UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-03691

LORD ABBETT MID CAP STOCK FUND, INC.

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, New Jersey 07302-3973

(Address of principal executive offices) (Zip code)

Lawrence B. Stoller, Esq.

Vice President, Secretary, and Chief Legal Officer

90 Hudson Street, Jersey City, New Jersey 07302-3973

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 522-2388

Date of fiscal year end: 12/31

Date of reporting period: 12/31/2022

| Item 1: | Report(s) to Shareholders. |

LORD ABBETT

ANNUAL REPORT

Lord Abbett

Mid Cap Stock Fund

For the fiscal year ended December 31, 2022

Table of Contents

Lord Abbett Mid Cap Stock Fund

Annual Report

For the fiscal year ended December 31, 2022

From left to right: James L.L. Tullis, Independent Chair of the Lord Abbett Funds and Douglas B. Sieg, Director, President and Chief Executive Officer of the Lord Abbett Funds. | | Dear Shareholders: We are pleased to provide you with this overview of the performance of Lord Abbett Mid Cap Stock Fund for the fiscal year ended December 31, 2022. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and timely information about the Fund, please visit our website at www.lordabbett.com, where you can also access quarterly commentaries that provide updates on the Fund’s performance and other portfolio related updates. Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come. Best regards,

Douglas B. Sieg

Director, President and Chief Executive Officer |

| | | |

For the fiscal year ended December 31, 2022, the Fund returned -11.06%, reflecting performance at the net asset value (“NAV”) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell Midcap® Value Index*, which returned -12.03% over the same period.

U.S. markets faced many challenges throughout the twelve-month period ending December 31, 2022, including the spread of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, tighter fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial Average and S&P 500® Index fell -6.86% and -18.11%, respectively, while the tech-

heavy Nasdaq Composite suffered even greater losses, falling -32.54%. Value stocks1 significantly outperformed growth stocks2 (-7.98% vs -28.97%), while large cap stocks3 slightly edged out small cap stocks4 (-19.13% vs -20.44%).

To begin the twelve-month period, U.S. markets grappled with COVID-19 cases hitting the highest levels of the pandemic, rising above 580,000 new cases in the last week of December 2021, more than doubling the previous record high. The spike in cases occurred shortly after the World Health Organization designated the newly discovered Omicron variant as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the

1

start of the pandemic, amid fears that the world would succumb to a new wave of infections. However, negative sentiment quickly reversed as cases proved to be generally less severe than prior strains. Market sentiment also increased after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 and became a dominant story throughout the period. Headline consumer price index (CPI) readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. This debate was intensified by the December 2021 headline CPI rising 7.0% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to supply and demand imbalances across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June. Increases in energy costs were even more profound, rising by more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction with Russia’s invasion of Ukraine since Russia has been a large exporter of oil and certain minerals. Various sanctions imposed on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive approach to combating

inflation. After remaining mostly consistent in its messaging that price pressures would likely be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25 basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee (FOMC) meeting, the first hike in more than three years. Six additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, 75 bps, and 50 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.5% by the end of the period, the highest level in 15 years. While the shift down in the pace of rate hikes supported the narrative that the Fed may begin to cut rates by the end of 2023, the Fed’s updated Summary of Economic Projections showed a more hawkish outlook, raising the outlook for the fed funds rate through 2025 from September’s forecasts – including a median forecast of 5.1% for 2023, 4.1% in 2024, and 3.1% in 2025. Fed Chair Powell also struck a hawkish tone in the press conference following the December FOMC meeting, sticking to the higher-for-longer messaging. Bond yields shot up over the period in response to this aggressive policy, leading to a bearish curve flattening and ultimately a yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets faced increased geopolitical tensions due to Russia’s invasion of Ukraine on February 23rd. Tensions remained elevated for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and

2

ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August.

Key macroeconomic indicators mostly trended lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.6% in the second quarter before growing 3.2% in the third quarter. Worries among investors that a recession was pending continued to grow, leading to a decline in the consumer confidence index to lower levels than during the height of the COVID-19 pandemic and the global financial crisis of 2008.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one positive development was the peak inflation narrative, which included a 99-day stretch of declines in U.S. gasoline prices and November CPI coming in better than expected on both the headline and core numbers. In addition, apartment rents fell for the first time in nearly two years in July, and lumber prices declined by more than 70% from their March peak late in the third quarter, falling back to pre-COVID levels. The third quarter of the 2022 earnings season also generated a lot of “better-than-feared” takeaways, including a common theme of relatively stable demand and pricing power protecting margins. While third quarter earnings were slightly below expectations, comments from management generally provided evidence of healthy consumer spending. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply

chain constraints. The U.S. labor market also remained strong over the period, with the national unemployment rate at 3.5% as of the end of December.

In terms of the Fund’s key performance drivers, over the twelve-month period ending December 31, 2022, security selection within the Industrials sector contributed to the Fund’s relative performance. Within the Industrials sector, EMCOR Group, Inc., which engages in the provision of electrical and mechanical construction, and facilities services, contributed to relative performance. Shares rallied after the company reported third quarter earnings above expectations. The Fund’s position in Nexstar Media Group, Inc., a television broadcasting and digital media company, also contributed to relative performance. Shares rallied after the company announced that the board approved a new share repurchase program authorizing the company to repurchase up to $1.5B of its common stock. The Fund’s position in Curtiss-Wright Corporation, a global integrated business that provides engineered products, solutions, and services mainly to the aerospace and defense markets, also contributed to relative performance. Shares rallied after the company reported strong second quarter earnings, followed by another strong third quarter earnings report. In the second quarter specifically, the company reported new orders of $776M, up 13%, reflecting strong aerospace & defense market demand.

Conversely, one of the largest detractors from relative performance during the twelve-month period ending December 31, 2022, was Caesars Entertainment, a casino management company. Shares fell after the company

3

reported that revenue was short of expectations in the first quarter. The company faced headwinds throughout the period as it had notable financial leverage. We believe the company should benefit both from the company’s intention to reduce its overall leverage as well as the resumption of international travel. The Fund’s position in KKR & Co., Inc, a leading alternatives investment firm, also detracted from relative performance. Amid the flattening of the yield curve, rate volatility, and skepticism around global growth prospects, the Financials sector came under pressure. In addition to the sector headwinds, shares of KKR & Co. were negatively impacted by its failure to close its acquisition of Telecom Italia. We believe the company stands to benefit from

increasing allocations to alternatives by retail and institutional investors as well as a rising proportion of fee-related income. The Fund’s position in Spectrum Brands Holdings, Inc., a consumer products and home essentials company, also detracted from relative performance. Shares fell after Assa Abloy, which engages in the provision of intelligent lock and security solutions, issued a statement regarding the U.S. DOJ’s blocking of Assa Abloys’s proposed acquisition of the hardware and home improvement division of Spectrum Brands. The Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

* The Russell Midcap® Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. The stocks are also members of the Russell 1000® Value index.

1 As represented by the Russell 3000® Value Index as of 12/31/2022.

2 As represented by the Russell 3000® Growth Index as of 12/31/2022.

3 As represented by the Russell 1000® Index as of 12/31/2022.

4 As represented by the Russell 2000® Index as of 12/31/2022.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. The Fund offers classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see the Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place. Without such expense waivers and reimbursements, the Fund’s returns would have been lower.

The annual commentary above discusses the views of the Fund’s management and various portfolio holdings of the Fund as of December 31, 2022. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Fund’s portfolio is actively managed and may change significantly, the Fund may no longer own the securities described above or may have otherwise changed its position in the securities. For more recent information about the Fund’s portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with the Fund, please see the Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

4

Investment Comparison

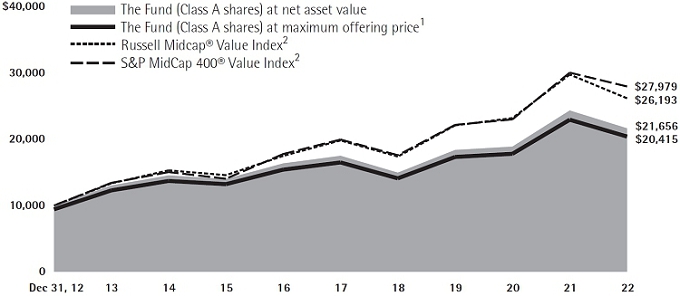

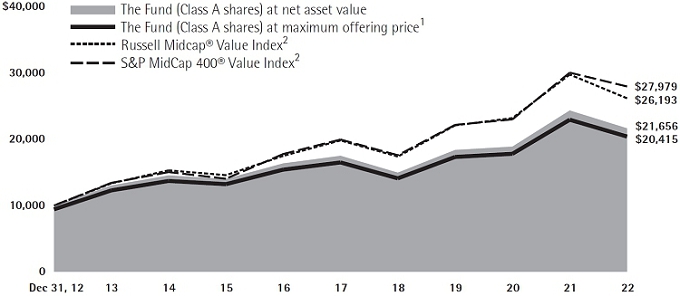

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell Midcap® Value Index and the S&P MidCap 400® Value Index, assuming reinvestment of all dividends and distributions. The performance of the other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended December 31, 2022 |

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class | |

| Class A3 | | –16.19% | | 3.12% | | 7.40% | | – | |

| Class C4 | | –12.57% | | 3.56% | | 7.24% | | – | |

| Class F5 | | –10.93% | | 4.51% | | 8.22% | | – | |

| Class F36 | | –10.78% | | 4.70% | | – | | 4.96% | |

| Class I5 | | –10.85% | | 4.61% | | 8.32% | | – | |

| Class P5 | | –11.27% | | 4.13% | | 7.87% | | – | |

| Class R25 | | –11.40% | | 3.97% | | 7.67% | | – | |

| Class R35 | | –11.31% | | 4.11% | | 7.79% | | – | |

| Class R47 | | –11.09% | | 4.34% | | – | | 5.15% | |

| Class R57 | | –10.85% | | 4.60% | | – | | 5.40% | |

| Class R67 | | –10.79% | | 4.69% | | – | | 5.51% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance of each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended December 31, 2022, is calculated using the SEC-required uniform method to compute such return.

4 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Performance is at net asset value.

6 Commenced operations and performance for the Class began on April 4, 2017. Performance is at net asset value.

7 Commenced operations and performance for the Class began on June 30, 2015. Performance is at net asset value.

5

Expense Example

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (July 1, 2022 through December 31, 2022).

Actual Expenses

For each class of the Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 7/1/22 – 12/31/22” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of the Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

6

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† | |

| | | 7/1/22 | | 12/31/22 | | 7/1/22 –

12/31/22 | |

| Class A | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,074.90 | | | $ | 5.28 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.11 | | | $ | 5.14 | | |

| Class C | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,070.50 | | | $ | 9.24 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,016.28 | | | $ | 9.00 | | |

| Class F | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,075.60 | | | $ | 4.50 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.87 | | | $ | 4.38 | | |

| Class F3 | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,076.40 | | | $ | 3.56 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | |

| Class I | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,075.90 | | | $ | 4.03 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.32 | | | $ | 3.92 | | |

| Class P | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,073.70 | | | $ | 6.32 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,019.11 | | | $ | 6.16 | | |

| Class R2 | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,072.70 | | | $ | 7.11 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.35 | | | $ | 6.92 | | |

| Class R3 | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,073.20 | | | $ | 6.64 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,018.80 | | | $ | 6.46 | | |

| Class R4 | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,074.80 | | | $ | 5.33 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,020.06 | | | $ | 5.19 | | |

| Class R5 | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,076.00 | | | $ | 3.98 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.37 | | | $ | 3.87 | | |

| Class R6 | | | | | | | | | | | | | |

| Actual | | $ | 1,000.00 | | | $ | 1,076.40 | | | $ | 3.56 | | |

| Hypothetical (5% Return Before Expenses) | | $ | 1,000.00 | | | $ | 1,021.78 | | | $ | 3.47 | | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.01% for Class A, 1.77% for Class C, 0.86% for Class F, 0.68% for Class F3, 0.77% for Class I, 1.21% for Class P, 1.36% for Class R2, 1.27% for Class R3, 1.02% for Class R4, 0.76% for Class R5 and 0.68% for Class R6) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

7

Portfolio Holdings Presented by Sector

December 31, 2022

| Sector* | | %** | |

| Communication Services | | 1.16 | % |

| Consumer Discretionary | | 7.59 | % |

| Consumer Staples | | 5.19 | % |

| Energy | | 6.11 | % |

| Financials | | 20.01 | % |

| Health Care | | 9.25 | % |

| Industrials | | 19.32 | % |

| Information Technology | | 9.09 | % |

| Materials | | 7.72 | % |

| Real Estate | | 6.28 | % |

| Utilities | | 6.37 | % |

| Repurchase Agreements | | 1.91 | % |

| Total | | 100.00 | % |

| * | | A sector may comprise several industries. |

| ** | | Represents percent of total investments, which excludes derivatives. |

8

Schedule of Investments

December 31, 2022

| Investments | | Shares | | | Fair

Value | |

| LONG-TERM INVESTMENTS 98.12% | | | | |

| | | | | | | | | |

| COMMON STOCKS 98.12% | | | | | | | | |

| | | | | | | | | |

| Aerospace & Defense 2.31% | | | | | | | | |

| Curtiss-Wright Corp. | | | 148,040 | | | $ | 24,721,200 | |

| | | | | | | | | |

| Automobiles 0.59% | | | | | | | | |

| Harley-Davidson, Inc. | | | 152,410 | | | | 6,340,256 | |

| | | | | | | | | |

| Banks 3.83% | | | | | | | | |

| Columbia Banking System, Inc. | | | 363,450 | | | | 10,950,749 | |

| East West Bancorp, Inc. | | | 235,450 | | | | 15,516,155 | |

| Popular, Inc. | | | 220,020 | | | | 14,591,726 | |

| Total | | | | | | | 41,058,630 | |

| | | | | | | | | |

| Beverages 1.30% | | | | | | | | |

| Carlsberg A/S Class B (Denmark)(a) | | | 105,380 | | | | 13,978,335 | |

| | | | | | | | | |

| Biotechnology 1.55% | | | | | | | | |

| Horizon Therapeutics plc* | | | 145,541 | | | | 16,562,566 | |

| | | | | | | | | |

| Building Products 1.56% | | | | | | | | |

| Masco Corp. | | | 357,150 | | | | 16,668,191 | |

| | | | | | | | | |

| Capital Markets 5.49% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 82,670 | | | | 25,740,958 | |

| Evercore, Inc. Class A | | | 131,850 | | | | 14,382,198 | |

| KKR & Co., Inc. | | | 403,310 | | | | 18,721,650 | |

| Total | | | | | | | 58,844,806 | |

| | | | | | | | | |

| Chemicals 2.95% | | | | | | | | |

| Corteva, Inc. | | | 224,910 | | | | 13,220,210 | |

| Valvoline, Inc. | | | 564,548 | | | | 18,432,492 | |

| Total | | | | | | | 31,652,702 | |

| | | | | | | | | |

| Communications Equipment 1.49% | | | | | |

| F5, Inc.* | | | 111,530 | | | | 16,005,670 | |

| | | | | | | | | |

| Construction & Engineering 4.35% | | | | | | | |

| AECOM | | | 248,670 | | | | 21,119,543 | |

| EMCOR Group, Inc. | | | 171,800 | | | | 25,445,298 | |

| Total | | | | | | | 46,564,841 | |

| Investments | | Shares | | | Fair

Value | |

| Construction Materials 1.71% | | | | | | | | |

| Eagle Materials, Inc. | | | 138,090 | | | $ | 18,345,256 | |

| | | | | | | | | |

| Containers & Packaging 1.22% | | | | | | | | |

| Avery Dennison Corp. | | | 72,280 | | | | 13,082,680 | |

| | | | | | | | | |

| Diversified Financial Services 0.50% | | | | | |

| Equitable Holdings, Inc. | | | 186,730 | | | | 5,359,151 | |

| | | | | | | | | |

| Electric: Utilities 4.58% | | | | | | | | |

| Entergy Corp. | | | 185,030 | | | | 20,815,875 | |

| NRG Energy, Inc. | | | 340,977 | | | | 10,849,888 | |

| Portland General Electric Co. | | | 355,370 | | | | 17,413,130 | |

| Total | | | | | | | 49,078,893 | |

| | | | | | | | | |

| Electrical Equipment 1.54% | | | | | | | | |

| Sensata Technologies Holding plc | | | 409,200 | | | | 16,523,496 | |

| | | | | | | | | |

| Electronic Equipment, Instruments & Components 1.70% | | | |

| Teledyne Technologies, Inc.* | | | 45,430 | | | | 18,167,911 | |

| | | | | | | | | |

| Energy Equipment & Services 2.09% | | | | | |

| NOV, Inc. | | | 1,074,300 | | | | 22,442,127 | |

| | | | | | | | | |

| Equity Real Estate Investment Trusts 6.28% | | | | | |

| American Homes 4 Rent Class A | | | 449,930 | | | | 13,560,890 | |

| Camden Property Trust | | | 130,240 | | | | 14,571,252 | |

| First Industrial Realty Trust, Inc. | | | 223,570 | | | | 10,789,488 | |

| Kimco Realty Corp. | | | 860,500 | | | | 18,225,390 | |

| Life Storage, Inc. | | | 102,900 | | | | 10,135,650 | |

| Total | | | | | | | 67,282,670 | |

| | | | | | | | | |

| Food & Staples Retailing 1.74% | | | | | | | | |

| BJ’s Wholesale Club Holdings, Inc.* | | | 281,190 | | | | 18,603,530 | |

| | See Notes to Financial Statements. | 9 |

Schedule of Investments (continued)

December 31, 2022

| Investments | | Shares | | | Fair

Value | |

| Health Care Providers & Services 5.39% | | | | | |

| AmerisourceBergen Corp. | | | 124,940 | | | $ | 20,703,808 | |

| Molina Healthcare, Inc.* | | | 68,160 | | | | 22,507,795 | |

| Tenet Healthcare Corp.* | | | 298,860 | | | | 14,581,379 | |

| Total | | | | | | | 57,792,982 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure 1.49% | | | | | |

| Caesars Entertainment, Inc.* | | | 385,150 | | | | 16,022,240 | |

| | | | | | | | | |

| Household Durables 1.47% | | | | | | | | |

| Helen of Troy Ltd.* | | | 141,840 | | | | 15,731,474 | |

| | | | | | | | | |

| Household Products 2.15% | | | | | | | | |

| Reynolds Consumer Products, Inc. | | | 178,830 | | | | 5,361,323 | |

| Spectrum Brands Holdings, Inc. | | | 290,270 | | | | 17,683,249 | |

| Total | | | | | | | 23,044,572 | |

| | | | | | | | | |

| Information Technology Services 3.00% | | | |

| Euronet Worldwide, Inc.* | | | 159,690 | | | | 15,071,542 | |

| Global Payments, Inc. | | | 172,490 | | | | 17,131,707 | |

| Total | | | | | | | 32,203,249 | |

| | | | | | | | | |

| Insurance 10.19% | | | | | | | | |

| Allstate Corp. (The) | | | 199,460 | | | | 27,046,776 | |

| American Financial Group, Inc./OH | | | 113,470 | | | | 15,577,161 | |

| Arch Capital Group Ltd.* | | | 311,660 | | | | 19,566,015 | |

| Arthur J Gallagher & Co. | | | 99,880 | | | | 18,831,375 | |

| Assurant, Inc. | | | 93,230 | | | | 11,659,344 | |

| RenaissanceRe Holdings Ltd. | | | 89,900 | | | | 16,562,277 | |

| Total | | | | | | | 109,242,948 | |

| | | | | | | | | |

| Machinery 7.56% | | | | | | | | |

| Crane Holdings Co. | | | 188,940 | | | | 18,979,023 | |

| Otis Worldwide Corp. | | | 241,960 | | | | 18,947,888 | |

| Parker-Hannifin Corp. | | | 86,060 | | | | 25,043,460 | |

| Westinghouse Air Brake Technologies Corp. | | | 180,820 | | | | 18,047,644 | |

| Total | | | | | | | 81,018,015 | |

| Investments | | Shares | | | Fair

Value | |

| Media 1.16% | | | | | | | | |

| Nexstar Media Group, Inc. | | | 70,950 | | | $ | 12,418,379 | |

| | | | | | | | | |

| Metals & Mining 1.84% | | | | | | | | |

| Alcoa Corp. | | | 172,310 | | | | 7,834,935 | |

| Reliance Steel & Aluminum Co. | | | 58,620 | | | | 11,867,033 | |

| Total | | | | | | | 19,701,968 | |

| | | | | | | | | |

| Multi-Utilities 1.79% | | | | | | | | |

| CMS Energy Corp. | | | 303,340 | | | | 19,210,522 | |

| | | | | | | | | |

| Oil, Gas & Consumable Fuels 4.02% | | | | | | | | |

| Chesapeake Energy Corp. | | | 229,912 | | | | 21,696,796 | |

| Devon Energy Corp. | | | 347,520 | | | | 21,375,955 | |

| Total | | | | | | | 43,072,751 | |

| | | | | | | | | |

| Pharmaceuticals 2.32% | | | | | | | | |

| Organon & Co. | | | 888,880 | | | | 24,826,418 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment 1.20% | | | |

| Teradyne, Inc. | | | 146,770 | | | | 12,820,360 | |

| | | | | | | | | |

| Specialty Retail 1.69% | | | | | | | | |

| AutoZone, Inc.* | | | 7,330 | | | | 18,077,099 | |

| | | | | | | | | |

| Technology Hardware, Storage & Peripherals 1.70% | | | |

| NetApp, Inc. | | | 302,500 | | | | 18,168,150 | |

| | | | | | | | | |

| Textiles, Apparel & Luxury Goods 2.35% | | | |

| Deckers Outdoor Corp.* | | | 28,901 | | | | 11,536,123 | |

| Tapestry, Inc. | | | 357,680 | | | | 13,620,455 | |

| Total | | | | | | | 25,156,578 | |

| | | | | | | | | |

| Trading Companies & Distributors 2.02% | | | |

| AerCap Holdings NV (Ireland)*(a) | | | 370,380 | | | | 21,600,562 | |

Total Common Stocks

(cost $967,408,652) | | | | | | | 1,051,391,178 | |

| 10 | See Notes to Financial Statements. |

Schedule of Investments (concluded)

December 31, 2022

| Investments | | Principal

Amount | | | Fair

Value | |

| SHORT-TERM INVESTMENTS 1.91% | | | |

| | | | | | | | | |

| Repurchase Agreements 1.91% | | | | | | | |

Repurchase Agreement dated 12/30/2022, 2.05% due 1/3/2023 with Fixed Income Clearing Corp. collateralized by $17,298,900 of U.S. Treasury Inflation Indexed Note at 0.250% due 1/15/2025; value: $20,918,530; proceeds: $20,513,015

(cost $20,508,343) | $ | 20,508,343 | | | $ | 20,508,343 | |

Total Investments in Securities 100.03%

(cost $987,916,995) | | | | | | 1,071,899,521 | |

| Other Assets and Liabilities – Net (0.03)% | | | | | | (298,091 | ) |

| Net Assets 100.00% | | | | | $ | 1,071,601,430 | |

| * | | Non-income producing security. |

| (a) | | Foreign security traded in U.S. dollars. |

The following is a summary of the inputs used as of December 31, 2022 in valuing the Fund’s investments carried at fair value(1):

| Investment Type(2) | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Long-Term Investments | | | | | | | | | | | | | | | | |

| Common Stocks | | | | | | | | | | | | | | | | |

| Beverages | | $ | – | | | $ | 13,978,335 | | | $ | – | | | $ | 13,978,335 | |

| Remaining Industries | | | 1,037,412,843 | | | | – | | | | – | | | | 1,037,412,843 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Repurchase Agreements | | | – | | | | 20,508,343 | | | | – | | | | 20,508,343 | |

| Total | | $ | 1,037,412,843 | | | $ | 34,486,678 | | | $ | – | | | $ | 1,071,899,521 | |

| (1) | | Refer to Note 2(h) for a description of fair value measurements and the three-tier hierarchy of inputs. |

| (2) | | See Schedule of Investments for fair values in each industry and identification of foreign issuers and/or geography. The table above is presented by Investment Type. Industries are presented within an Investment Type should such Investment Type include securities classified as two or more levels within the three-tier fair value hierarchy. When applicable, each Level 3 security is identified on the Schedule of Investments along with the valuation technique utilized. |

A reconciliation of Level 3 investments is presented when the Fund has a material amount of Level 3 investments at the beginning or end of the year in relation to the Fund’s net assets.

| | See Notes to Financial Statements. | 11 |

Statement of Assets and Liabilities

December 31, 2022

| ASSETS: | | | | |

| Investments in securities, at fair value (cost $987,916,995) | | $ | 1,071,899,521 | |

| Cash | | | 1,217 | |

| Foreign cash, at value (cost $1) | | | 1 | |

| Receivables: | | | | |

| Investment securities sold | | | 1,615,686 | |

| Interest and dividends | | | 805,098 | |

| Capital shares sold | | | 345,744 | |

| Prepaid expenses and other assets | | | 8,224 | |

| Total assets | | | 1,074,675,491 | |

| LIABILITIES: | | | | |

| Payables: | | | | |

| 12b-1 distribution plan | | | 824,114 | |

| Capital shares reacquired | | | 818,494 | |

| Directors’ fees | | | 553,550 | |

| Management fee | | | 543,648 | |

| Fund administration | | | 37,037 | |

| Accrued expenses | | | 297,218 | |

| Total liabilities | | | 3,074,061 | |

| NET ASSETS | | $ | 1,071,601,430 | |

| COMPOSITION OF NET ASSETS: | | | | |

| Paid-in capital | | $ | 990,866,822 | |

| Total distributable earnings (loss) | | | 80,734,608 | |

| Net Assets | | $ | 1,071,601,430 | |

| 12 | See Notes to Financial Statements. |

Statement of Assets and Liabilities (concluded)

December 31, 2022

| Net assets by class: | | | | |

| Class A Shares | | $ | 808,839,491 | |

| Class C Shares | | $ | 23,866,960 | |

| Class F Shares | | $ | 62,472,933 | |

| Class F3 Shares | | $ | 19,312,343 | |

| Class I Shares | | $ | 86,662,091 | |

| Class P Shares | | $ | 26,567,584 | |

| Class R2 Shares | | $ | 1,800,280 | |

| Class R3 Shares | | $ | 16,485,897 | |

| Class R4 Shares | | $ | 8,032,249 | |

| Class R5 Shares | | $ | 3,357,744 | |

| Class R6 Shares | | $ | 14,203,858 | |

| Outstanding shares by class: | | | | |

| Class A Shares (1.18 billion shares of common stock authorized, $.001 par value) | | | 28,734,160 | |

| Class C Shares (200 million shares of common stock authorized, $.001 par value) | | | 927,807 | |

| Class F Shares (472.5 million shares of common stock authorized, $.001 par value) | | | 2,242,539 | |

| Class F3 Shares (472.5 million shares of common stock authorized, $.001 par value) | | | 688,111 | |

| Class I Shares (472.5 million shares of common stock authorized, $.001 par value) | | | 3,112,385 | |

| Class P Shares (200 million shares of common stock authorized, $.001 par value) | | | 981,729 | |

| Class R2 Shares (200 million shares of common stock authorized, $.001 par value) | | | 65,132 | |

| Class R3 Shares (381.6 million shares of common stock authorized, $.001 par value) | | | 592,337 | |

| Class R4 Shares (381.6 million shares of common stock authorized, $.001 par value) | | | 286,126 | |

| Class R5 Shares (381.6 million shares of common stock authorized, $.001 par value) | | | 120,658 | |

| Class R6 Shares (381.6 million shares of common stock authorized, $.001 par value) | | | 506,266 | |

Net asset value, offering and redemption price per share

(Net assets divided by outstanding shares): | | | | |

| Class A Shares-Net asset value | | | $28.15 | |

Class A Shares-Maximum offering price

(Net asset value plus sales charge of 5.75%) | | | $29.87 | |

| Class C Shares-Net asset value | | | $25.72 | |

| Class F Shares-Net asset value | | | $27.86 | |

| Class F3 Shares-Net asset value | | | $28.07 | |

| Class I Shares-Net asset value | | | $27.84 | |

| Class P Shares-Net asset value | | | $27.06 | |

| Class R2 Shares-Net asset value | | | $27.64 | |

| Class R3 Shares-Net asset value | | | $27.83 | |

| Class R4 Shares-Net asset value | | | $28.07 | |

| Class R5 Shares-Net asset value | | | $27.83 | |

| Class R6 Shares-Net asset value | | | $28.06 | |

| | See Notes to Financial Statements. | 13 |

Statement of Operations

For the Year Ended December 31, 2022

| Investment income: | | | | |

| Dividends (net of foreign withholding taxes of $121,311) | | $ | 25,051,655 | |

| Interest and other | | | 255,092 | |

| Interest earned from Interfund Lending (See Note 10) | | | 1,861 | |

| Total investment income | | | 25,308,608 | |

| Expenses: | | | | |

| Management fee | | | 7,028,560 | |

| 12b-1 distribution plan–Class A | | | 2,168,325 | |

| 12b-1 distribution plan–Class C | | | 282,190 | |

| 12b-1 distribution plan–Class F | | | 83,576 | |

| 12b-1 distribution plan–Class P | | | 129,432 | |

| 12b-1 distribution plan–Class R2 | | | 10,846 | |

| 12b-1 distribution plan–Class R3 | | | 90,463 | |

| 12b-1 distribution plan–Class R4 | | | 21,631 | |

| Shareholder servicing | | | 1,168,627 | |

| Fund administration | | | 486,285 | |

| Registration | | | 157,477 | |

| Reports to shareholders | | | 132,768 | |

| Professional | | | 67,636 | |

| Directors’ fees | | | 22,165 | |

| Custody | | | 16,567 | |

| Other | | | 108,902 | |

| Gross expenses | | | 11,975,450 | |

| Expense reductions (See Note 8) | | | (13,916 | ) |

| Fees waived and expenses reimbursed (See Note 3) | | | (16,567 | ) |

| Net expenses | | | 11,944,967 | |

| Net investment income | | | 13,363,641 | |

| Net realized and unrealized gain (loss): | | | | |

| Net realized gain (loss) on investments | | | 75,078,411 | |

| Net realized gain (loss) on foreign currency related transactions | | | 4,534 | |

| Net change in unrealized appreciation/depreciation on investments | | | (250,662,552 | ) |

| Net change in unrealized appreciation/depreciation on translation of assets and liabilities denominated in foreign currencies | | | (6,585 | ) |

| Net realized and unrealized gain (loss) | | | (175,586,192 | ) |

| Net Decrease in Net Assets Resulting From Operations | | $ | (162,222,551 | ) |

| 14 | See Notes to Financial Statements. |

Statements of Changes in Net Assets

| INCREASE (DECREASE) IN NET ASSETS | | For the Year Ended

December 31, 2022 | | | For the Year Ended

December 31, 2021 | |

| Operations: | | | | | | | | |

| Net investment income | | $ | 13,363,641 | | | $ | 11,325,714 | |

| Net realized gain (loss) on investments and foreign currency related transactions | | | 75,082,945 | | | | 200,177,926 | |

| Net change in unrealized appreciation/depreciation on investments and translation of assets and liabilities denominated in foreign currencies | | | (250,669,137 | ) | | | 151,579,949 | |

| Net increase (decrease) in net assets resulting from operations | | | (162,222,551 | ) | | | 363,083,589 | |

| Distributions to shareholders: | | | | | | | | |

| Class A | | | (64,554,019 | ) | | | (79,311,679 | ) |

| Class C | | | (1,919,850 | ) | | | (2,811,836 | ) |

| Class F | | | (5,211,363 | ) | | | (11,217,117 | ) |

| Class F3 | | | (1,584,133 | ) | | | (1,970,609 | ) |

| Class I | | | (8,094,551 | ) | | | (17,318,224 | ) |

| Class P | | | (2,128,453 | ) | | | (2,763,186 | ) |

| Class R2 | | | (137,274 | ) | | | (156,896 | ) |

| Class R3 | | | (1,300,183 | ) | | | (1,774,628 | ) |

| Class R4 | | | (647,349 | ) | | | (657,552 | ) |

| Class R5 | | | (280,345 | ) | | | (360,579 | ) |

| Class R6 | | | (1,173,248 | ) | | | (1,576,237 | ) |

| Total distributions to shareholders | | | (87,030,768 | ) | | | (119,918,543 | ) |

| Capital share transactions (Net of share conversions) (See Note 14): | | | | | | | | |

| Net proceeds from sales of shares | | | 162,355,263 | | | | 76,876,876 | |

| Reinvestment of distributions | | | 78,934,067 | | | | 109,625,072 | |

| Cost of shares reacquired | | | (421,444,364 | ) | | | (243,940,024 | ) |

| Net decrease in net assets resulting from capital share transactions | | | (180,155,034 | ) | | | (57,438,076 | ) |

| Net increase (decrease) in net assets | | | (429,408,353 | ) | | | 185,726,970 | |

| NET ASSETS: | | | | | | | | |

| Beginning of year | | $ | 1,501,009,783 | | | $ | 1,315,282,813 | |

| End of year | | $ | 1,071,601,430 | | | $ | 1,501,009,783 | |

| | See Notes to Financial Statements. | 15 |

Financial Highlights

| | | | | | Per Share Operating Performance: |

| | | | | | | | | | | | | |

| | | | | | Investment Operations: | | | Distributions to

shareholders from: |

| | | Net asset

value,

beginning

of period | | | Net

invest-

ment

income

(loss)(a) | | | Net

realized

and

unrealized

gain (loss) | | | Total

from

invest-

ment

oper-

ations | | | Net

investment

income | | | Net

realized

gain | | | Total

distri-

butions |

| Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | $34.35 | | | | $0.33 | | | | $(4.17 | ) | | | $(3.84 | ) | | | $(0.30 | ) | | | $(2.06 | ) | | | $(2.36 | ) |

| 12/31/2021 | | | 29.02 | | | | 0.25 | | | | 8.01 | | | | 8.26 | | | | (0.27 | ) | | | (2.66 | ) | | | (2.93 | ) |

| 12/31/2020 | | | 28.59 | | | | 0.32 | | | | 0.46 | (c) | | | 0.78 | | | | (0.35 | ) | | | – | | | | (0.35 | ) |

| 12/31/2019 | | | 24.01 | | | | 0.30 | | | | 5.19 | | | | 5.49 | | | | (0.25 | ) | | | (0.66 | ) | | | (0.91 | ) |

| 12/31/2018 | | | 29.90 | | | | 0.25 | | | | (4.56 | ) | | | (4.31 | ) | | | (0.26 | ) | | | (1.32 | ) | | | (1.58 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 31.59 | | | | 0.09 | | | | (3.84 | ) | | | (3.75 | ) | | | (0.06 | ) | | | (2.06 | ) | | | (2.12 | ) |

| 12/31/2021 | | | 26.88 | | | | – | | | | 7.39 | | | | 7.39 | | | | (0.02 | ) | | | (2.66 | ) | | | (2.68 | ) |

| 12/31/2020 | | | 26.47 | | | | 0.12 | | | | 0.40 | (c) | | | 0.52 | | | | (0.11 | ) | | | – | | | | (0.11 | ) |

| 12/31/2019 | | | 22.29 | | | | 0.09 | | | | 4.81 | | | | 4.90 | | | | (0.06 | ) | | | (0.66 | ) | | | (0.72 | ) |

| 12/31/2018 | | | 27.80 | | | | (0.03 | ) | | | (4.16 | ) | | | (4.19 | ) | | | – | (d) | | | (1.32 | ) | | | (1.32 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class F | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 34.02 | | | | 0.37 | | | | (4.13 | ) | | | (3.76 | ) | | | (0.34 | ) | | | (2.06 | ) | | | (2.40 | ) |

| 12/31/2021 | | | 28.76 | | | | 0.30 | | | | 7.94 | | | | 8.24 | | | | (0.32 | ) | | | (2.66 | ) | | | (2.98 | ) |

| 12/31/2020 | | | 28.34 | | | | 0.35 | | | | 0.46 | (c) | | | 0.81 | | | | (0.39 | ) | | | – | | | | (0.39 | ) |

| 12/31/2019 | | | 23.80 | | | | 0.34 | | | | 5.16 | | | | 5.50 | | | | (0.30 | ) | | | (0.66 | ) | | | (0.96 | ) |

| 12/31/2018 | | | 29.65 | | | | 0.29 | | | | (4.52 | ) | | | (4.23 | ) | | | (0.30 | ) | | | (1.32 | ) | | | (1.62 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class F3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 34.24 | | | | 0.44 | | | | (4.16 | ) | | | (3.72 | ) | | | (0.39 | ) | | | (2.06 | ) | | | (2.45 | ) |

| 12/31/2021 | | | 28.92 | | | | 0.37 | | | | 7.97 | | | | 8.34 | | | | (0.36 | ) | | | (2.66 | ) | | | (3.02 | ) |

| 12/31/2020 | | | 28.46 | | | | 0.40 | | | | 0.48 | (c) | | | 0.88 | | | | (0.42 | ) | | | – | | | | (0.42 | ) |

| 12/31/2019 | | | 23.88 | | | | 0.39 | | | | 5.18 | | | | 5.57 | | | | (0.33 | ) | | | (0.66 | ) | | | (0.99 | ) |

| 12/31/2018 | | | 29.74 | | | | 0.35 | | | | (4.55 | ) | | | (4.20 | ) | | | (0.34 | ) | | | (1.32 | ) | | | (1.66 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 34.01 | | | | 0.40 | | | | (4.13 | ) | | | (3.73 | ) | | | (0.38 | ) | | | (2.06 | ) | | | (2.44 | ) |

| 12/31/2021 | | | 28.76 | | | | 0.33 | | | | 7.93 | | | | 8.26 | | | | (0.35 | ) | | | (2.66 | ) | | | (3.01 | ) |

| 12/31/2020 | | | 28.33 | | | | 0.37 | | | | 0.47 | (c) | | | 0.84 | | | | (0.41 | ) | | | – | | | | (0.41 | ) |

| 12/31/2019 | | | 23.79 | | | | 0.37 | | | | 5.16 | | | | 5.53 | | | | (0.33 | ) | | | (0.66 | ) | | | (0.99 | ) |

| 12/31/2018 | | | 29.66 | | | | 0.30 | | | | (4.52 | ) | | | (4.22 | ) | | | (0.33 | ) | | | (1.32 | ) | | | (1.65 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class P | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 33.13 | | | | 0.26 | | | | (4.03 | ) | | | (3.77 | ) | | | (0.24 | ) | | | (2.06 | ) | | | (2.30 | ) |

| 12/31/2021 | | | 28.07 | | | | 0.18 | | | | 7.74 | | | | 7.92 | | | | (0.20 | ) | | | (2.66 | ) | | | (2.86 | ) |

| 12/31/2020 | | | 27.67 | | | | 0.26 | | | | 0.43 | (c) | | | 0.69 | | | | (0.29 | ) | | | – | | | | (0.29 | ) |

| 12/31/2019 | | | 23.25 | | | | 0.23 | | | | 5.04 | | | | 5.27 | | | | (0.19 | ) | | | (0.66 | ) | | | (0.85 | ) |

| 12/31/2018 | | | 28.99 | | | | 0.18 | | | | (4.41 | ) | | | (4.23 | ) | | | (0.19 | ) | | | (1.32 | ) | | | (1.51 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 33.79 | | | | 0.22 | | | | (4.11 | ) | | | (3.89 | ) | | | (0.20 | ) | | | (2.06 | ) | | | (2.26 | ) |

| 12/31/2021 | | | 28.58 | | | | 0.13 | | | | 7.88 | | | | 8.01 | | | | (0.14 | ) | | | (2.66 | ) | | | (2.80 | ) |

| 12/31/2020 | | | 28.16 | | | | 0.22 | | | | 0.45 | (c) | | | 0.67 | | | | (0.25 | ) | | | – | | | | (0.25 | ) |

| 12/31/2019 | | | 23.54 | | | | 0.18 | | | | 5.10 | | | | 5.28 | | | | – | (d) | | | (0.66 | ) | | | (0.66 | ) |

| 12/31/2018 | | | 29.40 | | | | 0.15 | | | | (4.48 | ) | | | (4.33 | ) | | | (0.21 | ) | | | (1.32 | ) | | | (1.53 | ) |

| 16 | See Notes to Financial Statements. |

| | | | | | | Ratios to Average Net Assets: | | Supplemental Data: |

Net

asset

value,

end of

period | | Total

return(b)

(%) | | Total

expenses

after

waivers

and/or

reimburse-

ments

(%) | | Total

expenses

(%) | | Net

investment

income

(loss)

(%) | | Net

assets,

end of

period

(000) | | Portfolio

turnover

rate

(%) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| $28.15 | | | | (11.06 | ) | | | 1.01 | | | | 1.01 | | | | 1.08 | | | $ | 808,839 | | | | 40 | |

| | 34.35 | | | | 28.88 | | | | 0.98 | | | | 0.98 | | | | 0.74 | | | | 1,002,000 | | | | 61 | |

| | 29.02 | | | | 2.73 | | | | 1.02 | | | | 1.02 | | | | 1.26 | | | | 851,886 | | | | 63 | |

| | 28.59 | | | | 22.91 | | | | 0.98 | | | | 0.98 | | | | 1.08 | | | | 978,197 | | | | 69 | |

| | 24.01 | | | | (14.54 | ) | | | 0.98 | | | | 0.98 | | | | 0.85 | | | | 872,864 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 25.72 | | | | (11.76 | ) | | | 1.76 | | | | 1.76 | | | | 0.33 | | | | 23,867 | | | | 40 | |

| | 31.59 | | | | 27.96 | | | | 1.73 | | | | 1.73 | | | | (0.01 | ) | | | 35,761 | | | | 61 | |

| | 26.88 | | | | 1.94 | | | | 1.78 | | | | 1.78 | | | | 0.51 | | | | 33,469 | | | | 63 | |

| | 26.47 | | | | 22.04 | | | | 1.73 | | | | 1.73 | | | | 0.36 | | | | 54,897 | | | | 69 | |

| | 22.29 | | | | (15.20 | ) | | | 1.73 | | | | 1.73 | | | | (0.11 | ) | | | 28,694 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 27.86 | | | | (10.93 | ) | | | 0.85 | | | | 0.85 | | | | 1.19 | | | | 62,473 | | | | 40 | |

| | 34.02 | | | | 29.09 | | | | 0.83 | | | | 0.83 | | | | 0.89 | | | | 135,505 | | | | 61 | |

| | 28.76 | | | | 2.86 | | | | 0.88 | | | | 0.88 | | | | 1.41 | | | | 120,942 | | | | 63 | |

| | 28.34 | | | | 23.14 | | | | 0.83 | | | | 0.83 | | | | 1.25 | | | | 146,125 | | | | 69 | |

| | 23.80 | | | | (14.38 | ) | | | 0.83 | | | | 0.83 | | | | 0.99 | | | | 96,500 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 28.07 | | | | (10.78 | ) | | | 0.67 | | | | 0.67 | | | | 1.42 | | | | 19,312 | | | | 40 | |

| | 34.24 | | | | 29.29 | | | | 0.64 | | | | 0.64 | | | | 1.07 | | | | 24,037 | | | | 61 | |

| | 28.92 | | | | 3.11 | | | | 0.68 | | | | 0.68 | | | | 1.61 | | | | 21,165 | | | | 63 | |

| | 28.46 | | | | 23.36 | | | | 0.66 | | | | 0.66 | | | | 1.42 | | | | 23,828 | | | | 69 | |

| | 23.88 | | | | (14.25 | ) | | | 0.64 | | | | 0.64 | | | | 1.19 | | | | 19,137 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 27.84 | | | | (10.85 | ) | | | 0.75 | | | | 0.75 | | | | 1.31 | | | | 86,662 | | | | 40 | |

| | 34.01 | | | | 29.19 | | | | 0.73 | | | | 0.73 | | | | 0.99 | | | | 212,934 | | | | 61 | |

| | 28.76 | | | | 3.00 | | | | 0.77 | | | | 0.77 | | | | 1.46 | | | | 196,164 | | | | 63 | |

| | 28.33 | | | | 23.26 | | | | 0.73 | | | | 0.73 | | | | 1.36 | | | | 407,723 | | | | 69 | |

| | 23.79 | | | | (14.34 | ) | | | 0.73 | | | | 0.73 | | | | 1.04 | | | | 249,326 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 27.06 | | | | (11.27 | ) | | | 1.21 | | | | 1.21 | | | | 0.88 | | | | 26,568 | | | | 40 | |

| | 33.13 | | | | 28.64 | | | | 1.18 | | | | 1.18 | | | | 0.54 | | | | 34,019 | | | | 61 | |

| | 28.07 | | | | 2.51 | | | | 1.23 | | | | 1.23 | | | | 1.06 | | | | 31,575 | | | | 63 | |

| | 27.67 | | | | 22.69 | | | | 1.19 | | | | 1.19 | | | | 0.88 | | | | 39,511 | | | | 69 | |

| | 23.25 | | | | (14.71 | ) | | | 1.18 | | | | 1.18 | | | | 0.63 | | | | 43,079 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 27.64 | | | | (11.40 | ) | | | 1.36 | | | | 1.36 | | | | 0.74 | | | | 1,800 | | | | 40 | |

| | 33.79 | | | | 28.46 | | | | 1.33 | | | | 1.33 | | | | 0.39 | | | | 2,054 | | | | 61 | |

| | 28.58 | | | | 2.37 | | | | 1.38 | | | | 1.38 | | | | 0.91 | | | | 1,791 | | | | 63 | |

| | 28.16 | | | | 22.46 | | | | 1.33 | | | | 1.33 | | | | 0.70 | | | | 2,510 | | | | 69 | |

| | 23.54 | | | | (14.84 | ) | | | 1.33 | | | | 1.33 | | | | 0.51 | | | | 11,616 | | | | 47 | |

| | See Notes to Financial Statements. | 17 |

Financial Highlights (concluded)

| | | | | | Per Share Operating Performance: |

| | | | | | |

| | | | | | Investment Operations: | | Distributions to

shareholders from: |

| | | Net asset

value,

beginning

of period | | Net

invest-

ment

income

(loss)(a) | | Net

realized

and

unrealized

gain (loss) | | Total

from

invest-

ment

oper-

ations | | Net

investment

income | | Net

realized

gain | | Total

distri-

butions |

| Class R3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | $33.99 | | | | $0.25 | | | | $(4.13 | ) | | | $(3.88 | ) | | | $(0.22 | ) | | | $(2.06 | ) | | | $(2.28 | ) |

| 12/31/2021 | | | 28.74 | | | | 0.17 | | | | 7.92 | | | | 8.09 | | | | (0.18 | ) | | | (2.66 | ) | | | (2.84 | ) |

| 12/31/2020 | | | 28.32 | | | | 0.25 | | | | 0.44 | (c) | | | 0.69 | | | | (0.27 | ) | | | – | | | | (0.27 | ) |

| 12/31/2019 | | | 23.78 | | | | 0.23 | | | | 5.15 | | | | 5.38 | | | | (0.18 | ) | | | (0.66 | ) | | | (0.84 | ) |

| 12/31/2018 | | | 29.58 | | | | 0.17 | | | | (4.47 | ) | | | (4.30 | ) | | | (0.18 | ) | | | (1.32 | ) | | | (1.50 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R4 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 34.27 | | | | 0.33 | | | | (4.17 | ) | | | (3.84 | ) | | | (0.30 | ) | | | (2.06 | ) | | | (2.36 | ) |

| 12/31/2021 | | | 28.92 | | | | 0.24 | | | | 7.99 | | | | 8.23 | | | | (0.22 | ) | | | (2.66 | ) | | | (2.88 | ) |

| 12/31/2020 | | | 28.50 | | | | 0.31 | | | | 0.46 | (c) | | | 0.77 | | | | (0.35 | ) | | | – | | | | (0.35 | ) |

| 12/31/2019 | | | 23.93 | | | | 0.30 | | | | 5.19 | | | | 5.49 | | | | (0.26 | ) | | | (0.66 | ) | | | (0.92 | ) |

| 12/31/2018 | | | 29.79 | | | | 0.24 | | | | (4.54 | ) | | | (4.30 | ) | | | (0.24 | ) | | | (1.32 | ) | | | (1.56 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R5 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 34.00 | | | | 0.40 | | | | (4.13 | ) | | | (3.73 | ) | | | (0.38 | ) | | | (2.06 | ) | | | (2.44 | ) |

| 12/31/2021 | | | 28.75 | | | | 0.34 | | | | 7.92 | | | | 8.26 | | | | (0.35 | ) | | | (2.66 | ) | | | (3.01 | ) |

| 12/31/2020 | | | 28.32 | | | | 0.38 | | | | 0.46 | (c) | | | 0.84 | | | | (0.41 | ) | | | – | | | | (0.41 | ) |

| 12/31/2019 | | | 23.79 | | | | 0.38 | | | | 5.14 | | | | 5.52 | | | | (0.33 | ) | | | (0.66 | ) | | | (0.99 | ) |

| 12/31/2018 | | | 29.66 | | | | 0.34 | | | | (4.56 | ) | | | (4.22 | ) | | | (0.33 | ) | | | (1.32 | ) | | | (1.65 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class R6 | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12/31/2022 | | | 34.23 | | | | 0.44 | | | | (4.16 | ) | | | (3.72 | ) | | | (0.39 | ) | | | (2.06 | ) | | | (2.45 | ) |

| 12/31/2021 | | | 28.91 | | | | 0.37 | | | | 7.97 | | | | 8.34 | | | | (0.36 | ) | | | (2.66 | ) | | | (3.02 | ) |

| 12/31/2020 | | | 28.45 | | | | 0.40 | | | | 0.48 | (c) | | | 0.88 | | | | (0.42 | ) | | | – | | | | (0.42 | ) |

| 12/31/2019 | | | 23.88 | | | | 0.39 | | | | 5.17 | | | | 5.56 | | | | (0.33 | ) | | | (0.66 | ) | | | (0.99 | ) |

| 12/31/2018 | | | 29.74 | | | | 0.36 | | | | (4.56 | ) | | | (4.20 | ) | | | (0.34 | ) | | | (1.32 | ) | | | (1.66 | ) |

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Total return for Classes A and C does not consider the effects of sales loads and assumes the reinvestment of all distributions. Total return for all other classes assumes the reinvestment of all distributions. |

| (c) | Realized and unrealized gain (loss) per share does not correlate to the aggregate of the net realized and unrealized gain (loss) in the Statement of Operations for the year ended December 31, 2020, primarily due to the timing of the sales and repurchases of the Fund’s shares in relation to fluctuating market values of the Fund’s portfolio. |

| (d) | Amount less than $0.01. |

| 18 | See Notes to Financial Statements. |

| | | | | | | Ratios to Average Net Assets: | | Supplemental Data: |

Net

asset

value,

end of

period | | Total

return(b)

(%) | | Total

expenses

after

waivers

and/or

reimburse-

ments

(%) | | Total

expenses

(%) | | Net

investment

income

(loss)

(%) | | Net

assets,

end of

period

(000) | | Portfolio

turnover

rate

(%) |

| | | | | | | | | | | | | | | | | | | | |

| $27.83 | | | | (11.31 | ) | | | 1.26 | | | | 1.26 | | | | 0.83 | | | | $16,486 | | | | 40 | |

| | 33.99 | | | | 28.58 | | | | 1.23 | | | | 1.23 | | | | 0.49 | | | | 22,910 | | | | 61 | |

| | 28.74 | | | | 2.46 | | | | 1.28 | | | | 1.28 | | | | 1.01 | | | | 20,618 | | | | 63 | |

| | 28.32 | | | | 22.65 | | | | 1.23 | | | | 1.23 | | | | 0.84 | | | | 26,024 | | | | 69 | |

| | 23.78 | | | | (14.66 | ) | | | 1.23 | | | | 1.23 | | | | 0.59 | | | | 20,815 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 28.07 | | | | (11.09 | ) | | | 1.01 | | | | 1.01 | | | | 1.09 | | | | 8,032 | | | | 40 | |

| | 34.27 | | | | 28.90 | | | | 0.98 | | | | 0.98 | | | | 0.73 | | | | 8,477 | | | | 61 | |

| | 28.92 | | | | 2.71 | | | | 1.03 | | | | 1.03 | | | | 1.26 | | | | 17,417 | | | | 63 | |

| | 28.50 | | | | 22.96 | | | | 0.98 | | | | 0.98 | | | | 1.09 | | | | 18,203 | | | | 69 | |

| | 23.93 | | | | (14.54 | ) | | | 0.98 | | | | 0.98 | | | | 0.83 | | | | 12,678 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 27.83 | | | | (10.85 | ) | | | 0.76 | | | | 0.76 | | | | 1.33 | | | | 3,358 | | | | 40 | |

| | 34.00 | | | | 29.20 | | | | 0.73 | | | | 0.73 | | | | 1.00 | | | | 4,211 | | | | 61 | |

| | 28.75 | | | | 3.00 | | | | 0.78 | | | | 0.78 | | | | 1.52 | | | | 3,654 | | | | 63 | |

| | 28.32 | | | | 23.22 | | | | 0.73 | | | | 0.73 | | | | 1.38 | | | | 3,951 | | | | 69 | |

| | 23.79 | | | | (14.33 | ) | | | 0.73 | | | | 0.73 | | | | 1.17 | | | | 424 | | | | 47 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | 28.06 | | | | (10.79 | ) | | | 0.67 | | | | 0.67 | | | | 1.42 | | | | 14,204 | | | | 40 | |

| | 34.23 | | | | 29.30 | | | | 0.64 | | | | 0.64 | | | | 1.07 | | | | 19,102 | | | | 61 | |

| | 28.91 | | | | 3.11 | | | | 0.68 | | | | 0.68 | | | | 1.62 | | | | 16,603 | | | | 63 | |

| | 28.45 | | | | 23.32 | | | | 0.66 | | | | 0.66 | | | | 1.42 | | | | 23,949 | | | | 69 | |

| | 23.88 | | | | (14.25 | ) | | | 0.64 | | | | 0.64 | | | | 1.22 | | | | 16,363 | | | | 47 | |

| | See Notes to Financial Statements. | 19 |

Notes to Financial Statements

Lord Abbett Mid Cap Stock Fund, Inc. (the “Fund”) is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified, open-end management investment company and was incorporated under Maryland law on March 14, 1983.

The Fund’s investment objective is to seek capital appreciation through investments, primarily in equity securities, which are believed to be undervalued in the marketplace. The Fund has eleven active classes of shares: Class A, C, F, F3, I, P, R2, R3, R4, R5 and R6, each with different expenses and dividends. A front-end sales charge is normally added to the net asset value (“NAV”) for Class A shares. There is no front-end sales charge in the case of Class C, F, F3, I, P, R2, R3, R4, R5 and R6 shares, although there may be a contingent deferred sales charge (“CDSC”) in certain cases as follows: Class A shares purchased without a sales charge and redeemed before the first day of the month in which the one-year anniversary of the purchase falls (subject to certain exceptions as set forth in the Fund’s prospectus); and Class C shares redeemed before the first anniversary of purchase. Class C shares automatically convert to Class A shares on the 25th day of the month (or, if the 25th day is not a business day, the next business day thereafter) following the eighth anniversary of the month on which the purchase order was accepted, provided that the Fund or financial intermediary through which a shareholder purchased Class C shares has records verifying that the C shares have been held at least eight years. The Fund’s Class P shares are closed to substantially all new investors, with certain exceptions as set forth in the Fund’s prospectus.

The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”) requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

| (a) | Investment Valuation–Under procedures approved by the Fund’s Board of Directors (the “Board”), the Board has designated the determination of fair value of the Fund’s portfolio investments to Lord, Abbett & Co. LLC (“Lord Abbett”), as its valuation designee. Accordingly, Lord Abbett is responsible for, among other things, assessing and managing valuation risks, establishing, applying and testing fair value methodologies, and evaluating pricing services. Lord Abbett has formed a Pricing Committee that performs these responsibilities on behalf of Lord Abbett, administers the pricing and valuation of portfolio investments and ensures that prices utilized reasonably reflect fair value. Among other things, these procedures allow Lord Abbett, subject to Board oversight, to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value. |

| | |

| | Securities actively traded on any recognized U.S. or non-U.S. exchange or on The NASDAQ Stock Market LLC are valued at the last sale price or official closing price on the exchange or system on which they are principally traded. Events occurring after the close of trading on non-U.S. exchanges may result in adjustments to the valuation of foreign securities to reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Board has approved the use of an independent fair valuation service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that correlate to the fair-valued securities. Unlisted equity securities are valued at the last quoted sale price or, if no sale price is available, at the mean between the most recently quoted bid and ask prices. |

20

Notes to Financial Statements (continued)

| | Securities for which prices are not readily available are valued at fair value as determined by the Pricing Committee. The Pricing Committee considers a number of factors, including observable and unobservable inputs, when arriving at fair value. The Pricing Committee may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information to determine the fair value of portfolio investments. The Board or a designated committee thereof periodically reviews reports that may include fair value determinations made by the Pricing Committee, related market activity, inputs and assumptions, and retrospective comparison of prices of subsequent purchases and sales transactions to fair value determinations made by the Pricing Committee. |

| | |

| | Short-term securities with 60 days or less remaining to maturity are valued using the amortized cost method, which approximates fair value. |

| | |

| (b) | Security Transactions–Security transactions are recorded as of the date that the securities are purchased or sold (trade date). Realized gains and losses on sales of portfolio securities are calculated using the identified-cost method. Realized and unrealized gains (losses) are allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day. |

| | |

| (c) | Investment Income–Dividend income is recorded on the ex-dividend date. Interest income is recorded on the accrual basis as earned. Discounts are accreted and premiums are amortized using the effective interest method and are included in Interest and other, if applicable, on the Statement of Operations. Withholding taxes on foreign dividends have been provided for in accordance with the applicable country’s tax rules and rates. Investment income is allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day. |

| | |

| (d) | Income Taxes–It is the policy of the Fund to meet the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all taxable income and capital gains to its shareholders. Therefore, no income tax provision is required. |

| | |

| | The Fund files U.S. federal and various state and local tax returns. No income tax returns are currently under examination. The statute of limitations on the Fund’s filed U.S. federal tax returns remains open for the fiscal years ended December 31, 2019 through December 31, 2022. The statutes of limitations on the Fund’s state and local tax returns may remain open for an additional year depending upon the jurisdiction. |

| | |

| (e) | Expenses–Expenses, excluding class-specific expenses, are allocated to each class of shares based upon the relative proportion of net assets at the beginning of the day. In addition, Class F3 and R6 bear only their class-specific shareholder servicing expenses. Class A, C, F, P, R2, R3, and R4 shares bear their class-specific share of all expenses and fees relating to the Fund’s 12b-1 Distribution Plan. |

| | |

| (f) | Foreign Transactions–The books and records of the Fund are maintained in U.S. dollars and transactions denominated in foreign currencies are recorded in the Fund’s records at the rate prevailing when earned or recorded. Asset and liability accounts that are denominated in foreign currencies are adjusted daily to reflect current exchange rates and any unrealized gain (loss), if applicable, is included in Net change in unrealized appreciation/depreciation on translation of assets and liabilities denominated in foreign currencies on the Fund’s Statement of Operations. The resultant exchange gains and losses upon settlement of such transactions, if applicable, are included in Net realized gain (loss) on foreign currency related transactions |

21

Notes to Financial Statements (continued)

| | on the Fund’s Statement of Operations. The Fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in market prices of the securities. |

| | |

| | The Fund uses foreign currency exchange contracts to facilitate transactions in foreign-denominated securities. Losses from these transactions may arise from changes in the value of the foreign currency or if the counterparties do not perform under the contracts’ terms. |

| | |

| (g) | Repurchase Agreements–The Fund may enter into repurchase agreements with respect to securities. A repurchase agreement is a transaction in which a fund acquires a security and simultaneously commits to resell that security to the seller (a bank or securities dealer) at an agreed-upon price on an agreed-upon date. The Fund requires at all times that the repurchase agreement be collateralized by cash, or by securities of the U.S. Government, its agencies, its instrumentalities, or U.S. Government sponsored enterprises having a value equal to, or in excess of, the value of the repurchase agreement (including accrued interest). If the seller of the agreement defaults on its obligation to repurchase the underlying securities at a time when the fair value of these securities has declined, the Fund may incur a loss upon disposition of the securities. |

| | |

| (h) | Fair Value Measurements–Fair value is defined as the price that the Fund would receive upon selling an investment or transferring a liability in an orderly transaction to an independent buyer in the principal or most advantageous market of the investment. A three-tier hierarchy is used to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk - for example, the risk inherent in a particular valuation technique used to measure fair value (such as a pricing model) and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability. Observable inputs are based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. Unobservable inputs are based on the best information available in the circumstances. The three-tier hierarchy classification is determined based on the lowest level of inputs that is significant to the fair value measurement, and is summarized in the three broad Levels listed below: |

| | · | Level 1 – | unadjusted quoted prices in active markets for identical investments; |

| | | | |

| | · | Level 2 – | other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.); and |

| | | | |

| | · | Level 3 – | significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). |

| | | | |

| | A summary of inputs used in valuing the Fund’s investments as of December 31, 2022 and, if applicable, Level 3 rollforwards for the fiscal year then ended is included in the Fund’s Schedule of Investments. |

| | |

| | Changes in valuation techniques may result in transfers into or out of an assigned level within the three-tier hierarchy. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. |

22

Notes to Financial Statements (continued)

| 3. | MANAGEMENT FEE AND OTHER TRANSACTIONS WITH AFFILIATES |

Management Fee

The Fund has a management agreement with Lord Abbett, pursuant to which Lord Abbett provides the Fund with investment management services and executive and other personnel, provides office space and pays for ordinary and necessary office and clerical expenses relating to research and statistical work and supervision of the Fund’s investment portfolio. The management fee is accrued daily and payable monthly.

The management fee is based on the Fund’s average daily net assets at the following annual rate:

| First $200 million | .75% |

| Next $300 million | .65% |

| Over $500 million | .50% |

For the fiscal year ended December 31, 2022, the effective management fee was at an annualized rate of .58% of the Fund’s average daily net assets.

In addition, Lord Abbett provides certain administrative services to the Fund pursuant to an Administrative Services Agreement in return for a fee at an annual rate of .04% of the Fund’s average daily net assets. The fund administration fee is accrued daily and payable monthly. Lord Abbett voluntarily waived $16,567 of fund administration fee during the fiscal year ended December 31, 2022.

12b–1 Distribution Plan

The Fund has adopted a distribution plan with respect to Class A, C, F, P, R2, R3 and R4 shares pursuant to Rule 12b–1 under the Act, which provides for the payment of ongoing distribution and service fees to Lord Abbett Distributor LLC (the “Distributor”), an affiliate of Lord Abbett. The distribution and service fees are accrued daily and payable monthly. The following annual rates have been authorized by the Board pursuant to the plan:

| Fees* | | Class A | | | Class C | | Class F(1) | | Class P | | Class R2 | | Class R3 | | Class R4 |

| Service | | .25% | (2) | | .25% | | – | | .25% | | .25% | | .25% | | .25% |

| Distribution | | – | | | .75% | | .10% | | .20% | | .35% | | .25% | | – |

| * | | The Fund may designate a portion of the aggregate fee as attributable to service activities for purposes of calculating Financial Industry Regulatory Authority, Inc. sales charge limitations. |

| (1) | | The Class F shares Rule 12b-1 fee may be designated as a service fee in limited circumstances as described in the Fund’s prospectus. |

| (2) | | Annual service fee on shares sold prior to June 1, 1990 was .15% of the average daily net assets attributable to Class A shares. |

Class F3, Class I, Class R5 and Class R6 shares do not have a distribution plan.

Commissions

Distributor received the following commissions on sales of shares of the Fund, after concessions were paid to authorized dealers, for the fiscal year ended December 31, 2022:

Distributor

Commissions | Dealers’

Concessions |

| $21,361 | $117,892 |

Distributor received CDSCs of $134 and $1,171 for Class A and Class C shares, respectively, for the fiscal year ended December 31, 2022.

One Director and certain of the Fund’s officers have an interest in Lord Abbett.

23

Notes to Financial Statements (continued)

| 4. | DISTRIBUTIONS AND CAPITAL LOSS CARRYFORWARDS |

Dividends from net investment income, if any, are declared and paid at least semi-annually. Taxable net realized gains from investment transactions, reduced by allowable capital loss carryforwards, if any, are declared and distributed to shareholders at least annually. The capital loss carryforward amount, if any, is available to offset future net capital gains. Dividends and distributions to shareholders are recorded on the ex-dividend date. The amounts of dividends and distributions from net investment income and net realized capital gains are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. These book/tax differences are either considered temporary or permanent in nature. To the extent these differences are permanent in nature, such amounts are reclassified within the components of net assets based on their federal tax basis treatment; temporary differences do not require reclassification. Dividends and distributions that exceed earnings and profits for tax purposes are reported as a tax return of capital.

The tax character of distributions paid during the fiscal years ended December 31, 2022 and 2021 was as follows:

| | | Year Ended

12/31/2022 | | | Year Ended

12/31/2021 |

| Distributions paid from: | | | | | | | |

| Ordinary income | | $ | 12,413,229 | | | $ | 39,832,562 |

| Net long-term capital gains | | | 74,617,539 | | | | 80,085,981 |

| Total distributions paid | | $ | 87,030,768 | | | $ | 119,918,543 |

As of December 31, 2022, the components of accumulated gains (losses) on a tax-basis were as follows:

| Undistributed long-term capital gains | | $ | 3,446,518 | |

| Total undistributed earnings | | | 3,446,518 | |

| Temporary differences | | | (553,550 | ) |

| Unrealized gains – net | | | 77,841,640 | |

| Total accumulated gains – net | | $ | 80,734,608 | |

As of December 31, 2022, the aggregate unrealized security gains and losses on investments and other financial instruments based on cost for U.S. federal income tax purposes were as follows:

| Tax cost | | $ | 994,051,358 | |

| Gross unrealized gain | | | 147,030,471 | |

| Gross unrealized loss | | | (69,182,308 | ) |

| Net unrealized security gain | | $ | 77,848,163 | |

The difference between book-basis and tax-basis unrealized gains (losses) is attributable to the tax treatment of certain distributions received and wash sales.

Permanent items identified during the fiscal year ended December 31, 2022 have been reclassified among the components of net assets based on their tax basis treatment as follows:

Total distributable

earnings (loss) | | Paid-in

Capital | |

| $(15,125,916) | | $ | 15,125,916 | |

The permanent differences are attributable to the tax treatment of certain distributions.

24

Notes to Financial Statements (continued)

| 5. | PORTFOLIO SECURITIES TRANSACTIONS |

Purchases and sales of investment securities (excluding short-term investments) for the fiscal year ended December 31, 2022 were as follows:

| Purchases | | Sales |

| $475,352,462 | | $ | 744,172,085 |

There were no purchases or sales of U.S. Government securities for the fiscal year ended December 31, 2022.

The Fund is permitted to purchase and sell securities (“cross-trade”) from and to other Lord Abbett funds or client accounts pursuant to procedures approved by the Board in compliance with Rule 17a-7 under the Act (the “Rule”). Each cross-trade is executed at a fair market price in compliance with provisions of the Rule. For the fiscal year ended December 31, 2022, the Fund engaged in cross-trade sales of $3,768,743 which resulted in a net realized gain of $310,083.