Confidential I. Review of Cincinnati Bell (“CBB”) Today J.P. Morgan Global High Yield & Leveraged Finance Conference February 28, 2017

Confidential 2 Safe Harbor This presentation and the documents incorporated by reference herein contain forward-looking statements regarding future events and our future results that are subject to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical facts, are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts, and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “predicts,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “endeavors,” “strives,” “may,” variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of our future financial performance, our anticipated growth and trends in our businesses, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned these forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially and adversely from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this release and those discussed in other documents we file with the Securities and Exchange Commission (SEC). More information on potential risks and uncertainties is available in our recent filings with the SEC, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. Actual results may differ materially and adversely from those expressed in any forward- looking statements. We undertake no obligation to revise or update any forward-looking statements for any reason.

Confidential 3 Non GAAP Financial Measures This presentation contains information about adjusted earnings before interest, taxes, depreciation and amortization (Adjusted EBITDA), Adjusted EBITDA margin, net debt and free cash flow. These are non-GAAP financial measures used by Cincinnati Bell management when evaluating results of operations and cash flow. Management believes these measures also provide users of the financial statements with additional and useful comparisons of current results of operations and cash flows with past and future periods. Non-GAAP financial measures should not be construed as being more important than comparable GAAP measures. Detailed reconciliations of Adjusted EBITDA, net debt and free cash flow (including the Company’s definition of these terms) to comparable GAAP financial measures can be found in the earnings release on our website at www.cincinnatibell.com within the Investor Relations section.

Confidential Company Update 4

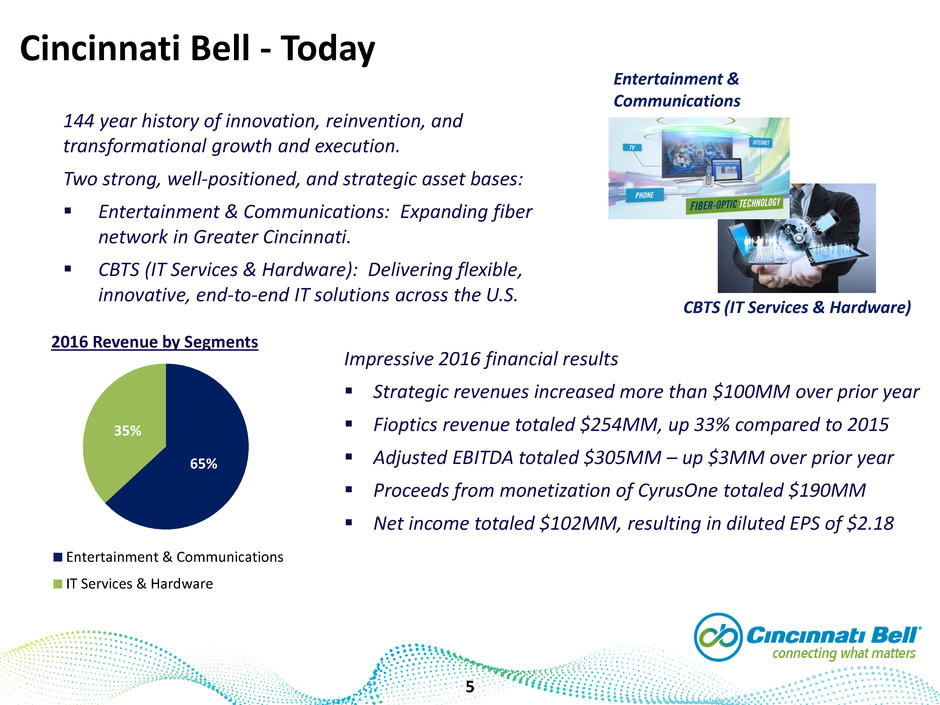

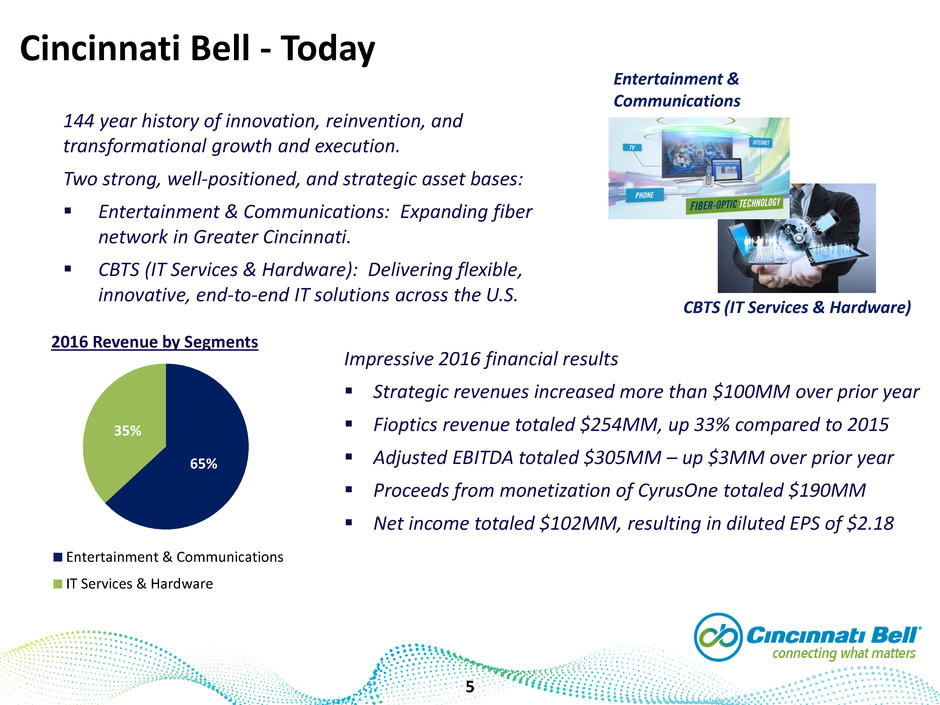

Confidential 144 year history of innovation, reinvention, and transformational growth and execution. Two strong, well-positioned, and strategic asset bases: Entertainment & Communications: Expanding fiber network in Greater Cincinnati. CBTS (IT Services & Hardware): Delivering flexible, innovative, end-to-end IT solutions across the U.S. Entertainment & Communications CBTS (IT Services & Hardware) 2016 Revenue by Segments Cincinnati Bell - Today 5 65% 35% Entertainment & Communications IT Services & Hardware Impressive 2016 financial results Strategic revenues increased more than $100MM over prior year Fioptics revenue totaled $254MM, up 33% compared to 2015 Adjusted EBITDA totaled $305MM – up $3MM over prior year Proceeds from monetization of CyrusOne totaled $190MM Net income totaled $102MM, resulting in diluted EPS of $2.18 5

Confidential Highlights and Financial Overview Entertainment & Communications IT Services & Hardware Eliminations Corporate Revenue Revenue Adjusted EBITDA (Non-GAAP) Adjusted EBITDA (Non-GAAP) $1,168 $1,186 $302 $305 YTD 2015 YTD 2016 Consolidated Revenue totaled $1.2B, increasing 2% compared to the prior year Revenue from strategic products totaled $638MM, up 19% compared to the prior year Net income totaled $102MM, resulting in diluted earnings per share of $2.18 Strong Adjusted EBITDA of $305MM, increasing $3MM over the prior year Issued $625MM of 7% Senior Notes due 2024 Proceeds used to redeem 8 3/8% Senior Notes due 2020 and $208MM of the outstanding Tranche B Term Loan Gain on the sale of 4.1MM CyrusOne common shares totaled $157MM YTD 2016 Highlights ($ in MM) __ __ 6

Confidential Assets Fiber network covering approximately 67% of Greater Cincinnati addresses Growing revenue from strategic services “Success based” capital investments with attractive returns Regional fiber-based network connecting Cincinnati, Chicago, Indianapolis, Columbus and Louisville Legacy telecommunications network connects Greater Cincinnati, including areas in northern Kentucky and southeast Indiana Strategy Gain market share from cable competition through superior assets, brand equity and customer relationships “Success based” investments for growth in business market (Ethernet and VoIP) Migrate customers from legacy to strategic services to lock in long-term revenue Positioned to win share of Internet market where satellite wins the video (ongoing relationship with DirecTV) Entertainment & Communications 7 7

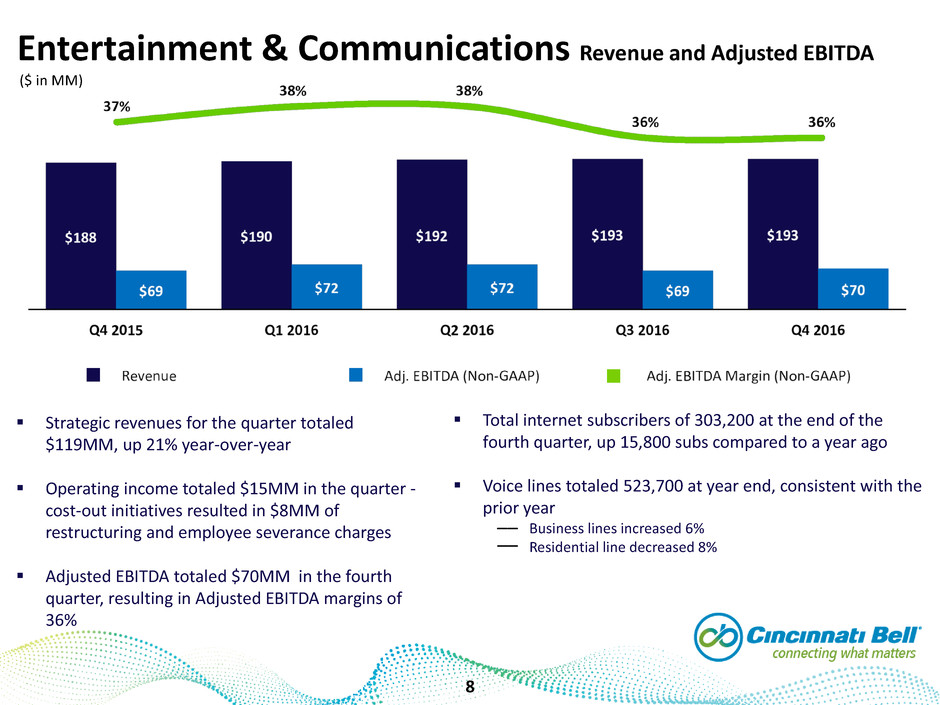

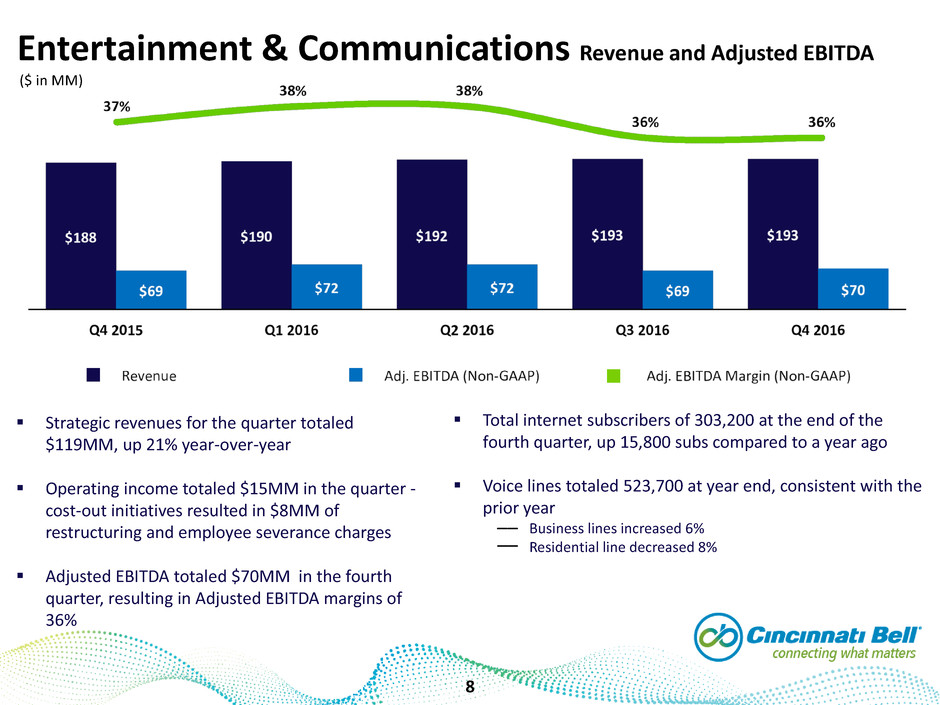

Confidential Entertainment & Communications Revenue and Adjusted EBITDA Strategic revenues for the quarter totaled $119MM, up 21% year-over-year Operating income totaled $15MM in the quarter - cost-out initiatives resulted in $8MM of restructuring and employee severance charges Adjusted EBITDA totaled $70MM in the fourth quarter, resulting in Adjusted EBITDA margins of 36% Total internet subscribers of 303,200 at the end of the fourth quarter, up 15,800 subs compared to a year ago Voice lines totaled 523,700 at year end, consistent with the prior year Business lines increased 6% Residential line decreased 8% __ __ ($ in MM) 8

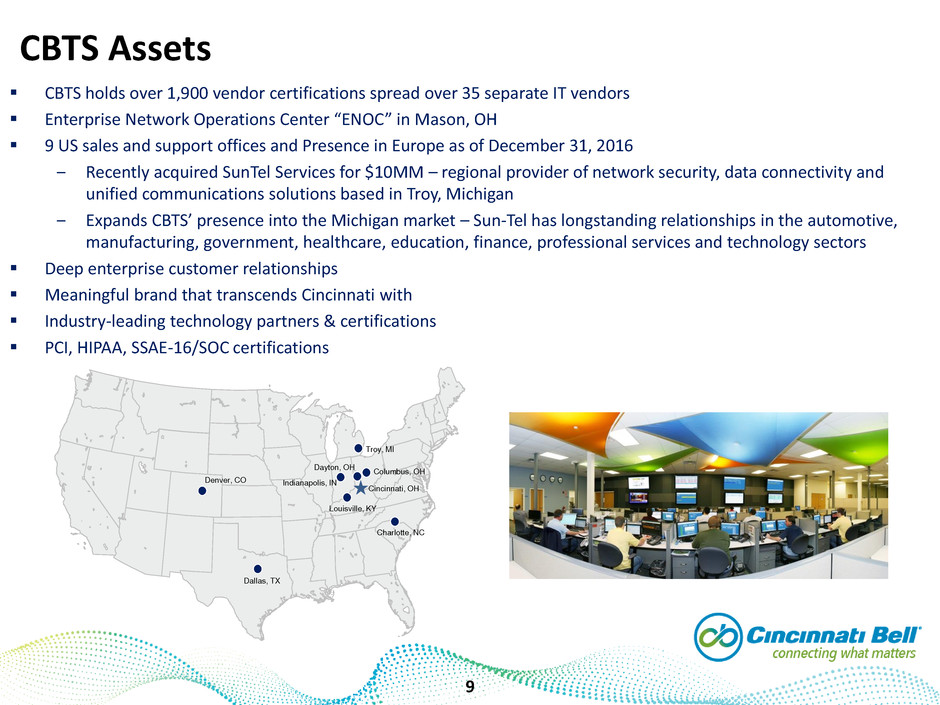

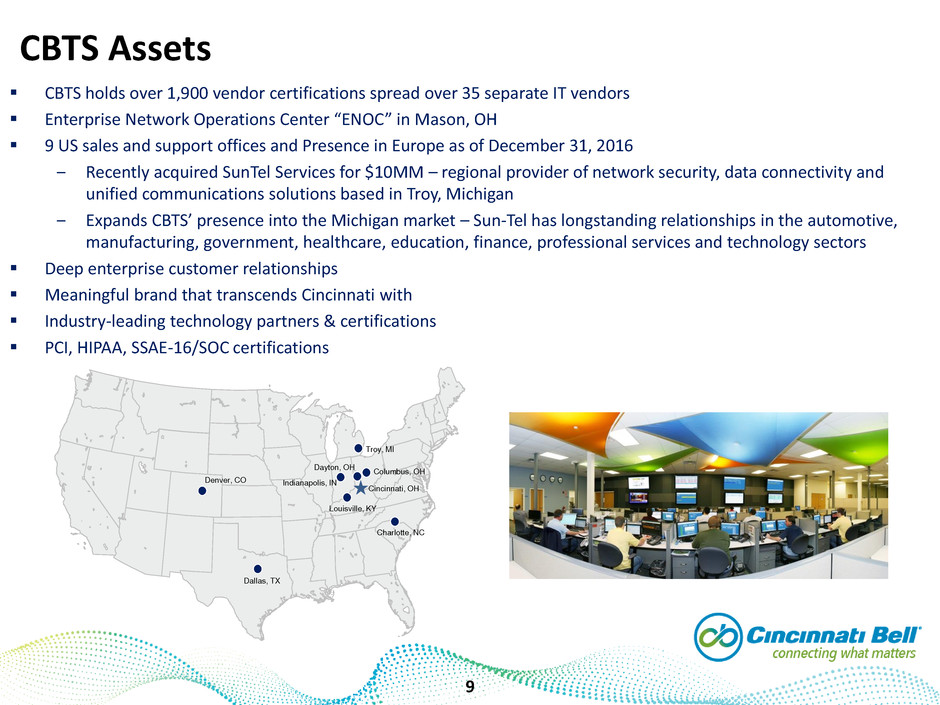

Confidential CBTS holds over 1,900 vendor certifications spread over 35 separate IT vendors Enterprise Network Operations Center “ENOC” in Mason, OH 9 US sales and support offices and Presence in Europe as of December 31, 2016 ‒ Recently acquired SunTel Services for $10MM – regional provider of network security, data connectivity and unified communications solutions based in Troy, Michigan ‒ Expands CBTS’ presence into the Michigan market – Sun-Tel has longstanding relationships in the automotive, manufacturing, government, healthcare, education, finance, professional services and technology sectors Deep enterprise customer relationships Meaningful brand that transcends Cincinnati with Industry-leading technology partners & certifications PCI, HIPAA, SSAE-16/SOC certifications Cincinnati, OH Columbus, OH Indianapolis, IN Dallas, TX Charlotte, NC Dayton, OH Louisville, KY Denver, CO CBTS Assets 9 9 Troy, MI

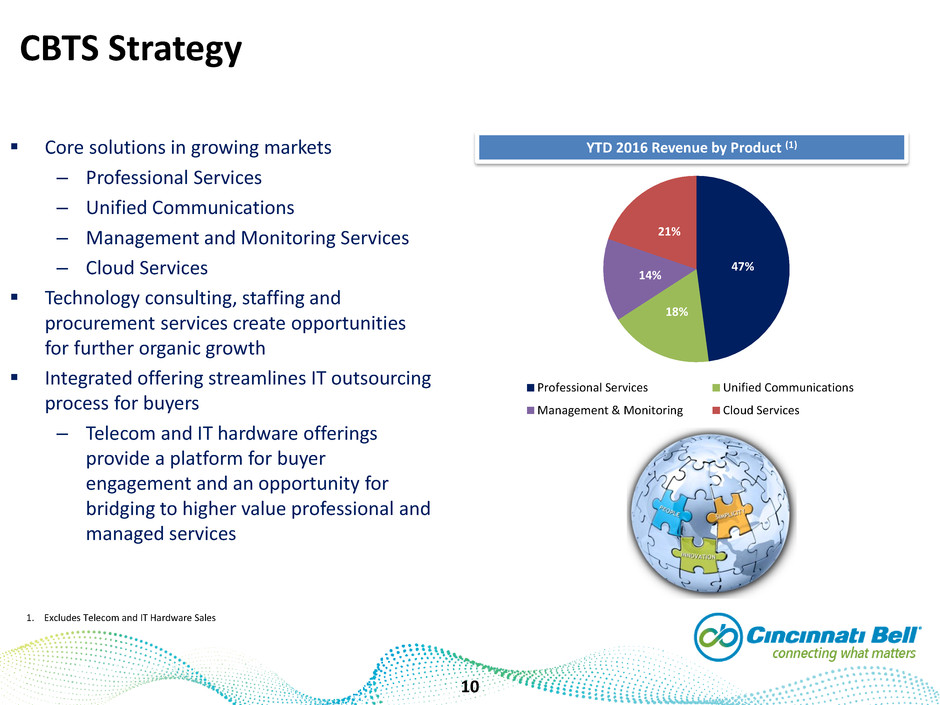

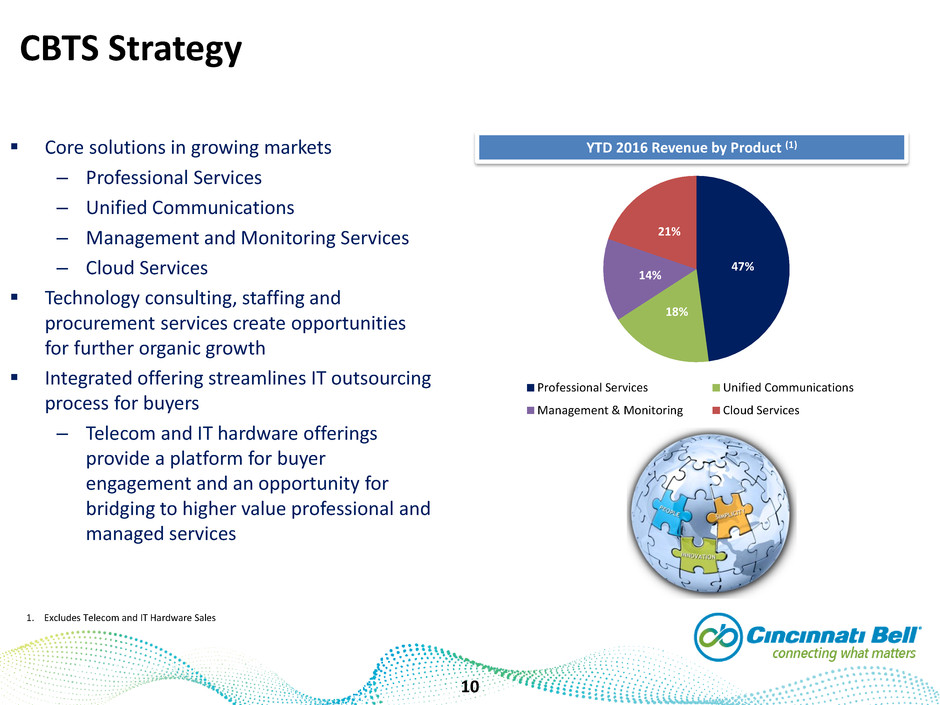

Confidential Core solutions in growing markets – Professional Services – Unified Communications – Management and Monitoring Services – Cloud Services Technology consulting, staffing and procurement services create opportunities for further organic growth Integrated offering streamlines IT outsourcing process for buyers – Telecom and IT hardware offerings provide a platform for buyer engagement and an opportunity for bridging to higher value professional and managed services YTD 2016 Revenue by Product (1) CBTS Strategy 10 [1] Excludes Telecom and IT Hardware sales 1. Excludes Telecom and IT Hardware Sales 10 47% 18% 14% 21% Professional Services Unified Communications Management & Monitoring Cloud Services

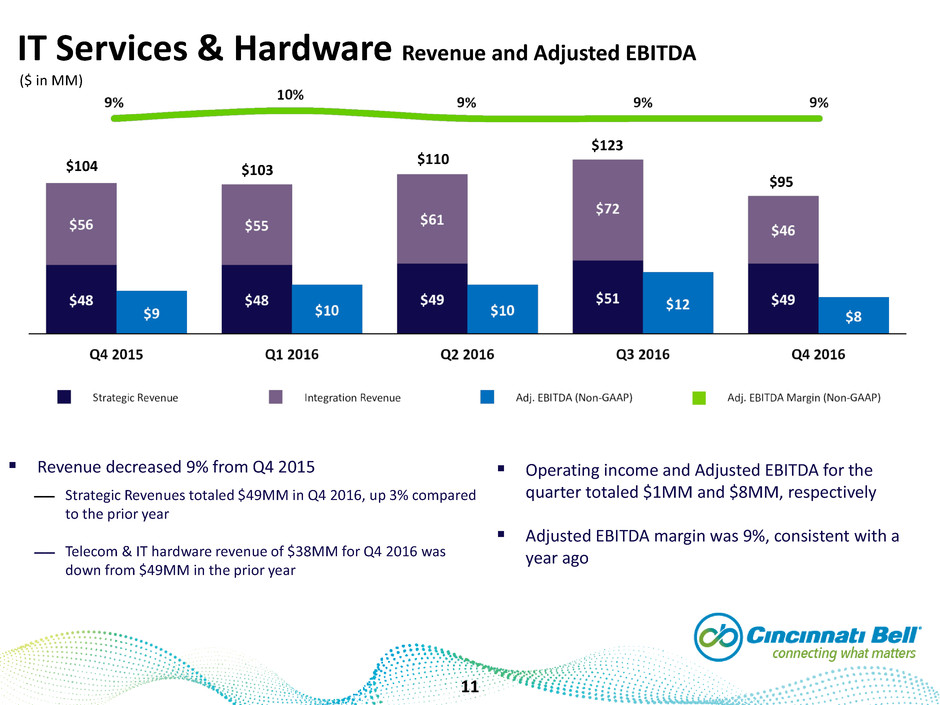

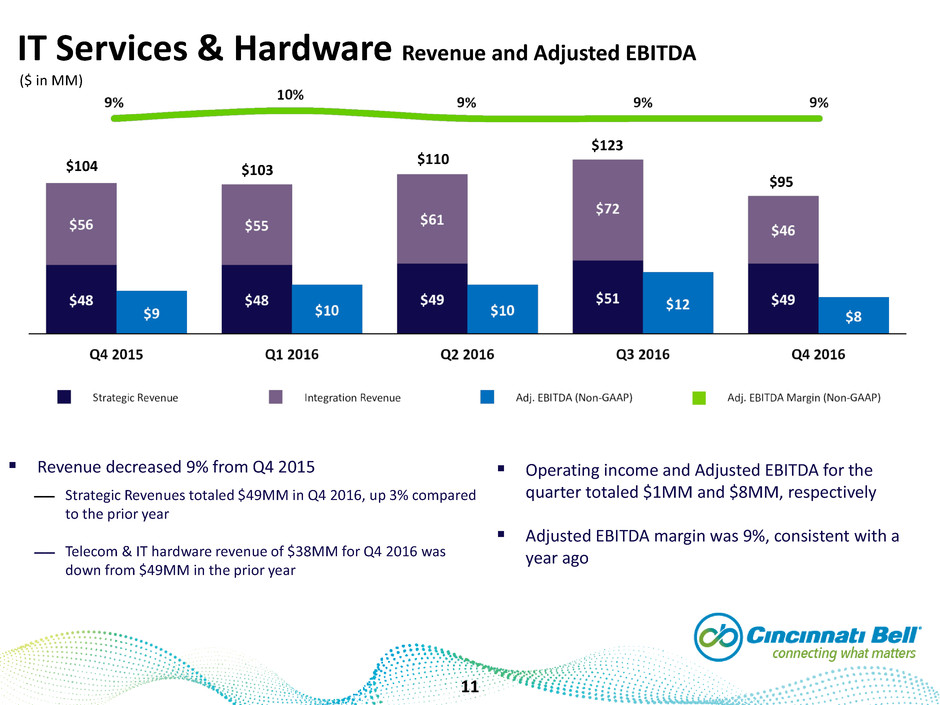

Confidential IT Services & Hardware Revenue and Adjusted EBITDA Revenue decreased 9% from Q4 2015 Strategic Revenues totaled $49MM in Q4 2016, up 3% compared to the prior year Telecom & IT hardware revenue of $38MM for Q4 2016 was down from $49MM in the prior year Operating income and Adjusted EBITDA for the quarter totaled $1MM and $8MM, respectively Adjusted EBITDA margin was 9%, consistent with a year ago $104 $103 $110 $123 $95 __ __ ($ in MM) 11

Confidential $316 $22 $625 $88 $120 $150 Term Loan B Bonds Revolving Debt ProForma ($ in MM) 12/31/2016 Adj[1] 12/31/2016 Maturity Cash & Cash Equivalents 10$ -$ 10$ Corporate Credit Facility - - - 1/15/20 Receivables Facility 90 (90) - 5/26/17 Tranche B Term Loan 316 - 316 9/10/20 Cincinnati Bell Telephone Notes 88 - 88 12/1/28 7.25% Senior Secured Notes due 2023 22 - 22 6/15/23 Capital Leases and Other Debt 17 - 17 Various Senior Secured Debt 533$ (90)$ 443$ 7% Senior Notes Du 2024 625 - 625 7/15/24 Capital Leases - Wireless Towers 52 - 52 Various Net Unamortized Discount 9 - 9 Unamortized Note Issuance Costs (12) - (12) Total Debt 1,207$ (90)$ 1,117$ ($ in MM) Confidential Maturities Extended Maturities + Strong Liquidity + CONE Stake + Pre-payable Debt = Flexible Capital Structure Liquidity ProForma 12/31/2016 Adj[1] 12/31/2016 Cash and Cash Equivalents 10$ -$ 10$ Corporate Credit Facility 150 - 150 Receivables Facility 24 90 114 Liquidity 184$ 90$ 274$ Flexible Capital Structure 12 ($ in MM) [1] Adjustment reflects sale of approximately 2MM shares of CyrusOne for proceeds of approximately $100MM. Proceeds were primarily used to repay amounts outstanding on the Receivables Facility and $10MM for the acquisition of SunTel Services.

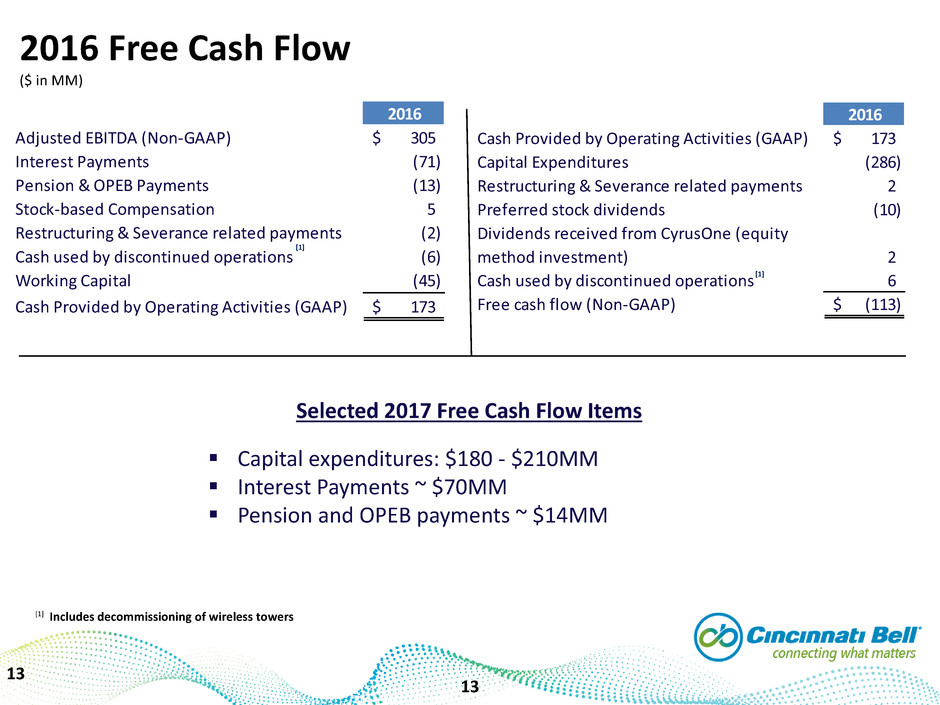

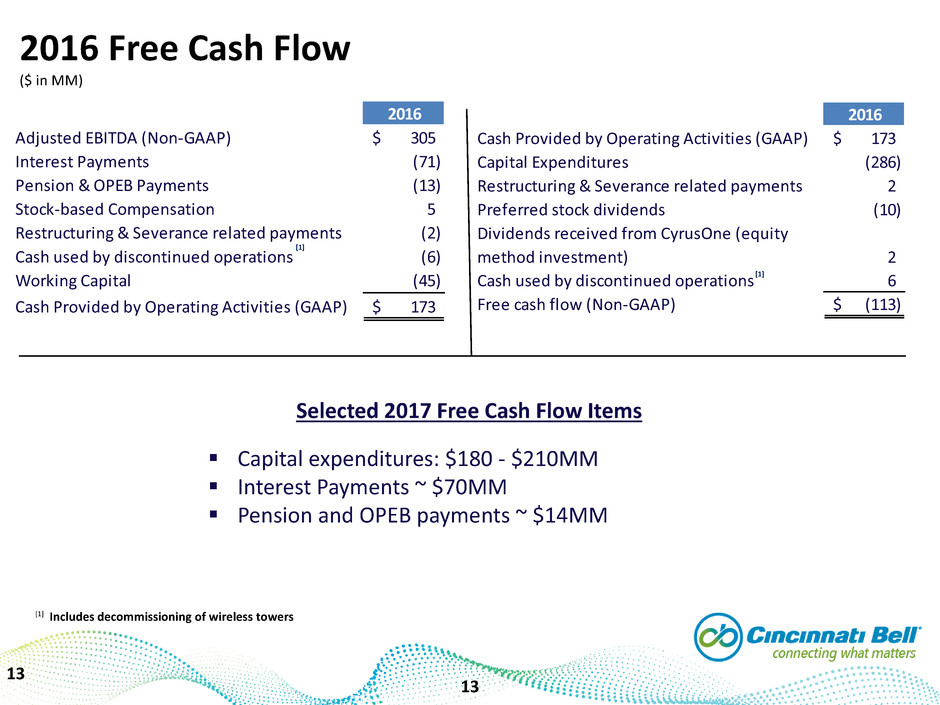

Confidential 2016 Cash Provided by Operating Activities (GAAP) 173$ Capital Expe ditures (286) Restructuring & Severance related payments 2 Preferred stock dividends (10) Dividends received from CyrusOne (equity method investment) 2 Cash used by discontinued operations 6 Free cash flow (Non-GAAP) (113)$ 2016 Adjusted EBITDA (Non-GAAP) 305$ Interest Payments (71) Pension & OPEB Payments (13) Stock-based Comp nsation 5 Restructuring & Se era ce lated payments (2) Cash used by discon inued operations (6) Working Capital (45) Cash Provided by Oper ting Activities (G AP) 173$ 2016 Free Cash Flow Selected 2017 Free Cash Flow Items Capital expenditures: $180 - $210MM Interest Payments ~ $70MM Pension and OPEB payments ~ $14MM 13 ($ in MM) Includes decommissioning of wireless towers [1] [1] [1] 13

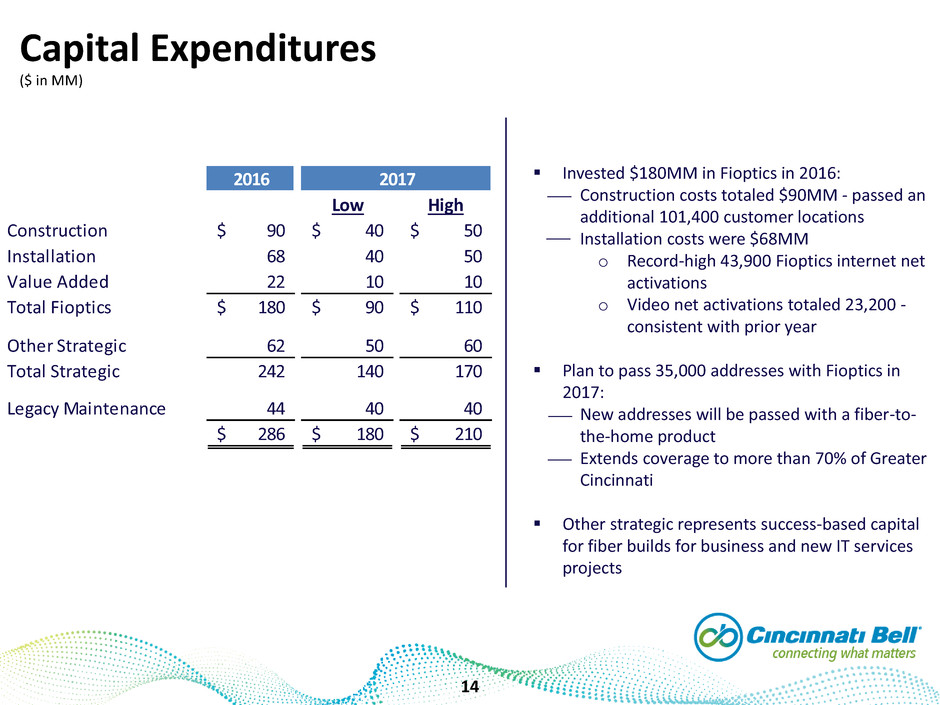

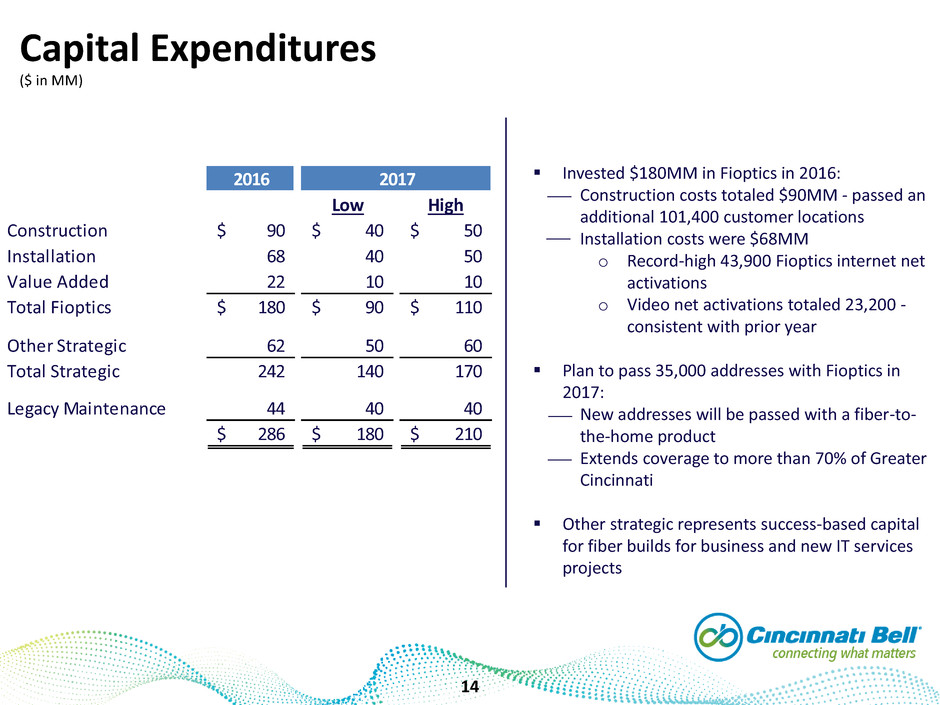

Confidential Capital Expenditures ($ in MM) Invested $180MM in Fioptics in 2016: Construction costs totaled $90MM - passed an additional 101,400 customer locations Installation costs were $68MM o Record-high 43,900 Fioptics internet net activations o Video net activations totaled 23,200 - consistent with prior year Plan to pass 35,000 addresses with Fioptics in 2017: New addresses will be passed with a fiber-to- the-home product Extends coverage to more than 70% of Greater Cincinnati Other strategic represents success-based capital for fiber builds for business and new IT services projects __ __ __ __ 14 2016 Low High Construction 90$ 40$ 50$ Installation 68 40 50 Value Add d 22 10 10 Total Fioptics 180$ 90$ 110$ Other Strategic 62 50 60 Total Strategic 242 140 170 Legacy Maintenance 44 40 40 286$ 180$ 210$ 2017

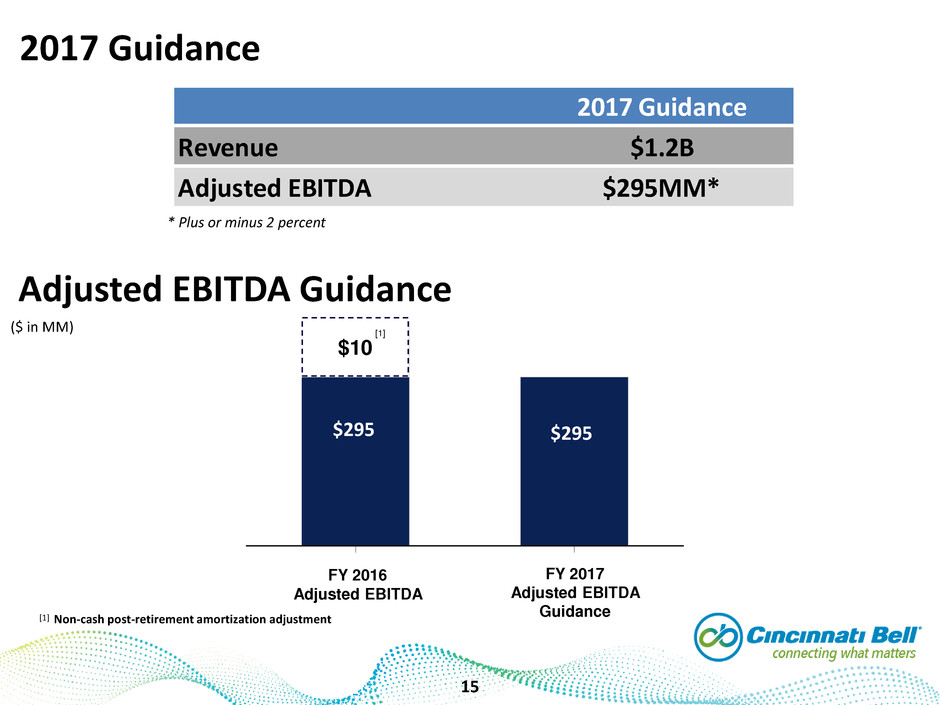

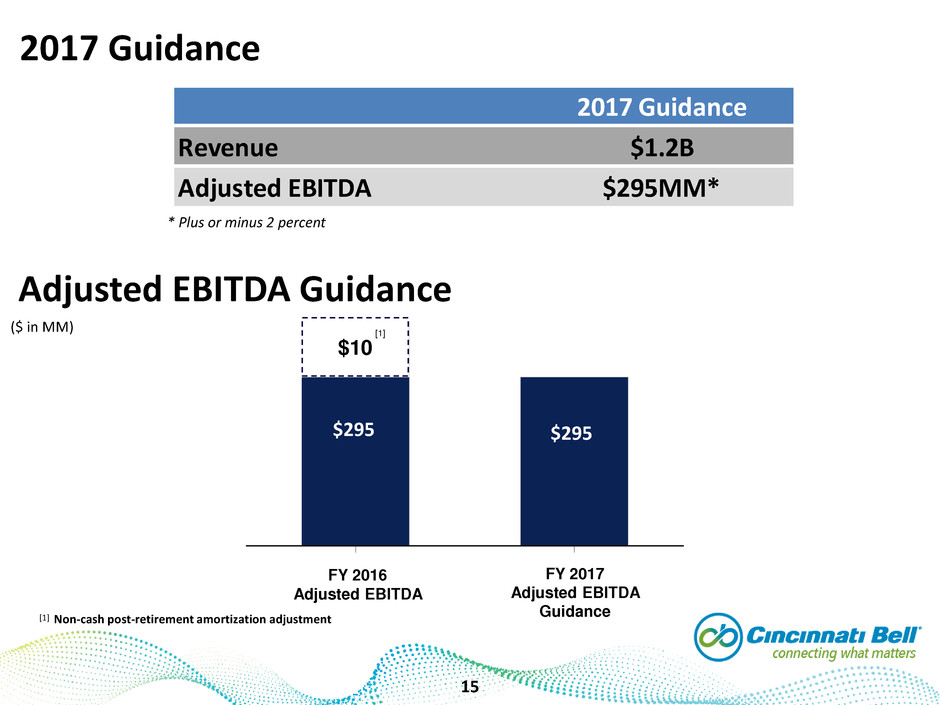

Confidential 2017 Guidance * Plus or minus 2 percent FY 2016 Adjusted EBITDA FY 2017 Adjusted EBITDA Guidance $295 $297 Adjusted EBITDA Guidance ($ in MM) Non-cash post-retirement amortization adjustment $295 $295 [1] $10 [1] 15 2017 Guidance Revenue $1.2B Adjusted EBITDA $295MM*