2Q 2024 Investor Presentation July 25, 2024

2 Safe Harbor This presentation may contain certain forward-looking statements about Arrow Financial Corporation (“Arrow” or the “Company”). Forward-looking statements, as defined in Section 21E of the Securities Exchange Act of 1934, as amended, include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the banking industry or securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged. We are not obligated to revise or update these statements to reflect unanticipated events. This document should be read in conjunction with the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 10-K”), other filings with the SEC, and the second quarter 2024 earnings release issued July 25, 2024.

3 Table of Contents • 2Q 2024 Results and Performance Metrics • Non-Interest Income/Expense • Loans • Deposits/Funding Sources • Credit Quality • Capital Actions & Strategy • Liquidity and Investments • Arrow Overview and History

2Q 2024 Results 4

5 Takeaways & Themes • Rebound in Earnings & Performance Metrics • Robust Loan Growth • Expanding Net Interest Margin • Excellent Credit Profile • Strong Capital Base • Diversified Revenue Sources Core Banking Wealth Management Insurance • Ample Liquidity & Moderating Deposit Costs

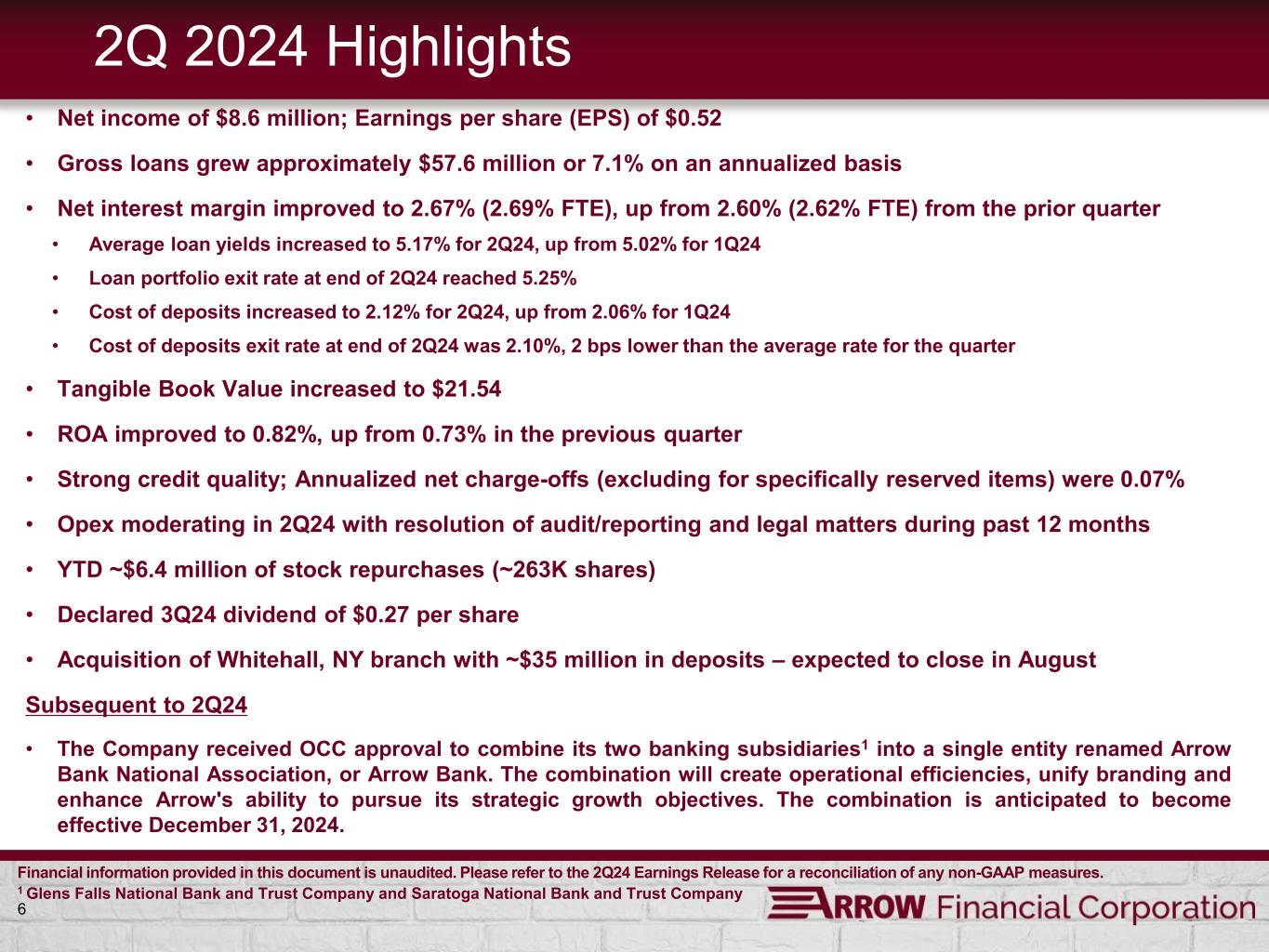

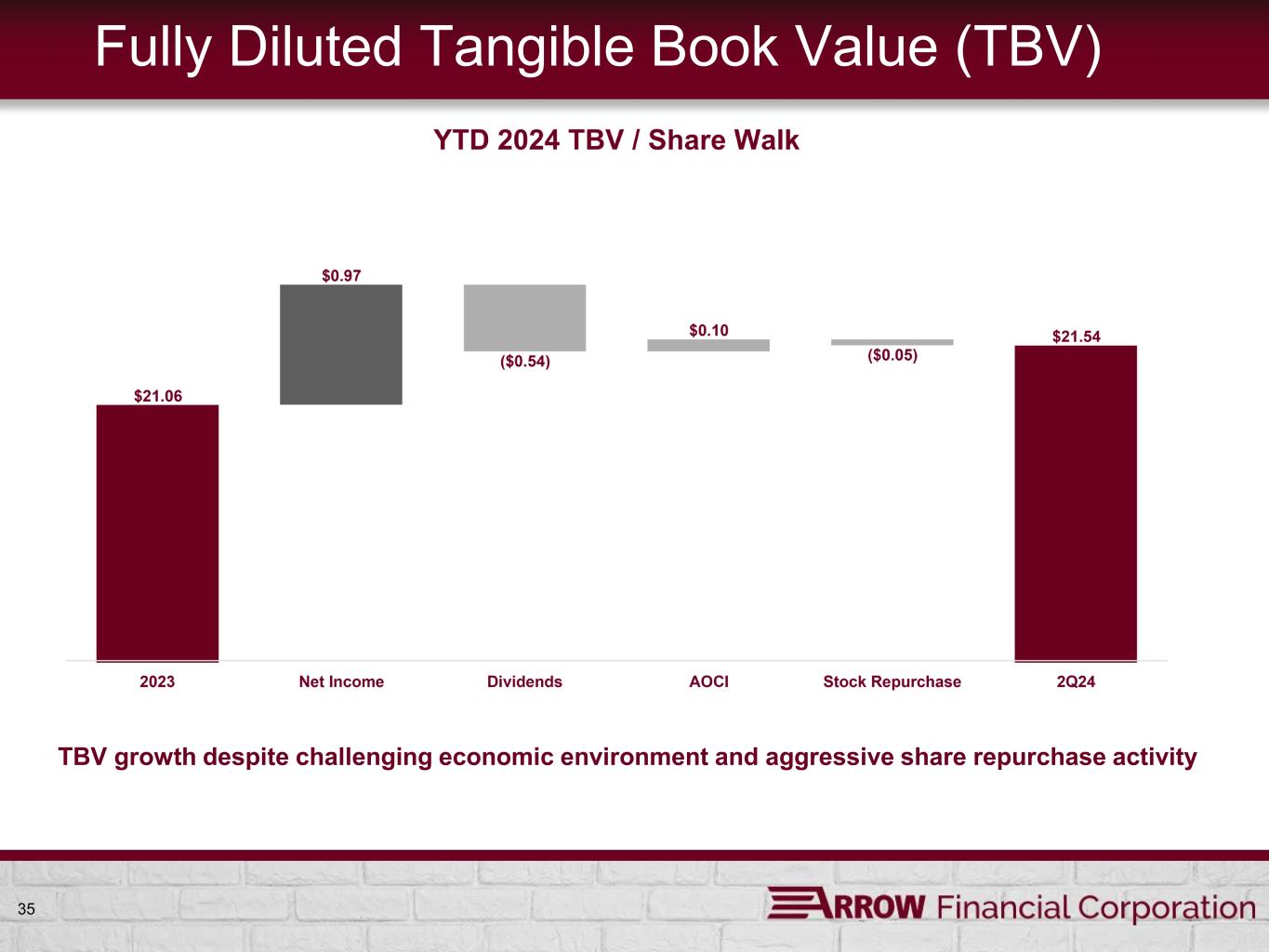

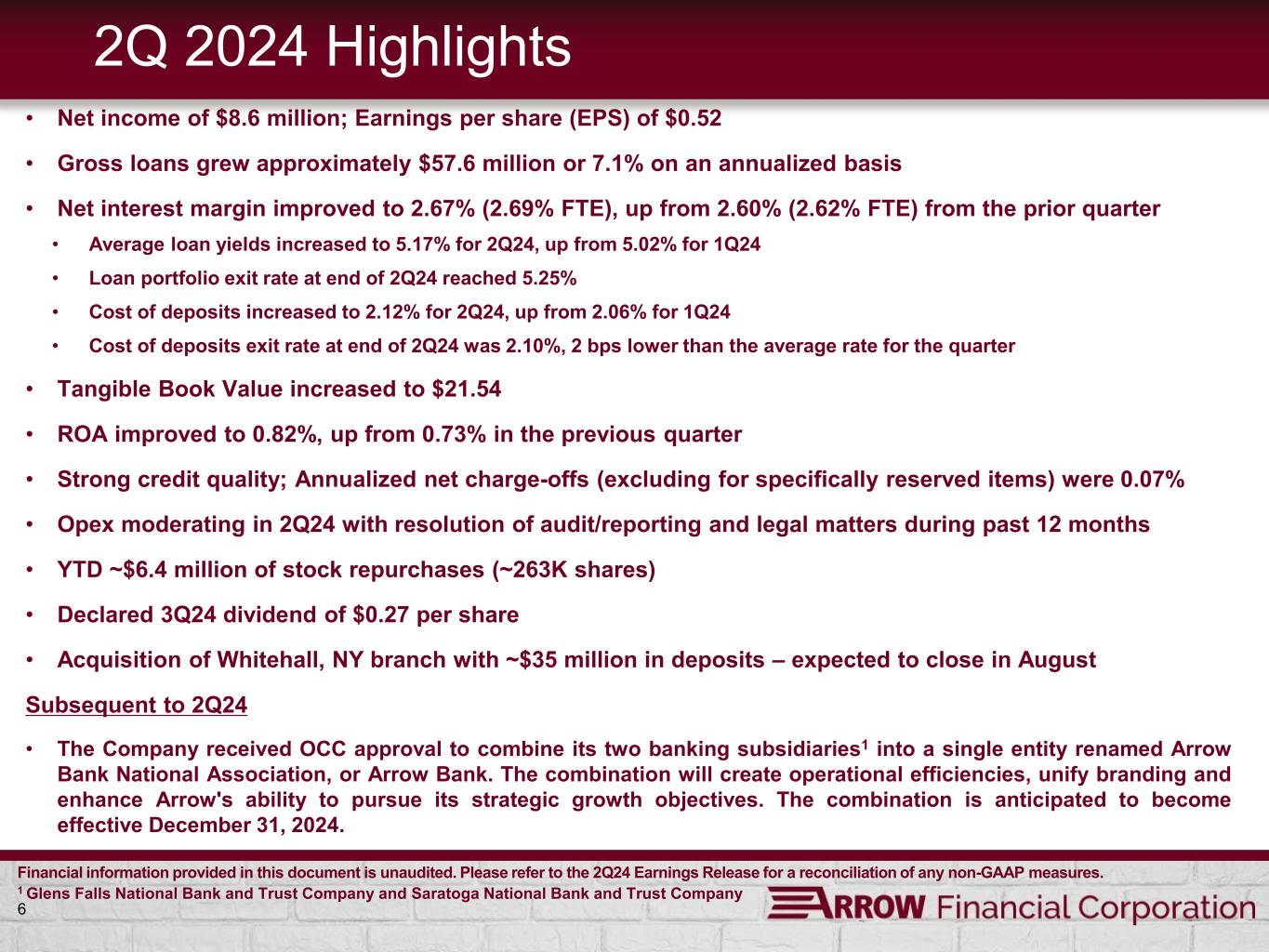

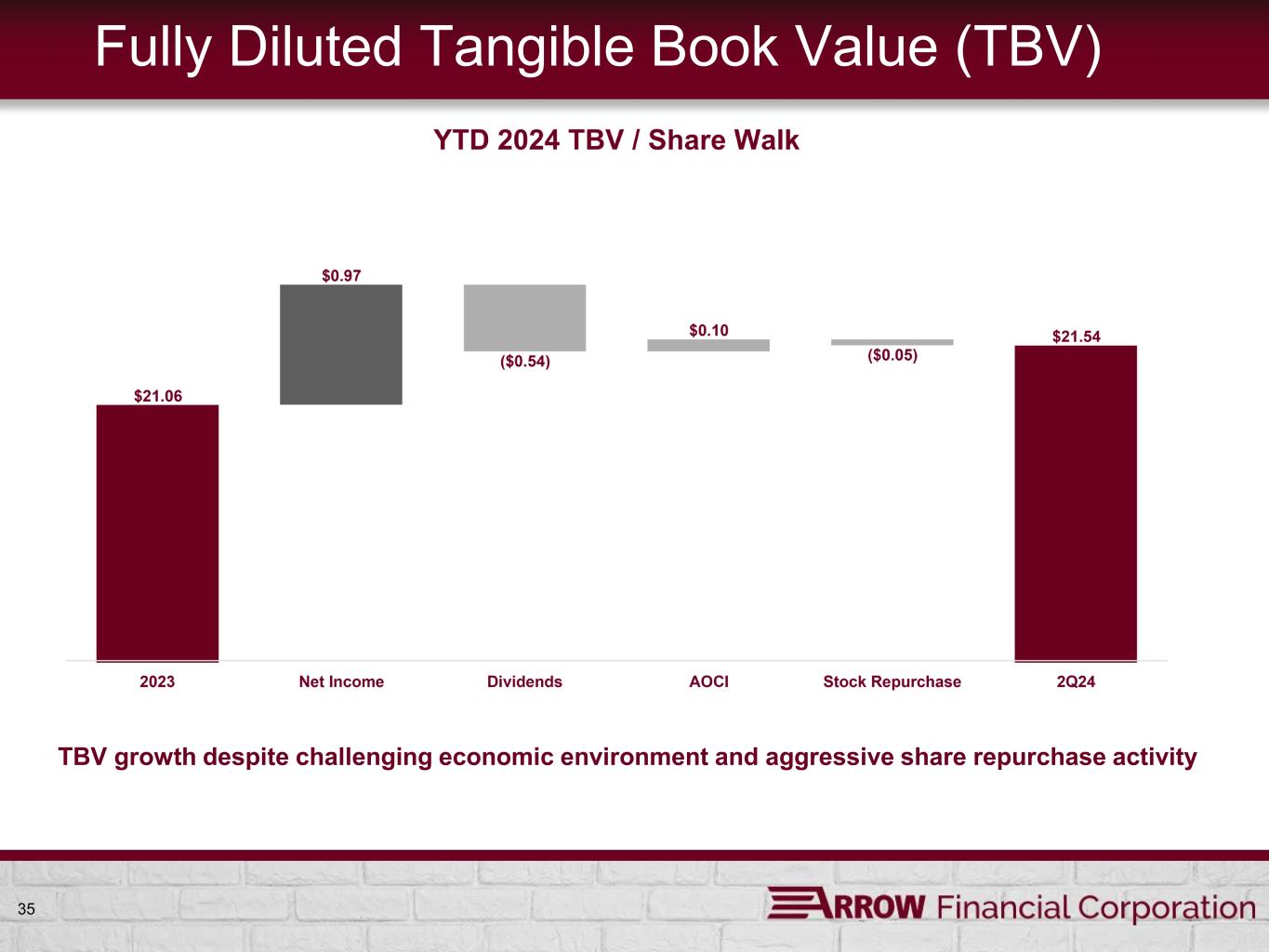

6 2Q 2024 Highlights • Net income of $8.6 million; Earnings per share (EPS) of $0.52 • Gross loans grew approximately $57.6 million or 7.1% on an annualized basis • Net interest margin improved to 2.67% (2.69% FTE), up from 2.60% (2.62% FTE) from the prior quarter • Average loan yields increased to 5.17% for 2Q24, up from 5.02% for 1Q24 • Loan portfolio exit rate at end of 2Q24 reached 5.25% • Cost of deposits increased to 2.12% for 2Q24, up from 2.06% for 1Q24 • Cost of deposits exit rate at end of 2Q24 was 2.10%, 2 bps lower than the average rate for the quarter • Tangible Book Value increased to $21.54 • ROA improved to 0.82%, up from 0.73% in the previous quarter • Strong credit quality; Annualized net charge-offs (excluding for specifically reserved items) were 0.07% • Opex moderating in 2Q24 with resolution of audit/reporting and legal matters during past 12 months • YTD ~$6.4 million of stock repurchases (~263K shares) • Declared 3Q24 dividend of $0.27 per share • Acquisition of Whitehall, NY branch with ~$35 million in deposits – expected to close in August Subsequent to 2Q24 • The Company received OCC approval to combine its two banking subsidiaries1 into a single entity renamed Arrow Bank National Association, or Arrow Bank. The combination will create operational efficiencies, unify branding and enhance Arrow's ability to pursue its strategic growth objectives. The combination is anticipated to become effective December 31, 2024. Financial information provided in this document is unaudited. Please refer to the 2Q24 Earnings Release for a reconciliation of any non-GAAP measures. 1 Glens Falls National Bank and Trust Company and Saratoga National Bank and Trust Company

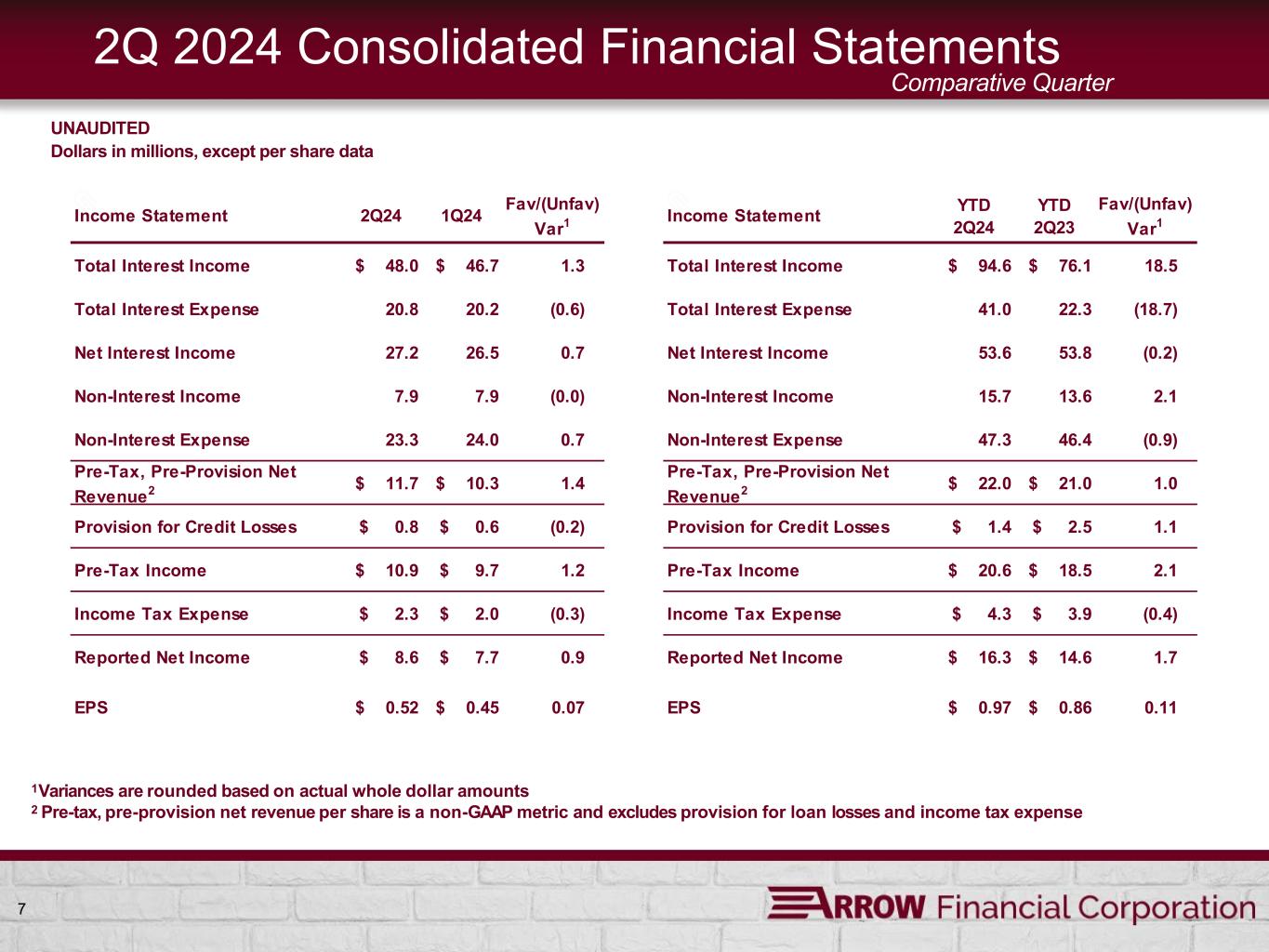

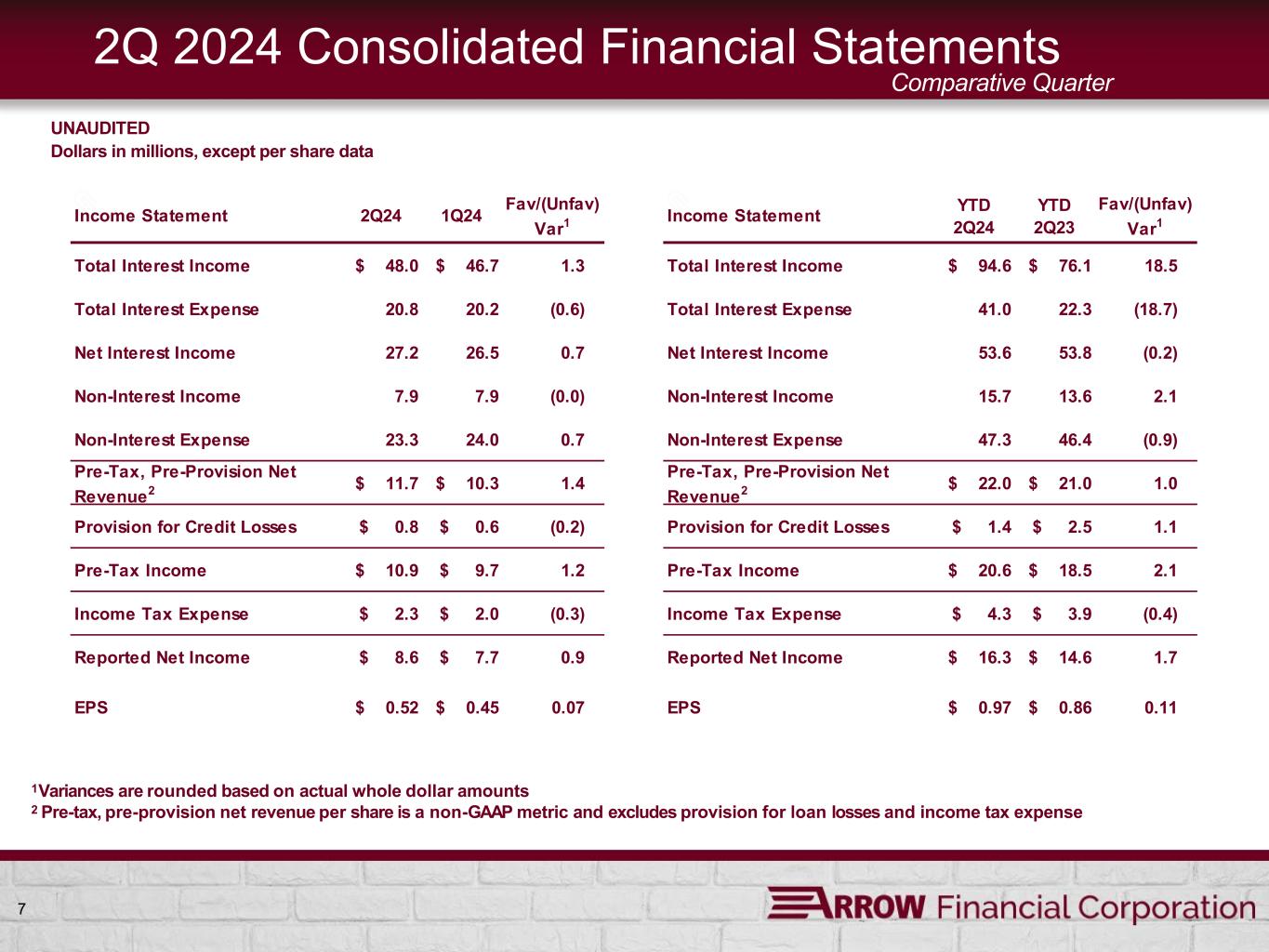

7 2Q 2024 Consolidated Financial Statements 1 Variances are rounded based on actual whole dollar amounts 2 Pre-tax, pre-provision net revenue per share is a non-GAAP metric and excludes provision for loan losses and income tax expense UNAUDITED Dollars in millions, except per share data Comparative Quarter Income Statement 2Q24 1Q24 Fav/(Unfav) Var1 Total Interest Income $ 48.0 $ 46.7 1.3 Total Interest Expense 20.8 20.2 (0.6) Net Interest Income 27.2 26.5 0.7 Non-Interest Income 7.9 7.9 (0.0) Non-Interest Expense 23.3 24.0 0.7 Pre-Tax, Pre-Provision Net Revenue2 $ 11.7 $ 10.3 1.4 Provision for Credit Losses $ 0.8 $ 0.6 (0.2) Pre-Tax Income $ 10.9 $ 9.7 1.2 Income Tax Expense $ 2.3 $ 2.0 (0.3) Reported Net Income $ 8.6 $ 7.7 0.9 EPS $ 0.52 $ 0.45 0.07 Income Statement YTD 2Q24 YTD 2Q23 Fav/(Unfav) Var1 Total Interest Income $ 94.6 $ 76.1 18.5 Total Interest Expense 41.0 22.3 (18.7) Net Interest Income 53.6 53.8 (0.2) Non-Interest Income 15.7 13.6 2.1 Non-Interest Expense 47.3 46.4 (0.9) Pre-Tax, Pre-Provision Net Revenue2 $ 22.0 $ 21.0 1.0 Provision for Credit Losses $ 1.4 $ 2.5 1.1 Pre-Tax Income $ 20.6 $ 18.5 2.1 Income Tax Expense $ 4.3 $ 3.9 (0.4) Reported Net Income $ 16.3 $ 14.6 1.7 EPS $ 0.97 $ 0.86 0.11

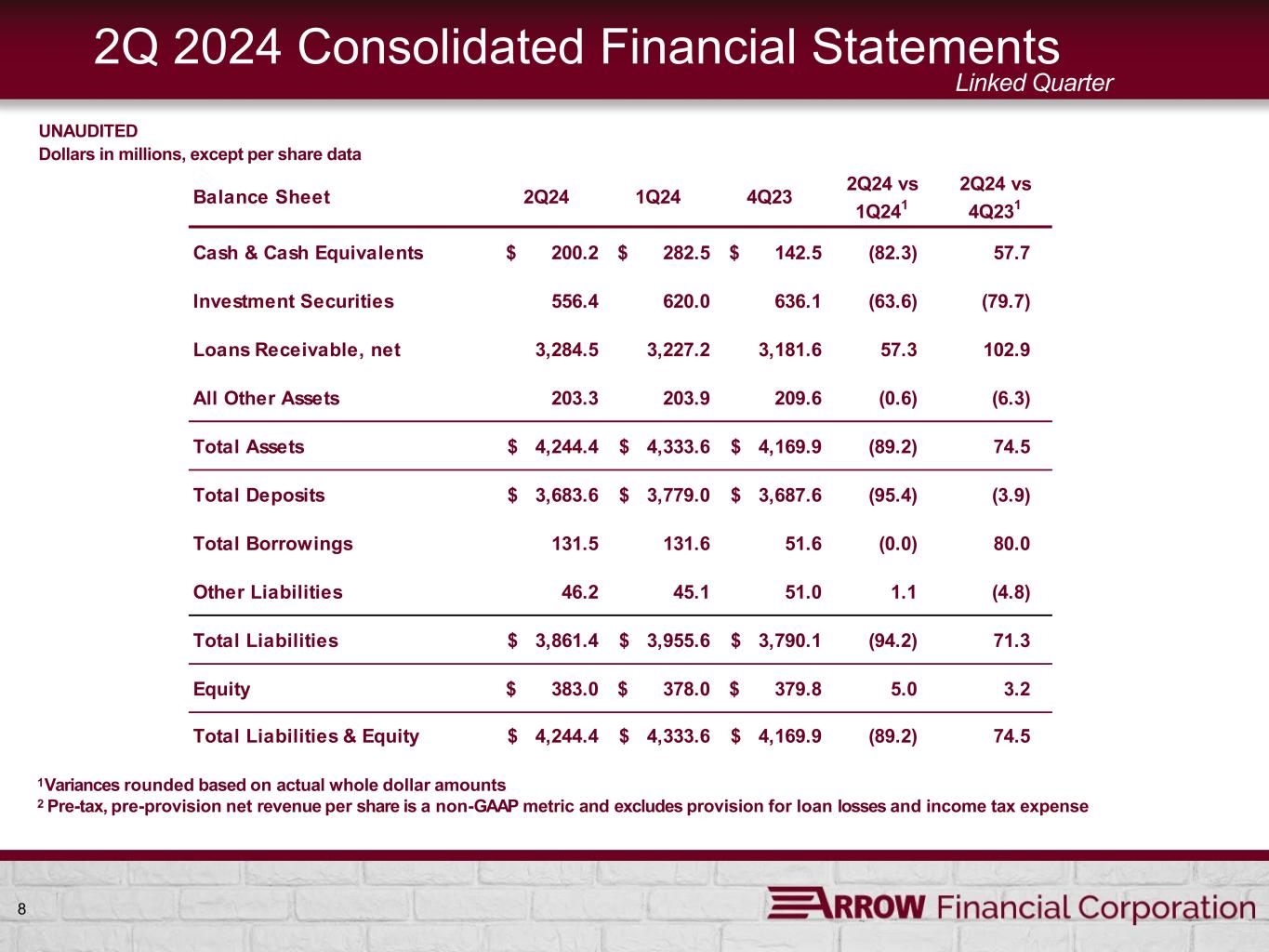

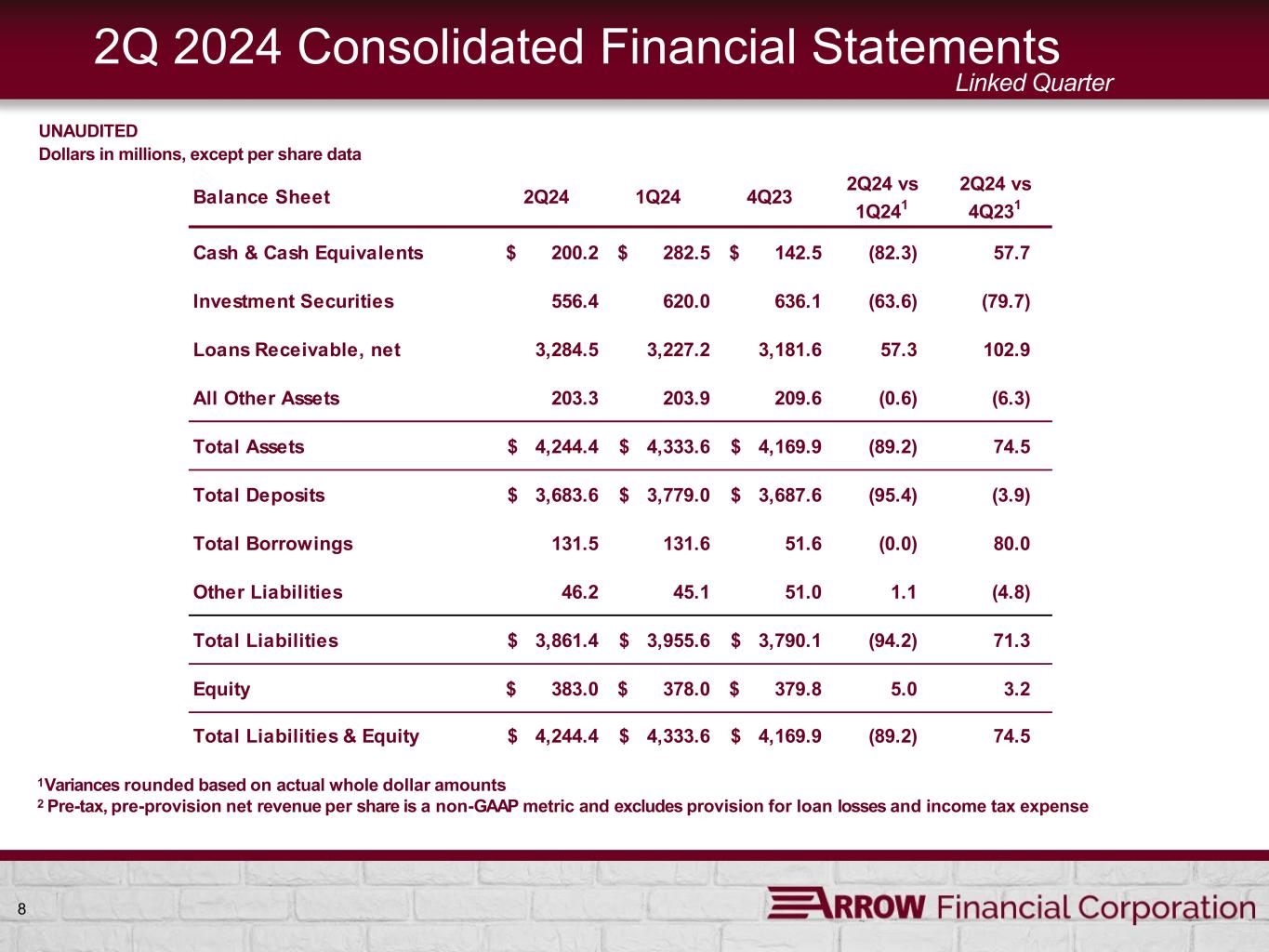

8 2Q 2024 Consolidated Financial Statements 1 Variances rounded based on actual whole dollar amounts 2 Pre-tax, pre-provision net revenue per share is a non-GAAP metric and excludes provision for loan losses and income tax expense UNAUDITED Dollars in millions, except per share data Linked Quarter Balance Sheet 2Q24 1Q24 4Q23 2Q24 vs 1Q241 2Q24 vs 4Q231 Cash & Cash Equivalents $ 200.2 $ 282.5 $ 142.5 (82.3) 57.7 Investment Securities 556.4 620.0 636.1 (63.6) (79.7) Loans Receivable, net 3,284.5 3,227.2 3,181.6 57.3 102.9 All Other Assets 203.3 203.9 209.6 (0.6) (6.3) Total Assets $ 4,244.4 $ 4,333.6 $ 4,169.9 (89.2) 74.5 Total Deposits $ 3,683.6 $ 3,779.0 $ 3,687.6 (95.4) (3.9) Total Borrowings 131.5 131.6 51.6 (0.0) 80.0 Other Liabilities 46.2 45.1 51.0 1.1 (4.8) Total Liabilities $ 3,861.4 $ 3,955.6 $ 3,790.1 (94.2) 71.3 Equity $ 383.0 $ 378.0 $ 379.8 5.0 3.2 Total Liabilities & Equity $ 4,244.4 $ 4,333.6 $ 4,169.9 (89.2) 74.5

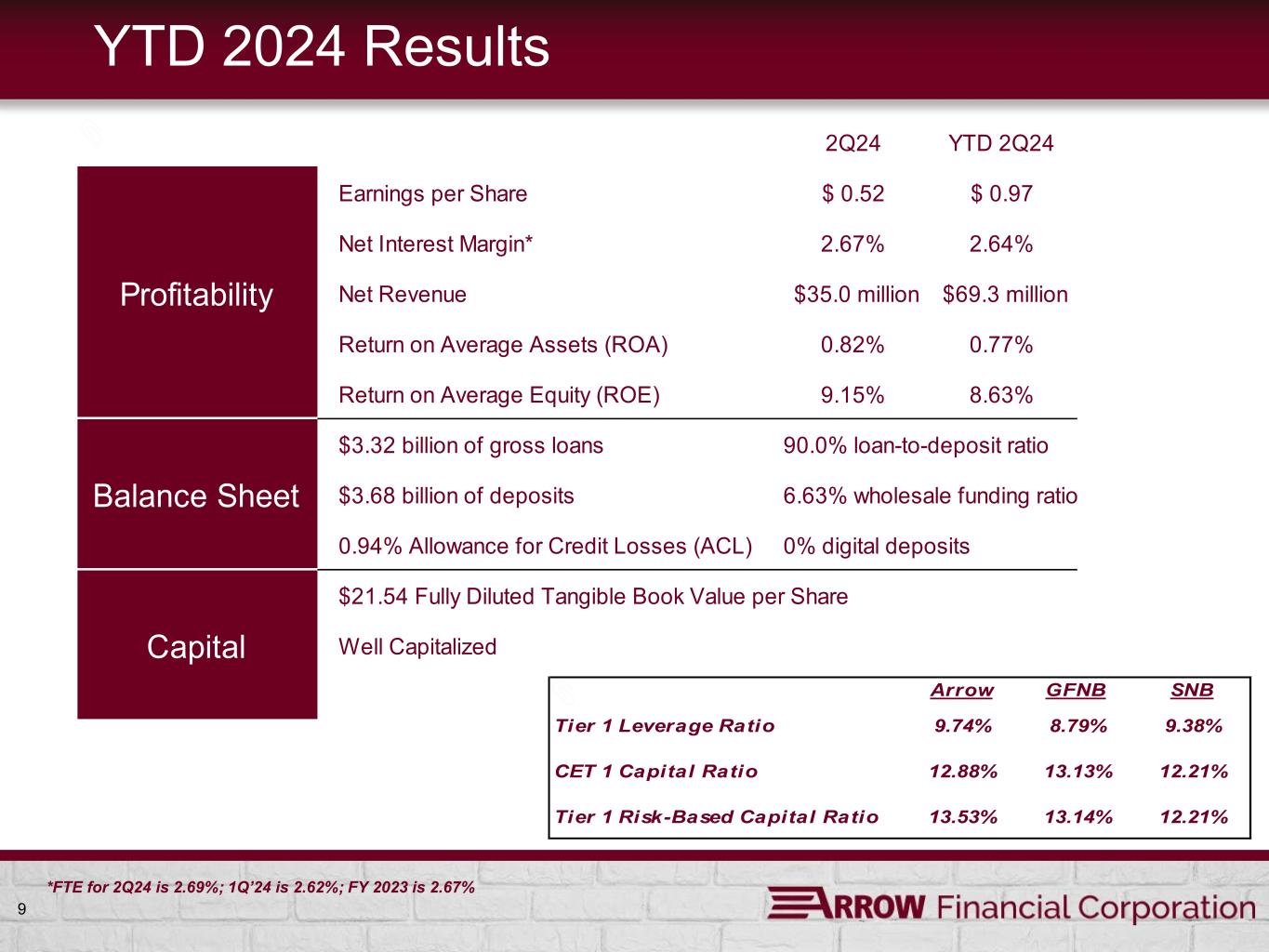

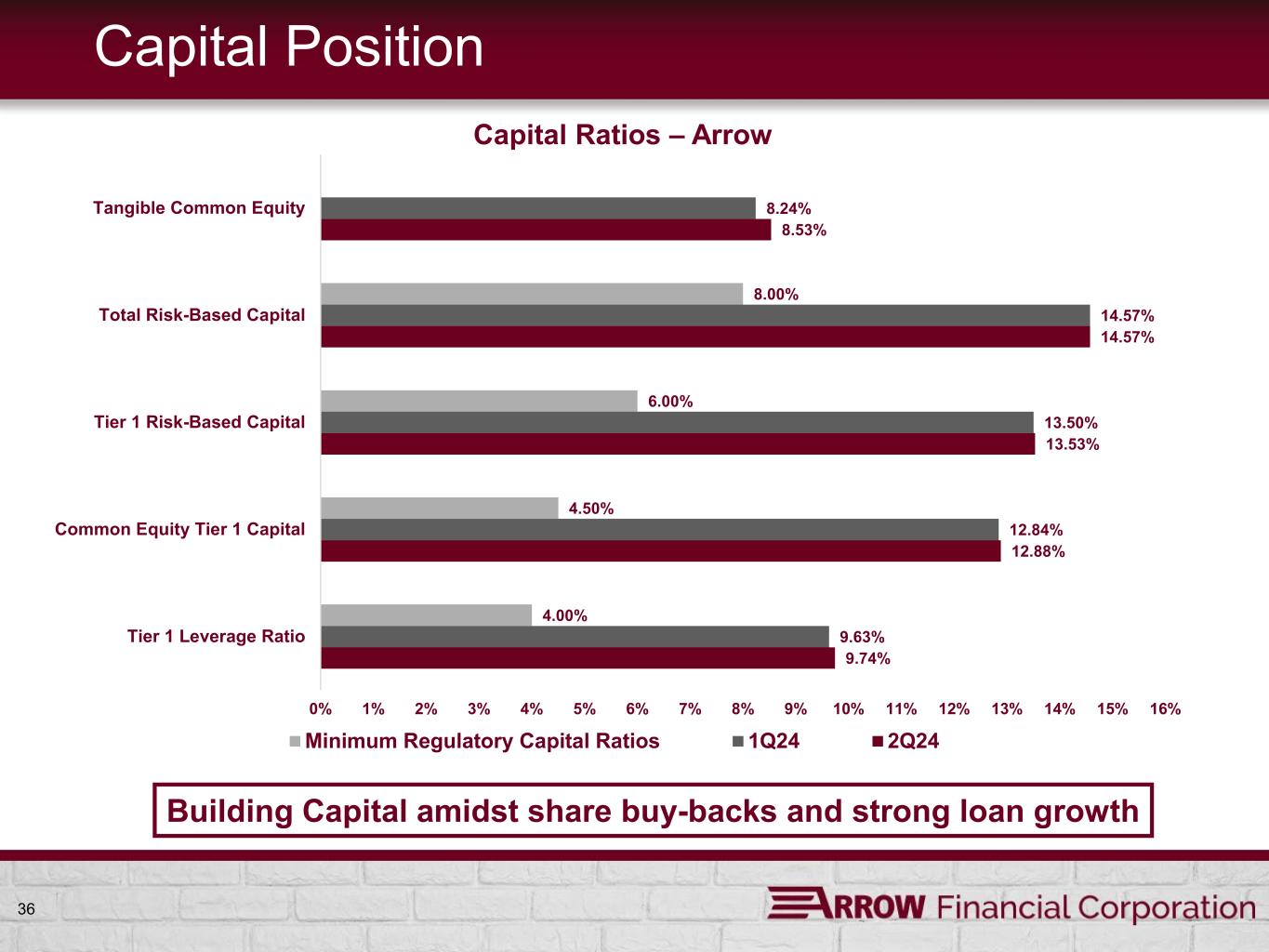

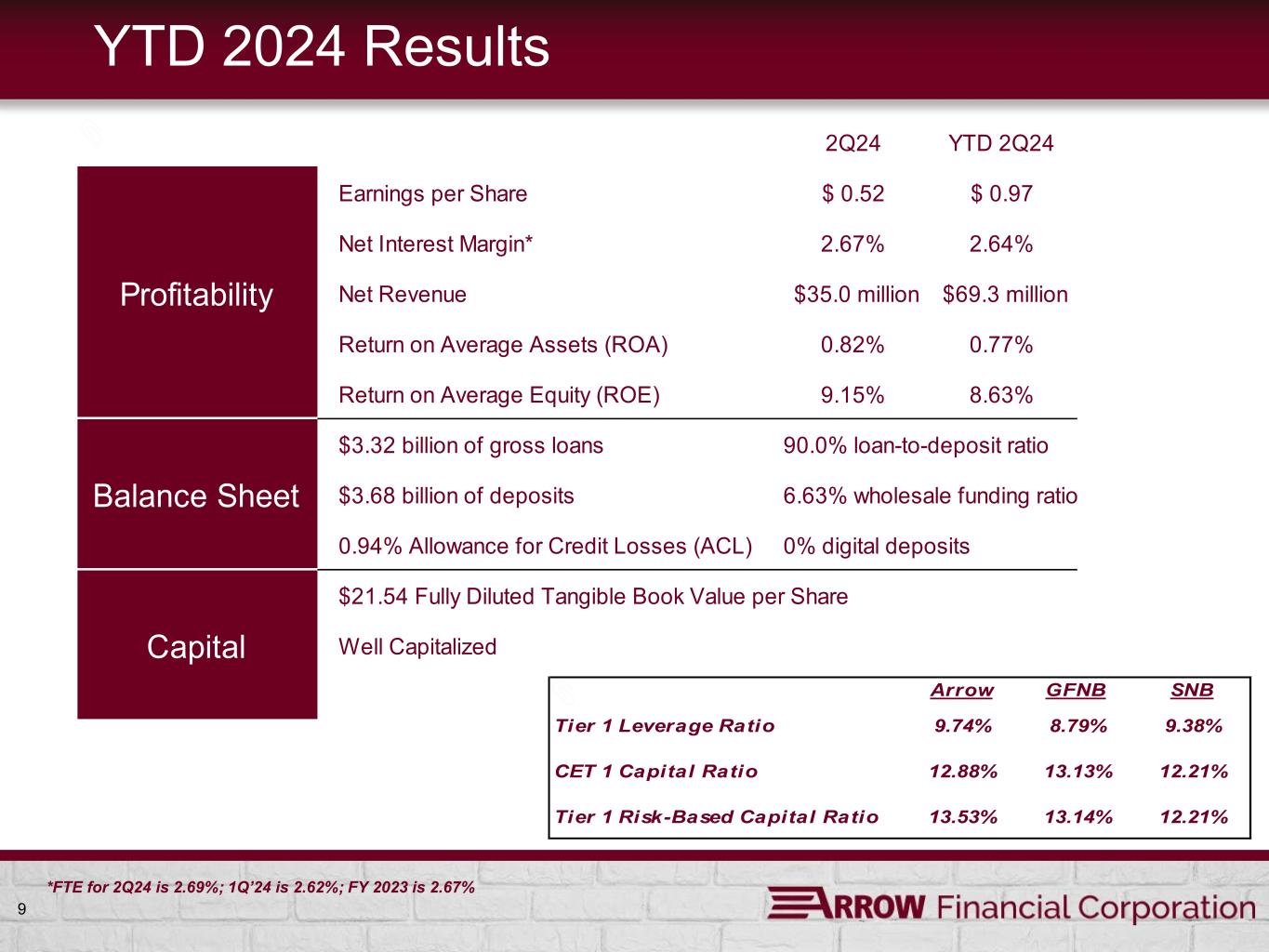

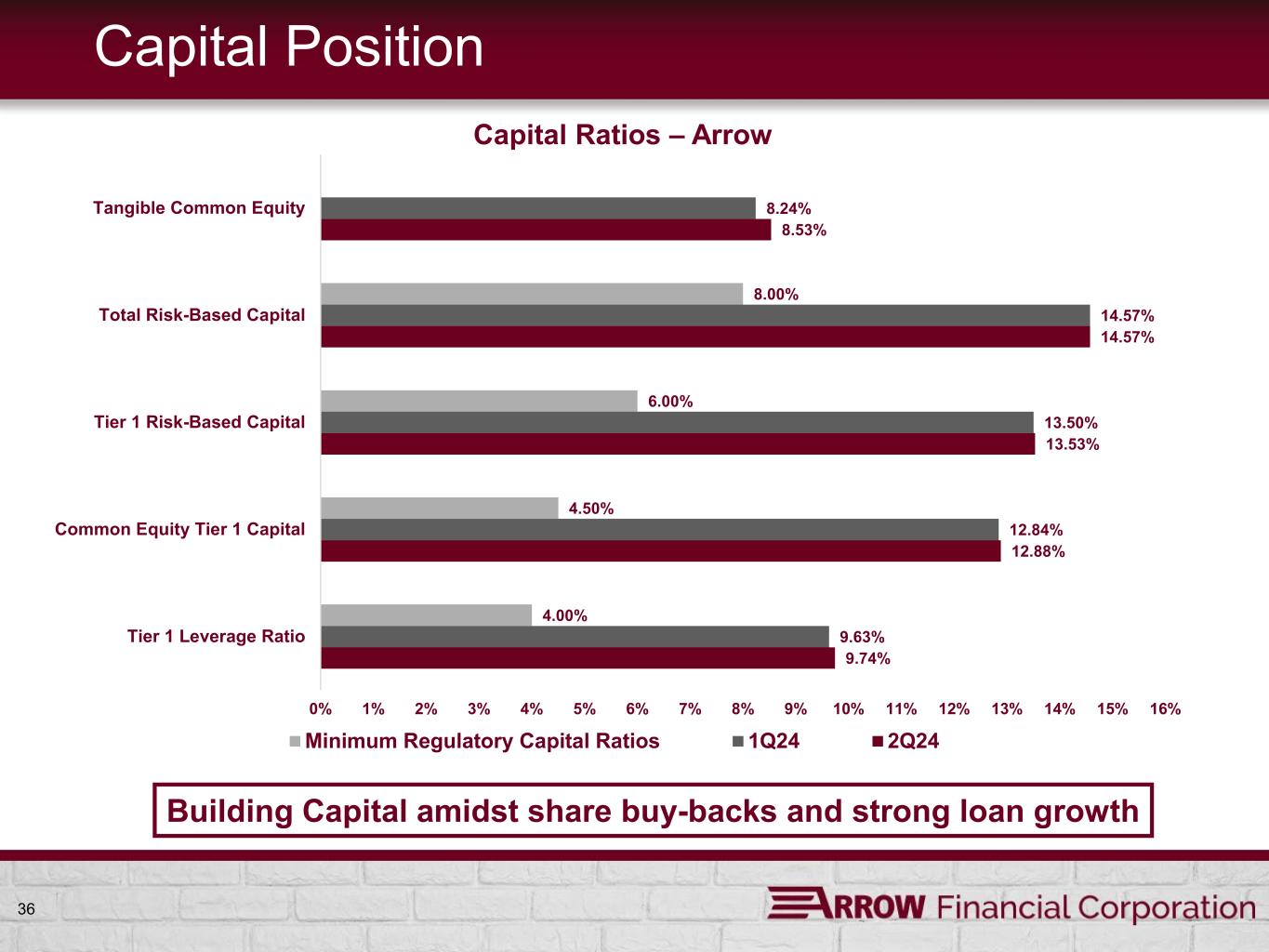

9 2Q24 YTD 2Q24 Earnings per Share $ 0.52 $ 0.97 Net Interest Margin* 2.67% 2.64% Profitability Net Revenue $35.0 million $69.3 million Return on Average Assets (ROA) 0.82% 0.77% Return on Average Equity (ROE) 9.15% 8.63% $3.32 billion of gross loans 90.0% loan-to-deposit ratio Balance Sheet $3.68 billion of deposits 6.63% wholesale funding ratio 0.94% Allowance for Credit Losses (ACL) 0% digital deposits $21.54 Fully Diluted Tangible Book Value per Share Capital Well Capitalized YTD 2024 Results *FTE for 2Q24 is 2.69%; 1Q’24 is 2.62%; FY 2023 is 2.67% Arrow GFNB SNB Tier 1 Leverage Ratio 9.74% 8.79% 9.38% CET 1 Capital Ratio 12.88% 13.13% 12.21% Tier 1 Risk-Based Capital Ratio 13.53% 13.14% 12.21%

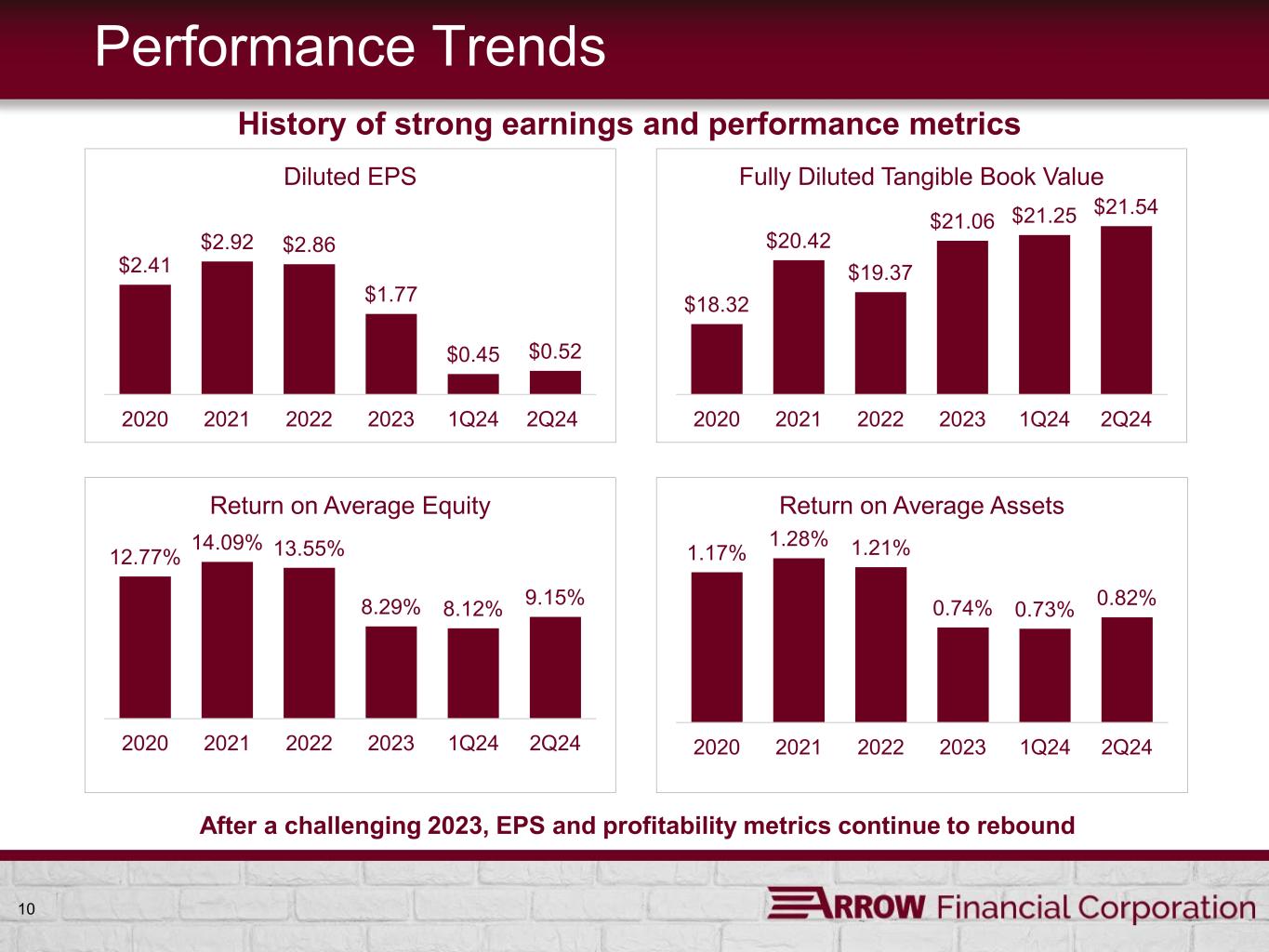

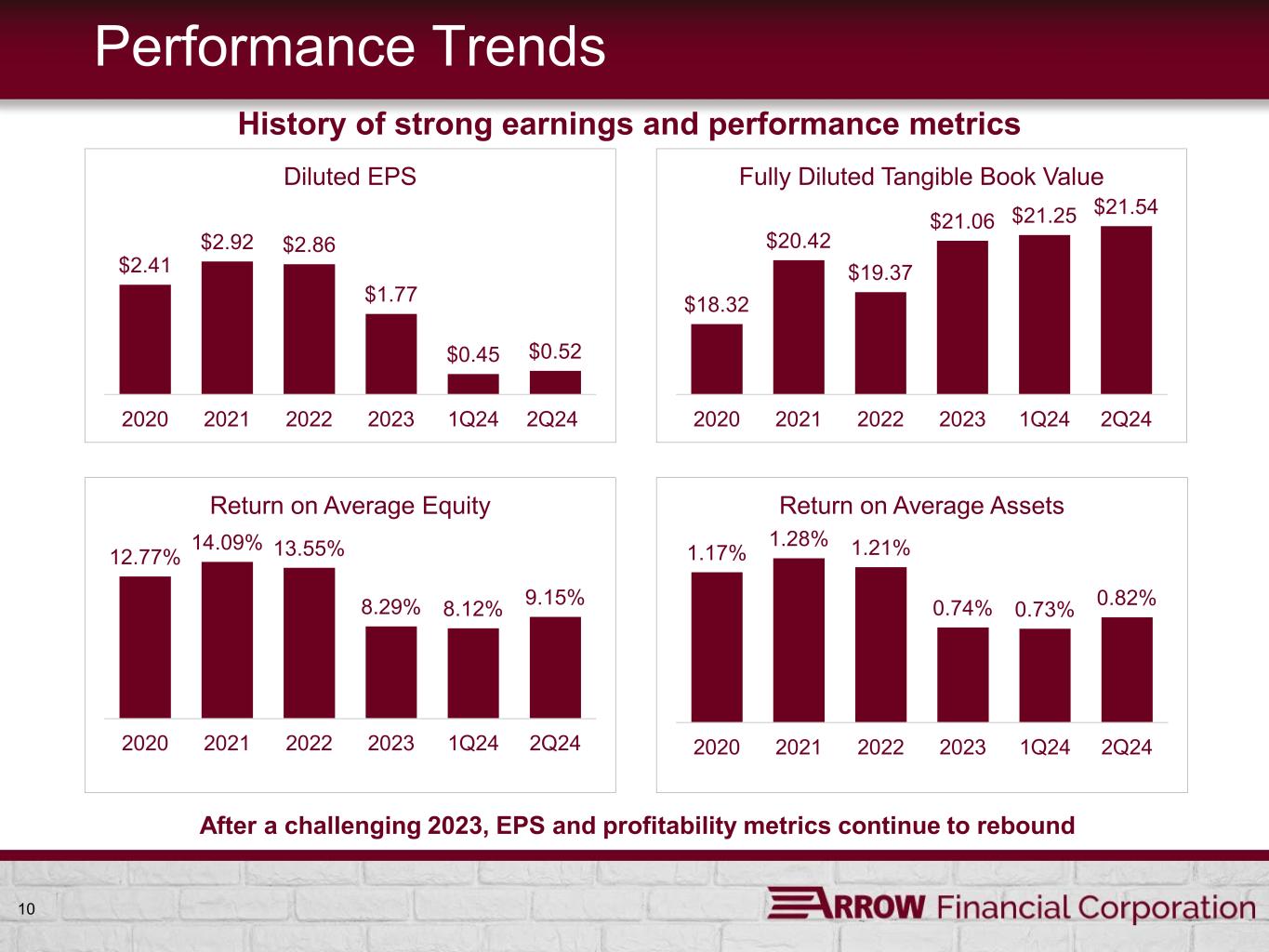

10 Performance Trends $2.41 $2.92 $2.86 $1.77 $0.45 $0.52 2020 2021 2022 2023 1Q24 2Q24 Diluted EPS $18.32 $20.42 $19.37 $21.06 $21.25 $21.54 2020 2021 2022 2023 1Q24 2Q24 Fully Diluted Tangible Book Value 12.77% 14.09% 13.55% 8.29% 8.12% 9.15% 2020 2021 2022 2023 1Q24 2Q24 Return on Average Equity 1.17% 1.28% 1.21% 0.74% 0.73% 0.82% 2020 2021 2022 2023 1Q24 2Q24 Return on Average Assets After a challenging 2023, EPS and profitability metrics continue to rebound History of strong earnings and performance metrics

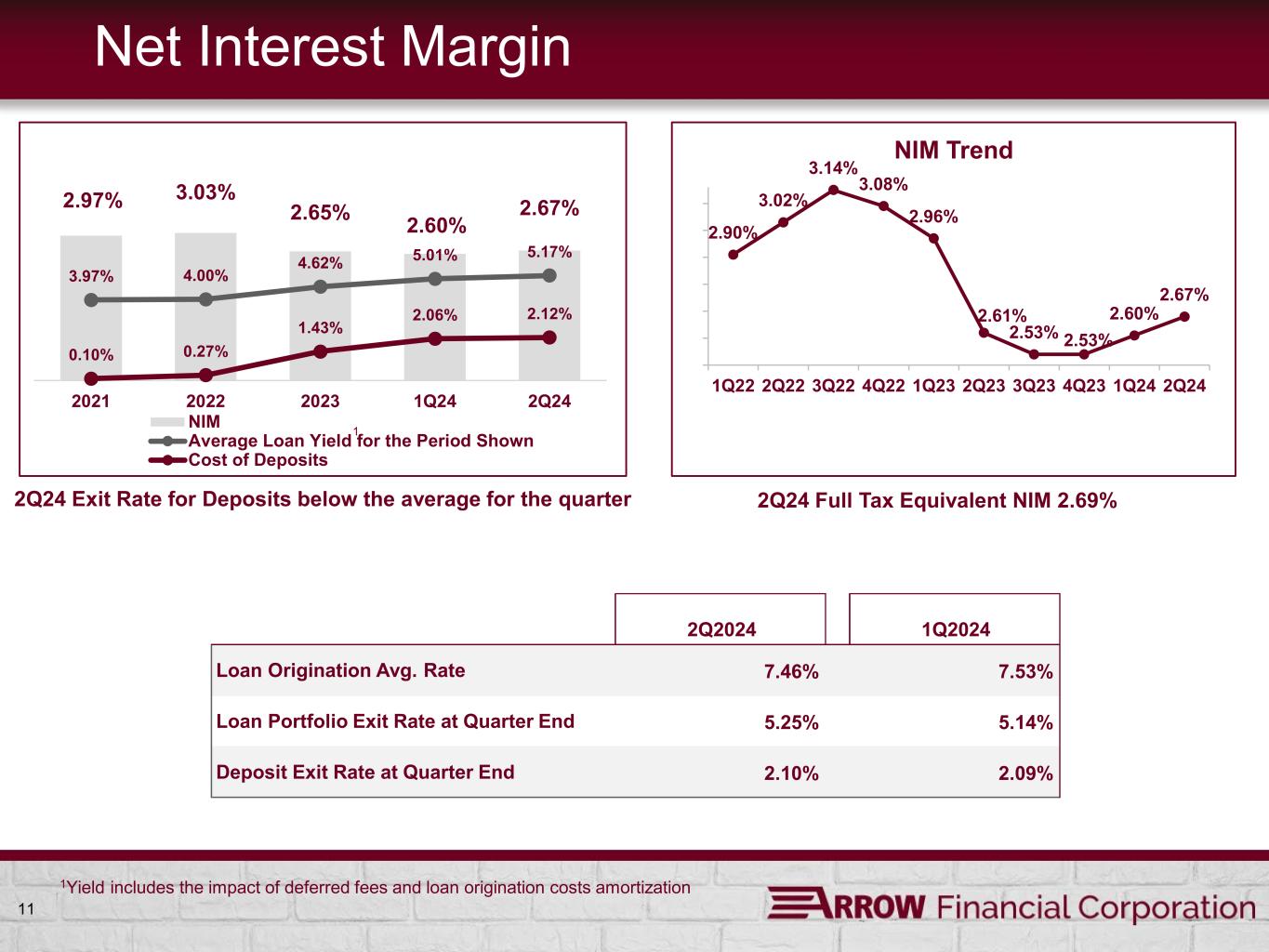

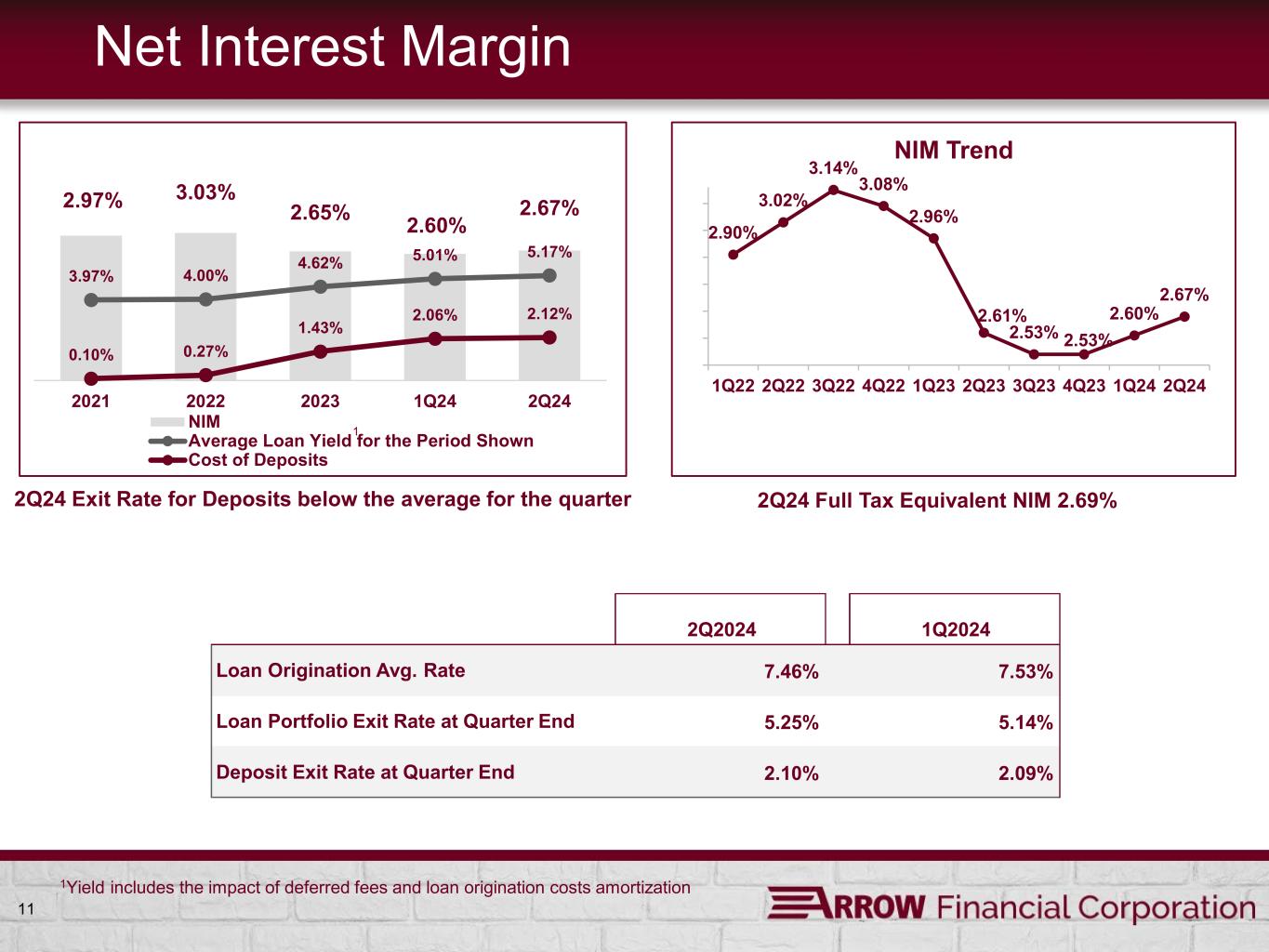

11 Net Interest Margin 2.97% 3.03% 2.65% 2.60% 2.67% 3.97% 4.00% 4.62% 5.01% 5.17% 0.10% 0.27% 1.43% 2.06% 2.12% 2021 2022 2023 1Q24 2Q24 NIM Average Loan Yield for the Period Shown Cost of Deposits 1 1Yield includes the impact of deferred fees and loan origination costs amortization 2.90% 3.02% 3.14% 3.08% 2.96% 2.61% 2.53% 2.53% 2.60% 2.67% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 NIM Trend 2Q24 Full Tax Equivalent NIM 2.69% 2Q2024 1Q2024 Loan Origination Avg. Rate 7.46% 7.53% Loan Portfolio Exit Rate at Quarter End 5.25% 5.14% Deposit Exit Rate at Quarter End 2.10% 2.09% 2Q24 Exit Rate for Deposits below the average for the quarter

Non-Interest Income/Expense 12

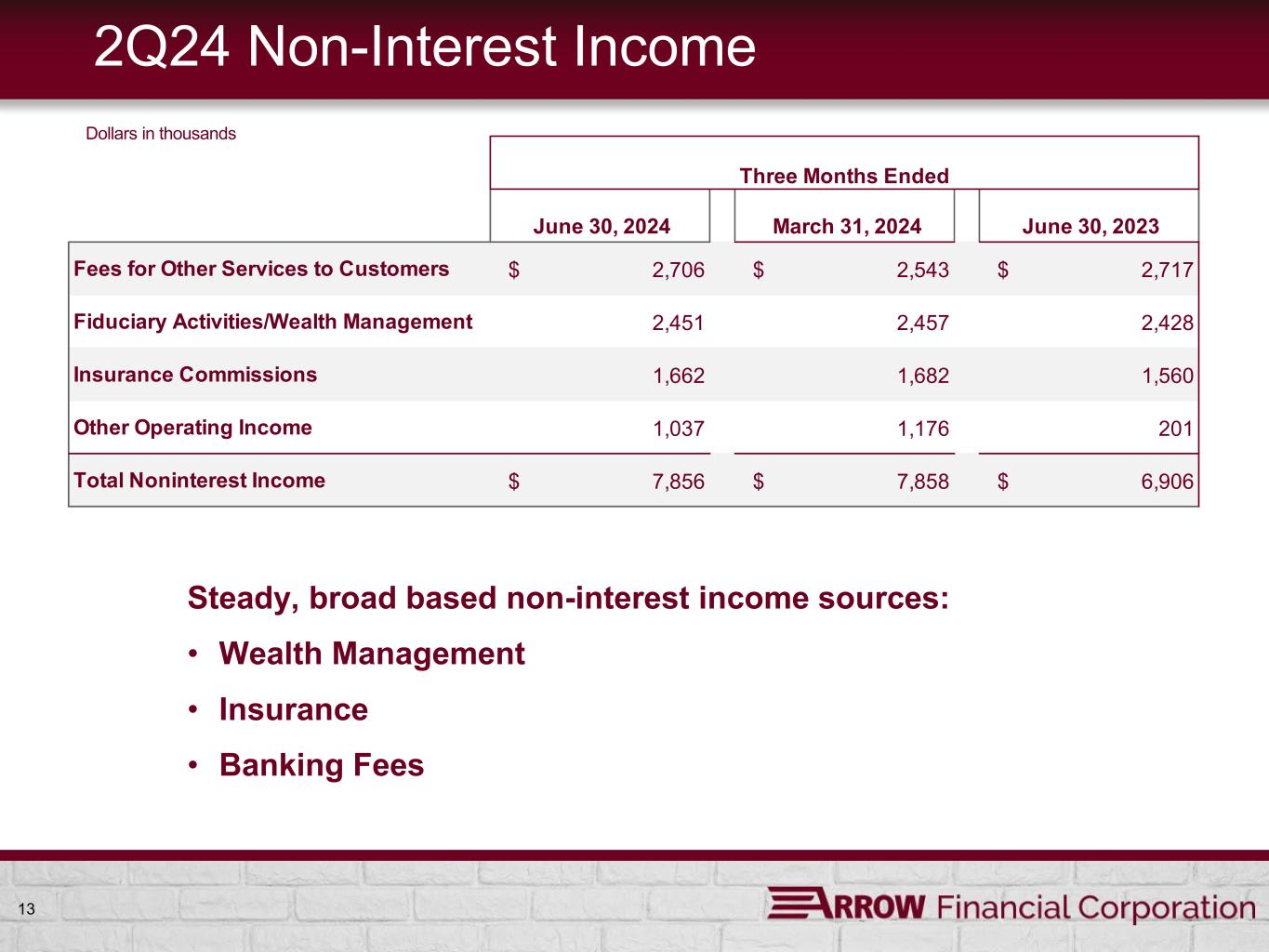

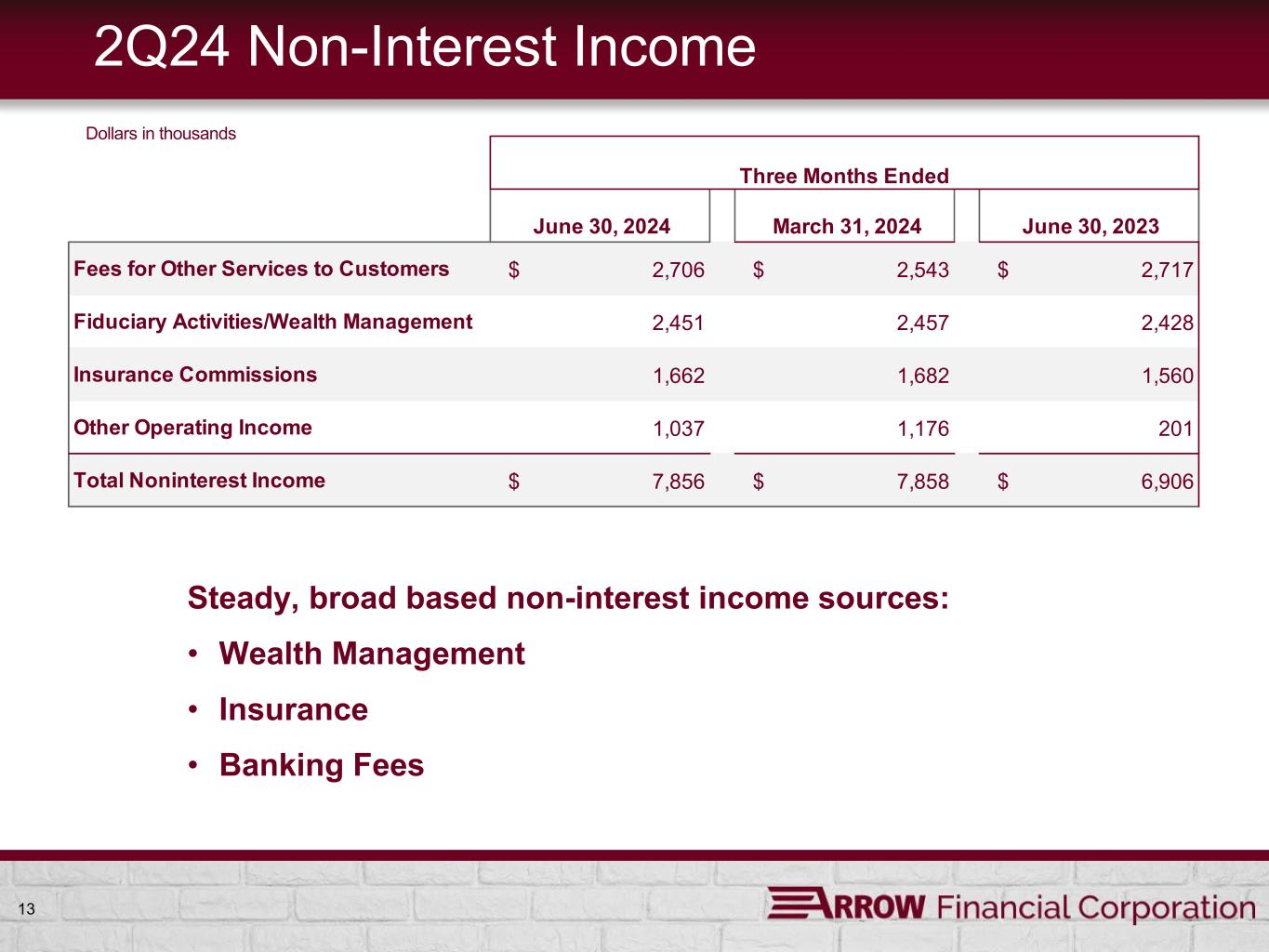

13 June 30, 2024 March 31, 2024 June 30, 2023 Fees for Other Services to Customers $ 2,706 $ 2,543 $ 2,717 Fiduciary Activities/Wealth Management 2,451 2,457 2,428 Insurance Commissions 1,662 1,682 1,560 Other Operating Income 1,037 1,176 201 Total Noninterest Income $ 7,856 $ 7,858 $ 6,906 Three Months Ended 2Q24 Non-Interest Income Steady, broad based non-interest income sources: • Wealth Management • Insurance • Banking Fees Dollars in thousands

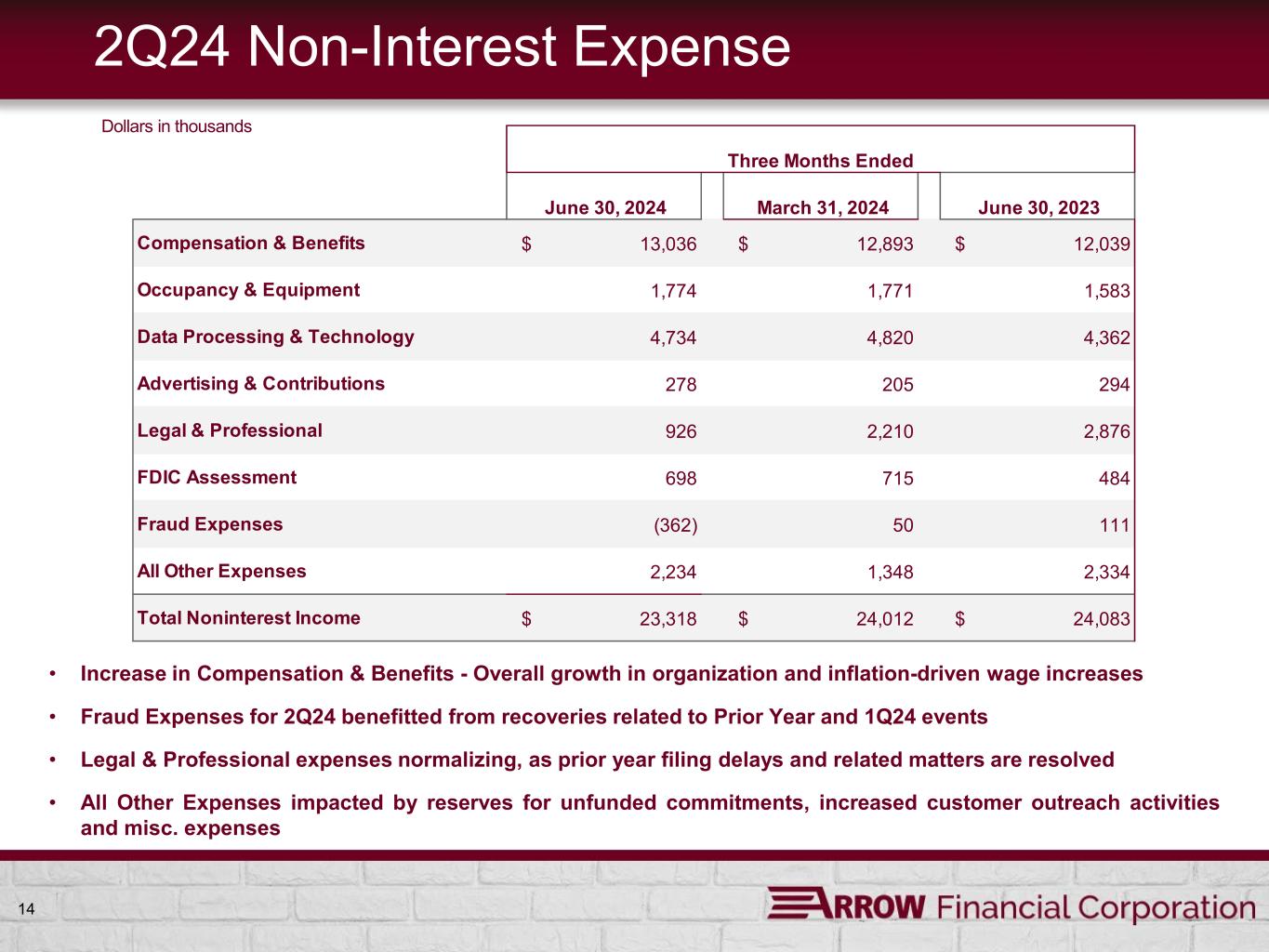

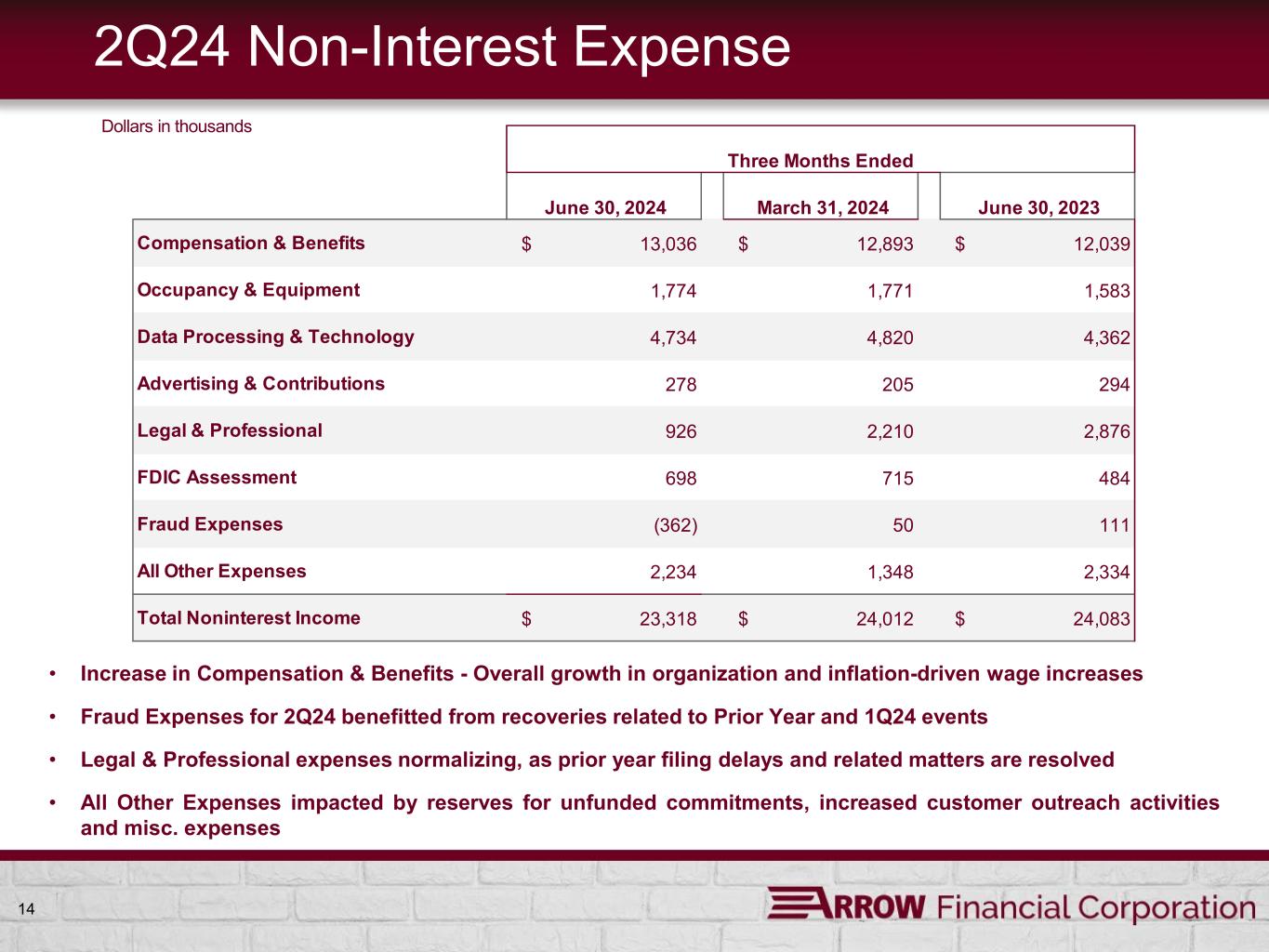

14 2Q24 Non-Interest Expense • Increase in Compensation & Benefits - Overall growth in organization and inflation-driven wage increases • Fraud Expenses for 2Q24 benefitted from recoveries related to Prior Year and 1Q24 events • Legal & Professional expenses normalizing, as prior year filing delays and related matters are resolved • All Other Expenses impacted by reserves for unfunded commitments, increased customer outreach activities and misc. expenses Dollars in thousands June 30, 2024 March 31, 2024 June 30, 2023 Compensation & Benefits $ 13,036 $ 12,893 $ 12,039 Occupancy & Equipment 1,774 1,771 1,583 Data Processing & Technology 4,734 4,820 4,362 Advertising & Contributions 278 205 294 Legal & Professional 926 2,210 2,876 FDIC Assessment 698 715 484 Fraud Expenses (362) 50 111 All Other Expenses 2,234 1,348 2,334 Total Noninterest Income $ 23,318 $ 24,012 $ 24,083 Three Months Ended

15 Operating Expenses - Efficiency Trends 57.1% 52.8% 54.2% 54.3% 68.8% 2.22% 2.02% 2.00% 2.01% 2.28% 2019 2020 2021 2022 2023 Efficiency Ratio Net Non-interest Expense / Average Assets 2023 impacted by margin compression and elevated expenses (audit, professional, legal) due to regulatory filing delays 63.4% 72.7% 69.9% 69.8% 69.5% 66.3% 2.27% 2.36% 2.26% 2.21% 2.27% 2.21% 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Efficiency Ratio Net Non-interest Expense / Average Assets 2Q24 expenses moderating/efficiency measures improving: • Sustainable reduction in audit, professional and legal expenses • Impact of Salary and Benefit adjustments from increased staffing levels and wage inflation primarily absorbed in 1Q24

Loans 16

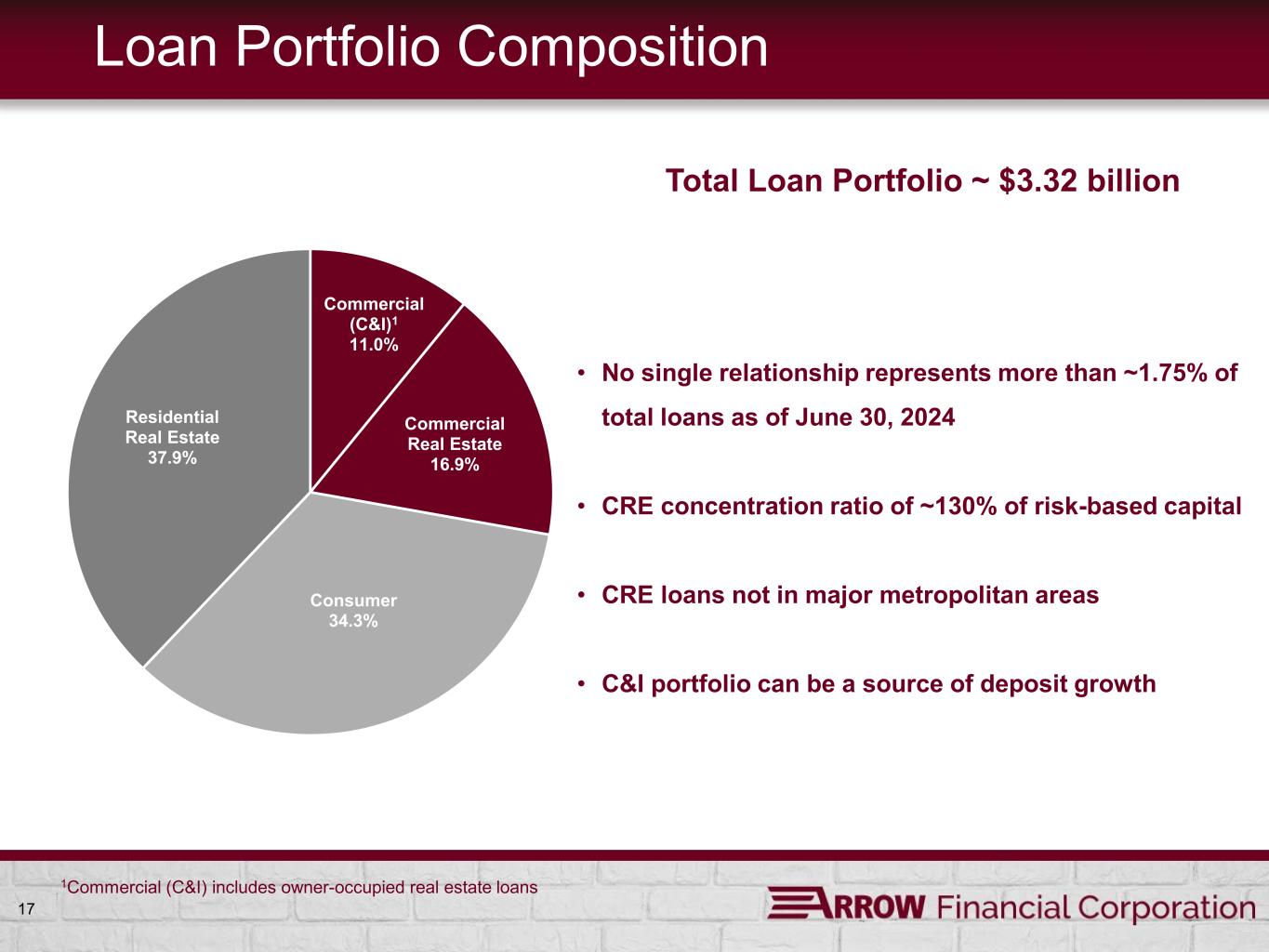

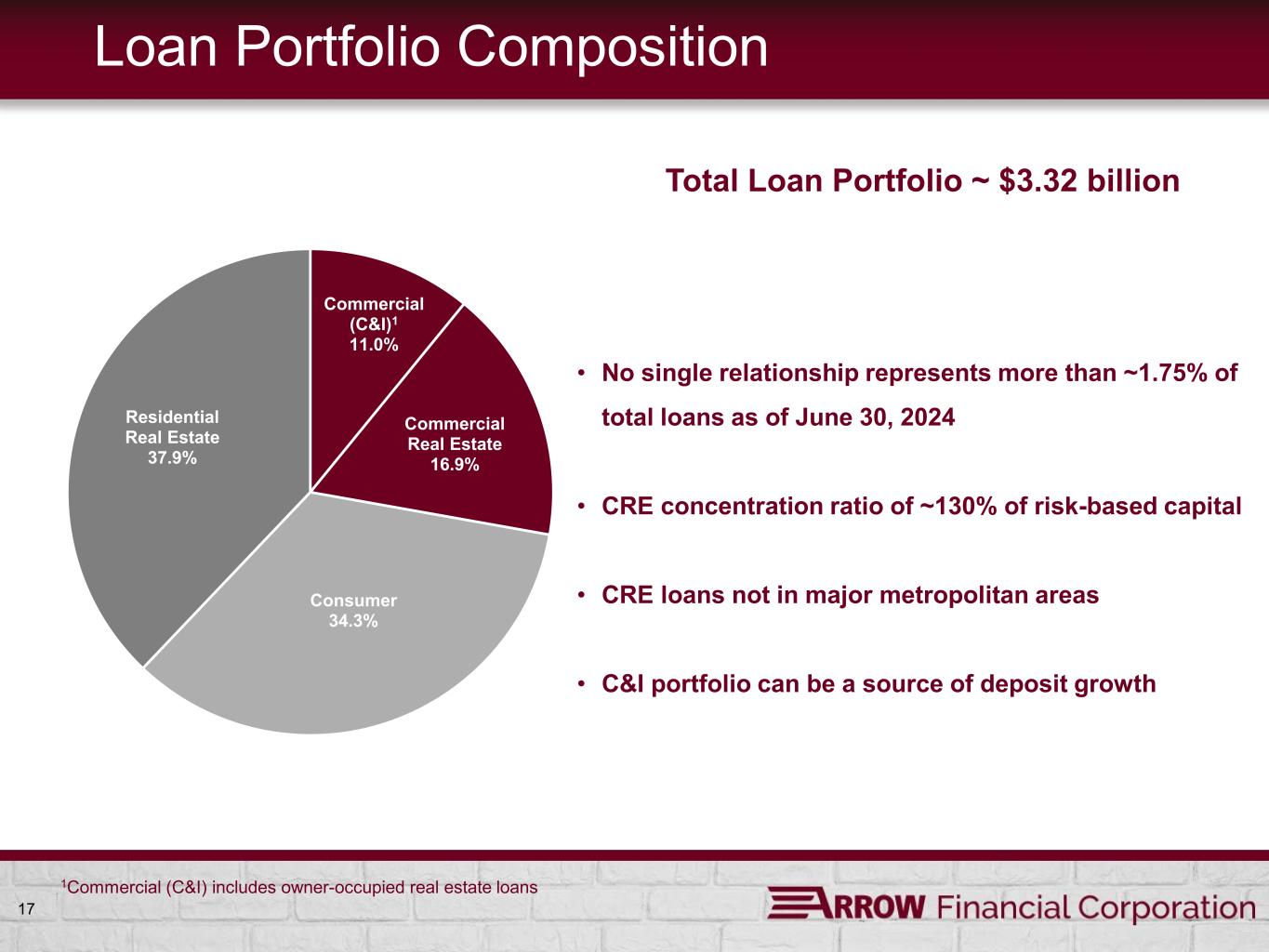

17 Loan Portfolio Composition Commercial (C&I)1 11.0% Commercial Real Estate 16.9% Consumer 34.3% Residential Real Estate 37.9% • No single relationship represents more than ~1.75% of total loans as of June 30, 2024 • CRE concentration ratio of ~130% of risk-based capital • CRE loans not in major metropolitan areas • C&I portfolio can be a source of deposit growth Total Loan Portfolio ~ $3.32 billion 1Commercial (C&I) includes owner-occupied real estate loans

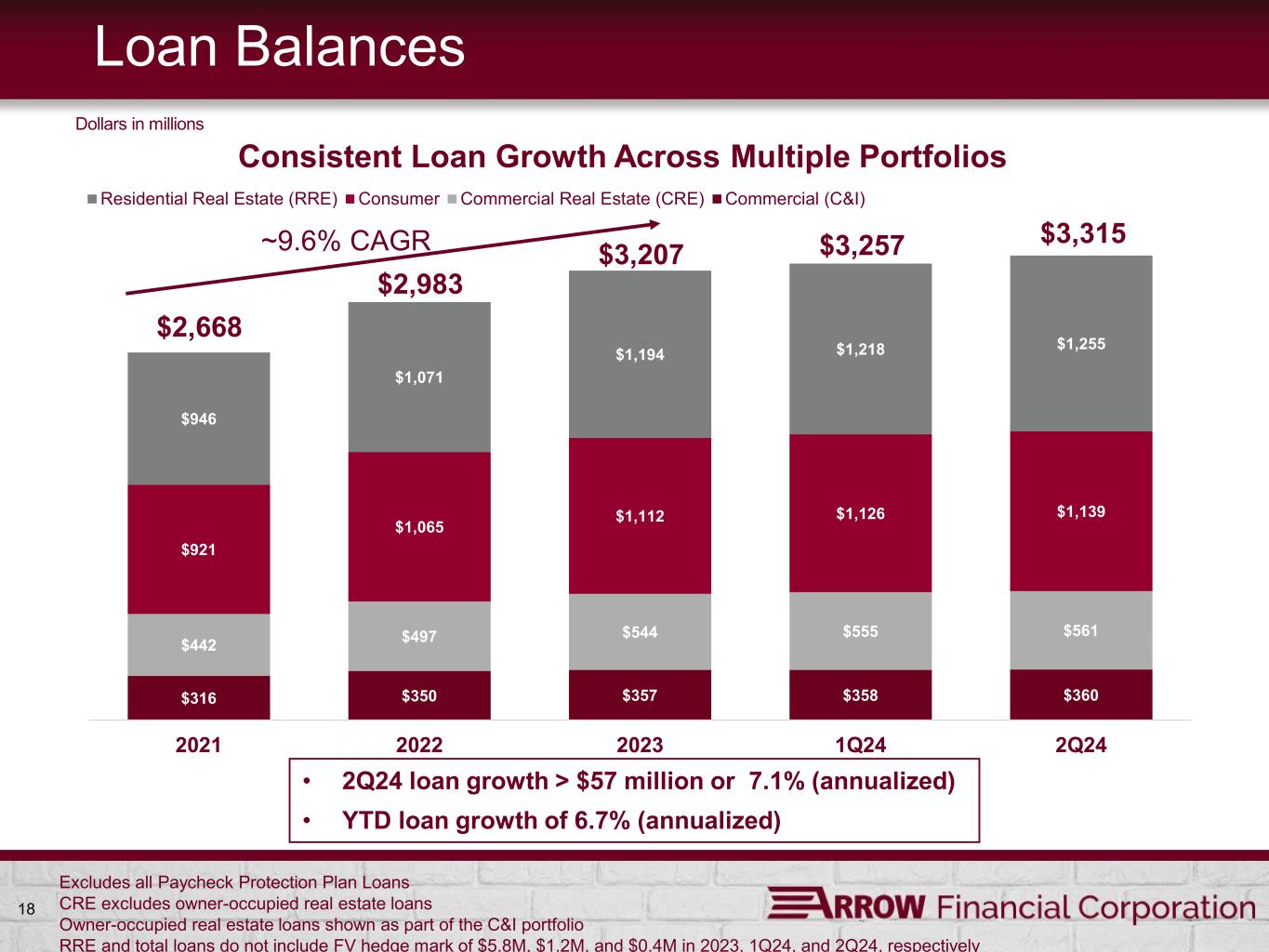

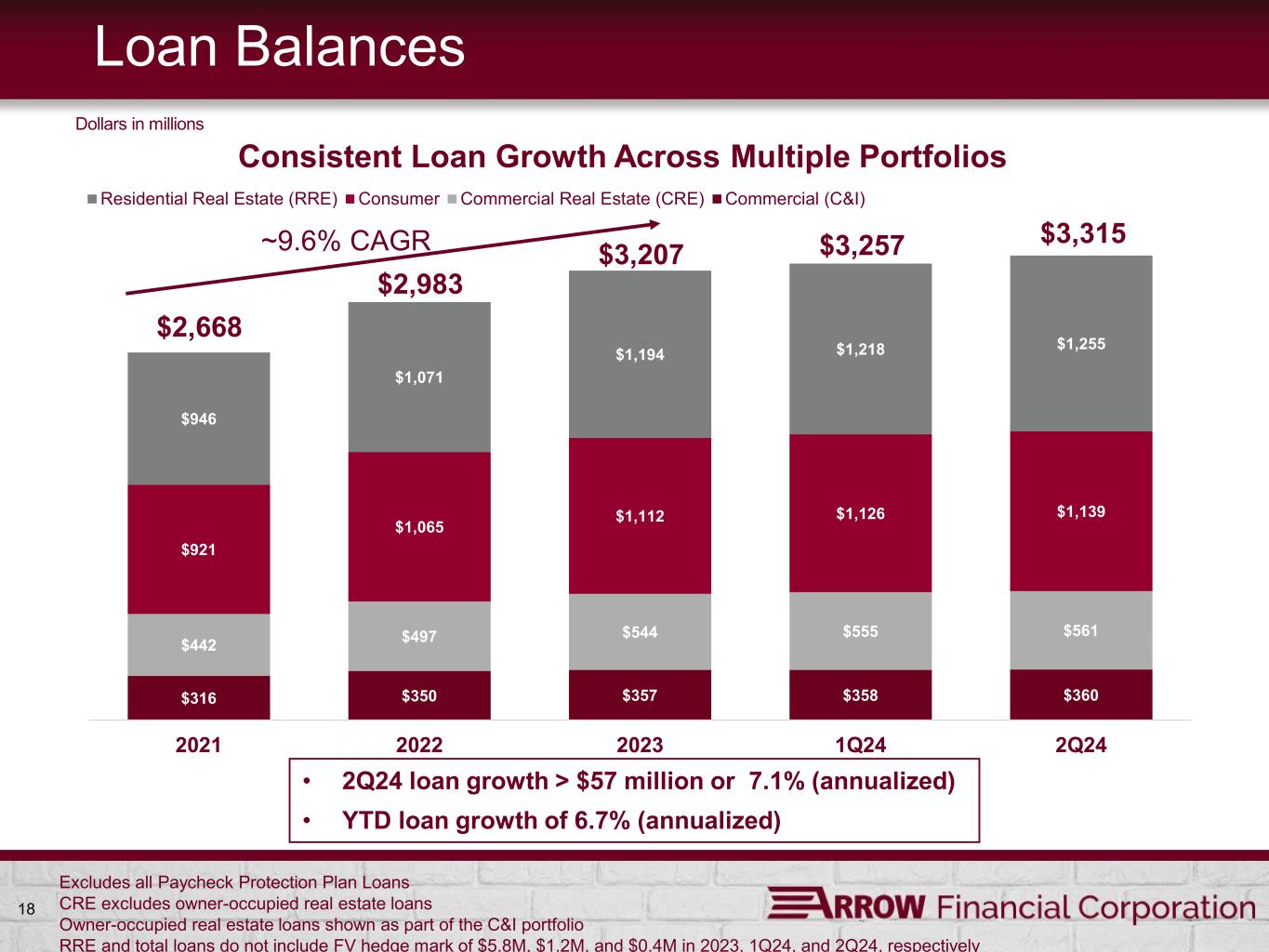

18 $316 $350 $357 $358 $360 $442 $497 $544 $555 $561 $921 $1,065 $1,112 $1,126 $1,139 $946 $1,071 $1,194 $1,218 $1,255 2021 2022 2023 1Q24 2Q24 Residential Real Estate (RRE) Consumer Commercial Real Estate (CRE) Commercial (C&I) $2,668 $2,983 $3,207 $3,257 $3,315 Loan Balances Dollars in millions Consistent Loan Growth Across Multiple Portfolios Excludes all Paycheck Protection Plan Loans CRE excludes owner-occupied real estate loans Owner-occupied real estate loans shown as part of the C&I portfolio RRE and total loans do not include FV hedge mark of $5.8M, $1.2M, and $0.4M in 2023, 1Q24, and 2Q24, respectively • 2Q24 loan growth > $57 million or 7.1% (annualized) • YTD loan growth of 6.7% (annualized) ~9.6% CAGR

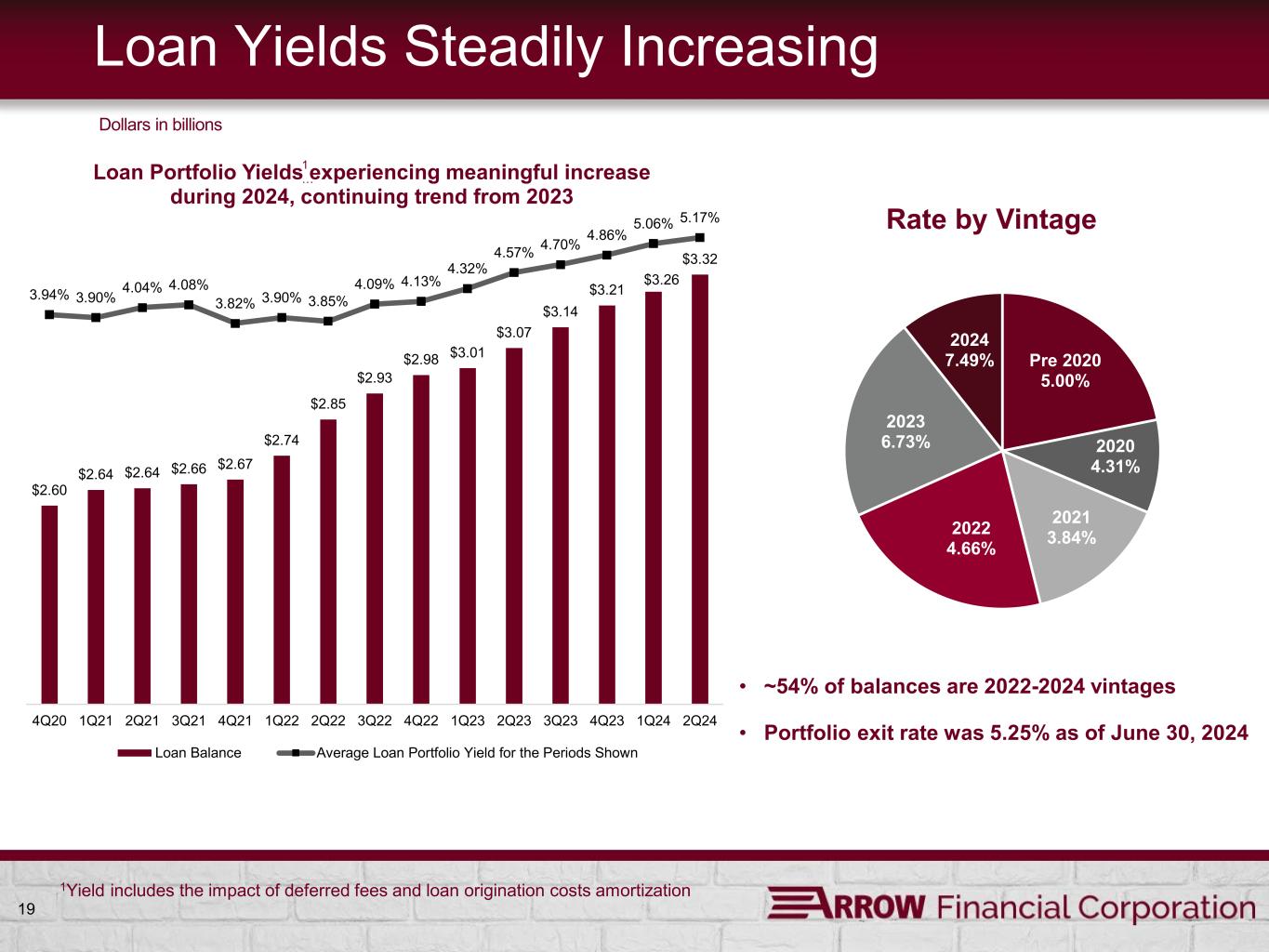

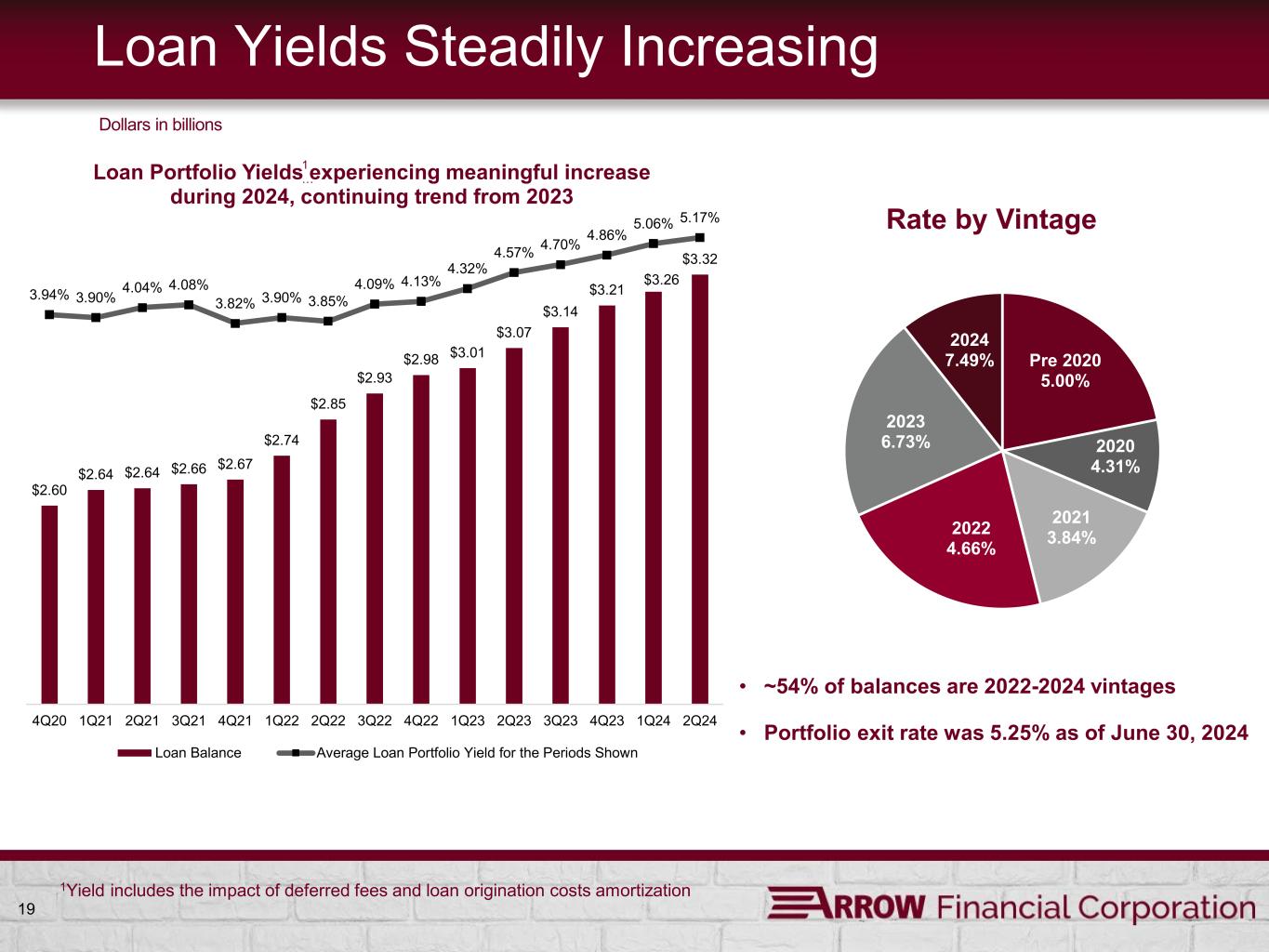

19 Loan Yields Steadily Increasing $2.60 $2.64 $2.64 $2.66 $2.67 $2.74 $2.85 $2.93 $2.98 $3.01 $3.07 $3.14 $3.21 $3.26 $3.32 3.94% 3.90% 4.04% 4.08% 3.82% 3.90% 3.85% 4.09% 4.13% 4.32% 4.57% 4.70% 4.86% 5.06% 5.17% 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Loan Portfolio Yields experiencing meaningful increase during 2024, continuing trend from 2023 Loan Balance Average Loan Portfolio Yield for the Periods Shown Dollars in billions Pre 2020 5.00% 2020 4.31% 2021 3.84%2022 4.66% 2023 6.73% 2024 7.49% Rate by Vintage • ~54% of balances are 2022-2024 vintages • Portfolio exit rate was 5.25% as of June 30, 2024 1Yield includes the impact of deferred fees and loan origination costs amortization 1 …

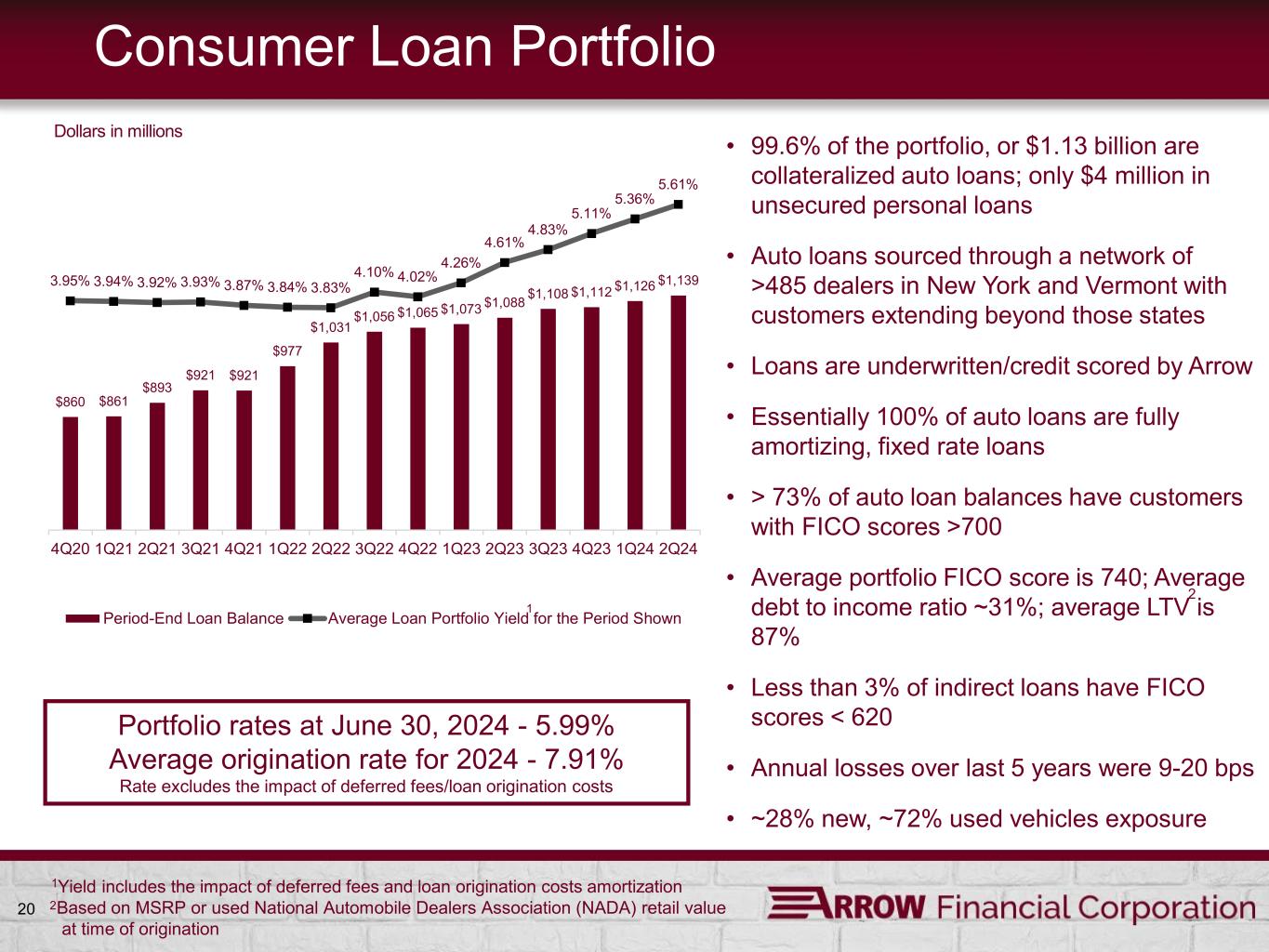

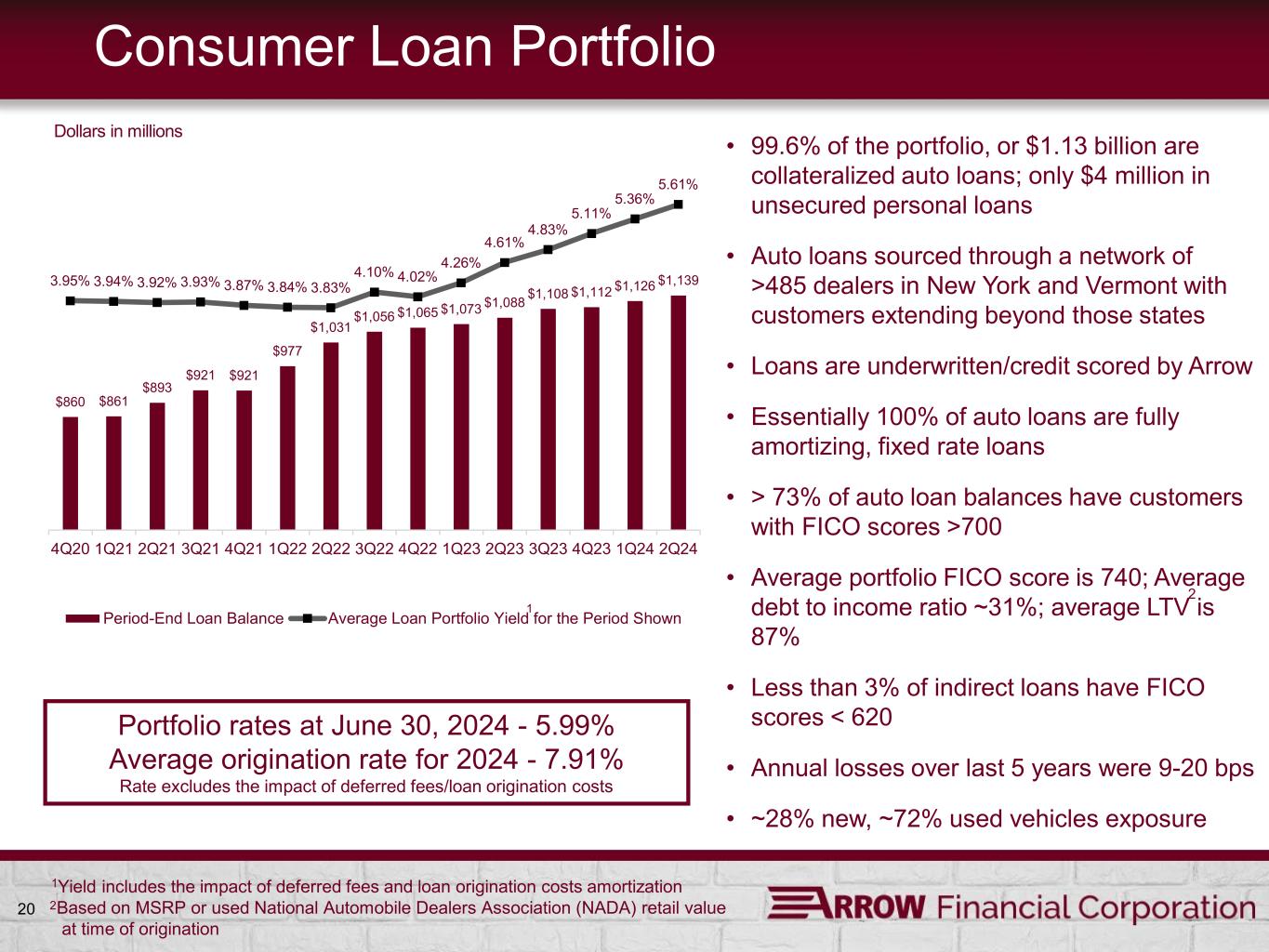

20 Consumer Loan Portfolio $860 $861 $893 $921 $921 $977 $1,031 $1,056 $1,065 $1,073 $1,088 $1,108 $1,112 $1,126 $1,139 3.95% 3.94% 3.92% 3.93% 3.87% 3.84% 3.83% 4.10% 4.02% 4.26% 4.61% 4.83% 5.11% 5.36% 5.61% 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Period-End Loan Balance Average Loan Portfolio Yield for the Period Shown Dollars in millions • 99.6% of the portfolio, or $1.13 billion are collateralized auto loans; only $4 million in unsecured personal loans • Auto loans sourced through a network of >485 dealers in New York and Vermont with customers extending beyond those states • Loans are underwritten/credit scored by Arrow • Essentially 100% of auto loans are fully amortizing, fixed rate loans • > 73% of auto loan balances have customers with FICO scores >700 • Average portfolio FICO score is 740; Average debt to income ratio ~31%; average LTV is 87% • Less than 3% of indirect loans have FICO scores < 620 • Annual losses over last 5 years were 9-20 bps • ~28% new, ~72% used vehicles exposure 2 1Yield includes the impact of deferred fees and loan origination costs amortization 2 Based on MSRP or used National Automobile Dealers Association (NADA) retail value at time of origination 1 Portfolio rates at June 30, 2024 - 5.99% Average origination rate for 2024 - 7.91% Rate excludes the impact of deferred fees/loan origination costs

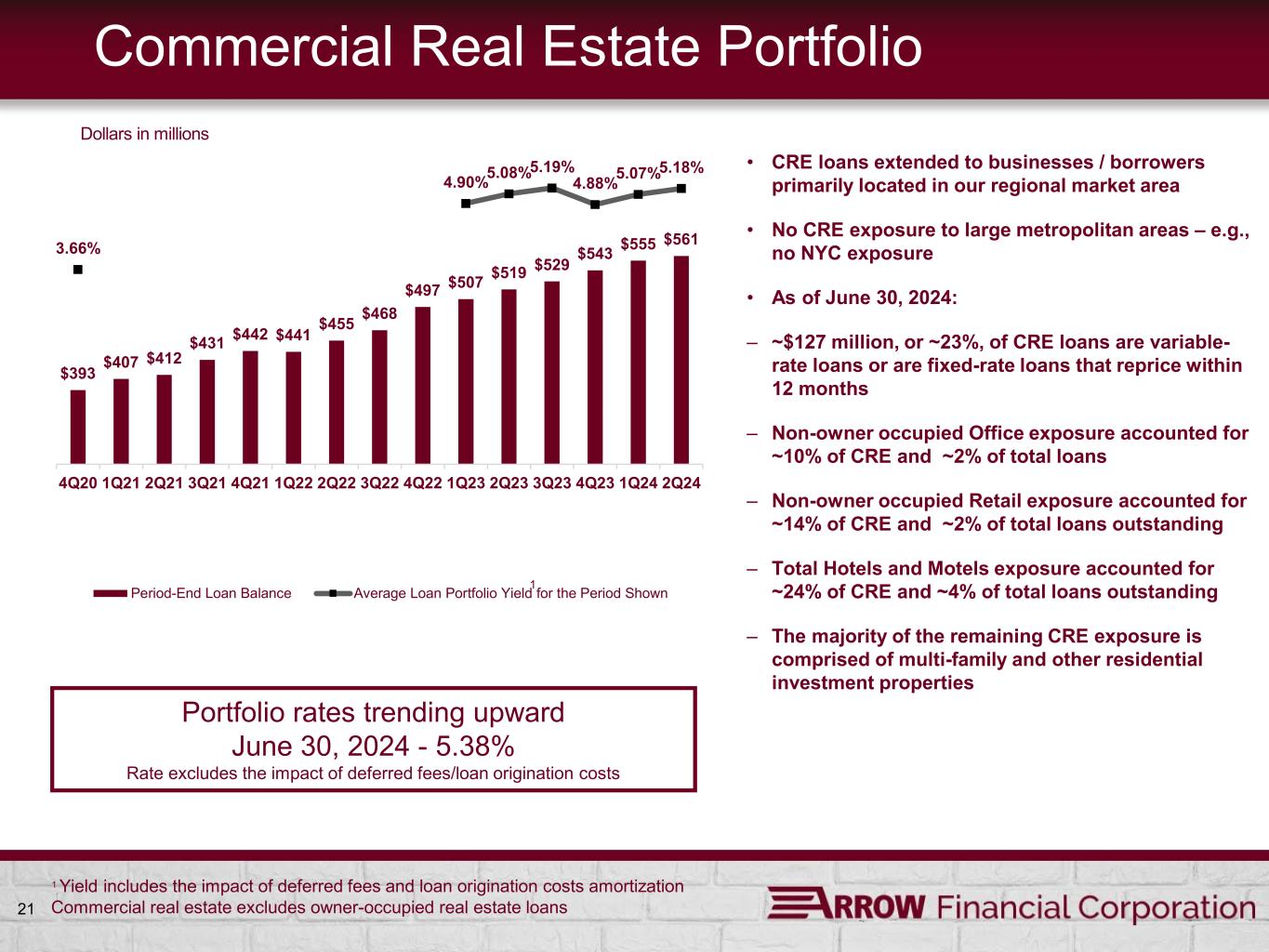

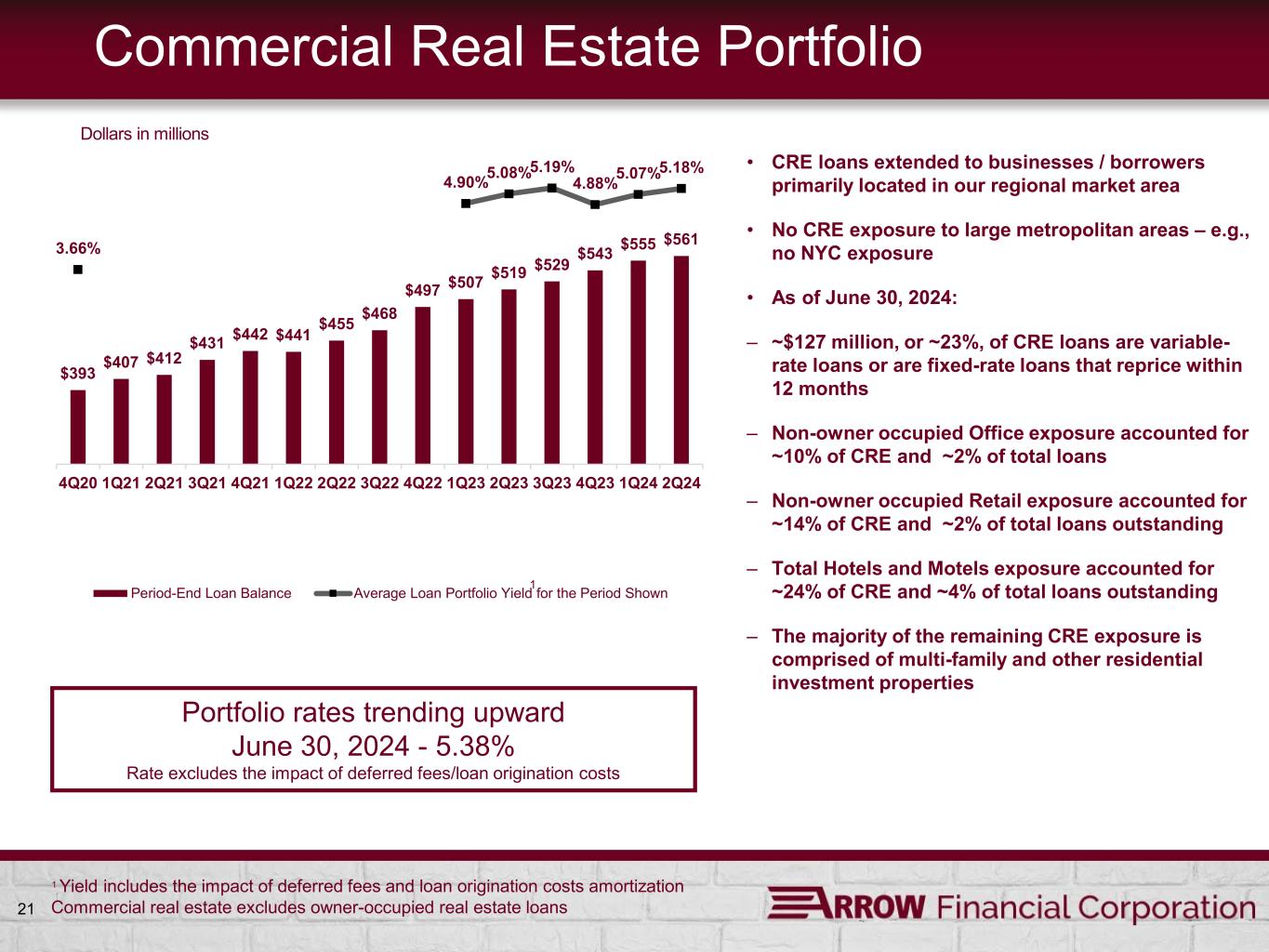

21 Commercial Real Estate Portfolio $393 $407 $412 $431 $442 $441 $455 $468 $497 $507 $519 $529 $543 $555 $561 3.66% 4.90%5.08%5.19% 4.88%5.07%5.18% 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Period-End Loan Balance Average Loan Portfolio Yield for the Period Shown Dollars in millions • CRE loans extended to businesses / borrowers primarily located in our regional market area • No CRE exposure to large metropolitan areas – e.g., no NYC exposure • As of June 30, 2024: – ~$127 million, or ~23%, of CRE loans are variable- rate loans or are fixed-rate loans that reprice within 12 months – Non-owner occupied Office exposure accounted for ~10% of CRE and ~2% of total loans – Non-owner occupied Retail exposure accounted for ~14% of CRE and ~2% of total loans outstanding – Total Hotels and Motels exposure accounted for ~24% of CRE and ~4% of total loans outstanding – The majority of the remaining CRE exposure is comprised of multi-family and other residential investment properties 1 Yield includes the impact of deferred fees and loan origination costs amortization Commercial real estate excludes owner-occupied real estate loans 1 Portfolio rates trending upward June 30, 2024 - 5.38% Rate excludes the impact of deferred fees/loan origination costs

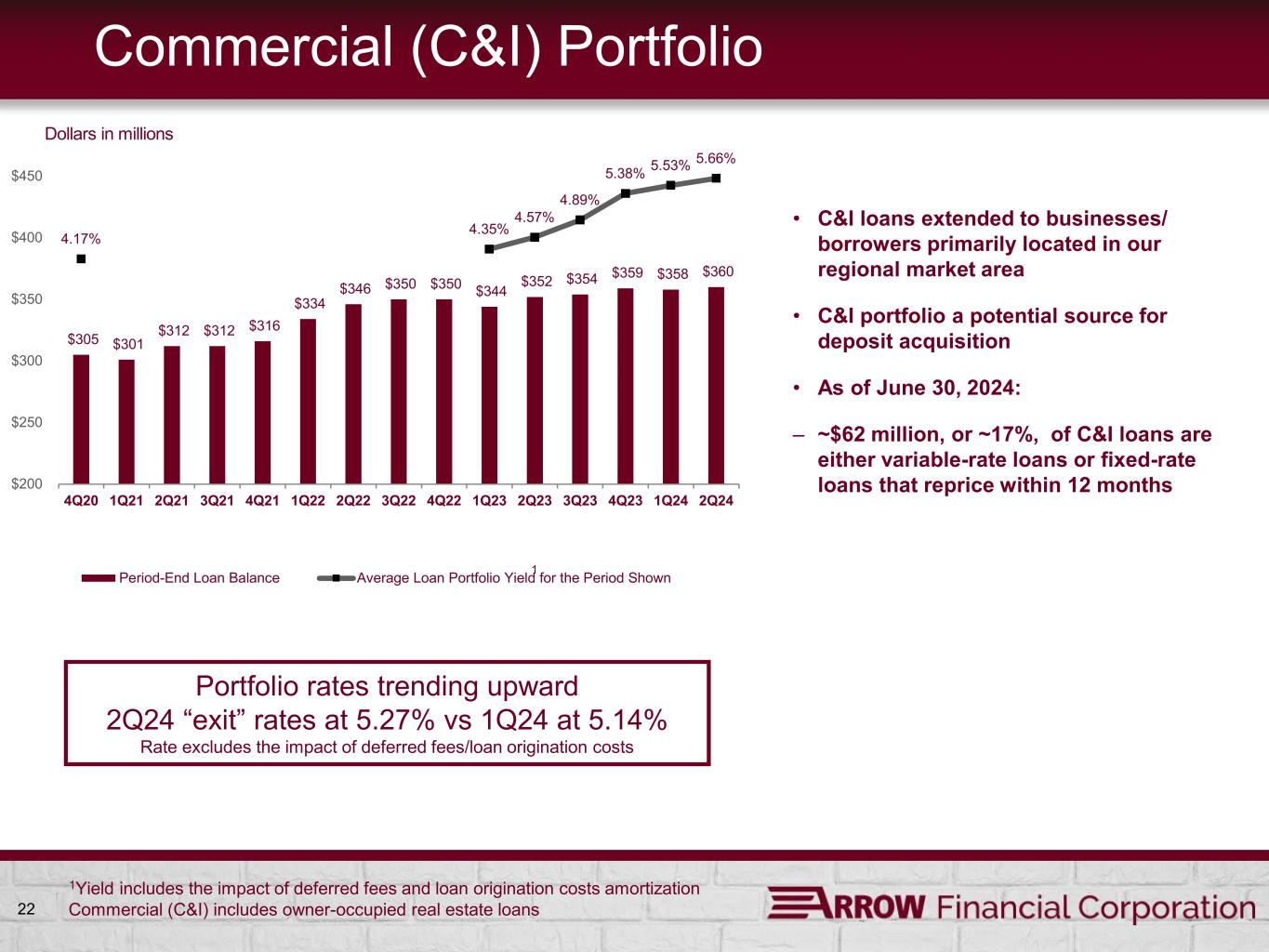

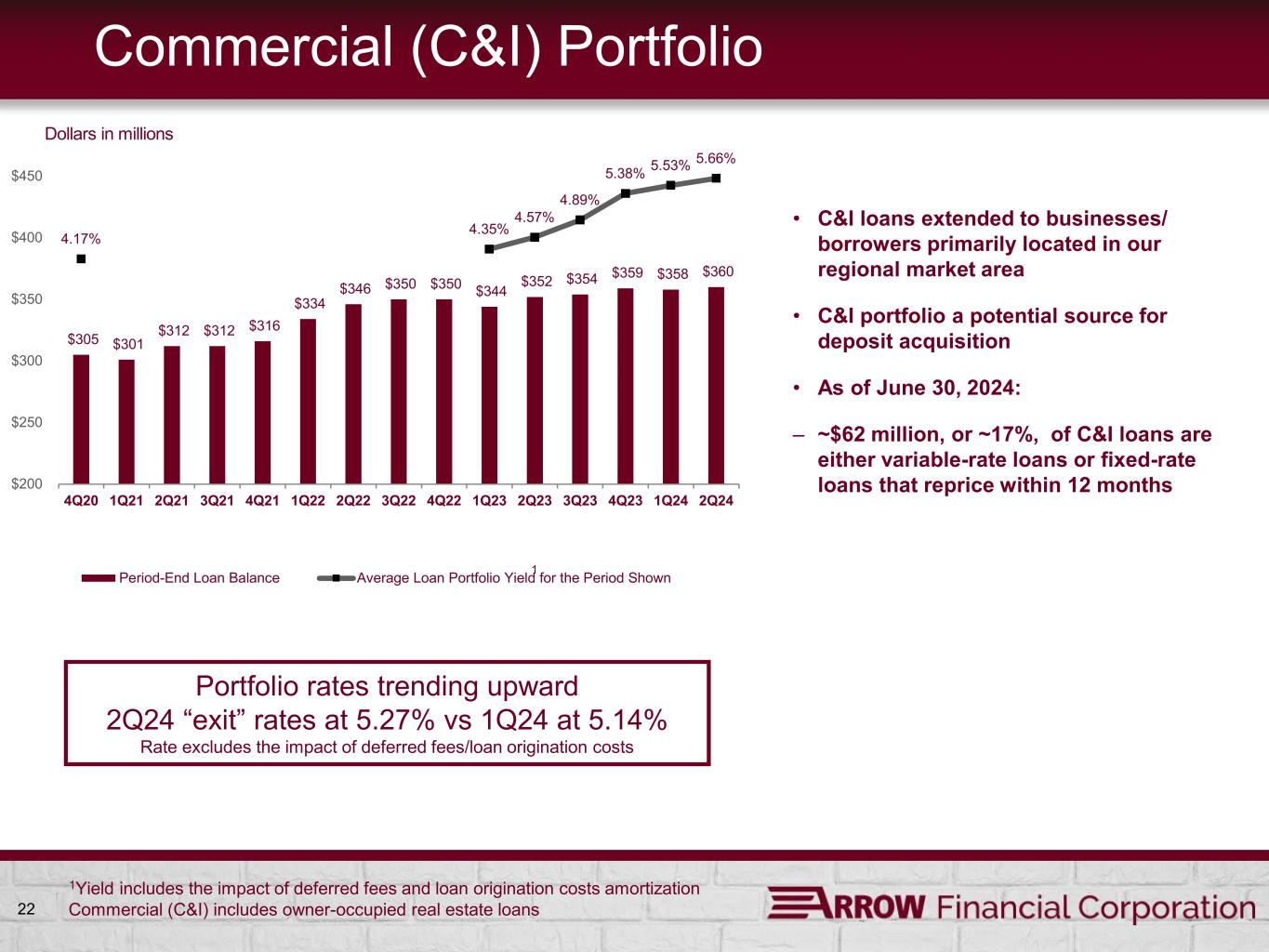

22 Commercial (C&I) Portfolio $305 $301 $312 $312 $316 $334 $346 $350 $350 $344 $352 $354 $359 $358 $360 4.17% 4.35% 4.57% 4.89% 5.38% 5.53% 5.66% $200 $250 $300 $350 $400 $450 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Period-End Loan Balance Average Loan Portfolio Yield for the Period Shown Dollars in millions • C&I loans extended to businesses/ borrowers primarily located in our regional market area • C&I portfolio a potential source for deposit acquisition • As of June 30, 2024: – ~$62 million, or ~17%, of C&I loans are either variable-rate loans or fixed-rate loans that reprice within 12 months 1Yield includes the impact of deferred fees and loan origination costs amortization Commercial (C&I) includes owner-occupied real estate loans 1 Portfolio rates trending upward 2Q24 “exit” rates at 5.27% vs 1Q24 at 5.14% Rate excludes the impact of deferred fees/loan origination costs

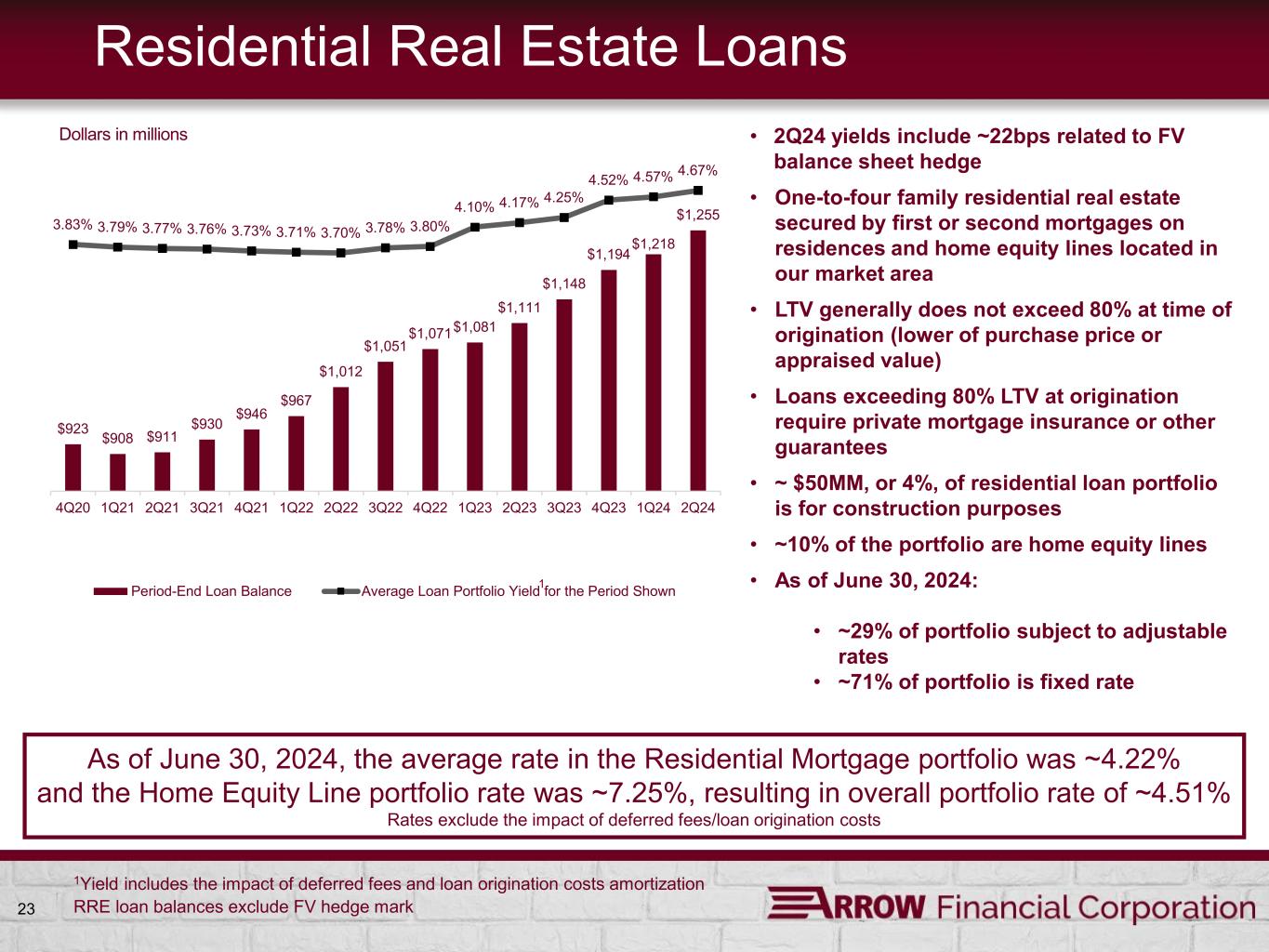

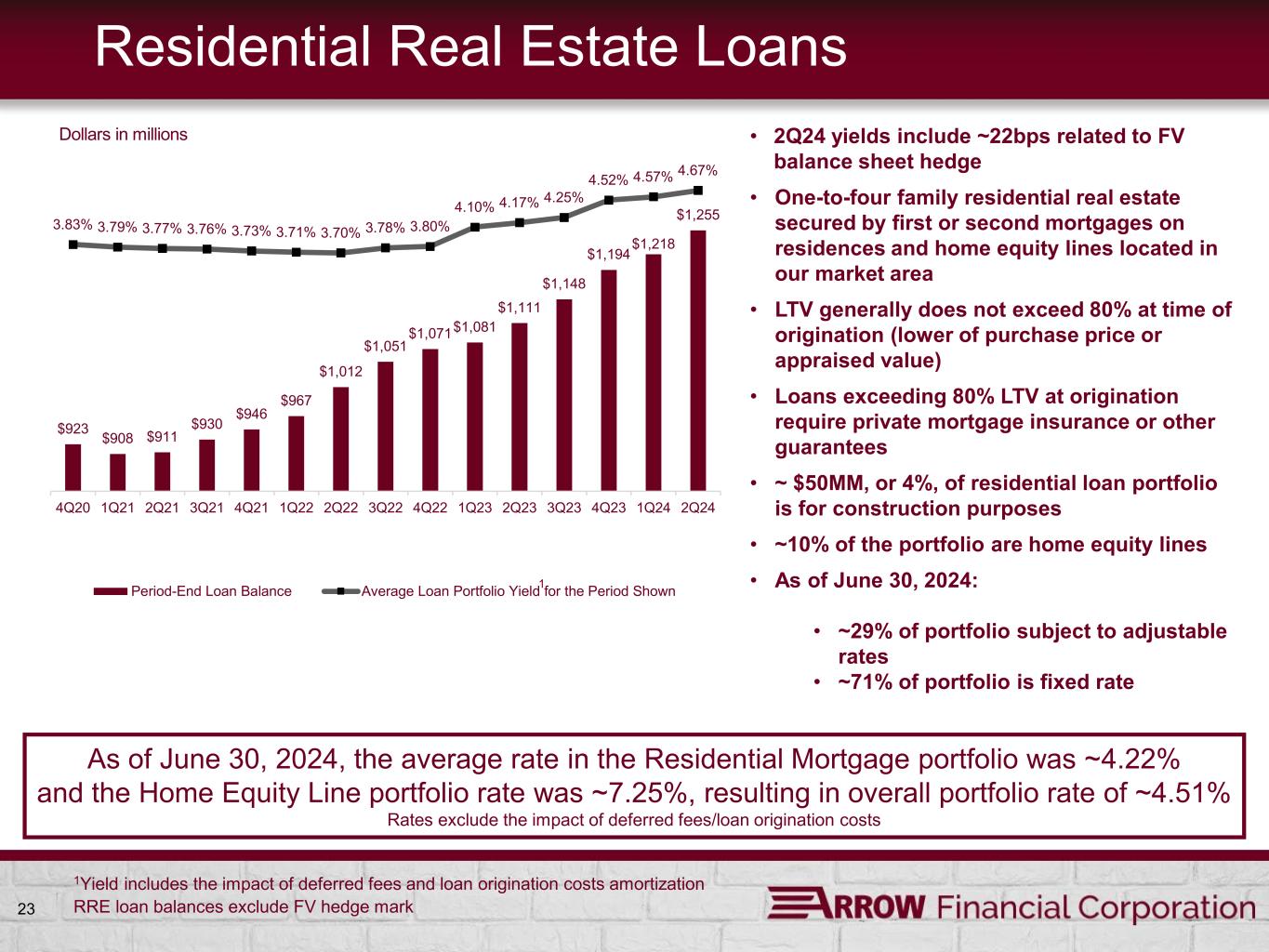

23 Residential Real Estate Loans $923 $908 $911 $930 $946 $967 $1,012 $1,051 $1,071 $1,081 $1,111 $1,148 $1,194 $1,218 $1,255 3.83% 3.79% 3.77% 3.76% 3.73% 3.71% 3.70% 3.78% 3.80% 4.10% 4.17% 4.25% 4.52% 4.57% 4.67% 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Period-End Loan Balance Average Loan Portfolio Yield for the Period Shown Dollars in millions • 2Q24 yields include ~22bps related to FV balance sheet hedge • One-to-four family residential real estate secured by first or second mortgages on residences and home equity lines located in our market area • LTV generally does not exceed 80% at time of origination (lower of purchase price or appraised value) • Loans exceeding 80% LTV at origination require private mortgage insurance or other guarantees • ~ $50MM, or 4%, of residential loan portfolio is for construction purposes • ~10% of the portfolio are home equity lines • As of June 30, 2024: • ~29% of portfolio subject to adjustable rates • ~71% of portfolio is fixed rate 1Yield includes the impact of deferred fees and loan origination costs amortization RRE loan balances exclude FV hedge mark 1 As of June 30, 2024, the average rate in the Residential Mortgage portfolio was ~4.22% and the Home Equity Line portfolio rate was ~7.25%, resulting in overall portfolio rate of ~4.51% Rates exclude the impact of deferred fees/loan origination costs

Deposits/Funding Sources 24

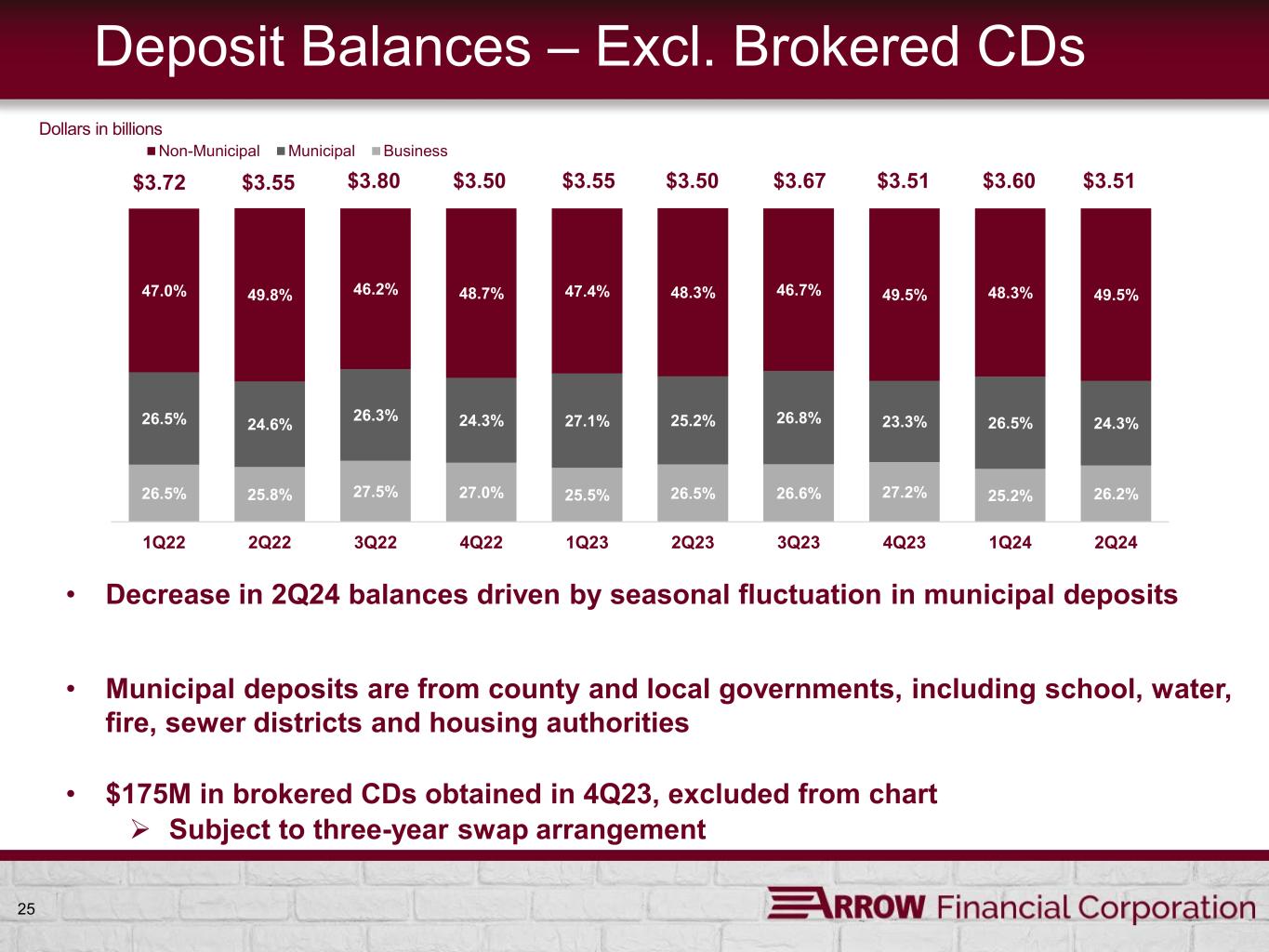

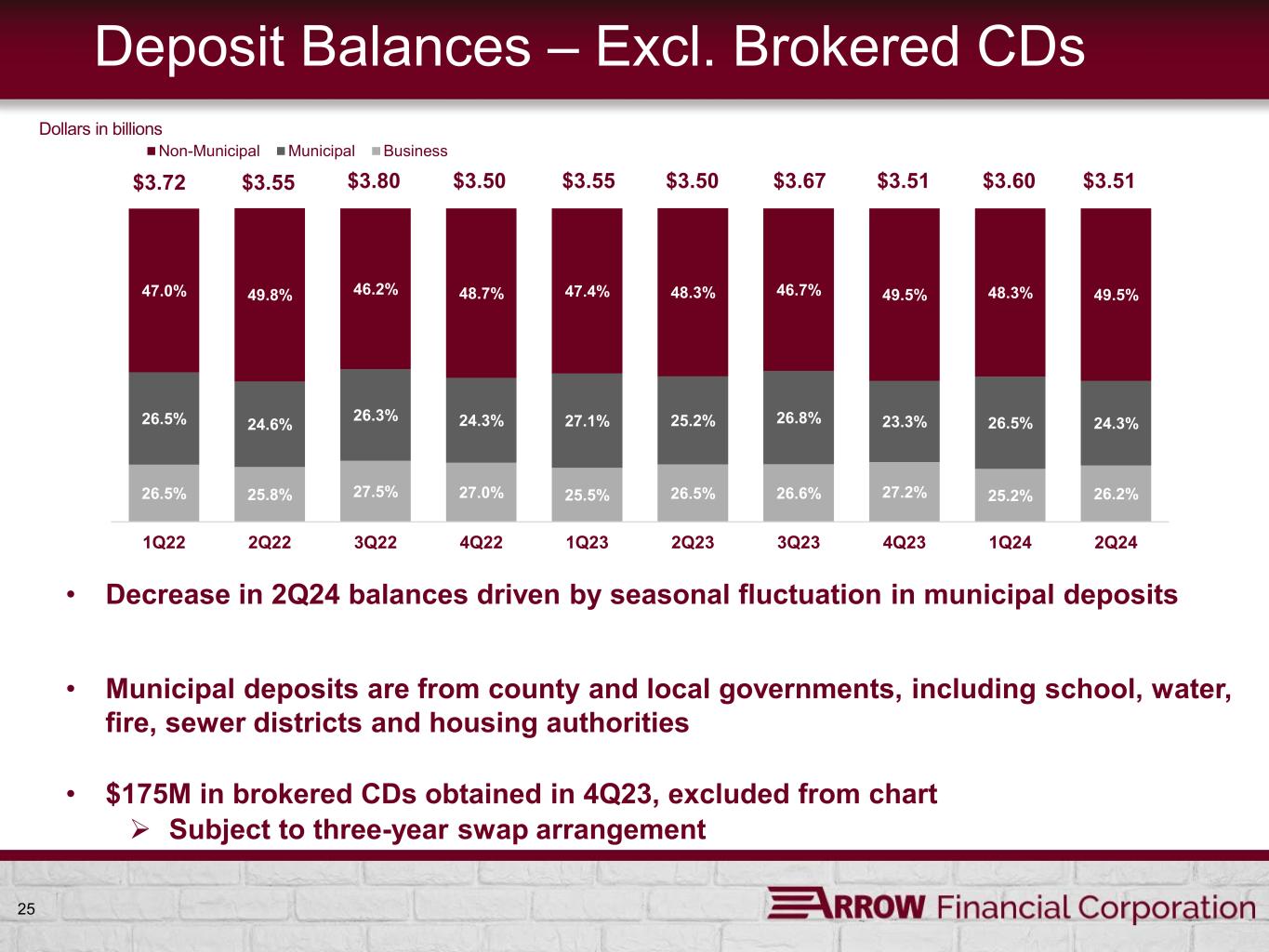

25 Deposit Balances – Excl. Brokered CDs 26.5% 25.8% 27.5% 27.0% 25.5% 26.5% 26.6% 27.2% 25.2% 26.2% 26.5% 24.6% 26.3% 24.3% 27.1% 25.2% 26.8% 23.3% 26.5% 24.3% 47.0% 49.8% 46.2% 48.7% 47.4% 48.3% 46.7% 49.5% 48.3% 49.5% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Axis Title Non-Municipal Municipal Business Dollars in billions $3.72 $3.55 $3.80 $3.50 $3.55 $3.50 $3.67 $3.51 $3.60 $3.51 • Decrease in 2Q24 balances driven by seasonal fluctuation in municipal deposits • Municipal deposits are from county and local governments, including school, water, fire, sewer districts and housing authorities • $175M in brokered CDs obtained in 4Q23, excluded from chart Subject to three-year swap arrangement

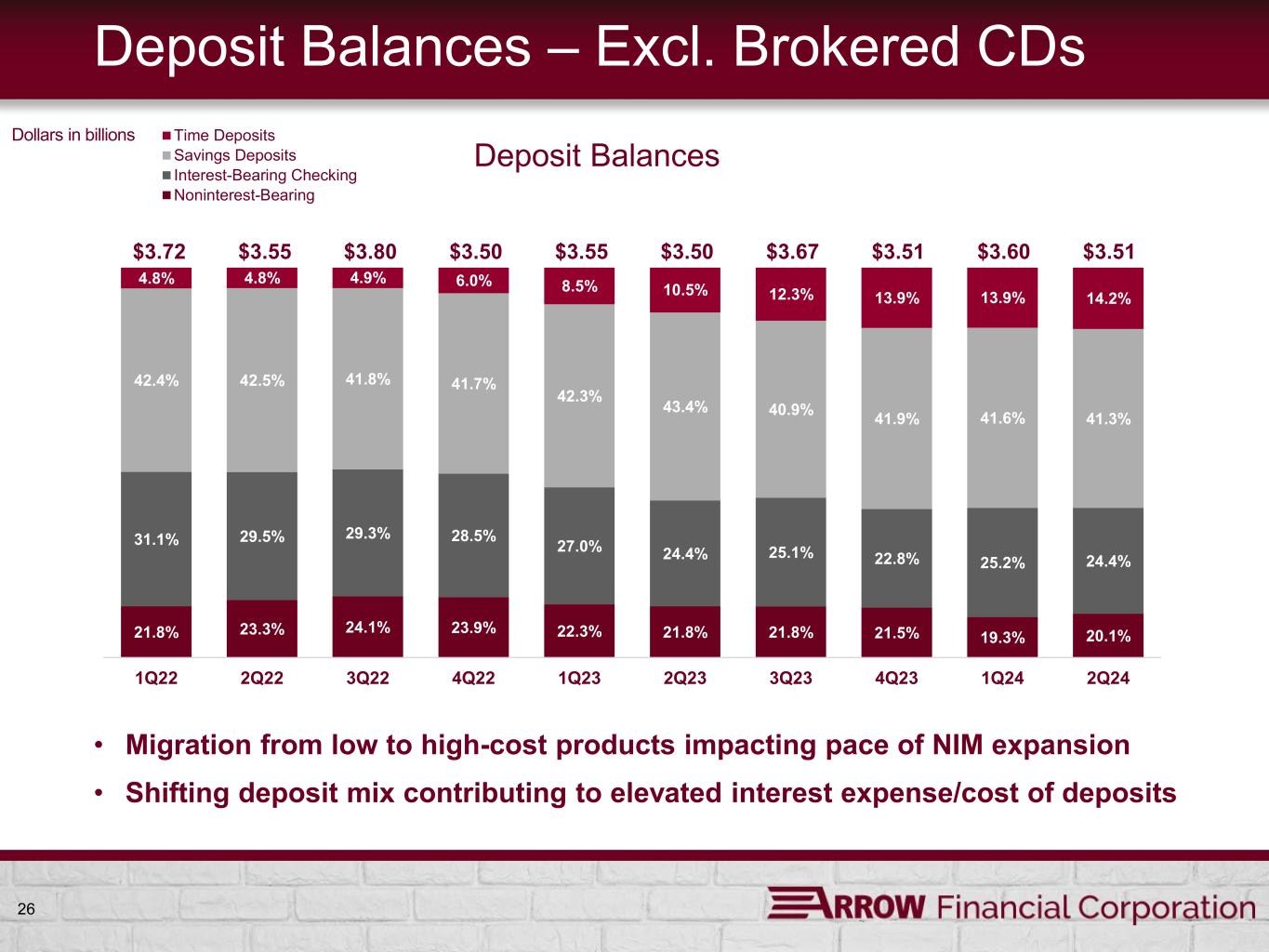

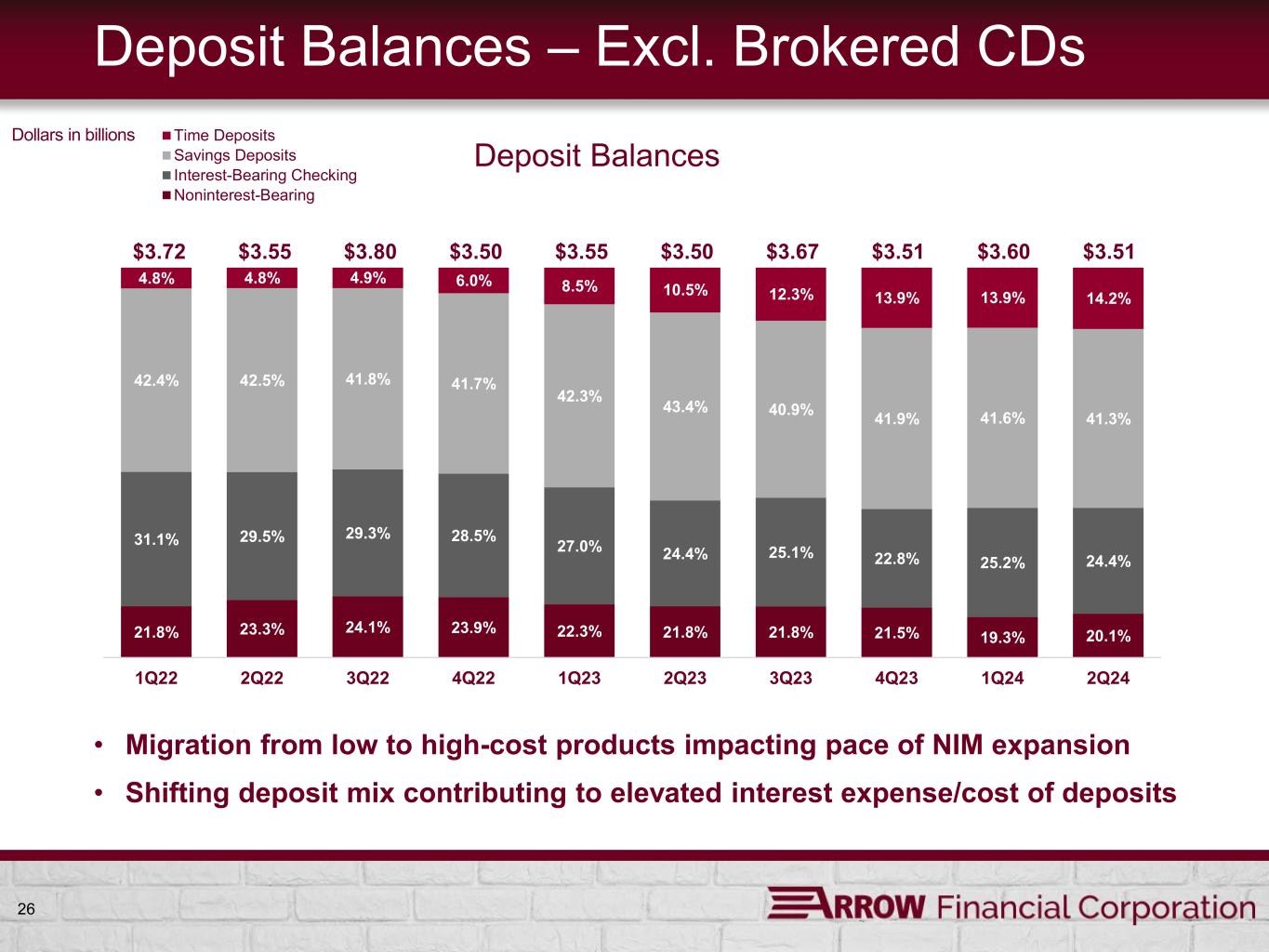

26 Deposit Balances – Excl. Brokered CDs 21.8% 23.3% 24.1% 23.9% 22.3% 21.8% 21.8% 21.5% 19.3% 20.1% 31.1% 29.5% 29.3% 28.5% 27.0% 24.4% 25.1% 22.8% 25.2% 24.4% 42.4% 42.5% 41.8% 41.7% 42.3% 43.4% 40.9% 41.9% 41.6% 41.3% 4.8% 4.8% 4.9% 6.0% 8.5% 10.5% 12.3% 13.9% 13.9% 14.2% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Axis Title Deposit Balances Time Deposits Savings Deposits Interest-Bearing Checking Noninterest-Bearing Dollars in billions $3.72 $3.55 $3.80 $3.50 $3.55 $3.50 $3.67 $3.51 $3.60 $3.51 • Migration from low to high-cost products impacting pace of NIM expansion • Shifting deposit mix contributing to elevated interest expense/cost of deposits

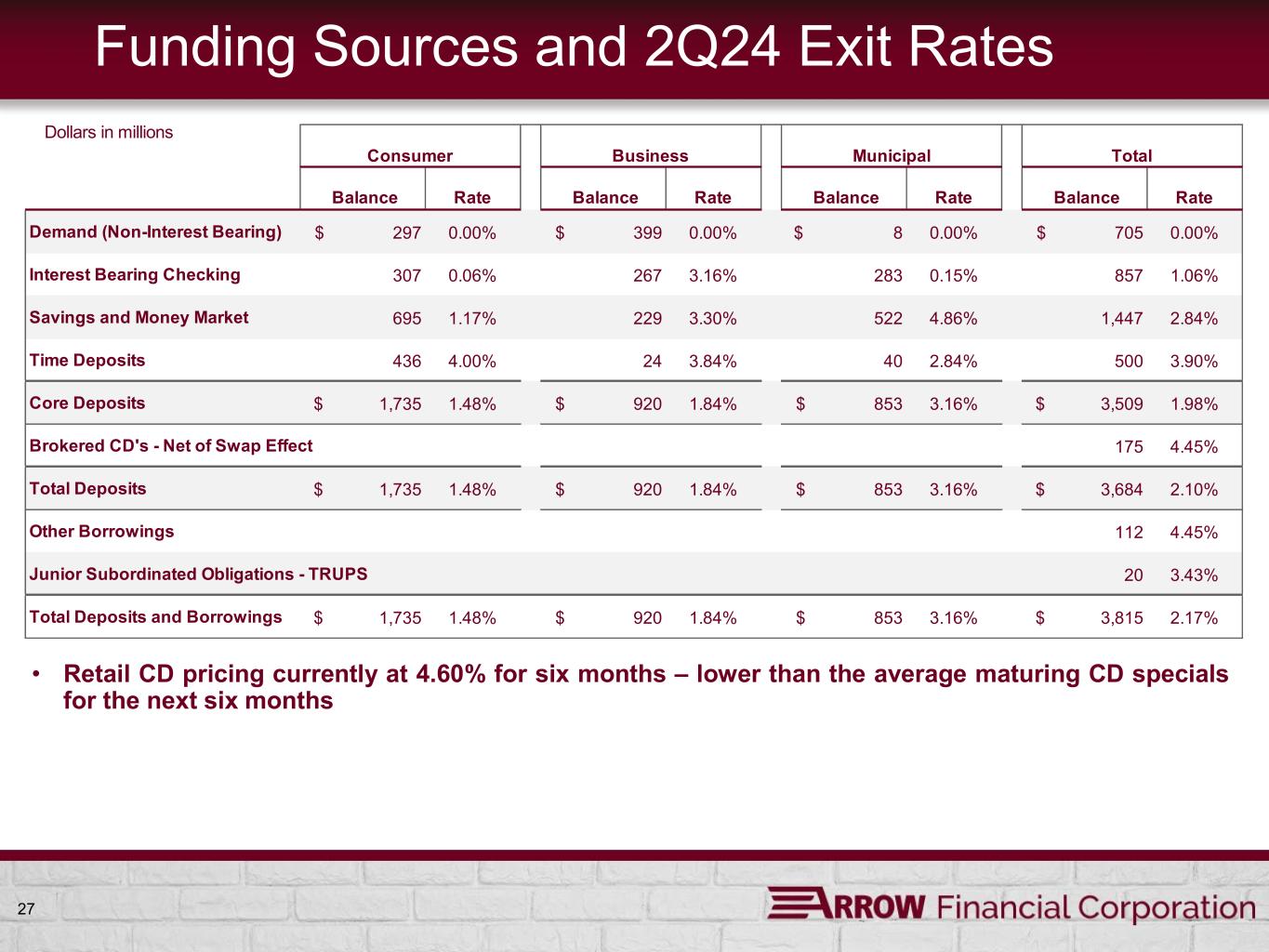

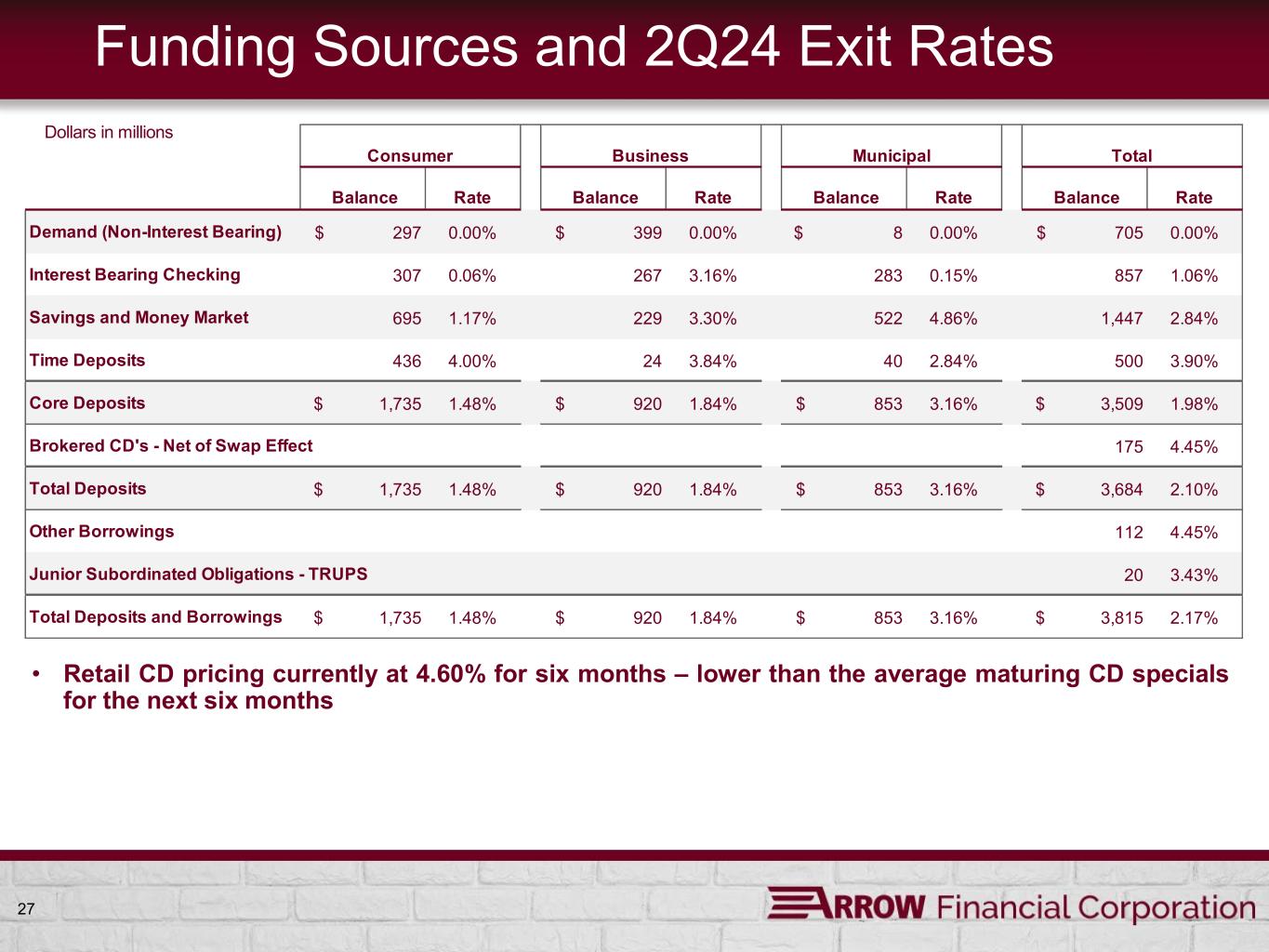

27 Funding Sources and 2Q24 Exit Rates • Retail CD pricing currently at 4.60% for six months – lower than the average maturing CD specials for the next six months Dollars in millions Balance Rate Balance Rate Balance Rate Balance Rate Demand (Non-Interest Bearing) $ 297 0.00% $ 399 0.00% $ 8 0.00% $ 705 0.00% Interest Bearing Checking 307 0.06% 267 3.16% 283 0.15% 857 1.06% Savings and Money Market 695 1.17% 229 3.30% 522 4.86% 1,447 2.84% Time Deposits 436 4.00% 24 3.84% 40 2.84% 500 3.90% Core Deposits $ 1,735 1.48% $ 920 1.84% $ 853 3.16% $ 3,509 1.98% Brokered CD's - Net of Swap Effect 175 4.45% Total Deposits $ 1,735 1.48% $ 920 1.84% $ 853 3.16% $ 3,684 2.10% Other Borrowings 112 4.45% Junior Subordinated Obligations - TRUPS 20 3.43% Total Deposits and Borrowings $ 1,735 1.48% $ 920 1.84% $ 853 3.16% $ 3,815 2.17% Consumer Business Municipal Total

28 Deposit Rate Analysis Balance Exit Rate1 Balance Exit Rate1 Balance Exit Rate1 Demand (Non-Interest Bearing) $705 0.00% $697 0.00% $8 0.00% Interest Bearing Checking $857 1.06% $908 0.97% -$52 0.09% Savings and Money Market $1,447 2.84% $1,497 2.81% -$51 0.03% Time Deposits $500 3.90% $502 4.06% -$1 -0.16% Total $3,509 1.98% $3,604 1.98% -$95 0.02% 2Q 2024 1Q 2024 Variance Deposit pricing discipline challenged by changes in deposit mix Exit Rate is the rate as of the end of the quarter1

Credit Quality 29

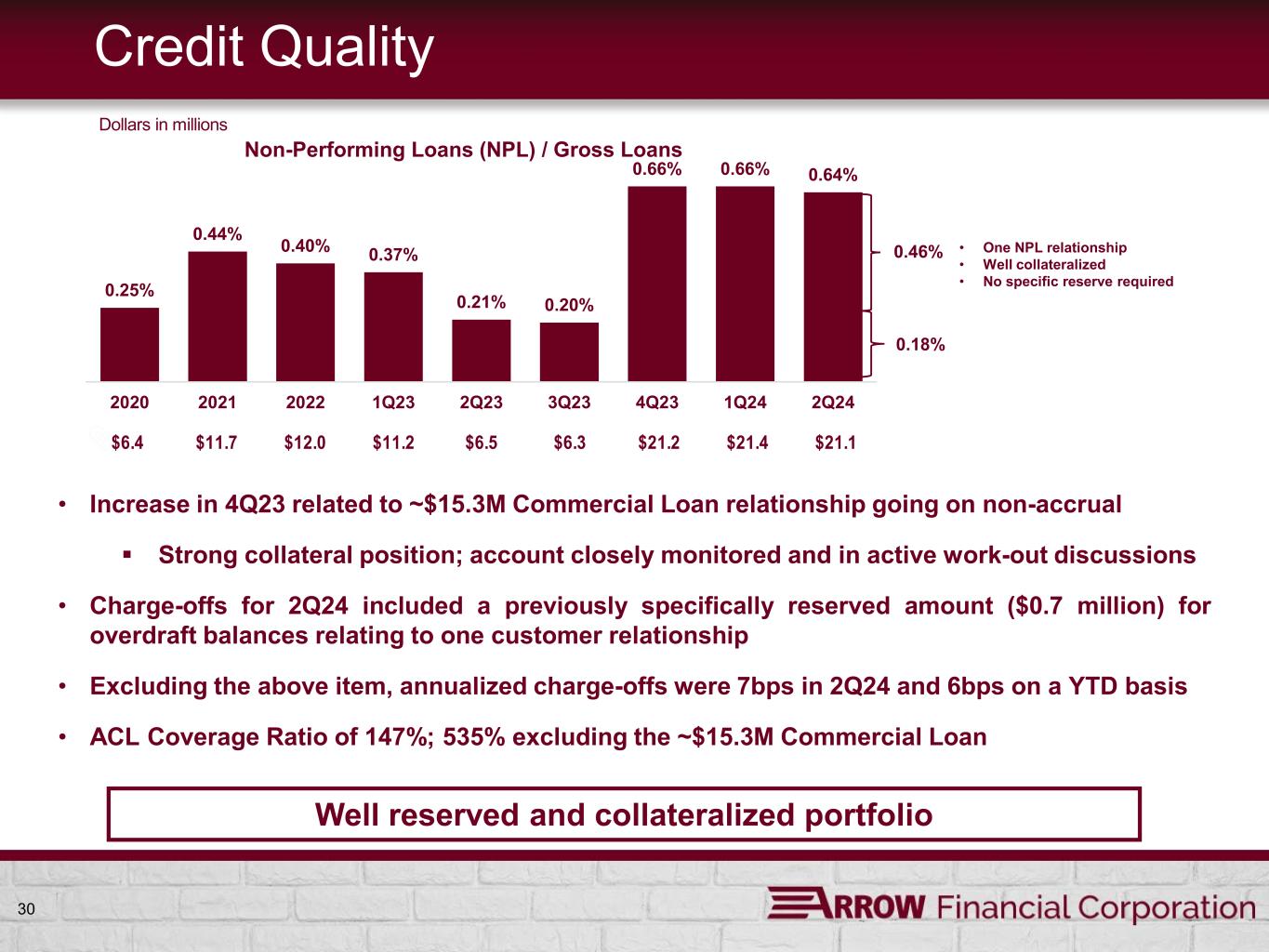

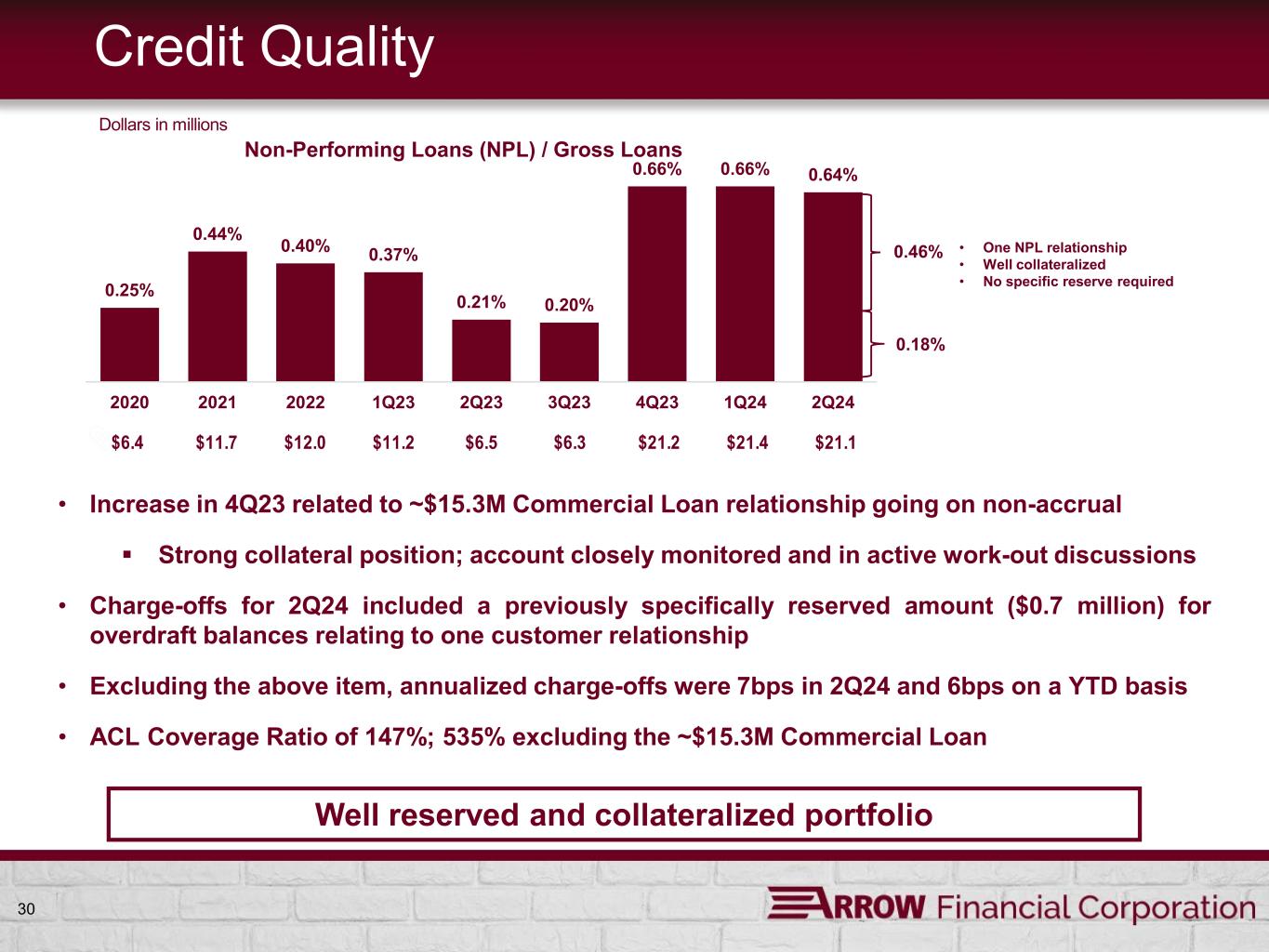

30 Credit Quality 0.25% 0.44% 0.40% 0.37% 0.21% 0.20% 0.66% 0.66% 0.64% 2020 2021 2022 1Q23 2Q23 3Q23 4Q23 1Q24 2Q24 Non-Performing Loans (NPL) / Gross Loans Dollars in millions $6.4 $11.7 $12.0 $11.2 $6.5 $6.3 $21.2 $21.4 $21.1 • Increase in 4Q23 related to ~$15.3M Commercial Loan relationship going on non-accrual Strong collateral position; account closely monitored and in active work-out discussions • Charge-offs for 2Q24 included a previously specifically reserved amount ($0.7 million) for overdraft balances relating to one customer relationship • Excluding the above item, annualized charge-offs were 7bps in 2Q24 and 6bps on a YTD basis • ACL Coverage Ratio of 147%; 535% excluding the ~$15.3M Commercial Loan Well reserved and collateralized portfolio • One NPL relationship • Well collateralized • No specific reserve required 0.46% 0.18%

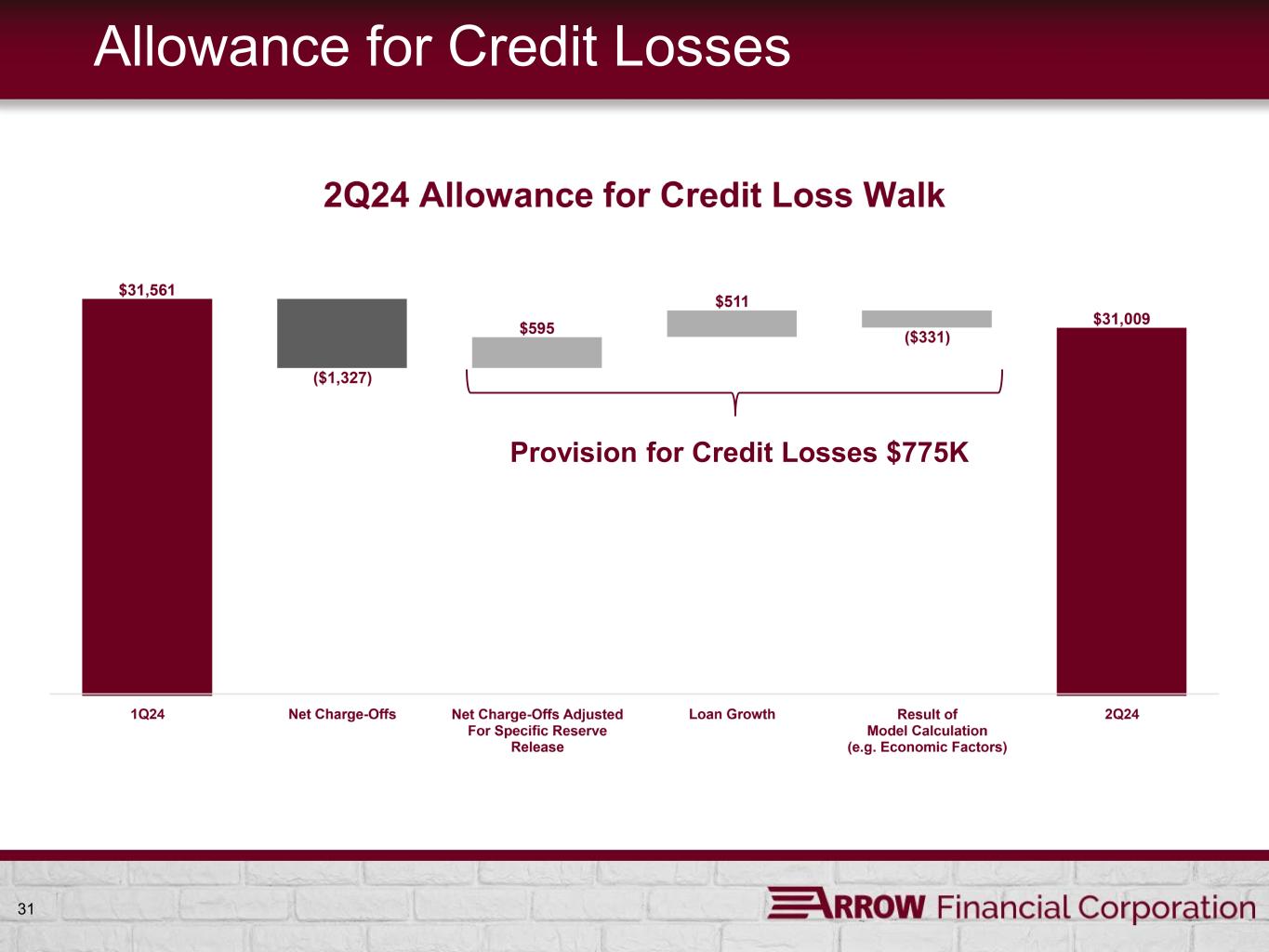

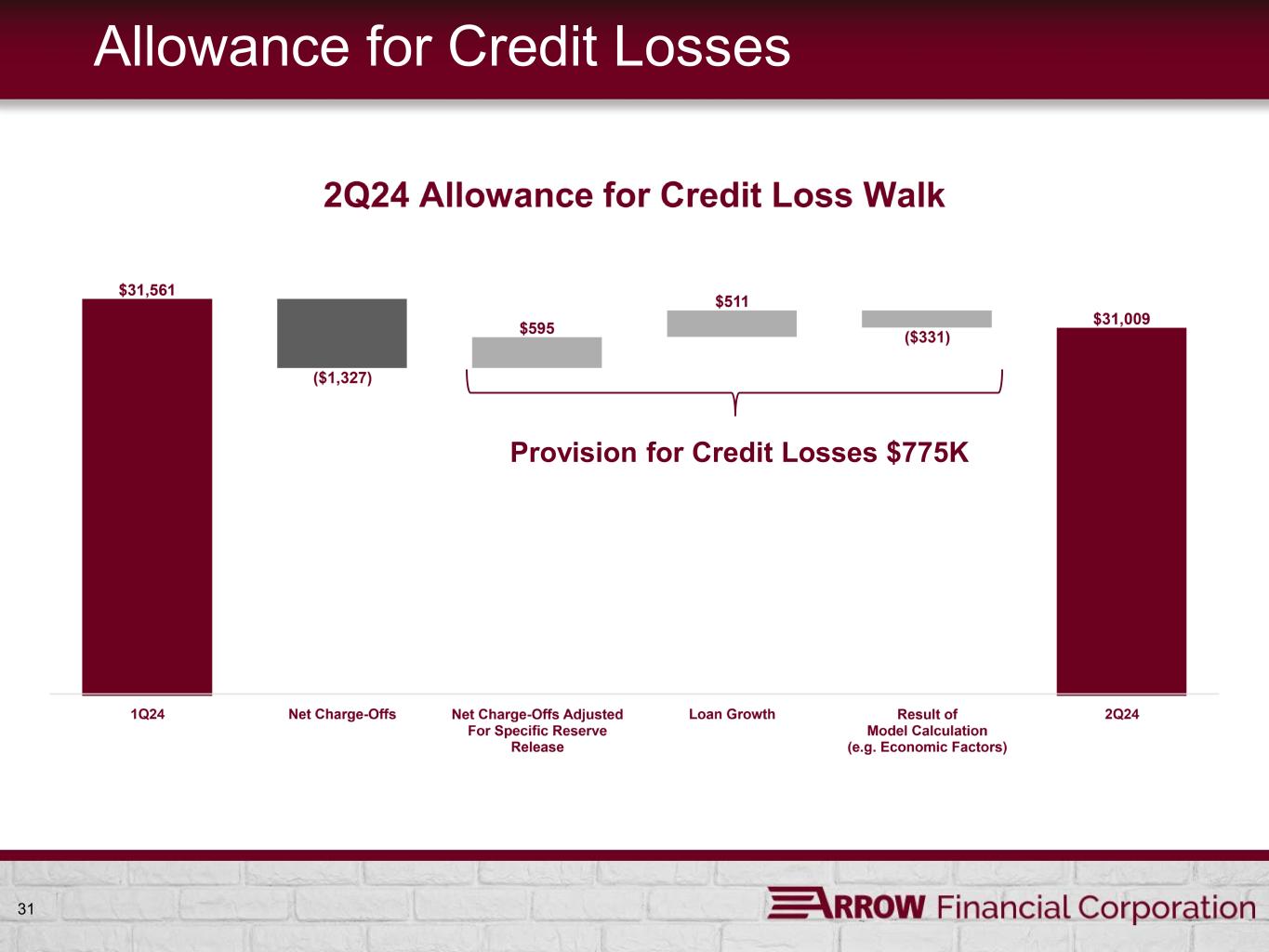

31 Allowance for Credit Losses Provision for Credit Losses $775K

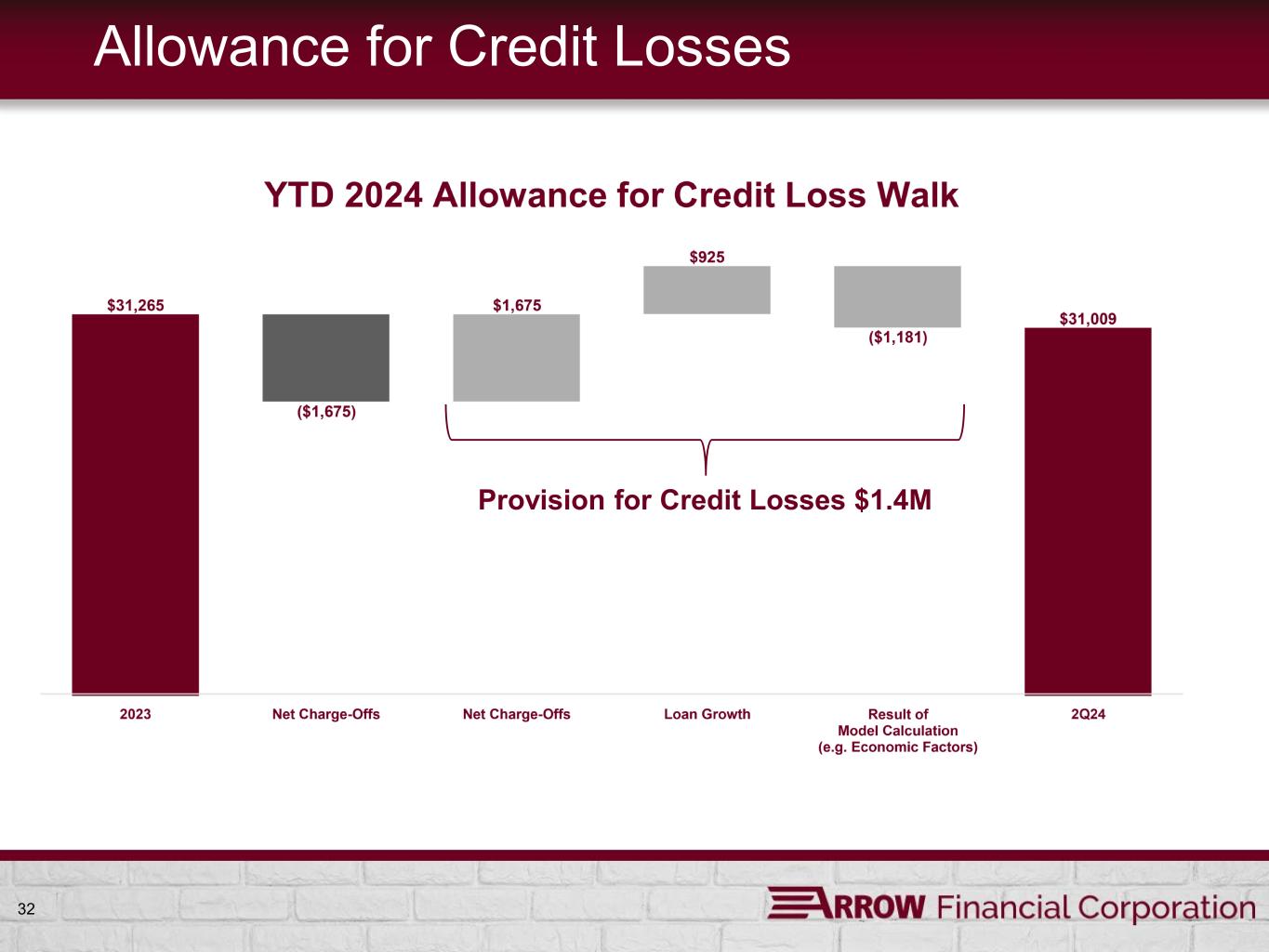

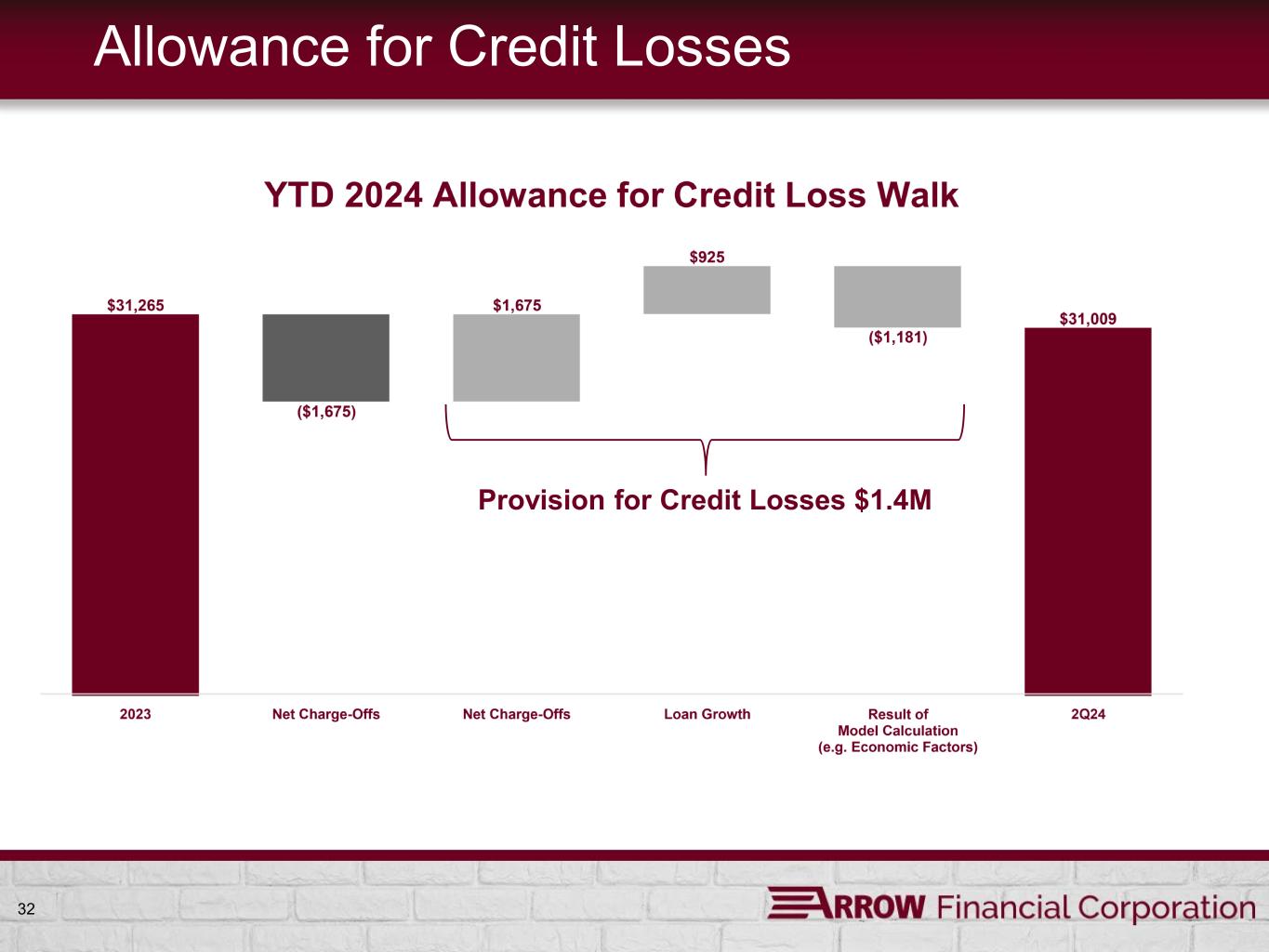

32 Allowance for Credit Losses Provision for Credit Losses $1.4M

Capital Actions and Strategy 33

34 Equity and Ownership Dividends and Return of Capital • Declared 3rd Quarter Dividend of $0.27 payable August 23, 2024 • 45th consecutive quarter of dividends • YTD ~$6.4 million of stock repurchases (263K shares) Equivalent of additional $0.37 per share dividend Capital Strategy • Evaluating potential Q4 dividend increase vs. stock dividend • $5M stock buyback authorization in place for opportunistic use Ownership • Directors, Management and Employees (through employee ownership plans) currently own ~6% of Arrow

35 Fully Diluted Tangible Book Value (TBV) TBV growth despite challenging economic environment and aggressive share repurchase activity

36 Capital Position 9.74% 12.88% 13.53% 14.57% 8.53% 9.63% 12.84% 13.50% 14.57% 8.24% 4.00% 4.50% 6.00% 8.00% 0% 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% Tier 1 Leverage Ratio Common Equity Tier 1 Capital Tier 1 Risk-Based Capital Total Risk-Based Capital Tangible Common Equity Capital Ratios – Arrow Minimum Regulatory Capital Ratios 1Q24 2Q24 Building Capital amidst share buy-backs and strong loan growth

Liquidity and Investments 37

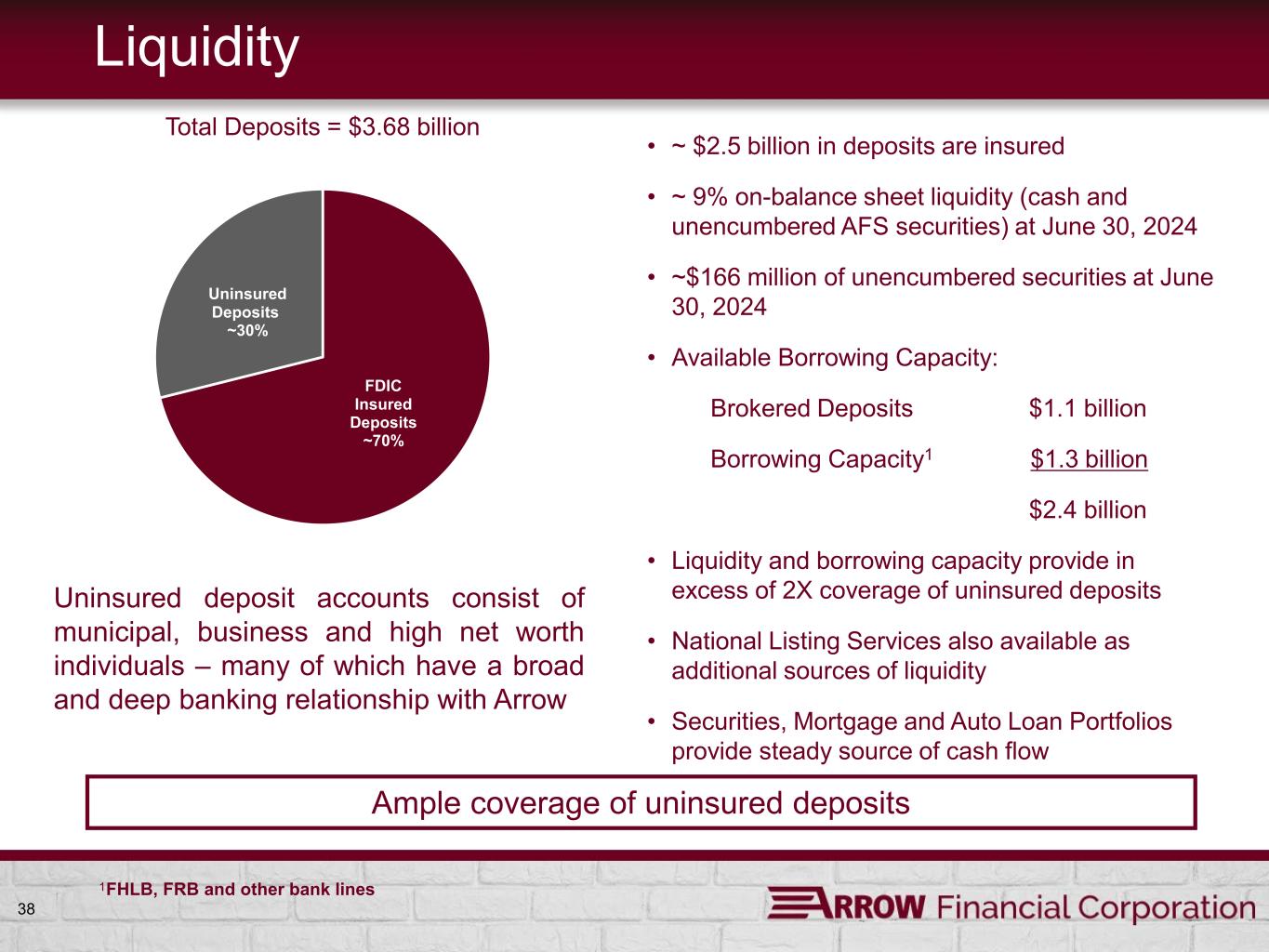

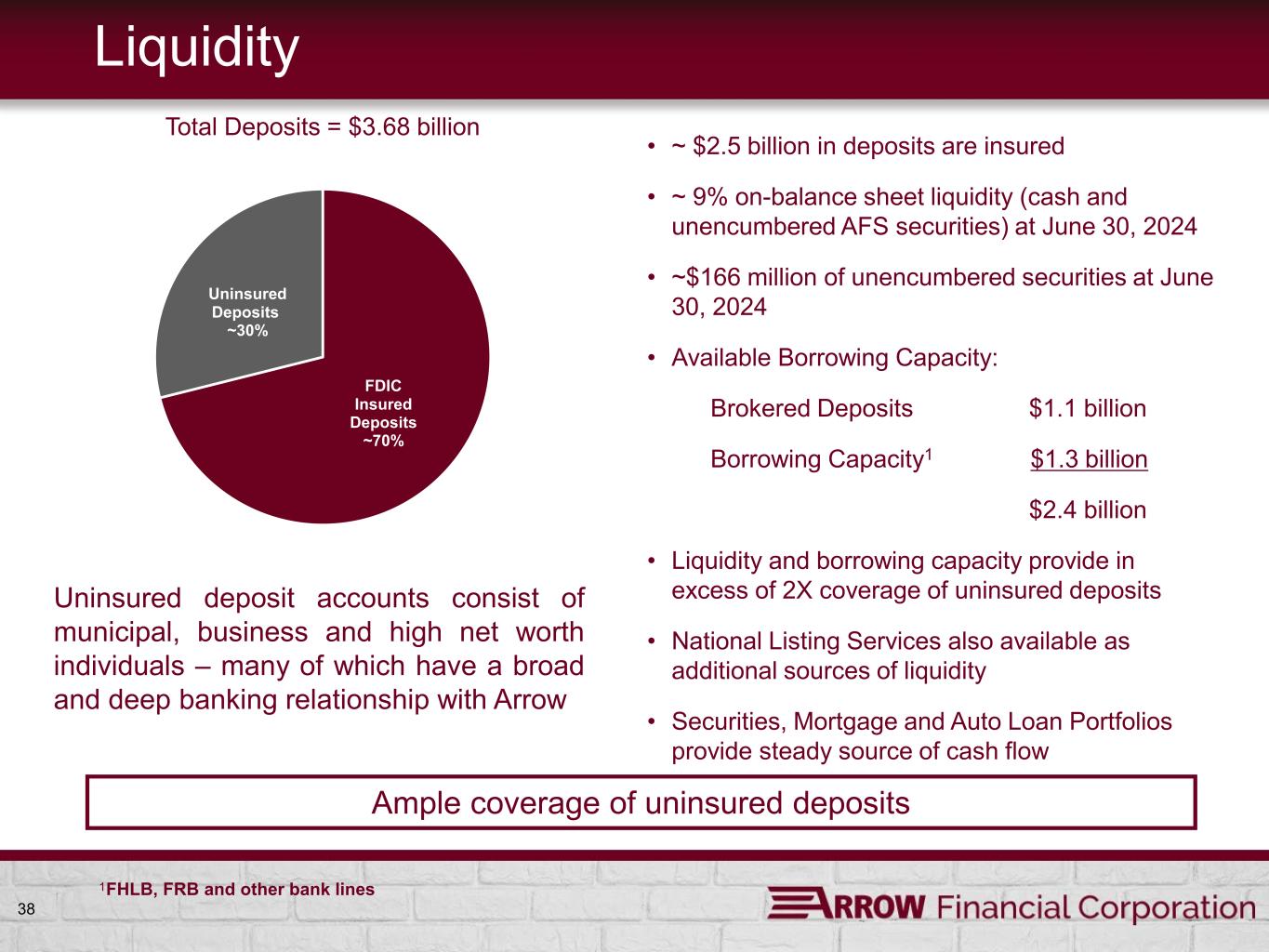

38 Liquidity FDIC Insured Deposits ~70% Uninsured Deposits ~30% Total Deposits = $3.68 billion • ~ $2.5 billion in deposits are insured • ~ 9% on-balance sheet liquidity (cash and unencumbered AFS securities) at June 30, 2024 • ~$166 million of unencumbered securities at June 30, 2024 • Available Borrowing Capacity: Brokered Deposits $1.1 billion Borrowing Capacity1 $1.3 billion $2.4 billion • Liquidity and borrowing capacity provide in excess of 2X coverage of uninsured deposits • National Listing Services also available as additional sources of liquidity • Securities, Mortgage and Auto Loan Portfolios provide steady source of cash flow 1 FHLB, FRB and other bank lines Ample coverage of uninsured deposits Uninsured deposit accounts consist of municipal, business and high net worth individuals – many of which have a broad and deep banking relationship with Arrow

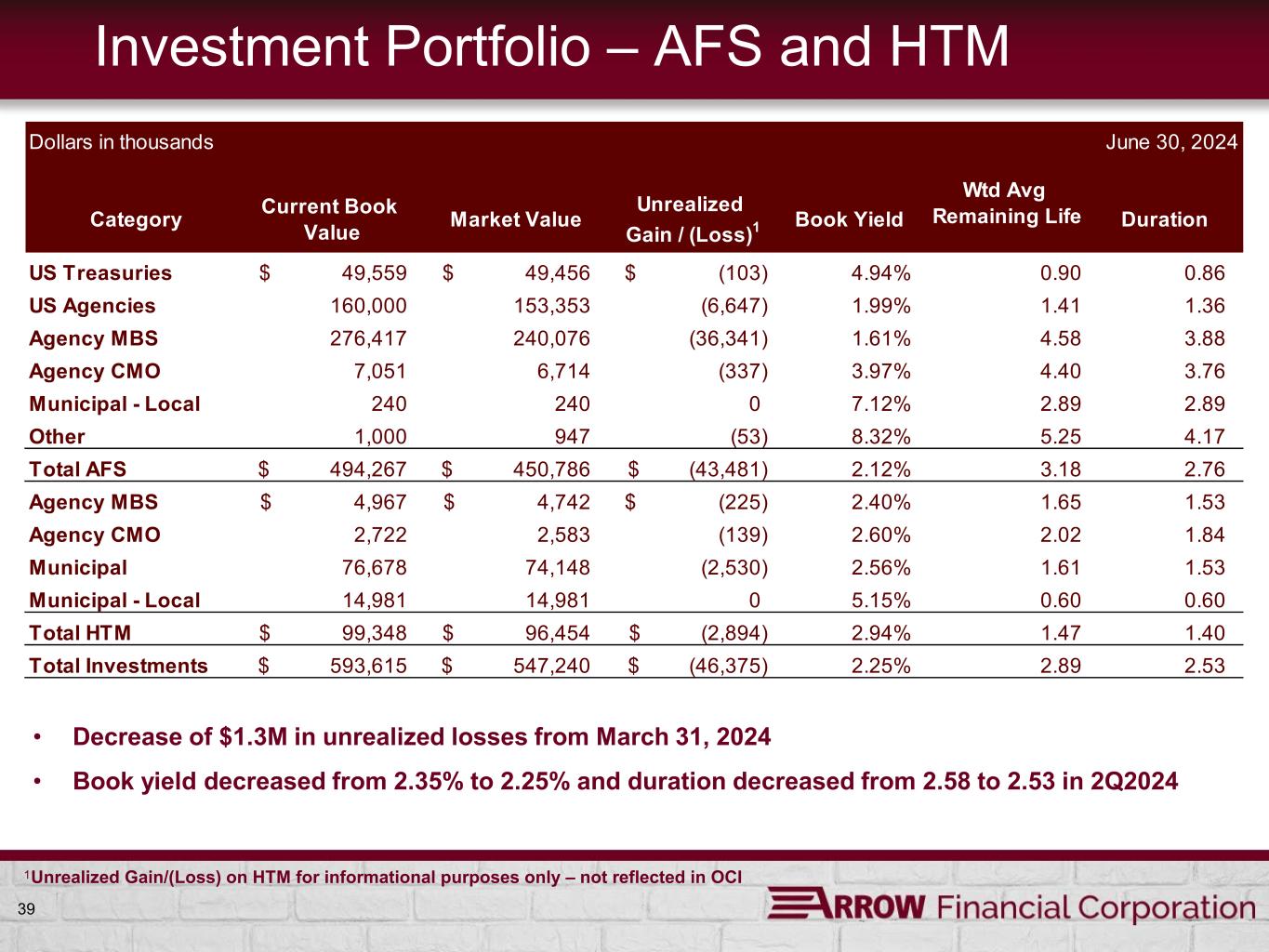

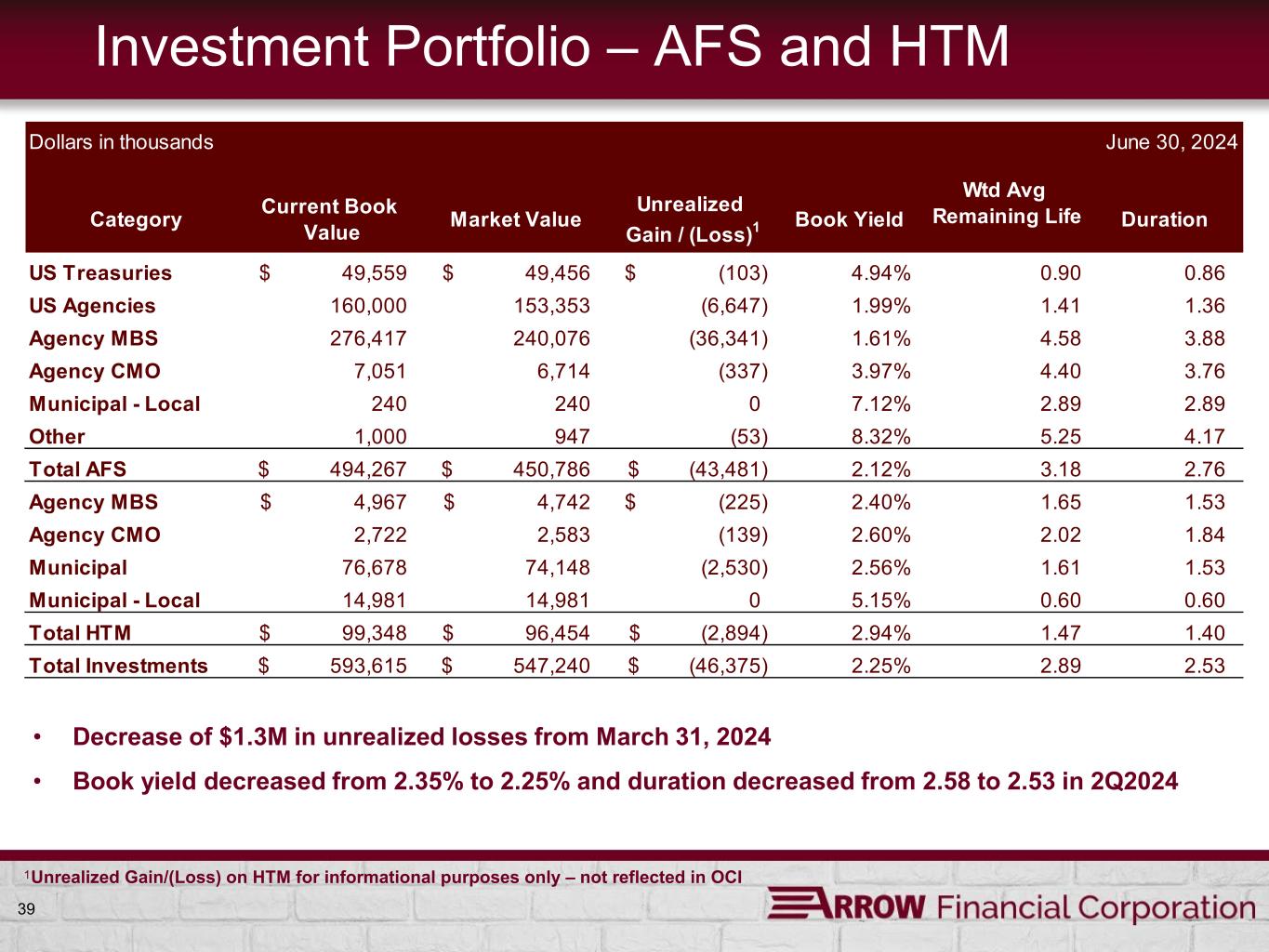

39 Duration Wtd Avg Remaining LifeCurrent Book Value Market ValueCategoy Unrealized Gain / (Loss) Book Yield • Decrease of $1.3M in unrealized losses from March 31, 2024 • Book yield decreased from 2.35% to 2.25% and duration decreased from 2.58 to 2.53 in 2Q2024 Investment Portfolio – AFS and HTM 1 1 Unrealized Gain/(Loss) on HTM for informational purposes only – not reflected in OCI Dollars in thousands June 30, 2024 1.84 593,615$ 547,240$ 2.56% 5.15% 2.94% 2.25% (2,530) 0 (2,894)$ Duration 1.36 3.88 3.76 2.89 Wtd Avg Remaining Life 1.41 4.58 4.40 1.53 0.60 1.40 2.89 5.25 3.18 1.65 2.02 1.61 0.60 1.47 2.89 4.17 2.76 1.532.40% 2.60% 96,454$ Agency MBS Agency CMO Municipal Municipal - Local Total HTM 74,148 99,348$ (225)$ (139) Category 2.53 7,051 6,714 (337) 3.97% 276,417 240,076 (36,341) 1.61% Unrealized Gain / (Loss)1 Book Yield 1.99% Current Book Value 160,000 Total Investments US Agencies 240 1,000 494,267$ 4,967$ Agency MBS (46,375)$ Market Value 153,353 76,678 14,981 2,722 2,583 14,981 240 947 450,786$ 4,742$ 49,559$ 49,456$ (103)$ 4.94% 0.90 0.86 (6,647) Agency CMO Municipal - Local Other Total AFS US Treasuries 7.12% 8.32% 2.12% 0 (53) (43,481)$

Overview and History 40

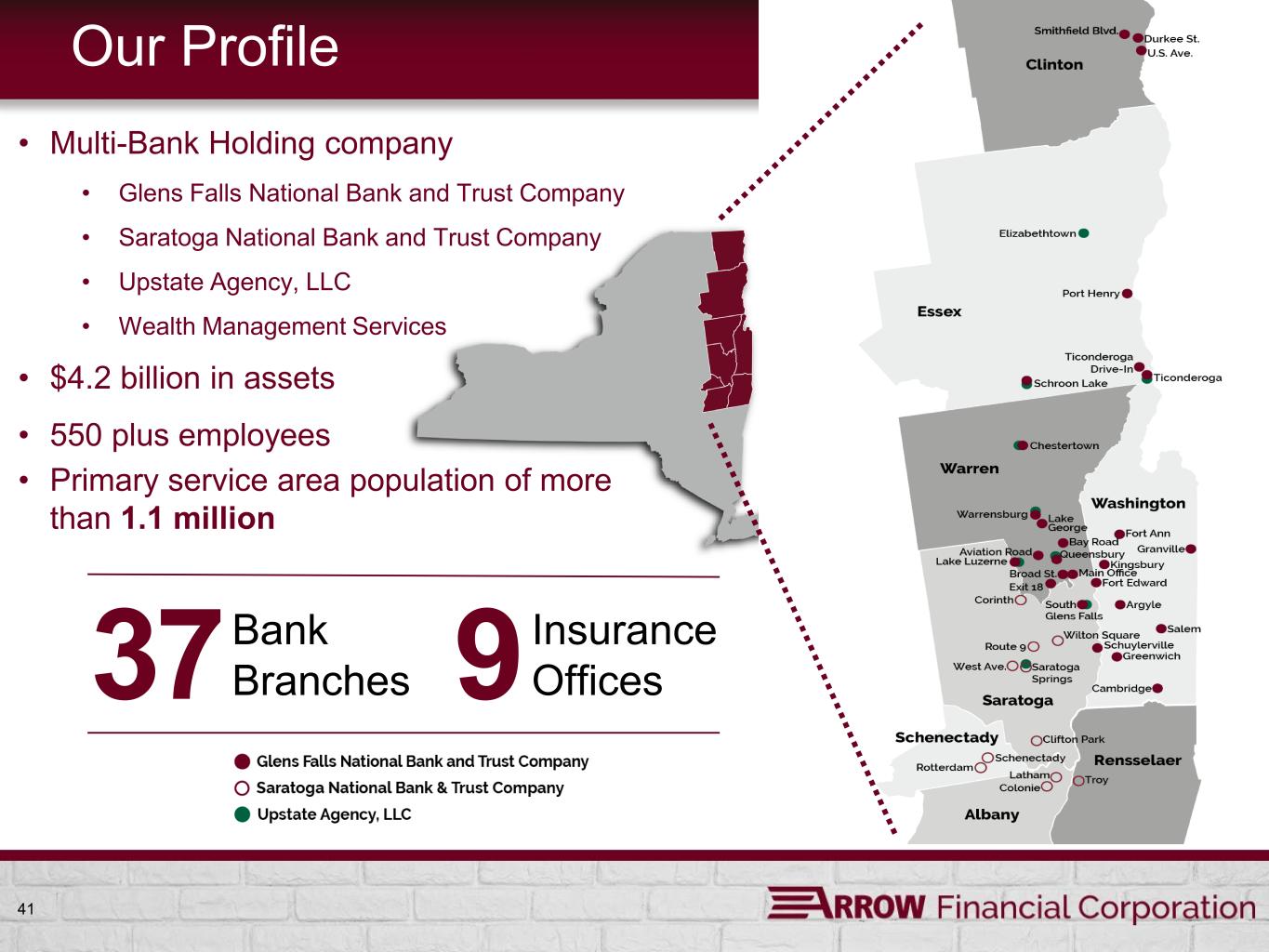

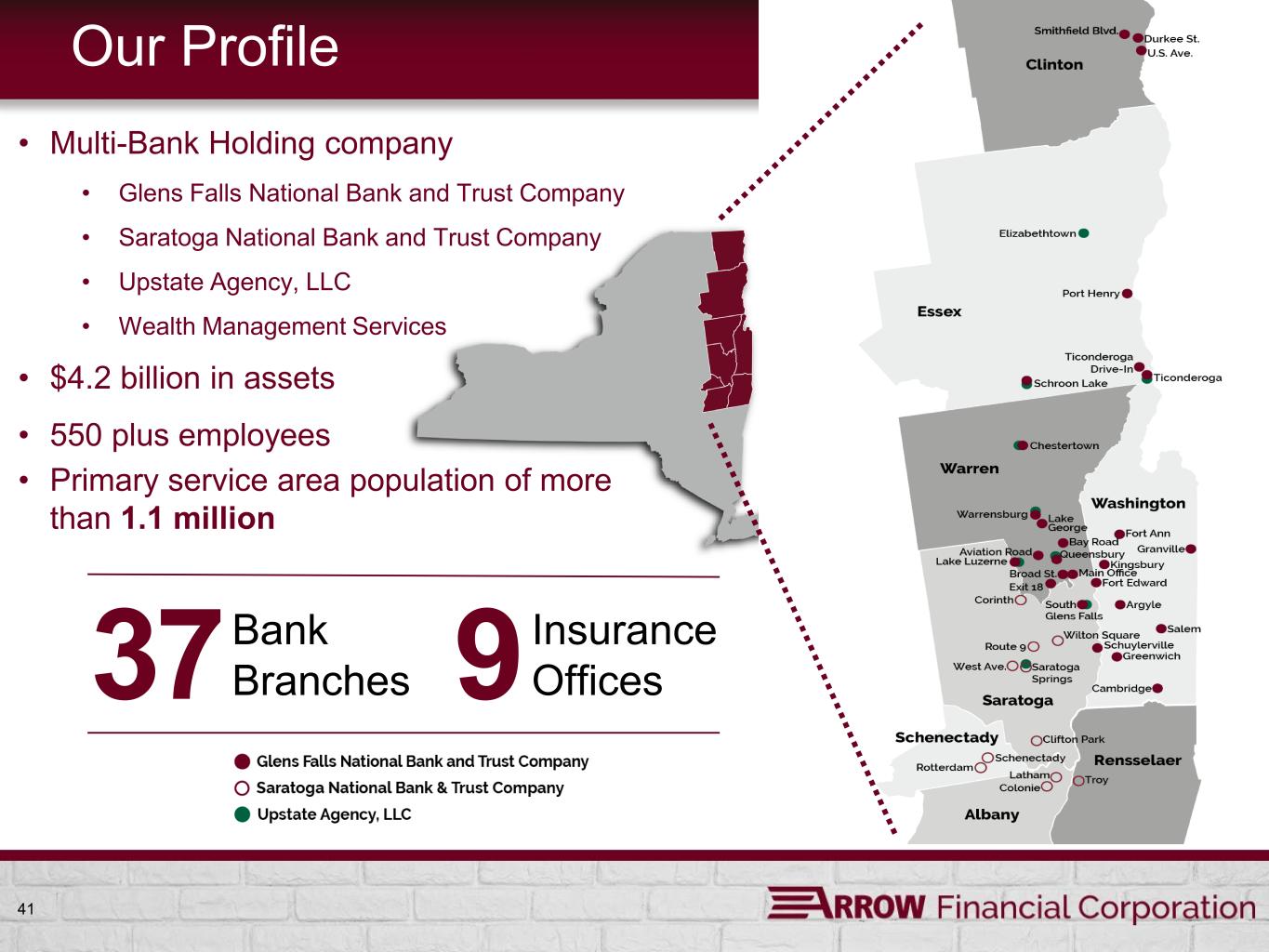

41 Our Profile Insurance Offices Bank Branches 937 • Multi-Bank Holding company • Glens Falls National Bank and Trust Company • Saratoga National Bank and Trust Company • Upstate Agency, LLC • Wealth Management Services • $4.2 billion in assets • 550 plus employees • Primary service area population of more than 1.1 million

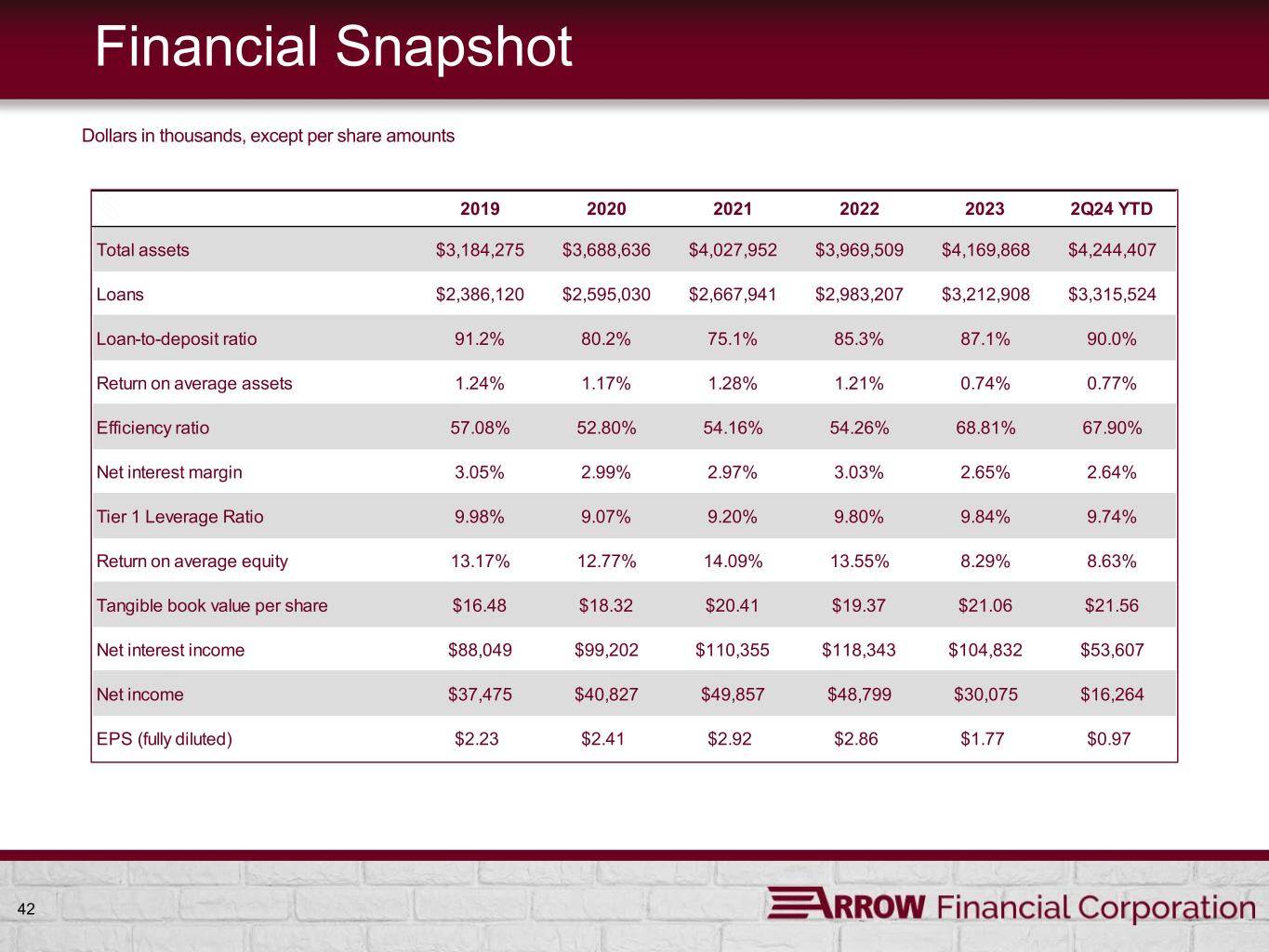

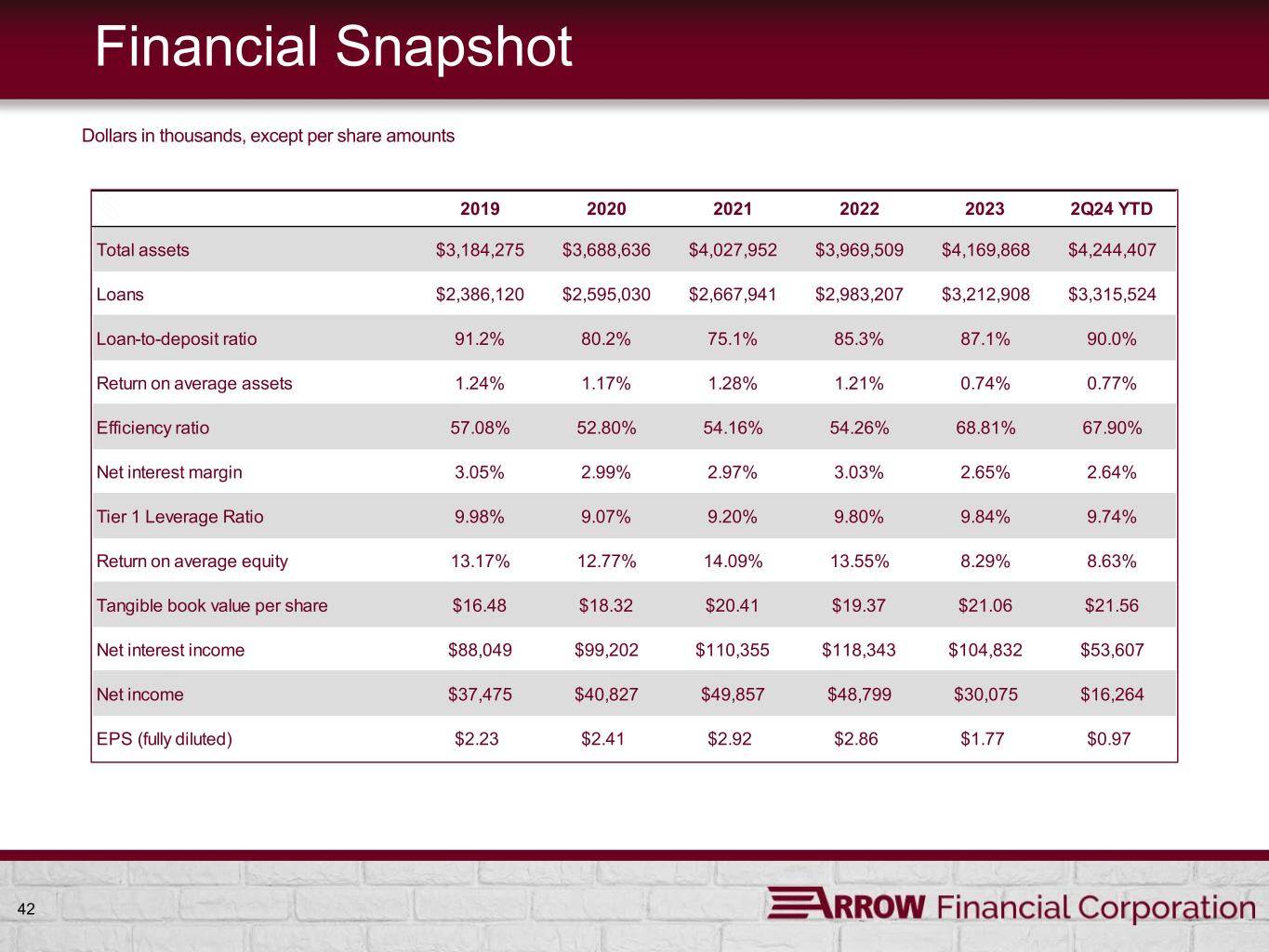

42 Financial Snapshot 2019 2020 2021 2022 2023 2Q24 YTD Total assets $3,184,275 $3,688,636 $4,027,952 $3,969,509 $4,169,868 $4,244,407 Loans $2,386,120 $2,595,030 $2,667,941 $2,983,207 $3,212,908 $3,315,524 Loan-to-deposit ratio 91.2% 80.2% 75.1% 85.3% 87.1% 90.0% Return on average assets 1.24% 1.17% 1.28% 1.21% 0.74% 0.77% Efficiency ratio 57.08% 52.80% 54.16% 54.26% 68.81% 67.90% Net interest margin 3.05% 2.99% 2.97% 3.03% 2.65% 2.64% Tier 1 Leverage Ratio 9.98% 9.07% 9.20% 9.80% 9.84% 9.74% Return on average equity 13.17% 12.77% 14.09% 13.55% 8.29% 8.63% Tangible book value per share $16.48 $18.32 $20.41 $19.37 $21.06 $21.56 Net interest income $88,049 $99,202 $110,355 $118,343 $104,832 $53,607 Net income $37,475 $40,827 $49,857 $48,799 $30,075 $16,264 EPS (fully diluted) $2.23 $2.41 $2.92 $2.86 $1.77 $0.97 Dollars in thousands, except per share amounts

43 Our History 1851 Glens Falls Bank opened for business in a newly constructed building on Ridge Street. 1932 1912 > 1949 Changed name to Glens Falls National Bank and Trust Company. Broke ground at 250 Glen Street — our current headquarters. > 1965 addition 1981 Glens Falls National Bank (GFNB) went public on NASDAQ as GFAL. 1983 Formed Arrow Bank Corporation (now Arrow Financial Corporation) and trading began on NASDAQ as AROW.

44 Our History 1988 Formed Saratoga National Bank and Trust Company (SNB) and expanded footprint 1999 Surpassed $1 billion in assets 2004 2021 Bought first insurance agency Topped $4 billion in assets. 2018 Consolidated our insurance business into the Upstate Agency brand. 2012 Reached $2 billion in assets. 2001 Added to the Russell 2000 Index

45 President and Chief Executive Officer Mr. DeMarco joined the Company in 1987 as a commercial lender and since that time has served in positions of increasing responsibility within the organization. In 2012, he was named President and CEO of Saratoga National Bank. In May 2023, he was named President and CEO of Arrow Financial Corporation and Glens Falls National Bank. He holds a bachelor’s degree in finance from the University of Texas at Austin. Mr. DeMarco is a graduate of the Adirondack Regional Chamber of Commerce’s Leadership Program and the Stonier Graduate School of Banking. He serves as a Director of the Company and its subsidiary banks and sits on the boards of various non-profits dedicated to healthcare and economic development. David S. DeMarco, President and CEO

46 Experienced Leadership Team Mr. Kaiser joined the Company in 2001 as Vice President and Commercial Loan Officer. He served as Corporate Banking Manager and was later promoted to Senior Vice President, before being named Chief Credit Officer in 2011, followed by promotions to Executive Vice President and Senior Executive Vice President. Prior to joining the Company, he spent 15 years in the Capital Region as a Commercial Loan Officer. Mr. Kaiser has a bachelor’s degree in business administration from Siena College. Mr. Kaiser actively serves on boards of numerous community organizations. David D. Kaiser, Senior Executive Vice President and CCO Mr. Ivanov joined the Company in 2023 with more than 30 years of experience in Financial Planning & Analysis, Controllership, SOX, Financial Reporting and Treasury. Mr. Ivanov previously served as CFO for Bankwell Financial Group, helping it almost double in size over six-plus years to $3.3 billion. He has held CFO positions at Darien Rowayton Bank and for Doral Bank’s U.S. Operations. He began his career with Ernst & Young and held accounting/ finance positions at PepsiCo, GE Capital and Bridgewater Associates. Mr. Ivanov holds an MBA and bachelor’s degree in accounting and finance from the University of South Florida. He is also Six Sigma Black Belt certified. Penko Ivanov, Senior Executive Vice President, CFO, Treasurer and CAO Mr. Wise joined the Company in 2016 as Senior Vice President of Administration for Glens Falls National Bank. He has since been promoted to Senior Executive Vice President and Chief Risk Officer of the Company. He has more than 30 years of experience building and leading both community banks and bank-owned insurance agencies. Mr. Wise previously served as Vice President and CISO for The Adirondack Trust Company and acted as Executive Vice President, COO for Wise Insurance Brokers, Inc. He has extensive experience in designing, implementing and managing workflows and delivering operational efficiency. He holds a bachelor’s degree from Boston University’s School of Management. Andrew J. Wise, Senior Executive Vice President and CRO

47 Experienced Leadership Team Ms. Pancoe joined the Company in 2018 as Director of Human Resources. In her current role as Chief Human Resources Officer, she has executive oversight of the Company’s human resource strategies, which includes organizational design and succession planning, talent acquisition and retention, performance management, professional development and compensation and benefits. Prior to joining the Company, Ms. Pancoe held various human resource management roles within the power generation and engineering services industry. Ms. Pancoe holds a bachelor’s degree in psychology from Clark University in Worcester, MA, and an MBA from the University at Albany. In addition, she maintains a certified professional human resources designation. Brooke Pancoe, Executive Vice President, Chief Human Resources Officer Mr. Yrsha joined the Company in 2015. He currently is the Chief Banking Officer and oversees the strategic direction of the Retail Banking unit, which includes retail deposits and lending, business development, consumer payments, business services, municipal banking, as well as small business and retail lending. In addition, Marc oversees the Wealth Management division and Marketing. Prior to joining our Company, Mr. Yrsha spent time in retail leadership, retail and commercial lending at large regional and community banks within the Arrow footprint. Mr. Yrsha is active in the community serving in leadership roles on a variety of boards. He is a graduate of Castleton University in Vermont and the Adirondack Regional Chamber of Commerce’s Leadership Adirondack Program. Marc Yrsha, Senior Executive Vice President, Chief Banking Officer Mr. Jacobs joined Glens Falls National Bank in 2003 as Information Systems Manager. He was later promoted to Senior Vice President and then Executive Vice President. As Chief Information Officer, Mr. Jacobs guides the Company’s strategic technology plans. He has more than 30 years of experience in the community banking industry, having previously served as Operations Manager at Cohoes Savings Bank and Item Processing Manager at Hudson River Bank and Trust. Mr. Jacobs earned a bachelor’s degree in finance from Siena College and an associate degree in business administration from Hudson Valley Community College. Michael Jacobs, Executive Vice President, Chief Information Officer

Thank You