Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year ended December 31, 2006

Or

| ¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission File Number 0-11685

Radyne Corporation

(Exact name of Registrant as specified in its charter)

| Delaware | 11-2569467 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 3138 East Elwood Street, Phoenix, Arizona | 85034 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number including area code: (602) 437-9620

Securities Registered Under Section 12(b) of the Exchange Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share | The NASDAQ Stock Market LLC |

Securities Registered Under Section 12(g) of the Exchange Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check One).

Large accelerated filer ¨ Accelerated filer x Non-accelerated filer ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $171 million computed by reference to the closing price of the stock on the NASDAQ Stock Market on June 30, 2006, the last trading day of the registrant’s most recently completed second fiscal quarter. For purposes of this determination, shares of common stock held by each officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock, that were outstanding as of the close of business on January 31, 2007 was 18,362,451.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement relating to its 2007 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K. The Annual Meeting of Stockholders is to be held on June 27, 2006 at 2 p.m. in the registrant’s Phoenix office.

Table of Contents

| PART I | ||||||

Item 1. | 3 | |||||

Item 1A. | 11 | |||||

Item 1B. | 15 | |||||

Item 2. | 15 | |||||

Item 3. | 15 | |||||

Item 4. | 15 | |||||

| PART II | ||||||

Item 5. | Market for Company’s Common Equity and Related Shareholder Matters | 16 | ||||

Item 6. | 18 | |||||

Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operation | 19 | ||||

Item 7A. | 28 | |||||

Item 8. | 28 | |||||

Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 49 | ||||

Item 9A. | 49 | |||||

Item 9B. | 52 | |||||

| PART III | ||||||

Item 10. | 53 | |||||

Item 11. | 53 | |||||

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 53 | ||||

Item 13. | 54 | |||||

Item 14. | 54 | |||||

| PART IV | ||||||

Item 15. | 55 |

2

Table of Contents

Development of Business

History of Business

Radyne Corporation (“Company”) was formed in 1980 as a corporation under the laws of the state of New York. In 1995, a new management team moved the Company to Arizona. The Company reincorporated in Delaware in July 2000. The Company completed the following acquisitions of complementary business lines: ComStream Corp of San Diego, CA in 1998, Armer Communications of Chandler, AZ in 2000, the assets of Tiernan Communications of San Diego, CA in 2001 and Xicom Technology, Inc. of Santa Clara, CA in May 2005.

Current Business

The Company designs, manufactures, sells, integrates and installs products, systems and software used for the transmission and reception of data and video over satellite, troposcatter, microwave and cable communication networks. The Company’s products are used in applications for telephone (land line and mobile), data, video and audio broadcast communications, private and corporate data networks, Internet applications, and digital television for cable and network broadcast. Through its Tiernan subsidiary, the Company is a supplier of HDTV and SDTV encoding and transmission equipment. The Xicom subsidiary is a producer of high power amplifiers for communications applications. The Company is headquartered in Phoenix, Arizona, has sales and manufacturing facilities in Phoenix, Arizona and San Diego and Santa Clara, California, and sales or service centers in; Boca Raton, Florida; Singapore; China; Indonesia; the Netherlands; and the United Kingdom. We serve customers in over 90 countries, including customers in the television broadcast industry, international telecommunications companies, Internet service providers, private communications networks, network and cable television, and the United States government.

Our products have or will be utilized in major communication systems worldwide, including the following:

| • | Satellite modems and high power amplifiers used as the backbone for major U.S. Department of Defense and Homeland Security communications systems. |

| • | Satellite modems, high power Ka band amplifiers and HD encoders for expanded direct to home (DTH) distribution of HDTV from satellite. |

| • | HDTV encoders and decoders for a major American television network for use during their coverage of the 2008 Olympics in Beijing and the National Basketball Association. |

| • | Satellite backhaul systems for GSM mobile phone providers in India and China. |

| • | Tri-band satellite amplifiers for a major U.S. satellite communications integrator that are used in a mobile satellite program for the U.S. military. |

| • | DMD20 satellite modem, frequency converters, and redundancy switches for a large expansion project by leading telecom providers in the Asia Pacific region. |

| • | Major expansion of U.S. government satellite monitoring network. |

| • | DataPath, a premier U.S. government supplier, with DMD20s to use in its DKET and TRACKX products. |

| • | Solid-State Block Upconverters for major U.S. satellite communication integrators. |

| • | Satellite products for disaster recovery projects, including, for example, the Hurricane Katrina recovery effort. |

Financial Information about Segments

The Company has been organized into two operating segments: 1) Satellite Electronics and Broadcast Equipment, which provides Radyne and Tiernan brand products to satellite, microwave, television, and cable communications customers; and 2) Amplifiers, which provides Xicom Traveling Wave Tube Amplifiers (TWTAs), Klystron Power Amplifiers (KPAs) and Solid State Power Amplifiers (SSPAs) used in broadcast and broadband satcom applications including IP-over-Satellite markets. Each

3

Table of Contents

segment is organized and managed separately to make key decisions such as sales/marketing and product development. Please refer tonote 13 – Segment Reportingin the consolidated financial statements for additional segment reporting information and financial data.

Description of Business

Industry Overview

Satellite technology is a key element in the worldwide infrastructure of communications systems. Satellites enable communications service where there is no suitable alternative available to provide a redundant backup solution for terrestrial based infrastructure (like fiber-optic cables and microwave networks) or to supplement existing inadequate service. Unlike the cost of land-based networks, such as microwave and fiber cable, the cost to provide services via satellite does not increase with the distance between sending and receiving stations. Satellite networks can be rapidly installed, upgraded, and reconfigured as compared with land-based networks, which require rights-of-way and are expensive and time consuming to install and upgrade.

Satellite communication systems consist of two key segments: satellites (the “space segment”); and ground-based transmission/reception systems (the “ground segment”). The space segment consists of a single satellite or a constellation of satellites in earth orbit, which typically provide continuous communications coverage over a wide geographic area. These satellites typically contain multiple transponders, each of which is capable of simultaneously receiving and transmitting one or more signals to or from multiple users. The satellite ground segment, the segment of the industry within which the Company operates, consists principally of one or more earth stations. An earth station is an integrated system consisting of antennae, radio signal transmitting and receiving equipment, amplifiers, satellite modems, frequency converters, redundancy switches and voice, data, and/or video network interface equipment. Earth stations provide a communications link from the content originator (such as a broadcast studio or Internet service provider) to the end user either directly or through land-based networks.

The ground segment consists of multiple applications in which the Company operates. The three principal categories of satellite communication applications are fixed satellite services, mobile satellite services, and direct broadcast services.

| • | Fixed Satellite.Fixed satellite services provide point-to-point and point-to-multipoint satellite communication of voice, data, and video between fixed ground-based earth stations. The introduction of high-power satellites has created new opportunities within the fixed satellite services segment by enabling the use of smaller, less costly earth stations for applications such as corporate data networks, Intranet access, and rural telephony. |

| • | Mobile Satellite.Mobile satellite services operate between fixed earth stations and mobile earth stations, or terminals. These services provide mobile voice and data transmission capability on land, sea, and air. New mobile satellite services are being developed to bring more extensive coverage and circuit reliability for mobile telephone and data services to underserved populations throughout the world. Further, there is increased demand for “live” origination of broadcast television programming, such as live coverage of news, sports or cultural events that employ mobile satellite services for transmission from the venue to television studios. |

| • | Direct Broadcast.Direct broadcast services provide a direct transmission link from high-power satellites to customers over a wide geographic area. This includes direct-to-home television and radio services, distribution of television and radio programming to local affiliates direct broadcast data services, and Internet access. |

Industry Growth and Market Opportunity

We believe that demand for satellite system ground-based equipment has been and will continue to be driven by:

Worldwide Demand for Communications Services.Factors contributing to the demand for communications services include worldwide economic development and the increasing globalization of commerce. Businesses have a need for higher bandwidth services to communicate with their customers and employees around the world and are increasingly reliant upon Internet and multimedia applications. We expect demand for these kinds of higher bandwidth services to continue to grow in both developed and developing countries.

Deregulation and Privatization.Many developing countries that had previously not committed significant resources to or placed a high priority on developing and upgrading their communications systems are now doing so, primarily through deregulation and privatization. A significant number of these countries lack the resources, or have large geographic areas or terrain that make it difficult, to install extensive land-based networks on a cost-effective basis. This provides an opportunity for satellite communications services systems to meet the growing demand for communications services in these countries.

4

Table of Contents

Cost-Effectiveness of Satellite Communications.The relative cost-effectiveness of satellite communications services is a major factor driving the growth of satellite communications services in areas with rapidly growing telecommunications infrastructures. Large geographic areas, where significant distances separate population concentrations, require a technology whose cost and speed of implementation is relatively insensitive to distance. Unlike the cost of land-based networks, the cost to provide services via satellite does not increase with the distance between sending and receiving stations.

Technological Advances.Technological advances continue to increase the capacity of a single satellite and reduce the overall cost of a system and the service it delivers. This increases the number of potential end-users for the services and expands the available market. We believe that recent technological developments such as complex bandwidth efficient modulation schemes, turbo error correcting codes, bandwidth on demand, digital television compression technology, and signal processing methods will continue to stimulate the demand for the use of satellite communication services.

Government and Military.Satellites allow the military to have instant secure communications when deploying rapidly to troubled parts of the world and further support the infrastructure necessary for military tactical deployments. The U.S. government provides a significant market opportunity for satellite equipment manufacturers as government policies encourage the use of commercial “off-the-shelf” components whenever feasible. This provides us with the opportunity to configure our standard products for a sizable customer that is likely to provide consistent business.

Because of current concerns with international terrorism, the militaries of many countries have increased requirements for communications as their forces are spread around the world in such places as Afghanistan and Iraq. The U.S. government’s needs, such as maintaining communications with embassies, and the U.S. military’s worldwide command and control requirements, continue to drive more demand for satellite communications.

Television Video Distribution. Compressed HDTV digital video is a technology that has the potential to provide significant new market growth. The development of digital compression technology preserves the quality of TV signals and allows the transmission of television signals via satellite, point-to-point or fiber in a smaller bandwidth than is currently possible through alternative technologies, the most prevalent of which is over-the-air analog signals which use much larger frequency spectums than digital systems require. This advance in communications technology is enabling a wider application of satellite solutions for television and video broadcast services. The increased compression allows broadcasters to increase their channel offering within a smaller, allocated spectrum. New HDTV content provides opportunities for additional network and local programming choices along with related revenue opportunities. Satellites provide television broadcasters with an efficient and economical method to distribute their programming to cable service providers and direct broadcast satellite operators. Direct Broadcast Services, in turn, use satellites to distribute digital television programming. Compressed video encoding and decoding make satellites available for less demanding video transmissions, including business teleconferencing, private business networks, and telemedicine. The economics of compressed video allow the use of satellite transmission for long-distance teaching applications. Digital cinema distribution is a viable alternative to the physical distribution of feature length films and special media events.

Radio Broadcasts.Satellites are an ideal transmission medium for broadcast services, as a single satellite has the ability to communicate with ground locations spread across up to one-third of the surface of the earth. Radio network operators, financial news providers, merchandise retailers, and others use satellite systems to provide financial data and other audio transmissions for a variety of applications, such as local radio programming, news wire services and supermarket in-store radio. In addition, direct radio broadcasters use satellites to broadcast multiple channels of programming directly to consumers.

Private Networks.As businesses and other organizations expand into regions of the world where the telecommunications infrastructure is inadequate for land-based networks, the need for alternative communications connections among multiple facilities becomes evident. A private network is a dedicated communications and/or data transmission network. Such a network may link employees of a multiple-location business with co-workers located throughout the world. Users can consolidate multiple applications over a single satellite network and receive the same quality of service at a lower over-all cost. We believe the satellite communications industry is poised to gain a foothold in this market by offering reliable high-speed connectivity. Satellite systems can bypass the complexity of land-based networks, multiple carriers, and varying price and billing schedules.

Internet Communications.The Internet has evolved into a global medium, allowing millions of individuals throughout the world to communicate, share information, and engage in electronic commerce. Growth in this sector is expected to be driven by the large and growing number of personal computers installed in homes and offices, the declining prices of personal computers, improvements in network infrastructure, the availability of faster and cheaper Internet access, and the increasing familiarity with and acceptance of the Internet by businesses and consumers. Internet usage also is expected to continue to grow rapidly due to unique characteristics that differentiate it from traditional media, such as real-time access to interactive content, real-time communication capabilities, and the absence of geographic or temporal limitations.

5

Table of Contents

We expect satellite communications to continue to offer a cost-effective augmentation capability for Internet service providers, particularly in markets where land-based networks are unlikely to be either cost-effective or abundant, such as rural areas.

Products

Satellite Electronics and Broadcast Equipment

The Company supplies satellite modems, converters, and switches and HDTV broadcast products and standard/digital encoders and decoders thru its Radyne and Tiernan brands. The two principal product groups are listed below:

| • | Satellite Electronics |

| • | Modems—Satellite modems transform user information, such as data, video or audio, into a signal that can be further processed for transmission via satellite. We produce several varieties of satellite modems, which operate at different speeds using a variety of modulation techniques. Featured products include: the DMD20 – Universal Satellite Modem, the DMD2050 – MIL-STD Compliant Universal Satellite Modem, and the DMD20LBST – L-Band Satellite Modem and ODU Driver. |

| • | Frequency Converters/Transceivers—Each satellite is configured to receive or transmit a particular radio wave pattern, otherwise called a frequency band, which is typically different from the frequency of the satellite modem. Frequency converters are used to alter the input/output of a satellite modem into a wave pattern that can be interpreted by the particular satellite being used in the satellite system to relay communication signals. The Company currently markets a variety of converters used to transmit and receive signals over satellites in the commercial satellite frequency ranges of C-Band, Ka-Band, and Ku-Band. We also produce a redundancy control unit, which will switch a satellite system to stand-by equipment in the event of a malfunction in a satellite modem or converter. Such redundancy is a critical element for many of our customers, such as rural or international telephony networks, that strive to provide uninterrupted satellite communications services to their customers. Featured products include: SFC-1450 Ku-Band up-converter and SFC-1275 Ku-Band down-converter. |

| • | Earth Stations—Our earth stations typically consist of several components, including a satellite modem, a frequency converter, a transceiver, a transmitter, redundancy switches and an antenna. Earth stations serve as an essential link in transmitting signals to and receiving signals from satellites. Our earth stations enable users to program power levels and operating parameters in order to compensate for low signal levels, extreme weather conditions, and other variables. We design and manufacture our earth stations using components that we manufacture as well as components that we obtain from other manufacturers. Featured products include: the DMD20LB/ST – Satellite Earth Station. |

| • | Troposcatter – In 2005, the Company introduced a new troposcatter product or “over-the-horizon” modem in partnership with General Dynamics C4 Systems. The TM-20 modem has the ability to transmit and receive radio waves over the curvature of the Earth by reflecting signals off irregularities in the troposphere which is approximately 10Km above the Earth’s surface. The TM-20’s patented software is a major advance in troposcatter technology and will be marketed to the U.S. military, which currently employs troposcatter systems throughout the world, and to commercial interests. |

| • | Broadcast Equipment |

| • | Standard and High Definition TV Encoders/Decoders – TV encoders convert analog signals to digital format and compress the signal to fit over available bandwidth. Decoders are used to convert the compressed signal back into a form that can be viewed and edited. Encoders are used in satellite, cable and terrestrial applications. Many U.S. broadcasters rely on encoders to provide news/live event gathering and direct to home service. The Company offers a complete product line of SDTV and HDTV encoders for professional applications. Both models feature MPEG-2 video encoding capability and audio compression. The HDTV encoder features a monitor screen on its faceplate which enables the technician to monitor actual unit performance in real time. Featured products include: the HE4000 – High and Standard Definition Encoder, the SE4000 – DVB MPEG-2 Contribution Encoder, the HD4000 – High Definition Contribution Decoder, and the TDR4022 – DVB Professional Integrated Receiver/Decoder. |

In early 2007, the Tiernan Division introduced a new standard definition encoder employing advance video codec, also known as MPEG-4. This encoder, known as the AVC-4000, is the first product in a new family of products that employ this technology which allows for further compression of video signals to levels that allow more efficient use of available bandwidth when compared with MPEG-2 alternatives.

6

Table of Contents

| • | High-Speed and DVB Modems—Modulators and demodulators are similar to modems as they transform a signal for transmission to a satellite and then, at the receiving station, convert the signal back into a form usable as part of the broadcast data stream. Featured products include: the DM240 – Digital Video Broadcast Modulator and the DD240— Digital Video Broadcast Demodulator. |

| • | Cable and Microwave—Our cable modulators are used primarily in the distribution of digital video for use by cable television distributors and in HDTV. The design of our cable modulators allows for the transmission of digital video on terrestrial, broadband cable and enables system operators to manage and control available bandwidth. Our microwave modems are used with point-to-point microwave radios and usually feature high-speed and multidata-rate capabilities that provide a complete point-to-multipoint communication link that facilitates microwave link upgrades. For example, television stations use our microwave modems to transmit audio and video over a microwave link to and from digital newsgathering trucks. Featured products include: the MM200—Terrestrial Microwave Modem and the QAM256 – Digital Video Modulator. |

Satellite electronics and broadcast equipment products accounted for 54% of consolidated revenue for the year ended 2006.

Amplifiers

The Company provides a variety of high powered amplifiers thru the Amplifier segment under the Xicom brand.

Satellite amplifiers boost the strength of a signal prior to transmission to satellites which are often more than 21,000 miles from the surface of the earth. Xicom’s Solid State Power Amplifiers (“SSPA”), Traveling Wave Tube Amplifiers (“TWTA”), and Klystron Tube Amplifiers (“KTA”) are used in commercial and military satellite communications terminals throughout the world. These High Power Amplifiers (“HPA”) provide power levels vital to satellite communications in fixed, satellite news gathering (“SNG”), flyaway, mobile, shipboard, and airborne platforms. Applications include mobile SNG television trucks, fixed satellite ground stations and mobile platforms such as helicopters and ships. Featured products include antenna and rack-mount SSPAs, single-band (C-, X-, Ku-, Ka-, and DBS), and multi-band TWTAs.

Amplifiers accounted for 46% of consolidated revenue for the year ended 2006.

Competition

We face significant competition in the satellite communications field. The major competitors include companies such as Comtech EFData Corp., Paradise Datacom, Tandberg Television, and Scopus in the Satellite Electronics and Broadcast Equipment segment. In the Amplifier segment, CPI (Communications & Power Industries) and Miteq Inc. are the principal competitors. The Company maintains a sizable market share in each of these segments and anticipates further penetration with subsequent acquisition and organic growth.

We compete by deploying a direct sales effort in domestic and international markets and emphasizing our product features, quality and service. We believe that the quality, performance, and capabilities of our products, our ability to customize certain network functions, and the relatively lower overall cost of our products as compared to the cost of the competing products generally offered by our major competitors represent major factors in our ability to compete. However, our major competitors have the resources to develop products with features and functions that are competitive with or superior to our products. Competition from current competitors or future entrants in the markets in which we compete could cause us to lose orders or customers or could force us to lower the prices we charge for our products.

We believe we are well positioned to capitalize on the demand for satellite ground segment systems and that our future success in this market will be based upon our ability to leverage our competitive advantages, which include the following:

| • | An experienced management group, which has extensive technological and engineering expertise and excellent customer relationships. The members of our management team average over 20 years experience in the satellite communications industry. |

| • | A broad line of well-known, well-respected, off-the-shelf, state-of-the-art equipment that enables us to meet our customers’ requirements. |

| • | Ongoing new product development and product introductions that address changing customer needs. |

7

Table of Contents

| • | Our ability to custom design products for our customers’ special applications and to provide a one-stop shopping option to our customers. |

| • | Equipment that meets or exceeds all applicable military and government standards, including the first satellite modem to obtain Defense Information Systems Administration (“DISA”) certification, the DMD-20. |

| • | The ability to meet the complex satellite ground communications systems requirements of our customers in diverse political, economic, and regulatory environments in various locations around the world. |

| • | Our worldwide sales and service organization with the expertise to successfully conduct business internationally through sales and service offices staffed by our employees in most of our major markets throughout the world, including Beijing, Singapore, London, Jakarta, and Amsterdam. |

| • | The ability to offer a full line of satellite ground equipment with the mix of the Company’s different product lines. |

Strategy

Our primary business goals are to expand market share in our ground-based satellite systems business and improve profitability. We expect to achieve these goals through the following strategies:

Target Providers of Fixed, Mobile, and Direct Broadcast Communications Services in Developing Markets.We plan to target developing markets that we believe will account for a significant portion of the demand for satellite-based systems. These markets typically lack terrestrial infrastructure adequate to support demand for domestic and international communications services. We believe that we offer a cost effective alternative to land based networks. We plan to target providers of mobile and rural telephony services and Internet service providers in developing markets because we believe they will rely extensively upon satellite communication solutions. In developed countries, we plan to target emerging satellite communications service providers such as those offering direct broadcast applications.

Pursue Military, Homeland Defense and Other US Government Markets.Continued demand for technological solutions to national defense, homeland security and other government security requirements represents a key opportunity for our products. We plan to extend development of existing and new products in all of our lines of business to serve these needs.

Capitalize On Our Existing Technology Leadership. We believe that the global satellite communications services and equipment market and the digital television market present a number of attractive opportunities to apply our advanced technologies and capabilities. We plan to develop new products and enhance existing products by leveraging our technology to capture a share of these growth opportunities.

Develop New Products to Exploit New Market Opportunities.We plan to use our international sales force and our research and development capabilities to identify new market opportunities and develop new products to exploit these opportunities. We intend to develop new products to penetrate and increase our presence in the markets for digital television, Internet communications, mobile and rural telephony for developing markets, high-speed satellite communications, government data equipment, cable television distribution, and private networks for businesses and governments.

Provide High-Margin Customized Products to Niche Markets.We design our products so we can adapt them to differing specifications with minimal engineering. We plan to design and produce customized products for niche markets, particularly military and government markets, which require customized technology.

Continual Emphasis on Operational Efficiency and Financial Performance.We have historically maintained a strong emphasis on operation efficiency and financial performance. We believe that continued focus on our operational efficiencies is essential to future financial success while continuing to grow our business. As part of this continued emphasis, we plan to devote significant time and resources to key components of our business, such as our manufacturing processes, design systems and customer relationships.

Pursue Strategic Acquisitions.We intend to pursue strategic acquisitions of competitive or complementary companies in order to gain market share, increase our revenues, expand our product lines, improve our sales force and increase our profitability.

8

Table of Contents

Research and Development

We conduct an active and ongoing research and development program that focuses on advancing technology, developing improved design and manufacturing processes, and improving the overall quality of the products we provide. Our goal is to provide our customers with new solutions that address their needs. Our research and development personnel concentrate on technology for the satellite and microwave communications, telecommunications, and cable television industries. Our future growth depends on increasing the market share of our new products, adapting our existing products/technologies to new applications, and introducing new communications products that will find market acceptance and benefit from our established international distribution channels. Accordingly, we are actively applying our communications technology expertise to improving the performance of our existing products and developing new products to serve existing and new markets.

We work closely with our customers and potential customers to assess their needs in order to facilitate our design and development of new products. We believe that this approach minimizes our development risk and improves the potential for market acceptance of our product introductions. Additionally, we use information obtained from our customers and our technological expertise to develop custom-designed products for our customers’ special applications.

We intend to use a significant portion of our cash flows from operations to fund our research into products for improved satellite communications, over-the-horizon (troposcatter) communications, new amplifier products, audio and HDTV encoders, and other new telecommunications products. We also plan to focus our research and development activities on digital audio, video, and data products. However, there is no assurance that we will continue to have access to sufficient capital to fund the necessary research and development or that such efforts, even if adequately funded, will ultimately prove successful. Refer toItem 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operationsfor research and development expense over a two year period.

Sales and Marketing

We sell our products through an international direct sales force with sales and/or service offices in the United States (Phoenix, Arizona; San Diego and Santa Clara California; and Boca Raton, Florida, Singapore, China, Indonesia, the United Kingdom, and the Netherlands. Our direct sales force consists of 36 individuals supported by systems and applications engineers. We focus direct sales activities on expanding our international sales by identifying emerging markets and establishing new customer accounts. Additionally, we directly target certain major accounts that may provide entry into new markets or lead to subsequent distribution arrangements. International representatives, agents and systems integrators sell our products, supported by our sales and marketing personnel.

We supplement our direct sales force through the use of distributors and local agents who help develop sales leads and provide ongoing support. Typically, a member of our direct sales staff then assists in completing the sale. Generally, our distributors do not carry inventory of our products.

We participate in approximately 15 trade shows each year. We also generate new sales leads through advertising in trade magazines, direct mail, and our website. For further information on our products please visitwww.radn.com.

We maintain a warranty department that also includes customer service and support staff that support customers and agents and provide installation supervision, if needed. In certain instances, we use third-party companies to install and maintain our products at customer sites.

Refer toItem 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operationsfor selling, general and administrative expense over a two year period.

Customers

Our customers generally include national and international telecommunications providers (including radio and television stations), digital television users (including broadcast and cable networks), Internet service providers, financial information providers, systems integrators, and other corporate entities and the U.S. government.

Our direct sales into principal foreign markets for the periods indicated consisted of the following percentages of total sales.

9

Table of Contents

| Years ended December 31, | |||||||||

Region | 2006 | 2005 | 2004 | ||||||

Asia | 19 | % | 16 | % | 21 | % | |||

Africa/Middle East | 5 | % | 7 | % | 10 | % | |||

Americas | 2 | % | 3 | % | 3 | % | |||

Europe | 16 | % | 15 | % | 13 | % | |||

Total Foreign Sales | 42 | % | 41 | % | 47 | % | |||

Domestic | 58 | % | 59 | % | 53 | % | |||

| 100 | % | 100 | % | 100 | % | ||||

In addition to the above sales, we believe that a substantial portion of our domestic sales are for products which ultimately are installed in foreign countries. We believe that foreign sales will continue to make up a major portion of our total sales in subsequent periods. We consider our ability to continue to sell our products in developing markets to be important to our future growth. We may not, however, succeed in our efforts to cultivate such markets due to political or other factors. Besides the USA, there is no other country that represents more than 10% of consolidated revenue for 2006. Seenote 11 – Significant Customers and Foreign and Domestic Salesfor significant customers with 10% or more of segment sales.

Manufacturing

We assemble and test certain products at our Phoenix, Arizona and San Diego and Santa Clara, California facilities using subsystems and circuit boards acquired from subcontractors. We obtain the remainder of our products, completely assembled and tested, from subcontractors. Although we believe that we maintain adequate stock to minimize the procurement lead-time for certain components, our products use a number of specialized components or subassemblies produced by a limited number of suppliers. In the event that such suppliers were unable or unwilling to fulfill our requirements, we could experience interruptions in production while we develop alternative procurement sources. We maintain an inventory of certain chips, components and subassemblies to limit the exposure for such an interruption; and we believe that there are a number of alternative suppliers capable of providing replacements for the types of chips, customized components and subassemblies used in production. However, there can be no assurance that this inventory is sufficient or that alternative suppliers can be secured quickly enough to prevent a significant interruption of our business.

For both segments, the Company maintains an adequate supply of inventory based upon a master production schedule that is reviewed by management on a regular basis. Although there is not a firm forecast, the Company takes into account current market trends and historical data to supply their product.

As of December 31, 2006, the Company had backlog (orders to be shipped in future periods) of $9.1 million in the Satellite Electronics and Broadcast Equipment segment and $16.6 million for the Amplifier segment before eliminations.

The Company’s Phoenix, San Diego, and Santa Clara facilities have been awarded ISO 9001 certification, the international quality control standard for research and development, marketing, sales, manufacturing, and distribution processes. Subsequently, we have continued to improve our processes and methods of operations, consistent with our goals and the certification requirements. This certification assists in increasing the acceptance of our products. As of December 31, 2006, the Company’s ISO 9001 certifications remained in effect.

Intellectual Property

We rely on our proprietary technology and intellectual property to maintain our competitive position. We protect a significant portion of our proprietary technology as trade secrets by relying on confidentiality agreements with our employees and certain suppliers. We also control access to and distribution of confidential information concerning our proprietary information.

We also have patents, which protect certain of our proprietary technology. We have been cautious in seeking to obtain patent protection for our products, since patents often provide only narrow protection that may not prevent competitors from developing products that function in a manner similar to those covered by our patents. In addition, some of the foreign countries in which we sell our products do not provide the same level of protection to intellectual property as the laws of the United States. We will continue to seek patent protection for our proprietary technology in those cases where we think it can be obtained and will provide us with a competitive advantage.

We also license proprietary technology from third parties under license agreements. Some of these agreements include royalty payments based on the number of units sold. These agreements allow us to produce sufficient numbers of units to assure availability of all of our products as required by market demands.

10

Table of Contents

Employees

As of December 31, 2006, we had 343 full-time employees, including 4 executive officers, 177 manufacturing and operations personnel, 79 research and development personnel, and 83 selling, general and administration personnel. These figures include employees who are based outside the United States. Our employees are not represented by a labor union. We believe that our relationships with our employees are satisfactory and in good standing.

Available Information

The Company’s website iswww.radn.com. We make available (free of charge), through our website, our annual, quarterly, and current reports, and any amendments to those reports as soon as practicable after electronically filing the reports with the Securities and Exchange Commission (the “Commission”). Any materials we file with the Commission may be read and copied at the Commission’s Public Reference Room at 450 Fifth Street N.W., Washington, D.C. 20549. Information concerning the operation of the Commission’s Public Reference Room may be obtained by calling the Commission at 1-800-SEC-0330. The Commission also maintains a website atwww.sec.gov where you can view and download copies of reports, proxy and information statements and other information filed electronically through the Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system. Information contained on our website is not a part of this report.

In addition to the factors affecting specific business operations identified in connection with the description of these operations contained elsewhere in this Form 10-K, the following risk factors should be considered in evaluating the Company’s business. The Company’s business, financial condition or results of operations could be materially adversely affected by any of these risks. Please note that additional risks not presently known to the Company or that the Company currently deems immaterial may also impair its business and operations.

We Have A History Of Inconsistent Operating Results, And Could Suffer A Reduction In Profitability and Even Losses In The Future.

As a result of operating losses from time to time in prior years, we had an accumulated deficit of $9.5 million at December 31, 2003. While the Company regained profitability, and has continued to be profitable each year since 2003, we are in a highly competitive business and our profitability is dependent on growth in our markets, the continued introduction and market acceptance of our products, and management of our expenses. There can be no assurance that we will be able to continue our earnings growth, maintain current earnings levels, or remain profitable at all. We anticipate that 2007 earnings could be impacted by margin pressures.

Our Quarterly Operating Results Have Fluctuated Significantly In The Past, And We Anticipate That They Could Do So In The Future, Which Could Adversely Affect Our Stock Price.

We may continue to experience significant quarter to quarter fluctuations in our operating results, which may result in volatility in the price of our common stock. These fluctuating operating results derive from a variety of factors, including the following:

| • | quarter to quarter variability in demand for our products; |

| • | introduction of new or enhanced products by us or our competitors; |

| • | growth of demand for Internet-based products and services in developing countries; |

| • | timing of significant marketing programs we may implement; |

| • | extent and timing of hiring additional personnel; |

| • | competitive conditions in our industry; and |

| • | general economic conditions in the United States and abroad. |

The factors described above are difficult to forecast and could harm our business, financial condition and results of operations. Furthermore, there have been recent years that have been challenging for the telecommunication and Internet industries. Our business is somewhat seasonal, with the first quarter generally being the weakest, and the fourth quarter generally the strongest. Accordingly, we may have difficulty in accurately forecasting our revenues for any future quarter.

We Depend On International Sales, Which Could Cause Our Sales Levels To Be Volatile.

A significant portion of our business depends on sales to customers outside the United States. We expect that international sales will continue to account for a significant portion of our revenues for the foreseeable future. For example, sales to foreign

11

Table of Contents

customers were approximately 42%, 41% and 47% for the years ended December 31, 2006, 2005 and 2004, respectively. Accordingly, we expect that our sales will continue to include a significant proportion of customers located outside the United States. As a result of our dependence on foreign markets, the occurrence of any negative international political, economic or geographic events could result in significant revenue shortfalls. These shortfalls could cause our business, financial condition and results of operations to be harmed. Some of the risks of doing business internationally include:

| • | changing regulatory requirements; |

| • | fluctuations in the exchange rate for the United States dollar; |

| • | the availability of export licenses; |

| • | political and economic instability; |

| • | difficulties in staffing and managing foreign operations, tariffs and other trade barriers; |

| • | changes in diplomatic and trade relationships; |

| • | complex foreign laws and treaties; |

| • | acts of terrorism; and |

| • | difficulty of collecting foreign accounts receivable. |

The Company is subject to the Foreign Corrupt Practices Act, which prohibits us from making payments to government officials and others in order to influence the granting of contracts we may be seeking. In addition, we must comply with US Customs laws that forbid us to do business with certain other countries. Our non-U.S. based competitors are not subject to these laws, which gives them a competitive advantage in those countries.

We Depend On Developing Markets And Their Uncertain Growth Potential Could Result In A Reduction In Revenues And Even Losses.

We believe a substantial portion of the growth in demand for our products will depend upon customers in developing countries. We cannot provide assurance that such increases in demand will occur or that prospective customers will accept our products. The degree to which we are able to penetrate potential markets in developing countries will be affected to a large extent by the speed with which other competing elements of the communications infrastructure, such as other satellite-delivered solutions, telephone lines, television cable, and land-based solutions, are installed in these developing countries.

A Significant Portion of Our Sales are to the US Government and Government Entities and Changes in Political Priorities Could Reduce Our Revenue

A significant portion of the Company’s consolidated net sales are directly to the US Government, or to entities reselling to these civilian agencies and the branches of the military. Demand for our products has been elevated due to natural disasters, high military alerts and governmental usage due to world wide terror levels and general upgrades to infrastructures throughout the worlds’ military and police forces. These customers’s needs vary according to the priorities of each respective entity. A change in control of any of the companies, political offices or other related entities could result in reduced demand for our products and, ultimately, lower sales and profits.

The Sales And Implementation Cycles for our Products are Long and Continue to Increase, and We May Incur Substantial, Non-Recoverable Expenses or Devote Significant Resources To Sales That May Not Occur When Anticipated, If At All.

A customer’s decision to purchase our products involves a significant commitment of its resources and a lengthy evaluation and product qualification process. After a customer decides to purchase our products, the timing of their deployment and implementation depends on a variety of factors specific to each customer. Further, prospective customers may delay purchasing our products in order to evaluate new technologies and develop and implement new systems. Throughout the sales cycle, we spend considerable resources educating and providing information to prospective customers regarding the use and benefits of our products.

Competition In Our Industry Is Intense And Can Lead To Reduced Sales And Market Share.

The markets for ground segment systems are highly competitive. We have a number of major competitors in the satellite communications equipment field. These include large companies, such as Comtech EFData Corp., Paradise Datacom, Tandberg Television, Scopus, CPI (Communications & Power Industries) and Miteq Inc., that have significantly larger and more diversified operations and greater financial, marketing, personnel and other resources than we possess. As a result, these competitors may develop and expand their products more quickly, adapt more quickly to new or emerging technologies and changes in customer requirements, take advantage of acquisition and other opportunities more readily, and devote greater resources to the marketing and sale of their products than we can.

12

Table of Contents

Competition from current competitors or future entrants in the markets in which we compete could cause us to lose orders or customers or could force us to lower the prices we charge for our products, all of which would have a material adverse impact on our business, financial condition, and results of operations.

Our Products May Become Obsolete Due To Rapid Technological Change.

The telecommunications industry, including the ground-based satellite communications systems business, is characterized by rapid and continuous technological change. Future technological advances in the telecommunications industry may result in the introduction of new products or services that compete with our products or render them obsolete. Our success depends in part on our ability to respond quickly to technological changes through the improvement of our current products and the development of new products. Accordingly, we believe that we will need to allocate a substantial amount of capital to research and development activities in the future. We may not generate cash flow from operations or have access to outside financing in amounts that are sufficient to adequately fund the development of new products. Even if we are able to obtain the required funding to develop new products, we cannot assure you that we will be able to develop products that we will be able to sell successfully. Our inability to improve our existing products and develop new products could have a material adverse effect on our business, financial condition, and results of operations.

Our Research And Development Efforts Are Costly And The Results Are Uncertain, Which May Reduce Our Profitability And Could Result In Losses.

Our continued growth depends on penetrating new markets, adapting existing satellite communications products to new applications, and introducing new communications products that achieve market acceptance and benefit from our established international distribution channels. Accordingly, we are actively applying our communications expertise to design and develop new hardware and software products and enhance existing products. These efforts are costly. We expended $10.9 million, or 8.2% of our net sales, in fiscal 2006 on research and development activities. Additionally, our research and development programs may not produce successful results, which could have a material adverse effect on our business, financial condition, and results of operations.

Continued Growth Through Acquisition Could Prove Unsuccessful And Strain Our Personnel And Systems And Divert Our Resources.

We have pursued, and will continue to pursue, growth opportunities through internal development and acquisition of complementary businesses, products and technologies. Our operations have expanded significantly as a result of our acquisitions of ComStream, Armer, Tiernan, and Xicom. We are unable to predict whether or when any other prospective acquisition will be completed. However, in order to pursue successfully the opportunities presented by emerging satellite-delivered communications and broadcast equipment markets, we will be required to continue to expand our operations. This expansion could entail various risks, including the following:

| • | difficulty of assimilating the operations and personnel of acquired businesses or products due to unforeseen circumstances; |

| • | the necessity to attract, train, motivate, and manage a significantly larger number of employees; |

| • | the use of a disproportionate amount of our management’s attention or our resources; |

| • | substantial cash expenditures, potentially dilutive issuances of equity securities, the incurrence of additional debt and contingent liabilities, and amortization expenses related to intangible assets; |

| • | potential disruption of our ongoing business; |

| • | our inability, once integrated, to achieve comparable levels of revenues, profitability or productivity as our existing business or otherwise perform as expected; and |

| • | our potential inability to obtain the desired financial and strategic benefits from the acquisition or investment. |

Moreover, we cannot assure that we will be able to successfully identify suitable acquisition candidates, complete acquisitions, or expand into new markets. The occurrence of any of the risks described above or any failure to manage further growth in an efficient manner and at a pace consistent with our business could have a material adverse effect on our growth and our business, financial condition, and results of operations.

Our Ability To Use Our Net Operating Loss Carryforwards May Be Limited By The Ownership Change Caused By The Sale Of All Of The Shares Of Our Common Stock Held By Our Majority Stockholders.

We have net operating loss carryforwards that expire between the years 2007 and 2022. As a result of the sale in 2004 by Stetsys Pte Ltd. and Stetsys US, Inc. of all of the shares of our common stock held by each company, we experienced an ownership change as defined by Section 382 of the U.S. Internal Revenue Code of 1986, as amended. Because of the

13

Table of Contents

ownership change, we are limited in our ability to use the net operating losses from before the date of the ownership change to offset items of taxable income realized after that date. The annual limitation will also result in the expiration of some of the net operating losses before utilization. In addition, any future ownership change could further limit the availability of our net operating loss carryforwards to offset tax liabilities and may be viewed negatively by a prospective buyer of the stock.

Our Competitive Position Relies Heavily On Our Proprietary Technology And Intellectual Property.

We rely on our proprietary technology and intellectual property to maintain our competitive position. Unauthorized parties could attempt to copy aspects of our technologies or to obtain information that we regard as proprietary. We may not be able to police unauthorized use of our intellectual property. Our failure to protect our proprietary technology and intellectual property could adversely affect our competitive position.

We generally rely on confidentiality agreements with our employees and some of our suppliers to protect our proprietary technology. We also control access to and distribution of confidential information concerning our proprietary technology. We cannot guarantee that the other parties to these agreements will not disclose or misappropriate the confidential information concerning our proprietary technology, which could have a material adverse effect on our business.

We rely on patents to protect certain of our proprietary technology. Patents, however, often provide only narrow protection that may not prevent competitors from developing products that function in a manner similar to those covered by our patents. In addition, some foreign countries in which we sell our products do not provide the same level of protection to intellectual property as the laws of the United States provide. We cannot assure you that any patents we currently own or control, or that we may acquire in the future, will prevent our competitors from independently developing products that are substantially similar or superior to ours.

We may find it necessary to take legal action in the future to enforce or protect our intellectual property rights. Litigation can be very expensive and can distract our management’s time and attention, which could adversely affect our business. In addition, we may not be able to obtain a favorable outcome in any intellectual property litigation.

We Depend Upon Certain Suppliers And Subcontractors, The Loss Of Which Could Cause An Interruption In The Production Of Our Products.

We rely on subcontractors to assemble and test some of our products. Additionally, our products use a number of specialized chips and customized components or subassemblies produced by a limited number of suppliers. We maintain limited inventories of these products and do not have long-term supply contracts with our vendors. In the event our subcontractors or suppliers are unable or unwilling to fulfill our requirements, we could experience an interruption in product availability until we are able to secure alternative sources of supplies. We are also subject to price increases by suppliers that could increase the cost of our products or require us to develop alternative suppliers, which could interrupt our business. It may not be possible to obtain alternative sources at a reasonable cost. Supply interruptions could cause us to lose orders or customers, which would result in a material adverse impact on our business, financial condition, and results of operations.

The Inability To Attract Or Retain Additional Technical Personnel Could Impair Our Ability To Conduct And Expand Our Business.

Our continued ability to attract and retain highly skilled personnel also is critical to the operation and expansion of our business. The market for skilled engineers and other technical personnel is extremely competitive, and recruitment and retention costs are high. Although we have been able to attract and retain the personnel necessary to operate our business, we may not be able to do so in the future, particularly as we continue to expand our business.

The Transition and Loss Of The Services Of Certain Members Of Our Senior Management

During 2006, the Company transitioned CEOs from Robert Fitting, a long time expert in the Satellite industry, to Carl Myron Wagner. The timeliness and ability of Mr. Wagner to successfully operate in his new role of CEO is critical to the Company’s performance. Along with Mr. Wagner, Steve Eymann, our CTO, is critical to our business. The Board of Directors has active succession plans that should mitigate the loss of one or more of our executives. Nonetheless, there can be no assurance that succession plans will be successful. Further, the failure to attract and retain personnel with the necessary skills when needed could materially and adversely affect our business and expansion plans.

14

Table of Contents

| Item 1B. | Unresolved Staff Comments |

None

| Item 2. | Properties |

We currently occupy approximately 40,000 square feet of building space in Phoenix, Arizona, and 26,000 square feet in our San Diego, California facility, and 72,000 square feet in our two Santa Clara, California facilities. The Phoenix and San Diego facilities are used in the Company’s satellite electronics and broadcast equipment segment. The Santa Clara facility is the base for the amplifier segment. In addition, we sublease 16,000 square feet in Chandler, Arizona. The lease for our Phoenix facility expires in July 2008, subject to an option to renew for two consecutive terms of five years each. The lease for the Chandler facility expires in October 2008, subject to an option for a five-year renewal. The lease for the San Diego facility expires in June 2010, subject to an option to renew for two consecutive terms of five years each. The lease for the Santa Clara facility was renewed in 2006 for an additional five years and added additional space. We also lease facilities for our regional sales and service offices in China, Singapore, the Netherlands, and the United Kingdom. The Company believes that our facilities are adequate to meet current and reasonably anticipated needs in the immediate future.

| Item 3. | Legal Proceedings |

On April 2006, Comtech EF Data Corp. filed a complaint (Comtech EF Data Corporation v. Radyne Corporation /Case No. CIV 06-1132-PHX-MHM) in the United States District Court for the District of Arizona alleging one count of patent infringement of US Patent No. 5,666,646 claiming that some of the Company’s radio frequency converter products infringed on the patent held by Comtech EF Data Corp. The complaint seeks an injunction and unspecified monetary damages. The Company submitted its answer to the complaint on May 30, 2006. Representatives of the Company have met with Comtech EFData in attempts to resolve the matter, but all efforts to date have been unsuccessful. The Company believes Comtech EF Data Corp.’s claims are without merit, that the accused products do not infringe, and that the Company has other substantial factual and legal defenses to the claims. The Company intends to defend itself vigorously in this lawsuit. However, there is no assurance that the Company will ultimately prevail in this proceeding.

From time to time, in addition to those identified above, Radyne is subject to legal proceedings, claims, investigations and proceedings in the ordinary course of business, including commercial, employment and other matters. In accordance with U.S. generally accepted accounting principles, Radyne makes a provision for a liability when it is both probable that a liability has been incurred and the amount of the loss can be reasonably estimated. These provisions are reviewed at least quarterly and adjusted to reflect the impacts of negotiations, settlements, rulings, advice of legal counsel, and other information and events pertaining to a particular case. Litigation is inherently unpredictable. However, we believe that we have valid defenses with respect to the legal matters pending against Radyne. It is possible, however, that our consolidated financial position, cash flows or results of operations could be affected by the resolution of one or more of such contingencies.

| Item 4. | Submission of Matters to a Vote of Security Holders |

No matters were submitted to a vote of the Company’s security holders during the fourth quarter of 2006.

15

Table of Contents

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Market for Common Stock

Our common stock is quoted on the NASDAQ Global Select Market under the symbol “RADN”. The following table sets forth the range of high and low closing prices per share for our common stock as reported by the NASDAQ Global Select Market for the periods indicated.

| High | Low | |||||

2006 | ||||||

First quarter | $ | 16.07 | $ | 12.95 | ||

Second quarter | $ | 17.41 | $ | 10.30 | ||

Third quarter | $ | 12.60 | $ | 10.31 | ||

Fourth quarter | $ | 13.15 | $ | 9.65 | ||

2005 | ||||||

First quarter | $ | 9.36 | $ | 7.38 | ||

Second quarter | $ | 9.20 | $ | 7.24 | ||

Third quarter | $ | 11.43 | $ | 8.91 | ||

Fourth quarter | $ | 15.17 | $ | 10.27 | ||

Holders of Record

As of January 1, 2006, we had approximately 260 holders of record of our common stock. We estimate that we have another 5,000 holders of our common stock in street name.

Dividends

We have not paid dividends on our common stock since inception and we do not intend to pay any dividends to our stockholders in the foreseeable future. We currently intend to reinvest earnings, if any, in the development and expansion of our business. The declaration of dividends in the future will be at the election of our Board of Directors and will depend upon our earnings, capital requirements and financial position, general economic conditions, and other pertinent factors.

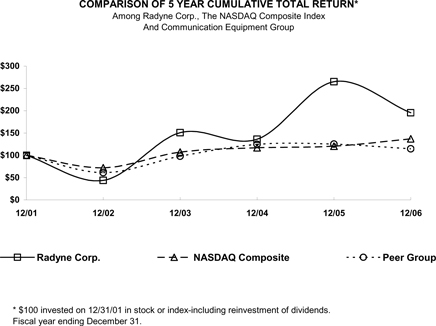

The following graph shows a comparison of cumulative total returns for our common stock, the NASDAQ Global Select Market, and the Communication Equipment group assuming the investment of $100 in our common stock and each index on December 31, 2001 and the reinvestment of dividends, if any. Prior period performance should not be used as a guide to future expected performance.

16

Table of Contents

Equity Compensation Plans

See Part III, Item 12.

17

Table of Contents

| Item 6. | Selected Financial Data |

The following selected consolidated statements of operations data for the years ended December 31, 2006, 2005, 2004, 2003 and 2002, and the selected consolidated balance sheet data at those dates, are derived from our consolidated financial statements and notes thereto, audited by an independent registered public accounting firm, KPMG LLP. The following data is not necessarily indicative of results of future operations and should be read in conjunction withItem 7.—Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and notes thereto as of December 31, 2006 and 2005 and for the three years ended December 31, 2006, included elsewhere in this Annual Report on Form 10-K. The selected financial data below includes a full year consolidation of Xicom during 2006. For 2005, the results of Xicom are from the date of acquisition, May 27, 2005, through December 31, 2005.

Years Ended December 31, (in thousands, except per share data) | ||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS DATA: | ||||||||||||||||||||

Net sales | $ | 134,209 | $ | 103,263 | $ | 56,578 | $ | 57,991 | $ | 57,662 | ||||||||||

Cost of sales | 77,738 | 57,251 | 26,435 | 31,640 | 38,472 | |||||||||||||||

| Gross profit | 56,471 | 46,012 | 30,143 | 26,351 | 19,190 | |||||||||||||||

Selling, general and administrative | 28,627 | 21,777 | 15,420 | 13,559 | 13,471 | |||||||||||||||

Research and development | 10,947 | 8,824 | 5,330 | 6,294 | 8,665 | |||||||||||||||

Asset impairment charge | — | — | — | — | 995 | |||||||||||||||

Restructuring charge | — | — | — | — | 1,102 | |||||||||||||||

Total operating expenses | 39,574 | 30,601 | 20,750 | 19,853 | 24,233 | |||||||||||||||

Earnings (loss) from operations | 16,897 | 15,411 | 9,393 | 6,498 | (5,043 | ) | ||||||||||||||

Interest expense | 241 | 252 | 29 | 28 | 62 | |||||||||||||||

Interest and other income | (1,359 | ) | (665 | ) | (492 | ) | (254 | ) | (236 | ) | ||||||||||

Earnings (loss) before income taxes and cumulative effect of change in accounting principle | 18,015 | 15,824 | 9,856 | 6,724 | (4,869 | ) | ||||||||||||||

Income taxes (benefit) | 6,150 | 5,138 | (3,644 | ) | 2,599 | (196 | ) | |||||||||||||

Earnings (loss) before cumulative effect of change in accounting principle | 11,865 | 10,686 | 13,500 | 4,125 | (4,673 | ) | ||||||||||||||

Cumulative effect of change in accounting principle | — | — | — | — | 4,281 | |||||||||||||||

Net earnings (loss) | $ | 11,865 | $ | 10,686 | $ | 13,500 | $ | 4,125 | $ | (8,954 | ) | |||||||||

Earnings (loss) per share: | ||||||||||||||||||||

Basic | $ | 0.66 | $ | 0.63 | $ | 0.83 | $ | 0.27 | $ | (0.59 | ) | |||||||||

Diluted | $ | 0.63 | $ | 0.60 | $ | 0.79 | $ | 0.26 | $ | (0.59 | ) | |||||||||

Weighted average number of common shares outstanding | ||||||||||||||||||||

Basic | 18,026 | 16,838 | 16,357 | 15,488 | 15,180 | |||||||||||||||

Diluted | 18,845 | 17,700 | 17,136 | 15,718 | 15,180 | |||||||||||||||

December 31, (in thousands) | ||||||||||||||||||||

| 2006 | 2005 | 2004 | 2003 | 2002 | ||||||||||||||||

CONSOLIDATED BALANCE SHEET DATA: | ||||||||||||||||||||

Cash and cash equivalents | $ | 27,540 | $ | 16,928 | $ | 39,300 | $ | 30,130 | $ | 16,230 | ||||||||||

Working capital | $ | 62,272 | 41,169 | 53,432 | 41,642 | 34,252 | ||||||||||||||

Total assets | $ | 120,004 | 100,628 | 65,416 | 50,609 | 44,407 | ||||||||||||||

Long-term obligations | $ | 148 | 4,961 | 430 | 475 | 849 | ||||||||||||||

Total liabilities | $ | 18,139 | 22,988 | 7,222 | 6,991 | 7,118 | ||||||||||||||

Stockholders’ equity | $ | 101,865 | 77,640 | 58,194 | 43,618 | 37,288 | ||||||||||||||

18

Table of Contents

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Introduction

The following should be read in conjunction with the Company’s Consolidated Financial Statements and the related Notes that appear in Item 8 of this Annual Report on Form 10-K. References to “Note” or “Notes” refer to the Notes to the Company’s Consolidated Financial Statements.

Overview

The Company designs, manufactures, sells, integrates and installs products, systems and software used for the transmission and reception of data and video over satellite, troposcatter, microwave and cable communication networks. The Company’s products are used in applications for telephone (land line and mobile), data, video and audio broadcast communications, private and corporate data networks, Internet applications, and digital television for cable and network broadcast. Through its Tiernan subsidiary, the Company is a supplier of HDTV and SDTV encoding and transmission equipment. The Xicom subsidiary is a producer of high power amplifiers for communications applications. The Company is headquartered in Phoenix, Arizona, has sales and manufacturing facilities in Phoenix, Arizona and San Diego and Santa Clara, California, and sales or service centers in Boca Raton, Florida; Singapore; China; Indonesia; the Netherlands; and the United Kingdom.

We sell our products through our direct sales offices and local agents and distributors. We serve customers in over 90 countries, including customers in the television broadcast industry, international telecommunications companies, Internet service providers, private communications networks, network and cable television and the U.S. government.

During 2006 our sales set a record at $134.2 million. The increase in sales was due, in part, to the strong results in our amplifier segment during 2006. Xicom sales for the year were $62.1 million and the satellite electronics and broadcast equipment business generated $72.2 million. The consolidated business also set a new record for earnings from operations at $16.9 million.

For 2007, we will continue to pursue customers around the world where we believe we are well positioned to offer cost effective technology solutions that are competitive with other products in the marketplace. Our approach remains to focus our efforts on well defined hardware markets where we can rapidly develop and market communications products. We are committed to offering reliable products that compare well with those of our competition in order to achieve our goal of growing sales while maintaining strong gross margins. We continue to manage our operations with tight cost control while investing in new product research and development where we believe we can achieve returns either through new product sales or reduced cost of manufacture.

In addition, we continue to evaluate opportunities to acquire new technologies or other businesses that complement our existing product lines and have a clear path to providing accretive returns.

Critical Accounting Policies and Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires the Company’s management to make a number of estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements. These estimates and assumptions also affect the reported amounts of revenues and expenses during the reporting period. On an ongoing basis, we evaluate our estimates, including those related to bad debts, inventories, income taxes, warranty obligations, and contingencies based upon historical results, anticipated future events, and various other assumptions, factors, and circumstances. We believe that our estimates and assumptions are reasonable in the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions and conditions.

Management believes the Company’s most critical accounting policies and estimates used in the preparation of its consolidated financial statements relate to:

| • | Revenue Recognition. Revenues from product sales are recognized upon the actual shipment of product and transfer of the risk of ownership from us, or our contract manufacturers, to our customers in accordance with SEC Staff Bulletins No. 104Revenue Recognition and No. 101,Revenue Recognition in Financial Statements,as amended. We do not sell through distributors and we do not use consignment resellers as a method of selling our products. Revenue from services principally |

19

Table of Contents

consists of sales related to services for installation and integration of satellite earth stations and video and microwave hub stations and are recognized at the time the services are performed. We consider products and services as separate units of accounting under EITF 00-21,Revenue Arrangements with Multiple Deliverables. Revenue is allocated to the separate units of accounting based on their relative fair values. Sales related to government agencies or subcontractors with “Cost Plus Fixed Fee” arrangements are accounted for using the “Percentage of Cost to Complete” method in accordance with ARB 43,Restatement and Revision of Accounting Research Bulletins – Chapter 11 Government Contracts. |

| • | Stock Compensation. On January 1, 2006, the Company adopted Statement of Financial Accounting Standard No. 123 (revised 2004) (“SFAS 123(R)”),Share-Based Payment, and SEC Staff Accounting Bulletin No. 107 (SAB 107),Share-Based Payment, which requires the measurement and recognition of all share-based compensation under the fair value method. The Company implemented SFAS 123(R) using the modified prospective transition method, which does not result in the restatement of previously issued financial statements. |

For those periods prior to December 31, 2005 the Company accounted for stock option grants in accordance with Accounting Principles Board Opinion No. 25 (APB 25),Accounting for Stock Issued to Employees, and related interpretations for fiscal year 2005 and prior years, and, accordingly, recognized no compensation expense for the stock option grants, until December 2005, when we accelerated the vesting of all unvested options.