Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

July 18, 2013

LM ERICSSON TELEPHONE COMPANY

(Translation of registrant’s name into English)

Torshamnsgatan 23, Kista

SE-164 83, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

Announcement of LM Ericsson Telephone Company, dated July 18, 2013 regarding “Ericsson Second Quarter Report 2013”

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELEFONAKTIEBOLAGET LM ERICSSON (publ) | ||

| By: | /s/ NINA MACPHERSON | |

Nina Macpherson Senior Vice President and General Counsel | ||

| By: | /s/ HELENA NORRMAN | |

Helena Norrman Senior Vice President Corporate Communications | ||

Date: July 18, 2013

Table of Contents

ERICSSON

SECOND QUARTER

REPORT 2013

Table of Contents

Ericsson second quarter report 2013

JULY 18, 2013

SECOND QUARTER HIGHLIGHTS

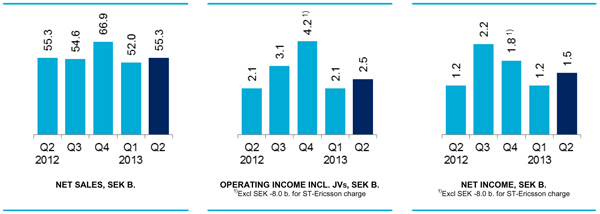

| • | Sales were flat YoY at SEK 55.3 b. For comparable units and adjusted for FX, sales increased 7% YoY and 6% QoQ. |

| • | Operating income incl. JV was SEK 2.5 (2.1) b. with an operating margin of 4.5% (3.8%). |

| • | The quarter was negatively impacted by one-time items of SEK -0.9 b. from losses due to divestments and exiting the telecom and power cable operations. |

| • | Net income was SEK 1.5 (1.2) b. |

| • | EPS diluted was SEK 0.45 (0.34). EPS Non-IFRS was SEK 0.88 (0.78). |

| • | Cash flow from operating activities was SEK 4.3 b. |

SEK b. | Q2 2013 | Q2 2012 | YoY Change | Q1 2013 | QoQ Change | 6 months 2013 | 6 months 2012 | |||||||||||||||||||||

Net sales | 55.3 | 55.3 | 0 | % | 52.0 | 6 | % | 107.4 | 106.3 | |||||||||||||||||||

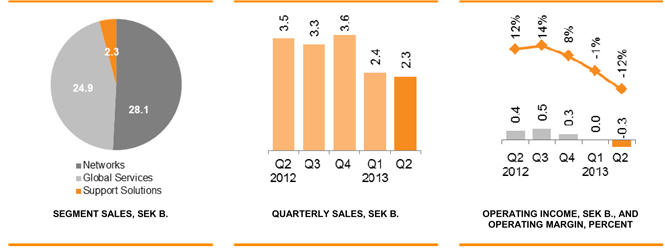

Of which Networks | 28.1 | 27.8 | 1 | % | 28.1 | 0 | % | 56.3 | 55.1 | |||||||||||||||||||

Of which Global Services | 24.9 | 24.1 | 3 | % | 21.5 | 16 | % | 46.3 | 44.7 | |||||||||||||||||||

Of which Support Solutions | 2.3 | 3.5 | -33 | % | 2.4 | -4 | % | 4.8 | 6.5 | |||||||||||||||||||

Gross margin | 32.4 | % | 32.0 | % | — | 32.0 | % | — | 32.2 | % | 32.6 | % | ||||||||||||||||

Operating income excl JV | 2.5 | 3.3 | -24 | % | 2.1 | 17 | % | 4.6 | 13.8 | |||||||||||||||||||

Operating margin excl JV | 4.5 | % | 5.9 | % | — | 4.1 | % | — | 4.3 | % | 13.0 | % | ||||||||||||||||

Of which Networks | 5 | % | 5 | % | — | 6 | % | — | 5 | % | 5 | % | ||||||||||||||||

Of which Global Services | 6 | % | 6 | % | — | 3 | % | — | 5 | % | 6 | % | ||||||||||||||||

Of which Support Solutions | -12 | % | 12 | % | — | -1 | % | — | -7 | % | 6 | % | ||||||||||||||||

Operating income incl JV | 2.5 | 2.1 | 19 | % | 2.1 | 17 | % | 4.6 | 11.2 | |||||||||||||||||||

Operating margin incl JV | 4.5 | % | 3.8 | % | — | 4.0 | % | — | 4.3 | % | 10.5 | % | ||||||||||||||||

Net income | 1.5 | 1.2 | 26 | % | 1.2 | 26 | % | 2.7 | 10.0 | |||||||||||||||||||

EPS diluted, SEK | 0.45 | 0.34 | 32 | % | 0.37 | 22 | % | 0.82 | 3.10 | |||||||||||||||||||

EPS (Non-IFRS), SEK1) | 0.88 | 0.78 | 13 | % | 0.99 | — | 1.88 | 3.91 | ||||||||||||||||||||

Cash flow from operating activities | 4.3 | -1.4 | — | -3.0 | — | 1.3 | -0.6 | |||||||||||||||||||||

Net cash, end of period | 27.4 | 25.9 | 6 | % | 32.2 | -15 | % | 27.4 | 25.9 | |||||||||||||||||||

| 1) | EPS, diluted, excl. amortizations, write-downs of acquired intangible assets and restructuring |

| Ericsson Second Quarter Report 2013 | 1 |

Table of Contents

Comments from Hans Vestberg, President and CEO

“Sales for comparable units, adjusted for FX, grew 7%. Reported sales were flat YoY, due to continued currency headwind,” said Hans Vestberg, President and CEO of Ericsson (NASDAQ:ERIC).

“There was continued high project activity in Europe as well as in North America where two large mobile broadband coverage projects have peaked in first half 2013. North East Asia had another challenging quarter following continued structural decline in GSM investments in China, FX in Japan and lower business activity in South Korea due to spectrum delays.

The business mix, with a higher share of coverage projects than capacity projects, started to shift slightly towards more capacity during the quarter.

We implemented our strategy to capture new market share in the network modernization projects in Europe starting in 2010, despite their initial lower margins. Now that these projects gradually come to an end, we can conclude that we have been successful in gaining market share and regained leadership in Europe. It is also encouraging to see that we are now starting to engage in new business, based on this footprint, regarding capacity and LTE projects in Europe.

We continue to strengthen our leading position in 4G/LTE. The vendor selection processes for 4G/LTE in Russia and China continue and to date we have been awarded contracts by two large operators in Russia.

During the quarter we also reached one billion subscribers in networks managed by Ericsson. This clearly shows the confidence our customers have in our ability to create value for them.

Profitability improved YoY, adjusted for one-time effects related to exiting the telecom and power cable operations and the divestment of Applied Communication Sciences (ACS). The improvement was driven by higher gross margins and lower operating expenses. This was partly offset by currency headwind.

With the announcement in April and July of the intended acquisitions of Microsoft’s Mediaroom and Red Bee Media, we continue to strengthen our position in TV and media. As TV and media converge with telecom we can leverage our strength in media management and managed services. Video is already the single largest contributor to traffic in mobile networks and is expected to grow by 60% annually until 2018.

While the macroeconomic situation in Europe remains challenging and the political uncertainty in parts of Region Middle East, such as Egypt, increases, the long-term fundamentals in the industry remain attractive and we are well positioned to continue to support our customers in a transforming ICT market,” concludes Vestberg.

| Ericsson Second Quarter Report 2013 | 2 |

Table of Contents

Financial highlights – second quarter

INCOME STATEMENT

Sales for comparable units, adjusted for FX, increased 7% YoY and 6% QoQ.

Networks sales increased 1% YoY, with strong growth in North America and Latin America as well as Western and Central Europe, while sales continued to decline in North East Asia. Networks sales were flat QoQ, with strong sales in Latin America. CDMA sales continued to decline rapidly both YoY and QoQ.

Global Services grew 3% YoY, driven by continued high activity in Network Rollout. Professional Services sales declined -1% YoY, negatively impacted by FX effects. Sequentially, Global Services grew by 16% and Professional Services grew by 15%. Services-related sales in North America were strong in the quarter.

Support Solutions sales declined -33% YoY and -4% QoQ. The YoY decline is mainly due to the divestment of Multimedia Brokering (IPX) in Q312 and continued decline in Media Management sales following the strong first half 2012 sales in IPTV and compression.

Restructuring charges for Ericsson amounted to SEK 0.9 (0.6) b.

Gross margin increased YoY to 32.4% (32.0%), and from 32.0% Q113, despite higher services share QoQ from 41% to 45%. The margin increase was primarily driven by improved hardware and services margins.

The business mix, with a higher share of coverage projects than capacity projects, started to shift slightly towards more capacity during the quarter.

Total operating expenses decreased YoY by SEK 0.6 b. to SEK 14.4 (15.0) b. due to earlier implemented efficiency measures. Excluding acquisitions, divestments and restructuring charges, operating expenses year-to-date were down -6% YoY. R&D expenses amounted to SEK 7.7 (8.1) b. Selling and general administrative expenses (SG&A) amounted to SEK 6.6 (6.9) b.

| Ericsson Second Quarter Report 2013 | 3 |

Table of Contents

Other operating income and expenses amounted to SEK -1.0 (0.5) b. due to costs for exiting the telecom and power cable operations of SEK -0.6 b., a loss related to the divestment of ACS1) of SEK -0.3 b. and a revaluation effect for new hedges taken in 2013 of SEK -0.2 b. For these new hedges we do not apply hedge accounting (see Accounting Policies). Ericsson’s share in ST-Ericsson’s income before tax was SEK 0.0 (-1.3) b.

Operating income, including JV, increased to SEK 2.5 (2.1) b. In Q412, Ericsson made a provision of SEK 3.3 b. which provides for Ericsson’s share of obligations for the wind-down of ST-Ericsson. As of December 31, 2012 there are no remaining investments related to ST-Ericsson on Ericsson’s balance sheet and therefore no result from ST-Ericsson is included in Ericsson’s result.

Operating income was positively impacted by reduced operating expenses and improved gross margin, partly offset by one-time effects of SEK -0.9 b. from losses due to divestments and exiting the telecom and power cable operations and FX.

Operating margin, including JV, was 4.5% (3.8%). Operating margin excluding one-time items improved to 6.1% (3.1%) driven by effects from ST-Ericsson, lower operating expenses and higher gross margin.

Financial net amounted to SEK -0.3 (-0.3) b. and improved QoQ from SEK -0.4 b. Tax costs were SEK -0.6 (-0.6) b.

Net income increased to SEK 1.5 (1.2) b.

EPS diluted was SEK 0.45 (0.34). EPS Non-IFRS was SEK 0.88 (0.78).

| 1) | ACS, formerly the research and engineering of Telcordia Technologies, was established in 2012 following Ericsson’s acquisition of Telcordia and was never operationally integrated into Ericsson. |

BALANCE SHEET AND OTHER PERFORMANCE INDICATORS – SECOND QUARTER

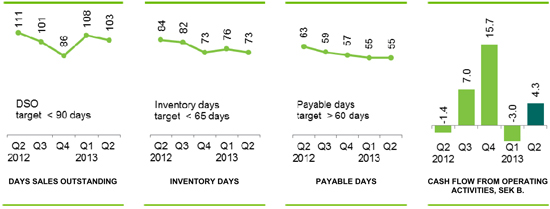

Trade receivables decreased QoQ to SEK 63.1 (65.1) b. Inventory decreased slightly QoQ to SEK 29.7 (29.8) b. Trade payables increased QoQ to 20.8 (19.9) b. following the high business activity.

During the quarter we have signed a new USD 2 b. multi-currency revolving credit facility and refinanced a credit facility signed in 2007. The new facility has a tenure of five years, with two extension options of one year each, and the facility serves for general corporate purposes. During the quarter we also repaid SEK 2.9 b. of maturing debt.

Cash, cash equivalents and short-term investments amounted to SEK 64.8 (72.1) b. The net cash position decreased QoQ by SEK -4.8 b. to SEK 27.4 (32.2) b., due to shareholder dividend payments of SEK -8.9 b. offset by positive operating cash flow.

During the quarter, approximately SEK 2.4 b. of provisions were utilized, of which SEK 1.0 b. were related to restructuring. Additions of SEK 1.2 b. were made, of which SEK 0.3 b. related to restructuring. Reversals of SEK 0.6 b. were made. Cash outlays of SEK 2.3 b. remain to be made from the restructuring provision.

Cash flow from operating activities was SEK 4.3 b. driven by reduced working capital. Cash conversion year-to-date is 26%.

The total number of employees increased QoQ to 111,805 (109,648) primarily due to new managed services contracts and closing of acquisitions.

| Ericsson Second Quarter Report 2013 | 4 |

Table of Contents

NETWORKS

SEK b. | Q2 2013 | Q2 2012 | YoY Change | Q1 2013 | QoQ Change | 6 months 2013 | 6 months 2012 | |||||||||||||||||||||

Network sales | 28.1 | 27.8 | 1 | % | 28.1 | 0 | % | 56.3 | 55.1 | |||||||||||||||||||

Operating income | 1.3 | 1.3 | 6 | % | 1.6 | -15 | % | 2.9 | 2.9 | |||||||||||||||||||

Operating margin | 5 | % | 5 | % | — | 6 | % | — | 5 | % | 5 | % | ||||||||||||||||

Sales for comparable units, adjusted for FX, increased 8% YoY, driven by mobile broadband deployments with LTE and HSPA, mainly in North America and Latin America. The strong sales in HSPA and LTE radio networks is a result of operators’ focus on enhancing data user experience and smart phone efficiency. Networks sales were flat QoQ.

The structural decline in GSM sales in China and in CDMA sales in North America continued as anticipated. CDMA sales declined by -54% YoY and -31% QoQ to SEK 0.9 b. In South Korea we saw lower business activity due to delays in releasing additional LTE spectrum. Sales related to circuit-switched core continued to decline.

During the quarter we reached an important milestone in our IP strategy by launching the third application on our multi-application router for both fixed and mobile networks. With the latest Smart Services Router (SSR 8000) application, Broadband Network Gateway (BNG) for fixed networks, we now address the converged IP Edge market with one router platform. Out of 15 new SSR contracts signed in the quarter, four were BNG. In the quarter, we

secured several break-in contracts for Evolved Packet Core (EPC), demonstrating our leading position in LTE and Packet Core.

Service providers increasingly focus on indoor and outdoor network performance as the key differentiator and a prime driver for customer retention. This drives the interest for Ericsson’s solutions around heterogeneous networks. The approach of building coordinated macro and small cells networks is gaining momentum as the preferred solution to offer superior mobile broadband user experience.

Excluding one-time items of SEK 0.6 (0.0) b. related to exiting the telecom and power cable operations, operating income improved due to declining negative impact from the network modernization projects in Europe as well as continued operational efficiency gains.

Restructuring charges amounted to SEK 0.3 (0.2) b. in the quarter.

| Ericsson Second Quarter Report 2013 | 5 |

Table of Contents

GLOBAL SERVICES

SEK b. | Q2 2013 | Q2 2012 | YoY Change | Q1 2013 | QoQ Change | 6 months 2013 | 6 months 2012 | |||||||||||||||||||||

Global Services sales | 24.9 | 24.1 | 3 | % | 21.5 | 16 | % | 46.3 | 44.7 | |||||||||||||||||||

Of which Professional Services | 16.8 | 16.9 | -1 | % | 14.6 | 15 | % | 31.4 | 31.8 | |||||||||||||||||||

Of which Managed Services | 6.8 | 6.5 | 4 | % | 5.9 | 15 | % | 12.6 | 12.2 | |||||||||||||||||||

Of which Network Rollout | 8.1 | 7.1 | 13 | % | 6.8 | 18 | % | 14.9 | 12.9 | |||||||||||||||||||

Operating income | 1.6 | 1.4 | 15 | % | 0.7 | 115 | % | 2.3 | 2.6 | |||||||||||||||||||

Of which Professional Services | 2.3 | 2.1 | 7 | % | 1.8 | 24 | % | 4.1 | 4.0 | |||||||||||||||||||

Of which Network Rollout | -0.7 | -0.8 | 7 | % | -1.1 | 35 | % | -1.8 | -1.4 | |||||||||||||||||||

Operating margin | 6 | % | 6 | % | — | 3 | % | — | 5 | % | 6 | % | ||||||||||||||||

Of which Professional Services | 14 | % | 13 | % | — | 13 | % | — | 13 | % | 13 | % | ||||||||||||||||

Of which Network Rollout | -9 | % | -11 | % | — | -16 | % | — | -12 | % | -11 | % | ||||||||||||||||

Sales growth for comparable units, adjusted for FX, was 9% YoY, driven by Network Rollout and Managed Services primarily due to high activities in North America. Professional Services sales decreased -1% YoY negatively impacted by FX. Global Services sales growth QoQ was 16%. We continue to see good momentum for Professional Services and QoQ sales grew 15%.

Operating margin for Global Services was flat YoY with Professional Services margin improving from 13% to 14% due to continued efficiency gains.

Global Services operating margin improved QoQ with reduced losses in Network Rollout. This was partly an effect of gradually decreasing negative effects from the network modernization projects in Europe.

Professional Services margin improved QoQ driven by higher sales, offset by the divestment of ACS, which resulted in a loss of SEK -0.3 b., equally divided between Professional Services and Support Solutions.

Restructuring charges amounted to SEK 0.6 (0.4) b. in the quarter.

Other information | Q2 2013 | Q1 2013 | Full year 2012 | |||||||||

No. of signed Managed Services contracts | 19 | 21 | 52 | |||||||||

Of which expansions/extensions | 5 | 8 | 19 | |||||||||

No. of signed significant consulting & systems integration contracts1) | 8 | 8 | 24 | |||||||||

Number of subscribers in networks managed by Ericsson, end of period2) | 1 b. | ~ 950 m. | ~ 950 m. | |||||||||

Of which in network operations contracts | 600 m. | 550 m. | 550 m. | |||||||||

Number of Ericsson services professionals, end of period | 64,000 | 61,000 | 60,000 | |||||||||

| 1) | In the areas of OSS and BSS, IP, Service Delivery Platforms and data center build projects. |

| 2) | The figure includes network operations contracts and field operation contracts. |

| Ericsson Second Quarter Report 2013 | 6 |

Table of Contents

SUPPORT SOLUTIONS

SEK b. | Q2 2013 | Q2 2012 | YoY Change | Q1 2013 | QoQ Change | 6 months 2013 | 6 months 2012 | |||||||||||||||||||||

Support Solutions sales | 2.3 | 3.5 | -33 | % | 2.4 | -4 | % | 4.8 | 6.5 | |||||||||||||||||||

Operating income | -0.3 | 0.4 | — | 0.0 | — | -0.3 | 0.4 | |||||||||||||||||||||

Operating margin | -12 | % | 12 | % | — | -1 | % | — | -7 | % | 6 | % | ||||||||||||||||

Sales for comparable units, adjusted for FX and the divestment of IPX in Q312, was -19% YoY. IPX sales amounted to SEK 0.4 b. in Q212.

The sales decline was driven by lower Media Management sales following the strong first half 2012 sales in IPTV and compression as well as a temporary decline in BSS sales in Latin America and Middle East. This was partly offset by growth in OSS.

Demand for OSS and BSS continues to be strong driven by operators’ focus on improving efficiency and adapting to mobile broadband business requirements. Sales cycles in these areas are typically long and volumes vary between quarters.

We have maintained our market position and during the quarter leading industry analyst firm Gartner ranked Ericsson first worldwide for OSS, BSS and next generation service delivery solutions and services.

We continue to invest in our support solution strategy targeting OSS and BSS, TV and Media and M-commerce. During the quarter we announced the intention to acquire Microsoft’s TV solution business Mediaroom, further strengthening our position in the growing media management market.

Operating margin was negatively impacted by lower sales volumes and the divestment of ACS, which resulted in a loss of SEK -0.3 b., equally divided between Global Services and Support Solutions.

The number of subscriptions served by Ericsson’s charging and billing solutions was 2 billion at end of the period.

| Ericsson Second Quarter Report 2013 | 7 |

Table of Contents

ST-ERICSSON

As announced on March 18, 2013, ST-Ericsson will be split between the parents. Ericsson will take on the design, development and sales of the LTE multimode thin modem business products, including 2G, 3G and 4G multimode. STMicroelectronics will take on the existing ST-Ericsson products, other than the LTE multimode thin modems and related business, as well as certain assembly and test facilities. The remaining parts of ST-Ericsson will be closed down. Both parents are assuming equal funding of the wind-down related activities. The formal transfer of the relevant parts of ST-Ericsson to the parent companies is expected to be completed during the third quarter of 2013, subject to regulatory approvals.

Ericsson’s share in ST-Ericsson’s income before tax was SEK 0.0 (-1.3) b. As of December 31, 2012 there are no remaining investments related to ST-Ericsson on Ericsson’s balance sheet and therefore no result from ST-Ericsson is included in Ericsson’s result.

In Q412, Ericsson made a provision of SEK 3.3 b., which provides for Ericsson’s share of obligations for the wind-down of ST-Ericsson and resulted in a net exposure of SEK 1.6 b. at the end of the quarter.

We are progressing as planned toward a Q313 transaction close to separate the thin modem business from ST-Ericsson and integrate into Ericsson. Our focus is on continued execution during the transition period and to continue the engagement with customer development teams.

Once the multimode thin modem business has been fully integrated into Ericsson in Q413 the operation will continue to be reported as a segment. Our current best estimate is that it will generate operating losses of approximately SEK -0.5 b. in Q413, primarily related to R&D expenses.

| Ericsson Second Quarter Report 2013 | 8 |

Table of Contents

REGIONAL SALES

| Second quarter 2013 | Growth | |||||||||||||||||||||||

SEK b. | Networks | Global Services | Support Solutions | Total | YoY | QoQ | ||||||||||||||||||

North America | 7.4 | 7.4 | 0.5 | 15.3 | 18 | % | -3 | % | ||||||||||||||||

Latin America | 3.0 | 2.3 | 0.3 | 5.6 | 6 | % | 27 | % | ||||||||||||||||

Northern Europe and Central Asia | 1.6 | 1.0 | 0.1 | 2.7 | -19 | % | 19 | % | ||||||||||||||||

Western and Central Europe | 2.0 | 2.4 | 0.1 | 4.5 | 10 | % | 4 | % | ||||||||||||||||

Mediterranean | 2.9 | 3.1 | 0.2 | 6.2 | -1 | % | 17 | % | ||||||||||||||||

Middle East | 1.8 | 2.0 | 0.2 | 4.0 | 7 | % | 26 | % | ||||||||||||||||

Sub-Saharan Africa | 1.2 | 1.1 | 0.3 | 2.7 | -5 | % | 24 | % | ||||||||||||||||

India | 0.5 | 0.7 | 0.1 | 1.3 | -25 | % | -20 | % | ||||||||||||||||

North East Asia | 3.8 | 2.8 | 0.1 | 6.6 | -21 | % | 10 | % | ||||||||||||||||

South East Asia and Oceania | 2.0 | 1.6 | 0.1 | 3.8 | 2 | % | -9 | % | ||||||||||||||||

Other1) | 1.9 | 0.3 | 0.5 | 2.7 | -13 | % | -6 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 28.1 | 24.9 | 2.3 | 55.3 | 0 | % | 6 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 1) | Region “Other” includes licensing revenues, sales of cables, broadcast services, power modules and other businesses. |

In the regional dimension, all of the Telcordia sales are reported in the Support Solutions segment except for North America where it is split 50/50 between Global Services and Support Solutions. The acquired Technicolor Broadcast Service Division is reported in region “Other”. Multimedia brokering (IPX) was previously reported in each region in segment Support Solutions. For the first three quarters 2012 it was part of region “Other”. IPX was divested end Q312.

North America

Sales grew with continued high activity levels in large mobile broadband coverage projects that peaked in first half 2013. CDMA equipment sales continued to decline. Network evolution and professional services remain a growth theme in North America.

Latin America

YoY sales growth was primarily driven by network quality investments in 3G and initial LTE rollouts, although still at slow pace. The business in several countries was impacted by currency depreciations.

Northern Europe and Central Asia

Sales declined YoY mainly due to very high project levels in Russia in Q212. Selection of LTE vendors in Russia is still ongoing, and deployment of the recently announced LTE contracts will start second half 2013. During the quarter we achieved new wins with non-operator customers in the Nordics and Baltics.

Western and Central Europe

YoY sales growth continued, driven by high activity level in network modernization projects. Continued demand for professional services where systems integration grew YoY.

Mediterranean

Modernization projects in France and high project activity in North West Africa continued to drive YoY sales, offset by lower investments in Spain and Italy. Macroeconomic development remained weak in parts of the region.

Middle East

Initial LTE deployments are ongoing but are still a small share of sales. Demand continued to be good for professional services as operators focus on network performance and operational efficiencies. Political unrest prevails and is still impacting sales.

| Ericsson Second Quarter Report 2013 | 9 |

Table of Contents

Sub-Saharan Africa

The growth in services is mainly fuelled by new managed services contracts. 3G as well as initial 4G deployments are ongoing. The majority of networks sales are, however, related to 2G.

India

Business volumes declined as operators continued to invest cautiously mainly due to sustained regulatory uncertainty and weak macroeconomic development. The growth in services was driven by a new managed services contract.

North East Asia

Sales continued to decline YoY mainly due to the continued structural decline in GSM investments in China combined with negative FX in Japan and lower business activity in South Korea due to delayed spectrum auctions.

South East Asia and Oceania

Sales were basically flat YoY, where a peak in deployment of major projects in Indonesia offset lower business activity in Australia in the quarter.

Other

IPX was divested at the end of Q312 impacting Support Solutions sales YoY comparison. Licensing revenues continued to show stable development YoY. Sales of broadcast services, cables, power modules and other businesses are also included in “Other”.

| Ericsson Second Quarter Report 2013 | 10 |

Table of Contents

Income after financial items was SEK 2.7 (7.0) b. The Parent Company’s financial position had the following major changes during the year; decreased cash, cash equivalents and short-term investments of SEK 13.0 b. and decreased current and non-current receivables from subsidiaries of SEK 5.9 b.

During the quarter, the dividend payment of SEK 8.9 b., as decided by the Annual General Meeting, was made. At the end of the quarter, cash, cash equivalents and short-term investments amounted to SEK 44.4 (57.4) b.

In accordance with the conditions of the long-term variable remuneration program (LTV) for Ericsson employees, 2,465,083 shares from treasury stock were sold or distributed to employees during the second quarter. The holding of treasury stock at June 30, 2013, was 79,744,080 Class B shares.

| Ericsson Second Quarter Report 2013 | 11 |

Table of Contents

Samsung litigation

On November 27, 2012, Ericsson filed two patent infringement lawsuits in the US District Court for the Eastern District of Texas against Samsung. Ericsson seeks damages and an injunction. Ericsson also asked the Court to adjudge that Samsung breached its commitment to license any standard-essential patents it owns on fair, reasonable, and non-discriminatory terms and to declare Samsung’s allegedly standard essential patents to be unenforceable. On November 30, 2012, Ericsson filed a complaint with the US International Trade Commission (ITC) seeking an exclusion order blocking Samsung from importing certain products into the US. On December 21, 2012, Samsung filed a complaint with the ITC seeking an exclusion order blocking Ericsson from import of certain products into the US.

On March 18, 2013, Samsung filed its answers and counterclaims in the Ericsson suits (above) in Texas, USA.

Airvana litigation

In February 2012, Airvana Networks Solutions Inc (Airvana) filed a complaint against Ericsson in the Supreme Court of the State of New York, USA, alleging that Ericsson has violated key contract terms and misappropriated Airvana trade secrets and proprietary information. Airvana is seeking damages of USD 330 million and to enjoin Ericsson from developing, deploying or commercializing Ericsson products allegedly based on Airvana’s proprietary technology.

On March 19, 2013, the Court issued a preliminary injunction barring Ericsson or any party in privity with Ericsson from using, operating, testing or deploying certain Airvana-based EV-DO hardware unless it is executing software that is licensed from Airvana.

The Court also conducted a separate related hearing in April on a second preliminary injunction motion filed by Airvana seeking to prevent deployment of the Digital Baseband Advanced (“DBA”) hardware with any EV-DO software other than Airvana’s. That hearing did not conclude at that time. Thereafter, the

parties entered in settlement negotiations which have resulted in a non-binding letter of intent. The parties are presently negotiating a definitive, binding agreement.

Settlement of H3G S.p.A. (H3G) dispute

In 2007, H3G S.p.A. filed arbitral proceedings in Italy against Ericsson. H3G claimed compensation from Ericsson for alleged breach of contract. In June 2013, the parties settled the dispute.

Ericsson to acquire Microsoft Mediaroom

On April 8, 2013, Ericsson announced that the company has reached an agreement with Microsoft to acquire its TV solution business Mediaroom. This will make Ericsson a leading provider of IPTV and multi-screen solutions with a market share of over 25%. Closing is expected in the second half of 2013 subject to customary regulatory approvals and other conditions.

Acquisition of Devoteam Telecom & Media

On May 2, 2013, Ericsson closed the acquisition of Devoteam Telecom & Media in France, bringing 400 IT-services professionals. The intention to acquire parts of Devoteam was originally announced on January 21, 2013.

Divestment of power cables operation to NKT Cables

On May 3, 2013, Ericsson announced a conditional agreement with Danish company NKT Cables to divest its power cables operation. As a result of the agreement approximately 320 employees and consultants will transfer to NKT Cables. The value of the transaction is SEK 250 million and the transaction was closed on July 1, 2013.

Divestment of Applied Communication Sciences

On May 15, 2013, Ericsson completed the sale of Applied Communication Sciences (ACS), the former research and engineering arm of Telcordia Technologies. The operation was acquired by the SI Organization, Inc in the US. ACS, a leading provider of applied research, technical consulting and technology solutions to U.S. defense and intelligence agencies, U.S. civil government organizations and commercial customers, was established in January 2012 when Ericsson acquired Telcordia and has never been integrated operationally into Ericsson.

| Ericsson Second Quarter Report 2013 | 12 |

Table of Contents

Exit of telecom cable manufacturing

On May 21, 2013, Ericsson initiated union negotiations to close down its telecom cables operation. This primarily impacts operations in Hudiksvall and Stockholm, Sweden.

Expected to be completed during second half 2013.

On new positions

As of July 1, 2013, Peter Laurin is appointed Head of Global Customer Unit Vodafone and a member of Ericsson’s Global Leadership Team. Laurin previously held the position as Head of Customer Unit T-Mobile within Region North America.

As of August 1, 2013, Valter D’Avino is appointed Head of Region Western & Central Europe and a member of Ericsson’s Global Leadership Team. D’Avino currently holds the position as Head of Managed Services within Business Unit Global Services.

Ericsson’s nomination committee appointed

On May 31, 2013, Ericsson announced the appointment of the Nomination Committee for the Annual General Meeting 2014, in accordance with the Instruction for the Nomination Committee resolved by the Annual General Meeting 2013.

Composition of the Board of Directors

On April 9, 2013, Ericsson announced that in accordance with the proposal of the Nomination Committee, the Annual General Meeting resolved to re-elect Leif Johansson as Chairman of the Board of Directors and Roxanne S. Austin, Sir Peter L. Bonfield, Börje Ekholm, Alexander Izosimov, Ulf J. Johansson, Sverker Martin-Löf, Hans Vestberg, and Jacob Wallenberg were re-elected as members of the Board of Directors. Nora Denzel, Kristin Skogen Lund and Pär Östberg were elected new members of the Board of Directors. Board members appointed by the unions are Pehr Claesson, Kristina Davidsson and Karin Åberg. Deputy board members appointed by the unions are Rickard Fredriksson, Karin Lennartsson and Roger Svensson.

POST-CLOSING EVENTS

Ericsson to acquire leading media services company Red Bee Media

On July 1, 2013, Ericsson announced its intention to acquire Red Bee Media from an entity controlled by Macquarie Advanced Investment Partners, L.P. The acquisition, which is subject to regulatory approvals, supports Ericsson’s strategy to grow in the broadcast services market. It will bring 1,500 employees, as well as media services and operations facilities in the UK, France, Germany, Spain and Australia.

Ruling in Wi-LAN litigation

In October 2010, Canadian company Wi-LAN sued Ericsson, in Texas, alleging that Ericsson’s RBS 3000 and RBS 6000 series base stations sold in the US infringe three patents that Wi-LAN claimed to be essential to HSDPA.

In October 2012, Wi-LAN filed a second lawsuit against Ericsson, in Florida, alleging that Ericsson’s LTE-compliant base stations sold in the US infringe three other patents that Wi-LAN claimed to be essential to the LTE standard.

In June 2013, a District Court Judge in the Florida case granted Ericsson’s request for a Summary Judgment and dismissed Wi-LAN’s claims against Ericsson.

On July 15, 2013, a jury in Tyler, Texas, found in Ericsson’s favor in the Texas case. The jury recognized that although Ericsson’s base stations comply with mandatory HSDPA and 3G standards, the patents Wi-LAN was asserting do not apply to these standards, nor do Ericsson’s base stations infringe any of those patents. The jury also agreed with every one of Ericsson and the other defendants’ invalidity challenges to the asserted patents, and finally, determined that Wi-LAN is not entitled to any damages from Ericsson or the other defendants.

| Ericsson Second Quarter Report 2013 | 13 |

Table of Contents

Assessment of risk environment

Ericsson’s operational and financial risk factors and uncertainties along with our strategies and tactics to mitigate risk exposures or limit unfavorable outcomes are described in our Annual Report 2012. Compared to the risks described in the Annual Report 2012, no material, new or changed risk factors or uncertainties have been identified in the quarter.

Risk factors and uncertainties in focus short-term for the Parent Company and the Ericsson Group include:

| • | Potential negative effects on operators’ willingness to invest in network development due to uncertainty in the financial markets and a weak economic business environment, or reduced consumer telecom spending, or increased pressure on us to provide financing; |

| • | Uncertainty regarding the financial stability of suppliers, for example due to lack of financing; |

| • | Effects on gross margins and/or working capital of the product mix in the Networks segment between sales of upgrades and expansions (mainly software) and new build-outs of coverage (mainly hardware); |

| • | Effects on gross margins of the product mix in the Global Services segment including proportion of new network build-outs and share of new managed services deals with initial transition costs; |

| • | A continued volatile sales pattern in the Support Solutions segment or variability in our overall sales seasonality could make it more difficult to forecast future sales; |

| • | Effects of the ongoing industry consolidation among our customers as well as between our largest competitors, e.g. with postponed investments and intensified price competition as a consequence; |

| • | Implementation of the strategic option for our joint venture ST-Ericsson and related capital need; |

| • | Changes in foreign exchange rates, in particular USD, JPY and EUR; |

| • | Political unrest or instability in certain markets; |

| • | Effects on production and sales from restrictions with respect to timely and adequate supply of materials, components and production capacity and other vital services on competitive terms; |

| • | Natural disasters and other events, affecting business, production, supply and transportation. |

Ericsson stringently monitors the compliance with all relevant trade regulations and trade embargos applicable to dealings with customers operating in countries where there are trade restrictions or trade restrictions are discussed. Moreover, Ericsson operates globally in accordance with Group policies and directives for business ethics and conduct.

Stockholm, July 18, 2013

Telefonaktiebolaget LM Ericsson (publ)

Hans Vestberg, President and CEO

Org. Nr. 556016-0680

This report has not been reviewed by Telefonaktiebolaget LM Ericsson’s auditors.

Date for next report: October 24, 2013

| Ericsson Second Quarter Report 2013 | 14 |

Table of Contents

The Board of Directors and the CEO certify that the financial report for the six months gives a fair view of the performance of the business, position and profit or loss of the Company and the Group, and describes the principal risks and uncertainties that the Company and the companies in the Group face.

Stockholm, July 18, 2013

Telefonaktiebolaget LM Ericsson (publ)

Org. Nr. 556016-0680

Sverker Martin-Löf Deputy chairman | Leif Johansson Chairman | Jacob Wallenberg Deputy chairman | ||

Roxanne S. Austin Member of the board | Sir Peter L. Bonfield Member of the board | Nora Denzel Member of the board | ||

Börje Ekholm Member of the board | Ulf J. Johansson Member of the board | Kristin Skogen Lund Member of the board | ||

Alexander Izosimov Member of the board | Pär Östberg Member of the board | |||

Pehr Claesson Member of the board | Kristina Davidsson Member of the board | Karin Åberg Member of the board | ||

Hans Vestberg Member of the board and President and CEO | ||||

| Ericsson Second Quarter Report 2013 | 15 |

Table of Contents

Ericsson invites media, investors and analysts to a press conference at the Ericsson Studio, Grönlandsgången 4, Stockholm, at 09.00 (CET), July 18, 2013. An analysts, investors and media conference call will begin at 15.00 (CET).

Live webcast of the press conference and conference call as well as supporting slides will be available at www.ericsson.com/press and www.ericsson.com/investors

Video material will be published during the day on www.ericsson.com/press

For further information, please contact:

Helena Norrman, Senior Vice President,

Communications

Phone: +46 10 719 34 72

E-mail: investor.relations@ericsson.com or media.relations@ericsson.com

Telefonaktiebolaget LM Ericsson (publ)

Org. number: 556016-0680

Torshamnsgatan 23

SE-164 83 Stockholm

Phone: +46 10 719 00 00

www.ericsson.com

Investors

Stefan Jelvin, Director,

Investor Relations

Phone: +46 10 714 20 39, +46 70 986 02 27

E-mail: investor.relations@ericsson.com

Åsa Konnbjer, Director,

Investor Relations

Phone: +46 10 713 39 28, +46 73 082 59 28

E-mail: investor.relations@ericsson.com

Rikard Tunedal, Director,

Investor Relations

Phone: +46 10 714 54 00, +46 761 005 400

E-mail: investor.relations@ericsson.com

Media

Ola Rembe, Vice President,

External Communications

Phone: +46 10 719 97 27, +46 73 024 48 73

E-mail: media.relations@ericsson.com

Corporate Communications

Phone: +46 10 719 69 92

E-mail: media.relations@ericsson.com

| Ericsson Second Quarter Report 2013 | 16 |

Table of Contents

All statements made or incorporated by reference in this release, other than statements or characterizations of historical facts, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Forward-looking statements can often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “potential”, “continue”, and variations or negatives of these words, and include, among others, statements regarding: (i) strategies, outlook and growth prospects; (ii) positioning to deliver future plans and to realize potential for future growth; (iii) liquidity and capital resources and expenditure, and our credit ratings; (iv) growth in demand for our products and services; (v) our joint venture activities; (vi) economic outlook and industry trends; (vii) developments of our markets; (viii) the impact of regulatory initiatives; (ix) research and development expenditures; (x) the strength of our competitors; (xi) future cost savings; (xii) plans to launch new products and services; (xiii) assessments of risks; (xiv) integration of acquired businesses; (xv) compliance with rules and regulations and (xvi) infringements of intellectual property rights of others.

In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These forward-looking statements speak only as of the date hereof and are based upon the information available to us at this time. Such information is subject to change, and we will not necessarily inform you of such changes. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference for Ericsson include, but are not limited to: (i) material adverse changes in the markets in which we operate or in global economic conditions; (ii) increased product and price competition; (iii) reductions in capital expenditure by network operators; (iv) the cost of technological innovation and increased expenditure to improve quality of service; (v) significant changes in market share for our principal products and services; (vi) foreign exchange rate or interest rate fluctuations; and (vii) the successful implementation of our business and operational initiatives.

| Ericsson Second Quarter Report 2013 | 17 |

Table of Contents

Financial statements and additional information

Financial statements

| 19 | Consolidated income statement | |

| 19 | Statement of comprehensive income | |

| 20 | Consolidated balance sheet | |

| 21 | Consolidated statement of cash flows | |

| 22 | Consolidated statement of changes in equity | |

| 23 | Consolidated income statement—isolated quarters | |

| 24 | Consolidated statement of cash flows—isolated quarters | |

| 25 | Parent Company income statement | |

| 25 | Parent Company balance sheet | |

Additional information

| 26 | Accounting policies | |

| 27 | Accounting policies (continued) | |

| 28 | Net sales by segment by quarter | |

| 28 | Sales growth for comparable units, adjusted for currency effects and hedging | |

| 29 | Operating income by segment by quarter | |

| 29 | Operating margin by segment by quarter | |

| 30 | EBITA by segment by quarter | |

| 30 | EBITA margin by segment by quarter | |

| 31 | Net sales by region by quarter | |

| 32 | Net sales by region by quarter (cont.) | |

| 32 | Top 5 countries in sales | |

| 33 | Net sales by region by segment | |

| 34 | Provisions | |

| 34 | Information on investments in assets subject to depreciation, amortizations, impairment and write-downs | |

| 34 | Reconciliation table, non-IFRS measurements | |

| 35 | Other information | |

| 35 | Number of employees | |

| 36 | Restructuring charges by function | |

| 36 | Restructuring charges by segment | |

| Ericsson Second Quarter Report 2013 | 18 |