Exhibit 99.2

Slide: 1 Cincinnati Bell 3rd Quarter 2008 Review October 30, 2008

Title: Agenda Performance Highlights Jack Cassidy, President & CEO 2. Operational Overview Brian Ross, Chief Operating Officer 4. Q & A 3. Financial Overview Gary Wojtaszek, Chief Financial Officer

Safe Harbor Certain of the statements and predictions contained in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. In particular, any statements, projections or estimates that include or reference the words “believes,” “anticipates,” “plans,” “intends,” “expects,” “will,” or any similar expression fall within the safe harbor for forward-looking statements contained in the Reform Act. Actual results or outcomes may differ materially from those indicated or suggested by any such forward-looking statement for a variety of reasons, including but not limited to, Cincinnati Bell’s ability to maintain its market position in communications services, including wireless, wireline and internet services; general economic trends affecting the purchase or supply of communication services; world and national events that may affect the ability to provide services; changes in the regulatory environment; any rulings, orders or decrees that may be issued by any court or arbitrator; restrictions imposed under various credit facilities and debt instruments; work stoppages caused by labor disputes; adjustments resulting from year-end audit procedures; and Cincinnati Bell’s ability to develop and launch new products and services. More information on potential risks and uncertainties is available in recent filings with the Securities and Exchange Commission, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. The forward-looking statements included in this presentation represent estimates as of October 30, 2008. It is anticipated that subsequent events and developments will cause estimates to change.

Slide: 4 Title: Performance Highlights Jack Cassidy President & CEO

3Q08 Accomplishments Overview Overview Technology Solutions Technology Solutions Wireless Wireless Wireline Wireline • Grew revenue 1% • 12th consecutive qtr of revenue growth • Maintained Adjusted EBITDA y/y • Improved diluted EPS by 12% • Purchased 5M shares in 3Q08 • Grew service revenue by 9% • Improved Adjusted EBITDA 10% • Increased postpaid subscriber base by 6% • Increased smart phone subs by 66% • Increased DSL subs by 6% • Grew wireline data revenue by 5% • Increased long distance and VoIP revenue by 25% • Increased Expansion Market access lines by 14% • Increased DC & managed services revenue by 39% • Grew Adjusted EBITDA by 33% • Improved EBITDA margin to 14% • Increased DC utilization rate to 88%

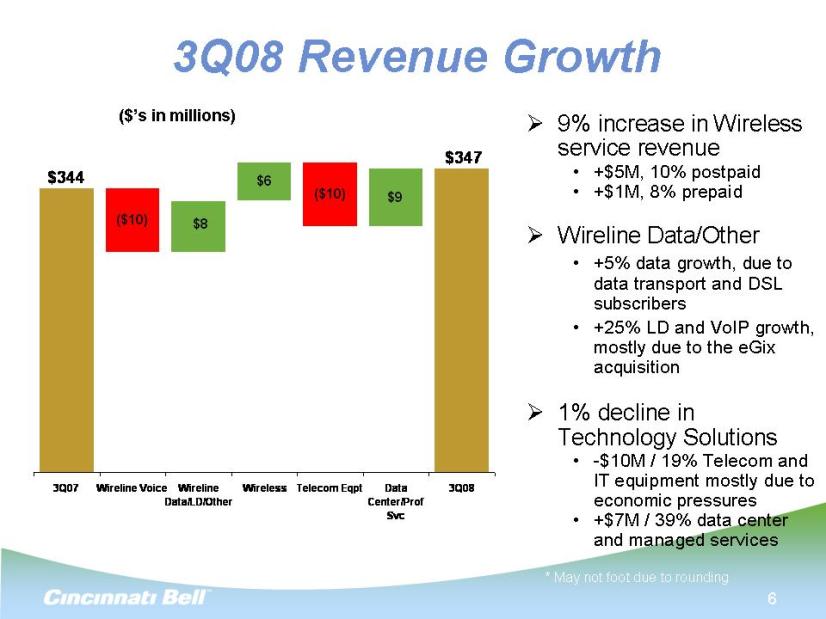

Slide: 6 Title: 3Q08 Revenue Growth Body: 9% increase in Wireless service revenue +$5M, 10% postpaid +$1M, 8% prepaid Wireline Data/Other +5% data growth, due to data transport and DSL subscribers +25% LD and VoIP growth, mostly due to the eGix acquisition 1% decline in Technology Solutions -$10M / 19% Telecom and IT equipment mostly due to economic pressures +$7M / 39% data center and managed services ($’s in millions) * May not foot due to rounding

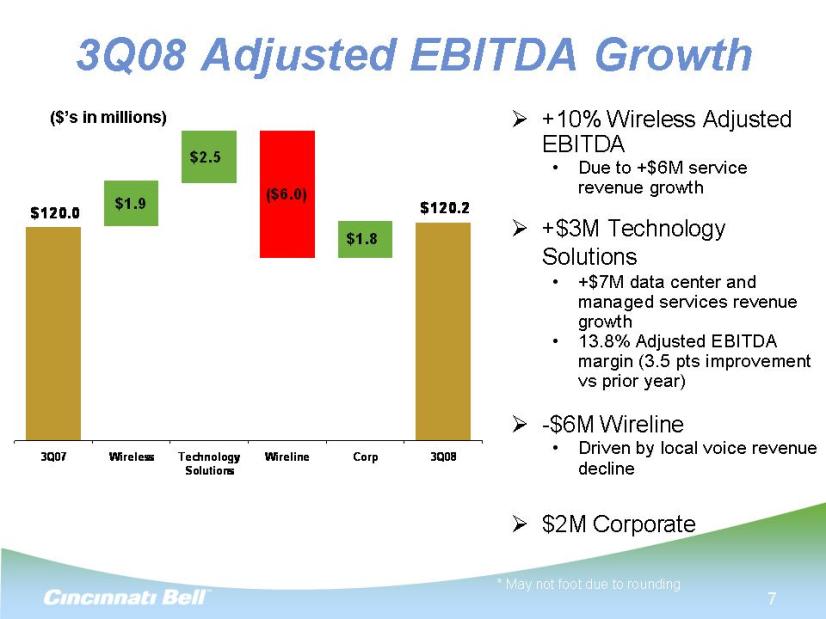

Slide: 7 Title: 3Q08 Adjusted EBITDA Growth Body: +10% Wireless Adjusted EBITDA Due to +$6M service revenue growth +$3M Technology Solutions +$7M data center and managed services revenue growth 13.8% Adjusted EBITDA margin (3.5 pts improvement vs prior year) -$6M Wireline Driven by local voice revenue decline $2M Corporate ($’s in millions) * May not foot due to rounding

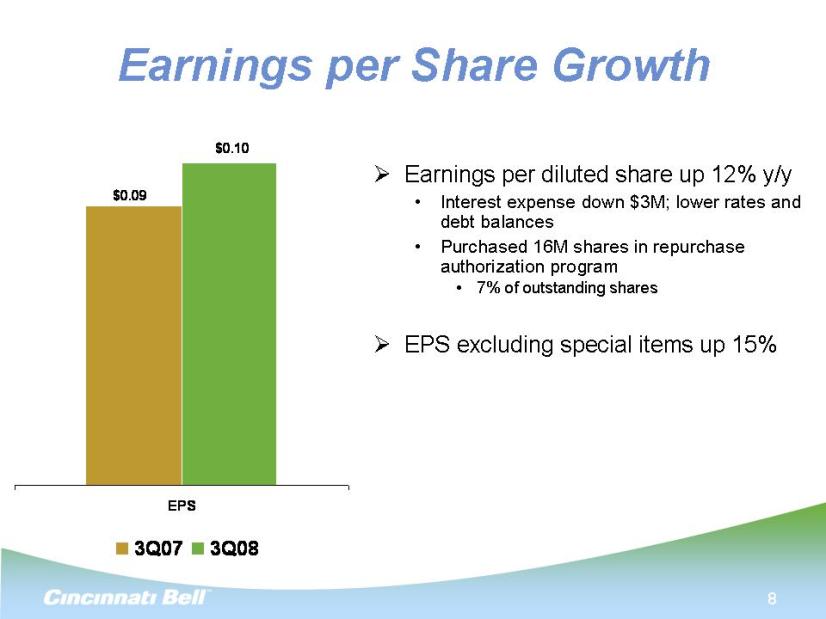

Slide: 8 Title: Earnings per Share Growth Body: Earnings per diluted share up 12% y/y Interest expense down $3M; lower rates and debt balances Purchased 16M shares in repurchase authorization program 7% of outstanding shares EPS excluding special items up 15%

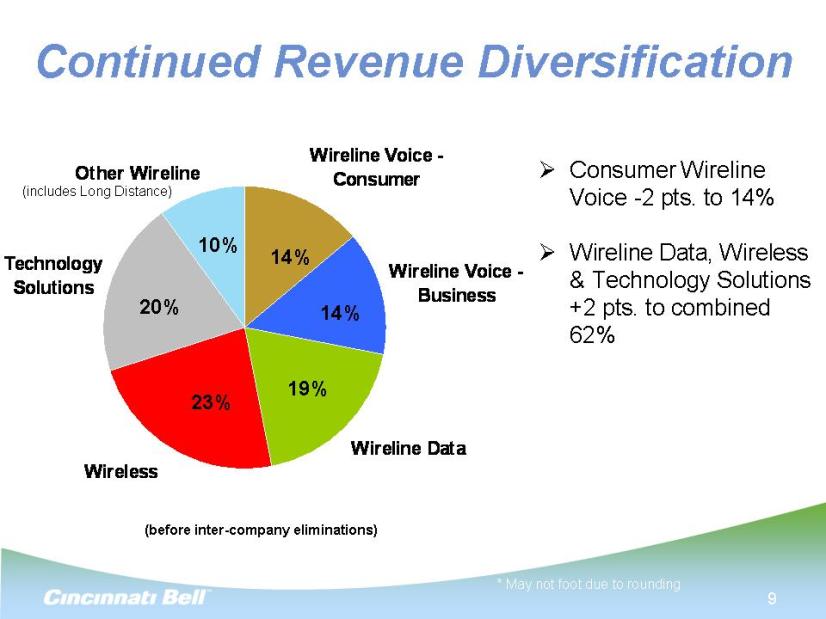

Slide: 9 Title: Continued Revenue Diversification Body: Consumer Wireline Voice -2 pts. to 14% Wireline Data, Wireless & Technology Solutions +2 pts. to combined 62% (before inter-company eliminations) (includes Long Distance) 14% 19% 23% 20% 10% 14% * May not foot due to rounding

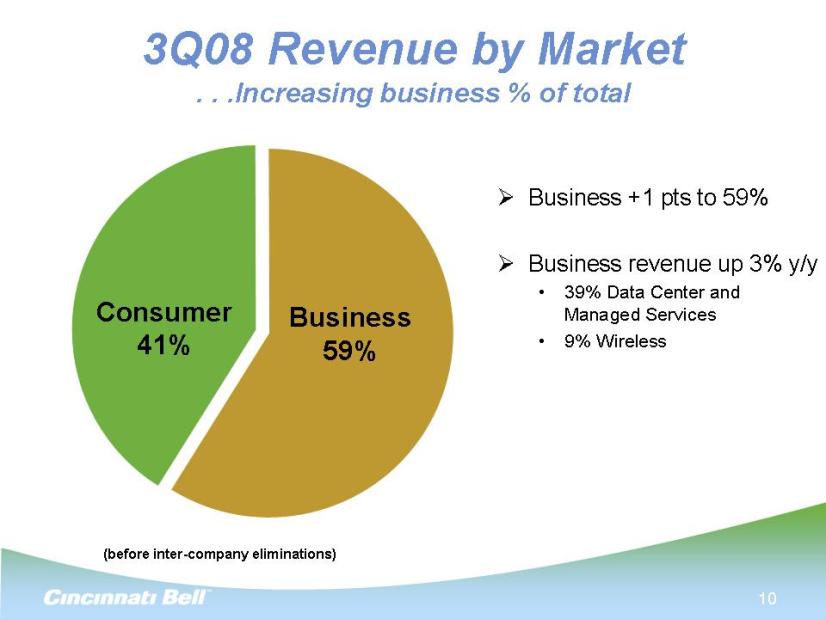

Slide: 10 Title: 3Q08 Revenue by Market Increasing business % of total (before inter-company eliminations) Consumer 41% Business 59% Body: Business +1 pts to 59% Business revenue up 3% y/y 39% Data Center and Managed Services 9% Wireless

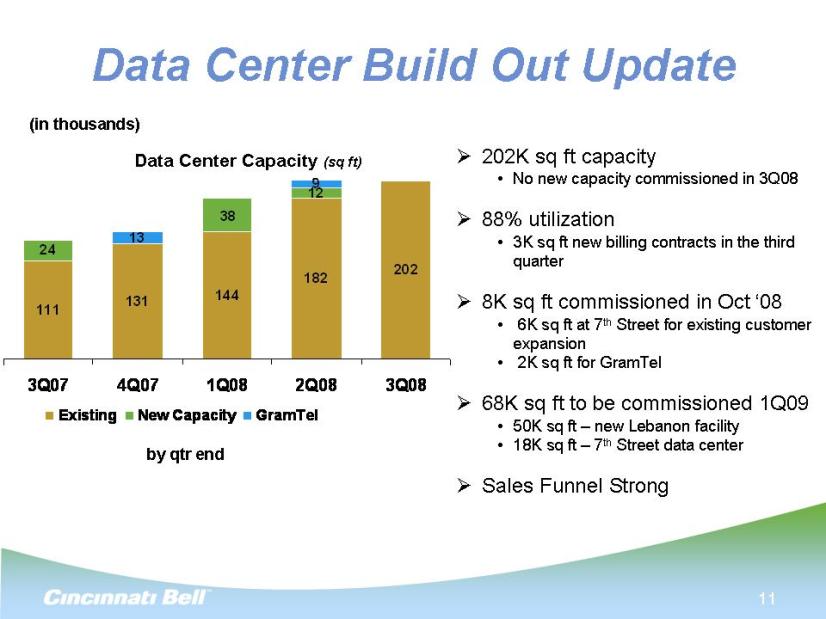

Slide: 11 Title: Data Center Build Out Update Data Center Capacity (sq ft) by qtr end 202K sq ft capacity No new capacity commissioned in 3Q08 88% utilization 3K sq ft new billing contracts in the third quarter 8K sq ft commissioned in Oct ‘08 6K sq ft at 7th Street for existing customer expansion 2K sq ft for GramTel 68K sq ft to be commissioned 1Q09 50K sq ft – new Lebanon facility 18K sq ft – 7th Street data center Sales Funnel Strong (in thousands)

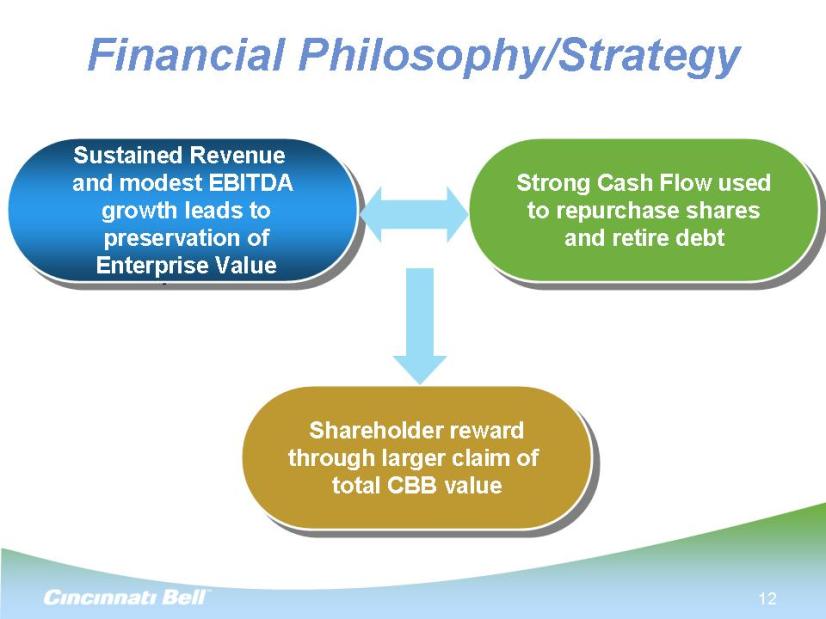

Slide: 12 Title: Financial Philosophy/Strategy Strong Cash Flow used to repurchase shares and retire debt Shareholder reward through larger claim of total CBB value Sustained Revenue and modest EBITDA growth leads to preservation of Enterprise Value

Slide: 13 Title: Operational Overview Brian Ross Chief Operating Officer

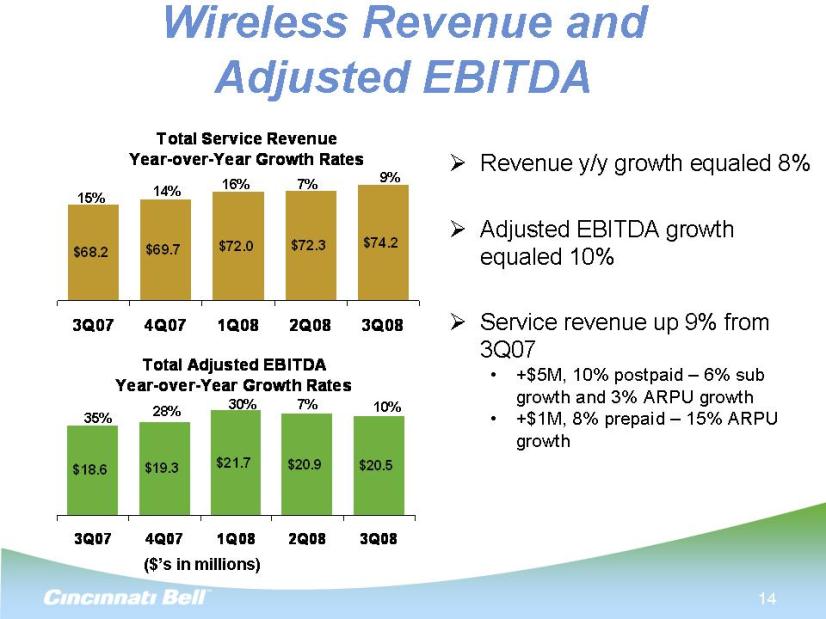

Slide: 14 Title: Wireless Revenue and Adjusted EBITDA Body: Revenue y/y growth equaled 8% Adjusted EBITDA growth equaled 10% Service revenue up 9% from 3Q07 +$5M, 10% postpaid – 6% sub growth and 3% ARPU growth +$1M, 8% prepaid – 15% ARPU growth 14% ($’s in millions) 15% 28% 7% 35% 16% 30% 7% 9% 10%

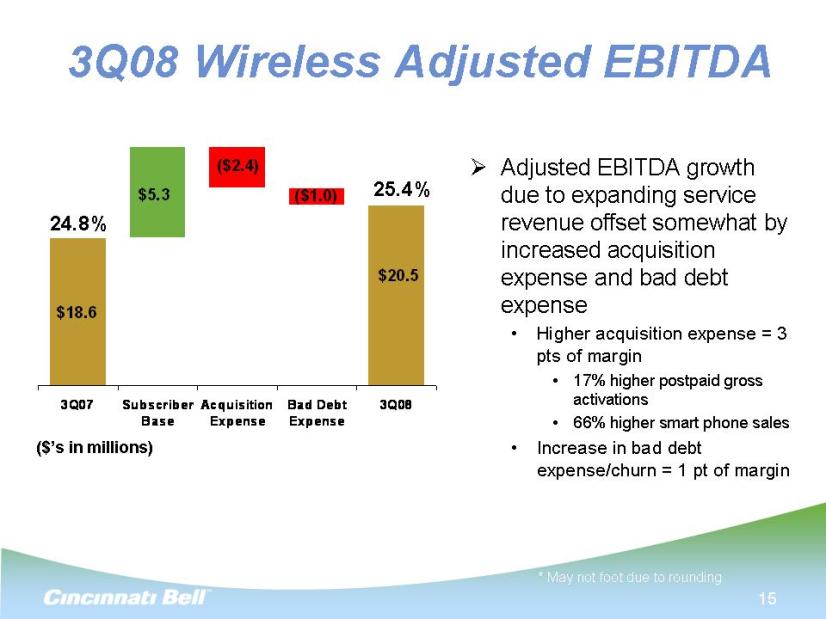

Slide: 15 Title: 3Q08 Wireless Adjusted EBITDA Body: Adjusted EBITDA growth due to expanding service revenue offset somewhat by increased acquisition expense and bad debt expense Higher acquisition expense = 3 pts of margin 17% higher postpaid gross activations 66% higher smart phone sales Increase in bad debt expense/churn = 1 pt of margin ($’s in millions) * May not foot due to rounding 25.4% 24.8%

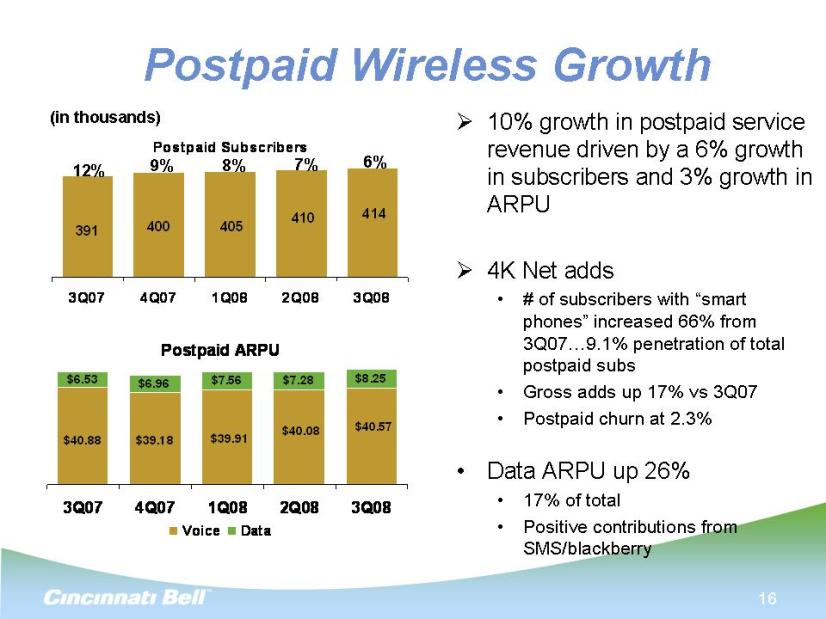

Slide: 16 Title: Postpaid Wireless Growth Body: 10% growth in postpaid service revenue driven by a 6% growth in subscribers and 3% growth in ARPU 4K Net adds # of subscribers with “smart phones” increased 66% from 3Q07…9.1% penetration of total postpaid subs Gross adds up 17% vs 3Q07 Postpaid churn at 2.3% Data ARPU up 26% 17% of total Positive contributions from SMS/blackberry (in thousands) 9% 7% 12% 8% 6%

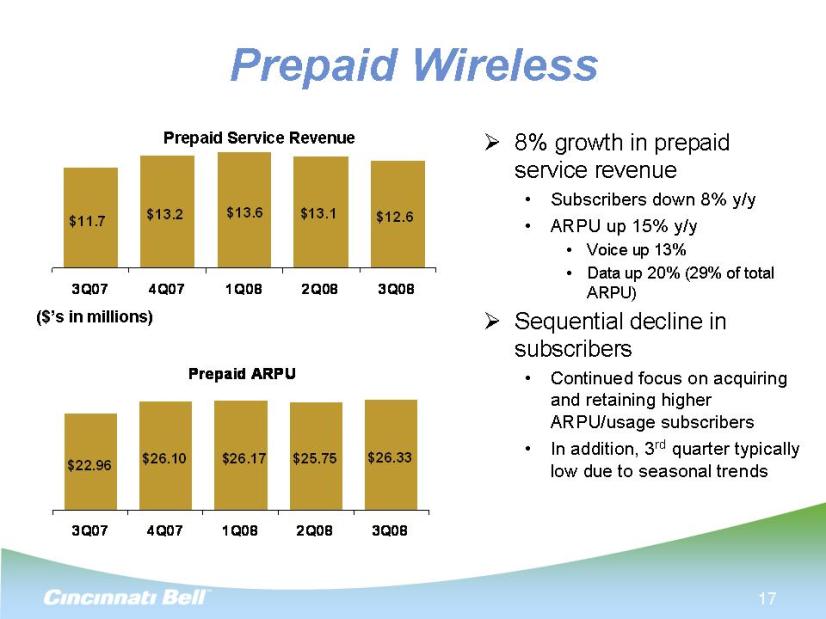

Slide: 17 Title: Prepaid Wireless Prepaid Service Revenue ($’s in millions) 8% growth in prepaid service revenue Subscribers down 8% y/y ARPU up 15% y/y Voice up 13% Data up 20% (29% of total ARPU) Sequential decline in subscribers Continued focus on acquiring and retaining higher ARPU/usage subscribers In addition, 3rd quarter typically low due to seasonal trends

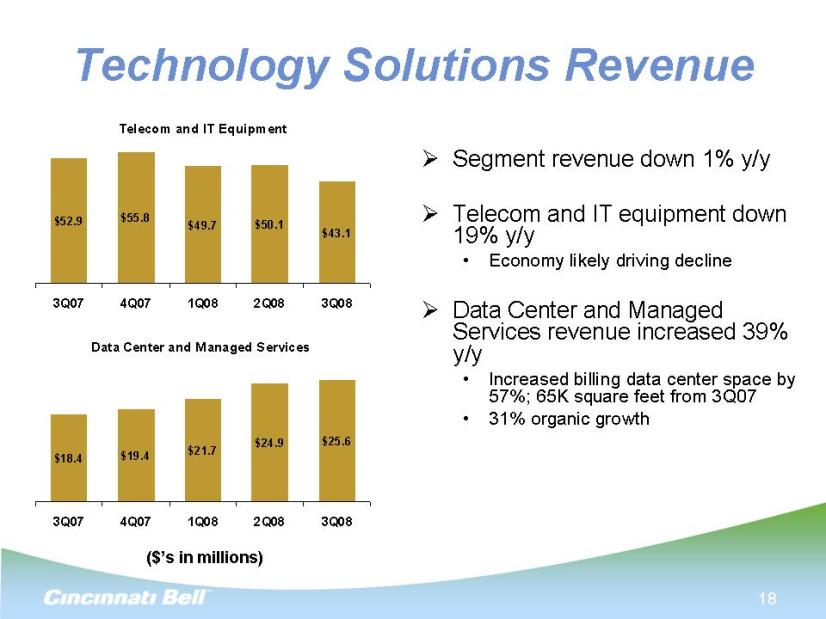

Technology Solutions Revenue($’s in millions) Segment revenue down 1% y/y Telecom and IT equipment down 19% y/y Economy likely driving decline Data Center and Managed Services revenue increased 39% y/y Increased billing data center space by 57%; 65K square feet from 3Q07 31% organic growth

Slide: 19 Title: Technology Solutions Profit Gross profit +$5M Driven mostly by data center square footage capacity growth and utilization as well as higher managed services +33% Adjusted EBITDA y/y Up $2M sequentially ($’s in millions)

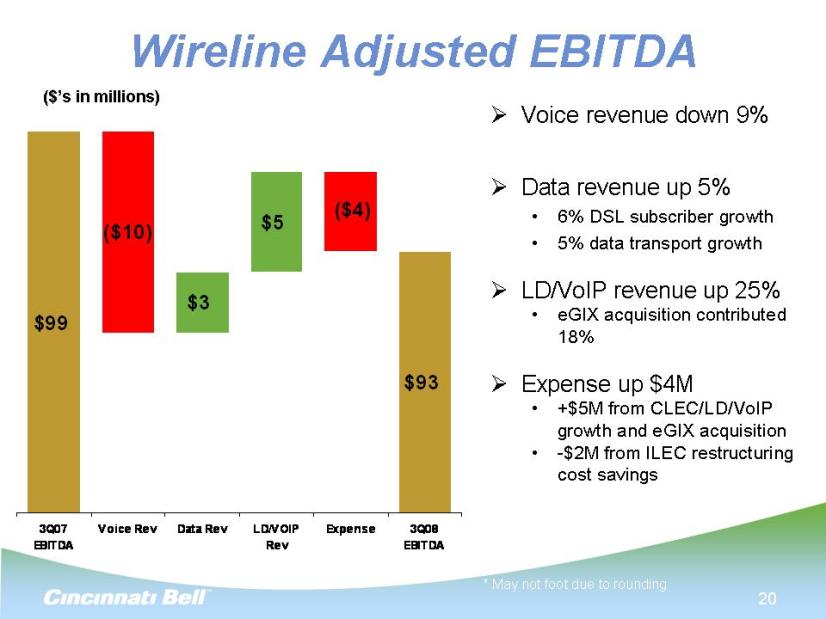

Slide: 20 Title: Wireline Adjusted EBITDA Body: Voice revenue down 9% Data revenue up 5% 6% DSL subscriber growth 5% data transport growth LD/VoIP revenue up 25% eGIX acquisition contributed 18% Expense up $4M +$5M from CLEC/LD/VoIP growth and eGIX acquisition -$2M from ILEC restructuring cost savings ($’s in millions) * May not foot due to rounding

Slide: 21 Title: CLEC Success Leads to Recent Acquisitions ($’s in millions) (units in thousands) 34% 14%

Slide: 22 Title: DSL Subscriber Activity Body: 6% subscriber base growth y/y 231,000 subscribers at the end of 3Q08 2K net adds Down 4K y/y primarily due to lower gross activations 11 basis points churn improvement 1.8% 2.1% 2.0% (in thousands) 1.8% 2.0%

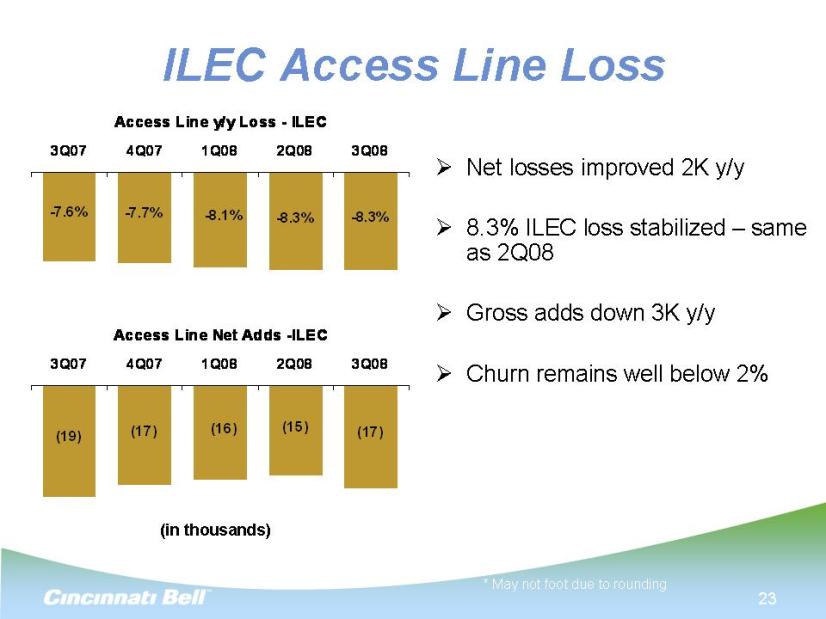

Slide: 23 Title: ILEC Access Line Loss Net losses improved 2K y/y 8.3% ILEC loss stabilized – same as 2Q08 Gross adds down 3K y/y Churn remains well below 2% (in thousands) May not foot due to rounding

Slide: 24 Title: Financial Overview Gary Wojtaszek Chief Financial Officer

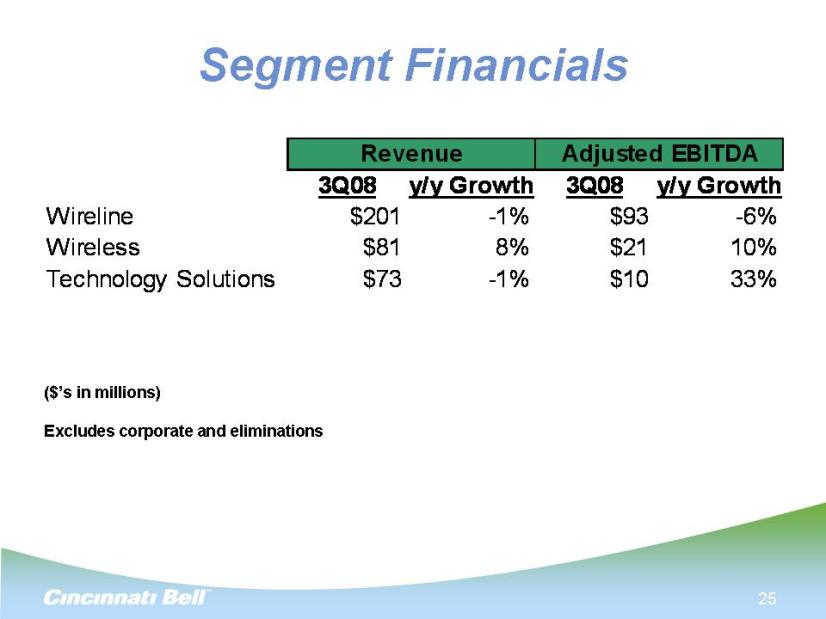

Slide: 25 Title: Segment Financials ($’s in millions) Excludes corporate and eliminations

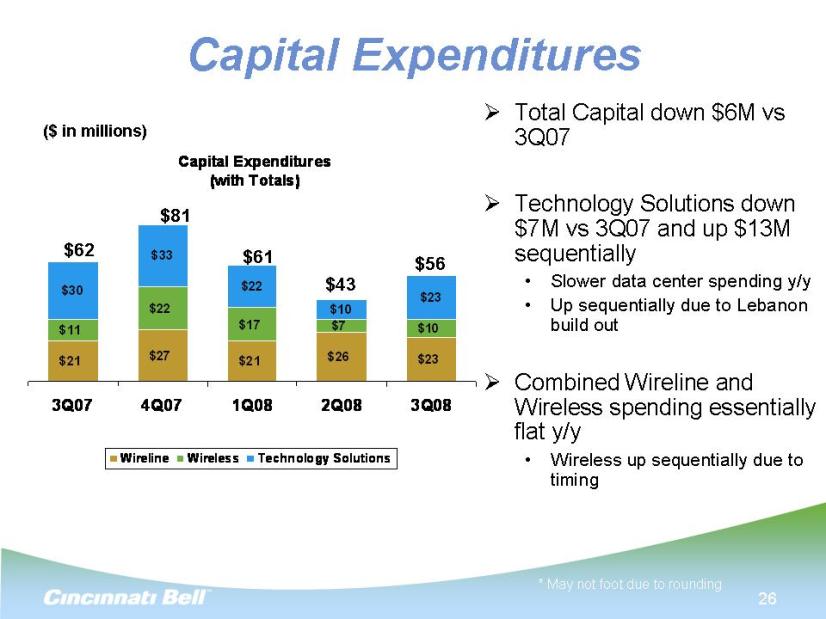

Slide: 26 Title: Capital Expenditures Body: Total Capital down $6M vs 3Q07 Technology Solutions down $7M vs 3Q07 and up $13M sequentially Slower data center spending y/y Up sequentially due to Lebanon build out Combined Wireline and Wireless spending essentially flat y/y Wireless up sequentially due to timing ($ in millions) * May not foot due to rounding $62 $81 $61 $43 $56

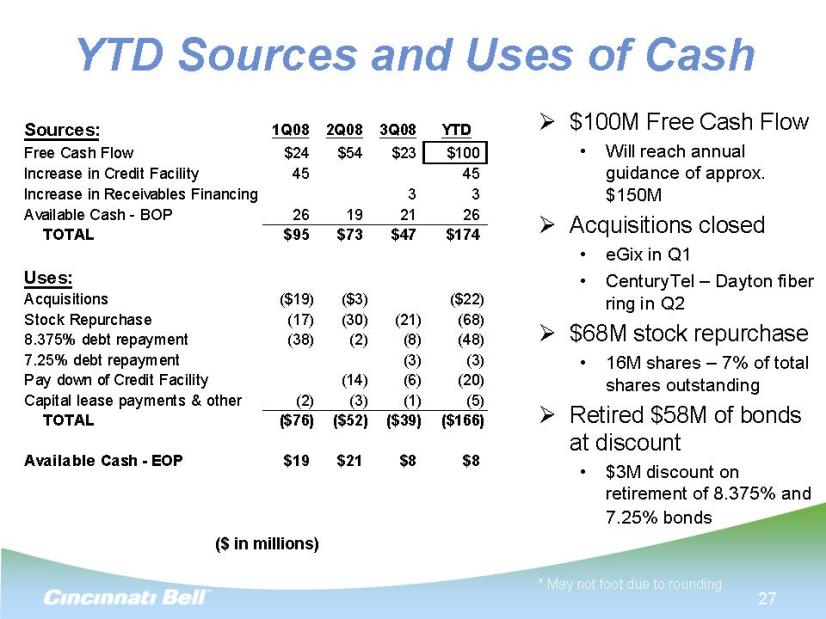

Slide7 Title: YTD Sources and Uses of Cash $100M Free Cash Flow Will reach annual guidance of approx. $150M Acquisitions closed eGix in Q1 CenturyTel – Dayton fiber ring in Q2 $68M stock repurchase 16M shares – 7% of total shares outstanding Retired $58 of bonds at discount $3M discount on retirement of 8.375% and 7.25% bonds ($ in millions) * May not foot due to rounding

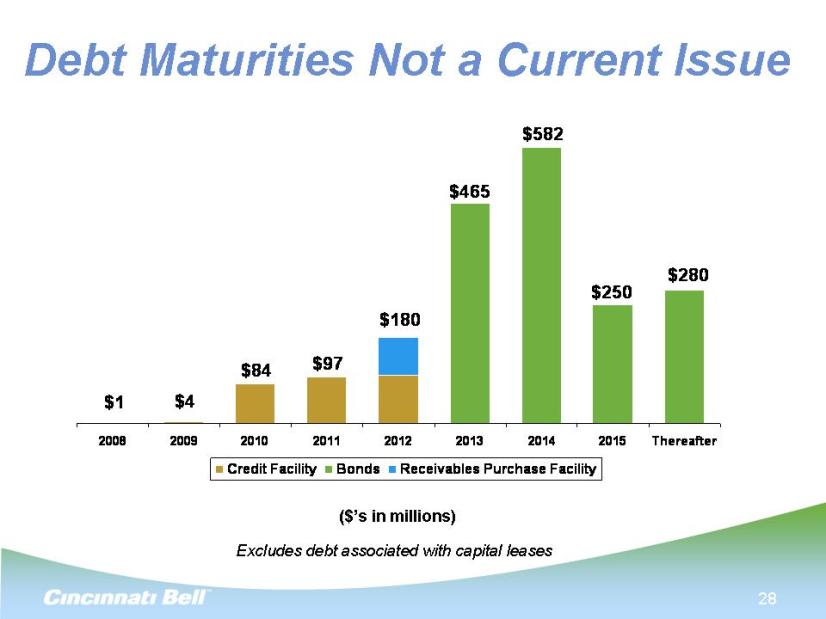

Slide: 28 Title: Debt Maturities Not a Current Issue ($’s in millions) Excludes debt associated with capital leases

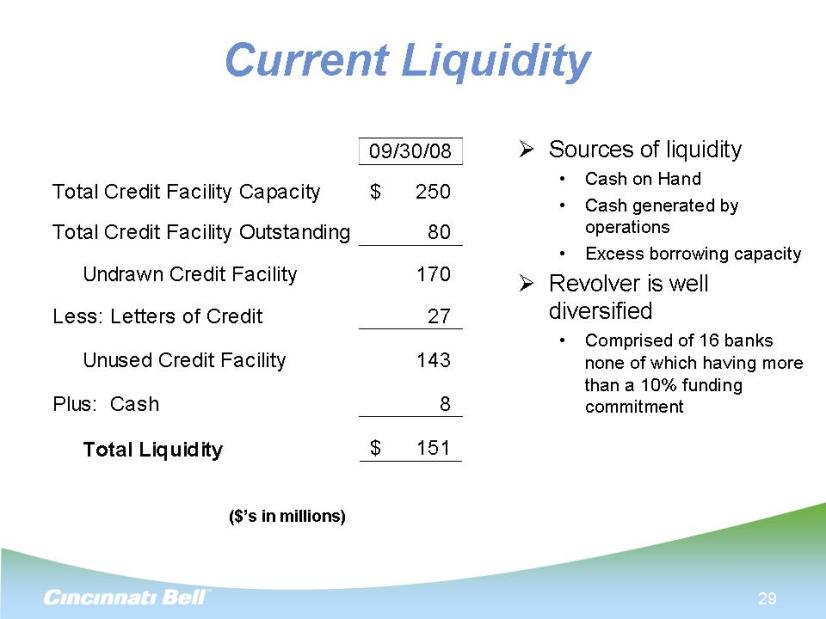

Current Liquidity Sources of liquidity Cash on Hand Cash generated by operations Excess borrowing capacity Revolver is well diversified Comprised of 16 banks none of which having more than a 10% funding commitment ($’s in millions)

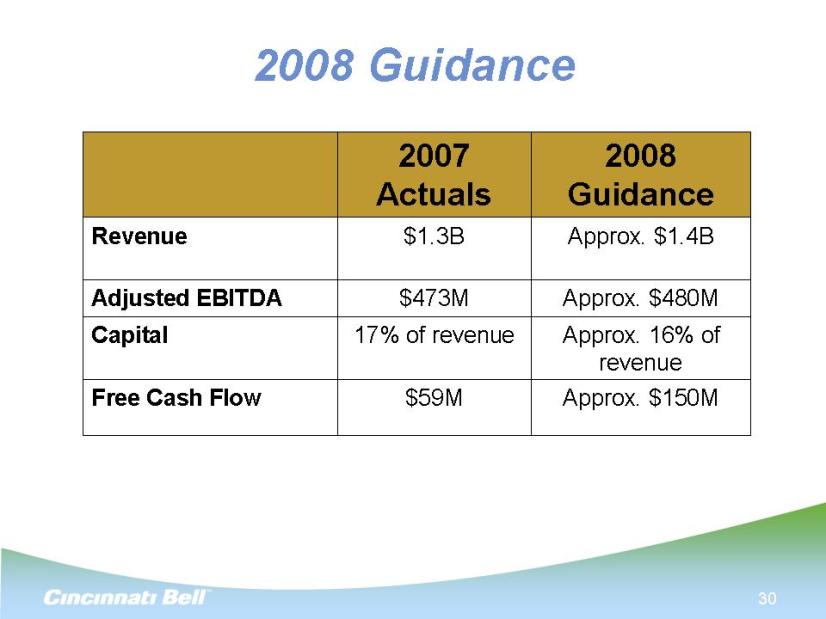

Slide: 30 Title: 2008 Guidance

Slide: 31 Non-GAAP Reconciliations (please refer to the Earnings Financials)