Yellow Corporation First Quarter 2023 Earnings Conference Call Exhibit 99.2

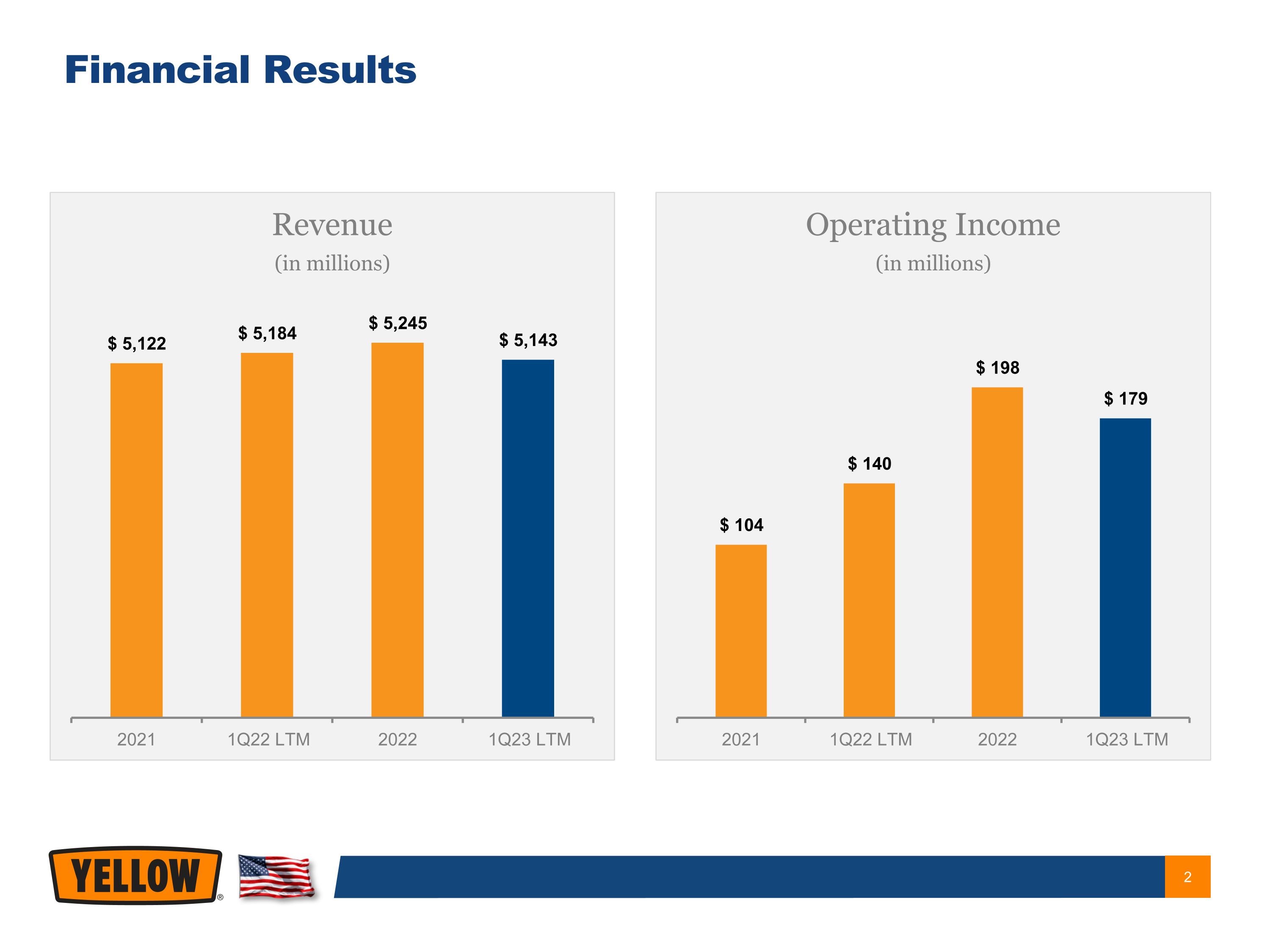

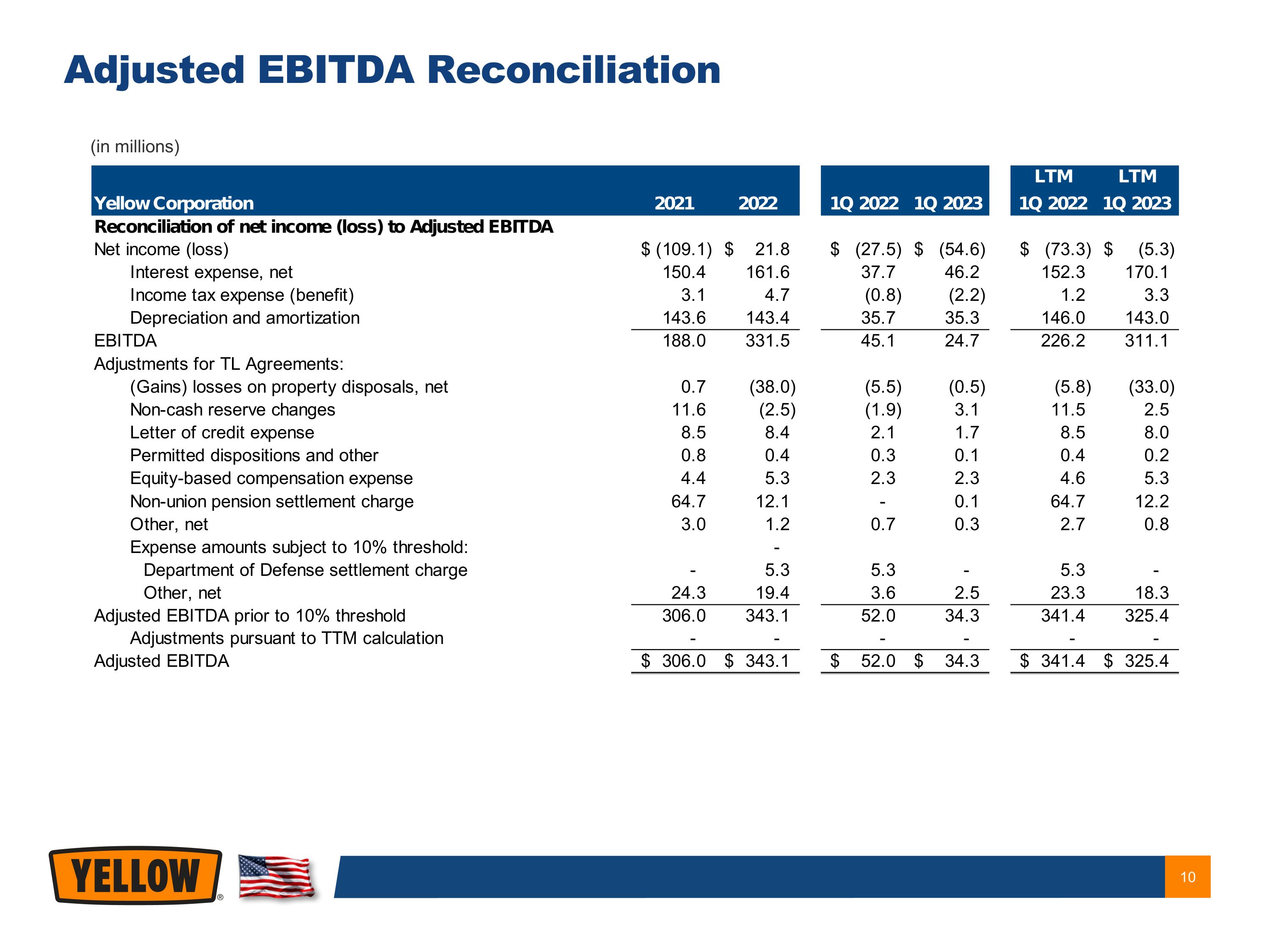

Financial Results

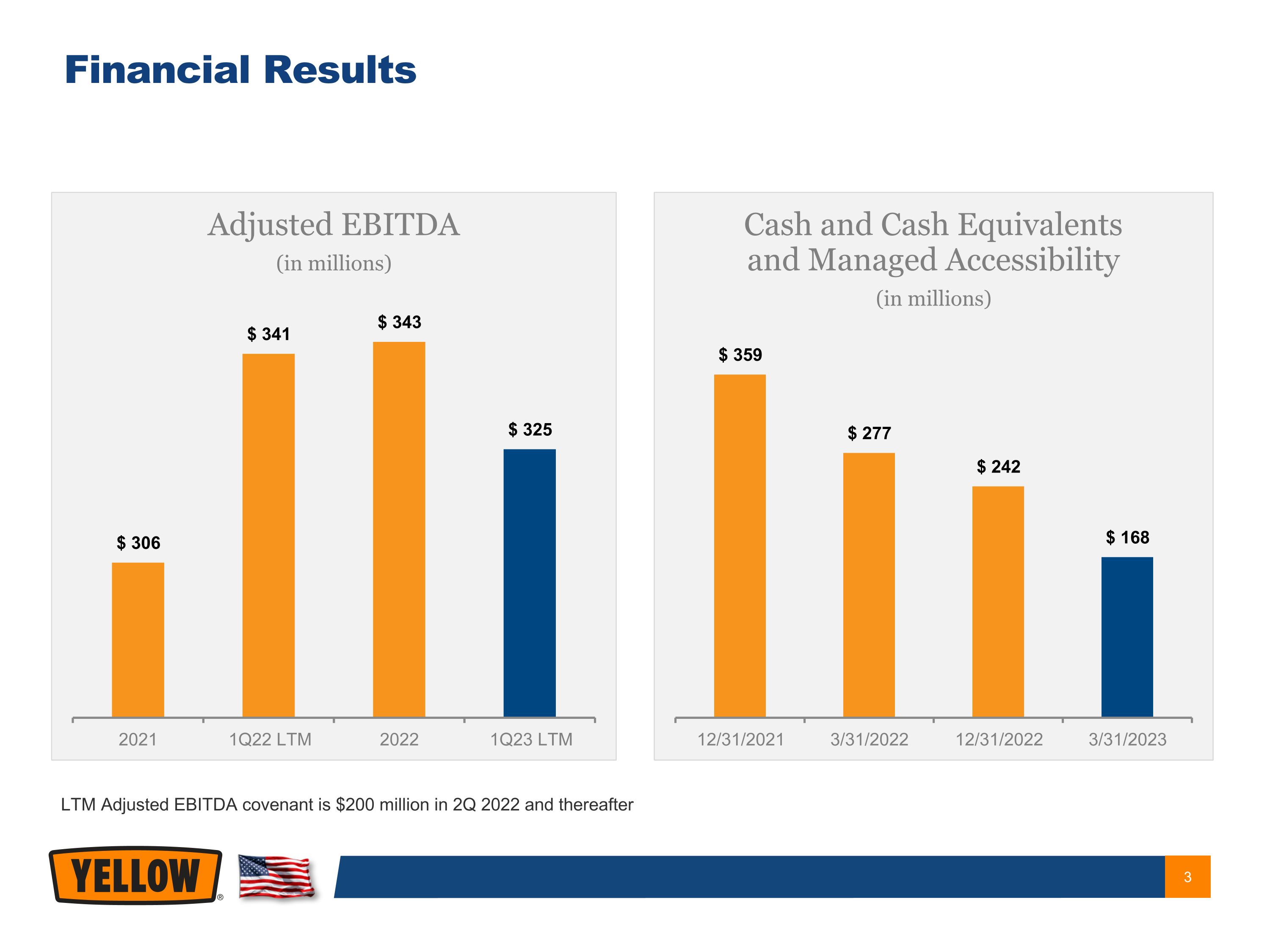

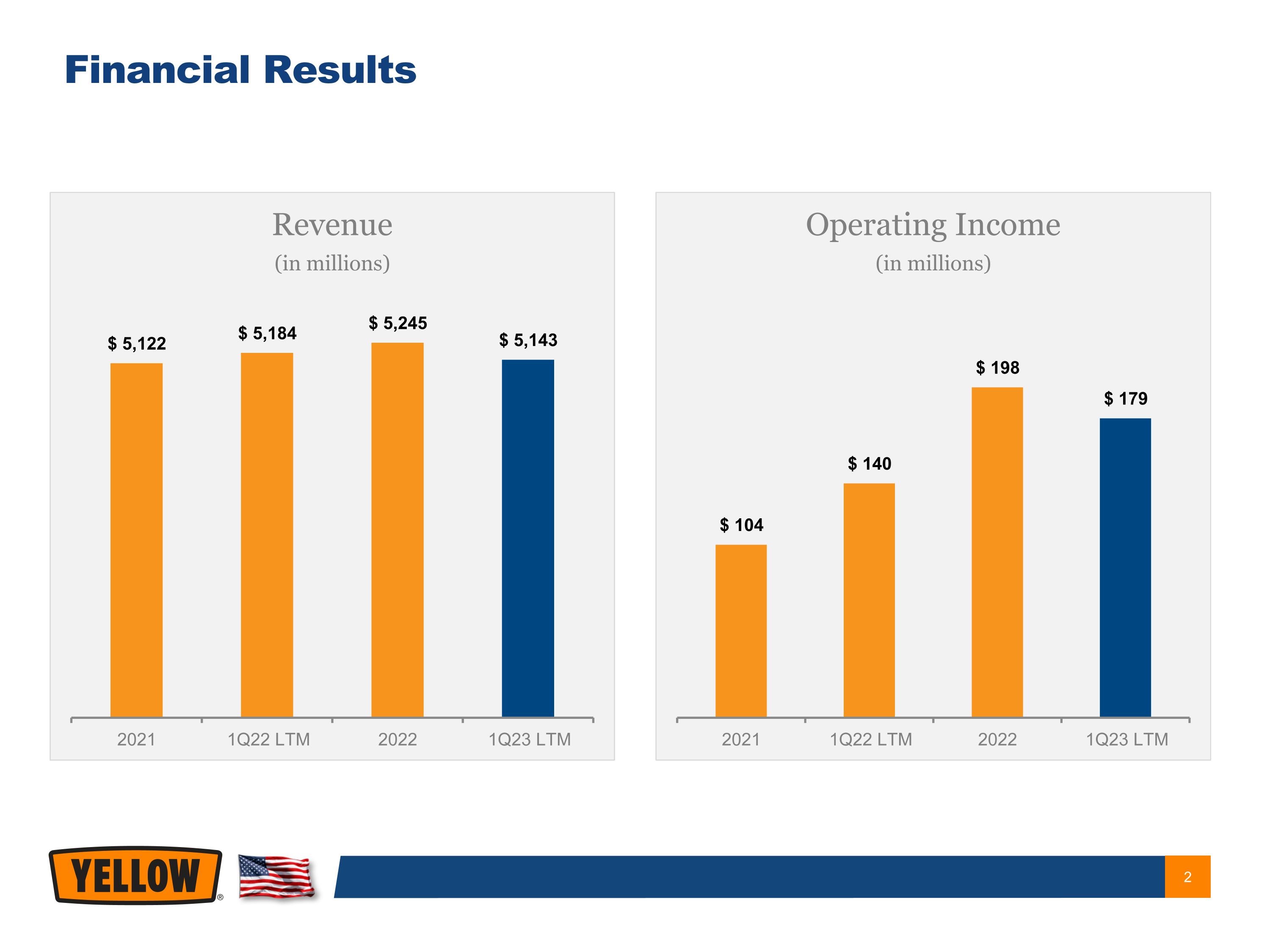

Financial Results LTM Adjusted EBITDA covenant is $200 million in 2Q 2022 and thereafter

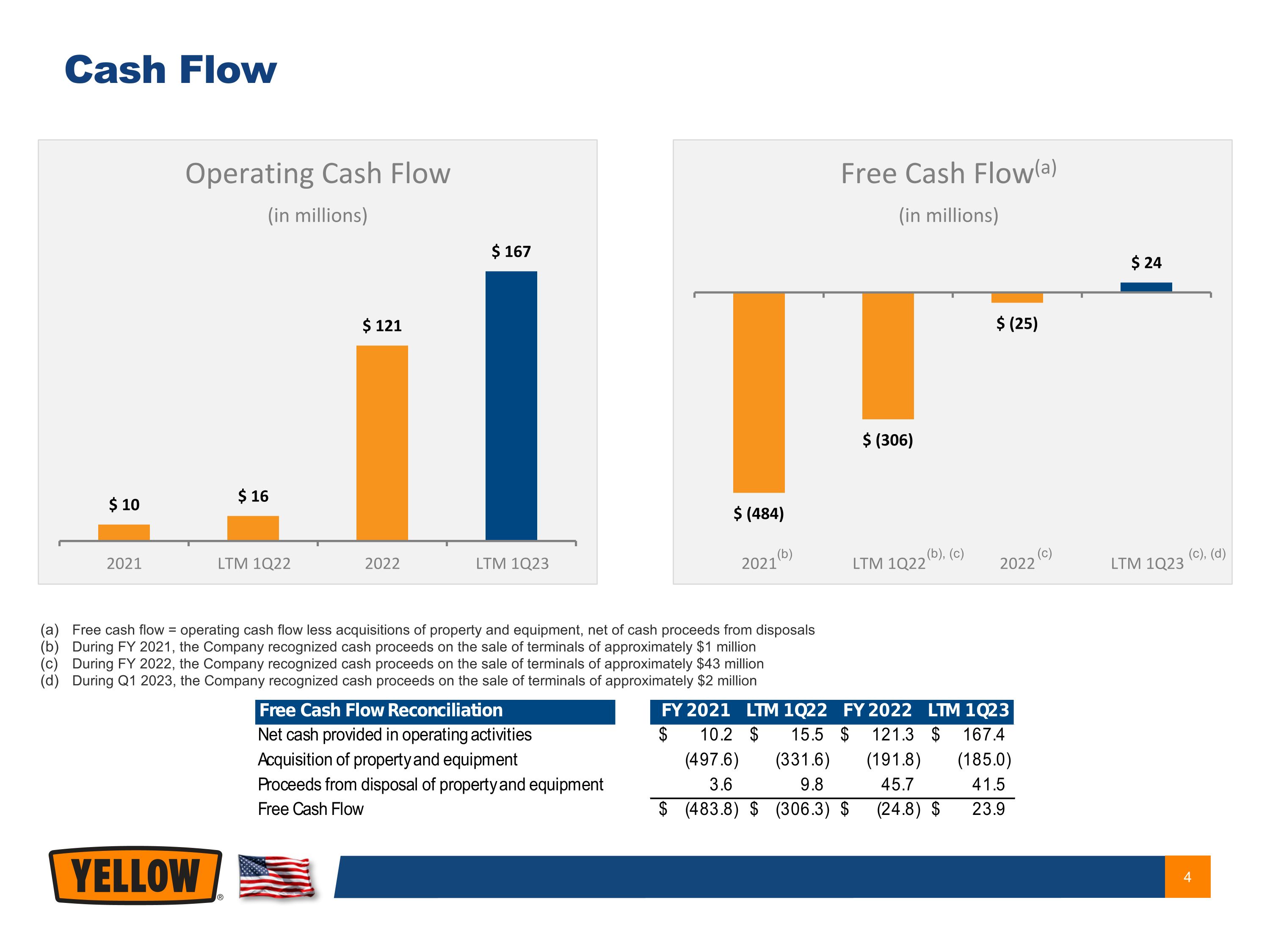

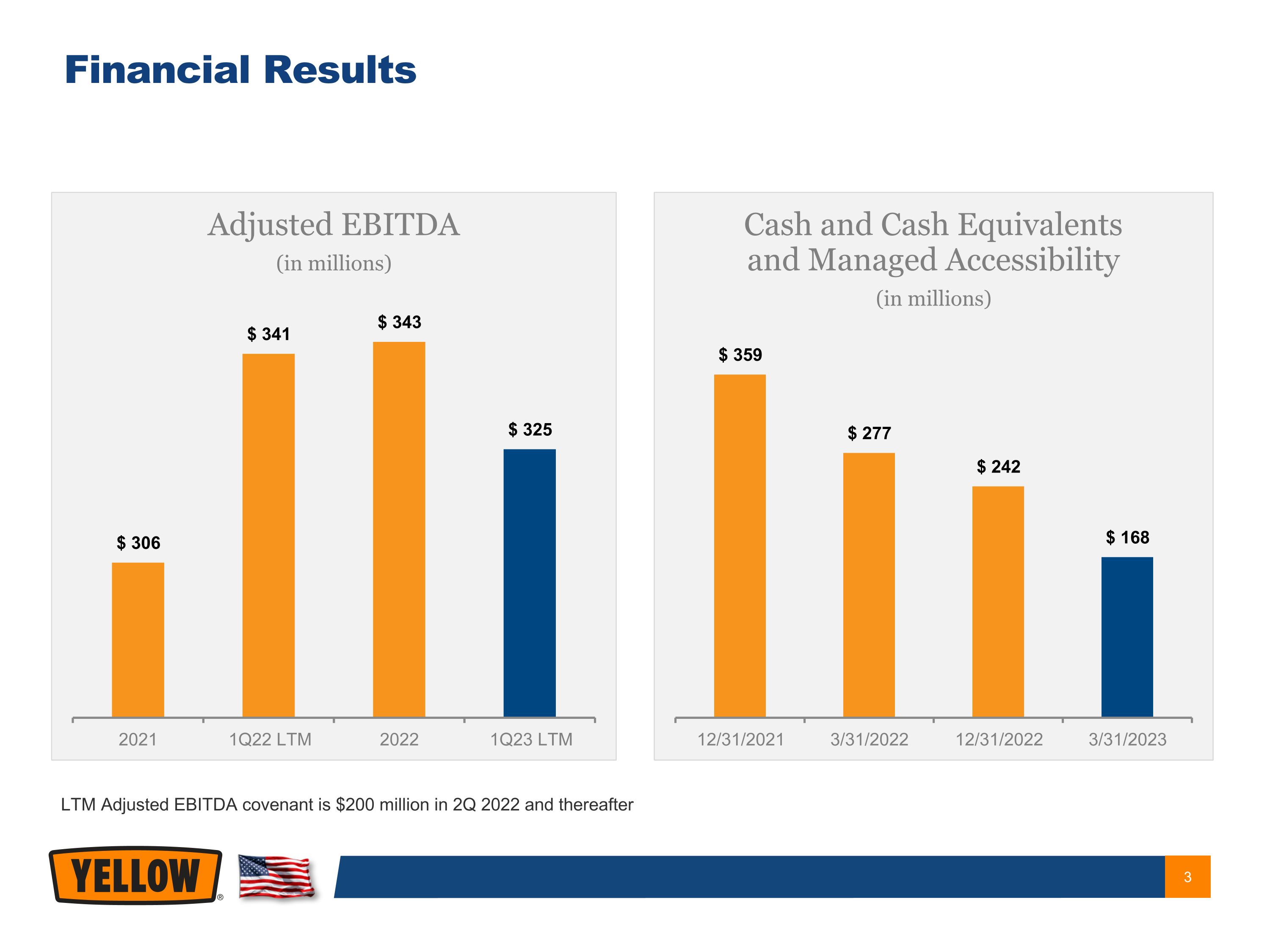

Free cash flow = operating cash flow less acquisitions of property and equipment, net of cash proceeds from disposals During FY 2021, the Company recognized cash proceeds on the sale of terminals of approximately $1 million During FY 2022, the Company recognized cash proceeds on the sale of terminals of approximately $43 million During Q1 2023, the Company recognized cash proceeds on the sale of terminals of approximately $2 million Cash Flow (b) (b), (c) (c), (d) (c)

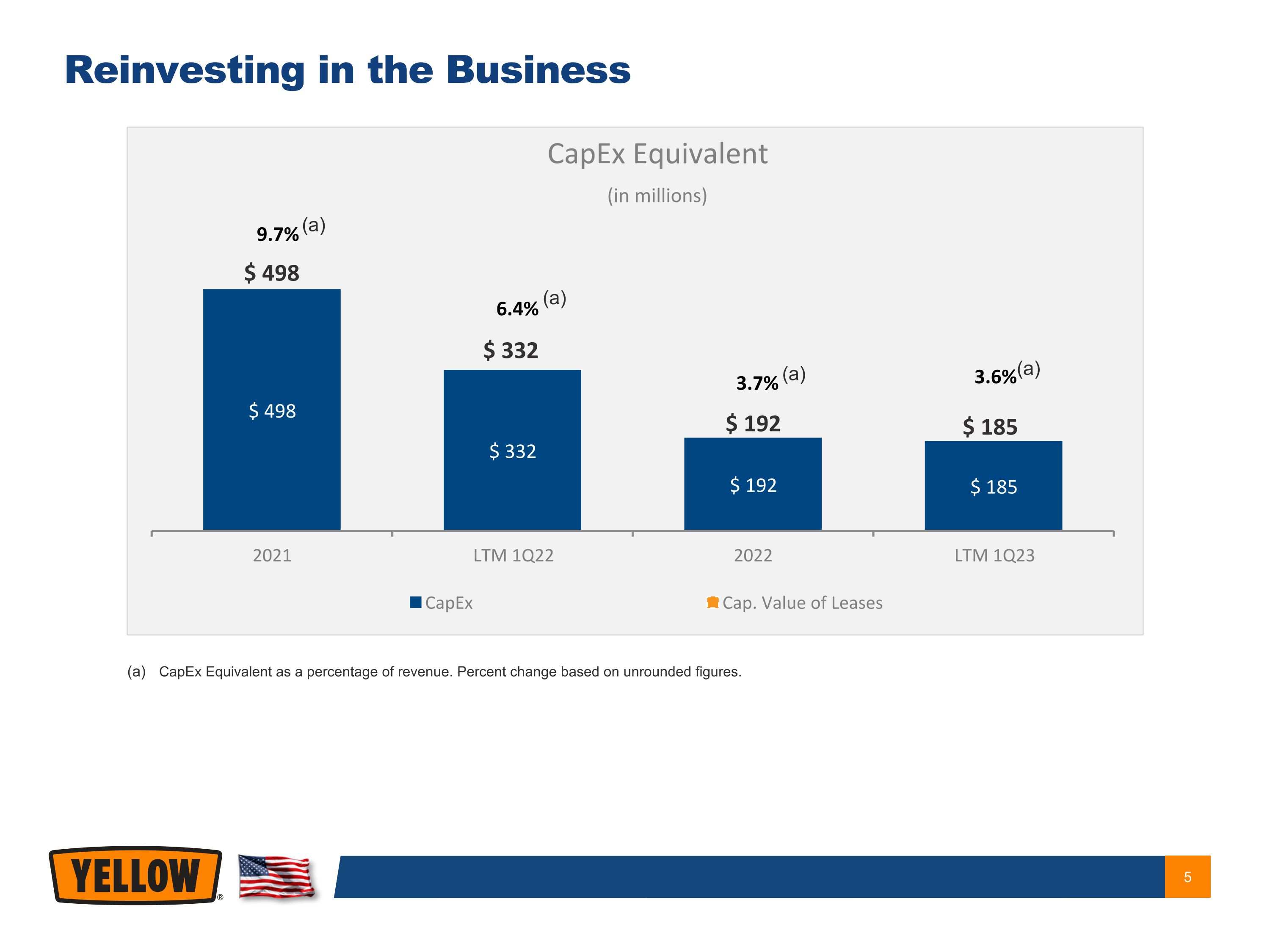

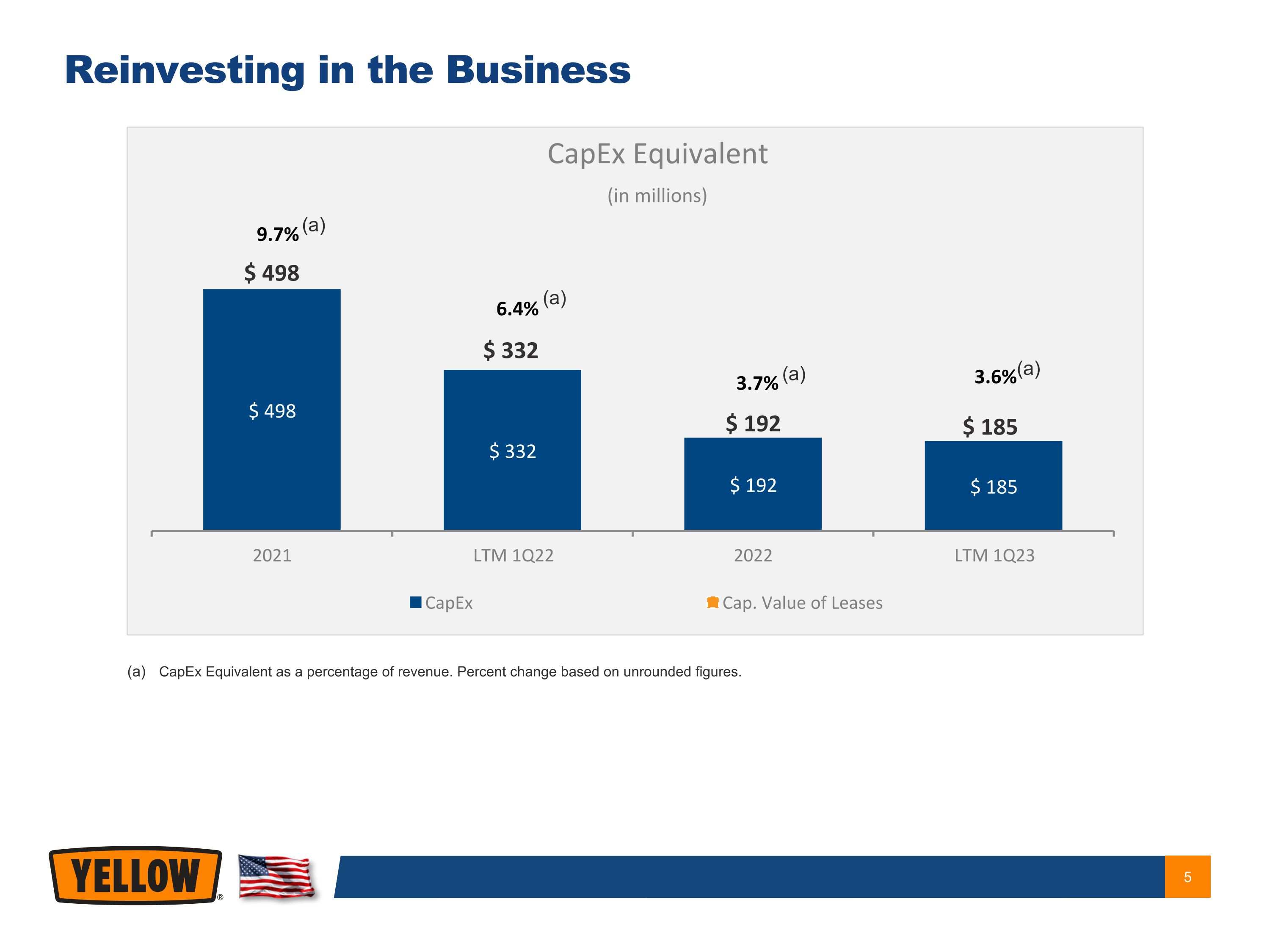

CapEx Equivalent as a percentage of revenue. Percent change based on unrounded figures. (a) (a) (a) Reinvesting in the Business (a)

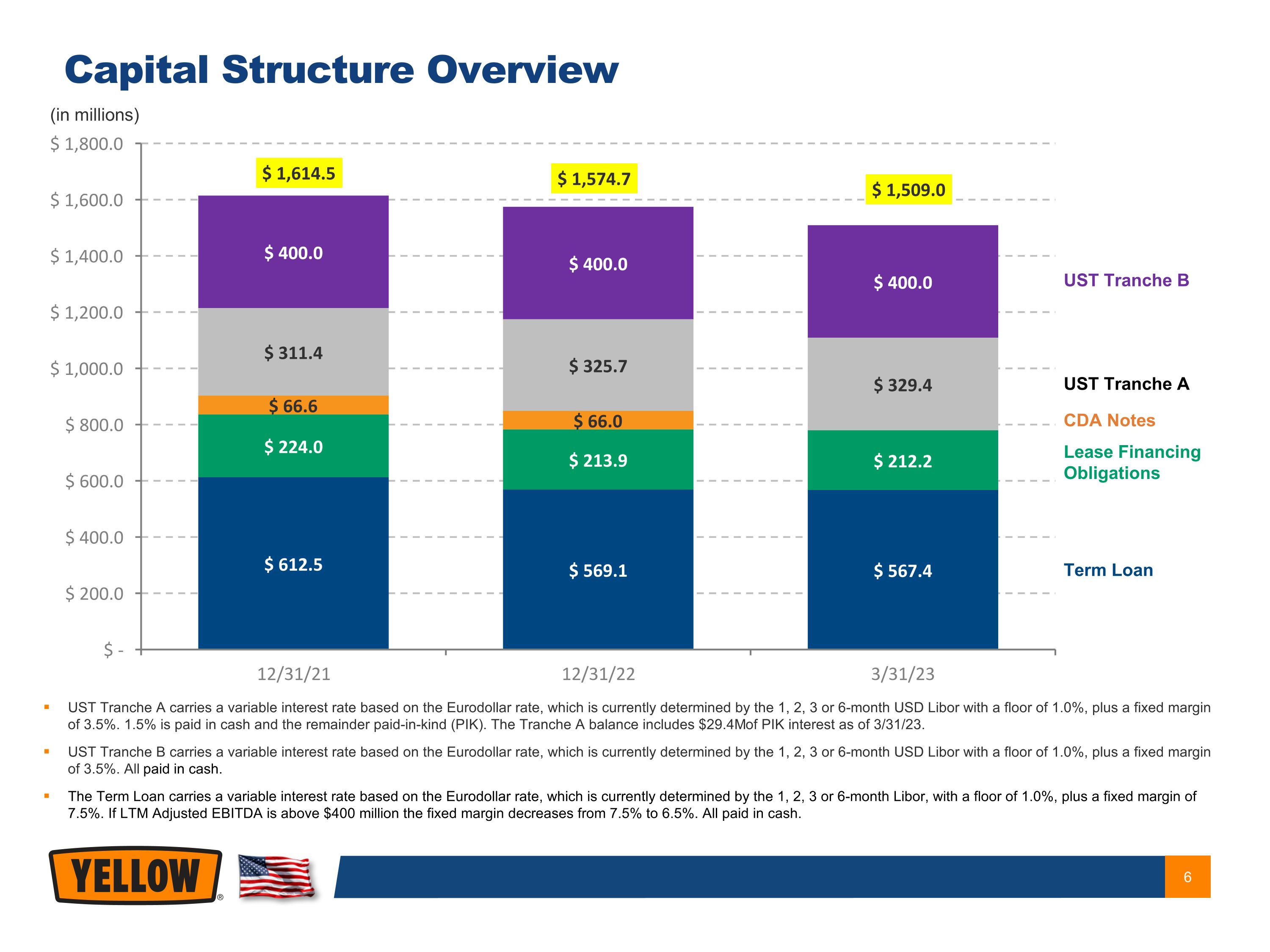

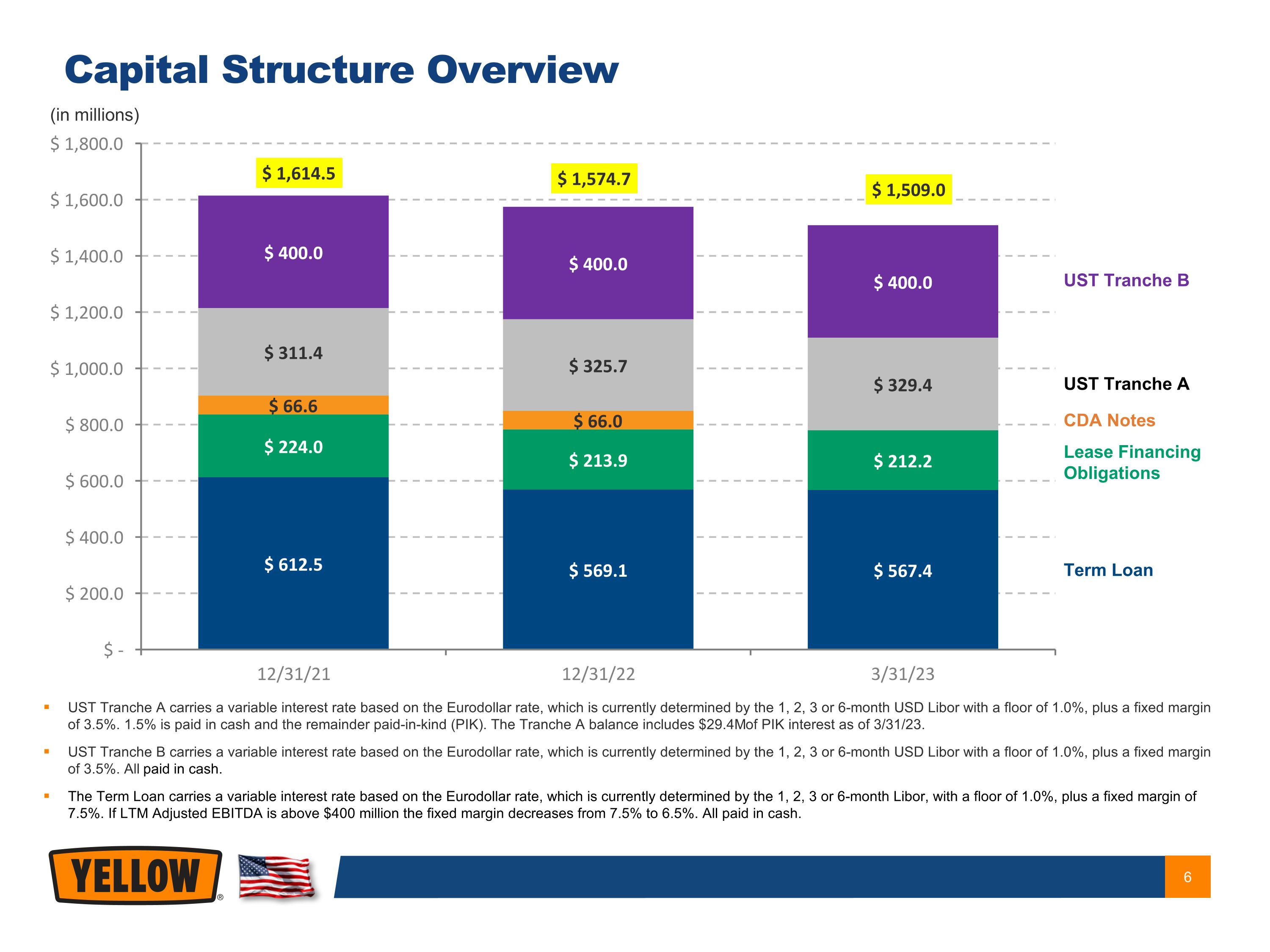

CDA Notes (in millions) UST Tranche A carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month USD Libor with a floor of 1.0%, plus a fixed margin of 3.5%. 1.5% is paid in cash and the remainder paid-in-kind (PIK). The Tranche A balance includes $29.4M of PIK interest as of 3/31/23. UST Tranche B carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month USD Libor with a floor of 1.0%, plus a fixed margin of 3.5%. All paid in cash. The Term Loan carries a variable interest rate based on the Eurodollar rate, which is currently determined by the 1, 2, 3 or 6-month Libor, with a floor of 1.0%, plus a fixed margin of 7.5%. If LTM Adjusted EBITDA is above $400 million the fixed margin decreases from 7.5% to 6.5%. All paid in cash. Capital Structure Overview Lease Financing Obligations UST Tranche A UST Tranche B Term Loan

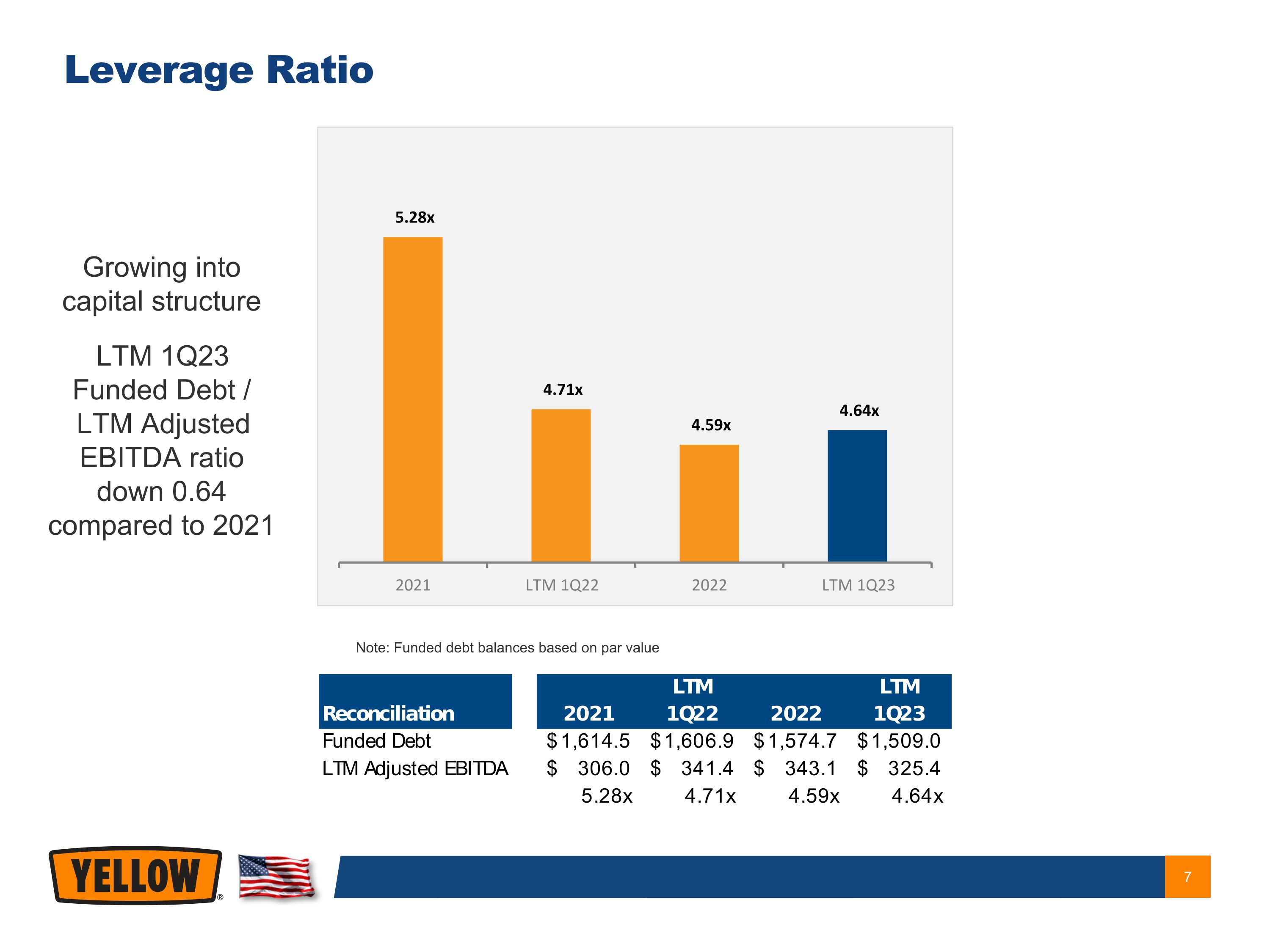

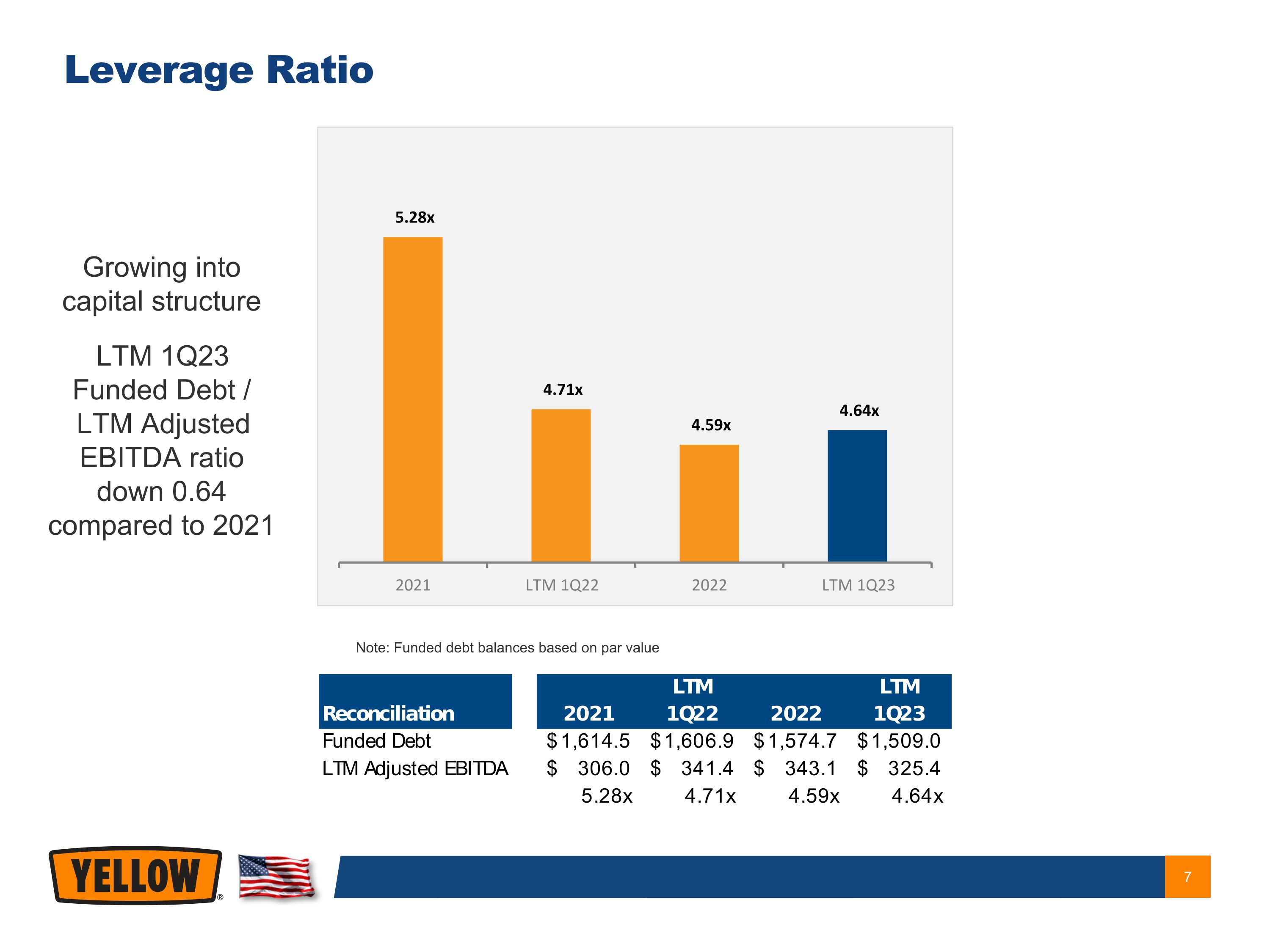

Leverage Ratio Note: Funded debt balances based on par value Growing into capital structure LTM 1Q23 Funded Debt / LTM Adjusted EBITDA ratio down 0.64 compared to 2021

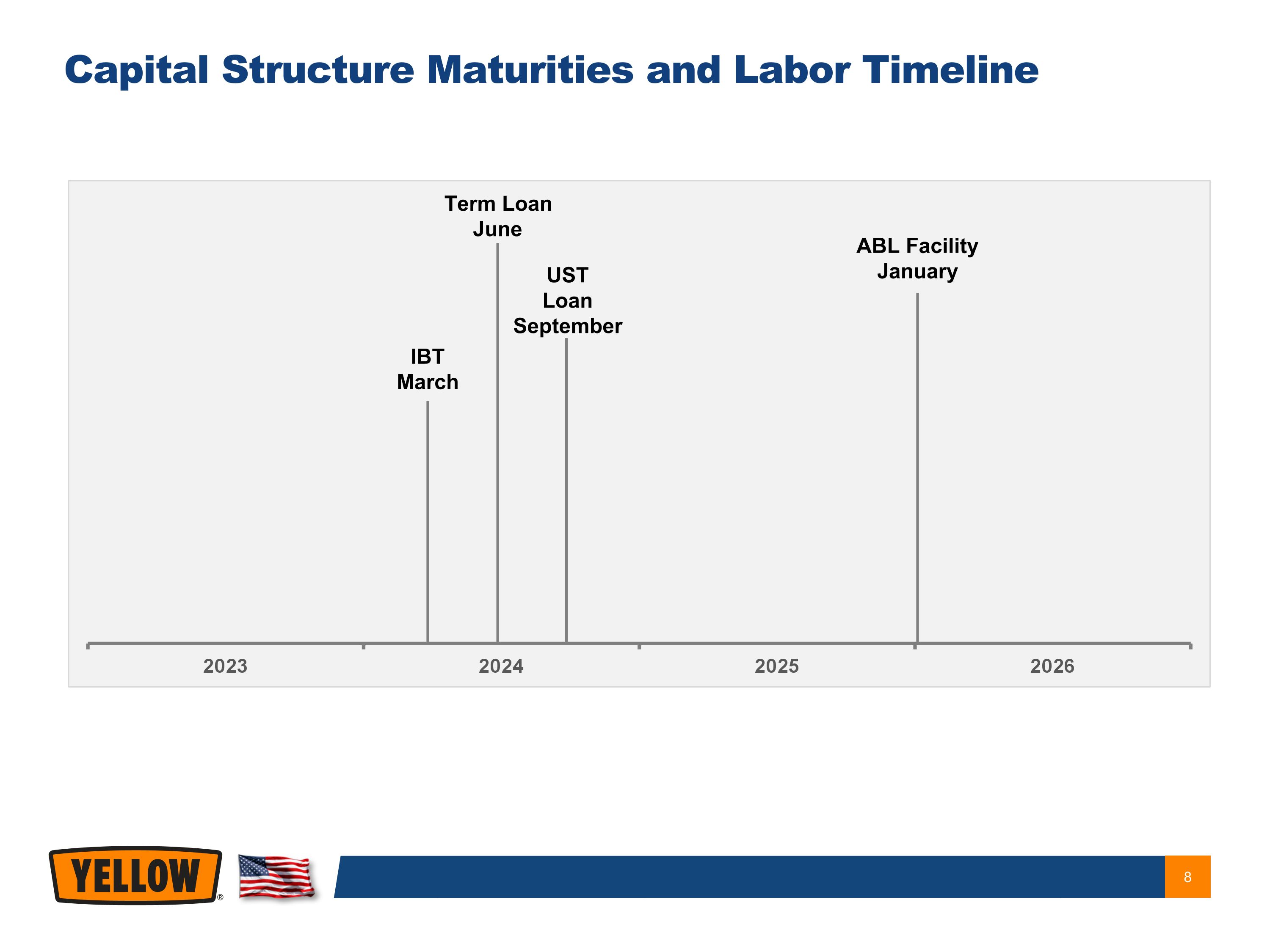

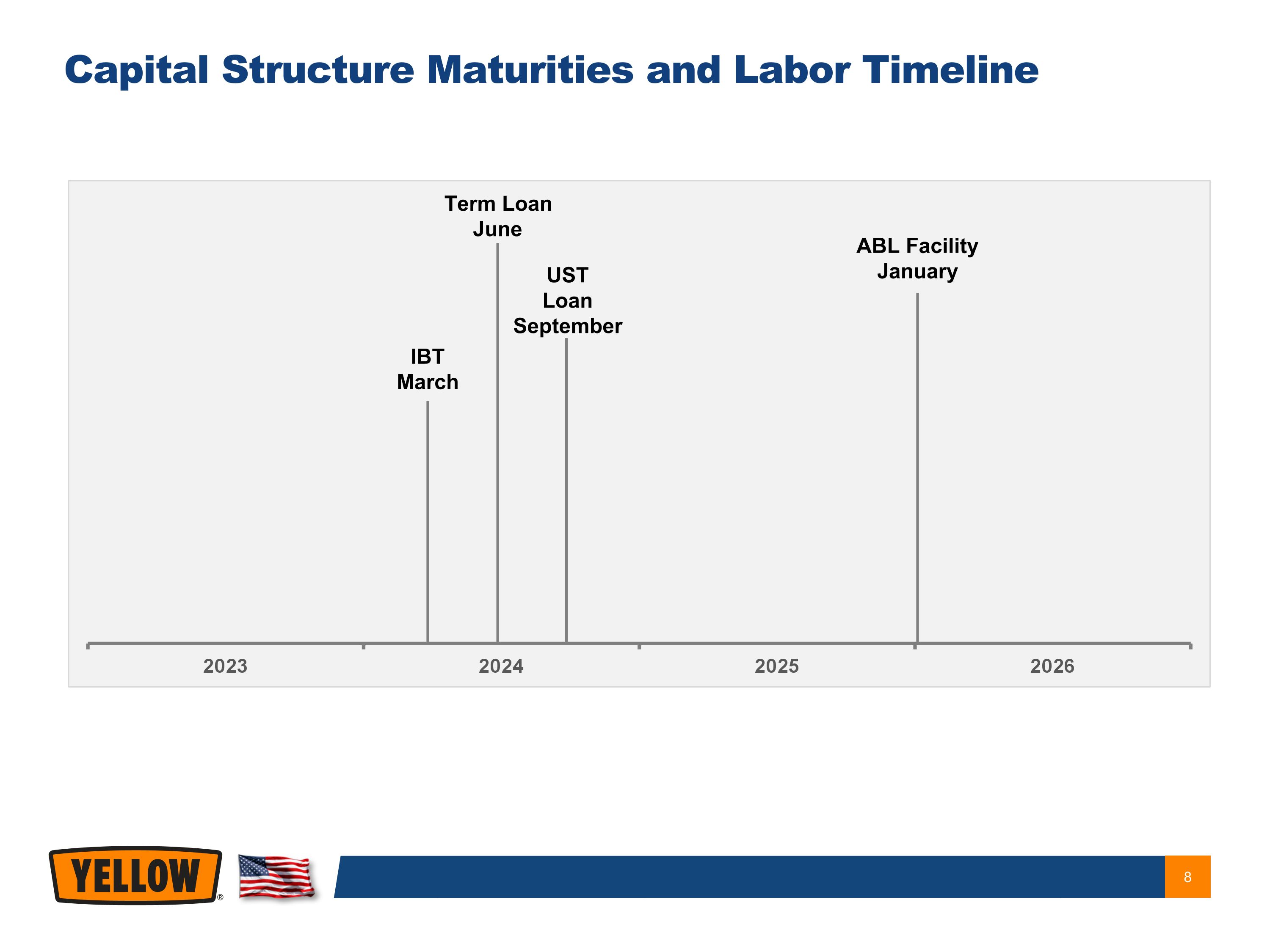

IBT March ABL Facility January Term Loan June UST Loan�September Capital Structure Maturities and Labor Timeline

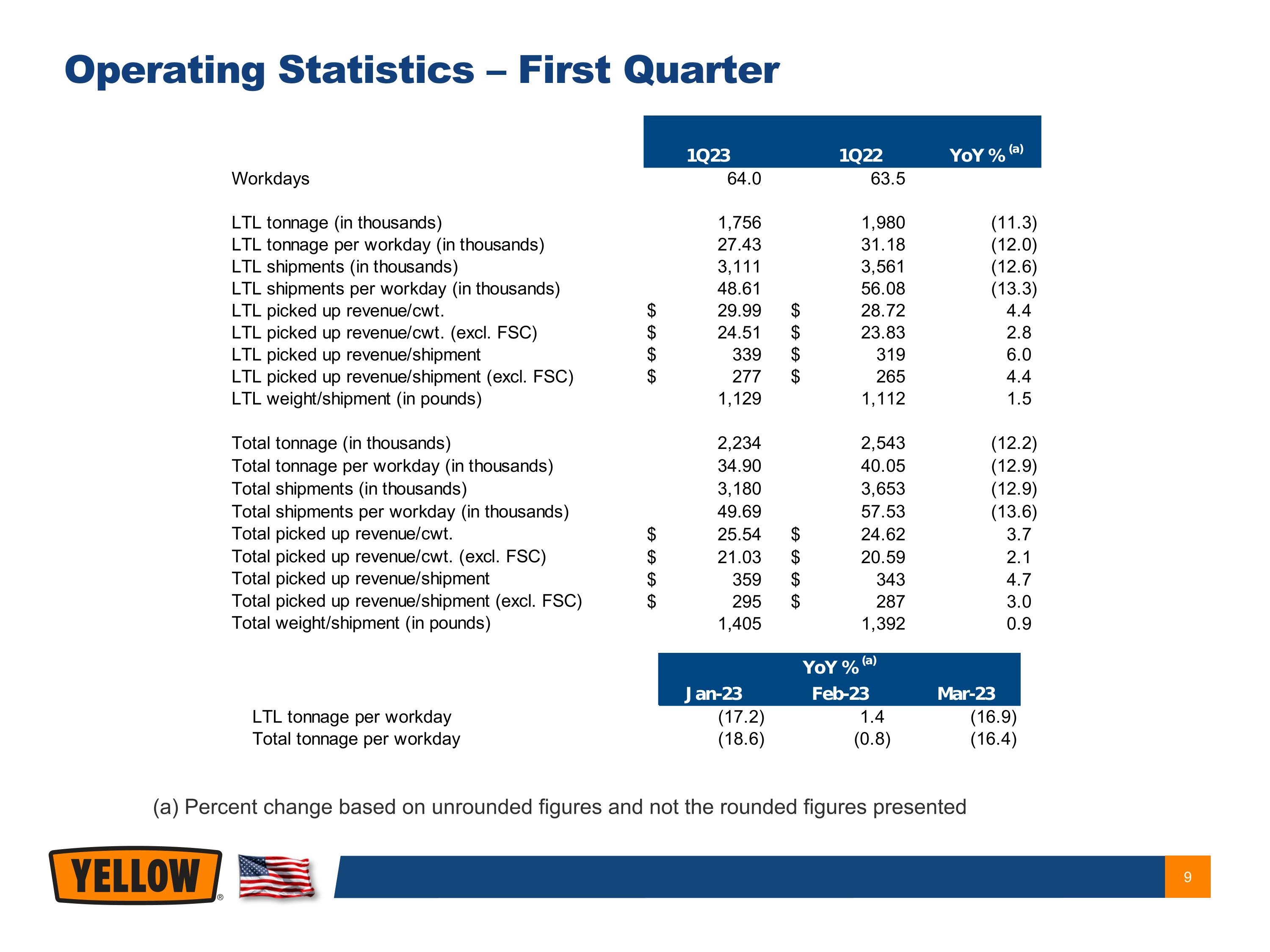

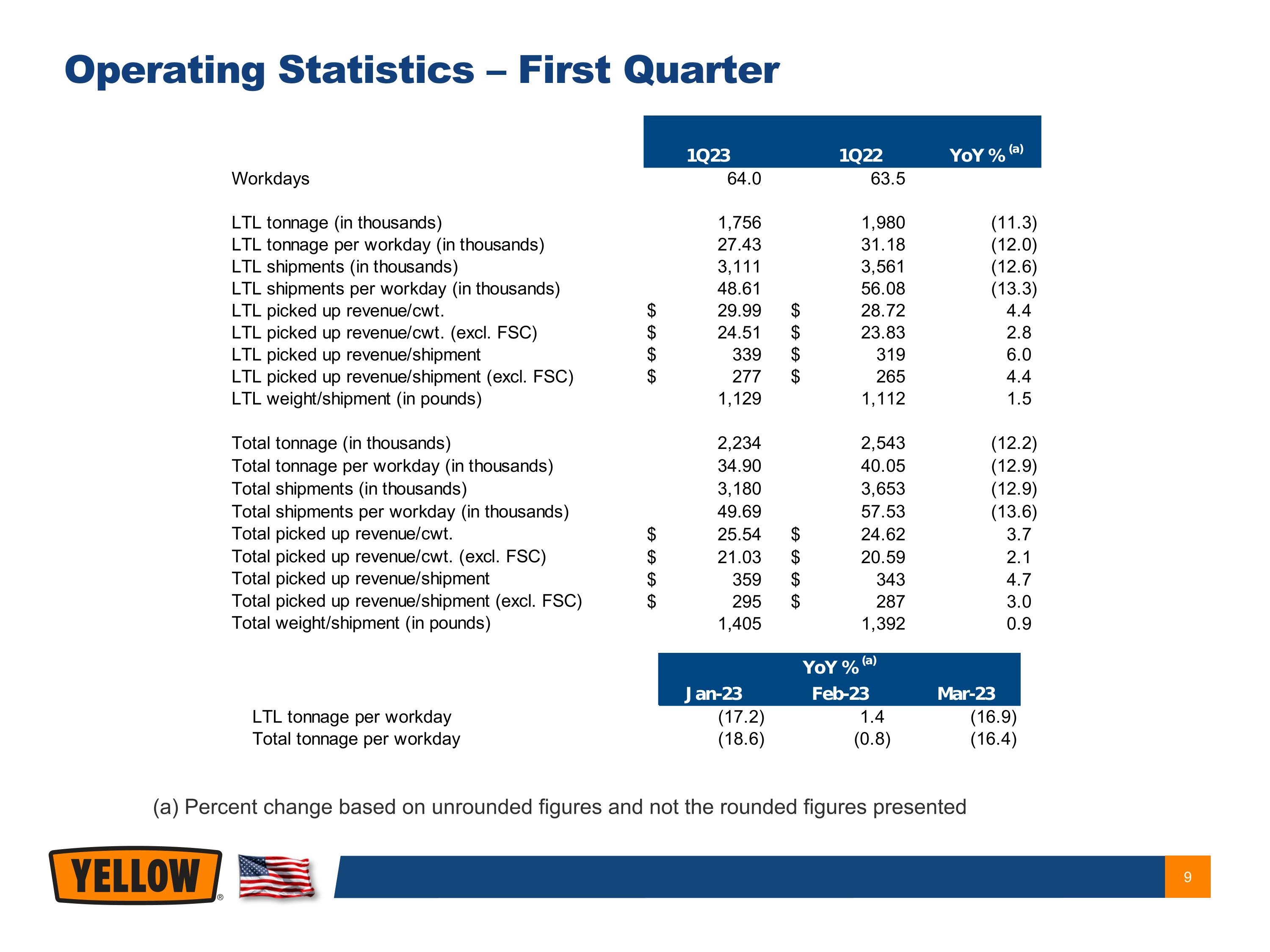

(a) Percent change based on unrounded figures and not the rounded figures presented Operating Statistics – First Quarter

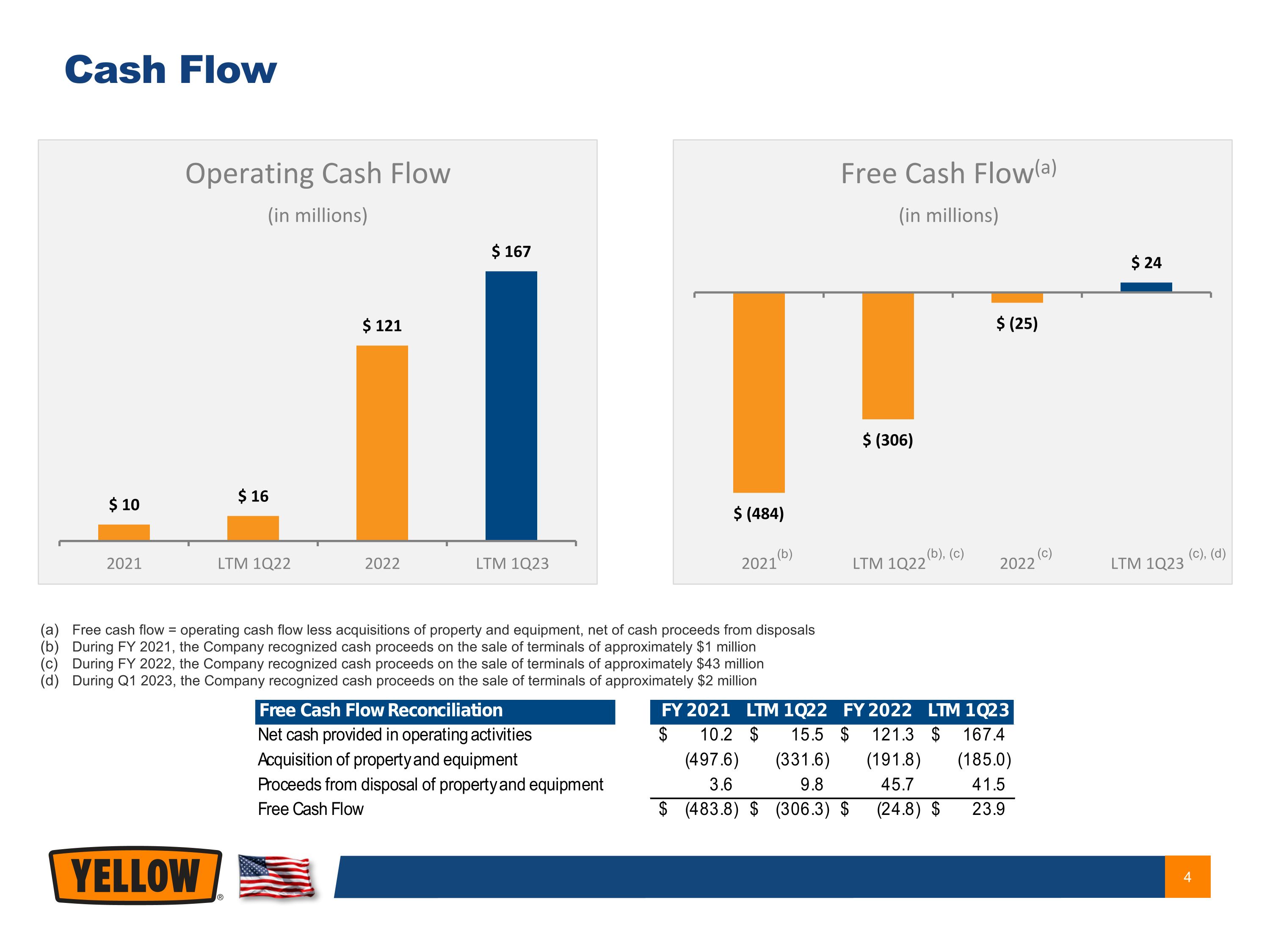

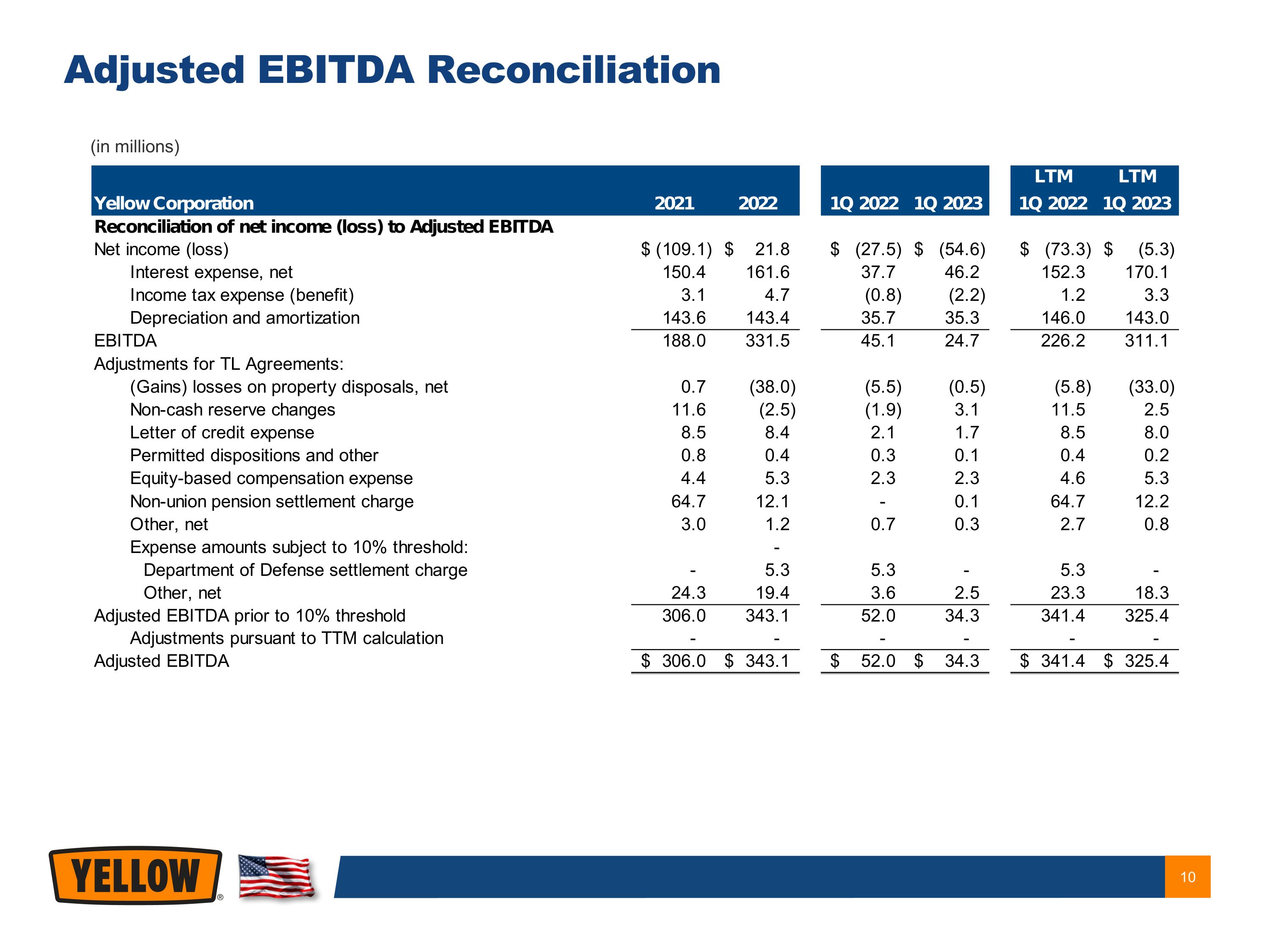

(in millions) Adjusted EBITDA Reconciliation