1

Ron Brown

Chairman, President & CEO

Forward Looking Statements

Any forward-looking statements made at this meeting by their nature involve

risks and uncertainties that could significantly impact operations, markets,

products and expected results. For further information, please refer to the

Cautionary Statement included in our most recent Form 10-Q on file with the

Securities and Exchange Commission.

2

Largest and broadest-line manufacturer and supplier of plastics processing equipment,

supplies and services in North America; third largest worldwide

Largest global manufacturer of consumable synthetic industrial fluids used in

metalworking applications

Major manufacturing locations in North America, Europe and Asia

Supplier to over 20,000 plastics processing and metalworking customers in the

packaging, automotive, industrial components, consumer goods and other end markets

Established, reputable sales and service organization and global distribution network

2003 sales of $740 million; 46% outside the United States

Overview of Milacron

3

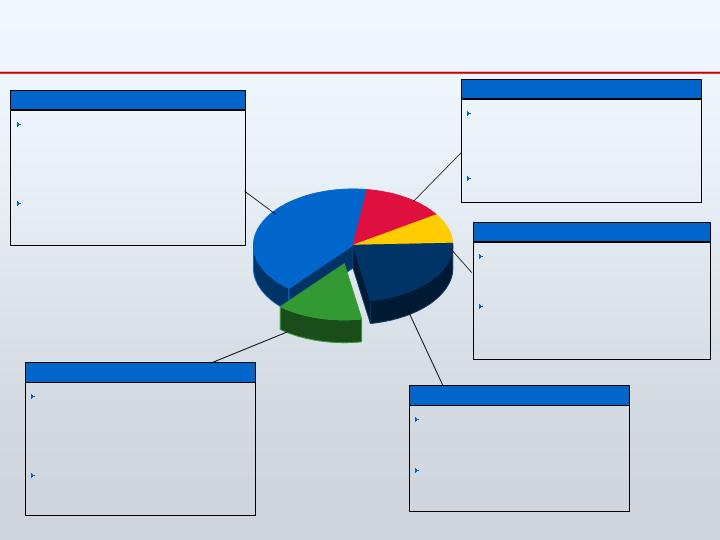

14%

23%

9%

13%

41%

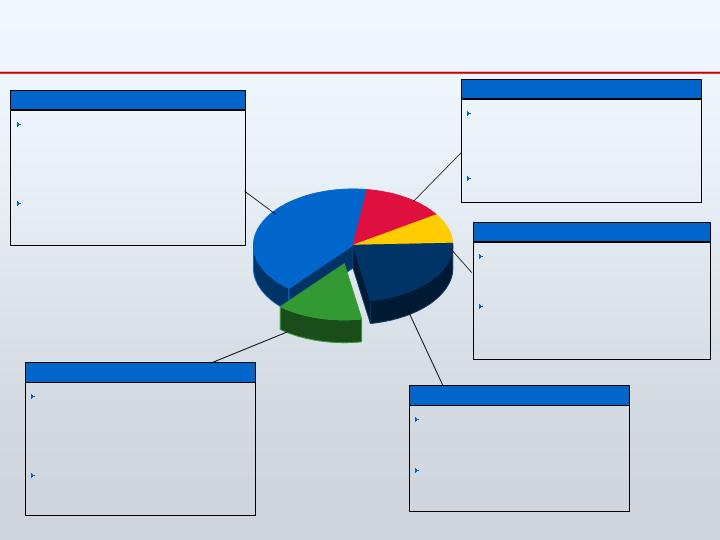

Comprehensive Product Offering

2003 Revenues

$740 million

Injection Molding Machinery

Applications: wide array of plastic

products, including automotive

components, toothbrushes, computer

devices, mobile phones, toys, medical

equipment and DVDs

Key end markets: automotive, medical

consumer goods, packaging and

appliances

Blow Molding Machinery

Applications: hollow and semi-hollow

plastic products for food containers,

automotive parts, outdoor furniture and

playground equipment

Key end markets: automotive, packaging

and housewares

Extrusion Machinery

Applications continuous profile plastic

products such as pipe, siding, decking,

fencing, and window and door frames

Key end markets: construction

materials, packaging and medical

Mold Technologies

Mold bases, hot runner systems,

components and supplies used with

injection molding machinery

Key end markets: plastics injection

molders, die sets and custom

molders

Coolants, lubricants, forming fluids,

process cleaners and corrosion

inhibitors used in the machining,

grinding, pressing or stamping of metal

parts

Key end markets: automotive,

industrial machinery, aerospace and

appliances

Industrial Fluids

4

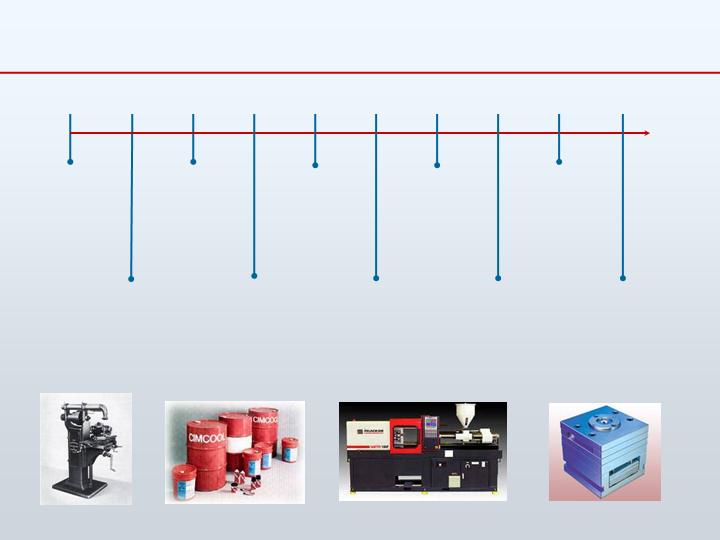

Small

machine

shop

Initial Public

Offering

(NYSE)

Pioneered

industry’s first

water-based

metalworking

fluids

1860

1947

2004

2002

Entered mold

technologies

market

Began

restructuring of

operations

The Evolution of Milacron

Entered plastics

injection molding

market

Entered

container

blowmolding

market / Exited

machine tools

1996

1968

1946

1998

Completed

operational

restructuring

2001

Exited cutting

tools

1971

Entered

plastics

extrusion

market

5

Key Strategies Going Forward

Grow Revenue – Focus on Organic Growth

Leverage our technology and service for key end markets

Maximize aftermarket parts and services opportunity

Expand our presence in emerging markets

Chinese joint-venture announced April 28

Drive Profitability and Cash Flow to Delever Balance Sheet

Leverage our low cost manufacturing base in Asia and Eastern Europe

Continue global implementation of Lean and Six Sigma strategies

Drive strategic sourcing initiatives

Margins expansion through selective price increases

Reduce primary working capital to 15% of sales (currently 23%)

6

Milacron is a market leader and the only full line supplier of plastics

processing machinery.

Not dependent on any one customer or end market.

Leading indicators suggest recovery is underway; new order trends are

promising.

Well positioned to capitalize on a rebound with improved cost structure

and more flexible capital structure.

Emerging from the bottom of the cycle.

$100 million of mandatorily convertible preferred equity from Glencore

and Mizuho.

Milacron: A Compelling Story

Market

Leadership

Strong Industry

and Business

Trends

Significant

Upside

Diverse

Business

Profile

Attractively

Positioned for

Rebound

Restructured

Balance Sheet

7

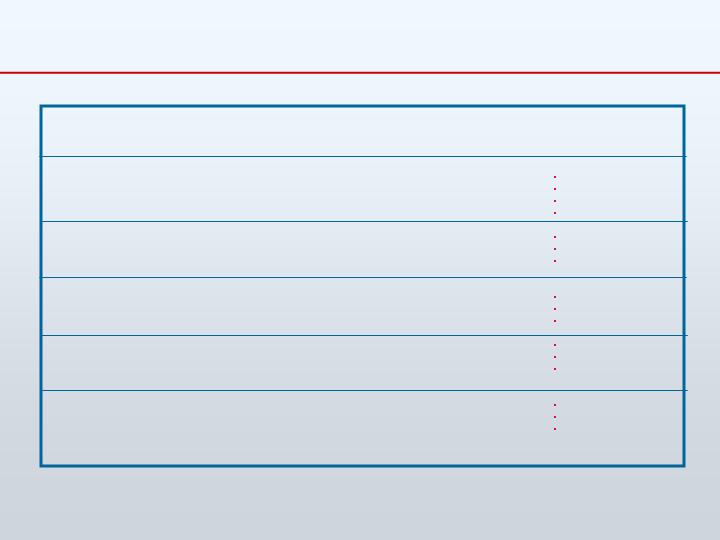

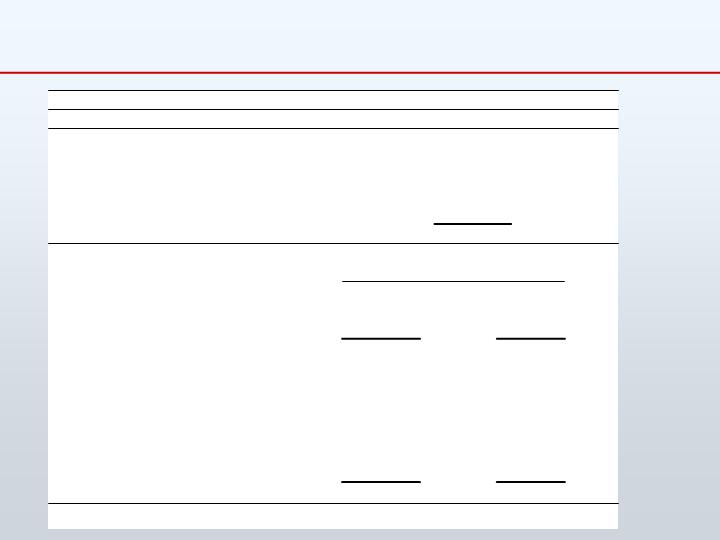

Milacron Maintains Leading Positions

Product

Line

MPM (Mannesmann)

Engel

Husky

Toshiba

SIG

Bekum

Graham Engineering

Davis Standard

Kraus Maffei (MPM)

Battenfeld (SMS)

Futaba

Hasco

Moldmasters

Castrol

Fuchs

Quaker

#3

#3

(Non-Pet)

____

#2

#2

(Synthetic)

#1

#1

(Non-Pet)

#1

(Twin Screw)

#1

#2

(Synthetic)

Injection Molding

Machinery

Blow Molding

Machinery

Extrusion

Machinery

Mold

Technologies

Industrial

Fluids

Estimated Position

North America Global

Primary

Competitors

8

Market Shares Supported By

Unique Core Competencies

Only true full-line supplier of machinery to the plastics processing

industry

Recognized leader in many plastics processing applications

Substantial R&D drives innovative products and solutions,

enhancing customer quality, productivity and profitability

Recognized technological leader in key products, including:

All-electric injection molding machinery

Multi-component and co-injection technology

High-performance synthetic and semi-synthetic fluids

Application engineering for highly customized processing solutions

24/7 product and technical support and remote diagnostics

Direct sales and service forces in North America, Europe and Asia

Significant

Product Breadth

Industry Leading

Technology

Reputable Customer

Service and

Support

9

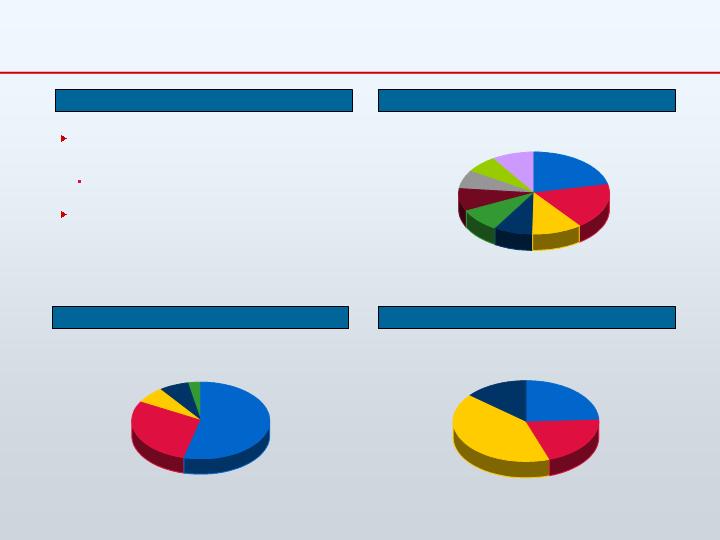

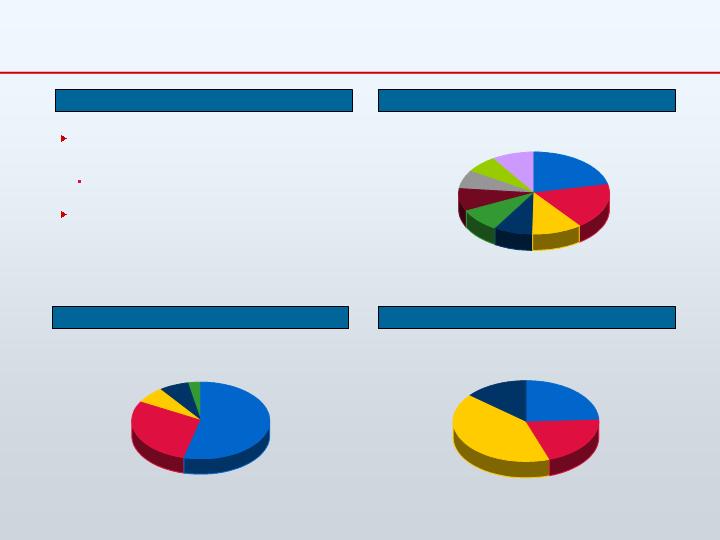

10

5,000 machinery customers

Serve in excess of 20,000 customers

No customer accounted for more than 2%

of sales in 2003 and top 10 accounted for

less than 10% of sales

End Market Diversity

Geographic Diversity

Product Diversity

14%

Industrial Fluids

41%

Machinery

21%

Aftermarket

Services &

24%

Durables

Customer Diversity

Diverse Business Profile

Packaging

22%

Automotive

18%

Components

11%

Consumer Goods

8%

Building

Materials

9%

Custom

Molders

9%

Medical

7%

Appliance

7%

Other

9%

United States

54%

Europe

29%

Canada &

Mexico

7%

Asia

7%

ROW

3%

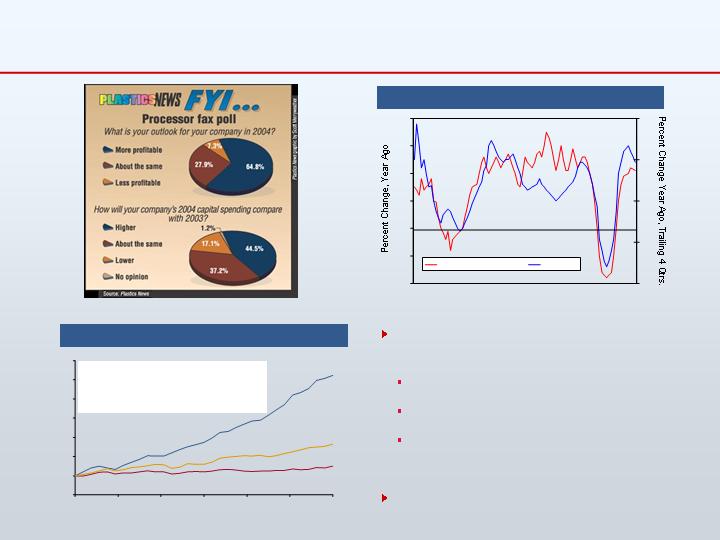

Drivers of a Plastics Machinery Recovery

Average age of existing plastics machinery estimated at 10+ years.

Today’s machines are more energy efficient and productive.

Plastics manufacturers need to be cost effective and cannot remain competitive

with antiquated machines.

Capacity is being stretched in certain end markets.

Average utilization rates approaching 84%.

Plastics processors’ earnings and cash flow continue to improve, enabling new

investment.

Continual conversion of manufacturing materials to plastics away from metal, wood,

glass, etc.

11

Beginning of Cyclical Recovery

Historical Capacity Utilization — Plastics Processors

In every cycle to date, industry sales have recovered beyond previous peak levels by

the peak of the next cycle.

Macro-economic and Milacron-specific data suggest that the plastics processing market

is poised for a recovery in the near-term:

Increased demand for Milacron’s machinery products has historically lagged two to

three quarters behind broader recovery in plastic part production.

Capacity utilization of 84% and higher has historically led to a strong pickup in

equipment orders/sales.

Source: Federal Reserve.

April 04: 83.1%

12

13

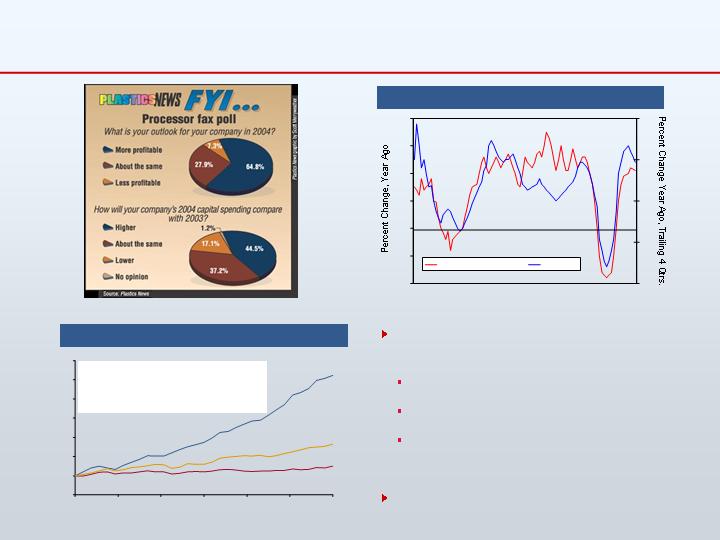

Plastics processors are optimistic about

2004:

65% expect a more profitable year.

Over 40% expect to add staff.

82% will spend equal or more on capital

expenditures in 2004.

As earnings improve, increased capital

spending should follow.

Plastics

Aluminum

Steel

2%

3%

4%

02 (5 Years)

-

1997

0%

2%

4%

02 (15 Years)

-

1986

1%

3%

6%

02 (32 Years)

-

1970

STEEL

ALUMINUM

PLASTICS

PERIOD

TH RATE

COMPOUND ANNUAL GROW

Source: APME

Capital Spending versus Earnings

Indexed Global Plastics Production

Sources: BEA (Bureau of Economic Analysis), Merrill Lynch

Positive Outlook and Long-term Trends

For Plastics Machinery Spending

-10

-5

0

5

10

15

20

-40

-20

0

20

40

Capital Spending ( L )

EPS ( R )

88

90

92

94

96

98

00

02

0

100

200

300

400

500

600

700

1970

1975

1980

1986

1991

1996

2002

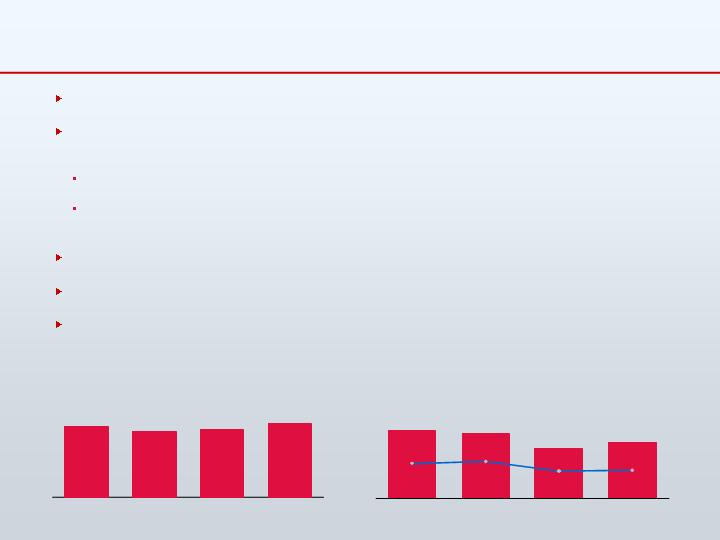

Industrial Fluids Business

Industrial Fluids Sales

($ in millions)

Industrial Fluids Segment EBIT

($ in millions)

14

Coolants, lubricants, fluids used in machining, grinding and other processes.

Despite a pronounced industry downturn, the industrial fluids segment has maintained its revenue

stream and margins.

Broad use and consumable nature of manufacturing fluid products result in operating stability.

While customers typically delay equipment purchases in a recession, their existing machinery

(and thus Milacron's industrial fluids) is still used to manufacture products.

In 2003, Industrial Fluids generated segment EBIT of $15.7 million.

During the deep manufacturing recession from 2000 to 2003 the business remained stable.

Operates as an independent, stand-alone business.

Remains a Strong, Stable Cash Flow Contributor

2003

2002

2001

2000

$101

$93

$96

$104

$18

$18

$14

$16

15%

15%

19%

18%

2000

2001

2002

2003

9 manufacturing facilities closed since 2000

Approximately 40% reduction in direct labor and

approximately 30% reduction in indirect staffing since 2000

Divested non-core assets (metalworking tools)

Continue to leverage technology and service

Leading positions in all product segments

Implemented Lean and Six Sigma programs

Reduced inventory by $129 million from Q1 2001 to Q1 2004

Improved capital structure

$280 million reduction in debt from 12/31/01 to 12/31/03

$100 million equity infusion to further reduce debt

Well Positioned To Capitalize On Rebound

Rationalized

Operations

Renewed Focus

On Core

Competencies

Strong Market

Position

Increased

Operating

Efficiency

Improved

Financial

Profile

15

Financial Review

Bob Lienesch

Vice President – Finance and CFO

16

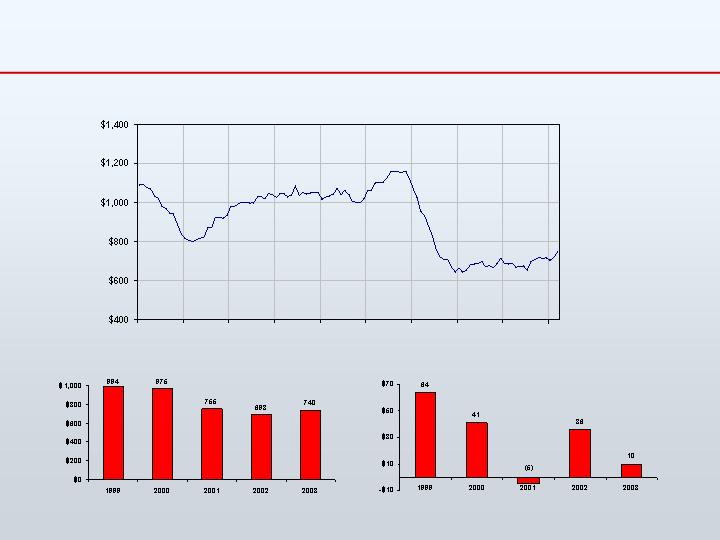

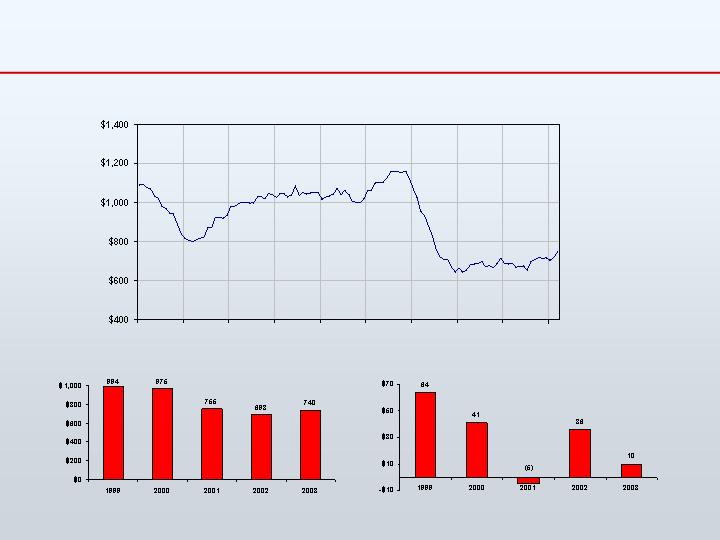

Effects of Manufacturing Recession

U.S. Injection Machinery – SPI Industry New Business

12 Month Moving Total

1995 1996 1997 1998 1999 2000 2001 2002 2003

Milacron Revenues

(In millions)

(In millions)

(In millions)

Cash Flow from Operations

17

Restructuring Is Driving Material

Employee Reductions

18

Improvements

Since 2000, focus has been on improving overall cost structure and operating efficiency:

Increased efficiencies from Lean & Six Sigma (e.g. $129 million in inventory reduction)

9 plants (420,000 sq. ft.) closed; production moved to more efficient facilities

Approximately 1,700 employee reductions: approximately 40% reduction in direct labor;

approximately 30% reduction in overhead staffing

Today, Milacron is seeing substantial benefits:

$49 million of annual restructuring cost benefits realized in 2003

$20 million of incremental benefits in 2004 from 2003 initiatives

$69 million of annual restructuring cost benefits is being realized in 2004

Note: Represents Milacron employees at year end.

5,203

3,513

3,967

4,474

2000

2001

2002

2003

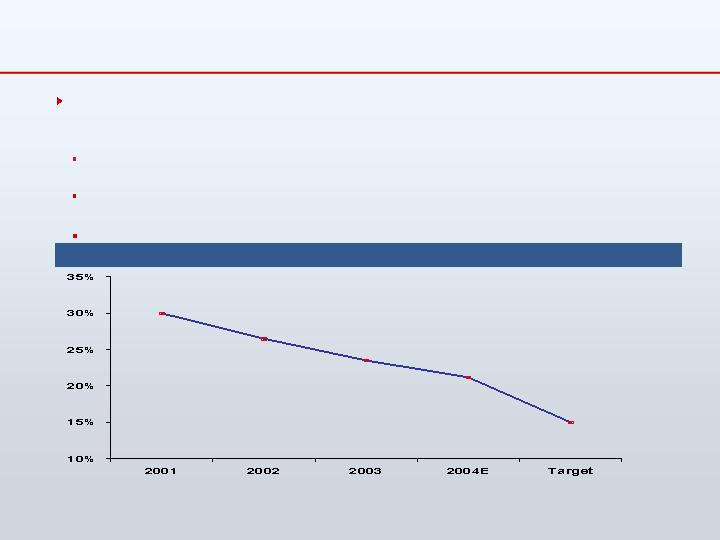

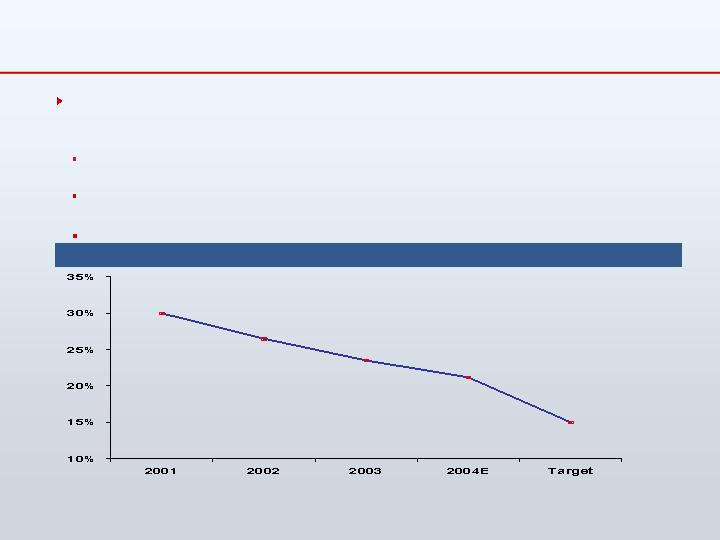

Significant Primary Working Capital Improvement

Continued focus on primary working capital(1) has resulted in supplemental free cash

flow throughout downturn:

Strategic sourcing

Lean manufacturing techniques (reduction of lead times)

Management incentives based on primary working capital targets level

Primary Working Capital (as % of Sales)

Note: Represents Primary Working Capital at year-end.

(1) Primary working capital defined as Inventory + Accounts Receivable – Accounts Payable – Advance Payments.

30.0%

26.5%

23.5%

21.2% Est.

15%

19

First Quarter 2004 Results In Line With Estimates

Sales were off 6% (excluding currency), largely due to refinancing uncertainties.

Earnings comparisons were penalized $4 million from sales decline and $2 million from increased

pension and insurance.

Earnings in 2004 were positively impacted by over $7 million of restructuring savings and $1 million

of savings from Lean and strategic sourcing initiatives.

2004 Operating Earnings guidance of $25 - $33 million is on track. (See page 21.)

5.7

5.0 - 6.0

5.3

Depreciation & Amortization

0.9

(3.0) - 3.0

0.5

Adjusted Operating Earnings

6.0

1.1

Restructuring Costs

6.4

Refinancing Costs

$ (5.1)

$ (7.0)

Operating Loss

$ 190.2

$182 - $192

$ 188.9

Sales

Actual

Guidance

Actual

Q1 2003

Q1 2004

($ in millions)

20

Confidence in 2004 Guidance

* Excludes restructuring and refinancing costs. See page 38.

$ 33

To

$ 25

Estimated 2004 Operating Earnings*

4

8

(+/-) Other

(10)

(10)

(-) Pension & Insurance

11

1

(+) Volume & Mix

22

20

(+) Restructuring Initiatives

$ 6

$ 6

Adjusted 2003 Operating Earnings*

$ 805

To

$ 785

2004 Sales

High

Low

Guidance

$ 6

Adjusted 2003 Operating Earnings*

2

Refinancing Costs

27

Restructuring Costs

66

Goodwill Charge

$ (89)

2003 Operating Loss

($ in millions)

21

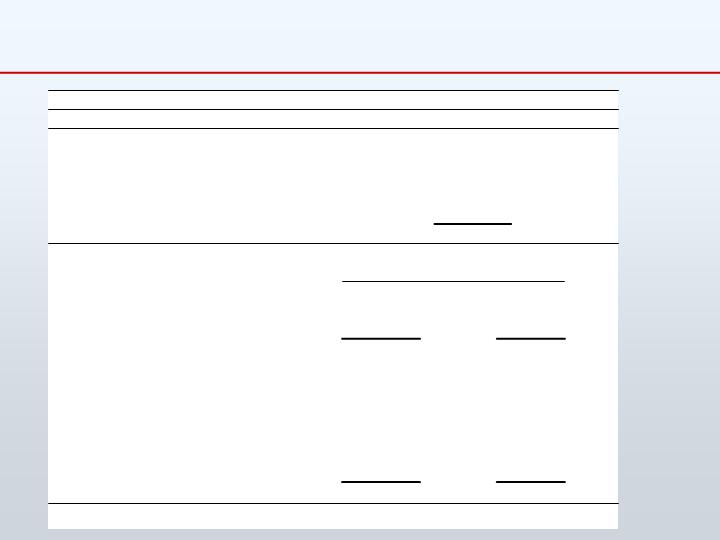

Refinancing and Proposals for Shareholder Approval

22

Capital Structure Transformation

Before Refinancing

$200 million in debt obligations maturing March 2004

$115 million 8-3/8% Senior Notes

Revolving credit facility ($54 million outstanding)

Accounts receivable liquidity facility ($30 million utilized)

Additional debt maturing in 2005

€115 million 7-5/8% Eurobonds due April 2005

Negative book equity – 35 million diluted common shares outstanding

After Refinancing (subject to shareholder approval)

All $200 million (‘04) and €115 million (‘05) debt obligations repaid (or funds

escrowed)

New $75 million asset-based loan provides liquidity

New $225 million long-term debt provides long-term financing

New $100 million mandatorily convertible preferred stock provides equity base

Positive book equity – 85 million diluted common shares outstanding

23

New Debt Securities

Senior Secured Notes - $225 M

Due 2011

11-1/2% coupon – discounted to yield 12%

Release of proceeds from escrow subject to conditions requiring

shareholder approval

Anticipated Asset-Based Revolving Credit Facility - $75 M

Being negotiated

Due 2008 with optional one-year extension

Libor + spread (275 bps initially)

Subject to conditions requiring shareholder approval

24

New Glencore / Mizuho Securities

$100 M investment

Initial investment in exchangeable debt securities

Upon shareholder approval of new shares and refinancing of Eurobonds,

exchangeable into convertible preferred stock

Two debt securities

$30 M Series A debt convertible into 15 M common shares (converted 4/15/04)

$70 M Series B debt

Terms of debt securities

With shareholder approval by 7/29/04:

6% interest

Without shareholder approval by 7/29/04:

20+% interest

Creates default

25

New Glencore / Mizuho Securities – continued

New $100 M convertible preferred stock (subject to shareholder approval)

6% (or 8% PIK) dividend rate

Convertible into 50 M common shares at $2.00 per share

Conversion price may be reset to $1.75; potential for 1M contingent warrants

Proceeds from a rights offering at $2.00 per share may be used to call up to

$30 M of the convertible preferred stock

Incremental portions may be called after four years over time at a premium

May be converted to common stock prior to seven years at holders’ option

Automatic conversion to common stock in seven years

Corporate governance

Glencore / Mizuho can elect board members proportionate to ownership

Presently one Glencore representative on the board and currently standing

for election to a three-year term

26

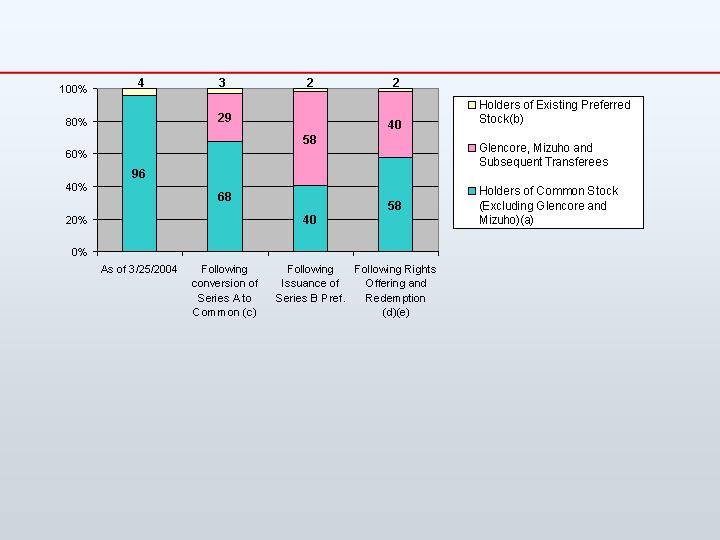

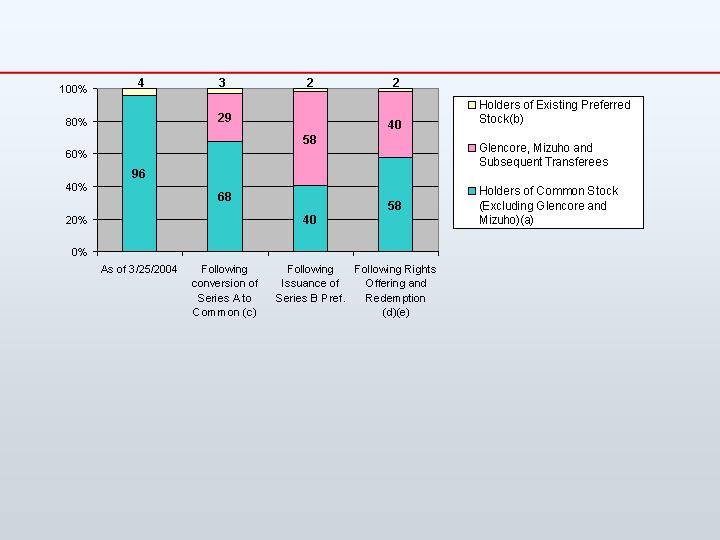

Voting Power

(a)

Holders of common stock are entitled to one vote per share held.

(b)

Holders of existing preferred stock are entitled to 24 votes per share.

(c)

On April 15, 2004, Glencore and Mizuho converted the entire $30 million of Series A Notes into

15 million shares of common stock.

(d)

Assumes no pay-in-kind dividends on the Series B Preferred Stock have been paid.

(e)

Assumes full subscription of the rights offering and the Board elects to redeem 150,000 shares

of Series B Preferred Stock with the proceeds.

27

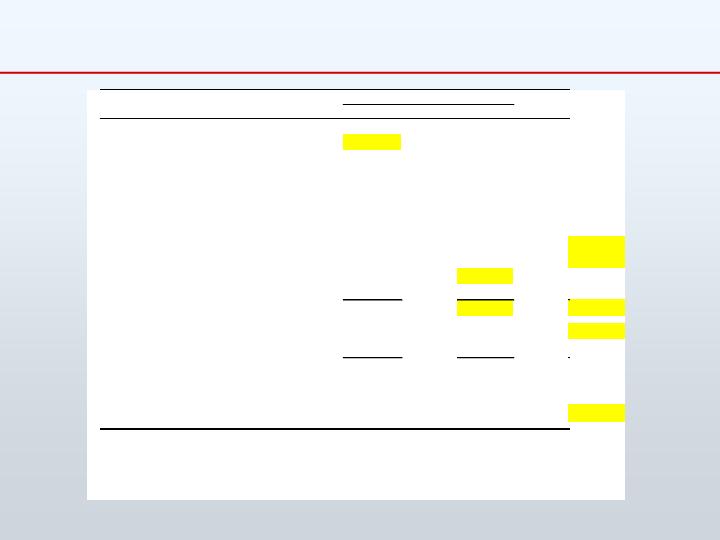

Pro Forma Capitalization

28

12/31/03

3/31/04

Total Cash

92.8

$

62.0

$

Accounts Receivables Facility

33.0

-

Debt:

Old Revolver

42.0

-

Bridge Credit Facility

-

82.5

U.S. Notes

115.0

-

Eurobonds

142.6

139.4

New ABL

-

-

Senior Secured Notes

-

-

Exchangeble Notes

-

102.9

Capitalized Leases & Other

23.8

23.3

Total Debt

323.4

348.1

Series B Preferred Stock

-

-

Other Shareholders' Equity

(1)

(33.9)

(43.4)

Total Equity

(33.9)

(43.4)

Total Capitalization

289.5

304.7

Liquidity

(2)

103.7

97.5

(1) Includes existing 4% cumulative preferred stock ($6 million)

(2) Liquidity = Borrowing Base + Total Cash - Amount Drawn on ABL - Letters of Credit - Minimum Availability

As Reported

If Refinancing Proposals Are Not Approved

Significant increase in the interest payable on $70 million of debt

Default under certain financial agreements totaling more than $175 million

Cross-default on other debt

If defaulted debt is accelerated, company would not have sufficient cash to satisfy

Ability to borrow would be greatly restricted, causing severe liquidity problems

these obligations

29

If Refinancing Proposals Are Approved

Glencore and Mizuho will exchange their securities for 500,000 shares of Series B

Preferred Stock.

The interest payable on the Glencore and Mizuho debt will be retroactively reset

from 20% to 6%.

The new asset-based facility will be available.

The proceeds from the $225 million notes offering will be released from escrow.

The bridge credit facility will be repaid.

The tendered Eurobonds will be repaid (or funds escrowed) and…

…The refinancing will be completed on June 10.

30

From the Proxy

1.

To approve the following proposals necessary to implement the Refinancing Transactions (as

defined in this Proxy Statement):

a.

An amendment to the Company’s restated certificate of incorporation (the “Certificate of

Incorporation”) to increase the amount of authorized common stock of the Company;

b.

An amendment to the Certificate of Incorporation to decrease the par value of the common

stock;

c.

An amendment to the Certificate of Incorporation to delete the requirement that all shares of

any series of serial preference stock be identical in all respects;

d.

The issuance of a new series of the Company’s serial preference stock (the “Series B

Preferred Stock”);

e.

The issuance of the Contingent Warrants (as defined in this Proxy Statement); and

f.

The issuance of common stock in conjunction with a Rights Offering;

2.

To approve amendments to the Certificate of Incorporation to allow the Series B Preferred

Stock to be senior to the Company’s 4% Cumulative Preferred Stock in right of dividends and

payment upon liquidation;

3.

To approve an amendment to the Certificate of Incorporation to exempt the new Series B

Preferred Stock from the Net Asset Test (as defined in this Proxy Statement);

4.

To approve an amendment to the Certificate of Incorporation to decrease the par value of the

serial preference stock of the Company;

31

From the Proxy

5.

To elect three directors to the Company’s Board of Directors;

6.

To approve a proposed 2004 Long-Term Incentive Plan;

7.

To ratify the appointment of Ernst & Young LLP as independent auditors of the Company for

fiscal year 2004;

8.

To vote on one proposal submitted by shareholder Stephen A. Sawzin.

32

With Shareholder Approval,

Milacron Is Well Positioned to Participate in the Recovery

Leading market position in all product segments

Operations rationalized over the past three years

Increased operating efficiency with Lean and Six Sigma programs

Significantly reduced cost structure with good operating leverage

Financial profile dramatically improved with implementation of refinancing plan

33

Appendix

34

Proposals to Complete Refinancing

1(a) Authorize up to 165 M common shares

Allows conversion of Series B preferred stock.

Creates reserve of stock for contingent warrants.

Allows issuance of stock in a rights offering.

Creates reserve of stock for employee stock options.

1(b) Decrease par value of common shares to $.01

Allows exercise of warrants at $.01 per share.

Provides greater flexibility in paying dividends.

1(c) Delete requirement that all shares of any series be identical

Required to allow new Series B preferred stock to have additional voting rights and information rights.

1(d) Approve issuance of Series B preferred stock

Required by NYSE shareholder approval policy.

Allows issuance of new convertible preferred stock.

1(e) Approve issuance of contingent warrants

Required by NYSE shareholder approval policy.

Allows issuance of contingent warrants.

35

Proposals to Complete Refinancing

1(f) Approve issuance of stock in rights offering

Allows issuance of approximately 15 million common shares to previously existing shareholders.

Allows existing shareholders to participate in the recapitalization of the company.

2 Allow Series B preferred stock to be senior to existing

preferred stock

Removes impediments to the company’s ability to optionally redeem Series B preferred shares

with the proceeds of the rights offering.

3 Delete Net Asset Test

Removes restrictions on stock redemption and dividend payments.

4 Decrease par value of serial preference stock to $.01

Removes restrictions on dividend payments.

36

Other Proposals at Milacron’s 2004 Annual Meeting

5 Election of Directors

6 Approval of Long-Term Incentive Plan

7 Ratification of Independent Auditors

8 Shareholder Proposal

David L. Burner, former Chairman and CEO, Goodrich Corporation

Steven N. Isaacs, Chairman and Managing Director, Glencore Finance AG

Joseph A. Steger, President Emeritus, University of Cincinnati

Attract, retain and motivate key employees.

Ernst & Young LLP

The board recommends voting against this proposal.

37

Guidance – April 26, 2004

38

Quarter Ended

Year Ended

(In millions)

June 30, 2004

Dec. 31, 2004

Projected profit & loss items

Sales

$190 - 205

$785 - 805

Total plastics technologies

160 - 175

675 - 690

Industrial fluids

26 - 28

110 - 115

Segment earnings

Total plastics technologies

3 - 6

26 - 31

Industrial fluids

2 - 4

14 - 16

Corporate and unallocated expenses

(1)

3 - 4

14 - 15

Restructuring charges

1 - 2

2 - 3

Projected cash flow & balance sheet items

Depreciation

5 - 6

20 - 22

Working capital - increase (decrease)

(2)

2 - (2)

0 - (10)

Capital expenditures

3 - 5

14 - 17

Cash restructuring

3 - 4

7 - 8

1

Corporate and unallocated expenses

Includes corporate expenses and ongoing financing costs.

2

Working capital

= inventory + receivables - trade payables - advance billings