UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary proxy statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive proxy statement |

| ¨ | Definitive additional materials |

| ¨ | Soliciting material pursuant to 240.14a-12 |

INTEGRAL SYSTEMS, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

INTEGRAL SYSTEMS, INC.

5000 Philadelphia Way

Lanham, Maryland 20706-4417

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 26, 2009

TO THE STOCKHOLDERS OF INTEGRAL SYSTEMS, INC.:

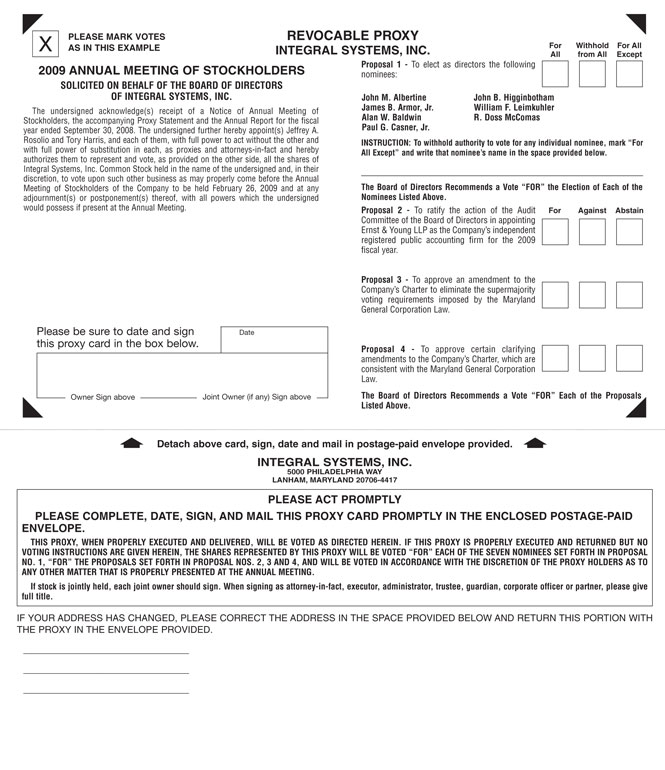

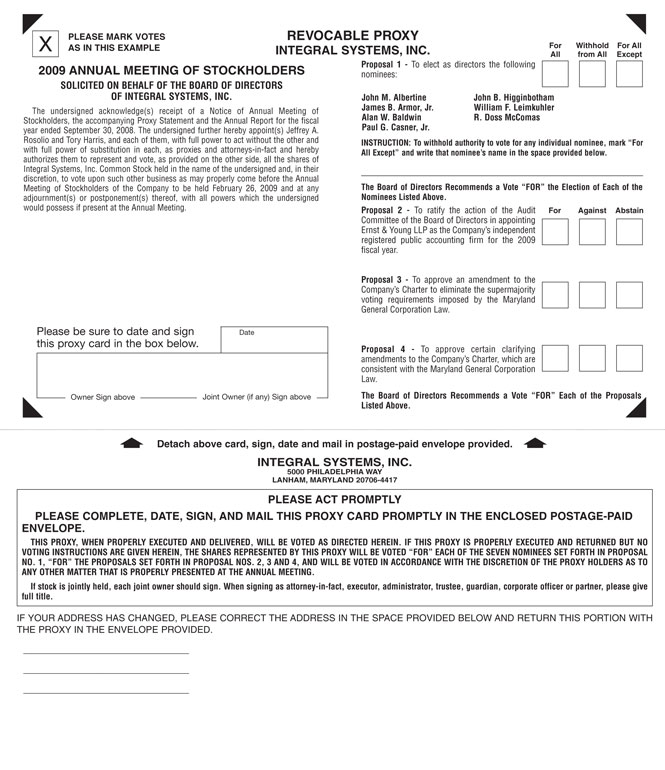

NOTICE IS HEREBY GIVEN that the 2009 Annual Meeting of Stockholders (the “Annual Meeting”) of Integral Systems, Inc., a Maryland corporation (the “Company”), will be held at the Company’s offices located at 5000 Philadelphia Way, Lanham, Maryland, at 10:00 a.m., on February 26, 2009, for the following purposes:

| | 1. | To elect seven directors to serve on the Board of Directors until the next annual meeting of stockholders and until their successors are duly elected and qualified; |

| | 2. | To ratify the action of the Audit Committee of the Board of Directors in appointing Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2009 fiscal year; |

| | 3. | To approve an amendment to the Company’s charter to eliminate the supermajority voting requirements imposed by the Maryland General Corporation Law; |

| | 4. | To approve certain clarifying amendments to the Company’s charter; and |

| | 5. | To transact such other business as may properly come before the Annual Meeting. |

All of the foregoing is more fully set forth in the Proxy Statement accompanying this Notice.

The Board of Directors of the Company has set the close of business on December 19, 2008 as the record date for determining stockholders of the Company entitled to notice of and to vote at the Annual Meeting and any adjournment or postponement thereof. A list of the stockholders as of the record date will be available for inspection by stockholders, for any purpose germane to the Annual Meeting, at the Company’s offices or the offices of Registrar & Transfer Co., the Company’s transfer agent, during normal business hours for a period of ten (10) days prior to the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person.REGARDLESS OF WHETHER YOU PLAN ON ATTENDING THE ANNUAL MEETING, PLEASE TAKE THE TIME TO PROMPTLY VOTE YOUR PROXY BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD.

|

| By Order of the Board of Directors, |

|

|

|

John B. Higginbotham |

Chief Executive Officer and President |

January 21, 2009

Lanham, Maryland

INTEGRAL SYSTEMS, INC.

2009 ANNUAL MEETING OF STOCKHOLDERS

TABLE OF CONTENTS

INTEGRAL SYSTEMS, INC.

5000 Philadelphia Way

Lanham, Maryland 20706-4417

PROXY STATEMENT

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON

THURSDAY, FEBRUARY 26, 2009

Integral Systems, Inc.’s Notice of Annual Meeting and Proxy Statement, Annual Report

and other proxy materials are available at http://www.cfpproxy.com/3409.

The Board of Directors (the “Board of Directors” or the “Board”) of Integral Systems, Inc., a Maryland corporation (the “Company”, “we”, “us” or “our”), solicits your proxy for the 2009 Annual Meeting of Stockholders of the Company (the “Annual Meeting”), to be held at 10:00 a.m. on Thursday, February 26, 2009, at the Company’s offices located at 5000 Philadelphia Way, Lanham, Maryland, and any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting.

These proxy solicitation materials were first distributed on or about January 21, 2009 to all stockholders entitled to vote at the Annual Meeting.

INFORMATION CONCERNING SOLICITATION AND VOTING

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters described in the accompanying Notice of Annual Meeting of Stockholders. These actions include: the election of seven directors; ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2009 fiscal year; approval of an amendment to the charter of the Company (the “Charter”) to eliminate the supermajority voting requirements imposed by the Maryland General Corporation Law; approval of certain clarifying amendments to the Charter; and any other matter properly presented. In addition, our management will report on the Company’s performance during fiscal 2008 and respond to questions from stockholders.

Who is entitled to vote?

Only stockholders of record at the close of business on the record date, December 19, 2008, are entitled to receive notice of and to vote at the Annual Meeting, and any postponement or adjournment of the Annual Meeting. Each outstanding share of the Company’s common stock, par value $0.01 per share (the “Common Stock”), entitles its holder to cast one vote with respect to each nominee for director and one vote on each other matter to be voted upon.

Who can attend the Annual Meeting?

All stockholders of record at the close of business on the record date, or their duly appointed proxies, may attend the Annual Meeting.

1

What constitutes a quorum?

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock outstanding on the record date and entitled to vote will constitute a quorum. A quorum is required for business to be conducted at the Annual Meeting. As of the December 19, 2008 record date, 17,250,334 shares of our Common Stock were outstanding and entitled to vote. If you submit a properly executed proxy card, even if you abstain from voting, then you will be considered part of the quorum. Similarly, “broker non-votes” (described below) will be counted in determining whether there is a quorum.

How do I vote?

You may vote either by casting your vote in person at the Annual Meeting, or by marking, signing and dating each proxy card you receive and returning it in the prepaid envelope. If you hold your shares in “street name” through a broker or other nominee, you may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided by that institution.

What does the Board of Directors recommend?

The recommendations of the Board of Directors are set forth after the description of each item in this proxy statement. In summary, the Board recommends a vote:

| | • | | “FOR” election of the seven (7) director nominees (see Proposal No. 1); |

| | • | | “FOR” ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2009 fiscal year (see Proposal No. 2); |

| | • | | “FOR” approval of the Charter amendment to eliminate the supermajority voting requirements imposed by the Maryland General Corporation Law (see Proposal No. 3); and |

| | • | | “FOR” approval of certain clarifying amendments to the Charter (see Proposal No. 4). |

How will my shares be voted?

Your shares will be voted as you indicate on the proxy card. If you return your signed proxy card but do not mark the boxes indicating how you wish to vote, your shares will be voted: “FOR” election of the seven (7) director nominees; “FOR” ratification of the Audit Committee��s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2009 fiscal year; “FOR” approval of the Charter amendment to eliminate the supermajority voting requirements imposed by the Maryland General Corporation Law; and “FOR” approval of certain clarifying amendments to the Charter. Your shares will be voted in accordance with the discretion of the proxy holders as to any other matter that is properly presented.

If you hold your shares in “street name” through a broker or other nominee, your broker or nominee may not be permitted to exercise voting discretion on some of the items to be acted upon. Thus, if you do not give your broker or nominee specific instructions, your shares may not be voted on those items and will not be counted in determining the number of shares necessary for approval for each item. A broker non-vote with respect to shares occurs if a broker or other nominee does not have discretionary authority and has not received instructions with respect to a particular item from the beneficial owner or other person entitled to vote such shares.

Can I change my vote or revoke my proxy after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised at the Annual Meeting. Regardless of the way in which you submitted your original proxy, you may change it by:

| | • | | returning a later-dated signed proxy card; |

2

| | • | | delivering a written notice of revocation to the Company at 5000 Philadelphia Way, Lanham, Maryland 20706-4417, Attn.: Jeffrey A. Rosolio, Secretary; or |

| | • | | attending the Annual Meeting and voting in person. |

If your shares are held through a broker or other nominee, you will need to contact that institution if you wish to change your voting instructions.

What vote is required to approve each proposal?

For Proposal No. 1, election of the directors, a plurality of the votes cast at the Annual Meeting at which a quorum is present is sufficient to elect each director. Thus, each stockholder will be entitled to vote “FOR” seven (7) nominees, and the seven (7) nominees with the greatest number of votes will be elected. Abstentions and broker non-votes (which may occur if a beneficial owner of Common Stock whose shares are held in a brokerage or bank account fails to provide the broker or bank with voting instructions as to such shares of Common Stock) will have no effect on the election of directors.

For Proposal No. 2, ratification of the Audit Committee’s appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2009 fiscal year, the affirmative vote of a majority of the votes cast at the Annual Meeting at which a quorum is present will be required for approval. Abstentions and broker non-votes are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum exists. Abstentions and broker non-votes will not be treated as votes cast and will not affect the outcome of the vote with respect to Proposal No. 2.

For each of Proposal No. 3 (approval of the Charter amendment to eliminate the supermajority voting requirements imposed by the Maryland General Corporation Law) and Proposal No. 4 (approval of certain clarifying amendments to the Charter), the affirmative vote of two-thirds of all the votes entitled to be cast on the matter at the Annual Meeting at which a quorum is present will be required for approval. Therefore, abstentions and broker non-votes effectively count as votes against Proposal No. 3 and Proposal No. 4.

Who will count the vote?

Representatives of Registrar & Transfer Co., our independent stock transfer agent, will count the votes and act as the inspector of election.

Who paid for the cost of this proxy solicitation?

The Company paid for this proxy solicitation, and we have retained D.F. King & Co., Inc. to solicit proxies for a fee of $12,500 plus a reasonable amount to cover expenses. We also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. Proxies will be solicited by mail, telephone, or other means of communication. Our directors, officers and regular employees who are not specifically employed for proxy solicitation purposes and who will not receive any additional compensation for such activities also may solicit proxies.

3

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board of Directors has adopted Corporate Governance Guidelines that meet or exceed the NASDAQ Stock Market, Inc. (“NASDAQ”) Listing Standards. As described in the Corporate Governance Guidelines, the Board of Directors makes an affirmative determination regarding the independence of each director annually. An “independent” director is a director who meets the NASDAQ definition of independence, as determined by the Board. The full text of the Corporate Governance Guidelines can be found in the Corporate Governance section of the Company’s website (www.integ.com/CorporateGovernance). A copy also may be obtained upon request to the Company at 5000 Philadelphia Way, Lanham, Maryland 20706-4417, Attn.: Jeffrey A. Rosolio, Secretary.

Director Independence

The Board of Directors undertook its annual review of director independence in December 2008, and in the process reviewed the independence of each director nominee. The purpose of these reviews was to determine whether any of the director nominees had relationships or transactions that were inconsistent with a determination that the nominee is independent. During these reviews, transactions and relationships between each director or any member of his or her immediate family and the Company and its subsidiaries were considered.

Based on the NASDAQ Listing Standards, the Board affirmatively determined that Dr. Albertine, General Armor, Mr. Casner, Mr. Leimkuhler and Mr. McComas is each an independent director. Mr. Baldwin and Mr. Higginbotham are considered inside directors, and therefore not independent, as a result of their employment by the Company during the 2008 fiscal year. Previously, the Board also had affirmatively determined that William F. Harley III (who served as a director from February 2006 to February 2008) was independent of the Company and its management.

Meetings of the Board of Directors; Attendance at Annual Meetings

The Board of Directors met 14 times in the fiscal year ended September 30, 2008. Each of the Company’s incumbent directors attended at least 75% of the aggregate number of meetings of the Board of Directors and the committees on which he served during the time he served as a director or a member of any committee. The Company encourages all directors to attend each Annual Meeting. With the exception of Mr. Leimkuhler, each of the current Board members who was a member of the Board at the time of the 2008 Annual Meeting of Stockholders attended the 2008 Annual Meeting.

4

Committees of the Board

The Board of Directors has five standing committees: an Audit Committee; a Nominating Committee; a Compensation Committee; a Strategic Growth Committee; and a Special Committee to handle the SEC investigation/NASDAQ inquiry, described in Item 3 (Legal Proceedings) in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2008. The Board has adopted a written charter for each of the Audit, Nominating and Compensation Committees, and those charters are available on the Corporate Governance section of the Company’s website (www.integ.com/CorporateGovernance). Copies of the committee charters also may be obtained upon request to the Company at 5000 Philadelphia Way, Lanham, Maryland 20706-4417, Attn.: Jeffrey A. Rosolio, Secretary. The members of the Board’s current committees are identified in the following table:

| | | | | | | | | | |

Director | | Audit

Committee | | Compensation

Committee | | Nominating

Committee | | Strategic Growth

Committee | | Special Committee

(SEC Investigation/

NASDAQ

Inquiry) |

John M. Albertine | | — | | X | | X | | X | | X |

James B. Armor, Jr. | | — | | — | | — | | X | | — |

Alan W. Baldwin | | — | | — | | — | | — | | — |

Paul G. Casner, Jr. | | X | | Chair | | Chair | | X | | X |

John B. Higginbotham | | — | | — | | — | | — | | — |

William F. Leimkuhler | | Chair | | X | | X | | X | | Chair |

R. Doss McComas | | X | | X | | — | | Chair | | X |

Audit Committee.The Audit Committee’s responsibilities include: selecting, evaluating, appointing, replacing and overseeing the services of the Company’s independent registered public accounting firm; pre-approving the terms of all audit services, and any permissible non-audit services, to be provided by the Company’s independent registered public accounting firm; evaluating the independent registered public accounting firm’s qualifications and independence, including considering whether any circumstance, including the performance of any permissible non-audit services, would impair the independence of the Company’s independent registered public accounting firm; overseeing the accounting, reporting, and financial practices of the Company and its subsidiaries, including the integrity of the Company’s financial statements; overseeing the Company’s internal control environment and compliance with legal and regulatory requirements; and overseeing the performance of the Company’s internal audit function and independent registered public accounting firm.

The Board of Directors has determined that the members of the Audit Committee are independent as defined in the NASDAQ Listing Standards and applicable rules of the U.S. Securities and Exchange Commission (“SEC”). In addition, the members of the Committee meet additional, heightened independence criteria that apply to audit committee members under the NASDAQ Listing Standards. The Audit Committee met six times during fiscal 2008. There is unrestricted access between the Audit Committee and the independent registered public accounting firm. The Board of Directors has determined that William F. Leimkuhler is an “audit committee financial expert,” as defined in SEC rules as a result of his service on various audit committees and his years working as an investment banker, which required him to analyze and evaluate the financial statements of numerous public companies.

Compensation Committee.The Compensation Committee’s responsibilities include reviewing and approving corporate goals and objectives relevant to the compensation of the Chief Executive Officer, evaluating the Chief Executive Officer’s performance in light of those goals and objectives, recommending to the independent directors the Chief Executive Officer’s compensation level based on this evaluation, recommending to the Board the compensation of other executive officers based upon the recommendation of the Chief Executive Officer, reviewing the compensation of directors for service on the Board and its committees and recommending changes in compensation to directors, and administering the Company’s equity incentive-based and equity-based compensation plans that are subject to the Board’s approval.

5

The Board of Directors has determined that the members of the Committee are independent as defined in the NASDAQ Listing Standards. The members of the Compensation Committee also are “outside directors” for purposes of Section 162(m) of the Internal Revenue Code. The Compensation Committee met seven times during fiscal 2008. For additional information regarding the processes and procedures used by the Compensation Committee, please see the section entitled “Compensation Discussion and Analysis” below.

Nominating Committee.The Nominating Committee’s responsibilities include identifying qualified individuals to become directors of the Company, recommending to the Board of Directors qualified director nominee(s) for election at annual meetings and special meetings of stockholders and persons to be considered to fill any Board vacancy and any newly created directorship, and recommending to the Board membership on the Audit Committee. The Board has determined that the members of the Nominating Committee are independent as defined in the NASDAQ Listing Standards. The Nominating Committee met four times during fiscal 2008.

Strategic Growth Committee.The Strategic Growth Committee’s responsibilities include overseeing the development and pursuit of the strategic plans and goals of the Company.

Special Committee (SEC Investigation/NASDAQ Inquiry). The Special Committee is composed of independent directors, and the Committee is responsible for supervising the Company’s responses to an investigation by the SEC and the related NASDAQ inquiry. For more information on the investigation and the inquiry, please see Item 3 (Legal Proceedings) in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2008.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is or has been an officer or employee of the Company, and no interlocking relationship exists between the Board of Directors or Compensation Committee and the board of directors or compensation committee of any other company.

Selection of Director Nominees

The Nominating Committee will consider candidates for Board membership suggested by its members and other Board members, as well as by management and stockholders. The Nominating Committee does not have a formal policy for consideration of director candidates recommended by the Company’s stockholders, because the Board has adopted Corporate Governance Guidelines that state that stockholder-recommended candidates will be evaluated using the same criteria as internally generated candidates. You may recommend any person for consideration as a director nominee by writing to the Nominating Committee of the Board of Directors, c/o Integral Systems, Inc., 5000 Philadelphia Way, Lanham, Maryland 20706-4417. Recommendations must include the name and address of the stockholder making the recommendation, a representation that the stockholder is a holder of our Common Stock, biographical information about the individual recommended and any other information the stockholder believes would be helpful to the Nominating Committee in evaluating the individual recommended.

Once the Nominating Committee has identified a candidate, the Nominating Committee evaluates the candidate by considering any and all factors that it deems to be relevant. Although there are no minimum qualifications, the factors evaluated by the Nominating Committee may include, among others, the following: relevant business and industry experience; level of education; business acumen; understanding of the Company’s business and industry; strategic thinking and willingness to share ideas; network of contacts; diversity of experiences; expertise and backgrounds among Board members; and independence.

The Nominating Committee makes a recommendation to the full Board of Directors as to any persons it believes should be nominated by the Board, and the Board determines the nominees after considering the recommendation and report of the Committee. Based on the Nominating Committee’s recommendation, the Board of Directors elected General Armor as a new director in March 2008. General Armor was suggested to the Nominating Committee by an executive officer of the Company.

6

Stockholder Communications with the Board of Directors

Any stockholder who wishes to communicate directly with the Board of Directors or any member of the Board should do so in writing, addressed to John M. Albertine, Chairman of the Board of Directors, c/o Integral Systems, Inc., 5000 Philadelphia Way, Lanham, Maryland 20706-4417. These communications will not be screened by management prior to receipt by the Board of Directors.

Code of Ethical Conduct

The Board of Directors has adopted a written Code of Ethical Conduct, a copy of which is available in the Corporate Governance section of the Company’s website (www.integ.com/CorporateGovernance) or upon written request to the Company at 5000 Philadelphia Way, Lanham, Maryland 20706-4417, Attn.: Jeffrey A. Rosolio, Secretary. The Company requires all directors, officers and employees to adhere to this Code in addressing the legal and ethical issues encountered in conducting their work. The Code requires avoidance of conflicts of interest, compliance with all laws and other legal requirements, conduct of business in an honest and ethical manner, integrity and actions in the Company’s best interest. Directors, officers and employees are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code. In addition, the Sarbanes-Oxley Act of 2002 requires companies to have procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters. The Company currently has such procedures in place.

7

PROPOSALS TO BE VOTED ON

PROPOSAL NO. 1

ELECTION OF DIRECTORS

General

The current by-laws of the Company (the “Bylaws”) provide that the number of members of the Board of Directors shall consist of not less than three nor more than nine directors and that the exact number may be determined by the Board of Directors or the stockholders. The Board of Directors has determined that the current number of members of the Board of Directors shall be seven. Each director is elected for a one-year term at each annual meeting of the stockholders. Directors serve until the next annual meeting of stockholders and until their respective successors have been duly elected and qualified, or until a director’s death or retirement or until the director resigns or is removed.

A Board of Directors consisting of seven (7) directors is to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote all of the proxies received by them for the Company’s seven (7) nominees. Each of the following seven (7) directors has been nominated for election at the Annual Meeting: John M. Albertine, James B. Armor, Jr., Alan W. Baldwin, Paul G. Casner, Jr., John B. Higginbotham, William F. Leimkuhler and R. Doss McComas (each, a “Nominee,” and collectively, the “Nominees”). Each of the Nominees presently serves on our Board of Directors. We do not know of any reason why any of the Nominees would be unable to serve. However, if any of the Nominees should become unavailable to serve as a director, the Board of Directors may designate a substitute nominee or reduce the size of the Board of Directors. If the Board of Directors designates a substitute nominee, the persons named as proxies will vote “FOR” that substitute nominee.

Director Nominee Information

Set forth below is certain information regarding the Nominees. The age shown below for each Nominee is as of February 26, 2009, the date of the Annual Meeting.

| | | | |

Directors | | Age | | Position |

John M. Albertine | | 64 | | Chairman of the Board and Independent Director |

James B. Armor, Jr. | | 58 | | Independent Director |

Alan W. Baldwin | | 71 | | Director |

Paul G. Casner, Jr. | | 71 | | Independent Director |

John B. Higginbotham | | 53 | | Chief Executive Officer, President and Director |

William F. Leimkuhler | | 57 | | Independent Director |

R. Doss McComas | | 54 | | Independent Director |

John M. Albertine, 64, joined the Board of Directors on December 6, 2006 and was appointed to the position of Chairman on April 10, 2007. In 1990, Dr. Albertine founded Albertine Enterprises, Inc., a merchant banking, consulting and lobbying firm. Dr. Albertine has been the Chairman and Chief Executive Officer of Albertine Enterprises for the last 18 years and continues in that position today. From 1986 through 1990, he served as Vice Chairman of the Fruit of the Loom Company. From 1981 through 1986, he served as President of the American Business Conference. From 1979 to 1980, he served as Executive Director to the Congressional Joint Economic Committee. From 1977 through 1979, he served as Legislative Assistant to U.S. Senator Lloyd M. Bentsen. From 1969 through 1977, Dr. Albertine served as an Instructor, Assistant Professor, Associate Professor and ultimately as Chair of the Department of Economics at Mary Washington College. Dr. Albertine holds a Ph.D. in Economics from the University of Virginia and a Bachelor of Arts in Economics from King’s College. Dr. Albertine has been a director of 14 publicly traded companies in his career. Currently, Dr. Albertine is a director of Kadant Inc., a supplier of technology-based systems for the global pulp and paper industry, and Intersections, Inc., a leading global provider of consumer and corporate identity risk management services.

8

James B. Armor,Jr., 58, joined the Board of Directors on March 14, 2008. General Armor is the owner and Chief Executive Officer of The Armor Group, LLC, a position he has held since September 2007. The Armor Group, LLC is an aerospace consultant to military, intelligence, and civil government organizations and commercial and international industry specializing in space systems development, operations, strategic planning and organizational management. Previously, General Armor served as an active duty officer in the United States Air Force from May 1973 until his retirement on January 1, 2008. Most recently, General Armor served as Director of the National Security Space Office, Office of the Under Secretary of the Air Force until his retirement on January 1, 2008. Prior to this, he served as Director, Signals Intelligence Acquisition and Operations, National Reconnaissance Office, where he was responsible for U.S. intelligence satellite systems. Earlier in his career, General Armor served as the Director of the Global Positioning System, the U.S. government’s largest satellite constellation. General Armor is a trained astronaut who holds a Master of Science degree in Electrical Engineering (Electro-Optics) from AF Institute of Technology, and Bachelor of Science degrees in Electrical Engineering and Psychology from Lehigh University. General Armor also serves as a director of Navsys Corporation, a firm providing high-quality technical products and services in GPS hardware design, systems engineering, systems analysis and software design.

Alan W. Baldwin, 71, joined the Board of Directors on December 6, 2006. He served as the interim Chief Executive Officer and as President of the Company, appointed on May 31, 2007 and November 13, 2007, respectively, until July 9, 2008 and December 10, 2008, respectively. Prior to joining the Company, Mr. Baldwin served as President and Chief Operating Officer of Argosy International from May 2005 through May 2006 and as a consultant to Argosy International from June 2006 until assuming the role of interim Chief Executive Officer of the Company. Argosy International is a supplier of composite materials, specialty chemicals, technology, equipment, products and services to aerospace OEMs, airlines and overhaul and maintenance facilities located in the Far East. Mr. Baldwin served as President of Alcore Inc., a subsidiary of the M.C. Gill Company that manufactures aluminum honeycomb composite materials for the aircraft industry, from May 2001 through November 2004. During the period 1980 through 2000, Mr. Baldwin served as the Chief Executive Officer and/or President of several high technology-based companies manufacturing a range of products including optical fiber, hybrid integrated circuits and composite aircraft structures. Mr. Baldwin spent 10 years from 1969 through 1979 with TRW Electronics in Los Angeles, managing a manufacturing plant specializing in producing high-reliability semiconductor products for guidance and navigation systems for the Air Force’s Minuteman and the Navy’s Poseidon ICBM systems. After graduating from the U.S. Military Academy at West Point, New York in June 1959, Mr. Baldwin was an officer in the U.S. military at the Army’s Redstone Arsenal in Huntsville, Alabama, and the Air Force Space and Missile Systems Organization in Los Angeles, California through 1968. While in the Air Force, he played a vital role in the early research and development of laser guided missiles and smart bomb technology for both the Army and subsequently the Air Force. He also managed a subsystems program office while in the Air Force providing boost-phase guidance & control and telemetry equipment for all Atlas and Titan space launches at Cape Kennedy in Florida and Vandenberg Air Force Base in California. Mr. Baldwin received a Bachelor of Science degree from the U.S. Military Academy at West Point, New York and a Master of Science degree from the University of Alabama. Mr. Baldwin currently serves on the Board of Directors of ReGen Biologics, an orthopedic products company that develops, manufactures and markets innovative tissue growth and repair products for U.S. and global markets, and is Chairman of ReGen Biologics’ Audit Committee.

Paul G. Casner, Jr., 71, joined the Board of Directors on December 18, 2006. On April 30, 2005, Mr. Casner retired from DRS Technologies, Inc., a supplier of integrated products, services and support to military forces, intelligence agencies and prime contractors worldwide, as Executive Vice President of Operations and Chief Operating Officer. Mr. Casner had served at DRS Technologies as Executive Vice President of Operations since 1998 and Chief Operating Officer since 2000. Mr. Casner previously formed Technical Applications and Service Company (TAS) in 1991, which purchased the assets of the Norden Service Company and merged into DRS Technologies in 1993. Following the merger, Mr. Casner became President of DRS Electronic Systems, a position he held until 1994. Previously, Mr. Casner served as President and Chief Executive Officer of the Norden Service Company, a company he joined in 1984 as Vice President in Charge of

9

Maryland Operations, eventually advancing to the role of Senior Vice President of Engineering for all Norden Systems. In 1979, Mr. Casner co-founded American Computer and Electronics Corporation, where he grew the military segment of the company and led the effort to develop a Console Emulation Capability, which was used by the U.S. Navy for combat training. After graduating from Drexel University, Mr. Casner joined the staff of The Johns Hopkins Applied Physics Laboratory (APL) and advanced to the status of Principal Staff. Mr. Casner earned a Bachelor of Science degree in Electrical Engineering from Drexel University and a Master of Science degree in Management Science from The Johns Hopkins University. He is a member of the Naval Reserve Association and is a Commodore of the Navy League of the United States, in addition to other professional affiliations. Mr. Casner has more than 40 years of defense industry experience, which includes several senior positions in business management, technical management, strategic planning and business development. In addition, Mr. Casner serves on the Board of Directors of Mikros Systems Corporation, Atair Aerospace, Inc. and Aurora Flight Sciences Corporation.

John B. Higginbotham,53, was appointed as the Company’s Chief Executive Officer and as a member of the Board of Directors on July 9, 2008 and as President of the Company on December 10, 2008. Mr. Higginbotham is the Founder and Managing Member of SpaceVest LLC, an entity providing strategic and management guidance to a number of early-stage and middle market enterprises, a position he has held since 2006. Mr. Higginbotham also currently is a General Partner of SpaceVest Fund, LP, SpaceVest Partners, LP and SpaceVest GP, venture capital investment facilities that are now inactive, a position he has held since 1995. In addition, from 1997 through 2006, Mr. Higginbotham was the Founder, Chairman and Managing Director of SpaceVest affiliated private equity venture capital entities (now Redshift Ventures), managing approximately $270 million of investments in more than 50 high-technology companies. Earlier in his career, Mr. Higginbotham co-founded International Technology Underwriters (Intec), which was acquired by AXA Insurance Company, a globally recognized space and telecommunications insurance underwriting management firm. Mr. Higginbotham initiated his career with Hewlett-Packard Company as Product Manager for HP’s successful initial entry into the microcomputer marketplace. Mr. Higginbotham also serves on the Board of Directors of Protostar, Ltd., a satellite operator. He was formerly Chairman, now Director Emeritus, of the Space Foundation, a premier non-profit organization supporting space activities, space professionals and education, and Mr. Higginbotham maintains affiliations with several other industry associations. He received his Bachelor of Science degree in civil engineering from Virginia Polytechnic Institute and State University (Virginia Tech) with Honors and his Master of Business Administration from Harvard Business School.

William F. Leimkuhler,57, joined the Board of Directors on May 3, 2006. Mr. Leimkuhler is the General Counsel and Director of Business Development of Paice Corporation, a privately held developer of advanced vehicle powertrains, a position he has held since 1999. From 2004 to 2006, Mr. Leimkuhler also was a partner of Semaphore Partners LLC, based in Stamford, Connecticut. From 1994 through 1999, he held various positions with Allen & Company, initially serving as the firm’s General Counsel. Prior to that, Mr. Leimkuhler was a corporate partner with the New York law firm of Werbel & Carnelutti (which later became Heller Ehrman White & McAuliffe), a firm he joined in 1984. Mr. Leimkuhler holds a Juris Doctor from New York University and a Bachelor of Science and a Master of Science from the Massachusetts Institute of Technology. Mr. Leimkuhler serves as a director of Speedus Corp., which is engaged in healthcare and wireless telecommunications and other businesses. Prior to and since joining the Board of Speedus Corp., Mr. Leimkuhler also has performed consulting assignments for Speedus and its affiliates, including working as Chief Operating Officer of VisionStar, a start-up company with a full CONUS Ka-band slot with a plan to develop Internet and other services with a small satellite developed by Orbital Systems. Mr. Leimkuhler also serves as a director of U.S. Neurosurgical, Inc., an owner and operator of stereotactic radiosurgery centers, and Argan, Inc., which provides a range of engineering and construction services to the power industry, offers telecommunications infrastructure services and manufactures and distributes nutritional supplements.

R. Doss McComas, 54, joined the Board of Directors in July 1995 and served as Chairman of the Board from April 21, 2006 until April 10, 2007. Mr. McComas currently serves as President of IWS Communications, a business process provider to, and investor in, companies serving internet, cellular, wireless and satellite links for

10

domestic and international customers, a position he has held since December 2008. He also serves as President of Persistent Telecom, a provider of cellular, wireless and satellite links for domestic and international customers, a position he has held since March 2008. Previously, from 2005 through March 2008, Mr. McComas served as Vice President of TECORE Wireless Systems, Inc., a supplier of cellular protocol-based wireless systems. From 2000 through 2006, Mr. McComas was President of LynxConnect, an Internet service provider, and President of Cybercommunitys, a community software provider. From 1999 through 2000, he served as President of Fortel Technologies, Inc., a communications service provider. From 1995 through 1999, Mr. McComas served as Chairman of Plexsys International, a cellular telephone infrastructure provider. From 1982 through 1995, he held positions with COMSAT RSI, a satellite control and network management company, and Radiation Systems, Inc., a public satellite and wireless communications antenna provider, including Group Vice President, Vice President of Acquisitions, Strategic Planning and International Marketing and General Counsel. Mr. McComas holds a Bachelor of Arts degree from Virginia Polytechnic Institute, a Master of Business Administration from Mt. Saint Mary’s University and a Juris Doctor from Gonzaga University.

The Board of Directors unanimously recommends that stockholders vote “FOR” each of the Nominees.

11

PROPOSAL NO. 2

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

General

The Audit Committee of the Board of Directors has appointed Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2009 fiscal year. Ernst & Young LLP, a firm of registered public accountants, has served as the Company’s independent registered public accounting firm since September 19, 2008. Ernst & Young LLP will examine and report to stockholders on the consolidated financial statements of the Company and its subsidiaries.

The Board of Directors has put this proposal before the stockholders because the Board believes that seeking stockholder ratification of the Audit Committee’s appointment of the Company’s independent registered public accounting firm is good corporate practice. This vote is only advisory, because the Audit Committee has the sole authority to retain and dismiss the Company’s independent registered public accounting firm. If the appointment of Ernst & Young LLP is not ratified, the Audit Committee will evaluate the basis for the stockholders’ vote when determining whether to continue the firm’s engagement.

A representative of Ernst & Young LLP is expected to be present at the Annual Meeting, will have the opportunity to make a statement if he or she desires to do so and will be available to respond to appropriate questions from stockholders.

The Board of Directors unanimously recommends that stockholders vote “FOR” the

ratification of the Audit Committee’s appointment of Ernst & Young LLP as the

Company’s independent registered public accounting firm for the 2009 fiscal year.

Change in Independent Registered Public Accounting Firm

On September 19, 2008, the Audit Committee of the Board of Directors dismissed Bernstein & Pinchuk LLP as the independent registered public accounting firm for the Company following completion of services related to review of the Company’s financial statements for the quarter ended June 30, 2008.

The reports of Bernstein & Pinchuk LLP on the Company’s consolidated financial statements and on the effectiveness of the Company’s internal control over financial reporting and management’s assessment thereof for the years ended September 30, 2007 and September 30, 2006, did not contain an adverse opinion or a disclaimer of opinion, nor were such reports qualified or modified as to uncertainty, audit scope, or accounting principle.

During the years ended September 30, 2007 and September 30, 2006, and through September 19, 2008, there were no disagreements with Bernstein & Pinchuk LLP on any matter of accounting principle or practice, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of Bernstein & Pinchuk LLP, would have caused them to make reference thereto in their reports on the financial statements for such years.

During the years ended September 30, 2007 and September 30, 2006, and through September 19, 2008, there were no “reportable events” requiring disclosure pursuant to paragraph (a)(1)(v) of Item 304 of Regulation S-K.

The Company furnished a copy of the above disclosures, which were filed with the SEC in a Current Report on Form 8-K on September 23, 2008, to Bernstein & Pinchuk LLP and requested that Bernstein & Pinchuk LLP

12

provide a letter addressed to the SEC stating whether or not it agrees with the statements made above. A copy of Bernstein & Pinchuk’s letter, dated September 23, 2008, was filed as Exhibit 16.1 to the Current Report on Form 8-K filed by the Company on September 23, 2008.

Also on September 19, 2008, the Audit Committee, following a comprehensive evaluation process of several leading public accounting firms, engaged Ernst & Young LLP as the Company’s new independent registered public accounting firm.

The Company has not, nor has anyone on its behalf, consulted Ernst & Young LLP during the fiscal years ended September 30, 2006 and 2007 and through September 19, 2008, regarding either (1) the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on the consolidated financial statements of the Company, and no written report or oral advice was provided by Ernst & Young LLP to the Company that Ernst & Young LLP concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue, or (2) any matter that was the subject of either a disagreement, as defined in paragraph (a)(1)(iv) of Item 304 of Regulation S-K, or a reportable event, as described in paragraph (a)(1)(v) of Item 304 of Regulation S-K.

Principal Accountant Fees and Services

The following table presents aggregate fees for professional services rendered by Ernst & Young LLP during fiscal year 2008 and aggregate fees for professional services rendered by Bernstein & Pinchuk LLP during fiscal year 2007.

| | | | | | |

Fee Category | | Fiscal 2008 | | Fiscal 2007 |

Audit fees | | $ | 2,525,000 | | $ | 211,004 |

Audit-related fees | | | 0 | | | 12,000 |

Tax fees | | | 0 | | | 0 |

All other fees | | | 0 | | | 0 |

Total fees | | $

| 2,525,000

| | $ | 223,004 |

Audit Fees.Audit fees consisted of the aggregate fees billed for professional services rendered for the audit of the Company’s annual financial statements, the audit of management’s assessment of its internal controls, review of the interim financial statements included in the Company’s quarterly reports on Form 10-Q, and services that are normally provided by an auditor in connection with statutory and regulatory filings.

Audit-Related Fees.Audit-related fees represented professional services rendered for assurance and related services that are reasonably related to the audit of the Company’s annual financial statements for the 2008 and 2007 fiscal years and the review of the financial statements included in the Company’s quarterly reports on Form 10-Q for the 2008 and 2007 fiscal years. These services included the review of a Registration Statement of the Company on Form S-3 and related amendments, employee benefit plan audits, and consultations concerning financial accounting and reporting standards and transactions.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

In accordance with the Company’s Audit Committee charter, the Audit Committee approves in advance any and all audit services, including audit engagement fees and terms, and non-audit services provided to the Company by its independent registered public accounting firm (subject to thede minimis exception for non-audit services contained in Section 10A(i)(1)(B) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)), all as required by applicable law or listing standards. The independent registered public accounting firm and the Company’s management are required to periodically report to the Audit Committee the extent of services provided by the independent registered public accounting firm and the fees associated with these services.

13

Audit Committee Report

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements, the reporting process and maintaining an effective system of internal controls over financial reporting. The Company’s independent registered public accounting firm is engaged to audit and express opinions on the conformity of the Company’s financial statements to accounting principles generally accepted in the United States, management’s assessment of the Company’s internal controls over financial reporting and the effectiveness of the Company’s internal controls over financial reporting.

In this context, the Audit Committee has reviewed and discussed the audited financial statements with management. The Audit Committee has discussed with Ernst & Young LLP the matters required to be discussed by the Statement on Accounting Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1, AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committee has received the written disclosures and the letter from Ernst & Young LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding Ernst & Young LLP’s communications with the Audit Committee concerning independence, and has discussed with Ernst & Young LLP their independence.

Relying on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended September 30, 2008, for filing with the SEC.

Submitted by the members of the Audit Committee:

William F. Leimkuhler, Chairman

Paul G. Casner, Jr.

R. Doss McComas

14

PROPOSAL NO. 3

PROPOSAL TO APPROVE AN AMENDMENT TO THE CHARTER TO

ELIMINATE THE SUPERMAJORITY VOTING REQUIREMENTS IMPOSED

BY THE MARYLAND GENERAL CORPORATION LAW

Our Board of Directors, in its continuing review of the Company’s corporate governance practices, has concluded that it is advisable and in the best interests of the Company’s stockholders to amend the Charter to add a provision eliminating “supermajority voting” requirements imposed by the Maryland General Corporation Law (the “MGCL”) and to request approval by the Company’s stockholders of such amendment.

The MGCL imposes a supermajority stockholder voting requirement for approval of material amendments to a company’s charter and for certain extraordinary transactions (such as most consolidations, mergers, share exchanges, transfers of all or substantially all of a company’s assets and dissolutions of the company), requiring approval by the affirmative vote of two-thirds of all votes entitled to be cast on the matter. However, the MGCL also provides that a corporation’s charter may include a provision that requires for any purpose a lesser proportion of stockholder votes than the proportion required under the MGCL, provided that such proportion may not be less than a majority of all the votes entitled to be cast on the matter. Currently, the Charter does not provide for a different voting standard.

Many investors and others have begun to view supermajority voting provisions similar to those imposed by Maryland law and currently applicable to the Company as conflicting with principles of good corporate governance, and an increasing number of companies have eliminated these provisions in recent years. For example, supermajority voting requirements are perceived as “unfriendly” to stockholders, as such requirements can limit the stockholders’ ability to effect change by essentially providing a veto to a large minority of stockholders. Moreover, providing a lower threshold for stockholder votes can increase the ability of stockholders to participate effectively in the Company’s corporate governance. Accordingly, upon weighing the advantages and disadvantages of such provisions, the Board has concluded that it is advisable and in the best interests of our stockholders to eliminate the supermajority voting requirements imposed by the MGCL.

The Board of Directors has adopted resolutions approving and declaring the advisability of an amendment to the Charter, subject to consideration and approval by the Company’s stockholders, to provide that notwithstanding any provision of Maryland law permitting or requiring any action to be taken or approved by the affirmative vote of the holders of shares entitled to cast a greater number of votes, any such action shall be effective and valid if taken or approved by the affirmative vote of holders of shares entitled to cast a majority of all votes entitled to be cast on the matter.

This amendment will be effected by inserting into the Charter a new Article Ninth as set forth in Appendix A attached to this proxy statement. If Proposal No. 3 is approved by the Company’s stockholders, the amendment to the Charter set forth in this Proposal No. 3 will become effective upon filing the Articles of Amendment incorporating such approved amendment with the State Department of Assessments and Taxation of Maryland, as provided under the MGCL.

The amendments to the Charter proposed under this Proposal No. 3, as well as Proposal No. 4, are set forth in Appendix A, with deletions indicated by strikeout and additions indicated by underline, and reflecting conforming changes in the numbering and cross-references in the Charter that will be made to the extent stockholders approve the amendments. The current provisions and proposed amendments described in each Proposal are qualified in their entirety by reference to the actual text of the Charter as set forth in Appendix A.

The Board of Directors unanimously recommends that stockholders vote “FOR” approval

of an amendment to the Charter to eliminate the supermajority voting requirements

imposed by the MGCL.

15

PROPOSAL NO. 4

PROPOSAL TO APPROVE CERTAIN

CLARIFYING AMENDMENTS TO THE CHARTER

The Board of Directors, in its continuing review of the Company’s corporate governance practices, has concluded that it is advisable and in the best interests of the Company’s stockholders to amend the Charter to make certain clarifying amendments in order to update the Charter provisions in accordance with the MGCL. Given that these proposed Charter amendments are intended to clarify, update and conform the Charter, the Board of Directors has determined that stockholders should consider and vote on the amendments as a whole in this Proposal No. 4. Specifically, the Board is proposing the following Charter amendments:

| | • | | In Article Second: amending Article Second to clarify that the purposes for which the Company is formed include carrying on an engineering and consulting business as well as engaging in any other lawful act or activity for which corporations may be organized under the laws of Maryland. This amendment would clarify the purposes for which the Company is formed to eliminate any ambiguity in Article Second; |

| | • | | In Article Second: replacing the reference to “Articles of Incorporation” with the reference to “charter of the Corporation,” which is the correct term under the MGCL; |

| | • | | In Article Third: updating factual information by replacing the reference to Thomas L. Gough, a former resident agent of the Company who resigned as President and a director of the Company on May 30, 2007, with the reference to the current resident agent of the Company, William M. Bambarger, Jr., the Company’s Chief Financial Officer; |

| | • | | In Article Fifth: setting the initial number of directors serving on the Board at seven to accurately reflect the current number of directors; and |

| | • | | Deleting in its entirety Article Sixth, which states that there are no provisions for regulation of the internal affairs of the Company, and making certain conforming changes in numbering. The provisions of Article Sixth are not required by the MGCL to be included in the Charter. |

The Board of Directors has adopted resolutions approving and declaring the advisability of these clarifying amendments to the Charter, subject to consideration and approval by the Company’s stockholders. These amendments will be effected by amending the Charter as set forth in Appendix A attached to this proxy statement. If Proposal No. 4 is approved by the Company’s stockholders, the amendments to the Charter set forth in this Proposal No. 4 will become effective upon filing the Articles of Amendment incorporating such approved amendments with the State Department of Assessments and Taxation of Maryland, as provided under the MGCL.

The amendments to the Charter proposed under this Proposal No. 4, as well as Proposal No. 3, are set forth in Appendix A, with deletions indicated by strikeout and additions indicated by underline, and reflecting conforming changes in the numbering and cross-references in the Charter that will be made to the extent stockholders approve the amendments. The current provisions and proposed amendments described in each Proposal are qualified in their entirety by reference to the actual text of the Charter as set forth in Appendix A.

The Board of Directors unanimously recommends that stockholders vote “FOR” approval

of the clarifying amendments to the Charter.

16

OWNERSHIP OF SECURITIES

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of the Common Stock as of December 19, 2008, unless otherwise noted, by (i) each person known by the Company to beneficially own more than five percent of the outstanding shares of Common Stock, (ii) each director, director Nominee and named executive officer of the Company listed in the Summary Compensation Table and (iii) all executive officers and directors of the Company as a group. The beneficial ownership amounts provided have been adjusted as necessary for the Company’s two-for-one stock split, which was effective August 25, 2008. Except as indicated, the persons named in the table have sole voting and investment power with respect to all shares beneficially owned. Except as indicated, the address of each of the persons named in the table is that of the Company’s principal executive offices at 5000 Philadelphia Way, Lanham, Maryland 20706-4417.

| | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Owner | | | Percent of

Class (1) | |

Greater-than-Five Percent Stockholders: | | | | | | |

FMR LLC 82 Devonshire Street Boston, MA 02109 | | 1,922,390 | (2) | | 11.14 | % |

| | |

Royce & Associates, LLC 1414 Avenue of the Americas, 9th Floor New York, NY 10019-2578 | | 1,632,688 | (3) | | 9.46 | % |

| | |

Bank of America Corporation et al. 100 North Tryon Street, Floor 25 Bank of America Corporate Center Charlotte, NC 28255 | | 1,184,818 | (4) | | 6.87 | % |

| | |

Chartwell Capital Investors II, L.P. 3120 Independent Square Jacksonville, FL 32202 | | 1,029,812 | (5) | | 5.97 | % |

| | |

Executive Officers, Directors and Nominees: | | | | | | |

John M. Albertine (6) | | 30,000 | | | * | |

James B. Armor, Jr. (6) | | 10,000 | | | * | |

Alan W. Baldwin (6) | | 0 | | | * | |

Paul G. Casner, Jr. (6) | | 30,000 | | | * | |

John B. Higginbotham (6) | | 0 | | | * | |

William F. Leimkuhler (6) | | 64,484 | | | * | |

R. Doss McComas (6) | | 70,000 | | | * | |

William M. Bambarger, Jr. (6) | | 10,000 | | | * | |

Elaine M. Brown (6)(7) | | 10,800 | | | * | |

Stuart C. Daughtridge (6)(8) | | 33,906 | | | * | |

Peter J. Gaffney (6)(9) | | 74,696 | | | * | |

James G. Schuetzle (6) | | 2,800 | | | * | |

All Directors and Executive Officers as a group (13 persons) | | 252,990 | | | 1.45 | % |

| * | Less than one percent of the Common Stock outstanding. |

| (1) | Percentage based on 17,250,334 shares outstanding as of December 19, 2008. |

| (2) | Based on a Schedule 13G filed by FMR LLC on November 10, 2008. The reporting person has sole voting power with respect to 502,669 shares and sole dispositive power with respect to all 1,922,390 shares. |

17

| (3) | Based on a Schedule 13G/A filed by Royce & Associates, LLC on February 1, 2008. The reporting person has sole voting power and sole dispositive power with respect to all 1,632,688 shares. |

| (4) | Based on a Schedule 13G filed jointly on February 7, 2008 by Bank of America Corporation, NB Holdings Corporation, Bank of America, NA, United States Trust Company, NA, Columbia Management Group, LLC and Columbia Management Advisors, LLC. Bank of America Corporation and NB Holdings Corporation have shared voting power with respect to 777,064 shares and shared dispositive power with respect to 1,184,818 shares. Bank of America, NA has sole voting power with respect to 170 shares, shared voting power with respect to 676,674 shares, sole dispositive power with respect to 170 shares and shared dispositive power with respect to 1,184,428 shares. United States Trust Company, NA has sole voting power with respect to 220 shares and sole dispositive power with respect to 220 shares. Columbia Management Group, LLC has shared voting power with respect to 776,674 shares and shared dispositive power with respect to 1,184,428 shares. Columbia Management Advisors, LLC has sole voting power with respect to 776,674 shares, sole dispositive power with respect to 1,180,488 shares and shared dispositive power with respect to 3,940 shares. |

| (5) | Based on a Schedule 13G/A filed by Chartwell Capital Investors II, L.P. on February 14, 2002. The reporting person has sole voting power and sole dispositive power with respect to all 1,029,812 shares. |

| (6) | Includes shares subject to options currently exercisable or exercisable within 60 days of December 19, 2008, as follows: Dr. Albertine: 30,000 shares; Gen. Armor: 10,000 shares; Mr. Baldwin: 0 shares; Mr. Casner: 30,000 shares; Mr. Higginbotham: 0 shares; Mr. Leimkuhler: 60,000 shares; Mr. McComas: 70,000 shares; Mr. Bambarger: 10,000 shares; Ms. Brown: 0 shares; Mr. Daughtridge: 24,800 shares; Mr. Gaffney: 70,000 shares; Mr. Schuetzle: 2,800 shares; and all current directors and executive officers as a group: 237,600 shares. |

| (7) | Ms. Brown resigned as the Company’s Executive Vice President, Administration on July 2, 2008. |

| (8) | Includes 960 shares owned by Mr. Daughtridge’s spouse. |

| (9) | Mr. Gaffney resigned his position as Executive Vice President, New Business and Technology Development on October 21, 2008. |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s officers and directors, and persons who own more than 10% of the Common Stock, to file reports of ownership and changes in ownership of the Common Stock with the SEC and NASDAQ. Based on a review of the copies of such reports, the Company believes that during the fiscal year ended September 30, 2008, its executive officers, directors and greater-than-10% stockholders filed on a timely basis all reports due under Section 16(a) of the Exchange Act, except for a Form 4 filed by Peter J. Gaffney reporting the exercise of two stock option awards and the sale of the related shares, which was inadvertently filed late, and a Form 4 reporting the sale of Common Stock by Fursa Alternative Strategies LLC at the time when Fursa was a greater-than-10% stockholder.

18

EXECUTIVE OFFICERS

Set forth below is certain information regarding the executive officers of the Company not currently serving on the Board of Directors. The age shown below for each executive officer is as of February 26, 2009, the date of the Annual Meeting.

| | | | |

Executive Officers | | Age | | Position |

William M. Bambarger, Jr. | | 44 | | Chief Financial Officer and Treasurer |

Stuart C. Daughtridge | | 45 | | Executive Vice President and General Manager, Space Communications Systems |

James J. Frelk | | 48 | | Senior Vice President, Corporate Business Development |

James B. Kramer | | 38 | | Senior Vice President, Commercial Systems |

Jeffrey A. Rosolio | | 59 | | Executive Vice President, Human Resources and Administration, and Secretary |

James G. Schuetzle | | 54 | | Executive Vice President, Government Systems |

William M. Bambarger, Jr., 44, joined the Company in September 2007 as Chief Financial Officer and was appointed Treasurer on December 5, 2007. Mr. Bambarger previously served as Executive Vice President, Corporate Controller and Chief Accounting Officer at Energy Solutions, LLC (formerly Duratek Inc.), a full-service nuclear fuel cycle company. Prior to joining Duratek in 2001, Mr. Bambarger served as Director of Corporate Accounting for McCormick and Company from 2000 to 2001. Mr. Bambarger holds a Bachelor of Science degree in Accounting from the University of Baltimore and is a Certified Public Accountant.

Stuart C. Daughtridge,45, joined the Company in January 1999. Mr. Daughtridge currently serves as Executive Vice President and General Manager, Space Communications Systems and acting President of RT Logic, Inc., a wholly-owned subsidiary of the Company. Mr. Daughtridge was appointed to these positions on October 17, 2008. Mr. Daughtridge previously served as the Company’s Executive Vice President, Commercial Division, a position he held since October 2004. In February 2000, Mr. Daughtridge was appointed Vice President of the Commercial Division. From January 1999 to February 2000, he was a senior program manager for the Orion 1, 2 and 3 and New Skies Satellite programs. Prior to joining the Company, Mr. Daughtridge worked in several management positions in the spacecraft engineering and satellite operations division of Orion Satellite Corporation (which later became part of Loral Space & Communications). His last position at Orion was Director of Satellite Operations. From 1990 to 1992, he worked at INTELSAT in spacecraft engineering and satellite operations for the INTELSAT-K spacecraft and the INTELSAT V, IV and VII series of satellites. From 1986 to 1990, he worked for Contel Corporation (which later became part of GTE Corporation) as a spacecraft engineer for NASA’s Tracking and Data Relay Satellite System. Mr. Daughtridge holds a Bachelor of Science degree in Electrical Engineering from Lafayette College.

James J. Frelk,48, joined the Company in September 2008 as an Executive Management Consultant and advisor to the Company’s Chief Executive Officer and coordinator of the Company’s Senior Executive Advisor Corps (C-Corps) group of executive consultants. Mr. Frelk currently serves as the Company’s Senior Vice President, Corporate Business Development, a position he has held since January 2009. Previously, Mr. Frelk served as Senior Vice President for Government Programs at TerreStar Networks, an integrated mobile satellite services with ancillary terrestrial components communications company, from April 2006 through June 2008. From March 2003 through April 2006, he held various positions at the National Aeronautics and Space Administration (NASA), including Director of NASA Headquarters Operations, Special Assistant to the Assistant Administrator for Infrastructure Management and Deputy Associate Administrator for Program Analysis and Evaluation. In addition to the primary occupations set forth above, Mr. Frelk has been a Principal in the Frelk Family Limited Partnership, with business operations in gravel pit mining, since 1999. Mr. Frelk also currently serves as an Advisor to IAMCO, a provider of investment advisory and other services, a position he has

19

held since May 2008. In addition, from August 2008 through the present date, Mr. Frelk has served (or currently serves) as an Individual Executive Management Consultant to various companies in a range of business areas, including satellite services providers, software companies and providers of mission support engineering services and products.

James B. Kramer, 38, joined the Company in November 1999 and was appointed to Senior Vice President, Commercial Systems in October 2008. Previously he served as Vice President of Commercial Programs from June 2008 to October 2008. In April 2007, he was appointed Director of Commercial Command and Control Systems. From May 2005 to April 2007, Mr. Kramer was a senior program manager for the Intelsat (formerly PanAmSat) programs. From November 1999 until May 2005, he was program manager for the New Skies Satellites programs. Prior to joining the Company, Mr. Kramer worked for Orbital Sciences Corporation as a mission operations lead on the RADARSAT-2 and OrbView-3 programs. From 1992 to 1998, he worked for Orion Satellite Corporation (which later became part of Loral Space & Communications), where he held several positions in the satellite engineering department, most recently as lead satellite bus subsystem engineer on the Orion-2 program. Mr. Kramer holds a Bachelor of Science degree in Aerospace Engineering from the University of Virginia.

Jeffrey A. Rosolio,59, joined the Company in November 2007 as Executive Vice President, Human Resources and Administration, and was appointed Secretary on July 23, 2008. Mr. Rosolio has over 25 years of experience in human resources and organizational development. He has served as a human resources executive in a variety of industries including information technology, telecommunications, systems integration, software engineering, civil engineering, architecture and local government. Prior to joining the Company, from February 2002 to November 2007, Mr. Rosolio served as Vice President, Human Resources for INDUS Corporation, an information technology company providing high-level IT services to the federal government. Prior to his work at INDUS, Mr. Rosolio also served as Vice President, Human Resources for Datazen Corporation, a manufacturer of computer peripheral equipment, e.spire Communications, Inc., a provider of facilities-based integrated communications, and I-NET, Inc., a leading technology sales and marketing company. Mr. Rosolio holds a Master of Science in Public Administration from the George Washington University and graduated from the University of Maryland at College Park with a Bachelor’s degree in Psychology.

James G. Schuetzle,54, joined the Company in 1998 and currently serves as Executive Vice President, Government Systems, a position he has held since August 2006. Mr. Schuetzle served as Vice President, Government Division from April 2006 to August 2006 and as Vice President of Air Force Programs from April 2002 to April 2006. Mr. Schuetzle started with the Company in 1998 as Program Manager for the NOAA Polar Antenna Systems Integration contract and, in 2001, became Program Manager for the Air Force Command and Control System – Consolidated Contract. Before joining the Company, Mr. Schuetzle worked for the Lockheed Martin Corporation (formerly Loral Aerospace) from 1984 to 1996. While at Lockheed, Mr. Schuetzle held the positions of Manager of Research & Development and Manager of Mission Operations for the N-STAR satellite program. Mr. Schuetzle holds Bachelor of Science degrees in Computer Science and Business Administration from the University of Maryland.

20

EXECUTIVE AND DIRECTOR COMPENSATION

Compensation Committee Report

The Compensation Committee, which is composed solely of independent members of the Board of Directors, assists the Board of Directors in fulfilling its responsibilities relating to executive compensation. The Compensation Committee reviewed and discussed with management the Company’s Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K. Based upon the reviews and discussions referred to above, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K and this proxy statement.

Submitted by the members of the Compensation Committee:

Paul G. Casner, Jr., Chairman

John M. Albertine

William F. Leimkuhler

R. Doss McComas

Compensation Discussion and Analysis

Introduction

This section describes our compensation strategy, programs and practices for the executive officers listed in the Summary Compensation Table that follows this discussion. In this proxy statement, we refer to these individuals as our “Named Executive Officers.” In 2008, our Company continued our leadership transition and hired a new Chief Executive Officer, John B. Higginbotham. Our Named Executive Officers in fiscal 2008 include our former interim Chief Executive Officer, Alan W. Baldwin, and one executive officer, Elaine M. Brown, whose employment with the Company terminated during fiscal 2008.

Executive Compensation Philosophy and Overview

Our executive compensation program is designed to provide an overall total direct compensation package that enables us to attract and retain talented employees, provide incentives for performance and create long-term value for our stockholders. Our executive compensation program generally consists of three forms of compensation: base salary; annual cash incentive bonus; and long-term equity-based incentives. Our executive officers also participate in benefit plans available to our employees generally, including

a 401(k) savings plan. We do not sponsor a defined benefit retirement plan or deferred compensation plan for any of our employees.

Our executive compensation program is designed to pay for performance and align our executive officers’ interests with stockholder interests. Because our executive officers are in a position to directly influence the Company’s performance, compensation for our executive officers involves a significant proportion of pay that is “at risk” – namely, the annual incentive bonus plan and the value of long-term equity-based incentives. The Compensation Committee believes that our annual incentive bonus plan and equity-based incentives play a significant role in aligning our executive officers’ interests with those of our stockholders. We do not have a specific allocation goal between cash and equity-based compensation or between annual and long-term incentive compensation.

In accordance with its charter, the Compensation Committee of the Board, which is composed solely of independent members of the Board of Directors, oversees the Company’s overall compensation structure, policies and programs, recommends to the Board for approval the compensation of our executive officers, including our Named Executive Officers (and to the independent members of the Board of Directors with respect to the Chief Executive Officer), and administers our annual cash and equity-based incentive plans. In the performance of its duties, the Compensation Committee annually reviews and determines the compensation of each Named Executive Officer. The recommendations of our Chief Executive Officer play a significant role in

21

the annual compensation-setting process. Our Chief Executive Officer reports to the Compensation Committee on Named Executive Officers’ performance, including his own, and provides recommendations regarding the other Named Executive Officers’ compensation packages. The Compensation Committee has discretion to accept, reject or modify our Chief Executive Officer’s recommendations. Our Chief Executive Officer also consults with and provides recommendations to the Compensation Committee on the design of our annual cash incentive bonus program as discussed further below.

Compensation Considerations

The Compensation Committee strives to make our executive compensation packages competitive with the current practices in our industry and the geographic market in which we conduct business. In addition, the Compensation Committee considers the Company’s budget and performance and each executive officer’s individual contribution and performance, internal pay relationships within the Company, the complexity and importance of each executive officer’s role and responsibility, leadership skills and growth potential, and experience.

Individual Performance.The Compensation Committee reviews the individual performance of our Named Executive Officers when making compensation decisions. At the beginning of each fiscal year, our Named Executive Officers meet with our Chief Executive Officer and develop their performance goals for the year. At the end of the year, our Chief Executive Officer assesses each other executive officer’s performance against these goals and provides the Compensation Committee with a performance appraisal for each executive officer. The Compensation Committee considers this assessment when recommending any base salary increase or annual cash incentive bonus to the Board for approval. The Compensation Committee also considers this assessment when granting any equity-based awards.