Exhibit 99.2

1 Cincinnati Bell2nd Quarter 2009 Review August 4, 2009

2 Agenda 1. Performance Highlights Jack Cassidy, President & CEO 2. Operational Overview Brian Ross, Chief Operating Officer 3. Financial Overview Gary Wojtaszek, Chief Financial Officer 4. Q & A

3 Safe Harbor Certain of the statements and predictions contained in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. In particular, any statements, projections or estimates that include or reference the words “believes,” “anticipates,” “plans,” “intends,” “expects,” “will,” or any similar expression fall within the safe harbor for forward-looking statements contained in the Reform Act. Actual results or outcomes may differ materially from those indicated or suggested by any such forward-looking statement for a variety of reasons, including but not limited to, Cincinnati Bell’s ability to maintain its market position in communications services, including wireless, wireline and internet services; general economic trends affecting the purchase or supply of communication services; world and national events that may affect the ability to provide services; changes in the regulatory environment; any rulings, orders or decrees that may be issued by any court or arbitrator; restrictions imposed under various credit facilities and debt instruments; work stoppages caused by labor disputes; adjustments resulting from year-end audit procedures; and Cincinnati Bell’s ability to develop and launch new products and services. More information on potential risks and uncertainties is available in recent filings with the Securities and Exchange Commission, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. The forward-looking statements included in this presentation represent estimates as of August 3, 2009. It is anticipated that subsequent events and developments will cause estimates to change.

4 Performance Highlights Jack Cassidy President & CEO

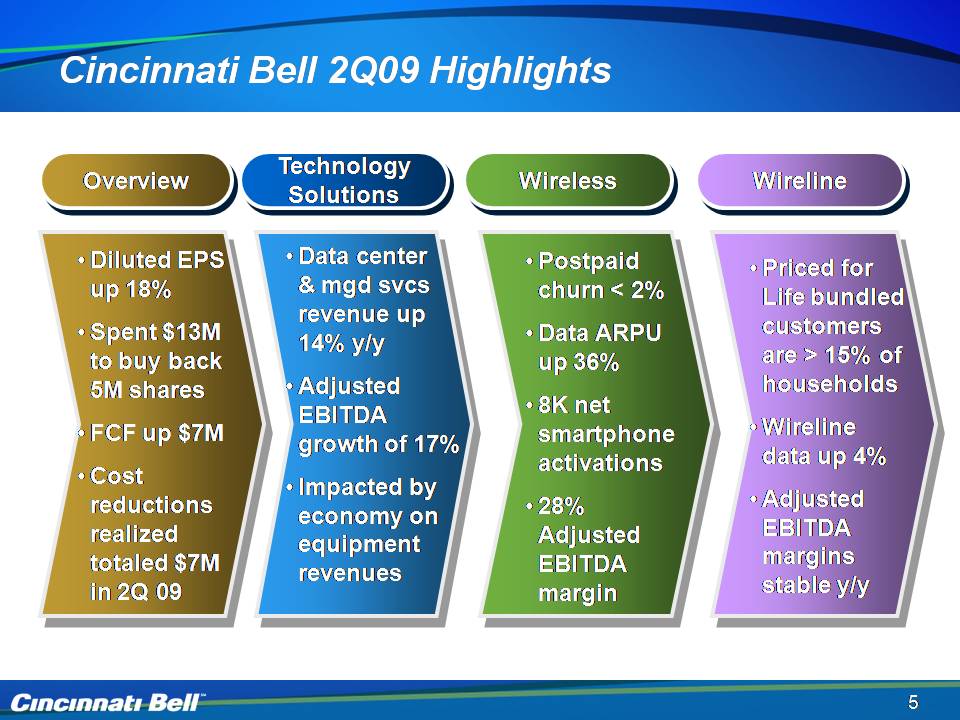

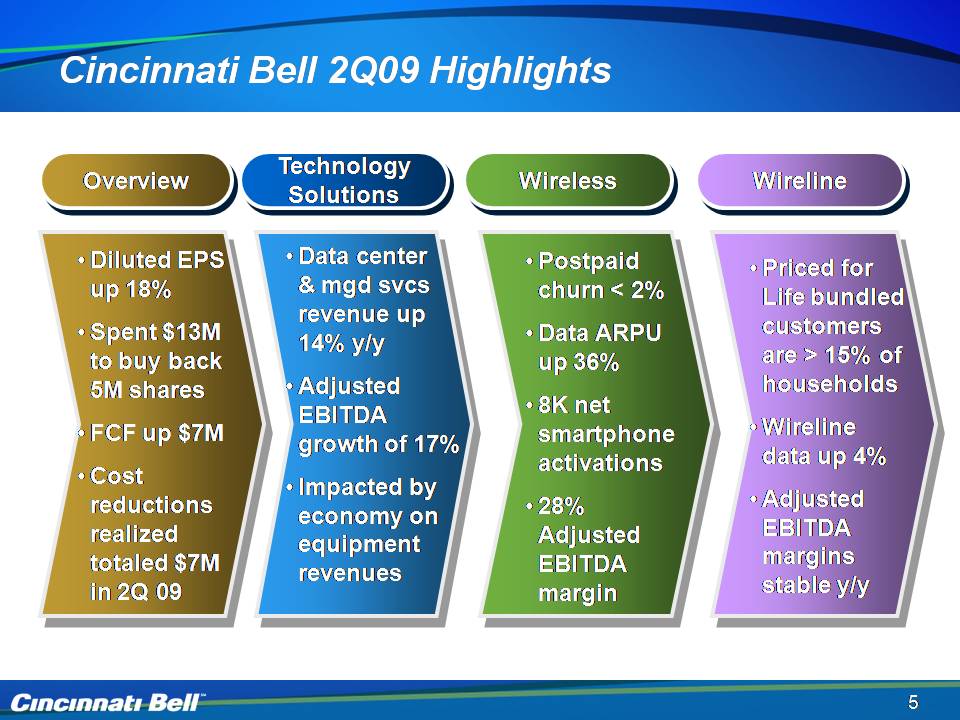

5 Cincinnati Bell 2Q09 Highlights Overview Technology Solutions Wireless Wireline Diluted EPS up 18% Spent $13M to buy back 5M shares FCF up $7M Cost reductions realized totaled $7M in 2Q 09 Postpaid churn < 2% Data ARPU up 36% 8K net smartphone activations 28% Adjusted EBITDA margin Priced for Life bundled customers are > 15% of households Wireline data up 4% Adjusted EBITDA margins stable y/y Data center & mgd svcs revenue up 14% y/y Adjusted EBITDA growth of 17% Impacted by economy on equipment revenues

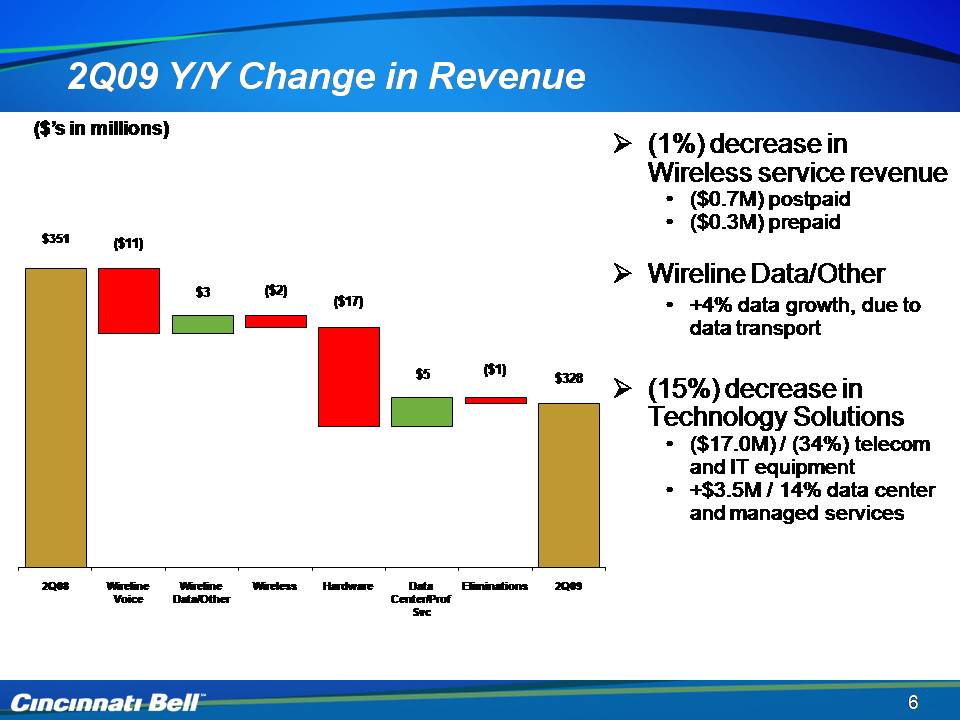

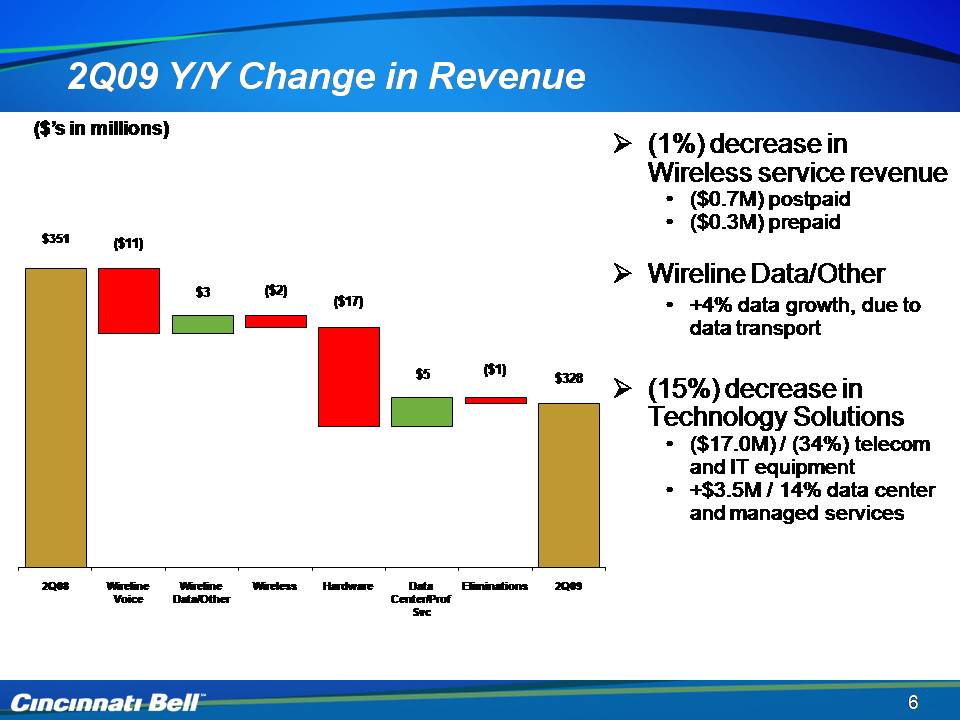

6 2Q09 Y/Y Change in Revenue (1%) decrease in Wireless service revenue($0.7M) postpaid($0.3M) prepaid Wireline Data/Other +4% data growth, due to data transport (15%) decrease in Technology Solutions ($17.0M) / (34%) telecom and IT equipment +$3.5M / 14% data center and managed services $351 ($11) 3 ($2) ($17) $5 ($1) $328 2Q08 Wireline Voice Wireline Data/Other Wireless Hardware Data Center/Prof Svc Eliminations 2Q09 ($’s in millions)

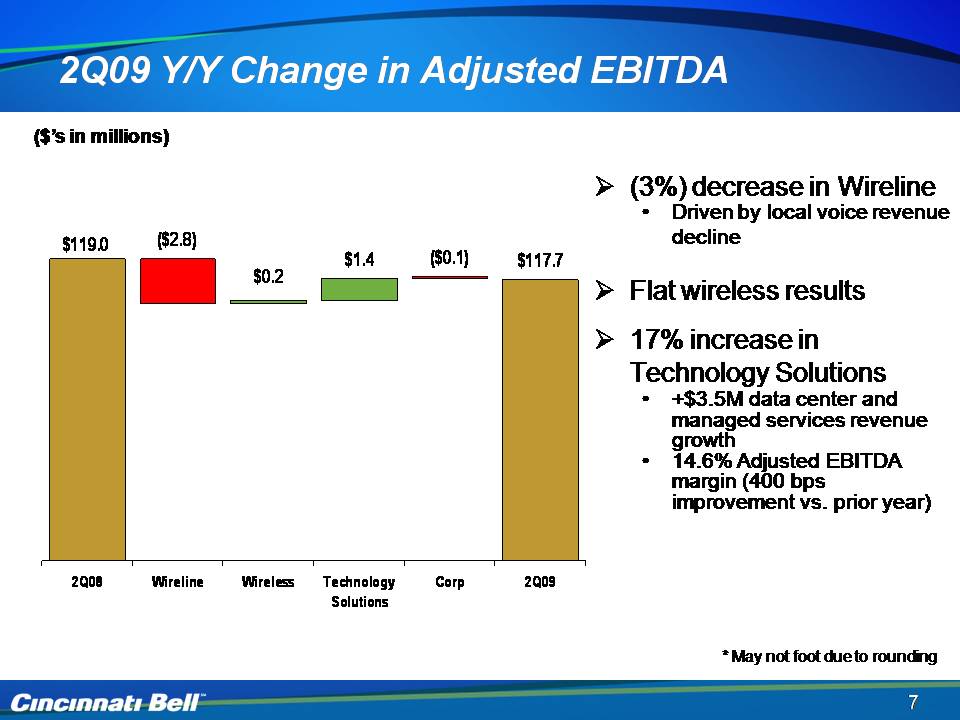

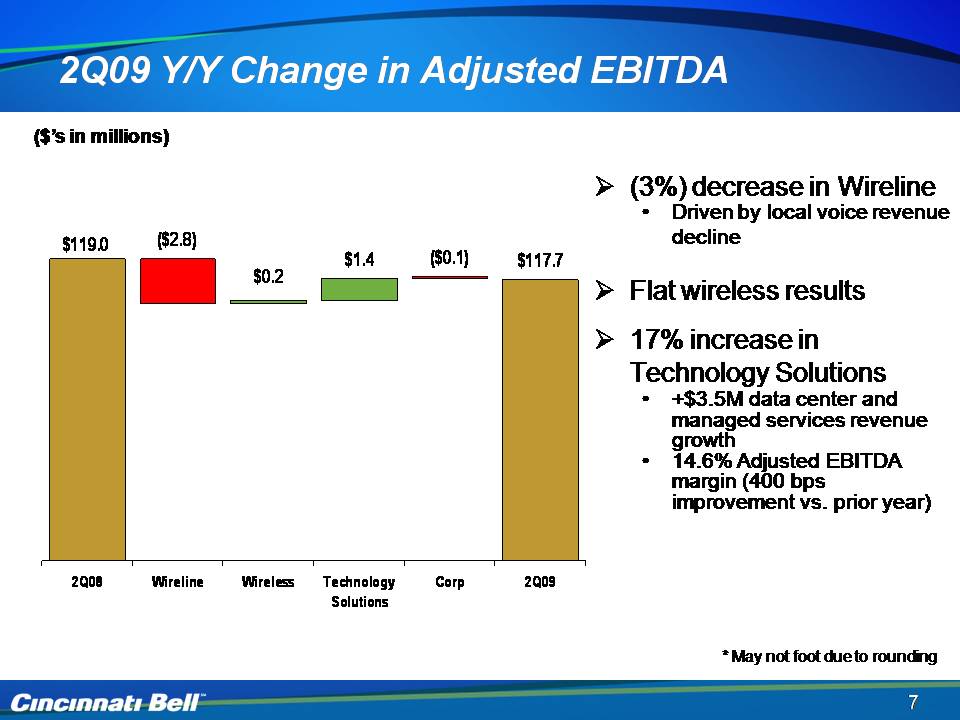

7 2Q09 Y/Y Change in Adjusted EBITDA (3%) decrease in Wireline Driven by local voice revenue decline Flat wireless results 17% increase in Technology Solutions +$3.5M data center and managed services revenue growth 14.6% Adjusted EBITDA margin (400 bps improvement vs. prior year) $119.0 ($2.8) $0.2 $1.4 ($0.1) $117.7 2Q08 Wireline Wireless Technology Solutions Corp 2Q09 ($’s in millions) * May not foot due to rounding

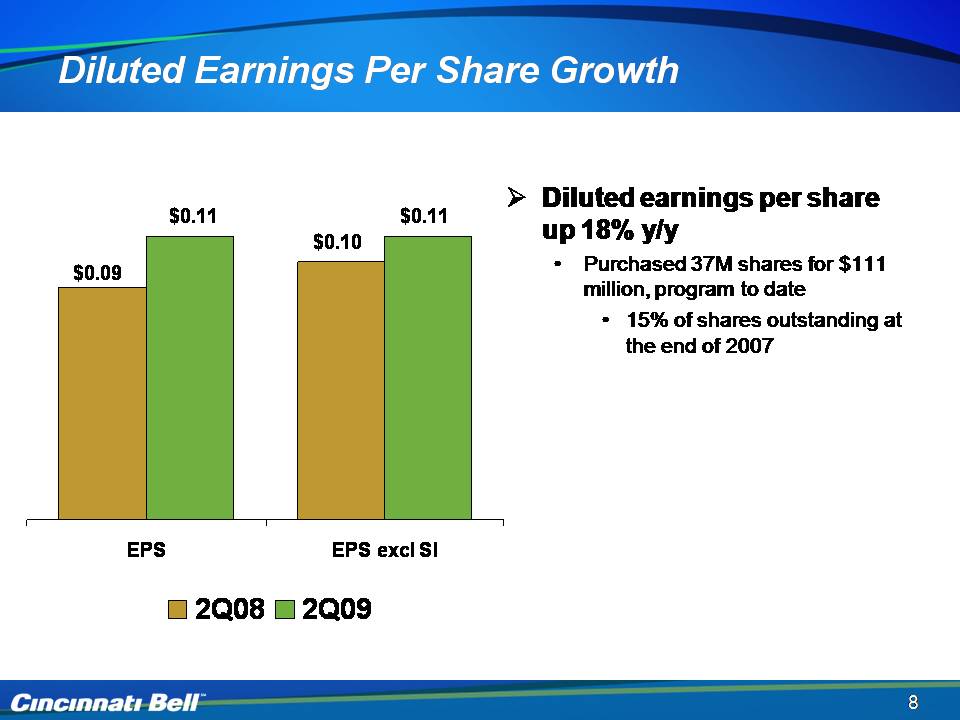

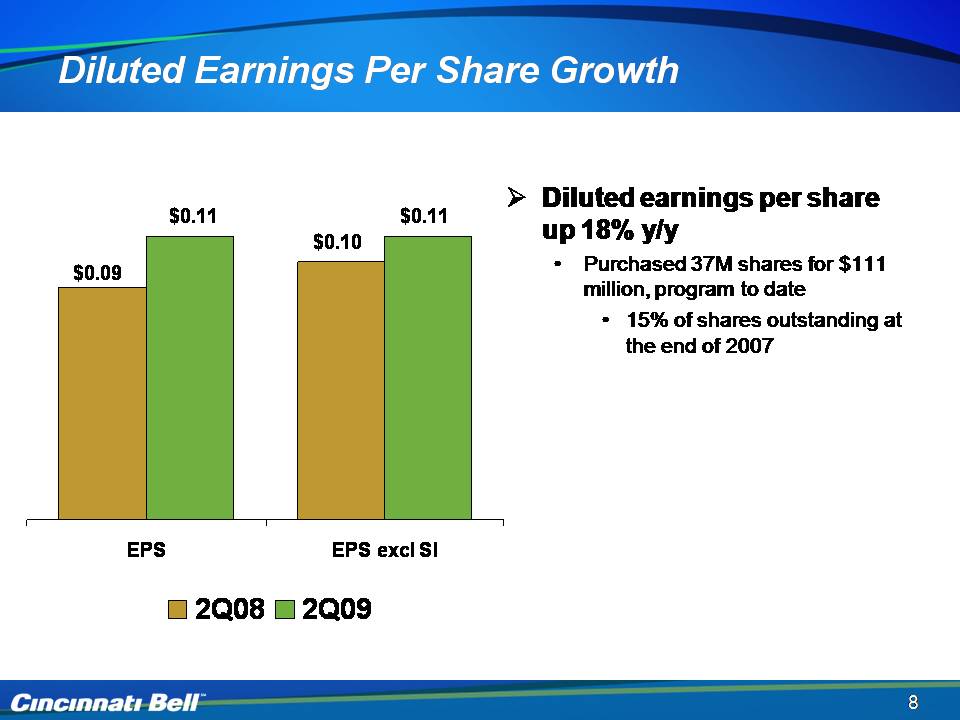

8 Diluted Earnings Per Share Growth Diluted earnings per share up 18% y/y Purchased 37M shares for $111 million, program to date 15% of shares outstanding at the end of 2007 2Q08 2Q09 EPS EPS excl SI $0.09 $0.11 $0.10 $0.11

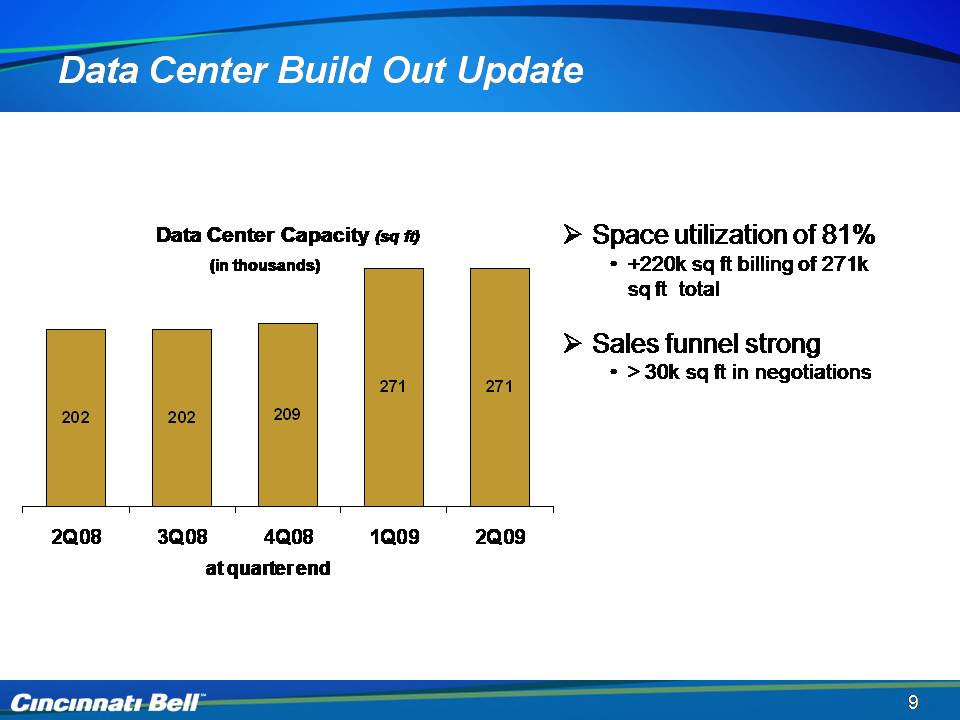

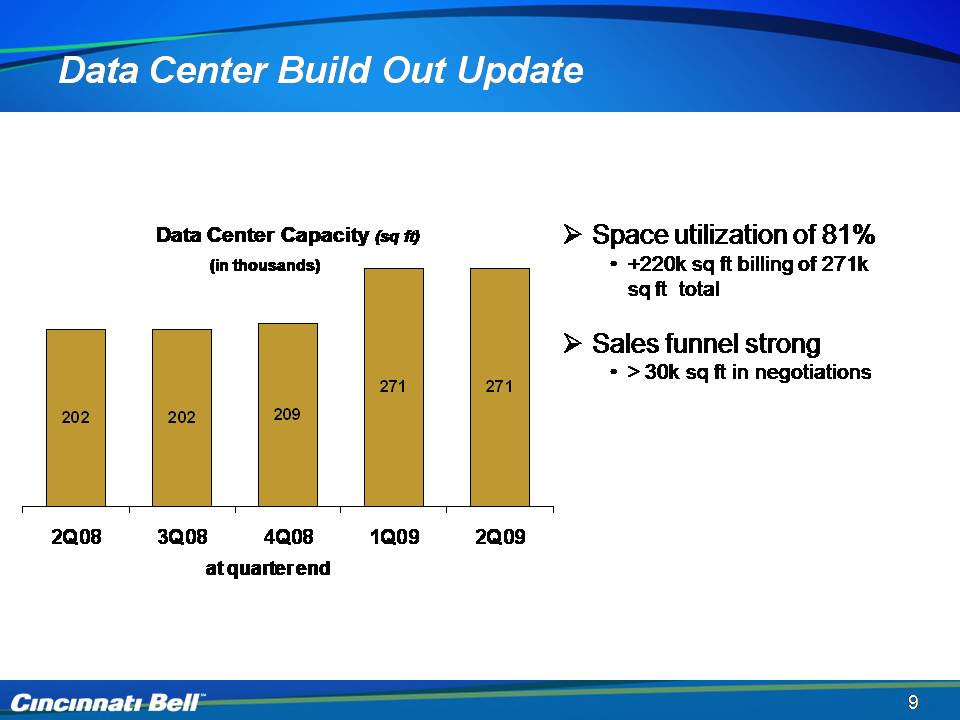

9 Data Center Build Out Update Data Center Capacity (sq ft) (in thousands) at quarter end Space utilization of 81% +220k sq ft billing of 271k sq ft total Sales funnel strong 30k sq ft in negotiations 2Q08 3Q08 4Q08 1Q09 2Q09 202 202 209 271 271

10 Operational Overview Brian Ross Chief Operating Officer

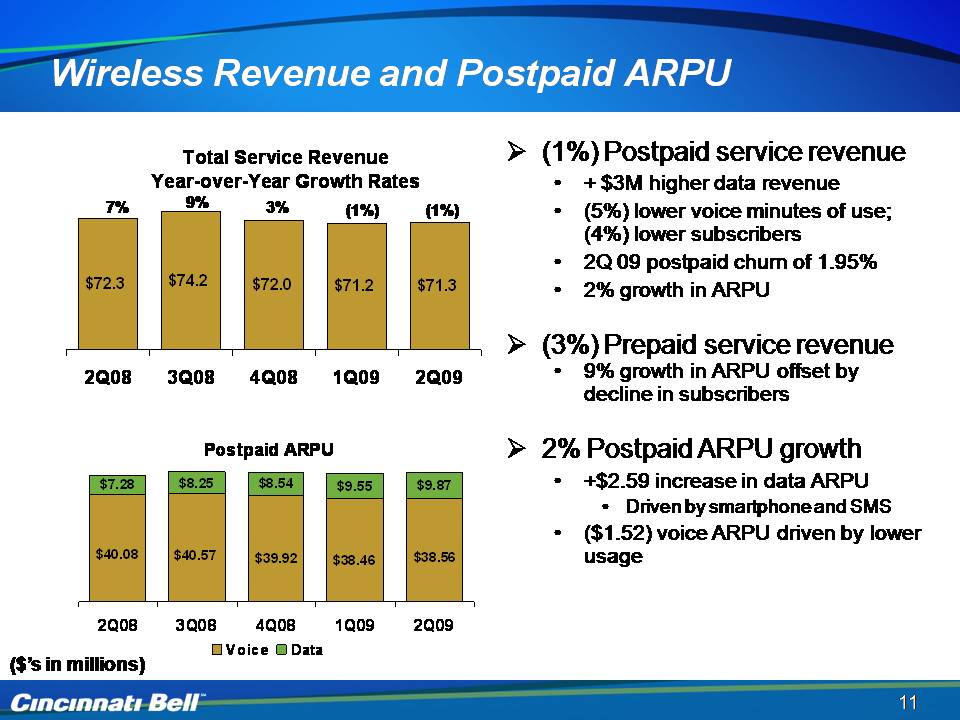

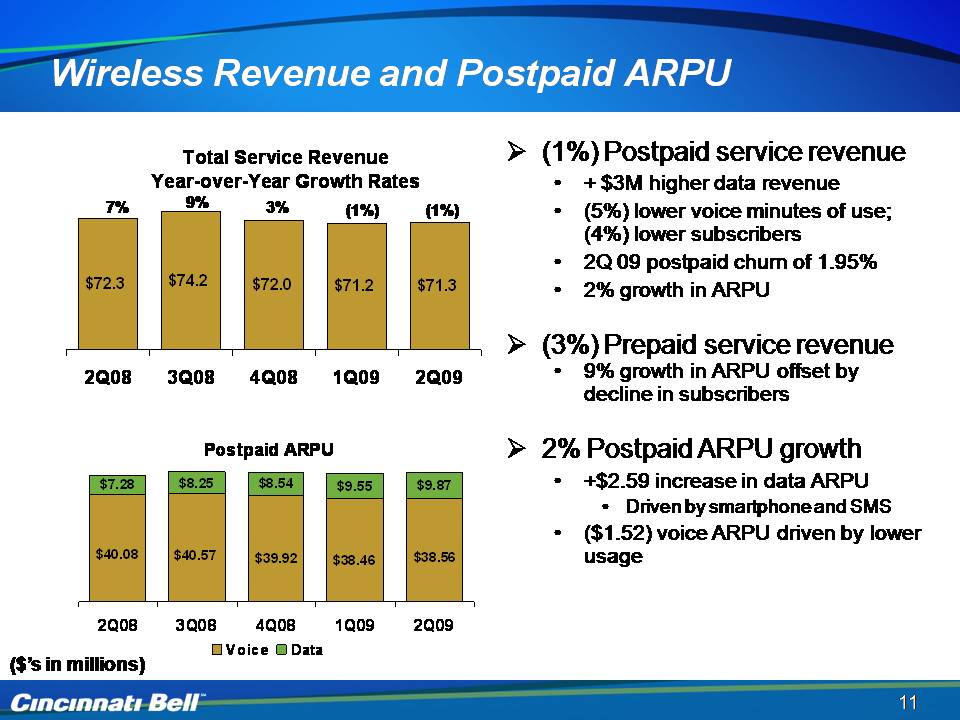

11 Wireless Revenue and Postpaid ARPU (1%) Postpaid service revenue + $3M higher data revenue (6%) lower voice minutes of use and (4%) lower subscribers 2Q 09 postpaid churn of 1.95% 2% growth in ARPU (3%) Prepaid service revenue 9% growth in ARPU offset by decline in subscribers 2% Postpaid ARPU growth +$2.59 increase in data ARPU Driven by smartphone and SMS ($1.52) voice ARPU driven by lower usage ($’s in millions) Voice Data Total Service Revenue Year-over-Year Growth Rates 7% $72.3 2Q08 9% $74.2 3Q08 3% $72.0 4Q08 (1%) $71.2 1Q09 (1%) $71.3 2Q09 Postpaid ARPU $7.28 $40.08 2Q08 $8.25 $40.57 3Q08 $8.54 $39.92 4Q08 $9.55 $38.46 1Q09 $9.87 $38.56 2Q09

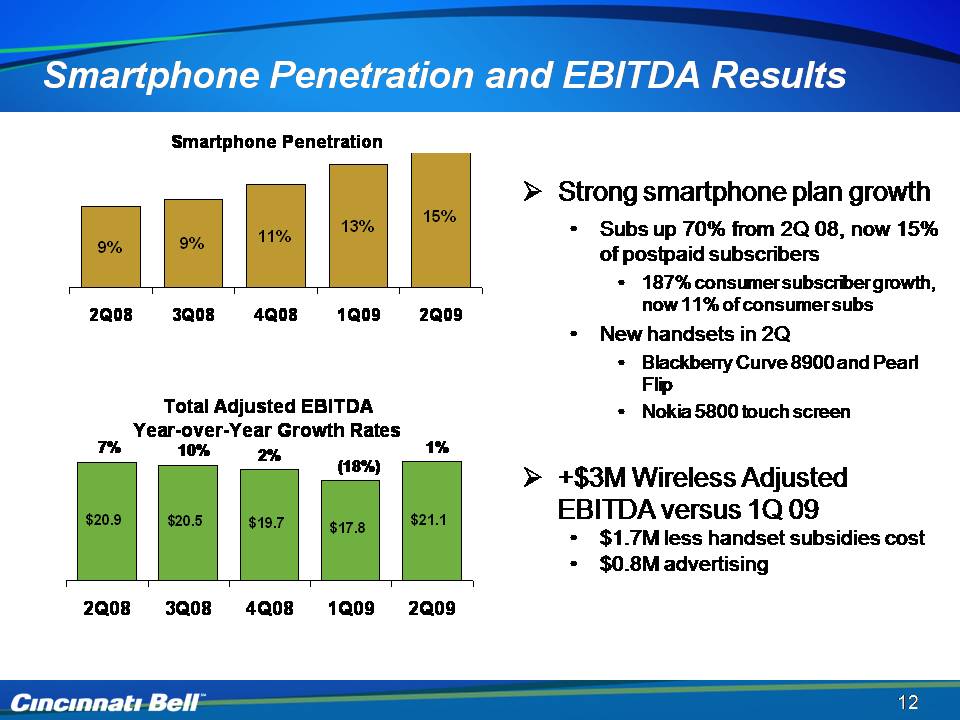

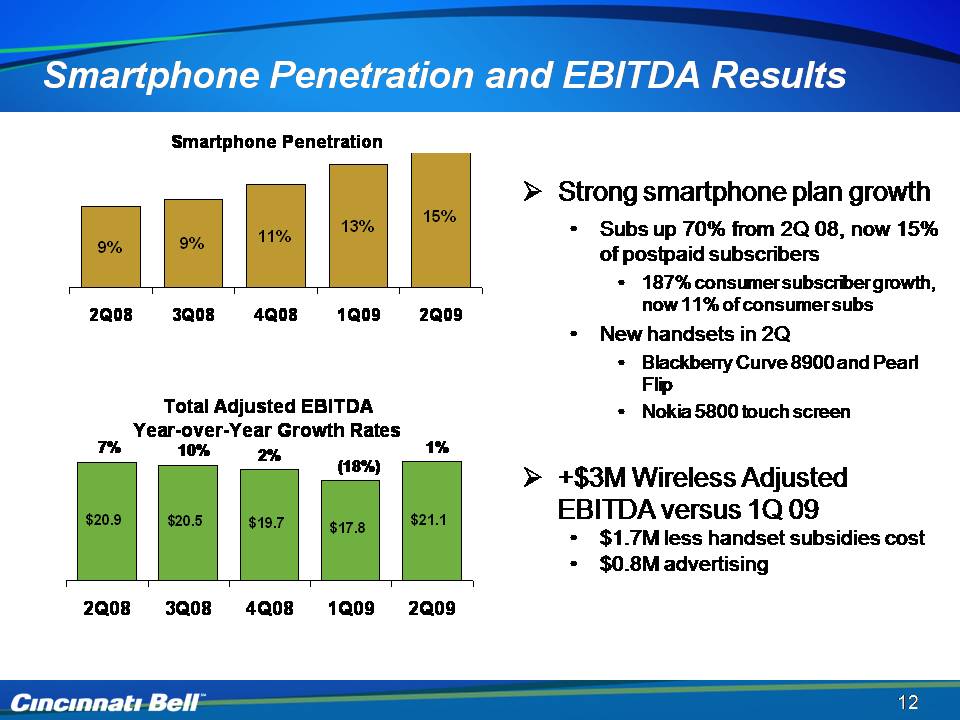

Smartphone Penetration and EBITDA Results Strong smartphone plan growth Subs up 70% from 2Q 08, now 15% of postpaid subscribers 187% consumer subscriber growth, now 11% of consumer subs New handsets in 2Q Blackberry Curve 8900 and Pearl Flip Nokia 5800 touch screen +$3M Wireless Adjusted EBITDA versus 1Q 09 $1.7M less handset subsidies cost $0.8M advertising 10% (18%) 7% 2% 1%

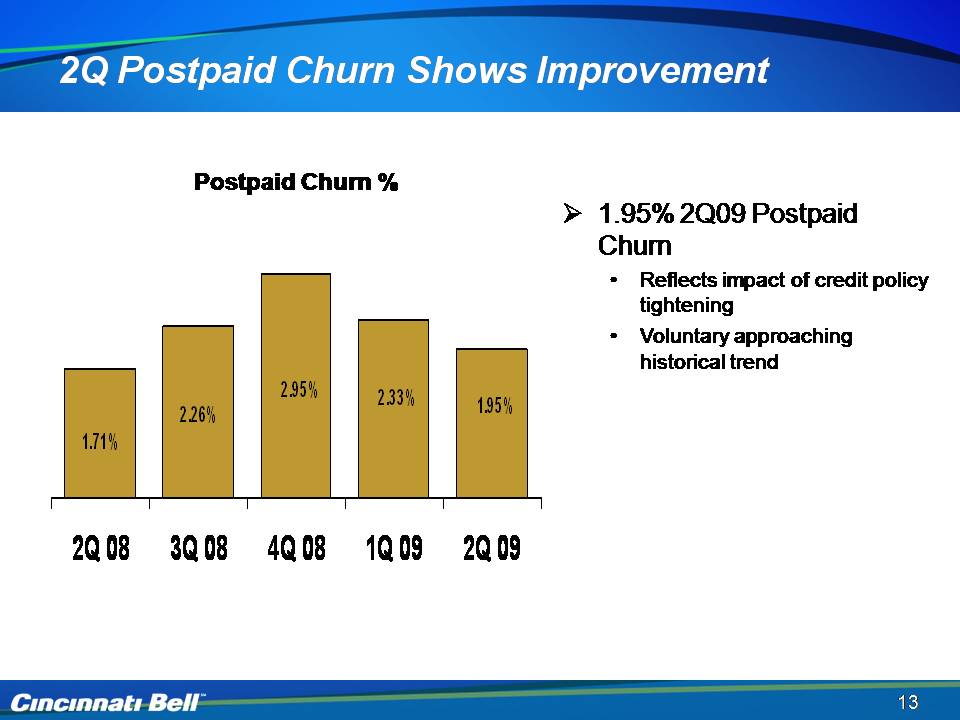

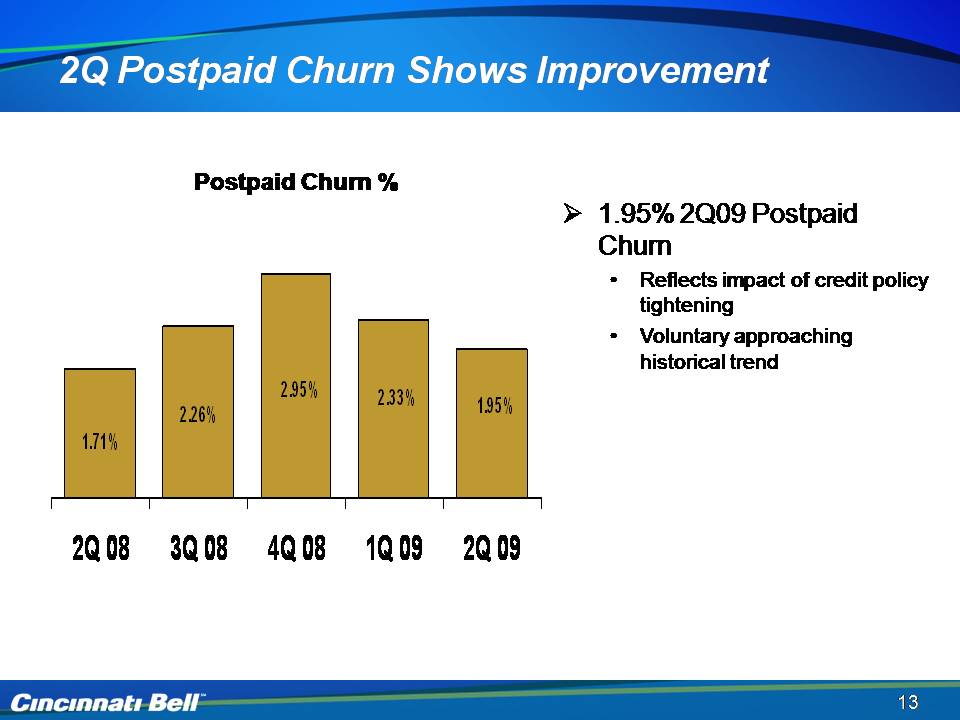

2Q Postpaid Churn Shows Improvement 1.95% 2Q09 Postpaid ChurnReflects impact of credit policy tighteningVoluntary approaching historical trend Postpaid Churn %

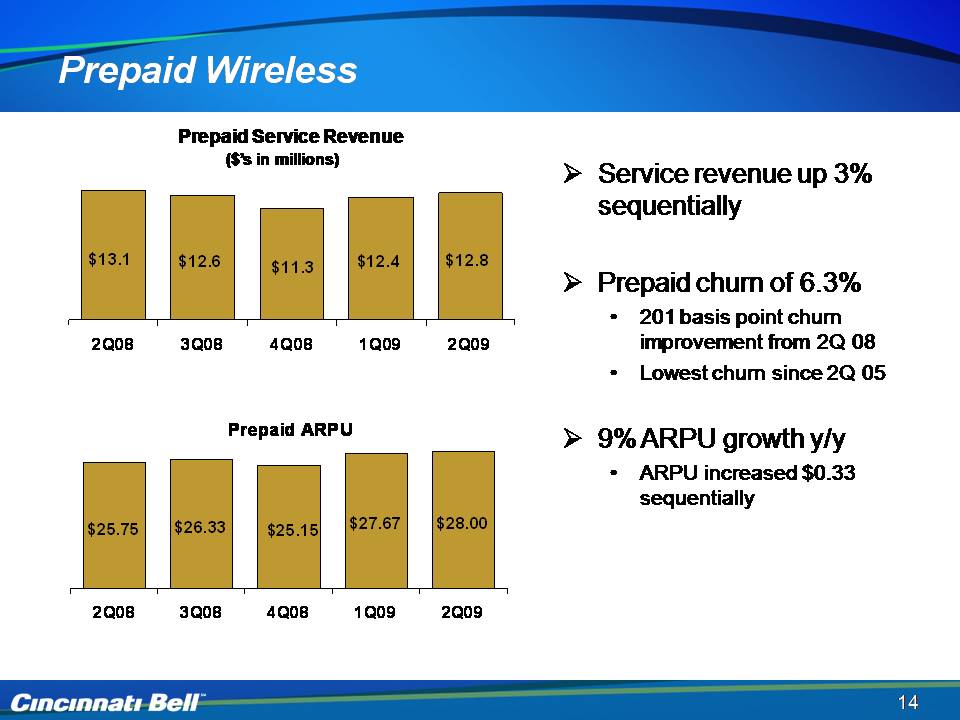

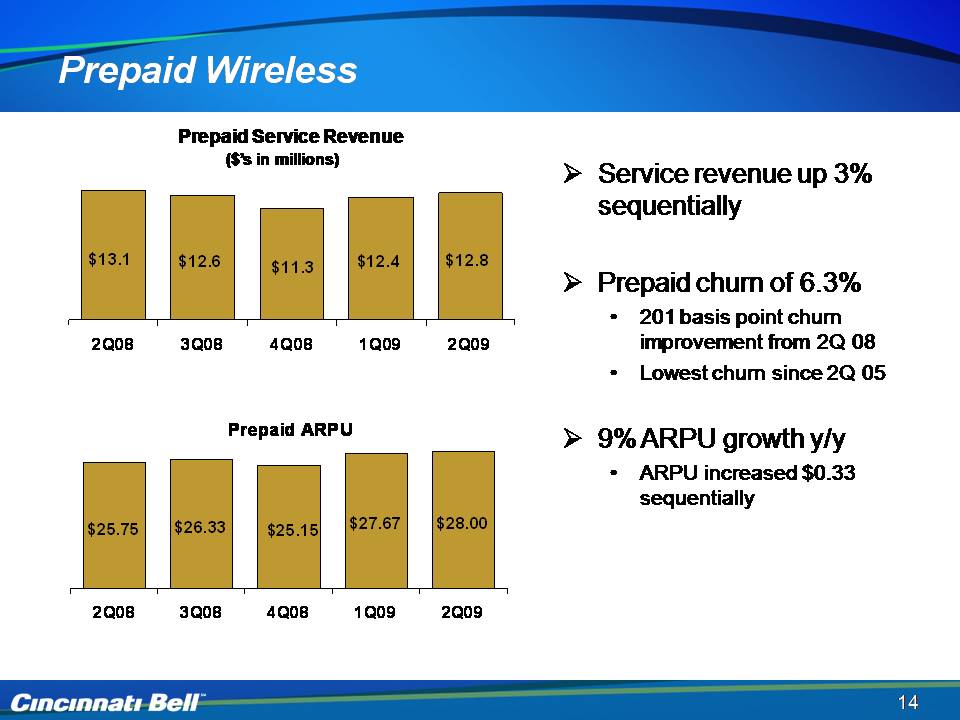

14 Prepaid Wireless Prepaid Service Revenue ($’s in millions) $13.1 2Q08 $12.6 3Q08 $11.3 4Q08 $12.4 1Q09 $12.8 2Q09 Prepaid ARPU $25.75 2Q08 $26.33 3Q08 $25.15 4Q08 $27.67 1Q09 $28.00 2Q09 Service revenue up 3% sequentially Prepaid churn of 6.3% 201 basis point churn improvement from 2Q 08 Lowest churn since 2Q 05 9% ARPU growth y/y ARPU increased $0.33 sequentially

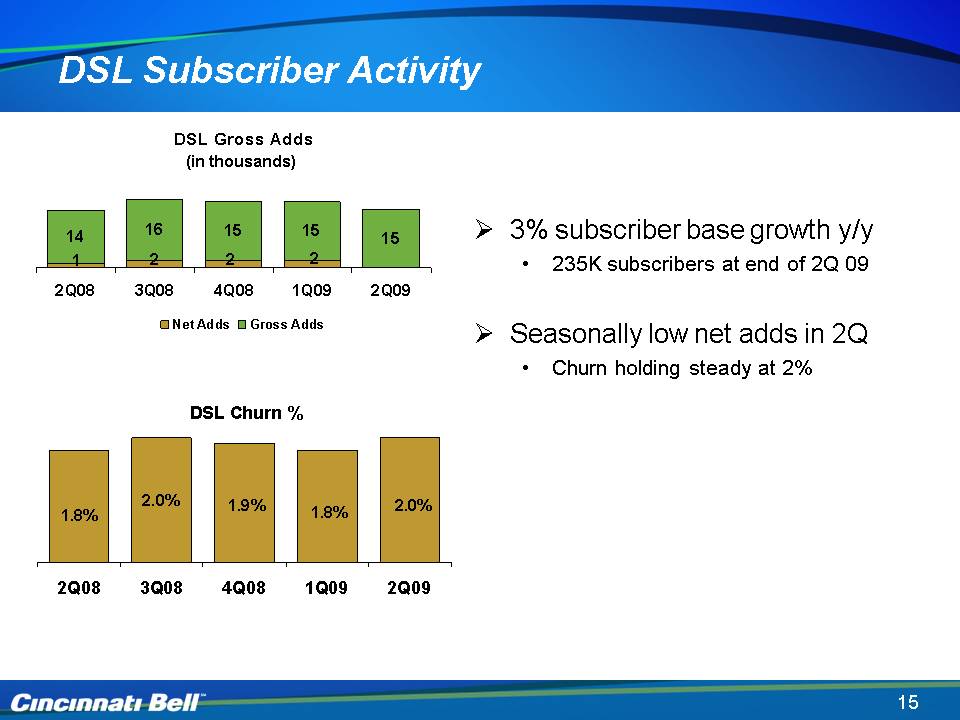

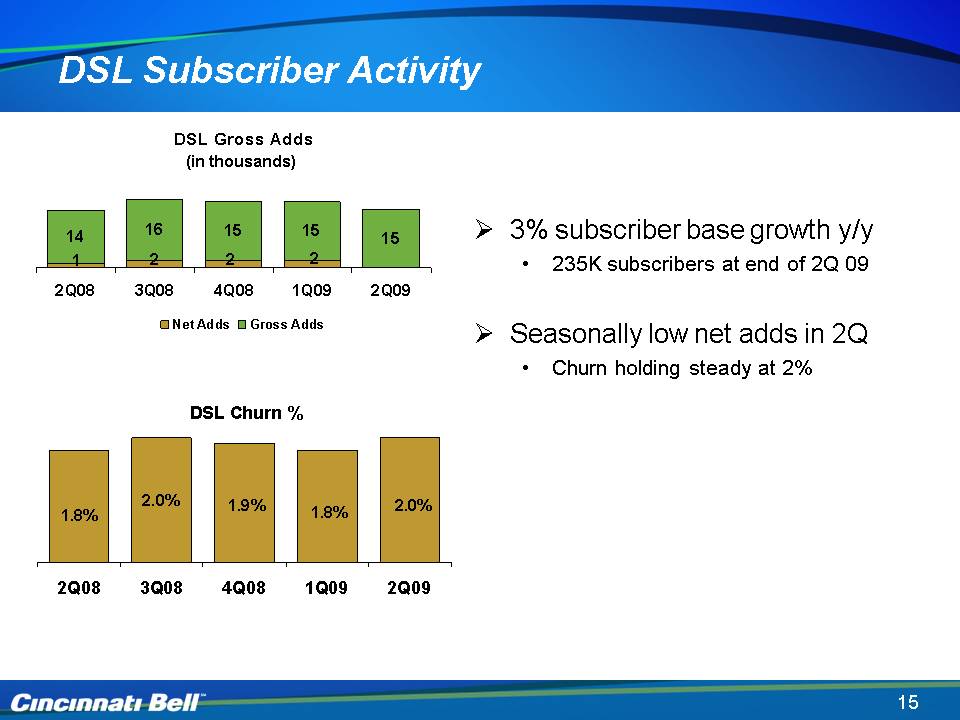

15 DSL Subscriber Activity DSL Gross Adds (in thousands) 1 14 2Q08 2 16 3Q08 2 15 4Q08 2 15 1Q09 15 2Q09 Net Adds Gross Adds DSL Churn % 1.8% 2Q08 1.8% 3Q08 2.0% 4Q08 1.9% 1Q09 2.0% 2Q09 3% subscriber base growth y/y 235K subscribers at end of 2Q 09 Seasonally low net adds in 2Q Churn holding steady at 2%

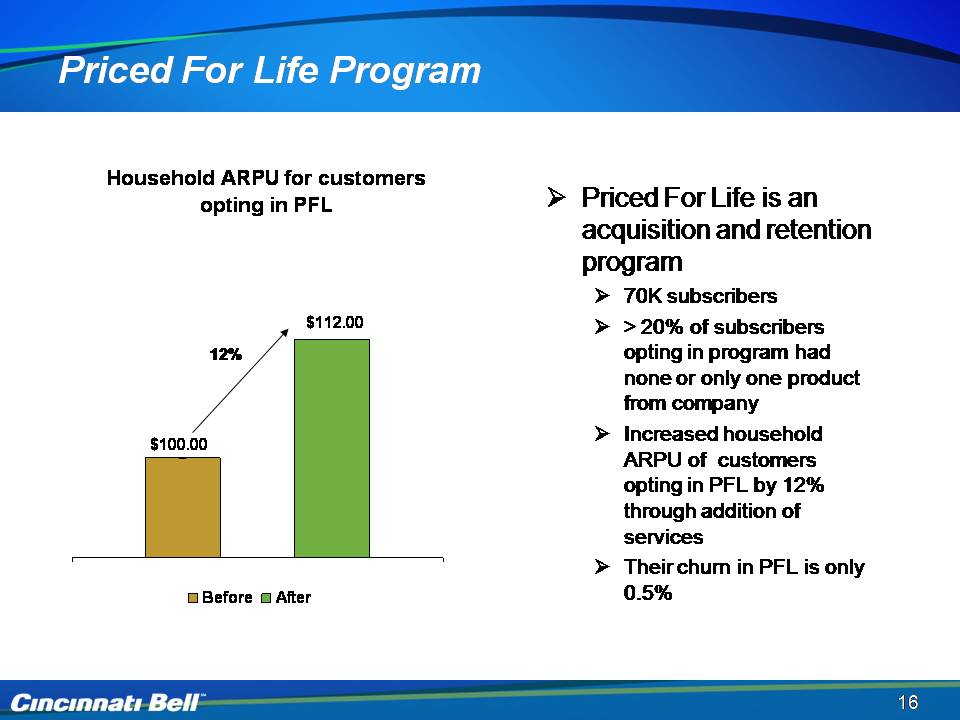

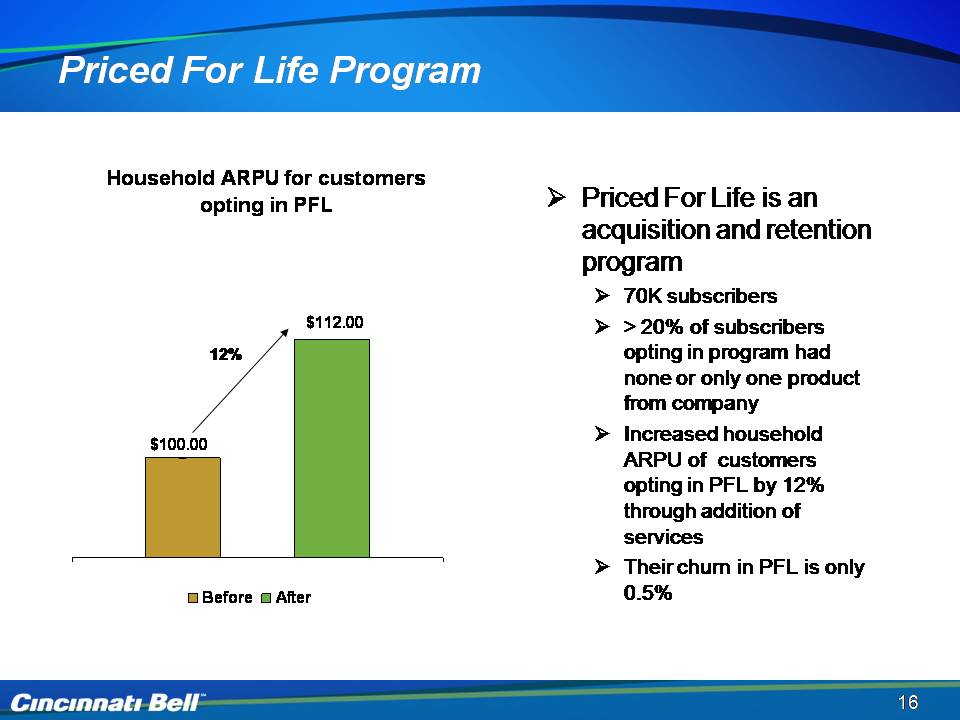

DSL Subscriber Activity 16 Price For Life program Priced For Life is an acquisition and retention program 70K subscribers 20% of subscribers opting in program had none or only one product from company Increased household ARPU of customers opting in PFL by 12% through addition of services Their churn in PFL is only 0.5% 12%

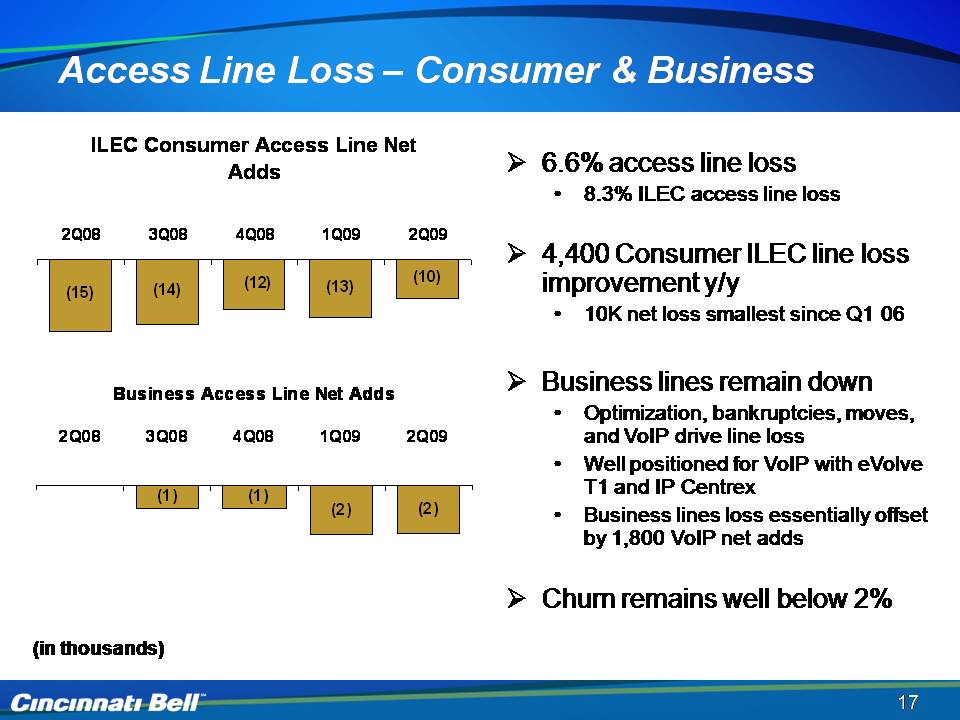

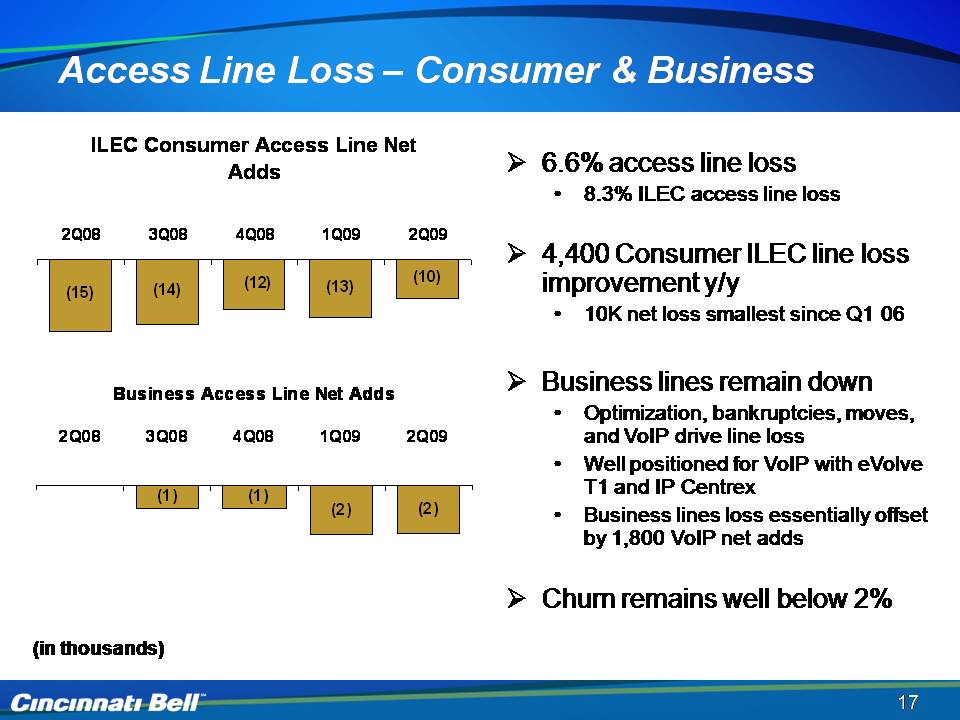

Access Line Loss – Consumer & Business 6.6% access line loss 8.3% ILEC access line loss 4,400 Consumer ILEC line loss improvement y/y 10K net loss smallest since Q1 06 Business lines remain down Optimization, bankruptcies, moves, and VoIP drive line loss Well positioned for VoIP with eVolve T1 and IP Centrex Business lines loss essentially offset by 1,800 VoIP net adds Churn remains well below 2% (in thousands)

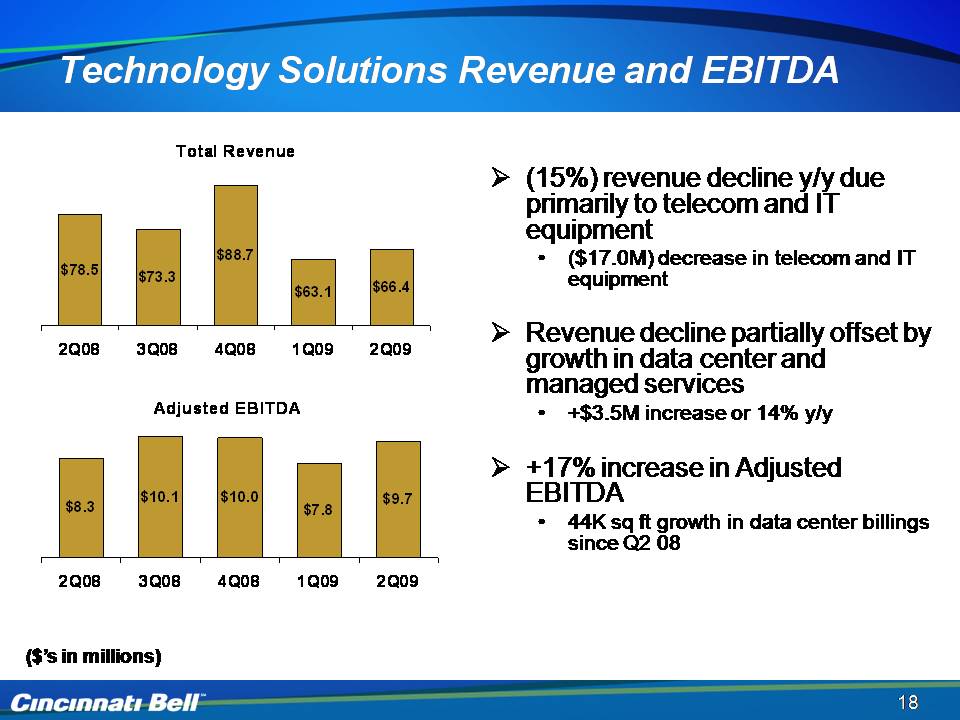

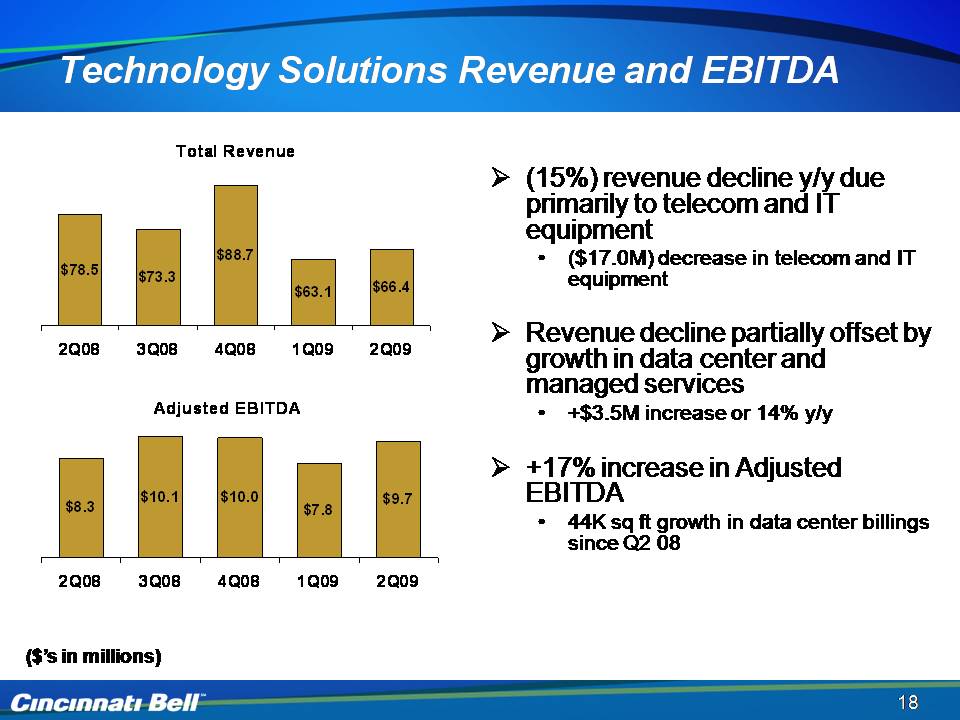

(15%) revenue decline y/y due primarily to telecom and IT equipment ($17.0M) decrease in telecom and IT equipment Revenue decline partially offset by growth in data center and managed services +$3.5M increase or 14% y/y +17% increase in Adjusted EBITDA 44K sq ft growth in data center billings since Q2 08 Total Revenue 2Q08 $78.5 3Q08 $73.3 4Q08 $88.7 1Q09 $63.1 2Q09 $66.4 Adjusted EBITDA 2Q08 $8.3 3Q08 $10.1 4Q08 $10.0 1Q09 $7.8 2Q09 $9.7

19 Financial Overview Gary Wojtaszek Chief Financial Officer

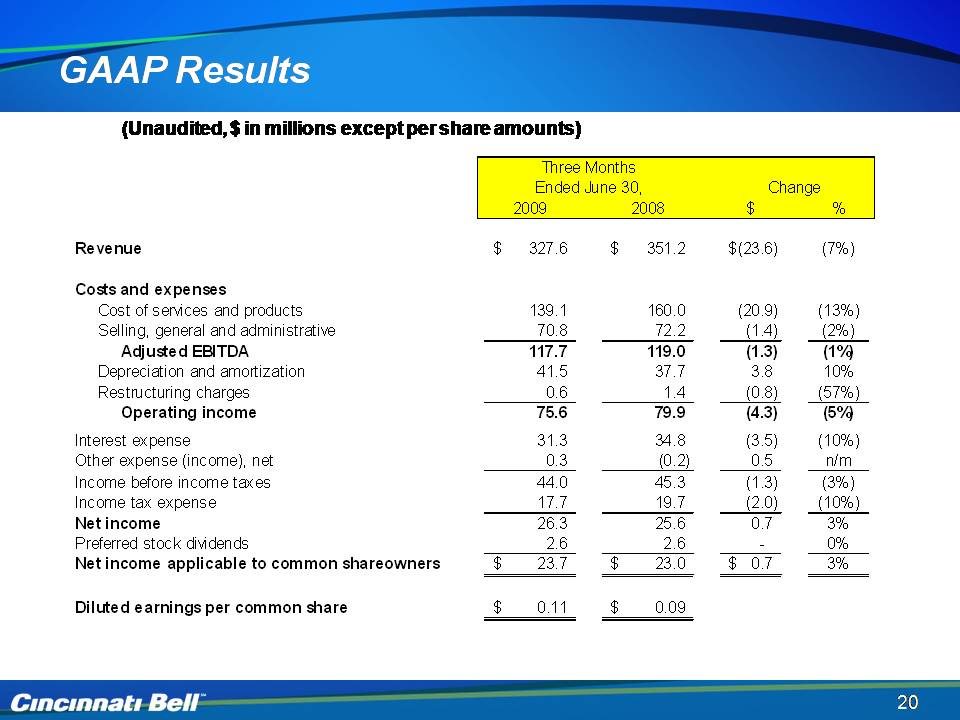

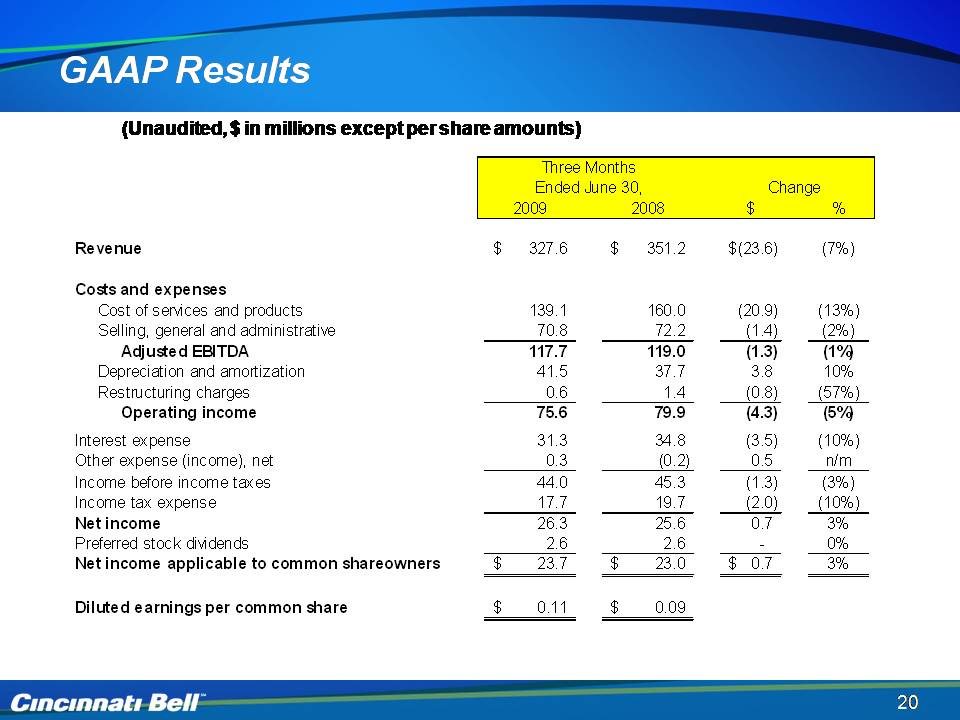

20 GAAP Results (Unaudited, $ in millions except per share amounts) 2009 2008 $ % Three Months Ended June 30, Change Revenue 327.6 $ 351.2 $ (23.6) $ (7%) Costs and expenses Cost 139 1 160 0 (20 9) (13%) of services and products 139.1 160.0 20.9) Selling, general and administrative 70.8 72.2 (1.4) (2%) Adjusted EBITDA 117.7 119.0 (1.3) (1%) Depreciation and amortization 41.5 37.7 3.8 10% Restructuring charges 0.6 1.4 (0.8) (57%) Operating income 75 6 79 9 (4 3) (5%) 75.6 79.9 4.3) Interest expense 31.3 34.8 (3.5) (10%) Other expense (income), net 0.3 (0.2) 0.5 n/m Income before income taxes 44.0 45.3 (1.3) (3%) Income tax expense 17.7 19.7 (2.0) (10%) Net income 26.3 25.6 0.7 3% Preferred stock dividends 2.6 2.6 - 0% Net income applicable to common shareowners 23.7 $ 23.0 $ 0.7 $ 3% Diluted earnings per common share 0.11 $ 0.09 $

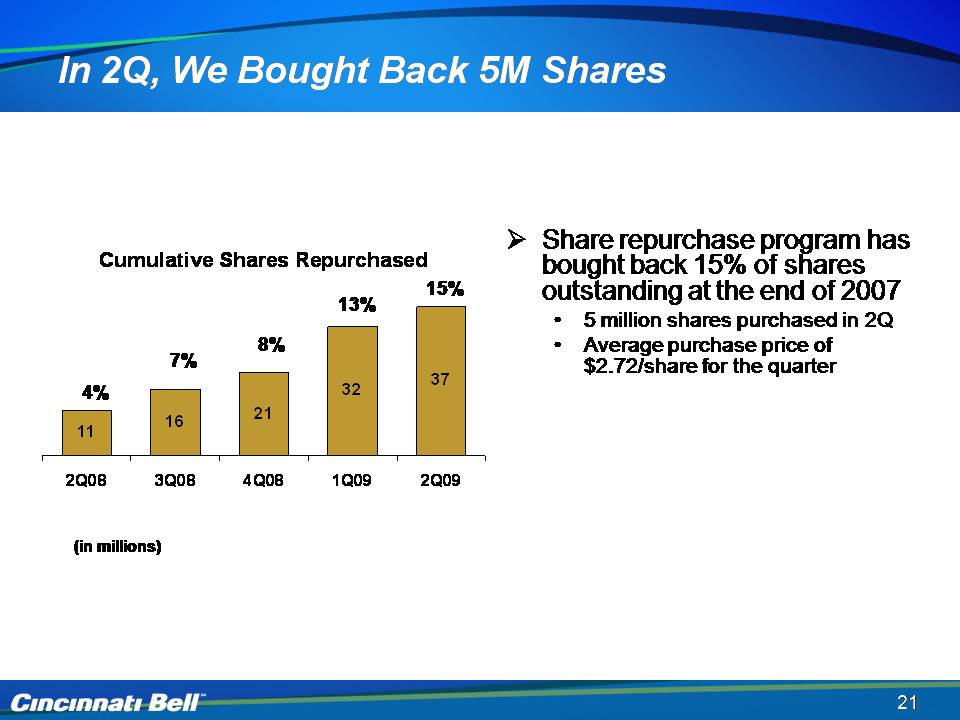

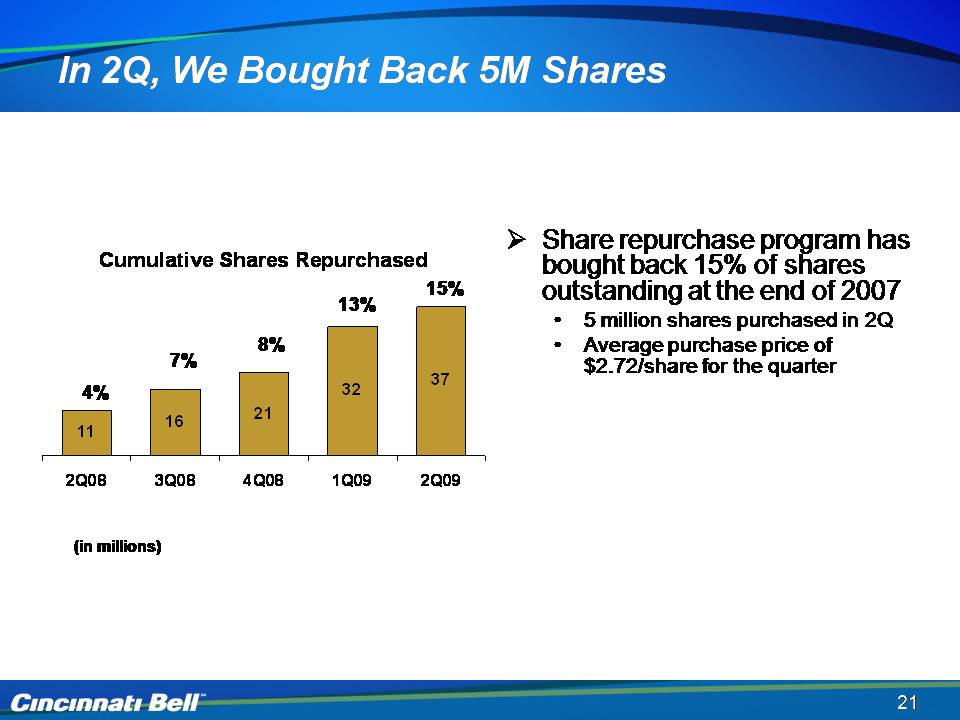

21 In 2Q, We Bought Back 5M Shares (in millions) Share repurchase program has bought back 15% of shares outstanding at the end of 2007 5 million shares purchased in 2Q Average purchase price of $2.72/share for the quarter Cumulative Shares Repurchased 4% 11 2Q08 7% 16 3Q08 8% 21 4Q08 13% 32 1Q09 15% 37 2Q09

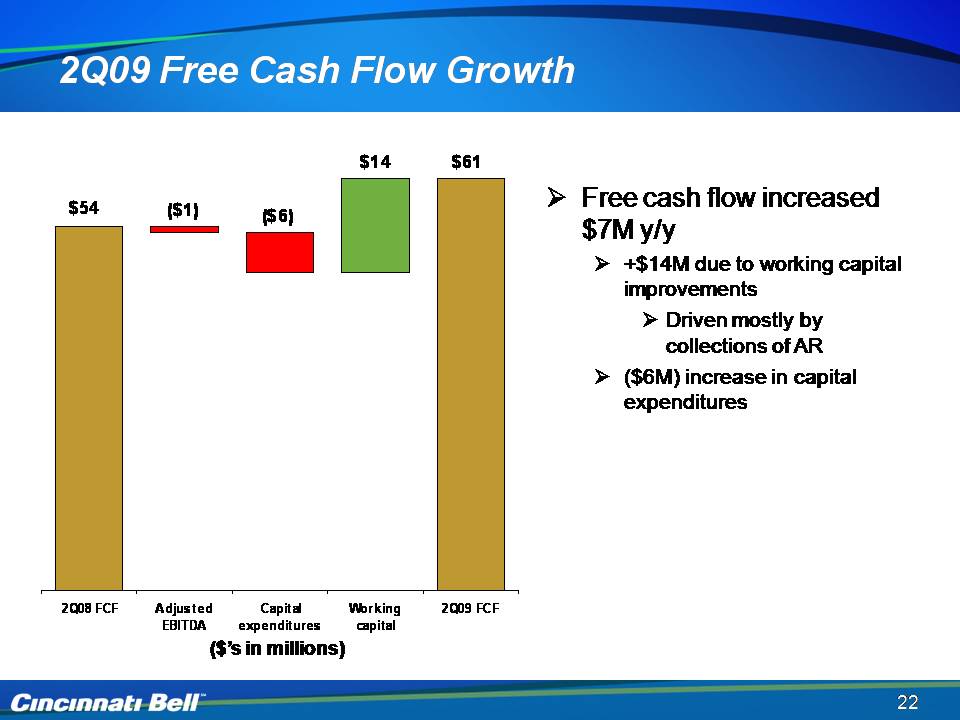

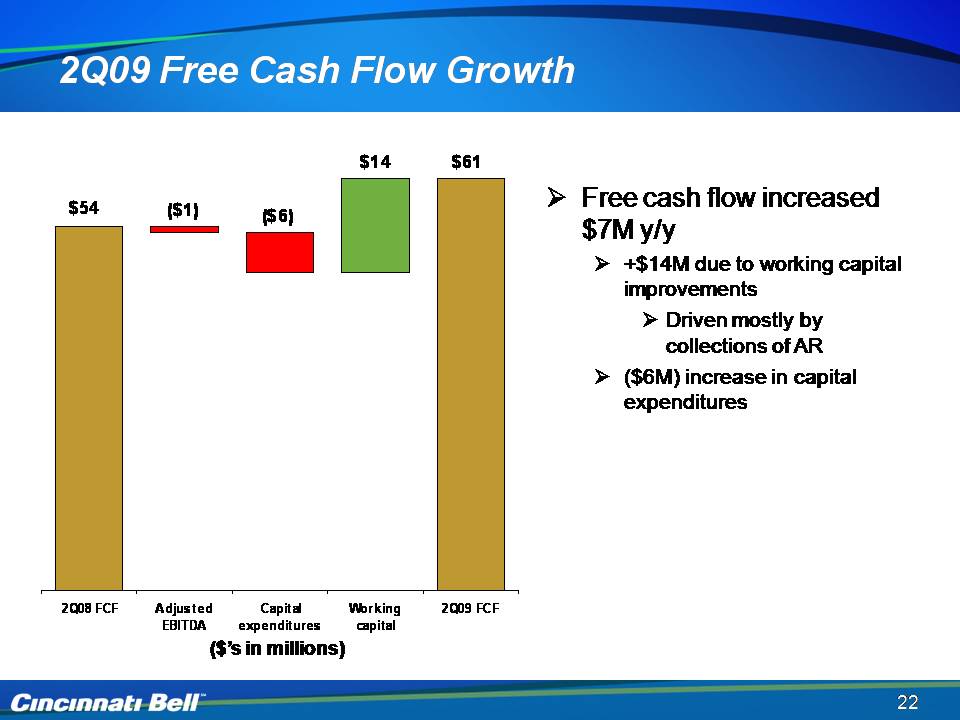

22 2Q09 Free Cash Flow Growth ($’s in millions) Free cash flow increased $7M y/y +$14M due to working capital improvements Driven mostly by collections of AR ($6M) increase in capital expenditures $54 2Q08 FCF ($1) Adjusted EBITDA ($6) Capital expenditures $14 Working capital $61 2Q09 FCF

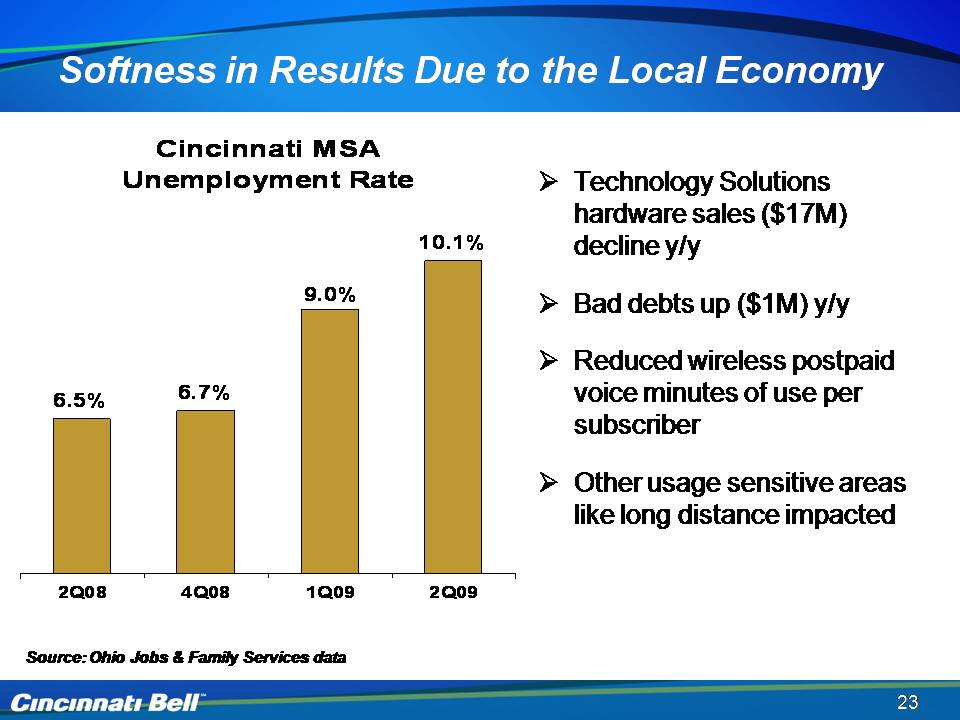

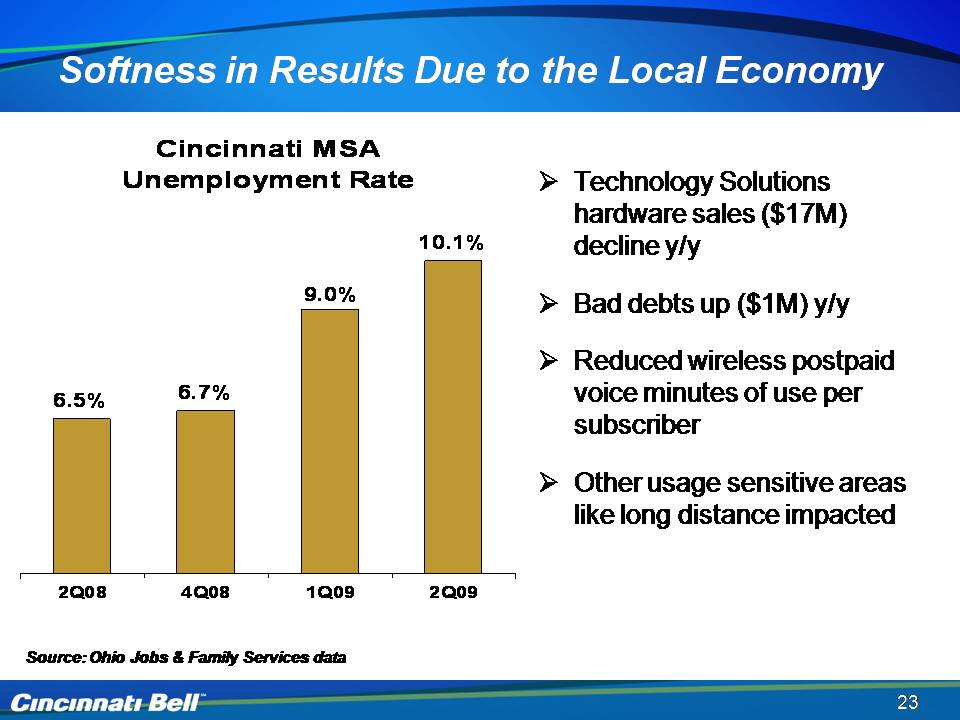

23 Softness in Results Due to the Local Economy Technology Solutions hardware sales ($17M) decline y/y Bad debts up ($1M) y/y Reduced wireless postpaid voice minutes of use per subscriber Other usage sensitive areas like long distance impacted Cincinnati MSA Unemployment Rate 6.5% 2Q08 6.7% 4Q08 9.0% 1Q09 10.1% 2Q09 Source: Ohio Jobs & Family Services data

24 Adjusted EBITDA Was Impacted by the Economy Wireless voice service revenue down ($2M) y/y Bad debts up ($1M) y/y Incremental pension & benefits expense up ($3M) y/y prior to Feb plan changes Impact of drop in IT and telecom equipment offset by growth in data center & managed services revenue ($’s in millions) Adjusted EBITDA $119 2Q08 EBITDA ($4) Wireless usage ($1) Bad debt ($3) Pension expense $7 Costs & other $118 2Q09 EBITDA

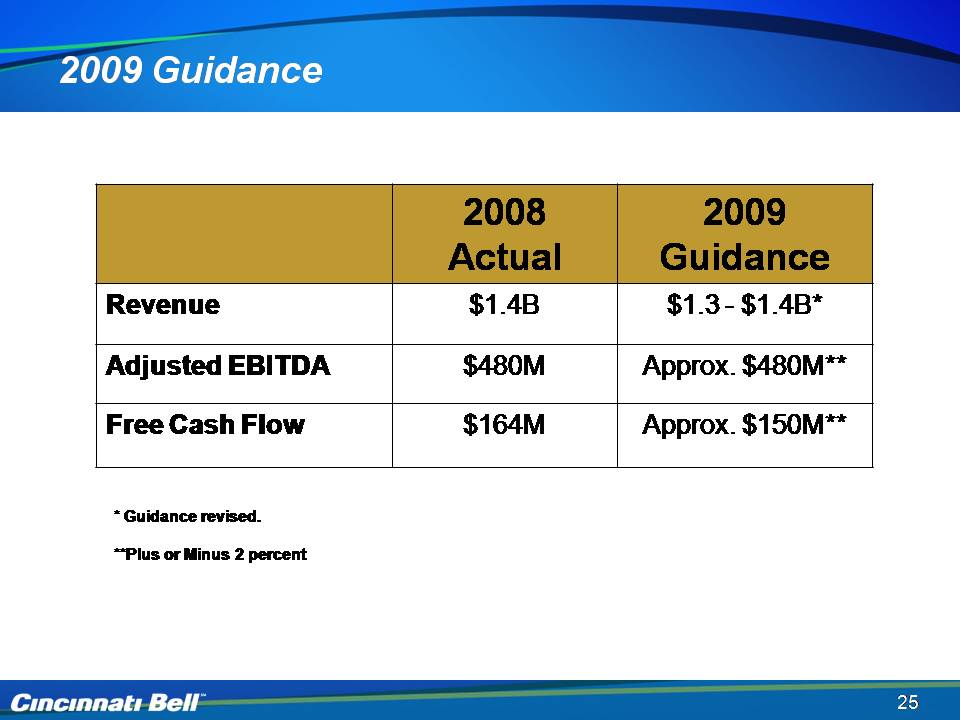

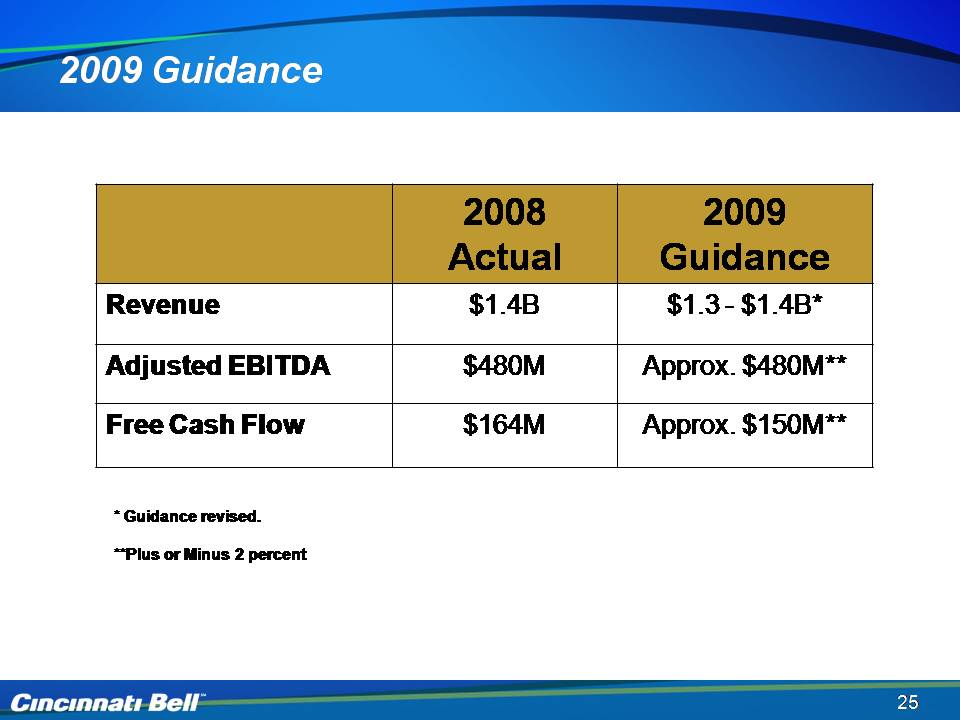

25 2009 Guidance 2008 Actual 2009 Guidance Revenue $1.4B $1.3 - $1.4B* Adjusted EBITDA $480M Approx. $480 M** Free Cash Flow $164M Approx. $150M** * Guidance revised.**Plus or Minus 2 percent

26 Cincinnati Bell 2nd Quarter 2009 Review August 4, 2009

27 Non-GAAP Reconciliations(please refer to the Earnings Financials)