Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

July 18, 2014

LM ERICSSON TELEPHONE COMPANY

(Translation of registrant’s name into English)

Torshamnsgatan 21, Kista

SE-164 83, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

Announcement of LM Ericsson Telephone Company, dated July18, 2014 regarding “Second Quarter Report 2014”

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELEFONAKTIEBOLAGET LM ERICSSON (publ) | ||

| By: | /S/NINAMACPHERSON | |

| Nina Macpherson | ||

| Senior Vice President and | ||

| General Counsel | ||

| By: | /S/HELENANORRMAN | |

| Helena Norrman | ||

| Senior Vice President | ||

| Corporate Communications |

Date:July 18, 2014

Table of Contents

Second quarter report 2014

Stockholm, July 18, 2014

| SECOND QUARTER HIGHLIGHTS | Read more (page) | |||

• Sales in the quarter were SEK 54.8 (55.3) b. Sales for comparable units, adjusted for currency, decreased -1% YoY and increased 13% QoQ | 3 | |||

• Sales recovered compared to the previous quarter driven by growth in the Middle East, China and India, as well as continued capacity business in North America | 2 | |||

• Gross margin increased YoY to 36.4% (32.4%), driven by strong development in capacity business, increased IPR revenues and lower restructuring charges | 3 | |||

• With current visibility, key contracts awarded will gradually impact sales and business mix, in the second half of the year | 2 | |||

• Operating margin improved YoY to 7.3% (4.5%), mainly driven by stronger performance in segment Networks | 3 | |||

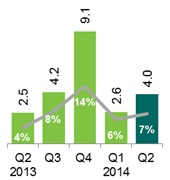

• Operating income amounted to SEK 4.0 (2.5) b. | 5-8 | |||

• Cash flow from operating activities was SEK 2.1 (4.3) b. | 11 | |||

SEK b. | Q2 2014 | Q2 2013 | YoY change | Q1 2014 | QoQ change | Six months 2014 | Six months 2013 | |||||||||||||||||||||

Net sales | 54.8 | 55.3 | -1 | % | 47.5 | 15 | % | 102.4 | 107.4 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | -1 | % | — | 13 | % | -4 | % | 7 | % | |||||||||||||||||

Gross margin | 36.4 | % | 32.4 | % | — | 36.5 | % | — | 36.4 | % | 32.2 | % | ||||||||||||||||

Operating income | 4.0 | 2.5 | 62 | % | 2.6 | 52 | % | 6.6 | 4.6 | |||||||||||||||||||

Operating margin | 7.3 | % | 4.5 | % | — | 5.5 | % | — | 6.5 | % | 4.3 | % | ||||||||||||||||

Net income | 2.7 | 1.5 | 76 | % | 1.7 | 57 | % | 4.4 | 2.7 | |||||||||||||||||||

EPS diluted, SEK | 0.79 | 0.45 | 76 | % | 0.65 | 22 | % | 1.44 | 0.82 | |||||||||||||||||||

EPS (Non-IFRS), SEK1) | 1.07 | 0.88 | 22 | % | 0.90 | 19 | % | 1.98 | 1.88 | |||||||||||||||||||

Cash flow from operating activities | 2.1 | 4.3 | -52 | % | 9.4 | -78 | % | 11.5 | 1.3 | |||||||||||||||||||

Net cash, end of period | 32.5 | 27.4 | 18 | % | 43.6 | -26 | % | 32.5 | 27.4 | |||||||||||||||||||

| 1) | EPS, diluted, excl. amortizations and write-downs of acquired intangible assets, and restructuring |

Ericsson Second Quarter Report 2014 | 1 |

Table of Contents

CEO Comments

Sales for comparable units, adjusted for currency, recovered compared to the previous quarter and were down by -1% year-over-year. Operating margin improved year-over-year, mainly driven by stronger performance in segment Networks.

Sales in the quarter year-over-year were driven by growth in the Middle East, China and India, as well as continued capacity business in North America. This was offset by, as previously communicated, lower revenues from two large mobile broadband coverage projects in North America that peaked in the first half of 2013, and reduced activity in Japan.

The operating margin improved year-over-year, especially in segment Networks. This was due to a higher gross margin primarily from improved business mix with an increased share of mobile broadband capacity projects in advanced LTE markets, as well as higher recurring IPR revenues and efficiency improvements.

After a slow start of the year, we are executing on previously awarded 4G/LTE contracts in Mainland China and Taiwan. Furthermore, the investment climate in India is improving following the concluded spectrum auctions and government elections held in May.

Political unrest prevails in parts of the Middle East and Africa and is still impacting sales. There is also a continued political uncertainty in Russia and the Ukraine, but this had no negative impact on sales in the quarter.

As previously stated and with current visibility, key contracts awarded will gradually impact sales and business mix in the second half of the year.

In line with our strategic agenda, we have continued investing into new and targeted areas. The addition of the modems and Mediaroom businesses, as well as increased investments in IP, have resulted in increased R&D spending. At the same time, we continue to execute on profit improvement activities.

Our modems business will start generating sales by the end of this year, as our modem M7450 will be featured in smartphones and data devices. During the first half of 2014, we have invested SEK 1.2 b. primarily in R&D and we have a strong technology platform. However, the performance of the business is linked to our customers’ success. As previously communicated, success will be measured in an 18-24 months timeframe after integration of the modems business, which was completed in August 2013.

Support Solutions showed negative result in the quarter due to lower sales related to legacy portfolio. However, the transition from traditional telecom software license business models to recurrent license revenue deals continues.

Operating cash flow was positive in the quarter driven mainly by improved income and maintained working capital days. The execution of the company-wide order-to-cash initiative continues and shows good progress.

In a transforming ICT market, we continue to evolve through investments in both our core business as well as in new and targeted areas. Through our technology and services leadership we are well positioned to continue to be a strategic partner to our customers as they move to capture new market opportunities.

Hans Vestberg

President and CEO

Ericsson Second Quarter Report 2014 | 2 |

Table of Contents

Financial highlights

SEK b. | Q2 2014 | Q2 2013 | YoY change | Q1 2014 | QoQ change | 6 months 2014 | 6 months 2013 | |||||||||||||||||||||

Net sales | 54.8 | 55.3 | -1 | % | 47.5 | 15 | % | 102.4 | 107.4 | |||||||||||||||||||

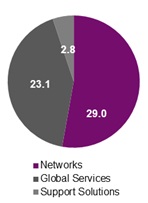

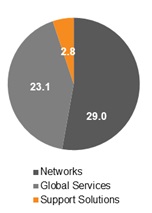

Of which Networks | 29.0 | 28.1 | 3 | % | 24.4 | 19 | % | 53.3 | 56.3 | |||||||||||||||||||

Of which Global Services | 23.1 | 24.9 | -7 | % | 20.4 | 13 | % | 43.4 | 46.3 | |||||||||||||||||||

Of which Support Solutions | 2.8 | 2.3 | 21 | % | 2.8 | 2 | % | 5.6 | 4.8 | |||||||||||||||||||

Of which Modems | 0.0 | — | — | 0.0 | — | 0.0 | — | |||||||||||||||||||||

Gross income | 19.9 | 17.9 | 11 | % | 17.3 | 15 | % | 37.3 | 34.6 | |||||||||||||||||||

Gross margin (%) | 36.4 | % | 32.4 | % | — | 36.5 | % | — | 36.4 | % | 32.2 | % | ||||||||||||||||

Research and development expenses | -9.1 | -7.7 | 17 | % | -8.3 | 10 | % | -17.4 | -15.6 | |||||||||||||||||||

Selling and administrative expenses | -6.5 | -6.6 | -1 | % | -6.5 | 1 | % | -13.0 | -13.3 | |||||||||||||||||||

Other operating income and expenses | -0.2 | -1.0 | -80 | % | 0.0 | — | -0.2 | -1.0 | ||||||||||||||||||||

Operating income | 4.0 | 2.5 | 62 | % | 2.6 | 52 | % | 6.6 | 4.6 | |||||||||||||||||||

Operating margin | 7.3 | % | 4.5 | % | — | 5.5 | % | — | 6.5 | % | 4.3 | % | ||||||||||||||||

for Networks | 12 | % | 5 | % | — | 10 | % | — | 11 | % | 5 | % | ||||||||||||||||

for Global Services | 6 | % | 6 | % | — | 5 | % | — | 6 | % | 5 | % | ||||||||||||||||

for Support Solutions | -13 | % | -12 | % | — | 0 | % | — | -7 | % | -7 | % | ||||||||||||||||

for Modems | — | — | — | — | — | — | — | |||||||||||||||||||||

Financial net | -0.2 | -0.3 | -35 | % | -0.2 | -7 | % | -0.4 | -0.7 | |||||||||||||||||||

Taxes | -1.1 | -0.6 | 76 | % | -0.7 | 57 | % | -1.9 | -1.2 | |||||||||||||||||||

Net income | 2.7 | 1.5 | 76 | % | 1.7 | 57 | % | 4.4 | 2.7 | |||||||||||||||||||

Restructuring charges | -0.2 | -0.9 | -74 | % | -0.1 | 87 | % | -0.4 | -2.8 | |||||||||||||||||||

Net sales

Sales in the quarter, compared to last year, were driven by growth in the Middle East, China and India, as well as continued capacity business in North America. This was offset by, as previously communicated, lower revenues from two large mobile broadband coverage projects in North America that peaked in the first half of 2013, and the impact from reduced activity in Japan.

Segment Networks sales grew YoY while sales in Network Rollout, within segment Global Services, continued to decline. IPR revenues grew YoY following the Samsung license agreement reached in January 2014.

Sales increased sequentially after a weak Q1 2014, driven by strong sales in North America, China and Brazil.

Gross margin

Gross margin increased YoY. Continued strong development in capacity business contributed to higher hardware margins. Increased IPR revenues, lower restructuring charges and efficiency improvements combined with lower Network Rollout sales, also contributed positively to the gross margin.

Restructuring charges

Restructuring charges increased somewhat QoQ but remained at a low level and decreased YoY. The execution on the service delivery strategy, to move local service delivery resources to global centers, continues, but at slower pace compared to last year.

Operating expenses

Total operating expenses increased YoY, mainly due to increased R&D expenses primarily related to the added modems and Mediaroom businesses.

SG&A expenses decreased slightly YoY.

Ericsson Second Quarter Report 2014 | 3 |

Table of Contents

|  |  | ||

Quarterly sales, SEK b. and reported sales growth year over year, percent | Operating expenses, SEK b. and operating expenses as percentage of sales | Operating income SEK b. and operating margin, percent |

Other operating income and expenses

The revaluation effect from hedges was SEK -0.5 b. compared to SEK -0.1 b. in Q1 2014 and -0.2 b. in Q2 2013. In Q2 2013, there were one-time items of SEK -0.9 b. related to divestments and for exiting the power and telecom cable operations.

Operating income

Operating income increased YoY driven by favorable business mix, IPR revenues and lower restructuring charges, partly offset by increased operating expenses.

Q2 2013 was also impacted by the one-time items of SEK -0.9 b. as mentioned above.

Financial net

Financial net improved slightly YoY mainly due to interest rate revaluation effects.

Net income and EPS

Net income and EPS diluted increased following the improved operating income.

Ericsson Second Quarter Report 2014 | 4 |

Table of Contents

Segment results

NETWORKS

|  |  | ||

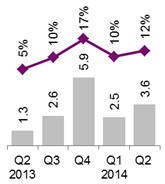

| Segment sales, SEK b. | Quarterly sales, SEK b. and sales growth year over year | Operating income, SEK b. and operating margin, percent |

SEK b. | Q2 2014 | Q2 2013 | YoY change | Q1 2014 | QoQ change | 6 months 2014 | 6 months 2013 | |||||||||||||||||||||

Net sales | 29.0 | 28.1 | 3 | % | 24.4 | 19 | % | 53.3 | 56.3 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | 5 | % | — | 16 | % | -3 | % | 7 | % | |||||||||||||||||

Operating income | 3.6 | 1.3 | 168 | % | 2.5 | 44 | % | 6.1 | 2.9 | |||||||||||||||||||

Operating margin | 12 | % | 5 | % | — | 10 | % | — | 11 | % | 5 | % | ||||||||||||||||

EBITA margin | 14 | % | 7 | % | — | 13 | % | — | 14 | % | 8 | % | ||||||||||||||||

Restructuring charges | -0.1 | -0.3 | -59 | % | -0.1 | 38 | % | -0.2 | -1.6 | |||||||||||||||||||

Net sales

Sales, adjusted for comparable units and currency, recovered in the quarter driven by growth in the Middle East, China, US and India. The majority of sales growth was in Radio Access. In addition, IP Edge and IMS solutions showed good growth. Capacity business developed favorably also this quarter, particularly in advanced LTE markets, driven by operators’ focus on network performance as a key differentiator. The decline in mobile broadband coverage projects in North America and Japan continued as expected.

Sales increased QoQ following a weak first quarter 2014. CDMA sales have stabilized with sales at SEK 0.4 b. in the quarter with a YoY sales decline.

Operating income and margin

For the fourth consecutive quarter, operating margin was 10% or above and operating income has more than doubled over the last six months. The YoY increase was supported by improved business mix, higher IPR revenues and continued focus on commercial excellence and operational effectiveness. The operating margin increased QoQ as a result of higher sales volumes.

Business update

Mobile broadband demand, VoLTE and growing interest in LTE broadcast drives performance initiatives including carrier aggregation and network densification. Small cells and the use of new frequency bands will also be key to address demand.

The momentum for the multi-application router, SSR 8000, continued with 120 contracts signed since the launch in December 2011. During the quarter, 11 new contracts were signed of which 3 were for fixed networks.

Ericsson Second Quarter Report 2014 | 5 |

Table of Contents

GLOBAL SERVICES

|  |  | ||

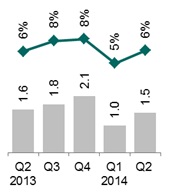

| Segment sales, SEK b. | Quarterly sales, SEK b. and sales growth year over year | Operating income, SEK b. and operating margin, percent |

SEK b. | Q2 2014 | Q2 2013 | YoY change | Q1 2014 | QoQ change | 6 months 2014 | 6 months 2013 | |||||||||||||||||||||

Net sales | 23.1 | 24.9 | -7 | % | 20.4 | 13 | % | 43.4 | 46.3 | |||||||||||||||||||

Of which Professional Services | 16.6 | 16.8 | -1 | % | 15.1 | 10 | % | 31.7 | 31.4 | |||||||||||||||||||

Of which Managed Services | 6.5 | 6.8 | -4 | % | 5.8 | 13 | % | 12.2 | 12.6 | |||||||||||||||||||

Of which Network Rollout | 6.5 | 8.1 | -19 | % | 5.3 | 23 | % | 11.8 | 14.9 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | -8 | % | — | 11 | % | -5 | % | 9 | % | |||||||||||||||||

Operating income | 1.5 | 1.6 | -5 | % | 1.0 | 44 | % | 2.5 | 2.3 | |||||||||||||||||||

Of which Professional Services | 2.1 | 2.3 | -8 | % | 1.9 | 11 | % | 4.0 | 4.1 | |||||||||||||||||||

Of which Network Rollout | -0.6 | -0.7 | -16 | % | -0.9 | -29 | % | -1.5 | -1.8 | |||||||||||||||||||

Operating margin | 6 | % | 6 | % | — | 5 | % | — | 6 | % | 5 | % | ||||||||||||||||

for Professional Services | 13 | % | 14 | % | — | 13 | % | — | 13 | % | 13 | % | ||||||||||||||||

for Network Rollout | -9 | % | -9 | % | — | -16 | % | — | -12 | % | -12 | % | ||||||||||||||||

EBITA margin | 8 | % | 7 | % | — | 6 | % | — | 7 | % | 6 | % | ||||||||||||||||

Restructuring charges | -0.1 | -0.6 | -86 | % | 0.0 | 153 | % | -0.1 | -1.0 | |||||||||||||||||||

Net sales

Sales, adjusted for comparable units and currency, declined due to reduced mobile broadband network rollout activities in North America and Japan. Professional Services sales remained stable.

Managed Services continues to show high business activity and sales grew QoQ. During the quarter, several new contracts were announced, including a 5-year managed services deal in Romania involving more than 700 employees moving to Ericsson.

Global Services sales increased QoQ driven by increased activities in North America, impacting both Professional Services and Network Rollout.

Operating income and margin

Operating margin remained stable YoY. Network Rollout profitability improved sequentially, due to a reduced negative impact from the European modernization projects and lower temporary project costs in North America.

Professional Services margin declined slightly YoY due to lower sales.

Business update

The acquisition of Red Bee Media was finalized and consolidated as of May. The acquisition has strengthened Ericsson’s position in the transforming television and media industry and several new contracts have been signed in the quarter.

Other information | Q2 2014 | Q1 2014 | Full year 2013 | |||||||||

Number of signed Managed Services contracts | 21 | 16 | 84 | |||||||||

Number of signed significant consulting & systems integration contracts1) | 12 | 9 | 31 | |||||||||

Number of Ericsson services professionals, end of period | 64,000 | 61,000 | 64,000 | |||||||||

| 1) | In the areas of OSS and BSS, IP, Service Delivery Platforms and data center build projects. |

Ericsson Second Quarter Report 2014 | 6 |

Table of Contents

SUPPORT SOLUTIONS

|  |  | ||

| Segment sales, SEK b. | Quarterly sales, SEK b. and sales growth year over year | Operating income, SEK b. and operating margin, percent |

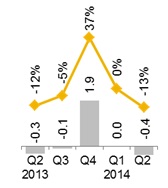

SEK b. | Q2 2014 | Q2 2013 | YoY change | Q1 2014 | QoQ change | 6 months 2014 | 6 months 2013 | |||||||||||||||||||||

Net sales | 2.8 | 2.3 | 21 | % | 2.8 | 2 | % | 5.6 | 4.8 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | 5 | % | — | 1 | % | 4 | % | -12 | % | |||||||||||||||||

Operating income | -0.4 | -0.3 | 34 | % | 0.0 | — | -0.4 | -0.3 | ||||||||||||||||||||

Operating margin | -13 | % | -12 | % | — | 0 | % | — | -7 | % | -7 | % | ||||||||||||||||

EBITA margin | -7 | % | -6 | % | — | 7 | % | — | 0 | % | 0 | % | ||||||||||||||||

Restructuring charges | 0.0 | 0.0 | 0 | % | 0.0 | — | 0.0 | -0.1 | ||||||||||||||||||||

Net sales

Reported sales, and sales adjusted for comparable units and currency, increased YoY. Growth from the acquired Mediaroom business and in OSS was partly offset by lower BSS sales in Latin America, Sub-Sahara Africa and India.

Sales increased slightly QoQ with strong growth in North America offset by weak sales in emerging markets.

Operating income and margin

Operating income and margin declined YoY and QoQ due to lower sales from legacy portfolio. In addition, investments in next-generation TV solutions are accelerating and this impacted operating income negatively.

Business update

An important multi-year BSS contract with T-Mobile in the US was announced in the quarter. The contract includes software, professional services and third party hardware.

The overall transition from traditional telecom software license business models to recurrent license revenue deals continues.

Ericsson Second Quarter Report 2014 | 7 |

Table of Contents

MODEMS

SEK b. | Q2 2014 | Q1 2014 | QoQ change | |||||||||

Net sales | 0.0 | 0.0 | — | |||||||||

Sales growth for comparable units and currency | — | — | — | |||||||||

Operating income | -0.5 | -0.7 | -39 | % | ||||||||

Operating margin | — | — | — | |||||||||

EBITA margin | — | — | — | |||||||||

Restructuring charges | 0.0 | 0.0 | — | |||||||||

Background

Since August 2013, Ericsson has a LTE thin-modems business with industry leading technology and intellectual property. The operation was integrated into Ericsson after the split-up of the joint venture ST-Ericsson last year. Modems are part of Ericsson’s vision of 50 billion connected devices and the ambition is to be a leading supplier in the thin-modems market. The first product, Ericsson M7450, was released for commercial use in Q4 2013.

Operating income

Operating income was SEK -0.5 b. Total operating expenses for the modems business in 2014 are still estimated at approximately SEK -2.6 b.

Net sales are expected in the second half of 2014.

Business update

Global operator certification for M7450 is progressing as planned, and work is ongoing with tier one smartphone manufacturers to integrate it in their devices. Smartphones and data devices featuring M7450 will be on the market by the end of this year.

Ericsson Second Quarter Report 2014 | 8 |

Table of Contents

Regional Sales

| Second quarter 2014 | Change | |||||||||||||||||||||||

SEK b. | Networks | Global Services | Support Solutions | Total | YoY | QoQ | ||||||||||||||||||

North America | 7.7 | 6.4 | 1.1 | 15.2 | -1 | % | 24 | % | ||||||||||||||||

Latin America | 2.6 | 2.6 | 0.2 | 5.4 | -3 | % | 15 | % | ||||||||||||||||

Northern Europe and Central Asia | 1.8 | 0.9 | 0.0 | 2.7 | 0 | % | 12 | % | ||||||||||||||||

Western and Central Europe | 1.8 | 2.6 | 0.2 | 4.6 | 1 | % | 5 | % | ||||||||||||||||

Mediterranean | 2.5 | 2.9 | 0.2 | 5.5 | -11 | % | 15 | % | ||||||||||||||||

Middle East | 2.5 | 1.8 | 0.2 | 4.5 | 13 | % | 17 | % | ||||||||||||||||

Sub-Saharan Africa | 0.9 | 1.0 | 0.1 | 1.9 | -29 | % | 4 | % | ||||||||||||||||

India | 0.9 | 0.7 | 0.0 | 1.6 | 29 | % | -3 | % | ||||||||||||||||

North East Asia | 4.3 | 2.0 | 0.1 | 6.4 | -4 | % | 31 | % | ||||||||||||||||

South East Asia and Oceania | 1.8 | 1.7 | 0.1 | 3.7 | -3 | % | 6 | % | ||||||||||||||||

Other1) | 2.2 | 0.5 | 0.6 | 3.4 | 23 | % | 3 | % | ||||||||||||||||

Total | 29.0 | 23.1 | 2.8 | 54.8 | -1 | % | 15 | % | ||||||||||||||||

| 1) | Region “Other” includes licensing revenues, broadcast services, power modules, mobile broadband modules, Ericsson-LG Enterprise and other businesses. |

North America

Sales in the quarter were driven by network quality and capacity expansion business, primarily as a result of increasing video traffic. This was offset by lower revenues from two large mobile broadband coverage projects that peaked in the first half of 2013. Recent network ICT transformation contracts, including the modernization of OSS and BSS, drove the Professional Services business.

Latin America

Sales decreased slightly YoY. Operators continue to invest to increase 3G network quality as well as deploy LTE.

Northern Europe and Central Asia

Sales were stable driven by mobile broadband infrastructure investments in Russia and operator focus on network quality. The non-operator business in the Nordics continued to show stable progress.

Western and Central Europe

Sales increased YoY predominantly driven by Managed Services. Investments in network quality and capacity continue to be the main driver. However, this does not fully offset the decline in network modernization projects. Support Solutions increased YoY through the inclusion of Mediaroom.

Mediterranean

Sales in the region declined YoY due to major modernization projects that peaked in the beginning of 2013. Demand for Professional Services continued, driven by Managed Services.

Middle East

Sales continued to show solid growth YoY mainly driven by 3G deployments. 4G is also being deployed in parts of the region. Overall demand for network infrastructure is driven by the rapid increase in data traffic, as well as coverage requirements fueled by new mobile licenses.

Sub-Saharan Africa

During the quarter, sales declined due to overall cautious operator investment levels. This was partly offset by growth in Managed Services as operators seek operational efficiencies.

India

Sales grew YoY as operators increased mobile broadband infrastructure spending in response to rising data volumes. Increased sales related to OSS and BSS also contributed to growth.

North East Asia

Sales decreased YoY as a result of expected lower network investment levels in Japan and the continued structural decline of GSM in China. The decline was partly offset by execution on previously awarded 4G/LTE contracts in Mainland China and Taiwan.

South East Asia and Oceania

Networks sales declined further as major 3G projects in Indonesia peaked in 2013. Global Services sales increased QoQ and YoY driven by a significant rollout project in Australia. There is an increased focus on network quality to improve customer experience in several markets.

Other

Licensing revenues showed good development YoY, following the Samsung agreement. Broadcast services continued to grow as the acquired Red Bee Media business was consolidated in the quarter.

Ericsson Second Quarter Report 2014 | 9 |

Table of Contents

Cash flow

SEK b. | Q2 2014 | Q2 2013 | Q1 2014 | |||||||||

Net income reconciled to cash | 5.9 | 3.5 | 3.2 | |||||||||

Changes in operating net assets | -3.8 | 0.8 | 6.2 | |||||||||

Cash flow from operating activities | 2.1 | 4.3 | 9.4 | |||||||||

Cash flow from investing activities | 3.7 | 7.5 | -8.8 | |||||||||

Cash flow from financing activities | -12.2 | -13.1 | -5.1 | |||||||||

Net change in cash and cash equivalents | -5.0 | 1.0 | -4.0 | |||||||||

Cash conversion (%) | 35 | % | 123 | % | 290 | % | ||||||

The positive cash flow from operating activities was driven by strong income with maintained working capital days. Working capital increased mainly as a result of increased sales and preparation for new projects.

Investing activities were impacted by acquisitions of SEK -1.5 b., primarily related to Red Bee Media, and normal capex investments of SEK -1.3 b.

Short-term investments with maturity of more than 3 months have decreased by SEK 7.0 b., primarily as a result of transferred liquidity to Cash and cash equivalents in order to cater for dividend payout.

Cash flow from financing activities in the quarter was mainly related to dividend payouts of SEK -9.8 b. and repayment of debt of SEK -2.0 b.

Payments for ongoing restructuring charges amounted to approximately SEK 0.2 b. in the quarter.

Working capital KPIs, number of days | Jan-Jun 2014 | Jan-Mar 2014 | Jan-Dec 2013 | Jan-Sep 2013 | Jan-Jun 2013 | |||||||||||||||

Sales outstanding | 113 | 112 | 97 | 109 | 103 | |||||||||||||||

Inventory | 70 | 72 | 62 | 72 | 73 | |||||||||||||||

Payable | 61 | 62 | 53 | 53 | 55 | |||||||||||||||

Days of sales outstanding increased, mainly due to increased sales in the quarter.

Inventory days decreased due to higher volumes and improved process lead times. However, inventory levels increased as an effect of preparation for coming mobile broadband deployments.

Efforts to reduce working capital through a better order-to-cash process continue.

Ericsson Second Quarter Report 2014 | 10 |

Table of Contents

Financial position

SEK b. | Jun 30 2014 | Mar 31 2014 | Dec 31 2013 | |||||||||

+ Short-term investments | 35.3 | 41.8 | 35.0 | |||||||||

+ Cash and cash equivalents | 33.1 | 38.1 | 42.1 | |||||||||

Gross cash | 68.4 | 79.9 | 77.1 | |||||||||

- Interest bearing liabilities and post-employment benefits | 35.9 | 36.3 | 39.3 | |||||||||

Net cash | 32.5 | 43.6 | 37.8 | |||||||||

Equity | 138.0 | 142.6 | 141.6 | |||||||||

Total assets | 265.5 | 267.2 | 269.2 | |||||||||

Capital turnover (times) | 1.2 | 1.1 | 1.3 | |||||||||

Return on capital employed (%) | 8.2 | % | 6.7 | % | 10.7 | % | ||||||

Equity ratio (%) | 52.0 | % | 53.4 | % | 52.6 | % | ||||||

Return on equity (%) | 6.8 | % | 6.0 | % | 8.7 | % | ||||||

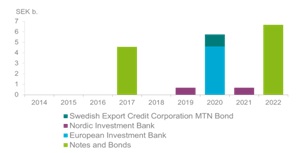

Net cash decreased in the quarter as a result of dividend payout. Borrowings decreased after a loan repayment of EUR 220 million (SEK 2.0 b.) that matured in the quarter.

Post-employment benefits increased by SEK 1.3 b.,mainly due to lower discount rates.

The average maturity of long-term borrowings as of June 30, 2014, was 6.2 years, compared to 5.4 years 12 months ago.

Ericsson has one unutilized Revolving Credit Facility of USD 2.0 b. During the quarter the facility was extended by one year and will mature 2020.

|

| Debt maturity profile, Parent Company, SEK b. |

Ericsson Second Quarter Report 2014 | 11 |

Table of Contents

Parent company

Income after financial items was SEK 2.9 (2.7) b.

Major changes in the Parent Company’s financial position for the year; decreased cash, cash equivalents and short-term investments of SEK 6.1 b., increased current and non-current receivables to subsidiaries of SEK 5.2 b. and increased current and non-current liabilities to subsidiaries of SEK 12.6 b. At the end of the quarter, cash, cash equivalents and short-term investments amounted to SEK 52.4 (58.5) b.

In June the Parent Company repaid bonds of EUR 220 million at maturity date.

A dividend payment of SEK 9.7 b. was made in the quarter as decided by the Annual General Meeting.

In accordance with the conditions of the long-term variable compensation program (LTV) for Ericsson employees, 2,172,945 shares from treasury stock were sold or distributed to employees during the second quarter. The holding of treasury stock at June 30, 2014, was 69,017,337 Class B shares.

Ericsson Second Quarter Report 2014 | 12 |

Table of Contents

Other information

Ericsson’s Nomination Committee appointed

On May 21, 2014, Ericsson announced that the Nomination Committee for the Annual General Meeting (AGM) 2015 has been appointed in accordance with the Instruction for the Nomination Committee resolved by the AGM 2012.

Ericsson completes acquisition of Red Bee Media

On May 12, 2014, Ericsson announced completion of its acquisition of Red Bee Media, a leading media services company headquartered in the UK, from Creative Broadcast Services Holdings - an entity controlled by Macquarie Advanced Investment Partners, L.P. Ericsson announced its intention to acquire Red Bee Media on July 1, 2013, and the UK’s Competition Commission formally cleared the acquisition on March 27, 2014.

Ericsson appoints Rima Qureshi as Chief Strategy Officer

On April 30, 2014, Ericsson announced the appointment of Rima Qureshi as Chief Strategy Officer for the Ericsson Group. She will also drive the company’s mergers and acquisitions (M&A) strategy and activities. In addition, she will serve as Chairman of Business Unit Modems.

New structure to support segment Networks growth

On April 24, 2014, Ericsson announced the establishment of two new business units within segment Networks in a move to accelerate transformation and support growth. The company has created two new units, Business Unit Radio and Business Unit Cloud & IP, replacing the old Business Unit Networks. The change in organization will enable more focus on the needs of each business while maintaining an end-to-end view on segment Networks. Johan Wibergh, Executive Vice President, will continue to lead segment Networks and remains a member of Ericsson’s Executive Leadership Team.

Composition of the Board of Directors

In conjunction with theAGM on April 11, 2014, Ericsson announced that, in accordance with the proposal of the Nomination Committee, Leif Johansson was re-elected Chairman of the Board of Directors. Roxanne S. Austin, Sir Peter L. Bonfield, Nora Denzel, Börje Ekholm, Alexander Izosimov, Ulf J. Johansson, Sverker Martin-Löf, Kristin Skogen Lund, Hans Vestberg, Jacob Wallenberg and Pär Östberg were re-elected to the Board. Board members appointed by the unions are Pehr Claesson, Kristina Davidsson and Karin Åberg. Deputy board members appointed by the unions are Rickard Fredriksson, Karin Lennartsson and Roger Svensson.

Antitrust investigations against Ericsson

In March 2013, Ericsson filed a patent infringement lawsuit in the Indian Delhi High Court against Micromax Informatics Limited. As part of its defense, Micromax filed a complaint with the Competition Commission of India (CCI) and in November 2013 the CCI decided to refer the case to the Director General’s Office for an in-depth investigation. In January 2014 the CCI announced they had opened another investigation against Ericsson based on claims made by Intex Technologies (India) Limited. Ericsson has made numerous attempts to sign a license agreement with Micromax and Intex on Fair, Reasonable and Non-discriminatory (FRAND) terms.

Ericsson Second Quarter Report 2014 | 13 |

Table of Contents

Risk factors

Ericsson’s operational and financial risk factors and uncertainties along with our strategies and tactics to mitigate risk exposures or limit unfavorable outcomes are described in our Annual Report 2013. Compared to the risks described in the Annual Report 2013, no material, new or changed risk factors or uncertainties have been identified in the year.

Risk factors and uncertainties in focus short-term for the Parent Company and the Ericsson Group include:

| • | Potential negative effects on operators’ willingness to invest in network development due to uncertainty in the financial markets and a weak economic business environment, or reduced consumer telecom spending, or increased pressure on us to provide financing; |

| • | Uncertainty regarding the financial stability of suppliers, for example due to lack of financing; |

| • | Effects on gross margins and/or working capital of the product mix in the Networks segment between sales of upgrades and expansions (mainly software) and new build outs of coverage (mainly hardware); |

| • | Effects on gross margins of the product mix in the Global Services segment including proportion of new network build outs and share of new managed services deals with initial transition costs; |

| • | A continued volatile sales pattern in the Support Solutions segment or variability in our overall sales seasonality could make it more difficult to forecast future sales; |

| • | Effects of the ongoing industry consolidation among our customers as well as between our largest competitors, e.g. with postponed investments and intensified price competition as a consequence; |

| • | Changes in foreign exchange rates, in particular USD, JPY and EUR; |

| • | Political unrest or instability in certain markets; |

| • | Effects on production and sales from restrictions with respect to timely and adequate supply of materials, components and production capacity and other vital services on competitive terms; |

| • | Natural disasters and other events, affecting business, production, supply and transportation. |

Ericsson stringently monitors the compliance with all relevant trade regulations and trade embargos applicable to dealings with customers operating in countries where there are trade restrictions or trade restrictions are discussed. Moreover, Ericsson operates globally in accordance with Group policies and directives for business ethics and conduct.

Stockholm, July 18, 2014

Telefonaktiebolaget LM Ericsson

Hans Vestberg, President and CEO

Org. Nr. 556016-0680

This report has not been reviewed by

Telefonaktiebolaget LM Ericsson’s auditors.

Date for next report: October 24, 2014

Ericsson Second Quarter Report 2014 | 14 |

Table of Contents

Board Assurance

The Board of Directors and the CEO certify that the financial report for the six months gives a fair view of the performance of the business, position and profit or loss of the Company and the Group, and describes the principal risks and uncertainties that the Company and the companies in the Group face.

Stockholm, July 18, 2014

Telefonaktiebolaget LM Ericsson (publ)

Org. Nr. 556016-0680

Sverker Martin-Löf Deputy chairman | Leif Johansson Chairman | Jacob Wallenberg Deputy chairman | ||||||

Roxanne S. Austin Member of the board | Sir Peter L. Bonfield Member of the board | Nora Denzel Member of the board | ||||||

Börje Ekholm Member of the board | Ulf J. Johansson Member of the board | Kristin Skogen Lund Member of the board | ||||||

Alexander Izosimov Member of the board | Pär Östberg Member of the board | |||||||

Pehr Claesson Member of the board | Kristina Davidsson Member of the board | Karin Åberg Member of the board | ||||||

Hans Vestberg Member of the board and President and CEO | ||||||||

Ericsson Second Quarter Report 2014 | 15 |

Table of Contents

Editor’s note

Ericsson invites media, investors and analysts to a press briefing at the Ericsson Studio, Grönlandsgången 4, Stockholm, at 09.00 (CET), July 18, 2014. An analysts, investors and media conference call will begin at 14.00 (CET).

Live webcast of the press conference and conference call as well as supporting slides will be available at

www.ericsson.com/press and

www.ericsson.com/investors

Video material will be published during the day on

www.ericsson.com/press

For further information, please contact:

Helena Norrman, Senior Vice President,

Communications

Phone: +46 10 719 34 72

E-mail: investor.relations@ericsson.com or

media.relations@ericsson.com

Telefonaktiebolaget LM Ericsson

Org. number: 556016-0680

Torshamnsgatan 21

SE-164 83 Stockholm

Phone: +46 10 719 00 00

www.ericsson.com

Investors

Peter Nyquist, Vice President,

Investor Relations

Phone: +46 10 714 64 49, +46 70 575 29 06

E-mail: peter.nyquist@ericsson.com

Stefan Jelvin, Director,

Investor Relations

Phone: +46 10 714 20 39, +46 70 986 02 27

E-mail: stefan.jelvin@ericsson.com

Åsa Konnbjer, Director,

Investor Relations

Phone: +46 10 713 39 28, +46 73 082 59 28

E-mail: asa.konnbjer@ericsson.com

Rikard Tunedal, Director,

Investor Relations

Phone: +46 10 714 54 00, +46 761 005 400

E-mail: rikard.tunedal@ericsson.com

Media

Ola Rembe, Vice President,

Head of External Communications

Phone: +46 10 719 97 27, +46 73 024 48 73

E-mail: media.relations@ericsson.com

Corporate Communications

Phone: +46 10 719 69 92

E-mail: media.relations@ericsson.com

Ericsson Second Quarter Report 2014 | 16 |

Table of Contents

Safe harbor statement

All statements made or incorporated by reference in this release, other than statements or characterizations of historical facts, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Forward-looking statements can often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “potential”, “continue”, and variations or negatives of these words, and include, among others, statements regarding: (i) strategies, outlook and growth prospects; (ii) positioning to deliver future plans and to realize potential for future growth; (iii) liquidity and capital resources and expenditure, and our credit ratings; (iv) growth in demand for our products and services; (v) our joint venture activities; (vi) economic outlook and industry trends; (vii) developments of our markets; (viii) the impact of regulatory initiatives; (ix) research and development expenditures; (x) the strength of our competitors; (xi) future cost savings; (xii) plans to launch new products and services; (xiii) assessments of risks; (xiv) integration of acquired businesses; (xv) compliance with rules and regulations and (xvi) infringements of intellectual property rights of others.

In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These forward-looking statements speak only as of the date hereof and are based upon the information available to us at this time. Such information is subject to change, and we will not necessarily inform you of such changes. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors. Important factors that may cause such a difference for Ericsson include, but are not limited to: (i) material adverse changes in the markets in which we operate or in global economic conditions; (ii) increased product and price competition; (iii) reductions in capital expenditure by network operators; (iv) the cost of technological innovation and increased expenditure to improve quality of service; (v) significant changes in market share for our principal products and services; (vi) foreign exchange rate or interest rate fluctuations; and (vii) the successful implementation of our business and operational initiatives.

Ericsson Second Quarter Report 2014 | 17 |

Table of Contents

Financial statements and additional information

Ericsson Second Quarter Report 2014 | 18 |

Table of Contents

| Apr - Jun | Jan - Jun | |||||||||||||||||||||||

SEK million | 2013 | 2014 | Change | 2013 | 2014 | Change | ||||||||||||||||||

Net sales | 55,331 | 54,849 | -1 | % | 107,363 | 102,354 | -5 | % | ||||||||||||||||

Cost of sales | -37,412 | -34,910 | -7 | % | -72,806 | -65,094 | -11 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross income | 17,919 | 19,939 | 11 | % | 34,557 | 37,260 | 8 | % | ||||||||||||||||

Gross margin (%) | 32.4 | % | 36.4 | % | 32.2 | % | 36.4 | % | ||||||||||||||||

Research and development expenses | -7,747 | -9,084 | 17 | % | -15,624 | -17,359 | 11 | % | ||||||||||||||||

Selling and administrative expenses | -6,629 | -6,541 | -1 | % | -13,272 | -12,993 | -2 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating expenses | -14,376 | -15,625 | 9 | % | -28,896 | -30,352 | 5 | % | ||||||||||||||||

Other operating income and expenses | -1,040 | -206 | -1,020 | -185 | ||||||||||||||||||||

Shares in earnings of JV and associated companies | -38 | -109 | -70 | -94 | 34 | % | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income | 2,465 | 3,999 | 62 | % | 4,571 | 6,629 | 45 | % | ||||||||||||||||

Financial income | 304 | 268 | 484 | 669 | ||||||||||||||||||||

Financial expenses | -606 | -465 | -1,171 | -1,077 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income after financial items | 2,163 | 3,802 | 76 | % | 3,884 | 6,221 | 60 | % | ||||||||||||||||

Taxes | -647 | -1,140 | -1,164 | -1,867 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income | 1,516 | 2,662 | 76 | % | 2,720 | 4,354 | 60 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income attributable to: | ||||||||||||||||||||||||

- Stockholders of the Parent Company | 1,469 | 2,579 | 2,674 | 4,699 | ||||||||||||||||||||

- Non-controlling interests | 47 | 83 | 46 | -345 | ||||||||||||||||||||

Other information | ||||||||||||||||||||||||

Average number of shares, basic (million) | 3,224 | 3,235 | 3,223 | 3,234 | ||||||||||||||||||||

Earnings per share, basic (SEK)1) | 0.46 | 0.80 | 0.83 | 1.45 | ||||||||||||||||||||

Earnings per share, diluted (SEK)1) | 0.45 | 0.79 | 0.82 | 1.44 | ||||||||||||||||||||

| Apr - Jun | Jan - Jun | |||||||||||||||||||||||

SEK million | 2013 | 2014 | 2013 | 2014 | ||||||||||||||||||||

Net income | 1,516 | 2,662 | 2,720 | 4,354 | ||||||||||||||||||||

Other comprehensive income | ||||||||||||||||||||||||

Items that will not be reclassified to profit or loss | ||||||||||||||||||||||||

Remeasurements of defined benefits pension plans incl. asset ceiling | 954 | -574 | 1,773 | -2,196 | ||||||||||||||||||||

Tax on items that will not be reclassified to profit or loss | -318 | 114 | -706 | 443 | ||||||||||||||||||||

Items that may be reclassified to profit or loss | ||||||||||||||||||||||||

Cash flow hedges | ||||||||||||||||||||||||

Gains/losses arising during the period | -36 | — | 138 | — | ||||||||||||||||||||

Reclassification adjustments for gains/losses included in profit or loss | -297 | — | -763 | — | ||||||||||||||||||||

Adjustments for amounts transferred to initial carrying amount of hedged items | ||||||||||||||||||||||||

Revaulation of other investments in shares and participations | ||||||||||||||||||||||||

Fair value remeasurement | 69 | — | 69 | — | ||||||||||||||||||||

Changes in cumulative translation adjustments | 1,404 | 2,619 | 686 | 3,020 | ||||||||||||||||||||

Share of other comprehensive income on JV and associated companies | 120 | 117 | 104 | 128 | ||||||||||||||||||||

Tax on items that may be reclassified to profit or loss | 65 | — | 127 | — | ||||||||||||||||||||

Total other comprehensive income, net of tax | 1,961 | 2,276 | 1,428 | 1,395 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income | 3,477 | 4,938 | 4,148 | 5,749 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

Total comprehensive income attributable to: | ||||||||||||||||||||||||

Stockholders of the Parent Company | 3,394 | 4,792 | 4,087 | 6,032 | ||||||||||||||||||||

Non-controlling interest | 83 | 146 | 61 | -283 | ||||||||||||||||||||

| 1) | Based on Net income attributable to stockholders of the Parent Company |

Ericsson Second Quarter Report 2014 | 19 |

Table of Contents

| Dec 31 | Mar 31 | Jun 30 | ||||||||||

SEK million | 2013 | 2014 | 2014 | |||||||||

ASSETS | ||||||||||||

Non-current assets | ||||||||||||

Intangible assets | ||||||||||||

Capitalized development expenses | 3,348 | 3,212 | 3,082 | |||||||||

Goodwill | 31,544 | 32,114 | 34,243 | |||||||||

Intellectual property rights, brands and other intangible assets | 12,815 | 11,889 | 11,765 | |||||||||

Property, plant and equipment | 11,433 | 11,209 | 11,924 | |||||||||

Financial assets | ||||||||||||

Equity in JV and associated companies | 2,568 | 2,595 | 2,324 | |||||||||

Other investments in shares and participations | 505 | 509 | 510 | |||||||||

Customer finance, non-current | 1,294 | 1,146 | 1,240 | |||||||||

Other financial assets, non-current | 5,684 | 5,779 | 6,303 | |||||||||

Deferred tax assets | 9,103 | 10,030 | 10,880 | |||||||||

|

|

|

|

|

| |||||||

| 78,294 | 78,483 | 82,271 | ||||||||||

Current assets | ||||||||||||

Inventories | 22,759 | 24,962 | 26,915 | |||||||||

Trade receivables | 71,013 | 63,643 | 66,763 | |||||||||

Customer finance, current | 2,094 | 1,698 | 1,994 | |||||||||

Other current receivables | 17,941 | 18,528 | 19,208 | |||||||||

Short-term investments | 34,994 | 41,779 | 35,310 | |||||||||

Cash and cash equivalents | 42,095 | 38,096 | 33,088 | |||||||||

|

|

|

|

|

| |||||||

| 190,896 | 188,706 | 183,278 | ||||||||||

Total assets | 269,190 | 267,189 | 265,549 | |||||||||

|

|

|

|

|

| |||||||

EQUITY AND LIABILITIES | ||||||||||||

Equity | ||||||||||||

Stockholders’ equity | 140,204 | 141,643 | 136,948 | |||||||||

Non-controlling interest in equity of subsidiaries | 1,419 | 990 | 1,010 | |||||||||

|

| �� |

|

|

|

| ||||||

| 141,623 | 142,633 | 137,958 | ||||||||||

Non-current liabilities | ||||||||||||

Post-employment benefits | 9,825 | 11,633 | 12,884 | |||||||||

Provisions, non-current | 222 | 198 | 202 | |||||||||

Deferred tax liabilities | 2,650 | 2,466 | 2,624 | |||||||||

Borrowings, non-current | 22,067 | 18,900 | 19,504 | |||||||||

Other non-current liabilities | 1,459 | 1,532 | 1,699 | |||||||||

|

|

|

|

|

| |||||||

| 36,223 | 34,729 | 36,913 | ||||||||||

Current liabilities | ||||||||||||

Provisions, current | 5,140 | 4,730 | 4,377 | |||||||||

Borrowings, current | 7,388 | 5,737 | 3,525 | |||||||||

Trade payables | 20,502 | 20,482 | 22,795 | |||||||||

Other current liabilities | 58,314 | 58,878 | 59,981 | |||||||||

|

|

|

|

|

| |||||||

| 91,344 | 89,827 | 90,678 | ||||||||||

Total equity and liabilities | 269,190 | 267,189 | 265,549 | |||||||||

|

|

|

|

|

| |||||||

Of which interest-bearing liabilities and post-employment benefits | 39,280 | 36,270 | 35,913 | |||||||||

Of which net cash | 37,809 | 43,605 | 32,485 | |||||||||

Assets pledged as collateral | 2,556 | 2,528 | 2,522 | |||||||||

Contingent liabilities | 657 | 658 | 664 | |||||||||

Ericsson Second Quarter Report 2014 | 20 |

Table of Contents

CONSOLIDATED STATEMENT OF CASH FLOWS

| Apr-Jun | Jan - Jun | Jan - Dec | ||||||||||||||||||

SEK million | 2013 | 2014 | 2013 | 2014 | 2013 | |||||||||||||||

Operating activities | ||||||||||||||||||||

Net income | 1,516 | 2,662 | 2,720 | 4,354 | 12,174 | |||||||||||||||

Adjustments to reconcile net income to cash | ||||||||||||||||||||

Taxes | -689 | 26 | -2,538 | -1,322 | -1,323 | |||||||||||||||

Earnings/dividends in JV and associated companies | 37 | 356 | 70 | 340 | 258 | |||||||||||||||

Depreciation, amortization and impairment losses | 2,436 | 2,414 | 4,847 | 4,774 | 10,137 | |||||||||||||||

Other | 183 | 404 | -18 | 953 | 756 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 3,483 | 5,862 | 5,081 | 9,099 | 22,002 | ||||||||||||||||

Changes in operating net assets | ||||||||||||||||||||

Inventories | 600 | -1,188 | -826 | -3,287 | 4,868 | |||||||||||||||

Customer finance, current and non-current | 912 | -341 | 1,172 | 217 | 1,809 | |||||||||||||||

Trade receivables | 3,084 | -892 | 1,150 | 7,065 | -8,504 | |||||||||||||||

Trade payables | 518 | 1,644 | -2,430 | 1,534 | -2,158 | |||||||||||||||

Provisions and post-employment benefits | -1,752 | -225 | -597 | -689 | -3,298 | |||||||||||||||

Other operating assets and liabilities, net | -2,554 | -2,806 | -2,229 | -2,483 | 2,670 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 808 | -3,808 | -3,760 | 2,357 | -4,613 | ||||||||||||||||

Cash flow from operating activities | 4,291 | 2,054 | 1,321 | 11,456 | 17,389 | |||||||||||||||

Investing activities | ||||||||||||||||||||

Investments in property, plant and equipment | -1,278 | -1,320 | -2,474 | -2,354 | -4,503 | |||||||||||||||

Sales of property, plant and equipment | 11 | 53 | 102 | 327 | 378 | |||||||||||||||

Acquisitions/divestments of subsidiaries and other operations, net | -39 | -1,512 | -175 | -2,361 | -2,682 | |||||||||||||||

Product development | -214 | -185 | -496 | -382 | -915 | |||||||||||||||

Other investing activities | -203 | -388 | 95 | -557 | -1,330 | |||||||||||||||

Short-term investments | 9,209 | 7,012 | 6,349 | 222 | -2,057 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from investing activities | 7,486 | 3,660 | 3,401 | -5,105 | -11,109 | |||||||||||||||

Cash flow before financing activities | 11,777 | 5,714 | 4,722 | 6,351 | 6,280 | |||||||||||||||

Financing activities | ||||||||||||||||||||

Dividends paid | -8,863 | -9,828 | -8,924 | -9,828 | -9,153 | |||||||||||||||

Other financing activities | -4,236 | -2,393 | -4,144 | -7,462 | -355 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from financing activities | -13,099 | -12,221 | -13,068 | -17,290 | -9,508 | |||||||||||||||

Effect of exchange rate changes on cash | 2,357 | 1,499 | 2,143 | 1,932 | 641 | |||||||||||||||

Net change in cash and cash equivalents | 1,035 | -5,008 | -6,203 | -9,007 | -2,587 | |||||||||||||||

Cash and cash equivalents, beginning of period | 37,444 | 38,096 | 44,682 | 42,095 | 44,682 | |||||||||||||||

Cash and cash equivalents, end of period | 38,479 | 33,088 | 38,479 | 33,088 | 42,095 | |||||||||||||||

Ericsson Second Quarter Report 2014 | 21 |

Table of Contents

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Jan - Jun | Jan - Jun | Jan - Dec | ||||||||||

SEK million | 2013 | 2014 | 2013 | |||||||||

Opening balance | 138,483 | 141,623 | 138,483 | |||||||||

Total comprehensive income | 4,148 | 5,749 | 11,881 | |||||||||

Sale/repurchase of own shares | 40 | 54 | 90 | |||||||||

Stock purchase plan | 193 | 360 | 388 | |||||||||

Dividends paid | -8,924 | -9,828 | -9,153 | |||||||||

Transactions with non-controlling interests | -73 | — | -66 | |||||||||

|

|

|

|

|

| |||||||

Closing balance | 133,867 | 137,958 | 141,623 | |||||||||

|

|

|

|

|

| |||||||

Ericsson Second Quarter Report 2014 | 22 |

Table of Contents

CONSOLIDATED INCOME STATEMENT – ISOLATED QUARTERS

| 2013 | 2014 | |||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

Net sales | 52,032 | 55,331 | 52,981 | 67,032 | 47,505 | 54,849 | ||||||||||||||||||

Cost of sales | -35,394 | -37,412 | -36,028 | -42,171 | -30,184 | -34,910 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross income | 16,638 | 17,919 | 16,953 | 24,861 | 17,321 | 19,939 | ||||||||||||||||||

Gross margin (%) | 32.0 | % | 32.4 | % | 32.0 | % | 37.1 | % | 36.5 | % | 36.4 | % | ||||||||||||

Research and development expenses | -7,877 | -7,747 | -7,710 | -8,902 | -8,275 | -9,084 | ||||||||||||||||||

Selling and administrative expenses | -6,643 | -6,629 | -5,778 | -7,223 | -6,452 | -6,541 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating expenses | -14,520 | -14,376 | -13,488 | -16,125 | -14,727 | -15,625 | ||||||||||||||||||

Other operating income and expenses | 20 | -1,040 | 805 | 328 | 21 | -206 | ||||||||||||||||||

Shares in earnings of JV and associated companies | -32 | -38 | -51 | -9 | 15 | -109 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income | 2,106 | 2,465 | 4,219 | 9,055 | 2,630 | 3,999 | ||||||||||||||||||

Financial income | 180 | 304 | 678 | 184 | 401 | 268 | ||||||||||||||||||

Financial expenses | -565 | -606 | -595 | -327 | -612 | -465 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income after financial items | 1,721 | 2,163 | 4,302 | 8,912 | 2,419 | 3,802 | ||||||||||||||||||

Taxes | -517 | -647 | -1,292 | -2,468 | -727 | -1,140 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income | 1,204 | 1,516 | 3,010 | 6,444 | 1,692 | 2,662 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income attributable to: | ||||||||||||||||||||||||

- Stockholders of the Parent Company | 1,205 | 1,469 | 2,921 | 6,410 | 2,120 | 2,579 | ||||||||||||||||||

- Non-controlling interests | -1 | 47 | 89 | 34 | -428 | 83 | ||||||||||||||||||

Other information | ||||||||||||||||||||||||

Average number of shares, basic (million) | 3,222 | 3,224 | 3,227 | 3,230 | 3,233 | 3,235 | ||||||||||||||||||

Earnings per share, basic (SEK)1) | 0.37 | 0.46 | 0.91 | 1.98 | 0.66 | 0.80 | ||||||||||||||||||

Earnings per share, diluted (SEK) 1) | 0.37 | 0.45 | 0.90 | 1.97 | 0.65 | 0.79 | ||||||||||||||||||

| 1) | Based on Net income attributable to stockholders of the Parent Company |

Ericsson Second Quarter Report 2014 | 23 |

Table of Contents

CONSOLIDATED STATEMENT OF CASH FLOWS - ISOLATED QUARTERS

| 2013 | 2014 | |||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

Operating activities | ||||||||||||||||||||||||

Net income | 1,204 | 1,516 | 3,010 | 6,444 | 1,692 | 2,662 | ||||||||||||||||||

Adjustments to reconcile net income to cash | ||||||||||||||||||||||||

Taxes | -1,849 | -689 | -881 | 2,096 | -1,348 | 26 | ||||||||||||||||||

Earnings/dividends in JV and associated companies | 33 | 37 | 50 | 138 | -16 | 356 | ||||||||||||||||||

Depreciation, amortization and impairment losses | 2,411 | 2,436 | 2,546 | 2,744 | 2,360 | 2,414 | ||||||||||||||||||

Other | -201 | 183 | -327 | 1,101 | 549 | 404 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 1,598 | 3,483 | 4,398 | 12,523 | 3,237 | 5,862 | |||||||||||||||||||

Changes in operating net assets | ||||||||||||||||||||||||

Inventories | -1,426 | 600 | 357 | 5,337 | -2,099 | -1,188 | ||||||||||||||||||

Customer finance, current and non-current | 260 | 912 | 800 | -163 | 558 | -341 | ||||||||||||||||||

Trade receivables | -1,934 | 3,084 | -4,744 | -4,910 | 7,957 | -892 | ||||||||||||||||||

Trade payables | -2,948 | 518 | -588 | 860 | -110 | 1,644 | ||||||||||||||||||

Provisions and post-employment benefits | 1,155 | -1,752 | -970 | -1,731 | -464 | -225 | ||||||||||||||||||

Other operating assets and liabilities, net | 325 | -2,554 | 2,206 | 2,693 | 323 | -2,806 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| -4,568 | 808 | -2,939 | 2,086 | 6,165 | -3,808 | |||||||||||||||||||

Cash flow from operating activities | -2,970 | 4,291 | 1,459 | 14,609 | 9,402 | 2,054 | ||||||||||||||||||

Investing activities | ||||||||||||||||||||||||

Investments in property, plant and equipment | -1,196 | -1,278 | -778 | -1,251 | -1,034 | -1,320 | ||||||||||||||||||

Sales of property, plant and equipment | 91 | 11 | 97 | 179 | 274 | 53 | ||||||||||||||||||

Acquisitions/divestments of subsidiaries and other operations, net | -136 | -39 | -1,794 | -713 | -849 | -1,512 | ||||||||||||||||||

Product development | -282 | -214 | -237 | -182 | -197 | -185 | ||||||||||||||||||

Other investing activities | 298 | -203 | -230 | -1,195 | -169 | -388 | ||||||||||||||||||

Short-term investments | -2,860 | 9,209 | -144 | -8,262 | -6,790 | 7,012 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Cash flow from investing activities | -4,085 | 7,486 | -3,086 | -11,424 | -8,765 | 3,660 | ||||||||||||||||||

Cash flow before financing activities | -7,055 | 11,777 | -1,627 | 3,185 | 637 | 5,714 | ||||||||||||||||||

Financing activities | ||||||||||||||||||||||||

Dividends paid | -61 | -8,863 | -21 | -208 | — | -9,828 | ||||||||||||||||||

Other financing activities | 92 | -4,236 | 43 | 3,746 | -5,069 | -2,393 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Cash flow from financing activities | 31 | -13,099 | 22 | 3,538 | -5,069 | -12,221 | ||||||||||||||||||

Effect of exchange rate changes on cash | -214 | 2,357 | -1,711 | 209 | 433 | 1,499 | ||||||||||||||||||

Net change in cash and cash equivalents | -7,238 | 1,035 | -3,316 | 6,932 | -3,999 | -5,008 | ||||||||||||||||||

Cash and cash equivalents, beginning of period | 44,682 | 37,444 | 38,479 | 35,163 | 42,095 | 38,096 | ||||||||||||||||||

Cash and cash equivalents, end of period | 37,444 | 38,479 | 35,163 | 42,095 | 38,096 | 33,088 | ||||||||||||||||||

Ericsson Second Quarter Report 2014 | 24 |

Table of Contents

PARENT COMPANY INCOME STATEMENT

| Apr - Jun | Jan -Jun | |||||||||||||||

SEK million | 2013 | 2014 | 2013 | 2014 | ||||||||||||

Net sales | — | — | — | — | ||||||||||||

Cost of sales | — | — | — | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Gross income | — | — | — | — | ||||||||||||

Operating expenses | -330 | -209 | -586 | -551 | ||||||||||||

Other operating income and expenses | 711 | 658 | 1,351 | 1,323 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Operating income | 381 | 449 | 765 | 772 | ||||||||||||

Financial net | 1,177 | 2,023 | 1,969 | 2,140 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Income after financial items | 1,558 | 2,472 | 2,734 | 2,912 | ||||||||||||

Transfers to (-) / from untaxed reserves | — | — | — | — | ||||||||||||

Taxes | -110 | -187 | -229 | -261 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net income | 1,448 | 2,285 | 2,505 | 2,651 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

| STATEMENT OF COMPREHENSIVE INCOME | ||||||||||||||||

| Apr - Jun | Jan -Jun | |||||||||||||||

SEK million | 2013 | 2014 | 2013 | 2014 | ||||||||||||

Net income | 1,448 | 2,285 | 2,505 | 2,651 | ||||||||||||

Cash flow hedges | — | — | — | — | ||||||||||||

Fair value remeasurement | — | — | — | — | ||||||||||||

Total other comprehensive income, net of tax | — | — | — | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total comprehensive income | 1,448 | 2,285 | 2,505 | 2,651 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Ericsson Second Quarter Report 2014 | 25 |

Table of Contents

The Group

This interim report is prepared in accordance with IAS 34. The term “IFRS” used in this document refers to the application of IAS and IFRS as well as interpretations of these standards as issued by IASB’s Standards Interpretation Committee (SIC) and IFRS Interpretations Committee (IFRIC). The accounting policies adopted are consistent with those of the annual report for the year ended December 31, 2013, and should be read in conjunction with that annual report.

As from January 1, 2014, the Company has applied the following new or amended IFRSs and IFRICs:

Amendment to IAS 32, “Financial instruments: Presentation,” Offsetting Financial Assets and Financial Liabilities. This amendment is related to the application guidance in IAS 32, ‘Financial instruments: Presentation,’ and clarifies some of the requirements for offsetting financial assets and financial liabilities on the balance sheet.

IFRIC 21, “Levies.” This interpretation of IAS 37 “Provisions, contingent liabilities and contingent assets” sets out the accounting for an obligation to pay a levy that is not income tax. The interpretation addresses what the obligating event is that gives rise to the need to pay a levy and when a liability should be recognized.

None of the new or amended standards and interpretations has had any significant impact on the financial result or position of the Company. There is no significant difference between IFRS effective as per June 30, 2014 and IFRS as endorsed by the EU.

In the interim reports of 2013 disclosure was given in relation to IFRS 7 about fair valuation of financial instruments. Due to that the amounts are not considered material this disclosure will not be given in the interim reports as from the first quarter of 2014. Should amounts become material quarterly disclosure will be given as from then.

Ericsson Second Quarter Report 2014 | 26 |

Table of Contents

NET SALES BY SEGMENT BY QUARTER

Segment Modems was consolidated as of October 1, 2013.

Ericsson Second Quarter Report 2014 | 27 |

Table of Contents

OPERATING INCOME BY SEGMENT BY QUARTER

| 1) | “Unallocated” consists mainly of costs for corporate staff, non-operational capital gains and losses |

Ericsson Second Quarter Report 2014 | 28 |

Table of Contents

| 1) | “Unallocated” consists mainly of costs for corporate staff, non-operational capital gains and losses |

Ericsson Second Quarter Report 2014 | 29 |

Table of Contents

NET SALES BY REGION BY QUARTER

| 2013 | 2014 | |||||||||||||||||||||||

Isolated quarters, SEK million | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

North America | 15,773 | 15,341 | 14,453 | 13,772 | 12,215 | 15,179 | ||||||||||||||||||

Latin America | 4,374 | 5,565 | 5,294 | 6,749 | 4,710 | 5,414 | ||||||||||||||||||

Northern Europe & Central Asia1) 2) | 2,283 | 2,708 | 2,949 | 3,678 | 2,436 | 2,717 | ||||||||||||||||||

Western & Central Europe2) | 4,349 | 4,522 | 4,399 | 5,215 | 4,381 | 4,582 | ||||||||||||||||||

Mediterranean2) | 5,271 | 6,159 | 5,659 | 7,067 | 4,785 | 5,487 | ||||||||||||||||||

Middle East | 3,160 | 3,978 | 4,386 | 5,914 | 3,859 | 4,514 | ||||||||||||||||||

Sub Saharan Africa | 2,131 | 2,653 | 2,693 | 2,572 | 1,813 | 1,886 | ||||||||||||||||||

India | 1,606 | 1,279 | 1,280 | 1,973 | 1,695 | 1,645 | ||||||||||||||||||

North East Asia | 6,054 | 6,642 | 6,053 | 8,649 | 4,908 | 6,406 | ||||||||||||||||||

South East Asia & Oceania | 4,129 | 3,758 | 3,617 | 4,283 | 3,446 | 3,662 | ||||||||||||||||||

Other1) 2) | 2,902 | 2,726 | 2,198 | 7,160 | 3,257 | 3,357 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 52,032 | 55,331 | 52,981 | 67,032 | 47,505 | 54,849 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which in Sweden | 1,020 | 1,276 | 798 | 1,333 | 999 | 1,008 | ||||||||||||||||||

2) Of which in EU | 9,782 | 10,816 | 10,111 | 12,835 | 9,720 | 10,320 | ||||||||||||||||||

| 2013 | 2014 | |||||||||||||||||||||||

Sequential change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

North America | -7 | % | -3 | % | -6 | % | -5 | % | -11 | % | 24 | % | ||||||||||||

Latin America | -33 | % | 27 | % | -5 | % | 27 | % | -30 | % | 15 | % | ||||||||||||

Northern Europe & Central Asia1) 2) | -24 | % | 19 | % | 9 | % | 25 | % | -34 | % | 12 | % | ||||||||||||

Western & Central Europe2) | -20 | % | 4 | % | -3 | % | 19 | % | -16 | % | 5 | % | ||||||||||||

Mediterranean2) | -25 | % | 17 | % | -8 | % | 25 | % | -32 | % | 15 | % | ||||||||||||

Middle East | -38 | % | 26 | % | 10 | % | 35 | % | -35 | % | 17 | % | ||||||||||||

Sub Saharan Africa | -40 | % | 24 | % | 2 | % | -4 | % | -30 | % | 4 | % | ||||||||||||

India | 0 | % | -20 | % | 0 | % | 54 | % | -14 | % | -3 | % | ||||||||||||

North East Asia | -41 | % | 10 | % | -9 | % | 43 | % | -43 | % | 31 | % | ||||||||||||

South East Asia & Oceania | -9 | % | -9 | % | -4 | % | 18 | % | -20 | % | 6 | % | ||||||||||||

Other1) 2) | -3 | % | -6 | % | -19 | % | 226 | % | -55 | % | 3 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | -22 | % | 6 | % | -4 | % | 27 | % | -29 | % | 15 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which in Sweden | -20 | % | 25 | % | -37 | % | 67 | % | -25 | % | 1 | % | ||||||||||||

2) Of which in EU | -24 | % | 11 | % | -7 | % | 27 | % | -24 | % | 6 | % | ||||||||||||

| 2013 | 2014 | |||||||||||||||||||||||

Year-over-year change, percent | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | ||||||||||||||||||

North America | 23 | % | 18 | % | 3 | % | -19 | % | -23 | % | -1 | % | ||||||||||||

Latin America | -9 | % | 6 | % | -2 | % | 4 | % | 8 | % | -3 | % | ||||||||||||

Northern Europe & Central Asia1) 2) | 0 | % | -19 | % | 9 | % | 23 | % | 7 | % | 0 | % | ||||||||||||

Western & Central Europe2) | 1 | % | 10 | % | 21 | % | -4 | % | 1 | % | 1 | % | ||||||||||||

Mediterranean2) | 14 | % | -1 | % | 5 | % | 0 | % | -9 | % | -11 | % | ||||||||||||

Middle East | 0 | % | 7 | % | 21 | % | 17 | % | 22 | % | 13 | % | ||||||||||||

Sub Saharan Africa | -3 | % | -5 | % | -4 | % | -28 | % | -15 | % | -29 | % | ||||||||||||

India | 13 | % | -25 | % | -26 | % | 23 | % | 6 | % | 29 | % | ||||||||||||

North East Asia | -34 | % | -21 | % | -28 | % | -16 | % | -19 | % | -4 | % | ||||||||||||

South East Asia & Oceania | 22 | % | 2 | % | 3 | % | -5 | % | -17 | % | -3 | % | ||||||||||||

Other1) 2) | 2 | % | -13 | % | -34 | % | 141 | % | 12 | % | 23 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 2 | % | 0 | % | -3 | % | 0 | % | -9 | % | -1 | % | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

1) Of which in Sweden | 22 | % | 0 | % | -52 | % | 5 | % | -2 | % | -21 | % | ||||||||||||

2) Of which in EU | 3 | % | -3 | % | -5 | % | -1 | % | -1 | % | -5 | % | ||||||||||||

Ericsson Second Quarter Report 2014 | 30 |

Table of Contents

NET SALES BY REGION BY QUARTER (continued)

Ericsson Second Quarter Report 2014 | 31 |

Table of Contents

NET SALES BY REGION BY SEGMENT

Revenue from Telcordia is reported 50/50 between segments Global Services and Support Solutions.

| Q2 2014 | Jan - Jun 2014 | |||||||||||||||||||||||||||||||||||||||

SEK milion | Net- works | Global Services | Support Solutions | Modems | Total | Net- works | Global Services | Support Solutions | Modems | Total | ||||||||||||||||||||||||||||||

North America | 7,708 | 6,365 | 1,106 | — | 15,179 | 14,253 | 11,403 | 1,738 | — | 27,394 | ||||||||||||||||||||||||||||||

Latin America | 2,615 | 2,643 | 156 | — | 5,414 | 5,050 | 4,681 | 393 | — | 10,124 | ||||||||||||||||||||||||||||||

Northern Europe & Central Asia | 1,754 | 914 | 49 | — | 2,717 | 3,127 | 1,918 | 108 | — | 5,153 | ||||||||||||||||||||||||||||||

Western & Central Europe | 1,830 | 2,592 | 160 | — | 4,582 | 3,624 | 5,050 | 289 | — | 8,963 | ||||||||||||||||||||||||||||||

Mediterranean | 2,450 | 2,860 | 177 | — | 5,487 | 4,438 | 5,466 | 368 | — | 10,272 | ||||||||||||||||||||||||||||||

Middle East | 2,541 | 1,776 | 197 | — | 4,514 | 4,349 | 3,648 | 376 | — | 8,373 | ||||||||||||||||||||||||||||||

Sub Saharan Africa | 858 | 955 | 73 | — | 1,886 | 1,583 | 1,785 | 331 | — | 3,699 | ||||||||||||||||||||||||||||||

India | 887 | 710 | 48 | — | 1,645 | 1,775 | 1,409 | 156 | — | 3,340 | ||||||||||||||||||||||||||||||

North East Asia | 4,312 | 2,006 | 88 | — | 6,406 | 7,082 | 4,031 | 201 | — | 11,314 | ||||||||||||||||||||||||||||||

South East Asia & Oceania | 1,814 | 1,724 | 124 | — | 3,662 | 3,676 | 3,216 | 216 | — | 7,108 | ||||||||||||||||||||||||||||||

Other | 2,195 | 514 | 646 | 2 | 3,357 | 4,390 | 808 | 1,413 | 3 | 6,614 | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Total | 28,964 | 23,059 | 2,824 | 2 | 54,849 | 53,347 | 43,415 | 5,589 | 3 | 102,354 | ||||||||||||||||||||||||||||||

Share of Total | 53 | % | 42 | % | 5 | % | 0 | % | 100 | % | 51 | % | 43 | % | 6 | % | 0 | % | 100 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

| Q2 2014 | ||||||||||||||||||||||||||||||||||||||||

Sequential change, percent | Net- works | Global Services | Support Solutions | Modems | Total | |||||||||||||||||||||||||||||||||||

North America | 18 | % | 26 | % | 75 | % | — | 24 | % | |||||||||||||||||||||||||||||||

Latin America | 7 | % | 30 | % | -34 | % | — | 15 | % | |||||||||||||||||||||||||||||||

Northern Europe & Central Asia | 28 | % | -9 | % | -17 | % | — | 12 | % | |||||||||||||||||||||||||||||||

Western & Central Europe | 2 | % | 5 | % | 24 | % | — | 5 | % | |||||||||||||||||||||||||||||||

Mediterranean | 23 | % | 10 | % | -7 | % | — | 15 | % | |||||||||||||||||||||||||||||||

Middle East | 41 | % | -5 | % | 10 | % | — | 17 | % | |||||||||||||||||||||||||||||||

Sub Saharan Africa | 18 | % | 15 | % | -72 | % | — | 4 | % | |||||||||||||||||||||||||||||||

India | 0 | % | 2 | % | -56 | % | — | -3 | % | |||||||||||||||||||||||||||||||

North East Asia | 56 | % | -1 | % | -22 | % | — | 31 | % | |||||||||||||||||||||||||||||||

South East Asia & Oceania | -3 | % | 16 | % | 35 | % | — | 6 | % | |||||||||||||||||||||||||||||||

Other | 0 | % | 75 | % | -16 | % | 100 | % | 3 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total | 19 | % | 13 | % | 2 | % | 100 | % | 15 | % | ||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Q2 2014 | ||||||||||||||||||||||||||||||||||||||||

Year over year change, percent | Net- works | Global Services | Support Solutions | Modems | Total | |||||||||||||||||||||||||||||||||||

North America | 4 | % | -14 | % | 126 | % | — | -1 | % | |||||||||||||||||||||||||||||||

Latin America | -12 | % | 15 | % | -45 | % | — | -3 | % | |||||||||||||||||||||||||||||||

Northern Europe & Central Asia | 8 | % | -11 | % | -17 | % | — | 0 | % | |||||||||||||||||||||||||||||||

Western & Central Europe | -6 | % | 6 | % | 17 | % | — | 1 | % | |||||||||||||||||||||||||||||||

Mediterranean | -16 | % | -7 | % | 8 | % | — | -11 | % | |||||||||||||||||||||||||||||||

Middle East | 40 | % | -11 | % | 15 | % | — | 13 | % | |||||||||||||||||||||||||||||||

Sub Saharan Africa | -31 | % | -16 | % | -73 | % | — | -29 | % | |||||||||||||||||||||||||||||||

India | 83 | % | -1 | % | -37 | % | — | 29 | % | |||||||||||||||||||||||||||||||

North East Asia | 14 | % | -29 | % | 52 | % | — | -4 | % | |||||||||||||||||||||||||||||||

South East Asia & Oceania | -10 | % | 6 | % | 13 | % | — | -3 | % | |||||||||||||||||||||||||||||||

Other | 16 | % | 69 | % | 24 | % | — | 23 | % | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total | 3 | % | -7 | % | 21 | % | — | -1 | % | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Jan - Jun 2014 | ||||||||||||||||||||||||||||||||||||||||

Year over year change, percent | Net- works | Global Services | Support Solutions | Modems | Total | |||||||||||||||||||||||||||||||||||

North America | -14 | % | -16 | % | 78 | % | — | -12 | % | |||||||||||||||||||||||||||||||

Latin America | 1 | % | 8 | % | -38 | % | — | 2 | % | |||||||||||||||||||||||||||||||

Northern Europe & Central Asia | 8 | % | -3 | % | -12 | % | — | 3 | % | |||||||||||||||||||||||||||||||

Western & Central Europe | -6 | % | 6 | % | 14 | % | — | 1 | % | |||||||||||||||||||||||||||||||

Mediterranean | -17 | % | -5 | % | 21 | % | — | -10 | % | |||||||||||||||||||||||||||||||

Middle East | 35 | % | 5 | % | -15 | % | — | 17 | % | |||||||||||||||||||||||||||||||

Sub Saharan Africa | -33 | % | -9 | % | -31 | % | — | -23 | % | |||||||||||||||||||||||||||||||

India | 32 | % | 5 | % | -21 | % | — | 16 | % | |||||||||||||||||||||||||||||||

North East Asia | -1 | % | -25 | % | 39 | % | — | -11 | % | |||||||||||||||||||||||||||||||

South East Asia & Oceania | -20 | % | 5 | % | -1 | % | — | -10 | % | |||||||||||||||||||||||||||||||

Other | 13 | % | 13 | % | 40 | % | — | 18 | % | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Total | -5 | % | -6 | % | 17 | % | — | -5 | % | |||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||||||||||||

Ericsson Second Quarter Report 2014 | 32 |

Table of Contents

Ericsson Second Quarter Report 2014 | 33 |

Table of Contents

Ericsson Second Quarter Report 2014 | 34 |

Table of Contents

RESTRUCTURING CHARGES BY FUNCTION

Ericsson Second Quarter Report 2014 | 35 |