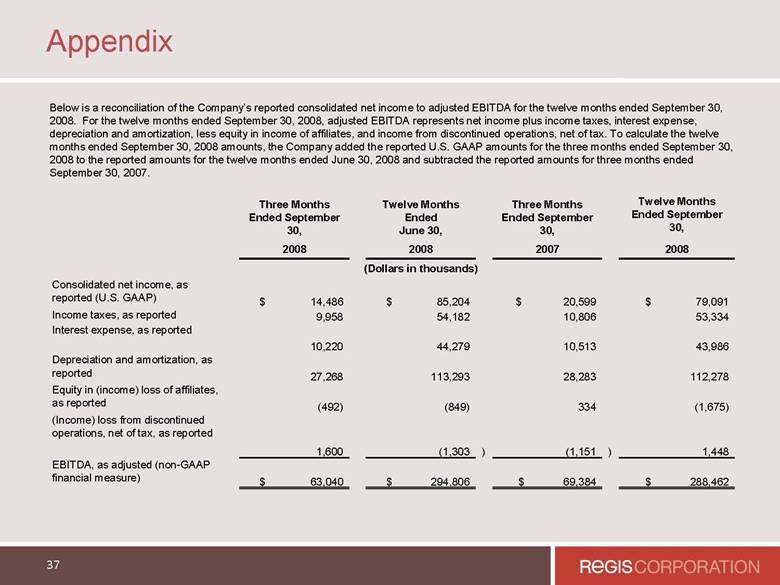

| 35 Appendix Below is a reconciliation of the Company’s reported consolidated net (loss) income to adjusted EBITDA for the twelve months ended June 30, 2011, 2010, 2009, 2008, 2007, and 2006. For the twelve months ended June 30, 2011, adjusted EBITDA represents net loss plus interest expense, depreciation and amortization, goodwill impairment, a note receivable reserve for a note with Pure Beauty, senior management restructure, legal settlements, and strategic alternatives costs less income taxes, and equity in income of affiliates. For the twelve months ended June 30, 2010, adjusted EBITDA represents net income plus income taxes, interest expense, depreciation and amortization, goodwill impairment, less equity in income of affiliates and income from discontinued operations, net of tax. For the twelve months ended June 30, 2009, adjusted EBITDA represents net loss plus income taxes, interest expense, depreciation and amortization, goodwill impairment, equity in loss of affiliates, and loss from discontinued operations, net of tax. For the twelve months ended June 30, 2008, adjusted EBITDA represents net income plus income taxes, interest expense and depreciation and amortization, less equity in income of affiliates, and income from discontinued operations, net of tax. For the twelve months ended June 30, 2007, adjusted EBITDA represents net income plus income taxes, interest expense, depreciation and amortization and goodwill impairment, less income from discontinued operations, net of tax. For the twelve months ended June 30, 2006, adjusted EBITDA represents net income plus income taxes, interest expense, and depreciation and amortization, less terminated acquisition income, net and income from discontinued operations, net of tax. Twelve Months Ended June 30, 2011 2010 2009 2008 2007 2006 (Dollars in thousands) Consolidated net (loss) income, as $ $ reported (U.S. GAAP) $ (8,905) $ 42,740 $ (124,466) 85,204 83,170 $ 109,578 Income taxes, as reported (9,496) 25,577 41,950 54,182 37,173 51,952 Interest expense, as reported 34,388 54,414 39,768 44,279 41,647 34,913 Depreciation and amortization, as reported 105,109 108,764 115,655 113,293 111,464 103,074 Goodwill impairment, as reported 74,100 35,277 41,661 ——— 23,000 ——— Terminated acquisition income, net, as reported ——— ——— ——— ——— ——— (33,683) Equity in (income) loss of affiliates, as reported (7,228) (11,942) 29,846 (849) ——— ——— (Income) loss from discontinued operations, net of tax, as reported ——— (3,161) 131,436 (1,303) (15,431) (16,675) Pure Beauty note receivable reserve 31,227 ——— ——— ——— ——— ——— Senior management restructure 4,299 ——— ——— ——— ——— ——— Legal settlements 2,433 ——— ——— ——— ——— ——— Strategic alternatives costs 1,253 ——— ——— ——— ——— ——— EBITDA, as adjusted (non-GAAP $ $ financial measure) $ 227,180 $ 251,669 $ 275,850 294,806 281,023 $ 249,159 |