UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d ) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-8590

MURPHY OIL CORPORATION

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 71-0361522 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

| |

| 200 Peach Street, P.O. Box 7000, El Dorado, Arkansas | | 71731-7000 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (870) 862-6411

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

| Title of each class | | | | Name of each exchange on which registered |

| Common Stock, $1.00 Par Value | | | | New York Stock Exchange |

| | |

Series A Participating Cumulative Preferred Stock Purchase Rights | | | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x.

Aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based on the last sale price at June 30, 2007 as quoted by the New York Stock Exchange, was approximately $11,204,643,000.

Number of shares of Common Stock, $1.00 Par Value, outstanding at January 31, 2008 was 189,730,149.

Documents incorporated by reference:

Portions of the Registrant’s definitive Proxy Statement relating to the Annual Meeting of Stockholders on May 14, 2008 have been incorporated by reference in Part III herein.

MURPHY OIL CORPORATION

TABLE OF CONTENTS – 2007 FORM 10-K

i

PART I

Summary

Murphy Oil Corporation is a worldwide oil and gas exploration and production company with refining and marketing operations in the United States and the United Kingdom. As used in this report, the terms Murphy, Murphy Oil, we, our, its and Company may refer to Murphy Oil Corporation or any one or more of its consolidated subsidiaries.

The Company was originally incorporated in Louisiana in 1950 as Murphy Corporation. It was reincorporated in Delaware in 1964, at which time it adopted the name Murphy Oil Corporation, and was reorganized in 1983 to operate primarily as a holding company of its various businesses. Its operations are classified into two business activities: (1) “Exploration and Production” and (2) “Refining and Marketing.” For reporting purposes, Murphy’s exploration and production activities are subdivided into six geographic segments, including the United States, Canada, the United Kingdom, Malaysia, Ecuador and all other countries. Murphy’s refining and marketing activities are subdivided into geographic segments for North America and United Kingdom. Murphy exited the gasoline retailing business in Canada during 2007, but the relatively insignificant historical results for the Canadian operations have been combined with U.S. refining and marketing operations in the North American segment. Additionally, “Corporate” activities include interest income, interest expense, foreign exchange effects and overhead not allocated to the segments.

The information appearing in the 2007 Annual Report to Security Holders (2007 Annual Report) is incorporated in this Form 10-K report as Exhibit 13 and is deemed to be filed as part of this Form 10-K report as indicated under Items 1, 2 and 7.

In addition to the following information about each business activity, data about Murphy’s operations, properties and business segments, including revenues by class of products and financial information by geographic area, are provided on pages 14 through 25, F-12 and F-13, F-31 through F-39, and F-41 of this Form 10-K report and on pages 6 and 7 of the 2007 Annual Report.

At December 31, 2007, Murphy had 7,539 employees, including 2,890 full-time and 4,649 part-time.

Interested parties may access the Company’s public disclosures filed with the Securities and Exchange Commission, including Form 10-K, Form 10-Q, Form 8-K and other documents, by accessing the Investor Relations section of Murphy Oil Corporation’s website at www.murphyoilcorp.com.

Exploration and Production

The Company’s exploration and production business explores for and produces crude oil, natural gas and natural gas liquids worldwide. The Company’s exploration and production management team in Houston, Texas directs the Company’s worldwide exploration and production activities.

During 2007, Murphy’s principal exploration and production activities were conducted in the United States by wholly owned Murphy Exploration & Production Company – USA (Murphy Expro USA), in Ecuador, Malaysia and the Republic of Congo by wholly owned Murphy Exploration & Production Company – International (Murphy Expro International) and its subsidiaries, in western Canada and offshore eastern Canada by wholly owned Murphy Oil Company Ltd. (MOCL) and its subsidiaries, and in the U.K. North Sea and the Atlantic Margin by wholly owned Murphy Petroleum Limited. Murphy’s crude oil and natural gas liquids production in 2007 was in the United States, Canada, the United Kingdom, Malaysia and Ecuador; its natural gas was produced and sold in the United States, Canada and the United Kingdom. MOCL owns a 5% undivided interest in Syncrude Canada Ltd. in northern Alberta, the world’s largest producer of synthetic crude oil.

Murphy’s worldwide crude oil, condensate and natural gas liquids production in 2007 averaged 91,522 barrels per day, an increase of 4% compared to 2006. The increase was primarily due to start-up of production at the Kikeh field in Block K, offshore Sabah, Malaysia, in August 2007. Oil production was also higher in 2007 in Canada primarily due to a full year of production at Terra Nova and higher oil volumes at Syncrude. The Terra Nova field was shut down for major equipment maintenance for six months in 2006. Oil production in the U.S. Gulf of Mexico was lower in 2007 due to production declines at several fields. The Company’s worldwide sales volume of natural gas averaged 61 million cubic feet (MMCF) per day in 2007, down 19% from 2006 levels. The lower natural gas sales volumes were primarily attributable to production declines in 2007 for fields in South Louisiana and the Gulf of Mexico. Total worldwide 2007 production on a barrel of oil equivalent basis (six thousand cubic feet of natural gas equals one barrel of oil) was 101,702 barrels per day, up 1% compared to 2006.

Total production in 2008 is currently expected to average approximately 135,000 barrels of oil equivalent per day. The projected production increase in 2008 is related to a full year of oil production plus continued ramp up of volumes at the Kikeh field. In addition, initial natural gas production is expected during the year in Malaysia and from the Tupper area in western Canada. These improved volumes are expected to more than offset anticipated field declines in 2008 in the Gulf of Mexico, onshore South Louisiana and at Hibernia and Terra Nova.

1

In the United States, Murphy has production of oil and/or natural gas from four fields operated by the Company and four main fields operated by others. Of the total producing fields at December 31, 2007, six are in the deepwater Gulf of Mexico and two are onshore in Louisiana. The Company’s primary focus in the U.S. is in the deepwater Gulf of Mexico, which is generally defined as water depths of 1,000 feet or more. The Company produced approximately 13,000 barrels of oil per day and 45 million cubic feet of natural gas per day in the U.S. in 2007. These amounts represented 14% of total worldwide oil and 74% of worldwide natural gas production volumes. The Medusa field in Mississippi Canyon Blocks 538/582 is the only major field in the U.S. and represented 40% of total production on a barrel of oil equivalent basis during 2007. The Company operates and holds a 60% interest in Medusa, which produced total daily net oil and natural gas of about 7,000 barrels and 7 MMCF, respectively, in 2007. At December 31, 2007, the Medusa field has total net proved oil and natural gas reserves of approximately 9 million barrels and 11 billion cubic feet, respectively. Production from Medusa is expected to continue to decline in 2008 and should average 4,900 barrels of oil and 4 MMCF of natural gas on a daily basis. Total oil and natural gas reserves in the U.S. at December 31, 2007 were 31.2 million barrels and 113.3 billion cubic feet, respectively.

In Canada, the Company owns an interest in three nonoperated significant, long-lived assets, the Hibernia and Terra Nova fields offshore Newfoundland and Syncrude Canada Ltd. in northern Alberta. In addition, the Company owns interests in two heavy oil areas and one natural gas area in the Western Canadian Sedimentary Basin (WCSB). Murphy has a 6.5% interest in Hibernia and a 12% interest in Terra Nova in the Jeanne d’Arc Basin, offshore Newfoundland. Total net production in 2007 was about 8,300 barrels of oil per day at Hibernia, while net production from Terra Nova was about 10,600 barrels of oil per day. Terra Nova was on production for all of 2007 following a six-month shut down for major equipment maintenance in 2006. Total 2008 net oil production at Hibernia and Terra Nova is anticipated to be approximately 7,100 and 8,700 barrels per day, respectively. Total net proved oil reserves at December 31, 2007 at Hibernia and Terra Nova were approximately 8.7 million barrels and 7.4 million barrels, respectively. Murphy owns a 5% undivided interest in Syncrude Canada Ltd., a joint venture located about 25 miles north of Fort McMurray, Alberta. Syncrude utilizes its assets to extract bitumen from oil sand deposits and to upgrade this bitumen into a high-value synthetic crude oil. Syncrude completed an expansion in 2006 by adding a third coker that allows for increased production. Total net production in 2007 was about 12,900 barrels of synthetic crude oil per day and is expected to average about 13,200 barrels per day in 2008. Although Syncrude produces a very high quality synthetic crude oil from bitumen, the U.S. Securities and Exchange Commission (SEC) considers Syncrude to be a mining operation, and not a conventional oil operation and therefore, does not allow the Company to include Syncrude’s reserves in its total proved oil reserves reported on page F-35. Total net reserves for Syncrude at year-end 2007 were approximately 128.4 million barrels. Daily net production in 2007 in the WCSB averaged about 12,100 barrels of mostly heavy oil and about 10 MMCF of natural gas. WCSB oil and natural gas production in 2008 is expected to decline to 8,000 barrels and nine MMCF per day, with the reduction mostly due to planned property sales. In January 2008, Murphy sold its 80% interest in Berkana Energy Corp. for net proceeds of approximately Cdn $103.8 million. Through early 2008, the Company has acquired approximately 80,000 acres of mineral rights in northeastern British Columbia in an area named Tupper. Although the Company has booked no proved reserves at Tupper at year-end 2007, a significant natural gas development has been sanctioned by the Company’s Board of Directors and development activities are underway. Initial natural gas production at Tupper is currently anticipated in the fourth quarter 2008.

Murphy produces oil and natural gas in the United Kingdom sector of the North Sea. Total 2007 net production in the U.K. amounted to about 5,300 barrels of oil per day and six MMCF of natural gas per day, which represented 6% of oil produced and 10% of natural gas produced by the Company during the year. Total 2008 net daily production levels in the U.K. are anticipated to average 4,600 barrels of oil and five MMCF of natural gas. Total proved reserves in the U.K. at December 31, 2007 were 18.8 million barrels of oil and 23.6 billion cubic feet of natural gas.

In Malaysia, the Company has majority interests in eight separate production sharing contracts (PSCs). The Company serves as the operator of all these areas, which cover approximately 9.6 million acres. Through 2006, Murphy had an 85% interest in two shallow water blocks, SK 309 and SK 311, offshore Sarawak. In February 2007, the Company renewed the contract on these two Sarawak blocks at a 60% interest for areas with no discoveries, while retaining its 85% interest in the portion of these blocks on which discoveries have been made. The West Patricia and Congkak fields in Block SK 309 produced about 8,700 net barrels of oil per day in 2007. Net production in 2008 is anticipated to decrease at these fields to about 4,900 barrels of oil per day due to field decline and a lower percentage of production allocable to the Company under the production sharing contract. The Company has also made multiple natural gas discoveries in these shallow-water Sarawak blocks. In February 2007, the Company finalized a gas sales contract for the Sarawak area with PETRONAS, the Malaysian state-owned oil company, with initial gas deliveries anticipated in the first quarter 2009. Total proved reserves of oil and natural gas at December 31, 2007 for Blocks SK 309/311 were 6.6 million barrels and 317 billion cubic feet of natural gas.

The Company made a major discovery at the Kikeh field in deepwater Block K, offshore Sabah, in 2002 and added another important discovery at Kakap in 2004. Further discoveries have been made in Block K at Senangin, Kerisi and Jangas. In 2006, the Company relinquished a portion of Block K and was granted a 60% interest in an extension of a portion of Block K covering 1.02 million acres. The Company retained its 80% interest at Kikeh, Kakap and other discoveries in Block K. First oil production from Kikeh began in August 2007, less than five years after the initial discovery. Production volumes at Kikeh averaged 11,600 net barrels of oil per day for the full year 2007 and the field produced about 40,000 net barrels per day in December 2007. Net oil production at Kikeh is anticipated to average 56,000 barrels per day for 2008 as additional wells are completed and brought online. In February 2007, the Company signed a Kikeh field natural gas sales contract with PETRONAS. The natural gas development at Kikeh will lead to initial production beginning at mid-year 2008, with an average net volume of 67 MMCF per day in the fourth quarter and 35 MMCF per day for the full year. Total proved reserves booked in Block K as of year-end 2007 were 76 million barrels of oil and 107 billion cubic feet of natural gas. These proved oil reserves do not include any volumes attributable to pressure maintenance programs that the Company utilizes at the Kikeh field.

2

In early 2006, the Company also added a 60% interest in a new PSC for Block P, which includes 1.05 million acres of the previously relinquished Block K area. Murphy drilled an unsuccessful wildcat well in Block P during 2006. The Company has an 80% interest in deepwater Block H offshore Sabah. In early 2007, the Company announced a significant natural gas discovery at the Rotan well in Block H, and in early 2008, the Company followed up with a discovery at Biris. The Company was awarded interests in two PSCs covering deepwater Blocks L (60%) and M (70%) in 2003. The Sultanate of Brunei also claims this acreage. Murphy drilled a wildcat well in Block L in mid-2003. Well results have been kept confidential and well costs of $12 million remain capitalized pending the resolution of the ownership issue. The Company is unable to predict when or how ownership of Blocks L and M will be resolved. A total of 2.9 million gross acres associated with Blocks L and M have been included in the acreage table below.

Murphy relinquished 75% interests in most of Block PM 311 and all of Block PM 312, located offshore peninsular Malaysia, during 2007. However, Murphy retained its 75% interest in two discoveries at Kenarong and Pertang in Block PM 311. Murphy has requested gas holding agreements for Kenarong and Pertang pending a further study of available development options.

In Ecuador, Murphy owns a 20% working interest in Block 16, which is operated by Repsol-YPF under a participation contract that expires in January 2012. The Company’s net production was about 9,000 barrels of oil per day in 2007 and is expected to average about 7,200 barrels per day in 2008, with the decline expected due to reduced development drilling after a late 2007 government sharing adjustment. In October 2007, the government of Ecuador passed a law that increased its share of revenue for sales prices that exceed a base price (about $23.28 per barrel at December 31, 2007) from 50% to 99%. The government had previously enacted a 50% revenue sharing rate in April 2006. The working interest owners in Block 16 intend to initiate arbitration proceedings against the government claiming that they do not have a right under the contract to enforce a revenue sharing provision. The arbitration proceedings could take many months to reach conclusion. Meanwhile, the Company and its partners are actively negotiating a contract revision with the government.

The Company has interests in Production Sharing Agreements covering two offshore blocks in the Republic of Congo. These blocks are named Mer Profonde Sud (MPS) and Mer Profonde Nord (MPN), and together, cover approximately 1.8 million acres with water depths ranging from 490 to 6,900 feet. Murphy drilled its first exploration well in late 2004 and in early 2005 announced an oil discovery at Azurite Marine #1 in the southern block, MPS. In 2005, the Company successfully followed up the Azurite discovery with an appraisal well that tested at 8,000 barrels of oil per day from one zone. A third well in early 2006 further appraised the Azurite area. The Company’s Board of Directors approved the development of the Azurite field in late 2006. During 2007, the Company continued its development of the Azurite field, with first oil production currently anticipated in 2009. In late 2007, the Company sold down its interest in the MPS block, including the Azurite field, from 85% to 50%, subject to the approval of the government of the Republic of Congo, which is expected in early 2008. The initial sales price was $83.5 million with additional consideration of up to $26.5 million contingent upon achieving certain financial and operating goals for Azurite field development. In addition, the Company will receive a partial carry on costs for two upcoming exploration wells in MPS. Once the transfer is approved by the Congolese government, the Company’s net acreage will be reduced by approximately 495 thousand acres.

In June 2007, Murphy entered into a production sharing contact covering Block 37, offshore Suriname. Murphy operates this block and has an 80% interest. Block 37 covers approximately 2.1 million acres and has water depths ranging from 160 to 1,000 feet. The contract provides for an initial six-year exploration phase and requires the acquisition of 3D seismic and the drilling of two wells, the first of which is likely to be drilled in 2009.

The Company acquired a 40% interest and operatorship of an exploration permit covering approximately 1.0 million gross acres in Block AC/P36 in the Browse Basin offshore northwestern Australia in November 2007. The transfer of the interest to Murphy is pending government approval, which is expected in early 2008. Three-dimensional seismic was obtained in late 2007 and the first exploration well is anticipated to spud in late 2008.

Murphy’s estimated net quantities of proved oil and gas reserves and proved developed oil and gas reserves at December 31, 2004, 2005, 2006 and 2007 by geographic area are reported on pages F-35 and F-36 of this Form 10-K report. Murphy has not filed and is not required to file any estimates of its total net proved oil or gas reserves on a recurring basis with any federal or foreign governmental regulatory authority or agency other than the U.S. Securities and Exchange Commission. Annually, Murphy reports gross reserves of properties operated in the United States to the U.S. Department of Energy; such reserves are derived from the same data from which estimated net proved reserves of such properties are determined.

Net crude oil, condensate and gas liquids production and sales, and net natural gas sales by geographic area with weighted average sales prices for each of the seven years ended December 31, 2007 are shown on page 6 of the 2007 Annual Report. In 2007, the Company’s production of oil and natural gas represented approximately 0.1% of the respective worldwide totals.

3

Production expenses for the last three years in U.S. dollars per equivalent barrel are discussed on page 20 of this Form 10-K report. For purposes of these computations, natural gas sales volumes are converted to equivalent barrels of crude oil using a ratio of six thousand cubic feet (MCF) of natural gas to one barrel of crude oil.

Supplemental disclosures relating to oil and gas producing activities are reported on pages F-34 through F-41 of this Form 10-K report.

At December 31, 2007, Murphy held leases, concessions, contracts or permits on developed and undeveloped acreage as shown by geographic area in the following table. Gross acres are those in which all or part of the working interest is owned by Murphy. Net acres are the portions of the gross acres attributable to Murphy’s interest.

| | | | | | | | | | | | |

| | | Developed | | Undeveloped | | Total |

Area (Thousands of acres) | | Gross | | Net | | Gross | | Net | | Gross | | Net |

United States – Onshore | | 3 | | 2 | | 190 | | 118 | | 193 | | 120 |

– Gulf of Mexico | | 13 | | 5 | | 1,194 | | 783 | | 1,207 | | 788 |

– Alaska | | 3 | | 1 | | 4 | | — | | 7 | | 1 |

| | | | | | | | | | | | |

Total United States | | 19 | | 8 | | 1,388 | | 901 | | 1,407 | | 909 |

| | | | | | | | | | | | |

Canada – Onshore | | 41 | | 30 | | 317 | | 284 | | 358 | | 314 |

– Offshore | | 88 | | 8 | | 6,526 | | 1,682 | | 6,614 | | 1,690 |

| | | | | | | | | | | | |

Total Canada | | 129 | | 38 | | 6,843 | | 1,966 | | 6,972 | | 2,004 |

| | | | | | | | | | | | |

United Kingdom | | 33 | | 4 | | 40 | | 6 | | 73 | | 10 |

Malaysia | | 7 | | 6 | | 9,628 | | 6,521 | | 9,635 | | 6,527 |

Ecuador | | 7 | | 1 | | 524 | | 105 | | 531 | | 106 |

Republic of Congo | | — | | — | | 1,773 | | 1,201 | | 1,773 | | 1,201 |

Suriname | | — | | — | | 2,164 | | 1,731 | | 2,164 | | 1,731 |

Spain | | — | | — | | 36 | | 6 | | 36 | | 6 |

| | | | | | | | | | | | |

Totals | | 195 | | 57 | | 22,396 | | 12,437 | | 22,591 | | 12,494 |

| | | | | | | | | | | | |

Oil sands – Syncrude | | 96 | | 5 | | 160 | | 8 | | 256 | | 13 |

The above table excludes 191 thousand net acres held by Berkana Energy, a subsidiary which was sold by the Company in January 2008, and approximately 401 thousand net acres in Block AC/P36 in the Browse Basin offshore northwestern Australia that is pending government approval for the Company’s acquisition. Significant undeveloped net acreage that expires in 2008 consists of approximately 299 thousand net acres in the Republic of Congo and 1,592 thousand net acres in Block H Malaysia. In 2010 net acreage expirations include 1,133 thousand net acres in Blocks SK 309/311 in Malaysia and 1,913 thousand net acres in Blocks L and M Malaysia. As discussed more fully on page 3, Blocks L and M are also claimed by the Sultanate of Brunei.

As used in the three tables that follow, “gross” wells are the total wells in which all or part of the working interest is owned by Murphy, and “net” wells are the total of the Company’s fractional working interests in gross wells expressed as the equivalent number of wholly owned wells.

The following table shows the number of oil and gas wells producing or capable of producing at December 31, 2007.

| | | | | | | | |

| | | Oil Wells | | Gas Wells |

Country | | Gross | | Net | | Gross | | Net |

United States | | 34 | | 9 | | 14 | | 6 |

Canada | | 502 | | 387 | | 20 | | 12 |

United Kingdom | | 33 | | 3 | | 23 | | 2 |

Malaysia | | 21 | | 18 | | — | | — |

Ecuador | | 167 | | 33 | | — | | — |

| | | | | | | | |

Totals | | 757 | | 450 | | 57 | | 20 |

| | | | | | | | |

4

Murphy’s net wells drilled in the last three years are shown in the following table.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | United

States | | Canada | | United

Kingdom | | Malaysia | | Ecuador

and Other | | Totals |

| | | Productive | | Dry | | Productive | | Dry | | Productive | | Dry | | Productive | | Dry | | Productive | | Dry | | Productive | | Dry |

2007 | | | | | | | | | | | | | | | | | | | | | | | | |

Exploratory | | 0.8 | | 3.0 | | 0.3 | | — | | — | | — | | 0.8 | | 0.8 | | — | | — | | 1.9 | | 3.8 |

Development | | 1.4 | | — | | 47.2 | | 9.2 | | 0.2 | | 0.1 | | 5.6 | | — | | 5.0 | | — | | 59.4 | | 9.3 |

| | | | | | | | | | | | |

2006 | | | | | | | | | | | | | | | | | | | | | | | | |

Exploratory | | 0.8 | | 1.4 | | — | | — | | — | | — | | 11.8 | | 3.4 | | 1.0 | | 0.2 | | 13.6 | | 5.0 |

Development | | — | | — | | 61.5 | | 24.8 | | 0.1 | | — | | 2.4 | | — | | 5.2 | | — | | 69.2 | | 24.8 |

| | | | | | | | | | | | |

2005 | | | | | | | | | | | | | | | | | | | | | | | | |

Exploratory | | 1.5 | | 2.2 | | — | | — | | — | | 0.5 | | 10.2 | | 5.0 | | 2.0 | | 4.2 | | 13.7 | | 11.9 |

Development | | 0.9 | | — | | 87.0 | | 8.0 | | 0.1 | | — | | — | | — | | 4.0 | | — | | 92.0 | | 8.0 |

Murphy’s drilling wells in progress at December 31, 2007 are shown below.

| | | | | | | | | | | | |

| | | Exploratory | | Development | | Total |

Country | | Gross | | Net | | Gross | | Net | | Gross | | Net |

Canada | | — | | — | | 4.0 | | 2.1 | | 4.0 | | 2.1 |

United Kingdom | | — | | — | | 2.0 | | 0.1 | | 2.0 | | 0.1 |

Ecuador | | — | | — | | 2.0 | | 0.4 | | 2.0 | | 0.4 |

Malaysia | | 1.0 | | 0.8 | | — | | — | | 1.0 | | 0.8 |

| | | | | | | | | | | | |

Totals | | 1.0 | | 0.8 | | 8.0 | | 2.6 | | 9.0 | | 3.4 |

| | | | | | | | | | | | |

Refining and Marketing

The Company’s refining and marketing businesses are located in the United States and the United Kingdom, and primarily consist of operations that refine crude oil and other feedstocks into petroleum products such as gasoline and distillates, buy and sell crude oil and refined products, and transport and market petroleum products. During 2007, the Company closed eight gasoline stations in Canada and no longer has gasoline marketing operations in that country.

Murphy Oil USA, Inc. (MOUSA), a wholly owned subsidiary of Murphy Oil Corporation, owns and operates two refineries in the United States. The larger of its U.S. refineries is at Meraux, Louisiana, on the Mississippi River approximately 10 miles southeast of New Orleans. The refinery is located on fee land. The Company’s refinery at Superior, Wisconsin is also located on fee land. Murco Petroleum Limited (Murco), a wholly owned U.K. subsidiary, owns 100% interest in a refinery at Milford Haven, Wales. Murco acquired the remaining 70% of the Milford Haven refinery that it did not already own on December 1, 2007 and now fully operates the facility, which is primarily located on fee land.

5

Refinery capacities at December 31, 2007 are shown in the following table.

| | | | | | | | |

| | | Meraux,

Louisiana | | Superior,

Wisconsin | | Milford Haven,

Wales | | Total |

Crude capacity – b/sd* | | 125,000 | | 35,000 | | 108,000 | | 268,000 |

| | | | |

Process capacity – b/sd* | | | | | | | | |

Vacuum distillation | | 50,000 | | 20,500 | | 55,000 | | 125,500 |

Catalytic cracking – fresh feed | | 37,000 | | 11,000 | | 37,000 | | 85,000 |

Naphtha hydrotreating | | 35,000 | | 10,500 | | 18,300 | | 63,800 |

Catalytic reforming | | 32,000 | | 8,000 | | 18,300 | | 58,300 |

Gasoline hydrotreating | | — | | 7,500 | | — | | 7,500 |

Distillate hydrotreating | | 52,000 | | 11,800 | | 74,000 | | 137,800 |

Hydrocracking | | 32,000 | | — | | — | | 32,000 |

Gas oil hydrotreating | | 12,000 | | — | | — | | 12,000 |

Solvent deasphalting | | 18,000 | | — | | — | | 18,000 |

Isomerization | | — | | — | | 11,300 | | 11,300 |

| | | | |

Production capacity – b/sd* | | | | | | | | |

Alkylation | | 8,500 | | 1,500 | | 6,300 | | 16,300 |

Asphalt | | — | | 7,500 | | — | | 7,500 |

| | | | |

Crude oil and product storage capacity – barrels | | 2,820,000 | | 3,085,000 | | 8,908,000 | | 14,813,000 |

In late August 2005, the Meraux, Louisiana refinery was severely damaged by flooding and high winds caused by Hurricane Katrina. The Meraux refinery was shut-down for repairs for about nine months following the hurricane and restarted in mid-2006. The majority of costs to repair the Meraux refinery are expected to be covered by insurance. Oil Insurance Limited (O.I.L.), the Company’s primary property insurance coverage, has informed insureds that it has currently estimated that recoveries for Hurricane Katrina damages will likely be no more than 46% of claimants’ eligible losses. Murphy has other commercial insurance coverage for repair costs not covered by O.I.L., but this coverage limits recoveries from flood damage to $50.0 million. Costs to repair the refinery were approximately $196.0 million. Based on the expected insurance recoveries and repair costs as described, the Company recorded expenses for repair costs not recoverable from insurance of $50.7 million in 2006 and a further $3.0 million in 2007. The final settlement and recovery of insurance could take several years to complete. At December 31, 2007, total receivables from insurance companies related to hurricane repairs at Meraux was $38.9 million.

In 2003, Murphy expanded the Meraux refinery allowing the refinery to meet low-sulfur gasoline specifications which became effective January 1, 2008. The expansion included a new hydrocracker unit, central control room and two new utility boilers; expansion of the crude oil processing capacity to 125,000 barrels per stream day (b/sd); expansion of naphtha hydrotreating capacity to 35,000 b/sd; expansion of the catalytic reforming capacity to 32,000 b/sd; and construction of a new sulfur recovery complex, including amine regeneration, sour water stripping and high efficiency sulfur recovery. During 2004 the Company also completed the addition of a fluid catalytic cracking gasoline hydrotreater unit at its Superior, Wisconsin refinery, that allows the refinery to meet low-sulfur gasoline specifications. In 2006, the isomerization unit at the Superior refinery was revamped to a hydrotreater and one of two existing naptha hydrotreaters was revamped to a kerosine hydrotreater.

MOUSA markets refined products through a network of retail gasoline stations and branded and unbranded wholesale customers in a 23-state area of the southern and midwestern United States. Murphy’s retail stations are primarily located in the parking lots of Wal-Mart Supercenters in 20 states and use the brand name Murphy USA®. The Company also markets gasoline and other products at standalone stations under the Murphy Express® brand. Branded wholesale customers use the brand name SPUR®. Refined products are supplied from 12 terminals that are wholly owned and operated by MOUSA and numerous terminals owned by others. Of the wholly owned terminals, three are supplied by marine transportation, three are supplied by truck, four are supplied by pipeline and two are adjacent to MOUSA’s refineries. The Company opened a newly built finished products terminal near Jonesboro, Arkansas in 2007. MOUSA also receives products at terminals owned by others either in exchange for deliveries from the Company’s terminals or by outright purchase. At December 31, 2007, the Company marketed products through 973 Murphy stations and 153 branded wholesale SPUR stations. MOUSA plans to build additional retail gasoline stations at Wal-Mart Supercenters and other standalone locations in 2008.

As of December 31, 2007 all but two of the Company’s operated gasoline stations are located in the parking lots of Wal-Mart Supercenters. During 2007, the Company agreed to buy the land underlying most of these stations from Wal-Mart. Through February 2008, the Company had acquired 730 sites from Wal-Mart, and additional sites are expected to be purchased in the future. Ownership of the sites effectively

6

terminates the master ground rent agreement as to these sites, and no further rent is payable to Wal-Mart for the purchased locations. For the remaining gasoline station sites not acquired from Wal-Mart, Murphy has master agreements that allow the Company to rent land from Wal-Mart. The master agreements contain general terms applicable to all rental sites in the United States. The terms of the agreements range from 10-15 years at each station, with Murphy holding two successive five-year extension options at each site. The agreements permit Wal-Mart to terminate the agreements in their entirety, or only as to affected sites, at its option for the following reasons: Murphy vacates or abandons the property; Murphy improperly transfers the rights under this agreement to another party; an agreement or a premises is taken upon execution or by process of law; Murphy files a petition in bankruptcy or becomes insolvent; Murphy fails to pay its debts as they become due; Murphy fails to pay rent or other sums required to be paid within 90 days after written notice; or Murphy fails to perform in any material way as required by the agreements. Sales from these stations represented 48.8% of consolidated Company revenues in 2007, 51.7% in 2006 and 44.6% in 2005. As the Company continues to expand the number of gasoline stations at Wal-Mart Supercenters and other locations, total revenue generated by this business is expected to grow.

Murphy owns a 20% interest in a 120-mile refined products pipeline, with a capacity of 165,000 barrels per day, that transports products from the Meraux refinery to two common carrier pipelines serving the southeastern United States. The Company also owns a 3.2% interest in the Louisiana Offshore Oil Port LLC (LOOP), which provides deepwater unloading accommodations off the Louisiana coast for oil tankers and onshore facilities for storage of crude oil. A crude oil pipeline with a diameter of 24 inches connects LOOP storage at Clovelly, Louisiana to the Meraux refinery. In December 2006, Murphy acquired an additional 10.7% interest in the first 22 miles of this pipeline from Clovelly to Alliance, Louisiana, thereby raising its ownership interest to 40.1%; the Company owns 100% of the remaining 24 miles from Alliance to Meraux. This crude oil pipeline is connected to another company’s pipeline system, allowing crude oil transported by that system to also be shipped to the Meraux refinery.

In 2007, Murphy owned approximately 1.0% of the crude oil refining capacity in the United States and its market share of U.S. retail gasoline sales was approximately 2.2%.

At the end of 2007, Murco distributed refined products in the United Kingdom from the wholly-owned Milford Haven refinery, three wholly owned terminals supplied by rail, six terminals owned by others where products are received in exchange for deliveries from the Company’s terminals, and 389 branded stations primarily under the brand name MURCO. The Company owns 162 of these branded stations and the remainder are branded dealers.

A statistical summary of key operating and financial indicators for each of the seven years ended December 31, 2007 are reported on page 7 of the 2007 Annual Report.

Competition

Murphy operates in the oil and gas industry and experiences intense competition from other oil and gas companies, which include state-owned foreign oil companies, major integrated oil companies, independent producers of oil and natural gas and independent refining companies. Virtually all of the state-owned and major integrated oil companies and many of the independent producers and refiners that compete with the Company have substantially greater resources than Murphy. In addition, the oil industry as a whole competes with other industries in supplying energy requirements around the world. Murphy competes, among other things, for valuable acreage positions, exploration licenses, drilling equipment and human resources.

Reserve Replacement

Murphy continually depletes its oil and natural reserves as production occurs. In order to sustain and grow its business, the Company must successfully replace the crude oil and natural gas it produces with additional reserves. Therefore, it must create and maintain a portfolio of good prospects for future reserve additions and production by obtaining rights to explore for, develop and produce hydrocarbons in promising areas. In addition, it must find, develop and produce and/or purchase reserves found at a competitive cost structure to be successful in the long-term. Murphy’s ability to operate profitably in the exploration and production segments of its business, therefore, is dependent on its ability to find, develop and produce and/or purchase oil and natural gas reserves at costs that are less than the realized sales price for these products and at costs competitive with competing companies in the industry.

Proved Reserves

Proved crude oil and natural gas reserves included in this report on pages F-35 and F-36 have been prepared by Company personnel and outside experts based on oil and natural gas prices in effect at the end of each year as well as other conditions and information available at the time the estimates were prepared. Estimation of reserves is a subjective process that involves professional judgment by engineers about volumes to be recovered in future periods from underground crude oil and natural gas reservoirs. Estimates of economically recoverable crude oil and natural gas reserves and future net cash flows depend upon a number of variable factors and assumptions, and consequently, different engineers could arrive at different estimates of reserves and future net cash flows based on the same available data and using industry accepted engineering practices and scientific methods.

7

Future changes in crude oil and natural gas prices may have a material effect on the reported quantity of our proved reserves and the standardized measure of discounted future cash flows relating to proved reserves. Future reserve revisions could also occur as a result of changes in other factors such as governmental regulations.

The Company’s proved undeveloped reserves and non-producing proved developed reserves represent significant portions of total proved reserves. As of December 31, 2007, approximately 34% of the Company’s proved oil reserves and 69% of proved natural gas reserves are undeveloped. The ability of the Company to reclassify these undeveloped proved reserves to the proved developed classification is generally dependent on the successful completion of one or more operations, which might include further development drilling, construction of facilities or pipelines, and well workovers. Proved undeveloped reserves have inherently more risk than proved developed reserves, generally due to significant development work which is both costly and uncertain as to timing of completion prior to the start of production. Also, at December 31, 2007, the Company’s non-producing proved developed reserves represent approximately 5% of the Company’s total proved reserves on a barrel of oil equivalent basis. These non-producing proved developed reserves are primarily in the U.S. Gulf of Mexico and generally represent “behind pipe” reserves that will require an uphole recompletion to produce the more shallow oil or natural gas reservoir. These “behind pipe” reserves have more risk than producing proved developed reserves.

The discounted future net revenues from our proved reserves should not be considered as the market value of the reserves attributable to our properties. As required by generally accepted accounting principles, the estimated discounted future net revenues from our proved reserves are based generally on prices and costs as of year-end, while actual future prices and costs may be materially higher or lower. In addition, the 10 percent discount factor that is required to be used to calculate discounted future net revenues for reporting purposes under generally accepted accounting principles is not necessarily the most appropriate discount factor based on our cost of capital and the risks associated with our business and the crude oil and natural gas business in general.

Price Volatility

The most significant variables affecting the Company’s results of operations are the sales prices for crude oil, natural gas and refined products that it produces. The Company’s income in 2007 was favorably affected by high crude oil and natural gas prices. If these prices decline significantly in 2008 or future years, the Company’s results of operations would be negatively impacted. In addition, the Company’s net income could be adversely affected by lower future refining and marketing margins. Except in limited cases, the Company typically does not seek to hedge any significant portion of its exposure to the effects of changing prices of crude oil, natural gas and refined products. Certain of the Company’s crude oil production is heavy and more sour than West Texas Intermediate (WTI) quality crude; therefore, this crude oil usually sells at a discount to WTI and other light and sweet crude oils. In addition, the sales prices for heavy and sour crude oils do not always move in relation to price changes for WTI and lighter/sweeter crude oils.

Dry Hole Exposure

The Company generally drills numerous wildcat wells each year which subjects its exploration and production operating results to significant exposure to dry holes expense, which have adverse effects on, and create volatility for, the Company’s overall net income. In 2007, significant wildcat wells were primarily drilled offshore Malaysia and in the U.S. Gulf of Mexico. The Company’s 2008 budget calls for wildcat drilling primarily in the Gulf of Mexico, and in waters offshore Malaysia, the Republic of Congo and Australia.

Capital Financing

Murphy usually must spend and risk a significant amount of capital to find and develop reserves before revenue is generated from production. Although most capital needs are funded from operating cash flow, the timing of cash flows from operations and capital funding needs may not always coincide. Therefore, the Company maintains financing arrangements with lending institutions to meet certain funding needs. The Company must periodically renew these financing arrangements based on foreseeable financing needs. Although not considered likely, there is the possibility that financing arrangements may not always be available at sufficient levels required to fund the Company’s development activities.

Limited Control

The ability of the Company to successfully manage development and operating costs is important because virtually all of the products it sells are energy commodities such as crude oil, natural gas and refined products, for which the Company has little or no influence on the sales prices or regional and worldwide consumer demand for these products. Murphy is a net purchaser of crude oil and other refinery feedstocks, and also purchases refined products, particularly gasoline, needed to supply its retail marketing stations. Therefore, its most significant costs are subject to volatility of prices for these commodities. The Company also often experiences pressure on its operating and capital expenditures in periods of strong crude oil, natural gas and refined product prices such as those experienced in 2007 and 2006 because an increase in exploration and production activities due to high oil and gas sales prices generally leads to higher demand for, and consequently higher costs for, goods and services in the oil and gas industry.

Many of the Company’s major oil and natural gas producing properties are operated by others. During 2007, approximately 56% of the Company’s total production was at fields operated by others, while at December 31, 2007, approximately 32% of the Company’s total proved reserves were at fields operated by others. Therefore, Murphy does not fully control all activities at certain of its significant revenue generating properties.

8

Outside Forces

The operations and earnings of Murphy have been and will continue to be affected by worldwide political developments. Many governments, including those that are members of the Organization of Petroleum Exporting Countries (OPEC), unilaterally intervene at times in the orderly market of crude oil and natural gas produced in their countries through such actions as setting prices, determining rates of production, and controlling who may buy and sell the production. As of December 31, 2007, approximately 58% of proved reserves, as defined by the U.S. Securities and Exchange Commission, were located in countries other than the U.S., Canada and the U.K. Certain of the reserves held outside these three countries could be considered to have more political risk. In addition, prices and availability of crude oil, natural gas and refined products could be influenced by political unrest and by various governmental policies to restrict or increase petroleum usage and supply. Other governmental actions that could affect Murphy’s operations and earnings include tax changes, royalty increases and regulations concerning: currency fluctuations, protection and remediation of the environment (See the caption “Environmental” beginning on page 25 of this Form 10-K report), preferential and discriminatory awarding of oil and gas leases, restrictions on drilling and/or production, restraints and controls on imports and exports, safety, and relationships between employers and employees. Because these and other factors too numerous to list are subject to changes caused by governmental and political considerations and are often made in response to changing internal and worldwide economic conditions and to actions of other governments or specific events, it is not practical to attempt to predict the effects of such factors on Murphy’s future operations and earnings.

Industry and Other Risks

Murphy’s business is subject to operational hazards and risks normally associated with the exploration for and production of oil and natural gas and the refining and marketing of crude oil and petroleum products. The Company operates in urban and remote, and often inhospitable, areas around the world. The occurrence of an event, including but not limited to acts of nature such as hurricanes, floods, earthquakes and other forms of severe weather, and mechanical equipment failures, industrial accidents, fires, explosions, acts of war and intentional terrorist attacks could result in the loss of hydrocarbons and associated revenues, environmental pollution or contamination, and personal injury, including death, for which the Company could be deemed to be liable, and which could subject the Company to substantial fines and/or claims for punitive damages.

The location of many of Murphy’s key assets causes the Company to be vulnerable to severe weather, including hurricanes and tropical storms. A number of significant oil and natural gas fields lie in offshore waters around the world. Probably the most vulnerable of the Company’s offshore fields are in the U.S. Gulf of Mexico, where severe hurricanes and tropical storms have often led to shutdowns and damages. The U.S. hurricane season runs from June through November, but the most severe storm activities usually occur in late summer, such as with Hurricanes Katrina and Rita in 2005. Additionally, the Company’s largest refinery is located about 10 miles southeast of New Orleans, Louisiana. In August 2005, Hurricane Katrina passed near the refinery causing major flooding and severe wind damage. The gradual loss of coastal wetlands in southeast Louisiana increases the risk of future flooding should storms such as Katrina recur. Other assets such as gasoline terminals and certain retail gasoline stations also lie near the Gulf of Mexico coastlines and are vulnerable to storm damages. During the repairs at Meraux following Hurricane Katrina, the refinery took steps to try to reduce the potential for damages from future storms of similar magnitude. For example, certain key equipment such as motors and pumps were raised above ground level when feasible. These steps may somewhat reduce the damages associated with windstorm and major flooding that could occur with a future storm similar in strength to Katrina, but the risks from such a storm are not eliminated. Although the Company also maintains insurance for such risks as described below, due to policy deductibles and possible coverage limits, weather-related risks are not fully insured.

Insurance

Murphy maintains insurance against certain, but not all, hazards that could arise from its operations, and such insurance is believed to be reasonable for the hazards and risks faced by the Company. As of December 31, 2007, the Company maintained total excess liability insurance with limits of $750 million per occurrence covering certain general liability and certain “sudden and accidental” environmental risks. The Company also maintained insurance coverage with an additional limit of $250 million per occurrence, all or part of which could be applicable to certain sudden and accidental pollution events. There can be no assurance that such insurance will be adequate to offset costs associated with certain events or that insurance coverage will continue to be available in the future on terms that justify its purchase. The occurrence of an event that is not fully insured could have a material adverse effect on the Company’s financial condition and results of operations in the future. During 2005, damages from hurricanes caused shut-down of certain U.S. oil and gas production operations as well as the Meraux, Louisiana refinery. The Company repaired the Meraux refinery and it restarted operations in mid-2006. The Company does not expect to fully recover repair costs incurred at Meraux under its insurance policies. See Note Q in the consolidated financial statements for further discussion.

Litigation

The Company is involved in numerous lawsuits seeking cash settlements for alleged personal injuries, property damages and other business-related matters. The most significant of these matters are addressed in more detail in Item 3 beginning on page 10 of this Form 10-K report.

Credit Exposure

Although Murphy limits its credit risk by selling its products to numerous entities worldwide, it still, at times, carries substantial credit risk from its customers. For certain oil and gas properties operated by the Company, other companies which own partial interests may not be able to meet their financial obligation to pay for their share of capital and operating costs as they come due.

9

Retirement Plans

A number of actuarial assumptions impact funding requirements for the Company’s retirement plans. The most significant of these assumptions include return on assets, long-term interest rates and mortality. If the actual results for the plans vary significantly from the actuarial assumptions used, or if laws regulating such retirement plans are changed, Murphy could be required to make significant funding payments to one or more of its retirement plans in the future and/or it could be required to record a larger liability for future obligations in its Consolidated Balance Sheet.

| Item 1B. | UNRESOLVED STAFF COMMENTS |

The Company had no unresolved comments from the staff of the U.S. Securities and Exchange Commission as of December 31, 2007.

Descriptions of the Company’s oil and natural gas and refining and marketing properties are included in Item 1 of this Form 10-K report beginning on page 1. Information required by the Securities Exchange Act Industry Guide No. 2 can be found in the Supplemental Oil and Gas Information section of this Annual Report on Form 10-K on pages F-34 to F-41 and in Note E—Property, Plant and Equipment on page F-12.

Executive Officers of the Registrant

The age at January 1, 2008, present corporate office and length of service in office of each of the Company’s executive officers are reported in the following listing. Executive officers are elected annually but may be removed from office at any time by the Board of Directors.

Claiborne P. Deming – Age 53; President and Chief Executive Officer since October 1994 and Director and Member of the Executive Committee since 1993.

Steven A. Cossé – Age 60; Executive Vice President since February 2005 and General Counsel since August 1991. Mr. Cossé was elected Senior Vice President in 1994 and Vice President in 1993.

Harvey Doerr – Age 49; Executive Vice President responsible for the Company’s worldwide refining and marketing operations and strategic planning effective January 1, 2007. Mr. Doerr served as President of Murphy Oil Company Ltd. from September 1997 through December 2006.

David M. Wood – Age 50; Executive Vice President responsible for the Company’s worldwide exploration and production operations effective January 1, 2007. Mr. Wood served as President of Murphy Exploration & Production Company-International from March 2003 through December 2006 and was Senior Vice President of Frontier Exploration & Production from April 1999 through February 2003.

Kevin G. Fitzgerald – Age 52; Senior Vice President and Chief Financial Officer since January 1, 2007. He served as Treasurer from July 2001 through December 2006 and was Director of Investor Relations from 1996 through June 2001.

Bill H. Stobaugh – Age 56; Senior Vice President since February 2005. Mr. Stobaugh joined the Company as Vice President in 1995.

Mindy K. West – Age 38; Vice President and Treasurer since January 1, 2007. Ms. West was Director of Investor Relations from July 2001 through December 2006.

John W. Eckart – Age 49; Vice President and Controller since January 1, 2007. Mr. Eckart served as Controller since March 2000.

Walter K. Compton – Age 45; Secretary since December 1996.

On September 9, 2005, a class action lawsuit was filed in federal court in the Eastern District of Louisiana seeking unspecified damages to the class comprised of residents of St. Bernard Parish caused by a release of crude oil at Murphy Oil USA, Inc.’s (a wholly-owned subsidiary of Murphy Oil Corporation) Meraux, Louisiana, refinery as a result of flood damage to a crude oil storage tank following Hurricane Katrina. Additional class action lawsuits were consolidated with the first suit into a single action in the U.S. District Court for the Eastern District of Louisiana. In September 2006, the Company reached a settlement with class counsel and on October 10, 2006, the court granted preliminary approval of a class action Settlement Agreement. A Fairness Hearing was held January 4, 2007 and the court entered its ruling on January 30, 2007 approving the class settlement. The majority of the settlement of $330 million will be paid by insurance. The Company recorded an expense of $18 million in 2006 related to settlement costs not expected to be covered by insurance. As part of the settlement, all properties in the class area will receive a fair and equitable cash payment and will have residual oil cleaned. As part of the settlement, the Company will offer to purchase all properties in an agreed area adjacent to the west side of the Meraux refinery; these property purchases and associated remediation will be paid by the Company and are expected to total $55 million. Approximately 75 non-class action suits regarding the oil spill have been filed and remain pending. The Company believes that insurance coverage exists and it does not expect to incur significant costs

10

associated with this litigation. On August 14, 2007, four of the Company’s high level excess insurers noticed the Company for arbitration in London. The insurers do not deny coverage, but seek arbitration as to whether and to what extent expenditures made by the Company in resolving the oil spill litigation have reached the attachment point for covered loss under their respective policies. The Company is of the position that full coverage should be afforded. Accordingly, the Company believes neither the ultimate resolution of the remaining litigation nor the insurance arbitration will have a material adverse effect on its net income, financial condition or liquidity in a future period.

On June 10, 2003, a fire severely damaged the Residual Oil Supercritical Extraction (ROSE) unit at the Company’s Meraux, Louisiana refinery. The ROSE unit recovers feedstock from the heavy fuel oil stream for conversion into gasoline and diesel. Subsequent to the fire, numerous class action lawsuits have been filed seeking damages for area residents. All the lawsuits have been administratively consolidated into a single legal action in St. Bernard Parish, Louisiana, except for one such action which was filed in federal court. Additionally, individual residents of Orleans Parish, Louisiana, have filed an action in that venue. On May 5, 2004, plaintiffs in the consolidated action in St. Bernard Parish amended their petition to include a direct action against certain of the Company’s liability insurers. The St. Bernard Parish action has since been removed to federal court where a class certification decision is pending. In responding to this direct action, one of the Company’s insurers, AEGIS, has raised lack of coverage as a defense. The Company believes that this contention lacks merit and has been advised by counsel that the applicable policy does provide coverage for the underlying incident. Because the Company believes that insurance coverage exists for this matter, it does not expect to incur any significant costs associated with the class action lawsuits. Accordingly, the Company continues to believe that the ultimate resolution of the June 2003 ROSE fire litigation will not have a material adverse effect on its net income, financial condition or liquidity in a future period.

Murphy and its subsidiaries are engaged in a number of other legal proceedings, all of which Murphy considers routine and incidental to its business. Based on information currently available to the Company, the ultimate resolution of matters referred to in this item is not expected to have a material adverse effect on the Company’s net income, financial condition or liquidity in a future period.

| Item 4. | SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS |

No matters were submitted to a vote of security holders during the fourth quarter of 2007.

PART II

| Item 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The Company’s Common Stock is traded on the New York Stock Exchange using “MUR” as the trading symbol. There were 2,655 stockholders of record as of December 31, 2007. Information as to high and low market prices per share and dividends per share by quarter for 2007 and 2006 are reported on page F-42 of this Form 10-K report.

11

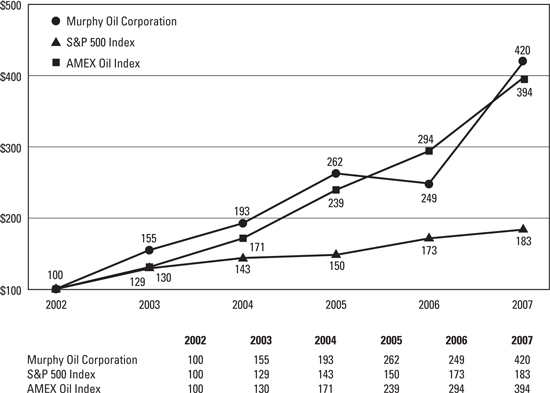

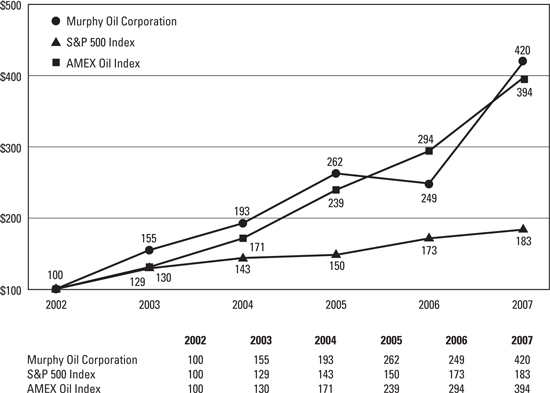

SHAREHOLDER RETURN PERFORMANCE PRESENTATION

The following line graph is furnished with this Form 10-K and presents a comparison of the cumulative five-year shareholder returns (including the reinvestment of dividends) for the Company, the Standard & Poor’s 500 Stock Index (S&P 500 Index) and the AMEX Oil Index.

Murphy Oil Corporation

Comparison of Five-Year Cumulative Shareholder Returns

SOURCE: Bloomberg L.P.

12

| Item 6. | SELECTED FINANCIAL DATA |

| | | | | | | | | | | |

(Thousands of dollars except per share data) | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Results of Operations for the Year | | | | | | | | | | | |

Sales and other operating revenues | | $ | 18,423,771 | | 14,279,325 | | 11,680,079 | | 8,299,147 | | 5,094,518 |

Net cash provided by continuing operations | | | 1,740,420 | | 975,478 | | 1,240,382 | | 1,043,049 | | 562,999 |

Income from continuing operations | | | 766,529 | | 644,669 | | 846,193 | | 500,208 | | 278,927 |

Net income | | | 766,529 | | 644,669 | | 854,742 | | 705,128 | | 294,714 |

Per Common share – diluted | | | | | | | | | | | |

Income from continuing operations | | | 4.01 | | 3.41 | | 4.50 | | 2.68 | | 1.50 |

Net income | | | 4.01 | | 3.41 | | 4.55 | | 3.77 | | 1.59 |

Cash dividends per Common share | | | .675 | | .525 | | .45 | | .425 | | .40 |

Percentage return on | | | | | | | | | | | |

Average stockholders’ equity | | | 16.8 | | 16.8 | | 28.0 | | 30.7 | | 16.1 |

Average borrowed and invested capital | | | 13.9 | | 14.4 | | 23.5 | | 21.6 | | 10.8 |

Average total assets | | | 8.5 | | 9.3 | | 14.6 | | 13.4 | | 6.6 |

| | | | | |

Capital Expenditures for the Year | | | | | | | | | | | |

Continuing operations | | | | | | | | | | | |

Exploration and production | | $ | 1,780,743 | | 1,082,756 | | 1,091,954 | | 839,182 | | 689,632 |

Refining and marketing | | | 572,458 | | 173,400 | | 202,401 | | 134,706 | | 215,362 |

Corporate and other | | | 4,146 | | 6,383 | | 35,476 | | 1,505 | | 1,120 |

| | | | | | | | | | | |

| | | 2,357,347 | | 1,262,539 | | 1,329,831 | | 975,393 | | 906,114 |

Discontinued operations | | | — | | — | | — | | 9,065 | | 73,050 |

| | | | | | | | | | | |

| | $ | 2,357,347 | | 1,262,539 | | 1,329,831 | | 984,458 | | 979,164 |

| | | | | | | | | | | |

Financial Condition at December 31 | | | | | | | | | | | |

Current ratio | | | 1.37 | | 1.61 | | 1.43 | | 1.35 | | 1.28 |

Working capital | | $ | 777,530 | | 795,986 | | 551,938 | | 424,372 | | 228,529 |

Net property, plant and equipment | | | 7,109,822 | | 5,106,282 | | 4,374,229 | | 3,685,594 | | 3,530,800 |

Total assets | | | 10,535,849 | | 7,483,161 | | 6,410,396 | | 5,498,903 | | 4,769,808 |

Long-term debt | | | 1,516,156 | | 840,275 | | 609,574 | | 613,355 | | 1,090,307 |

Stockholders’ equity | | | 5,066,174 | | 4,121,273 | | 3,522,070 | | 2,702,632 | | 1,999,391 |

Per share | | | 26.70 | | 21.97 | | 18.94 | | 14.68 | | 10.88 |

Long-term debt – percent of capital employed | | | 23.0 | | 16.9 | | 14.8 | | 18.5 | | 35.3 |

13

| Item 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

Overview

Murphy Oil Corporation is a worldwide oil and gas exploration and production company with refining and marketing operations in the United States and United Kingdom. A more detailed description of the Company’s significant assets can be found in Item 1 of this Form 10-K report.

Murphy generates revenue primarily by selling oil and natural gas production and refined petroleum products to customers at hundreds of locations in the United States, Canada, the United Kingdom, Malaysia and other countries. The Company’s revenue is highly affected by the prices of oil, natural gas and refined petroleum products that it sells. Also, because crude oil is purchased by the Company for refinery feedstocks, natural gas is purchased for fuel at its refineries and oil fields, and gasoline is purchased to supply its retail gasoline stations in the U.S. that are primarily located at Wal-Mart Supercenters, the purchase prices for these commodities also have a significant effect on the Company’s costs. In order to make a profit and generate cash in its exploration and production business, revenue generated from the sales of oil and natural gas produced must exceed the combined costs of producing these products, amortization of capital expenditures and expenses related to exploration and administration. Profits and generation of cash in the Company’s refining and marketing operations are dependent upon achieving adequate margins, which are determined by the sales prices for refined petroleum products less the costs of purchased refinery feedstocks and gasoline and expenses associated with manufacturing, transporting and marketing these products. Murphy also incurs certain costs for general company administration and for capital borrowed from lending institutions.

Worldwide oil prices were higher in 2007 than in 2006, while the average price for North American natural gas was up only slightly in 2007 compared to 2006. The average price for a barrel of West Texas Intermediate crude oil in 2007 was $72.25, an increase of 9% compared to 2006. The NYMEX natural gas price in 2007 averaged $7.11 per million British Thermal Units (MMBTU), up 1% from 2006. Changes in the price of crude oil and natural gas have a significant impact on the profitability of the Company, especially the price of crude oil as oil represented approximately 90% of the total hydrocarbons produced on an energy equivalent basis by the Company in 2007. If the prices for crude oil and natural gas decline significantly in 2008 or beyond, the Company would expect this to have an unfavorable impact on operating profits for its exploration and production business. Such lower oil and gas prices could, but may not, have a favorable impact on the Company’s refining and marketing operating profits.

Results of Operations

The Company had net income in 2007 of $766.5 million, $4.01 per diluted share, compared to net income in 2006 of $644.7 million, $3.41 per diluted share. In 2005 the Company’s net income was $854.7 million, $4.55 per diluted share. The net income improvement in 2007 compared to 2006 primarily related to higher earnings generated by both the exploration and production and refining and marketing businesses. The net cost of corporate activities was higher, however, in 2007 than in 2006. The lower net income in 2006 compared to 2005 was caused by a combination of lower earnings in the Company’s exploration and production and refining and marketing operations and higher net costs for corporate activities. Further explanations of each of these variances are found in the following sections.

Income from continuing operations was $766.5 million, $4.01 per diluted share, in 2007, $644.7 million, $3.41 per diluted share, in 2006, and $846.1 million, $4.50 per diluted share, in 2005.

Income from discontinued operations was $8.6 million, $0.05 per diluted share, in 2005. There were no results from discontinued operations in 2007 and 2006. In the second quarter 2004 the Company sold most of its conventional oil and natural gas properties in western Canada for cash proceeds of $583 million, which generated an after-tax gain on the sale of $171.1 million in 2004. Income from discontinued operations in 2005 related to a favorable adjustment of income taxes associated with the gain on sale of the western Canada properties in 2004. In accordance with Statement of Financial Accounting Standards No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets, the favorable tax adjustment associated with the sale in 2005 has been presented as Discontinued Operations in the consolidated statement of income for the year ended December 31, 2005.

As explained in Note P to the consolidated financial statements, net income in 2006 and all prior years have been adjusted to reflect the adoption of FSP AUG AIR-1, Accounting for Planned Major Maintenance Activities, in 2007. Consequently, net income in 2006 and 2005 as presented above increased by $6.4 million ($.04 per diluted share) and $8.2 million ($.04 per diluted share), respectively, from the amounts previously reported.

2007 vs. 2006 – Net income in 2007 was $766.5 million, $4.01 per diluted share, compared to $644.7 million, $3.41 per diluted share, in 2006. The improvement in consolidated net income in 2007 of $121.8 million compared to 2006 was primarily related to higher earnings in both major businesses – exploration and production (“ E&P”) and refining and marketing (“R&M” or “downstream”). The net costs of corporate activities were higher in 2007 and partially offset the improved results in E&P and R&M. Earnings in the E&P business improved by $40.3 million in 2007 as this business benefited from higher oil sales prices, lower exploration expenses and lower income taxes in 2007 compared to 2006. E&P earnings were adversely affected in 2007 by lower sales volumes for oil and natural gas and slightly lower realized natural gas sales prices as well as higher expenses for production, depreciation, depletion and administration. The R&M business generated record company profits in 2007, increasing $95.1 million compared to 2006. The improvement was primarily due to stronger U.S. refining margins in 2007 compared to

14

2006, a fully operational refinery at Meraux, Louisiana, during 2007, and lower hurricane repair expenses in 2007, but R&M earnings in 2007 included an unfavorable impact from noncash inventory revaluations. The Meraux refinery was shut-down for repairs for the first five months of 2006 following significant damage caused by Hurricane Katrina in late August 2005. The Company incurred significant repair costs in 2006 at Meraux following Hurricane Katrina, certain of which were not recoverable through insurance policies. In the U.K., the Company acquired the remaining 70% interest in the Milford Haven, Wales, refinery in late 2007. Under the Company’s last-in first-out accounting policy for inventory, an after-tax noncash charge of $59.5 million was recorded in 2007 to reduce the carrying value of crude oil and refined products inventory to beginning of year prices, which were significantly lower than at the end of the year. The net costs of corporate activities increased by $13.6 million in 2007 compared to 2006, with the cost increase mostly attributable to higher net interest expense and higher losses on transactions denominated in foreign currencies. The higher net interest expense was caused by higher average borrowing levels, partially offset by a higher level of interest costs capitalized to E&P development projects. The U.S. dollar generally weakened against other significant foreign currencies used in the Company’s business in 2007, especially compared to the Canadian dollar. The 2007 period included lower corporate administrative costs mostly due to higher expense in 2006 for an educational assistance contribution commitment.

Sales and other operating revenues were $4.1 billion higher in 2007 than in 2006 mostly due to higher sales volumes and sales prices for gasoline and other refined products, higher sales prices for crude oil produced by the Company, and higher sales volumes for merchandise at retail gasoline stations. Sales volumes for oil and natural gas were lower in 2007 than in 2006. Gain/loss on sales of assets in 2007 was $9.8 million unfavorable to 2006 as the Company had no major asset sales in 2007. Interest and other income was lower by $3.0 million in 2007 due mostly to higher losses on foreign currency exchange attributable to a continued weakening of the U.S. dollar against the primary foreign currencies affecting the Company’s operations, which include the Canadian dollar, the British pound sterling, the Euro and the Malaysian ringgit. Crude oil and product purchases expense increased by $3.7 billion in 2007 compared to 2006 due to a combination of higher purchase prices and throughput volumes of crude oil and other feedstocks at the Company’s refineries, higher prices and volumes of refined petroleum products purchased for sale at retail gasoline stations, and higher levels of merchandise purchased for sale at the gasoline stations. The higher crude oil purchase volumes in 2007 were caused by the Meraux refinery being operational throughout 2007 following about five months of downtime in 2006 for hurricane-related repairs. Operating expenses increased by $218.8 million in 2007 compared to 2006 and included higher refinery and retail station costs, higher workover and repair costs for Gulf of Mexico oil and gas fields, and higher costs for oil and gas field operations in Malaysia, the U.K. and Ecuador and for synthetic oil operations at Syncrude. Exploration expenses were $16.2 million lower in 2007 than in 2006 primarily associated with less dry hole and geophysical expenses in Malaysia, but partially offset by higher costs in Canada for dry holes, geophysical, lease amortization and settlement of two work commitments on the Scotian Shelf. Selling and general expenses were $0.8 million higher in 2007 than in 2006 as higher compensation, insurance and Berkana Energy administrative costs in the just completed year were almost offset by lower costs associated with an educational assistance program called the El Dorado Promise. The Company acquired 80% of Berkana Energy in December 2006, and subsequently sold this investment in January 2008. Depreciation, depletion and amortization expense was $105.8 million higher in 2007 compared to 2006 due mostly to higher barrel-equivalent unit rates for depreciation for virtually all E&P segments and higher depreciation for the Meraux refinery and retail gasoline stations. Impairment of long-lived assets of $40.7 million in 2007 primarily related to closing 55 underperforming gasoline stations in the U.S. and Canada. Accretion of asset retirement obligations increased by $5.3 million in 2007 mostly due to additional abandonment obligations incurred as additional Kikeh development wells were drilled during the year, and higher anticipated future abandonment costs on existing wells in the U.S. Net costs associated with hurricanes was lower in 2007 by $106.2 million mostly due to uninsured repair costs incurred in 2006 at the Meraux refinery following Hurricane Katrina in 2005. The costs recorded in 2007 related to a downward adjustment for anticipated insurance recoveries at the Meraux refinery based on recently updated loss limits published by the Company’s primary property insurer. Interest expense increased by $22.9 million in 2007 mostly associated with a higher average level of outstanding borrowings during the year compared to 2006. The amount of interest costs capitalized to property, plant and equipment increased by $6.8 million in 2007 due to higher levels of spending on E&P development projects in Malaysia, the U.S. and the Republic of Congo. Minority interest in operations of Berkana Energy in Canada was favorable $0.6 million in 2007 compared to 2006. Income tax expense was $77.0 million higher in 2007 than in 2006 and was mainly attributable to higher pretax income levels. The effective income tax rate for consolidated earnings rose from 37.9% in 2006 to 38.0% in 2007. The tax rate in both years was higher than the U.S. federal statutory tax rate of 35.0% due to a combination of U.S. state income taxes, certain foreign tax rates that exceed the U.S. federal tax rate, and certain exploration and other expenses in foreign taxing jurisdictions for which no income tax benefit is currently being recognized because the ability to obtain tax benefits for these costs in future years is uncertain. The tax rates in both years benefitted, however, from overall favorable effects of tax rate changes in foreign countries.

2006 vs. 2005– Net income in 2006 was $644.7 million, $3.41 per diluted share, compared to $854.7 million, $4.55 per diluted share, in 2005. Net income in 2005 included income from discontinued operations of $8.6 million, which was $0.05 per share. The $210.1 million decline in net income in 2006 was primarily due to lower earnings in both the Company’s E&P and downstream businesses, plus higher net costs for corporate activities. The Company’s E&P earnings declined by $133.2 million in 2006 due to several factors, including an after-tax gain of $104.5 million in 2005 related to a sale of most mature oil and natural gas properties on the continental shelf of the Gulf of Mexico, plus in 2006, lower sales volumes for crude oil and natural gas caused by lower production levels for these products, lower natural gas sales prices in North America and higher production and administrative expenses. The 2006 E&P results were favorably impacted by higher crude oil sales prices, lower exploration expenses, lower hurricane-related costs and higher income tax benefits due to various tax rate changes. Company-wide, the net costs associated with hurricanes were $42.5 million higher in 2006 compared to 2005. Hurricane costs in the Company’s R&M business were $59.8 million higher in 2006 due to more uninsured costs associated with repairs at the Meraux, Louisiana refinery, clean-up of a crude oil spill that occurred at the refinery as a result of damages from Hurricane Katrina, and settlement of litigation associated

15