UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Integral Systems, Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement no.: |

INTEGRAL SYSTEMS, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD APRIL 12, 2006

TO THE STOCKHOLDERS OF INTEGRAL SYSTEMS, INC.:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders (the “Annual Meeting”) of Integral Systems, Inc. (“the Company”) will be held at Patuxent Greens Country Club, located at 14415 Greensview Drive, Laurel, Maryland at 6:00 p.m. on Wednesday, April 12, 2006, for the following purposes:

| | 1. | To elect one (1) Class I Director to serve for a term of three (3) years or until his successor is duly elected and qualified; and |

| | 2. | To consider and transact such other business as may properly and lawfully come before the Annual Meeting or any adjournment or postponement thereof. |

All of the foregoing is more fully set forth in the Proxy Statement accompanying this Notice.

The Board of Directors of the Company has set the close of business on February 10, 2006 as the record date for determining stockholders of the Company entitled to notice of and to vote at the Annual Meeting. A list of the stockholders as of the record date will be available for inspection by stockholders at the Company’s offices during normal business hours for a period of 10 days prior to the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. IF YOU CANNOT ATTEND THE ANNUAL MEETING, PLEASE TAKE THE TIME TO PROMPTLY SIGN, DATE AND MAIL THE ENCLOSED PROXY IN THE ENVELOPE WE HAVE PROVIDED. If you attend the Annual Meeting and decide that you want to vote in person, you may revoke your proxy.

| | |

| | By Order of the Board of Directors, |

| |

| | /s/ THOMAS L. GOUGH |

| March 16, 2006 | | Thomas L. Gough |

| Lanham, Maryland | | President |

INTEGRAL SYSTEMS, INC.

5000 Philadelphia Way

Lanham, Maryland 20706-4417

Annual Meeting of Stockholders

April 12, 2006

PROXY STATEMENT

Information Concerning Solicitation and Voting

General

The enclosed proxy is solicited on behalf of Integral Systems, Inc. (the “Company”),a Maryland corporation, for the annual meeting of stockholders of the Company (the “Annual Meeting”) to be held at 6:00 p.m. on Wednesday, April 12, 2006, at Patuxent Greens Country Club, located at 14415 Greensview Drive, Laurel, Maryland or any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting.

These proxy solicitation materials were mailed on or about March 20, 2006 to all stockholders entitled to vote at the meeting.

Record Date; Outstanding Shares

Only stockholders of record at the close of business on February 10, 2006 (the “Record Date”) are entitled to receive notice of and to vote at the Annual Meeting. The outstanding voting securities of the Company as of the Record Date consisted of10,810,697 shares of common stock of the Company, par value $.01 per share (the “Common Stock”). For information regarding holders of more than 5% of the outstanding Common Stock, see “Security Ownership of Certain Beneficial Owners and Management.”

Revocability of Proxies

The enclosed proxy is revocable at any time before its use by delivering to the Company a written notice of revocation or a duly executed proxy bearing a later date. If a stockholder who has executed and returned a proxy is present at the Annual Meeting and wishes to vote in person, he, she or it may elect to do so and thereby suspend the power of the proxy holders to vote his, her or its proxy.

Voting and Solicitation

Every stockholder of record on the Record Date is entitled, for each share of Common Stock held, to one vote on each proposal or item that comes before the meeting. All shares represented at the Annual Meeting by a proxy will be voted in accordance with the choices specified on the proxy. If no direction is given, proxies will be voted in accordance with the recommendations of the Board of Directors set forth in this Proxy Statement. One (1) Class I Director is to be elected at the Annual Meeting (Proposal 1). In the election of the Class I Director, a plurality of the votes cast at the Annual Meeting at which a quorum is present is sufficient to elect the director. Thus, each stockholder will be entitled to vote for one (1) nominee and the nominee with the greatest number of votes will be elected. Proposal 1 is proposed by the Company. Under Maryland law, there are no appraisal or dissenter’s rights with respect to any matter to be voted on at the Annual Meeting that is described herein.

1

The cost of soliciting proxies will be borne by the Company. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation materials to such beneficial owners. Proxies may also be solicited by certain of the Company’s directors, officers and regular employees, without additional compensation, personally or by telephone, telecopy or electronic mail.

Quorum; Abstentions; and Broker Non-Votes

The presence, in person or by proxy, of the holders of a majority of the shares entitled to be voted generally at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. An abstaining vote and a broker “non-vote” (a broker non-vote with respect to shares occurs if a broker or other nominee does not have discretionary authority and has not received instructions with respect to a particular item from the beneficial owner or other person entitled to vote such shares) are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum of shares exists. Abstentions and broker non-votes will not be treated as a vote cast and will not affect the outcome of the vote with respect to the election of one (1) Class I Director (Proposal 1).

Stockholder Proposals

The Amended and Restated By-laws of the Company (the “Bylaws”) provide that, to be properly brought before the annual meeting, business must be (1) specified in the notice of the annual meeting (or any supplement thereto) given by the Company pursuant to the Bylaws, (2) brought before the annual meeting by or under the direction of the board of directors (or the chairman of the board, the chief executive officer or the president), or (3) properly brought before the annual meeting by a stockholder. In addition to any other applicable requirements, for business to be properly brought before the annual meeting by a stockholder, the stockholder must have given timely notice thereof in writing to the Secretary of the Company. The Bylaws provide that nominations of persons for election to the board of directors of the Company may be made at the annual meeting, by or under the direction of the board of directors, or by any nominating committee or person appointed by the board of directors, or by any stockholder of the Company entitled to vote for the election of directors at the annual meeting who complies with the notice procedures set forth below. Such nominations, other than those made by or under the direction of the board of directors or by any nominating committee or person appointed by the board of directors, can only be made pursuant to timely notice in writing to the Secretary of the Company.

In each case, to be timely, such stockholder’s notice must be delivered to or mailed to and received by the Secretary of the Company at the principal executive offices of the Company, not earlier than the close of business on the 120th day and not later than the close of business on the 90th day prior to the date of the annual meeting. If, during the prior year the Company did not hold an annual meeting, or if the date of the annual meeting has changed more than 30 days from the first anniversary of the prior year’s annual meeting (other than as a result of adjournment), then, to be timely, such stockholder’s notice must be delivered to or mailed and received by the Secretary of the Company at the principal executive offices of the Company not earlier than the close of business on the 120th day prior to the date of the annual meeting and not later than the close of business on the later of the 90th day prior to the date of the annual meeting or the 10th day following the day on which public announcement (as described in the Company’s Bylaws) of the date of the annual meeting is first made.

Such stockholder’s notice shall set forth: (a) as to each person whom the stockholder proposes to nominate for election as a director, (1) the name, age, business address and residence address of the person, (2) the principal occupation or employment of the person, (3) the class and number of shares of the Company stock which are beneficially owned by the person, and (4) any other information relating to the person that is required to be disclosed in solicitations for proxies for election of directors pursuant to the rules and regulations under the Securities Exchange Act of 1934, as amended; (b) as to each matter the stockholder proposes to bring before the annual meeting, (1) a brief description of the business desired to be brought before the annual meeting, (2) the reasons for conducting such business at the annual

2

meeting, and (3) any material interest of the stockholder in such business; and (c) as to the stockholder giving the notice, (1) the name and address of the stockholder and (2) the class and number of shares of the Company which are beneficially owned by the stockholder. The Company may require any proposed nominee or stockholder to furnish such other information as may reasonably be required by the Company to determine the eligibility of such proposed nominee to serve as a director of the Company or the eligibility of the stockholder to bring business before the annual meeting.

Pursuant to applicable rules under the Securities Exchange Act of 1934, as amended, some stockholder proposals may be eligible for inclusion in the Company’s 2007 Proxy Statement and proxy card. Any such stockholder proposals must be submitted in writing to the Secretary of the Company no later than November 20, 2006. Stockholders interested in submitting such a proposal are advised to contact knowledgeable counsel with regard to the detailed requirements of such securities rules. Any such stockholder proposal should be addressed to the Company’s Secretary, Elaine M. Brown, and delivered to the Company’s principal executive offices at 5000 Philadelphia Way, Lanham, Maryland 20706-4417. It is suggested that proposals be forwarded by certified mail, return receipt requested.

If a stockholder intends to present a stockholder proposal at the 2007 annual meeting in a manner other than by the inclusion of the proposal in the Company’s proxy statement and proxy relating to that meeting, unless the stockholder has timely notified the Company of such intention pursuant to the notice requirements set forth above, the proxies named by the Company may exercise their discretionary voting authority on the matter in accordance with their best judgment.

Annual Report

The Company’s Annual Report to Stockholders on Form 10-K for the fiscal year ended September 30, 2005, is included with these proxy solicitation materials.A copy of the Company’s Annual Report, including the financial statements and the financial statement schedules included therein, is also available without charge by visiting www.integ.com or upon written request to the Company at 5000 Philadelphia Way, Lanham, Maryland 20706-4417, Attn.: Elaine M. Brown, Corporate Secretary.

3

ELECTION OF DIRECTORS

(Proposal 1)

General

The Company’s Article of Restatement, as supplemented by the Company’s Articles Supplementary dated March 13, 2006, provide that the Board of Directors shall be divided into three (3) classes. At each annual meeting of the stockholders of the Company, the successor or successors to the class of directors whose term expires at that meeting are elected to hold office for a term continuing until the annual meeting of stockholders held in the third year following the year of their election or until their successors are elected and qualify. The power to fix the number of directors by resolution and to fill any vacancies on the Board of Directors for the remainder of the full term of the class of directors in which the vacancy occurred and until a successor is elected and qualifies is vested in the Board of Directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the Board of Directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board of Directors previously fixed the number of directors at six (6), and the Board is presently composed of six (6) members. There are currently two (2) Class I Directors, which is the class of directors whose term of office expires in 2006. Bonnie K. Wachtel and Mark Funston are the Company’s Class I Directors. Ms. Wachtel has declined to stand for re-election to the Board of Directors. The Board of Directors presently intends to reduce the size of the Board to five (5) members and simultaneously reduce the authorized number of Class I Directors to one (1). As a result, only one (1) Class I Director is to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote all of the proxies received by them for the Company’s one (1) nominee. The one (1) nominee nominated for election as a Class I Director at the Annual Meeting is Mark Funston (the “Nominee”). As noted above, the Nominee is currently a Class I Director of the Company. In the event that the Nominee shall become unavailable, the proxy holders will vote in their discretion for a substitute nominee. It is not expected that the Nominee will be unavailable.

Because the Board of Directors presently intends to reduce the size of the Board to five (5) members and simultaneously reduce the authorized number of Class I Directors to one (1), only one (1) Class I Director is to be elected at the Annual Meeting, and therefore the Company has fewer nominees named than the number of Class I Directors previously fixed by our Board of Directors. Stockholders may not vote for a greater number of persons than the number of nominees named.

Officers are elected by the Board of Directors. Each officer holds office until his or her successor is elected or appointed and qualified or until his or her earlier resignation or removal.

The Company’s current Class II Directors are Thomas L. Gough and R. Doss McComas, and their term will expire at the annual meeting of stockholders in 2007 or when their successors are elected and qualify. The Company’s current Class III Directors are Steven R. Chamberlain and Dominic A. Laiti, and their term will expire at the annual meeting of stockholders in 2008 or when their successors are elected and qualify. If elected at the Annual Meeting, the Nominee would serve until the 2009 annual meeting of stockholders or until his successor is elected and has qualified.

4

The Board of Directors Unanimously Recommends

That Stockholders Vote “FOR” the Nominee

Set forth below is certain information regarding the directors (including the Nominee) and executive officers of the Company.

| | | | |

Directors and Executive Officers: | | Age | | Position |

Steven R. Chamberlain | | 50 | | Chairman of the Board, Chief Executive Officer and Director |

Thomas L. Gough | | 57 | | President and Director |

Peter J. Gaffney | | 46 | | Chief Operating Officer, Executive Vice President, Government Division |

Elaine M. Brown | | 42 | | Executive Vice President, Chief Financial Officer, Secretary and Treasurer |

Stuart C. Daughtridge | | 42 | | Executive Vice President, Commercial Division |

Patrick R. Woods | | 50 | | Executive Vice President, Business Development |

Dominic A. Laiti | | 74 | | Outside Director |

R. Doss McComas | | 52 | | Outside Director |

Bonnie K. Wachtel | | 50 | | Outside Director |

Mark Funston | | 46 | | Outside Director |

Steven R. Chamberlain, 50, a Company founder, has been Chief Executive Officer and Chairman of the Board since June 1992 and a Director since 1982. He served as President from May 1988 until June 1992 and as Vice President from 1982 until he became President. From 1978 to 1982, Mr. Chamberlain was employed by OAO Corporation where he progressed from Systems Analyst to Manager of the Offutt Air Force Base field support office. Mr. Chamberlain holds a B.S. degree in Physics from Memphis State University and has done graduate work in Physics and Mathematics at Memphis State and the University of Maryland. Mr. Chamberlain has been indicted by a Howard County, Maryland, grand jury on two felonies, sexual abuse of a minor and third degree sex offense. The indictment occurred after Mr. Chamberlain requested that a jury decide his case. The two misdemeanor charges against Mr. Chamberlain in the District Court for Howard County, Maryland, previously reported by the Company have been dropped. A trial date has not yet been scheduled. Mr. Chamberlain maintains his innocence and has stated that he will vigorously fight the charges.

Thomas L. Gough, 57, became a member of the Company’s staff in January 1984. In March 1996, he was elected to the Board of Directors of the Company. He has served as President of the Company since June 1992. He served as Chief Operating Officer from June 1992 until August 2005. For three years before being named President, Mr. Gough served as Vice President and Chief Financial Officer. Prior to joining the Company, Mr. Gough was employed by Business and Technological Systems, Inc., where he managed the Software Systems Division. From 1972 to 1977, he was employed by Computer Sciences Corporation, where he progressed from Programmer Analyst to Section Manager. Mr. Gough earned a B.S. degree from the University of Maryland with a major in Information Systems Management in the School of Business and Public Administration.

5

Peter J. Gaffney, 46, joined the Company in 1986. He has served as Chief Operating Officer and Executive Vice President, Government Division since August 2005. He served as Executive Vice President, Commercial Products from April 2002 until August 2005. From February 2000 until April 2002, Mr. Gaffney served as Vice President, Commercial Products. From May 1999 until February 2000, he served as Vice President, Commercial Division. In 1992, he became a project manager for EPOCH 2000 ground systems programs, which included the Command and Range Generator project for GE Americom, the Loral Skynet Telstar 3, 4, and 5 ground systems, and the Echostar 1, 2, 3, and 4 ground systems. From 1986 to 1992, he worked on simulators for the Company’s DMSP and Tiros programs. Prior to joining Integral Systems, Mr. Gaffney was a design engineer for the General Electric Co., where he worked on the DSCS, Milstar, Landsat, and Spot satellite programs. Mr. Gaffney graduated from the University of Maryland in 1981 with a B.S. degree in Electrical Engineering.

Elaine M. Brown, 42, joined the Company in 1983. Ms. Brown has served as Chief Financial Officer since March 1997 and as Executive Vice President since April 2002. In February 2000, she was appointed Secretary and Treasurer. She served as Staff Accountant/Personnel Administrator until January 1995, when she was promoted to Controller/Director of Accounting. In March 1997, Ms. Brown was appointed Vice President. She holds a B.S. degree in Accounting from the University of Maryland and is a Certified Public Accountant.

Stuart C. Daughtridge,42, joined Integral Systems in January 1999. In October 2004, Mr. Daughtridge was promoted to Executive Vice President of the Commercial Division. In February 2000, he was appointed Vice President of the Commercial Division. From January 1999 to February 2000, he was a senior program manager for the Orion 1, 2 and 3 and New Skies Satellite programs. Prior to joining Integral Systems, Mr. Daughtridge worked in several management positions in the spacecraft engineering and satellite operations division of Orion Satellite Corporation (which later became part of Loral). His last position at Orion was Director of Satellite Operations. From 1990 to 1992, he worked at INTELSAT in spacecraft engineering and satellite operations for the INTELSAT-K spacecraft and the INTELSAT V, VI and VII series of satellites. From 1986 to 1990, he worked for Contel (which later became part of GTE) as a spacecraft engineer for NASA’s Tracking and Data Relay Satellite System. Mr. Daughtridge graduated from Lafayette College in 1986 with a B.S. degree in electrical engineering.

Patrick R. Woods, 50, joined the Company in 1995 as Director of Program Development. He has served as Executive Vice President, Business Development since August 2005, and he served as Executive Vice President, Government Programs from April 2002 until August 2005. Prior to becoming Executive Vice President, Mr. Woods served as Vice President of Government Programs from April 1998 until April 2002. From 1996 to April 1998, Mr. Woods served as Vice President, NOAA Programs. From 1994 to 1995, he worked for Space Systems/Loral (SS/L), and from 1985 to 1994, he worked for the Lockheed Martin Corporation (formerly Loral Aerospace). Mr. Woods served as the Director of Mission Operations for both SS/L and the AeroSys Division of Loral Aerospace. Mr. Woods holds a B.S. degree in Public Administration and an M.P.A. in Public Management from Indiana University.

Dominic A. Laiti,74, has served as an outside director of the Company since July 1995. Mr. Laiti presently provides independent consulting services to several companies. He was founder, President and Director of Globalink, Inc. (an AMX company) from January 1990 to December 1994. He has over 30 years of experience in starting, building, and managing high-technology private and public companies with annual revenues from $2 million to over $120 million. Mr. Laiti was President of Hadron, Inc. from 1979 to 1989; Vice President of Xonics, Inc. from 1972 to 1979; and Vice President of KMS Industries from 1968 to 1972. He is a Director of Pantheon Software Inc.

R. Doss McComas, 52, has served as an outside director of the Company since July 1995. He is Vice President of TECORE Wireless Systems, Inc., a supplier of cellular protocol based wireless systems. Previously he was President of LynxConnect and Cybercommunitys, Chairman of Plexsys International, President of Fortel Technologies, Inc., and held positions with COMSAT RSI and Radation Systems, Inc.,

6

including Group Vice President, Vice President of Acquisitions, Strategic Planning and International Marketing, and General Counsel. Mr. McComas was previously a Board member of AirNet Communcations Corp. (NASDAQ: ANCC), a supplier of software defined radios for cellular and special applications. He holds a B.A. degree from Virginia Polytechnic Institute; an M.B.A. from Mt. Saint Mary’s; and a J.D. from Gonzaga University.

Bonnie K. Wachtel, 50, has served as an outside director of the Company since May 1988. Since 1984, she has been Vice President, General Counsel, and a Director of Wachtel & Co., Inc., an investment-banking firm in Washington, DC. Ms. Wachtel serves as a Director of several corporations, including VSE Corporation and Information Analysis, Inc. She holds a B.A. and M.B.A. from the University of Chicago and a J.D. from the University of Virginia, and is a Certified Financial Analyst.

Mark D. Funston,46,was appointed as an outside director of the Company on March 13, 2006. Mr. Funston is the interim CFO of Digital Harbor, Inc. a software company serving both the government and financial services markets. Mr. Funston was Chief Financial Officer of Group 1 Software from 1996 to 2004 and Vice President of Finance and Chief Financial Officer of COMSAT RSI, Inc. (formerly Radiation Systems, Inc.) from 1989 to 1996. Mr. Funston has significant financial experience and expertise, including experience in both buy-side and sell-side mergers and acquisitions. Mr. Funston holds a B. S. degree in Accounting from Virginia Polytechnic Institute and State University and he became a Certified Public Accountant in 1982.

7

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s officers and directors, and persons who own more than 10% of the Company’s Common Stock, to file reports of ownership and changes in ownership of the Company’s Common Stock with the Securities and Exchange Commission and Nasdaq. Based on a review of the copies of such reports, the Company believes that during the fiscal year ending September 30, 2005, its executive officers, directors and greater than ten percent stockholders filed on a timely basis all reports due under Section 16(a) of the Exchange Act, with the following exceptions: Stuart C. Daughtridge, an executive officer of the Company, inadvertently filed late a Form 4 for December 2004, reporting one transaction; and Bonnie K. Wachtel, an outside Director of the Company, inadvertently filed late a Form 4 for May 2005, reporting one transaction.

Board of Directors and Committees

The Board of Directors met eight times in the fiscal year ended September 30, 2005. Each of the Company’s incumbent directors attended at least 75% of all meetings of the Board of Directors, each of the Board members attended the 2005 annual meeting of stockholders, and each of the Company’s incumbent directors who was a member of a committee attended at least 75% of all meetings of the committee. The Company has three standing committees: an Audit Committee, a Stock Option Committee and a Compensation Committee.

On November 2, 2005, the Board of Directors formed a Special Committee to review, evaluate and investigate (1) the charges filed against Mr. Chamberlain in the District Court for Howard County, Maryland and (2) certain corporate governance issues raised by Bonnie K. Wachtel. The Board of Directors appointed Dominic M. Laiti and R. Doss McComas, both of whom the Board of Directors has determined to be independent directors, to serve as members of the Special Committee.

The Audit Committee met four times in the fiscal year ended September 30, 2005. The Stock Option Committee met one time and the Compensation Committee met one time in the fiscal year ended September 30, 2005. The Audit Committee and Stock Option Committee meetings were held concurrently with the meetings of the Board of Directors while the Compensation Committee meetings were held telephonically. The Board of Directors has adopted a charter for the Audit Committee, a copy of which is available on the Company’s website at www.integ.com.

Dominic A. Laiti, R. Doss McComas, Bonnie K. Wachtel and Mark Funston have been determined by the Board of Directors to be independent in accordance with the applicable rules of the Nasdaq National Market. The Board of Directors has determined that Bonnie Wachtel and Mark Funston are currently the “audit committee financial experts” as defined in Item 401 of Regulation S-K under the Securities Exchange Act of 1934, as amended.

The Audit Committee, Compensation Committee and Stock Option Committee are comprised of Dominic A. Laiti, R. Doss McComas, Bonnie Wachtel and Mark Funston, each a non-employee outside director.

The Stock Option Committee administers the Company’s 2002 Stock Option Plan. The Audit Committee, which was established in accordance with Section 3(a)(58)(A) of the Exchange Act, engages independent public accountants, reviews with the independent public accountants the plan and results of the audit engagement, reviews the independence of the Company’s public accountants, considers the range of audit and non-audit fees and reviews the adequacy of the Company’s internal accounting controls. For more information regarding the Audit Committee, see “Audit Committee Report.” Effective February 2005, the Compensation Committee determines the salary and bonus for the Chief Executive Officer and the other officers of the Company. See “Compensation Committee Report.”

8

The Company does not currently have a Nominating Committee, nor does it have a charter for a Nominating Committee. The Board of Directors, including a majority of the directors who are “independent” as defined in the Nasdaq listing standards, believes that a formal Nominating Committee is not necessary since it can adequately perform the functions of the Nominating Committee. The Board of Directors, including the independent directors, select the nominee(s) for election to the Board and may consider any and all factors that it deems to be relevant in connection with such selection of nominee(s). Such factors may or may not include, among others, the following: relevant business and industry experience; level of education; business acumen; understanding of the Company’s business and industry; strategic thinking and willingness to share ideas; network of contacts; and diversity of experiences, expertise and backgrounds among Board members. The Company does not have a formal policy for consideration of director candidates recommended for selection as a nominee for election to the Board by the Company’s stockholders other than that the Board will evaluate stockholder-recommended candidates using the same criteria as internally generated candidates.

Stockholder Communications with the Board of Directors

Any stockholder who wishes to communicate directly with the Board of Directors should do so in writing, addressed to R. Doss McComas at Cybercommunitys Inc., P.O. Box 1136, Front Royal, VA 22630. These communications will not be screened by management prior to receipt by the Board of Directors.

Code of Ethical Conduct

The Board of Directors has adopted a written code of ethical conduct, a copy of which is available on the Company’s website at www.integ.com. The Company requires all directors, officers and employees to adhere to this code in addressing the legal and ethical issues encountered in conducting their work. The code requires avoidance of conflicts of interest, compliance with all laws and other legal requirements, conduct of business in an honest and ethical manner, integrity and actions in the Company’s best interest. Directors, officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the code. The Sarbanes-Oxley Act of 2002 requires companies to have procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Company currently has such procedures in place.

Director’s Declination To Stand For Re-Election

The Board of Directors of the Company has received written correspondence from Bonnie K. Wachtel, a member of the Company’s Board of Directors, regarding Ms. Wachtel’s decision not to stand for re-election to the Board of Directors and the circumstances and date thereof. Copies of such written correspondence, which are exhibits to the Company’s Current Report on Form 8-K filed by the Company with the Securities and Exchange Commission on January 10, 2006, are attached hereto as Attachment A. The Company disagrees with the contents of such written correspondence.

9

Director Compensation

Directors who are employees of the Company do not receive any compensation for their service as directors. During the past year, the Company paid each director who is not an employee of the Company (other than Mr. Funston, who became a member of the Board of Directors on March 13, 2006) an aggregate of $18,500 per year for their services, which amount was paid in equal quarterly installments. Prior to August 2005, outside directors were also annually granted options to purchase 5,000 shares of the Company’s Common Stock pursuant to the then current stock option plan. No option shares were granted to directors in the fiscal year ending September 30, 2005.

In February 2006, the Compensation Committee elected to compensate outside directors an aggregate of $20,000 per year for their services, which amount will be paid in equal quarterly installments. At the same time, outside directors were also granted options to purchase 5,000 shares of the Company’s Common Stock pursuant to the stock option plan.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of February 10, 2006, by (i) each person known by the Company to beneficially own more than five percent of the outstanding shares of Common Stock, (ii) the Nominee and each current director and executive officer of the Company and (iii) all current executive officers and directors as a group. Except as indicated, the persons named in the table have sole voting and investment power with respect to all shares beneficially owned. Except as indicated, the address of each of the persons named in the table is that of the Company’s principal executive offices.

| | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Owner | | | Percent of

Class | |

Five Percent Stockholders: Mellon HBV Alternative Strategies L.L.C. 200 Park Avenue, 54th Floor New York, NY 10166-3399 | | 1,286,400 | | | 11.9 | % |

| | |

Royce & Associates L.L.C. 1414 Avenue of the Americas, 9th Floor New York, N.Y. 10019-2578 | | 1,033,495 | | | 9.6 | % |

| | |

Ashford Capital Management, Inc. 1 Walkers Mill Road Wilmington, DE 19807-2317 | | 808,600 | | | 7.5 | % |

| | |

Wachovia Securities 901 East Byrd Street Richmond, VA 23219-4047 | | 626,419 | | | 5.8 | % |

| | |

Executive Officers, Directors and Nominee: | | | | | | |

Steven R. Chamberlain | | 446,405 | (1) | | 4.3 | % |

Thomas L. Gough | | 187,600 | (2) | | 1.8 | % |

Peter J. Gaffney | | 54,000 | (3) | | | * |

Elaine M. Brown | | 45,400 | (4) | | | * |

Patrick Woods | | 50,046 | (5) | | | * |

Stuart C. Daughtridge | | 23,100 | (6) | | | * |

Dominic A. Laiti

12525 Knoll Brook Drive

Clifton, VA 22024 | | 25,000 | (7) | | | * |

R. Doss McComas

409 Biggs Drive

Front Royal, VA 22630 | | 25,000 | (8) | | | * |

10

| | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Owner | | | Percent of

Class | |

Bonnie K. Wachtel

1101 Fourteenth Street, N.W.

Suite 800

Washington, D.C. 20036 | | 73,000 | (9) | | | * |

Mark D. Funston

13401 Esworthy Road

North Potomac, MD 20878 | | 0 | | | 0 | |

All Directors and Executive Officers as a group

(9 persons). | | 929,551 | | | 8.34 | % |

| * | Less than one percent of the Common Stock outstanding. |

| (1) | Includes outstanding options to purchase 61,000 shares of Common Stock which are exercisable within 60 days. |

| (2) | Includes outstanding options to purchase 45,000 shares of Common Stock which are exercisable within 60 days. |

| (3) | Includes outstanding options to purchase 50,000 shares of Common Stock which are exercisable within 60 days. |

| (4) | Includes outstanding options to purchase 37,000 shares of Common Stock which are exercisable within 60 days. |

| (5) | Includes outstanding options to purchase 45,000 shares of Common Stock which are exercisable within 60 days. |

| (6) | Includes outstanding options to purchase 20,000 shares of Common Stock which are exercisable within 60 days. |

| (7) | Includes outstanding options to purchase 25,000 shares of Common Stock which are exercisable within 60 days. |

| (8) | Includes outstanding options to purchase 25,000 shares of Common Stock which are exercisable within 60 days. |

| (9) | Includes outstanding options to purchase 25,000 shares of Common Stock which are exercisable within 60 days. |

11

Executive Compensation

The following table sets forth compensation received by the Company’s CEO and four highest paid executive officers who were serving as executive officers of the Company at the end of fiscal year 2005 and who earned over $100,000 during the fiscal year ended September 30, 2005.

Summary Compensation Table

| | | | | | | | | | | | | |

Name and Principal Position | | Year | | Annual Compensation | | Long-Term

Compensation

Awards | | All Other Compensation (1) |

| | | Salary | | Bonus | | Number of Shares Underlying Options | |

Chief Executive Officer Steven R. Chamberlain | | 2005

2004

2003 | | $

$

$ | 299,960

288,532

272,263 | | $

$

$ | 60,000

60,000

50,000 | | 0

10,000

15,000 | | $

$

$ | 23,100

23,332

23,223 |

President Thomas L. Gough | | 2005

2004

2003 | | $

$

$ | 235,345

223,682

216,047 | | $

$

$ | 50,000

35,000

35,000 | | 0

6,000

10,000 | | $

$

$ | 23,505

24,264

22,012 |

Chief Operating Officer, Exec. Vice Pres., Government Programs Peter J. Gaffney | | 2005

2004

2003 | | $

$

$ | 208,150

197,808

180,305 | | $

$

$ | 65,000

45,000

35,000 | | 0

18,000

10,000 | | $

$

$ | 22,859

21,595

18,187 |

Exec. Vice Pres. Commercial Division Stuart Daughtridge | | 2005

2004

2003 | | $

$

$ | 197,988

185,856

170,586 | | $

$

$ | 55,000

35,000

15,000 | | 0

6,000

4,000 | | $

$

$ | 21,746

20,087

17,113 |

Exec. Vice Pres. Chief Financial Officer Elaine.M. Brown | | 2005

2004

2003 | | $

$

$ | 195,180

197,808

180,305 | | $

$

$ | 60,000

45,000

35,000 | | 0

6,000

10,000 | | $

$

$ | 21,432

21,501

18,353 |

| (1) | All Other Compensation represents employer pension contributions. It does not include the value of insurance premiums paid by or on behalf of the Company with respect to term life insurance for the benefit of each identified individual in the amounts of $598, $689, and $747 for fiscal years 2005, 2004, and 2003, respectively. |

Option/SAR Grants in Last Fiscal Year

No stock option/SAR grants otherwise reportable pursuant to Item 402(c) of Regulation S-K under the Securities Exchange Act of 1934, as amended, were made during the fiscal year ended September 30, 2005 to any of the named executive officers.

12

Fiscal Year 2005 Stock Option Exercises and Fiscal Year-End Option Values

Four of the five executive officers named below exercised options during the fiscal year ended September 30, 2005.

Steven R. Chamberlain exercised 20,000 Incentive Stock Options. Peter J. Gaffney exercised 23,000 Incentive Stock Options. Elaine M. Brown exercised 10,000 Incentive Stock Options. Stuart C. Daughtridge exercised 1,000 Incentive Stock Options.

| | | | | | | | | |

Name | | Shares Acquired

on Exercise (#) | | Value

Realized | | Number of

Securities Underlying

Unexercised Options/

SARS at FY end (#)

Exercisable/

Unexercisable | | Value of

Unexercised

In-the-Money

Options/ SARS

at FY end ($)1

Exercisable/

Unexercisable |

Chief Executive Officer Steven R. Chamberlain | | 20,000 | | $ | 401,977 | | 61,000

(exercisable)

0

(unexercisable) | | $83,380

(exercisable)

$0

(unexercisable) |

President Thomas L. Gough | | — | | $ | 0 | | 45,000

(exercisable)

0

(unexercisable) | | $69,700

(exercisable)

$0

(unexercisable) |

COO, Executive Vice President, Government Programs Peter J. Gaffney | | 23,000 | | $ | 454,825 | | 50,000

(exercisable)

0

(unexercisable) | | $82,300

(exercisable)

$0

(unexercisable) |

Executive Vice President, Chief Financial Officer Elaine M. Brown | | 10,000 | | $ | 198,331 | | 37,000

(exercisable)

0

(unexercisable) | | $48,580

(exercisable)

$0

(unexercisable) |

Executive Vice President, Commercial Division Stuart Daughtridge | | 1,000 | | $ | 19,450 | | 20,000

(exercisable)

0

(unexercisable) | | $32,700

(exercisable)

$0

(unexercisable) |

| (1) | Value for “In the Money” options represents the difference between the exercise prices of outstanding options and the fair market value of the Company’s common stock of $20.64 per share at September 30, 2005. |

Performance Graph

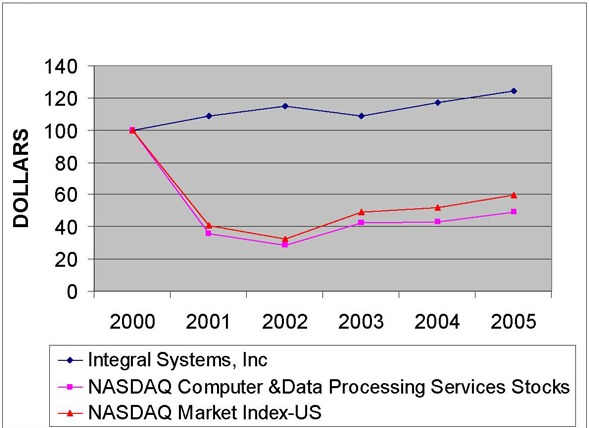

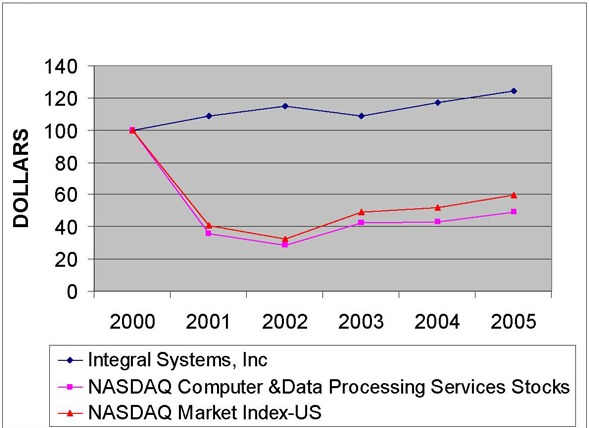

The following graph shows a comparison of the total return to stockholders of an investment in the Company’s Common Stock, the NASDAQ Computer & Data Processing Services Stock Index and the NASDAQ Composite Stock Market Index (US). The graph assumes $100 was invested in the Company’s Common Stock, the NASDAQ Computer & Data Processing Services Stock Index and the NASDAQ Composite Stock Market (US) on September 30, 2000 through September 30, 2005.

13

Total stockholder return in each case is calculated assuming reinvestment of all dividends. Note that historical stock price performance of the Company is not necessarily indicative of any future stock price performance.

| | | | | | | | | | | | |

| | | Sep-00 | | Sep-01 | | Sep-02 | | Sep-03 | | Sep-04 | | Sep-05 |

Integral Systems, Inc | | 100.00 | | 108.51 | | 114.95 | | 108.69 | | 117.35 | | 124.15 |

NASDAQ Computer &Data | | 100.00 | | 35.87 | | 28.20 | | 42.30 | | 42.91 | | 49.19 |

Processing Services Stocks | | | | | | | | | | | | |

NASDAQ Market Index-US | | 100.00 | | 40.86 | | 32.18 | | 49.03 | | 52.09 | | 59.45 |

Employment Agreements

There are no employment agreements in effect with respect to any directors, the Nominee or executive officers of the Company. However, the Compensation Committee is considering employment agreements for certain executive officers and other key personnel and may retain an independent consultant to assist with the process.

Compensation Pursuant to Plans

The Company’s Board of Directors awards annual bonuses to officers and employees on a discretionary basis. In fiscal year 2005, no formal plan existed for determining bonus amounts.

Effective October 1, 1987, the Company established a 401(k) pension and profit sharing plan (the “Plan”) under Section 401 of the Internal Revenue Code. Under the Plan, the Company currently, annually contributes a discretionary amount equal to 11% of eligible employee’s salary. The employee may contribute up to an additional 25% as salary deferral up to statutory limitations.

14

Compensation Committee Interlocks and Insider Participation

The Compensation Committee was, during fiscal year 2005, made up of Dominic A. Laiti, R. Doss McComas and Bonnie K. Wachtel, each of whom is an outside non-employee director. Mark Funston, who is an outside non-employee director, was appointed to the Board of Directors and Compensation Committee on March 13, 2006.

Compensation Committee Report

The Compensation Committee’s goals with respect to executive officers, including the chief executive officer, are to provide compensation sufficient to attract, motivate and retain executives of outstanding ability and potential, and to establish and maintain an appropriate relationship between executive compensation and the creation of shareholder value. When determining adjustments to an individual’s compensation package, the Compensation Committee evaluates the importance to stockholders of that person’s continued service.

The executive officers’ compensation structure consists of (1) base salary, (2) cash bonus and (3) stock options.

Base Salary.Salaries for the fiscal year ended September 30, 2005 were set based on the above factors and after review of industry comparables. The Company’s philosophy is to maintain executive base salary at a competitive level sufficient to recruit individuals possessing the skills and values necessary to achieve the Company’s vision and mission over the long term. Each individual’s base salary is determined by the Compensation Committee after considering a variety of factors that make up market value and prospective value to the Company, including the knowledge, experience and accomplishments of the individual, the individual’s level of responsibility, and the typical compensation levels for individuals with similar credentials. The Compensation Committee may, considering the advice of Company management, change the salary of an individual on the basis of its judgment for any reason, including the performance of the individual or the Company, changes in responsibility and changes in the market for executives with similar credentials. Determinations of appropriate base salary levels and other compensation elements are generally made through consideration of a variety of industry surveys and studies, as well as by monitoring developments in relevant industries.

Cash Bonus.Bonuses for the fiscal year ended September 30, 2005 were awarded for accomplishments during such fiscal year. Bonuses were determined by the Compensation Committee with advice from Company management, based upon the Committee’s assessment of the individual’s contributions toward Company goals and objectives. In addition, the committee reviewed and considered industry comparables. The Committee also considered that no stock options were granted to executive management during fiscal year 2005 and therefore bonuses were relatively higher in fiscal year 2005 than in fiscal year 2004.

Stock Options.Stock options have been a fundamental element in the Company’s executive compensation program because they emphasize long-term Company performance, as measured by creation of stockholder value, and foster a commonality of interest between stockholders and employees. In determining the size of an option grant to an executive officer, the Compensation Committee considers competitive factors, changes in responsibility and the executive officer’s achievement of individual goals. The Company generally has awarded options to officers upon the commencement of employment and at regular intervals, but other awards may be made as well. Options granted to employees have generally vested over periods ranging from one to five years after grant. Despite the benefits, no stock option awards were granted to executive officers during fiscal year 2005. However, the Compensation Committee may elect to grant stock options to executive officers in the future.

15

Compensation of the Chief Executive Officer

Mr. Chamberlain’s 2005 compensation consisted of base salary and cash bonus award. The Committee used the criteria discussed above in determining each of these elements consistent with the method used for determining the other executive officers compensation. Mr. Chamberlain’s base salary was set at an annual rate of $301,746, an increase of 4% over the prior year’s salary.

The Committee awarded Mr. Chamberlain a fiscal year 2005 bonus in the amount of $60,000. The bonus amount was arrived at after the Committee discussed management’s bonus recommendation with the Board of Directors and discussed the methodology used to arrive at the bonus amount. The Committee also took into consideration its own analysis of the CEO’s performance along with the overall performance of the Company in making its determination.

Submitted by members of the Compensation Committee:

Dominic A. Laiti

R. Doss McComas

Bonnie K. Wachtel

Audit Committee Report

The Audit Committee of the Board of Directors consists of Dominic A. Laiti, R. Doss McComas, Bonnie K. Wachtel and Mark Funston, all of whom are outside non-employee directors. Each of these members of the Audit Committee is considered independent as defined under the applicable National Association of Securities Dealers’ listing standards governing the qualification of Audit Committee members. The duties and responsibilities of the Audit Committee are laid out in a written charter, which was adopted by the Board of Directors on June 14, 2000, as amended and restated on February 4, 2004.

The Audit Committee has reviewed and discussed the Company’s audited financial statements for the fiscal year ended September 30, 2005 with management and with Grant Thornton LLP, the Company’s independent auditors for fiscal 2005. The Audit Committee has discussed with Grant Thornton the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU § 380) relating to the conduct of the audit. The Audit Committee has received the written disclosures and the letter from Grant Thornton required by Independence Standards Board No. 1 (Independence Standards Board Standard No. 1, Independence Discussions with Audit Committee) and has discussed with Grant Thornton their independence. Based on the review of the audited financial statements and the discussions and review with management and Grant Thornton mentioned above, the Audit Committee recommended to the Board of Directors that the audited financial statements for fiscal year ended September 30, 2005 be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2005, for filing with the Securities and Exchange Commission.

Submitted by the members of the Audit Committee:

Dominic A. Laiti

R. Doss McComas

Bonnie K. Wachtel

Termination of Employment and Change of Control Termination

The Company has no employment contracts and no compensatory plan or arrangement with respect to any individual named in the Summary Compensation Table which results or will result from the resignation, retirement or any other termination of such individual’s employment with the Company or its subsidiaries or from a change in control of the Company or a change in the individual’s responsibilities following a change in control. However, the Compensation Committee is considering employment agreements for certain executive officers and other key personnel and may retain an independent consultant to assist with the process.

16

Certain Relationships and Related Transactions

On October 1, 2002, the Company acquired all of the issued and outstanding stock of RT Logic pursuant to the Reorganization Agreement for an initial purchase price payable to the shareholders of RT Logic of $13.25 million in cash and 683,870 shares of Integral Systems common stock, par value $0.01 per share. Pursuant to the terms of the Reorganization Agreement with RT Logic, in November 2002, the former shareholders of RT Logic subsequently received additional aggregate consideration equal to $500,000 in cash and 25,806 shares of Integral Common Stock.

The Reorganization Agreement further provides that the former RT Logic shareholders will be entitled to receive contingent purchase price, which will be payable in accordance with the Reorganization Agreement in the event that RT Logic’s business meets certain earnings performance targets during a period of up to four (4) years following the merger. Fifty percent (50%) of any contingent purchase price will be payable in cash and fifty percent (50%) thereof will be payable in shares of the Company’s common stock. Any of the Company’s common stock issued in connection with the contingent purchase price will be valued based on a 30-trading-day average leading up to the end of each applicable earn out period. The contingent purchase price is subject to claims by the Company under the indemnification provisions of the Reorganization Agreement. For the year ended September 30, 2003 and pursuant to the Reorganization Agreement, in January 2004 the former shareholders of RT Logic received additional consideration of $3.8 million in cash and 209,926 shares of the Company’s common stock. For the year ended September 30, 2004 and pursuant to the Reorganization Agreement, in January 2005, the former shareholders of RT Logic received additional consideration of $4.2 million in cash and 230,349 shares of the Company’s common stock. For the year ended September 30, 2005 and pursuant to the Reorganization Agreement, in January 2006, the former shareholders of RT Logic received additional consideration of $3.8 million in cash and 171,396 shares of the Company’s common stock. This represents the final payment relating to the contingent purchase price in accordance with the Reorganization Agreement.

Patrick R. Woods, Executive Vice President, Business Development, of the Company, served as an independent director of RT Logic from June 26, 2000 until the consummation of the acquisition of RT Logic by the Company and held approximately 0.3% of the outstanding shares of RT Logic common stock at the effective time of such acquisition.

Principal Auditor Fees and Services

The following is a summary of the fees recorded by the Company in fiscal years 2005 and 2004 for professional services rendered by Grant Thornton LLP.

| | | | | | |

Fee Category | | Fiscal 2005 | | Fiscal 2004 |

Audit Fees | | $ | 261,000 | | $ | 90,000 |

Audit-Related Fees | | | 40,000 | | | 30,000 |

Tax Fees | | | 28,000 | | | 32,000 |

All Other Fees | | | 6,000 | | | 4,000 |

Total Fees | | $ | 335,000 | | $ | 156,000 |

The following is a summary of fees recorded by the Company in fiscal years 2005 and 2004 for professional services rendered by Ernst & Young LLP. The audit fees billed by Ernst & Young in fiscal year 2004 pertain to the audit of the Company’s financial statements for fiscal year 2003.

| | | | | | |

Fee Category | | Fiscal 2005 | | Fiscal 2004 |

Audit Fees | | $ | 0 | | $ | 108,000 |

Audit-Related Fees | | | 22,000 | | | 15,000 |

Tax Fees | | | 0 | | | 0 |

All Other Fees | | | 0 | | | 0 |

Total Fees | | $ | 22,000 | | $ | 123,000 |

17

Audit Fees: Audit fees consist of the aggregate fees billed for professional services rendered for the audit of the Company’s annual financial statements, the audit of management’s assessment of its internal controls, review of the interim financial statements included in the Company’s quarterly reports on Form 10-Q, and services that are normally provided by an auditor in connection with statutory and regulatory filings.

Audit-Related Fees: Audit-related fees represent professional services rendered for assurance and related services that are reasonably related to the audit of the Company’s annual financial statements for the 2005 and 2004 fiscal years and the review of the financial statements included in the Company’s quarterly reports on Form 10-Q for the 2005 and 2004 fiscal years. These services included the review of Form S-3, employee benefit plan audits, and consultations concerning financial accounting and reporting standards and transactions.

Tax Fees: Tax fees consists of the aggregate fees billed for professional services rendered for tax compliance, tax advice and tax planning.

All Other Fees: Consists of fees billed for professional services, other than the services reported as “Audit Fees”, “Audit –Related Fees”, or “Tax Fees”.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

In accordance with the Company’s Audit Committee Charter, the Audit Committee approves in advance any and all audit services, including audit engagement fees and terms, and non-audit services provided to the Company by the independent auditors (subject to the de minimus exception for non-audit services contained in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934, as amended), all as required by applicable law or listing standards. The independent auditors and the Company’s management are required to periodically report to the Audit Committee the extent of services provided by the independent auditors and the fees associated with these services.

Change in Independent Auditors

As reported in the Company’s Current Report on Form 8-K filed on January 6, 2004 with the Securities and Exchange Commission (the “Company’s January 2004 8-K”), on December 30, 2003, the Company dismissed Ernst & Young LLP as its independent auditors and notified Ernst & Young LLP (“Ernst & Young”) of their dismissal. On December 30, 2003, the Company engaged Grant Thornton LLP (“Grant Thornton”) as the Company’s independent auditors to audit the Company’s financial statements for the fiscal year 2004. Each of the dismissal of Ernst & Young and the engagement of Grant Thornton was recommended and approved by the Audit Committee of the Board of Directors of the Company on December 30, 2003.

As reported in the Company’s January 2004 8-K, Ernst & Young’s audit reports on the Company’s consolidated financial statements for the fiscal years ended September 30, 2003 and 2002 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

As reported in the Company’s January 2004 8-K, during the Company’s fiscal years ended September 30, 2003 and 2002 and the subsequent interim period preceding the date of Ernst & Young’s dismissal, there were no “disagreements”, as that term is defined in Item 304(a) of Regulation S-K and the related instructions, with Ernst & Young on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which, if not resolved to the satisfaction of Ernst &

18

Young, would have caused Ernst & Young to make reference to the matter in their report. During the Company’s fiscal years ended September 30, 2003 and 2002 and the subsequent interim period preceding the date of Ernst & Young’s dismissal, there were no “reportable events”, as that term is defined in Item 304(a) of Regulation S-K.

As reported in the Company’s January 2004 8-K, on December 30, 2003, the Company engaged Grant Thornton as the Company’s independent auditors to audit the Company’s financial statements for fiscal year 2004. During the Company’s fiscal years ended September 30, 2003 and 2002 and the subsequent interim period preceding the engagement of Grant Thornton, the Company did not (nor did someone on the Company’s behalf) consult Grant Thornton regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements; or (ii) any matter that was either the subject of a “disagreement,” as that term is defined in Item 304(a) of Regulation S-K and the related instructions, or a “reportable event,” as that term is defined in Item 304(a) of Regulation S-K and the related instructions.

As reported in the Company’s Current Report on Form 8-K filed on January 23, 2006 with the Securities and Exchange Commission (the “Company’s January 23, 2006 8-K”), on January 17, 2006, the Company was notified by Grant Thornton that Grant Thornton resigned as the Company’s independent auditors.

As reported in the Company’s January 23, 2006 8-K, Grant Thornton’s audit reports on the Company’s consolidated financial statements for the fiscal years ended September 30, 2004 and 2005 did not contain an adverse opinion or a disclaimer of opinion and were not qualified or modified as to uncertainty, audit scope or accounting principles.

As reported in the Company’s January 23, 2006 8-K, during the Company’s fiscal years ended September 30, 2004 and 2005 and the subsequent interim period preceding the date of Grant Thornton’s resignation, there were no “disagreements,” as that term is defined in Item 304(a) of Regulation S-K and the instructions related thereto, with Grant Thornton on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedures, which disagreement(s), if not resolved to the satisfaction of Grant Thornton, would have caused Grant Thornton to make reference to the subject matter of the disagreement(s) in connection with its report.

As reported in the Company’s January 23, 2006 8-K, during the Company’s fiscal years ended September 30, 2004 and 2005 and the subsequent interim period preceding the date of Grant Thornton’s resignation, there were no “reportable events,” as that term is defined in Item 304(a)(1)(v) of Regulation S-K and the instructions related thereto.

As reported in the Company’s Current Report on Form 8-K filed on February 3, 2006 with the Securities and Exchange Commission (the “Company’s February 2006 8-K”), on February 1, 2006, the Company has selected and engaged Bernstein & Pinchuk LLP (“Bernstein & Pinchuk”) as the Company’s independent auditors to audit the Company’s books and records for fiscal year 2006. The engagement of Bernstein & Pinchuk was recommended and approved by the Audit Committee of the Company on February 1, 2006.

As reported in the Company’s February 2006 8-K, during the Company’s fiscal years ended September 30, 2004 and 2005 and the subsequent interim period prior to the engagement of Bernstein & Pinchuk, the Company has not (nor has someone on the Company’s behalf) consulted Bernstein & Pinchuk regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and either a written report was provided to the Company or oral advice was provided that Bernstein & Pinchuk concluded was an important factor considered by the Company as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a

19

“disagreement,” as that term is defined in Item 304 of Regulation S-K and the instructions related thereto, or a “reportable event,” as that term is defined in Item 304 of Regulation S-K and the instructions related thereto.

A representative of Bernstein & Pinchuk is expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from stockholders. A representative of Grant Thornton is not expected to be present at the Annual Meeting. A representative of Ernst & Young is not expected to be present at the Annual Meeting.

20

OTHER MATTERS

There is no reason to believe that any other business will be presented at the Annual Meeting or any adjournment or postponement therefore; however, if any other business should properly and lawfully come before the Annual Meeting, the proxies will vote in accordance with their best judgment in such matters pursuant to discretionary authority granted in the proxy.

| | |

| | BY ORDER OF THE BOARD OF DIRECTORS |

| |

| | /s/ Thomas L. Gough |

| March 16, 2006 | | Thomas L. Gough |

| Lanham, Maryland | | President |

21

ATTACHMENT A

A-1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):January 9, 2006

INTEGRAL SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| | | | |

| Maryland | | 0-18603 | | 52-1267968 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

5000 Philadelphia Way, Lanham, Maryland 20706-4417

| | |

| (Address of principal executive offices) (ZIP Code) |

Registrant’s telephone number, including area code:(301) 731-4233

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 5 – Corporate Governance and Management

| Item 5.02. | Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers. |

The Board of Directors (the “Board of Directors”) of Integral Systems, Inc., a Maryland corporation, has received written correspondence from Bonnie K. Wachtel, a member of the Integral Systems Board of Directors, regarding Ms. Wachtel’s decision not to stand for re-election to the Board of Directors and the circumstances and date thereof. Copies of such written correspondence are attached to this Current Report on Form 8-K as exhibits hereto.

The Company disagrees with the contents of Ms. Wachtel’s written correspondence attached to this Current Report on Form 8-K as exhibits hereto.

Ms. Wachtel, who has served as a director of the Company since May 1988, is serving as a member of the Audit Committee and the Compensation Committee. She has also been identified in the Company’s periodic filings with the SEC as the Audit Committee’s financial expert.

No later than the day that the Company files this Current Report on Form 8-K with the Securities and Exchange Commission (the “SEC”), the Company will provide Ms. Wachtel with a copy of the disclosures that it is making herein and inform her that she has the opportunity to furnish the Company as promptly as possible with a letter addressed to the Company stating whether she agrees with the statements made by the Company herein and, if not, stating the respects in which she does not agree. Any such letter received by the Company from Ms. Wachtel will be filed with the SEC as an exhibit by an amendment to this Current Report on Form 8-K within two business days after receipt thereof by the Company.

Section 9 – Financial Statements and Exhibits

| Item 9.01. | Financial Statements and Exhibits. |

(c) Exhibits

Exhibit Description

99.1 Letter dated January 9, 2006 from Bonnie K. Wachtel to the Board of Directors of the Company

99.2 Letter dated January 4, 2006 from Bonnie K. Wachtel to the Board of Directors of the Company

99.3 Letter captioned “DRAFT – Undated/Unsigned”

99.4 Letter captioned “DRAFT – Undated/Unsigned”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

| INTEGRAL SYSTEMS, INC. |

| |

| By: | | /s/ Thomas L. Gough |

| | | Thomas L. Gough President |

EXHIBIT INDEX

| | |

Exhibit Number

| | Description

|

| |

| 99.1 | | Letter dated January 9, 2006 from Bonnie K. Wachtel to the Board of Directors of the Company |

| |

| 99.2 | | Letter dated January 4, 2006 from Bonnie K. Wachtel to the Board of Directors of the Company |

| |

| 99.3 | | Letter captioned “DRAFT – Undated/Unsigned” |

| |

| 99.4 | | Letter captioned “DRAFT – Undated/Unsigned” |

Exhibit 99.1

| | | | | | |

| | | | | | | Bonnie K. Wachtel |

| | | | | | | 1101 Fourteenth St., NW |

| | | | | | | Washington, DC 20005 |

| | | | | | | 202-898-1144 |

January 9, 2006

Board of Directors

Integral Systems, Inc.

Gentlemen:

Please accept this letter as formal communication that I decline to stand for re-election to the Board of Directors of Integral Systems. After much consideration, I do not agree with my fellow directors that Integral should continue as an independent company. I am fully aware of the firm’s potential, and indeed because of that potential, believe that the interests of shareholders would best be served by retaining an investment banker to evaluate the company for sale. As a secondary alternative, I encourage the Board to actively recruit substantial shareholders to serve as directors, and hope this letter may encourage participation by qualified readers who fit this description.

My decision is based on a variety of financial and corporate governance concerns, highlighted by the recently announced criminal charges against the company’s talented CEO, Steven R. Chamberlain. Let me emphasize that, in my opinion, the financial and governance concerns are related, and were it not for this belief, I would not be elaborating the latter concerns. Both issues have the same source and must be addressed with the same focus: the leadership of the firm’s CEO. Because these concerns are well known to the Board, the balance of this letter will be directed to shareholders.

By way of background, I have served on this Board for seventeen years, since my family-owned securities firm managed the company’s initial public offering in 1988. I am an experienced professional investor and corporate director, and hold degrees in finance (MBA, University of Chicago) and law (JD, University of Virginia) and am a Certified Financial Analyst. For several years, I have served as the de facto Chairman of the company’s Audit Committee, and as a named financial expert in SEC filings. I have never had a personal relationship with any member of the company’s management, although several have maintained accounts at my firm.

In addition, I own approximately one million dollars worth of Integral stock, exclusive of options which I received as a director, and have held a substantial portion of these shares in excess of ten years. To the best of my knowledge, I am the only outside director who owns — or has ever owned — a single share of company stock.

1

Financial Concerns

Let’s begin with consideration of financial issues, which have periodically created tension in the Boardroom, and form the backdrop of the corporate governance issues arising this year.

The company’s financial results for the past three years have been unusual and merit careful consideration by any serious investor. The vast majority of earnings have come from the RT Logic subsidiary, which was acquired in late 2002. During this period, RT Logic has operated under a contract formula, agreed in connection with its acquisition, which in practice has provided that one hundred percent of its pretax earnings have been paid to the former shareholders (principally current management) of RT Logic. In accounting terms, this means that a dollar of retained earnings from RT Logic did not result in cash or tangible assets on Integral’s balance sheet, but in a dollar of goodwill. In economic terms, this produced the paradoxical result that the better RT’s earnings — and they have vastly exceeded expectations since 2002 — the more Integral paid for the firm.

In fiscal 2006, RT Logic’s earn-out period will have ended, and the firm may well continue to grow or at least maintain the profitability of prior years. That is certainly my hope. Avid students of business and human nature, however, may contemplate another possibility. Because of the implicit question (are recent earnings sustainable) I have considered the RT Logic results through last year to be low quality earnings, or at least of lower quality than if they had been obtained through another part of the company. Of course, all of this has been fully disclosed through the financial statements and elsewhere, and interested investors can evaluate the facts and decide for themselves.

Not so open to question, however, are the earnings of the balance of Integral, which have been deeply disappointing. These results are due in part to a weak commercial satellite market; however, the company has also experienced surprising and substantial losses in other subsidiaries and divisions, litigation losses, and profitability issues on government contracts. These are the parts of the company – not RT Logic – which have been the principal focus of Mr. Chamberlain and his team. Unless these results are improved, shareholders will not receive the return they should demand and expect.

Finally, the Lumistar acquisition, announced in October 2005, follows the same outline as RT Logic. Serious students of Integral will be interested to note the component of any growth in earnings arising from Lumistar (which carries the temporary but supercharged incentive of the earn-out) as opposed to the core business, other RT Logic or interest on cash reserves.

Corporate Governance Concerns

Against the backdrop of these unusual financial results, recent corporate governance developments have been dramatic. These events began in March 2005, when I received an unusual telephone call from Mr. Chamberlain, in which I was invited to resign (my

2

interpretation) based on a wide-ranging critique of my personality, Board contributions, the services of my firm, and my penchant for talking to employees. In my opinion, this call was inappropriate and unwarranted. It is also my opinion that Mr. Chamberlain has a highly unusual personality, which merits more attention by shareholders and the Board.

After initially defending me, in mid-August the above invitation was joined by Integral’s two other outside directors, Messrs. Laiti and McComas, on the grounds that I lacked management support. I deeply disagree with the judgment of my colleagues in this action, where an effort to obtain harmony with a difficult CEO was used to justify shielding that gentleman from his best informed shareholder critic. Moreover, had I left silently as was suggested, it would mean that any outspoken director could be targeted by the management team, backed up by the rest of the Board who apparently place an absence of friction above several other corporate governance values.

Ironically, a few days after the second of these conversations, I verified the information, recently reported to shareholders, that Mr. Chamberlain had been criminally charged with sexual misconduct involving a young teenage girl. The charging statement, which recounts in graphic detail allegations regarding a course of conduct over several months at Mr. Chamberlain’s home, is a publicly available document. According to this record, formal charges were preferred in early June 2005 as a result of an investigation that began in November 2004. Mr. Chamberlain is scheduled for trial on January 20, 2006.

After I obtained this information (which resulted in its being circulated to the other directors) investigation revealed that Mr. Chamberlain had informed his senior staff of developments in this matter on an ongoing basis, while withholding the facts from the Board. Further investigation revealed that Integral’s then outside counsel, DLA Piper Rudnick Gray Cary, had also not been informed. That firm is no longer counsel to Integral Systems.

I understand that Mr. Chamberlain and his management team originally took the position that the criminal charges were purely personal, and determined to withhold the information for that reason. At the time that Mr. Chamberlain made this decision, he had been the CEO of a public company — a U.S. Government contractor — for more than twelve years.

On October 11, 2005, I circulated a confidential draft memorandum to the Audit Committee (Messrs. Laiti and McComas) pulling together my concerns regarding the company’s financial results, the criminal charges, withholding of information and several other Board issues and requested that the concerns be addressed. The memorandum requested that the outside directors stop deferring to Mr. Chamberlain, but did not ask that he resign. The memorandum provided three alternatives: (l) that all five directors and management work together to solve the problems; (2) that the company be sold; or (3) that these concerns be reflected to shareholders.

Among the concerns noted in this memorandum was the presence of Gary Prince in a position not formally disclosed in SEC filings. Mr. Prince is a full-time employee (not an officer) who ranks as the second or third most highly compensated person at the company, and attends every Board meeting, as do most of senior staff. Mr. Prince was convicted of a felony involving

3