Note A1, cont’d.

Contract asset is unbilled sales amount relating to performance obligation that has been satisfied under customer contract but is conditional on terms other than only the passage of time before payment of the consideration is due.

Contract liability relates to amounts that are paid by or due from customers for which performance obligations are unsatisfied or partially satisfied. Advances from customers are also included in the contract liability balance.

Deferred sales commissions

The Company has various incremental commission costs for internal sales personnel and channel partners that relate to the acquisition of customer contracts in the Enterprise segment. These costs are capitalized as deferred contract acquisition costs (within Other

non-current

and Other current assets) and amortized on a straight-line basis to selling and administrative expenses over the contract period. The Company expenses sales commissions for commission plans related to customer arrangements with a duration of one year or less. The Company periodically assesses for changes in its business or market conditions which would indicate that its amortization period shall be changed or if there are potential indicators of impairment.

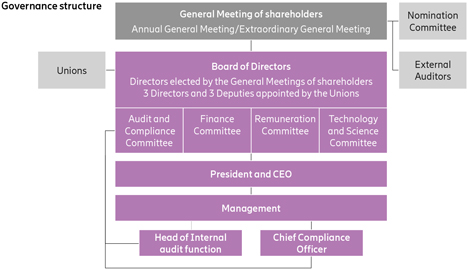

The segment presentation, as per each segment, is based on the Company’s accounting policies as disclosed in this note. An operating segment is a component of a company whose operating results are regularly reviewed by the Company’s chief operating decision maker (CODM), to make decisions about resources to be allocated to the segment and assess its performance. The President and the CEO is defined as the CODM function in the Company.

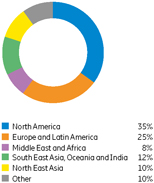

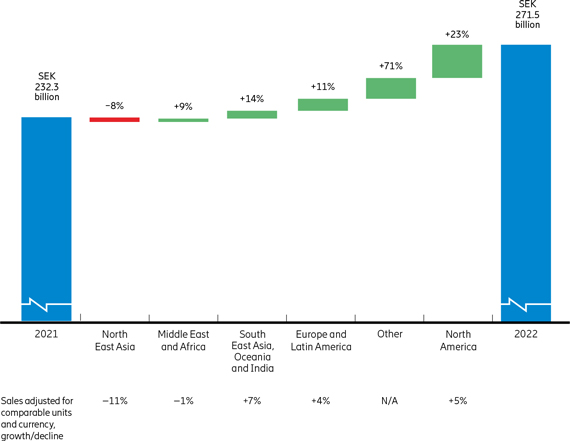

The Company’s segment disclosure about geographical areas is based on the country in which transfer of control of products and services occur. For further information, see note B1 “Segment information.”

Inventories are measured at the lower of cost or net realizable value and using cost formula

first-in,

first-out

(FIFO) related to the Company’s owned production and weighted average cost formula for externally purchased components and raw materials within the Company’s production units. The cost of inventories related to work in progress is measured at its individual costs.

Risks of obsolescence have been measured by estimating market value based on future customer demand and changes in technology and customer acceptance of new products.

A significant part of inventories is Contract work in progress (CWIP). Recognition and derecognition of CWIP relates to the Company’s revenue recognition principles meaning that costs incurred under a customer contract are initially recognized as CWIP (see Revenue recognition policy). When the related revenue is recognized, CWIP is derecognized and is instead recognized as Cost of sales.

In note A2, “Critical accounting estimates and judgments,” further disclosure is presented in relation to (i) key sources of estimation uncertainty and (ii) the decision made in relation to accounting policies applied.

For further disclosure, see the notes under section C.

As from the acquisition date, goodwill acquired in a business combination is allocated to each cash-generating unit (CGU) of the Company expected to benefit from the synergies of the combination.

An annual impairment test for the CGUs to which goodwill has been allocated is performed in the fourth quarter, or when there is an indication of impairment. An impairment loss is recognized if the carrying amount of an asset or its cash-generating unit exceeds its recoverable amount. The recoverable amount is the higher of the value in use and the fair value less costs of disposal. In assessing value in use, the estimated future cash flows after tax are discounted to their present value using an

after-tax

discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. Application of

after-tax

amounts in calculation, both in

relation to cash flows and discount rate is applied because available models for calculating discount rate include a tax component. The effect of

after-tax

discount rates applied by the Company is not materially different from a discounting based on

before-tax

future cash flows and

before-tax

discount rates, as required by IFRS. An impairment loss in respect of goodwill is not reversed. Write-downs of goodwill are reported under other operating expenses.

Additional disclosure is required in relation to goodwill impairment testing: see note A2 “Critical accounting estimates and judgments” and note C1 “Intangible assets.”

Intangible assets other than goodwill

Intangible assets other than goodwill comprises intangible assets acquired through business combination in order of materiality they are customer relationships, technology (patents), trademarks and software. In addition there are capitalized development expenses and separately acquired intangibles assets, mainly consisting of software. At initial recognition, acquired intangible assets relating to business combinations are stated at fair value and capitalized development expenses and software are stated at cost. Subsequent to initial recognition, these intangible assets are stated at the initially recognized amounts less accumulated amortization and any impairment. Amortization and any impairment losses are included in Research and development expenses, which mainly consists of capitalized development expenses and technology; in Selling and administrative expenses, which mainly consists of expenses relating to customer relations and brands; and in Cost of sales.

Costs incurred for the development of products to be sold, leased, or otherwise marketed or intended for internal use are capitalized as from when technological and economic feasibility has been established until the product is available for sale or use. Research and development expenses directly related to orders from customers are accounted for as a part of Cost of sales. Other research and development expenses are charged to the income statement as incurred. Amortization of acquired intangible assets, such as patents, customer relations, trademarks, and software, is made according to the straight-line method over their estimated useful lives, not exceeding ten years. Amortization of capitalized development expenses is made according to the straight-line method over their useful lives, which is normally three years.

The Company has not recognized any intangible assets with indefinite useful life other than goodwill.

Impairment tests are performed when there is an indication of impairment. Tests are performed in the same way as for goodwill but on an asset level, see above. However, intangible assets not yet available for use are tested annually for impairment.

Corporate assets have been allocated to cash-generating units in relation to each unit’s proportion of total net sales. The amount related to corporate assets is not significant. Impairment losses recognized in prior periods are assessed at each reporting date for any indications that the loss has decreased or no longer exists.

In note A2, “Critical accounting estimates and judgments,” further disclosure is presented in relation to (i) key sources of estimation uncertainty and (ii) the decision made in relation to accounting policies applied.

Property, plant, and equipment

Property, plant, and equipment consist of real estate, machinery and other technical assets, other equipment, tools and installations, and construction in progress. They are stated at cost less accumulated depreciation and any impairment losses.

Depreciation is charged to the income statement, on a straight-line basis, over the estimated useful life of each component of an item of property, plant, and equipment, including buildings. Estimated useful lives are, in general, 25–50 years for real estate and 3–10 years for machinery and equipment. Depreciation and any impairment charges are included in Cost of sales, Research and development or Selling and administrative expenses.

For each item of property, plant and equipment, the Company recognizes separate components based on 1) physical component, and 2) a

non-physical

component that represents a major inspection of overhaul. The Company