Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

July 18, 2012

LM ERICSSON TELEPHONE COMPANY

(Translation of registrant’s name into English)

Torshamnsgatan 23, Kista

SE-164 83, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

THIS REPORT ON FORM 6-K SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM F-3 (NO. 333-180880) OF TELEFONAKTIEBOLAGET LM ERICSSON (PUBL.) AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELEFONAKTIEBOLAGET LM ERICSSON (publ) | ||

| By: | /S/ NINAMACPHERSON | |

| Nina Macpherson | ||

| Senior Vice President and | ||

| General Counsel | ||

| By: | /S/ HELENANORRMAN | |

| Helena Norrman | ||

| Senior Vice President | ||

| Corporate Communications | ||

Date:July 18, 2012

Table of Contents

This report on Form 6-K shall be deemed to be incorporated by reference in the registration statement on Form F-3 (No. 333-180880) of Telefonaktiebolaget LM Ericsson (publ.) and to be a part thereof from the date on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

Ericsson SECOND QUARTER report ADJUSTED for registration statement on Form F-3 (No. 333.180880) July 18, 2012

| • | Sales increased 1% YoY and showed a good performance QoQ, +9%. |

| • | Networks sales decreased YoY due to the expected decline in CDMA equipment sales as well as weaker sales in China and Russia. |

| • | Global Services and Support Solutions showed strong performance YoY and QoQ. |

| • | The underlying business mix, with higher share of coverage projects than capacity projects, was unchanged in the quarter and is expected to prevail short-term. The negative gross margin impact from the network modernization projects in Europe will start to gradually decline end 2012. |

| • | Cash flow from operations SEK -1.4 b. impacted by high working capital mainly due to late invoicing. |

| • | Net income SEK 1.2 b., down from SEK 3.2 b. YoY, impacted by lower profitability in Network and increased loss in ST-Ericsson. |

| • | EPS diluted SEK 0.34 (0.96). |

SEK b. | Q2 2012 | Q2 2011 | YoY Change | Q1 2012 | QoQ Change | Six m. 2012 | Six m. 2011 | |||||||||||||||||||||

Net sales | 55.3 | 54.8 | 1 | % | 51.0 | 9 | % | 106.3 | 107.7 | |||||||||||||||||||

Of which Networks | 27.8 | 33.4 | -17 | % | 27.3 | 2 | % | 55.1 | 66.6 | |||||||||||||||||||

Of which Global Services | 24.1 | 19.0 | 26 | % | 20.6 | 17 | % | 44.7 | 36.5 | |||||||||||||||||||

Of which Support Solutions | 3.5 | 2.4 | 47 | % | 3.0 | 15 | % | 6.5 | 4.7 | |||||||||||||||||||

Gross margin | 32.0 | % | 37.8 | % | — | 33.3 | % | — | 32.6 | % | 38.1 | % | ||||||||||||||||

Operating income excl JVs | 3.3 | 5.0 | -35 | % | 10.5 | — | 13.8 | 11.3 | ||||||||||||||||||||

Operating margin excl JVs | 5.9 | % | 9.2 | % | — | 20.6 | % | — | 13.0 | % | 10.5 | % | ||||||||||||||||

Of which Networks | 5 | % | 14 | % | — | 6 | % | — | 5 | % | 16 | % | ||||||||||||||||

Of which Global Services | 6 | % | 5 | % | — | 6 | % | — | 6 | % | 6 | % | ||||||||||||||||

Of which Support Solutions | 12 | % | -11 | % | — | -1 | % | — | 6 | % | -13 | % | ||||||||||||||||

Operating income incl JVs | 2.1 | 4.3 | -51 | % | 9.1 | — | 11.2 | 10.1 | ||||||||||||||||||||

Income after financial items | 1.8 | 4.6 | — | 9.1 | — | 10.8 | 10.4 | |||||||||||||||||||||

Net income | 1.2 | 3.2 | -63 | % | 8.8 | — | 10.0 | 7.3 | ||||||||||||||||||||

EPS diluted, SEK | 0.34 | 0.96 | -65 | % | 2.76 | -88 | % | 3.10 | 2.23 | |||||||||||||||||||

Cash flow from operations | -1.4 | 5.8 | — | 0.7 | — | -0.6 | 2.9 | |||||||||||||||||||||

Q112 includes a gain from the divestment of Sony Ericsson of SEK 7.7 b.

COMMENTS FROM HANS VESTBERG, PRESIDENT AND CEO

“In the quarter, demand for Global Services and Support Solutions was strong, while Networks sales decreased YoY mainly due to the expected decline in CDMA equipment sales as well as lower business activity in China, including weaker sales of GSM and lower 3G sales in Russia,” says Hans Vestberg, President and CEO of Ericsson (NASDAQ:ERIC). “In Global Services all areas showed good growth in the quarter due to operators’ focus on operational efficiency and high project activities. The strong development for Support Solutions was driven by billing systems and TV solutions. Global Services and Support Solutions together represented about half of the Group’s revenues. The growing Global Services business has a dilutive impact on gross margin.

| 1 |

Table of Contents

NET SALES, SEK b.

OPERATING INCOME INCL. JVs, SEK b.

| * | excl SEK 7.7 b. gain from Sony Ericson divestment |

NET INCOME, SEK b.

| * | excl SEK 7.7 b. gain from Sony Ericson divestment |

CASH FLOW FROM OPERATIONS, SEK b.

We continue to stay close to our customers to monitor the impacts of macroeconomic development and political uncertainty in certain regions on their investments. In customer conversations it is clear that the fundamental drivers for increased data traffic are unchanged. Today there are more than 700 million smartphone subscriptions and according to our estimates this number will increase to three billion in 2017. Based on these drivers, we see an increasing focus from our customers on network performance and quality of service. This will require continuous operator investments in hardware, software and services.

Our joint venture ST-Ericsson is still in a challenging situation due to a significant drop in sales of new products to one of the largest customers and continued decline in legacy products. The company continues to focus on securing the successful execution and delivery of its NovaThor ModAp platforms and Thor modems to customers while executing on company transformation aiming at lowering its break-even point.

In 2010 we made a conscious decision to gain market share and increase technology and services leadership, well aware of the short-term profitability pressure. Our focus is now on translating these gains into sustainable profitable growth,” concludes Vestberg.

Financial Highlights

INCOME STATEMENT AND CASH FLOW

Sales in the quarter increased 1% YoY and 9% QoQ. The acquired Telcordia operation added sales of SEK 1.1 b. in the quarter, split 50/50 between segments Global Services and Support Solutions.

Networks sales decreased -17% YoY primarily due to the expected decline in CDMA equipment sales as well as weaker development for GSM sales in China and slower operator investments in Russia. Networks sales increased 2% QoQ. CDMA equipment sales declined close to -50% YoY to SEK 2 b. and are expected to continue its rapid decline in H212.

Global Services continued to show strong momentum with growth of 26% YoY and 17% QoQ and all areas grew. Global Services represented 44% (35%) of total sales in the quarter compared to 40% in Q112. Support Solutions sales were strong with 47% growth YoY and 15% QoQ driven by strong demand for billing systems and TV solutions. Both Global Services and Support Solutions were positively impacted by the added sales from the acquired Telcordia.

Ericsson restructuring charges amounted to SEK 0.6 (1.7) b., mainly related to execution of the service delivery strategy through transformation from local to global resource centers. As previously communicated, restructuring charges are estimated to approximately SEK 4 b. for the FY12.

Gross margin was down YoY to 32.0% (37.8%), and from 33.3% QoQ. The YoY decrease is due to the increased Global Services share as well as a higher proportion of coverage projects and network modernization projects in Europe. Approximately half of the YoY gross margin percentage decline is related to the increased services mix. The QoQ gross margin reduction is due to a higher Global Services share and lower sales of mobile broadband capacity than in Q112.

The underlying business mix, with higher share of coverage projects, was unchanged in the quarter and is expected to prevail short-term. The negative gross margin impact from the network modernization projects in Europe will start to gradually decline end 2012.

| Ericsson Second Quarter Report 2012 | 2 |

Table of Contents

The modernization of networks in Europe became an opportunity for us mid-2010 when operators in Europe started to evaluate potential swaps of older 2G and 3G equipment to new multi-standard radio equipment. Ericsson, who had lost out on market share in the 3G race compared to its strong 2G position, identified this as an opportunity to regain footprint. Competition for new footprint is always tough and a strategic decision was taken to accept short-term pressure on margins to increase market share. As a result, market share has increased and the Company has restored its leading market position in Europe. Average project duration for these modernization projects are 18-24 months and the margin effects will start to gradually decline late 2012. In Q411, all projects were up to full speed.

Total operating expenses amounted to SEK 15.0 (15.8) b. R&D expenses amounted to SEK 8.1 (8.1) b. and increased slightly QoQ due to restructuring. Full year R&D expenses is now expected to be SEK 30-32 b. compared to previous estimate of SEK 29-31 b. The increase is due to selective investments in key radio technology areas to extend technology leadership and FX. Selling and general administrative expenses (SG&A) amounted to SEK 6.9 (7.7) b. SG&A is down -8% YTD, excluding restructuring charges and the impact from the acquisition of Telcordia. In Q211, SG&A was impacted by restructuring charges of SEK 1.2 b. vs. restructuring charges of SEK 0.1 b. in Q212.

Other operating income and expenses was SEK 0.5 (0.2) b. and decreased SEK -7.2 b. QoQ due to the gain of SEK 7.7 b. from the divestment of Sony Ericsson that was reported in Q112. The SEK 0.3 b. in segment Sony Ericsson relates to a resolved dispute from a litigation process with a third party.

Operating income, excluding JVs, decreased to SEK 3.3 (5.0) b. due to lower profitability in Networks but with a positive impact from lower restructuring costs. Operating margin was 5.9% (9.2%) compared to 5.5% (excl. gain from divestment of Sony Ericsson) in Q112.

Ericsson’s share in ST-Ericsson’s income before tax was SEK -1.3 (-0.7) b.

Financial net amounted to SEK -0.3 (0.3) b. and decreased QoQ from SEK 0.0 b. mainly related to negative currency exchange revaluation effects.

Net income decreased to SEK 1.2 (3.2) b. due to lower profitability in Networks and increased loss in ST-Ericsson.

EPS diluted was SEK 0.34 (0.96). Cash flow from operations was negative SEK -1.4 (5.8) b., mainly due to late invoicing in the quarter. Cash outlays for restructuring amounted to SEK 0.3 (1.2) b. Cash outlays of SEK 1.0 b. remain to be made from the restructuring provision.

| Ericsson Second Quarter Report 2012 | 3 |

Table of Contents

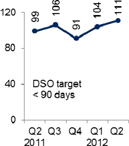

DAYS SALES OUTSTANDING

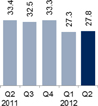

INVENTORY DAYS

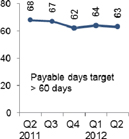

PAYABLE DAYS

BALANCE SHEET AND OTHER PERFORMANCE INDICATORS

Trade receivables increased QoQ to SEK 67.3 (60.7) b., reflecting changes in FX and late invoicing in the quarter. As a result, days sales outstanding (DSO) increased from 104 to 111 days QoQ due to the increase in trade receivables and change in FX.

Inventory increased QoQ to SEK 33.1 (32.5) b. Inventory turnover days decreased from 88 to 84 days.

During the quarter, Ericsson has performed refinancing activities to extend the average debt maturity profile and to further diversify funding sources:

| • | Issue of a USD denominated 1 b. 10-year bond in order to refinance debt maturing in 2012 to 2014 and to diversify the funding resources. |

| • | Repurchase of EUR 441 m. related to the 2013 and 2014 EMTN bonds in order to reduce gross debt and optimize net interest. |

| • | During the quarter, two SEK denominated bonds with a total of SEK 3 b. were repaid at maturity. |

Cash, cash equivalents and short-term investments amounted to SEK 66.4 (75.6) b. Capex investments amounted to SEK 1.6 (1.0) b.

During the quarter, approximately SEK 0.9 b. of provisions was utilized, of which SEK 0.3 b. related to restructuring. Additions of SEK 0.6 b. were made, of which SEK 0.2 b. related to restructuring. Reversals of SEK 0.5 b. were made.

Total number of employees at the end of the quarter decreased to 108,095 (108,551). The reduction is mainly related to efficiency programs in service delivery and within sales and administration.

| Ericsson Second Quarter Report 2012 | 4 |

Table of Contents

SEGMENT SALES, SEK b.

NETWORKS QUARTERLY SALES, SEK b.

Segment Results

NETWORKS

SEK b. | Q2 2012 | Q2 2011 | YoY Change | Q1 2012 | QoQ Change | Six m. 2012 | Six m. 2011 | |||||||||||||||||||||

Network sales | 27.8 | 33.4 | -17 | % | 27.3 | 2 | % | 55.1 | 66.6 | |||||||||||||||||||

Operating margin | 5 | % | 14 | % | — | 6 | % | — | 5 | % | 16 | % | ||||||||||||||||

CDMA equipment sales decreased -50% YoY to SEK 2 b. in the quarter. CDMA equipment sales are expected to continue its rapid decline in H212. YoY sales were negatively impacted by lower business activity in China, including weaker sales of GSM as well as lower 3G sales in Russia and reduced operator investments in India.

In 2010, we acquired Nortel’s CDMA business in order to strengthen our position in North America. We were quickly established as the market leader in North America. Already at the acquisition, CDMA equipment sales were expected to decline due to the subsequent rapid shift to LTE. The CDMA acquisition has created substantial value for the company.

Ericsson has made good inroads in the converged IP Edge market with seven contracts for the Smart Services Router (SSR) signed to date.

Operating margin was negatively impacted YoY by lower volumes as well as the underlying business mix, with more coverage than capacity projects, and the European network modernization projects. The QoQ decline is also impacted by lower sales of mobile broadband capacity than in Q112.

After the initial large scale LTE rollouts in the US, Japan and Korea, we now start to see other countries following and we expect LTE deployments to commence on a broader scale also in e.g. Europe and Latin America. We have a well proven LTE solution, outperforming competition, and according to measurements end of 2011, we have a 60% market share measured in LTE volumes.

Focus is on improving profitability and leveraging the installed base. Other key priorities are to grow IP sales and secure contracts for Voice over LTE. In CDMA, the priority is to support customers’ migration to our LTE solution and excel in life cycle management.

| Ericsson Second Quarter Report 2012 | 5 |

Table of Contents

GLOBAL SERVICES QUARTERLY SALES, SEK b.

GLOBAL SERVICES

SEK b. | Q2 2012 | Q2 2011 | YoY Change | Q1 2012 | QoQ Change | Six m. 2012 | Six m. 2011 | |||||||||||||||||||||

Global Services sales | 24.1 | 19.0 | 26 | % | 20.6 | 17 | % | 44.7 | 36.5 | |||||||||||||||||||

Of which Professional Services | 16.9 | 13.5 | 26 | % | 14.9 | 14 | % | 31.8 | 26.0 | |||||||||||||||||||

Of which Managed Services | 6.5 | 4.7 | 37 | % | 5.7 | 13 | % | 12.2 | 9.6 | |||||||||||||||||||

Of which Network Rollout | 7.1 | 5.6 | 28 | % | 5.7 | 24 | % | 12.9 | 10.4 | |||||||||||||||||||

Operating margin | 6 | % | 5 | % | — | 6 | % | — | 6 | % | 6 | % | ||||||||||||||||

Of which Professional Services | 13 | % | 12 | % | — | 13 | % | — | 13 | % | 12 | % | ||||||||||||||||

Of which Network Rollout | -11 | % | -11 | % | — | -11 | % | — | -11 | % | -9 | % | ||||||||||||||||

All areas showed strong growth in the quarter and business momentum remains. The increase in Professional Services is to a large extent driven by Managed Services and Consulting & Systems Integration. The demand for Professional Services is driven by operators’ focus on increasing operational efficiency and reducing opex through transformation activities in the voice, IP and OSS/BSS domains as well as outsourcing. Also this quarter, Network Rollout sales increased YoY, driven by high volumes of network modernization in Europe and coverage projects in other regions.

Global Services operating margin increased YoY due to increased profitability in Professional Services, positively impacted by an improvement in all areas as a result of increased sales and lower restructuring charges. Network Rollout operating margin continued to be negatively impacted by the network modernization projects in Europe. The margin impact from restructuring charges was 2%-points Q212 for Global Services as well as Professional Services, compared to 3%-points in Q211.

Ericsson now supports networks with more than 2.5 billion subscribers.

Other information | Q2 2012 | Q1 2012 | Full year 2011 | |||||||||

No. of signed managed services contracts | 17 | 9 | 70 | |||||||||

Of which expansions/extensions | 5 | 4 | 32 | |||||||||

No. of signed significant consulting & systems integration contracts1) | 7 | 6 | 33 | |||||||||

Number of subscribers in networks managed by Ericsson, end of period2) | > 900 m. | > 900 m. | 900 m. | |||||||||

Of which in network operations contracts | 500 m. | 500 m. | 500 m. | |||||||||

Number of Ericsson services professionals, end of period | 57,000 | 57,000 | 56,000 | |||||||||

| 1) | In the areas of OSS/BSS, IP, Service Delivery Platforms and data center build projects. |

| 2) | The figure includes network operations contracts and field operation contracts. |

| Ericsson Second Quarter Report 2012 | 6 |

Table of Contents

SUPPORT SOLUTIONS QUARTERLY SALES, SEK b.

SUPPORT SOLUTIONS

SEK b. | Q2 2012 | Q2 2011 | YoY Change | Q1 2012 | QoQ Change | Six m. 2012 | Six m. 2011 | |||||||||||||||||||||

Support Solutions sales | 3.5 | 2.4 | 47 | % | 3.0 | 15 | % | 6.5 | 4.7 | |||||||||||||||||||

Operating margin | 12 | % | -11 | % | — | -1 | % | — | 6 | % | -13 | % | ||||||||||||||||

The acquired Telcordia operation added sales of SEK 0.55 b. in the quarter. The strong YoY development in the quarter is related to billing solutions in Middle East and Sub-Saharan Africa. The solid growth in TV is especially related to IPTV and compression.

Operating margins improved YoY due to increased volumes and favorable product mix. Focus continues to be on transforming the business for sustainable profit generation as well as integrating Telcordia. Support Solutions is a software business with a high fixed cost base, which makes profitability volume driven.

Number of subscribers served by our charging and billing solutions were 1.7 billion at end of period.

ST-ERICSSON

USD m. | Q2 2012 | Q2 2011 | YoY Change | Q1 2012 | QoQ Change | |||||||||||||||

Net sales | 344 | 385 | -11 | % | 290 | 19 | % | |||||||||||||

Operating income | -309 | -222 | -39 | % | -326 | 5 | % | |||||||||||||

Net income | -318 | -221 | -44 | % | -312 | -2 | % | |||||||||||||

ST-Ericsson’s sales increased 19% QoQ, reflecting a significant ramp-up of volumes of NovaThor platforms shipping to its major customers. The net debt at the end of the quarter was USD -1.2 b. Last quarter net debt was USD -1.0 b. ST-Ericsson is reported in US GAAP and Ericsson’s share in ST-Ericsson’s income before tax, adjusted to IFRS, was SEK -1.3 (-0.7) b. in the quarter. By the end of the quarter, ST-Ericsson had utilized USD 1.2 b. of a short-term credit facility of USD 1.4 b. granted on a 50/50 basis by the parent companies, which corresponds to an increase of USD 260 m. since Q112.

Ericsson Group balance sheet items related to its investment in ST-Ericsson (IFRS);

SEK m. | March 31, 2012 | June 30, 2012 | ||||||

Investment in ST-Ericsson | 1,982 | 767 | ||||||

Loans to ST-Ericsson | 3,241 | 4,311 | ||||||

Total | 5,223 | 5,078 | ||||||

|

|

|

| |||||

Though their path to success is challenging, ST-Ericsson continues to focus on securing the successful execution and delivery of its NovaThor ModAp platforms and Thor modems to customers while executing a company transformation aiming at lowering its break-even point.

Ericsson accounts for ST- Ericsson in accordance with the equity method which means that Ericsson share of income after tax in ST-Ericsson increases or decreases the carrying investment amount.

| Ericsson Second Quarter Report 2012 | 7 |

Table of Contents

Regional Overview

| Second quarter 2012 | Growth | |||||||||||||||||||||||

SEK b. | Net- works | Global Services | Support Solutions | Total | YoY | QoQ | ||||||||||||||||||

North America | 6.1 | 6.1 | 0.7 | 13.0 | 5 | % | 2 | % | ||||||||||||||||

Latin America | 2.3 | 2.5 | 0.4 | 5.2 | 6 | % | 9 | % | ||||||||||||||||

Northern Europe and Central Asia | 2.1 | 1.2 | 0.1 | 3.4 | -26 | % | 47 | % | ||||||||||||||||

Western and Central Europe | 1.3 | 2.6 | 0.2 | 4.1 | -6 | % | -5 | % | ||||||||||||||||

Mediterranean | 2.7 | 3.3 | 0.2 | 6.2 | 12 | % | 35 | % | ||||||||||||||||

Middle East | 1.6 | 1.8 | 0.3 | 3.7 | 4 | % | 17 | % | ||||||||||||||||

Sub-Saharan Africa | 1.6 | 0.9 | 0.3 | 2.8 | 26 | % | 27 | % | ||||||||||||||||

India | 0.9 | 0.6 | 0.1 | 1.7 | -39 | % | 20 | % | ||||||||||||||||

China and North East Asia | 5.2 | 3.1 | 0.1 | 8.4 | -7 | % | -8 | % | ||||||||||||||||

South East Asia and Oceania | 1.9 | 1.6 | 0.1 | 3.7 | 21 | % | 9 | % | ||||||||||||||||

Other | 2.1 | 0.2 | 0.8 | 3.1 | 27 | % | 10 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 27.8 | 24.1 | 3.5 | 55.3 | 1 | % | 9 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

In Segment Networks “Other” includes licensing revenues, sales of cables, power modules and other businesses. Revenue from the acquired Telcordia business operation, consolidated January 2012, is reported 50/50 between segments Global Services and Support Solutions. In the regional dimension, all of the Telcordia sales are reported in the Support Solution segment except for North America where it is split 50/50 between Global Services and Support Solutions. Multimedia brokering (IPX) was previously reported in each region in segment Support Solution. As of Q112 it is part of region “Other” in segment Support Solutions.

North America.Network sales were negatively impacted by the decline in CDMA sales, however, partly offset by the continued transition to LTE. Major wireless network expansion and transformation projects contributed to the growth in Global Services sales. The acquisition of Telcordia has generated momentum in OSS/BSS.

Latin America.The YoY increase was driven by services. Network Rollout sales increased due to project executions in Brazil, Chile and Mexico. Support Solutions increased due to Telcordia acquisition and strong sales in charging. Operators in Brazil and Mexico are preparing for LTE deployments.

Northern Europe and Central Asia.Sales of Networks decreased YoY mainly due to continued low investment levels in Russia. Solid increase in sequential sales due to continued modernization projects and the win of a WCDMA contract with pan-Russian operator Rostelecom. In the Nordics, all major operators have now launched LTE services.

Western and Central Europe.The region sees some impact from the macroeconomic environment causing cautious operator capex spending and focus on measures to improve efficiency. Most operators are looking at transformation of their OSS/BSS environments. As a result, sales of Global Services and Support Solutions represent more than 60% of the sales in the region and there is continued good momentum for managed services.

Mediterranean.Sales growth is mainly driven by network modernization projects, which drive both sales of networks and services. In Global Services, both Network Rollout and Systems Integration sales contributed to the positive development. Operators focus on mobile broadband in order to meet traffic growth, quality demands and secure network performance.

Middle East.YoY sales growth was mainly driven by sales in Global Services and Support Solutions. Political unrest is still impacting the region and operators in those countries continue to be cautious with infrastructure investments. Services grew, especially in Managed Services and Systems Integration, as operators are looking into network performance quality and operational efficiencies.

Sub-Saharan Africa.Sales increased YoY and QoQ, driven by increased investments in 2G. 2G investments are expected to level out, while 3G will increase. Mobile broadband penetration is slowly expanding from its low level of 4% today, as low cost smartphones enter the market and the internet connectivity is improving.

| Ericsson Second Quarter Report 2012 | 8 |

Table of Contents

India.Some recovery in network capex spend as operators have started focused investments in areas where data traffic is growing. YoY sales decreased due to the strong H111, when the initial 3G deployments peaked. Regulatory uncertainties continue in India.

China and North East Asia.The YoY decrease in Networks is mainly related to lower sales of GSM and generally lower business activity in China, as well as continued transition to LTE in Korea, impacting 3G sales. Services sales were driven by more turnkey projects in Japan. The product mix is rapidly changing towards more of initial LTE deployments and a larger share of services.

South East Asia and Oceania.Networks sales increased YoY in several countries, driven by 3G investments and initial LTE deployments. The QoQ increase is due to capacity investments in Indonesia and deployments in other markets. Global Services reported an increase YoY driven by network rollout and support services aligned with infrastructure investments.

Other. Licensing revenues continued to show a stable development YoY. Also sales of cables, power modules and other businesses are included in “Other”. Multimedia brokering (IPX) was previously reported in each region, but from Q112 it is part of “Other”, under Support Solutions.

Market data

GROWTH RATES ARE BASED ON ERICSSON AND MARKET ESTIMATES

| Q2 | Q2 | FULL YEAR | Ericsson forecast | |||||||||||||||||||||||||

| 2012 | 2011 | Change | 2009 | 2010 | 2011 | 2012 | ||||||||||||||||||||||

Mobile subscriptions, billion | 6.3 | 5.7 | 11 | % | 4.6 | 5.3 | 6.0 | 6.7 | ||||||||||||||||||||

Net additions, million | 140 | 150 | -8 | % | 640 | 700 | 650 | 700 | ||||||||||||||||||||

Mobile broadband, million1) | 1,250 | 800 | 56 | % | 360 | 620 | 1,000 | 1,400 | ||||||||||||||||||||

Net additions, million | 110 | 100 | 15 | % | 150 | 260 | 400 | 450 | ||||||||||||||||||||

| 1) | Mobile broadband includes handsets, tablets and mobile PCs for the following technologies: HSPA, LTE, CDMA2000 EV-DO, TD-SCDMA and WiMAX. Note: due to continuous improvements in reported data from operators, historical subscriptions figures might have changed compared to previously reported, affecting comparison of net additions and total figures. All figures are approximates. |

| Ericsson Second Quarter Report 2012 | 9 |

Table of Contents

Parent Company Information

Income after financial items was SEK 7.0 (4.7) b. Major changes in the Parent Company’s financial position for the six month period; decreased cash, cash equivalents and short-term investments of SEK 12.8 b., and increased current and non-current receivables from subsidiaries of SEK 10.6 b. During the quarter, the dividend payment of SEK 8.0 b., as decided by the Annual General Meeting, was made. At the end of the quarter, cash, cash equivalents and short-term investments amounted to SEK 43.3 (56.1) b. In the quarter, the Parent Company Telefonaktiebolaget LM Ericsson, borrowed USD 1.0 b. through a SEC-registered bond. Two loans of SEK 1.0 b. and SEK 2.0 b. matured in the quarter. The Parent Company also repurchased two EMTN bonds of EUR 441 m. The net change in gross debt is close to zero. By the end of the quarter, ST-Ericsson had utilized USD 619 million of a short-term credit facility.

In accordance with the conditions of the long-term variable compensation program (LTV) for Ericsson employees, 2,483,350 shares from treasury stock were sold or distributed to employees during the second quarter. The holding of treasury stock at June 30, 2012, was 89,695,956 Class B shares. During the quarter, a stock issue of SEK 0.2 b. and a subsequent repurchase was made for the share-based employee remuneration program. 31.7 million Class C shares were issued and later repurchased as treasury stock. The shares were converted into Class B shares.

Other Information

ERICSSON’S NOMINATION COMMITTEE APPOINTED

On June 27, 2012, Ericsson announced the appointment of the Nomination Committee for the Annual General Meeting 2013, in accordance with the Instruction for the Nomination Committee resolved by the Annual General Meeting 2012.

ERICSSON RESOLVES ON AN ACQUISITION OFFER FOR C-SHARES FOR LTV 2012

On May 18, 2012, Ericsson announced that, in accordance with the resolution by the Annual General Meeting 2012, the company would expand its treasury stock in order to provide shares for the Long-Term variable Remuneration Program (LTV) 2012 for employees in Ericsson.

COMPOSITION OF THE BOARD OF DIRECTORS

On May 3, 2012, Ericsson announced that in accordance with the proposal of the Nomination Committee, the Annual General Meeting resolved to re-elect Leif Johansson as Chairman of the Board of Directors and Roxanne S. Austin, Sir Peter L. Bonfield, Börje Ekholm, Ulf J Johansson, Sverker Martin-Löf, Nancy McKinstry, Anders Nyrén, Hans Vestberg, Michelangelo Volpi and Jacob Wallenberg were re-elected as members of the Board of Directors. Alexander Izosimov was elected new member of the Board of Directors. Board members appointed by the unions are Pehr Claesson, Kristina Davidsson and Karin Åberg. Deputy board members appointed by the unions are Rickard Fredriksson, Karin Lennartsson and Roger Svensson.

POST-CLOSING EVENT: CLOSING OF TECHNICOLOR ACQUISITION

On July 3, 2012 Ericsson announced the closing of the acquisition of Technicolor’s Broadcast Services Division. The acquisition brings leading broadcast customers, approximately 900 highly skilled professionals and playout services in France, UK and Netherlands. Purchase price amounted to EUR 19 million and a potential earn-out based on 2015 revenues of the Broadcast Services activity up to EUR 9 million.

| Ericsson Second Quarter Report 2012 | 10 |

Table of Contents

ASSESSMENT OF RISK ENVIRONMENT

Ericsson’s operational and financial risk factors and uncertainties along with our strategies and tactics to mitigate risk exposures or limit unfavorable outcomes are described in our Annual Report 2011. Compared to the risks described in the Annual Report 2011, no material, new or changed risk factors or uncertainties have been identified in the quarter.

Risk factors and uncertainties in focus during the forthcoming nine-month period for the Parent Company and the Ericsson Group include:

| • | Potential negative effects on operators’ willingness to invest in network development due to a increased uncertainty in the financial markets and a weak economic business environment as well as uncertainty regarding the financial stability of suppliers, for example due to lack of financing, or reduced consumer telecom spending, or increased pressure on us to provide financing; |

| • | Effects on gross margins and/or working capital of the product mix in the Networks segment between sales of upgrades and expansions (mainly software) and new buildouts of coverage (mainly hardware); |

| • | Effects on gross margins of the product mix in the Global Services segment including proportion of new network build-outs and share of new managed services deals with initial transition costs; |

| • | A continued volatile sales pattern in the Support Solutions segment or variability in our overall sales seasonality could make it more difficult to forecast future sales; |

| • | Effects of the ongoing industry consolidation among our customers as well as between our largest competitors, e.g. with postponed investments and intensified price competition as a consequence; |

| • | Execution of the business plan and related capital need of our joint venture ST-Ericsson; |

| • | Changes in foreign exchange rates, in particular USD and EUR; |

| • | Political unrest or instability in certain markets; |

| • | Effects on production and sales from restrictions with respect to timely and adequate supply of materials, components and production capacity and other vital services on competitive terms; |

| • | Natural disasters and other events, affecting business, production, supply and transportation. |

Ericsson conducts business in certain countries which are subject to trade restrictions or which are focused on by certain investors. We stringently monitor the compliance with all relevant regulations and trade embargos applicable to us in our dealings with customers operating in such countries. Moreover, Ericsson operates globally in accordance with Group level policies and directives for business ethics and conduct. In no way should our business activities in these countries be construed as supporting a particular political agenda or regime.

Stockholm, July 18, 2012

Telefonaktiebolaget LM Ericsson (publ)

Hans Vestberg, President and CEO

Date for next report: October 26, 2012

| Ericsson Second Quarter Report 2012 | 11 |

Table of Contents

BOARD ASSURANCE

The Board of Directors and the CEO certify that the financial report for the six months gives a fair view of the performance of the business, position and profit or loss of the Company and the Group, and describes the principal risks and uncertainties that the Company and the companies in the Group face.

Stockholm, July 18, 2012

Telefonaktiebolaget LM Ericsson (publ)

Org. Nr. 556016-0680

| Sverker Martin-Löf Deputy chairman | Leif Johansson Chairman | Jacob Wallenberg Deputy chairman | ||

| Roxanne S. Austin Member of the board | Sir Peter L. Bonfield Member of the board | Anders Nyrén Member of the board | ||

| Börje Ekholm Member of the board | Ulf J. Johansson Member of the board | Nancy McKinstry Member of the board | ||

| Alexander Izosimov Member of the board | Michelangelo Volpi Member of the board | |||

| Pehr Claesson Member of the board | Kristina Davidsson Member of the board | Karin Åberg Member of the board | ||

| Hans Vestberg Member of the board and President and CEO | ||||

| Ericsson Second Quarter Report 2012 | 12 |

Table of Contents

Editor’s Note

Ericsson invites media, investors and analysts to a press conference at the Ericsson Studio, Grönlandsgången 4, Stockholm, at 09.00 (CET), July 18, 2012. An analysts, investors and media conference call will begin at 14.00 (CET).

FOR FURTHER INFORMATION, PLEASE CONTACT

Helena Norrman, Senior Vice President, Communications

Phone: +46 10 719 3472

E-mail:investor.relations@ericsson.com ormedia.relations@ericsson.com

INVESTORS

Åse Lindskog, Vice President, Head of Investor and Analyst Relations Phone: +46 10 719 9725 +46 730 244 872 E-mail:investor.relations@ericsson.com

Stefan Jelvin, Director, Investor Relations Phone: +46 10 714 2039 +46 709 860 227 E-mail:investor.relations@ericsson.com

Åsa Konnbjer, Director, Investor Relations Phone: +46 10 713 3928 +46 730 825 928 E-mail: investor.relations@ericsson.com

Rikard Tunedal, Director, Investor Relations Phone: +46 10 714 5400 +46 761 005 400 E-mail:investor.relations@ericsson.com | MEDIA

Ola Rembe, Vice President, Head of Corporate Public & Media Relations Phone: +46 10 719 9727 +46 730 244 873 E-mail:media.relations@ericsson.com

Corporate Public & Media Relations Phone: +46 10 719 69 92 E-mail:media.relations@ericsson.com

Telefonaktiebolaget LM Ericsson (publ) Org. number: 556016-0680 Torshamnsgatan 23 SE-164 83 Stockholm Phone: +46 10 719 0000 |

| Ericsson Second Quarter Report 2012 | 13 |

Table of Contents

Safe Harbor Statement of Ericsson under the US Private Securities Litigation Reform Act of 1995;

All statements made or incorporated by reference in this release, other than statements or characterizations of historical facts, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Forward-looking statements can often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “potential”, “continue”, and variations or negatives of these words, and include, among others, statements regarding: (i) strategies, outlook and growth prospects; (ii) positioning to deliver future plans and to realize potential for future growth; (iii) liquidity and capital resources and expenditure, and our credit ratings; (iv) growth in demand for our products and services; (v) our joint venture activities; (vi) economic outlook and industry trends; (vii) developments of our markets; (viii) the impact of regulatory initiatives; (ix) research and development expenditures; (x) the strength of our competitors; (xi) future cost savings; (xii) plans to launch new products and services; (xiii) assessments of risks; (xiv) integration of acquired businesses; (xv) compliance with rules and regulations and (xvi) infringements of intellectual property rights of others.

In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These forward-looking statements speak only as of the date hereof and are based upon the information available to us at this time. Such information is subject to change, and we will not necessarily inform you of such changes. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference for Ericsson include, but are not limited to: (i) material adverse changes in the markets in which we operate or in global economic conditions; (ii) increased product and price competition; (iii) reductions in capital expenditure by network operators; (iv) the cost of technological innovation and increased expenditure to improve quality of service; (v) significant changes in market share for our principal products and services; (vi) foreign exchange rate or interest rate fluctuations; and (vii) the successful implementation of our business and operational initiatives.

| Ericsson Second Quarter Report 2012 | 14 |

Table of Contents

Financial Statements and Additional Information

| Financial statements | Page | |||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 21 | ||||

| Additional information | Page | |||

| 22 | ||||

| 23 | ||||

| 24 | ||||

| 24 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| Ericsson Second Quarter Report 2012 | 15 |

Table of Contents

| Apr - Jun | Jan - Jun | |||||||||||||||||||||||

SEK million | 2011 | 2012 | Change | 2011 | 2012 | Change | ||||||||||||||||||

Net sales | 54,770 | 55,319 | 1 | % | 107,736 | 106,293 | -1 | % | ||||||||||||||||

Cost of sales | -34,064 | -37,611 | 10 | % | -66,642 | -71,596 | 7 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross income | 20,706 | 17,708 | -14 | % | 41,094 | 34,697 | -16 | % | ||||||||||||||||

Gross margin (%) | 37.8 | % | 32.0 | % | 38.1 | % | 32.6 | % | ||||||||||||||||

Research and development expenses | -8,108 | -8,097 | 0 | % | -16,099 | -16,113 | 0 | % | ||||||||||||||||

Selling and administrative expenses | -7,741 | -6,855 | -11 | % | -14,182 | -13,087 | -8 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating expenses | -15,849 | -14,952 | -6 | % | -30,281 | -29,200 | -4 | % | ||||||||||||||||

Other operating income and expenses1) | 166 | 530 | 509 | 8,279 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income before shares in earnings of JV and associated companies | 5,023 | 3,286 | -35 | % | 11,322 | 13,776 | 22 | % | ||||||||||||||||

Operating margin before shares in earnings of JV and associated companies (%) | 9.2 | % | 5.9 | % | 10.5 | % | 13.0 | % | ||||||||||||||||

Shares in earnings of JV and associated companies | -771 | -1,208 | 57 | % | -1,239 | -2,611 | 111 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income | 4,252 | 2,078 | -51 | % | 10,083 | 11,165 | 11 | % | ||||||||||||||||

Financial income | 977 | 618 | 1,279 | 880 | -31 | % | ||||||||||||||||||

Financial expenses | -636 | -924 | -942 | -1,197 | 27 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income after financial items | 4,593 | 1,772 | -61 | % | 10,420 | 10,848 | 4 | % | ||||||||||||||||

Taxes | -1,377 | -567 | -3,124 | -839 | ||||||||||||||||||||

Net income | 3,216 | 1,205 | -63 | % | 7,296 | 10,009 | 37 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income attributable to: | ||||||||||||||||||||||||

- Stockholders of the Parent Company | 3,116 | 1,110 | 7,219 | 10,060 | ||||||||||||||||||||

- Non-controlling interests | 100 | 95 | 77 | -51 | ||||||||||||||||||||

Other information | ||||||||||||||||||||||||

Average number of shares, basic (million) | 3,204 | 3,215 | 3,203 | 3,213 | ||||||||||||||||||||

Earnings per share, basic (SEK)2) | 0.97 | 0.35 | 2.25 | 3.13 | ||||||||||||||||||||

Earnings per share, diluted (SEK)2) | 0.96 | 0.34 | 2.23 | 3.10 | ||||||||||||||||||||

STATEMENT OF COMPREHENSIVE INCOME

| Apr - Jun | Jan - Jun | |||||||||||||||

SEK million | 2011 | 2012 | 2011 | 2012 | ||||||||||||

Net income | 3,216 | 1,205 | 7,296 | 10,009 | ||||||||||||

Other comprehensive income | ||||||||||||||||

Actuarial gains and losses, and the effect of the asset ceiling, related to pensions | -1,737 | -1,201 | -1,349 | -765 | ||||||||||||

Revaluation of other investments in shares and participations | ||||||||||||||||

Fair value remeasurement | 1 | 1 | — | 1 | ||||||||||||

Cash flow hedges | ||||||||||||||||

Gains/losses arising during the period | 138 | -586 | 1,762 | 199 | ||||||||||||

Reclassification adjustments for gains/losses included in profit or loss | -1,198 | 70 | -2,119 | -143 | ||||||||||||

Adjustments for amounts transferred to initial carrying amount of hedged items | — | — | — | 92 | ||||||||||||

Changes in cumulative translation adjustments | 1,143 | 1,323 | -2,274 | -681 | ||||||||||||

Share of other comprehensive income on JV and associated companies | 128 | 34 | -616 | -18 | ||||||||||||

Tax on items relating to components of other comprehensive income | 666 | 545 | 444 | 153 | ||||||||||||

Total other comprehensive income | -859 | 186 | -4,152 | -1,162 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total comprehensive income | 2,357 | 1,391 | 3,144 | 8,847 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total comprehensive income attributable to: | ||||||||||||||||

Stockholders of the Parent Company | 2,211 | 1,229 | 3,117 | 8,879 | ||||||||||||

Non-controlling interests | 146 | 162 | 27 | -32 | ||||||||||||

| 1) | Includes gain on sale of Sony Ericsson SEK 7.7 b. in Q1 2012 |

| 2) | Based on Net income attributable to stockholders of the Parent Company |

| Ericsson Second Quarter Report 2012 | 16 |

Table of Contents

| Dec 31 | Mar 31 | Jun 30 | ||||||||||

SEK million | 2011 | 2012 | 2012 | |||||||||

ASSETS | ||||||||||||

Non-current assets | ||||||||||||

Intangible assets | ||||||||||||

Capitalized development expenses | 3,523 | 3,529 | 3,795 | |||||||||

Goodwill | 27,438 | 31,245 | 31,342 | |||||||||

Intellectual property rights, brands and other intangible assets | 13,083 | 17,263 | 17,616 | |||||||||

Property, plant and equipment | 10,788 | 11,268 | 11,435 | |||||||||

Financial assets | ||||||||||||

Equity in JV and associated companies | 5,965 | 3,271 | 2,110 | |||||||||

Other investments in shares and participations | 2,199 | 2,122 | 2,207 | |||||||||

Customer financing, non-current | 1,400 | 1,139 | 1,340 | |||||||||

Other financial assets, non-current | 4,117 | 5,747 | 4,932 | |||||||||

Deferred tax assets | 13,020 | 13,231 | 14,164 | |||||||||

|

|

|

|

|

| |||||||

| 81,533 | 88,815 | 88,941 | ||||||||||

Current assets | ||||||||||||

Inventories | 33,070 | 32,546 | 33,118 | |||||||||

Trade receivables | 64,522 | 60,695 | 67,320 | |||||||||

Customer financing, current | 2,845 | 2,798 | 2,581 | |||||||||

Other current receivables | 17,837 | 20,333 | 19,337 | |||||||||

Short-term investments1) | 41,866 | 44,992 | 37,674 | |||||||||

Cash and cash equivalents | 38,676 | 30,638 | 28,707 | |||||||||

|

|

|

|

|

| |||||||

| 198,816 | 192,002 | 188,737 | ||||||||||

Total assets | 280,349 | 280,817 | 277,678 | |||||||||

|

|

|

|

|

| |||||||

EQUITY AND LIABILITIES | ||||||||||||

Equity | ||||||||||||

Stockholders’ equity | 143,105 | 150,506 | 143,827 | |||||||||

Non-controlling interest in equity of subsidiaries | 2,165 | 1,962 | 1,920 | |||||||||

|

|

|

|

|

| |||||||

| 145,270 | 152,468 | 145,747 | ||||||||||

Non-current liabilities | ||||||||||||

Post-employment benefits | 10,016 | 9,339 | 9,859 | |||||||||

Provisions, non-current | 280 | 208 | 205 | |||||||||

Deferred tax liabilities | 2,250 | 3,749 | 3,732 | |||||||||

Borrowings, non-current | 23,256 | 22,969 | 23,033 | |||||||||

Other non-current liabilities | 2,248 | 2,590 | 2,534 | |||||||||

|

|

|

|

|

| |||||||

| 38,050 | 38,855 | 39,363 | ||||||||||

Current liabilities | ||||||||||||

Provisions, current | 5,985 | 5,722 | 5,113 | |||||||||

Borrowings, current | 7,765 | 6,229 | 7,583 | |||||||||

Trade payables | 25,309 | 22,283 | 24,410 | |||||||||

Other current liabilities | 57,970 | 55,260 | 55,462 | |||||||||

|

|

|

|

|

| |||||||

| 97,029 | 89,494 | 92,568 | ||||||||||

Total equity and liabilities | 280,349 | 280,817 | 277,678 | |||||||||

|

|

|

|

|

| |||||||

Of which interest-bearing liabilities and post-employment benefits | 41,037 | 38,537 | 40,475 | |||||||||

Of which net cash | 39,505 | 37,093 | 25,906 | |||||||||

Assets pledged as collateral | 452 | 403 | 530 | |||||||||

Contingent liabilities | 609 | 581 | 518 | |||||||||

| 1) | Including loan to ST-Ericsson of SEK 4,311 million as of June 30, 2012 |

(SEK 3,241 million as of March 31, 2012, SEK 2,759 million as of December 31, 2011)

| Ericsson Second Quarter Report 2012 | 17 |

Table of Contents

CONSOLIDATED STATEMENT OF CASH FLOWS

| Apr - Jun | Jan - Jun | Jan - Dec | ||||||||||||||||||

SEK million | 2011 | 2012 | 2011 | 2012 | 2011 | |||||||||||||||

Operating activities | ||||||||||||||||||||

Net income | 3,216 | 1,205 | 7,296 | 10,009 | 12,569 | |||||||||||||||

Adjustments to reconcile net income to cash | ||||||||||||||||||||

Taxes | -29 | -1,185 | 692 | -2,303 | 1,994 | |||||||||||||||

Earnings/dividends in JV and associated companies | 783 | 1,193 | 1,235 | 2,483 | 3,710 | |||||||||||||||

Depreciation, amortization and impairment losses | 2,172 | 2,401 | 4,381 | 4,716 | 9,036 | |||||||||||||||

Other | -1,107 | -466 | -2,308 | -7,488 | -2,127 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 5,035 | 3,148 | 11,296 | 7,417 | 25,182 | ||||||||||||||||

Changes in operating net assets | ||||||||||||||||||||

Inventories | -2,370 | 43 | -5,832 | -16 | -3,243 | |||||||||||||||

Customer financing, current and non-current | 195 | 0 | 391 | 282 | 74 | |||||||||||||||

Trade receivables | 2,114 | -5,427 | 504 | -1,705 | -1,700 | |||||||||||||||

Trade payables | -834 | 1,717 | -1,089 | -996 | -1,648 | |||||||||||||||

Provisions and post-employment benefits | -485 | -353 | -1,237 | -2,124 | -5,695 | |||||||||||||||

Other operating assets and liabilities, net | 2,126 | -492 | -1,158 | -3,491 | -2,988 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 746 | -4,512 | -8,421 | -8,050 | -15,200 | ||||||||||||||||

Cash flow from operating activities | 5,781 | -1,364 | 2,875 | -633 | 9,982 | |||||||||||||||

Investing activities | ||||||||||||||||||||

Investments in property, plant and equipment | -1,196 | -994 | -2,176 | -2,642 | -4,994 | |||||||||||||||

Sales of property, plant and equipment | 58 | -10 | 155 | 299 | 386 | |||||||||||||||

Acquisitions/divestments of subsidiaries and other operations, net1) | -507 | -110 | -962 | -1,840 | -3,128 | |||||||||||||||

Product development | -429 | -525 | -698 | -776 | -1,515 | |||||||||||||||

Other investing activities | -100 | -520 | 79 | -325 | -900 | |||||||||||||||

Short-term investments | 3,196 | 8,133 | 6,902 | 4,134 | 14,692 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from investing activities | 1,022 | �� | 5,974 | 3,300 | -1,150 | 4,541 | ||||||||||||||

Cash flow before financing activities | 6,803 | 4,610 | 6,175 | -1,783 | 14,523 | |||||||||||||||

Financing activities | ||||||||||||||||||||

Dividends paid | -7,209 | -8,252 | -7,209 | -8,252 | -7,455 | |||||||||||||||

Other financing activities | -1,097 | 1,112 | 143 | -206 | 961 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from financing activities | -8,306 | -7,140 | -7,066 | -8,458 | -6,494 | |||||||||||||||

Effect of exchange rate changes on cash | 211 | 599 | -509 | 272 | -217 | |||||||||||||||

Net change in cash | -1,292 | -1,931 | -1,400 | -9,969 | 7,812 | |||||||||||||||

Cash and cash equivalents, beginning of period | 30,756 | 30,638 | 30,864 | 38,676 | 30,864 | |||||||||||||||

Cash and cash equivalents, end of period | 29,464 | 28,707 | 29,464 | 28,707 | 38,676 | |||||||||||||||

| 1) | Includes payment of external loan of SEK -6.2 b. attributable to the acquisition of Telcordia in Q1 2012 |

| Ericsson Second Quarter Report 2012 | 18 |

Table of Contents

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Jan - Jun | Jan - Jun | Jan - Dec | ||||||||||

SEK million | 2011 | 2012 | 2011 | |||||||||

Opening balance | 146,785 | 145,270 | 146,785 | |||||||||

Total comprehensive income | 3,144 | 8,847 | 5,506 | |||||||||

Stock issue | — | 159 | — | |||||||||

Sale/Repurchase of own shares | 45 | -126 | 92 | |||||||||

Stock purchase | 213 | 218 | 413 | |||||||||

Dividends paid | -7,209 | -8,252 | -7,455 | |||||||||

Transactions with non-controlling interests | -88 | -369 | -71 | |||||||||

|

|

|

|

|

| |||||||

Closing balance | 142,890 | 145,747 | 145,270 | |||||||||

|

|

|

|

|

| |||||||

| Ericsson Second Quarter Report 2012 | 19 |

Table of Contents

CONSOLIDATED INCOME STATEMENT - ISOLATED QUARTERS

| 2011 | 2012 | |||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

Net sales | 52,966 | 54,770 | 55,518 | 63,667 | 50,974 | 55,319 | ||||||||||||||||||

Cost of sales | -32,578 | -34,064 | -36,095 | -44,463 | -33,985 | -37,611 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross income | 20,388 | 20,706 | 19,423 | 19,204 | 16,989 | 17,708 | ||||||||||||||||||

Gross margin (%) | 38.5 | % | 37.8 | % | 35.0 | % | 30.2 | % | 33.3 | % | 32.0 | % | ||||||||||||

Research and development expenses | -7,991 | -8,108 | -7,824 | -8,715 | -8,016 | -8,097 | ||||||||||||||||||

Selling and administrative expenses | -6,441 | -7,741 | -5,664 | -6,837 | -6,232 | -6,855 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating expenses | -14,432 | -15,849 | -13,488 | -15,552 | -14,248 | -14,952 | ||||||||||||||||||

Other operating income and expenses1) | 343 | 166 | 366 | 403 | 7,749 | 530 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income before shares in earnings of JV and associated companies | 6,299 | 5,023 | 6,301 | 4,055 | 10,490 | 3,286 | ||||||||||||||||||

Operating margin before shares in earnings of JV and associated companies (%) | 11.9 | % | 9.2 | % | 11.3 | % | 6.4 | % | 20.6 | % | 5.9 | % | ||||||||||||

Shares in earnings of JV and associated companies | -468 | -771 | -640 | -1,899 | -1,403 | -1,208 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income | 5,831 | 4,252 | 5,661 | 2,156 | 9,087 | 2,078 | ||||||||||||||||||

Financial income | 302 | 977 | 1,198 | 405 | 262 | 618 | ||||||||||||||||||

Financial expenses | -306 | -636 | -987 | -732 | -273 | -924 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income after financial items | 5,827 | 4,593 | 5,872 | 1,829 | 9,076 | 1,772 | ||||||||||||||||||

Taxes | -1,747 | -1,377 | -2,090 | -338 | -272 | -567 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income | 4,080 | 3,216 | 3,782 | 1,491 | 8,804 | 1,205 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income attributable to: | ||||||||||||||||||||||||

- Stockholders of the Parent Company | 4,103 | 3,116 | 3,821 | 1,154 | 8,950 | 1,110 | ||||||||||||||||||

- Non-controlling interests | -23 | 100 | -39 | 337 | -146 | 95 | ||||||||||||||||||

Other information | ||||||||||||||||||||||||

Average number of shares, basic (million) | 3,202 | 3,204 | 3,207 | 3,209 | 3,212 | 3,215 | ||||||||||||||||||

Earnings per share, basic (SEK)2) | 1.28 | 0.97 | 1.19 | 0.36 | 2.79 | 0.35 | ||||||||||||||||||

Earnings per share, diluted (SEK)2) | 1.27 | 0.96 | 1.18 | 0.36 | 2.76 | 0.34 | ||||||||||||||||||

| 1) | Includes gain on sale of Sony Ericsson SEK 7.7 b. in Q1 2012 |

| 2) | Based on Net income attributable to stockholders of the Parent Company |

| Ericsson Second Quarter Report 2012 | 20 |

Table of Contents

CONSOLIDATED STATEMENT OF CASH FLOWS - ISOLATED QUARTERS

| 2011 | 2012 | |||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

Operating activities | ||||||||||||||||||||||||

Net income | 4,080 | 3,216 | 3,782 | 1,491 | 8,804 | 1,205 | ||||||||||||||||||

Adjustments to reconcile net income to cash | ||||||||||||||||||||||||

Taxes | 721 | -29 | 550 | 752 | -1,118 | -1,185 | ||||||||||||||||||

Earnings/dividends in JV and associated companies | 452 | 783 | 658 | 1,817 | 1,290 | 1,193 | ||||||||||||||||||

Depreciation, amortization and impairment losses | 2,209 | 2,172 | 2,227 | 2,428 | 2,315 | 2,401 | ||||||||||||||||||

Other | -1,201 | -1,107 | -291 | 472 | -7,022 | -466 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 6,261 | 5,035 | 6,926 | 6,960 | 4,269 | 3,148 | |||||||||||||||||||

Changes in operating net assets | ||||||||||||||||||||||||

Inventories | -3,462 | -2,370 | -2,619 | 5,208 | -59 | 43 | ||||||||||||||||||

Customer financing, current and non-current | 196 | 195 | -607 | 290 | 282 | 0 | ||||||||||||||||||

Trade receivables | -1,610 | 2,114 | -2,769 | 565 | 3,722 | -5,427 | ||||||||||||||||||

Trade payables | -255 | -834 | -805 | 246 | -2,713 | 1,717 | ||||||||||||||||||

Provisions and post-employment benefits | -752 | -485 | -2,180 | -2,278 | -1,771 | -353 | ||||||||||||||||||

Other operating assets and liabilities, net | -3,284 | 2,126 | 3,694 | -5,524 | -2,999 | -492 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| -9,167 | 746 | -5,286 | -1,493 | -3,538 | -4,512 | |||||||||||||||||||

Cash flow from operating activities | -2,906 | 5,781 | 1,640 | 5,467 | 731 | -1,364 | ||||||||||||||||||

Investing activities | ||||||||||||||||||||||||

Investments in property, plant and equipment | -980 | -1,196 | -1,294 | -1,524 | -1,648 | -994 | ||||||||||||||||||

Sales of property, plant and equipment | 97 | 58 | 59 | 172 | 309 | -10 | ||||||||||||||||||

Acquisitions/divestments of subsidiaries and other operations, net1) | -455 | -507 | -1,931 | -235 | -1,730 | -110 | ||||||||||||||||||

Product development | -269 | -429 | -257 | -560 | -251 | -525 | ||||||||||||||||||

Other investing activities | 179 | -100 | -769 | -210 | 195 | -520 | ||||||||||||||||||

Short-term investments | 3,706 | 3,196 | 9,323 | -1,533 | -3,999 | 8,133 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Cash flow from investing activities | 2,278 | 1,022 | 5,131 | -3,890 | -7,124 | 5,974 | ||||||||||||||||||

Cash flow before financing activities | -628 | 6,803 | 6,771 | 1,577 | -6,393 | 4,610 | ||||||||||||||||||

Financing activities | ||||||||||||||||||||||||

Dividends paid | — | -7,209 | -241 | -5 | — | -8,252 | ||||||||||||||||||

Other financing activities | 1,240 | -1,097 | -10 | 828 | -1,318 | 1,112 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Cash flow from financing activities | 1,240 | -8,306 | -251 | 823 | -1,318 | -7,140 | ||||||||||||||||||

Effect of exchange rate changes on cash | -720 | 211 | 278 | 14 | -327 | 599 | ||||||||||||||||||

Net change in cash | -108 | -1,292 | 6,798 | 2,414 | -8,038 | -1,931 | ||||||||||||||||||

Cash and cash equivalents, beginning of period | 30,864 | 30,756 | 29,464 | 36,262 | 38,676 | 30,638 | ||||||||||||||||||

Cash and cash equivalents, end of period | 30,756 | 29,464 | 36,262 | 38,676 | 30,638 | 28,707 | ||||||||||||||||||

| 1) | Includes payment of external loan of SEK -6.2 b. attributable to the acquisition of Telcordia in Q1 2012 |

| Ericsson Second Quarter Report 2012 | 21 |

Table of Contents

The Group

This interim report is prepared in accordance with IAS 34. The term “IFRS” used in this document refers to the application of IAS and IFRS as well as interpretations of these standards as issued by IASB’s Standards Interpretation Committee (SIC) and IFRS Interpretations Committee (IFRIC). The accounting policies adopted are consistent with those of the annual report for the year ended December 31, 2011, and should be read in conjunction with that annual report.

As from January 1, 2012, the Company has applied the following new or amended IFRSs and IFRICs:

| • | Amendment to IAS 12, income taxes: deferred tax: recovery of underlying assets (not yet endorsed by the EU) |

| • | Amendments to IFRS 7, Financial instruments, disclosures: transfers of Financial Assets |

None of the new or amended standards and interpretations has had any significant impact on the financial result or position of the Company. There is no difference between IFRS effective as per June 30, 2012 and IFRS as endorsed by the EU, except for IAS 12 above.

| Ericsson Second Quarter Report 2012 | 22 |

Table of Contents

NET SALES BY SEGMENT BY QUARTER

Segments Sony Ericsson and ST-Ericsson are reported in accordance with the equity method, thus their sales are not included.

| 2011 | 2012 | |||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

Networks | 33,249 | 33,360 | 32,506 | 33,280 | 27,314 | 27,766 | ||||||||||||||||||

Global Services | 17,435 | 19,036 | 20,438 | 26,975 | 20,631 | 24,074 | ||||||||||||||||||

Of which Professional Services | 12,571 | 13,463 | 14,719 | 18,081 | 14,884 | 16,947 | ||||||||||||||||||

Of which Managed Services | 4,924 | 4,724 | 5,304 | 6,046 | 5,708 | 6,468 | ||||||||||||||||||

Of which Network Rollout | 4,864 | 5,573 | 5,719 | 8,894 | 5,747 | 7,127 | ||||||||||||||||||

Support Solutions | 2,282 | 2,374 | 2,574 | 3,412 | 3,029 | 3,479 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 52,966 | 54,770 | 55,518 | 63,667 | 50,974 | 55,319 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 2011 | 2012 | |||||||||||||||||||||||

Sequential change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

Networks | -9 | % | 0 | % | -3 | % | 2 | % | -18 | % | 2 | % | ||||||||||||

Global Services | -24 | % | 9 | % | 7 | % | 32 | % | -24 | % | 17 | % | ||||||||||||

Of which Professional Services | -25 | % | 7 | % | 9 | % | 23 | % | -18 | % | 14 | % | ||||||||||||

Of which Managed Services | -8 | % | -4 | % | 12 | % | 14 | % | -6 | % | 13 | % | ||||||||||||

Of which Network Rollout | -21 | % | 15 | % | 3 | % | 56 | % | -35 | % | 24 | % | ||||||||||||

Support Solutions | -34 | % | 4 | % | 8 | % | 33 | % | -11 | % | 15 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | -16 | % | 3 | % | 1 | % | 15 | % | -20 | % | 9 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 2011 | 2012 | |||||||||||||||||||||||

Year over year change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

Networks | 35 | % | 31 | % | 25 | % | -9 | % | -18 | % | -17 | % | ||||||||||||

Global Services | -4 | % | -5 | % | 7 | % | 18 | % | 18 | % | 26 | % | ||||||||||||

Of which Professional Services | -5 | % | -9 | % | 7 | % | 8 | % | 18 | % | 26 | % | ||||||||||||

Of which Managed Services | 1 | % | -16 | % | 1 | % | 13 | % | 16 | % | 37 | % | ||||||||||||

Of which Network Rollout | 0 | % | 6 | % | 7 | % | 44 | % | 18 | % | 28 | % | ||||||||||||

Support Solutions | -1 | % | -2 | % | 11 | % | -2 | % | 33 | % | 47 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 17 | % | 14 | % | 17 | % | 1 | % | -4 | % | 1 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 2011 | 2012 | |||||||||||||||||||||||

Year to date, SEK million | Jan - Mar | Jan - Jun | Jan - Sep | Jan - Dec | Jan - Mar | Jan - Jun | ||||||||||||||||||

Networks | 33,249 | 66,609 | 99,115 | 132,395 | 27,314 | 55,080 | ||||||||||||||||||

Global Services | 17,435 | 36,471 | 56,909 | 83,884 | 20,631 | 44,705 | ||||||||||||||||||

Of which Professional Services | 12,571 | 26,034 | 40,753 | 58,834 | 14,884 | 31,830 | ||||||||||||||||||

Of which Managed Services | 4,924 | 9,648 | 14,952 | 20,998 | 5,708 | 12,176 | ||||||||||||||||||

Of which Network Rollout | 4,864 | 10,437 | 16,156 | 25,050 | 5,747 | 12,875 | ||||||||||||||||||

Support Solutions | 2,282 | 4,656 | 7,230 | 10,642 | 3,029 | 6,508 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 52,966 | 107,736 | 163,254 | 226,921 | 50,974 | 106,293 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Year to date, | 2011 | 2012 | ||||||||||||||||||||||

year over year change, percent | Jan - Mar | Jan - Jun | Jan - Sep | Jan - Dec | Jan - Mar | Jan - Jun | ||||||||||||||||||

Networks | 35 | % | 33 | % | 30 | % | 17 | % | -18 | % | -17 | % | ||||||||||||

Global Services | -4 | % | -4 | % | -1 | % | 5 | % | 18 | % | 23 | % | ||||||||||||

Of which Professional Services | -5 | % | -7 | % | -3 | % | 1 | % | 18 | % | 22 | % | ||||||||||||

Of which Managed Services | 1 | % | -8 | % | -5 | % | -1 | % | 16 | % | 26 | % | ||||||||||||

Of which Network Rollout | 0 | % | 3 | % | 5 | % | 16 | % | 18 | % | 23 | % | ||||||||||||

Support Solutions | -1 | % | -2 | % | 3 | % | 1 | % | 33 | % | 40 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 17 | % | 16 | % | 16 | % | 12 | % | -4 | % | -1 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| Ericsson Second Quarter Report 2012 | 23 |

Table of Contents

OPERATING INCOME BY SEGMENT BY QUARTER

| 1) | “Unallocated” consists mainly of costs for corporate staff, non-operational capital gains and losses |

| 2) | Includes gain on sale of Sony Ericsson SEK 7.7 b. in Q1 2012 |

| Ericsson Second Quarter Report 2012 | 24 |

Table of Contents

NET SALES BY REGION BY QUARTER

| 2011 | 2012 | |||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

North America | 13,162 | 12,324 | 12,096 | 11,203 | 12,775 | 12,987 | ||||||||||||||||||

Latin America | 4,015 | 4,927 | 6,012 | 7,028 | 4,822 | 5,243 | ||||||||||||||||||

Northern Europe & Central Asia1) 2) | 3,365 | 4,552 | 3,527 | 3,781 | 2,292 | 3,358 | ||||||||||||||||||

Western & Central Europe2) | 4,806 | 4,342 | 4,612 | 5,270 | 4,306 | 4,094 | ||||||||||||||||||

Mediterranean2) | 4,799 | 5,543 | 5,225 | 8,240 | 4,620 | 6,214 | ||||||||||||||||||

Middle East | 3,070 | 3,546 | 3,650 | 5,195 | 3,157 | 3,701 | ||||||||||||||||||

Sub Saharan Africa | 2,212 | 2,214 | 2,519 | 3,218 | 2,200 | 2,791 | ||||||||||||||||||

India | 3,169 | 2,798 | 2,273 | 1,522 | 1,421 | 1,700 | ||||||||||||||||||

China & North East Asia | 8,633 | 9,025 | 9,662 | 10,889 | 9,154 | 8,423 | ||||||||||||||||||

South East Asia & Oceania | 3,108 | 3,033 | 3,720 | 4,009 | 3,374 | 3,674 | ||||||||||||||||||

Other1) 2) | 2,627 | 2,466 | 2,222 | 3,312 | 2,853 | 3,134 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 52,966 | 54,770 | 55,518 | 63,667 | 50,974 | 55,319 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which Sweden | 927 | 1,103 | 944 | 908 | 834 | 1,282 | ||||||||||||||||||

2) Of which EU | 10,020 | 10,317 | 10,195 | 13,428 | 9,502 | 11,201 | ||||||||||||||||||

| 2011 | 2012 | |||||||||||||||||||||||

Sequential change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

North America | -6 | % | -6 | % | -2 | % | -7 | % | 14 | % | 2 | % | ||||||||||||

Latin America | -34 | % | 23 | % | 22 | % | 17 | % | -31 | % | 9 | % | ||||||||||||

Northern Europe & Central Asia1) 2) | -30 | % | 35 | % | -23 | % | 7 | % | -39 | % | 47 | % | ||||||||||||

Western & Central Europe2) | -19 | % | -10 | % | 6 | % | 14 | % | -18 | % | -5 | % | ||||||||||||

Mediterranean2) | -31 | % | 16 | % | -6 | % | 58 | % | -44 | % | 35 | % | ||||||||||||

Middle East | -34 | % | 16 | % | 3 | % | 42 | % | -39 | % | 17 | % | ||||||||||||

Sub Saharan Africa | 9 | % | 0 | % | 14 | % | 28 | % | -32 | % | 27 | % | ||||||||||||

India | 11 | % | -12 | % | -19 | % | -33 | % | -7 | % | 20 | % | ||||||||||||

China & North East Asia | -9 | % | 5 | % | 7 | % | 13 | % | -16 | % | -8 | % | ||||||||||||

South East Asia & Oceania | -21 | % | -2 | % | 23 | % | 8 | % | -16 | % | 9 | % | ||||||||||||

Other1) 2) | 25 | % | -6 | % | -10 | % | 49 | % | -14 | % | 10 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | -16 | % | 3 | % | 1 | % | 15 | % | -20 | % | 9 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which Sweden | -21 | % | 19 | % | -14 | % | -4 | % | -8 | % | 54 | % | ||||||||||||

2) Of which EU | -20 | % | 3 | % | -1 | % | 32 | % | -29 | % | 18 | % | ||||||||||||

| 2011 | 2012 | |||||||||||||||||||||||

Year-over-year change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

North America | 39 | % | -6 | % | -6 | % | -20 | % | -3 | % | 5 | % | ||||||||||||

Latin America | 1 | % | 17 | % | 64 | % | 16 | % | 20 | % | 6 | % | ||||||||||||

Northern Europe & Central Asia1) 2) | 46 | % | 70 | % | 49 | % | -22 | % | -32 | % | -26 | % | ||||||||||||

Western & Central Europe2) | -8 | % | -2 | % | 7 | % | -11 | % | -10 | % | -6 | % | ||||||||||||

Mediterranean2) | -5 | % | -2 | % | 4 | % | 19 | % | -4 | % | 12 | % | ||||||||||||

Middle East | -22 | % | -7 | % | 34 | % | 12 | % | 3 | % | 4 | % | ||||||||||||

Sub Saharan Africa | -9 | % | -25 | % | 40 | % | 59 | % | -1 | % | 26 | % | ||||||||||||

India | 38 | % | 107 | % | 7 | % | -46 | % | -55 | % | -39 | % | ||||||||||||

China & North East Asia | 74 | % | 96 | % | 39 | % | 15 | % | 6 | % | -7 | % | ||||||||||||

South East Asia & Oceania | -12 | % | -17 | % | -3 | % | 2 | % | 9 | % | 21 | % | ||||||||||||

Other1) 2) | 37 | % | 49 | % | 19 | % | 57 | % | 9 | % | 27 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 17 | % | 14 | % | 17 | % | 1 | % | -4 | % | 1 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which Sweden | -11 | % | 11 | % | -8 | % | -22 | % | -10 | % | 16 | % | ||||||||||||

2) Of which EU | -9 | % | -1 | % | 5 | % | 7 | % | -5 | % | 9 | % | ||||||||||||

| Ericsson Second Quarter Report 2012 | 25 |

Table of Contents

NET SALES BY REGION BY QUARTER (continued)

| 2011 | 2012 | |||||||||||||||||||||||

Year to date, SEK million | Jan - Mar | Jan - Jun | Jan - Sep | Jan - Dec | Jan - Mar | Jan - Jun | ||||||||||||||||||

North America | 13,162 | 25,486 | 37,582 | 48,785 | 12,775 | 25,762 | ||||||||||||||||||

Latin America | 4,015 | 8,942 | 14,954 | 21,982 | 4,822 | 10,065 | ||||||||||||||||||

Northern Europe & Central Asia1) 2) | 3,365 | 7,917 | 11,444 | 15,225 | 2,292 | 5,650 | ||||||||||||||||||

Western & Central Europe2) | 4,806 | 9,148 | 13,760 | 19,030 | 4,306 | 8,400 | ||||||||||||||||||

Mediterranean2) | 4,799 | 10,342 | 15,567 | 23,807 | 4,620 | 10,834 | ||||||||||||||||||

Middle East | 3,070 | 6,616 | 10,266 | 15,461 | 3,157 | 6,858 | ||||||||||||||||||

Sub Saharan Africa | 2,212 | 4,426 | 6,945 | 10,163 | 2,200 | 4,991 | ||||||||||||||||||

India | 3,169 | 5,967 | 8,240 | 9,762 | 1,421 | 3,121 | ||||||||||||||||||

China & North East Asia | 8,633 | 17,658 | 27,320 | 38,209 | 9,154 | 17,577 | ||||||||||||||||||

South East Asia & Oceania | 3,108 | 6,141 | 9,861 | 13,870 | 3,374 | 7,048 | ||||||||||||||||||

Other1) 2) | 2,627 | 5,093 | 7,315 | 10,627 | 2,853 | 5,987 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 52,966 | 107,736 | 163,254 | 226,921 | 50,974 | 106,293 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which Sweden | 927 | 2,030 | 2,974 | 3,882 | 834 | 2,116 | ||||||||||||||||||

2) Of which EU | 10,020 | 20,337 | 30,532 | 43,960 | 9,502 | 20,703 | ||||||||||||||||||

| Year to date, | 2011 | 2012 | ||||||||||||||||||||||

year-over-year change, percent | Jan - Mar | Jan - Jun | Jan - Sep | Jan - Dec | Jan - Mar | Jan - Jun | ||||||||||||||||||

North America | 39 | % | 13 | % | 6 | % | -1 | % | -3 | % | 1 | % | ||||||||||||

Latin America | 1 | % | 10 | % | 26 | % | 23 | % | 20 | % | 13 | % | ||||||||||||

Northern Europe & Central Asia1) 2) | 46 | % | 59 | % | 56 | % | 25 | % | -32 | % | -29 | % | ||||||||||||

Western & Central Europé2) | -8 | % | -5 | % | -1 | % | -4 | % | -10 | % | -8 | % | ||||||||||||

Mediterranean2) | -5 | % | -3 | % | -1 | % | 5 | % | -4 | % | 5 | % | ||||||||||||

Middle East | -22 | % | -15 | % | -2 | % | 2 | % | 3 | % | 4 | % | ||||||||||||

Sub Saharan Africa | -9 | % | -18 | % | -3 | % | 11 | % | -1 | % | 13 | % | ||||||||||||

India | 38 | % | 63 | % | 42 | % | 13 | % | -55 | % | -48 | % | ||||||||||||

China & North East Asia | 74 | % | 85 | % | 66 | % | 47 | % | 6 | % | 0 | % | ||||||||||||

South East Asia & Oceania | -12 | % | -14 | % | -10 | % | -7 | % | 9 | % | 15 | % | ||||||||||||

Other1) 2) | 37 | % | 43 | % | 35 | % | 41 | % | 9 | % | 18 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 17 | % | 16 | % | 16 | % | 12 | % | -4 | % | -1 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which Sweden | -11 | % | -1 | % | -3 | % | -8 | % | -10 | % | 4 | % | ||||||||||||

2) Of which EU | -9 | % | -5 | % | -2 | % | 1 | % | -5 | % | 2 | % | ||||||||||||

| Q2 | Jan - Jun | |||||||||||||||

Country | 2011 | 2012 | 2011 | 2012 | ||||||||||||

UNITED STATES | 22 | % | 23 | % | 23 | % | 24 | % | ||||||||

JAPAN | 5 | % | 7 | % | 7 | % | 8 | % | ||||||||

CHINA | 8 | % | 6 | % | 7 | % | 5 | % | ||||||||

ITALY | 4 | % | 4 | % | 4 | % | 4 | % | ||||||||

BRAZIL | 3 | % | 4 | % | 3 | % | 4 | % | ||||||||

| Ericsson Second Quarter Report 2012 | 26 |

Table of Contents

NET SALES BY REGION BY SEGMENT

Since the segment ST-Ericsson is reported in accordance with the equity method, their sales are not included below. Net sales related to these segments are disclosed under SEGMENT RESULTS. Net sales related to other segments are set out below.

Revenue from Telcordia is reported 50/50 between Segments Global Services and Support Solutions. In the regional dimension, all of Telcordia sales is reported in Support Solutions, except for North America where it is split 50/50. Multimedia brokering (IPX) was previously reported in each region in Segment Support Solutions, from Q112 it is part of region “Other” in Segment Support Solutions.

| Isolated quarter | Q2 2012, SEK million | Accumulated Jan - Jun 2012, SEK million | ||||||||||||||||||||||||||||||

| Net- works | Global Services | Support Solutions | Total | Net- works | Global Services | Support Solutions | Total | |||||||||||||||||||||||||

North America | 6,122 | 6,131 | 734 | 12,987 | 13,607 | 10,833 | 1,322 | 25,762 | ||||||||||||||||||||||||