- YELLQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Yellow (YELLQ) 8-KRegulation FD Disclosure

Filed: 1 Nov 05, 12:00am

Stephens Transportation Conference November 2, 2005 Stephens Transportation Conference November 2, 2005 Exhibit 99.1 |

2 Yellow Roadway is a global transportation services company focused on large shipments We offer our clients expansive resources: 70,000 employees Over 1,000 locations worldwide Nearly 27,000 trucks Nearly 90,000 trailers Over 600 technology professionals All dedicated to the Yellow Roadway core purpose: Making global commerce work by connecting people, places and information |

3 Ranked #1 in our industry 3 years in a row by Fortune Magazine Named to Forbes Platinum 400 List of America’s Best Big Companies Independent Recognition |

4 Strategic Actions April 2002 Follow-on equity offering (net proceeds of $94 million) September 2002 Spin-off of SCS Transportation (operating companies of Saia and Jevic) December 2003 Acquisition of Roadway Corporation ($1.1 billion, 50% cash / 50% stock) May 2005 Acquisition of USF Corporation ($1.5 billion, 65% cash / 35% stock) September 2005 Finalized China-Based Freight Forwarding Joint Venture |

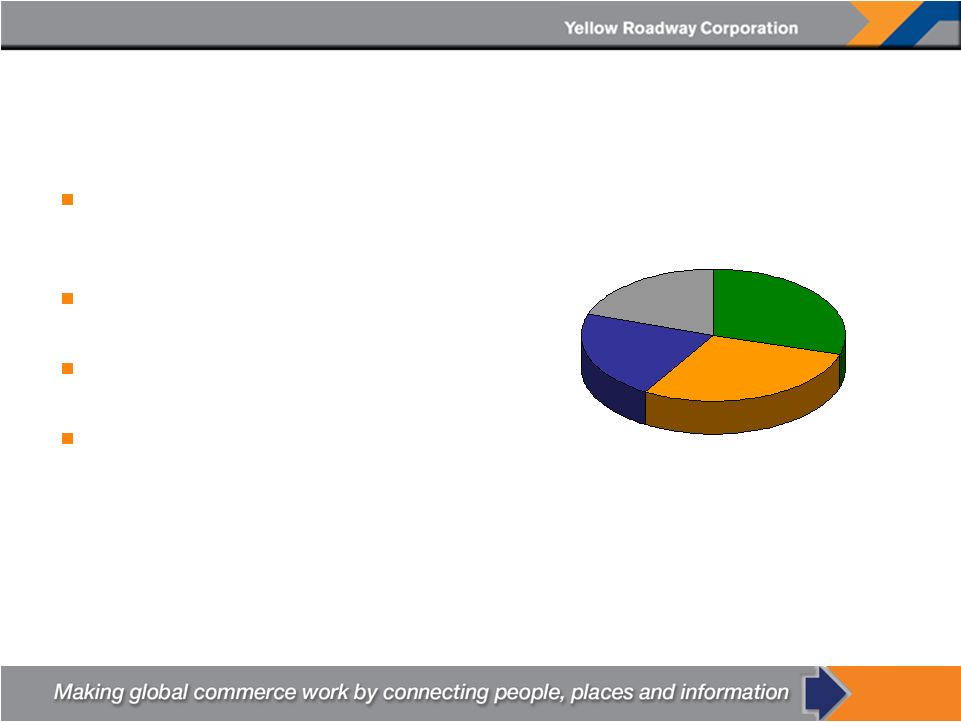

5 Service Portfolio Comprehensive next-day nationwide Extensive national networks Truckload Logistics capabilities Next Day 29% 2 Days 29% 4+ Days 20% 3 Days 22% Based on actual shipments delivered |

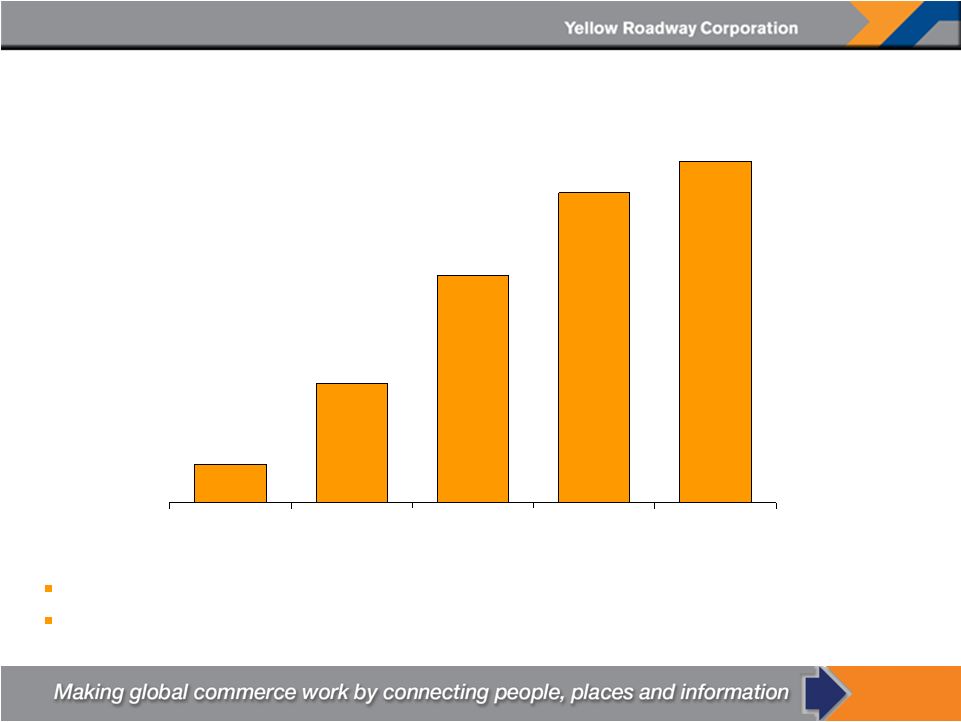

6 Combined Synergies from Roadway and USF Acquisitions $50 $158 $300 $410 $450 2004A 2005E 2006E 2007E 2008E Calendar Year Benefit (in millions) Full synergy benefit of $450 million equals about $4.50 of earnings per share We expect to exit 2005 with a $200 million run-rate from the Roadway acquisition Note: 2005 through 2008 synergies are current company estimates |

7 Synergy Areas Pick-up & delivery planning Dock layout Manpower planning Digital dispatch Implement planning & optimization tools Exchange of best practices & technology Operations Optimization Purchasing card Forms Accounts payable volume Expense management Capture significant buying power Use of advanced systems & processes Procurement Data centers Communications systems Common financials Data consolidation Optimize technology infrastructures Develop common applications Technology Legal Marketing Human Resources Finance/Accounting Exchange best practices & technology Reduce duplicate staff & functions Corporate/Back Office Specific Examples Opportunity Area |

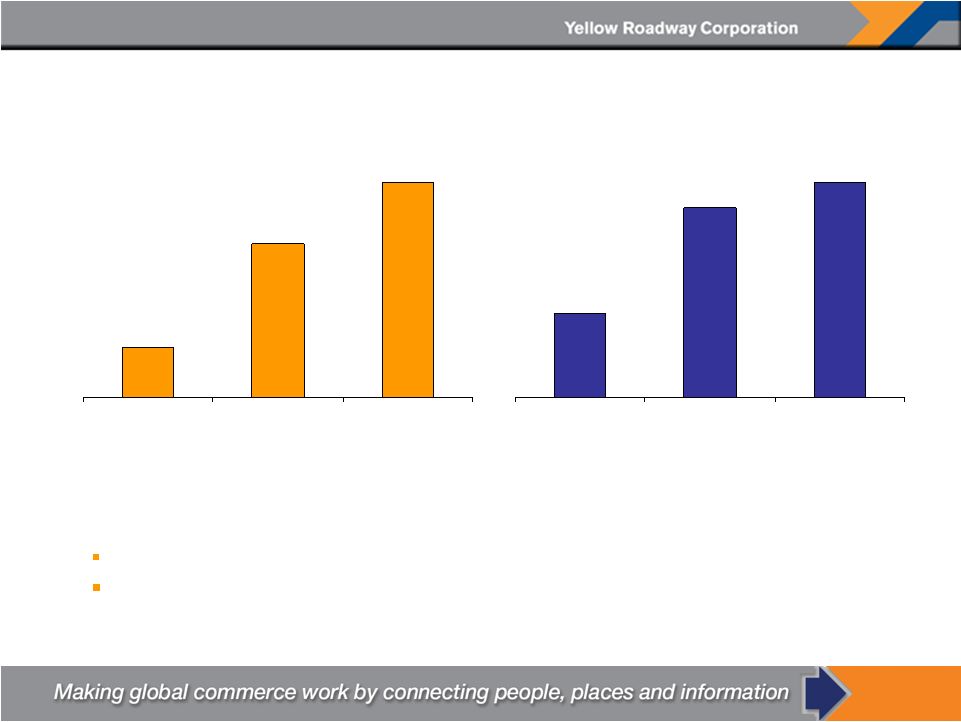

8 Adjusted Operating Income* (in millions) Adjusted EPS* 3Q03 3Q04 3Q05 3Q03 3Q04 3Q05 $0.75 Highest quarterly EPS in company history; 11% growth over prior year Consolidated operating ratio of 93.3% Record Results in the Third Quarter $39.1 $119.7 $167.6 $1.38 $1.53 *Adjustments were related to property gains/losses, acquisition and severance charges not considered core operations |

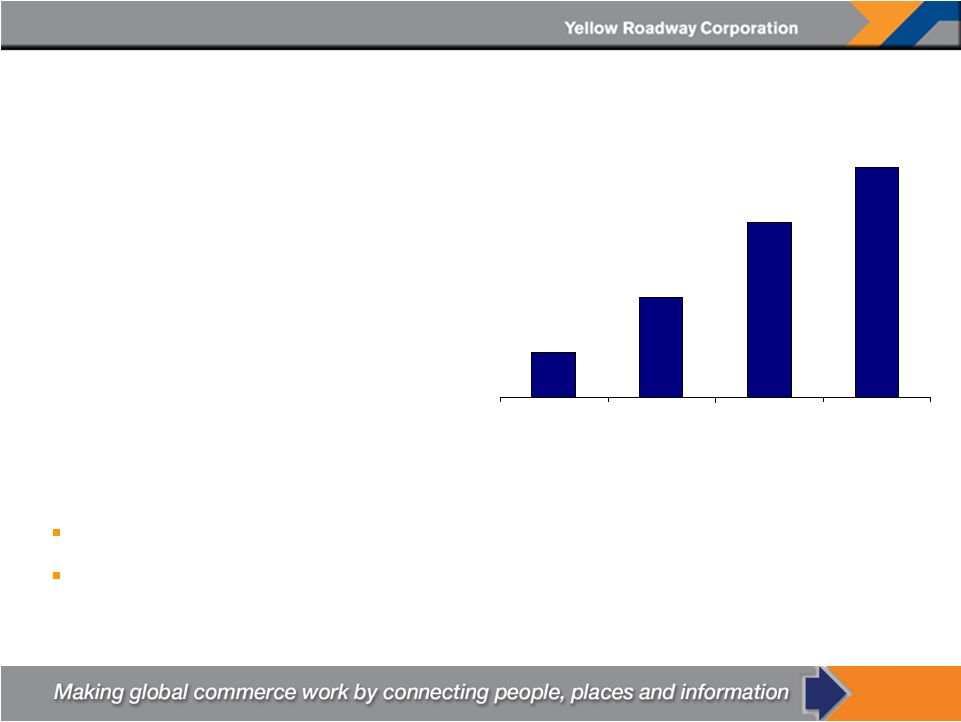

9 57 million Diluted shares $63 million Interest expense $8.7 billion Revenue $5.18 - $5.23 per share EPS Our full year EPS has increased over 400% in the last four years Our consolidated operating ratio has improved from 97.9% in 2002 to the upper 93% range in 2005 2002 2003 2004 2005 $1.03 $3.96 $5.18 - $5.23 Full Year 2005 Consolidated Guidance (forecast) Adjusted EPS* *Adjustments were related to property gains/losses, acquisition, spin-off and severance charges not considered core operations $2.27 |

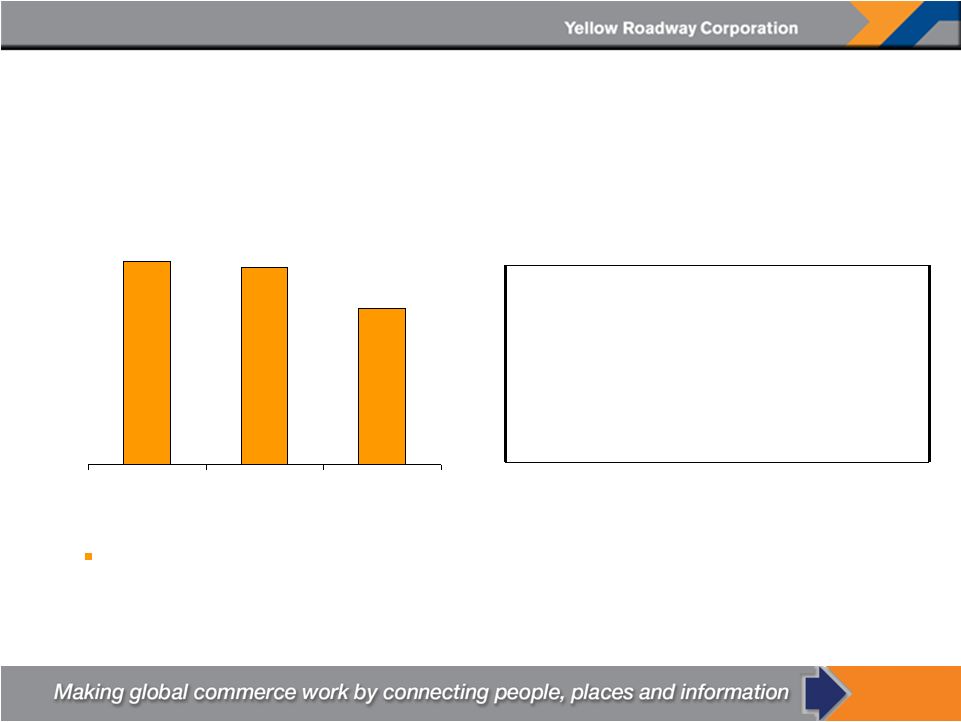

10 Capital Structure/Credit Ratings Debt to Capital (net of cash) Stable BBB- Fitch Stable Ba1 Moody’s Stable BBB- S&P Credit Ratings: We expect our debt-to-cap to be within our targeted range of around 35% by the end of 2006 9/30/05 12/31/05 12/31/06 45.4% ~44% ~35% |

11 Future Opportunities Growth Significant resources, capabilities and market reach Large customer bases with limited overlap Continued penetration of premium services Expansive service offerings Global expansion Leverage our strong brands Continued investments in our distinct brands Operate networks separately Capture synergies Substantial synergy opportunities are unique to Yellow Roadway Synergies are mostly independent of the economy |

12 This presentation, and oral statements made regarding the subjects of this presentation, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words “expect,” “projected,” “estimated,” “anticipated,” “forecasted” and similar expressions are intended to identify forward-looking statements. It is important to note that the company’ s actual future results could differ materially from those projected in such forward-looking statements because of a number of factors, including (without limitation), inflation, inclement weather, price and availability of fuel, sudden changes in the cost of fuel or the index upon which the company bases its fuel surcharge, competitor pricing activity, expense volatility, ability to capture cost synergies, the company’ s ability to improve productivity results at its Roadway Express subsidiary and its resulting effects on efficiencies, service and yield, a downturn in general or regional economic activity, changes in equity and debt markets, effects of a terrorist attack, and labor relations, including (without limitation), the impact of work rules, any obligations to multi- employer health, welfare and pension plans, wage requirements and employee satisfaction. Forward-Looking Statements |

|