1 Cincinnati Bell 4th Quarter and Full Year 2009 Review February 11, 2010

2 Agenda Performance Highlights Jack Cassidy, President & CEO 2. Operational OverviewBrian Ross, Chief Operating Officer 4. Q & A 3. Financial Overview Gary Wojtaszek, Chief Financial Officer

3 Safe Harbor Body: Certain of the statements and predictions contained in this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act. In particular, statements, projections or estimates that include or reference the words “believes,” “anticipates,” “plans,” “intends,” “expects,” “will,” or any similar expression fall within the safe harbor for forward-looking statements contained in the Reform Act. Actual results or outcomes may differ materially from those indicated or suggested by any such forward-looking statement for a variety of reasons, including, but not limited to: changing market conditions and growth rates within the telecommunications industry or generally within the overall economy; changes in competition in markets in which the company operates; pressures on the pricing of company products and services; advances in telecommunications technology; the ability to generate sufficient cash flow to fund the company’s business plan, repay the company’s debt and interest obligations, and maintain its networks; the ability to refinance indebtedness when required on commercially reasonable terms; changes in the telecommunications regulatory environment; changes in the demand for the company’s services and products; the demand for particular products and services within the overall mix of products sold, as the company’s products and services have varying profit margins; the company’s ability to introduce new service and product offerings on a timely and cost effective basis; work stoppage caused by labor disputes; restrictions imposed under various credit facilities and debt instruments; the company’s ability to attract and retain highly qualified employees; the company’s ability to access capital markets and the successful execution of restructuring initiatives; changes in the funded status of the company’s retiree pension and healthcare plans; disruption in operations caused by a health pandemic, such as the H1N1 influenza virus; changes in the company’s relationships with current large customers, a small number of whom account for a significant portion of company revenue; and disruption in the company’s back-office information technology systems, including its billing system. More information on potential risks and uncertainties is available in recent filings with the Securities and Exchange Commission, including Cincinnati Bell’s Form 10-K report, Form 10-Q reports and Form 8-K reports. The forward-looking statements included in this presentation represent company estimates as of February 10, 2010. Cincinnati Bell anticipates that subsequent events and developments will cause its estimates to change.

4 Performance Highlights Jack Cassidy President & CEO

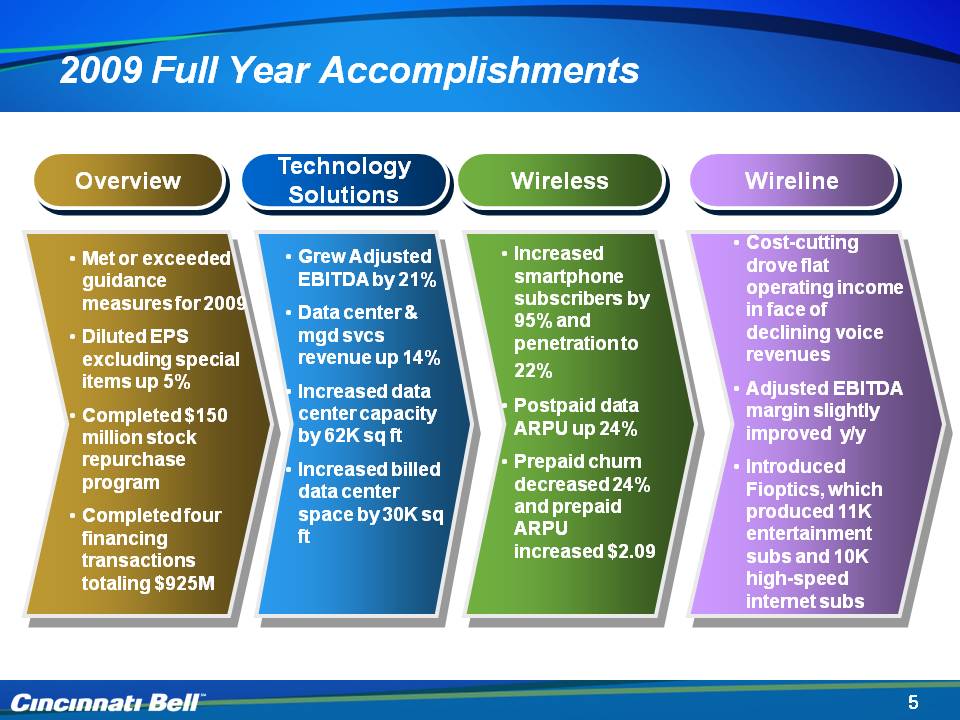

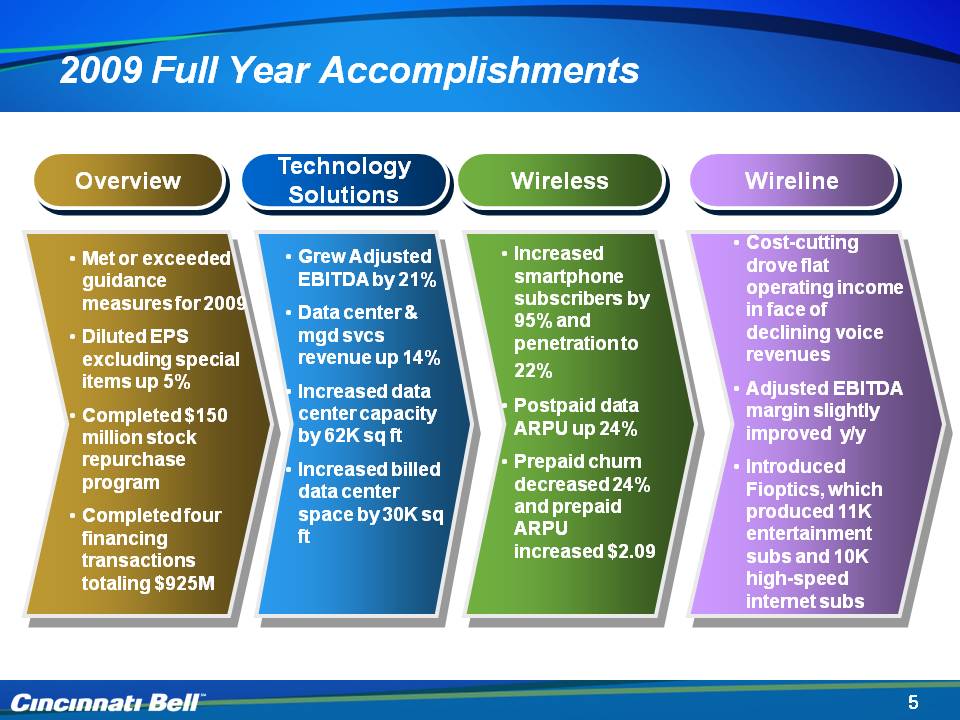

5 2009 Full Year Accomplishments Overview Technology Solutions Wireless Wireline Met or exceeded guidance measures for 2009 Diluted EPS excluding special items up 5% Completed $150 million stock repurchase program Completed four financing transactions totaling $925M Increased smartphone subscribers by 95% and penetration to 22% Postpaid data ARPU up 24% Prepaid churn decreased 24% and prepaid ARPU increased $2.09 Cost-cutting drove flat operating income in face of declining voice revenues Adjusted EBITDA margin slightly improved y/y Introduced Fioptics, which produced 11K entertainment subs and 10K high-speed internet subs Grew Adjusted EBITDA by 21%Data center & mgd svcs revenue up 14% Increased data center capacity by 62K sq ft Increased billed data center space by 30K sq ft

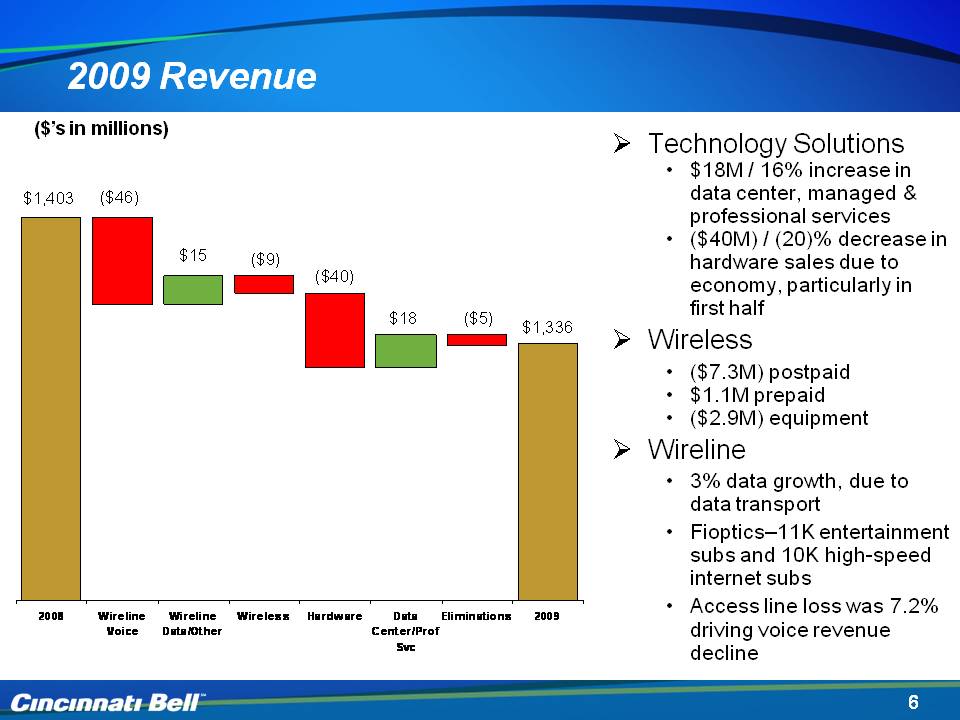

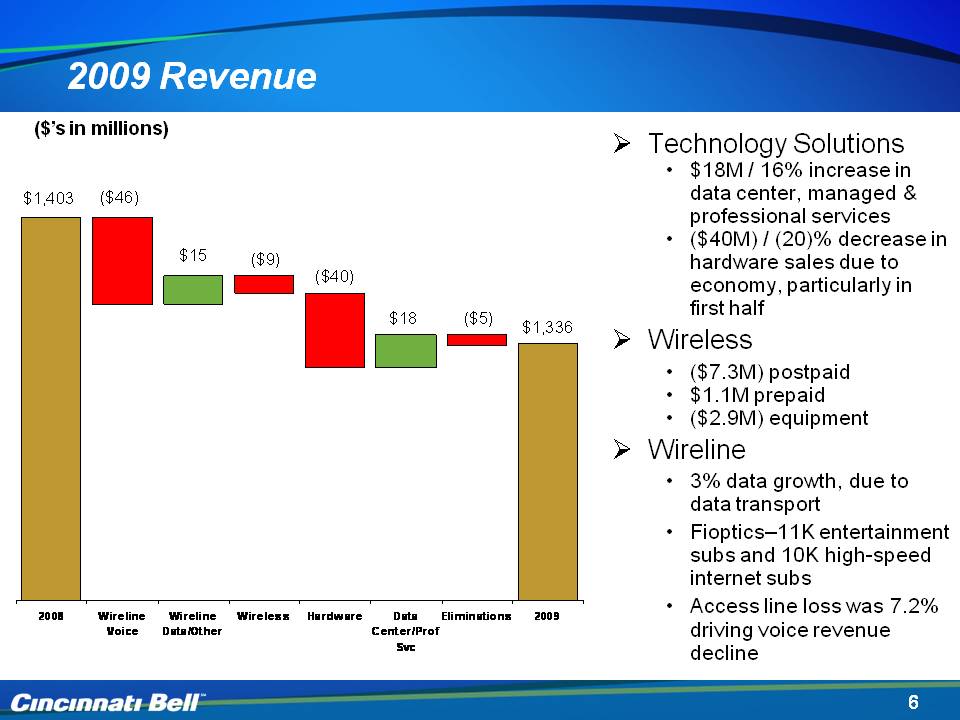

6 2009 Revenue Body: Technology Solutions$18M / 16% increase in data center, managed & professional services($40M) / (20)% decrease in hardware sales due to economy, particularly in first halfWireless ($7.3M) postpaid$1.1M prepaid($2.9M) equipmentWireline 3% data growth, due to data transportFioptics–11K entertainment subs and 10K high-speed internet subsAccess line loss was 7.2% driving voice revenue decline ($’s in millions)

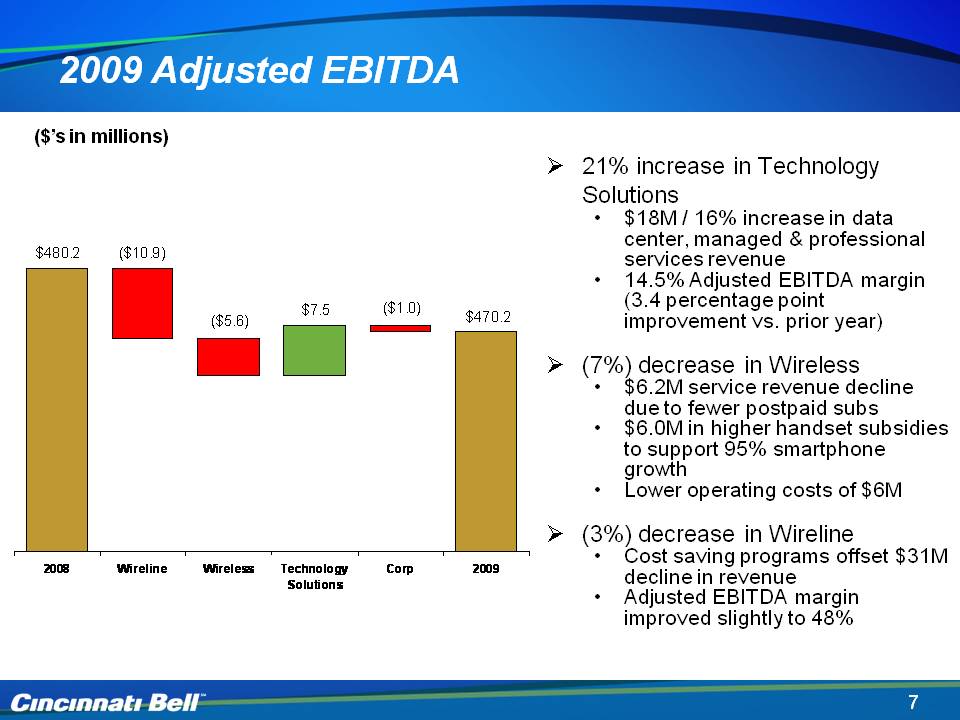

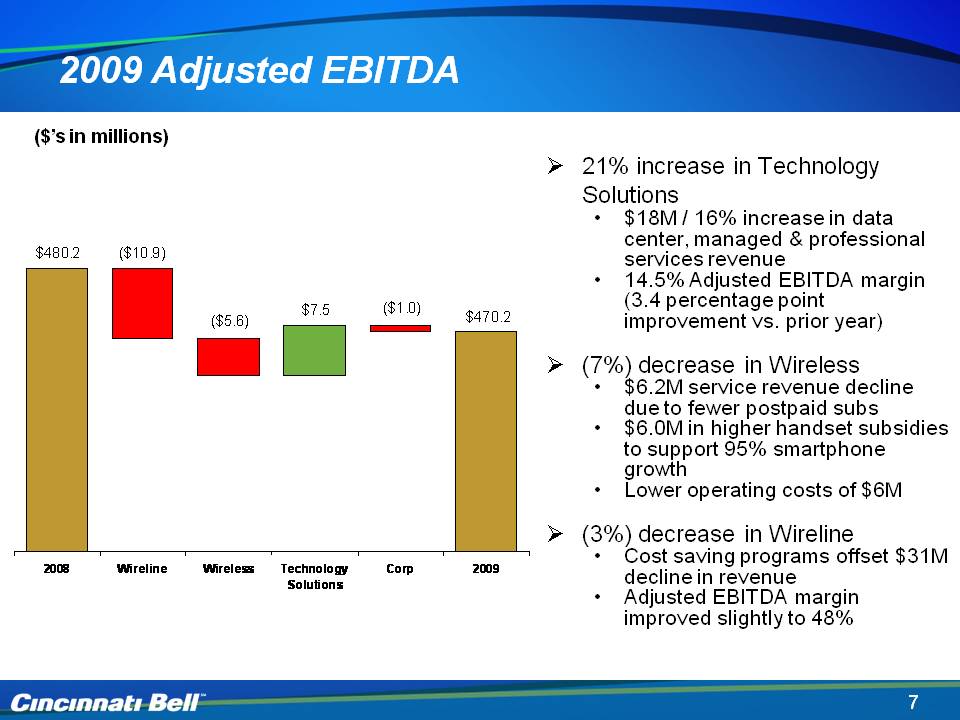

7 2009 Adjusted EBITDA Body: 21% increase in Technology Solutions $18M / 16% increase in data center, managed & professional services revenue 14.5% Adjusted EBITDA margin (3.4 percentage point improvement vs. prior year) (7%) decrease in Wireless 6.2M service revenue decline due to fewer postpaid subs $6.0M in higher handset subsidies to support 95% smartphone growth $5.5M in lower operating costs (3%) decrease in Wireline Cost saving programs offset $31M decline in revenueAdjusted EBITDA margin improved slightly to 48% ($’s in millions)

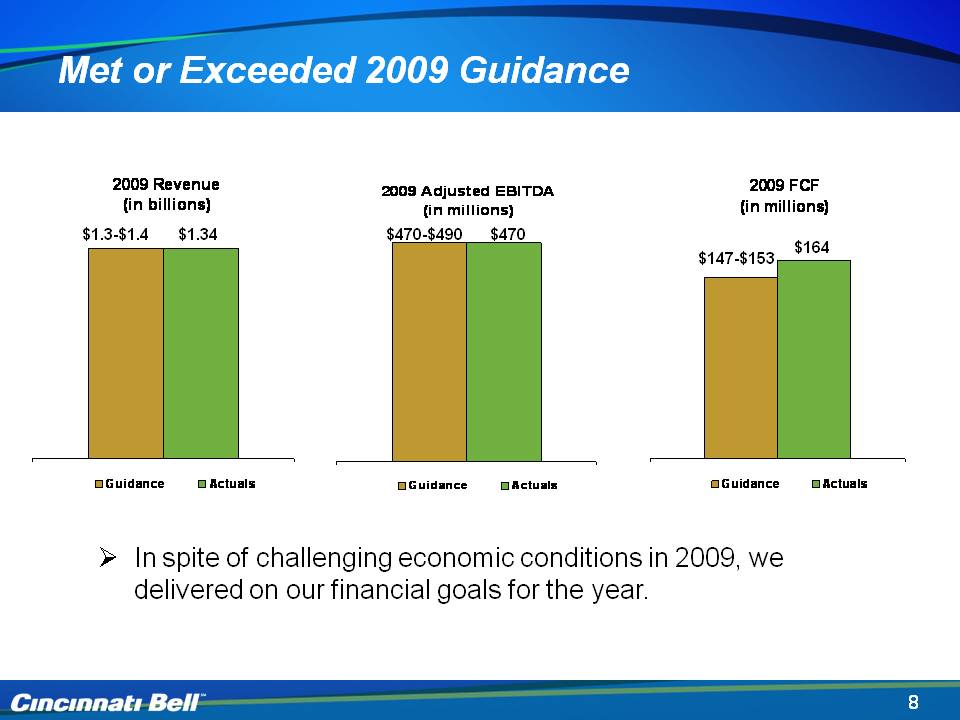

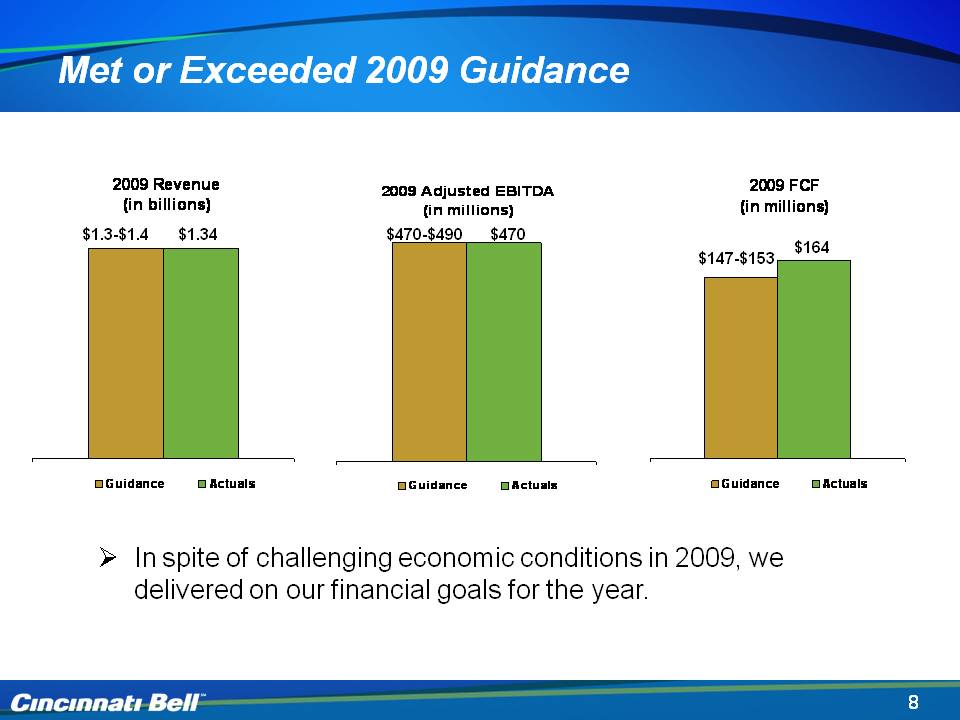

8 Met or Exceeded 2009 Guidance In spite of challenging economic conditions in 2009, we delivered on our financial goals for the year. $1.3-$1.4 $470-$490 $470 $1.34 $147-$153 $164

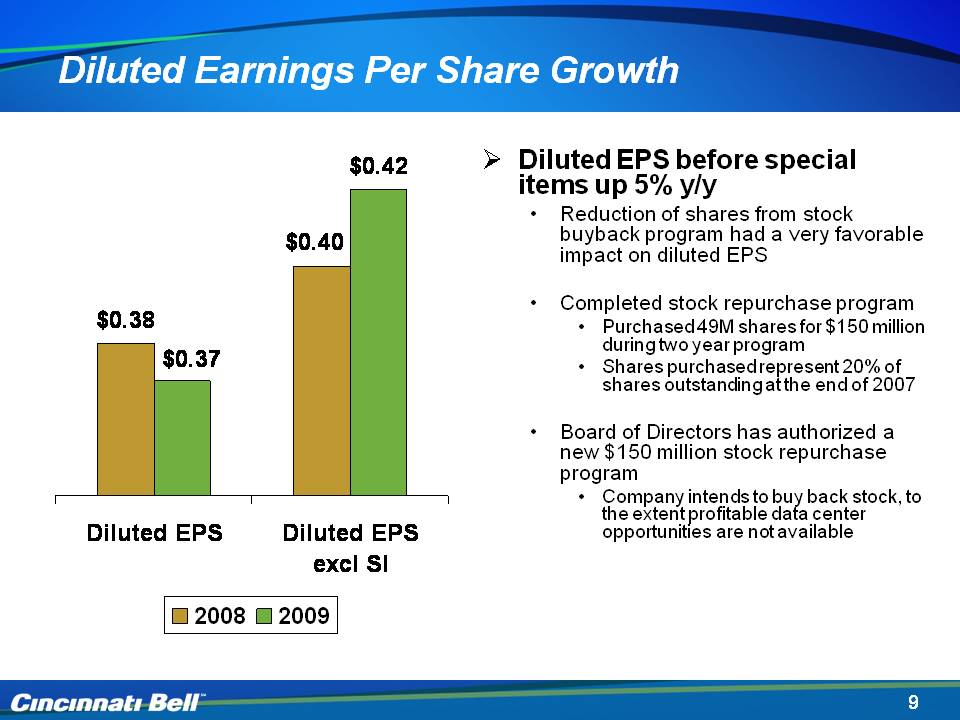

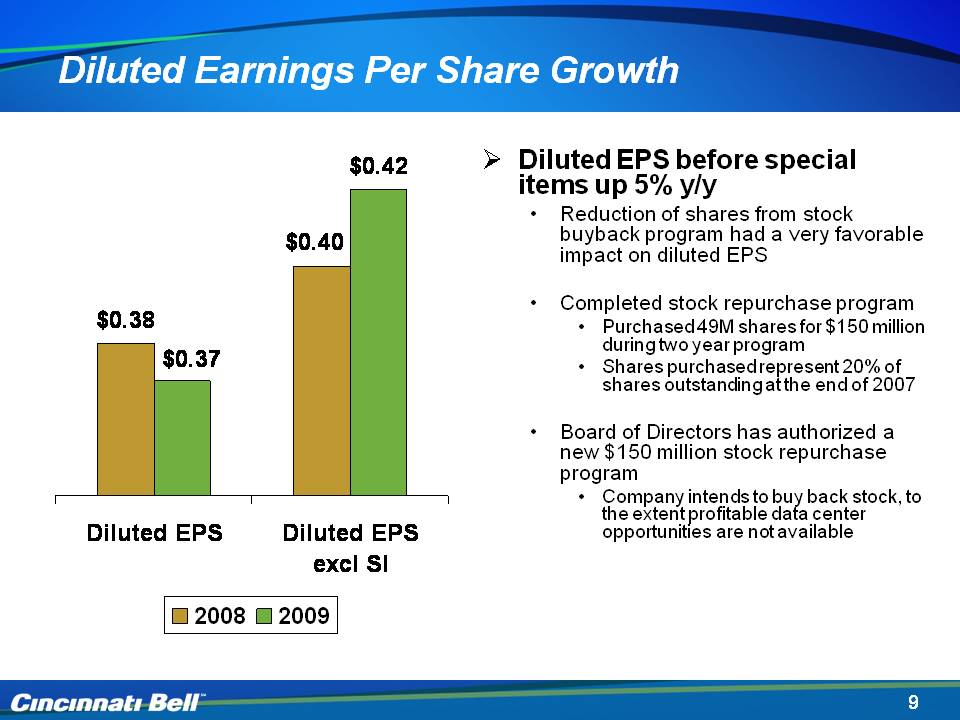

9 Diluted Earnings Per Share Growth Body: Diluted EPS before special items up 5% y/yReduction of shares from stock buyback program had a very favorable impact on diluted EPS Completed stock repurchase program Purchased 49M shares for $150 million during two year programShares purchased represent 20% of shares outstanding at the end of 2007 Board of Directors has authorized a new $150 million stock repurchase program Company intends to buy back stock, to the extent profitable data center opportunities are not available

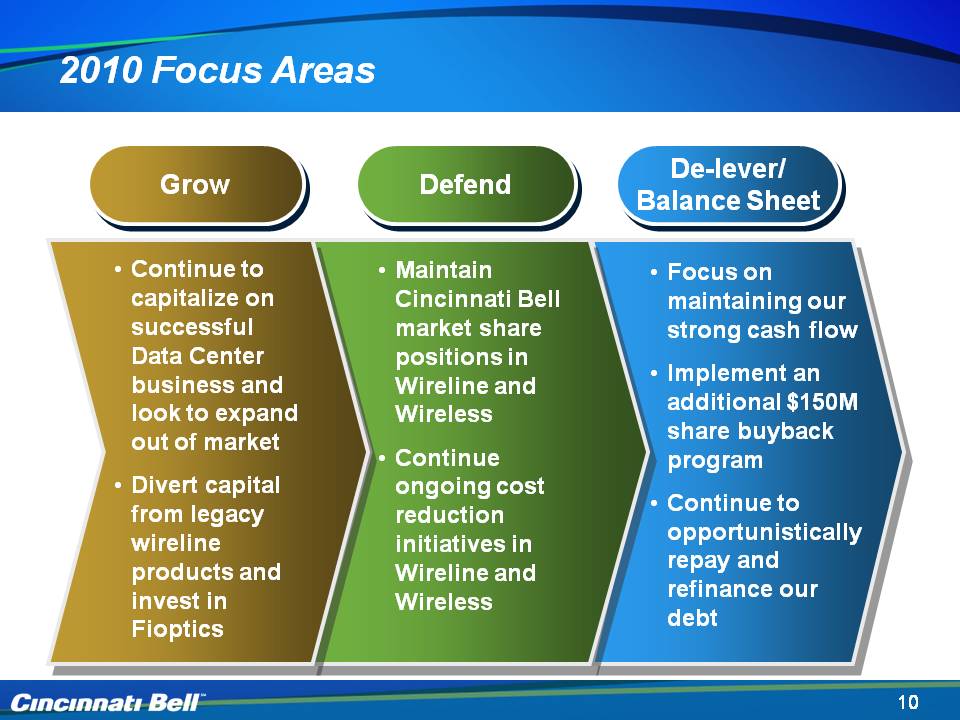

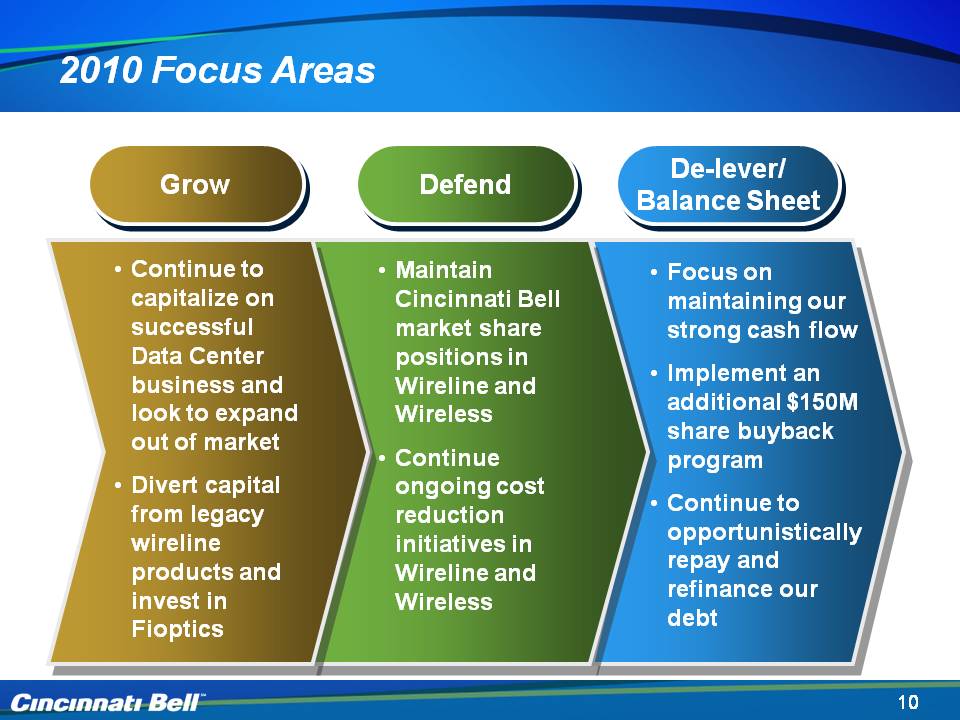

10 2010 Focus Areas Grow Defend De-lever/Balance Sheet Maintain Cincinnati Bell market share positions in Wireline and Wireless Continue ongoing cost reduction initiatives in Wireline and Wireless Focus on maintaining our strong cash flow Implement an additional $150M share buyback program Continue to opportunistically repay and refinance our debt Continue to capitalize on successful Data Center business and look to expand out of market Divert capital from legacy wireline products and invest in Fioptics

11 Operational Overview Brian Ross Chief Operating Officer

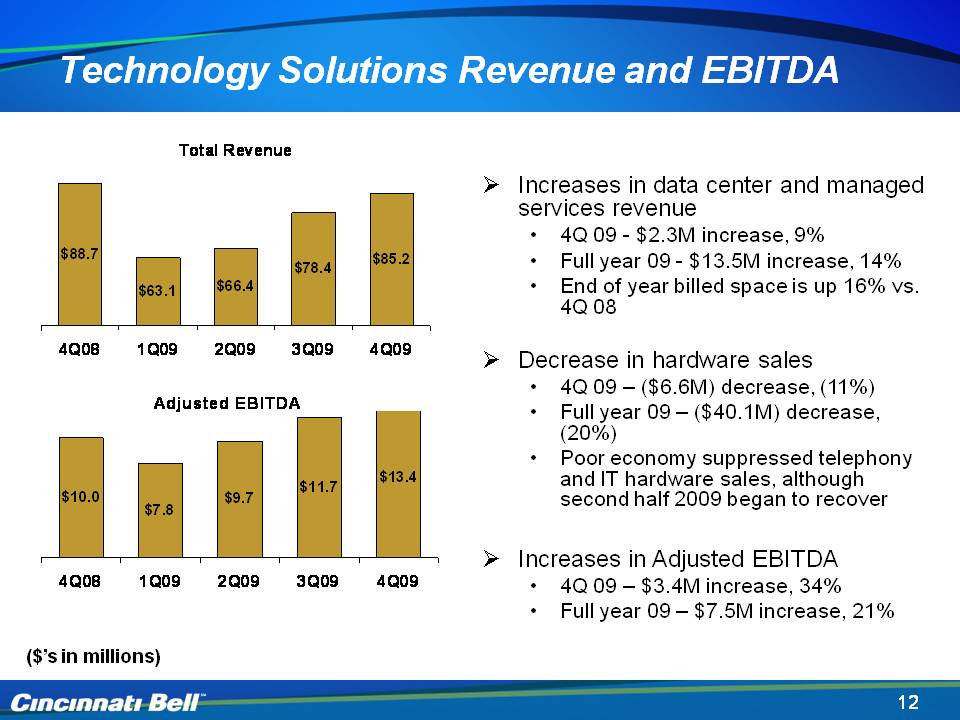

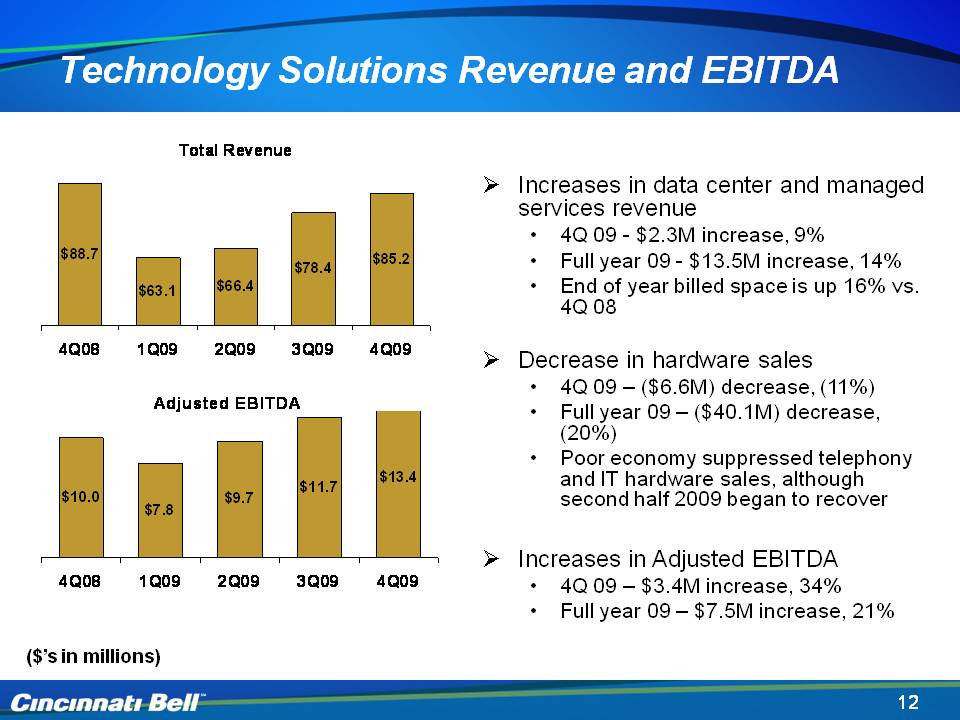

12 Technology Solutions Revenue and EBITDA ($’s in millions) Increases in data center and managed services revenue 4Q 09 - $2.3M increase, 9% Full year 09 - $13.5M increase, 14%End of year billed space is up 16% vs. 4Q 08 Decrease in hardware sales 4Q 09 – ($6.6M) decrease, (11%) Full year 09 – ($40.1M) decrease, (20%) Poor economy suppressed telephony and IT hardware sales, although second half 2009 began to recover Increases in Adjusted EBITDA 4Q 09 – $3.4M increase, 34% Full year 09 – $7.5M increase, 21%

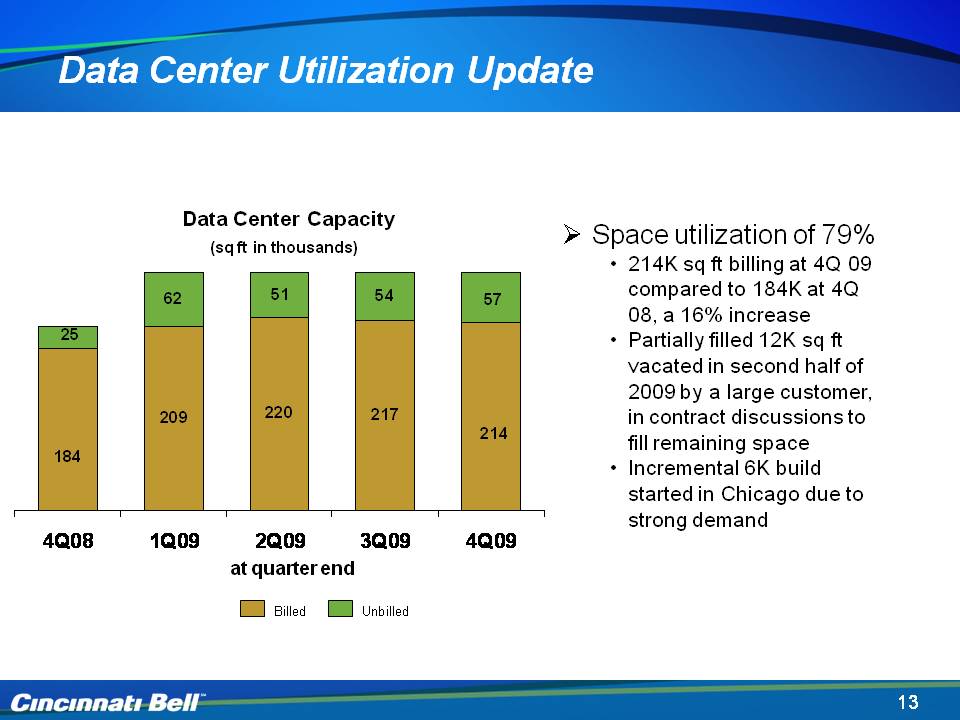

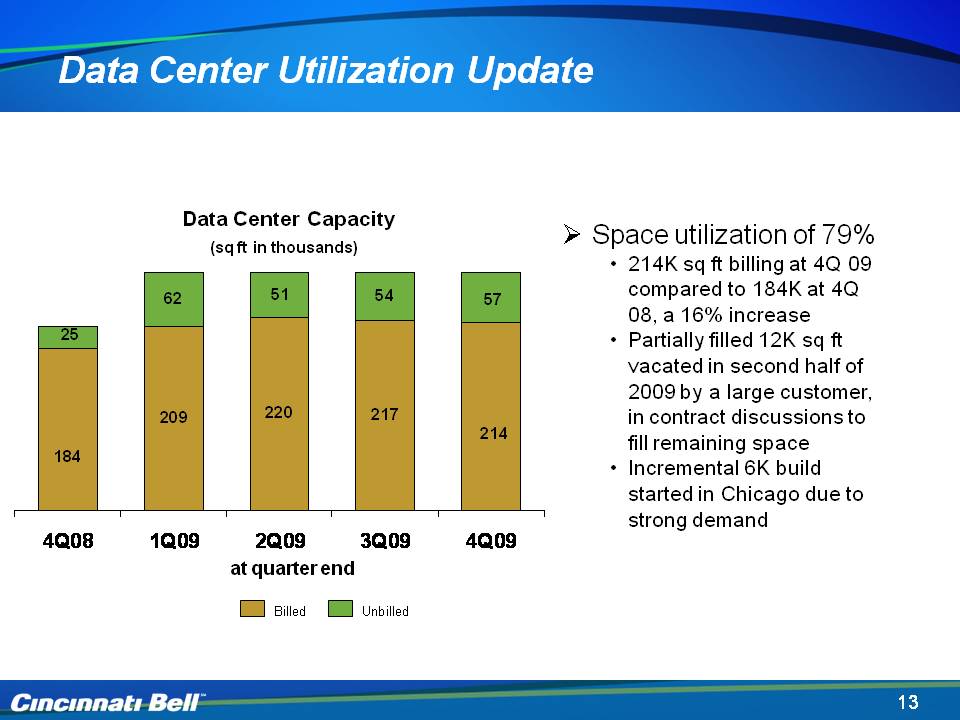

13 Data Center Utilization Update Data Center Capacity at quarter end Space utilization of 79%214K sq ft billing at 4Q 09 compared to 184K at 4Q 08, a 16% increase Partially filled 12K sq ft vacated in second half of 2009 by a large customer, in contract discussions to fill remaining space Incremental 6K build started in Chicago due to strong demand (sq ft in thousands) Billed Unbilled

14 Cincinnati Bell Introduces Fioptics Product Body: Wireline results include new Fioptics product Provides entertainment, high-speed internet, and traditional voice via fiber line to the home300 channel line-up, 50 in HD resolution Offers music, premium channels, on demand, DVR Internet service sold in speeds up to 30mbps

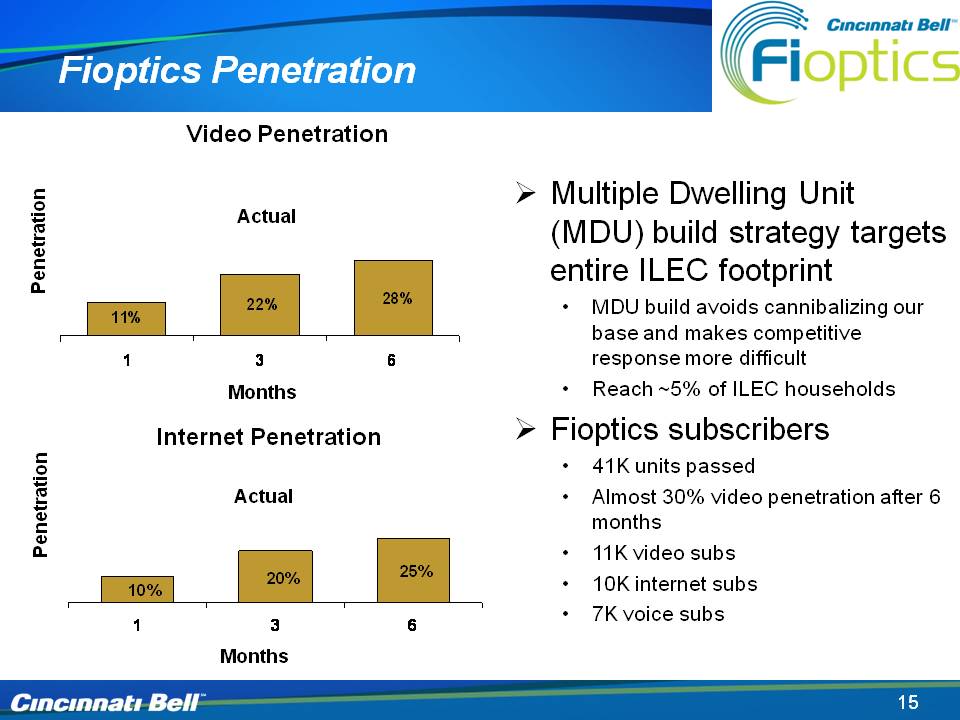

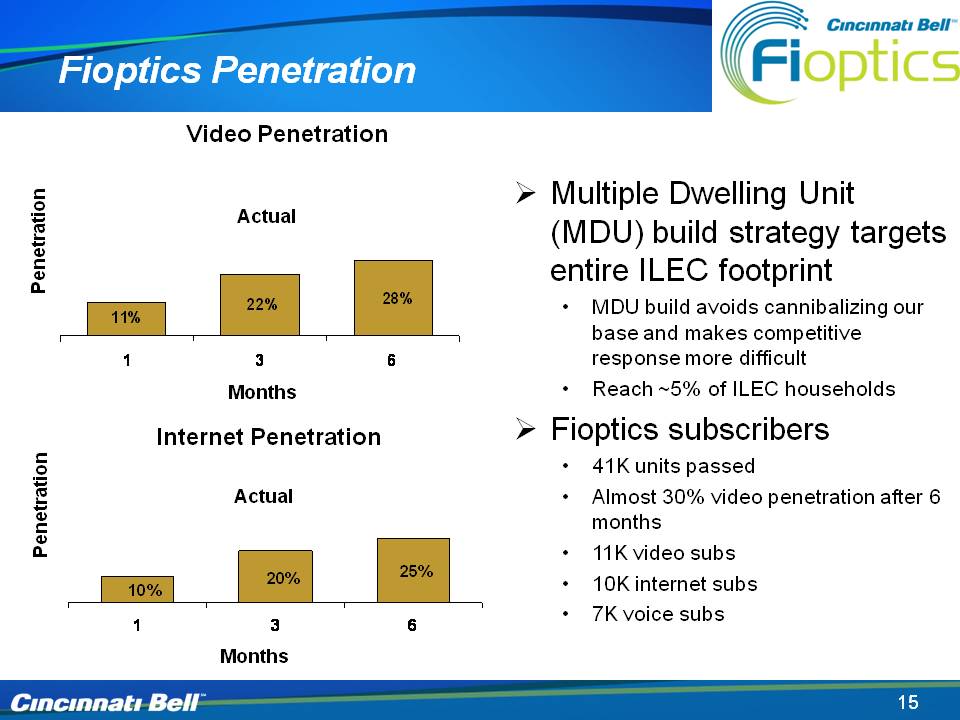

15 Fioptics Penetration Video Penetration Multiple Dwelling Unit (MDU) build strategy targets entire ILEC footprint MDU build avoids cannibalizing our base and makes competitive response more difficult Reach ~5% of ILEC households Fioptics subscribers 41K units passed 30% video penetration after 6 months 11K video subs 10K internet subs 7K voice subs Months Penetration Actual Months Actual Internet Penetration Penetration

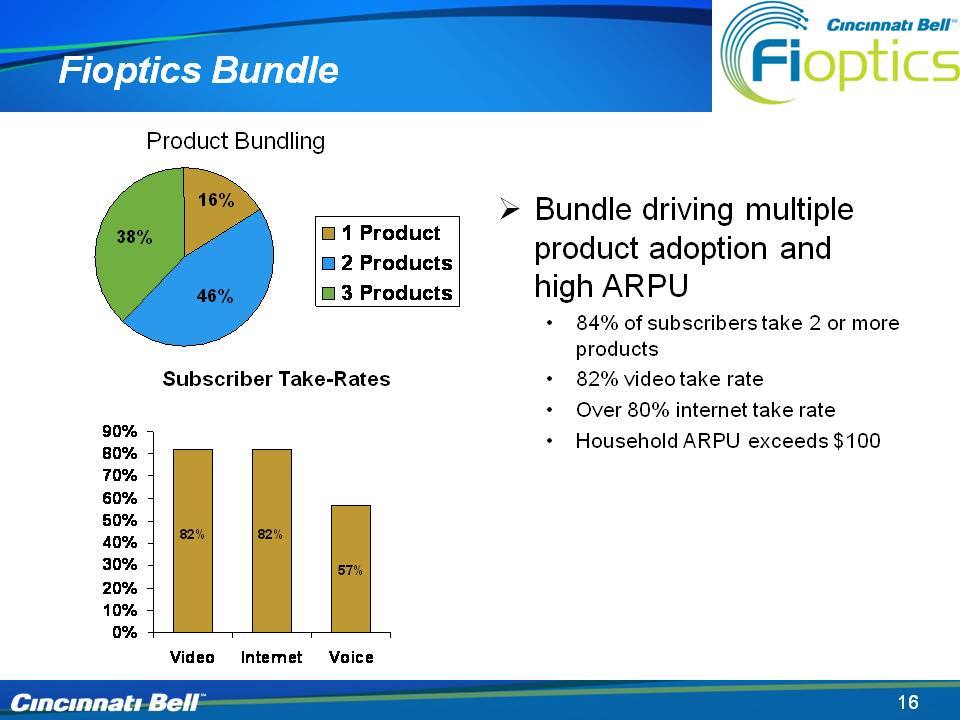

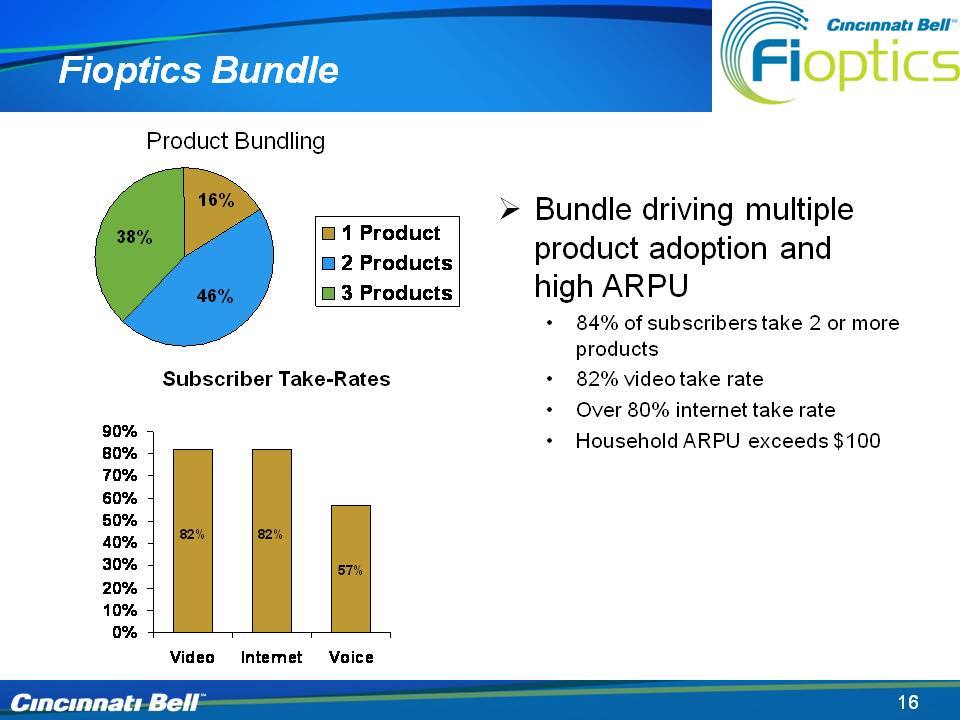

16 Fioptics Bundle Body: Bundle driving multiple product adoption and high ARPU84% of subscriber take 2 or more products 82% video take rate Over 80% internet take rateHousehold ARPU exceeds $100 Subscriber Take-Rates Product Bundling

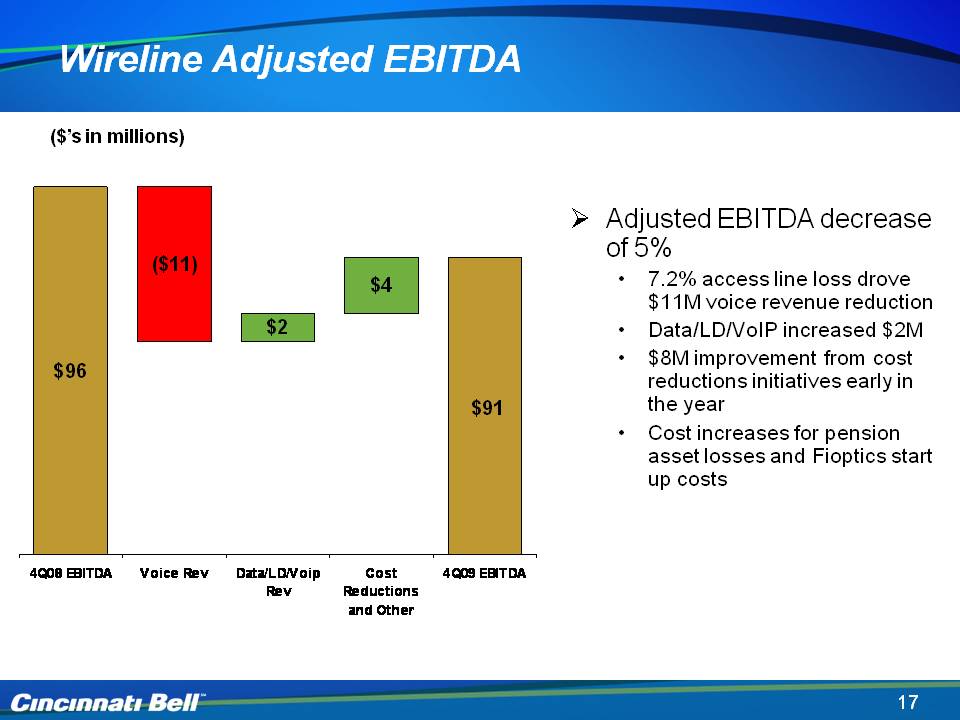

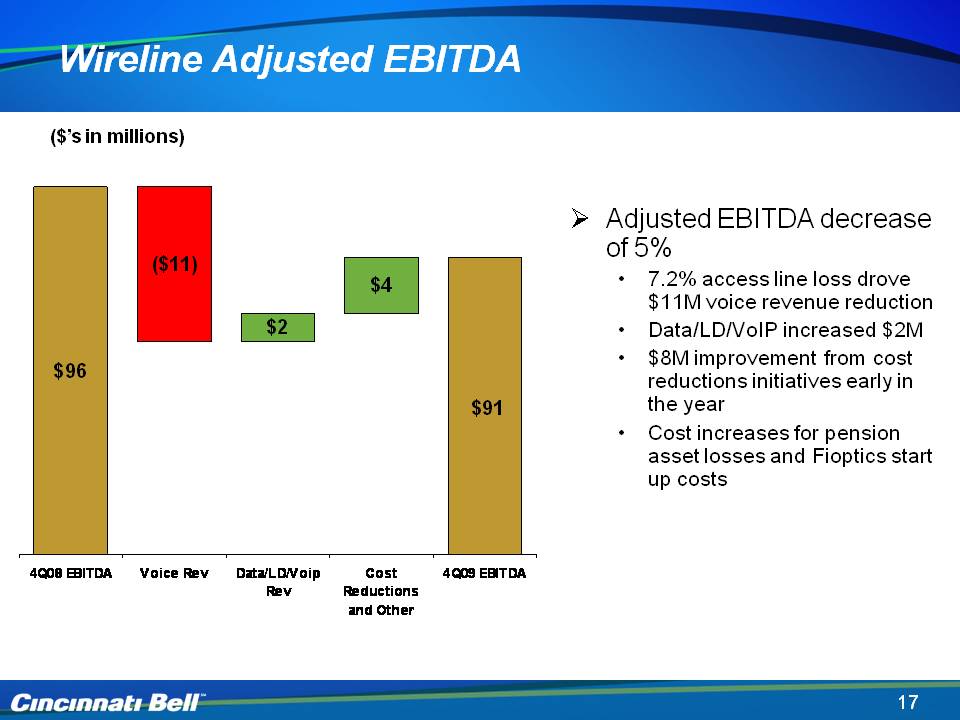

17 Wireline Adjusted EBITDA Body: Adjusted EBITDA decrease of 5% 7.2% access line loss drove $11M voice revenue reduction Data/LD/VoIP increased $2M $8M improvement from cost reductions initiatives early in the year Start up cost increases for Fioptics ($’s in millions)

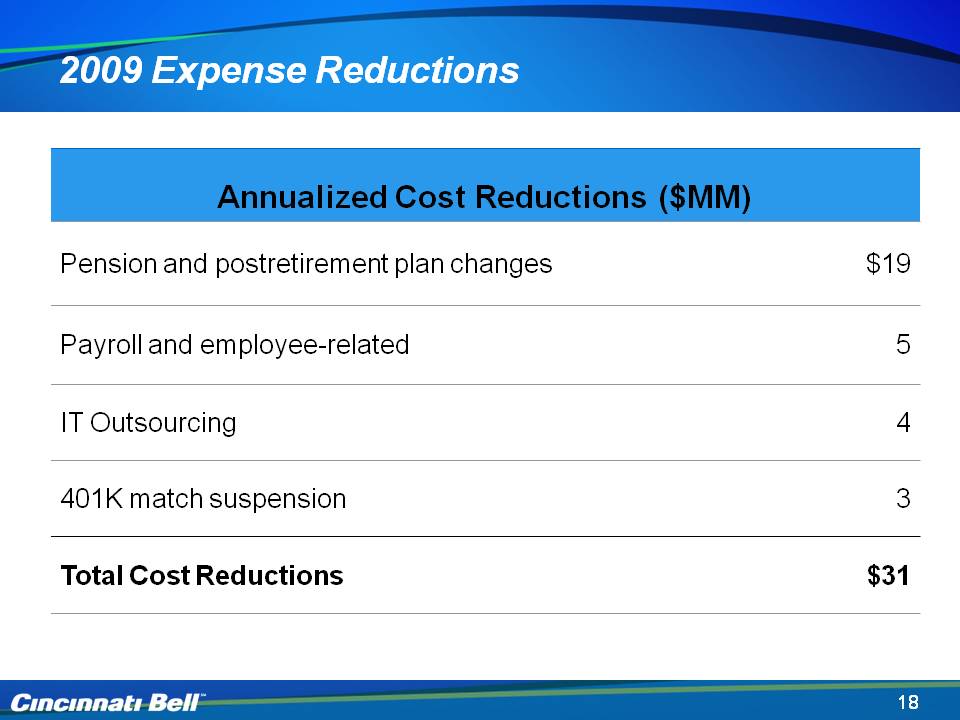

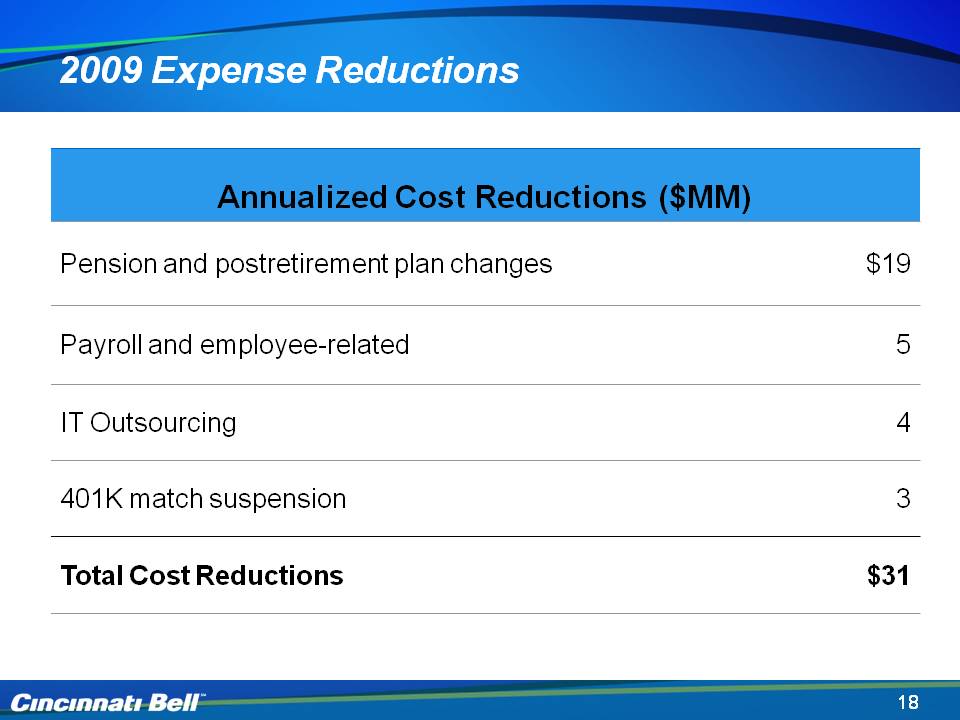

18 2009 Expense Reductions

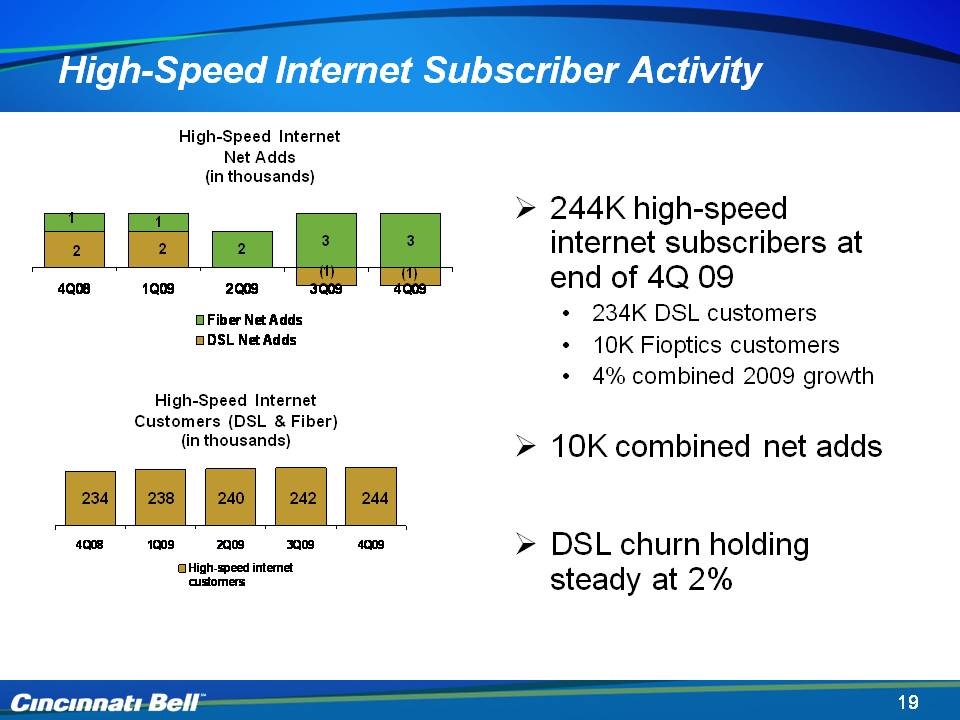

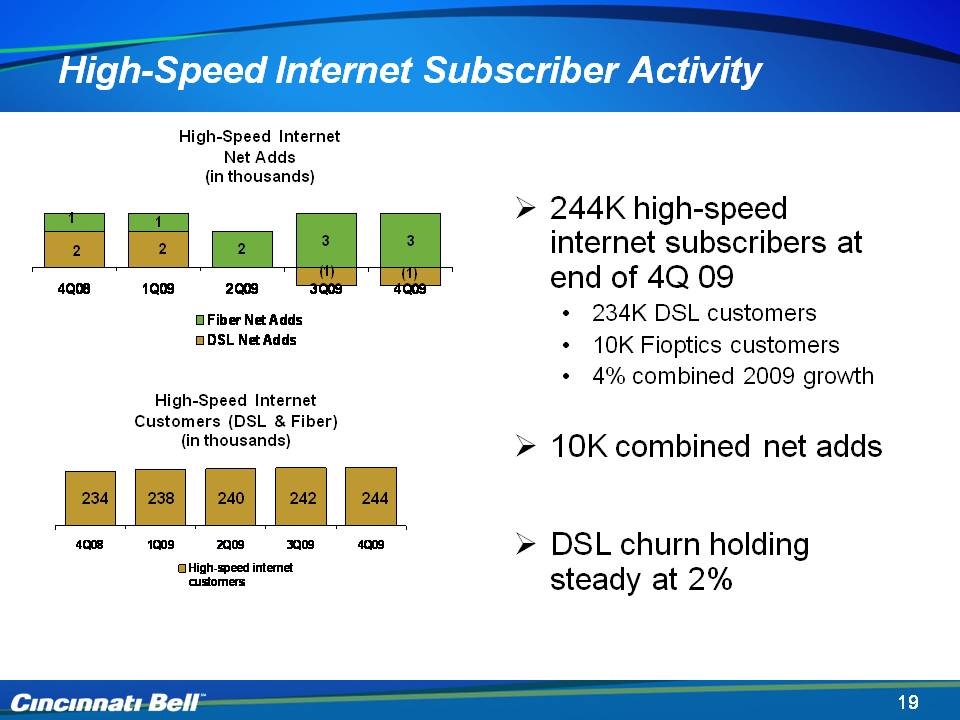

19 High-Speed Internet Subscriber Activity Body: 244K high-speed internet subscribers at end of 4Q 09 234K DSL customers 10K Fioptics customers 4% combined 2009 growth 10K combined net adds DSL churn holding steady at 2% High-Speed Internet Net Adds (in thousands) 234 238 240 242 244 High-Speed Internet Customers (DSL & Fiber) (in thousands)

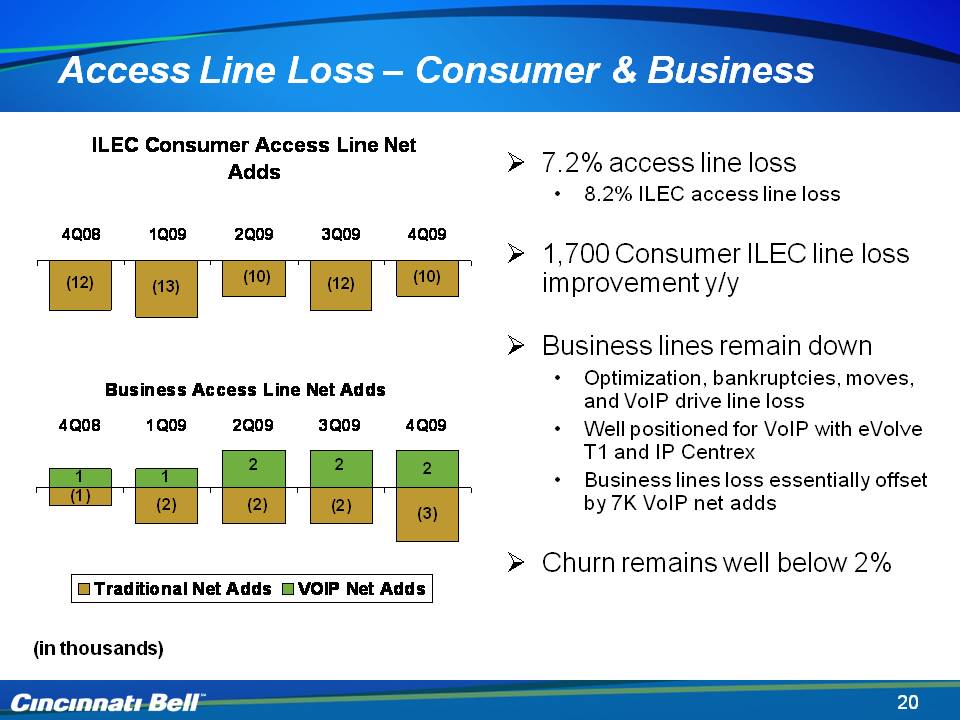

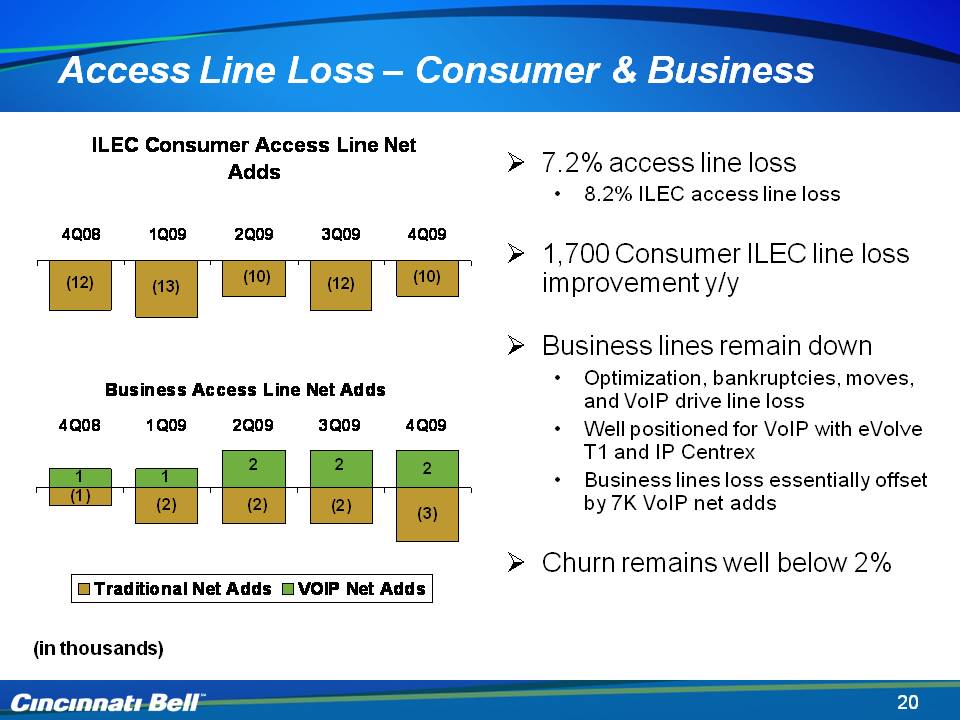

20 Access Line Loss – Consumer & Business 7.2% access line loss8.2% ILEC access line loss 1,700 Consumer ILEC line loss improvement y/y Business lines remain downOptimization, bankruptcies, moves, and VoIP drive line loss Well positioned for VoIP with eVolve T1 and IP Centrex Business lines loss essentially offset by 7K VoIP net adds Churn remains well below 2% (in thousands)

21 Wireless Revenue and EBITDA Results Body: (6%) Postpaid service revenue $2M higher data revenue (5%) lower voice minutes of use per subscriber; (6%) lower subscribers19% Prepaid service revenue 16% growth in ARPU and higher subscribers Wireless Adjusted EBITDA flat y/y and up 3% sequentially ($’s in millions) (1%) (2)% 3% (1%) (4%) (2%) 2% (18%) 1% (8%)

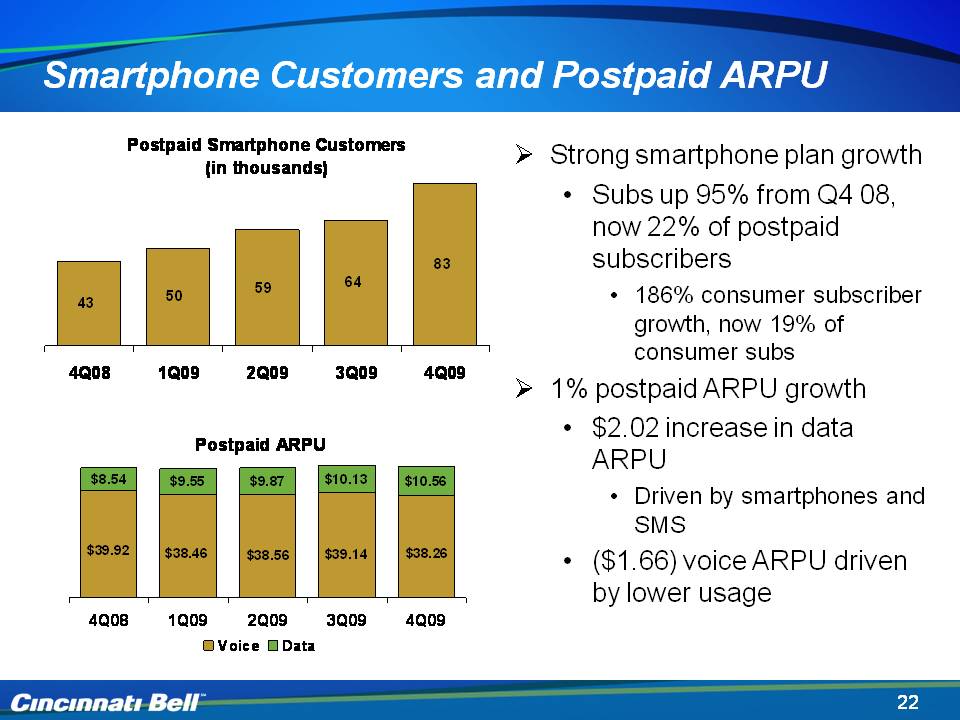

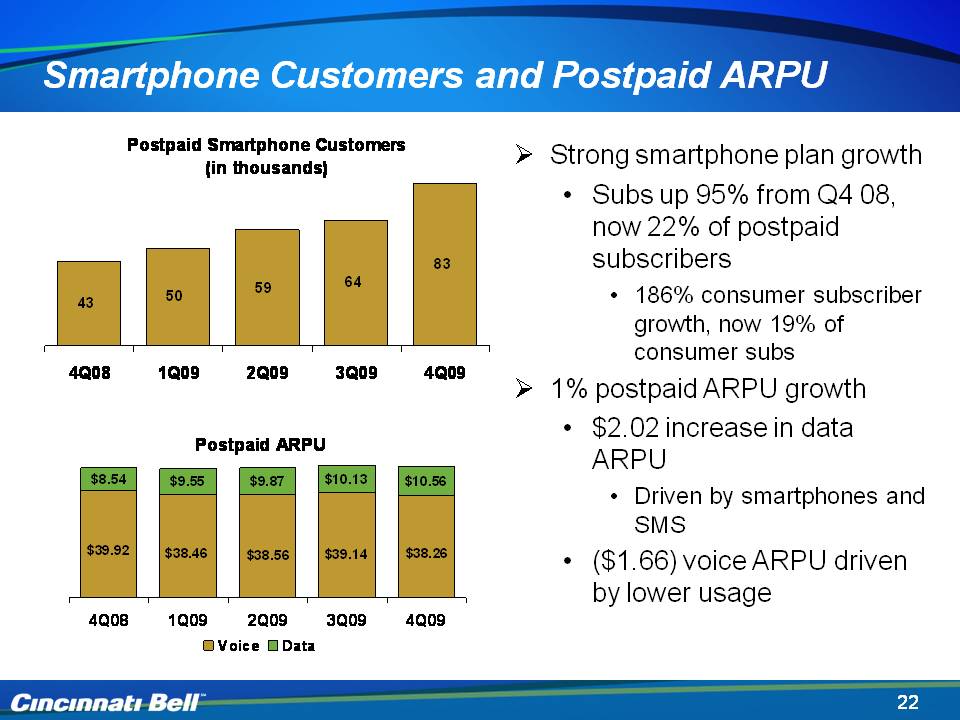

22 Smartphone Customers and Postpaid ARPU Body: Strong smartphone plan growth Subs up 95% from Q4 08, now 22% of postpaid subscribers 186% consumer subscriber growth, now 19% of consumer subs 1% postpaid ARPU growth $2.02 increase in data ARPU Driven by smartphones and SMS ($1.66) voice ARPU driven by lower usage

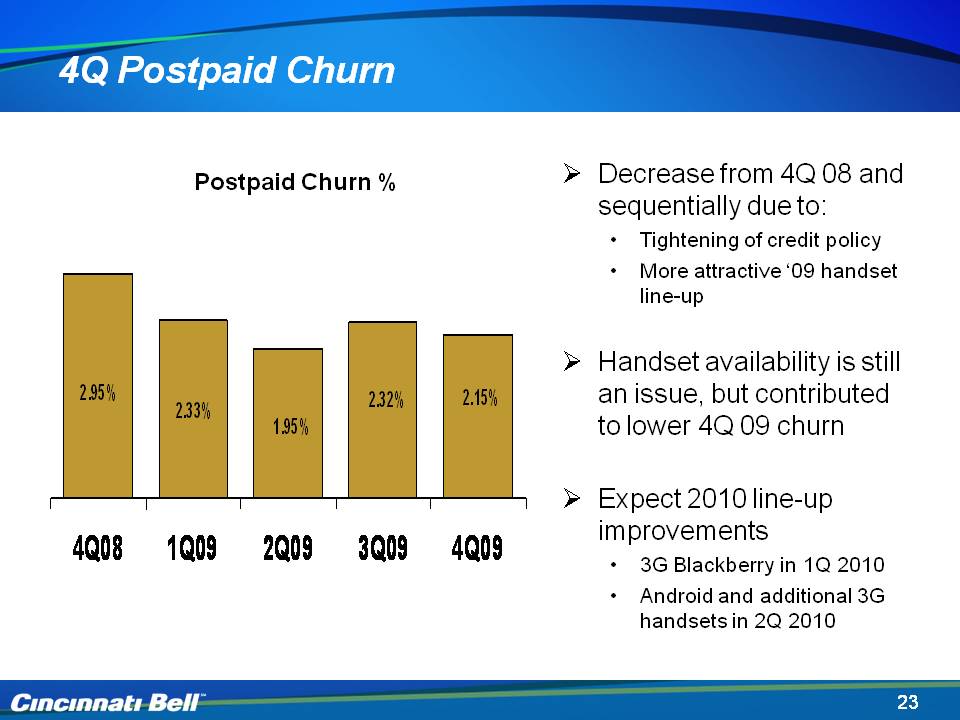

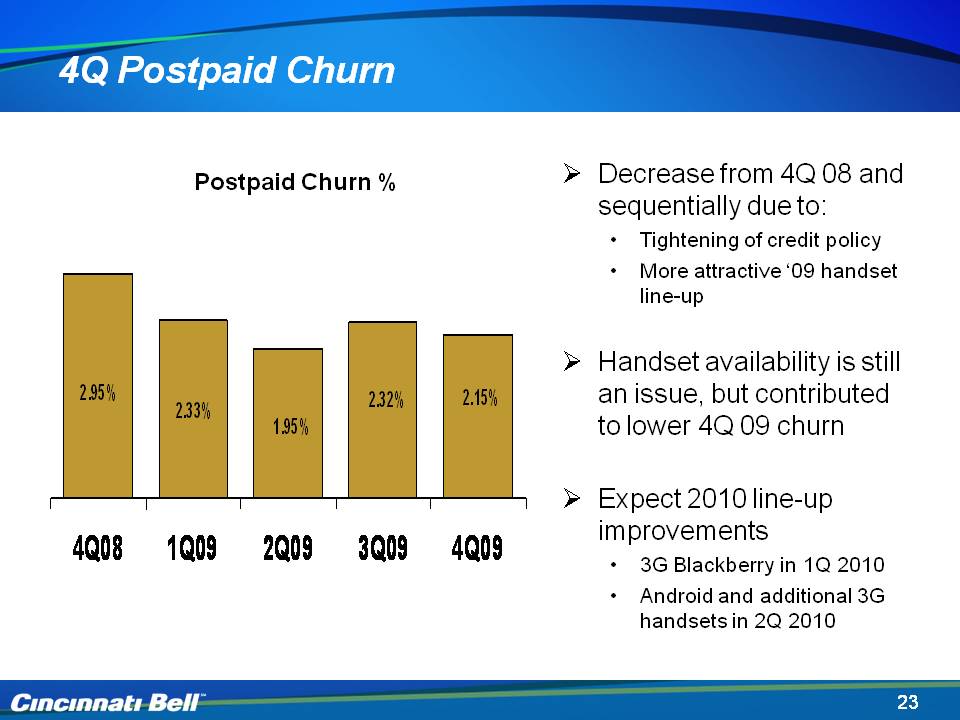

23 4Q Postpaid Churn Decrease from 4Q 08 and sequentially due to:Tightening of credit policy More attractive ‘09 handset line-up Handset availability is still an issue, but contributed to lower 4Q 09 churn Expect 2010 line-up improvements3G Blackberry in 1Q 2010 Android and additional 3G handsets in 2Q 2010 Postpaid Churn %

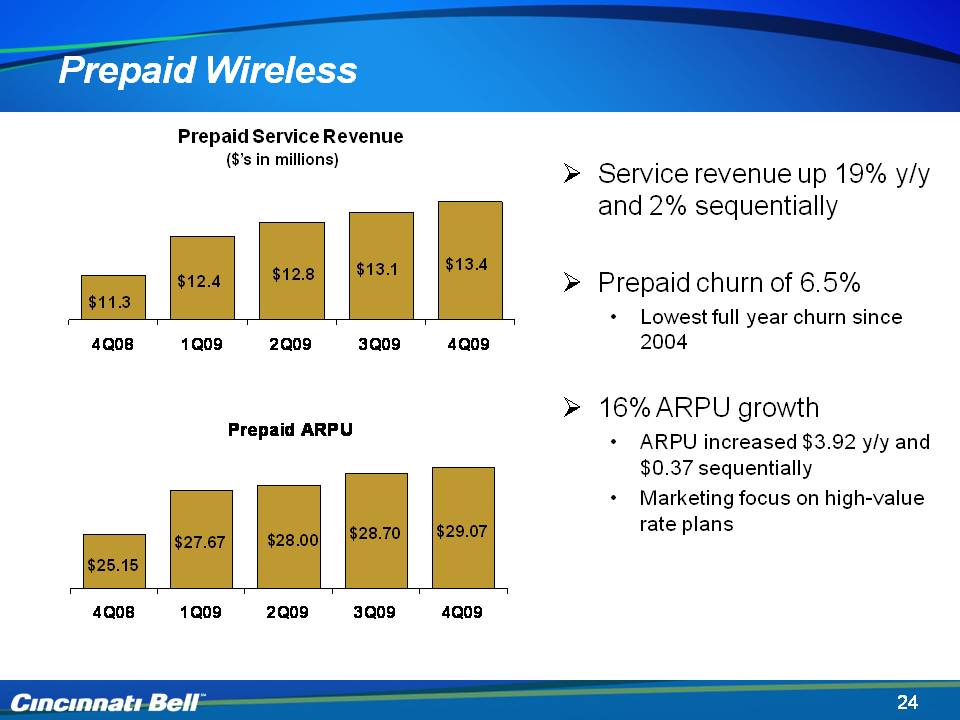

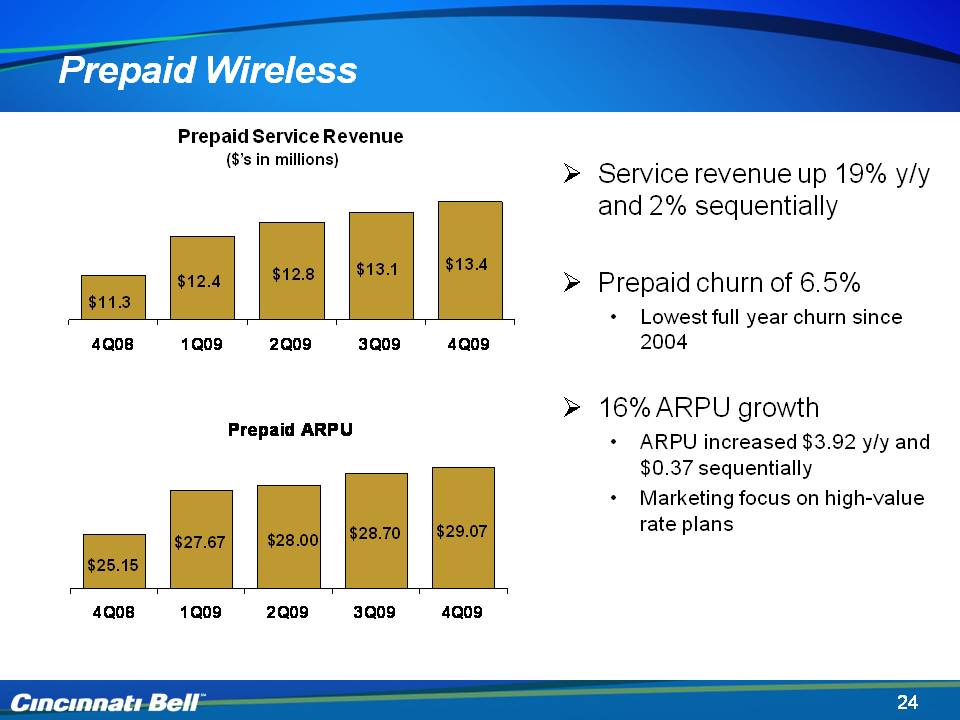

24 Prepaid Wireless Prepaid Service Revenue ($’s in millions) Service revenue up 19% y/y and 2% sequentially Prepaid churn of 6.5% Lowest full year churn since 2004 16% ARPU growth ARPU increased $3.92 y/y and $0.37 sequentially Marketing focus on high-value rate plans

25 Financial Overview Gary Wojtaszek Chief Financial Officer

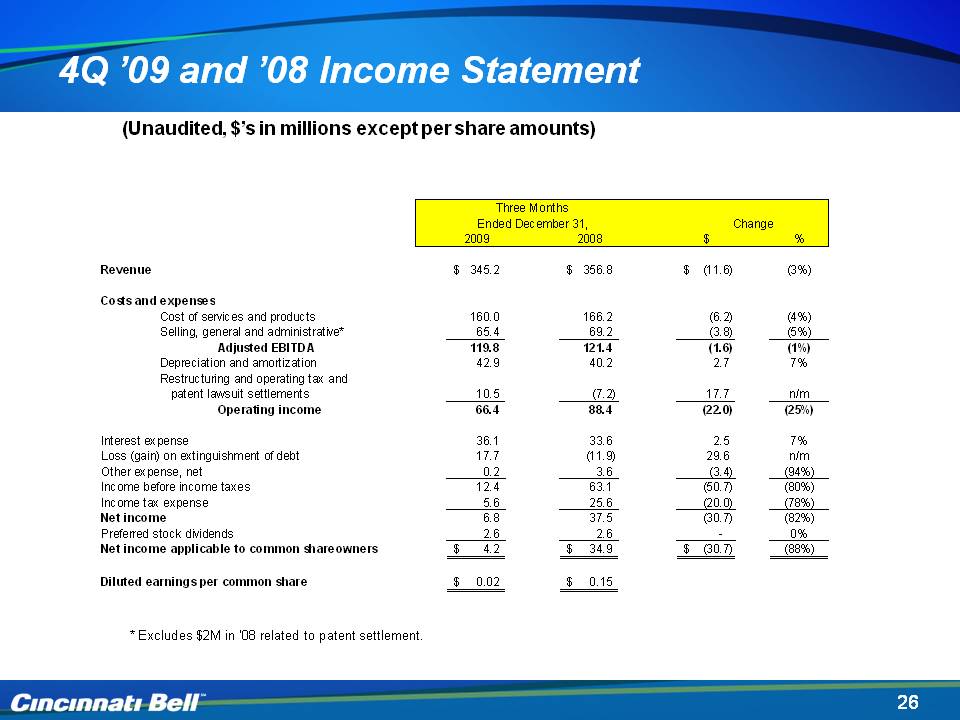

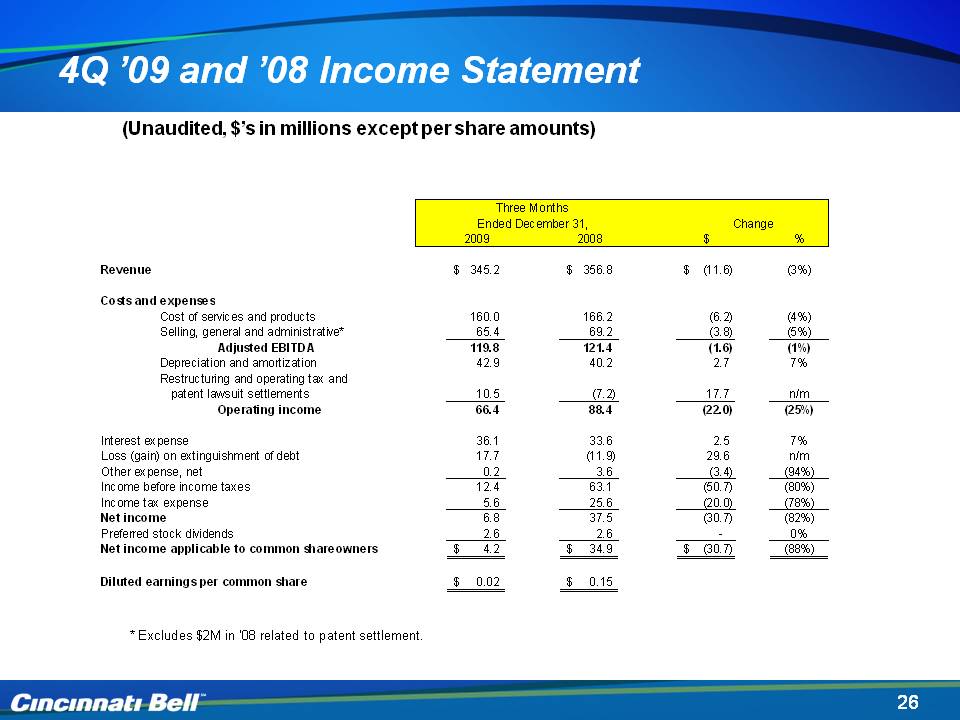

26 4Q ’09 and ’08 Income Statement (Unaudited, $’s in millions except per share amounts) * Excludes $2M in ’08 related to patent settlement.

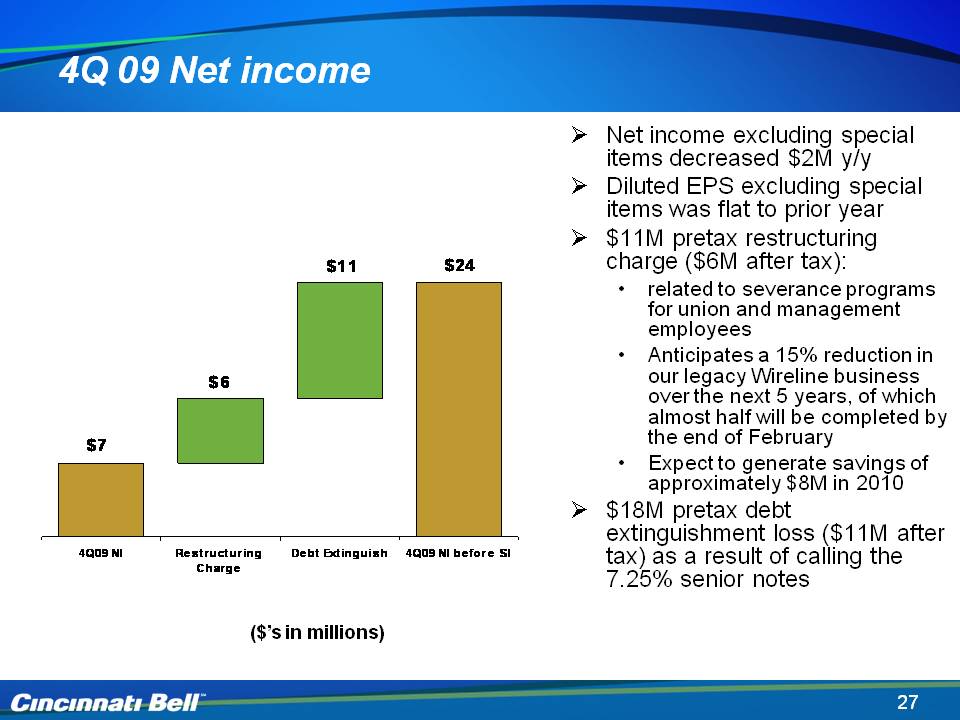

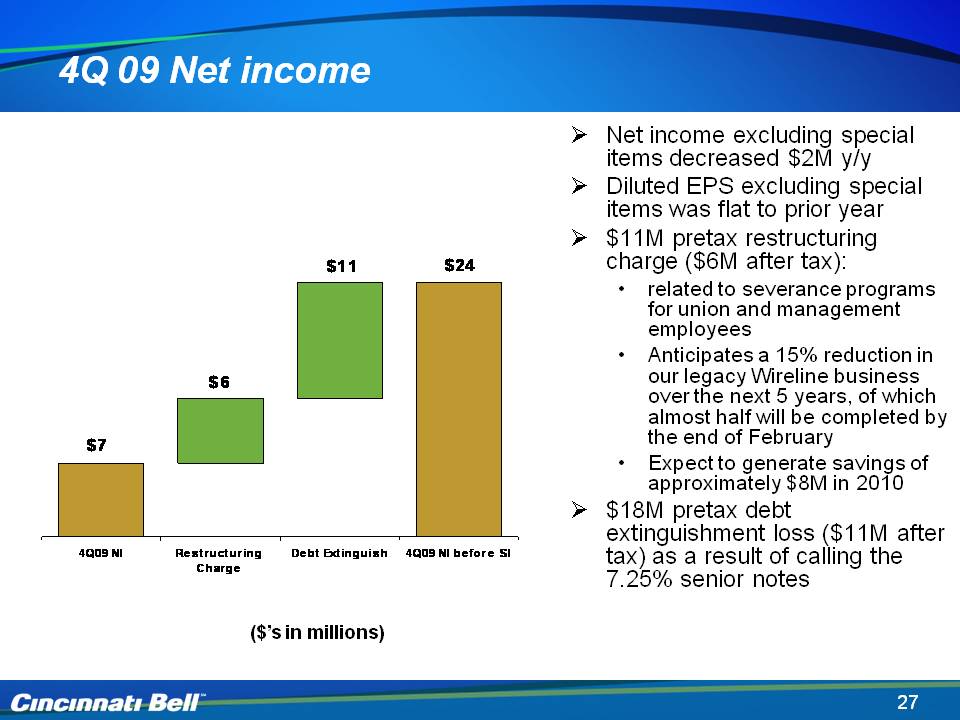

27 4Q 09 Net income ($’s in millions) Body: Net income excluding special items decreased $2M y/y Diluted EPS excluding special items was flat to prior year $11M pretax restructuring charge ($6M after tax): related to severance programs for union and management employees Anticipates a 15% reduction in our legacy Wireline business over the next 5 years, of which almost half will be completed by the end of February Expect to generate savings of approximately $9M in 2010 $18M pretax debt extinguishment loss ($11M after tax) as a result of calling the 7.25% senior notes

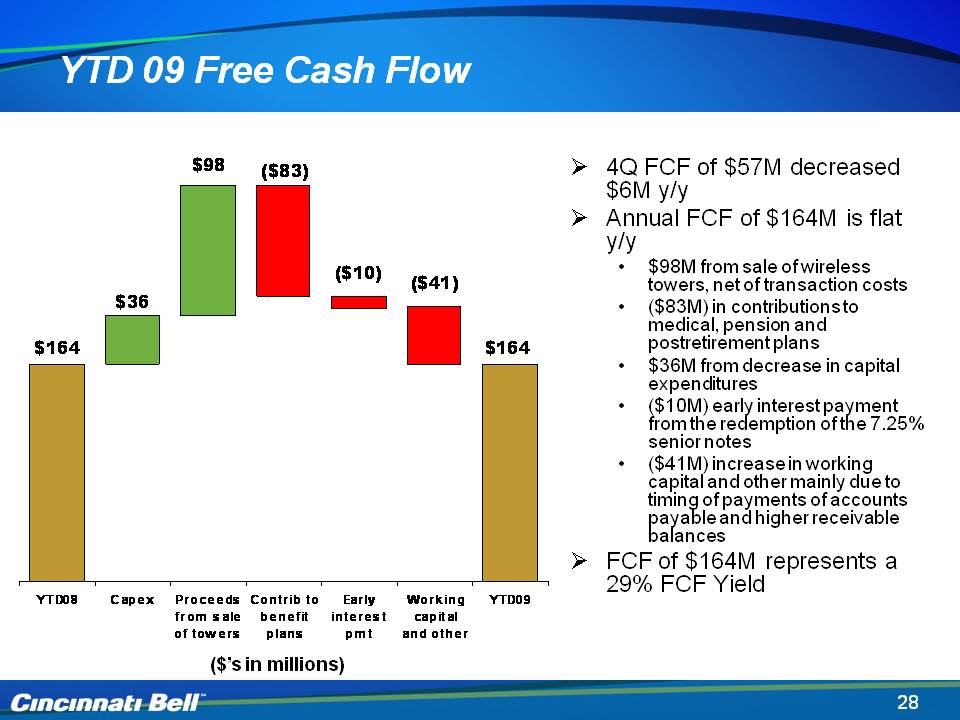

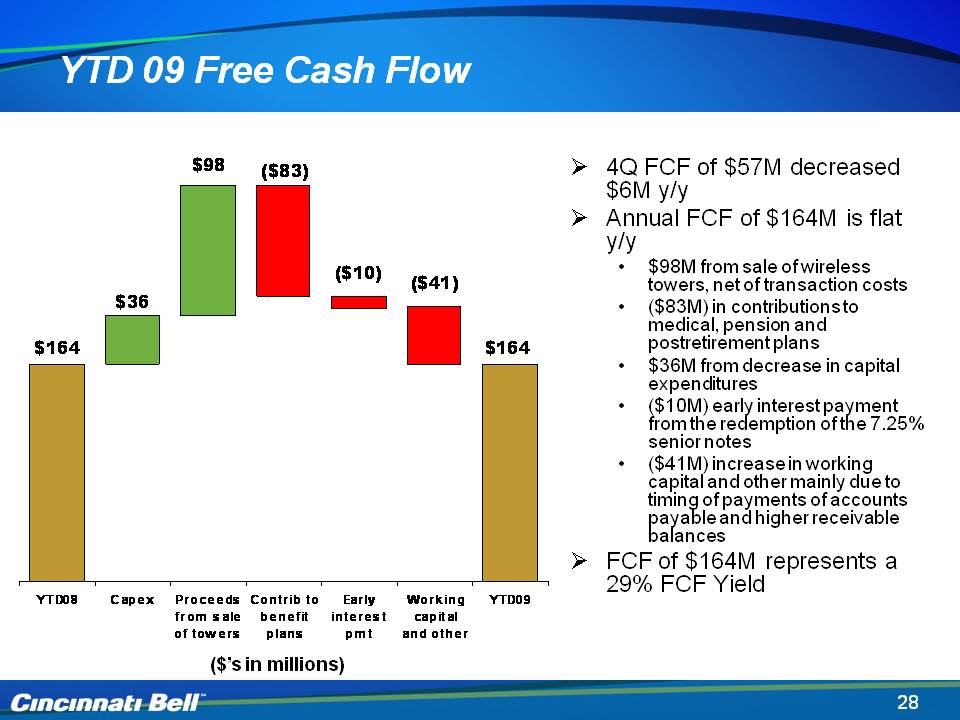

28 YTD 09 Free Cash Flow ($’s in millions) Body: 4Q FCF of $57M decreased $6M y/yAnnual FCF of $164M is flat y/y $98M from sales of wireless towers, net of transaction costs ($83M) in contributions to medical, pension and postretirement plans $36M from decrease in capital expenditures ($10M) early interest payment from the redemption of the 7.25% senior notes ($41M) increase in working capital and other mainly due to timing of payments of accounts payable and higher receivable balances FCF of $164M represents a 29% FCF Yield $164 $36 $98 ($83) ($10) ($41)

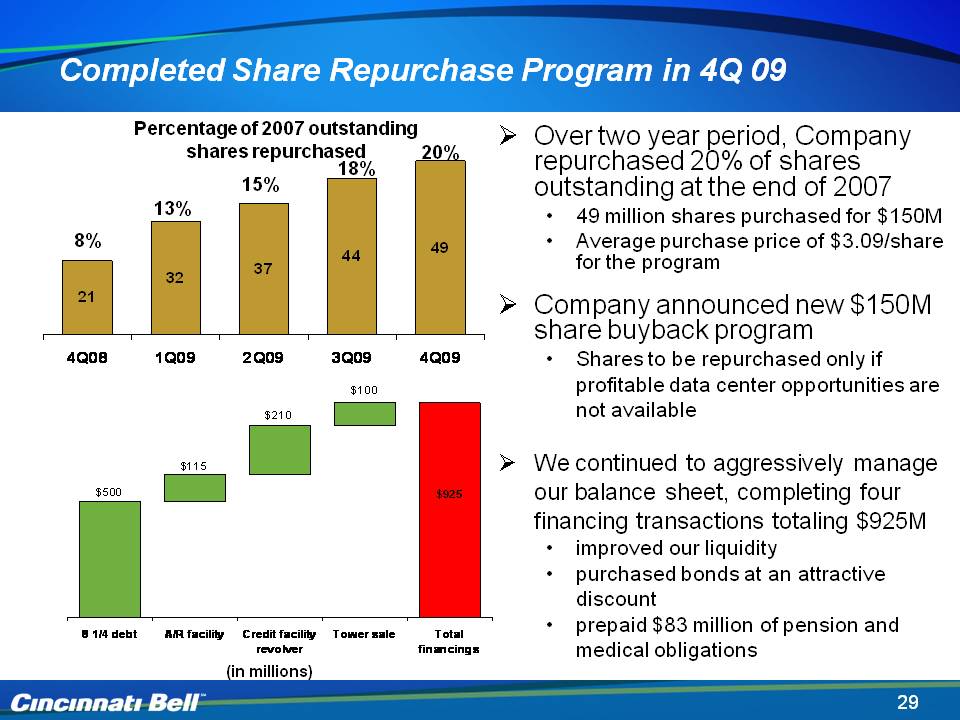

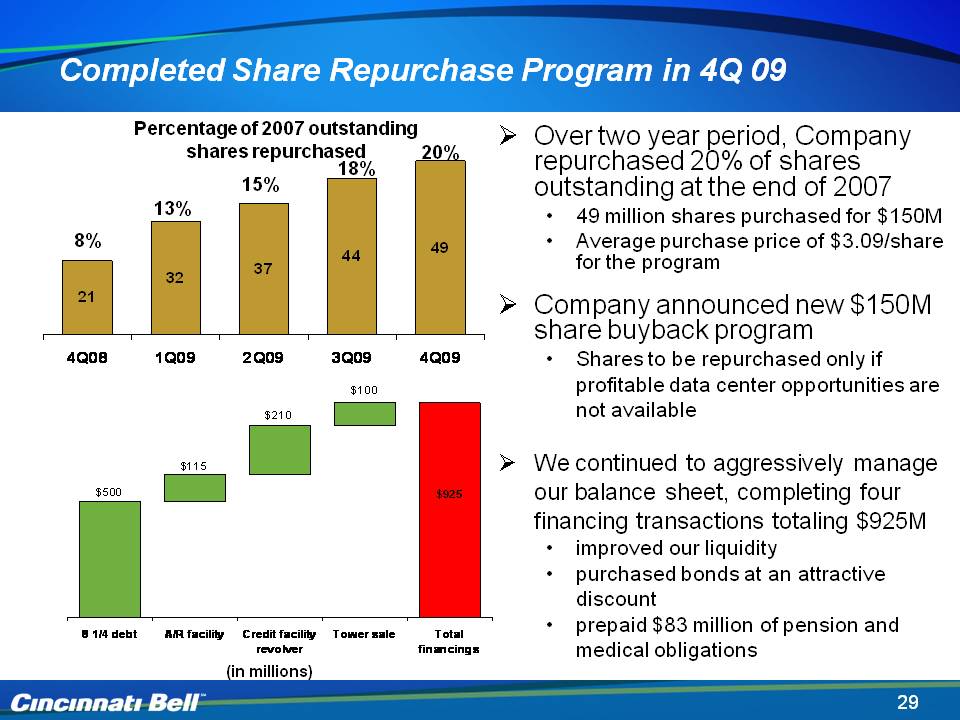

29 Completed Share Repurchase Program in 4Q 09 (in millions) Over two year period, Company repurchased 20% of shares outstanding at the end of 2007 49 million shares purchased for $150M Average purchase price of $3.09/share for the program Company announced new $150M share buyback program Shares to be repurchased only if profitable data center opportunities are not availableWe continued to aggressively manage our balance sheet, completing four financing transactions totaling $925M improved our liquidity purchased bonds at an attractive discount prepaid $83 million of pension and medical obligations 8% 15% 13% 18% 20% Percentage of 2007 outstanding shares repurchased

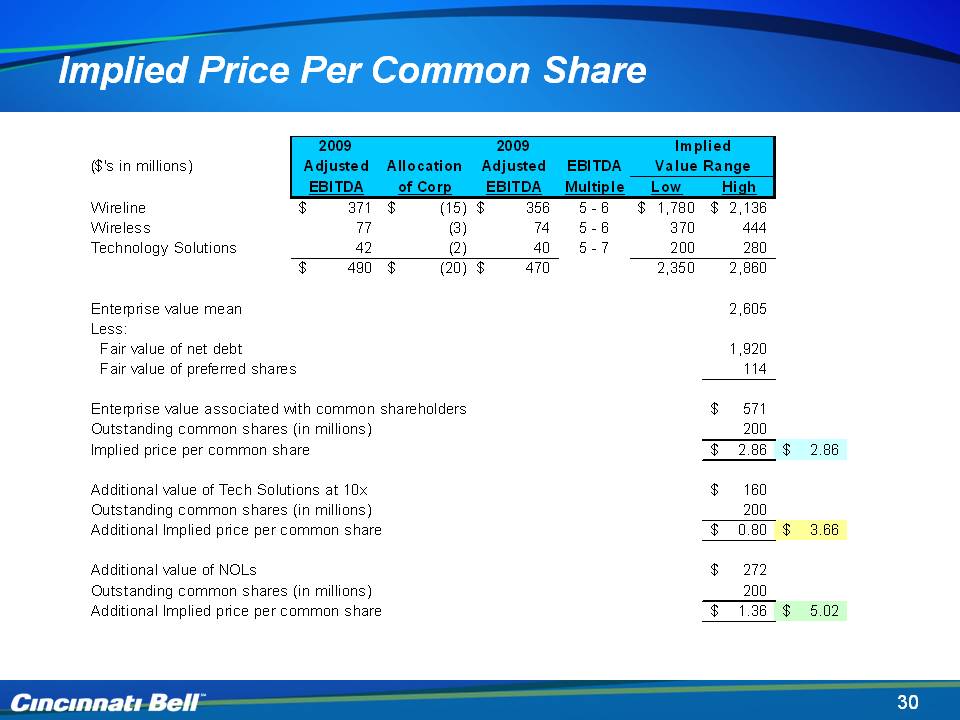

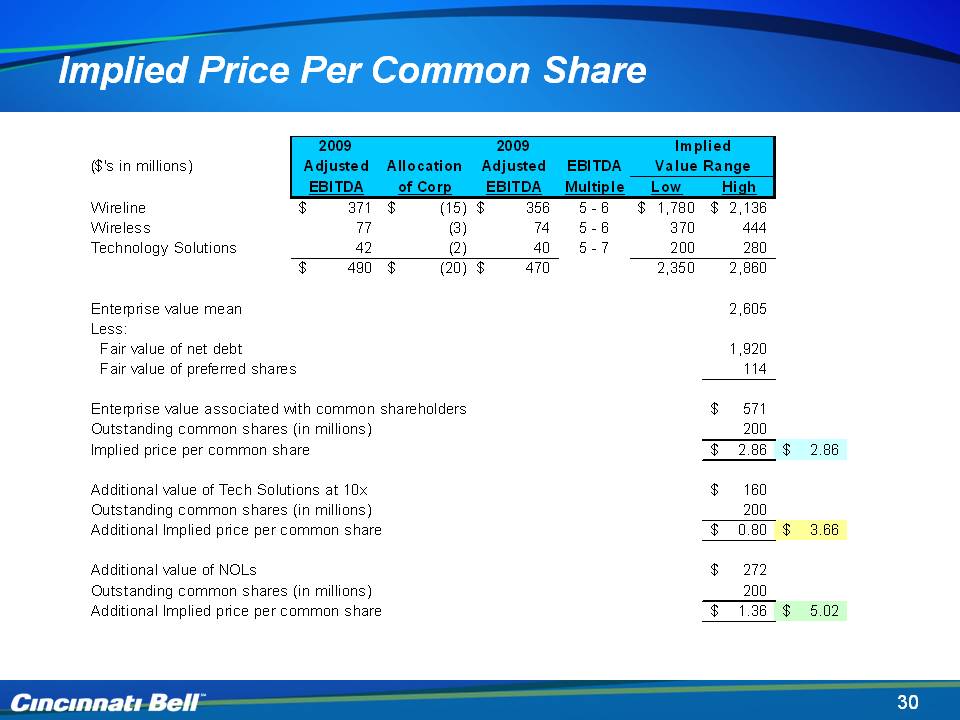

30 Implied Price Per Common Share

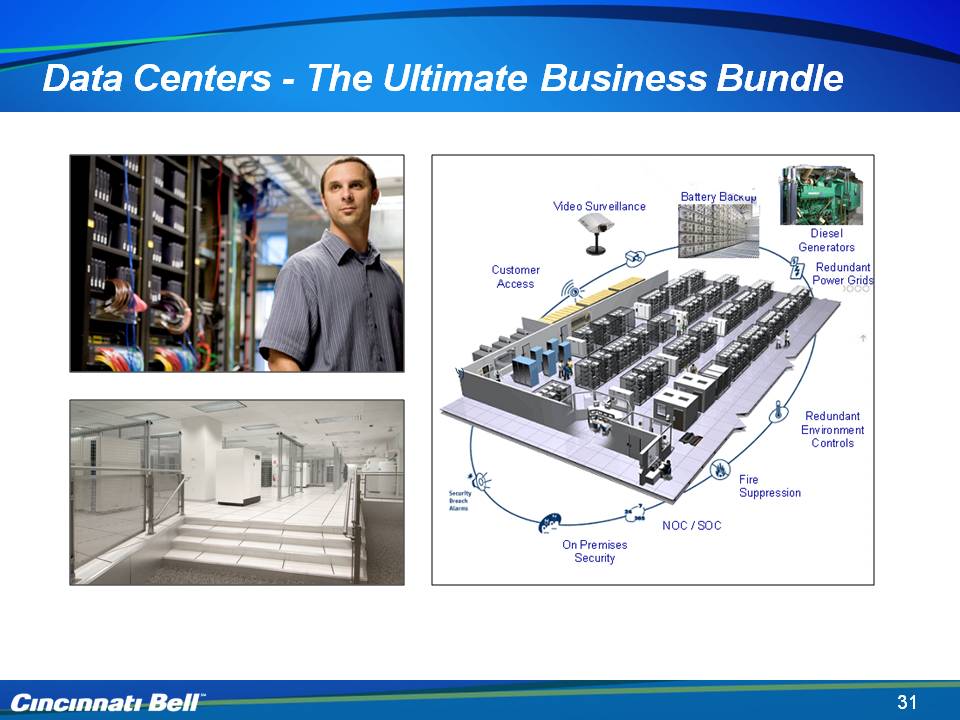

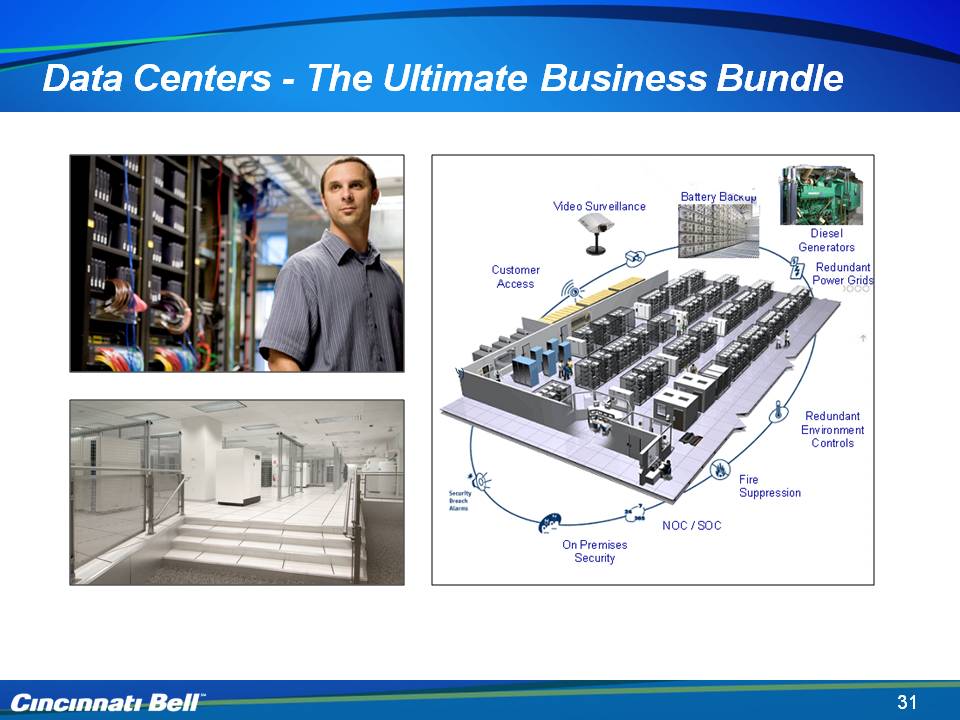

31 Data Centers - The Ultimate Business Bundle

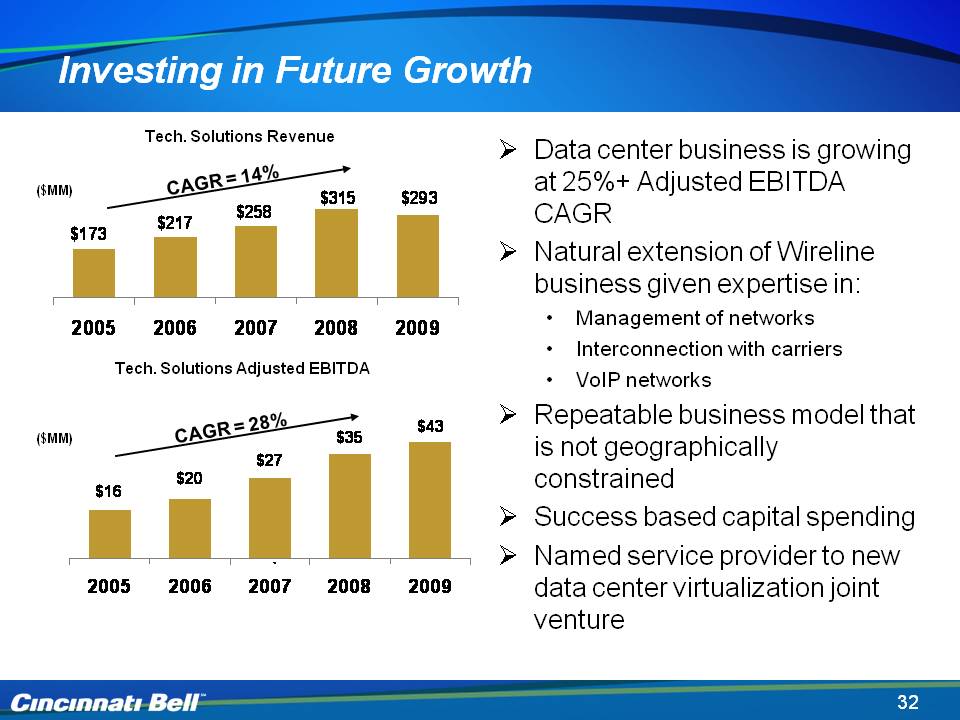

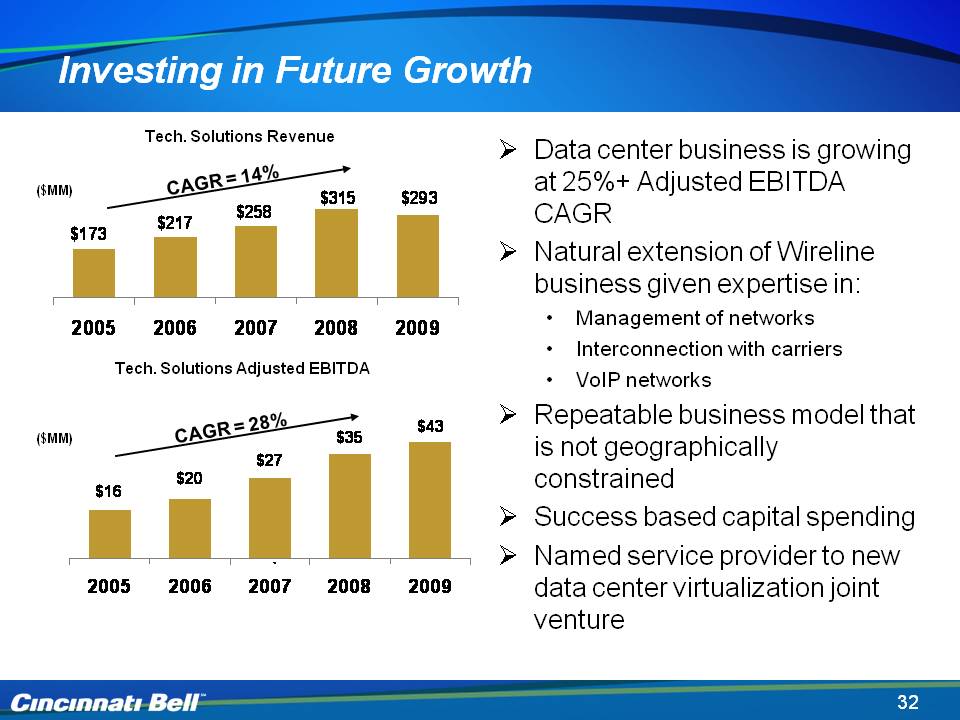

32 Investing in Future Growth Data center business is growing at 20%+ Adjusted EBITDA CAGRNatural extension of Wireline business given expertise in:Management of networksInterconnection with carriersVoIP networksRepeatable business model that is not geographically constrainedSuccess based capital spendingNamed service provider to new data center virtualization joint venture Tech. Solutions Revenue ($MM) Tech. Solutions Adjusted EBITDA ($MM) CAGR = 14% CAGR = 28%

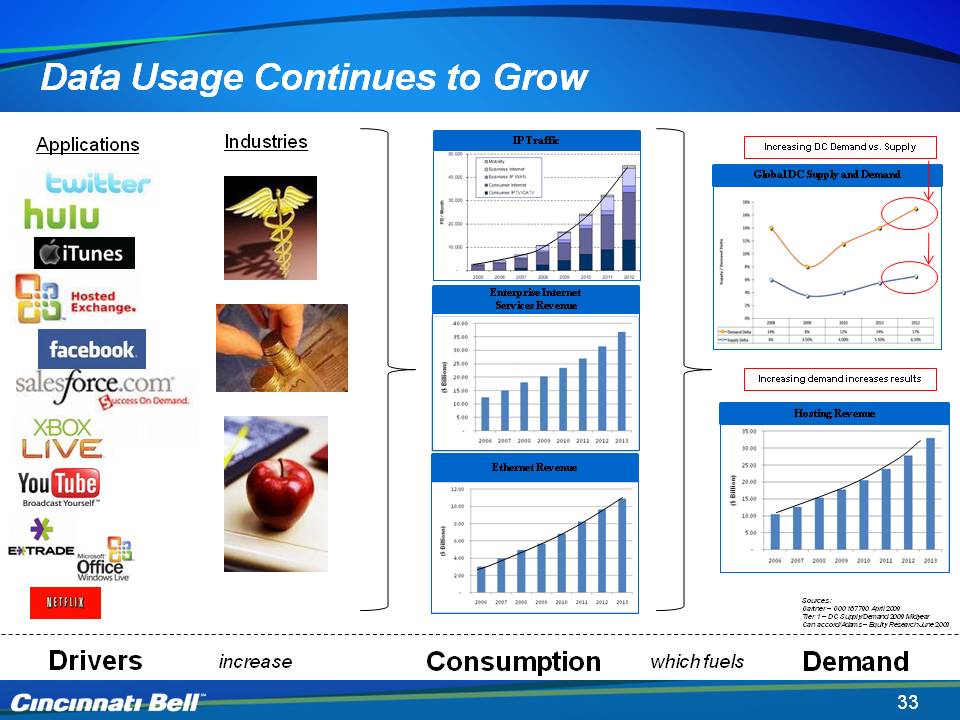

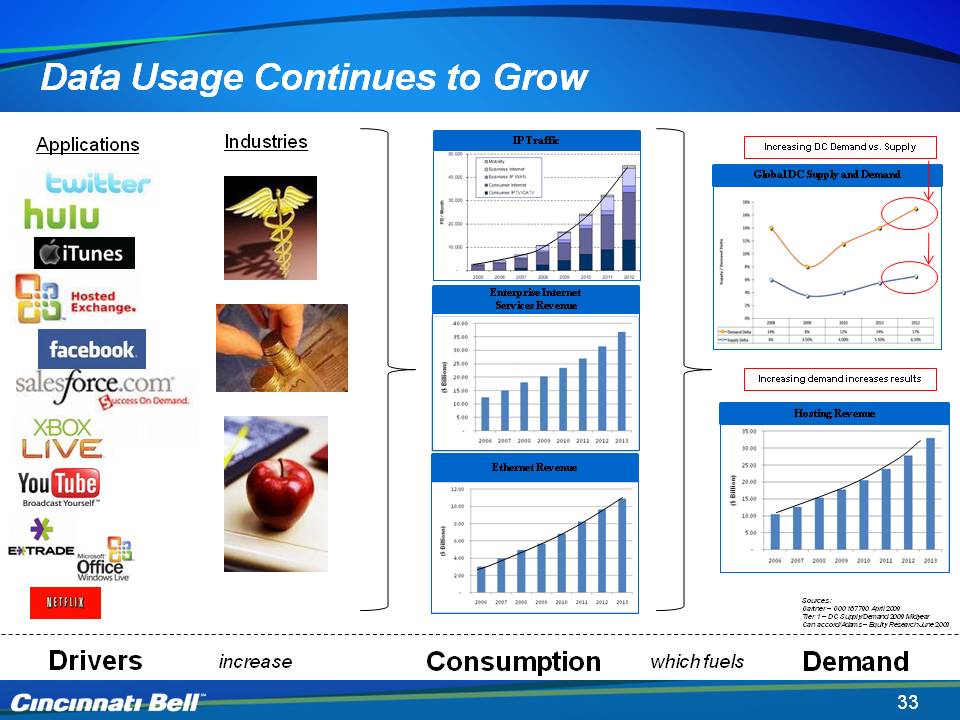

33 IP Traffic Enterprise Internet Services Revenue Ethernet Revenue Hosting Revenue Drivers Consumption Demand increase which fuels Data Usage Continues to Grow Sources: Gartner – G00167790 April 2009 Tier 1 – DC Supply/Demand 2009 Midyear Can accord/Adams – Equity Research June 2009 Global DC Supply and Demand Increasing DC Demand vs. Supply Applications Industries Increasing demand increases results

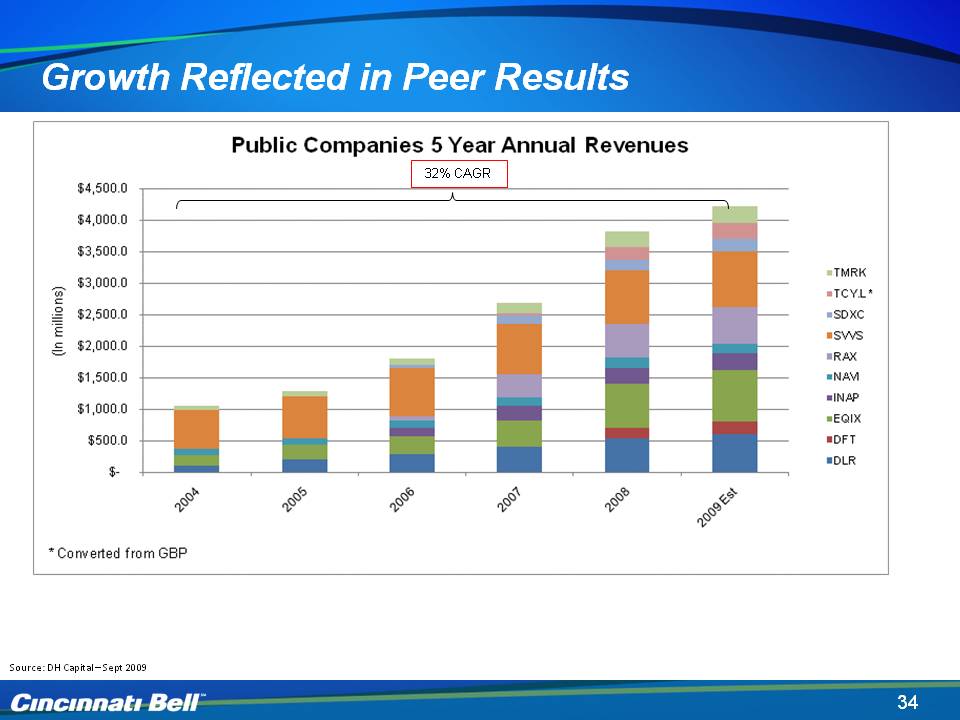

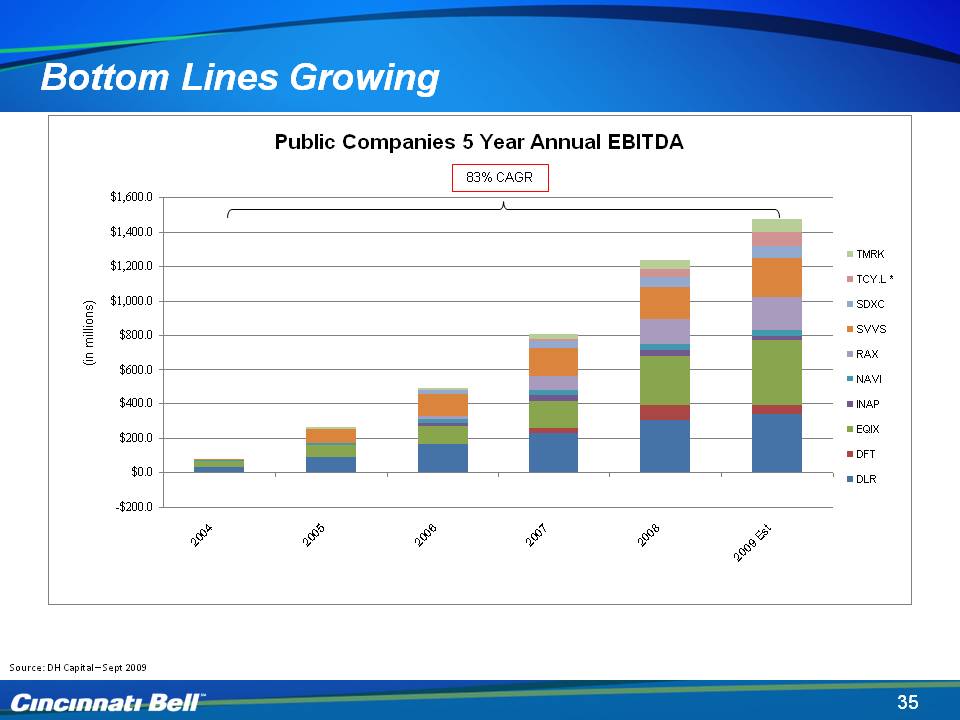

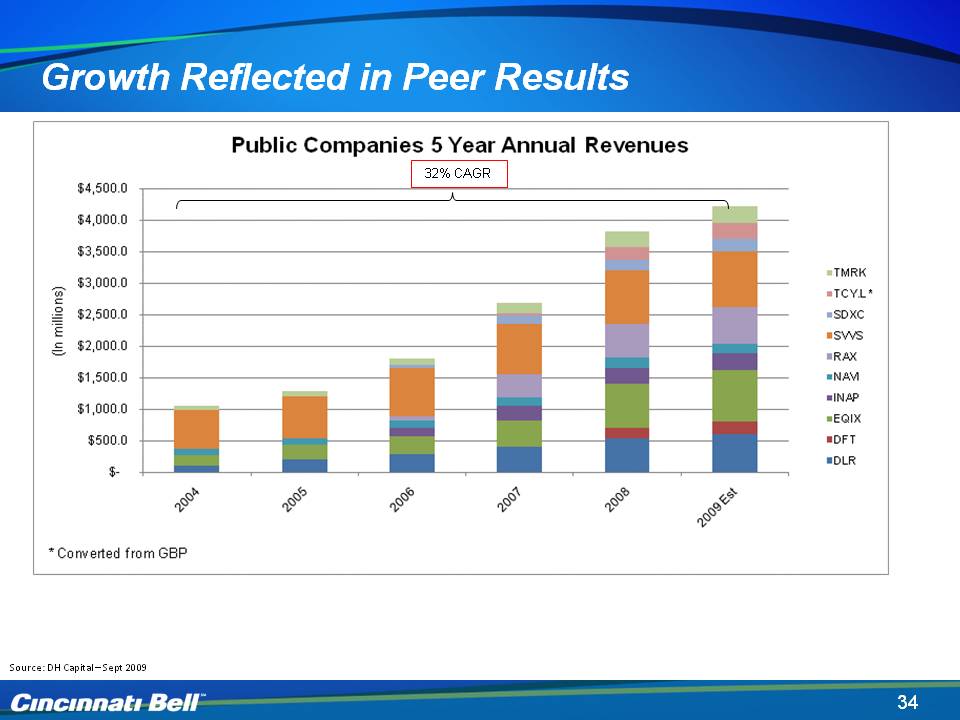

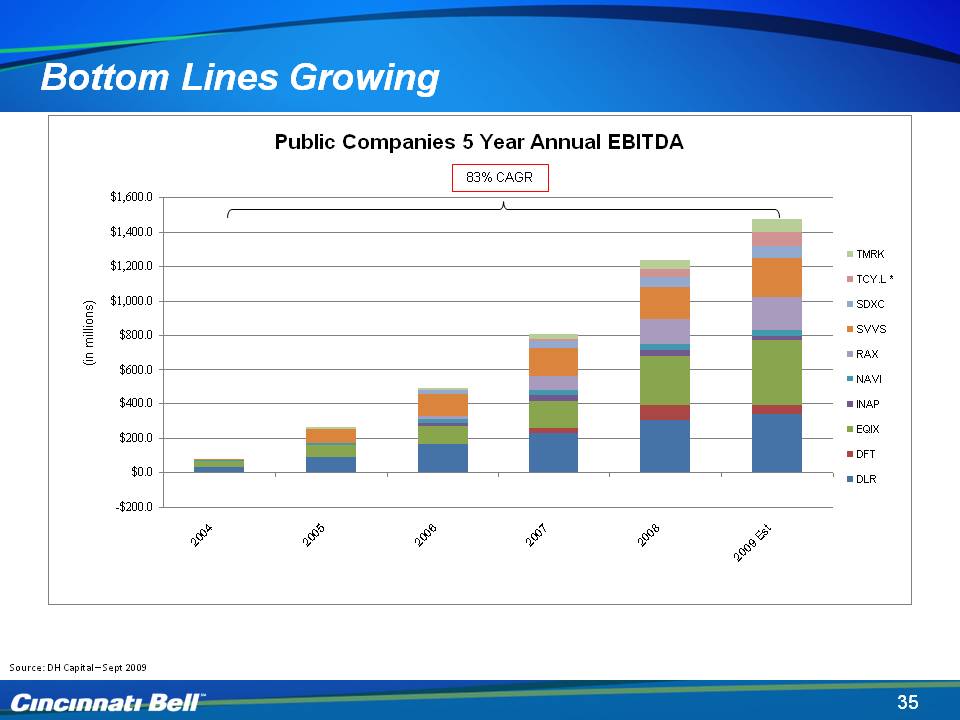

34 Growth Reflected in Peer Results Source: DH Capital – Sept 2009 32% CAGR

35 Bottom Lines Growing Source: DH Capital – Sept 2009 83% CAGR 83% CAGR

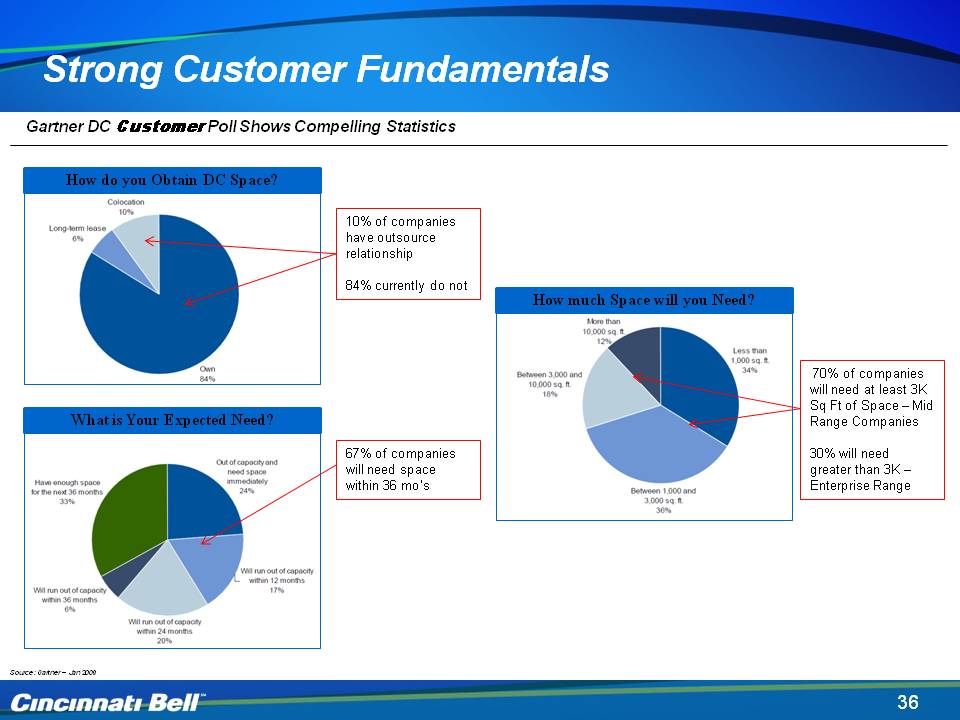

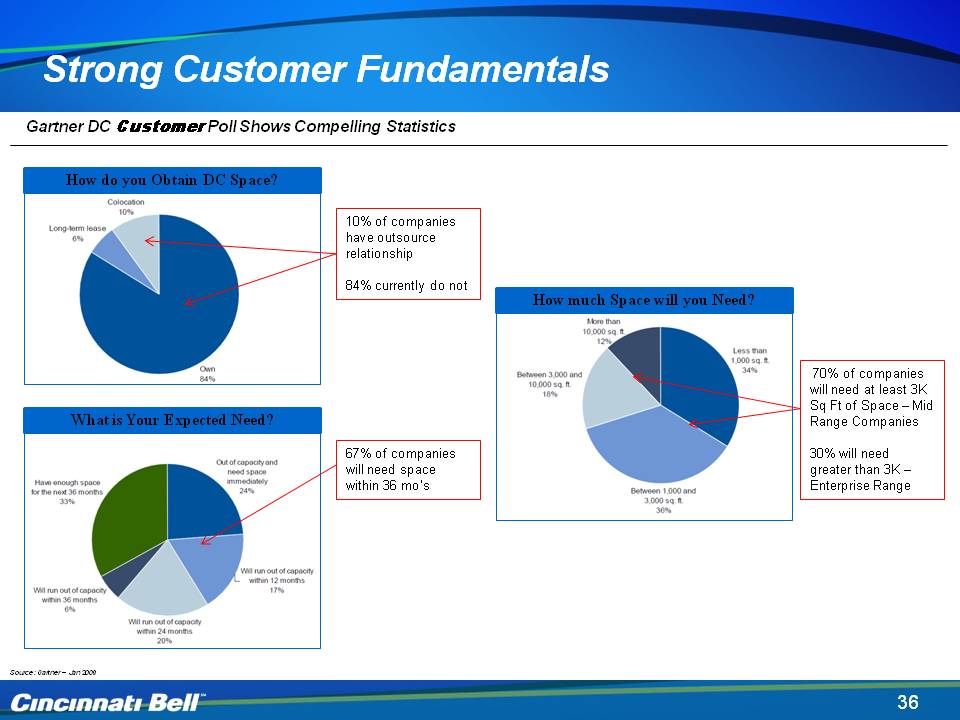

36 Strong Customer Fundamentals Source: Gartner – Jan 2009 How do you Obtain DC Space? What is Your Expected Need? How much Space will you Need? Gartner DC Customer Poll Shows Compelling Statistics 10% of companies have outsource relationship 84% currently do not 67% of companies will need space within 36 mo’s 70% of companies will need at least 3K Sq Ft of Space – Mid Range Companies 30% will need greater than 3K – Enterprise Range

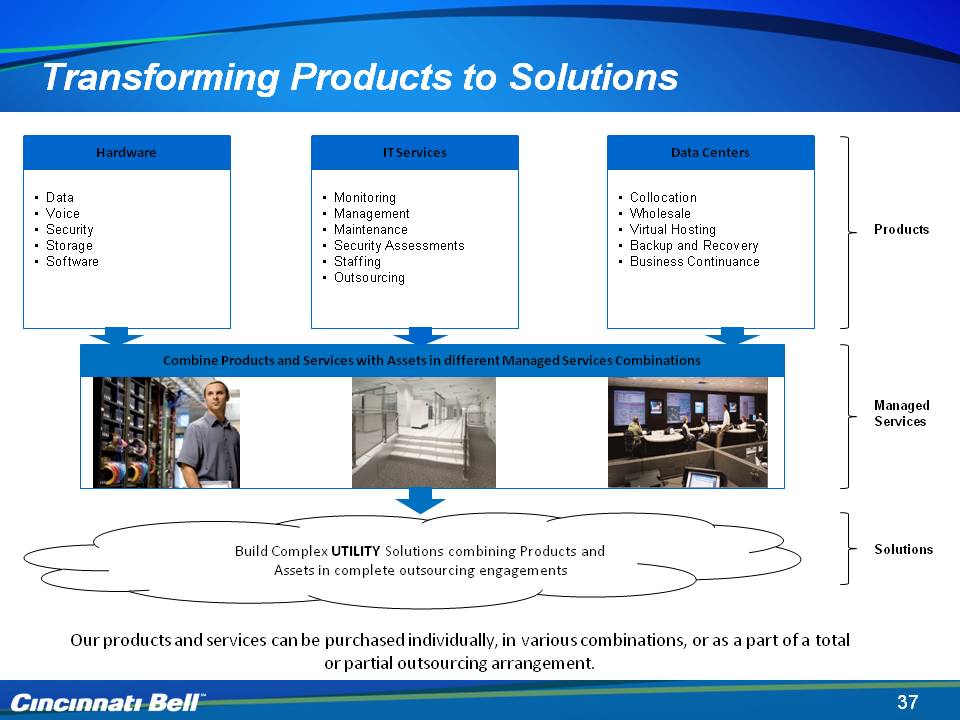

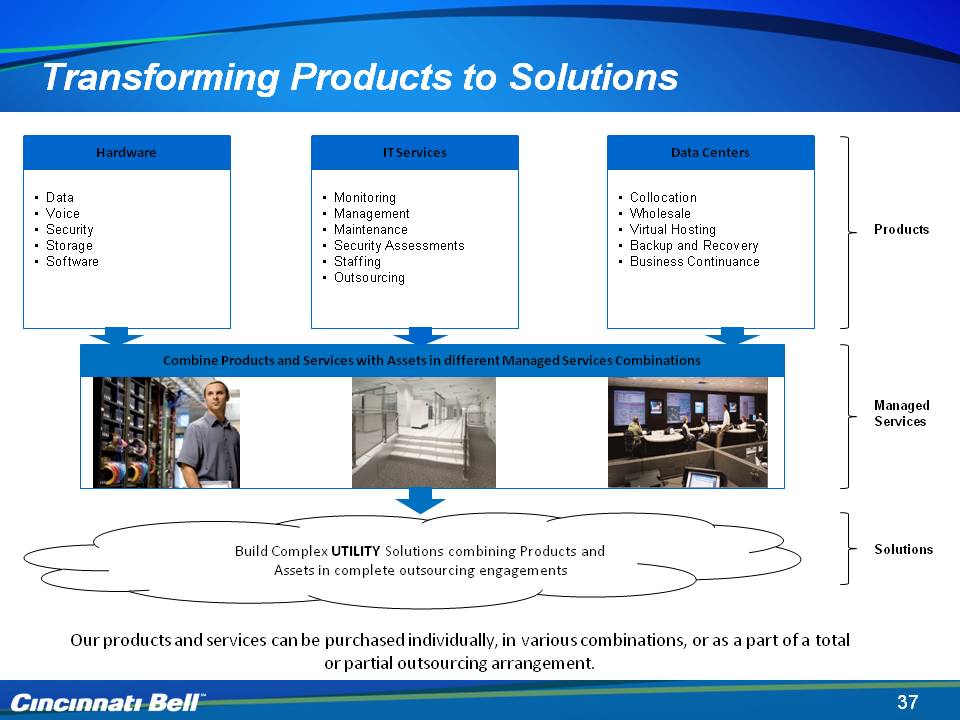

37 Transforming Products to Solutions Hardware IT Services Data Centers Data Voice Security Storage Software Monitoring Management Maintenance Security Assessments Staffing Outsourcing Collocation Wholesale Virtual Hosting Backup and Recovery Business Continuance Build Complex UTILITY Solutions combining Products and Assets in complete outsourcing engagements Products Solutions Our products and services can be purchased individually, in various combinations, or as a part of a total or partial outsourcing arrangement. Managed Services Combine Products and Services with Assets in different Managed Services Combinations

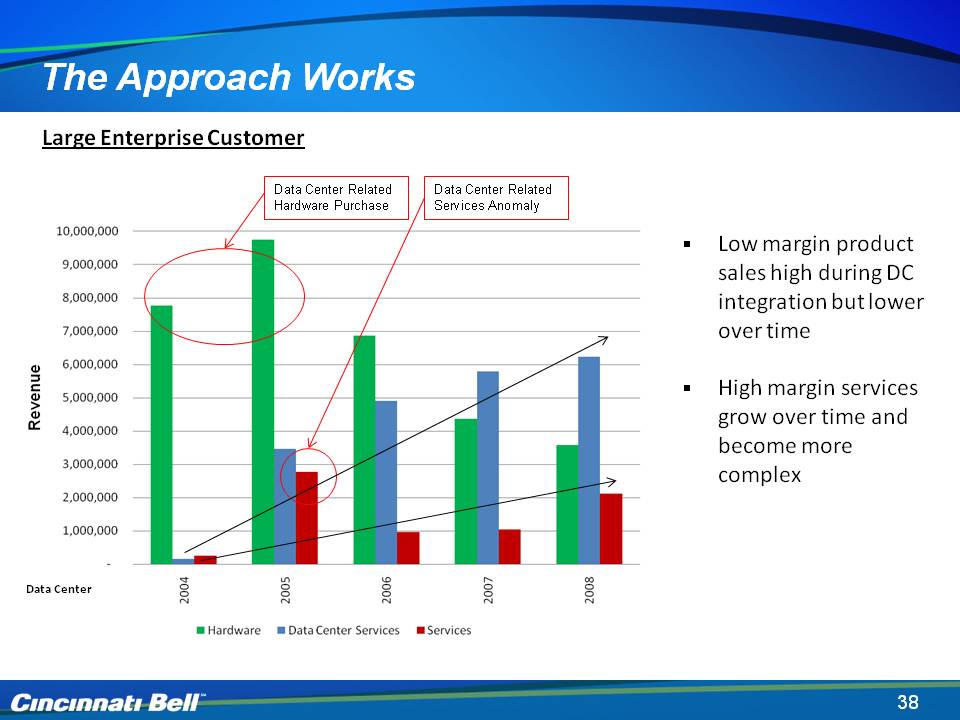

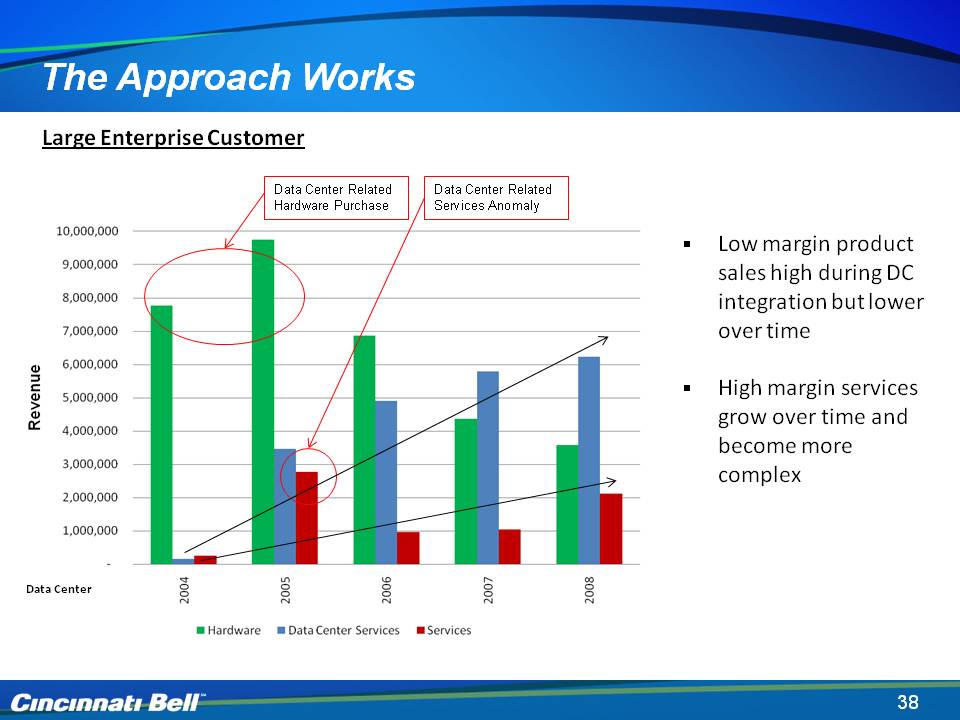

38 The Approach Works Large Enterprise Customer Data Center Related Hardware Purchase Data Center Related Services Anomaly Data Center Low margin product sales high during DC integration but lower over time High margin services grow over time and become more complex

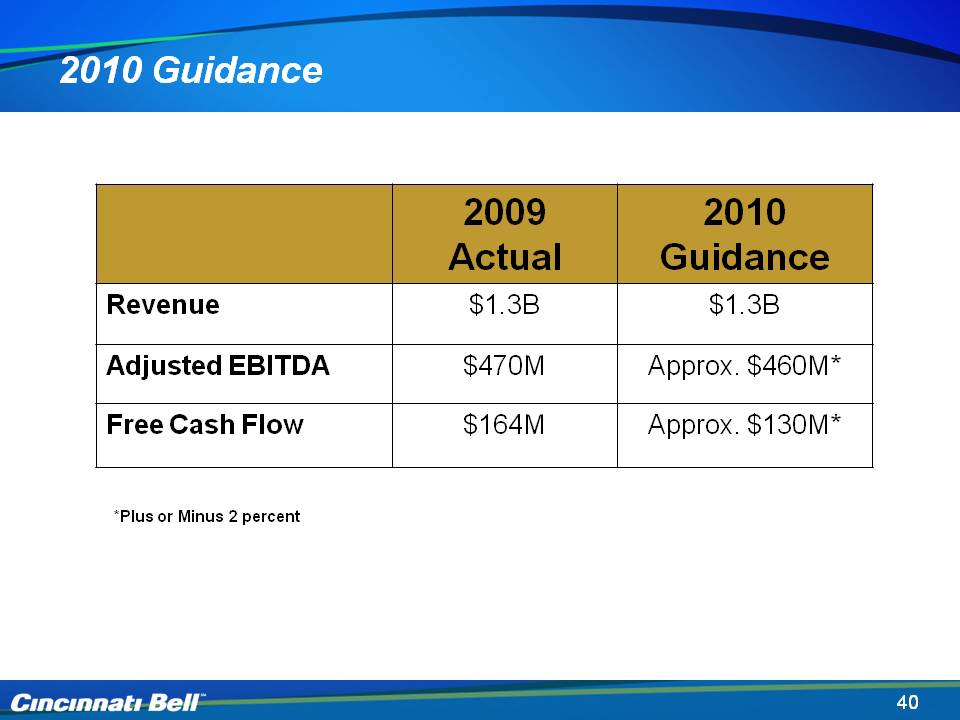

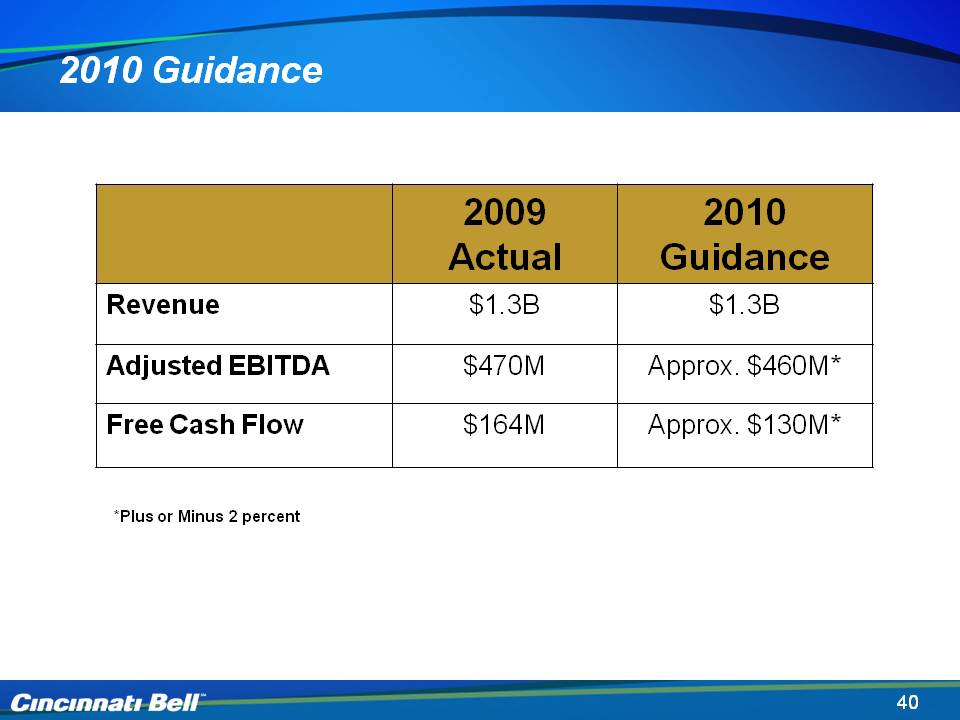

39 2010 Guidance *Plus or Minus 2 percent

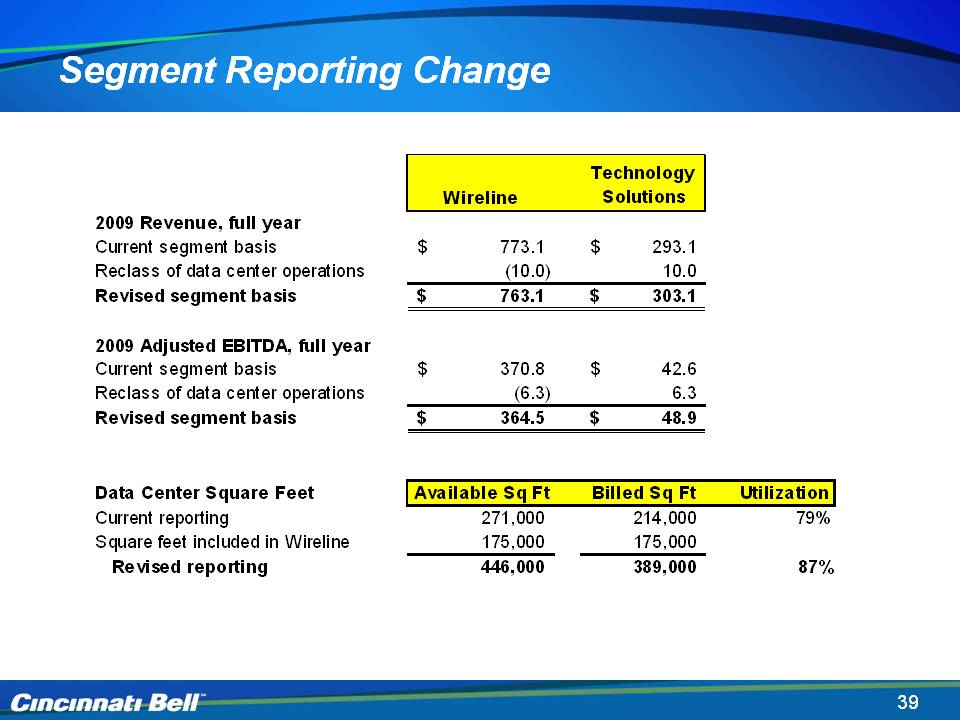

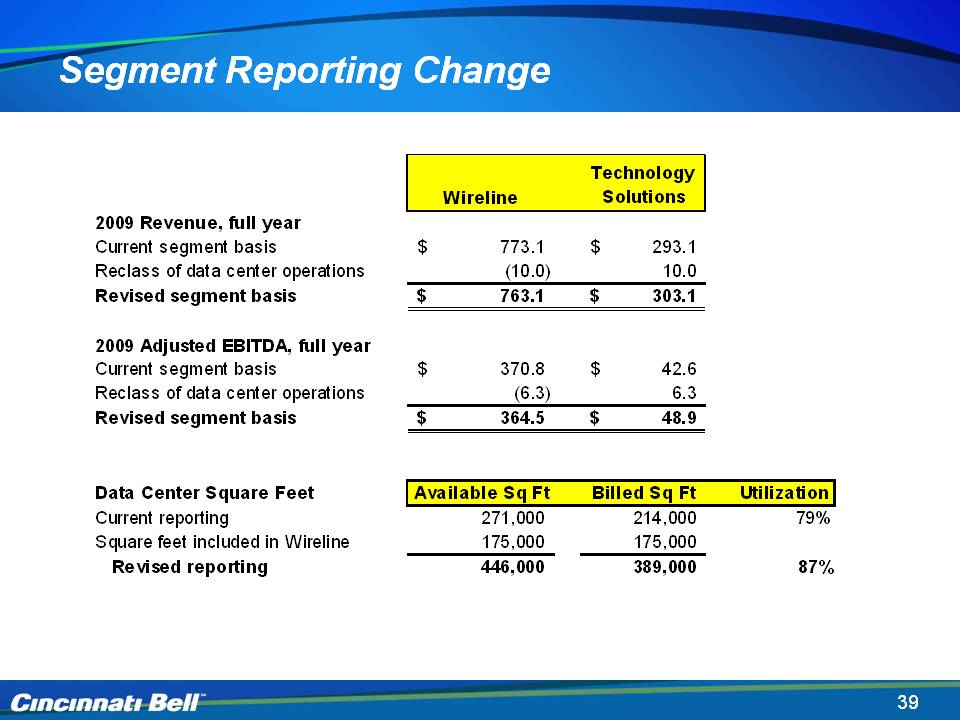

40 Segment Reporting Change

41 Cincinnati Bell4th Quarter and Full Year 2009ReviewFebruary 11, 2010

42 Non-GAAP Reconciliations (please refer to the Earnings Financials)