Table of Contents

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM6-K

REPORT OF FOREIGN ISSUER

Pursuant to Rule13a-16 or15d-16 of

the Securities Exchange Act of 1934

October 20, 2017

Commission File Number

000-12033

LM ERICSSON TELEPHONE COMPANY

(Translation of registrant’s name into English)

Torshamnsgatan 21, Kista

SE-164 83, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F ☒Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Announcement of LM Ericsson Telephone Company, October 20, 2017 regarding “Ericsson reports third quarter results 2017”.

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TELEFONAKTIEBOLAGET LM ERICSSON (publ) | ||

| By: | /s/ NINAMACPHERSON | |

| Nina Macpherson | ||

| Senior Vice President & Chief Legal Officer | ||

| By: | /s/ HELENANORRMAN | |

| Helena Norrman | ||

| Senior Vice President | ||

| Corporate Marketing & Communications Officer | ||

Date:October 20, 2017

Table of Contents

THIRD QUARTER 2017

Stockholm, October 20, 2017

THIRD QUARTER HIGHLIGHTS | Read more (page) | |||

| • | Reported sales decreased by-6% YoY. Sales adjusted for comparable units and currency declined by-3%. | 3 | ||

| • | Networks sales declined by-4% YoY. Sales adjusted for comparable units, currency and the rescoped managed services contract in North America, increased slightly. | 7 | ||

| • | Gross margin was 25.4% (28.3%). Adjusted1)gross margin was 30.0% (29.4%) driven by increased adjusted1)gross margin in Networks. | 4 | ||

| • | Operating income was SEK-4.8 (0.3) b. Adjusted1)operating income declined to SEK 0.0 (1.6) b. Higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs had a negative impact on operating income of SEK-1.5 (0.5) b. | 4 | ||

| • | As communicated in the second quarter report 2017, the company identified an increased risk of further market and customer project adjustments. In the quarter provisions and adjustments were made impacting operating income by SEK-2.3 b., with limited effect on cash flow. | 3 | ||

| • | As a result of the ongoing cost reductions, restructuring charges of SEK-2.8(-1.3) b. were taken in the quarter. This included a write-down of SEK-1.6 b. related to the decision to close and divest the ICT center in Canada. | 4 | ||

| • | Cash flow from operating activities was SEK 0.0(-2.3) b. Free cash flow2)was SEK-0.5(-5.0) b. Net cash per Sept. 30, 2017, was SEK 24.1 (16.3) b. | 11 | ||

| 1) | Adjusted: the numbers are adjusted for restructuring charges and for certain other items affecting comparability in 2017. |

| 2) | Free cash flow: Cash flow from operating activities less net capital expenditures and other investments, see APMs at the end of the report. |

SEK b. | Q3 2017 | Q3 2016 | YoY change | Q2 2017 | QoQ change | 9 months 2017 | 9 months 2016 | |||||||||||||||||||||

Net sales | 47.8 | 51.1 | -6 | % | 49.9 | -4 | % | 144.1 | 157.4 | |||||||||||||||||||

Net sales adjusted for certain items affecting comparability in 2017 | 47.7 | 51.1 | -7 | % | 49.9 | -5 | % | 145.4 | 157.4 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | -3 | % | — | 1 | % | -11 | % | -8 | % | |||||||||||||||||

Gross margin | 25.4 | % | 28.3 | % | — | 27.9 | % | — | 22.6 | % | 31.4 | % | ||||||||||||||||

Gross margin excluding restructuring charges and adjusted for certain items affecting comparability in 2017 | 30.0 | % | 29.4 | % | — | 29.8 | % | — | 30.1 | % | 32.2 | % | ||||||||||||||||

Operating income | -4.8 | 0.3 | — | -1.2 | — | -18.4 | 6.6 | |||||||||||||||||||||

Operating income excluding restructuring charges and adjusted for certain items affecting comparability in 2017 | 0.0 | 1.6 | -102 | % | 0.3 | -114 | % | 1.3 | 9.5 | |||||||||||||||||||

Operating margin | -10.0 | % | 0.7 | % | — | -2.5 | % | — | -12.7 | % | 4.2 | % | ||||||||||||||||

Operating margin excluding restructuring charges and adjusted for certain items affecting comparability in 2017 | -0.1 | % | 3.1 | % | — | 0.6 | % | — | 0.9 | % | 6.0 | % | ||||||||||||||||

Net income | -4.3 | -0.2 | — | -1.0 | — | -16.2 | 3.5 | |||||||||||||||||||||

EPS diluted, SEK | -1.34 | -0.07 | — | -0.30 | — | -4.93 | 1.01 | |||||||||||||||||||||

EPS(non-IFRS), SEK3) | -0.55 | 0.34 | -262 | % | 0.17 | — | -2.80 | 2.04 | ||||||||||||||||||||

Cash flow from operating activities | 0.0 | -2.3 | -99 | % | 0.0 | — | -1.6 | -5.4 | ||||||||||||||||||||

Net cash, end of period | 24.1 | 16.3 | 48 | % | 24.0 | 0 | % | 24.1 | 16.3 | |||||||||||||||||||

| 3) | EPS diluted, excl. amortizations and write-downs of acquired intangible assets, and excluding restructuring charges. |

Non-IFRS financial measures are reconciled to the most directly reconcilable line items in the financial statements at the end of this report.

1 Ericsson | Third Quarter Report 2017

Table of Contents

CEO COMMENTS

We continue to execute on our focused business strategy. While more remains to be done we are starting to see some encouraging improvements in our performance despite a continued challenging market. Networks showed a slight sales growth year over year, adjusted for the rescoped managed services contract in North America and for currency. Networks adjusted1) operating margin was 11%. While losses continue in IT & Cloud, we see increased stability in product roadmaps and projects.

The general market conditions continue to be tough. Sales adjusted for comparable units and currency declined by-3% YoY. Sales in North America, adjusted for comparable units, currency and the rescoped managed services contract were stable. We also saw growth returning in several countries as operators are increasing their investments in network capacity. Sales in Mainland China declined as the market is normalizing following a period of significant 4G deployments, representing more than 60% of global 4G volumes in the industry. We have managed to increase our LTE market shares in Mainland China to position Ericsson in 5G. However, this will have a dilutive effect on gross margin in Mainland China in Q4 2017, but the ambition is to continue to deliver double digit adjusted operating margin in Networks in Q4 2017.

Reported operating income was negative at SEK-4.8 (0.3) b. in the quarter while the operating income, adjusted for restructuring, additional provisions and adjustments as well as a gain from divestment of the power modules business, was SEK 0.0 (1.6) b. Operating income was negatively impacted by higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs of SEK-1.5 (0.5) b. As described in the second quarter report, we have reduced capitalization of development expenses and deferral of hardware costs due to technology and portfolio shifts.

As communicated in the Q2 2017 report we have identified an increased risk of further market and customer project adjustments, considering the current market environment and our focused strategy. In total, the negative impact on results was then estimated to be SEK3-5 b. untilmid-2018. In the quarter, costs of SEK 2.3 b. impacted the result, with limited effect on cash flow. With current visibility, we believe we will be in the higher end of the range of the risk estimate.

Restructuring charges in the quarter were SEK-2.8 b. including a write-down of SEK-1.6 b. related to one of our global ICT centers, as rapid technology development allows us to consolidate test activities to the two remaining centers. For full-year 2017 we expect restructuring charges to be approximately SEK9-10 b.

In the quarter, we have accelerated cost and efficiency measures, which are key in our focused strategy. Activities to reduce the workforce have been initiated in many markets. In the quarter, there was a net reduction of 3,000 employees despite 1,100 new recruitments in R&D. We expect efficiency improvements to accelerate in the fourth quarter to reach an annualrun-rate effect of at least SEK 10 b. bymid-2018.

Sales in Networks grew, adjusted for currency and the previously communicated rescoped managed services contract in North America. Higher hardware capacity sales and a more competitive product portfolio resulted in an adjusted1) operating margin of 11% (9 %). The Ericsson Radio System portfolio, accounting for 55% of total radio volumes year to date, is proving competitive, contributing both to improved earnings and a stronger market position.

The work to focus the managed services business and to review under-performing contracts continues. To date we have either exited, renegotiated or transformed 13 out of the 42 contracts, resulting in an annualized profit improvement of SEK 0.4 b.

In IT & Cloud, sales declined and losses increased in the quarter. The increase in QoQ losses is largely due to higher amortization than capitalization of development expenses of SEK-0.7 (0.4) b. Our turn-around plan builds on stability, profitability and growth in that order. The initial focus has been on stabilizing both product roadmaps and challenging contracts. We have made good progress in the quarter. However, securing deliveries on large transformation projects puts pressure on gross margin in the near term.

The IT & Cloud business is of strategic importance as our customers are preparing for 5G and will digitalize their operations and invest in a future network architecture based on software-defined logic.

We now expand our focus to improve profitability through increased efficiency in service delivery. In addition, we will scale the software part of the business mix and increase the level ofpre-integration services, which will lead to a higher gross margin but lower services sales. Positive effects on gross margin are expected in 2018.

Despite continued decline in legacy product sales there is good traction in our new media portfolio with several important wins in the quarter. We have accelerated our efficiency measures and continue to pursue strategic opportunities for this business.

Managing our cash is a top priority. Free cash flow2) in the quarter was SEK-0.5(-5.0) b., driven by reductions in working capital and lower CAPEX. Our net cash position remained solid at SEK 24.1b.

We remain fully committed to our focused business strategy. We continue to invest to secure technology leadership and year to date we have recruited more than 1,000 R&D employees in Networks. Customers give positive feedback on both our long-term strategy and on our current5G-ready portfolio.

Börje Ekholm

President and CEO

| 1) | Adjusted: the numbers are adjusted for restructuring charges and for certain other items affecting comparability in 2017. |

| 2) | Free cash flow: Cash flow from operating activities less net capital expenditures and other investments, see APMs at the end of the report. |

2 Ericsson | Third Quarter Report 2017

Table of Contents

FINANCIAL HIGHLIGHTS

SEK b. | Q3 2017 | Q3 2016 | YoY change | Q2 2017 | QoQ change | 9 months 2017 | 9 months 2016 | |||||||||||||||||||||

Net sales | 47.8 | 51.1 | -6 | % | 49.9 | -4 | % | 144.1 | 157.4 | |||||||||||||||||||

Of which Networks | 35.5 | 37.0 | -4 | % | 36.8 | -4 | % | 107.2 | 117.2 | |||||||||||||||||||

Of which IT & Cloud | 10.3 | 11.7 | -12 | % | 10.9 | -6 | % | 30.7 | 33.0 | |||||||||||||||||||

Of which Other | 2.0 | 2.3 | -13 | % | 2.2 | -8 | % | 6.2 | 7.1 | |||||||||||||||||||

Gross income | 12.1 | 14.5 | -16 | % | 13.9 | -13 | % | 32.5 | 49.3 | |||||||||||||||||||

Gross margin (%) | 25.4 | % | 28.3 | % | — | 27.9 | % | — | 22.6 | % | 31.4 | % | ||||||||||||||||

Research and development expenses | -10.5 | -7.9 | 34 | % | -8.4 | 26 | % | -28.0 | -22.7 | |||||||||||||||||||

Selling and administrative expenses | -6.8 | -6.2 | 10 | % | -7.1 | -3 | % | -23.7 | -20.1 | |||||||||||||||||||

Other operating income and expenses | 0.4 | 0.0 | — | 0.2 | 74 | % | 0.8 | 0.0 | ||||||||||||||||||||

Operating income | -4.8 | 0.3 | — | -1.2 | — | -18.4 | 6.6 | |||||||||||||||||||||

Operating margin | -10.0 | % | 0.7 | % | — | -2.5 | % | — | -12.7 | % | 4.2 | % | ||||||||||||||||

for Networks | 1 | % | 8 | % | — | 7 | % | — | 2 | % | 11 | % | ||||||||||||||||

for IT & Cloud | -41 | % | -15 | % | — | -26 | % | — | -52 | % | -16 | % | ||||||||||||||||

for Other | -48 | % | -32 | % | — | -44 | % | — | -77 | % | -22 | % | ||||||||||||||||

Financial net | -0.3 | -0.6 | -47 | % | 0.1 | — | -0.7 | -1.6 | ||||||||||||||||||||

Taxes | 0.8 | 0.1 | — | 0.2 | — | 2.9 | -1.5 | |||||||||||||||||||||

Net income | -4.3 | -0.2 | — | -1.0 | — | -16.2 | 3.5 | |||||||||||||||||||||

Restructuring charges | -2.8 | -1.3 | 123 | % | -1.5 | 86 | % | -6.1 | -2.9 | |||||||||||||||||||

Q3 2017 ADJUSTED FOR RESTRUCTURING CHARGES AND CERTAIN OTHER ITEMS AFFECTING COMPARABILITY

SEK b. | Q3 2017 reported | Restructuring charges | Provisions and customer project adjustments | Gain from divestment of Power Modules | Q3 2017 adjusted | Q3 2016 adjusted | Q2 2017 adjusted | Q1 2017 adjusted | ||||||||||||||||||||||||

Net sales | 47.8 | — | -0.1 | — | 47.7 | 51.1 | 49.9 | 47.8 | ||||||||||||||||||||||||

Cost of sales | -35.7 | 0.8 | 1.5 | — | -33.4 | -36.1 | -35.1 | -33.2 | ||||||||||||||||||||||||

Gross income | 12.1 | 0.8 | 1.3 | — | 14.3 | 15.0 | 14.9 | 14.6 | ||||||||||||||||||||||||

Gross margin (%) | 25 | % | — | — | — | 30 | % | 29 | % | 30 | % | 31 | % | |||||||||||||||||||

Research and development expenses | -10.5 | 1.9 | — | — | -8.6 | -7.3 | -8.0 | -6.7 | ||||||||||||||||||||||||

Selling and administrative expenses | -6.8 | 0.1 | 0.9 | — | -5.8 | -6.0 | -6.8 | -7.0 | ||||||||||||||||||||||||

Other operating income and expenses | 0.4 | — | — | -0.3 | 0.1 | 0.0 | 0.2 | 0.1 | ||||||||||||||||||||||||

Operating income | -4.8 | 2.8 | 2.3 | -0.3 | 0.0 | 1.6 | 0.3 | 1.1 | ||||||||||||||||||||||||

for Networks | 0.4 | 1.5 | 2.2 | -0.3 | 3.8 | 3.4 | 3.5 | 4.3 | ||||||||||||||||||||||||

for IT & Cloud | -4.2 | 1.1 | 0.0 | — | -3.1 | -1.1 | -2.4 | -2.2 | ||||||||||||||||||||||||

for Other | -1.0 | 0.2 | 0.0 | — | -0.8 | -0.7 | -0.8 | -1.0 | ||||||||||||||||||||||||

Operating margin | -10 | % | — | — | — | 0 | % | 3 | % | 1 | % | 2 | % | |||||||||||||||||||

Restructuring charges, provisions and adjustments related to customer projects had a significant negative impact on the reported Q3 2017 result. Numbers excluding these items are referred to in the text as “adjusted”.

Net sales

Sales as reported decreased by-6 % YoY. Networks sales declined by-4% YoY, partly due to the earlier communicated rescoped managed services contract in North America effective as from Q4, 2016.Sales in IT & Cloud and Other declined YoY by-12% and-13% respectively, mainly due to the continued decline in legacy product sales. Sales adjusted for comparable units and currency decreased-3% YoY.

Sequential sales were down-4%, impacted by lower exchange rate between USD and SEK and by seasonality. Sales, adjusted for comparable units and currency, increased by 1%.

Total sales of Managed Services as defined in 2016, including Broadcast Services, were SEK 6.2 (7.2) b. The decline is mainly an effect of the earlier communicated rescoped managed services

contract in North America. The definition of Managed Services will be adjusted by Jan 1, 2018, at the latest, to mirror the new organization.

IPR licensing revenues

IPR licensing revenues declined to SEK 1.9 (2.0) b. YoY and from SEK 2.0 b. QoQ, due to a weaker USD to SEK.

Provisions and customer project adjustments

As announced in the Q2 report, 2017, the company identified a risk of further market and customer project adjustments, which would have a negative impact on results, of an estimated SEK3-5 b., up tomid-2018. In the quarter, SEK 2.3 b. of provisions and adjustments were made, of which SEK 2.1 b. had no impact on cash outflow. The SEK 2.3 b. relates mainly to consequences of strategy implementation and changes in market environment in certain countries. The lion’s share relates to ongoing negotiations of customer contract executions and SEK 0.9 b. is for impairment of trade receivables.

3 Ericsson | Third Quarter Report 2017

Table of Contents

Gross margin

Gross margin declined to 25.4% (28.3%) due to the additional provisions and adjustments made in the quarter. The adjusted gross margin increased to 30.0% (29.4%) with an improved gross margin in Networks, partly offset by a lower gross margin in IT & Cloud.

Gross margin decreased sequentially to 25.4% from 27.9% due to the additional provisions and adjustments. The adjusted gross margin increased slightly QoQ to 30.0% from 29.8%, with an improved gross margin in Networks partly offset by a decreased gross margin in IT & Cloud.

Higher recognition than deferral of hardware costs had a negative effect on Networks gross margin of SEK-0.4 (0.1) b. In Q2 there was no negative effect of deferral of hardware costs. For more details, see section Consequences of technology and portfolio shifts.

Operating expenses

Operating expenses increased to SEK 17.4 (14.1) b. mainly due to SEK 1.3 b. of higher restructuring charges and SEK 0.9 b. of additional provisions and adjustments made in the quarter. Adjusted operating expenses increased to SEK 14.4 (13.4) b. due to increased R&D expenses at SEK 8.6 (7.3) b. The adjusted R&D expenses increased mainly due to higher amortized than capitalized development expenses with a negative effect of SEK-0.6 (0.8) b.

Adjusted selling and administrative expenses declined to SEK 5.8 (6.0) b.

Operating expenses increased sequentially to SEK 17.4 b. from SEK 15.4 b. due to additional provisions and adjustments of SEK 0.9 b. and increased restructuring charges of SEK-2.0 (0.6) b. Adjusted operating expenses decreased QoQ to SEK 14.4 b. from SEK 14.8 b., mainly due to seasonality. Higher amortized than capitalized development expenses had a negative QoQ effect of SEK-0.7 b. For more details, see section Consequences of technology and portfolio shifts.

Other operating income and expenses

Other operating income and expenses increased both YoY and QoQ. The main part of the SEK 0.4 b. of other operating income and expenses is related to a gain for the sale of the power modules business of SEK 0.3 b.

As of Q1 2017, the funding of foreign exchange forecast hedging is managed through foreign exchange loans (USD) instead of foreign exchange derivatives. Therefore the revaluation and realization effects are included in financial expenses instead of in other operating income and expenses.

Revaluation and realization effects of currency hedge contracts, impacted other operating income and expenses with SEK-0.2 b. in Q3 2016.

Consequences of technology and portfolio shifts

Due to technology and portfolio shifts the company is reducing the capitalization of product platforms, software release development expenses and hardware costs. As a consequence, higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs had a negative impact on operating income of SEK-1.5 (0.5) b. in the quarter. A negative impact on operating income of SEK-1.4 b. is expected in Q4 2017 for the same reason. Full-year impact is expected to be SEK-3 b. for 2018 and SEK-1 to-2 b. for 2019.

IMPACT FROM AMORTIZATION AND CAPITALIZATION OF DEVELOPMENT EXPENSES AND FROM RECOGNITION AND DEFERRAL OF HARDWARE COSTS

SEK b. | Q3 2017 | Q3 2016 | Q2 2017 | |||||||||

Cost of Sales | -0.9 | -0.3 | -0.4 | |||||||||

R&D expenses | -0.6 | 0.8 | 0.1 | |||||||||

Total impact | -1.5 | 0.5 | -0.3 | |||||||||

Restructuring charges

Restructuring charges were SEK-2.8(-1.3) b. Restructuring charges in Q2 2017 were SEK-1.5 b. In the quarter the company decided to close and initiate a divestment process for one of its three global ICT centers, the one in Canada, following less need of capacity. This is expected to be completed by the second half of 2018, with an estimated R&D annualrun-rate saving of SEK 0.3 b. This resulted in a write-down of property, plant and equipment and the total restructuring charges related to this decision were SEK-1.6 b. in the quarter, with no impact on cash flow.

Restructuring charges for Q4 2017 are estimated to be SEK3-4 b. For full-year 2017, the total restructuring charges are estimated to be SEK9-10 b., previously estimated to be in the higher end of the range of SEK6-8 b.

Operating income

Operating income decreased to SEK-4.8 (0.3) b. negatively impacted by increased restructuring charges of SEK-2.8(-1.3) b. and by additional provisions and adjustments of SEK-2.3 b. in the quarter. The negative impact was partly offset by a gain related to the divestment of the power modules business of SEK 0.3 b.

Adjusted operating income declined to SEK 0.0 (1.6) b. due to higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs of SEK-1.5 (0.5) b. as well as lower sales. This was partly offset by improved adjusted gross margin.

Operating income declined sequentially to SEK-4.8 b. from SEK-1.2 b. due to higher restructuring charges and additional provisions and adjustments made in the quarter. Adjusted operating income declined slightly QoQ due to higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs partly offset by seasonally lower SG&A expenses.

4 Ericsson | Third Quarter Report 2017

Table of Contents

Financial net

Financial net was SEK-0.3(-0.6) b. In the quarter there were positive revaluation and realization effects of foreign exchange forecast hedging of SEK 0.2 b. The QoQ decline was related to lower currency revaluation effects in Q3 compared with Q2. The SEK strengthened against the USD between June 30, 2017 (SEK/USD rate 8.46) and Sept. 30, 2017 (SEK/USD rate 8.15). The hedge balance is in USD.

Taxes

Taxes were positive in the quarter following the negative income. The tax rate applied is the best estimate for the full year.

Net income and EPS

Net income and EPS diluted decreased YoY and QoQ following the reduced operating income. EPS diluted was SEK-1.34(-0.07) and EPS(non-IFRS) was SEK-0.55 (0.34).

Employees

The number of employees on Sept. 30, 2017 was 105,852 - a net reduction of more than 3,000 employees in Q3.

Focused strategy execution

The company has so far identified three indicators to measure the progress of strategy execution. KPIs for cost reduction will be added later.

Area | Activity | Status Q3 2017 | ||

| Networks | Transition to new Ericsson Radio System | 55% (Q2: 49%) (ERS radio unit deliveries out of total, year to date) | ||

| IT & Cloud | Growth in sales of new product portfolio | Net sales decline of-5% (Q2: 7%), rolling 12 months | ||

| Managed Services | Addressinglow-performing contracts | Out of 42 contracts identified, 13 (Q2: 9) have been renegotiated to result in an annualized future profit improvement of SEK 0.4 b. (Q2: SEK 0.1 b.) | ||

As part of the focused business strategy the company divested its power modules business in the quarter. In addition, Francisco Partners completed its acquisition of 16.7% ownership in Ericsson subsidiary iconectiv.

PLANNING ASSUMPTIONS GOING FORWARD

Market related

| • | In line with previous estimate and that of external sources, the Radio Access Network (RAN) equipment market outlook is estimated to decline by-8% for full-year 2017. |

Ericsson related

| • | Focusing the business and addressinglow-performing operations in Managed Services, Industry & Society and Network Rollout is expected to reduce full-year sales by up to SEK 10 b. by 2019. |

| • | Sequential sales increase between Q3 and Q4 is expected to be lower than normal seasonality (normal +24%) driven by decreased 4G investments levels in Mainland China, primarily impacting Networks. |

| • | The plan is to implement cost savings with an annual run rate effect of at least SEK 10 b. bymid-2018. |

| • | Expanded focus on profitability in IT & Cloud is expected to generate positive effects on gross margin in 2018. |

| • | The company aims to increase R&D efficiency. However, to strengthen the technology leadership, R&D expenses will increase primarily in Networks. |

| • | Impact of higher amortization than capitalization of development expenses and higher recognition than deferral of hardware costs: Q3 2017 SEK-1.5 b. Estimate for: Q4 2017 SEK-1.4 b., full-year 2018 SEK-3 b., full-year 2019 SEK-1 to-2 b. |

| • | Restructuring charges for Q4 2017 are estimated to be SEK3-4 b. |

| • | The earlier estimated risk of market and customer project adjustments of SEK3-5 b. from July 1, 2017, to June 30, 2018, are now expected to be in the higher end of the range. 30% is estimated to impact cash. |

| • | To position Ericsson in 5G in Mainland China, the company has managed to increase its market shares. However, this will have a dilutive effect on gross margin in Mainland China in Q4 2017, but the ambition is to continue to deliver double digit adjusted operating margin in Networks in Q4 2017. |

5 Ericsson | Third Quarter Report 2017

Table of Contents

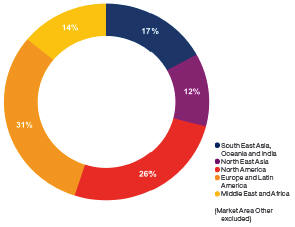

MARKET AREA SALES

| Third quarter 2017 | Change | |||||||||||||||||||||||

SEK b. | Networks | IT & Cloud | Other | Total | YoY | QoQ | ||||||||||||||||||

South East Asia, Oceania and India | 6.3 | 1.1 | 0.1 | 7.5 | -3 | % | -3 | % | ||||||||||||||||

North East Asia | 4.1 | 1.5 | 0.0 | 5.6 | -9 | % | -5 | % | ||||||||||||||||

North America | 9.6 | 2.0 | 0.3 | 11.9 | -10 | % | -5 | % | ||||||||||||||||

Europe and Latin America | 9.6 | 3.7 | 0.8 | 14.1 | -6 | % | -7 | % | ||||||||||||||||

Middle East and Africa | 4.3 | 1.9 | 0.1 | 6.2 | -1 | % | 4 | % | ||||||||||||||||

Other1) | 1.7 | 0.1 | 0.7 | 2.5 | -7 | % | -5 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Total | 35.5 | 10.3 | 2.0 | 47.8 | -6 | % | -4 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| 1) | Market Area “Other” includes licensing revenues, power modules, mobile broadband modules,Ericsson-LG Enterprise and other businesses. |

South East Asia, Oceania and India

Reported sales declined slightly YoY due to currency movements and timing of mobile broadband infrastructure investments. This was partly offset by increased IT & Cloud sales primarily in India.

North East Asia

Sales declined YoY partly due to currency movements. Sales in Mainland China declined due to reduced LTE investments. IT & Cloud sales declined YoY as one customer requested deliveries in Q2, previously planned for Q3. Networks sales in Japan increased.

North America

North America sales declined YoY, due to the earlier communicated rescoped managed services contract and weaker currency. Mobile broadband infrastructure sales remained stable, driven by capacity expansions for increased data traffic in the networks. IT & Cloud sales declined slightly, where sales follow project milestones.

Europe and Latin America

Sales declined YoY, primarily driven by lower sales in Latin America despite growth in mobile broadband investments in Brazil. Sales in Europe were stable YoY. Currency movements had a negative impact on sales growth YoY.

Middle East and Africa

Sales were flat YoY, negatively impacted by currency movements and declining sales in Africa. Sales in the Middle East showed growth despite a continued challenging macroeconomic environment.

Other

IPR licensing revenues amounted to SEK 1.9 (2.0) b. impacted by a weaker USD to SEK.

6 Ericsson | Third Quarter Report 2017

Table of Contents

SEGMENT RESULTS

NETWORKS

SEK b. | Q3 2017 | Q3 2016 | YoY change | Q2 2017 | QoQ change | 9 months 2017 | 9 months 2016 | |||||||||||||||||||||

Net sales | 35.5 | 37.0 | -4 | % | 36.8 | -4 | % | 107.2 | 117.2 | |||||||||||||||||||

Of which products | 19.8 | 19.2 | 3 | % | 20.8 | -5 | % | 60.0 | 65.1 | |||||||||||||||||||

Of which IPR licensing revenues | 1.5 | 1.6 | -5 | % | 1.6 | -2 | % | 4.7 | 6.4 | |||||||||||||||||||

Of which services | 15.7 | 17.8 | -12 | % | 16.1 | -2 | % | 47.2 | 52.1 | |||||||||||||||||||

Net sales adjusted for certain items affecting comparability in 2017 | 35.4 | 37.0 | -4 | % | 36.8 | -4 | % | 108.4 | 117.2 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | -1 | % | — | 3 | % | -11 | % | — | ||||||||||||||||||

Gross income | 9.1 | 9.9 | -8 | % | 10.4 | -12 | % | 27.4 | 35.4 | |||||||||||||||||||

Gross income excluding restructuring charges and adj. for certain items affecting comparability in 2017 | 10.9 | 10.2 | 7 | % | 11.0 | 0 | % | 33.2 | 36.4 | |||||||||||||||||||

Gross margin | 26 | % | 27 | % | — | 28 | % | — | 26 | % | 30 | % | ||||||||||||||||

Gross margin excluding restructuring charges and adj. for certain items affecting comparability in 2017 | 31 | % | 28 | % | — | 30 | % | — | 31 | % | 31 | % | ||||||||||||||||

Operating income | 0.4 | 2.8 | -87 | % | 2.6 | -86 | % | 2.4 | 13.4 | |||||||||||||||||||

Operating income excl. restructuring charges and adj. certain for items affecting comparability in 2017 | 3.8 | 3.4 | 12 | % | 3.5 | 8 | % | 11.7 | 14.9 | |||||||||||||||||||

Operating margin | 1 | % | 8 | % | — | 7 | % | — | 2 | % | 11 | % | ||||||||||||||||

Operating margin excl. restructuring charges and adj. for certain items affecting comparability in 2017 | 11 | % | 9 | % | — | 10 | % | — | 11 | % | 13 | % | ||||||||||||||||

EBITA margin | 1 | % | 8 | % | — | 7 | % | — | 3 | % | 12 | % | ||||||||||||||||

Restructuring charges | -1.5 | -0.6 | 178 | % | -0.9 | 67 | % | -3.9 | -1.5 | |||||||||||||||||||

Q3 2017 ADJUSTED FOR RESTRUCTURING CHARGES AND CERTAIN OTHER ITEMS AFFECTING COMPARABILITY

SEK b. | Q3 2017 reported | Restructuring charges | Provisions and customer project adjustments | Gain from divestment of Power Modules | Q3 2017 adjusted | Q3 2016 adjusted | Q2 2017 adjusted | Q1 2017 adjusted | ||||||||||||||||||||||||

Net Sales | 35.5 | — | -0.1 | — | 35.4 | 37.0 | 36.8 | 36.2 | ||||||||||||||||||||||||

Cost of sales | 26.4 | 0.5 | 1.4 | — | -24.4 | -26.8 | -25.9 | -24.9 | ||||||||||||||||||||||||

Gross income | 9.1 | 0.5 | 1.3 | — | 10.9 | 10.2 | 11.0 | 11.3 | ||||||||||||||||||||||||

Gross margin | 26 | % | — | — | — | 31 | % | 28 | % | 30 | % | 31 | % | |||||||||||||||||||

Operating income | 0.4 | 1.5 | 2.2 | -0.3 | 3.8 | 3.4 | 3.5 | 4.3 | ||||||||||||||||||||||||

Operating margin | 1 | % | — | — | — | 11 | % | 9 | % | 10 | % | 12 | % | |||||||||||||||||||

Restructuring charges, provisions and adjustments related to customer projects had a significant negative impact on the reported Q3 2017 result. Numbers excluding these items are referred to in the text as “adjusted”.

Net sales

Sales as reported declined by-4% YoY due to a decline in network services sales of-12%. The network product sales increased by 3% YoY. The decline in network services sales YoY was due to lower sales of managed services and network rollout. The lower managed services sales was mainly a result of the earlier communicated rescoped contract in North America. In addition, both network rollout sales and managed services sales decreased as a consequence of the ongoing work to focus the business and address low performing contracts. Network design and optimization showed good growth. Sales adjusted for comparable units and currency decreased by-1% YoY.

Reported sales decreased by-4% QoQ. Sales, adjusted for comparable units and currency, increased by 3%.

The new radio portfolio continued to generate business. The Ericsson Radio System (ERS) accounted for 55% of total radio unit deliveries year to date.

The plan is to have fully transitioned the radio unit deliveries to ERS by the end of 2018.

Gross margin

Gross margin declined to 26% (27%) YoY, due to the additional provisions and adjustments. The adjusted gross margin increased to 31% (28%) mainly due to higher hardware capacity sales. This was partly offset by a negative effect from higher recognition than deferral of hardware costs of SEK-0.4 (0.1) b. The gross margin increased across all businesses except for managed services.

As earlier communicated, 42 managed services contracts have been identified for exit, renegotiation or transformation, in order to focus the business and improve profitability. Year to date 13 of these contracts have been addressed, resulting in an annualized profit improvement of approximately SEK 0.4 b. going forward.

Gross margin decreased sequentially to 26% from 28% following the additional provisions and adjustments made in the quarter. Adjusted gross margin increased to 31% from 30%. This was mainly due to higher software sales, partly offset by higher recognition than deferral of hardware costs of SEK-0.4 (0.0) b.

7 Ericsson | Third Quarter Report 2017

Table of Contents

Operating income and margin

Operating income and margin decreased YoY and QoQ, due to increased restructuring charges and the additional provisions and adjustments made in the quarter. The decrease was partly offset by a gain related to divestment of the power modules business of SEK 0.3 b. The adjusted operating income increased to SEK 3.8 (3.4) b., due to improved gross margin. This was partly offset by lower sales and higher amortization than capitalization and higher recognition than deferral of hardware costs together amounting to SEK-0.7 (0.0) b. which is a consequence of technology and portfolio shifts. R&D expenses, excluding the effect of lower capitalization of development expenses, increased slightly YoY. This is in line with the already communicated focused business strategy.

IMPACT FROM AMORTIZATION AND CAPITALIZATION OF DEVELOPMENT EXPENSES AND FROM RECOGNITION AND DEFERRAL OF HARDWARE COSTS

SEK b. | Q3 2017 | Q3 2016 | Q2 2017 | |||||||||

Cost of Sales | -0.6 | -0.1 | -0.1 | |||||||||

R&D expenses | -0.1 | 0.1 | 0.1 | |||||||||

Total impact | -0.7 | 0.0 | 0.0 | |||||||||

Sequentially the adjusted operating income increased to SEK 3.8 b. from SEK 3.5 b. and the adjusted operating margin increased to 11% (10%). The improvement is due to increased gross margin and lower operating expenses. The increase was partly offset by lower sales.

8 Ericsson | Third Quarter Report 2017

Table of Contents

IT & CLOUD

SEK b. | Q3 2017 | Q3 2016 | YoY change | Q2 2017 | QoQ change | 9 months 2017 | 9 months 2016 | |||||||||||||||||||||

Net sales | 10.3 | 11.7 | -12 | % | 10.9 | -6 | % | 30.7 | 33.0 | |||||||||||||||||||

Of which products | 4.7 | 5.5 | -15 | % | 5.1 | -8 | % | 13.8 | 15.6 | |||||||||||||||||||

Of which IPR licensing revenues | 0.2 | 0.2 | -5 | % | 0.2 | -2 | % | 0.6 | 0.8 | |||||||||||||||||||

Of which services | 5.6 | 6.2 | -10 | % | 5.8 | -4 | % | 16.9 | 17.5 | |||||||||||||||||||

Net sales adjusted for certain items affecting comparability in 2017 | 10.3 | 11.7 | -12 | % | 10.9 | -6 | % | 30.8 | 33.0 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | -9 | % | — | -1 | % | -9 | % | — | ||||||||||||||||||

Gross income | 2.4 | 3.8 | -38 | % | 2.8 | -16 | % | 3.1 | 11.2 | |||||||||||||||||||

Gross income excluding restructuring charges and adj. for certain items affecting comparability in 2017 | 2.6 | 3.9 | -33 | % | 3.1 | -14 | % | 8.4 | 11.5 | |||||||||||||||||||

Gross margin | 23 | % | 33 | % | — | 26 | % | — | 10 | % | 34 | % | ||||||||||||||||

Gross margin excluding restructuring charges and adj. for certain items affecting comparability in 2017 | 26 | % | 34 | % | — | 28 | % | — | 27 | % | 35 | % | ||||||||||||||||

Operating income | -4.2 | -1.7 | 141 | % | -2.9 | 46 | % | -16.1 | -5.3 | |||||||||||||||||||

Operating income excl. restructuring charges and adj. for certain items affecting comparability in 2017 | -3.1 | -1.1 | 172 | % | -2.4 | 28 | % | -7.8 | -4.0 | |||||||||||||||||||

Operating margin | -41 | % | -15 | % | — | -26 | % | — | -52 | % | -16 | % | ||||||||||||||||

Operating margin excl. restructuring charges and adj. for certain items affecting comparability in 2017 | -30 | % | -10 | % | — | -22 | % | — | -25 | % | -12 | % | ||||||||||||||||

EBITA margin | -39 | % | -12 | % | — | -24 | % | — | -48 | % | -14 | % | ||||||||||||||||

Restructuring charges | -1.1 | -0.6 | 75 | % | -0.5 | 132 | % | -1.8 | -1.3 | |||||||||||||||||||

Q3 2017 ADJUSTED FOR RESTRUCTURING CHARGES AND CERTAIN OTHER ITEMS AFFECTING COMPARABILITY

SEK b. | Q3 2017 reported | Restructuring charges | Provisions and customer project adjustments | Q3 2017 adjusted | Q3 2016 adjusted | Q2 2017 adjusted | Q1 2017 adjusted | |||||||||||||||||||||

Net Sales | 10.3 | — | — | 10.3 | 11.7 | 10.9 | 9.6 | |||||||||||||||||||||

Cost of sales | -7.9 | 0.2 | 0.0 | -7.6 | -7.8 | -7.8 | -6.9 | |||||||||||||||||||||

Gross income | 2.4 | 0.2 | 0.0 | 2.6 | 3.9 | 3.1 | 2.7 | |||||||||||||||||||||

Gross margin | 23 | % | — | — | 26 | % | 34 | % | 28 | % | 28 | % | ||||||||||||||||

Operating income | -4.2 | 1.1 | 0.0 | -3.1 | -1.1 | -2.4 | -2.2 | |||||||||||||||||||||

Operating margin | -41 | % | — | — | -30 | % | -10 | % | -22 | % | -23 | % | ||||||||||||||||

Net sales

Sales as reported declined by-12% YoY. Sales adjusted for comparable units and currency decreased by-9% YoY, with reduced sales in North East Asia, also impacting sales of new portfolio. Due to the ongoing technology shift in the portfolio, sales of legacy portfolio products continued to decline. Services sales declined following lower activity in large transformation projects.

Sales decreased by-6% QoQ mainly due to currency effects.

Gross margin

Gross margin declined YoY, partly impacted by a sales mix with a higher share of services sales. In addition, the services margin continues to be negatively impacted by ongoing large transformation projects.

Gross margin decreased QoQ, mainly due to reduced services margins in large transformation projects. Focus is on fulfilling customer commitments, which puts pressure on near-term profitability.

Operating income and margin

Operating income decreased YoY impacted by reduced gross margin, lower sales and increased restructuring charges. In addition, due to technology changes, there was a negative impact YoY from higher amortized than capitalized development expenses. This impact was SEK-0.7 b. in Q3 2017, SEK 0.4 b in Q3 2016 and SEK-0.2 b. in Q2 2017. Reductions in operating expenses contributed positively to operating income.

IMPACT FROM AMORTIZATION AND CAPITALIZATION OF DEVELOPMENT EXPENSES

SEK b. | Q3 2017 | Q3 2016 | Q2 2017 | |||||||||

Cost of Sales | -0.3 | -0.2 | -0.3 | |||||||||

R&D expenses | -0.4 | 0.6 | 0.1 | |||||||||

Total impact | -0.7 | 0.4 | -0.2 | |||||||||

Operating income declined QoQ mainly due to increased restructuring charges, lower capitalized development expenses and a reduced gross margin.

9 Ericsson | Third Quarter Report 2017

Table of Contents

OTHER

SEK b. | Q3 2017 | Q3 2016 | YoY change | Q2 2017 | QoQ change | 9 months 2017 | 9 months 2016 | |||||||||||||||||||||

Net sales | 2.0 | 2.3 | -13 | % | 2.2 | -8 | % | 6.2 | 7.1 | |||||||||||||||||||

Of which IPR licensing revenues | 0.2 | 0.2 | -5 | % | 0.2 | -2 | % | 0.6 | 0.8 | |||||||||||||||||||

Sales growth adj. for comparable units and currency | — | — | -11 | % | — | -4 | % | -15 | % | — | ||||||||||||||||||

Gross income | 0.7 | 0.8 | -13 | % | 0.7 | -12 | % | 2.0 | 2.8 | |||||||||||||||||||

Gross income excluding restructuring charges and adj. for certain items affecting comparability in 2017 | 0.7 | 0.8 | -13 | % | 0.8 | -11 | % | 2.1 | 2.9 | |||||||||||||||||||

Gross margin | 32 | % | 32 | % | — | 34 | % | — | 32 | % | 39 | % | ||||||||||||||||

Gross margin excluding restructuring charges and adj. for certain items affecting comparability in 2017 | 35 | % | 36 | % | — | 37 | % | — | 34 | % | 40 | % | ||||||||||||||||

Operating income | -1.0 | -0.8 | 30 | % | -1.0 | 2 | % | -4.8 | -1.5 | |||||||||||||||||||

Operating income excl. restructuring charges and adj for certain items affecting comparability in 2017 | -0.8 | -0.7 | 17 | % | -0.8 | -8 | % | -2.6 | -1.4 | |||||||||||||||||||

Operating margin | -48 | % | -32 | % | — | -44 | % | — | -77 | % | -22 | % | ||||||||||||||||

Operating margin excl. restructuring charges and adj. for certain items affecting comparability in 2017 | -38 | % | -28 | % | — | -38 | % | — | -42 | % | -19 | % | ||||||||||||||||

EBITA margin | -44 | % | -24 | % | — | -38 | % | — | -58 | % | -13 | % | ||||||||||||||||

Restructuring charges | -0.2 | -0.1 | 107 | % | -0.1 | 65 | % | -0.4 | -0.2 | |||||||||||||||||||

Q3 2017 ADJUSTED FOR RESTRUCTURING CHARGES AND CERTAIN OTHER ITEMS AFFECTING COMPARABILITY

SEK b. | Q3 2017 reported | Restructuring charges | Provisions and customer project adjustments | Q3 2017 adjusted | Q3 2016 adjusted | Q2 2017 adjusted | Q1 2017 adjusted | |||||||||||||||||||||

Net Sales | 2.0 | — | — | 2.0 | 2.3 | 2.2 | 2.0 | |||||||||||||||||||||

Cost of sales | -1.4 | 0.1 | — | -1.3 | -1.5 | -1.4 | -1.4 | |||||||||||||||||||||

Gross income | 0.7 | 0.1 | — | 0.7 | 0.8 | 0.8 | 0.6 | |||||||||||||||||||||

Gross margin | 32 | % | — | — | 35 | % | 36 | % | 37 | % | 31 | % | ||||||||||||||||

Operating income | -1.0 | 0.2 | — | -0.8 | -0.7 | -0.8 | -1.0 | |||||||||||||||||||||

Operating margin | -48 | % | — | — | -38 | % | -28 | % | -38 | % | -51 | % | ||||||||||||||||

The former Media segment is renamed to “Other” in the external reporting as per Q2 2017.

Net sales

Sales as reported declined by-13% YoY. Sales adjusted for comparable units and currency decreased by-11% YoY, with a continued decline in legacy products sales in Media Solutions. In addition, sales in Broadcast Services declined due to contract scope changes and renegotiations. The momentum for the next-generation MediaFirst platform continued with an important customer agreement in Japan announced in the quarter. The iconectiv business (number portability solutions) continued to show growth YoY. The UDN (Unified Delivery Network) business reported its initial revenues and a contract with DTV, NTT DOCOMO’s content provider entity, was announced in the quarter.

Sales as reported decreased by-8% QoQ, mainly due to currency effects and seasonality.

Gross margin

Gross margin was stable YoY. Gross margin declined QoQ, due to a changed sales mix with a larger share of services.

Operating income and margin

Operating income decreased YoY mainly due to lower capitalization of development expenses of SEK-0.1 (0.1) b., which is a consequence of technology shift. In addition, increased restructuring charges had a negative effect on reported operating income. Continued efficiency improvements in Media Solutions and Broadcast Services contributed positively to operating income.

IMPACT FROM AMORTIZATION AND CAPITALIZATION OF DEVELOPMENT EXPENSES

SEK b. | Q3 2017 | Q3 2016 | Q2 2017 | |||||||||

Cost of Sales | — | — | — | |||||||||

R&D expenses | -0.1 | 0.1 | -0.1 | |||||||||

Total impact | -0.1 | 0.1 | -0.1 | |||||||||

Operating income was stable QoQ. Operating income excluding restructuring charges improved slightly QoQ, driven by lower operating expenses, however partly offset by lower sales.

10 Ericsson | Third Quarter Report 2017

Table of Contents

CASH FLOW

| Q3 | Q3 | Q2 | ||||||||||

SEK b. | 2017 | 2016 | 2017 | |||||||||

Net income reconciled to cash | -1.9 | 1.5 | -0.8 | |||||||||

Changes in operating net assets | 1.9 | -3.8 | 0.8 | |||||||||

Cash flow from operating activities | 0.0 | -2.3 | 0.0 | |||||||||

Cash flow from investing activities | 3.3 | -2.0 | -2.0 | |||||||||

Cash flow from financing activities | 1.4 | -1.5 | -8.9 | |||||||||

Net change in cash and cash equivalents | 4.8 | -4.5 | -11.5 | |||||||||

Free cash flow: Cash flow from operating activities less net capital expenditures and other investments | -0.5 | -5.0 | -1.3 | |||||||||

Cash conversion (%) | 1 | % | -155 | % | 0 | % | ||||||

Operating activities

Cash flow from operating activities was SEK 0.0 b. in the quarter. A negative net income reconciled to cash was fully offset by a positive effect from changes in operating net assets. Cash flow from other operating assets and liabilities was SEK 1.2 b. which was mainly due to increased advance payment from customers.

Cash outlays related to restructuring charges were SEK-1.5(-0.5) b. in the quarter.

Investing activities

Cash flow from investing activities was positive at SEK 3.3 b. and that of interest-bearing securities was 3.8 b. The power modules business was divested, resulting in SEK 0.5 b. in cash inflow in the quarter. The cash flow effect from capitalized development expenses amounted to SEK-0.1 b. in the quarter, a significant reduction from SEK-0.9 b. a year earlier. Investments in property, plant and equipment are now established at a lower level and the cash flow effect in Q3 was SEK-0.7 b.

Financing activities

Cash flow from financing activities was positive at SEK 1.4 b. driven by increased borrowings of SEK 1.7 b. This relates to a payment the company received from Francisco Partners for a 16.7% ownership in Ericsson’s independent subsidiary iconectiv. Due to the structure of the investment, IFRS accounting standards stipulate the main part of the USD 200 million is to be treated as financing, i.e as borrowings and corresponding cash flow from financing activities.

Net cash was SEK 24.1 b. at the end of the quarter compared with SEK 24.0 b. last quarter.

Free cash flow

Free cash flow was SEK-0.5(-5.0) b. Free cash flow year to date was SEK-5.0(-14.1) b.

| Jan-Sep | Jan-Jun | Jan-Mar | Jan-Dec | Jan-Sep | ||||||||||||||||

Working capital KPIs, number of days | 2017 | 2017 | 2017 | 2016 | 2016 | |||||||||||||||

Sales outstanding (target: <90) | 112 | 114 | 117 | 95 | 122 | |||||||||||||||

Inventory (target: <65) | 77 | 78 | 73 | 69 | 79 | |||||||||||||||

Payable (target: >60) | 60 | 60 | 58 | 56 | 56 | |||||||||||||||

11 Ericsson | Third Quarter Report 2017

Table of Contents

FINANCIAL POSITION

SEK b. | Sep 30 2017 | Sep 30 2016 | Jun 30 2017 | |||||||||

+ Cash and cash equivalents | 26.2 | 24.4 | 21.4 | |||||||||

+ Interest-bearing securities, current | 6.5 | 18.7 | 10.8 | |||||||||

+ Interest-bearing securities,non-current | 22.4 | 0.5 | 22.1 | |||||||||

|

|

|

|

|

| |||||||

Gross cash | 55.1 | 43.6 | 54.3 | |||||||||

– Borrowings, current | 3.0 | 9.0 | 3.2 | |||||||||

– Borrowings,non-current | 28.0 | 18.3 | 27.1 | |||||||||

|

|

|

|

|

| |||||||

Net cash | 24.1 | 16.3 | 24.0 | |||||||||

Equity | 115.7 | 134.0 | 123.8 | |||||||||

Total assets | 267.2 | 275.7 | 274.9 | |||||||||

Capital turnover (times) | 1.1 | 1.1 | 1.0 | |||||||||

Return on capital employed (%) | -13.6 | % | 4.4 | % | -14.8 | % | ||||||

Equity ratio (%) | 43.3 | % | 48.6 | % | 45.0 | % | ||||||

Return on equity (%) | -17.1 | % | 3.2 | % | -18.1 | % | ||||||

Net cash increased by SEK 0.1 b. in the quarter. The net cash position was SEK 24.1 b.

Post-employment benefits were SEK 26.5 b., compared with SEK 23.6 b. on June 30, 2017, following lower discount rate in Sweden.

In addition, the company received a USD 200 million payment relating to Francisco Partners’ investments for a 16.7% ownership in Ericsson’s independent subsidiary iconectiv. Due to the structure of the investment, IFRS accounting standards stipulates the main part of the USD 200 million is to be treated as borrowings,non-current.

The average maturity of long-term borrowings as of Sept. 30, 2017, was 4.3 years, compared with 4.0 years 12 months earlier.

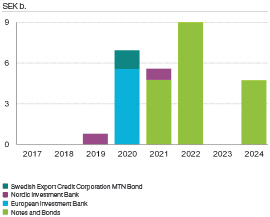

Debt maturity profile, Parent Company

12 Ericsson | Third Quarter Report 2017

Table of Contents

PARENT COMPANY

Income after financial items was SEK 2.6 (14.1) b. The decrease was mainly due to lower recognized dividends from subsidiaries.

At the end of the quarter, gross cash (cash, cash equivalents, short-term investments, and interest-bearing securitiesnon-current) amounted to SEK 42.1 b. compared with SEK 42.9 b. at the end of 2016.

In accordance with the conditions of the long-term variable compensation program (LTV) for Ericsson employees, 3,689,878 shares from treasury stock were sold or distributed to employees during the third quarter.

The holding of treasury stock on September 30, 2017, was 54,458,316 Class B shares.

13 Ericsson | Third Quarter Report 2017

Table of Contents

OTHER INFORMATION

Changes to Ericsson’s Executive Team

On September 12, 2017, Ericsson announced a change to the Executive Team. The company has appointed Niklas Heuveldop to be Head of Market Area North America, effective September 12, 2017. In addition to his current role as Chief Strategy Officer and Head of Technology & Emerging Business, he has also been Acting Head of Market Area North America since May 2017.

Niklas Heuveldop will, on a permanent basis, lead the organization of approximately 11,500 employees in serving Ericsson’s customers in the United States and Canada with technology and services.

Heuveldop will, until further notice, be acting in his former role as Chief Strategy Officer, Head of Technology & Emerging Business. The search for a replacement for this role is ongoing.

Patent infringement lawsuit

The company Intellectual Ventures that has previously filed a number of patent infringement lawsuits in the United States accusing a number of Ericsson’s U.S. customers of patent infringement, has during the third quarter of 2017 filed additional lawsuits in the Eastern District of Texas asserting patent infringement by Ericsson and a number of Ericsson’s U.S. customers.

POST-CLOSING EVENTS

Ronnie Leten proposed as new Chairman of the Board of Ericsson. Kurt Jofs proposed as new member of the Board.

On October 9, 2017, Ericsson announced that its Nomination Committee will propose Ronnie Leten as new Chairman of the Board of Ericsson. Between 1985 and 2017, Leten held various positions within Atlas Copco, being the company’s President and CEO 2009-2017. He is currently a board member in SKF, the Chairman of the Board of Electrolux and proposed Chairman of the Board of Epiroc, the part of Atlas Copco planned to be spun off to its shareholders in 2018. Leten is a Belgian citizen, born in 1956, and holds a M.Sc in Applied Economics from the University of Hasselt, Belgium.

Ericsson’s current Chairman of the Board Leif Johansson has previously announced that he will not make himself available for reelection at the 2018 Annual General Meeting.

The Nomination Committee will also propose Kurt Jofs as new member of the Board. Jofs was responsible for Ericsson’s Networks business 2003-2008 and is currently the Chairman of the Board in Tieto.

Kristin Skogen Lund has notified the Nomination Committee that she will not be available for reelection.

The Nomination Committee’s additional proposals will be published later, in conjunction with the notice of the 2018 Annual General Meeting at the latest.

14 Ericsson | Third Quarter Report 2017

Table of Contents

RISK FACTORS

Ericsson’s operational and financial risk factors and uncertainties are described in our Annual Report 2016.

Risk factors and uncertainties in focus short term for the Parent Company and the Ericsson Group include, but are not limited to:

| • | Potential negative effects on operators’ willingness to invest in network development due to uncertainty in the financial markets and a weak economic business environment, or reduced consumer telecom spending, or increased pressure on us to provide financing, or delayed auctions of spectrums; |

| • | Uncertainty regarding the financial stability of suppliers, for example due to lack of financing; |

| • | Effects on gross margins and/or working capital of the business mix in the Networks segment between capacity sales and new coverage build-outs; |

| • | Effects on gross margins of the business mix in the Networks and IT & Cloud segments including new network build-outs and new managed services or digital transformation deals with initial transition costs; |

| • | Effects of the ongoing industry consolidation among our customers as well as between our largest competitors, e.g. with postponed investments and intensified price competition as a consequence; |

| • | New and ongoing partnerships which may not be successful and expose us to future costs; |

| • | Changes in foreign exchange rates, in particular USD; |

| • | Political unrest and uncertainty in certain markets; |

| • | Effects on production and sales from restrictions with respect to timely and adequate supply of materials, components and production capacity and other vital services on competitive terms; |

| • | No guarantees that strategy execution, specific restructuring or cost-savings initiatives, profitability restoring efforts and/or organizational changes will be sufficient, successful or executed in time to deliver any improvements in earnings; |

| • | Cybersecurity incidents, which may have a material negative impact. |

Ericsson stringently monitors the compliance with all relevant trade regulations and trade embargoes applicable to dealings with customers operating in countries where there are trade restrictions or trade restrictions are discussed. Ericsson operates globally in accordance with Group policies and directives for business ethics and conduct and has a dedicated anti-corruption program. However, in some of the countries where the company operates, corruption risks can be high and compliance failure could have a material adverse impact on our business, financial condition and brand.

Stockholm, October 20, 2017

Telefonaktiebolaget LM Ericsson

Börje Ekholm, President and CEO

Org. no. 556016-0680

Date for next report: January 31, 2018

15 Ericsson | Third Quarter Report 2017

Table of Contents

AUDITORS’ REVIEW REPORT

Introduction

We have reviewed the condensed interim financial information (interim report) of Telefonaktiebolaget LM Ericsson (publ.) as of September 30, 2017, and the nine months period then ended. The board of directors and the CEO are responsible for the preparation and presentation of the interim financial report in accordance with IAS 34 and the Swedish Annual Accounts Act. Our responsibility is to express a conclusion on this interim report based on our review.

Scope of review

We conducted our review in accordance with the International Standard on Review Engagements ISRE 2410, Review of Interim Report Performed by the Independent Auditor of the Entity.

A review consists of making inquiries, primarily of persons responsible for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than an audit conducted in accordance with International Standards on Auditing, ISA, and other generally accepted auditing standards in Sweden. The procedures performed in a review do not enable us to obtain assurance that we would become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that causes us to believe that the interim report is not prepared, in all material respects, in accordance with IAS 34 and the Swedish Annual Accounts Act, regarding the Group, and with the Swedish Annual Accounts Act, regarding the Parent Company.

Stockholm, October 20, 2017

PricewaterhouseCoopers AB

Bo Hjalmarsson

Authorized Public Accountant

Auditor in Charge

Johan Engstam

Authorized Public Accountant

16 Ericsson | Third Quarter Report 2017

Table of Contents

EDITOR’S NOTE

Ericsson invites media, investors and analysts to conference calls on October 20, 2017; one starting at 09.00 (CET) and the other at 14.00 (CET).

Live audio webcasts of the conference calls as well as supporting slides will be available at: www.ericsson.com/press and www.ericsson.com/investors

Replay of the conference calls will be available approximately one hour after each call has ended and will remain available for seven days.

For further information, please contact:

Helena Norrman, Senior Vice President, Chief Marketing and Communications Officer

Phone: +46 10 719 34 72

E-mail: investor.relations@ericsson.com or

media.relations@ericsson.com

Telefonaktiebolaget LM Ericsson

Org. number: 556016-0680

Torshamnsgatan 21

SE-164 83 Stockholm

Phone: +46 10 719 00 00

www.ericsson.com

Investors

| Peter Nyquist, Vice President, | ||

| Head of Investor Relations | ||

| Phone: | +46 10 714 64 49, +46 70 575 29 06 | |

| E-mail: | peter.nyquist@ericsson.com | |

Stefan Jelvin, Director, Investor Relations | ||

| Phone: | +46 10 714 20 39, +46 70 986 02 27 | |

| E-mail: | stefan.jelvin@ericsson.com | |

Åsa Konnbjer, Director, Investor Relations | ||

| Phone: | +46 10 713 39 28, +46 73 082 59 28 | |

| E-mail: | asa.konnbjer@ericsson.com | |

Rikard Tunedal, Director, Investor Relations | ||

| Phone: | +46 10 714 54 00, +46 761 005 400 | |

| E-mail: | rikard.tunedal@ericsson.com | |

| Media | ||

Ola Rembe, Vice President, Head of External Communications | ||

| Phone: | +46 10 719 97 27, +46 73 024 48 73 | |

| E-mail: | media.relations@ericsson.com | |

| Corporate Communications | ||

| Phone: | +46 10 719 69 92 | |

| E-mail: | media.relations@ericsson.com | |

17 Ericsson | Third Quarter Report 2017

Table of Contents

SAFE HARBOR STATEMENT

All statements made or incorporated by reference in this release, other than statements or characterizations of historical facts, are forward-looking statements. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us.

Forward-looking statements can often be identified by words such as “anticipates”, “expects”, “intends”, “plans”, “predicts”, “believes”, “seeks”, “estimates”, “may”, “will”, “should”, “would”, “potential”, “continue”, and variations or negatives of these words, and include, among others, statements regarding: (i) strategies, outlook and growth prospects; (ii) positioning to deliver future plans and to realize potential for future growth; (iii) liquidity and capital resources and expenditure, and our credit ratings; (iv) growth in demand for our products and services; (v) our joint venture activities; (vi) economic outlook and industry trends; (vii) developments of our markets; (viii) the impact of regulatory initiatives; (ix) research and development expenditures; (x) the strength of our competitors; (xi) future cost savings and profitability; (xii) plans to launch new products and services; (xiii) assessments of risks; (xiv) integration of acquired businesses; (xv) compliance with rules and regulations and (xvi) infringements of intellectual property rights of others.

In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These forward-looking statements speak only as of the date hereof and are based upon the information available to us at this time. Such information is subject to change, and we will not necessarily inform you of such changes. These statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions that are difficult to predict. Therefore, our actual results could differ materially and adversely from those expressed in any forward-looking statements as a result of various factors, such as those factors described under the risk factor section. Important factors that may cause such a difference for Ericsson include, but are not limited to: (i) material adverse changes in the markets in which we operate or in global economic conditions; (ii) increased product and price competition; (iii) reductions in capital expenditure by network operators; (iv) the cost of technological innovation and increased expenditure to improve quality of service; (v) significant changes in market share for our principal products and services; (vi) foreign exchange rate or interest rate fluctuations; and (vii) the failure to successfully implement our business and operational initiatives

18 Ericsson | Third Quarter Report 2017

Table of Contents

FINANCIAL STATEMENTS

AND OTHER INFORMATION

| Contents | ||||

| 20 | ||||

| 20 | ||||

| 21 | ||||

| 22 | ||||

| 23 | ||||

| 23 | ||||

| 24 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 32 | ||||

| 32 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

Gross income and gross margin excluding restructuring by segment by quarter | 36 | |||

Operating income and operating margin excluding restructuring by segment by quarter | 36 | |||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 43 | ||||

19 Ericsson | Third Quarter Report 2017

Table of Contents

| Jul-Sep | Jan-Sep | |||||||||||||||||||||||

SEK million | 2017 | 2016 | Change | 2017 | 2016 | Change | ||||||||||||||||||

Net sales | 47,796 | 51,076 | -6 | % | 144,104 | 157,393 | -8 | % | ||||||||||||||||

Cost of sales | -35,661 | -36,616 | -3 | % | -111,598 | -108,048 | 3 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Gross income | 12,135 | 14,460 | -16 | % | 32,506 | 49,345 | -34 | % | ||||||||||||||||

Gross margin (%) | 25.4 | % | 28.3 | % | 22.6 | % | 31.4 | % | ||||||||||||||||

Research and development expenses | -10,520 | -7,855 | 34 | % | -27,953 | -22,745 | 23 | % | ||||||||||||||||

Selling and administrative expenses | -6,834 | -6,238 | 10 | % | -23,747 | -20,067 | 18 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating expenses | -17,354 | -14,093 | 23 | % | -51,700 | -42,812 | 21 | % | ||||||||||||||||

Other operating income and expenses | 415 | -3 | 795 | 40 | ||||||||||||||||||||

Shares in earnings of JV and associated companies | 6 | -23 | 29 | 6 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Operating income | -4,798 | 341 | -1507 | % | -18,370 | 6,579 | -379 | % | ||||||||||||||||

Financial income | -135 | -226 | -239 | -176 | ||||||||||||||||||||

Financial expenses | -181 | -371 | -448 | -1,414 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Income after financial items | -5,114 | -256 | 1898 | % | -19,057 | 4,989 | -482 | % | ||||||||||||||||

Taxes | 766 | 76 | 2,858 | -1,497 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income | -4,348 | -180 | 2316 | % | -16,199 | 3,492 | -564 | % | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

Net income attributable to: | ||||||||||||||||||||||||

Stockholders of the Parent Company | -4,452 | -233 | -16,359 | 3,320 | ||||||||||||||||||||

Non-controlling interests | 104 | 53 | 160 | 172 | ||||||||||||||||||||

Other information | ||||||||||||||||||||||||

Average number of shares, basic (million) | 3,279 | 3,264 | 3,275 | 3,261 | ||||||||||||||||||||

Earnings per share, basic (SEK)1) | -1.35 | -0.07 | -4.99 | 1.02 | ||||||||||||||||||||

Earnings per share, diluted (SEK)1) | -1.34 | -0.07 | -4.93 | 1.01 | ||||||||||||||||||||

|

|

|

|

|

|

|

| |||||||||||||||||

| 1) | Based on Net income attributable to stockholders of the Parent Company. |

STATEMENT OF COMPREHENSIVE INCOME

| Jul-Sep | Jan-Sep | |||||||||||||||

SEK million | 2017 | 2016 | 2017 | 2016 | ||||||||||||

Net income | -4,348 | -180 | -16,199 | 3,492 | ||||||||||||

Other comprehensive income | ||||||||||||||||

Items that will not be reclassified to profit or loss | ||||||||||||||||

Remeasurements of defined benefits pension plans incl. asset ceiling | -2,618 | -5,347 | -1,646 | -9,790 | ||||||||||||

Tax on items that will not be reclassified to profit or loss | 546 | 1,218 | 217 | 2,406 | ||||||||||||

Items that may be reclassified to profit or loss | ||||||||||||||||

Available-for-sale financial assets | ||||||||||||||||

Gains/losses arising during the period | 5 | — | 78 | — | ||||||||||||

Reclassification adjustments on gains/losses included in profit or loss | — | — | 5 | — | ||||||||||||

Revaluation of other investments in shares and participations | ||||||||||||||||

Fair value remeasurement | -5 | — | -3 | -4 | ||||||||||||

Changes in cumulative translation adjustments | -1,728 | 1,520 | -4,522 | 2,368 | ||||||||||||

Share of other comprehensive income on JV and associated companies | -8 | 11 | -7 | -355 | ||||||||||||

Tax on items that may be reclassified to profit or loss | 1 | — | -17 | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total other comprehensive income, net of tax | -3,807 | -2,598 | -5,895 | -5,375 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total comprehensive income | -8,155 | -2,778 | -22,094 | -1,883 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total comprehensive income attributable to: | ||||||||||||||||

Stockholders of the Parent Company | -8,218 | -2,871 | -22,197 | -2,121 | ||||||||||||

Non-controlling interest | 63 | 93 | 103 | 238 | ||||||||||||

20 Ericsson | Third Quarter Report 2017

Table of Contents

SEK million | Sep 30 2017 | Jun 30 2017 | Dec 31 2016 | |||||||||

ASSETS | ||||||||||||

Non-current assets | ||||||||||||

Intangible assets | ||||||||||||

Capitalized development expenses | 5,337 | 6,085 | 8,076 | |||||||||

Goodwill | 40,200 | 41,364 | 43,387 | |||||||||

Intellectual property rights, brands and other intangible assets | 4,776 | 5,234 | 7,747 | |||||||||

Property, plant and equipment | 13,884 | 16,276 | 16,734 | |||||||||

Financial assets | ||||||||||||

Equity in JV and associated companies | 627 | 791 | 775 | |||||||||

Other investments in shares and participations | 1,192 | 1,115 | 1,179 | |||||||||

Customer finance,non-current | 1,993 | 2,288 | 2,128 | |||||||||

Interest-bearing securities,non-current | 22,405 | 22,122 | 7,586 | |||||||||

Other financial assets,non-current | 5,063 | 4,409 | 4,442 | |||||||||

Deferred tax assets | 19,275 | 17,463 | 15,522 | |||||||||

|

|

|

|

|

| |||||||

| 114,752 | 117,147 | 107,576 | ||||||||||

Current assets | ||||||||||||

Inventories | 32,758 | 34,194 | 30,307 | |||||||||

Trade receivables | 59,802 | 62,493 | 68,117 | |||||||||

Customer finance, current | 1,961 | 2,156 | 2,625 | |||||||||

Other current receivables | 25,231 | 26,741 | 24,431 | |||||||||

Interest-bearing securities, current | 6,526 | 10,754 | 13,325 | |||||||||

Cash and cash equivalents | 26,210 | 21,446 | 36,966 | |||||||||

|

|

|

|

|

| |||||||

| 152,488 | 157,784 | 175,771 | ||||||||||

|

|

|

|

|

| |||||||

Total assets | 267,240 | 274,931 | 283,347 | |||||||||

|

|

|

|

|

| |||||||

EQUITY AND LIABILITIES | ||||||||||||

Equity | ||||||||||||

Stockholders’ equity | 115,072 | 123,045 | 139,817 | |||||||||

Non-controlling interest in equity of subsidiaries | 615 | 710 | 675 | |||||||||

|

|

|

|

|

| |||||||

| 115,687 | 123,755 | 140,492 | ||||||||||

Non–current liabilities | ||||||||||||

Post-employment benefits | 26,534 | 23,624 | 23,723 | |||||||||

Provisions,non-current | 3,930 | 4,794 | 946 | |||||||||

Deferred tax liabilities | 1,736 | 1,838 | 2,147 | |||||||||

Borrowings,non-current | 28,039 | 27,100 | 18,653 | |||||||||

Othernon-current liabilities | 2,563 | 2,602 | 2,621 | |||||||||

|

|

|

|

|

| |||||||

| 62,802 | 59,958 | 48,090 | ||||||||||

Current liabilities | ||||||||||||

Provisions, current | 5,646 | 5,618 | 5,411 | |||||||||

Borrowings, current | 3,004 | 3,230 | 8,033 | |||||||||

Trade payables | 23,560 | 25,025 | 25,318 | |||||||||

Other current liabilities | 56,541 | 57,345 | 56,003 | |||||||||

|

|

|

|

|

| |||||||

| 88,751 | 91,218 | 94,765 | ||||||||||

|

|

|

|

|

| |||||||

Total equity and liabilities | 267,240 | 274,931 | 283,347 | |||||||||

|

|

|

|

|

| |||||||

Of which interest-bearing liabilities | 31,043 | 30,330 | 26,686 | |||||||||

Assets pledged as collateral | 5,215 | 5,076 | 2,584 | |||||||||

Contingent liabilities | 1,547 | 1,679 | 1,186 | |||||||||

21 Ericsson | Third Quarter Report 2017

Table of Contents

CONSOLIDATED STATEMENT OF CASH FLOWS

| Jul-Sep | Jan-Sep | Jan-Dec | ||||||||||||||||||

SEK million | 2017 | 2016 | 2017 | 2016 | 2016 | |||||||||||||||

Operating activities | ||||||||||||||||||||

Net income | -4,348 | -180 | -16,199 | 3,492 | 1,895 | |||||||||||||||

Adjustments to reconcile net income to cash | ||||||||||||||||||||

Taxes | -1,574 | -1,282 | -7,897 | -5,900 | -6,200 | |||||||||||||||

Earnings/dividends in JV and associated companies | 73 | 22 | 58 | 79 | 58 | |||||||||||||||

Depreciation, amortization and impairment losses | 4,146 | 2,308 | 11,774 | 6,509 | 9,119 | |||||||||||||||

Other | -218 | 630 | 261 | 2,270 | 3,135 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net income reconciled to cash | -1,921 | 1,498 | -12,003 | 6,450 | 8,007 | |||||||||||||||

Changes in operating net assets | ||||||||||||||||||||

Inventories | 582 | 980 | -4,149 | -4,899 | -613 | |||||||||||||||

Customer finance, current andnon-current | 456 | 223 | 762 | -844 | -950 | |||||||||||||||

Trade receivables | 1,124 | -624 | 3,971 | 2,220 | 5,933 | |||||||||||||||

Trade payables | -819 | -2,371 | -152 | -531 | 2,775 | |||||||||||||||

Provisions and post-employment benefits | -601 | 130 | 4,368 | 334 | 3,106 | |||||||||||||||

Other operating assets and liabilities, net | 1,161 | -2,153 | 5,645 | -8,132 | -4,248 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

| 1,903 | -3,815 | 10,445 | -11,852 | 6,003 | ||||||||||||||||

Cash flow from operating activities | -18 | -2,317 | -1,558 | -5,402 | 14,010 | |||||||||||||||

Investing activities | ||||||||||||||||||||

Investments in property, plant and equipment | -739 | -1,384 | -2,772 | -4,430 | -6,129 | |||||||||||||||

Sales of property, plant and equipment | 12 | 111 | 118 | 205 | 482 | |||||||||||||||

Acquisitions/divestments of subsidiaries and other operations, net | 371 | 16 | 383 | -572 | -622 | |||||||||||||||

Product development | -126 | -885 | -1,306 | -3,192 | -4,483 | |||||||||||||||

Other investing activities | 42 | -508 | 110 | -663 | -3,004 | |||||||||||||||

Interest-bearing securities | 3,756 | 610 | -8,806 | 6,978 | 5,473 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from investing activities | 3,316 | -2,040 | -12,273 | -1,674 | -8,283 | |||||||||||||||

Cash flow before financing activities | 3,298 | -4,357 | -13,831 | -7,076 | 5,727 | |||||||||||||||

Financing activities | ||||||||||||||||||||

Dividends paid | -145 | -163 | -3,423 | -12,263 | -12,263 | |||||||||||||||

Other financing activities | 1,563 | -1,295 | 6,829 | 1,560 | 521 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash flow from financing activities | 1,418 | -1,458 | 3,406 | -10,703 | -11,742 | |||||||||||||||

Effect of exchange rate changes on cash | 48 | 1,285 | -331 | 1,956 | 2,757 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Net change in cash and cash equivalents | 4,764 | -4,530 | -10,756 | -15,823 | -3,258 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash and cash equivalents, beginning of period | 21,446 | 28,931 | 36,966 | 40,224 | 40,224 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash and cash equivalents, end of period | 26,210 | 24,401 | 26,210 | 24,401 | 36,966 | |||||||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

22 Ericsson | Third Quarter Report 2017

Table of Contents

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

| Jan-Sep | Jan-Dec | |||||||||||

SEK million | 2017 | 2016 | 2016 | |||||||||

Opening balance | 140,492 | 147,366 | 147,366 | |||||||||

Total comprehensive income | -22,094 | -1,883 | 4,514 | |||||||||

Sale/repurchase of own shares | -28 | -51 | -216 | |||||||||

Stock issue (net) | 15 | 131 | 131 | |||||||||

Stock purchase plan | 650 | 711 | 957 | |||||||||

Dividends paid | -3,424 | -12,263 | -12,263 | |||||||||

Transactions withnon-controlling interests | 76 | 1 | 3 | |||||||||

|

|

|

|

|

| |||||||

Closing balance | 115,687 | 134,012 | 140,492 | |||||||||

|

|

|

|

|

| |||||||

CONSOLIDATED INCOME STATEMENT - ISOLATED QUARTERS

| 2017 | 2016 | |||||||||||||||||||||||||||

Isolated quarters, SEK million | Q3 | Q2 | Q1 | Q4 | Q3 | Q2 | Q1 | |||||||||||||||||||||

Net sales | 47,796 | 49,939 | 46,369 | 65,215 | 51,076 | 54,108 | 52,209 | |||||||||||||||||||||

Cost of sales | -35,661 | -36,006 | -39,931 | -48,195 | -36,616 | -36,613 | -34,819 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Gross income | 12,135 | 13,933 | 6,438 | 17,020 | 14,460 | 17,495 | 17,390 | |||||||||||||||||||||

Gross margin (%) | 25.4 | % | 27,9 | % | 13.9 | % | 26.1 | % | 28.3 | % | 32.3 | % | 33.3 | % | ||||||||||||||

Research and development expenses | -10,520 | -8,365 | -9,068 | -8,890 | -7,855 | -7,405 | -7,485 | |||||||||||||||||||||

Selling and administrative expenses | -6,834 | -7,052 | -9,861 | -8,799 | -6,238 | -7,109 | -6,720 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating expenses | -17,354 | -15,417 | -18,929 | -17,689 | -14,093 | -14,514 | -14,205 | |||||||||||||||||||||

Other operating income and expenses | 415 | 239 | 141 | 364 | -3 | -230 | 273 | |||||||||||||||||||||

Shares in earnings of JV and associated companies | 6 | 12 | 11 | 25 | -23 | 12 | 17 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Operating income | -4,798 | -1,233 | -12,339 | -280 | 341 | 2,763 | 3,475 | |||||||||||||||||||||

Financial income | -135 | -22 | -82 | 61 | -226 | 139 | -89 | |||||||||||||||||||||

Financial expenses | -181 | 83 | -350 | -744 | -371 | -666 | -377 | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Income after financial items | -5,114 | -1,172 | -12,771 | -963 | -256 | 2,236 | 3,009 | |||||||||||||||||||||