Cincinnati Bell Second Quarter 2013 Results August 8, 2013

2 Today’s Agenda 2 Overview & Strategic Investments Ted Torbeck, President & Chief Executive Officer Segment Results & Financial Overview Kurt Freyberger, Chief Financial Officer Question & Answer

3 Safe Harbor 3 This presentation and the documents incorporated by reference herein contain forward- looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward- looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward-looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

4 Non GAAP Financial Measures 4 This presentation contains information about adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), Adjusted EBITDA margin, net debt and free cash flow. These are non-GAAP financial measures used by Cincinnati Bell management when evaluating results of operations and cash flow. Management believes these measures also provide users of the financial statements with additional and useful comparisons of current results of operations and cash flows with past and future periods. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures. Detailed reconciliations of Adjusted EBITDA, net debt and free cash flow (including the Company’s definition of these terms) to comparable GAAP financial measures can be found in the earnings release on our website at www.cincinnatibell.com within the Investor Relations section.

Ted Torbeck President & Chief Executive Officer

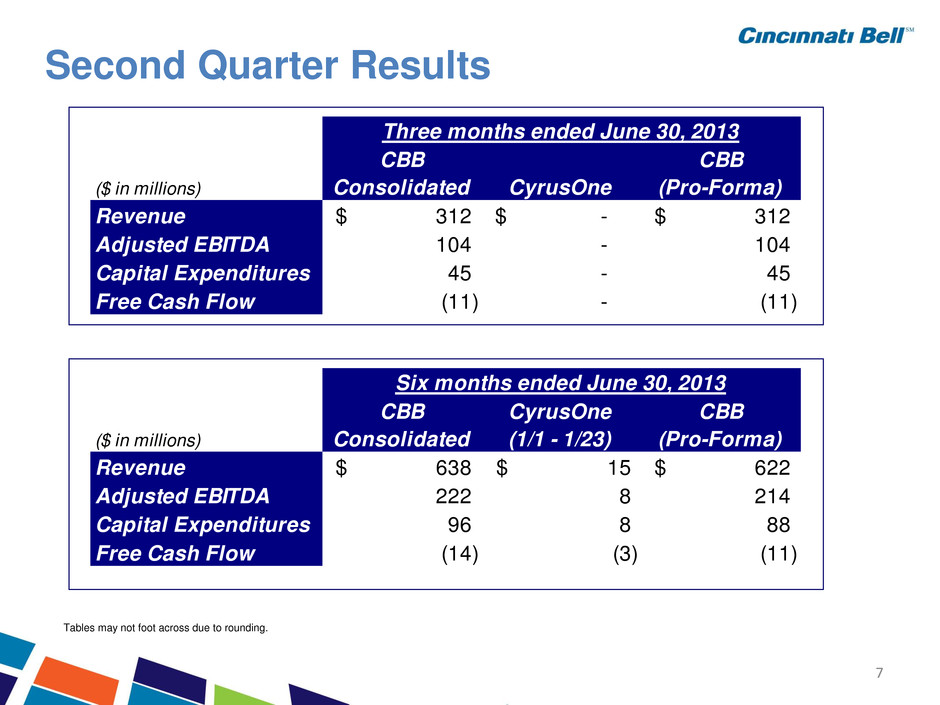

6 6 Second Quarter Highlights Strong second quarter Adjusted EBITDA of $104 million Net subscriber activations for Fioptics reaches all-time high • 5,600 entertainment net activations • 6,100 high-speed internet net activations Fioptics revenue totaled $24 million, up 50 percent year-over-year

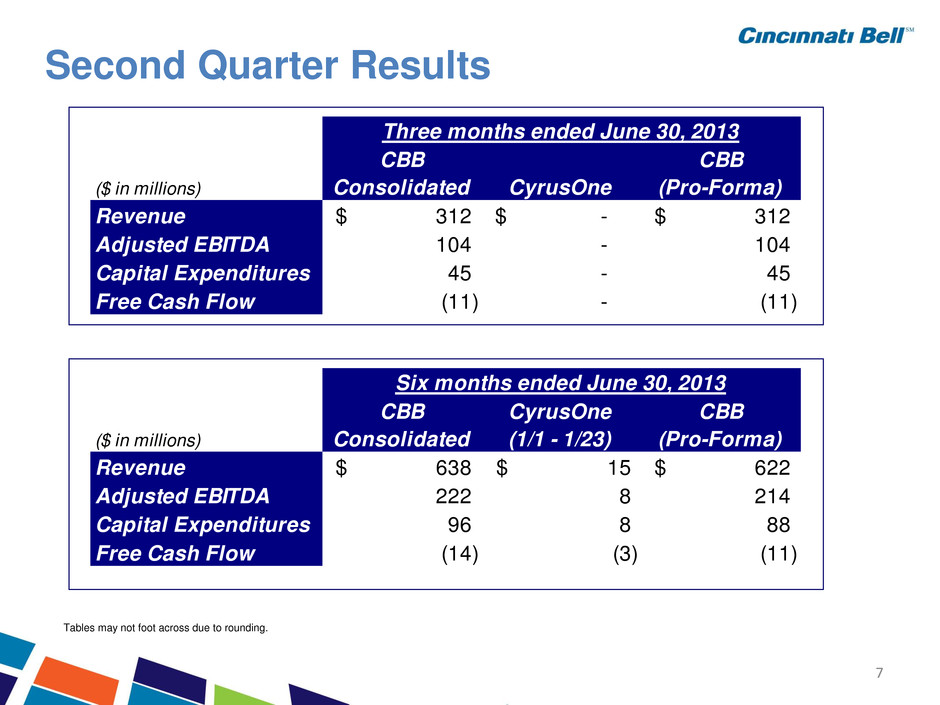

7 7 Second Quarter Results ($ in millions) CBB Consolidated CyrusOne CBB (Pro-Forma) Revenue 312$ -$ 312$ Adjusted EBITDA 104 - 104 Capital Expenditures 45 - 45 Free Cash Flow (11) - (11) Three months ended June 30, 2013 ($ in millions) CBB Consolidated CyrusOne (1/1 - 1/23) CBB (Pro-Forma) Revenue 638$ 15$ 622$ Adjusted EBITDA 222 8 214 Capital Expenditures 96 8 88 Free Cash Flow (14) (3) (11) Six months ended June 30, 2013 Tables may not foot across due to rounding.

8 8 Tables may not foot across due to rounding. Revenue View Strategic, Legacy and Integration … Capital investments fundamentally transform the revenue base ($ in millions) Q2 2013 Q2 2012 Variance % Q2 2013 Q2 2012 Variance % Strategic Voice 16.0$ 13.7$ 2.3$ 17% 31.2$ 27.3$ 3.9$ 14% Video 12.9 8.2 4.7 57% 24.7 15.5 9.1 59% Data 34.0 29.3 4.7 16% 66.0 57.8 8.2 14% Service 28.0 27.5 0.6 2% 53.9 53.6 0.3 1% Total Strategic 90.9 78.7 12.2 16% 175.8 154.3 21.5 14% Legacy Voice 69.9 78.3 (8.3) -11% 141.6 157.8 (16.2) -10% Data 47.0 49.8 (2.8) -6% 94.7 99.8 (5.1) -5% Service 6.7 7.7 (1.0) -13% 13.3 15.4 (2.1) -14% Total Legacy 123.6 135.7 (12.1) -9% 249.5 273.0 (23.5) -9% Integration Service 8.8 9.7 (0.9) -10% 18.4 19.1 (0.7) -4% Value Added Reseller 51.4 44.2 7.2 16% 102.6 84.7 18.0 21% Total Integration 60.2 53.9 6.3 12% 121.0 103.8 17.3 17% Wireless 51.7 61.8 (10.1) -16% 105.0 125.5 (20.5) -16% Total Revenue (before elims) 326.4$ 330.1$ (3.7)$ -1% 651.3$ 656.5$ (5.2)$ -1% Quarter-to-date Year-to-date

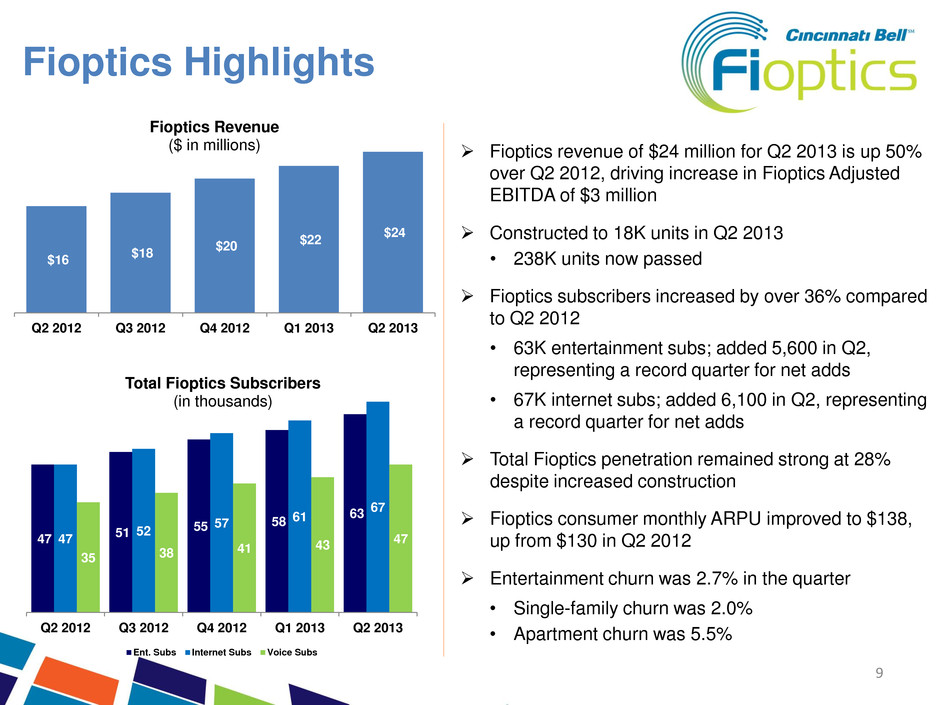

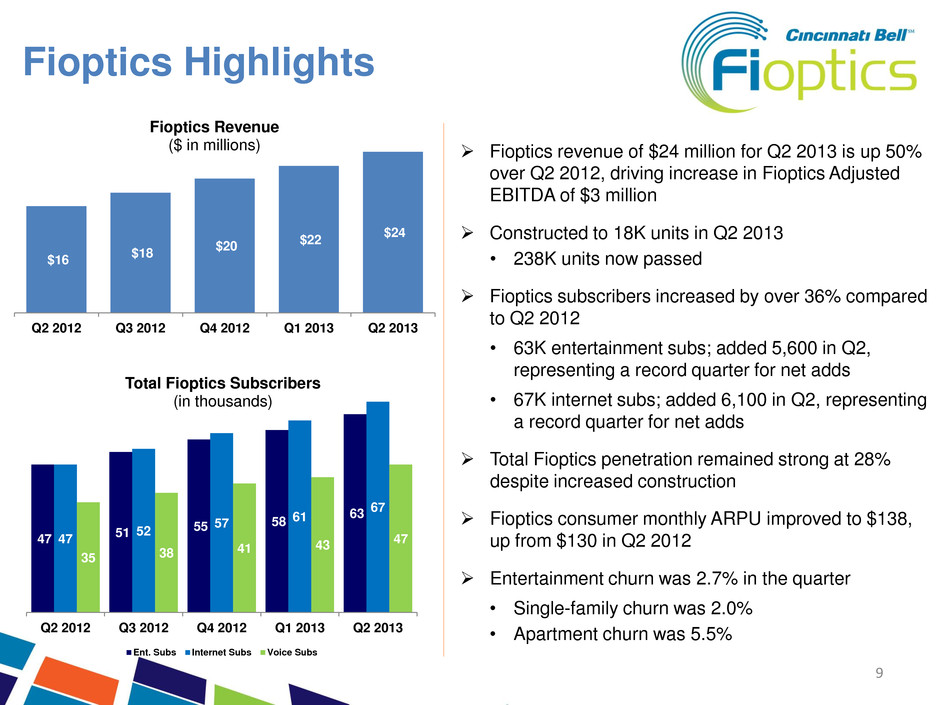

9 Fioptics revenue of $24 million for Q2 2013 is up 50% over Q2 2012, driving increase in Fioptics Adjusted EBITDA of $3 million Constructed to 18K units in Q2 2013 • 238K units now passed Fioptics subscribers increased by over 36% compared to Q2 2012 • 63K entertainment subs; added 5,600 in Q2, representing a record quarter for net adds • 67K internet subs; added 6,100 in Q2, representing a record quarter for net adds Total Fioptics penetration remained strong at 28% despite increased construction Fioptics consumer monthly ARPU improved to $138, up from $130 in Q2 2012 Entertainment churn was 2.7% in the quarter • Single-family churn was 2.0% • Apartment churn was 5.5% 9 Fioptics Highlights $16 $18 $20 $22 $24 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Fioptics Revenue ($ in millions) 47 51 55 58 63 47 52 57 61 67 35 38 41 43 47 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Total Fioptics Subscribers (in thousands) Ent. Subs Internet Subs Voice Subs

10 Internet Consumer subs by Provisioned Bandwidth Speed is THE Issue 10 49 77 97 90 40 35 44 32 Q2 2012 Q2 2013 Subs Less than 2 Mbps 2 to 4 Mbps 4 to 9 Mbps 10 Mbps or Higher Subscribers in thousands Now able to provide 10 meg of speed to more than 50 percent of our operating territory, up from 40 percent in the prior year 77K, or 33 percent, of our consumer subscribers now take a product with 10 meg of speed or more 57 percent year-over-year growth in consumer high-speed internet subs that take a product with 10 meg of speed or more Speed is important to churn • DSL churn in upgraded areas = 1.6% • DSL churn in areas not upgraded = 2.2%

11 11 Revenue from Business and Carrier Markets 81 79 78 76 75 62 63 63 63 67 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Legacy Strategic $143 $142 $141 $139 $142 Strategic and Legacy Revenue* ($ in millions) Strategic revenue increased 7 percent over prior year – continued strong demand for higher speed data connections • Metro-ethernet, cell site backhaul, and managed VOIP solutions Currently have 4,300 buildings and towers lit with fiber • More than 5x our closest competitor Targeted 400 additional Multiple Tenant Units (MTU) in our market to which we can efficiently expand our fiber services and achieve a high-level of penetration and return. * Excludes revenue from wireless, hardware sales and other integration services

12 12 CyrusOne Investment 2013 revenue and Adjusted EBITDA guidance remain unchanged CBB effectively owns 69% of CyrusOne, which is valued at $922 million as of June 30, 2013 Key considerations for monetization: • Retaining upside appreciation potential for a portion of the investment • Taking risk “off the table” with a portion of the investment * Adjusted EBITDA is defined as net (loss) income as defined by U.S. GAAP before noncontrolling interests plus interest expense, income tax (benefit) expense, depreciation and amortization, non-cash compensation, transaction costs and transaction-related compensation, including acquisition pursuit costs, loss on sale of receivables to affiliate, restructuring costs, loss on extinguishment of debt, asset impairments and excluding (gain) loss on sale of real estate improvements. ($ in millions) Q2 2013 Q2 2012 YTD 2013 YTD 2012 Revenue $64 $54 $124 $106 Adjusted EBITDA * 31 29 62 57

Kurt Freyberger Chief Financial Officer

14 14 ($ in millions) Revenue Adj. EBITDA Adj. EBITDA Margin Wireline Revenue and Adjusted EBITDA Investment in growth opportunities substantially offsets declines from access line and other legacy products Adjusted EBITDA declines from high margin access lines continue to outpace gains from strategic product offerings and cost savings initiatives, putting pressure on margins Access line loss in Q2 2013 controlled at 8.1% $184 $182 $182 $180 $182 $88 $84 $84 $85 $84 48% 46% 46% 47% 46% Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013

15 210 208 202 199 195 47 52 57 61 67 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 DSL Fioptics 15 High-speed Internet Highlights High-Speed Internet Customers (DSL & Fioptics) (in thousands) 262K high-speed internet subs at quarter end Growth in Fioptics high-speed internet subs offsets DSL subscriber decline High-speed internet churn was 2.0% in the quarter Organization Optimization CBTS / CBT integration update • Combined sales forces resulting in more than $1 million of annual savings • Additional annual cost savings of approximately $4 million expected from consolidating product offerings, systems, and back office • Integration provides opportunity to provide customers with an integrated IT and telecommunications solution with one trusted advisor Optimization project focused on “right-sizing” corporate functions expected to result in $10 million of annual savings once fully implemented

16 16 Revenue Adj. EBITDA Adj. EBITDA Margin Wireless Revenue & Adjusted EBITDA Continued cost containment efforts drove a strong Adjusted EBITDA margin of 37% in the quarter, despite 16% decrease in revenue compared to Q2 2012 ($ in millions) Postpaid revenue decreased by 20% from Q2 2012 • Year-over-year subscriber loss of 22% • Postpaid ARPU of $52.05 up $0.50 from Q2 2012 • Data ARPU grew 13% year-over-year • Churn was 2.5% for the quarter Prepaid revenue decreased by 8% from Q2 2012 • Subscribers migrate to lower rate plans, driving prepaid ARPU of $26.16, down 9% from Q2 2012 • Churn was 5.5% for the quarter, improved from 5.9% in Q2 2012 $62 $60 $57 $53 $52 $24 $21 $17 $20 $19 39% 35% 30% 38% 37% Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013

17 17 ($ in millions) IT Services and Hardware Strong revenue of $86 million in Q2 2013 • Telecom & IT Equipment revenue of $56 million was up 13% compared to Q2 2012 • Revenue from Managed and Professional Services of $30 million was up 9% compared to Q2 2012 Adjusted EBITDA and margin of $4 million and 4%, respectively, during the quarter $3 $6 $4 $4 $4 4% 8% 5% 5% 4% Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Adjusted EBITDA Adj. EBITDA Adj. EBITDA Margin $77 $78 $87 $85 $86 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Revenue

18 18 CBB Consolidated Results ($ in millions, except per share amounts) 2013 2012 $ % Revenue 312.0$ 368.2$ (56.2)$ (15)% Costs and expenses Cost of services and products 157.6 171.7 (14.1) (8)% Selling, general and administrative 54.7 63.4 (8.7) (14)% Depreciation and amortization 37.2 53.7 (16.5) (31)% Transaction-related compensation 7.1 - 7.1 n/m Restructuring charges 8.2 1.2 7.0 n/m Curtailment gain (0.6) - (0.6) n/m Loss on sale or disposal of assets, net 0.3 - 0.3 n/m Transaction costs 0.7 - 0.7 n/m Asset impairments - 13.0 (13.0) n/m Operating income 46.8 65.2 (18.4) (28)% Interest expense 45.4 53.7 (8.3) (15)% Loss from CyrusOne equity method investment 4.7 - 4.7 n/m Other expense, net 0.1 - 0.1 n/m (Loss) income before income taxes (3.4) 11.5 (14.9) n/m Income tax (benefit) expense (4.2) 7.0 (11.2) n/m Net income 0.8 4.5 (3.7) (82)% Preferred stock dividends 2.6 2.6 - 0% Net (loss) income applicable to common shareowners (1.8)$ 1.9$ (3.7)$ n/m Basic and diluted (loss) earnings per common share (0.01)$ 0.01$ Three Months Ended June 30, Change * Results for 2013 only include CyrusOne's results through January 23, 2013. Effective January 24, 2013, the date of completion of CyrusOne's IPO, the Company owns 69% of CyrusOne as an equity method investment, and therefore does not consolidate the CyrusOne results of operations in the total company or segment results.

19 Free Cash Flow (excluding CyrusOne) 19 Q2 2013 YTD 2013 ($ in millions) Adjusted EBITDA 104$ 214$ Interest Payments (58) (88) Capital Expenditures (45) (88) Pension and OPEB Payments (10) (18) Dividends from CyrusOne 7 7 Working Capital and Other (9) (38) Free Cash Flow (11)$ (11)$

20 2013 Capital Expenditures (excluding CyrusOne) 20 Full Year QTD YTD Low High Q2 2013 Q2 2013 ($ in millions) Fioptics 70$ 75$ 20$ 37$ Maintenance 60 60 12 26 Strategic Business 35 40 11 15 Wireless 15 15 2 10 180$ 190$ 45$ 88$

21 CONE shares owned by CBB 44,476,835 CONE stock price (Jun 30) 20.74$ CBB Equity value of CONE shares 922,449,558$ CBB Equity Value of CONE Shares in millions, except for Leverage ratio As of June 30, 2013 Net Debt 2,185$ Less: CBB Equity value of CONE shares 922 Net Debt - As Adjusted 1,263 Adjusted EBITDA - 2013 Guidance 390$ Leverage - Unadjusted 5.6x Leverage - As Adjusted for CONE investment 3.2x Leverage Position 21

Appendix

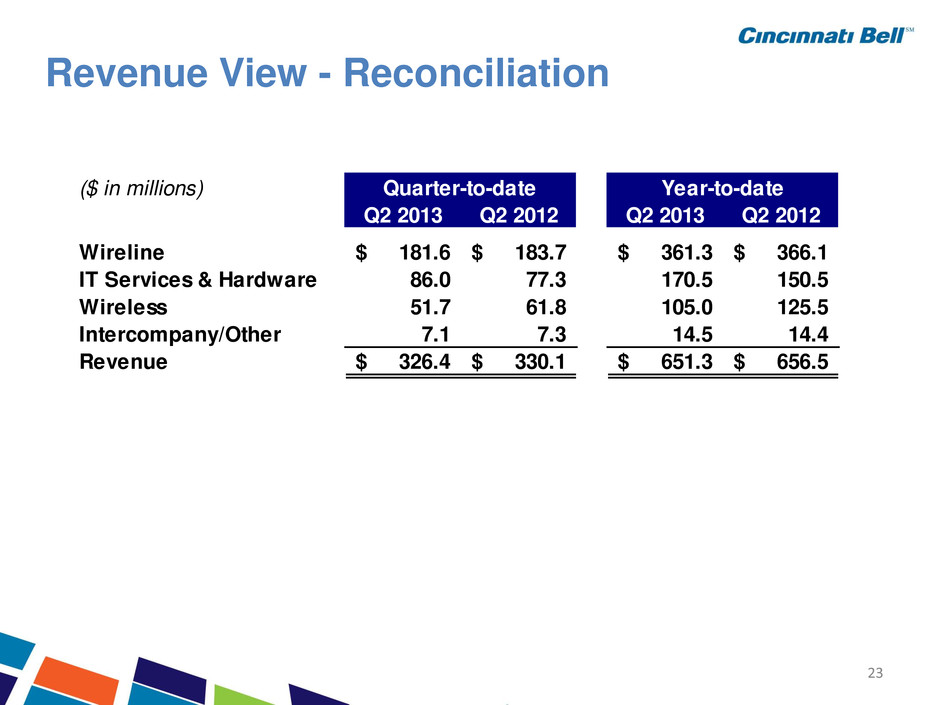

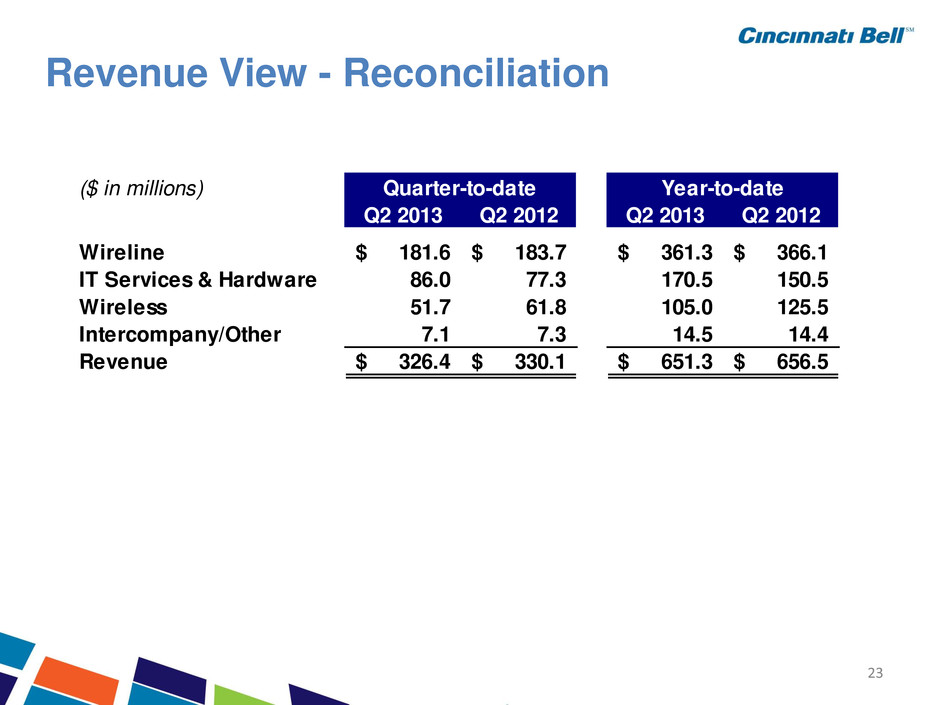

23 23 Revenue View - Reconciliation ($ in millions) Q2 2013 Q2 2012 Q2 2013 Q2 2012 Wireline 181.6$ 183.7$ 361.3$ 366.1$ IT Services & Hardware 86.0 77.3 170.5 150.5 Wireless 51.7 61.8 105.0 125.5 Intercompany/Other 7.1 7.3 14.5 14.4 Revenue 326.4$ 330.1$ 651.3$ 656.5$ Quarter-to-date Year-to-date

24 24 Revenue Captions - Examples Voice STRATEGIC LEGACY INTEGRATION Fioptics VoIP Services Access Lines Long Distance Prime Advantage Trunk Advantage Data Fioptics (Internet) Wave / DWDM Private Line MPLS Conferencing Metro Ethernet Dedicated Internet DSL LAN (less than 1.5 Mb) DSO, DS1, DS3 Video Fioptics (entertainment) Service Cloud & Collaboration Managed Services Professional Services Directory Assistance Rent Installation Maintenance VAR Hardware