BERRY . DUNN . MCNEIL & PARKER

BDMP

CERTIFIED PUBLIC ACCOUNTANTS

MANAGEMENT CONSULTANTS

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders

Community Bancorp. and Subsidiary

We have audited the accompanying consolidated balance sheets of Community Bancorp. and Subsidiary as of December 31, 2006 and 2005 and the related consolidated statements of income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2006. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of Community Bancorp. and Subsidiary at December 31, 2006 and 2005, and the consolidated results of their operations and their consolidated cash flows for each of the three years in the period ended December 31, 2006, in conformity with accounting principles generally accepted in the United States of America.

/s/ Berry, Dunn, McNeil & Parker

Portland, Maine

March 20, 2007

Vermont Registration No. 92-0000278

PORTLAND, ME · BANGOR, ME · MANCHESTER, NH

WWW.BDMP.COM

COMMUNITY BANCORP. AND SUBSIDIARY |

CONSOLIDATED BALANCE SHEETS |

December 31, 2006 and 2005 |

| | | | | | | |

ASSETS | | 2006 | | | 2005 | |

| Cash and due from banks | $ | 11,292,831 | | $ | 11,066,745 | |

| Federal funds sold and overnight deposits | | 8,173,779 | | | 6,508,194 | |

| Cash and cash equivalents | | 19,466,610 | | | 17,574,939 | |

| Securities held-to-maturity (fair value $21,301,000 | | | | | | |

| and $28,444,000 at December 31, 2006 and 2005) | | 21,069,866 | | | 28,391,665 | |

| Securities available-for-sale | | 22,612,207 | | | 36,454,426 | |

| Restricted equity securities | | 2,828,250 | | | 3,252,150 | |

| Loans held for sale | | 566,300 | | | 1,586,582 | |

| Loans | | 268,729,726 | | | 250,622,955 | |

| Allowance for loan losses | | (2,267,821 | ) | | (2,189,187 | ) |

| Unearned net loan fees | | (632,105 | ) | | (684,106 | ) |

| Net loans | | 265,829,800 | | | 247,749,662 | |

| Bank premises and equipment, net | | 12,334,024 | | | 11,617,119 | |

| Accrued interest receivable | | 1,667,135 | | | 1,789,251 | |

| Other assets | | 5,440,350 | | | 5,411,770 | |

| | | | | | | |

| Total assets | $ | 351,814,542 | | $ | 353,827,564 | |

| | | | | | | |

LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | |

| LIABILITIES | | | | | | |

| Deposits: | | | | | | |

| Demand, non-interest bearing | $ | 47,402,628 | | $ | 45,848,972 | |

| NOW and money market accounts | | 81,402,928 | | | 100,078,793 | |

| Savings | | 38,471,441 | | | 45,281,605 | |

| Time, $100,000 and over | | 33,835,057 | | | 25,621,541 | |

| Other time | | 99,876,140 | | | 77,481,500 | |

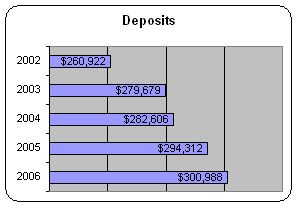

| Total deposits | | 300,988,194 | | | 294,312,411 | |

| Other borrowed funds | | 40,000 | | | 10,040,000 | |

| Securities sold under agreements to repurchase | | 17,083,946 | | | 17,347,140 | |

| Accrued interest and other liabilities | | 2,971,591 | | | 3,004,679 | |

| | | | | | | |

| Total liabilities | | 321,083,731 | | | 324,704,230 | |

| | | | | | | |

| COMMITMENTS AND CONTINGENT LIABILITIES (Notes 6, 15, 16, 17 and 20) |

| | | | | | | |

| SHAREHOLDERS' EQUITY | | | | | | |

| Common stock, $2.50 par value; 6,000,000 shares authorized, | | | | | | |

| 4,339,619 shares issued at December 31, 2006 and 4,279,884 shares | | | | | | |

| shares issued at December 31, 2005 (including 15,222 shares issued | | | | | | |

| February 1, 2007 and 13,522 shares issued February 1, 2006) | | 10,849,048 | | | 10,699,709 | |

| Additional paid-in capital | | 22,006,492 | | | 21,324,481 | |

| Retained earnings | | 760,667 | | | 165,983 | |

| Accumulated other comprehensive loss | | (270,664 | ) | | (452,118 | ) |

| Less treasury stock, at cost (2006 and 2005 - 209,510 shares) | | (2,614,732 | ) | | (2,614,721 | ) |

| | | | | | | |

| Total shareholders' equity | | 30,730,811 | | | 29,123,334 | |

| | | | | | | |

| Total liabilities and shareholders' equity | $ | 351,814,542 | | $ | 353,827,564 | |

| | | | | | | |

| The accompanying notes are an integral part of these consolidated financial statements. |

COMMUNITY BANCORP. AND SUBSIDIARY |

CONSOLIDATED STATEMENTS OF INCOME |

Years Ended December 31, 2006, 2005, and 2004 |

| |

| | | 2006 | | | 2005 | | | 2004 | |

| Interest and dividend income | | | | | | | | | |

| Interest and fees on loans | $ | 18,471,445 | | $ | 15,645,438 | | $ | 13,869,932 | |

| Interest on debt securities | | | | | | | | | |

| Taxable | | 1,082,241 | | | 1,482,998 | | | 1,973,437 | |

| Tax-exempt | | 1,079,573 | | | 1,059,198 | | | 1,023,986 | |

| Dividends | | 176,610 | | | 133,119 | | | 61,075 | |

| Interest on federal funds sold and overnight deposits | | 165,975 | | | 36,809 | | | 37,915 | |

| | | 20,975,844 | | | 18,357,562 | | | 16,966,345 | |

| | | | | | | | | | |

| Interest expense | | | | | | | | | |

| Interest on deposits | | 6,684,827 | | | 4,596,744 | | | 4,335,331 | |

| Interest on borrowed funds and securities | | | | | | | | | |

| sold under agreements to repurchase | | 1,018,261 | | | 830,654 | | | 426,839 | |

| | | 7,703,088 | | | 5,427,398 | | | 4,762,170 | |

| | | | | | | | | | |

| Net interest income | | 13,272,756 | | | 12,930,164 | | | 12,204,175 | |

| Provision for loan losses | | 137,500 | | | 150,000 | | | 95,000 | |

| Net interest income after provision for loan losses | | 13,135,256 | | | 12,780,164 | | | 12,109,175 | |

| | | | | | | | | | |

| Non-interest income | | | | | | | | | |

| Service fees | | 1,322,360 | | | 1,251,910 | | | 1,212,020 | |

| Net realized gains on securities | | 56,875 | | | 0 | | | 44,059 | |

| Other income | | 1,744,941 | | | 1,920,811 | | | 1,961,622 | |

| | | 3,124,176 | | | 3,172,721 | | | 3,217,701 | |

| | | | | | | | | | |

| Non-interest expense | | | | | | | | | |

| Salaries and wages | | 4,562,000 | | | 4,567,003 | | | 4,268,960 | |

| Employee benefits | | 1,699,405 | | | 1,628,501 | | | 1,536,441 | |

| Occupancy expenses | | 2,180,336 | | | 2,002,091 | | | 1,973,934 | |

| Other expenses | | 3,712,629 | | | 3,544,654 | | | 3,420,155 | |

| | | 12,154,370 | | | 11,742,249 | | | 11,199,490 | |

| | | | | | | | | | |

| Income before income taxes | | 4,105,062 | | | 4,210,636 | | | 4,127,386 | |

| Income taxes | | 729,614 | | | 790,001 | | | 730,422 | |

| | | | | | | | | | |

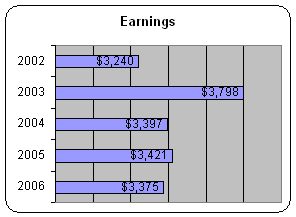

| Net income | $ | 3,375,448 | | $ | 3,420,635 | | $ | 3,396,964 | |

| | | | | | | | | | |

| Earnings per common share | | $0.82 | | | $0.84 | | | $0.85 | |

| Weighted average number of common shares | | | | | | | | | |

| used in computing earnings per share | | 4,097,577 | | | 4,050,993 | | | 4,010,894 | |

| Dividends declared per share | | $0.68 | | | $0.67 | | | $0.64 | |

| Book value per share on shares outstanding at December 31 | | $7.44 | | | $7.15 | | | $6.96 | |

| |

| All per share data and number of shares have been restated to reflect a 5% stock dividend declared in June 2005. |

| |

| The accompanying notes are an integral part of these consolidated financial statements. |

COMMUNITY BANCORP. AND SUBSIDIARY |

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY |

Years Ended December 31, 2006, 2005, and 2004 |

| |

| | ---Common Stock--- |

| | Shares | | | Amount |

| | | | | |

| Balances, December 31, 2003 | 3,789,084 | | $ | 9,929,973 |

| | | | | |

| Comprehensive income, net of taxes | | | | |

| Net income | 0 | | | 0 |

| Net unrealized holding losses on securities | | | | |

| available-for-sale, net of tax benefit, ($347,565) | 0 | | | 0 |

| | | | | |

| Total comprehensive income | | | | |

| | | | | |

| Dividends declared | 0 | | | 0 |

| Issuance of stock | 65,559 | | | 163,898 |

| Purchase of treasury stock | (15,539 | ) | | 0 |

| | | | | |

| Balances, December 31, 2004 | 3,839,104 | | | 10,093,871 |

| | | | | |

| Comprehensive income, net of taxes | | | | |

| Net income | 0 | | | 0 |

| Net unrealized holding losses on securities | | | | |

| available-for-sale, net of tax benefit, ($146,014) | 0 | | | 0 |

| | | | | |

| Total comprehensive income | | | | |

| | | | | |

| Dividends declared | 0 | | | 0 |

| 5% stock dividend | 192,544 | | | 481,360 |

| Issuance of stock | 49,791 | | | 124,478 |

| Purchase of treasury stock | (11,065 | ) | | 0 |

| | | | | |

| Balances, December 31, 2005 | 4,070,374 | | | 10,699,709 |

| | | | | |

| Comprehensive income, net of taxes | | | | |

| Net income | 0 | | | 0 |

| Net unrealized holding gain on securities | | | | |

| available-for-sale, net of tax, $93,477 | 0 | | | 0 |

| | | | | |

| Total comprehensive income | | | | |

| | | | | |

| Dividends declared | 0 | | | 0 |

| Issuance of stock | 59,736 | | | 149,339 |

| Purchase of treasury stock (fractional share redeemed) | (1 | ) | | 0 |

| | | | | |

| Balances, December 31, 2006 | 4,130,109 | | $ | 10,849,048 |

| | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

| | | | | | | | | | | | | | |

| | | | | | | Accumulated | | | | | | | |

| | Additional | | | | | other | | | | | | Total | |

| | paid-in | | Retained | | | comprehensive | | | Treasury | | | shareholders' | |

| | capital | | earnings | | | income (loss) | | | stock | | | equity | |

| | | | | | | | | | | | | | |

| $ | 16,861,802 | $ | 1,971,870 | | $ | 506,006 | | $ | (2,184,505 | ) | $ | 27,085,146 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 0 | | 3,396,964 | | | 0 | | | 0 | | | 3,396,964 | |

| | | | | | | | | | | | | | |

| | 0 | | 0 | | | (674,685 | ) | | 0 | | | (674,685 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 2,722,279 | |

| | | | | | | | | | | | | | |

| | 0 | | (2,592,823 | ) | | 0 | | | 0 | | | (2,592,823 | ) |

| | 916,803 | | 0 | | | 0 | | | 0 | | | 1,080,701 | |

| | 0 | | 0 | | | 0 | | | (251,857 | ) | | (251,857 | ) |

| | | | | | | | | | | | | | |

| | 17,778,605 | | 2,776,011 | | | (168,679 | ) | | (2,436,362 | ) | | 28,043,446 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 0 | | 3,420,635 | | | 0 | | | 0 | | | 3,420,635 | |

| | | | | | | | | | | | | | |

| | 0 | | 0 | | | (283,439 | ) | | 0 | | | (283,439 | ) |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,137,196 | |

| | | | | | | | | | | | | | |

| | 0 | | (2,720,332 | ) | | 0 | | | 0 | | | (2,720,332 | ) |

| | 2,828,971 | | (3,310,331 | ) | | 0 | | | 0 | | | 0 | |

| | 716,905 | | 0 | | | 0 | | | 0 | | | 841,383 | |

| | 0 | | 0 | | | 0 | | | (178,359 | ) | | (178,359 | ) |

| | | | | | | | | | | | | | |

| | 21,324,481 | | 165,983 | | | (452,118 | ) | | (2,614,721 | ) | | 29,123,334 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 0 | | 3,375,448 | | | 0 | | | 0 | | | 3,375,448 | |

| | | | | | | | | | | | | | |

| | 0 | | 0 | | | 181,454 | | | 0 | | | 181,454 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 3,556,902 | |

| | | | | | | | | | | | | | |

| | 0 | | (2,780,764 | ) | | 0 | | | 0 | | | (2,780,764 | ) |

| | 682,011 | | 0 | | | 0 | | | 0 | | | 831,350 | |

| | 0 | | 0 | | | 0 | | | (11 | ) | | (11 | ) |

| | | | | | | | | | | | | | |

| $ | 22,006,492 | $ | 760,667 | | $ | (270,664 | ) | $ | (2,614,732 | ) | $ | 30,730,811 | |

| | | | | | | | | | | | | | |

COMMUNITY BANCORP. AND SUBSIDIARY |

CONSOLIDATED STATEMENTS OF CASH FLOWS |

Years Ended December 31, 2006, 2005, and 2004 |

| |

| |

| | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | | |

| Net income | $ | 3,375,448 | | $ | 3,420,635 | | $ | 3,396,964 | |

| Adjustments to reconcile net income to net | | | | | | | | | |

| cash provided by operating activities: | | | | | | | | | |

| Depreciation and amortization | | 874,564 | | | 789,587 | | | 776,093 | |

| Provision for loan losses | | 137,500 | | | 150,000 | | | 95,000 | |

| Provision for deferred income taxes | | (28,349 | ) | | (36,931 | ) | | 72,768 | |

| Net gain on sale of securities | | (56,875 | ) | | 0 | | | (44,059 | ) |

| Net gain on sale of loans | | (314,850 | ) | | (376,946 | ) | | (426,198 | ) |

| Loss on disposal or sale of bank premises and equipment | | 6,589 | | | 32,835 | | | 24,796 | |

| Gain on sales of other real estate owned | | 0 | | | (7,710 | ) | | (12,684 | ) |

| (Gain) loss on Trust LLC | | (60,409 | ) | | (20,825 | ) | | 15,829 | |

| Amortization of bond premium, net | | 84,650 | | | 251,535 | | | 406,234 | |

| Proceeds from sales of loans held for sale | | 30,058,562 | | | 29,074,835 | | | 36,277,381 | |

| Originations of loans held for sale | | (28,723,430 | ) | | (28,451,074 | ) | | (35,431,429 | ) |

| Decrease (increase) in interest receivable | | 122,116 | | | (136,424 | ) | | 23,363 | |

| Increase in mortgage servicing rights | | (166,799 | ) | | (174,143 | ) | | (231,583 | ) |

| (Increase) decrease in other assets | | (210,815 | ) | | (101,135 | ) | | 42,063 | |

| Amortization of limited partnerships | | 354,156 | | | 338,216 | | | 292,915 | |

| Decrease in unamortized loan fees | | (52,001 | ) | | (79,668 | ) | | (41,510 | ) |

| Increase in taxes payable | | 7,963 | | | 90,881 | | | 113,416 | |

| Increase (decrease) in interest payable | | 128,579 | | | 49,169 | | | (18,636 | ) |

| Increase (decrease) in accrued expenses | | 4,140 | | | 225,818 | | | (351,322 | ) |

| Increase (decrease) in other liabilities | | 95,410 | | | (5,167 | ) | | 47,242 | |

| | | | | | | | | | |

| Net cash provided by operating activities | | 5,636,149 | | | 5,033,488 | | | 5,026,643 | |

| | | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | | |

| Securities held-to-maturity | | | | | | | | | |

| Maturities and paydowns | | 43,144,522 | | | 40,946,852 | | | 47,074,787 | |

| Purchases | | (35,822,723 | ) | | (37,755,503 | ) | | (37,107,593 | ) |

| Securities available-for-sale | | | | | | | | | |

| Sales and maturities | | 15,089,375 | | | 17,000,000 | | | 20,461,560 | |

| Purchases | | (1,000,000 | ) | | (2,988,906 | ) | | (16,659,541 | ) |

| Proceeds from redemption (purchase) of restricted equity securities | | 423,900 | | | (936,700 | ) | | (958,600 | ) |

| Decrease in limited partnership contributions payable | | (301,625) | | | (149,294 | ) | | (668,178 | ) |

| Increase in loans, net | | (18,234,097 | ) | | (23,013,545 | ) | | (23,840,610 | ) |

| Capital expenditures, net | | (1,598,059 | ) | | (4,382,421 | ) | | (1,043,086 | ) |

| Investments in limited partnerships, net | | 0 | | | (494,505 | ) | | (678,178 | ) |

| Proceeds from sales of other real estate owned | | 0 | | | 100,510 | | | 68,048 | |

| Recoveries of loans charged off | | 68,460 | | | 66,193 | | | 127,809 | |

| | | | | | | | | | |

| Net cash provided by (used in) investing activities | | 1,769,753 | | | (11,607,319 | ) | | (13,223,582 | ) |

| | | | | | | | | | |

| | | 2006 | | | 2005 | | | 2004 | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | | |

| Net (decrease) increase in demand, NOW, savings, and | | | | | | | | | |

| money market accounts | | (23,932,373 | ) | | 6,692,807 | | | 6,601,419 | |

| Net increase (decrease) in time deposits | | 30,608,156 | | | 5,013,733 | | | (3,674,807 | ) |

| Net (decrease) increase in repurchase agreements | | (263,194 | ) | | 2,439,622 | | | 2,890,948 | |

| Net (decrease) increase in short-term borrowings | | (2,000,000 | ) | | 633,000 | | | (1,633,000 | ) |

| Advances in long-term borrowings | | 20,000,000 | | | 10,000,000 | | | 0 | |

| Repayments in long-term borrowings | | (28,000,000 | ) | | (7,000,000 | ) | | 0 | |

| Payments to acquire treasury stock | | (11 | ) | | (178,359 | ) | | (251,857 | ) |

| Dividends paid | | (1,926,809 | ) | | (1,842,839 | ) | | (1,716,868 | ) |

| | | | | | | | | | |

| Net cash (used in) provided by financing activities | | (5,514,231 | ) | | 15,757,964 | | | 2,215,835 | |

| Net increase (decrease) in cash and cash equivalents | | 1,891,671 | | | 9,184,133 | | | (5,981,104 | ) |

| Cash and cash equivalents | | | | | | | | | |

| Beginning | | 17,574,939 | | | 8,390,806 | | | 14,371,910 | |

| Ending | $ | 19,466,610 | | $ | 17,574,939 | | $ | 8,390,806 | |

| | | | | | | | | | |

| SUPPLEMENTAL SCHEDULE OF CASH PAID DURING THE YEAR |

| Interest | $ | 7,574,509 | | $ | 5,378,229 | | $ | 4,780,806 | |

| Income taxes | $ | 750,000 | | $ | 688,200 | | $ | 592,088 | |

| | | | | | | | | | |

| SUPPLEMENTAL SCHEDULE OF NONCASH INVESTING | | | | | | | | | |

| AND FINANCING ACTIVITIES | | | | | | | | | |

| Change in unrealized loss on securities available-for-sale | $ | 274,931 | | $ | (429,453 | ) | $ | (1,022,250 | ) |

| | | | | | | | | | |

| Other real estate owned acquired in settlement of loans | $ | 0 | | $ | 10,000 | | $ | 49,887 | |

| | | | | | | | | | |

| Dividends paid: | | | | | | | | | |

| Dividends declared | $ | 2,780,764 | | $ | 2,720,332 | | $ | 2,592,823 | |

| Increase in dividends payable | | | | | | | | | |

| attributable to dividends declared | | (7,585 | ) | | (41,516 | ) | | (6,304 | ) |

| Dividends reinvested | | (846,370 | ) | | (835,977 | ) | | (869,651 | ) |

| | $ | 1,926,809 | | $ | 1,842,839 | | $ | 1,716,868 | |

| | | | | | | | | | |

| Stock dividend | $ | 0 | | $ | 3,310,331 | | $ | 0 | |

COMMUNITY BANCORP. & SUBSIDIARY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Significant Accounting Policies

The accounting policies of Community Bancorp. and Subsidiary ("Company") are in conformity with accounting principles generally accepted in the United States of America and general practices within the banking industry. The following is a description of the Company’s significant accounting policies.

Basis of presentation and consolidation

The consolidated financial statements include the accounts of Community Bancorp. and its wholly-owned subsidiary, Community National Bank ("Bank"). All significant intercompany accounts and transactions have been eliminated.

Nature of operations

The Company provides a variety of financial services to individuals, municipalities, and corporate customers through its branches, ATMs, and telephone and internet banking capabilities in northeastern and central Vermont, which is primarily a small business and agricultural area. The Company's primary deposit products are checking and savings accounts and certificates of deposit. Its primary lending products are commercial, real estate, municipal, and consumer loans.

Concentration of risk

The Company's operations are affected by various risk factors, including interest-rate risk, credit risk, and risk from geographic concentration of its deposit taking and lending activities. Management attempts to manage interest rate risk through various asset/liability management techniques designed to match maturities of assets and liabilities. Loan policies and administration are designed to provide assurance that loans will only be granted to creditworthy borrowers, although credit losses are expected to occur because of subjective factors and factors beyond the control of the Company. While the Company has a diversified loan portfolio and economic conditions are relatively stable at this time, most of its lending activities are conducted within the geographic area where it is located. As a result, the Company and its borrowers may be especially vulnerable to the consequences of changes in the local economy. In addition, a substantial portion of the Company's loans are secured by real estate, which could experience a decline in value, especially during times of adverse economic conditions.

Use of estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates and assumptions involve inherent uncertainties. Accordingly, actual results could differ from those estimates and those differences could be material.

Material estimates that are particularly susceptible to significant change relate to the determination of the allowance for losses on loans and the valuation of real estate acquired in connection with foreclosures or in satisfaction of loans. In connection with the determination of the allowances for losses on loans and foreclosed real estate, management generally obtains independent appraisals for significant properties. While the allowances for loan losses and foreclosed real estate represent management's best estimate of probable loan and foreclosure losses as of the balance sheet date, the ultimate collectibility of a substantial portion of the Company's loan portfolio and the recovery of a substantial portion of the carrying amount of foreclosed real estate are susceptible to changes in a number of factors, especially local market conditions. The amount of the change that is reasonably possible cannot be estimated.

While management uses available information to recognize losses on loans and foreclosed real estate, future additions to the allowances may be necessary based on changes in local economic conditions. In addition, regulatory agencies, as an integral part of their examination process, periodically review the Company's allowances for losses on loans and foreclosed real estate. Such agencies may require the Company to recognize additions to the allowances based on their judgments about information available to them at the time of their examination.

Under current accounting rules, mortgage servicing rights associated with loans originated and sold, where servicing is retained, are capitalized and included in other assets in the consolidated balance sheet. Mortgage servicing rights are amortized into non-interest income in proportion to, and over the period of, estimated future net servicing income of the underlying financial assets. Mortgage servicing rights are evaluated for impairment based upon the fair value of the rights as compared to amortized cost. The value of capitalized servicing rights represents the present value of the future servicing fees arising from the right to service loans in the portfolio. The carrying value of the mortgage servicing rights is periodically reviewed for impairment based on a determination of fair value and impairment, if any, is recognized through a valuation allowance and is recorded as amortization of other assets. Critical accounting policies for mortgage servicing rights relate to the initial valuation and subsequent impairment tests. The methodology used to determine the valuation of mortgage servicing rights requires the development and use of a number of estimates, including anticipated principal amortization and prepayments of that principal balance. Events that may significantly affect the estimates used are changes in interest rates and the payment performance of the underlying loans.

Management utilizes numerous techniques to estimate the carrying value of various assets held by the Company, including, but not limited to, property, plant and equipment, and deferred taxes. The assumptions considered in making these estimates are based on historical experience and on various other factors that are believed by management to be reasonable under the circumstances. Management acknowledges that the use of different estimates or assumptions could produce different estimates of carrying values

Presentation of cash flows

For purposes of presentation in the consolidated statements of cash flows, cash and cash equivalents includes cash on hand, amounts due from banks (including cash items in process of clearing), federal funds sold (generally purchased and sold for one day periods), and overnight deposits.

Investment securities

Debt securities the Company has the positive intent and ability to hold to maturity are classified as held-to-maturity and reported at amortized cost. Debt and equity securities not classified as held-to-maturity are classified as available-for-sale. Investments classified as available-for-sale are carried at fair value, with unrealized gains and losses, net of tax and reclassification adjustments, reported as a net amount in other comprehensive income (loss). Investment securities transactions are accounted for on a trade date basis. The specific identification method is used to determine realized gains and losses on sales of securities available-for-sale. Premiums and discounts are recognized in interest income using the interest method over the period to maturity or call date.

Other investments

The Company acquires partnership interests in limited partnerships for low income housing projects. The investments in limited partnerships are amortized using the effective yield method.

The Company has a one-third ownership interest in Community Financial Services Group, LLC (CFSG), as discussed further in Note 8 of this report. The Company's investment in CFSG is accounted for under the equity method of accounting.

Restricted equity securities

Restricted equity securities are comprised of Federal Reserve Bank stock and Federal Home Loan Bank stock. These securities are carried at cost and evaluated for impairment. As a member of the Federal Reserve Bank of Boston (FRB), the Company is required to invest in FRB stock in an amount equal to 3% of Community National Bank's capital stock and surplus.

As a member of the Federal Home Loan Bank of Boston (FHLB), the Company is required to invest in $100 par value stock of the FHLB in an amount that approximates 1% of unpaid principal balances on qualifying loans, as well as an activity based requirement. The stock is nonmarketable, and when redeemed, the Company would receive from the FHLB an amount equal to the par value of the stock.

Loans held for sale

Loans originated and intended for sale in the secondary market are carried at the lower of cost or estimated fair value in the aggregate. Net unrealized losses are recognized through a valuation allowance by charges to income.

Loans

Loans receivable that management has the intent and ability to hold for the foreseeable future or until maturity or pay-off are reported at their outstanding principal adjusted for any charge-offs, the allowance for loan losses, and any unearned fees or costs on originated loans.

Loan interest income is accrued daily on the outstanding balances. The accrual of interest is discontinued when a loan is specifically determined to be impaired or when the loan is delinquent 90 days and management believes, after considering collection efforts and other factors, that the borrower's financial condition is such that collection of interest is doubtful. Any unpaid interest previously accrued on those loans is reversed from income. Interest income is generally not recognized on specific impaired loans unless the likelihood of further loss is remote. Interest payments received on such loans are generally applied as a reduction of the loan principal balance. Interest income on other nonaccrual loans is recognized only to the extent of interest payments received. Loans are returned to accrual status when principal and interest payments are brought current and the customer has proven the ability to make future payments on a timely basis. Loans are charged off when collection of principal is considered doubtful. Past due status is determined on a contractual basis.

Loan origination and commitment fees and certain direct loan origination costs are being deferred and the net amount amortized as an adjustment of the related loan's yield. The Company is generally amortizing these amounts over the contractual life of the loans.

Allowance for loan losses

The allowance for loan losses is maintained at a level which, in management's judgment, is adequate to absorb credit losses inherent in the loan portfolio. The amount of the allowance reflects management's estimate as to the collectibility of the loan portfolio, based on its periodic evaluation of factors it considers relevant, including the nature of the portfolio, credit concentrations, trends in historical loss experience, specific impaired loans, and prevailing economic conditions. Allowances for impaired loans are generally determined based on collateral values or the present value of estimated cash flows. The allowance is increased by a provision for loan losses, which is charged to expense, and reduced by charge-offs, net of recoveries.

Bank premises and equipment

Bank premises and equipment are stated at cost less accumulated depreciation. Depreciation is computed principally by the straight-line method over their estimated useful lives. The cost of assets sold or otherwise disposed of, and the related accumulated depreciation, is eliminated from the accounts and the resulting gains or losses are reflected in the statement of income. Maintenance and repairs are charged to current expense as incurred and the cost of major renewals and betterments is capitalized.

Other real estate owned

Real estate properties acquired through or in lieu of loan foreclosure are initially recorded at the lower of the Company's carrying amount or fair value less estimated selling cost at the date of foreclosure. Any write-downs based on the asset's fair value at the date of acquisition are charged to the allowance for loan losses. After foreclosure, these assets are carried at the

lower of their new cost basis or fair value, less cost to sell. Costs of significant property improvements are capitalized, whereas costs relating to holding property are expensed. Appraisals are then done periodically on properties that management deems significant, or evaluations may be performed by management on properties in the portfolio that are less vulnerable to market conditions. Subsequent write-downs are recorded as a charge to operations, if necessary, to reduce the carrying value of a property to the lower of its cost or fair value, less cost to sell.

Income taxes

The Company recognizes income taxes under the asset and liability method. Under this method, deferred tax assets and liabilities are established for the temporary differences between the accounting bases and the tax bases of the Company's assets and liabilities at enacted tax rates expected to be in effect when the amounts related to such temporary differences are realized or settled. Adjustments to the Company's deferred tax assets are recognized as deferred income tax expense or benefit based on management's judgments relating to the realizability of such asset.

Foreign currency transactions

Foreign currency (principally Canadian) amounts are converted to U.S. dollars. The U.S. dollar is the functional currency and therefore translation adjustments are recognized in income. Total conversion adjustments, including adjustments on foreign currency transactions, are immaterial.

Mortgage servicing

Servicing assets are recognized as separate assets when rights are acquired through purchase or through sale of financial assets. Capitalized servicing rights are reported in other assets and are amortized into non-interest income in proportion to, and over the period of, the estimated future net servicing income of the underlying financial assets. Servicing rights are evaluated for impairment based upon the fair value of the rights as compared to amortized cost. Impairment is determined by stratifying the rights by predominant characteristics, such as interest rates and terms. Fair value is determined using prices for similar assets with similar characteristics, when available, or based upon discounted cash flows using market-based assumptions. Impairment is recognized through a valuation allowance, to the extent that fair value is less than the capitalized amount.

Pension costs

Pension costs are charged to salaries and employee benefits expense and accrued over the active service period.

Advertising costs

The Company expenses advertising costs as incurred.

Comprehensive income

Accounting principles generally require recognized revenue, expenses, gains, and losses to be included in net income. Certain changes in assets and liabilities, such as the after-tax effect of unrealized gains and losses on available-for-sale securities, are not reflected in the statement of income, but the cumulative effect of such items from period-to-period is reflected as a separate component of the equity section of the balance sheet (accumulated other comprehensive income or loss). Other comprehensive income or loss, along with net income, comprises the Company's total comprehensive income.

The Company's total comprehensive income for the years ended December 31 is calculated as follows:

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Net income | | $ | 3,375,448 | | $ | 3,420,635 | | $ | 3,396,964 | |

| Other comprehensive income (loss), net of tax: | | | | | | | | | | |

| Change in unrealized holding losses on available- | | | | | | | | | | |

| for-sale securities arising during the period | | | 331,806 | | | (429,453 | ) | | (983,603 | ) |

| Reclassification adjustment for gains realized in income | | | (56,875 | ) | | 0 | | | (38,647 | ) |

| Net unrealized gain (losses) | | | 274,931 | | | (429,453 | ) | | (1,022,250 | ) |

| Tax effect | | | (93,477 | ) | | 146,014 | | | 347,565 | |

| Other comprehensive income (loss), net of tax | | | 181,454 | | | (283,439 | ) | | (674,685 | ) |

| Total comprehensive income | | $ | 3,556,902 | | $ | 3,137,196 | | $ | 2,722,279 | |

Earnings per common share

Earnings per common share amounts are computed based on the weighted average number of shares of common stock issued during the period including Dividend Reinvestment Plan (DRIP) shares payable through dividends declared (retroactively adjusted for a 5% stock dividend declared in June 2005) and reduced for shares held in treasury.

Off-balance-sheet financial instruments

In the ordinary course of business, the Company has entered into off-balance-sheet financial instruments consisting of commitments to extend credit, commitments under credit card arrangements, commercial and municipal letters of credit, standby letters of credit, and risk-sharing commitments on certain sold loans. Such financial instruments are recorded in the financial statements when they are funded.

Fair values of financial instruments

The following methods and assumptions were used by the Company in estimating its fair value disclosures for financial instruments:

Cash and cash equivalents: The carrying amounts reported in the balance sheet for cash and cash equivalents approximate their fair values.

Investment securities: Fair values for investment securities are based on quoted market prices, where available. If quoted market prices are not available, fair values are based on quoted market prices of comparable instruments.

Restricted equity securities: The carrying amounts of these securities approximate their fair values.

Loans and loans held for sale: For variable-rate loans that reprice frequently and with no significant change in credit risk, fair values are based on carrying amounts. The fair values for other loans (for example, fixed rate residential, commercial real estate, and rental property mortgage loans, and commercial and industrial loans) are estimated using discounted cash flow analysis, based on interest rates currently being offered for loans with similar terms to borrowers of similar credit quality. Loan fair value estimates include judgments regarding future expected loss experience and risk characteristics. The carrying amounts reported in the balance sheet for loans that are held for sale approximate their market values. Fair values for impaired loans are estimated using discounted cash flow analyses or underlying collateral values, where applicable.

Deposits and borrowed funds: The fair values disclosed for demand deposits (for example, checking and savings accounts) are, by definition, equal to the amount payable on demand at the reporting date (that is, their carrying amounts). The fair values for certificates of deposit and debt are estimated using a discounted cash flow calculation

that applies interest rates currently being offered on certificates and debt to a schedule of aggregated contractual maturities on such time deposits and debt.

Short-term borrowings: The fair value is estimated using current interest rates on borrowings of similar maturity.

Off-balance-sheet credit related instruments: Commitments to extend credit were evaluated and fair value was estimated using the fees currently charged to enter into similar agreements, taking into account the remaining terms of the agreements and the present credit-worthiness of the counterparties. For fixed-rate loan commitments, fair value also considers the difference between current levels of interest rates and the committed rates.

Accrued interest: The carrying amounts of accrued interest approximate their fair values.

Transfers of financial assets

Transfers of financial assets are accounted for as sales when control over the assets has been surrendered. Control over transferred assets is deemed to be surrendered when (1) the assets have been isolated from the Company, (2) the transferee obtains the right (free of conditions that constrain it from taking advantage of that right) to pledge or exchange the transferred assets, and (3) the Company does not maintain effective control over the transferred assets through an agreement to repurchase them before their maturity.

Reclassification

Certain amounts in the 2005 and 2004 financial statements have been reclassified to conform to the current year presentation.

Impact of Recently Issued Accounting Standards:

Statement of Financial Accounting Standards (SFAS) No. 156, “Accounting for Servicing of Financial Assets-an Amendment to FASB Statement No. 140,” requires all separately recognized servicing assets and servicing liabilities to be initially measured at fair value, if practicable. Servicing assets and servicing liabilities will subsequently be reported using the amortization method or the fair value measurement method. An entity should adopt SFAS No. 156 as of the beginning of its first fiscal year that begins after September 15, 2006 with earlier application permitted with certain restrictions. The initial application of the fair value measurement method would be reported as a cumulative effect adjustment to beginning retained earnings. SFAS No. 156 requires certain disclosures about the basis for measurement and regarding risks, activity, and fair value of servicing assets and of servicing liabilities. Management does not expect SFAS No. 156 to have a material impact on the Company’s financial statements.

In July 2006, FASB issued Financial Accounting Standards Interpretation No. 48 (“FIN 48”), “Accounting for Uncertainty in Income Taxes.” FIN 48 clarifies the accounting for uncertainty in income taxes recognized in a company’s financial statements in accordance with SFAS No. 109, “Accounting for Income Taxes.” FIN 48 prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on derecognition, classification, interest and penalties, accounting in interim periods, disclosures and transitions. FIN 48 is effective for fiscal years beginning after December 15, 2006. The Company does not expect FIN 48 to have a material effect on the financial condition and results of operations of the Company.

In September 2006, the SEC issued SAB No. 108, “Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in Current Year Financial Statements.” SAB No. 108 requires registrants to evaluate the materiality of unadjusted financial statement misstatements using both the rollover and iron curtain methods. The rollover method quantifies a misstatement based on the amount of the error originating in the current period statement of income. The iron curtain method quantifies a misstatement based on the effects of correcting the misstatement existing in the balance sheet at the end of the current period, irrespective of the misstatement’s year(s) of origination. SAB No. 108 is effective for years ending after November 15, 2006. The cumulative effect of the initial application on prior years is required to be reported as an adjustment to retained earnings at the beginning of the year of initial application. The adoption of SAB No. 108 did not have a material effect on the Company’s financial statements for the year ended December 31, 2006.

Note 2. Investment Securities

Securities available-for-sale (AFS) and held-to-maturity (HTM) consist of the following:

| | | | | Gross | | Gross | | | |

| | | Amortized | | Unrealized | | Unrealized | | Fair | |

Securities AFS | | Cost | | Gains | | Losses | | Value | |

| | | | | | | | | | |

| December 31, 2006 | | | | | | | | | |

| U. S. sponsored enterprise securities | | $ | 19,030,313 | | $ | 0 | | $ | 382,168 | | $ | 18,648,145 | |

| U. S. Government securities | | | 3,991,991 | | | 5,068 | | | 32,997 | | | 3,964,062 | |

| | | $ | 23,022,304 | | $ | 5,068 | | $ | 415,165 | | $ | 22,612,207 | |

| | | | | | | | | | | | | | |

| December 31, 2005 | | | | | | | | | | | | | |

| U. S. sponsored enterprise securities | | $ | 33,115,577 | | $ | 1,770 | | $ | 651,476 | | $ | 32,465,871 | |

| U. S. Government securities | | | 2,989,486 | | | 983 | | | 39,844 | | | 2,950,625 | |

| Corporate debt securities | | | 1,001,891 | | | 3,539 | | | 0 | | | 1,005,430 | |

| Other investments | | | 32,500 | | | 0 | | | 0 | | | 32,500 | |

| | | $ | 37,139,454 | | $ | 6,292 | | $ | 691,320 | | $ | 36,454,426 | |

| | | | | | | | | | | | | | |

Securities HTM | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| December 31, 2006 | | | | | | | | | | | | | |

| States and Political Subdivisions | | $ | 21,069,866 | | $ | 231,134 | | $ | 0 | | $ | 21,301,000 | |

| | | | | | | | | | | | | | |

| December 31, 2005 | | | | | | | | | | | | | |

| States and Political Subdivisions | | $ | 28,391,665 | | $ | 52,335 | | $ | 0 | | $ | 28,444,000 | |

Included in the caption "States and Political Subdivisions" are securities of local municipalities carried at $21,069,866 and $28,391,665 at December 31, 2006 and 2005, respectively, which are attributable to private financing transactions arranged by the Company. The current fair value of these securities is an estimation based on an analysis that takes into account future maturities and scheduled future repricing. The Company anticipates no losses on these securities and expects to hold them until their maturity.

Investment securities with a book value of $21,022,304 and $22,106,561 and a fair value of $20,645,566 and $21,675,699 at December 31, 2006 and 2005, respectively, were pledged as collateral for larger dollar repurchase agreement accounts and for other purposes as required or permitted by law.

Proceeds from the maturities, call or sale of securities available-for-sale amounted to $15,089,375 in 2006, $17,000,000 in 2005, and $20,461,560 in 2004. Realized gains from sales of investments available-for-sale were $56,875 in 2006, $0 in 2005, and $70,311 in 2004. Realized losses were $0 in 2006 and 2005, and $31,664 in 2004. When an investment classified as held-to-maturity has a call option, sale of the investment is permitted if the sale is within 90 days of the call date and it is highly probable that it will be called. In 2004, a realized gain of $5,412 was recognized through the sale of a held-to-maturity security that met the criteria.

The carrying amount and estimated fair value of securities by contractual maturity are shown below. Expected maturities will differ from contractual maturities because borrowers may have the right to call or prepay obligations with or without call or prepayment penalties.

The scheduled maturities of securities available-for-sale at December 31, 2006 were as follows:

| | | Carrying | | Fair | |

| | | Amount | | Value | |

| | | | | | |

| Due in one year or less | | $ | 5,003,179 | | $ | 4,949,006 | |

| Due from one to five years | | | 18,019,125 | | | 17,663,201 | |

| | | $ | 23,022,304 | | $ | 22,612,207 | |

The scheduled maturities of securities held-to-maturity at December 31, 2006 were as follows:

| | | Carrying | | Fair | |

| | | Amount | | Value* | |

| | | | | | |

| Due in one year or less | | $ | 17,253,914 | | $ | 17,254,000 | |

| Due from one to five years | | | 1,444,078 | | | 1,502,000 | |

| Due from five to ten years | | | 1,744,228 | | | 1,802,000 | |

| Due after ten years | | | 627,646 | | | 743,000 | |

| | | $ | 21,069,866 | | $ | 21,301,000 | |

*Method used to determine fair value rounds values to nearest thousand.

All investments with unrealized losses are presented either as those with a continuous loss position less than 12 months or as those with a continuous loss position for 12 months or more. Investments with unrealized losses at December 31, 2006 and 2005 were as follows:

| December 31, 2006 | | Less than 12 months | | 12 months or more | | Total | |

| | | Fair | | Unrealized | | Fair | | Unrealized | | Fair | | Unrealized | |

| | | Value | | Loss | | Value | | Loss | | Value | | Loss | |

| U.S. sponsored | | | | | | | | | | | | | |

| enterprise securities | | $ | 999,836 | | $ | 163 | | $ | 17,648,309 | | $ | 382,005 | | $ | 18,648,145 | | $ | 382,168 | |

| U.S. Government | | | | | | | | | | | | | | | | | | | |

| Securities | | | 993,438 | | | 4,841 | | | 1,968,437 | | | 28,156 | | | 2,961,875 | | | 32,997 | |

| | | $ | 1,993,274 | | $ | 5,004 | | $ | 19,616,746 | | $ | 410,161 | | $ | 21,610,020 | | $ | 415,165 | |

| December 31, 2005 | | Less than 12 months | | 12 months or more | | Total | |

| | | Fair | | Unrealized | | Fair | | Unrealized | | Fair | | Unrealized | |

| | | Value | | Loss | | Value | | Loss | | Value | | Loss | |

| U.S. sponsored | | | | | | | | | | | | | |

| enterprise securities | | $ | 2,958,580 | | $ | 35,003 | | $ | 27,499,097 | | $ | 616,473 | | $ | 30,457,677 | | $ | 651,476 | |

| U.S. Government | | | | | | | | | | | | | | | | | | | |

| securities | | | 979,375 | | | 14,919 | | | 974,062 | | | 24,925 | | | 1,953,437 | | | 39,844 | |

| | | $ | 3,937,955 | | $ | 49,922 | | $ | 28,473,159 | | $ | 641,398 | | $ | 32,411,114 | | $ | 691,320 | |

The unrealized losses are a result of increases in market interest rates and not of deterioration in the creditworthiness of the issuer. At December 31, 2006 there were 22 securities in the investment portfolio that were in an unrealized loss position compared to 33 securities in an unrealized loss position at December 31, 2005. These unrealized losses were principally attributable to changes in current interest rates for similar types of securities.

Management evaluates securities for other-than-temporary impairment at least on a quarterly basis, and more frequently when economic or market concerns, or adverse developments relating to the issuer, warrant such evaluation. Consideration is given

to (1) the length of time and the extent to which the fair value has been less than cost, (2) the financial condition and near-term prospects of the issuer, and (3) the intent and ability of the Company to retain its investment in the issuer for a period of time sufficient to allow for any anticipated recovery in fair value. In analyzing an issuer's financial condition, management considers whether the securities are issued by the federal government or its agencies, whether downgrades by bond rating agencies have occurred, and the results of reviews of the issuer's financial condition. As management has the ability to hold debt securities until maturity, or for the foreseeable future if classified as available-for-sale, no declines are deemed to be other-than-temporary at December 31, 2006 and 2005.

Note 3. Loans

The composition of net loans at December 31 was as follows:

| | | 2006 | | 2005 | |

| Commercial | | $ | 22,217,047 | | $ | 20,262,855 | |

| Real estate - Construction | | | 11,889,203 | | | 13,931,238 | |

| Real estate - Mortgage | | | 213,894,135 | | | 194,565,926 | |

| Installment and other | | | 20,729,341 | | | 21,862,936 | |

| | | | 268,729,726 | | | 250,622,955 | |

| Deduct: | | | | | | | |

| Allowance for loan losses | | | 2,267,821 | | | 2,189,187 | |

| Unearned net loan fees | | | 632,105 | | | 684,106 | |

| | | | 2,899,926 | | | 2,873,293 | |

| | | $ | 265,829,800 | | $ | 247,749,662 | |

The total recorded investment in impaired loans as determined in accordance with accounting principles generally accepted in the United States of America was $508,571 and $219,766 at December 31, 2006 and 2005, respectively. The allowance for loan losses allocated to these loans amounted to $68,229 and $87,938 at December 31, 2006 and 2005, respectively. The average recorded investment in impaired loans amounted to $643,307, $284,542, and $282,270 for the years ended December 31, 2006, 2005, and 2004, respectively. Interest income recognized on impaired loans during 2006 was $90,829, all of which was on a cash basis. No interest income was recognized or received on impaired loans in 2005 and 2004.

The Company had non-accrual loans of $720,587 and $436,419 at December 31, 2006 and 2005, respectively. If interest on non-accrual loans had been recognized at the original interest rates, interest income would have increased approximately $61,718, $49,644, and $63,212 for the years ended December 31, 2006, 2005, and 2004, respectively. The total recorded investment in loans past due ninety days or more and still accruing interest was $205,801 and $176,885 at December 31, 2006 and 2005, respectively.

The Company is not committed to lend additional funds to debtors with impaired, non-accrual or modified loans.

Note 4. Loan Servicing

Commercial and mortgage loans serviced for others are not included in the accompanying balance sheets. The unpaid principal balances of commercial and mortgage loans serviced for others were $144,573,102 and $131,941,606 at December 31, 2006 and 2005, respectively. Net gains realized on the sale of loans amounted to $314,850, $376,946, and $426,198 for the years ended December 31, 2006, 2005, and 2004, respectively. The balance of capitalized servicing rights, net of valuation allowances, included in other assets at December 31, 2006 and 2005, was $1,113,607 and $946,808, respectively. The fair values of these rights were $1,463,324 and $1,365,244, respectively. The fair value of servicing rights was determined using market prices for similar assets with similar characteristics. The Company will be implementing changes to its analysis

procedures during the first quarter of 2007, as required by virtue of its implementation of SFAS No. 156, “Accounting for Servicing of Financial Assets - an Amendment to FASB Statement No. 140”, which is discussed in more detail in Note 1 above, under the heading “Impact of Recently Issued Accounting Standards”.

The following summarizes mortgage servicing rights capitalized and amortized in each year:

| | Years Ended December 31, |

| | | 2006 | | 2005 | | 2004 | |

| | | | | | | | |

| Mortgage servicing rights capitalized | $ | 447,939 | $ | 423,133 | $ | 446,079 | |

| Mortgage servicing rights amortized | $ | 281,140 | $ | 248,990 | $ | 214,496 | |

Note 5. Allowance for Loan Losses

Changes in the allowance for loan losses for the years ended December 31 were as follows:

| | | 2006 | | | 2005 | | | 2004 | |

| | | | | | | | | | |

| Balance, beginning of year | $ | 2,189,187 | | $ | 2,153,372 | | $ | 2,199,110 | |

| Provision for loan losses | | 137,500 | | | 150,000 | | | 95,000 | |

| Recoveries of amounts charged off | | 68,460 | | | 66,193 | | | 127,809 | |

| | | 2,395,147 | | | 2,369,565 | | | 2,421,919 | |

| Amounts charged off | | (127,326 | ) | | (180,378 | ) | | (268,547 | ) |

| Balance, end of year | $ | 2,267,821 | | $ | 2,189,187 | | $ | 2,153,372 | |

Note 6. Bank Premises and Equipment

The major classes of bank premises and equipment and accumulated depreciation and amortization at December 31 were as follows:

| | | 2006 | | 2005 | |

| | | | | | |

| Land and land improvements | | $ | 2,315,414 | | $ | 1,566,010 | |

| Buildings and improvements | | | 9,746,666 | | | 9,301,401 | |

| Furniture and equipment | | | 5,282,007 | | | 5,039,609 | |

| Leasehold improvements | | | 623,621 | | | 636,789 | |

| Other prepaid assets and construction in progress | | | 94,688 | | | 8,127 | |

| | | | 18,062,396 | | | 16,551,936 | |

| Less accumulated depreciation and amortization | | | (5,728,372 | ) | | (4,934,817 | ) |

| | | $ | 12,334,024 | | $ | 11,617,119 | |

Depreciation included in occupancy expenses amounted to $878,645, $789,587, and $772,886 for the years ended December 31, 2006, 2005, and 2004, respectively.

The Company is obligated under non-cancelable operating leases at four branch office locations expiring in various years through 2022 with options to renew. Minimum future rental payments for these leases with original terms in excess of one year as of December 31, 2006 for each of the next five years and in aggregate are:

| 2007 | $ | 142,563 |

| 2008 | | 143,872 |

| 2009 | | 145,220 |

| 2010 | | 118,451 |

| 2011 | | 98,924 |

| Subsequent to 2011 | | 335,641 |

| | $ | 984,671 |

Total rental expense amounted to $198,370, $181,201, and $173,882 for the years ended December 31, 2006, 2005, and 2004, respectively.

Note 7. Other Real Estate Owned (OREO)

There was no OREO at December 31, 2006 or 2005, and there was no change in the allowance for losses on OREO for the years ended December 31, 2006, 2005 or 2004.

Note 8. Other Investments

The Company has purchased from time to time various partnership interests in limited partnerships. These partnerships were established to acquire, own and rent residential housing for low and moderate income Vermonters located in northeastern and central Vermont.

The tax credits from these investments were estimated at $345,522, $320,165, and $248,521 for the years ended December 31, 2006, 2005, and 2004, respectively, and are recorded as a reduction of income tax expense. Expenses related to amortization of the investments in the limited partnerships are recognized as a component of "other expenses", and were $354,156, $338,216, and $292,915 for 2006, 2005, and 2004, respectively. The carrying values of these investments, which are included in other assets, were $2,170,053 and $2,543,344 at December 31, 2006 and 2005, respectively.

The Bank has a one-third ownership interest in a nondepository trust company, Community Financial Services Group, LLC (“CFSG”) based in Newport, Vermont, which is held indirectly through Community Financial Services Partners, LLC, ("Partners") a Vermont limited liability company that owns 100% of the limited liability company equity interests of CFSG. The Bank accounts for its investment in Partners under the equity method of accounting. As of December 31, 2006, the Company's investment in Partners amounted to $170,427 with income for 2006 of $72,109, compared to an investment of $119,018 as of December 31, 2005 with income of $20,825 for 2005.

Note 9. Deposits

The following is a maturity distribution of time certificates of deposit at December 31, 2006:

2007 | $ | 103,452,693 |

2008 | | 11,249,101 |

2009 | | 11,034,356 |

2010 | | 1,442,297 |

2011 | | 6,532,750 |

Total | $ | 133,711,197 |

Note 10. Borrowed Funds

Borrowings from the Federal Home Loan Bank of Boston (FHLB) as of December 31 were as follows:

| | | 2006 | | 2005 |

| | | | | |

| FHLB term borrowing, 4.11% fixed rate, payable January 18, 2006 | $ | 0 | $ | 2,000,000 |

| FHLB term borrowing, 4.47% fixed rate, payable March 27, 2006 | | 0 | | 3,000,000 |

| Community Investment Program borrowing, 7.57% | | | | |

| fixed rate, payable November 16, 2007 | | 30,000 | | 30,000 |

| FHLB term borrowing, 4.78% fixed rate, payable | | | | |

| January 18, 2011, callable quarterly | | 0 | | 5,000,000 |

| Community Investment Program borrowing, 7.67% | | | | |

| fixed rate, payable November 16, 2012 | | 10,000 | | 10,000 |

| | $ | 40,000 | $ | 10,040,000 |

Principal maturities of borrowed funds as of December 31, 2006 were as follows:

| 2007 | $ | 30,000 | |

| 2012 | | 10,000 | |

| | $ | 40,000 | |

The Company maintains a $4,301,000 IDEAL Way Line of Credit with FHLB. As of December 31, 2006 and 2005, there were no outstanding advances under this line. Interest on these borrowings is at a rate determined daily by FHLB and payable monthly.

Borrowings from FHLB are secured by a blanket lien on qualified collateral consisting primarily of loans with first mortgages secured by one to four family properties and other qualified assets. Qualified collateral for these borrowings approximated $110,574,000 and $114,089,000 as of December 31, 2006 and 2005, respectively.

Under a separate agreement, the Company has the authority to collateralize public unit deposits, up to its available borrowing capacity, with letters of credit issued by FHLB. As of December 31, 2006, the Company's potential borrowing capacity was $82.9 million, reduced by outstanding advances. At December 31, 2006, $52.3 million in letters of credit was pledged as collateral for these deposits. A fee is charged to the Company, quarterly, based on the average daily balance outstanding at a rate of 20 basis points. The average daily balance for the fourth quarter of 2006 was $26.0 million.

Note 11. Securities Sold Under Agreements to Repurchase

Securities sold under agreements to repurchase amounted to $17,083,946 and $17,347,140 as of December 31, 2006 and 2005, respectively. These agreements are collateralized by U. S. government sponsored enterprise securities and U. S. Treasury notes with a book value of $20,022,304 and $18,115,155 and a fair value of $19,667,030 and $17,737,454 at December 31, 2006 and 2005, respectively.

The average daily balance of these repurchase agreements approximated $15,687,663 and $13,986,763 during 2006 and 2005, respectively. The maximum borrowings outstanding on these agreements at any month-end reporting period of the Company were $17,536,357 and $17,347,140 in 2006 and 2005, respectively. These repurchase agreements mature daily and carried a weighted average interest rate of 2.07% during 2006, compared to 1.48% during 2005. The securities underlying these agreements are held in safekeeping at the Investors Bank & Trust Company.

Note 12. Income Taxes

The Company prepares its federal income tax return on a consolidated basis. Federal income taxes are allocated to members of the consolidated group based on taxable income.

Federal income tax expense for the years ended December 31 was as follows:

| | 2006 | | 2005 | | 2004 | |

| | | | | | | |

| Currently paid or payable | $ | 757,963 | | $ | 826,932 | | $ | 657,654 | |

| Deferred | | (28,349 | ) | | (36,931 | ) | | 72,768 | |

| | $ | 729,614 | | $ | 790,001 | | $ | 730,422 | |

Total income tax expense differed from the amounts computed at the statutory federal income tax rate of 34 percent primarily due to the following for the years ended December 31:

| | 2006 | | 2005 | | 2004 | |

| Computed expected tax expense | $ | 1,395,721 | | $ | 1,431,616 | | $ | 1,403,311 | |

| Tax exempt interest | | (367,055 | ) | | (360,127 | ) | | (348,155 | ) |

| Disallowed interest | | 42,257 | | | 34,813 | | | 36,932 | |

| Partnership tax credits | | (345,522 | ) | | (320,165 | ) | | (248,521 | ) |

| Other | | 4,213 | | | 3,864 | | | (113,145 | ) |

| | $ | 729,614 | | $ | 790,001 | | $ | 730,422 | |

The deferred income tax (benefit) provision consisted of the following items for the years ended December 31:

| | 2006 | | 2005 | | 2004 | |

| | | | | | | |

| Depreciation | $ | (20,178 | ) | $ | (60,525 | ) | $ | 4,199 | |

| Loan fees | | 1,814 | | | 2,721 | | | 5,181 | |

| Mortgage servicing | | 56,711 | | | 59,209 | | | 78,738 | |

| Deferred compensation | | (36,458 | ) | | (27,654 | ) | | (44,742 | ) |

| Bad debts | | (26,735 | ) | | (12,177 | ) | | 15,551 | |

| Nonaccrual loan interest | | (8,661 | ) | | 1,495 | | | 32,567 | |

| Other | | 5,158 | | | 0 | | | (18,726 | ) |

| | $ | (28,349 | ) | $ | (36,931 | ) | $ | 72,768 | |

Listed below are the significant components of the net deferred tax asset at December 31:

| | 2006 | | 2005 | |

| Components of the deferred tax asset: | | | | |

| Bad debts | $ | 596,883 | | $ | 570,148 | |

| Unearned loan fees | | 4,577 | | | 6,391 | |

| Nonaccrual loan interest | | 11,003 | | | 2,342 | |

| Deferred compensation | | 366,925 | | | 330,467 | |

| Unrealized loss on securities available-for-sale | | 139,433 | | | 232,910 | |

| Other | | 94,858 | | | 100,014 | |

| Total deferred tax asset | | 1,213,679 | | | 1,242,272 | |

| | | | | | | |

| Components of the deferred tax liability: | | | | | | |

| Depreciation | | 284,941 | | | 305,119 | |

| Limited partnerships | | 255,280 | | | 255,280 | |

| Mortgage servicing rights | | 378,627 | | | 321,915 | |

| Total deferred tax liability | | 918,848 | | | 882,314 | |

| Net deferred tax asset | $ | 294,831 | | $ | 359,958 | |

Accounting principles generally accepted in the United States of America allow for the recognition and measurement of deductible temporary differences (including general valuation allowances) to the extent that it is more likely than not that the deferred tax asset will be realized.

Net deferred tax assets are included in the caption "Other Assets" in the balance sheets at December 31, 2006 and 2005.

Note 13. 401(k) and Profit-Sharing Plan

The Company has a defined contribution plan covering all employees who meet certain age and service requirements. Due to the fact that the plan is a defined contribution plan, rather than a defined benefit plan, there is no unfunded past service liability. The provisions for pension expense were $448,784, $429,000, and $379,435 for 2006, 2005, and 2004, respectively. These amounts represent discretionary matching contributions of a portion of the voluntary employee salary deferrals under the 401(k) plan and discretionary profit-sharing contributions under the plan.

Note 14. Deferred Compensation and Supplemental Employee Retirement Plans

The Company maintains a directors’ deferred compensation plan and, prior to 2005, a retirement plan for its directors. Participants are general creditors of the Company with respect to these benefits. The benefits accrued under these plans were $601,951 and $578,937 at December 31, 2006 and 2005, respectively. Expenses associated with these plans were $35,013, $15,587, and $64,779 for the years ended December 31, 2006, 2005, and 2004, respectively.

Deferrals of director compensation under the plan were suspended during 2005 pending receipt of guidance from the Internal Revenue Service (IRS) for compliance with Internal Revenue Code (IRC) section 409A, added by the American Jobs Creation Act of 2004. In accordance with IRS guidance issued in 2005, the Company permits new deferrals under the plan for eligible directors effective January 1, 2006. Benefits accrued under this plan during 2006 were $19,058 and are included in the 2006 total of $601,951 in the paragraph above.

The Company terminated the directors’ retirement plan during 2005, and no benefits for 2005 were accrued. Eligible directors will receive additional current compensation in lieu of accruing additional benefits payable under the retirement plan. Retirement benefits accrued prior to termination of the plan will be paid out to participants at their retirement from the board.

The Company also maintains a supplemental employee retirement plan for key employees of the Company. Benefits accrued under this plan were $477,241 and $393,025 at December 31, 2006 and 2005, respectively. The expense associated with this plan was $84,216, $69,000, and $70,565 for the years ended December 31, 2006, 2005, and 2004, respectively.

It was anticipated that certain provisions of these plans would be amended during 2006 to ensure compliance with IRC section 409A; however, the deadline was extended to December 2007, pending the issuance of final IRS regulations. Such amendments are not expected to have any material impact upon the Company's financial obligations under the plans.

Note 15. Financial Instruments with Off-Balance-Sheet Risk

The Company is a party to financial instruments with off-balance-sheet risk in the normal course of business to meet the financing needs of its customers and to reduce its own exposure to fluctuations in interest rates. These financial instruments include commitments to extend credit, standby letters of credit and financial guarantees, commitments to sell loans, and risk-sharing commitments on certain sold loans. Such instruments involve, to varying degrees, elements of credit and interest rate risk in excess of the amount recognized in the balance sheet. The contract or notional amounts of those instruments reflect the extent of involvement the Company has in particular classes of financial instruments.

The Company's exposure to credit loss in the event of nonperformance by the other party to the financial instrument for commitments to extend credit and standby letters of credit and financial guarantees written is represented by the contractual notional amount of those instruments. The Company uses the same credit policies in making commitments and conditional obligations as it does for on-balance-sheet instruments.

The Company generally requires collateral or other security to support financial instruments with credit risk. At December 31, the following financial instruments were outstanding whose contract amount represent credit risk:

| | Contract or |

| | --Notional Amount-- |

| | 2006 | 2005 |

| | | | | |

| Unused portions of commercial lines of credit | $ | 11,116,285 | $ | 17,497,235 |

| Unused portions of home equity lines of credit | | 11,212,136 | | 8,867,594 |

| Other commitments to extend credit | | 11,982,321 | | 10,303,630 |

| Standby letters of credit and commercial letters of credit | | 1,004,200 | | 621,135 |

| Credit card arrangements | | 9,086,665 | | 8,890,318 |

| MPF credit enhancement obligation, net (See Note 16) | | 1,130,949 | | 1,066,162 |

Commitments to extend credit are agreements to lend to a customer as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. Since many of the commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. At December 31, 2006 and 2005, the Company had binding loan commitments at fixed rates approximating $0 and $607,600, respectively, which are included in commitments to extend credit.

The Company evaluates each customer's credit-worthiness on a case-by-case basis. The amount of collateral obtained if deemed necessary by the Company upon extension of credit is based on management's credit evaluation of the counter-party. Collateral held varies but may include real estate, accounts receivable, inventory, property, plant and equipment, and income-producing commercial properties.

Standby letters of credit and financial guarantees written are conditional commitments issued by the Company to guarantee the performance of a customer to a third party. Those guarantees are primarily issued to support private borrowing arrangements. The credit risk involved in issuing letters of credit is essentially the same as that involved in extending loans to customers. The fair value of standby letters of credit has not been included in the balance sheets as required by Financial Accounting Standards Board Interpretation No. 45 as the fair value is immaterial.

Note 16. Contingent Liability

The Company sells 1-4 family residential loans under a program with FHLB, the Mortgage Partnership Finance program (MPF). Under this program the Company shares in the credit risk of each mortgage, while receiving fee income in return. The Company is responsible for a Credit Enhancement Obligation (CEO) based on the credit quality of these loans. FHLB funds a First Loss Account (FLA) based on the Company's outstanding MPF mortgage balances. This creates a laddered approach to sharing in any losses. In the event of default, homeowner's equity and Private Mortgage Insurance, if any, are the first sources of repayment; the FHLB's FLA funds are then utilized, followed by the member's CEO, with the balance picked up by FHLB. These loans meet specific underwriting standards of the FHLB. As of December 31, 2006 and 2005, the Company had $45.7 million and $44.1 million, respectively, in loans sold through the MPF program. The Company carries a contingent liability of $91,667 as of December 31, 2006 and 2005, which is calculated on the same methodology used in calculating its allowance for loan loss, adjusted to reflect the risk sharing arrangements with the FHLB. The volume of loans sold to the MPF program and the corresponding credit obligation continue to be closely monitored by management. As of December 31, 2006, the notional amount of the maximum contingent contractual liability related to this program was $1,222,616 compared to $1,157,829 as of December 31, 2005.

Note 17. Legal Contingencies

In the normal course of business, the Company is involved in various claims and legal proceedings. In the opinion of the Company's management, after consulting with the Company's legal counsel, any liabilities resulting from such proceedings are not expected to have a material adverse effect on the Company's financial statements.

Note 18. Transactions with Related Parties

The Company has had, and may be expected to have in the future, banking transactions in the ordinary course of business with directors, principal officers, their immediate families and affiliated companies in which they are principal shareholders (commonly referred to as related parties), all of which have been, in the opinion of management, on the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with others and which do not represent more than the normal risk of collectibility, or present other unfavorable features.

Aggregate loan transactions with related parties as of December 31 were as follows:

| | 2006 | | 2005 | |

| | | | | |

| Balance, beginning | $ | 520,675 | | $ | 567,907 | |

| Loans - New Directors | | 749,441 | | | 0 | |

| New loans | | 784,933 | | | 378,271 | |

| Repayments | | (669,552 | ) | | (425,503 | ) |

| Balance, ending | $ | 1,385,497 | | $ | 520,675 | |

Total deposits with related parties approximated $1,234,207 and $1,243,014 at December 31, 2006 and 2005, respectively.

The Company leases approximately 1,466 square feet of condominium space in the state office building on Main Street in Newport to its trust company affiliate, CFSG. This is the location of CFSG’s principal offices. CFSG also leases an office in the Company’s Barre branch.

The amount of rental income received from CFSG for the twelve months ended December 31 was:

| | 2006 | | 2005 | | 2004 | |

| | | | | | | |

| Newport | $ | 18,635 | | $ | 16,994 | | $ | 16,555 | |

| Barre | | 2,313 | | | 2,225 | | | 2,135 | |

| Total | $ | 20,948 | | $ | 19,219 | | $ | 18,690 | |

The Company has utilized the services of CFSG as an investment advisor for the 401(k) plan since August 1, 2002. The Human Resources committee of the Board of Directors is the Trustee of the plan, and CFSG is hired to provide investment advice for the plan. CFSG also acts as custodian of the retirement funds and makes investments on behalf of the plan and its participants. The Company pays monthly management fees to CFSG based on the market value of the total assets under management.

The amount paid to CFSG for the twelve months ended December 31 was:

| | 2006 | | 2005 | | 2004 | |

| | | | | | | |

| Management Fees | $ | 36,841 | | $ | 35,521 | | $ | 37,316 | |

Note 19. Restrictions on Cash and Due From Banks

The Company is required to maintain reserve balances in cash with the Federal Reserve Bank. The totals of those reserve balances were approximately $3,024,000 and $2,845,000 at December 31, 2006 and 2005, respectively.

The nature of the Company's business requires that it maintain amounts due from correspondent banks that, at times, may exceed federally insured limits. No losses have been experienced in these accounts. The Company believes it is not exposed to any significant risk with respect to these accounts. In addition, the Company was required to maintain contracted clearing balances with correspondent banks of $325,000 and $300,000 at December 31, 2006 and 2005, respectively, of which $275,000 is included in the year-end reserve balances reported for the Federal Reserve Bank in the paragraph above.

Note 20. Regulatory Matters

The Company (on a consolidated basis) and the Bank (Community National Bank) are subject to various regulatory capital requirements administered by the federal banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory - and possibly additional discretionary - actions by regulators that, if undertaken, could have a direct material effect on the Company's and the Bank's financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Company and the Bank must meet specific capital guidelines that involve quantitative measures of their assets, liabilities, and certain off-balance-sheet items as calculated under regulatory accounting practices. Capital amounts and classifications are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors. Prompt corrective action provisions are not applicable to bank holding companies.

Quantitative measures established by regulation to ensure capital adequacy require the Company and the Bank to maintain minimum amounts and ratios (set forth in the table below) of total and Tier 1 capital (as defined in the regulations) to risk-weighted assets (as defined), and of Tier 1 capital (as defined) to average assets (as defined). Management believes, as of December 31, 2006, that the Company and the Bank met all capital adequacy requirements to which they are subject.

As of December 31, 2006, the most recent notification from the Office of the Comptroller of the Currency (OCC) categorized the Bank as well capitalized under the regulatory framework for prompt corrective action. To be categorized as well capitalized, the Bank must maintain minimum total risk-based, Tier 1 risk-based, and Tier 1 leverage ratios as set forth in the table. There are no conditions or events since that notification that management believes have changed the Bank's regulatory capital categories.

The Company's and the Bank's actual capital amounts (in thousands) and ratios are also presented in the table.

| | | | | | Minimum |

| | | | | | To Be Well |

| | | | Minimum | Capitalized Under |

| | | | For Capital | Prompt Corrective |

| | | | Adequacy Purposes: | Action Provisions: |

| | Actual | | | | |

| | Amount | Ratio | Amount | Ratio | Amount | Ratio |

| | | | | | | |

As of December 31, 2006: | | | | | | |