An update from Bob James.

Dear Fellow Shareholders,

| | | |

| | By now I’m sure you are familiar with the promiseExpect More From Us.When we sayExpect More,we are communicating our honest commitment to do the best job, think beyond the ordinary and give more than expected. We promise to: |

| • | | Deliver exceptional service with a full range of products that help our customers achieve their dreams |

| |

| • | | Support the communities we serve |

| |

| • | | Help our employees realize their potential |

| |

| • | | Provide consistent, long-term returns for our shareholders |

As a team of financial professionals, we have the opportunity to make a positive difference in the lives of our customers. We help our clients achieve their dreams — fund a child’s education, buy a home, retire early. This is a responsibility that we take seriously. We deliver on the Expect More promise by combining full-service banking with the best customer service in the marketplace.

We realize that as a public company, we have a duty to our shareholders to provide consistent, long-term growth in their investment. We are focused on improving our financial performance and continuing our practice of increasing the dividend.

This is my first communication with you as the new president and CEO of First Charter. My goal is to share our progress with you on an ongoing basis, to let you know what we’re doing, where we’re going and how we’re trying to get there.

These are exciting times for our company, our employees and our communities. We live and work in an area of the country that is blessed with opportunity. I encourage you to read on and learn more about the people of First Charter and the initiatives we are undertaking to build a better a company for you.

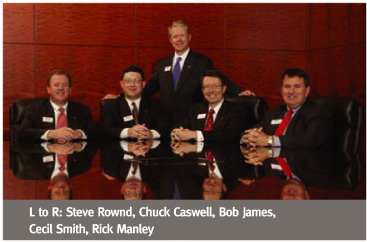

Meet the new management team.

As CEO, one of my first priorities has been to build a team of experienced bankers committed to long-term, disciplined growth. The responsibility of this team is to ensure our organization has the people and resources necessary to serve our customers and grow our company with a well-defined strategy. This team is pursuing our strategy with passion, discipline and a sense of urgency.

Bob James — President and CEO

Bob joined First Charter in 1999. He was elected President and CEO of First Charter Bank in 2004, before assuming the position of President and CEO of First Charter Corporation in 2005. Before that, Bob served 25 years with Centura Bank of Rocky Mount, North Carolina.

Steve Rownd — Chief Risk Officer

Steve has been with First Charter since 2000 and initially served as Chief Credit Officer before assuming the role of Chief Risk Officer in 2004. He previously worked for SunTrust Bank as Risk Manager for Corporate and Investment Banking, and served as Executive Vice President and Chief Credit Officer for the SunTrust affiliate bank in Sarasota.

Chuck Caswell — Chief Financial Officer

Before joining First Charter earlier this year, Chuck served as Chief Financial Officer for Integra Bank in Evansville, Indiana. He also spent five years at Centura Bank, first as Treasurer and later as CFO.

Cecil Smith — Chief Information Officer

Cecil Smith joined First Charter in 2005, bringing 30 years of information technology and operations experience from the banking and energy industries. He led information services efforts at Wachovia, including a number of mergers and acquisitions during his 20 years there. Most recently, he was Chief Information Officer for Duke Energy.

Rick Manley — Chief Banking Officer

Rick joined First Charter in 1999, and previously served more than 25 years in line and sales management, corporate marketing, commercial lending and retail management roles with Centura, Barnett and Regions banks.

Improving Our Performance.

It’s my responsibility to ensure First Charter has the organizational agility to capitalize on good opportunities as they present themselves. To achieve this agility, our management team is focusing on internal initiatives with an eye toward expense management, business improvement and performance. We are reviewing all lines of business. Here are a few examples:

| | • | | After reviewing our insurance operations, we consolidated seven offices into four. This consolidation and other expense reductions will result in cost savings of approximately $600,000 annually beginning next year. |

| |

| | • | | We are also reviewing all major supplier relationships. The initial reviews included stationary, checks and office supplies, where we expect an annual savings of about $500,000 beginning in 2006. |

| |

| | • | | In the area of business improvement, we extended Saturday hours in 14 high traffic branches — now keeping them open from 9:00 am to 3:00 pm. This decision was made after carefully reviewing the customer traffic patterns in our branches and by listening to customer feedback. |

2Q 2005 Financial Performance

| | | |

EPS | | Increased from $.34 to $.37, or 8.8% |

| | | |

Net Income | | Up $1.0 million, or 10.0%, to $11.3 million |

| | | |

Loan Growth | | Loans grew 22% over the past year and 23% annualized in the second quarter |

Investing in our community.

First Charter’s roots run deep in North Carolina. We have grown with the organizations and people in the communities we serve. Contributing to the economic and civic prosperity of the communities we call home is a responsibility and a privilege we value as a good corporate citizen.

We’re not one of the big banks that sees customers just as account numbers. We value customers as individuals and we look for opportunities to build strong communities through strong, lasting partnerships.

In the wake of Hurricane Katrina, we worked with our customers to help people in need from the Gulf Coast. We waived all fees on FEMA-related account transactions, ensuring that customers affected by the storm didn’t pay us any banking fees. Our teammates and customers raised over $5,000 in the first few weeks of our collection to benefit the hurricane relief effort.

First Charter continues to support United Way as a pacesetter company. Even though the 2006 campaign that kicked off in June officially ends on November 1, we successfully completed our campaign by August 31, raising more than $240,000 — a 17 percent increase over 2005.

We recently switched mobile phone providers and will be donating our previously owned phones to battered women’s shelters in the Charlotte area, where they can be distributed and used for emergency service calls.

This document is for informational purposes only and is neither an offer to buy or sell nor a solicitation of offers to buy or sell any securities. It should be read in conjunction with documents filed with the Securities and Exchange Commission, including the most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. All financial results, balance sheet data and other information presented in this document are qualified in their entirety by reference to these reports. This document contains forward-looking statements, including statements regarding expense reduction initiatives and the potential growth available in Raleigh. A discussion of various factors that could cause actual results to differ materially from these statements is included in our SEC filings and includes risks and uncertainties associated with the implementation of the Corporation’s business plan and strategic initiatives.

Expansion in new markets.

Our expansion into vibrant, new markets is one of the key elements of the First Charter growth strategy. On October 3, 2005 we opened the doors of our first financial center in the Raleigh area. We are very excited about the growth potential available in Raleigh. It’s a strong growing market where we are confident our community banking model will excel and provide additional opportunity to enhance the value of our franchise.

In addition, we are expanding in key growth areas of Charlotte and replacing older financial centers in inferior locations with newer, more modern buildings to attract more customers and build deposits at the new branches. By year end, we expect to have opened a total of two de novo branches and three replacement branches in North Carolina.

Thank You

I appreciate the time you have taken to let me share what we’re doing, what we’re thinking and how we’re performing. You can look forward to updates of this type each quarter. Thank you for your continued confidence and support.

Robert E. James, Jr.

President and CEO