| | |

| | Over 40 Years of Reliable Investing™ |

Davis New York Venture Fund, Inc.

Davis Global Fund

Davis International Fund

March 1, 2013

PROSPECTUS

Class A shares

Class B shares

Class C shares

Class Y shares

Tickers:

Davis Global Fund: Class A–DGFAX, Class B–DGFBX, Class C–DGFCX, Class Y–DGFYX

Davis International Fund: Class A–DILAX, Class B–DILBX, Class C–DILCX, Class Y–DILYX

The Securities and Exchange Commission has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

This Prospectus contains important information. Please read it carefully before investing and keep it for future reference.

No financial adviser, dealer, salesperson or any other person has been authorized to give any information or to make any representations, other than those contained in this Prospectus, in connection with the offer contained in this Prospectus and, if given or made, such other information or representations must not be relied on as having been authorized by the Funds, the Funds’ investment adviser or the Funds’ distributor.

This Prospectus does not constitute an offer by the Funds or by the Funds’ distributor to sell or a solicitation of an offer to buy any of the securities offered hereby in any jurisdiction to any person to whom it is unlawful for the Funds to make such an offer.

TABLEOF

CONTENTS

DAVIS

GLOBAL FUND

Investment objective

Davis Global Fund’s investment objective is long-term growth of capital.

Fees and Expenses of Davis Global Fund

These tables describe the fees and expenses that you may pay if you buy and hold shares of Davis Global Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Davis Funds. More information about these and other discounts is available from your financial professional and in the “How to Choose a Share Class, Class A Shares” section of the Fund’s statutory prospectus on page x and in the “Selecting the Appropriate Class of Shares” section of the Fund’s statement of additional information on page 20.

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | | | | | | | | | |

| | | Class A

shares | | Class B

shares | | Class C

shares | | Class Y

shares |

Maximum sales charge (load) imposed on purchases

(as a percentage of offering price) | | | | 4.75% | | | | | None | | | | | None | | | | | None | |

Maximum deferred sales charge (load) imposed on redemptions

(as a percentage of the lesser of the net asset value of the shares redeemed or the total cost of such shares. Only applies to Class A shares if you buy shares valued at $1 million or more without a sales charge and sell the shares within one year of purchase) | | | | 0.50% | | | | | 4.00% | | | | | 1.00% | | | | | None | |

Redemption Fee

(as a percentage of total redemption proceeds on shares redeemed or exchanged within 30 days) | | | | 2.00% | | | | | 2.00% | | | | | 2.00% | | | | | 2.00% | |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | | | | | | | | | |

| | | Class A

shares | | Class B

shares | | Class C

shares | | Class Y

shares |

Management Fees | | | | 0.55% | | | | | 0.55% | | | | | 0.55% | | | | | 0.55% | |

Distribution and/or service (12b-1) Fees | | | | 0.15% | | | | | 1.00% | | | | | 1.00% | | | | | 0.00% | |

Other Expenses | | | | 0.35% | | | | | 0.86% | | | | | 0.44% | | | | | 0.20% | |

Total Annual Fund Operating Expenses | | | | 1.05% | | | | | 2.41% | | | | | 1.99% | | | | | 0.75% | |

Less Fee Waiver or Expense Reimbursement | | | | 0.00% | | | | | (0.11)% | | | | | 0.00% | | | | | 0.00% | |

Net Expenses | | | | 1.05% | | | | | 2.30% | | | | | 1.99% | | | | | 0.75% | |

| (1) | The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses (Class A shares, 1.30%; Class B shares, 2.30%; Class C shares, 2.30%; Class Y shares, 1.05%) until March 1, 2014. After that date, there is no assurance that the Adviser will continue to cap expenses. The expense cap cannot be terminated prior to March 1, 2014, without the consent of the board of directors. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 4

This Example assumes that you invest $10,000 in Davis Global Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | | | | | | | | | | | | | |

| If you sell your shares in: | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class A shares | | | $ | 577 | | | | $ | 793 | | | | $ | 1,027 | | | | $ | 1,697 | |

Class B shares | | | $ | 644 | | | | $ | 1,051 | | | | $ | 1,485 | | | | $ | 2,247 | |

Class C shares | | | $ | 302 | | | | $ | 624 | | | | $ | 1,073 | | | | $ | 2,317 | |

Class Y shares | | | $ | 77 | | | | $ | 240 | | | | $ | 417 | | | | $ | 930 | |

| | | | | | | | | | | | | | | | | | | | |

You would pay the following expenses if you did not redeem your

shares: | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class A shares | | | $ | 577 | | | | $ | 793 | | | | $ | 1,027 | | | | $ | 1,697 | |

Class B shares | | | $ | 244 | | | | $ | 751 | | | | $ | 1,285 | | | | $ | 2,247 | |

Class C shares | | | $ | 202 | | | | $ | 624 | | | | $ | 1,073 | | | | $ | 2,317 | |

Class Y shares | | | $ | 77 | | | | $ | 240 | | | | $ | 417 | | | | $ | 930 | |

Portfolio Turnover

Davis Global Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 43% of the average value of its portfolio.

Principal Investment Strategies

Davis Selected Advisers, L.P. (“Davis Advisors” or the “Adviser”), the Fund’s investment adviser, uses the Davis Investment Discipline to invest Davis Global Fund’s portfolio principally in common stocks (including indirect holdings of common stock through depositary receipts) issued by both United States and foreign companies, including countries with developed or emerging markets. The Fund may invest in large, medium, or small companies without regard to market capitalization. The Fund will invest significantly (at least 40%of total assets under normal market conditions and at least 30% of total assets if market conditions are not deemed favorable) in issuers: (i) organized or located outside of the U.S.; (ii) whose primary trading market is located outside the U.S.; or (iii) doing a substantial amount of business outside the U.S., which the Fund considers to be a company that derives at least 50% of its revenue from business outside the U.S. or has at least 50% of its assets outside the U.S. Under normal market conditions the Fund will invest in issuers representing at least three different countries.

Davis Investment Discipline. Davis Advisors manages equity funds using the Davis Investment Discipline. Davis Advisors conducts extensive research to try to identify businesses that possess characteristics that Davis Advisors believes foster the creation of long-term value, such as proven management, a durable franchise and business model, and sustainable competitive advantages. Davis Advisors aims to invest in such businesses when they are trading at discounts to their intrinsic worth. Davis Advisors emphasizes individual stock selection and believes that the ability to evaluate management is critical. Davis Advisors routinely visits managers at their places of business in order to gain insight into the relative value of different businesses. Such research, however rigorous, involves predictions and forecasts that are inherently uncertain. After determining which companies Davis

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 5

Advisors believes the Fund should own, Davis Advisors then turns its analysis to determining the intrinsic value of those companies’ equity securities. Davis Advisors seeks equity securities which can be purchased at attractive valuations relative to their intrinsic value. Davis Advisors’ goal is to invest in companies for the long term (In fiscal year 2012 the portfolio turnover ratio indicted that the Fund held companies for an average of 2.3 years). Davis Advisors considers selling a company’s equity securities if the securities’ market price exceeds Davis Advisors’ estimates of intrinsic value, or if the ratio of the risks and rewards of continuing to own the company’s equity securities is no longer attractive.

Principal Risks of Investing in Davis Global Fund

You may lose money by investing in Davis Global Fund. Investors in the Fund should have a long-term perspective and be able to tolerate potentially sharp declines in value. The principal risks of investing in the Fund are:

Stock Market risk. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices, including the possibility of sharp declines.

Manager risk. Poor security selection or focus on securities in a particular sector, category, or group of companies may cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective.

Common Stock risk. Common stock represents an ownership position in a company. An adverse event may have a negative impact on a company and could result in a decline in the price of its common stock. Common stock is generally subordinate to an issuer’s other securities, including preferred, convertible, and debt securities.

Foreign Country risk. Foreign companies may be subject to greater risk as foreign economies may not be as strong or diversified, foreign political systems may not be as stable, and foreign financial reporting standards may not be as rigorous as they are in the United States.

Emerging Market risk. The Fund invests in emerging or developing markets. Securities of issuers in emerging and developing markets may offer special investment opportunities, but present risks not found in more mature markets.

Foreign Currency risk. Securities issued by foreign companies in foreign markets are frequently denominated in foreign currencies. The change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency.

Depositary Receipts risk. Depositary receipts, including American Depositary Receipts, European Depositary Receipts, and Global Depositary Receipts, are certificates evidencing ownership of shares of a foreign issuer. These certificates are issued by depositary banks and generally trade on an established market in the United States or elsewhere. The underlying shares are held in trust by a custodian bank or similar financial institution in the issuer’s home country. The depositary bank may not have physical custody of the underlying securities at all times and may charge fees for various services, including forwarding dividends and interest and corporate actions. Depositary receipts are alternatives to directly purchasing the underlying foreign securities in their national markets and currencies. However, depositary receipts continue to be subject to many of the risks associated with investing directly in foreign securities. These risks include foreign exchange risk as well as the political and economic risks of the underlying issuer’s country. Depositary receipts may trade at a discount (or premium) to the underlying security and may be less liquid than the underlying securities listed on an exchange.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 6

Large-Capitalization Companies risk. Companies with $10 billion or more in market capitalization are considered by the Adviser to be large-capitalization companies. Large-capitalization companies generally experience slower rates of growth in earnings per share than do small- and mid-capitalization companies.

Small- and Mid-Capitalization Companies risk. Companies with less than $10 billion in market capitalization are considered by the Adviser to be mid- or small-capitalization companies. Small- and mid-capitalization companies typically have more limited product lines, markets and financial resources than larger companies, and their securities may trade less frequently and in more limited volume than those of larger, more mature companies.

Headline risk. The Fund may invest in a company when the company becomes the center of controversy after receiving adverse media attention concerning its operations, long-term prospects, or management or for other reasons. While Davis Advisors researches companies subject to such contingencies, it cannot be correct every time, and the company’s stock may never recover or may become worthless.

Fees and Expenses risk. The Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund. All mutual funds incur operating fees and expenses. Fees and expenses reduce the return which a shareholder may earn by investing in a fund, even when a fund has favorable performance. A low return environment, or a bear market, increases the risk that a shareholder may lose money.

Your investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, entity or person.

Performance Results

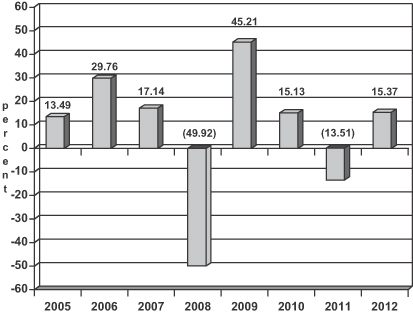

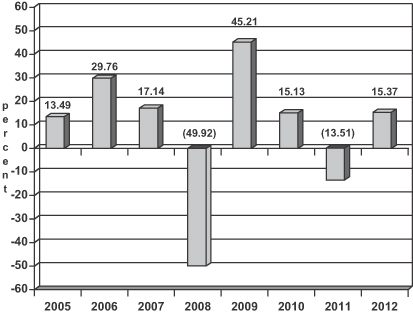

The bar chart below provides some indication of the risks of investing in Davis Global Fund by showing how the Fund’s investment results have varied from year to year. The following table shows how the Fund’s average annual total returns for the periods indicated compare with those of the MSCI ACWI (All Country World Index), a broad-based securities market index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated information on the Fund’s results can be obtained by visitingwww.davisfunds.com or by calling 1-800-279-0279.

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through a tax-deferred arrangement, such as a 401(k) plan or individual retirement accounts.

During the period from inception (December 22, 2004) through December 29, 2006, only the directors, officers and employees of Davis Global Fund or its investment adviser and sub-adviser (and the investment adviser itself and affiliated companies) were eligible to purchase Fund shares.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 7

Davis Global Fund

Annual Total Returns for Class A Shares

for the years ended December 31

(Results do not include sales charge)

Highest/Lowest quarterly results during this time period were:

| | |

| |

| Highest quarter | | 32.48% for the quarter ended June 30, 2009 |

| |

| Lowest quarter | | (22.95%) for the quarter ended December 31, 2008 |

Davis Global Fund Average Annual Total Returns

for the periods ended December 31, 2012 (with maximum sales charge)

| | | | | | | | | | | | | | | |

| | | Past 1 Year | | Past 5 Years | | Life of Class |

Class A shares

return before taxes | | | | 9.92% | | | | | (4.47)% | | | | | 4.36% | |

Class A shares

return after taxes on distributions | | | | 9.79% | | | | | (4.49)% | | | | | 4.28% | |

Class A shares

return after taxes on distributions and sale of fund shares | | | | 6.79% | | | | | (3.65)% | | | | | 3.87% | |

Class B shares

return before taxes | | | | 9.91% | | | | | (5.01)% | | | | | 4.01% | |

Class C shares

return before taxes | | | | 13.29% | | | | | (4.46)% | | | | | 3.96% | |

Class Y shares

return before taxes | | | | 15.74% | | | | | (3.29)% | | | | | (3.07)% | |

| | | | | | | | | | | | | | | | |

MSCI ACWI (All Country World Index)

reflects no deduction for fees, expenses or taxes | | | | 16.13% | | | | | (1.16)% | | | | | 4.56% | |

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 8

Management

Investment Adviser

Davis Selected Advisers, L.P., serves as Davis Global Fund’s investment adviser, and uses a system of multiple portfolio managers in managing the Fund’s assets. The portfolio managers listed below are primarily responsible for the day-to-day management of the Fund’s assets.

Sub-Adviser

Davis Selected Advisers-NY, Inc., a wholly owned subsidiary of the Adviser, serves as the Fund’s sub-adviser.

Portfolio Managers

As of the date of this prospectus, the four portfolio managers listed below manage a substantial majority of the Fund’s assets.

| | | | |

| Portfolio Managers | | Experience with this Fund | | Primary Title with Investment

Adviser or Sub-Adviser |

Stephen Chen | | Since December 2004 | | Vice President,

Davis Selected Advisers-NY, Inc. |

Christopher Davis | | Since December 2004 | | Chairman,

Davis Selected Advisers, L.P. |

Danton Goei | | Since December 2004 | | Vice President, Davis Selected Advisers-NY, Inc. |

Tania Pouschine | | Since December 2004 | | Vice President, Davis Selected Advisers-NY, Inc. |

Purchase and Sale of Fund Shares

After April 30, 2013 Class B Shares will no longer be offered for new purchases. New Class B share account applications will be returned and any investments for existing Class B share accounts that are received after that date will be made in Class A shares of Davis Government Money Market Fund. Investors may continue to exchange Class B Shares of other Davis Funds for Class B Shares of Davis Global Fund and to exchange Davis Global Fund Class B Shares for Class B Shares of other Davis Funds.

| | | | | | | | | | |

| | | Class A, B and C shares | | Class Y shares |

Minimum Initial Investment | | $1,000 | | $5,000,000 |

Minimum Additional Investment | | $25 | | $25 |

You may sell (redeem) shares each day the New York Stock Exchange is open. Your transaction may be placed through your dealer or financial adviser, by writing to Davis Funds c/o State Street Bank and Trust Company, P.O. Box 8406, Boston, MA 02266-8406, telephoning 1-800-279-0279 or accessing Davis Funds’ website (www.davisfunds.com).

Tax Information

If the Fund earns income or realizes capital gains, it intends to make distributions that may be taxed as ordinary income or capital gains by federal, state and local authorities.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Davis Global Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 9

DAVIS

INTERNATIONAL FUND

Investment objective

Davis International Fund’s investment objective is long-term growth of capital.

Fees and Expenses of Davis International Fund

These tables describe the fees and expenses that you may pay if you buy and hold shares of Davis International Fund. You may qualify for sales charge discounts if you and your family invest, or agree to invest in the future, at least $100,000 in Davis Funds. More information about these and other discounts is available from your financial professional and in the “How to Choose a Share Class, Class A Shares” section of the Fund’s statutory prospectus on page 31 and in the “Selecting the Appropriate Class of Shares” section of the Fund’s statement of additional information on page 50.

Shareholder Fees

(fees paid directly from your investment)

| | | | | | | | | | | | | | | | | | | | |

| | | Class A

shares | | Class B

shares | | Class C

shares | | Class Y

shares |

Maximum sales charge (load) imposed on purchases

(as a percentage of offering price) | | | | 4.75% | | | | | None | | | | | None | | | | | None | |

Maximum deferred sales charge (load) imposed on redemptions

(as a percentage of the lesser of the net asset value of the shares redeemed or the total cost of such shares. Only applies to Class A shares if you buy shares valued at $1 million or more without a sales charge and sell the shares within one year of purchase) | | | | 0.50% | | | | | 4.00% | | | | | 1.00% | | | | | None | |

Redemption Fee

(as a percentage of total redemption proceeds on shares redeemed or exchanged within 30 days) | | | | 2.00% | | | | | 2.00% | | | | | 2.00% | | | | | 2.00% | |

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

| | | | | | | | | | | | | | | | | | | | |

| | | Class A shares | | Class B shares | | Class C shares | | Class Y shares |

Management Fees | | | | 0.55% | | | | | 0.55% | | | | | 0.55% | | | | | 0.55% | |

Distribution and/or service (12b-1) Fees | | | | 0.20% | | | | | 1.00% | | | | | 1.00% | | | | | 0.00% | |

Other Expenses | | | | 0.62% | | | | | 2.85% | | | | | 2.33% | | | | | 0.35% | |

Total Annual Fund Operating Expenses | | | | 1.37% | | | | | 4.40% | | | | | 3.88% | | | | | 0.90% | |

Less Fee Waiver or Expense Reimbursement | | | | (0.07)% | | | | | (2.10)% | | | | | (1.58)% | | | | | 0.00% | |

Net Expenses | | | | 1.30% | | | | | 2.30% | | | | | 2.30% | | | | | 0.90% | |

| (1) | The Adviser is contractually committed to waive fees and/or reimburse the Fund’s expenses to the extent necessary to cap total annual fund operating expenses (Class A shares, 1.30%; Class B shares, 2.30%; Class C shares, 2.30%; Class Y shares, 1.05%) until March 1, 2014. After that date, there is no assurance that the Adviser will continue to cap expenses. The expense cap cannot be terminated prior to March 1, 2014, without the consent of the board of directors. |

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 10

This Example assumes that you invest $10,000 in Davis International Fund for the time periods indicated and then redeem all of your shares at the end of those periods. This Example also assumes that your investment has a 5% return each year and the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions, your costs would be:

| | | | | | | | | | | | | | | | | | | | |

| If you sell your shares in: | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class A shares | | | $ | 608 | | | | $ | 888 | | | | $ | 1,189 | | | | $ | 2,043 | |

Class B shares | | | $ | 841 | | | | $ | 1,632 | | | | $ | 2,433 | | | | $ | 3,598 | |

Class C shares | | | $ | 490 | | | | $ | 1,184 | | | | $ | 1,995 | | | | $ | 4,104 | |

Class Y shares | | | $ | 92 | | | | $ | 287 | | | | $ | 498 | | | | $ | 1,108 | |

| | | | | | | | | | | | | | | | | | | | |

You would pay the following expenses if you did not redeem your

shares: | | 1 Year | | 3 Years | | 5 Years | | 10 Years |

Class A shares | | | $ | 608 | | | | $ | 888 | | | | $ | 1,189 | | | | $ | 2,043 | |

Class B shares | | | $ | 441 | | | | $ | 1,332 | | | | $ | 2,233 | | | | $ | 3,598 | |

Class C shares | | | $ | 390 | | | | $ | 1,184 | | | | $ | 1,995 | | | | $ | 4,104 | |

Class Y shares | | | $ | 92 | | | | $ | 287 | | | | $ | 498 | | | | $ | 1,108 | |

Portfolio Turnover

Davis International Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 8% of the average value of its portfolio.

Principal Investment Strategies

Davis Selected Advisers, L.P. (“Davis Advisors” or the “Adviser”), the Fund’s investment adviser, uses the Davis Investment Discipline to invest Davis International Fund’s portfolio principally in common stocks (including indirect holdings of common stock through depositary receipts) issued by foreign companies, including countries with developed or emerging markets. The Fund may invest in large, medium, or small companies without regard to market capitalization. The Fund will invest significantly (at least 40%of total assets under normal market conditions and at least 30% of total assets if market conditions are not deemed favorable) in issuers: (i) organized or located outside of the U.S.; (ii) whose primary trading market is located outside the U.S.; or (iii) doing a substantial amount of business outside the U.S., which the Fund considers to be a company that derives at least 50% of its revenue from business outside the U.S. or has at least 50% of its assets outside the U.S. Under normal market conditions the Fund will invest in issuers representing at least three different countries.

Davis Investment Discipline. Davis Advisors manages equity funds using the Davis Investment Discipline. Davis Advisors conducts extensive research to try to identify businesses that possess characteristics that Davis Advisors believes foster the creation of long-term value, such as proven management, a durable franchise and business model, and sustainable competitive advantages. Davis Advisors aims to invest in such businesses when they are trading at discounts to their intrinsic worth. Davis Advisors emphasizes individual stock selection and believes that the ability to evaluate management is critical. Davis Advisors routinely visits managers at their places of business in order to gain insight into the relative value of different businesses. Such research, however rigorous, involves predictions and forecasts that are inherently uncertain. After determining which companies Davis

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 11

Advisors believes the Fund should own, Davis Advisors then turns its analysis to determining the intrinsic value of those companies’ equity securities. Davis Advisors seeks equity securities which can be purchased at attractive valuations relative to their intrinsic value. Davis Advisors’ goal is to invest in companies for the long term (In fiscal year 2012 the portfolio turnover ratio indicted that the Fund held companies for an average of 12.5 years). Davis Advisors considers selling a company’s equity securities if the securities’ market price exceeds Davis Advisors’ estimates of intrinsic value, or if the ratio of the risks and rewards of continuing to own the company’s equity securities is no longer attractive.

Principal Risks of Investing in Davis International Fund

You may lose money by investing in Davis International Fund. Investors in the Fund should have a long-term perspective and be able to tolerate potentially sharp declines in value. The principal risks of investing in the Fund are:

Stock Market risk. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices, including the possibility of sharp declines.

Manager risk.Poor security selection or focus on securities in a particular sector, category, or group of companies may cause the Fund to underperform relevant benchmarks or other funds with a similar investment objective.

Common Stock risk. Common stock represents an ownership position in a company. An adverse event may have a negative impact on a company and could result in a decline in the price of its common stock. Common stock is generally subordinate to an issuer’s other securities, including preferred, convertible, and debt securities.

Foreign Country risk.Foreign companies may be subject to greater risk as foreign economies may not be as strong or diversified, foreign political systems may not be as stable, and foreign financial reporting standards may not be as rigorous as they are in the United States.

Emerging Market risk.The Fund invests in emerging or developing markets. Securities of issuers in emerging and developing markets may offer special investment opportunities, but present risks not found in more mature markets.

Foreign Currency risk.Securities issued by foreign companies in foreign markets are frequently denominated in foreign currencies. The change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency.

Depositary Receipts risk. Depositary receipts, including American Depositary Receipts, European Depositary Receipts, and Global Depositary Receipts, are certificates evidencing ownership of shares of a foreign issuer. These certificates are issued by depositary banks and generally trade on an established market in the United States or elsewhere. The underlying shares are held in trust by a custodian bank or similar financial institution in the issuer’s home country. The depositary bank may not have physical custody of the underlying securities at all times and may charge fees for various services, including forwarding dividends and interest and corporate actions. Depositary receipts are alternatives to directly purchasing the underlying foreign securities in their national markets and currencies. However, depositary receipts continue to be subject to many of the risks associated with investing directly in foreign securities. These risks include foreign exchange risk as well as the political and economic risks of the underlying issuer’s country. Depositary receipts may trade at a discount (or premium) to the underlying security and may be less liquid than the underlying securities listed on an exchange.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 12

Large-Capitalization Companies risk. Companies with $10 billion or more in market capitalization are considered by the Adviser to be large-capitalization companies. Large-capitalization companies generally experience slower rates of growth in earnings per share than do small- and mid-capitalization companies.

Small- and Mid-Capitalization Companies risk. Companies with less than $10 billion in market capitalization are considered by the Adviser to be mid- or small-capitalization companies. Small- and mid-capitalization companies typically have more limited product lines, markets and financial resources than larger companies, and their securities may trade less frequently and in more limited volume than those of larger, more mature companies.

Headline risk.The Fund may invest in a company when the company becomes the center of controversy after receiving adverse media attention concerning its operations, long-term prospects, or management or for other reasons. While Davis Advisors researches companies subject to such contingencies, it cannot be correct every time, and the company’s stock may never recover or may become worthless.

Fees and Expenses risk.The Fund may not earn enough through income and capital appreciation to offset the operating expenses of the Fund. All mutual funds incur operating fees and expenses. Fees and expenses reduce the return which a shareholder may earn by investing in a fund, even when a fund has favorable performance. A low return environment, or a bear market, increases the risk that a shareholder may lose money.

Your investment in the Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency, entity or person.

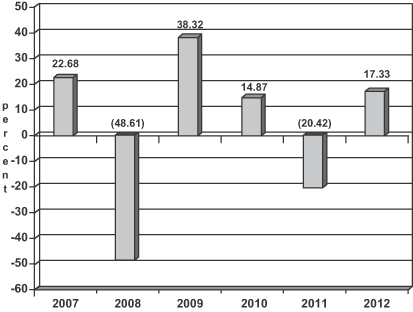

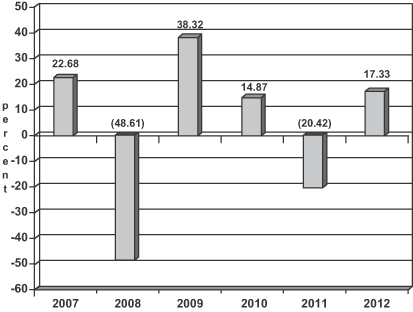

Performance Results

The bar chart below provides some indication of the risks of investing in Davis International Fund by showing how the Fund’s investment results have varied from year to year. The following table shows how the Fund’s average annual total returns for the periods indicated compare with those of the MSCI ACWI (All Country World Index) ex USA, a broad-based securities market index. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated information on the Fund’s results can be obtained by visitingwww.davisfunds.com or by calling 1-800-279-0279.

After-tax returns are shown only for Class A shares; after-tax returns for other share classes will vary. After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown are not relevant to investors who hold their Fund shares through a tax-deferred arrangement, such as a 401(k) plan or individual retirement accounts.

During the period from inception (December 29, 2006) through December 30, 2009, only the directors, officers and employees of Davis International Fund or its investment adviser and sub-adviser (and the investment adviser itself and affiliated companies) were eligible to purchase Fund shares.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 13

Davis International Fund

Annual Total Returns for Class A Shares

for the years ended December 31

Highest/Lowest quarterly results during this time period were:

| | |

| |

| Highest quarter | | 29.52% for the quarter ended June 30, 2009 |

| |

| Lowest quarter | | (24.95%) for the quarter ended September 30, 2011 |

Davis International Fund Average Annual Total Returns

for the periods ended December 31, 2012 (with maximum sales charge)

| | | | | | | | | | | | | | | |

| | | Past 1

Year | | Past 5

Years | | Life of

Class |

Class A shares

return before taxes | | | | 11.75% | | | | | (6.20)% | | | | | (1.90)% | |

Class A shares

return after taxes on distributions | | | | 11.66% | | | | | (6.23)% | | | | | (1.95)% | |

Class A shares

return after taxes on distributions and sale of fund shares | | | | 8.03% | | | | | (5.05)% | | | | | (1.49)% | |

Class B shares

return before taxes | | | | 12.28% | | | | | (6.96)% | | | | | (2.41)% | |

Class C shares

return before taxes | | | | 15.30% | | | | | (6.61)% | | | | | (2.43)% | |

Class Y shares

return before taxes | | | | 17.85% | | | | | N/A | | | | | 2.04% | |

| | | | | | | | | | | | | | | | |

MSCI ACWI (All Country World Index) Index ex USA

reflects no deduction for fees, expenses or taxes | | | | 16.83% | | | | | (2.89)% | | | | | 0.12% | |

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 14

Management

Investment Adviser

Davis Selected Advisers, L.P., serves as Davis International Fund’s investment adviser, and uses a system of multiple portfolio managers in managing the Fund’s assets. The portfolio managers listed below are primarily responsible for the day-to-day management of the Fund’s assets.

Sub-Adviser

Davis Selected Advisers-NY, Inc., a wholly owned subsidiary of the Adviser, serves as the Fund’s sub-adviser.

Portfolio Managers

As of the date of this prospectus, the four portfolio managers listed below manage a substantial majority of the Fund’s assets.

| | | | |

| Portfolio Managers | | Experience with this Fund | | Primary Title with Investment

Adviser or Sub-Adviser |

Stephen Chen | | Since December 2006 | | Vice President,

Davis Selected Advisers-NY, Inc. |

Christopher Davis | | Since December 2006 | | Chairman,

Davis Selected Advisers, L.P. |

Danton Goei | | Since December 2006 | | Vice President,

Davis Selected Advisers-NY, Inc. |

Tania Pouschine | | Since December 2006 | | Vice President,

Davis Selected Advisers-NY, Inc. |

Purchase and Sale of Fund Shares

After April 30, 2013 Class B Shares will no longer be offered for new purchases. New Class B share account applications will be returned and any investments for existing Class B share accounts that are received after that date will be made in Class A shares of Davis Government Money Market Fund. Investors may continue to exchange Class B Shares of other Davis Funds for Class B Shares of Davis International Fund and to exchange Davis International Fund Class B Shares for Class B Shares of other Davis Funds.

| | | | | | | | | | |

| | | Class A, B and C shares | | Class Y shares |

Minimum Initial Investment | | $1,000 | | $5,000,000 |

Minimum Additional Investment | | $25 | | $25 |

You may sell (redeem) shares each day the New York Stock Exchange is open. Your transaction may be placed through your dealer or financial adviser, by writing to Davis Funds c/o State Street Bank and Trust Company, P.O. Box 8406, Boston, MA 02266-8406, telephoning 1-800-279-0279 or accessing Davis Funds’ website (www.davisfunds.com).

Tax Information

If the Fund earns income or realizes capital gains, it intends to make distributions that may be taxed as ordinary income or capital gains by federal, state and local authorities.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase Davis International Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 15

INVESTMENT OBJECTIVES,

PRINCIPAL STRATEGIES,AND PRINCIPAL RISKS

Investment Objectives

The investment objective of both Davis Global Fund and Davis International Fund (collectively, the “Funds”) is long-term growth of capital. The Funds’ investment objectives are not fundamental policies and may be changed by the Board of Directors without a vote of shareholders. The Funds’ prospectus would be amended prior to any change in investment objective and shareholders would be provided at least 30 days notice before the change in investment objective was implemented.

Principal Investment Strategies

The principal investment strategies and risks for the Funds’ are described below. A number of investment strategies and risks which are not principal investment strategies or principal risks (and therefore are not included in this Prospectus) for the Funds are described in the Funds’ Statement of Additional Information. The Statement of Additional Information also describes Davis Advisors’ process for determining when the Fund may pursue a non-principal investment strategy.

Davis Advisors uses the Davis Investment Discipline to invest Davis Global Fund’s portfolio principally in common stocks (including indirect holdings of common stock through depositary receipts) issued by both United States and foreign companies, including countries with developed or emerging markets.

Davis Advisors uses the Davis Investment Discipline to invest Davis International Fund’s portfolio principally in common stocks (including indirect holdings of common stock through depositary receipts) issued by foreign companies, including countries with developed or emerging markets.

The Funds may invest in large, medium, or small companies without regard to market capitalization. The Funds will invest significantly (at least 40%of total assets under normal market conditions and at least 30% of total assets if market conditions are not deemed favorable) in issuers: (i) organized or located outside of the U.S.; (ii) whose primary trading market is located outside the U.S.; or (iii) doing a substantial amount of business outside the U.S., which the Funds consider to be a company that derives at least 50% of its revenue from business outside the U.S. or has at least 50% of its assets outside the U.S. Under normal market conditions the Funds will invest in at least three different countries.

The Davis Investment Discipline

Davis Advisors manages equity funds using the Davis Investment Discipline. Davis Advisors conducts extensive research to try to identify businesses that possess characteristics that Davis Advisors believes foster the creation of long-term value, such as proven management, a durable franchise and business model, and sustainable competitive advantages. Davis Advisors aims to invest in such businesses when they are trading at discounts to their intrinsic worth. Davis Advisors emphasizes individual stock selection and believes that the ability to evaluate management is critical. Davis Advisors routinely visits managers at their places of business in order to gain insight into the relative value of different businesses. Such research, however rigorous, involves predictions and forecasts that are inherently uncertain. After determining which companies Davis Advisors believes the Fund should own, Davis Advisors then turns its analysis to determining the intrinsic value of those companies’ equity securities. Davis Advisors seeks equity securities which can be purchased at attractive valuations relative to their intrinsic value. Davis Advisors’ goal is to invest in companies for the long term (In fiscal year 2012 the portfolio turnover ratios indicted that Davis Global Fund and Davis International Fund held companies for an average of 2.3 and 12.5 years, respectively). Davis Advisors considers selling a company’s equity securities if the securities’ market price exceeds Davis Advisors’ estimates of intrinsic value, or if the ratio of the risks and rewards of continuing to own the company’s equity securities is no longer attractive.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 16

Principal Risks of Investing in the Funds

If you buy shares of Davis Global Fund or Davis International Fund, you may lose some or all of the money that you invest. The investment return and principal value of an investment in either Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The likelihood of loss may be greater if you invest for a shorter period of time. This section describes the principal risks (but not the only risks) that could cause the value of your investment in the Funds to decline, and which could prevent the Funds from achieving their stated investment objectives.

| | | | | | | | | | |

| | | Davis

Global Fund | | Davis

International

Fund |

Stock Market Risk | | | | P | | | | | P | |

Manager Risk | | | | P | | | | | P | |

Common Stock Risk | | | | P | | | | | P | |

Foreign Country Risk | | | | P | | | | | P | |

Emerging Market Risk | | | | P | | | | | P | |

Foreign Currency Risk | | | | P | | | | | P | |

Depositary Receipts Risk | | | | P | | | | | P | |

Large-Capitalization Companies Risk | | | | | | | | | | |

Small- and Mid-Capitalization Companies Risk | | | | P | | | | | P | |

Headline Risk | | | | P | | | | | P | |

Fees and Expenses Risk | | | | P | | | | | P | |

Stock Market risk. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices, including the possibility of sharp declines. In 2008 and 2009 the equity and debt capital markets in the United States and internationally experienced unprecedented volatility. This financial crisis has caused a significant decline in the value and liquidity of many securities. It is impossible to predict whether these conditions will continue, improve, or worsen. Because the situation is unprecedented and widespread, it may be unusually difficult to identify both risks and opportunities using past models of the interplay of market forces, or to predict the duration of these events.

Manager risk. Poor security selection or focus on securities in a particular sector, category, or group of companies may cause the Funds to underperform relevant benchmarks or other funds with a similar investment objective.

Common Stock risk. Common stock represents ownership positions in companies. The prices of common stock fluctuate based on changes in the financial condition of their issuers and on market and economic conditions. Events that have a negative impact on a business probably will be reflected in a decline in the price of its common stock. Furthermore, when the total value of the stock market declines, most common stocks, even those issued by strong companies, likely will decline in value. Common stock is generally subordinate to an issuer’s other securities, including preferred, convertible and debt securities.

Foreign Country risk.Foreign companies may issue both equity and fixed income securities. A company may be classified as either “domestic” or “foreign” depending upon which factors the Adviser considers most important for a given company. Factors which the Adviser considers in classifying a company as domestic or foreign include: (1) whether the company is organized under the laws of the United States or a foreign country; (2) whether the company’s securities principally trade in securities markets outside of the United States; (3) the source of the majority of the company’s revenues or profits; and (4) the location of the majority of the company’s assets. The Adviser generally follows the country classification

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 17

indicated by a third party service provider but may use a different country classification if the Adviser’s analysis of the four factors provided above or other factors that the Adviser deems relevant indicates that a different country classification is more appropriate.

The Funds invest a significant portion of their assets in companies operating, incorporated, or principally traded in foreign countries. Investing in foreign countries involves risks that may cause the Funds’ performance to be more volatile than it would be if the Funds invested solely in the United States. Foreign economies may not be as strong or as diversified, foreign political systems may not be as stable, and foreign financial reporting standards may not be as rigorous as they are in the United States. In addition, foreign capital markets may not be as well developed, so securities may be less liquid, transaction costs may be higher, and investments may be subject to more government regulation. When the Funds invest in foreign securities, the Fund’s operating expenses are likely to be higher than those of an investment company investing exclusively in U.S. securities, since the custodial and certain other expenses associated with foreign investments are expected to be higher.

Emerging Market risk.The Fund invests in emerging or developing markets. Securities of issuers in emerging and developing markets may offer special investment opportunities, but present risks not found in more mature markets. Those securities may be more difficult to sell at an acceptable price and their prices may be more volatile than securities of issuers in more developed markets. Settlements of trades may be subject to greater delays so that the Fund might not receive the proceeds of a sale of a security on a timely basis. In unusual situations it may not be possible to repatriate sales proceeds in a timely fashion. These investments may be very speculative.

Emerging markets might have less developed trading markets and exchanges. These countries may have less- developed legal and accounting systems and investments may be subject to greater risks of government restrictions on withdrawing the sale proceeds of securities from the country. Companies operating in emerging markets may not be subject to U.S. prohibitions against doing business with countries which are state sponsors of terrorism. Economies of developing countries may be more dependent on relatively few industries that may be highly vulnerable to local and global changes. Governments may be more unstable and present greater risks of nationalization, expropriation, or restrictions on foreign ownership of stocks of local companies.

Foreign Currency risk.Securities issued by foreign companies in foreign markets are frequently denominated in foreign currencies. The change in value of a foreign currency against the U.S. dollar will result in a change in the U.S. dollar value of securities denominated in that foreign currency. The Fund may, but generally does not, hedge its currency risk. When the value of a foreign currency declines against the U.S. dollar, the value of the Fund’s shares will tend to decline.

Depositary Receipts risk. Depositary receipts, including American Depositary Receipts, European Depositary Receipts, and Global Depositary Receipts, are certificates evidencing ownership of shares of a foreign issuer. These certificates are issued by depositary banks and generally trade on an established market in the United States or elsewhere. The underlying shares are held in trust by a custodian bank or similar financial institution in the issuer’s home country. The depositary bank may not have physical custody of the underlying securities at all times and may charge fees for various services, including forwarding dividends and interest and corporate actions. Depositary receipts are alternatives to directly purchasing the underlying foreign securities in their national markets and currencies. However, depositary receipts continue to be subject to many of the risks associated with investing directly in foreign securities. These risks include foreign exchange risk as well as the political and economic risks of the underlying issuer’s country. Depositary receipts may trade at a discount (or premium) to the underlying security and may be less liquid than the underlying securities listed on an exchange.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 18

To the extent that the management fees paid to an investment company are for the same or similar services as the management fees paid by the Fund, there would be a layering of fees that would increase expenses and decrease returns. When the Fund invests in foreign securities, its operating expenses are likely to be higher than those of an investment company investing exclusively in U.S. securities, since the custodial and certain other expenses associated with foreign investments are expected to be higher.

Large-Capitalization Companies risk.Companies $10 billion or more in market capitalization are considered by the Adviser to be large-capitalization companies. Large-capitalization companies generally experience slower rates of growth in earnings per share than do small- and mid-capitalization companies.

Small- and Mid-Capitalization Companies risk.Companies with less than $10 billion in market capitalization are considered by the Adviser to be mid- or small-capitalization companies. Investing in mid- and small-capitalization companies may be more risky than investing in large-capitalization companies. Smaller companies typically have more limited product lines, markets and financial resources than larger companies, and their securities may trade less frequently and in more limited volume than those of larger, more mature companies. Securities of these companies may be subject to volatility in their prices. They may have a limited trading market, which may adversely affect the Fund’s ability to dispose of them and can reduce the price the Fund might be able to obtain for them. Other investors that own a security issued by a mid- or small-capitalization company for whom there is limited liquidity might trade the security when the Fund is attempting to dispose of its holdings in that security. In that case, the Fund might receive a lower price for its holdings than otherwise might be obtained. Small-capitalization companies also may be unseasoned. These include companies that have been in operation for less than three years, including the operations of any predecessors.

Headline risk. Davis Advisors seeks to acquire companies with durable business models that can be purchased at attractive valuations relative to what Davis Advisors believes to be the companies’ intrinsic values. Davis Advisors may make such investments when a company becomes the center of controversy after receiving adverse media attention. The company may be involved in litigation, the company’s financial reports or corporate governance may be challenged, the company’s public filings may disclose a weakness in internal controls, greater government regulation may be contemplated, or other adverse events may threaten the company’s future. While Davis Advisors researches companies subject to such contingencies, Davis Advisors cannot be correct every time, and the company’s stock may never recover or may become worthless.

Fees and Expenses risk.The Funds may not earn enough through income and capital appreciation to offset the operating expenses of the Funds. All mutual funds incur operating fees and expenses. Fees and expenses reduce the return which a shareholder may earn by investing in a fund even when a fund has favorable performance. A low return environment, or a bear market, increases the risk that a shareholder may lose money.

The Funds’ shares are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including possible loss of the principal amount invested.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 19

ADDITIONAL

INFORMATION ABOUT EXPENSES, FEES,AND PERFORMANCE

Information Concerning the Annual Total Returns for The Life of Class

Davis Global Fund’s average annual total returns for Life of Class are for the periods from the commencement of each class’s investment operations. Class A shares, Class B shares, and Class C shares each commenced operations on 12/22/04. Class Y shares commenced operations on 7/25/07. Index average annual total return for life is from 12/22/04.

Davis International Fund’s average annual total returns for life are for the periods from the commencement of each class’s investment operations. Class A shares, Class B shares, and Class C shares each commenced operations on 12/29/06. Class Y shares commenced operations on 12/31/09. Index average annual total return for life is from 12/29/06.

Information Concerning the Annual Total Returns for Class A Shares

Results do not include a sales charge. If a sales charge were included, results would be lower.

Information Concerning the Example Within the Fees and Expenses of the Funds

Class B shares’ expenses for the 10 year period include three years of Class A shares’ expenses since Class B shares automatically convert to Class A shares after seven years.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 20

NON-PRINCIPAL

INVESTMENT STRATEGIESAND RELATED RISKS

Davis Funds may implement investment strategies which are not principal investment strategies if, in the Adviser’s professional judgment, the strategies are appropriate. A strategy includes any policy, practice, or technique used by the Fund to achieve its investment objectives. Whether a particular strategy, including a strategy to invest in a particular type of security, is a principal investment strategy depends on the strategy’s anticipated importance in achieving the Fund’s investment objectives, and how the strategy affects the Fund’s potential risks and returns. In determining what is a principal investment strategy, the Adviser considers, among other things, the amount of the Fund’s assets expected to be committed to the strategy, the amount of the Fund’s assets expected to be placed at risk by the strategy, and the likelihood of the Fund’s losing some or all of those assets from implementing the strategy. Non-principal investment strategies are generally those investments which constitute less than 5% to 10% of a Fund’s assets depending upon their potential impact upon the investment performance of the Fund. There are exceptions to the 5% to 10% of assets test, including, but not limited to, the percentage of a Fund’s assets invested in a single industry or in a single country.

While the Adviser expects to pursue the Funds’ investment objectives by implementing the principal investment strategies described in the Funds’ prospectus, the Funds may employ non-principal investment strategies or securities if, in Davis Advisors’ professional judgment, the securities, trading, or investment strategies are appropriate. Factors that Davis Advisors considers in pursuing these other strategies include whether the strategy: (i) is likely to be consistent with shareholders’ reasonable expectations; (ii) is likely to assist the Adviser in pursuing the Funds’ investment objective; (iii) is consistent with the Funds’ investment objective; (iv) will not cause a Fund to violate any of its fundamental or non-fundamental investment restrictions, and (v) will not materially change the Funds’ risk profile from the risk profile that results from following the principal investment strategies as described in the Funds’ prospectus and further explained in the Statement of Additional Information, as amended from time to time.

Short-Term Investments. The Funds use short-term investments, such as treasury bills and repurchase agreements, to maintain flexibility while evaluating long-term opportunities.

Temporary Defensive Investments.The Funds may, but are not required to, use short-term investments for temporary defensive purposes. In the event that Davis Advisors’ Portfolio Managers anticipate a decline in the market values of the companies in which the Funds invest (due to economic, political or other factors), the Funds may reduce their risk by investing in short-term securities until market conditions improve. While the Funds are invested in short-term investments they will not be pursuing the long-term growth of capital. Unlike equity securities, these investments will not appreciate in value when the market advances and will not contribute to long-term growth of capital.

Repurchase Agreements.The Funds may enter into repurchase agreements. A repurchase agreement is an agreement to purchase a security and to sell that security back to the original owner at an agreed-on price. The resale price reflects the purchase price plus an agreed-on incremental amount which is unrelated to the coupon rate or maturity of the purchased security. The repurchase obligation of the seller is, in effect, secured by the underlying securities. In the event of a bankruptcy or other default of a seller of a repurchase agreement, the Funds could experience both delays in liquidating the underlying securities and losses, including: (a) possible decline in the value of the collateral during the period while the Funds seek to enforce its rights thereto; (b) possible loss of all or a part of the income during this period; and (c) expenses of enforcing its rights.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 21

The Funds will enter into repurchase agreements only when the seller agrees that the value of the underlying securities, including accrued interest (if any), will at all times be equal to or exceed the value of the repurchase agreement. The Funds may enter into tri-party repurchase agreements in which a third-party custodian bank ensures the timely and accurate exchange of cash and collateral. The majority of these transactions run from day to day, and delivery pursuant to the resale typically occurs within one to seven days of the purchase. The Funds normally will not enter into repurchase agreements maturing in more than seven days.

For more details concerning current investments and market outlook, please see the Fund’s most recent shareholder report.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 22

MANAGEMENT

AND ORGANIZATION

Davis Selected Advisers, L.P. (“Davis Advisors”) serves as the investment adviser for each of the Davis Funds. Davis Advisors’ offices are located at 2949 East Elvira Road, Suite 101, Tucson, Arizona 85756. Davis Advisors provides investment advice for the Davis Funds, manages their business affairs, and provides day-to-day administrative services. Davis Advisors also serves as investment adviser for other mutual funds and institutional and individual clients. For the fiscal year ended October 31, 2012, Davis Advisors’ net management fee paid by the Funds for its services (based on average net assets) was 0.55% for Davis Global Fund and 0.55% for Davis International Fund. A discussion regarding the basis for the approval of the Funds’ investment advisory and service agreement by the Funds’ Board of Directors is contained in the Funds’ most recent semi-annual report to shareholders.

Davis Selected Advisers-NY, Inc., serves as the sub-adviser for each of the Davis Funds. Davis Selected Advisers-NY, Inc.‘s offices are located at 620 Fifth Avenue 3rd Floor, New York, New York 10020. Davis Selected Advisers-NY, Inc., provides investment management and research services for the Davis Funds and other institutional clients, and is a wholly owned subsidiary of Davis Advisors. Davis Selected Advisers-NY, Inc.‘s fee is paid by Davis Advisors, not the Davis Funds.

Execution of Portfolio Transactions. Davis Advisors places orders with broker-dealers for Davis Funds’ portfolio transactions. Davis Advisors seeks to place portfolio transactions with brokers or dealers who will execute transactions as efficiently as possible and at the most favorable net price. In placing executions and paying brokerage commissions or dealer markups, Davis Advisors considers price, commission, timing, competent block trading coverage, capital strength and stability, research resources, and other factors. Subject to best price and execution, Davis Advisors may place orders for Davis Funds’ portfolio transactions with broker-dealers who have sold shares of Davis Funds. However, when Davis Advisors places orders for Davis Funds’ portfolio transactions, it does not give any consideration to whether a broker-dealer has sold shares of Davis Funds. In placing orders for Davis Funds’ portfolio transactions, the Adviser does not commit to any specific amount of business with any particular broker-dealer.

Over the last three years Davis Global Fund and Davis International Fund paid the following brokerage commissions:

| | | | | | | | | | | | | | | |

| | | For the Year ended October 31, |

| | | | | | | | | | | | | | | |

| | | 2012 | | 2011 | | 2010 |

Davis Global Fund | | | | | | | | | | | | | | | |

Brokerage commissions paid: | | | | $91,222 | | | | $ | 81,143 | | | | $ | 38,698 | |

Brokerage as a percentage of average net assets: | | | | 0.07% | | | | | 0.08% | | | | | 0.05% | |

Davis International Fund | | | | | | | | | | | | | | | |

Brokerage commissions paid: | | | | $7,630 | | | | $ | 21,199 | | | | $ | 44,647 | |

Brokerage as a percentage of average net assets: | | | | 0.02% | | | | | 0.04% | | | | | 0.28% | |

Portfolio Managers

Davis Global Fund and Davis International Fund are Team Managed.Davis Advisors uses a system of multiple Portfolio Managers to manage both Davis Global Fund and Davis International Fund. Under this approach, the portfolio of each Fund is divided into segments managed by individual Portfolio Managers. Christopher Davis is the Portfolio Manager responsible for overseeing and allocating segments of the Funds’ assets to the other Portfolio Managers. Stephen Chen, Danton Goei, and Tania Pouschine manage the substantial majority of the Funds’ assets and are primarily responsible for the day-to-day management of the Funds’ assets. In addition, a limited portion of the Funds’ assets may be

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 23

managed by Davis Advisors’ research analysts, subject to review by Christopher Davis and the Portfolio Review Committee. Portfolio Managers decide how their respective segments will be invested. All investment decisions are made within the parameters established by the Fund’s investment objectives, strategies, and restrictions.

| • | | Stephen Chen has served as a Portfolio Manager of both Davis Global Fund and Davis International Fund since their inceptions in December 2004 and December 2006, respectively. Mr. Chen also serves as a Portfolio Manager or research analyst for other equity funds advised by Davis Advisors. Mr. Chen joined Davis Advisors in December 2002. |

| • | | Christopher Davis has served as a Portfolio Manager of both Davis Global Fund and Davis International Fund since their inceptions in December 2004, and December 2006, respectively. Mr. Davis also serves as a Portfolio Manager for other equity funds advised by Davis Advisors. Mr. Davis joined Davis Advisors in September 1989. Mr. Davis oversees the other Portfolio Managers of Davis Global Fund and Davis International Fund and allocates segments of the Funds to each of them to invest. |

| • | | Danton Goei has served as a Portfolio Manager of both Davis Global Fund and Davis International Fund since their inceptions in December 2004 and December 2006, respectively. Mr. Goei also serves as a Portfolio Manager or research analyst for other equity funds advised by Davis Advisors. Mr. Goei joined Davis Advisors in November 1998. |

| • | | Tania Pouschine has served as a Portfolio Manager of both Davis Global Fund and Davis International Fund since their inceptions in December 2004 and December 2006, respectively. Ms. Pouschine also serves as a Portfolio Manager or research analyst for other equity funds advised by Davis Advisors. Ms. Pouschine joined Davis Advisors in July 2003. |

The Statement of Additional Information provides additional information about the Portfolio Managers’ compensation, other accounts managed by the Portfolio Managers and the Portfolio Managers’ investments in the Funds.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 24

SHAREHOLDER

INFORMATION

Procedures and Shareholder Rights are Described by Current Prospectus and Other Disclosure Documents

Investors should look to the most recent prospectus and statement of additional information for Davis Funds, as amended or supplemented from time to time, for information concerning the Funds —including information on how to purchase and redeem Fund shares and how to contact the Funds. The most recent prospectus and statement of information (including any supplements or amendments thereto) will be on file with the Securities and Exchange Commission as part of the Funds’ registration statement. Please also see the back cover of this prospectus for information on other ways to obtain information about the Funds.

How Your Shares are Valued

Once you open your Davis Fund account, you may purchase or sell shares at the net asset value (“NAV”) next determined after Davis Funds’ transfer agent or other “qualified financial intermediary” (a financial institution which has entered into a contract with Davis Advisors or its affiliates to offer, sell, and redeem shares of the Funds) receives your request to purchase or sell shares in “good order.” A request is in good order when all documents, which are required to constitute a legal purchase or sale of shares, have been received. The documents required to achieve good order vary depending upon a number of factors (e.g., are shares held in a joint account or a corporate account, has the account had any recent address change etc.). Contact your broker or Davis Funds if you have questions about what documents will be required.

If your purchase or sale order is received in good order prior to the close of trading on the New York Stock Exchange (“NYSE”), your transaction will be executed that day at that day’s NAV. If your purchase or sale order is received in good order after the close of the NYSE, your transaction will be processed the next day at the next day’s NAV. Davis Funds calculate the NAV of each class of shares issued by the Funds as of the close of trading on the NYSE, normally 4:00 p.m., Eastern time, on each day when the NYSE is open. NYSE holidays currently include New Year’s Day, Martin Luther King Jr. Day, President’s Day, Good Friday, Memorial Day, Independence Day, Labor Day, Thanksgiving Day and Christmas Day.

The NAV of each class of shares is determined by taking the market value of the class of shares’ total assets, subtracting the class of shares’ liabilities, and then dividing the result (net assets) by the number of outstanding shares of the class of shares. Since the equity funds invest in securities that may trade in foreign markets on days other than when Davis Funds calculate their NAVs, the value of the Funds’ portfolio may change on days that shareholders will not be able to purchase or redeem shares in the Funds.

If you have access to the Internet, you can also check the net asset value on the Funds’ website (www.davisfunds.com).

Valuation of Portfolio Securities

Davis Funds value securities for which market quotations are readily available at current market value other than certain short-term securities which are valued at amortized cost. Securities listed on the NYSE (and other national exchanges) are valued at the last reported sales price on the day of valuation. Securities traded in the over-the-counter market (e.g. NASDAQ) and listed securities for which no sale was reported on that date are valued at the average of closing bid and asked prices. Securities traded on

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 25

foreign exchanges are valued based upon the last sales price on the principal exchange on which the security is traded prior to the time when the Funds’ assets are valued. Securities (including restricted securities) for which market quotations are not readily available are valued at their fair value. Securities whose values have been materially affected by what Davis Advisors identifies as a significant event occurring before the Funds’ assets are valued but after the close of their respective exchanges will be fair valued. Fair value is determined in good faith using consistently applied procedures under the supervision of the Board of Directors. Fair valuation is based on subjective factors and, as a result, the fair value price of a security may differ from the security’s market price and may not be the price at which the security may be sold. Fair valuation could result in a different NAV than a NAV determined by using market quotations. The Board of Directors has delegated the determination of fair value of securities for which prices are either unavailable or unreliable to Davis Advisors. The Board of Directors reviews a summary of fair valued securities in quarterly board meetings.

In general, foreign securities are more likely to require a fair value determination than domestic securities because circumstances may arise between the close of the market on which the securities trade and the time as of which a Fund values its portfolio securities, which may affect the value of such securities. Securities denominated in foreign currencies and traded in foreign markets will have their values converted into U.S. dollar equivalents at the prevailing exchange rates as computed by State Street Bank and Trust Company. Fluctuation in the values of foreign currencies in relation to the U.S. dollar may affect the net asset value of a Fund’s shares even if there has not been any change in the foreign currency prices of that Fund’s investments.

Securities of smaller companies are also generally more likely to require a fair value determination because they may be thinly traded and less liquid than traditional securities of larger companies.

The Funds may occasionally be entitled to receive award proceeds from litigation relating to an investment security. The Funds generally do not recognize a gain on contingencies until it is realized or realizable, which for most litigation settlements is when a final settlement is reached as long as there are no further contingencies that remain once that final settlement has been awarded. The Funds’ practice is not to record a gain until it is certain, which generally occurs when payment is received.

To the extent that a Fund’s portfolio investments trade in markets on days when the Fund is not open for business, the Fund’s NAV may vary on those days. In addition, trading in certain portfolio investments may not occur on days the Fund is open for business because markets or exchanges other than the NYSE may be closed. If the exchange or market on which the Fund’s underlying investments are primarily traded closes early, the NAV may be calculated prior to its normal market calculation time. For example, the primary trading markets for a Fund may close early on the day before certain holidays and the day after Thanksgiving.

Fixed income securities may be valued at prices supplied by Davis Funds’ pricing agent based on broker or dealer supplied valuations or matrix pricing, a method of valuing securities by reference to the value of other securities with similar characteristics, such as rating, interest rate and maturity. Government, corporate, and asset-backed bonds and convertible securities, including high-yield or junk bonds, normally are valued on the basis of prices provided by independent pricing services. Prices provided by the pricing services may be determined without exclusive reliance on quoted prices, and may reflect appropriate factors such as institution-size trading in similar groups of securities, developments related to special securities, dividend rate, maturity and other market data. Prices for fixed income securities received from pricing services sometimes represent best estimates. In addition, if the prices provided by the pricing service and independent quoted prices are unreliable, Davis Funds will arrive at their own fair valuation using the Funds’ fair value procedures.

PROSPECTUS Ÿ DAVIS NEW YORK VENTURE FUND, INC. Ÿ 26

Portfolio Holdings

A description of Davis Funds’ policies and procedures with respect to the disclosure of the Funds’ portfolio holdings is available in the Statement of Additional Information.

Davis Funds’ portfolio holdings are published twice a year in the Annual and Semi-Annual Reports which are mailed approximately 60 days after the end of the Fund’s second and fourth fiscal quarters. In addition, each Fund publishes its portfolio holdings on the Davis Funds’ website (www.davisfunds.com) and the SEC website (www.sec.gov) approximately 60 days after the end of each fiscal quarter. Other information concerning the Funds’ portfolio holdings may also be published on the Davis Funds’ website from time to time.

How Davis Funds Pay Earnings

There are two ways you can receive payments from the Davis Fund you invest in:

| • | | Dividends.Dividends are distributions to shareholders of net investment income and short-term capital gains on investments. |

| • | | Capital Gains.Capital gains are profits received by a fund from the sale of securities held for the long term, which are then distributed to shareholders. |

If you would like information about when a particular Davis Fund pays dividends and distributes capital gains, please call 1-800-279-0279. Unless you choose otherwise, the Davis Funds will automatically reinvest your dividends and capital gains in additional fund shares.

You can request to have your dividends and capital gains paid to you by check or deposited directly into your bank account. Dividends and capital gains of $50 or less will not be sent by check but will be reinvested in additional fund shares.

Davis Funds also offer aDividend Diversification Program, which allows you to have your dividends and capital gains from one Davis Fund reinvested in shares of another Davis Fund.

You will receive a statement each year detailing the amount of all dividends and capital gains paid to you during the previous year. To ensure that these distributions are reported properly to the U.S. Treasury, you must certify on your Davis Funds Application Form or on IRS Form W-9 that your Taxpayer Identification Number is correct and you are not subject to backup withholding. If you are subject to backup withholding, or you did not certify your Taxpayer Identification Number, the IRS requires the Davis Funds to withhold a percentage of any dividends paid and redemption or exchange proceeds received.

How to Put Your Dividends and Capital Gains to Work