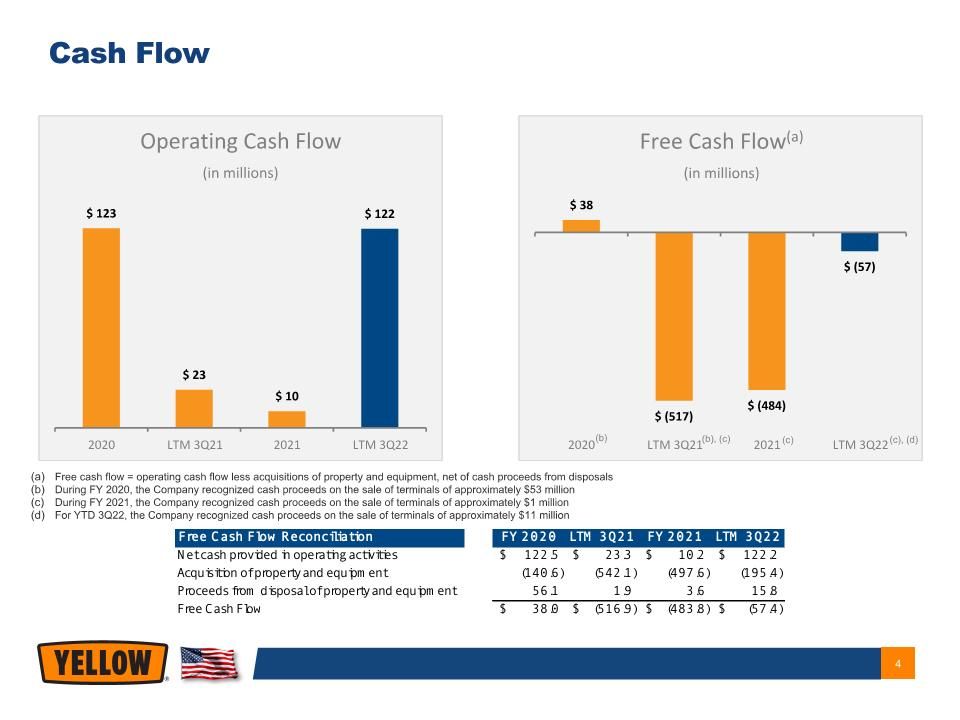

(in millions) Adjusted EBITDA Reconciliation