Exhibit 99.2

Cincinnati Bell 1st Quarter 2007 Review May 8, 2007

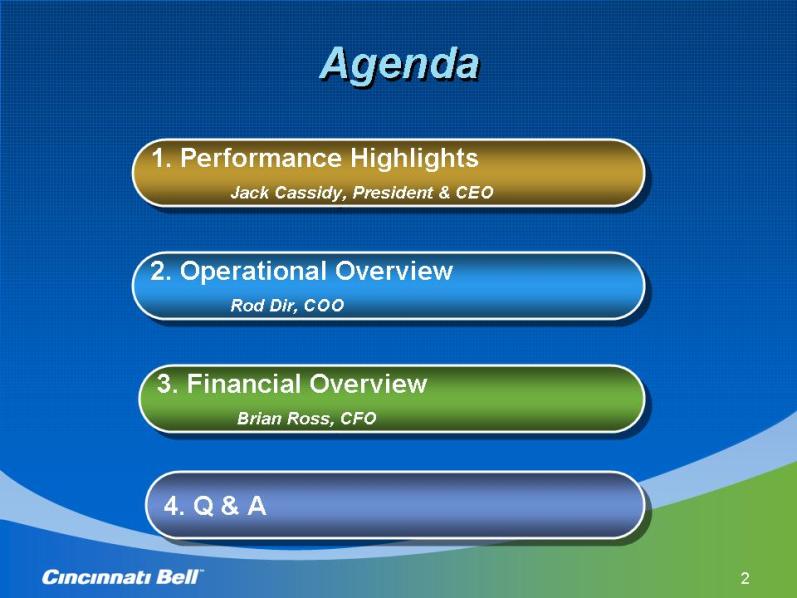

Agenda Agenda 1. Performance Highlights Jack Cassidy, President & CEO 1. Performance Highlights Jack Cassidy, President & CEO 2. Operational Overview Rod Dir, COO 2. Operational Overview Rod Dir, COO 3. Financial Overview Brian Ross, CFO 3. Financial Overview Brian Ross, CFO 4. Q & A 4. Q & A

Safe Harbor Safe Harbor Certain of the statements and predictions contained in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. In particular, any statements, projections or estimates that include or reference the words “believes,” “anticipates,” “plans,” “intends,” “expects,” “will,” or any similar expression fall within the safe harbor for forward-looking statements contained in the Reform Act. Actual results or outcomes may differ materially from those indicated or suggested by any such forward-looking statement for a variety of reasons, including but not limited to, Cincinnati Bell’s ability to maintain its market position in communications services, including wireless, wireline and internet services; general economic trends affecting the purchase or supply of communication services; world and national events that may affect the ability to provide services; changes in the regulatory environment; any rulings, orders or decrees that may be issued by any court or arbitrator; restrictions imposed under various credit facilities and debt instruments; work stoppages caused by labor disputes; adjustments resulting from year-end audit procedures; and Cincinnati Bell’s ability to develop and launch new products and services. More information on potential risks and uncertainties is available in recent filings with the Securities and Exchange Commission, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Forms 8-K. The forward-looking statements included in this presentation represent estimates as of the date on the first slide. It is anticipated that subsequent events and developments will cause estimates to change.

Performance Highlights Performance Highlights Jack Cassidy Jack Cassidy President & CEO President & CEO

1Q 2007 Accomplishments 1Q 2007 Accomplishments Year over year growth in revenue, EBITDA and net income 20%+ revenue & EBITDA growth in Technology Solutions Nearly 10% increase in business enterprise revenue

2007 Revenue Growth 2007 Revenue Growth 1Q06 Revenue Wireline Voice Data/Other Wireless Technology Solutions 1Q 07 Revenue ⑀⍂ Wireline data growth primarily due to 22% increase in DSL subscribers ⑀⍂ Wireless reflects a 12% increase in service revenue ⑀⍂ Technology Solutions revenue increase of 25% • 22% in telecom and IT equipment • 36% growth in managed services $’s in Millions $298 ($6) $7 $7 $10 $315 * May not foot due to rounding

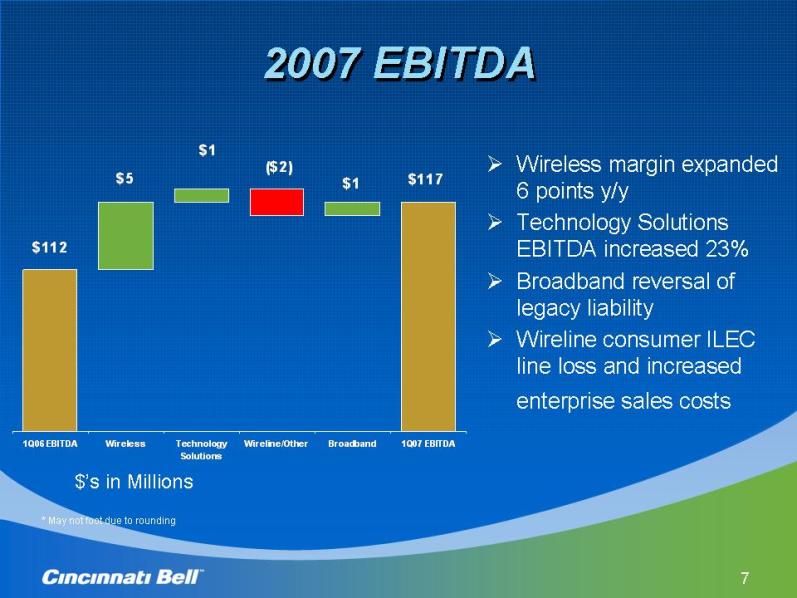

2007 EBITDA 2007 EBITDA ⑀⍂ Wireless margin expanded 6 points y/y ⑀⍂ Technology Solutions EBITDA increased 23% ⑀⍂ Broadband reversal of legacy liability ⑀⍂ Wireline consumer ILEC line loss and increased enterprise sales costs $’s in Millions $117 $112 $5 ($2) $1 $1 1Q06 EBITDA Wireless Technology Solutions Wireline/Other Broadband 1Q07 EBITDA * May not foot due to rounding

Earnings per Share Growth Earnings per Share Growth $0.08 $0.08 1Q06 1Q07 (Excludes special items) $0.05 $0.08 1Q06 1Q07 1Q06 included a $6M special item ($4M after-tax) related to settlement of a shareholder claim and a $4M state income tax write-off (per GAAP)

Continued Diversification of Revenue Base Wireline Voice - Consumer Wireline Voice - Business Wireline Data Technology Solutions Other Wireless ⑀⍂ Majority of total revenue derived from sources other than traditional consumer wireline voice • 81% vs 78% in 1Q06 (before intercompany eliminations) 19% 21% 15% 10% 16% 19% (includes Long Distance)

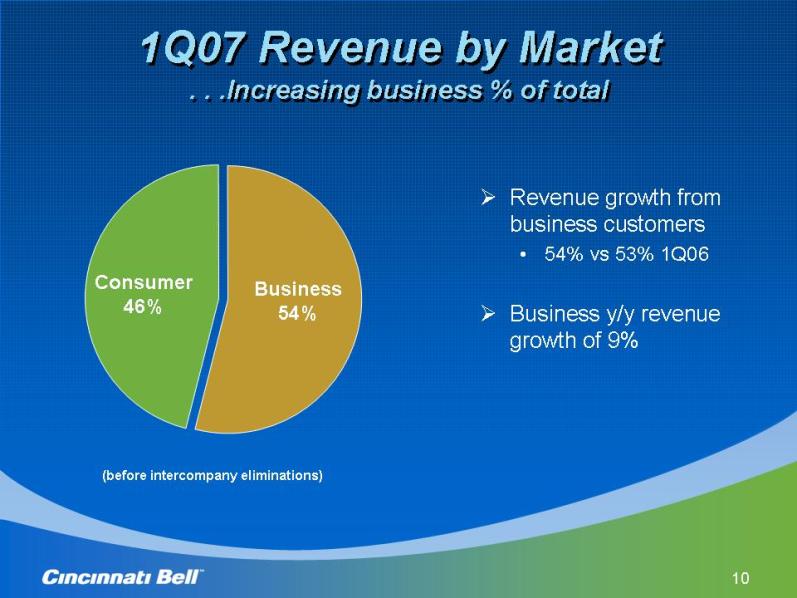

1Q07 Revenue by Market . . .Increasing business % of total (before intercompany eliminations) Consumer 46% Business 54% ⑀⍂ Revenue growth from business customers • 54% vs 53% 1Q06 ⑀⍂ Business y/y revenue growth of 9%

Technology Solutions . . . Our investment in this business ⑀⍂ Returns are attractive and contracts can be extended • Targeting 20%+ return on capital • Larger contracts can be up to 10 years in length ⑀⍂ 1Q07 $12M capital expenditure on future data center expansion ⑀⍂ Selected as the data center provider by both prospective and existing customers • Contract negotiations underway • Space under consideration approximates total space under construction

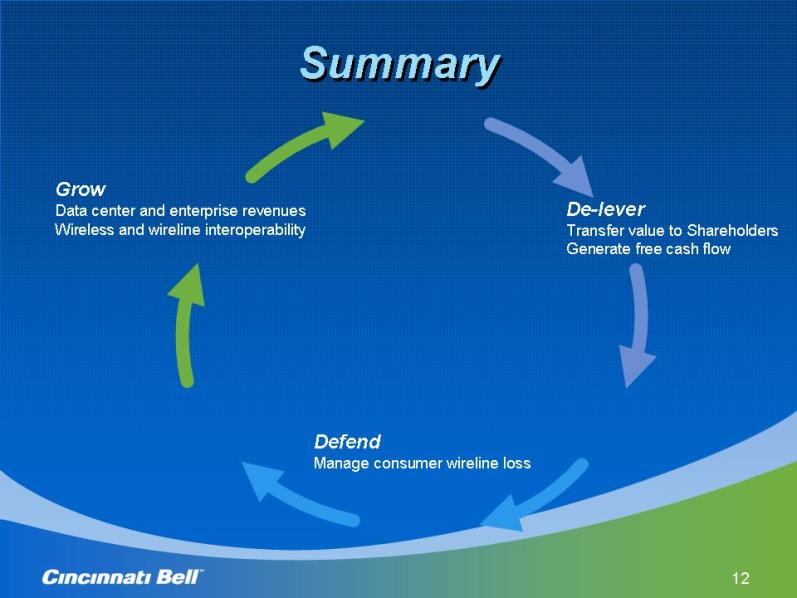

Summary Summary Grow Data center and enterprise revenues Wireless and wireline interoperability De-lever Transfer value to Shareholders Generate free cash flow Defend Manage consumer wireline loss

Operational Overview Operational Overview Rod Dir Chief Operating Officer

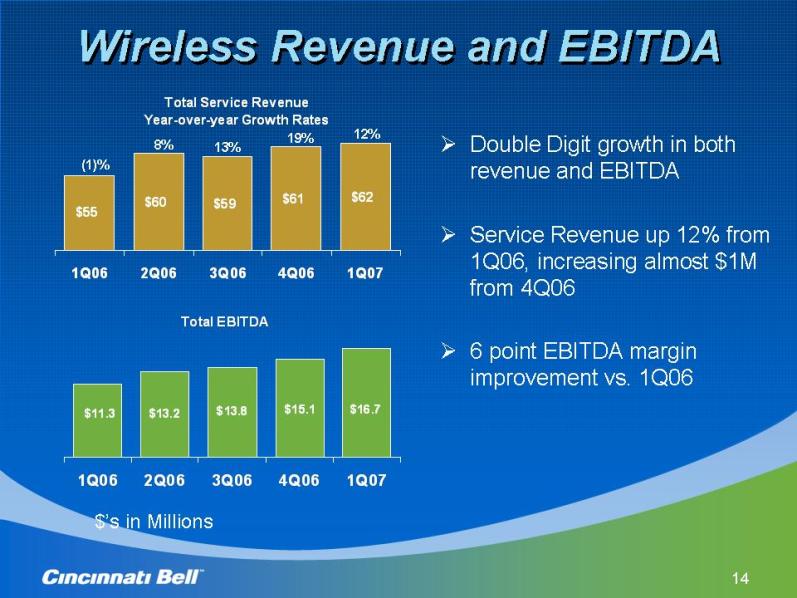

Wireless Revenue and EBITDA Wireless Revenue and EBITDA Total Service Revenue Year-over-year Growth Rates $55 $60 $59 $61 $62 1Q06 2Q06 3Q06 4Q06 1Q07 Total EBITDA $16.7 $15.1 $13.8 $13.2 $11.3 1Q06 2Q06 3Q06 4Q06 1Q07 ⑀⍂ Double Digit growth in both revenue and EBITDA ⑀⍂ Service Revenue up 12% from 1Q06, increasing almost $1M from 4Q06 ⑀⍂ 6 point EBITDA margin improvement vs. 1Q06 (1)% 8% 13% 19% $’s in Millions

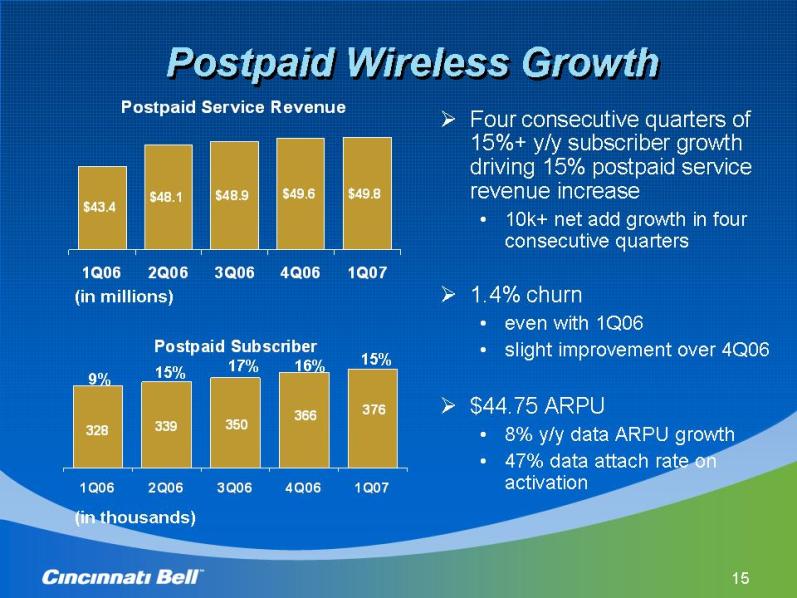

Postpaid Wireless Growth Postpaid Wireless Growth ⑀⍂ Four consecutive quarters of 15%+ y/y subscriber growth driving 15% postpaid service revenue increase • 10k+ net add growth in four consecutive quarters ⑀⍂ 1.4% churn • even with 1Q06 • slight improvement over 4Q06 ⑀⍂ $44.75 ARPU • 8% y/y data ARPU growth • 47% data attach rate on activation Postpaid Service Revenue $43.4 $48.1 $48.9 $49.6 $49.8 1Q06 2Q06 3Q06 4Q06 1Q07 (in millions) Postpaid Subscriber 328 339 376 366 350 1Q06 2Q06 3Q06 4Q06 1Q07 (in thousands) 9% 17% 15% 16% 15%

Prepaid Wireless Prepaid Wireless $10.8 $9.6 $11.1 $11.1 $11.3 1Q06 2Q06 3Q06 4Q06 1Q07 ⑀⍂ Strong seasonal 13k 1Q07 net activations ⑀⍂ Quarterly prepaid ARPU up 10% year-over-year ⑀⍂ New rate plans are driving ARPU and service revenue growth (in millions) Prepaid Service Revenue Prepaid ARPU $20.42 $20.87 $22.42 $22.71 $19.51 1Q06 2Q06 3Q06 4Q06 1Q07

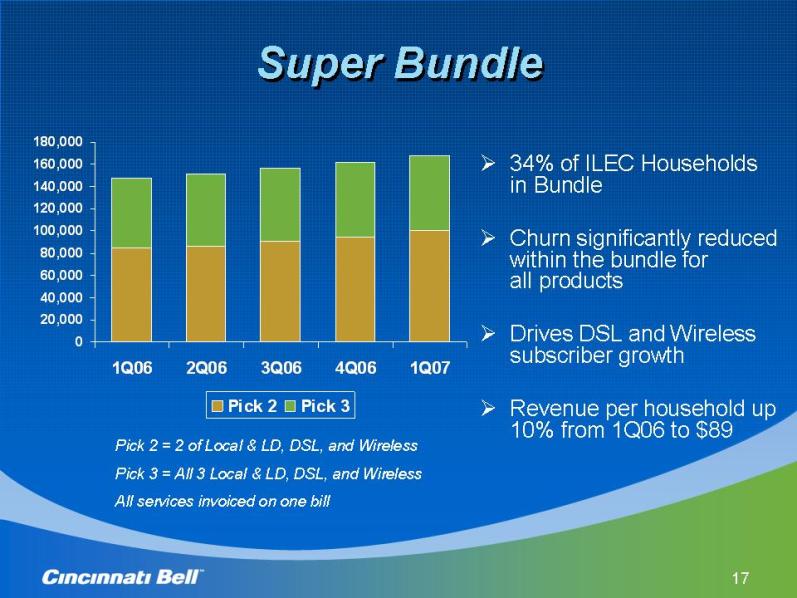

Super Bundle Super Bundle ⑀⍂ 34% of ILEC Households in Bundle ⑀⍂ Churn significantly reduced within the bundle for all products ⑀⍂ Drives DSL and Wireless subscriber growth ⑀⍂ Revenue per household up 10% from 1Q06 to $89 Pick 2 = 2 of Local & LD, DSL, and Wireless Pick 3 = All 3 Local & LD, DSL, and Wireless All services invoiced on one bill 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 1Q06 2Q06 3Q06 4Q06 1Q07 Pick 2 Pick 3

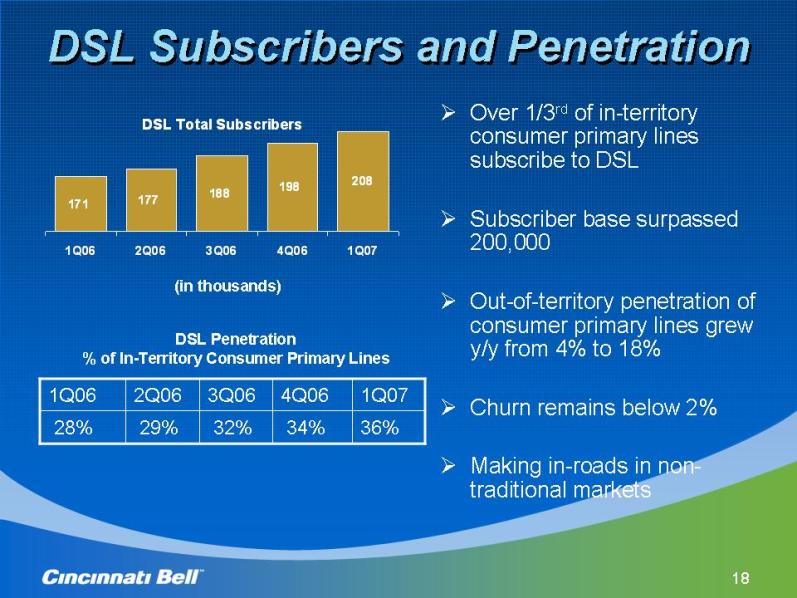

DSL Subscribers and Penetration DSL Subscribers and Penetration ⑀⍂ Over 1/3rd of in-territory consumer primary lines subscribe to DSL ⑀⍂ Subscriber base surpassed 200,000 ⑀⍂ Out-of-territory penetration of consumer primary lines grew y/y from 4% to 18% ⑀⍂ Churn remains below 2% ⑀⍂ Making in-roads in nontraditional markets DSL Total Subscribers 171 177 188 198 208 1Q06 2Q06 3Q06 4Q06 1Q07 (in thousands) 36% 34% 32% 29% 28% 1Q07 4Q06 3Q06 2Q06 1Q06 DSL Penetration % of In-Territory Consumer Primary Lines

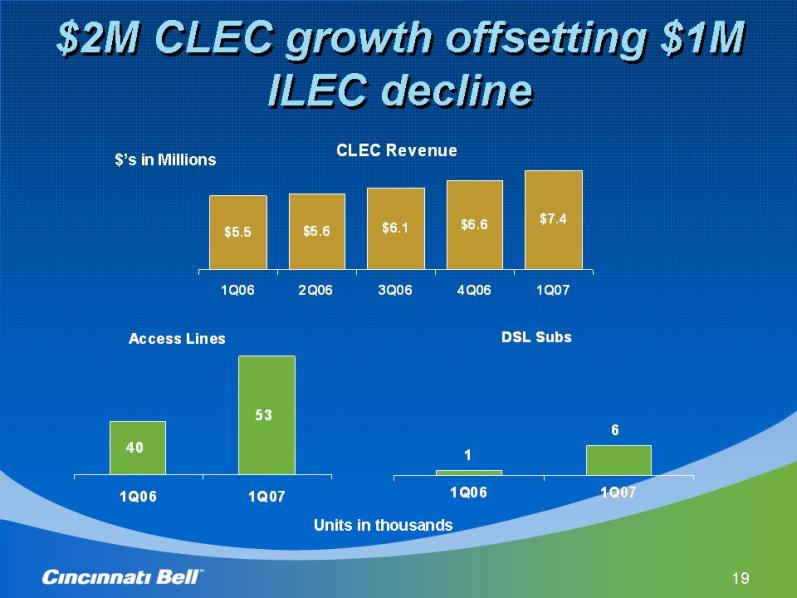

$2M CLEC growth offsetting $1M ILEC decline CLEC Revenue $5.5 $5.6 $6.1 $6.6 $7.4 1Q06 2Q06 3Q06 4Q06 1Q07 Access Lines 40 53 1Q06 1Q07 DSL Subs 1 6 1Q06 1Q07 $’s in Millions Units in thousands

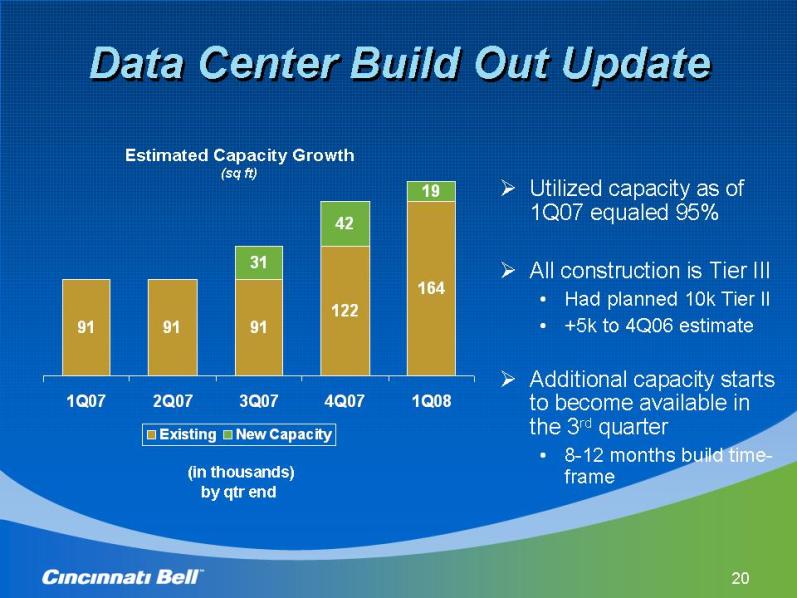

Data Center Build Out Update Data Center Build Out Update Estimated Capacity Growth (sq ft) 91 91 91 122 164 31 42 19 1Q07 2Q07 3Q07 4Q07 1Q08 Existing New Capacity (in thousands) ⑀⍂ Utilized capacity as of 1Q07 equaled 95% ⑀⍂ All construction is Tier III • Had planned 10k Tier II • +5k to 4Q06 estimate ⑀⍂ Additional capacity starts to become available in the 3rd quarter • 8-12 months build timeframe by qtr end

Financial Overview Financial Overview Brian Ross Brian Ross Chief Financial Officer Chief Financial Officer

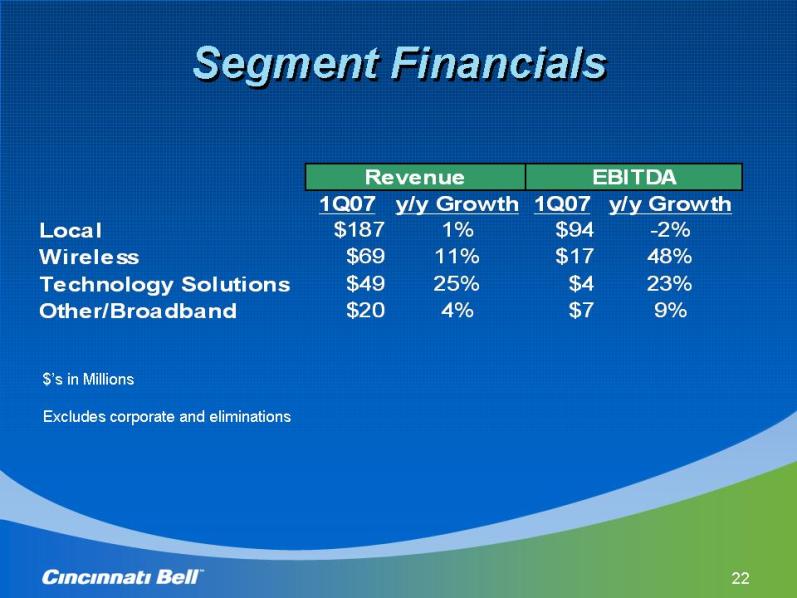

Segment Financials Segment Financials $’s in Millions Excludes corporate and eliminations 1Q07 y/y Growth 1Q07 y/y Growth Local $187 1% $94 -2% Wireless $69 11% $17 48% Technology Solutions $49 25% $4 23% Other/Broadband $20 4% $7 9% Revenue EBITDA

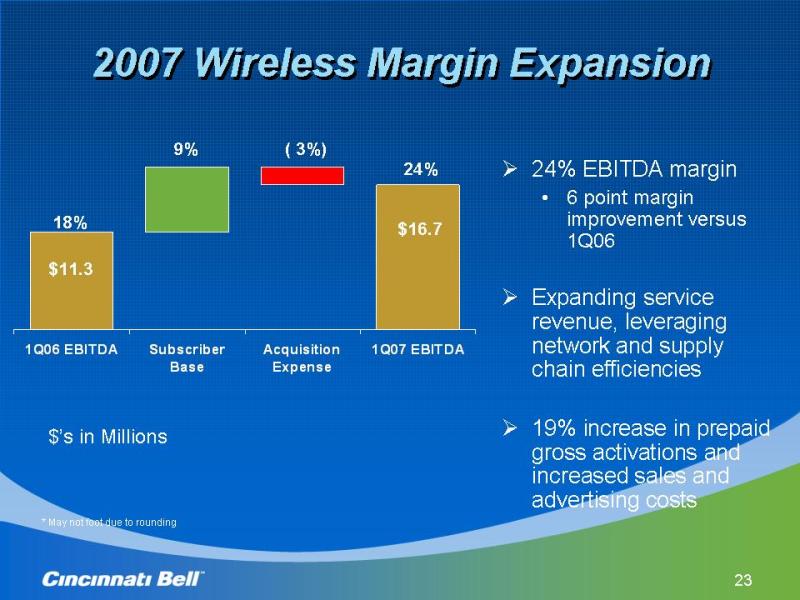

2007 Wireless Margin Expansion ( 3%) 9% 18% 24% $11.3 $16.7 1Q06 EBITDA Subscriber Base Acquisition Expense 1Q07 EBITDA $’s in Millions * May not foot due to rounding 24% EBITDA margin • 6 point margin improvement versus 1Q06 ⑀⍂ Expanding service revenue, leveraging network and supply chain efficiencies ⑀⍂ 19% increase in gross activations and increased sales and advertising costs

Free Cash Flow Strong In Spite of Capex Increase ($ in Millions) ⑀⍂ Earnings growth offset by increased capital and interest payment ⑀⍂ +$12M data center capex partially offset by lower local and wireless ⑀⍂ Interest payment up $4M on timing of bank credit facility payments $5 $22 $30 ($7) ($5) 1Q06 Free Cash Flow EBITDA Capital Interest Payments / Other 1Q07 Free Cash Flow

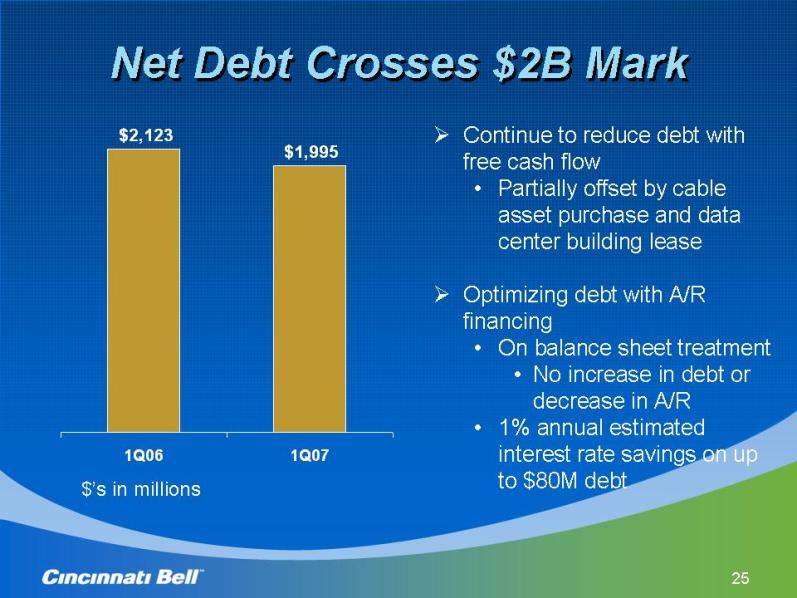

Net Debt Crosses $2B Mark Net Debt Crosses $2B Mark $1,995 $2,123 1Q06 1Q07 ⑀⍂ Continue to reduce debt with free cash flow • Partially offset by cable asset purchase and data center building lease ⑀⍂ Optimizing debt with A/R financing • On balance sheet treatment • No increase in debt or decrease in A/R • 1% annual estimated interest rate savings on up to $80M debt $’s in millions

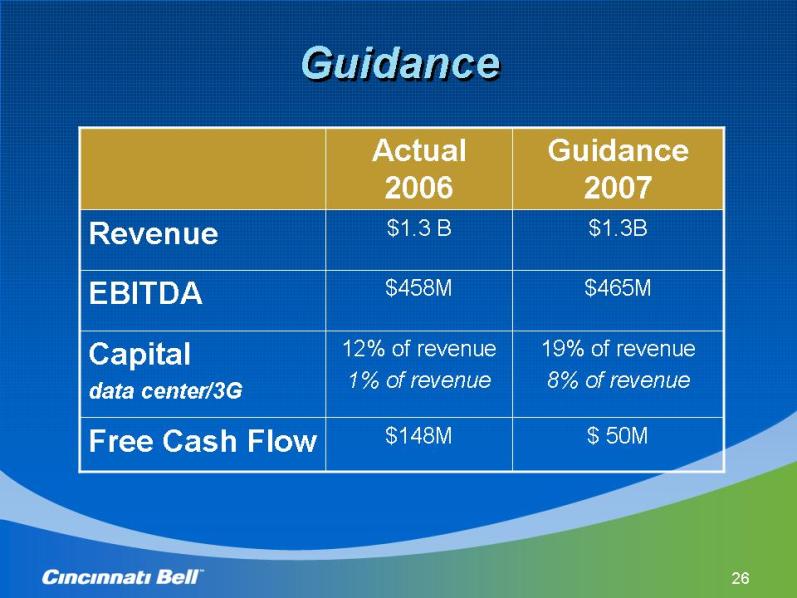

Guidance Guidance $ 50M $148M Free Cash Flow 19% of revenue 8% of revenue 12% of revenue 1% of revenue Capital data center/3G $465M $458M EBITDA $1.3B $1.3 B Revenue Guidance 2007 Actual 2006

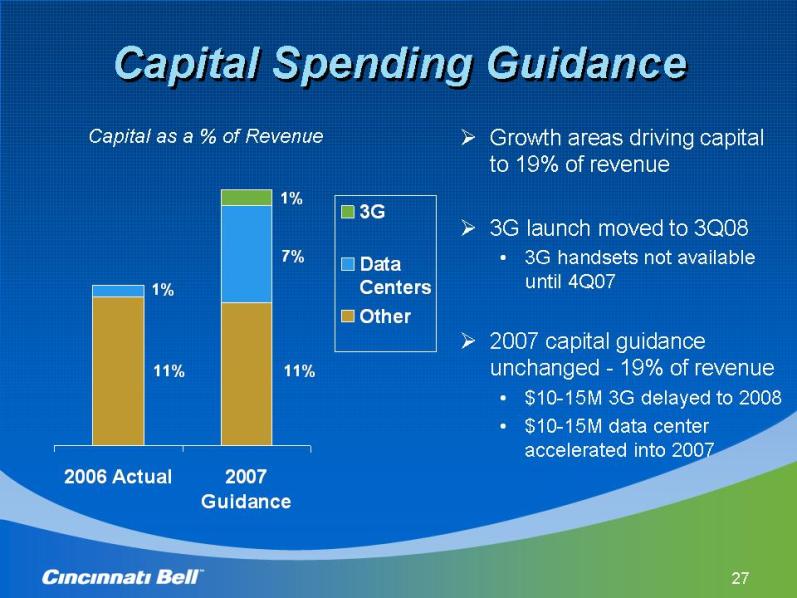

Capital Spending Guidance Capital Spending Guidance 11% 11% 7% 1% 1% 2006 Actual 2007 Guidance 3G Data Centers Other ⑀⍂ Growth areas driving capital to 19% of revenue ⑀⍂ 3G launch moved to 3Q08 • 3G handsets not available until 4Q07 ⑀⍂ 2007 capital guidance unchanged - 19% of revenue • $10-15M 3G delayed to 2008 • $10-15M data center accelerated into 2007 Capital as a % of Revenue

Non-GAAP Reconciliations (please refer to the Earnings Financials)