UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant [ x ]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule Section 240.14a-12

Arrow Financial Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[ X ] No fee required

[ ] Fee computed on the table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set

forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of the transaction:

5) Total fee paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

250 Glen Street

Glens Falls, New York 12801

April 25, 2024

Dear Shareholder:

You are cordially invited to attend the Arrow Financial Corporation Annual Meeting of Shareholders at 10:00 a.m. on June 5, 2024. The Company will host the Annual Meeting virtually. Visit our website at arrowfinancial.com for more information.

As in the past, our meeting will begin with a review of all voting matters and then feature a short presentation on the Company. Additional details about the Annual Meeting and related voting instructions can be found in the following Notice of 2024 Annual Meeting of Shareholders and related Proxy Statement.

While the last year posed its challenges with a changing interest rate environment and wider economic uncertainty, it did not distract us from growing the business. Our team continued to advance our strategic goals and we remained steadfast in our commitment to serve our shareholders, customers and communities and empower our employees. Following our delay in filing the 2022 Form 10-K and the 2023 First Quarter Form 10-Q, Arrow invested heavily in our remediation plan to address previously reported weaknesses in our internal control environment. We take these investments very seriously.

Arrow finished 2023 with robust loan growth and total deposit balances of $3.7 billion, maintaining strong credit, capital and liquidity positions. We maintained asset quality with total assets reaching $4.17 billion at year-end. We issued a cash dividend for the 43rd consecutive quarter, expanded our existing stock repurchase program by $5 million, reinstated our dividend reinvestment program and issued an annual stock dividend for the 15th consecutive year. Both of Arrow’s banking subsidiaries, Glens Falls National Bank and Trust Company and Saratoga National Bank and Trust Company, maintained their Bauer Financial 5-Star "Exceptional Performance" ratings for the 16th and 14th consecutive years, respectively.

In addition to driving shareholder value, we completed a multi-year renovation project on our downtown Glens Falls, New York headquarters, advanced our technology to deliver a superior customer experience and continued to strengthen financial lives in the communities we serve. Thank you to our Arrow team who serve the needs of our customers, communities and shareholders with such professionalism and care.

For a better understanding of our Company, including its compensation practices and corporate governance structure, please review our attached proxy materials and Annual Report on Form 10-K. Whether or not you plan to attend the Annual Meeting this year, it is important to us that your shares are represented. We encourage you to vote your shares promptly, and in advance of the Annual Meeting. Thank you.

Sincerely,

/s/ William L. Owens /s/ David S. DeMarco

William L. Owens David S. DeMarco

Chair of the Board President and Chief Executive Officer

250 Glen Street

Glens Falls, New York 12801

NOTICE OF

2024 ANNUAL MEETING OF SHAREHOLDERS

April 25, 2024

To the Shareholders of Arrow Financial Corporation:

The Annual Meeting of Shareholders of Arrow Financial Corporation, a New York corporation, will be held on Wednesday, June 5, 2024, beginning at 10:00 a.m. Eastern Daylight Time. The Company will host the Annual Meeting virtually. Instructions on how to participate via the Internet, including how to demonstrate proof of stock ownership, are available at: www.proxyvote.com. Shareholders may vote and submit questions prior to attending the Annual Meeting via the Internet. Please see the Additional Voting Information section of this Proxy Statement for additional important information regarding the virtual Annual Meeting.

The Annual Meeting of Shareholders of Arrow Financial Corporation will consider and vote upon the following matters, as described more fully in the Proxy Statement attached to this Notice:

1.The election of three Class B Directors to three-year terms.

2.Advisory approval of our 2023 executive compensation (“Say-on-Pay”).

3.Approval of the Arrow Financial Corporation 2023 Employee Stock Purchase Plan.

4.Ratification of the selection of Crowe LLP ("Crowe") as our independent auditor for 2024.

5.Any other business that may properly come before the 2024 Annual Meeting, or any adjournment

or postponement thereof.

Shareholders of record as of the close of business on April 8, 2024 will be entitled to vote at the 2024 Annual Meeting, or any adjournment or postponement thereof. Please see the Additional Voting Information section of the Proxy Statement for more information on how to vote.

Please ensure that your shares are represented at the 2024 Annual Meeting, as your vote is important. See the attached Proxy Statement for more information on how to vote your shares. Thank you.

By Order of the Board of Directors,

/s/Andrew J. Wise

Andrew J. Wise

Corporate Secretary

250 Glen Street

Glens Falls, New York 12801

PROXY STATEMENT TABLE OF CONTENTS

| | | | | |

| |

| |

| |

| |

| |

| |

| Voting Item 3 – Approval of the Arrow Financial Corporation 2023 Employee Stock Purchase Plan | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Litigation | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

250 Glen Street

Glens Falls, New York 12801

PROXY STATEMENT

General Voting Information

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (“Board”) of Arrow Financial Corporation (“Company”), a New York corporation, of proxies to be voted at the 2024 Annual Meeting of Shareholders (“Annual Meeting”) to be held virtually on June 5, 2024, at 10:00 a.m., or at any adjournment or postponement thereof.

The release of the Notice Regarding the Availability of Proxy Materials, the Notice of 2024 Annual Meeting of Shareholders, the Proxy Statement and the Company's Annual Report on Form 10-K for the year ended December 31, 2023 (collectively, the “Proxy Materials”) is scheduled to begin on April 25, 2024, to shareholders of record as of the close of business on April 8, 2024. As of the record date, there were 16,692,429 shares of Company common stock outstanding, and each share is entitled to one vote at the Annual Meeting.

To vote, please follow the instructions in the Notice Regarding the Availability of Proxy Materials or in the other Proxy Materials. If you wish to receive a printed copy of the Proxy Materials, please follow the instructions in the Notice Regarding the Availability of Proxy Materials. The Proxy Materials will be mailed within three business days of receipt of your request. Shareholders who previously requested electronic copies will receive them in that format.

Please be sure that your shares are represented at the Annual Meeting by completing and submitting your proxy by telephone, online or by requesting and returning a completed paper proxy card. Please see the Additional Voting Information section of this Proxy Statement for more information on how to vote.

Voting Item 1 – Election of Three Class B Directors to Three-Year Terms

Summary and Board Recommendation:

Item 1 at the Annual Meeting is the election of three Class B Directors to three-year terms expiring at the 2027 Annual Meeting of Shareholders and/or until their respective successors are elected and qualified. The Board has nominated for election David S. DeMarco, David G. Kruczlnicki and Raymond F. O'Conor as Class B Directors.

All three nominees were unanimously recommended by the Governance Committee to the Board, have been determined to be qualified and have consented to serve if elected.

There are no arrangements or understandings between any Director or Director nominee and any other persons pursuant to which such person was selected as a Director or nominee. None of the Directors are party to any agreement or arrangement that would require disclosure pursuant to Listing Rule 5250(b)(3) for the National Association of Securities Dealers, Inc. ("NASDAQ®") Stock Market, where the Company’s common stock is listed. This rule requires disclosure of agreements or arrangements between a Director and a third party related to the Director's service on the Board.

The Board has no reason to believe that any of these nominees will decline or be unable to serve if elected. Under applicable law and the Company’s bylaws, Directors are elected by a plurality of the shares voted at the Annual Meeting, meaning the nominees receiving the most “For” votes will be elected. For additional information regarding the vote requirements for Item 1 and a description of the Company’s Majority Voting Policy with respect to the election of Directors, please see the Additional Voting Information section.

•Vote Recommendation: Your Board recommends you vote “For” each of its three nominees: David S. DeMarco, David G. Kruczlnicki and Raymond F. O'Conor

Director Nomination Process:

The Governance Committee is responsible for identifying and recommending to the full Board suitable nominees to serve as Directors, including incumbents. Director nominees are selected based upon the following criteria, among others:

•Individual Strengths: The candidate’s knowledge, skill, experience and expertise

•Board Composition: The objective of achieving certain characteristics for the Board as a group, such as diversity of background, occupation, viewpoint, ethnicity, race, gender and other attributes

•Succession Planning: Balance among age groups from those who are in mid-career to those nearing or recently entered into retirement

Additionally, the Governance Committee will not generally recommend a new candidate for nomination unless the candidate has demonstrated notable leadership and accomplishment in business, higher education, politics and/or cultural endeavors. The Governance Committee further assesses a candidate’s understanding of the regulatory and policy environment in which the Company does business and the candidate's interest in the communities served by the Company. Other factors considered by the Governance Committee include a candidate’s personal character, integrity and financial acumen. For candidates with prior experience as a Director of the Company or one of its subsidiaries Glens Falls National Bank and Trust Company ("GFNB"), Saratoga National Bank and Trust Company ("SNB"), and Upstate Agency, LLC ("Upstate Agency") and together with GFNB and SNB (the "Subsidiaries"), such candidate's service record will be an important factor in evaluating the desirability of the candidate's continuing service as a Director. Generally, Directors may not serve on the boards of more than two other public companies and may not serve on the board of any other public company whose principal business is financial services.

To identify new candidates for Director, the Governance Committee will employ its own search protocols, seek suggestions from management and consider any Director nominee proposals it properly receives from shareholders. The same screening process is applied to all suggested candidates, regardless of the source. The Board will give substantial weight to the recommendations of the Governance Committee in selecting Director

nominees for election and in filling Director vacancies. Under normal circumstances, the Board will not select nominees, including incumbent Directors, who have not been recommended by a majority of the members of the Governance Committee. For information on how shareholders may participate in the Director nomination process, see “Shareholder Submissions of Director Nominees for the 2025 Annual Meeting” in the Additional Shareholder Information section.

Individual strengths and skills, diversity, experience, composition and succession planning are considered by the Governance Committee when identifying and approving new board candidates. The diversity composition of the Board is set forth in the following table:

| | | | | | | | | | | | | | |

| Board Diversity Matrix as of April 8, 2024 |

| Total Number of Directors | 10 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 2 | 8 | — | | — | |

| Part II: Demographic Background | | | | |

| African American or Black | — | | 1 | — | | — | |

| Alaskan Native or Native American | — | | — | | — | | — | |

| Asian | — | | — | | — | | — | |

| Hispanic or Latinx | — | | — | | — | | — | |

| Native Hawaiian or Pacific Islander | — | | — | | — | | — | |

| White | 2 | 7 | — | | — | |

| Two or More Races or Ethnicities | — | | — | | — | | — | |

| LGBTQ+ | — |

| Did Not Disclose Demographic Background | — |

Director Nominee and Continuing Director Biographies:

We have prepared the following biographies to provide shareholders with detailed information about each continuing Director and Director nominee, all of whom are currently serving as Directors of the Company. No specific minimum qualification standards have been established.

Class B Nominees (terms expiring in 2027, if elected)

| | | | | |

| David S. DeMarco Mr. DeMarco, age 62, has been a Director of the Company since July 26, 2023; he has been a Director of SNB and GFNB since December 2012 and April 2022, respectively. He has been President and Chief Executive Officer of Arrow Financial Corporation and GFNB since May 13, 2023; he was Senior Executive Vice President of Arrow since May 1, 2009 and Chief Banking Officer of Arrow from January 1, 2018 to May 13, 2023. Mr. DeMarco has been the President and Chief Executive Officer of SNB since January 1, 2013. Prior to that date, Mr. DeMarco served as Executive Vice President and Head of the Branch, Corporate Development, Financial Services and Marketing Division of GFNB since January 1, 2003. Mr. DeMarco started with the Company in 1987. Mr. DeMarco is also a Board Member of Independent Bankers Association of New York State and New York State Bankers Association Profit Solutions Board of Directors. |

| | | | | |

| David G. Kruczlnicki Mr. Kruczlnicki, age 71, has been a Director of the Company since 1989; he has been a Director of SNB and GFNB since 2015 and April 2022, respectively. He previously served 26 years as a Director of GFNB. Mr. Kruczlnicki is President of a consulting firm that advises nonprofits on business planning and teaches at Siena College and Clarkson University Graduate School, and UNC/Chapel Hill. He was President and CEO of Glens Falls Hospital, a large regional medical center, from 1989 until his retirement in 2013. Mr. Kruczlnicki received a bachelor’s degree from Siena College and a master’s degree from Rensselaer Polytechnic Institute. He also served on the boards of directors of several affiliates of Glens Falls Hospital, numerous other health-related organizations, and Pruyn & Company, a local, privately owned paper company. As a former health care executive, Mr. Kruczlnicki has significant experience overseeing finance and human resources as well as directorship experience from his service as a director of numerous private and regional organizations. |

| | | | | |

| Raymond F. O’Conor Mr. O'Conor, age 68, became a Director of the Company on January 1, 2017; he has been a Director of SNB since 1996 and Chair of the SNB Board since 2001. He has also served as a Director of GFNB since April 2022. He was a Senior Vice President of the Company from 2009 until his retirement and served as President and CEO of SNB from 1995 until his retirement at the end of 2012. Mr. O’Conor is also a published author and CEO of Saratoga County Capital Resource Corporation, a community development agency. He has extensive knowledge of community banking, and more specifically, the Company, as a former member of the executive management team. |

Continuing Class A Directors (terms expiring in 2026)

| | | | | |

| Mark L. Behan Mr. Behan, age 63, became a Director of the Company on January 1, 2017; he has been a Director of the Company’s Subsidiary banks, GFNB and SNB, since 2015 and April 2022, respectively. Mr. Behan founded Behan Communications, Inc., in 1988; the company is a public affairs and strategic communications firm serving national and regional clients and is an adviser to chief executives in major businesses and non-profit organizations in the Capital Region of New York. Mr. Behan is a director or trustee of several non-profit organizations. Mr. Behan is also a former newspaper executive with extensive knowledge of the economic, political and community issues of the Capital Region and the Adirondacks. He is a graduate of Colgate University. |

| | | | | |

| Gregory J. Champion Mr. Champion, age 69, became a Director of the Company on May 5, 2021; he has been a Director of GFNB and SNB since April 2018 and April 2022, respectively. Mr. Champion brings more than 30 years of legal experience, including advising both privately held and publicly traded companies on corporate governance matters. Mr. Champion has a B.A. from St. Lawrence University and a J.D. (summa cum laude) from Syracuse University College of Law. Mr. Champion now serves as Chief Legal Officer for Syncromune, Inc., a startup company seeking to develop intra-tumoral immunotherapy treatment for metastatic cancer patients. |

| | | | | |

| Elizabeth A. Miller Ms. Miller, age 70, has been a Director of the Company since January 2017; she has been a Director of GFNB and SNB since 2015 and April 2022, respectively. Ms. Miller is President and CEO of Miller Mechanical Services, Inc. and Miller Industrial Manufacturing in Glens Falls. She holds bachelor’s and master’s degrees from the College of Saint Rose. Ms. Miller has a strong understanding of the community and its business base, particularly local manufacturing. |

| | | | | |

| |

| William L. Owens, Esq. Mr. Owens, age 75, has been a Director of the Company and GFNB since 2015; he has been a Director of SNB since April 2022. Mr. Owens is a former U.S. Congressman who represented New York’s 21st District from 2009 to 2014. Prior to his election to Congress, he was a managing partner at Stafford, Owens, Piller, Murnane, Kelleher & Trombley, PLLC, a Plattsburgh, New York law firm, where he practiced business and tax law for more than 30 years. In 2015, he rejoined the firm as a partner and resumed his role as Managing Partner in 2016. He also serves as Senior Advisor for Dentons (formerly McKenna Long & Aldridge, LLP), an international law firm. Mr. Owens holds a bachelor’s degree from Manhattan College and a law degree from Fordham University. He has a unique understanding of the North Country, and specifically the Plattsburgh market, and is a leading authority on U.S.-Canada trade issues. |

Continuing Class C Directors (terms expiring in 2025)

| | | | | |

| Tenée R. Casaccio, AIA Ms. Casaccio, age 58, has been a Director of the Company since January 2014; she has also served as a Director of GFNB and SNB since 2010 and April 2022, respectively. Ms. Casaccio is the President of JMZ Architects and Planners, PC ("JMZ"), a nationally certified Women-Owned Business Enterprise located in Glens Falls, New York. She earned a Bachelor of Architecture degree from Virginia Tech and holds licenses to practice architecture in New York and several other states. Ms. Casaccio has been with JMZ since 1993. She has significant executive experience and a strong understanding of the New York business climate. |

| | | | | |

| Gary C. Dake Mr. Dake, age 63, has been a Director of the Company since 2003; he has also served as a Director of SNB and GFNB since 2001 and April 2022, respectively. Mr. Dake is President of Stewart’s Shops Corp., a large, privately owned, vertically integrated, multi-state convenience store chain. Mr. Dake holds a bachelor’s degree from St. Lawrence University. He has experience with large business operations as a result of his management of Stewart’s, which also gives him a unique and broad understanding of the many communities the Company serves. |

| | | | | |

| Colin L. Read, PhD Dr. Read, age 64, has been a Director of the Company since 2013; he has also served as a Director of GFNB and SNB since 2010 and April 2022, respectively. Dr. Read is a professor of economics and finance in the State University of New York system. He served as Mayor of the City of Plattsburgh, New York for four years, after three years of service on the Clinton County Legislature. He is President of ESG Analytics Group, an organization that assists corporations in environment, social and governance ("ESG") risk management. He has taught money and banking since 1987, and teaches sustainability. He is a published author, with various contributions to print, online and television media, as well as 12 books on global finance. Dr. Read has a PhD in economics from Queen’s University, an MBA from the University of Alaska, a law degree from the University of Connecticut, a master’s degree in Taxation from the University of Tulsa and a bachelor's degree in Physics from Simon Fraser University. His expertise in economics and understanding of the Plattsburgh, New York area are key strengths. |

Director Compensation:

The Compensation Committee makes recommendations to the full Board regarding Director compensation. The Board itself, however, is responsible for determining the compensation payable to Directors for their services. Amounts paid for service on Subsidiary bank boards are considered by the Board in its periodic review of total Director compensation.

• Director Compensation for 2023

With respect to 2023 Director compensation, at its October 2022 meeting, the Arrow Board of Directors approved the following Director retainer fees for 2023:

| | | | | | | | |

| 2023 Director Compensation Table |

| Annual Retainer | | Position |

| $ | 30,000 | | | Arrow Director |

| $ | 24,000 | | | GFNB Director |

| $ | 12,000 | | | SNB Director |

| | |

| $ | 4,000 | | | Member, Audit Committee |

| $ | 2,500 | | | Member, Compensation Committee |

| $ | 2,500 | | | Member, Governance Committee |

| $ | 2,500 | | | Member, NCIA Board and Wealth Management Committee |

| $ | 2,500 | | | Manager, Upstate Agency, LLC |

| | |

| $ | 10,000 | | | Chair, Audit Committee |

| $ | 10,000 | | | Chair, Compensation Committee |

| $ | 10,000 | | | Chair, Governance Committee |

| $ | 7,500 | | | Chair, Wealth Management Committee/NCIA |

| $ | 5,000 | | | Chair, Upstate Agency, LLC |

| | |

| $ | 25,000 | | | Chair, Arrow Board |

| $ | 10,000 | | | Chair, GFNB Board |

| $ | 10,000 | | | Chair, SNB Board |

| | |

|

Only non-management Directors receive compensation for their services as Directors. Management Directors (those persons who are also officers) receive no additional compensation for their services as Directors. Therefore, neither Mr. DeMarco, our President and CEO who also became a Director effective July 26, 2023, nor Mr. Murphy, who was both a Director and an executive officer until May 12, 2023, received Director compensation in 2023, although they

were entitled to reimbursement of any expenses incurred in connection with their service as Directors. Further, upon his appointment as Chair, Mr. Owens waived the member fees for each of the committees on which he served.

The January 2023 and October 2023 Director payments included a portion of the fees payable in shares of Company common stock in accordance with the Arrow Financial Corporation 2023 Directors' Stock Plan (the "2023 DSP") and the predecessor plan. As a result of the delayed filing of the Annual Report on Form 10-K for the year ended December 31, 2022 (the "2022 Form 10-K"), and the Quarterly Report on Form 10-Q for the quarter ended March 31, 2023 (the "2023 Q1 Form 10-Q"), the April 2023 and July 2023 quarterly director fees were paid solely in cash. In 2023, fees earned in shares of Company common stock consisted of $7,500 of the Director’s basic annual retainer fee for serving as a Company Director, $6,000 of the Director’s basic annual retainer fee for serving as a Director of GFNB and $3,000 of the Director's basic annual retainer fee for serving as a Director of SNB, as well as 25% of the fees related to serving as Chair of the Board and serving on or chairing the various Board committees.

• Director Compensation for 2024

With respect to 2024 Director compensation, at its January 2024 meeting, the Arrow Board of Directors left the 2024 Director retainer fees unchanged from 2023.

In accordance with the 2023 DSP, a portion of the Directors’ fees, as determined by the Board in its sole discretion, will be payable to the Directors in shares of Company common stock, as opposed to cash or any other form of compensation, subject to applicable law and the provisions of the plan. Each Director may elect to receive a greater amount or percentage of his or her directors’ fees payable in common stock from the portion that would otherwise be payable to the director by submitting a written annual election to the Chair of the Board by December 15 of each year. With respect to director compensation payable In 2024, Directors Dake and Miller elected to increase the portion of their fee payable in Common Stock such that 100% would be payable in Company common stock.

•Directors' Deferred Compensation Plan

Under the Company’s Directors’ Deferred Compensation Plan, Directors of the Company and its Subsidiary banks may elect to defer receipt of some or all of the cash fees otherwise payable to them in any year to a later date, subject to certain limits set forth in the Deferred Compensation Plan and applicable law. Under this unfunded plan, amounts deferred are credited to the plan account of the deferring Director. The deferred amounts earn interest from time to time at a rate equal to the highest rate being paid on individual retirement accounts by GFNB. Deferred amounts are ultimately distributable on a date or dates selected by the Director, subject to certain restrictions. Distributions under the plan are payable in cash, either in a lump-sum or in annual installments as the participant may choose. During 2023, no Directors elected to defer fees under the plan.

•Incentive Stock-Based Compensation

Under the Company’s current long-term incentive plan, the Arrow Financial Corporation 2022 Long-Term Incentive Plan (“2022 LTIP”), the Board is authorized, in its discretion and after consultation with the Compensation Committee, to make grants of stock-based incentive awards to non-management Directors of the Company as additional compensation for their service as Directors. The terms and conditions of awards granted to Directors are established by the Board itself, not by the Compensation Committee. The Board believes the grant of equity incentive awards serves an important purpose by further aligning Directors’ interests with those of our shareholders.

Historically, the Board has approved annual grants of a fixed number of stock options to non-management Directors under the 2022 LTIP (and predecessor plans). These options typically vest ratably over a four-year period, subject to accelerated vesting in the event of a change-in-control of the Company. All Directors’ stock options granted under the 2022 LTIP have a maximum term of 10 years from the date of the grant and are exercisable only while the Director continues to serve in such capacity and, for a short period following termination of service. The Board may elect to accelerate the vesting of options on a case-by-case basis, to extend the period of post-termination exercisability up to the maximum term of the option and has most often elected to do so in practice. All options granted to Directors in 2023 will vest ratably over a four-year period, reinforcing the long-term nature of the grant. The exercise price for all stock options granted to Directors in 2023 was the fair market value of the Company’s common stock on the date of grant, i.e., the reported closing price of the stock on such date.

In early 2023, the Board granted to each then-current non-management Director who also was a Director in 2022, a standard annual incentive award for a fixed maximum number of stock options under the 2013 LTIP (the then-current LTIP). The number and grant date value of all such options are listed in the “2023 Director Compensation Table” later in this section.

Stock Ownership Guidelines

In order to better align the interests of Directors with the interests of our shareholders, the Company has established individual stock ownership guidelines for non-management Directors. Under these guidelines, each non-management Director of the Company is expected to achieve, within five years following such Director's election or appointment to the Board, and thereafter to maintain as long as such Director serves as a Director, beneficial ownership of a number of shares of the Company’s stock having a market value at least equal to five times the basic annual retainer fee payable from time to time to such Director for serving on the Company’s Board. Under normal circumstances, if and for so long as a non-management Director does not meet this target level of beneficial ownership, restrictions may be placed on the Director’s ability to sell shares of the Company’s common stock obtained through the exercise of stock option awards previously or subsequently granted to the Director under the 2022 LTIP, predecessor plans or successor plans. The target ownership requirement for each non-management Director is set by the Compensation Committee and Governance Committee, and measured each year by the Governance Committee, using holdings valued as of the Company's record date each year. Common shares owned outright (including shares held jointly with a spouse) or held through Company plans (e.g., the Company’s Automatic Dividend Reinvestment Plan) are currently counted toward the stock ownership requirement. Stock options do not count toward the stock ownership requirement. The independent members of the Board have the discretion to address and approve exceptions. Management Directors are subject to a separate policy. For a description of those guidelines, see “Stock Ownership Policy” for Named Executive Officers in the Compensation Discussion and Analysis section.

2023 Director Compensation Table

The following Director Compensation Table summarizes all compensation paid by the Company and its Subsidiaries to the non-management Directors of the Company for the fiscal year ended December 31, 2023. Management Directors (who, in 2023, consisted of Messrs. DeMarco and Murphy) do not receive any compensation for service as Directors of the Company or either of its Subsidiary banks. Compensation received in 2023 by Messrs. DeMarco and Murphy is reported in the “Summary Compensation Table” within the Executive Compensation section.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | Fees Earned

or Paid

in Cash (a) | | Stock Awards (b) | | Option Awards (c) | | Change in

Pension Value/ Nonqualified Deferred Compensation Earnings | All Other Compensation | 2023 Director Compensation

Total |

| Mark L. Behan | $ | 53,250 | | | $ | 17,750 | | | $ | 8,017 | | | $ | — | | $ | — | | $ | 79,017 | |

| Tenée R. Casaccio | 57,000 | | | 19,000 | | | 8,017 | | | — | | — | | 84,017 | |

| Gregory J. Champion | 54,375 | | | 18,125 | | | 8,017 | | | — | | — | | 80,517 | |

| Gary C. Dake | 58,874 | | | 19,626 | | | 8,017 | | | — | | — | | 86,517 | |

Thomas L. Hoy (e) (f) | 37,875 | | | 12,625 | | | 8,017 | | | — | | — | | 58,517 | |

| David G. Kruczlnicki | 60,000 | | | 20,000 | | | 8,017 | | | — | | 1,164 | | (d) | 89,181 | |

| Elizabeth A. Miller | 54,375 | | | 18,125 | | | 8,017 | | | — | | — | | 80,517 | |

| Raymond F. O'Conor | 57,000 | | | 19,000 | | | 8,017 | | | — | | — | | 84,017 | |

| William L. Owens | 74,083 | | | 22,750 | | | 8,017 | | | — | | — | | 104,850 | |

| Colin L. Read | 58,874 | | | 19,626 | | | 8,017 | | | — | | — | | 86,517 | |

(a)Represents the cash portion of Basic Annual Retainer and fees relating to service on Boards and Committees.

(b)Represents that portion of each listed Director’s total 2023 Directors’ fees that were paid in shares of Company stock, in accordance with the 2023 DSP and its predecessor plan. For purposes of determining the number of shares of the Company’s common stock distributable to these Directors, the shares are valued at the market price of the Company’s common stock on the date of distribution, in accordance with FASB ASC TOPIC 718. For the quarterly payments made in January 2023 and October 2023 payments,

the Directors received, as payment of that portion of their basic annual retainer fee regularly payable in such year, shares of Company stock and a quarterly distribution of shares at a per share price based on the closing price of Company Stock on the date of distribution. As of December 31, 2023, no non-employee Directors held any unvested stock awards.

(c)Stock options granted to Directors are valued in accordance with FASB ASC TOPIC 718. The stock options were granted February 1, 2023, at a per share exercise price of $31.47, the closing price of our common stock on the date of grant as restated for the 3% stock dividend distributed in September 26, 2023. Options vest ratably over a period of four years following the date of grant. As of December 31, 2023, each non-employee Director held the following aggregate number of unexercised stock options (whether vested or not vested): Behan 6,665 options, Casaccio 10,456 options, Champion 2,637 options, Dake 6,701 options, Kruczlnicki 4,910 options, Miller 6,439 options, O'Conor 6,665 options, Owens 6,395 options and Read 7,011 options.

(d)Represents interest earned by the listed Director during 2023 on the principal balance of the Director’s account under the Directors’ Deferred Compensation Plan.

(e)Mr. Hoy passed away on June 11, 2023 and his 2023 Director compensation is reflective of the term of his service as a Director.

(f)Pursuant to the stock option award agreement, all unvested stock awards automatically vested in connection with Mr. Hoy's death. Such vested awards are exercisable by his beneficiary for the full exercise period of 10 years from the grant date.

Voting Item 2 – Advisory Approval of Our 2023 Executive Compensation ("Say-on-Pay")

Summary and Board Recommendation:

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934, as amended, Item 2 is a proposal to approve on an advisory basis the Company’s 2023 executive compensation (“Say-on-Pay”), as described in the Compensation Discussion and Analysis section. This vote is not intended to address a specific item of compensation, but rather the overall compensation of the Named Executive Officers (“NEOs”) and the philosophies, policies and practices as described in this Proxy Statement. Say-on-Pay is an advisory proposal, so the Company is not required to take any action as a result of this vote. However, the Compensation Committee will be asked to review the results of the shareholder vote to determine if any additional action is required, and it will carefully consider the results as part of its regular review and recommendations regarding executive compensation.

The Say-on-Pay advisory vote taken at the 2023 Annual Meeting of Shareholders was approved by shareholders. Approval of Say-on-Pay will require the affirmative vote of a majority of the shares of common stock present or represented by proxy at the Annual Meeting and voting on this proposal. Abstentions and broker “non-votes” will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of this vote.

•Vote Recommendation: Your Board recommends you vote “For,” on an advisory basis, the Company’s executive compensation, or Say-on-Pay.

Say-on-Pay Details:

The Company believes its executive compensation program is well-designed, appropriately aligns executive pay with Company performance and attracts, motivates and retains individuals whose interests are aligned with shareholders. Please see the Compensation Discussion and Analysis section for more information on compensation decisions and practices. As noted in the Compensation Discussion and Analysis section, the Company takes a conservative and consistent approach to its executive compensation program. We believe the program ties executive compensation in an appropriate way to corporate and individual performance in order to drive Company growth and shareholder value. We also believe the overall compensation programs, use responsible and reasonable methods to motivate, retain and reward the NEOs. This approach helps the Company promote long-term profitability within acceptable risk parameters. The Company's key practices are highlighted below:

•Say-on-Pay: Following the frequency of the Say-on-Pay advisory shareholder vote at the 2023 Annual Meeting of Shareholders, the Board determined its current intention to include an advisory vote on executive compensation every year in its Proxy Statement. This will provide annual feedback from shareholders on the Company's pay practices.

•Employment Agreements: Consistent with shareholder advisory guidance, the Company's executive employment agreements provide for change of control "double trigger" severance benefits upon a termination of employment without cause or by the executive for good reason by applying the applicable multiple of two to three times to the sum of base pay plus target bonus for the relevant year instead of applying the multiple to the executive average annual taxable compensation for the five-year period prior to the change of control.

•Conservative: Total executive compensation is conservative as compared to industry standards and the Company's peer group.

•Balanced: The Company's annual bonus plan is a balanced program based on quantitative and qualitative assessment of both the Company’s and the individual executive’s performance. In past years when targeted financial performance was not fully achieved, individually or company-wide, based on either objective or subjective standards, or both, bonuses were materially reduced or not awarded at all, in some cases even if threshold levels of performance were in fact achieved.

•Annual Review: The annual bonus is based on goals that are reviewed and updated yearly and are set to encourage long-term profitability within accepted conservative risk parameters.

•Shareholder Aligned: Long-term equity-based incentives, such as stock option awards and restricted stock units ("RSUs"), recognize and encourage an alignment of executives' goals over the long term with those of the shareholders. Awards provide for vesting over a three- to four-year period, which may be incremental or cliff vesting. Stock option awards, even at the highest executive level, are generally modest. Exercise prices are determined based on the closing price of the Company’s stock on the day of grant. Stock options only have value if the Company’s stock price increases.

•No Backdating or Reloading: The 2022 LTIP, and its predecessors, under which Company stock options are granted does not permit “backdating” or “reloading” of option grants. Downward repricing of our outstanding stock options is not permitted without shareholder approval.

•Ownership Requirements: NEOs are required to own specific amounts of our stock based on their annual salaries.

•No Tax Gross-Up: The Company does not have tax gross-up plans for NEOs.

•No Golden Parachutes: The Company does not have "golden parachutes" for NEOs; the top change-in-control payment is capped consistent with limits in the Internal Revenue Code of 1986, as amended (the "Code") so as to prevent the triggering of excess parachute taxes on the Company.

Voting Item 3 – Approval of the Arrow Financial Corporation 2023 Employee Stock Purchase Plan

Summary and Board Recommendation:

On October 25, 2023, the Board of Directors approved the Arrow Financial Corporation 2023 Employee Stock Purchase Plan (the “Plan”) and reserved 300,000 shares of the Company’s common stock for issuance thereunder. The Plan is an employee stock purchase plan that is intended to satisfy all requirements of Section 423 of the Code. The Board continues to believe that the maintenance of an employee stock purchase plan is in the best interests of the Company because it aligns the interests of the participants with that of the Company’s shareholders. The Company began operating the Plan on January 1, 2024 (the “Inception Date”), subject to approval by the Company’s shareholders within twelve (12) months after its adoption by the Board, as required by Section 423 of the Code.

Approval of the Plan will require the affirmative vote of a majority of the shares of the Company’s common stock present in person or represented by proxy at the Annual Meeting and voting on this proposal. Abstentions and broker “non-votes” will not be counted in determining the number of votes cast and, therefore, will have no effect on the outcome of this vote.

The Plan is subject to approval by the holders of a majority of the shares present in person or by proxy and voting at a meeting at which the Plan is considered. In the event the Plan is approved, it will replace the Arrow Financial Corporation 2020 Employee Stock Purchase Plan, which the Company suspended in the first quarter of 2023 as a result of delayed filing of the 2022 Form 10-K and 2023 Q1 Form 10-Q. In the event the shareholders of the Company do not approve the Plan at the Annual Meeting: (i) the Plan shall immediately terminate; (ii) all amounts contributed by each participant in the Plan which have not been used to purchase Common Stock will be returned to such participant as soon as practicable; and (iii) purchases under the Plan made from the Inception Date through the date of termination of the Plan shall not be treated as purchased pursuant to an employee stock purchase plan that satisfies Section 423 of the Code and participants would not qualify for favorable tax treatment of such purchases.

•Vote Recommendation: Your Board of Directors recommends that you vote ”For” the approval of the Arrow Financial Corporation 2023 Employee Stock Purchase Plan.

Summary of the Plan:

The principal features of the Plan are summarized below. The complete text of the Plan is set forth in Appendix A to this Proxy Statement. This summary does not purport to be a complete description of all of the provisions of the Plan and is subject in all respects to the provisions contained in the complete text.

•Purpose: The primary purpose of the Plan is to provide eligible persons employed by the Company or its Subsidiaries with an incentive to work for the continued success of the Company by encouraging them to acquire a proprietary interest in the Company in the form of the Company’s common stock in order to align their interests with those of the Company.

•Administration: The Plan will be administered by the Compensation Committee. As administrator, the Compensation Committee will have full power to interpret the Plan and its decisions will be final and binding. The administrator may appoint and/or retain one or more qualified service providers or other agents, including the Subsidiaries, to assist it in the oversight and operation of the Plan.

•Application to Insiders: The Company intends that the purchase and sale of shares of Common Stock under the Plan by or on behalf of those participants who are or may be subject to Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) (collectively, “Insiders”) will be structured and conducted so as to render such purchases and sales exempt, to the extent possible, from the reporting obligations of Insiders under Section 16(a) of the Exchange Act and any liability of the Insiders under Section 16(b) of the Exchange Act.

•Shares Eligible for Purchase: The maximum number of shares of Common Stock that may be purchased under the Plan on behalf of participants is three hundred thousand (300,000), subject to adjustment in the event of certain subsequent changes in the number of outstanding shares, e.g., stock splits, stock dividends, a corporate reorganization or recapitalization. The total remaining number of shares that may be purchased

under the Plan at the time of such change shall be adjusted accordingly. All shares will be purchased from the Company and will consist of authorized but unissued shares or shares held in the treasury of the Company.

A table setting forth certain information regarding Arrow's equity compensation plans as of December 31, 2023 can be found in Part II, Item 5 of our Annual Report on Form 10-K for the year ended December 31, 2023, under the caption “Equity Compensation Plan Information.”

•Participation: The following categories of persons are eligible to participate in the Plan: those regular employees of the Company or its Subsidiaries who have been employed continuously by the Company or a Subsidiary for at least one full month, provided that such employee is considered employed for purposes of Section 423(b)(4) of the Code; and provided, further that such employee does not or is not deemed to own 5% or more of the total combined voting power or value of all classes of stock of the Company or any Subsidiary.

Any eligible person who elects to start participating in the Plan may do so by completing the prescribed participation form, indicating thereon the initial level of participation by such participant (which may not be zero) and returning such form to the administrator. Participation in the Plan will commence only as of the first day of a pay period for an eligible enrolled participant.

A participant may voluntarily terminate their participation in the Plan at any time by submitting notice on a form prescribed by the administrator.

•Contributions: Contributions typically will be made through regular payroll deductions. In appropriate circumstances, the administrator, in its absolute discretion, may permit other methods of making contributions under the Plan. Participants may increase or decrease their level of contributions from time to time within limitations established by the Compensation Committee; provided, however, that those participants who are Insiders may not change the level of their contributions to the Plan except in accordance with applicable law and Company policy. The Compensation Committee may from time to time, at its discretion, establish limitations on the maximum amounts or levels and the minimum amounts or levels that may be contributed by individual participants during a designated period (e.g., per month or per pay period) under the Plan. The administrator may specify a single set or more than one set of such limitations (collectively, the “Contribution Limitations”) for participants, provided that all participants of any similarly-situated category shall be subject to the same set of Contribution Limitations at any given time.

•Purchase Price; Investment in Shares: As administrator, the Compensation Committee determines from time to time the purchase price for shares of our stock purchased under the Plan, including the discount from current market price that may apply from time to time. The discount for purchases under the Plan is 10%, or such greater or lower percentage as may be determined from time to time by the Compensation Committee, though the discount will not exceed 15%. Contributions are accumulated by the administrator at regular intervals determined by the administrator, but typically not less than monthly, for all of the participants and invested in shares acquired from the Company at the appropriate purchase price or prices. Acquired shares are held in Plan accounts for the participants until distributed or sold at their request into the market.

•Plan Accounts; Shareholder Rights; Dividends and Withdrawal of Shares: The administrator will ensure that a separate account is maintained for each participant (each a “Plan Account”), which will reflect all contributions by a participant, purchases of shares of Common Stock, all dividends and other amounts paid on shares held in such Plan Account, all sales of shares, and all withdrawals of shares or funds by the participant.

Each participant will have the authority to direct the administrator in the manner of voting the shares of Common Stock held in such participant’s Plan Account or regarding any other action that may be taken by shareholders of the Company with respect to shares of Common Stock owned by them.

Any dividends paid on shares of Common Stock credited to the Plan Account of a participant will be reinvested automatically in additional shares of Common Stock of the Company under the Arrow Financial Corporation Automatic Dividend Reinvestment Plan (the “DRIP”) on the next dividend reinvestment date under the DRIP, which will not necessarily coincide with the next investment date under the Plan. All additional shares of Common Stock purchased with reinvested dividends will also be credited to the Plan Accounts of such participant.

A participant may elect, without terminating his or her participation in the Plan, to receive a distribution of any or all whole shares of Common Stock held in such participant’s Plan Account not more than twice in any calendar year, by written request directed to the administrator.

•Amendment or Termination of the Plan: The Plan is subject to approval by the holders of a majority of the shares of the Company present in person or represented by proxy and voting at the Annual Meeting.

If the Plan is approved by the shareholders at the Annual Meeting, the Plan would continue until all reserved shares have been purchased unless earlier terminated. The Board in its sole discretion may amend or terminate the Plan at any time, provided that no such amendment or termination may adversely affect the rights or interests of existing participants with respect to the shares then held in their Plan Accounts. If any amendment of the Plan would require shareholder approval under any applicable law or regulation, including the rules and regulations of the Securities and Exchange Commission ("SEC") or an applicable securities exchange, the amendment will not be effective unless and until such approval is received.

In the event the shareholders of the Company do not approve the Plan at the Annual Meeting, the Plan shall immediately terminate.

•New Plan Benefits: If the Plan is approved by the shareholders, benefits under the Plan will depend on the extent to which eligible persons elect to participate and the fair market value of our stock at various future dates.

•Tax Consequences to Participants: Participants will not realize taxable income when the Company allows for discounted purchases of Common Stock under the terms of the Plan or when shares are purchased under the Plan. To qualify for favorable tax treatment on the sale, transfer or other disposition of shares acquired under the Plan, the disposition may not occur before the later of (a) one year after the purchase date, or (b) two years after the beginning of the applicable offering period or grant date (other than a disposition resulting from the participant’s death) (a “Qualifying Disposition”). In the event of a Qualifying Disposition, participants would be subject to ordinary income tax in the year in which the shares are sold on an amount equal to the lesser of (a) the applicable discount from the fair market value of the shares on the purchase date or (b) the excess of the sale price for the shares that are sold (or in the cases of death or other disposition, the fair market value of the shares on the date of death or other disposition) over the purchase price for the shares. In the event of any disposition other than a Qualifying Disposition, then the excess of the fair market value of the Common Stock on the purchase date over the purchase price would be recognized by the participant as ordinary income at the time of the sale or other disposition and capital gain or loss must also be recognized in the year of sale.

Notwithstanding the foregoing, in the event the shareholders of the Company do not approve the Plan at the Annual Meeting: (i) the Plan shall immediately terminate; (ii) all amounts contributed by each participant in the Plan which have not been used to purchase Common Stock will be returned to such participant as soon as practicable; and (iii) purchases under the Plan made from the Inception Date through the date of termination of the Plan shall not be treated as purchased pursuant to an employee stock purchase plan that satisfies Section 423 of the Code and participants would not qualify for favorable tax treatment of such purchases.

•Tax Consequences to the Company: To the extent a participant recognizes income in connection with a disqualified disposition of shares under the Plan, the Company will be entitled to take a tax deduction in an amount equal to the amount includable by the disposing participant as ordinary income. The Company’s tax deduction will be taken in the taxable year in which a participant recognizes the income.

Voting Item 4 – Ratification of the Selection of Crowe as Our Independent Auditor for 2024

Summary and Board Recommendation:

Appointment of Independent Registered Public Accounting Firm

The Audit Committee appoints our independent registered public accounting firm. In this regard, the Audit Committee evaluates the qualifications, performance and independence of our independent registered public accounting firm and determines whether to re-engage our current firm. As part of its evaluation, the Audit Committee considers, among other factors, the quality and efficiency of the services provided by the firm, including the performance, technical expertise, industry knowledge and experience of the lead audit partner and the audit team assigned to our account; the overall strength and reputation of the firm; the firm’s global capabilities relative to our business; and the firm’s knowledge of our operations. On March 14, 2024, the Audit Committee appointed Crowe as our independent registered public accounting firm for the fiscal year ending December 31, 2024 and dismissed KPMG LLP (“KPMG”), which had served as our independent registered public accounting firm since 1990 until its dismissal on March 14, 2024. Neither Crowe nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors and providing audit and permissible non-audit related services.

Although ratification is not required by our bylaws or otherwise, the Board is submitting the selection of Crowe to our shareholders for ratification because we value our shareholders’ views on the Company’s independent registered public accounting firm and it is a good corporate governance practice. If our shareholders do not ratify the selection, it will be considered as notice to the Board and the Audit Committee to consider the selection of a different firm. Even if the selection is ratified, the Audit Committee, in its discretion, may select a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its shareholders.

Representatives of Crowe are expected to attend the Annual Meeting.

Change in Independent Registered Public Accounting Firm

As previously disclosed, on March 14, 2024, the Audit Committee of the Board approved the engagement of Crowe as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

On March 14, 2024, the Audit Committee dismissed KPMG as the Company’s independent registered public accounting firm effective immediately. The reports of KPMG on the Company’s consolidated financial statements for each of the two fiscal years ended December 31, 2022 and 2023 did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. In the fiscal years ended December 31, 2022 and 2023 and in the subsequent interim period through March 14, 2024, there were no "disagreements" (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) between the Company and KPMG on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of KPMG, would have caused KPMG to make reference to the matter in its report on the financial statements for such years.

In the fiscal years ended December 31, 2022 and 2023 and in the subsequent interim period through March 14, 2024, there were no “reportable events” (as described in Item 304(a)(1)(v) of Regulation S-K), except that, as reported in Part II, Item 9A of the Company’s Annual Reports on Form 10-K for the fiscal years ended December 31, 2023 and 2022, as filed with the SEC on March 11, 2024 and July 17, 2023, respectively, the Company reported material weaknesses in its internal control over financial reporting during such period which are described below:

•The Company did not maintain effective monitoring controls related to 1) Internal Audit’s testing of management’s internal control over financial reporting, 2) the completeness and accuracy of information

presented to the Audit Committee by Internal Audit, and 3) the related Audit Committee oversight over Internal Audit’s testing of management’s internal control over financial reporting.

•With regard to the conversion of our core banking information technology system that occurred in September 2022, the Company did not effectively perform risk assessment procedures to identify the impact of the conversion on our internal control over financial reporting.

The Company provided KPMG with a copy of the disclosures contained in the Company’s Current Report on Form 8-K filed on March 19, 2024 and requested that KPMG furnish the Company with a letter addressed to the SEC stating whether it agrees with the statements contained herein. A copy of KPMG’s letter, dated March 19, 2024, was filed as Exhibit 16.1 to such Current Report on Form 8-K.

During the fiscal years ended December 31, 2022 and 2023 and the subsequent interim period through March 14, 2024, neither the Company nor anyone on its behalf consulted with Crowe with respect to (a) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and neither a written report nor oral advice was provided to the Company that Crowe concluded was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (b) any matter that was either the subject of a “disagreement” (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a “reportable event” (as described in Item 304(a)(1)(v) of Regulation S-K).

Ratification of the selection of Crowe will require the affirmative vote of the holders of a majority of the shares of common stock present or represented by proxy at the Annual Meeting and voting on this proposal.

•Vote Recommendation: Your Board recommends you vote “For” the ratification of the independent registered public accounting firm, Crowe, as the independent auditor of the Company for the fiscal year ending December 31, 2024.

Independent Registered Public Accounting Firm Fees:

The following table sets forth the aggregate fees billed to the Company and its Subsidiaries for the fiscal years ended December 31, 2023 and 2022, by the Company’s then independent registered public accounting firm, KPMG. The tax fees in this table represent fees paid to KPMG for the specified year for tax preparation and consulting services.

| | | | | | | | |

| Categories of Service | 2023 | 2022 |

| Audit Fees | $2,689,630 | $ | 1,700,573 | |

| Audit-Related Fees | 25,000 | | 8,500 | |

| Tax Fees | 108,250 | | 105,600 | |

| All Other Fees | — | — |

| Total Fees | $ | 2,822,880 | | $ | 1,814,673 | |

Audit Committee Report

Each member of the Audit Committee qualifies as independent under both the NASDAQ standards for independent directors and the more rigorous SEC standards for independent Audit Committee members. For more detail, see the Corporate Governance section. The Audit Committee assists the Board in fulfilling its oversight role relating to the Company’s financial statements and the financial reporting process, including the system of disclosure controls and the Company’s internal controls and procedures. Its duties include reviewing the independent registered public accounting firm’s qualifications and independence, the performance of the independent registered public accounting firm, and the Company’s internal audit function. The duties of the Audit Committee are set forth in the Audit Committee Charter, which has been adopted by the Board and is reviewed annually by the Committee. A copy of the current charter of the Audit Committee is available on our website at www.arrowfinancial.com/corporate/governance.

Management has the responsibility for preparing the Company’s consolidated financial statements and for assessing the effectiveness of its internal controls over financial reporting. The Company’s independent registered public accounting firm for 2023, KPMG, had the responsibility for auditing these consolidated 2023 financial statements. KPMG reported directly to the Audit Committee, and they met on a regular basis. The Audit Committee has reviewed and discussed with management and KPMG the Company’s audited consolidated financial statements as of and for the year ended December 31, 2023. The Audit Committee has also discussed with management its assertion on the design and effectiveness of the Company’s internal control over financial reporting as of December 31, 2023, and has discussed with KPMG the matters required to be discussed by professional standards. The Audit Committee has received and discussed the written disclosures and the letter from KPMG required by Public Company Accounting Oversight Board Rule 3526, “Communication with Audit Committees Concerning Independence.” The Audit Committee has discussed with KPMG the firm’s independence and determined that the non-audit services provided to the Company by KPMG are compatible with its independence. Based on this review and discussion, the Audit Committee recommended to the Board that the audited consolidated financial statements of the Company and its Subsidiaries, and management’s assertion on the design and effectiveness of internal control over financial reporting of the Company and its Subsidiaries, be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC.

On March 14, 2024, the Audit Committee approved the engagement of Crowe as the Company’s independent registered public accounting firm for 2024 and the scope of its work.

Colin L. Read, Chair

Gregory J. Champion

David G. Kruczlnicki

Elizabeth A. Miller

Corporate Governance

The Board’s Corporate Governance Guidelines provide the framework within which the Company’s Directors and executive officers manage the business and affairs of the Company. The Company is managed under the direction and oversight of the Board. The Board appoints the CEO, who is responsible for the day-to-day operation of the Company. The Board’s primary responsibilities, thereafter, are to oversee management and to exercise its business judgment to act in what it reasonably believes to be the best interests of the Company and its shareholders. At least once each year, the Board will review the Company’s long-term strategic plans and future key issues.

The Governance Committee of the Board is responsible for reviewing with the full Board, on an annual basis, the requisite skills and characteristics of all Board members, as well as nominees for Director and the composition of the Board as a whole. This assessment will include whether individual Directors or nominees qualify as independent under applicable law and guidelines, as well as consideration of diversity, age, skills and experience of the Directors as a group in the context of the needs of the Board. The Company believes that a diverse Board advances the Company's interests by providing a variety of perspectives on important matters and improving our service to our communities. The Company has had a longstanding commitment to board diversity and currently exceeds NASDAQ diversity requirements. Please see our "Board Diversity Matrix" included in Voting Item 1 – Election of Directors section for more detail on our current Board profile. A majority of Directors must meet the criteria for general Board independence as required and defined by NASDAQ. Directors generally must satisfy certain other applicable laws, rules and regulations.

The Board’s membership is divided into three classes, as equal in number as possible given the number of Directors. Generally, one class is elected each year by the Company’s shareholders to a term of three years. The Governance Committee identifies and recommends to the full Board suitable candidates for nomination for Director, including, when appropriate, incumbent Directors. In making its recommendations, the Governance Committee will consider any proposals it properly receives from shareholders for Director nominees. Shareholders may propose a Director candidate for consideration by the Governance Committee by following the rules described under “Shareholder Submissions of Director Nominees for the 2025 Annual Meeting” in the Additional Shareholder Information section. The Governance Committee’s recommendations of candidates for nomination will be based on its determination as to the suitability of the particular individuals, and the slate as a whole, to serve as Directors of the Company, taking into account the criteria discussed above. When evaluating incumbent Directors who are nominated for reelection, the Governance Committee considers, in addition to past performance, each such Director’s attendance record for meetings of the Company’s Board, its Subsidiary banks’ boards and committees on which the Director serves, as applicable. See “Director Nomination Process” in the Voting Item 1 – Election of Directors section for a discussion of additional criteria considered in the selection of Directors for nomination.

The Board does not believe that Directors should be subject to term limits. While term limits may in some cases enhance the flow of fresh ideas and viewpoints in the boardroom, they may also result in the loss of knowledgeable and experienced Directors, whose insights into the Company and its operations typically expand and deepen over time. When evaluating whether incumbent Directors should be renominated, the Governance Committee will consider, in addition to the incumbent’s prior performance on the Board, the same general qualities and attributes, such as suitability, character, general experience and background that it applies to new candidates for Director. Additionally, the Company’s bylaws provide that Directors will retire from the Board at the first Annual Meeting of Shareholders held on or after they attain the age of 75.

Board Leadership Structure:

Currently, the Board leadership structure separates the roles of Chair and CEO, therefore not requiring the appointment of a lead independent Director to serve as a liaison between the Chair and the independent Directors. The Board believes that the separation of the offices of the Chair and CEO is appropriate at this time as it maximizes the effectiveness of Board leadership and allows our CEO to focus primarily on management responsibilities. Further, the Company has a Board comprised largely of Directors who qualify as “independent” under the NASDAQ general independence guidelines. The Company’s bylaws permit the Board to appoint both a chair and vice-chair, as it deems appropriate in its discretion.

Mr. Hoy, the Company's former CEO who retired in 2012, served as Chair until May 2023 due to his longstanding experience with the Company, along with his strong leadership capability and banking expertise. When Mr. Hoy stepped down, the Board appointed Mr. Owens as Chair. Mr. Owens previously served as Lead Director from 2017 until his appointment as Chair. Mr. Hoy passed away on June 11, 2023. Mr. Murphy, the Company's President and CEO until May 12, 2023, was the only member of the Board who was also an employee of the Company. Upon Mr. Murphy's departure, the Board of Directors appointed Chief Banking Officer and Senior Executive Vice President David S. DeMarco as President and Chief Executive Officer of the Company and its lead Subsidiary, GFNB. Mr. DeMarco continues to serve as President and Chief Executive Officer of SNB. The Board appointed Mr. DeMarco as a Director on July 26, 2023. Since Mr. Owens has reached the age of 75, which is the Directors' retirement age as stipulated by the Company's bylaws, Mr. Owens is expected to retire from the Board at the Annual Meeting on June 5, 2024. At that time, the Chair of the Board and his committee memberships will be addressed by the Board.

The Governance Committee and the independent Directors will continue to evaluate the Board’s leadership structure as part of its regular review of corporate governance and succession planning to ensure that it remains best suited for the Company and shareholders.

Board Committees:

The Board has three standing committees whose membership and responsibilities must meet certain NASDAQ and SEC requirements. These standing committees are the Audit, Compensation and Governance Committees (collectively, the “Committees”). The Board may from time to time establish or maintain additional committees, as it deems necessary or appropriate, the membership of which may include one or more Directors, as well as non-Directors. One such additional committee that the Board has established is the Executive Committee, which is described later in this section.

Committee Membership

The Governance Committee regularly reviews committee membership and makes recommendations for changes on an annual basis, with consideration given to the qualifications and preferences of individual Directors and the specific requirements, if any, of NASDAQ and the SEC for service on such committees. The Board gives consideration to rotating committee members periodically, to the extent feasible under applicable laws and regulations governing the membership requirements of the Committees, but the Board does not believe rotation should be mandated as policy, nor that service by a Director on a committee should be subject to term limits. All members of the three standing Committees are independent Directors, as defined (and generally required) under applicable law, rules and regulations (see “Director Independence” later in this section for more detail). A table showing the current members of each of the standing Committees follows:

| | | | | | | | | | | |

| Director | Audit

Committee | Compensation

Committee | Governance

Committee |

| Mark L. Behan | | X | |

| | | |

| Gregory J. Champion | X | | X |

| Gary C. Dake | | X | Chair |

| David G. Kruczlnicki | X | Chair | |

| Elizabeth A. Miller | X | | X |

| William L. Owens | | X | X |

| Colin L. Read | Chair | | X |

| | | |

Each of the three standing Committees has its own charter that sets forth the purposes, goals and responsibilities of the Committee, as well as the qualifications for membership, procedures for appointing members, structure and operations and policies for Board oversight of the Committee. Each has the power to hire, at the Company’s expense, independent accounting, compensation, financial, legal or other consultants, as the members may deem necessary and appropriate, consistent with the overall authority to retain such advisors as set forth in the Committee’s charter, including budgeting or professional conditions and limitations. Management approval will not be required for engagement of consultants, although management normally will be advised and consulted prior to any such engagement to avoid, among other things, conflicts of interest.

Committee Descriptions

A description of each of the three standing Committees, as well as the Executive Committee, follows:

•Audit Committee: Dr. Read is Chair of the Audit Committee; he has served in this role since 2020. The Audit Committee’s primary duties and responsibilities are to select and appoint the independent auditors each year; monitor the independence and performance of the Company’s independent auditors and internal Audit Department; monitor the quality and integrity of the Company’s financial reporting process and systems of internal controls regarding accounting, financial and legal compliance; and provide a means of communication among the independent auditors, management, the internal Audit Department and the Board. The Audit Committee also reviews business or financial transactions between the Company and Company insiders and their related parties, such as any transactions with an individual Director or business entity in which the Director has a controlling or material interest. In accordance with applicable rules, the Audit Committee must specifically approve in advance all services performed by the independent auditor. The Audit Committee met 16 times in 2023, all then-serving members attended these meetings. For additional information, see the Audit Committee Report section.

•Compensation Committee: Mr. Kruczlnicki is Chair of the Compensation Committee; he has served in this role since 2013. The Compensation Committee’s principal responsibility is to review and approve, not less often than annually, all aspects of the compensation arrangements and benefit plans covering the Company's executive officers, including the CEO, subject to full Board approval, where appropriate. The Compensation Committee also periodically reviews the compensation of the Board and makes recommendations to the full Board with respect to the types and amounts of compensation payable to the Directors for service on the Company’s Board, the boards of its Subsidiary banks, and committees thereof. The Compensation Committee also consults with management and provides general oversight of the compensation and benefit programs and policies for employees. The Compensation Committee met five times in 2023, all then-serving members attended these meetings. For additional detail regarding executive compensation and the role of the Compensation Committee, see the Compensation Discussion and Analysis section.

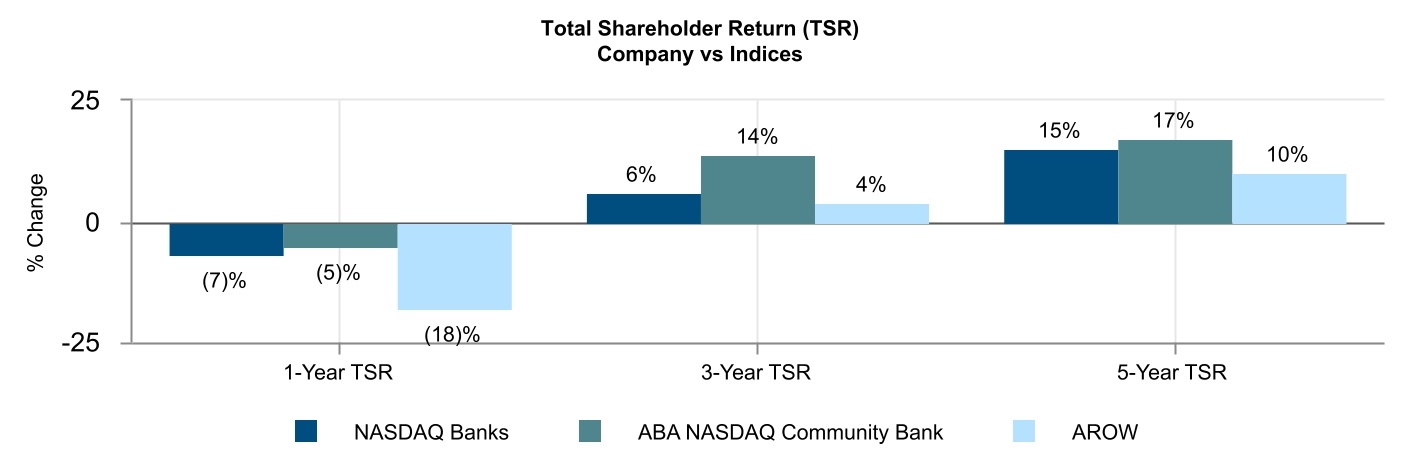

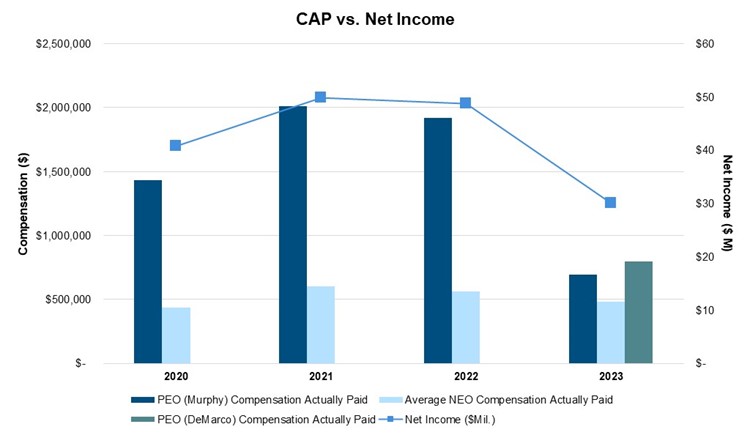

•Governance Committee: Mr. Dake is the Chair of the Governance Committee; he has served in this role since 2017. The Governance Committee is specifically charged with establishing procedures with respect to the Director nomination process; reviewing and considering Director nominees, including incumbent nominees, and making recommendations to the Board regarding nominees; reviewing and recommending practices and policies related to the Company's environmental, social and corporate governance strategy; reviewing annually and reporting to the Board regarding the independence of Company Directors and satisfaction by the Board and committee members of applicable requirements or qualifications; reviewing annually and reporting to the Board regarding the performance of the Board; reviewing periodically and making recommendations regarding Company codes of conduct and ethics policies for Directors, executive officers and employees and with respect to Board policy, including the Company's committee charters; and reviewing Director training initiatives. The Governance Committee met three times in 2023, and all then-serving members attended each of these meetings.