Exhibit 13

Financial and Operating Highlights

| | | | | | | | | | | | | | |

(Thousands of dollars except per share data) | | 2009 | | 2008 | | % Change

2009–2008 | | | 2007 | | % Change

2008–2007 |

For the Year | | | | | | | | | | | | | | |

Revenues | | $ | 19,012,392 | | $ | 27,432,331 | | -31 | % | | $ | 18,312,964 | | 50% |

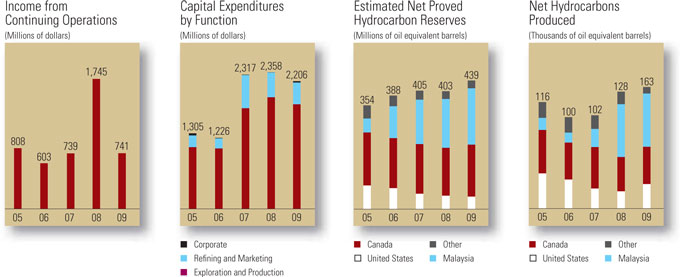

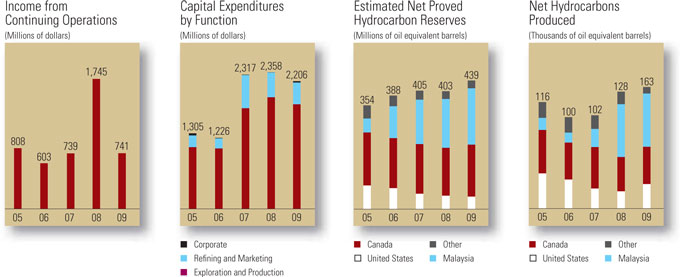

Income from continuing operations | | | 740,517 | | | 1,744,749 | | -58 | % | | | 739,080 | | 136% |

Net income | | | 837,621 | | | 1,739,986 | | -52 | % | | | 766,529 | | 127% |

Cash dividends paid | | | 190,788 | | | 166,501 | | 15 | % | | | 127,353 | | 31% |

Capital expenditures | | | 2,207,269 | | | 2,364,686 | | -7 | % | | | 2,357,347 | | 0% |

Net cash provided by operating activities | | | 1,864,633 | | | 3,039,912 | | -39 | % | | | 1,740,420 | | 75% |

Average common shares outstanding – diluted (thousands) | | | 192,468 | | | 192,134 | | 0 | % | | | 191,141 | | 1% |

| | | | | |

At End of Year | | | | | | | | | | | | | | |

Working capital | | $ | 1,194,087 | | $ | 958,818 | | 25 | % | | $ | 777,530 | | 23% |

Net property, plant and equipment | | | 9,065,088 | | | 7,727,718 | | 17 | % | | | 7,109,822 | | 9% |

Total assets | | | 12,756,359 | | | 11,149,098 | | 14 | % | | | 10,535,849 | | 6% |

Long-term debt | | | 1,353,183 | | | 1,026,222 | | 32 | % | | | 1,516,156 | | -32% |

Stockholders’ equity | | | 7,346,026 | | | 6,278,945 | | 17 | % | | | 5,066,174 | | 24% |

| | | | | |

Per Share of Common Stock | | | | | | | | | | | | | | |

Income from continuing operations – diluted | | $ | 3.85 | | $ | 9.08 | | -58 | % | | $ | 3.87 | | 135% |

Net income – diluted | | | 4.35 | | | 9.06 | | -52 | % | | | 4.01 | | 126% |

Cash dividends paid | | | 1.00 | | | .875 | | 14 | % | | | .675 | | 30% |

Stockholders’ equity | | | 38.44 | | | 32.92 | | 17 | % | | | 26.70 | | 23% |

| | | | | |

Net Crude Oil and Gas Liquids Produced – barrels per day | | | 131,839 | | | 118,254 | | 11 | % | | | 91,522 | | 29% |

United States | | | 17,053 | | | 10,668 | | 60 | % | | | 12,989 | | -18% |

Canada | | | 32,043 | | | 37,902 | | -15 | % | | | 43,939 | | -14% |

Malaysia | | | 76,322 | | | 57,403 | | 33 | % | | | 20,367 | | 182% |

Other International | | | 6,421 | | | 12,281 | | -48 | % | | | 14,227 | | -14% |

| | | | | |

Net Natural Gas Sold – thousands of cubic feet per day | | | 187,266 | | | 55,518 | | 237 | % | | | 61,082 | | -9% |

United States | | | 54,255 | | | 45,785 | | 18 | % | | | 45,139 | | 1% |

Canada | | | 54,857 | | | 1,910 | | 2,772 | % | | | 9,922 | | -81% |

Malaysia | | | 74,653 | | | 1,399 | | 5,236 | % | | | — | | N/A |

United Kingdom | | | 3,501 | | | 6,424 | | -46 | % | | | 6,021 | | 7% |

| | | | | |

Crude Oil Refined – barrels per day | | | 230,647 | | | 219,227 | | 5 | % | | | 175,183 | | 25% |

North America | | | 134,022 | | | 121,706 | | 10 | % | | | 139,183 | | -13% |

United Kingdom | | | 96,625 | | | 97,521 | | -1 | % | | | 36,000 | | 171% |

| | | | | |

Petroleum Products Sold – barrels per day | | | 536,474 | | | 539,000 | | 0 | % | | | 457,770 | | 18% |

North America | | | 432,700 | | | 427,490 | | 1 | % | | | 416,668 | | 3% |

United Kingdom | | | 103,774 | | | 111,510 | | -7 | % | | | 41,102 | | 171% |

| | | | | |

Stockholder and Employee Data | | | | | | | | | | | | | | |

Common shares outstanding (thousands)* | | | 191,115 | | | 190,714 | | 0 | % | | | 189,714 | | 1% |

Number of stockholders of record* | | | 2,490 | | | 2,564 | | -3 | % | | | 2,655 | | -3% |

Number of employees* | | | 8,369 | | | 8,277 | | 1 | % | | | 7,539 | | 10% |

Average number of employees | | | 8,157 | | | 7,890 | | 3 | % | | | 7,340 | | 7% |

Murphy Oil at a Glance

Murphy Oil Corporation (“Murphy” or “the Company”) is an international oil and gas company that conducts business through various operating subsidiaries. The Company produces oil and/or natural gas in the United States, Canada, the United Kingdom, Malaysia and Republic of the Congo and conducts exploration activities worldwide. Murphy also has an interest in a Canadian synthetic oil operation, owns two petroleum refineries and an ethanol production facility in the United States and one petroleum refinery in the United Kingdom. The Company operates a growing retail marketing gasoline station chain on the parking lots of Walmart Supercenters and at stand-alone locations in the United States, and also markets petroleum products under various brand names and to unbranded wholesale customers in the United States and the United Kingdom. Murphy is headquartered in El Dorado, Arkansas and has over 8,000 employees worldwide. The Company’s common stock is traded on the New York Stock Exchange under the ticker symbol “MUR”.

Major Subsidiaries of Murphy Oil Corporation

Murphy Exploration & Production Company, through various operating subsidiaries and affiliates, is engaged in crude oil and natural gas production activities in the United States, Malaysia, the U.K. sector of the North Sea and Republic of the Congo, and explores for oil and natural gas worldwide. The subsidiary has its headquarters in Houston, Texas, and conducts business from offices in Kuala Lumpur, Malaysia; St. Albans, England; Pointe-Noire, Republic of the Congo; Jakarta, Indonesia; and Perth, Western Australia.

Murphy Oil Company Ltd. is engaged in conventional crude oil and natural gas exploration and production in Western Canada and offshore Eastern Canada as well as the extraction and sale of synthetic crude oil from oil sands. The subsidiary’s office is located in Calgary, Alberta, and is operated as a component of the Company’s worldwide exploration and production operation directed from Houston.

Murphy Oil USA, Inc. is engaged in refining and marketing of petroleum products in the United States. It is headquartered in El Dorado, Arkansas. Refineries in Meraux, Louisiana, and Superior, Wisconsin, provide petroleum products to high-volume, low-cost Murphy USA® branded gasoline stations located on-site at Walmart Supercenters and at stand-alone Murphy Express locations in 21 Southern and Midwestern states. Murphy Oil USA also operates a network of 12 Company-owned terminals. These terminals, along with a number of third-party terminals, supply fuel to retail and wholesale stations in 24 states and to various asphalt and marine fuel customers. A subsidiary acquired an ethanol production facility in Hankinson, North Dakota in October 2009.

Murco Petroleum Limited is engaged in refining and marketing of petroleum products in the United Kingdom. Headquartered near London, England, Murco owns a refinery in Milford Haven, Wales and operates a network of fueling stations in the United Kingdom.

| | | | |

Offices | | | | |

| | |

| El Dorado, Arkansas | | Kuala Lumpur, Malaysia | | |

| | |

| Houston, Texas | | Pointe-Noire, Republic of the Congo | | |

| | |

| Calgary, Alberta, Canada | | Jakarta, Indonesia | | |

| | |

| St. Albans, Hertfordshire, England | | Perth, Western Australia, Australia | | |

1

Dear Fellow Shareholders

| | |

| Challenging but rewarding; perhaps the best way to describe 2009 and my first year as CEO. One thing that I witnessed first-hand over the past year and am pleased to report to you is that ours is a resilient company made up of capable and resourceful individuals, just what you search for when the going is toughest. As in previous economic and commodity market downturns, we adapted our strategy and managed to both utilize and maintain a healthy balance sheet while moving our business forward. Net income for 2009 totaled $837.6 million ($4.35 per share). This is down from a record setting 2008, due mainly to lower crude oil and natural gas prices coupled with poorer downstream product margins. In 2009, we remained financially disciplined resulting in a debt to capital employed ratio of 15.6% at year end, up slightly from the 2008 level. | |  |

Exploration and Production During 2009, three important development projects in separate regions of the world successfully started production. Two new oil fields–Thunder Hawk (37.5%) in the Gulf of Mexico and Azurite (50%) in Republic of the Congo–were joined by a new natural gas area offshore Sarawak (85%) Malaysia. These fields along with growth from existing projects at Tupper (100%) in British Columbia and associated natural gas at Kikeh (80%) in Malaysia, delivered record production for 2009. For the full year, production averaged 163,000 barrels of oil equivalent per day, an increase of 28% over the previous year. This comes on the heels of the 25% increase in 2008 compared to 2007. On a full year-to-year comparison 2010 will again show marked production growth. I am also pleased to report that during 2009, Murphy Oil replaced 168% of oil and gas reserves produced and brought down our overall finding and development costs in a marked way; both facts underscoring the quality within our producing portfolio. | |

Further production growth is lined up from projects already identified. In August 2009, our Board sanctioned the Tupper West development (100%) in British Columbia’s Montney formation. This sizable onshore natural gas resource will start producing in the second quarter of 2011 and will significantly enhance our North American natural gas volumes. A new gas treatment plant with a capacity of 180 million cubic feet per day will be constructed to process the gas. We have diligently accumulated an important position in this play and are presently one of the leading producers in the region despite production currently sourced only from Tupper Main.

To strengthen our onshore North American natural gas position further we added during 2009 a second development area in the Eagle Ford Shale of South Texas. Our initial three-well drilling program is progressing and we are now adding a second rig to the program. We have a high working interest covering a good acreage spread in key areas of the play and encouraging flow rates. With existing infrastructure in place nearby, we have already begun selling natural gas.

2

Our entry into the onshore natural gas resource business was deliberate and measured. Selecting plays that could deliver long-life, high-quality reserves at very competitive all-in costs was key. Being able to execute on new business during industry down cycles has again brought its rewards. North American natural gas is and will be a very important source of domestic energy and we are now well positioned with opportunity still ahead of us.

While our natural gas assets position us to capitalize on future price escalations, we are weighted and focused towards growth in our oil portfolio as we look forward. In 2009 three of the four discoveries that we made were oil. First, a discovery was made at Samurai (33.33%) in Gulf of Mexico Green Canyon Blocks 432/476. We will be drilling an appraisal well later in 2010 to size the discovery and help choose development options. In the Mer Profonde Sud (MPS) Block offshore Republic of the Congo, an oil discovery was made at Turquoise Marine (50%). Further appraisal wells will be drilled in 2010 and the most likely development plan calls for production to flow through the Azurite facility in the same block. Lastly, Siakap North (80%) in Block K, offshore Malaysia, was also an oil discovery. The field is part of a larger structure that will likely be jointly developed.

In 2010, our pace of exploration will increase with at least ten important exploration wells planned in various regions around the world including the Gulf of Mexico, Republic of the Congo, Malaysia, Indonesia and Suriname. The majority of the prospects will be targeting oil while some could be either oil or natural gas. It is exciting to see a quality program lie ahead of us and to shift back to the “wildcatting” levels seen before the price collapse that started in late 2008. This led to us naturally pulling back our horns during uncertain times. Several of the areas being targeted are frontier in nature and offer “move the needle” upsides.

3

Refining and Marketing Downstream results in 2009 were hampered by weaker margins and overall decreased consumer demand. This down cycle has been experienced before and it too will ameliorate. Our aim in 2010 is to run our facilities better and more consistently and minimize capital spend. We will resume our build-out of the U.S. retail gasoline chain with construction of 80 new sites planned in 2010.

Refining plant turnarounds at facilities in Meraux, Louisiana, and Milford Haven, Wales, are occurring in the first quarter. The Milford Haven turnaround is the lengthier of the two as the scope of work is more intensive. During the downtime, the facility will undergo de-bottlenecking that will increase the throughput capacity from 108,000 barrels of oil per day (bopd) to 130,000 bopd for limited capital outlay. The bulk of this new capacity will add distillate capability to the stream and better suit the U.K. market. At the Superior, Wisconsin plant, we have obtained additional asphalt storage capacity as we move to further capitalize on our niche in that market.

In U.S. retail operations, our business model of providing quality fuel directly to our customers at the most competitive price possible continues to strengthen. We ended 2009 with 1,048 locations spread throughout 21 states. Of these, 996 locations are Murphy USA sites located on Walmart Supercenter parking lots and 52 are Murphy Express sites which are independently located. As this industry will likely see consolidation over the next decade we are poised to be able to grow and fill our customers’ needs.

In October, we entered the bio-fuels business by acquiring a corn-based ethanol plant in Hankinson, North Dakota. With an annual production capacity of 110 million gallons, this plant is a natural fit for our retail business where we already sell this mandated fuel. Adding a new community to our enterprise is a great feeling and we have been delighted with the hard work and effort shown by our recently added employees at Hankinson.

In Closing While unpredictable and challenging external factors within the political and economic arena will invariably linger, we are well positioned to meet them head on. Our portfolio reflects an international breadth that I believe is necessary to facilitate the continued longevity of our company; being where and when the growth and opportunities exist. We have superbly talented people who work every day to make their community and country better and stronger and who have demonstrated the ability to act upon opportunity to help our company grow. I see more of this happening in 2010. I greatly appreciate the support shown me over the past year. Murphy is a unique company, one we can all take great pride in. With your continued support, we will continue to lead on!

David M. Wood

President and Chief Executive Officer

February 11, 2010

El Dorado, Arkansas

4

Exploration and Production Statistical Summary

| | | | | | | | | | | | | | | |

| | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Net crude oil, condensate and natural gas liquids production – barrels per day | | | | | | | | | | | | | | | |

United States | | | 17,053 | | 10,668 | | 12,989 | | 21,112 | | 25,897 | | 19,314 | | 4,526 |

Canada – light | | | 18 | | 46 | | 596 | | 443 | | 563 | | 650 | | 1,213 |

heavy | | | 6,813 | | 8,484 | | 11,524 | | 12,613 | | 11,806 | | 5,838 | | 4,705 |

offshore | | | 12,357 | | 16,826 | | 18,871 | | 14,896 | | 23,124 | | 25,407 | | 28,534 |

synthetic | | | 12,855 | | 12,546 | | 12,948 | | 11,701 | | 10,593 | | 11,794 | | 10,483 |

Malaysia | | | 76,322 | | 57,403 | | 20,367 | | 11,298 | | 13,503 | | 11,885 | | 7,301 |

United Kingdom | | | 3,361 | | 4,869 | | 5,281 | | 7,146 | | 7,992 | | 11,011 | | 14,686 |

Republic of the Congo | | | 1,743 | | — | | — | | — | | — | | — | | — |

| | | | | | | | | | | | | | | |

Continuing operations | | | 130,522 | | 110,842 | | 82,576 | | 79,209 | | 93,478 | | 85,899 | | 71,448 |

Discontinued operations | | | 1,317 | | 7,412 | | 8,946 | | 8,608 | | 7,871 | | 10,841 | | 12,004 |

| | | | | | | | | | | | | | | |

Total liquids produced | | | 131,839 | | 118,254 | | 91,522 | | 87,817 | | 101,349 | | 96,740 | | 83,452 |

| | | | | | | | | | | | | | | |

Net crude oil, condensate and natural gas liquids sold – barrels per day | | | | | | | | | | | | | | | |

United States | | | 17,053 | | 10,668 | | 12,989 | | 21,112 | | 25,897 | | 19,314 | | 4,526 |

Canada – light | | | 18 | | 46 | | 596 | | 443 | | 563 | | 650 | | 1,213 |

heavy | | | 6,813 | | 8,484 | | 11,524 | | 12,613 | | 11,806 | | 5,838 | | 4,705 |

offshore | | | 12,455 | | 16,690 | | 18,839 | | 15,360 | | 22,443 | | 26,306 | | 28,542 |

synthetic | | | 12,855 | | 12,546 | | 12,948 | | 11,701 | | 10,593 | | 11,794 | | 10,483 |

Malaysia | | | 72,575 | | 61,907 | | 16,018 | | 11,986 | | 13,818 | | 11,020 | | 7,235 |

United Kingdom | | | 2,445 | | 5,739 | | 5,218 | | 6,678 | | 8,303 | | 10,924 | | 14,722 |

Republic of the Congo | | | 973 | | — | | — | | — | | — | | — | | — |

| | | | | | | | | | | | | | | |

Continuing operations | | | 125,187 | | 116,080 | | 78,132 | | 79,893 | | 93,423 | | 85,846 | | 71,426 |

Discontinued operations | | | 1,162 | | 7,774 | | 9,470 | | 10,349 | | 9,821 | | 6,520 | | 11,829 |

| | | | | | | | | | | | | | | |

Total liquids sold | | | 126,349 | | 123,854 | | 87,602 | | 90,242 | | 103,244 | | 92,366 | | 83,255 |

| | | | | | | | | | | | | | | |

Net natural gas sold – thousands of cubic feet per day | | | | | | | | | | | | | | | |

United States | | | 54,255 | | 45,785 | | 45,139 | | 56,810 | | 70,452 | | 88,621 | | 82,281 |

Canada | | | 54,857 | | 1,910 | | 9,922 | | 9,752 | | 10,323 | | 13,972 | | 19,946 |

Malaysia – Sarawak | | | 28,070 | | — | | — | | — | | — | | — | | — |

– Kikeh | | | 46,583 | | 1,399 | | — | | — | | — | | — | | — |

United Kingdom | | | 3,501 | | 6,424 | | 6,021 | | 8,700 | | 9,423 | | 6,859 | | 9,564 |

| | | | | | | | | | | | | | | |

Continuing operations | | | 187,266 | | 55,518 | | 61,082 | | 75,262 | | 90,198 | | 109,452 | | 111,791 |

Discontinued operations | | | — | | — | | — | | — | | — | | 30,760 | | 103,543 |

| | | | | | | | | | | | | | | |

Total natural gas sold | | | 187,266 | | 55,518 | | 61,082 | | 75,262 | | 90,198 | | 140,212 | | 215,334 |

| | | | | | | | | | | | | | | |

Net hydrocarbons produced – equivalent barrels1,2 per day | | | 163,050 | | 127,507 | | 101,702 | | 100,361 | | 116,382 | | 120,109 | | 119,341 |

Estimated net hydrocarbon reserves – million equivalent barrels1,2,3 | | | 439.2 | | 402.8 | | 405.1 | | 388.3 | | 353.6 | | 385.6 | | 425.5 |

Weighted average sales prices4 | | | | | | | | | | | | | | | |

Crude oil, condensate and natural gas liquids – dollars per barrel | | | | | | | | | | | | | | | |

United States | | $ | 60.08 | | 95.74 | | 65.57 | | 57.30 | | 47.48 | | 35.35 | | 24.22 |

Canada5 – light | | | 64.24 | | 70.37 | | 50.98 | | 50.45 | | 44.27 | | 32.96 | | 26.02 |

heavy | | | 40.45 | | 59.05 | | 32.84 | | 25.87 | | 21.30 | | 20.26 | | 12.36 |

offshore | | | 58.19 | | 96.69 | | 69.83 | | 62.55 | | 51.37 | | 36.60 | | 27.08 |

synthetic | | | 61.49 | | 100.10 | | 74.35 | | 63.23 | | 58.12 | | 40.35 | | 24.97 |

Malaysia6 | | | 55.51 | | 87.83 | | 74.58 | | 51.78 | | 46.16 | | 41.35 | | 29.42 |

United Kingdom | | | 61.31 | | 90.16 | | 68.38 | | 64.30 | | 52.83 | | 36.82 | | 29.59 |

Republic of the Congo | | | 69.04 | | — | | — | | — | | — | | — | | — |

Natural gas – dollars per thousand cubic feet | | | | | | | | | | | | | | | |

United States | | | 4.05 | | 9.67 | | 7.38 | | 7.76 | | 8.52 | | 6.45 | | 5.29 |

Canada5 | | | 3.09 | | 6.40 | | 6.34 | | 6.49 | | 7.88 | | 5.64 | | 4.47 |

Malaysia – Sarawak | | | 4.05 | | — | | — | | — | | — | | — | | — |

– Kikeh | | | 0.23 | | 0.23 | | — | | — | | — | | — | | — |

United Kingdom5 | | | 5.04 | | 10.98 | | 7.54 | | 7.34 | | 5.80 | | 4.52 | | 3.50 |

| 1 | Natural gas converted at a 6:1 ratio. |

| 4 | Includes intracompany transfers at market prices. |

| 6 | Prices are net of payments under the terms of the production sharing contracts for Blocks K and SK 309. |

5

Refining and Marketing Statistical Summary

| | | | | | | | | | | | | | | |

| | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Refining | | | | | | | | | | | | | | | |

Crude capacity* of refineries – barrels per stream day | | | 268,000 | | 268,000 | | 268,000 | | 192,400 | | 192,400 | | 192,400 | | 192,400 |

| | | | | | | | | | | | | | | |

Refinery inputs – barrels per day | | | | | | | | | | | | | | | |

Crude – Meraux, Louisiana | | | 101,864 | | 95,126 | | 106,446 | | 55,129 | | 73,371 | | 101,644 | | 60,403 |

Superior, Wisconsin | | | 32,158 | | 26,580 | | 32,737 | | 34,066 | | 34,768 | | 31,598 | | 30,466 |

Milford Haven, Wales | | | 96,625 | | 97,521 | | 36,000 | | 30,036 | | 26,983 | | 31,033 | | 28,412 |

Other feedstocks | | | 14,317 | | 23,300 | | 10,805 | | 6,423 | | 9,131 | | 12,170 | | 10,113 |

| | | | | | | | | | | | | | | |

Total inputs | | | 244,964 | | 242,527 | | 185,988 | | 125,654 | | 144,253 | | 176,445 | | 129,394 |

| | | | | | | | | | | | | | | |

Refinery yields – barrels per day | | | | | | | | | | | | | | | |

Gasoline | | | 89,436 | | 86,310 | | 74,395 | | 48,314 | | 54,869 | | 68,663 | | 52,162 |

Kerosine | | | 29,308 | | 23,824 | | 5,371 | | 5,067 | | 7,805 | | 7,734 | | 6,568 |

Diesel and home heating oils | | | 70,531 | | 75,526 | | 67,111 | | 42,137 | | 48,535 | | 66,225 | | 41,277 |

Residuals | | | 26,134 | | 27,170 | | 18,910 | | 15,244 | | 18,231 | | 17,445 | | 14,595 |

Asphalt, LPG and other | | | 24,620 | | 24,815 | | 17,546 | | 12,855 | | 13,268 | | 14,693 | | 11,986 |

Fuel and loss | | | 4,935 | | 4,882 | | 2,655 | | 2,037 | | 1,545 | | 1,685 | | 2,806 |

| | | | | | | | | | | | | | | |

Total yields | | | 244,964 | | 242,527 | | 185,988 | | 125,654 | | 144,253 | | 176,445 | | 129,394 |

| | | | | | | | | | | | | | | |

Average cost of crude inputs to refineries – dollars per barrel | | | | | | | | | | | | | | | |

North America | | $ | 59.71 | | 96.46 | | 69.40 | | 59.54 | | 49.73 | | 40.00 | | 29.79 |

United Kingdom | | | 62.90 | | 100.61 | | 81.53 | | 66.66 | | 56.15 | | 39.60 | | 30.24 |

Marketing | | | | | | | | | | | | | | | |

Products sold – barrels per day | | | | | | | | | | | | | | | |

North America – Gasoline | | | 319,549 | | 313,827 | | 298,833 | | 266,353 | | 233,191 | | 207,786 | | 162,911 |

Kerosine | | | 11,928 | | 4,606 | | 1,685 | | 2,269 | | 5,671 | | 4,811 | | 4,388 |

Diesel and home heating oils | | | 76,599 | | 86,933 | | 91,344 | | 62,196 | | 60,228 | | 66,648 | | 43,373 |

Residuals | | | 15,501 | | 14,837 | | 15,422 | | 11,696 | | 15,330 | | 13,699 | | 10,972 |

Asphalt, LPG and other | | | 9,123 | | 7,287 | | 9,384 | | 8,087 | | 8,294 | | 8,857 | | 8,232 |

| | | | | | | | | | | | | | | |

| | | 432,700 | | 427,490 | | 416,668 | | 350,601 | | 322,714 | | 301,801 | | 229,876 |

| | | | | | | | | | | | | | | |

United Kingdom – Gasoline | | | 30,007 | | 34,125 | | 14,356 | | 12,425 | | 12,739 | | 11,435 | | 12,101 |

Kerosine | | | 12,954 | | 14,835 | | 4,020 | | 3,619 | | 2,410 | | 2,756 | | 2,526 |

Diesel and home heating oils | | | 35,721 | | 34,560 | | 14,785 | | 11,803 | | 14,910 | | 14,649 | | 13,506 |

Residuals | | | 10,560 | | 12,744 | | 3,728 | | 3,825 | | 3,242 | | 4,062 | | 3,816 |

LPG and other | | | 14,532 | | 15,246 | | 4,213 | | 2,998 | | 2,240 | | 4,205 | | 3,103 |

| | | | | | | | | | | | | | | |

| | | 103,774 | | 111,510 | | 41,102 | | 34,670 | | 35,541 | | 37,107 | | 35,052 |

| | | | | | | | | | | | | | | |

Total products sold | | | 536,474 | | 539,000 | | 457,770 | | 385,271 | | 358,255 | | 338,908 | | 264,928 |

| | | | | | | | | | | | | | | |

Branded retail outlets* | | | | | | | | | | | | | | | |

North America – Murphy USA® | | | 996 | | 992 | | 971 | | 987 | | 864 | | 752 | | 623 |

Murphy Express® | | | 52 | | 33 | | 2 | | — | | — | | — | | — |

Other | | | 121 | | 129 | | 153 | | 177 | | 337 | | 375 | | 371 |

Total | | | 1,169 | | 1,154 | | 1,126 | | 1,164 | | 1,201 | | 1,127 | | 994 |

United Kingdom | | | 453 | | 454 | | 389 | | 402 | | 412 | | 358 | | 384 |

Board of Directors

| | | | | | | | |

| | William C. Nolan, Jr. Partner, Nolan & Alderson, Attorneys, El Dorado, Arkansas. Director since 1977. Chairman of the Board, ex-officio member of all other committees | | | |  | | R. Madison Murphy Managing Member, Murphy Family Management, LLC, El Dorado, Arkansas. Director since 1993; Chairman from 1994–2002. Committees: Executive; Audit (Chairman) |

| | | | |

| | David M. Wood President and Chief Executive Officer, Murphy Oil Corporation, El Dorado, Arkansas. Director since January 2009. Committees: Executive | | | |  | | Ivar B. Ramberg Executive Officer, Ramberg Consulting AS, Osteraas, Norway. Director since 2003. Committees: Nominating and Governance; Environmental, Health & Safety |

| | | | |

| | Frank W. Blue International Legal Advisor/Arbitrator, Santa Barbara, California. Director since 2003. Committees: Audit; Nominating and Governance | | | |  | | Neal E. Schmale President and Chief Operating Officer, Sempra Energy, San Diego, California. Director since 2004. Committees: Audit; Executive Compensation |

| | | | |

| | Claiborne P. Deming President and Chief Executive Officer, Retired, Murphy Oil Corporation, El Dorado, Arkansas. Director since 1993. Committees: Executive (Chairman) | | | |  | | David J. H. Smith Chief Executive Officer, Retired, Whatman plc, Maidstone, Kent, England. Director since 2001. Committees: Executive Compensation (Chairman); Environmental, Health & Safety |

| | | | |

| | Robert A. Hermes Chairman of the Board, Retired, Purvin & Gertz, Inc., Houston, Texas. Director since 1999. Committees: Executive; Nominating and Governance (Chairman); Environmental, Health & Safety | | | |  | | Caroline G. Theus President, Inglewood Land and Development Co., Alexandria, Louisiana. Director since 1985. Committees: Executive; Environmental, Health & Safety (Chairman) |

| | | | |

| | James V. Kelley President and Chief Operating Officer, BancorpSouth, Inc., Tupelo, Mississippi. Director since 2006. Committees: Audit; Executive Compensation | | | | | | |

7

Principal Subsidiaries

| | | | | | |

| Murphy Exploration & | | 16290 Katy Freeway Suite 600 Houston, Texas 77094 (281) 675-9000 | | Roger W. Jenkins | | Keith S. Caldwell |

| Production Company | | | President | | Vice President, |

| Engages in worldwide crude oil and natural gas exploration and production. | | | Eugene T. Coleman | | Finance |

| | | Senior Vice President, | | Steven A. Cossé |

| | | | South East Asia | | Vice President and |

| | | | Sam Algar | | General Counsel |

| | | | Vice President, | | Kevin G. Fitzgerald |

| | | | Worldwide Exploration | | Vice President |

| | | | Daniel R. Hanchera | | Mindy K. West |

| | | | Vice President, | | Vice President and Treasurer |

| | | | Business Development and | | |

| | | | Planning | | John W. Eckart |

| | | | Harry J. Howard | | Vice President |

| | | | Vice President, | | Walter K. Compton |

| | | | Africa, Europe and Latin America | | Secretary |

| | | | Derek M. Stewart | | |

| | | | Vice President, | | |

| | | | | U.S. Operations | | |

| | | |

| Murphy Oil Company Ltd. | | 1700-555-4th Avenue SW | | Michael McFadyen | | Dennis Ward |

| Engages in crude oil and natural gas exploration and production, and extraction and sale of synthetic crude oil. | | Calgary, Alberta T2P 3E7 | | President | | Vice President, Finance |

| | (403) 294-8000 | | Cal Buchanan | | Mindy K. West |

| | Mailing Address: P.O. Box 2721, Station M Calgary, Alberta T2P 3Y3 Canada | | Vice President, Joint Ventures and Business Development | | Vice President and Treasurer |

| | | | Georg R. McKay |

| | | | Secretary |

| | | | |

| | | | |

Murphy Oil USA, Inc. Engages in manufacturing and marketing of petroleum and ethanol products in the United States. | | 200 Peach Street | | David M. Wood | | Stephen F. Hunkus |

| | El Dorado, Arkansas 71730 | | President | | Vice President, Refining |

| | (870) 862-6411 | | Henry J. Heithaus | | Steven A. Cossé |

| | Mailing Address: P.O. Box 7000 El Dorado, Arkansas 71731-7000 | | Senior Vice President, Marketing and President, Murphy USA Marketing Company | | Vice President and |

| | | | General Counsel |

| | | | Mindy K. West |

| | | Thomas McKinlay | | Vice President and Treasurer |

| | | | Senior Vice President, | | John W. Eckart |

| | | | U.S. Manufacturing | | Vice President and Controller |

| | | | Ernest C. Cagle | | Walter K. Compton |

| | | | Vice President, | | Secretary |

| | | | Refining Support | | |

| | | | Marn Cheng | | |

| | | | Vice President, | | |

| | | | Renewable Fuels | | |

| | | | |

| Murco Petroleum Limited | | 4 Beaconsfield Road St. Albans, Hertfordshire AL1 3RH, England 44-1727-892-400 | | Charles A. Ganus | | Simon V. Rhodes |

| Engages in refining and marketing of petroleum products in the United Kingdom. | | | Managing Director | | Financial Director |

| | | Jeremy Clarke | | Patricia E. Haylock |

| | | Marketing Director | | Secretary |

| | | | Bernard Pouille | | |

| | | | Supply Director | | |

8

Corporate Information

Corporate Office

200 Peach Street

P.O. Box 7000

El Dorado, Arkansas 71731-7000

(870) 862-6411

Stock Exchange Listings

Trading Symbol: MUR

New York Stock Exchange

Transfer Agent and Registrar

Computershare Investor Services, L.L.C.

2 North LaSalle St.

Chicago, Illinois 60602

Toll-free (888) 239-5303

Local Chicago (312) 360-5303

Electronic Payment of Dividends

Shareholders may have dividends deposited directly into their bank accounts by electronic funds transfer. Authorization forms may be obtained from:

Computershare Investor Services, L.L.C.

2 North LaSalle St.

Chicago, Illinois 60602

Toll-free (888) 239-5303

Local Chicago (312) 360-5303

Annual Meeting

The annual meeting of the Company’s shareholders will be held at 10:00 a.m. on May 12, 2010, at the South Arkansas Arts Center, 110 East 5th Street, El Dorado, Arkansas. A formal notice of the meeting, together with a proxy statement and proxy form, will be provided to all shareholders.

E-mail Address

murphyoil@murphyoilcorp.com

Web Site

www.murphyoilcorp.com

Murphy Oil’s website provides frequently updated information about the Company and its operations, including:

| | • | | Live webcasts of quarterly conference calls |

| | • | | Links to the Company’s SEC filings |

| | • | | Profiles of the Company’s operations |

| | • | | On-line stock investment accounts |

| | • | | Murphy’s U.S. retail gasoline station locator |

Inquiries

Inquiries regarding shareholder account matters should be addressed to:

Walter K. Compton

Vice President, Law and Secretary

Murphy Oil Corporation

P.O. Box 7000

El Dorado, Arkansas 71731-7000

wcompton@murphyoilcorp.com

Members of the financial community should direct their inquiries to:

Craig Bonsall

Supervisor, Investor Relations

Murphy Oil Corporation

P.O. Box 7000

El Dorado, Arkansas 71731-7000

(870) 881-6853

cbonsall@murphyoilcorp.com

Executive Officers

David M. Wood

President and Chief Executive Officer and Director and Member of the Executive Committee since January 2009. Mr. Wood served as Executive Vice President and President of Murphy Exploration & Production Company from January 2007 until December 2008, President of Murphy Exploration & Production Company-International from March 2003 through December 2006 and Senior Vice President of Frontier Exploration & Production from April 1999 through February 2003.

Steven A. Cossé

Executive Vice President since February 2005 and General Counsel since August 1991. Mr. Cossé was elected Senior Vice President in 1994 and Vice President in 1993.

Roger W. Jenkins

Executive Vice President since August 2009. Mr. Jenkins has served as President of Murphy Exploration & Production Company since January 2009, and prior to that was Senior Vice President, North America for this subsidiary from September 2007 to December 2008.

Kevin G. Fitzgerald

Senior Vice President and Chief Financial Officer since January 2007. Mr. Fitzgerald was Treasurer from July 2001 through December 2006 and Director of Investor Relations from 1996 through June 2001.

Bill H. Stobaugh

Senior Vice President since February 2005. Mr. Stobaugh joined the Company as Vice President in 1995.

Charles A. Ganus

Vice President, International Downstream since August 2009. Additionally, Mr. Ganus has been Managing Director of Murco Petroleum Limited since May 2008, and was Senior Vice President, Marketing of Murphy Oil USA, Inc. from June 2003 to April 2008.

Henry J. Heithaus

Vice President, Marketing since August 2009. Additionally, Mr. Heithaus has been Senior Vice President, Marketing of Murphy Oil USA, Inc. since May 2008, and was Vice President, Retail Marketing for this subsidiary from June 2003 to April 2008.

Thomas McKinlay

Vice President, U.S. Manufacturing since August 2009. Additionally, Mr. McKinlay has served as Senior Vice President of Murphy Oil USA, Inc. since April 2009. From August 2008 to March 2009, he was General Manager, Supply and Transportation for this U.S. subsidiary.

Mindy K. West

Vice President and Treasurer since January 2007. Ms. West was Director of Investor Relations from July 2001 through December 2006.

John W. Eckart

Vice President and Controller since January 2007. Mr. Eckart has been Controller since March 2000.

Kelli M. Hammock

Vice President, Administration since December 2009. Ms. Hammock was General Manager, Administration from June 2006 to November 2009.

Walter K. Compton

Vice President, Law since February 2009. Mr. Compton has been Secretary since December 1996.