UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

| ¨ | Registration statement pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934 |

or

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2010

or

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from/to

or

| ¨ | Shell company report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

Date of event requiring this shell company report:

Commission file number 000–12033

TELEFONAKTIEBOLAGET LM ERICSSON

(Exact Name of Registrant as Specified in Its Charter)

LM ERICSSON TELEPHONE COMPANY

(Translation of Registrant’s Name into English)

Kingdom of Sweden

(Jurisdiction of Incorporation or Organization)

SE-164 83 Stockholm, Sweden

(Address of Principal Executive Offices)

Roland Hagman, Vice President Group Function Financial Control

Telephone: +46 8 719 53 80, Facsimile: +46 8 719 42 22

SE-164 83 Stockholm, Sweden

(Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | |

Title of Each Class | | Name of Each Exchange on Which Registered | |

| American Depositary Shares | | | The NASDAQ Stock Market LLC | |

| B Shares* | | | The NASDAQ Stock Market LLC | |

| * | Not for trading, but only in connection with the registration of the American Depositary Shares representing such B Shares pursuant to the requirements of the Securities and Exchange Commission |

Securities registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report:

| | | | |

B shares (SEK 5.00 nominal value) | | | 3,011,595,752 | |

A shares (SEK 5.00 nominal value) | | | 261,755,983 | |

C shares (SEK 1.00 nominal value) | | | 0 | |

Indicate by check mark if the registrant is a well-seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

x Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ¨ International Financial Reporting Standards as issued by the International Accounting Standards Board x Other ¨

Indicate by check mark which financial statement item the registrant has elected to follow. Item 17 x Item 18 ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

CONTENTS

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

FORM 20-F 2010 CROSS REFERENCE TABLE

Our Annual Report on Form 20-F consists of the English version of our Swedish Annual Report for 2010, with certain adjustments made to comply with U.S. requirements, together with certain other information required by Form 20-F which is set forth under the heading Supplemental Information. The following cross reference table indicates where information required by Form 20-F may be found in this document.

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

PART I | | | | | | |

1 | | Identity of Directors, etc. | | N/A | | | | |

| | | |

2 | | Offer Statistics & Timetable | | N/A | | | | |

| | | |

3 | | Key Information | | | | | | |

| | A | | Selected Financial Data | | Five-Year Summary | | | 15 | |

| | | | | | Supplemental Information | | | | |

| | | | | | Exchange Rates | | | 224 | |

| | B | | Capitalization & Indebtedness | | N/A | | | - | |

| | C | | Reason for Offer & Use of Proceeds | | N/A | | | - | |

| | D | | Risk Factors | | Risk Factors | | | 167 | |

| | | |

4 | | Info on the Company | | | | | | |

| | A | | History and Development of the Company | | Our Solutions | | | | |

| | | | | | Mobile Broadband | | | 4 | |

| | | | | | Managed Services | | | 8 | |

| | | | | | Operations & Business Support Systems | | | 9 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Vision | | | 26 | |

| | | | | | Strategy | | | 27 | |

| | | | | | Business Focus | | | 29 | |

| | | | | | Cash Flow—Capital Expenditures | | | 43 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C26 Business Combinations | | | 145 | |

| | | | | | Note C33 Events After the Balance Sheet Date | | | 166 | |

| | | | | | Supplemental Information | | | | |

| | | | | | General Facts on the Company | | | 222 | |

| | | | | | Company History and Development | | | 223 | |

| | B | | Business Overview | | Our Business | | | 3 | |

| | | | | | Our Solutions | | | 4 | |

| | | | | | Our Assets | | | 11 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Vision | | | 26 | |

| | | | | | Strategy | | | 27 | |

| | | | | | Business Focus | | | 29 | |

| | | | | | Business Results | | | 44 | |

| | | | | | Material Contracts | | | 59 | |

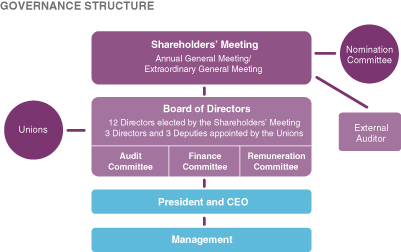

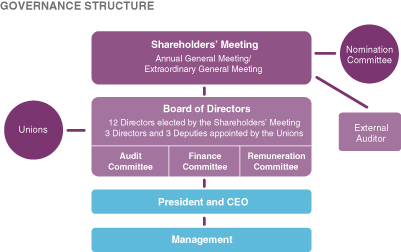

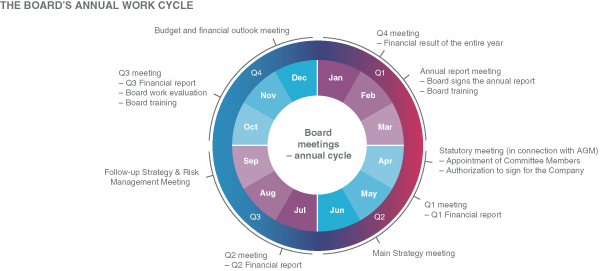

| | | | | | Corporate Governance | | | 59 | |

| | | | | | Sourcing and Supply | | | 61 | |

| | | | | | Sustainability and Corporate Responsibility | | | 61 | |

i

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C3—Segment Information | | | 95 | |

| | | | | | Note C32—Contractual Obligations | | | 166 | |

| | | | | | Risk Factors | | | | |

| | | | | | Market, Technology and Business Risks | | | 167 | |

| | | | | | Regulatory, Compliance and Corporate Governance Risks | | | 172 | |

| | C | | Organizational Structure | | Supplemental Information | | | | |

| | | | | | General Facts on the Company | | | 222 | |

| | | | | | Investments | | | 238 | |

| | D | | Property, Plants and Equipment | | Supplemental Information | | | | |

| | | | | | Primary Manufacturing and Assembly Facilities | | | 224 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C11—Property, Plant and Equipment | | | 110 | |

| | | | | | Note C27—Leasing | | | 149 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Cash Flow—Capital Expenditures | | | 43 | |

4A | | Unresolved Staff Comments | | — | | | | |

| | | |

5 | | Operating & Fin’l Review & Prospects | | — | | | - | |

| | A | | Operating Results | | Our Solutions | | | 4 | |

| | | | | | Our Assets | | | 11 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Business Results | | | 44 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C1—Significant Accounting Policies—Group Companies | | | 73 | |

| | | | | | Note C20—Financial Risk Management and Financial Instruments—Foreign Exchange Risk | | | 133 | |

| | | | | | Risk Factors | | | | |

| | | | | | Regulatory, Compliance and Corporate Governance Risks | | | 172 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Risk Management | | | 60 | |

| | | | | | Supplemental Information | | | | |

| | | | | | Operating Results | | | 225 | |

| | | | | | Taxation | | | 231 | |

| | B | | Liquidity and Capital Resources | | Board of Directors’ Report | | | | |

| | | | | | Financial Position | | | 38 | |

| | | | | | Cash Flow | | | 42 | |

| | | | | | Risk Management | | | 60 | |

ii

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C19—Interest-Bearing Liabilities | | | 132 | |

| | | | | | Note C20—Financial Risk Management and Financial Instruments | | | 133 | |

| | | | | | Note C25—Statement of Cash Flows | | | 143 | |

| | C | | R&D, Patents & Licenses | | Five-Year Summary | | | 15 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Strategy—Technology Leadership | | | 27 | |

| | | | | | Business Focus—Technology | | | 31 | |

| | | | | | Financial Results of Operations—Operating expenses | | | 36 | |

| | | | | | Consolidated Financial Statements | | | | |

| | | | | | Consolidated Income Statement and Statement of Comprehensive Income | | | 68 | |

| | D | | Trend Info | | Our Solutions | | | 4 | |

| | | | | | Our Assets | | | 11 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Business Results | | | 44 | |

| | E | | Off-Balance Sheet Arrangements | | Board of Directors’ Report | | | | |

| | | | | | Financial Position—Off-balance sheet arrangements | | | 41 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C14—Trade Receivables and Customer Finance—Credit Risk—Finance Credit Risk | | | 115 | |

| | | | | | Note C24—Contingent Liabilities | | | 143 | |

| | F | | Tabular Disclosure of Contractual Obligations | | Board of Directors’ Report | | | | |

| | | | | | Material Contracts | | | 59 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C32—Contractual Obligations | | | 166 | |

6 | | Directors, Senior Management and Employees | | | - | |

| | A | | Directors & Senior Management | | Corporate Governance Report 2010 | | | | |

| | | | | | Members of the Board of Directors | | | 202 | |

| | | | | | Members of the Executive Leadership Team | | | 211 | |

| | B | | Compensation | | Board of Directors’ Report | | | | |

| | | | | | Corporate Governance | | | 59 | |

| | | | | | Corporate Governance Report 2010 | | | | |

| | | | | | Committees of the Board of Directors—Remuneration Committee—Remuneration to Board members | | | 201 | |

| | | | | | Members of the Executive Leadership Team | | | 211 | |

| | | | | | Remuneration Report | | | 177 | |

iii

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C17—Post-Employment Benefits | | | 124 | |

| | | | | | Note C29—Information Regarding Members of the Board of Directors, the Group Management and Employees | | | 151 | |

| | C | | Board Practices | | Corporate Governance Report 2010 | | | | |

| | | | | | Board of Directors | | | 192 | |

| | | | | | Members of the Board of Directors | | | 202 | |

| | | | | | Members of the Executive Leadership Team | | | 211 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C29—Information Regarding Members of the Board of Directors, the Group Management and Employees | | | 151 | |

| | D | | Employees | | Five Year Summary | | | 15 | |

| | | | | | Board of Directors’ Report | | | | |

| | | | | | Business Focus | | | 29 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C29—Information Regarding Members of the Board of Directors, the Group Management and Employees | | | 151 | |

| | E | | Share Ownership | | Share Information | | | | |

| | | | | | Shareholders | | | 22 | |

| | | | | | Corporate Governance Report 2010 | | | | |

| | | | | | Members of the Board of Directors | | | 202 | |

| | | | | | Members of the Executive Leadership Team | | | 211 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C29—Information Regarding Members of the Board of Directors, the Group Management and Employees | | | 151 | |

| | | |

7 | | Major S/Hs and Related Party Transactions | | | | | | |

| | A | | Major Shareholders | | Share Information | | | | |

| | | | | | Shareholders | | | 22 | |

| | B | | Related Party Transactions | | | | | | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C30—Related Party Transactions | | | 162 | |

iv

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

| | C | | Interests of Experts & Counsel | | N/A | | | — | |

| | | |

8 | | Financial Information | | | | | | |

| | A | | Consolidated Statements and Other Financial Information | | Consolidated Financial Statements | | | 68 | |

| | | | | | Please see also Item 17 cross references | | | | |

| | | | | | Report of Independent Registered Public Accounting Firm | | | 67 | |

| | | | | | Notes to the Consolidated Financial Statements | | | 73 | |

| | | | | | Note C4 Net Sales | | | 102 | |

| | | | | | Supplemental Information | | | | |

| | | | | | Memorandum and Articles of Association—Dividends | | | 228 | |

| | B | | Significant Changes | | Board of Directors’ Report | | | | |

| | | | | | Post-Closing Events | | | 66 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C33—Events After the Balance Sheet Date | | | 166 | |

| | | |

9 | | The Offer and Listing | | | | | | |

| | A | | Offer and Listing Details | | Share Information | | | | |

| | | | | | Offer and Listing Details | | | 20 | |

| | B | | Plan of Distribution | | N/A | | | | |

| | C | | Markets | | Share Information | | | | |

| | | | | | Stock Exchange Trading | | | 16 | |

| | D | | Selling Shareholders | | N/A | | | | |

| | E | | Dilution | | N/A | | | | |

| | F | | Expenses of the issue | | N/A | | | | |

| | | |

10 | | Additional Information | | | | | | |

| | A | | Share Capital | | N/A | | | | |

| | B | | Articles of Association | | Supplemental Information | | | | |

| | | | | | Memorandum and Articles of Association | | | 228 | |

| | C | | Material Contracts | | Board of Directors’ Report | | | | |

| | | | | | Material Contracts | | | 59 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C32 Contractual Obligations | | | 166 | |

| | D | | Exchange Controls | | Supplemental Information | | | | |

| | | | | | Exchange Controls | | | 231 | |

| | E | | Taxation | | Supplemental Information | | | | |

| | | | | | Taxation | | | 231 | |

| | F | | Dividends and paying agents | | N/A | | | | |

| | G | | Statement by Experts | | N/A | | | | |

| | H | | Documents on Display | | Supplemental Information | | | | |

| | | | | | General Facts on the Company | | | 222 | |

| | I | | Subsidiary Information | | N/A | | | | |

v

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

11 | | Quantitative and Qualitative Disclosures

About Market Risk | | | | | | |

| | A | | Quantitative Information about Market Risk | | Board of Directors’ Report | | | | |

| | | | | | Risk Management | | | 60 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C20—Financial Risk Management and Financial Instruments | | | 133 | |

| | B | | Qualitative Information about Market Risk | | Board of Directors’ Report | | | | |

| | | | | | Risk Management | | | 60 | |

| | | | | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C20—Financial Risk Management and Financial Instruments | | | 133 | |

| | C | | Interim Periods | | N/A | | | | |

| | D | | Safe Harbor | | N/A | | | | |

| | E | | Small Business Issuers | | N/A | | | | |

| | | |

12 | | Description of Securities Other than Equity Securities | | | | | | |

| | A | | Debt Securities | | N/A | | | | |

| | B | | Warrants and Rights | | N/A | | | | |

| | C | | Other Securities | | N/A | | | | |

| | D | | American Depositary Shares | | Supplemental Information | | | | |

| | | | | | Depositary Fees and Charges | | | 235 | |

PART II | | | | | | |

| | | |

13 | | Defaults, Dividends, Arrearages and Delinquencies | | N/A | | | | |

| | | |

14 | | Material Modifications to the Rights of SecurityHolders and Use of Proceeds | | N/A | | | | |

| | | |

15 | | Controls and Procedures | | — | | | — | |

| | A | | Disclosure Controls and Procedures | | Corporate Governance Report 2010 | | | | |

| | | | | | Disclosure Controls and Procedures | | | 216 | |

| | B | | Management’s annual report on internal control over financial reporting | | Management’s report on internal control over financial reporting | | | 221 | |

| | | | | | | | | | |

| | C | | Attestation report of the registered public accounting firm | | | | | | |

| | D | | Changes in internal control over financial reporting | | | | | | |

vi

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

| | | | | | | | | | |

Form 20-F Item Heading | | Location in Document | | Page

Number | |

16 | | Reserved | | — | | | — | |

| | | | |

| | A | | Audit Committee Financial Expert | | Corporate Governance Report 2010 | | | | |

| | | | | | Audit Committee—Members of the Audit Committee | | | 198 | |

| | B | | Code of Ethics | | Corporate Governance Report 2010 | | | | |

| | | | | | Code of Business Ethics | | | 187 | |

| | C | | Principal Accountant Fees and Services | | Notes to the Consolidated Financial Statements | | | | |

| | | | | | Note C31 Fees to Auditors | | | 165 | |

| | | | | | Corporate Governance Report 2010 | | | | |

| | | | | | Committees of the Board of Directors—Audit Committee | | | 197 | |

| | D | | Exemptions from the Listing Standards for Audit Committees | | Corporate Governance Report 2010 | | | | |

| | | | | | Board of Directors—Independence | | | 193 | |

| | | | | | Supplemental Information | | | | |

| | | | | | Independence Requirements | | | 236 | |

| | E | | Purchase of Equity Securities by the Issuer and Affiliated Purchasers | | N/A | | | | |

| | F | | Change in Registrant’s Certifying Accountant | | N/A | | | | |

| | G | | Corporate Governance | | Corporate Governance Report 2010 | | | | |

| | | | | | Board of Directors—Independence | | | 193 | |

| | | | | | Supplemental Information | | | | |

| | | | | | Independence Requirements | | | 236 | |

| | |

PART III | | | | | | |

| | | |

17 | | Financial Statements | | — | | | — | |

| | | | | | Consolidated Income Statement and Statement of Comprehensive Income | | | 68 | |

| | | | | | Consolidated Balance Sheet | | | 70 | |

| | | | | | Consolidated Statement of Cash Flows | | | 71 | |

| | | | | | Consolidated Statement of Changes in Equity | | | 72 | |

| | | | | | Notes to the Consolidated Financial Statements | | | 73 | |

| | | | | | Note C1—Significant Accounting Policies | | | 73 | |

| | | | | | Note C16—Equity and Other Comprehensive Income | | | 119 | |

| | | | | | Report of Independent Registered Public Accounting Firm | | | 67 | |

| | | |

18 | | Financial Statements | | N/A | | | | |

vii

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

19 Exhibits

| | | | | | |

Form 20-F Item Heading | | Location in this document | | Page

Number | |

Exhibit 1 | | Articles of Association | | | | |

Exhibit 2 | | Not applicable | | | | |

Exhibit 3 | | Not applicable | | | | |

Exhibit 4 | | Not applicable | | | | |

Exhibit 5 | | Not applicable | | | | |

Exhibit 6 | | Please see Notes to the Consolidated Financial Statements, Note C1 Significant Accounting Policies | | | 73 | |

Exhibit 7 | | For definitions of certain ratios used in this report, please see Financial Terminology | | | 246 | |

Exhibit 8 | | Please see Supplemental Information, Investments | | | 238 | |

Exhibit 9 | | Not applicable | | | | |

Exhibit 10 | | Not applicable | | | | |

Exhibit 11 | | Our Code of Business Ethics and Conduct is included on our web site at www.ericsson.com/bg/res/thecompany/docs/corporate-responsibility/2009/cobe/cobe_english.pdf | | | | |

| | | | | | |

Exhibit 12 | | 302 Certifications | | | | |

| | | | | | |

Exhibit 13 | | 906 Certifications | | | | |

| | | | | | |

Exhibit 14 | | Not applicable | | | | |

| | | | | | |

Exhibit 15.1 | | Consent of Independent Registered Public Accounting Firm | | | | |

| | | | | | |

Exhibit 15.2 | | Consolidated Financial Statements of Sony Ericsson Mobile Communications AB | | | | |

| | | | | | |

Exhibit 15.3 | | Consent of Independent Registered Public Accounting Firm | | | | |

viii

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

LETTER FROM HANS VESTBERG

“LONG-TERM GROWTH AND PROFITABILITY ARE ERICSSON’S CHARACTERISTICS”

| | |

| FINANCIAL RESULTS IN SHORT | | |

| |

NET SALES | | NET CASH |

| |

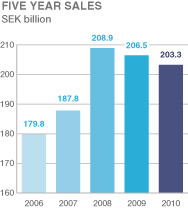

SEK 203.3 (206.5) billion | | SEK 51.3 (36.1) billion |

| |

OPERATING MARGIN* | | EARNINGS PER SHARE |

| |

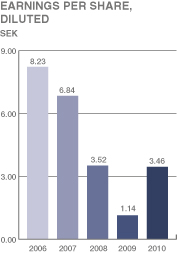

12% (12%) | | SEK 3.46 (1.14) |

| |

NET INCOME | | |

| |

SEK 11.2 (4.1) billion | | |

Dear shareholders,

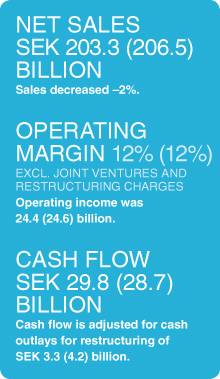

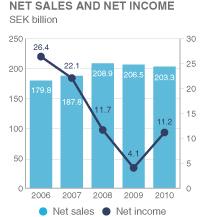

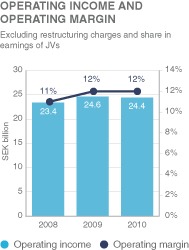

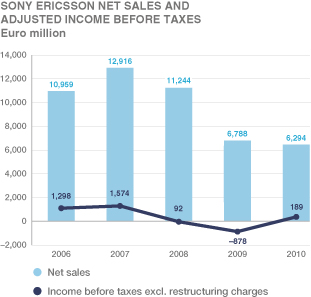

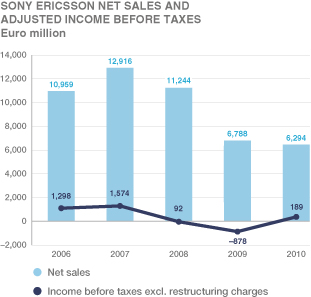

In 2010, Group sales decreased –2 percent to SEK 203.3 billion. Our operating margin, before JV’s and excluding restructuring charges, was flat at 12 percent. Net income increased 172 percent to SEK 11.2 billion, mainly due to improvements in earnings in our joint venture Sony Ericsson and less restructuring charges.

In the first half of 2010, we were still impacted by the economic slowdown in the world. In the latter part of the year, sales of mobile broadband took off, especially in North America and Japan. This was driven by a strong increase in mobile data traffic.

During the year, we struggled with the industry-wide component shortage. While the supply of components has now normalized we are still not fully meeting the increased demand on certain mobile broadband products due to the increased customer demand.

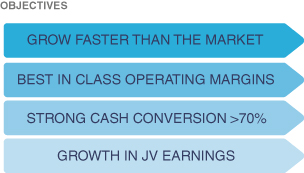

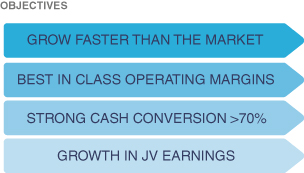

We have four Group targets that should secure increased shareholder value: grow faster than the market, deliver best-in-class margins, cash conversion of more than 70 percent and improved earnings in our JVs.

Early market data indicates that we kept our market shares in our network and services businesses. We delivered the industry’s best-in-class margins and achieved a cash conversion of 112 percent. The fourth target, growth in JV earnings, was partly reached thanks to better performance in Sony Ericsson.

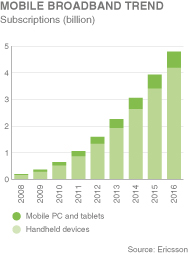

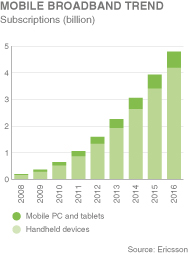

2010 was the year when mobile broadband took off. The number of mobile subscriptions increased by more than 60 percent to about 600 million and the number is forecasted to almost double and hit 1 billion this year.

Once you are connected, you want connectivity 24/7, wherever you are.

This will become a reality for more and more people since we will see more smartphones in the market, and also more affordable ones. Embedded mobile broadband modules will become standard in laptops and other devices. To meet this consumer demand, network speed, capacity and quality are prerequisites.

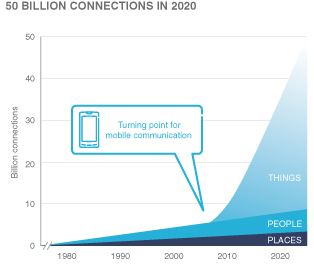

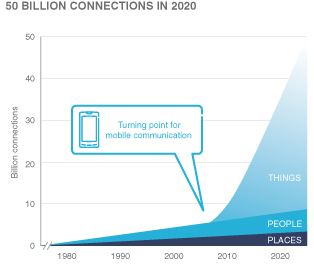

In the networked society, everything that benefits from a connection will be connected. We have spoken about how 50 billion devices will be networked by 2020. We are already today enabling the networked society: from the concept of building future networks in demanding urban settings, to our networks which recently attained speeds of 168 Mbps on HSPA—to our business in TV and media, and our services, which help manage and integrate the complex networks that are behind the networked society.

| * | Excluding restructuring charges and share in earnings of JVs |

1

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

Of course our joint ventures bring devices into the picture, and we are finding that this is getting more and more personal for consumers. No longer is the device only a tool for them; it is part of themselves that they want to have alongside them during their daily lives.

Finally, I would like to sincerely thank all our highly dedicated and skilled employees for their efforts in 2010. In 2011, we will focus even more on understanding and meeting our customer demand, ultimately seeking increased value for our shareholders. Continued long-term growth and profitability are Ericsson’s characteristics, along with a healthy financial position.

Hans Vestberg

President and CEO

2

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

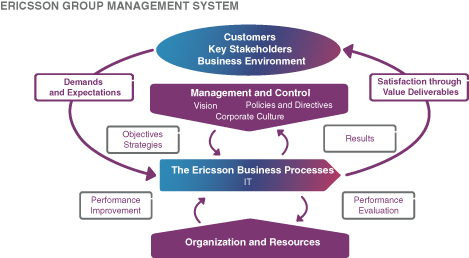

OUR BUSINESS

Communication technology is positively changing the way we work and live. As a leading provider of communications infrastructure, services and multimedia solutions, Ericsson strives to enable this change. We constantly innovate to empower people, business and society.

Network infrastructure provides the fundamentals for people to communicate. Today, more than 40 percent of the world’s mobile traffic passes through networks provided by Ericsson. The networks we support for operators serve more than 2 billion subscriptions.

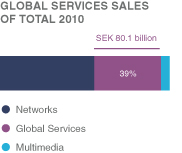

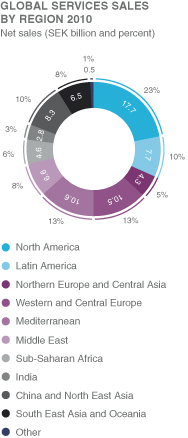

We are also a global leader in telecom services, which accounts for close to 40 percent of our revenues.

Currently, we serve approximately 400 customers, most of whom are network operators. Our ten largest customers account for 46 percent of our net sales.

New customers include TV and media companies as well as utility companies.

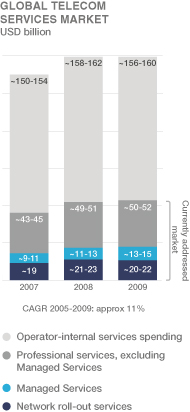

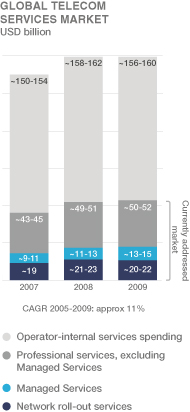

Our total addressable market was estimated at approximately USD 200 billion in 2009 (excluding joint ventures’ markets).

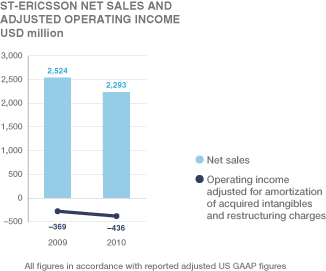

To best reflect our business, we report five business segments, two of which are the joint ventures Sony Ericsson and ST-Ericsson.

ERICSSON

NETWORKS

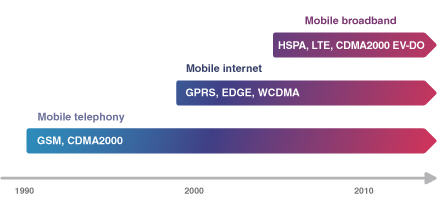

Segment Networks develops and delivers mobile and fixed infrastructure equipment and related software. We pioneered 2G/GSM and 3G/WCDMA mobile technologies. We now provide 4G/LTE as the evolution of mobile broadband and toward all-IP environments. Our portfolio also includes CDMA solutions as well as xDSL, fiber and microwave transmission.

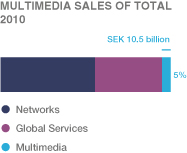

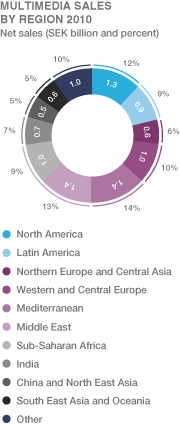

MULTIMEDIA

Segment Multimedia develops and delivers software-based solutions for real-time & on-demand TV, consumer & business applications and Business Support Systems (BSS) for telecom operators. Revenue management, i.e. software based solutions for charging and billing, is part of BSS.

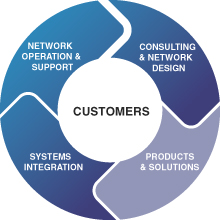

GLOBAL SERVICES

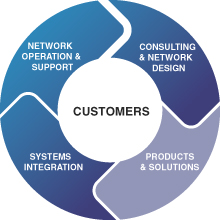

With more than 45,000 services professionals globally, we have robust local capabilities with global expertise in managed services, consulting, systems integration, customer support and network rollout. We manage complex projects with advanced IS/IT competence and multi-vendor experience.

JOINT VENTURES

SONY ERICSSON

Sony Ericsson offers mobile phones, accessories, content and applications. Sony Ericsson is a 50/50 joint venture with Sony Corporation.

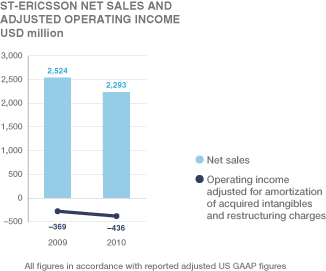

ST-ERICSSON

ST-Ericsson offers wireless platforms and semiconductors for leading handset manufacturers. ST-Ericsson is a 50/50 joint venture with STMicroelectronics.

3

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

OUR SOLUTIONS

We are shifting our focus toward a more solutions-oriented sales process. During the year, we therefore organized our portfolio into seven solution areas to better address customer needs. Here we describe our solutions, the business drivers and the market trends.

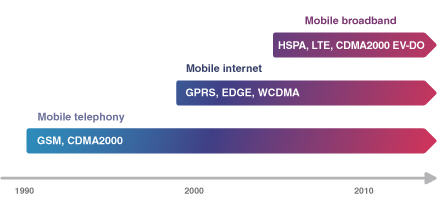

MOBILE BROADBAND

User trends

| | 1. | Smartphones change behavior |

| | 3. | Demand for 24/7 internet connectivity |

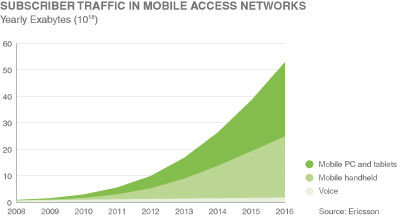

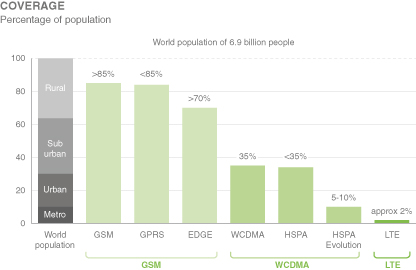

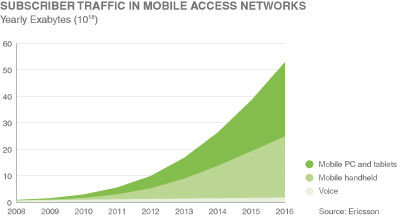

24/7 connectivity to the internet is becoming an essential part of modern life. During the year, we met increased demand for mobile broadband infrastructure and services. The accelerated demand was fuelled by smartphones and notebooks, coupled with sharply rising usage of video services (like YouTube). Mobile data traffic more than doubled in 2010 and is expected to double annually over the coming three years.

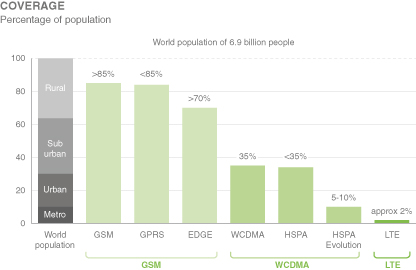

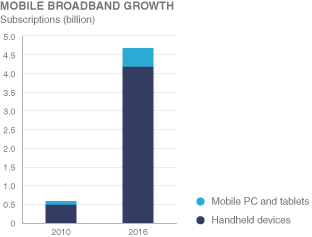

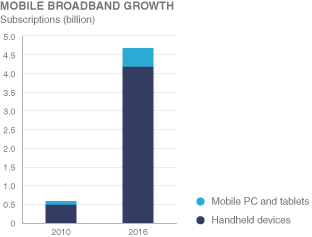

Expansion opportunities

Today, we are doing for broadband what we did for voice 20 years ago—making it mobile and affordable for the vast majority of people. Mobile subscriptions worldwide have reached approximately 5.3 billion of which approximately ten percent are now on mobile broadband. We estimate the number of mobile broadband subscriptions to reach almost 5 billion in 2016, the vast majority being for smartphones.

Our broadband solutions not only include equipment but also business advice, systems integration and roll-out service for fast implementation of cost-effective solutions.

4

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

Meeting the need for speed

To accommodate the massive growth in data traffic, operators are turning to us to boost capacity and speed in their networks. Networks are continuously being upgraded as the number of data users and data volume transported increase. All Ericsson-supplied commercial WCDMA networks have now been upgraded to HSPA. Four of our customers have launched 4G/LTE networks in 2010, covering 140 million people, 60 percent of whom are served by Ericsson LTE equipment.

On the devices side, notebooks and other electronic devices are equipped with our latest 3G/HSPA broadband modules, delivering speeds of up to 21 Mbps.

Operators implement tiered pricing

When mobile broadband was introduced, many operators offered flat rates and unlimited usage to encourage fast uptake of service. A challenge for operators today is to secure user experience and increase revenue from mobile broadband. The answer is differentiated service offerings. Tiered pricing and innovative business models are becoming more common. The user can thus select and pay for a subscription with a certain service level. Voice still represents the main source of revenue for operators. Data traffic accounts for approximately 30 percent of total revenues on average and will represent the majority of future growth.

5

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

Ramp up of our RBS 6000

The multi-standard radio base station, RBS 6000, can run 2G/GSM, 3G/WCDMA and 4G/LTE technologies in the same unit, using different frequency spectrum bands. The RBS 6000 takes up 25 percent less space and reduces power consumption by up to 65 percent compared to previous-generation RBSs. This is a significant saving as operators may spend up to 50 percent of operating expenses on power. Many operators are therefore looking to modernize their radio networks with the RBS 6000. Modernization projects often involve a high degree of consulting, systems integration and network rollout.

Core networks may also need capacity upgrades to accommodate increasing data traffic and speed. Our 4G/LTE core network, the Evolved Packet Core, is an all-IP network, supporting both mobile and fixed access. Our 2G and 3G packet core networks require only a software upgrade to support 4G/LTE access.

Mobile broadband stimulates GDP growth

High-speed broadband infrastructure (mobile and fixed) is becoming as essential as roads, water and electricity. Studies show a direct correlation between broadband penetration and GDP growth. In emerging markets, many users can access the internet only via mobile devices due to the lack of fixed network infrastructure.

SPEED AND DATA TRAFFIC

Feature phone user

10 kbps

approx. 10 MB/month

Smartphone user

100-1,000 kbps

approx. 100 MB/month

Mobile PC/tablet user

>1 Mbps

approx. 1 GB/month

6

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

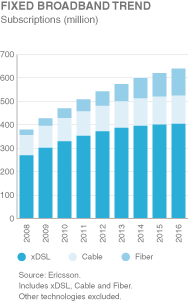

FIXED BROADBAND AND CONVERGENCE

Fixed broadband

In today’s mature markets, most data traffic is handled by fixed networks. Operators compete by evolving their networks to provide fast internet speeds, reliable high-definition IPTV and video on demand. We enable this by providing end-to-end broadband access solutions via high-speed fiber (such as GPON) and copper (xDSL).

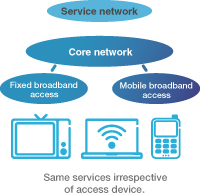

All-IP networks and convergence

To reduce cost and enable service bundling, fixed traffic can be provided over a multi-service network converging telephony, internet and TV. This multi-service network is IP based, providing lower-cost and higher-performance broadband services. IP starts in the core network. Our Evolved Packet Core (EPC) provides support for multiple access technologies and fixed-mobile convergence. New functionality is introduced through software upgrades. With our breadth of experience, we provide a service, including consulting and systems integration, to manage transformation of networks to all-IP, often involving multiple-vendor equipment.

7

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

COMMUNICATION SERVICES

Communication services are the services people use to interact with each other, such as voice and video calls as well as text and multimedia messaging. These operator-based services are provided globally and are based on industry standards, ensuring interoperability.

As voice and SMS still account for the main part of operator revenues, operators now exploit opportunities to enhance user experience while reducing costs for voice communication.

Users want enriched communication and the ability to instantaneously share experiences and information with family, friends and colleagues—anywhere, anytime and to any device. Our IP Multimedia Subsystem (IMS) makes this possible. Services controlled by IMS are voice (incl. HD-voice), video calls, the Rich Communication Suite (RCS) and messaging. With RCS, consumers get a suite of IMS-based services (e.g. presence information, chat and content sharing) from the address book of a mobile phone or from a broadband connection.

MANAGED SERVICES

Network operations have traditionally been seen as core to operators. Today, competitive pressure, rapid technology evolution and changing user demands drive another focus. Many operators now view strategy, marketing and customer retention as being equally important as technology. Our managed services agreements free up in-house resources for this focus, and can reduce network operating costs by as much as 20 percent.

We have a long history of taking on employees from operators. We have invested USD 1 billion in tools, methods and processes to secure capabilities and competence.

Improving operators’ operational efficiency

The need to improve operational efficiency, reducing both capital expenditures and operating expenses, is a key driver for an operator to change its business. It is estimated that a mature operator spends approximately 5-6 percent of revenues on network equipment and 10-12 percent on operating the network, i.e. operating expenses account for twice the capital expenditures for networks. Our network operations contracts are often multi-year, multi-technology and multi-vendor agreements.

Simplifying network complexity

Another key driver is the increasing complexity of networks as they are transformed and modernized. IT and telecom convergence creates many opportunities for us to act as an advisor, both in streamlining business and operations support systems and helping to quickly and cost-efficiently introduce new services.

Shared networks and shared capacity

The initial growth of managed services was driven by operational efficiency. There is now an increasing demand for business models that support shared capacity and network sharing between two or more operators. This trend also drives structural efficiencies in the networks. Managed services play a decisive role in this evolution.

TV AND MEDIA MANAGEMENT

TV is going digital and interactive

In the converging media landscape, broadcast and broadband are coming together, moving towards a connected world.

8

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

The worldwide digital TV market is growing. TV solutions and services enable global media companies and operators (cable, satellite, telecom and terrestrial) to deliver TV content, either directly to consumers or for professional digital video content exchange.

With a broad suite of open standards-based products, we offer high-quality solutions for digital TV, HDTV, video on demand, IPTV, mobile TV, connected home and content management.

High-performance video means large amounts of traffic in the networks. This can be handled with our media distribution (MDN) solution for video delivery over IP, combining a content distribution network with our TV portfolio.

Business consulting, systems integration and implementation ensure a smooth launch of new TV services and infrastructure.

Outsourcing trends:

| | • | | Reduce and control spending |

| | • | | Focus on key business priorities |

| | • | | Greater operational efficiency |

| | • | | Lower risks, reduce complexity |

| | • | | Shared capacity—structural efficiency |

OPERATIONS AND BUSINESS SUPPORT SYSTEMS

Operations Support Systems—for control

Rising network complexity drives the need for one consolidated “dashboard-style” Operations Support System (OSS).Our OSS includes capabilities for performance monitoring and fault management, configuration and security management as well as systems to optimize performance for efficiency. OSS can also handle multi-vendor equipment.

Business Support Systems—efficient billing and charging

Our Business Support Systems (BSS) support operators in instant provisioning and activation of services, devices and price plans. Our solutions can also provide real-time convergent charging (i.e. the user gets one invoice for both mobile and fixed usage) and billing and data management. With our solutions, operators can capture and secure revenue streams. Users can instantly start using a new service or device and control their spending.

Operators have to handle the increased data traffic in their networks along with many new devices. At the same time, operators introduce tiered pricing and new business models in order to maximize their revenues for mobile broadband services as well as voice traffic. This development requires upgrading of old support systems as well as the introduction of new BSS solutions.

Consulting and systems integration services are vital components of BSS solutions.

9

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

CONSUMER AND BUSINESS APPLICATIONS

Interaction and collaboration

To support operators in growing their revenues, we provide new means of interaction and collaboration. Our solutions include messaging, social networks, location-based services, media, advertising, internet commerce and enterprise applications.

We support our customers in the modernization and consolidation of legacy service delivery systems and messaging systems, such as SMS, MMS and video mail.

Our Business Communication Suite (BCS) targets the enterprise market. It enables sharing of voice, video data, messaging and web conferences in a collaborative environment.

Our multimedia brokering solution facilitates payment and distribution of content. We act as the interface between enterprises and multiple mobile operators with consumer data and services such as via SMS.

Several of our solutions can be delivered as cloud services.

10

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

OUR ASSETS

UNIQUE GLOBAL PRESENCE AND SCALE

Our global presence and scale give us a competitive advantage. In the industry consolidation, where operators are merging, we can handle larger cross-border contracts as well as targeted local assignments. It is key for us to stay close to customers, building trust, earning a strong track record and applying our in-depth expertise.

Today, over 1,000 networks in more than 180 countriesuse equipmentsupplied by us. Over the years, we have gained localknowledgeand experience in networkrollouts andsystemsintegrationaswell as managing, upgrading and modernizing networks.

TECHNOLOGY LEADERSHIP—INVESTING FOR THE FUTURE

Our technology leadership is a key asset that we leverage. We focus on early involvementin creatingnew technologies, strong contribution in technology standardization work, development of intellectual property rights and establishment of licensing agreements. We pioneered the development of digital AXE switching, 2G/GSM, 3G/WCDMAand 4G/LTE,leading to 27,000granted patents. We invested approximately 15 percent of our total sales into R&D in 2010. At year end, the number of R&D employees was more than 20,000. Over 80 percent of our product development is software related.

SERVICES LEADERSHIP

Networks are becoming increasingly complex and often include multi-vendor equipment. The knowledge gained from managing networks for 750 million subscribers is an asset. Today our global services organization handles consulting, systems integration, network rollout, network operation, customer support and education. Competence development is further enhanced by insourcing staff from operators and acquiring companies in consulting and systems integration.

11

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

Our breadth of experience enables us to offer end-to-end support to our customers.

ERICSSON ACADEMY

In 2010 we launched Ericsson Academy and Learning Services. It is an online platform for sharing knowledge and inspiration both internally and externally. The site offers free telecom tutorials, technical snapshots and a forum to exchange smart ideas.

CREATING A WINNING CULTURE

We want to attract and develop the most competent, high-performing and motivated people in the industry. The culture we encourage is innovative, fast moving and responsive, with a business-winning mindset. To get the entire company moving in this direction, we implemented a group wide empowerment program. We also run a leadership training program to promote global diversity and cultivate top talent worldwide.

PUTTING CONSUMER INSIGHT TO WORK

To stay abreast of consumer trends, we use our ConsumerLab market research unit, which conducts more than 40,000 interviews annually. This represents the combined opinions and behavior patterns of more than 1 billion people. Not only do we incorporate these insights into our product development, but we can also make them available to our customers.

12

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

2010 HIGHLIGHTS

JANUARY-MARCH

| | • | | World record of 84 Mbps HSPA demonstrated. |

| | • | | TeliaSonera rolls out 4G/LTE in Norway and Sweden, with core network and RBS 6000 from Ericsson. Three more customers have since launched LTE. |

| | • | | Ericsson delivers LTE network equipment and services to AT&T. |

| | • | | A world record is set with 1 Gbps for LTE in a live demo. |

| | • | | Ericsson performs a live demo of the world’s first high-speed microwave radio connection with a transporting capacity of 2.5 Gbps. |

APRIL-JUNE

| | • | | Ericsson increases presence in Korea by acquiring Nortel’s stake in the joint venture LG-Nortel. The business is consolidated by Ericsson. |

| | • | | First managed operations contract in Canada, for Mobilicity’s 3G network. |

| | • | | Indosat, Indonesia, prepares for 4G and launched Asia’s fastest network with 42 Mbps. |

| | • | | Ericsson chosen to operate Telefonica’s network operations center in São Paulo. |

| | • | | Ericsson provides industry’s first 3D sports television network, ESPN 3D, with standards-based video processing solution, tuned for 3D and HD broadcasts. |

JULY-SEPTEMBER

| | • | | Mobile data is growing ten times faster than voice. |

| | • | | China Mobile Hebei selects Ericsson as its managed services partner. |

| | • | | MetroPCS launches first 4G/LTE network in the USA, with Ericsson as primary supplier. |

13

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

| | • | | Ericsson gets its largest fiber-to-the-home contract in India. |

| | • | | Ericsson announces embedded mobile broadband modules—world’s first to support 21 Mbps (HSPA) for notebooks and other consumer electronics. |

| | • | | EMOBILE upgrades its HSPA network with the HSPA Evolution technology—the highest-speed network in Japan with a peak data rate of 42 Mbps. |

OCTOBER-DECEMBER

| | • | | TeliaSonera renews and expands its managed services contract with Ericsson to include field service for voice and data networks in 29 countries. |

| | • | | Hans Vestberg, CEO, participated via Telepresence at COP 16 in Mexico, to stress the importance of ICT in addressing climate change. |

| | • | | Ericsson is selected as key equipment and services provider for next evolution of the Sprint network, supplying radio access, core and IP/Microwave backhaul. |

| | • | | Ericsson wins managed services contract with China Unicom. |

| | • | | Verizon Wireless launches the world’s largest LTE network with Ericsson as the primary vendor. |

| | • | | 3 Italia chooses Ericsson for data center consolidation and modernization of IT infrastructure. |

14

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

FIVE-YEAR SUMMARY

For definitions of the financial terms used, see Glossary, Financial Terminology and Exchange Rates.

FIVE-YEAR SUMMARY

| | | | | | | | | | | | | | | | | | | | | | | | |

SEK million | | 2010 | | | Change | | | 2009 | | | 2008 | | | 2007 | | | 2006 | |

| | | | | | |

Income statement items | | | | | | | | | | | | | | | | | | |

Net sales | | | 203,348 | | | | –2 | % | | | 206,477 | | | | 208,930 | | | | 187,780 | | | | 179,821 | |

Operating income | | | 16,455 | | | | 178 | % | | | 5,918 | | | | 16,252 | | | | 30,646 | | | | 35,828 | |

Financial net | | | –672 | | | | –307 | % | | | 325 | | | | 974 | | | | 83 | | | | 165 | |

Net income | | | 11,235 | | | | 172 | % | | | 4,127 | | | | 11,667 | | | | 22,135 | | | | 26,436 | |

| | | | | | |

Year-end position | | | | | | | | | | | | | | | | | | |

Total assets | | | 281,815 | | | | 4 | % | | | 269,809 | | | | 285,684 | | | | 245,117 | | | | 214,940 | |

Working capital | | | 105,488 | | | | 6 | % | | | 99,079 | | | | 99,951 | | | | 86,327 | | | | 82,926 | |

Capital employed | | | 182,640 | | | | 1 | % | | | 181,680 | | | | 182,439 | | | | 168,456 | | | | 142,447 | |

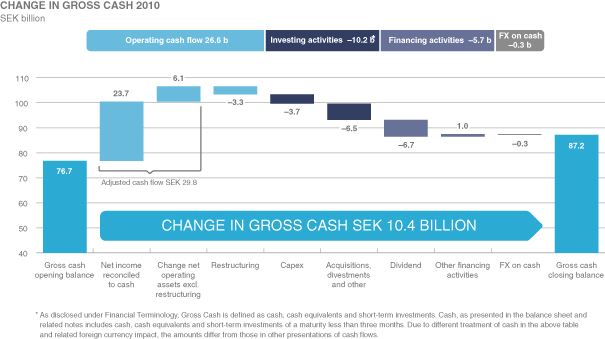

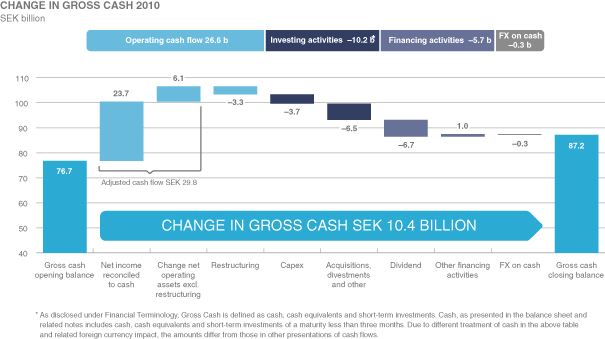

Gross cash | | | 87,150 | | | | 14 | % | | | 76,724 | | | | 75,005 | | | | 57,716 | | | | 62,280 | |

Net cash | | | 51,295 | | | | 42 | % | | | 36,071 | | | | 34,651 | | | | 24,312 | | | | 40,728 | |

Property, plant and equipment | | | 9,434 | | | | –2 | % | | | 9,606 | | | | 9,995 | | | | 9,304 | | | | 7,881 | |

Stockholders’ equity | | | 145,106 | | | | 4 | % | | | 139,870 | | | | 140,823 | | | | 134,112 | | | | 120,113 | |

Non-controlling interest | | | 1,679 | | | | 45 | % | | | 1,157 | | | | 1,261 | | | | 940 | | | | 782 | |

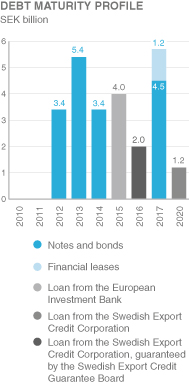

Interest-bearing liabilities and post-employment benefits | | | 35,855 | | | | –12 | % | | | 40,653 | | | | 40,354 | | | | 33,404 | | | | 21,552 | |

| | | | | | |

Other information | | | | | | | | | | | | | | | | | | |

Earnings, per share, basic, SEK | | | 3.49 | | | | 203 | % | | | 1.15 | | | | 3.54 | | | | 6.87 | | | | 8.27 | |

Earnings, per share, diluted, SEK | | | 3.46 | | | | 204 | % | | | 1.14 | | | | 3.52 | | | | 6.84 | | | | 8.23 | |

Cash dividends per share, SEK | | | 2.25 | 1) | | | 13 | % | | | 2.00 | | | | 1.85 | | | | 2.50 | | | | 2.50 | |

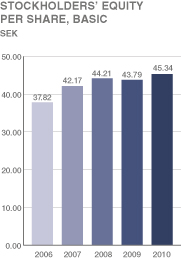

Stockholders’ equity per share, SEK | | | 45.34 | | | | 4 | % | | | 43.79 | | | | 44.21 | | | | 42.17 | | | | 37.82 | |

| | | | | | |

Number of shares outstanding (in millions) | | | | | | | | | | | | | | | | | | |

end of period, basic | | | 3,200 | | | | — | | | | 3,194 | | | | 3,185 | | | | 3,180 | | | | 3,176 | |

average, basic | | | 3,197 | | | | — | | | | 3,190 | | | | 3,183 | | | | 3,178 | | | | 3,174 | |

average, diluted | | | 3,226 | | | | — | | | | 3,212 | | | | 3,202 | | | | 3,193 | | | | 3,189 | |

Additions to property, plant and equipment | | | 3,686 | | | | –8 | % | | | 4,006 | | | | 4,133 | | | | 4,319 | | | | 3,827 | |

Depreciation and write-downs/impairments of property, plant and equipment | | | 3,296 | | | | –6 | % | | | 3,502 | | | | 3,105 | | | | 2,914 | | | | 3,038 | |

Acquisitions/capitalization of intangible assets | | | 7,246 | | | | — | | | | 11,413 | | | | 1,287 | | | | 29,838 | | | | 18,319 | |

Amortization and write-downs/impairments of intangible assets | | | 6,657 | | | | –23 | % | | | 8,621 | | | | 5,568 | | | | 5,459 | | | | 4,479 | |

Research and development expenses | | | 31,558 | | | | –5 | % | | | 33,055 | | | | 33,584 | | | | 28,842 | | | | 27,533 | |

as percentage of net sales | | | 15.5 | % | | | — | | | | 16.0 | % | | | 16.1 | % | | | 15.4 | % | | | 15.3 | % |

| | | | | | |

Ratios | | | | | | | | | | | | | | | | | | |

Operating margin excluding joint ventures | | | 8.7 | % | | | — | | | | 6.5 | % | | | 8.0 | % | | | 12.5 | % | | | 16.7 | % |

Operating margin | | | 8.1 | % | | | — | | | | 2.9 | % | | | 7.8 | % | | | 16.3 | % | | | 19.9 | % |

EBITA margin | | | 11.0 | % | | | — | | | | 6.7 | % | | | 9.4 | % | | | 18.0 | % | | | 21.0 | % |

Cash conversion | | | 112 | % | | | — | | | | 117 | % | | | 92 | % | | | 66 | % | | | 57 | % |

Return on equity | | | 7.8 | % | | | — | | | | 2.6 | % | | | 8.2 | % | | | 17.2 | % | | | 23.7 | % |

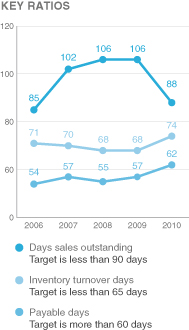

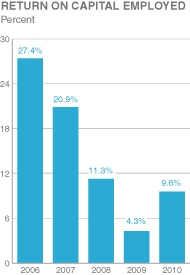

Return on capital employed | | | 9.6 | % | | | — | | | | 4.3 | % | | | 11.3 | % | | | 20.9 | % | | | 27.4 | % |

Equity ratio | | | 52.1 | % | | | — | | | | 52.3 | % | | | 49.7 | % | | | 55.1 | % | | | 56.2 | % |

Capital turnover | | | 1.1 | | | | — | | | | 1.1 | | | | 1.2 | | | | 1.2 | | | | 1.3 | |

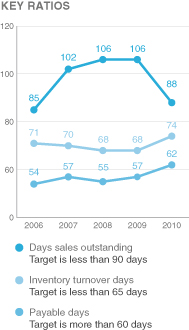

Inventory turnover days | | | 74 | | | | — | | | | 68 | | | | 68 | | | | 70 | | | | 71 | |

Trade receivables turnover | | | 3.2 | | | | — | | | | 2.9 | | | | 3.1 | | | | 3.4 | | | | 3.9 | |

Payment readiness, SEK million | | | 96,951 | | | | 9 | % | | | 88,960 | | | | 84,917 | | | | 64,678 | | | | 67,454 | |

as percentage of net sales | | | 47.7 | % | | | — | | | | 43.1 | % | | | 40.6 | % | | | 34.4 | % | | | 37.5 | % |

| | | | | | |

Statistical data, year-end | | | | | | | | | | | | | | | | | | |

Number of employees | | | 90,261 | | | | 9 | % | | | 82,493 | | | | 78,740 | | | | 74,011 | | | | 63,781 | |

of which in Sweden | | | 17,848 | | | | –2 | % | | | 18,217 | | | | 20,155 | | | | 19,781 | | | | 19,094 | |

Export sales from Sweden, SEK million | | | 100,070 | | | | 6 | % | | | 94,829 | | | | 109,254 | | | | 102,486 | | | | 98,694 | |

| 1) | For 2010, as proposed by the Board of Directors. |

15

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

SHARE INFORMATION

STOCK EXCHANGE TRADING

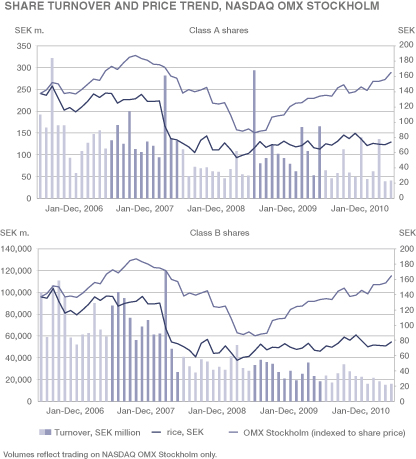

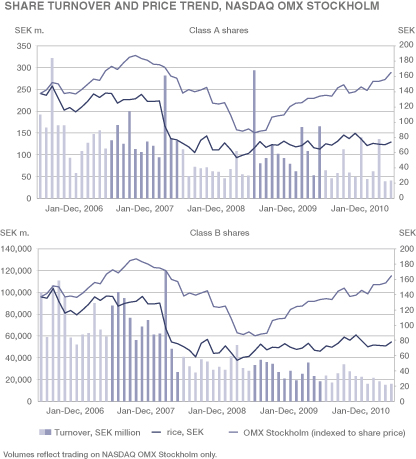

The Ericsson Class A and Class B shares are listed on NASDAQ OMX Stockholm. In the United States, the Class B shares are listed on NASDAQ in the form of American Depositary Shares (ADS) evidenced by American Depositary Receipts (ADR) under the symbol ERIC. Each ADS represents one Class B share.

In 2010, approximately 6 (7) billion Ericsson shares were traded, of which about 3.4 billion were traded on NASDAQ OMX Stockholm and about 1.6 billion were traded on NASDAQ. (Note: The approximate total volumes include trading on alternative trading venues such as BATS Europe, Burgundy, Chi-X Europe.)

Trading volume in Ericsson shares decreased by approximately 30 percent on NASDAQ OMX Stockholm and decreased by approximately 7 percent on NASDAQ as compared to 2009.

CHANGES IN NUMBER OF SHARES AND CAPITAL STOCK 2006–2010

| | | | | | | | | | |

| | | | | Number of shares | | | Share capital | |

2006 | | December 31 (no changes) | | | 16,132,258,678 | | | | 16,132,258,678 | |

2007 | | December 31 (no changes) | | | 16,132,258,678 | | | | 16,132,258,678 | |

2008 | | June 2, reverse split 1:5 | | | 3,226,451,735 | | | | 16,132,258,678 | |

2008 | | July 23, new issue. (Class C shares, later converted to Class B) | | | 19,900,000 | | | | 99,500,000 | |

2008 | | December 31 | | | 3,246,351,735 | | | | 16,231,758,678 | |

2009 | | June 8, new issue (Class C-shares, later converted to Class B) | | | 27,000,000 | | | | 135,000,000 | |

2009 | | December 31 | | | 3,273,351,735 | | | | 16,366,758,678 | |

2010 | | December 31 | | | 3,273,351,735 | | | | 16,366,758,678 | |

PERFORMANCE INDICATORS

| | | | | | | | | | | | | | | | | | | | |

| | | 2010 | | | 2009 | | | 2008 | | | 20072) | | | 20062) | |

Earnings per share, diluted (SEK) | | | 3.46 | | | | 1.14 | | | | 3.52 | | | | 6.84 | | | | 8.23 | |

Operating income per share (SEK)1) | | | 7.42 | | | | 5.80 | | | | 7.50 | | | | 9.64 | | | | 11.29 | |

Cash flow from operating activities per share (SEK) | | | 8.31 | | | | 7.67 | | | | 7.54 | | | | 6.04 | | | | 5.82 | |

Stockholders’ equity per share, basic, end of period (SEK) | | | 45.34 | | | | 43.79 | | | | 44.21 | | | | 42.17 | | | | 37.82 | |

P/E ratio | | | 22 | | | | 57 | | | | 17 | | | | 11 | | | | 17 | |

Total shareholder return (%) | | | 22 | | | | 15 | | | | –20 | | | | –43 | | | | 3 | |

Dividend per share (SEK)3) | | | 2.25 | | | | 2.00 | | | | 1.85 | | | | 2.50 | | | | 2.50 | |

| 1) | For 2010, 2009 and 2008 excluding restructuring charges. |

| 2) | 2006 and 2007 restated for reverse split 1:5 in 2008. |

| 3) | For 2010 as proposed by the Board of Directors. |

For definitions of the financial terms used, see Glossary, Financial Terminology and Exchange Rates.

All performance indicators except Earnings per share, diluted, and Stockholders’ equity per share, basic, end of period are calculated on average number of shares outstanding, basic.

16

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

THE ERICSSON SHARE

Share listings

NASDAQ OMX, Stockholm

NASDAQ, New York

| | | | |

Total number of shares outstanding | | | 3,273,351,735 | |

of which Class A shares | | | 261,755,983 | |

of which Class B shares | | | 3,011,595,752 | |

of which Ericsson treasury shares, Class B | | | 73,088,515 | |

Quotient value | | | SEK 5.00 | |

Market capitalization, December 31, 2010 | | | approx. SEK 255b. | |

GICs (Global Industry Classification) | | | 45201020 | |

| |

| Ticker codes | | | | |

| |

NASDAQ OMX | | | ERIC A | |

Stockholm | | | ERIC B | |

NASDAQ, New York | | | ERIC | |

Bloomberg NASDAQ | | | ERICA SS | |

OMX Stockholm | | | ERICB SS | |

Bloomberg NASDAQ | | | ERIC US | |

Reuters NASDAQ | | | ERICa.ST | |

OMX Stockholm | | | ERICb.ST | |

Reuters NASDAQ | | | ERIC.O | |

| |

ISIN | | | | |

ERIC A | | | SE0000108649 | |

ERIC B | | | SE0000108656 | |

ERIC | | | US2948216088 | |

CUSIP | | | 294821608 | |

17

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

18

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

SHARE TREND

In 2010, Ericsson’s total market capitalization increased by about 18 (13) percent to SEK 255 billion (SEK 215 billion in 2009). The OMX Stockholm Index on NASDAQ OMX Stockholm increased by 23 percent, the S&P 500 Index increased by 13 percent and the NASDAQ composite index increased by 17 percent.

19

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

OFFER AND LISTING DETAILS

Principal trading market—NASDAQ OMX Stockholm—share prices

The table below states the high and low share prices for our Class A and Class B shares as reported by NASDAQ OMX Stockholm for the last five years. Trading on the exchange generally continues until 5:30 p.m. (CET) each business day. In addition to trading on the exchange there is also trading off the exchange and on alternative venues during trading hours and also after 5:30 p.m. (CET).

NASDAQ OMX Stockholm publishes a daily Official Price List of Shares which includes the volume of recorded transactions in each listed stock, together with the prices of the highest and lowest recorded trades of the day. The Official Price List of Shares reflects price and volume information for trades completed by the members. The equity securities listed on the NASDAQ OMX Stockholm Official Price List of Shares currently comprise the shares of 258 companies.

Host market NASDAQ—ADS prices

The table below states the high and low share prices quoted for our ADSs on NASDAQ for the last five years. The NASDAQ quotations represent prices between dealers, not including retail mark-ups, markdowns or commissions, and do not necessarily represent actual transactions.

SHARE PRICES ON NASDAQ OMX STOCKHOLM

| | | | | | | | | | | | | | | | | | | | |

(SEK) | | 2010 | | | 2009 | | | 2008 | | | 20071) | | | 20061) | |

Class A at last day of trading | | | 74.00 | | | | 65.00 | | | | 59.30 | | | | 76.80 | | | | 138.00 | |

Class A high for year (June 21, 2010) | | | 88.40 | | | | 78.80 | | | | 83.60 | | | | 148.50 | | | | 154.50 | |

Class A low for year (January 4, 2010) | | | 65.20 | | | | 55.40 | | | | 40.60 | | | | 73.00 | | | | 104.50 | |

Class B at last day of trading | | | 78.15 | | | | 65.90 | | | | 58.80 | | | | 75.90 | | | | 138.25 | |

Class B high for year (June 21, 2010) | | | 90.45 | | | | 79.60 | | | | 83.70 | | | | 149.50 | | | | 155.00 | |

Class B low for year (January 4, 2010) | | | 65.90 | | | | 55.50 | | | | 40.60 | | | | 72.65 | | | | 104.50 | |

| 1) | 2006 and 2007 restated for reverse split 1:5 in 2008. |

20

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

SHARE PRICES ON NASDAQ NEW YORK

| | | | | | | | | | | | | | | | | | | | |

(USD) | | 2010 | | | 2009 | | | 2008 | | | 20071) | | | 20061) | |

ADS at last day of trading | | | 11.53 | | | | 9.19 | | | | 7.81 | | | | 11.68 | | | | 20.12 | |

ADS high for year (April 23, 2010) | | | 12.39 | | | | 10.92 | | | | 14.00 | | | | 21.71 | | | | 20.57 | |

ADS low for year (February 5, 2010) | | | 9.40 | | | | 6.60 | | | | 5.49 | | | | 11.12 | | | | 14.44 | |

| 1) | 2006 and 2007 restated for reverse split 1:5 in 2008. |

SHARE PRICES ON NASDAQ OMX STOCKHOLM AND NASDAQ

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | NASDAQ OMX Stockholm | | | NASDAQ | |

| | | SEK per Class A

share | | | SEK per Class B

share | | | USD per ADS1) | |

Period | | Low | | | High | | | Low | | | High | | | Low | | | High | |

Annual high and low | | | | | | | | | | | | | | | | | | | | | | | | |

20062) | | | 104.50 | | | | 154.50 | | | | 104.50 | | | | 155.00 | | | | 14.44 | | | | 20.57 | |

20072) | | | 73.00 | | | | 148.50 | | | | 72.65 | | | | 149.50 | | | | 11.12 | | | | 21.71 | |

2008 | | | 40.60 | | | | 83.60 | | | | 40.60 | | | | 83.70 | | | | 5.49 | | | | 14.00 | |

2009 | | | 55.40 | | | | 78.80 | | | | 55.50 | | | | 79.60 | | | | 6.60 | | | | 10.92 | |

2010 | | | 65.20 | | | | 88.40 | | | | 65.90 | | | | 90.45 | | | | 9.40 | | | | 12.39 | |

| | | | | | |

Quarterly high and low | | | | | | | | | | | | | | | | | | | | | | | | |

2009 First Quarter | | | 55.40 | | | | 78.00 | | | | 55.50 | | | | 78.70 | | | | 6.60 | | | | 9.65 | |

2009 Second Quarter | | | 64.10 | | | | 78.80 | | | | 64.00 | | | | 79.60 | | | | 8.10 | | | | 9.92 | |

2009 Third Quarter | | | 65.80 | | | | 78.60 | | | | 66.10 | | | | 79.50 | | | | 9.10 | | | | 10.84 | |

2009 Fourth Quarter | | | 64.70 | | | | 76.25 | | | | 65.25 | | | | 76.95 | | | | 8.94 | | | | 10.92 | |

2010 First Quarter | | | 65.20 | | | | 78.70 | | | | 65.90 | | | | 80.00 | | | | 9.40 | | | | 11.33 | |

2010 Second Quarter | | | 73.00 | | | | 88.40 | | | | 74.15 | | | | 90.45 | | | | 9.51 | | | | 12.39 | |

2010 Third Quarter | | | 69.00 | | | | 86.55 | | | | 70.85 | | | | 89.35 | | | | 9.62 | | | | 12.20 | |

2010 Fourth Quarter | | | 66.95 | | | | 77.05 | | | | 68.85 | | | | 79.95 | | | | 9.96 | | | | 11.71 | |

| | | | | | |

Monthly high and low | | | | | | | | | | | | | | | | | | | | | | | | |

August 2010 | | | 69.00 | | | | 79.45 | | | | 70.85 | | | | 81.05 | | | | 9.62 | | | | 11.40 | |

September 2010 | | | 69.70 | | | | 78.50 | | | | 71.85 | | | | 80.65 | | | | 9.98 | | | | 11.33 | |

October 2010 | | | 68.80 | | | | 74.50 | | | | 70.65 | | | | 76.80 | | | | 10.49 | | | | 11.60 | |

November 2010 | | | 66.95 | | | | 72.00 | | | | 68.85 | | | | 74.20 | | | | 9.96 | | | | 11.20 | |

December 2010 | | | 70.00 | | | | 77.05 | | | | 72.45 | | | | 79.95 | | | | 10.48 | | | | 11.71 | |

January 2011 | | | 72.50 | | | | 78.55 | | | | 74.80 | | | | 82.00 | | | | 10.99 | | | | 12.61 | |

February 2011 | | | 74.00 | | | | 80.05 | | | | 77.15 | | | | 83.00 | | | | 12.09 | | | | 12.93 | |

| 1) | One ADS = 1 Class B share. |

| 2) | 2006 and 2007 restated for reverse split 1:5 in 2008. |

21

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

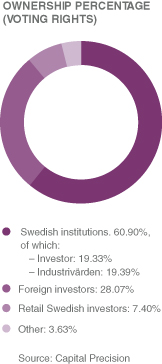

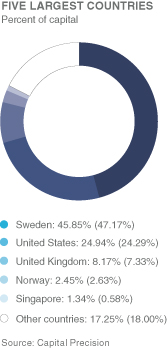

SHAREHOLDERS

As of December 31, 2010, the Parent Company had 630,592 shareholders registered at Euroclear Sweden AB (the Central Securities Depository—CSD), of which 1,334 holders had a US address. According to information provided by Citibank, there were 262,814,956 ADSs outstanding as of December 31, 2010, and 4,888 registered holders of such ADSs. A significant number of Ericsson ADSs are held by banks, broker and/or nominees for the accounts of their customer. As of December 31, 2010, the number of bank, broker and/or nominee accounts holding Ericsson ADSs was 196,360.

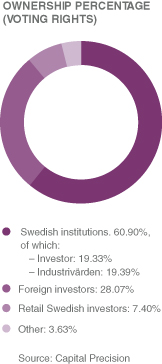

According to information known at year-end 2010, almost 78 percent of our Class A and Class B shares were owned by institutions, Swedish and international.

Our major shareholders do not have different voting rights than other shareholders holding the same classes of shares.

As far as we know, the Company is not directly or indirectly owned or controlled by another corporation, by any foreign government or by any other natural or legal person(s) separately or jointly.

TOP EXECUTIVES AND BOARD MEMBERS, OWNERSHIP

| | | | | | | | | | | | |

| | | Number of

Class A

shares | | | Number of

Class B

shares | | | Voting

rights,

percent | |

Top executives and Board members as a group (31 persons) | | | 2,416 | | | | 3,937,920 | | | | 0.07 | |

For individual holdings, see Corporate Governance Report.

22

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

The table shows the total number of shares in the Parent Company owned by top executives and Board members (including Deputy employee representatives) as a group as of December 31, 2010.

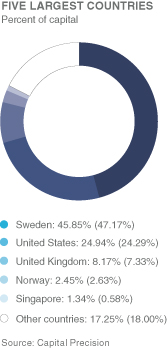

The following table shows share information, as of December 31, 2010, with respect to our 15 largest shareholders, ranked by voting rights, as well as percentage of voting rights as of December 31, 2010, 2009 and 2008.

LARGEST SHAREHOLDERS, DECEMBER 31, 2010 AND PERCENTAGE OF VOTING RIGHTS, DECEMBER 31, 2010, 2009 AND 2008

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Identity of person or group1) | | Number of

Class A

shares | | | Of total

Class A

shares,

percent | | | Number of

Class B

shares | | | Of total

Class B

shares,

percent | | | 2010

Voting rights,

percent | | | 2009

Voting rights,

percent | | | 2008

Voting rights,

percent | |

Investor AB | | | 102,664,038 | | | | 39.22 | | | | 61,414,664 | | | | 2.04 | | | | 19.33 | | | | 19.33 | | | | 19.42 | |

AB Industrivärden | | | 77,680,600 | | | | 29.68 | | | | 0 | | | | 0.00 | | | | 13.80 | | | | 13.62 | | | | 13.28 | |

Handelsbankens Pensionsstiftelse | | | 19,800,000 | | | | 7.56 | | | | 0 | | | | 0.00 | | | | 3.52 | | | | 3.52 | | | | 3.00 | |

Skandia Liv | | | 15,719,072 | | | | 6.01 | | | | 10,745,693 | | | | 0.36 | | | | 2.98 | | | | 3.02 | | | | 2.89 | |

Swedbank Robur Fonder AB | | | 1,495,549 | | | | 0.57 | | | | 138,868,343 | | | | 4.61 | | | | 2.73 | | | | 3.07 | | | | 2.44 | |

Pensionskassan SHB Försäkringsföreningen | | | 11,672,000 | | | | 4.46 | | | | 0 | | | | 0.00 | | | | 2.07 | | | | 2.25 | | | | 2.26 | |

BlackRock Fund Advisors | | | 0 | | | | 0.00 | | | | 81,187,654 | | | | 2.70 | | | | 1.44 | | | | 1.81 | | | | 0.00 | |

Dodge & Cox, Inc. | | | 0 | | | | 0.00 | | | | 80,330,400 | | | | 2.67 | | | | 1.43 | | | | 1.05 | | | | 0.98 | |

AMF Pensionsförsäkring AB | | | 800,000 | | | | 0.31 | | | | 67,174,148 | | | | 2.23 | | | | 1.34 | | | | 1.30 | | | | 1.55 | |

OppenheimerFunds, Inc. | | | 0 | | | | 0.00 | | | | 72,416,412 | | | | 2.40 | | | | 1.29 | | | | 1.29 | | | | 1.31 | |

Handelsbanken Fonder AB | | | 1,340 | | | | 0.00 | | | | 59,260,630 | | | | 1.97 | | | | 1.05 | | | | 0.94 | | | | 1.02 | |

Gamla Livförsäkringsbolaget SEB Trygg Liv | | | 4,675,919 | | | | 1.79 | | | | 12,275,600 | | | | 0.41 | | | | 1.05 | | | | 0.98 | | | | 1.04 | |

Aberdeen Asset Managers Ltd. | | | 0 | | | | 0.00 | | | | 56,648,517 | | | | 1.88 | | | | 1.01 | | | | 0.71 | | | | 0.38 | |

SEB Investment Management AB | | | 498,441 | | | | 0.19 | | | | 50,604,935 | | | | 1.68 | | | | 0.99 | | | | 0.89 | | | | 0.98 | |

PRIMECAP Management Co. | | | 0 | | | | 0.00 | | | | 52,241,292 | | | | 1.73 | | | | 0.93 | | | | 0.83 | | | | 0.56 | |

Others | | | 26,749,024 | | | | 10.21 | | | | 2,268,427,464 | | | | 75.32 | | | | 45.04 | | | | 45.39 | | | | 48.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | | 261,755,983 | | | | 100.00 | | | | 3,011,595,752 | | | | 100.00 | | | | 100.00 | | | | 100.00 | | | | 100.00 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1) | Source: Capital Precision. |

23

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

LETTER FROM MICHAEL TRESCHOW

Dear shareholders,

When I summarized year 2009, I wrote that the key future opportunities for the industry and Ericsson would be increased mobile traffic. In 2010 we saw massive data traffic uptake, driven by laptops and smartphones. The global mobile data traffic actually more than doubled. As a consequence, Ericsson saw a growing demand for mobile broadband.

The telecom industry has for a very long time been characterized by rapid technology development and consolidation. Along with the introduction of new technologies, Ericsson’s business is becoming more and more services and software-related. Management has taken action to adapt the Company to this change and the implementation of a new organization has so far been smooth. This is an important foundation for Ericsson’s future growth.

In 2010, Ericsson acquired companies to the value of SEK 3.3 billion. Many new employees came aboard during the year, 5,250 joined through acquisitions and about 1,300 through managed services contracts. The Board closely follows the integration of acquired businesses and the insourcing of new employees from operators via managed services contracts. Ericsson has a well-established integration process and a culture where new colleagues quickly become a part of the Company.

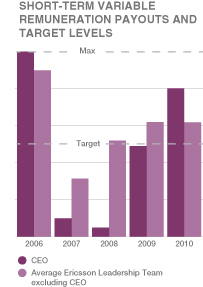

During the year, The Board has continued to monitor the Company’s remuneration principles. The Board is of the opinion that Ericsson has a well-balanced and competitive compensation structure which rewards performance. We think it is beneficial that senior executives invest in shares and we hope the new long-term variable remuneration (LTV) program will prove to be motivational.

Ericsson has a strong financial position with net cash of SEK 51.3 billion. A strong cash position is important since it gives the Company the ability to play a role in industry consolidation and to strengthen its assets in areas such as systems integration and consulting.

At my very first Board meeting in April 2002, Ericsson was in a quite different situation. The Company was in a financial crisis and at that meeting, we took the decision to propose a rights offering of SEK 30 billion. Since then we have paid back about SEK 41.9 billion in dividends to our shareholders, including the proposed dividend for 2010. In 2002 the share price declined below the subscription price of SEK 3.80 per B-share. Following the rights offering the share price saw sustained growth until 2007. Since then the share price has underperformed.

It has been an exciting journey for me to help to steer Ericsson and shape the industry during my years as Chairman of the Board. I have introduced two new CEOs and their management teams. We have seen the services part of the Company grow to represent close to 40 percent of revenues. Ericsson and the industry are now in the initial phase of rolling out mobile broadband on a large scale.

It is an exciting future ahead for Ericsson. Taking into account the Company’s strong market and financial position, it is well positioned to continue to lead the industry.

After nine years in this position it is time to hand over to my successor. I wish the new chairman and Ericsson all the best.

Michael Treschow

Chairman of the Board

24

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

BOARD OF DIRECTORS’ REPORT

CONTENTS

25

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

This Board of Directors’ Report is based on Ericsson’s consolidated financial statements, prepared in accordance with IFRS as endorsed by the EU. The application of reasonable but subjective judgments, estimates and assumptions to accounting policies and procedures affects the reported amounts of assets and liabilities and contingent assets and liabilities at the balance sheet date as well as the reported amounts of revenues and expenses during the reporting period. These amounts could differ materially under different judgments, assumptions and estimates. Please see Note C2—“Critical Accounting Estimates and Judgments” (p. 91).

Also non-IFRS measures are used to provide meaningful supplemental information to the IFRS results. Non-IFRS measures are designed to facilitate analysis by indicating Ericsson’s underlying performance. However, these measures should not be viewed in isolationor as substitutes to the IFRS measures. A reconciliation of non-IFRS measures with theIFRS results can be found on page 34.

Thisreport includes forward-lookingstatements subjectto risks and uncertainties.Actualbillion developments could differ materiallyfrom thosedescribed or implied. Pleasesee “Forward-Looking Statements” (p. 175) and “Risk Factors”(p. 167).

The external auditors review the quarterly interim reports, perform audits of the Annual Report and report their findings to the Board and its Audit Committee.

The terms “Ericsson”, “the Group”, and unless the context reasonably requires otherwise also “the Company”, all refer to Telefonaktiebolaget LM Ericsson and its subsidiaries. The “Parent Company” solely refers to Telefonaktiebolaget LM Ericsson. Unless otherwise noted, numbers in parentheses 0 refer to the previous year (i.e. 2009).

VISION

Ericsson’s vision is to be the prime driver in an all-communicating world. The vision of an all-communicating world is rapidly becoming a reality as there are more than 5.3 billion subscriptions today for mobile telecommunications. Ericsson envisions a continued evolution, from having connected 5 billion people to connecting 50 billion “things”. The Company envisions that anything that can benefit from being connected will be connected, mainly via mobile broadband.

26

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

STRATEGY

By leveraging global presence and scale as well as technology and services leadership, Ericsson will continue to be the prime driver in the telecom industry.

Global presence and scale

Ericsson has today business in more than 180 countries. The Company is the largest provider of operator equipment and with 45,000 service professionals, the Company has secured scale advantages.

Going forward, Ericsson intends to increase its market share in the solution areas: Communication Services, Consumer and Business Applications, Fixed Broadband and Convergence, Managed Services, Mobile Broadband, Operations and Business Support Systems and Television and Media Management.

With its strong financial position, the Company intends to grow also through acquisitions, targeting small and medium-sized companies.

Ericsson sees opportunities to increase its footprint, i.e. installed equipment base, mainly in Europe, where its market share is lower than the overall global position. By outperforming its competitors, there is an opportunity for the Company to grow footprint by achieving a larger part of a roll-out project than initially assigned by the customer.

Market indicators

In understanding where the market is heading, Ericsson follows different drivers.

For segment Networks the Company monitors the traffic development in the networks and the evolution of the installed equipment. These parameters vary between countries and regions. Operators’ total capital expenditure is not a key indicator since only around 50 percent of the cost is related to telecom. Of the telecom part, about 10-15 percent is designated for telecom equipment. Accordingly, operator capital expenditure can therefore decrease without necessarily impacting Ericsson sales.

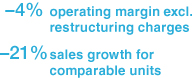

For segment Global Services, it is relevant to study operators’ operating expenses, since Ericsson offers services and solutions to reduce their operating cost.

Multimedia is more fragmented, with a number of parameters for different parts of the business.

Business mix

Ericsson’s Group margins depend to a high degree on the business mix with the proportion of services, software and hardware content as well as type of projects. Rolling out a new network, increasing coverage, or modernizing a network, means deploying hardware, i.e. radio base stations (RBSs) and controllers, on a large scale. These projects are often won in open tenders in a highly competitive environment. Later, after deployment, the hardware will be regularly upgraded with software to enable for example higher data speeds and new functionality/features. These upgrades normally provide the Company with more even revenue streams. The initial large projects are a necessary first step to secure future software and services business when upgrades and/or expansions of the networks take place.

Technology leadership

By continuing to invest in research and development (R&D), the Company will secure its technology leadership. The objectives are to deliver superior performance and to be the thought leader in the industry.

Ericsson has one of the industry’s largest organizations for R&D.

27

ERICSSON ANNUAL REPORT ON FORM 20-F 2010

Research and development

The Company’s total spend on R&D was SEK 29.9 (27.0) billion excluding restructuring charges. More than 20,000 people work in developing products and solutions. With approximately 600 research engineers, research accounts for about three percent of the overall investment in R&D.

All research is closely connected to future solutions and products. The applied research usually targets products that will reach the market within three to five years. Research performed in the areas of multimedia and user services target products and solutions which are closer in time. An increasing part of the solutions are software based which requires a different mode of operation in R&D. During the last years, developing the Company’s software capabilities has been important and a key part of this has been to implement new ways of working. An agile engineering method has been implemented, allowing quick response to market changes. The new ways of working as well as product packaging, enable online delivery of software, and new customization possibilities. The strategy to develop software-based solutions also means new business models in the customer engagement, such as software subscription or software-as-a-service.

The research activities are performed in-house as well as in collaboration with research institutes and universities. An essential part of the research work is performed in parallel with standardization work. Standardization is performed together with peers in different industry bodies. Open standards are a foundation for the industry in order to secure ecosystems and interoperability.