Table of Contents

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| þ | Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||

| For the fiscal year ended December 31, 2007 | ||||

| Or | ||||

| ¨ | Transition Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | |||

For the transition period from to

Commission File Number 0-11685

Radyne Corporation

(Exact name of Registrant as specified in its charter)

| Delaware | 11-2569467 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 3138 East Elwood Street, Phoenix, Arizona | 85034 | |

| (Address of Principal Executive Offices) | (Zip Code) | |

Registrant’s telephone number including area code: (602) 437-9620

Securities Registered Under Section 12(b) of the Exchange Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

| Common Stock, par value $0.001 per share | The NASDAQ Stock Market LLC |

Securities Registered Under Section 12(g) of the Exchange Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12-months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yesþ No¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act (Check One).

Large accelerated filer | ¨ | Accelerated filer | þ | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Non-accelerated filer | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes¨ Noþ

The aggregate market value of the common stock held by non-affiliates of the registrant was approximately $135 million computed by reference to the closing price of the stock on the NASDAQ Stock Market on June 29, 2007, the last trading day of the registrant’s most recently completed second fiscal quarter. For purposes of this determination, shares of common stock held by each officer and director and by each person who owns 5% or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock, that were outstanding as of the close of business on February 29, 2008 was 18,799,137.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Radyne Corporation’s Proxy Statement relating to its 2008 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

Table of Contents

RADYNE CORPORATION - 2007 FORM 10 - K

TABLE OF CONTENTS

2

Table of Contents

| Item 1. | Business |

Development of Business

History of Business

Radyne Corporation (“Radyne,” “we,” “us,” “our” or “ourselves”), was originally formed in 1980, as a corporation under the laws of the state of New York. In 1995, a new management team moved us to Arizona. We reincorporated in Delaware in July 2000. We have completed the following acquisitions of complementary business lines: ComStream Corp of San Diego, CA in 1998, Armer Communications of Chandler, AZ in 2000, the assets of Tiernan Communications of San Diego, CA in 2001, Xicom Technology, Inc. of Santa Clara, CA in May 2005 and AeroAstro, Inc. of Ashburn, VA in August 2007.

Current Business

Radyne Corporation designs, manufactures and sells products and systems used for the operation of satellite, troposcatter, microwave and cable communication networks. Our customers use our products for applications for telephone (landline and mobile), data, video and audio broadcast communication, national and homeland defense, private and corporate data networks, Internet applications and digital television for cable and network broadcast.

We sell under four brands:

| • | Radyne builds satellite modems, converters and switches, |

| • | Xicom Technology produces high power amplifiers, |

| • | AeroAstro designs and constructs microsatellite systems, components and advanced communication technologies, |

| • | Tiernan supplies HDTV and SDTV encoding and transmission equipment. |

Our headquarters is in Phoenix, Arizona and we have sales and manufacturing facilities in Phoenix, Arizona; San Diego and Santa Clara, California; and Ashburn, Virginia. Our principal sales or service centers are in Littleton, Colorado; Boca Raton, Florida; Singapore; China; Indonesia; the Netherlands; and the United Kingdom. We serve customers in over 120 countries; including customers in the television broadcast industry, international telecommunications companies, Internet service providers, private communication networks, network and cable television and the United States government.

Our products are used worldwide, including the following:

| Ø | Satellite modems, high power Ka band amplifiers and HD encoders for expanded direct to home (DTH) distribution of HDTV from satellite. |

| Ø | HDTV encoders and decoders for major American television networks for use during their coverage of the 2008 Olympics in China and the National Basketball Association. |

| Ø | Microsatellite buses used for missions sponsored by the U.S. Department of Defense and NASA. |

| Ø | Satellite backhaul systems for Global Systems for Mobile Communications (GSM) mobile phone providers in India and China. |

| Ø | Sensor Enabled Notification System (SENS) satellite tracking systems for global asset tracking and remote monitoring for transportation companies and oil exploration and production enterprises. |

| Ø | Tri-band satellite amplifiers for a major U.S. satellite communications integrator for use in a mobile satellite program for the U.S. military. |

| Ø | DMD20 satellite modem, frequency converters and redundancy switches for a large expansion project by leading telecom providers in the Asia Pacific region. |

| Ø | Major expansion of U.S. government satellite monitoring network. |

| Ø | Solid-State Block Upconverters for major U.S. satellite communication integrators. |

| Ø | Satellite modems and high power amplifiers used as the backbone for major U.S. Department of Defense and Homeland Security communications systems. |

Financial Information about Segments

Following the acquisition of AeroAstro on August 1, 2007, we organized our business into three reporting segments: 1) Satellite Electronics, represented by our Radyne & Tiernan product brands; 2) Amplifiers, represented by our Xicom products; and 3) Microsatellites, represented by our AeroAstro products. Financial information about our segments is included in Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Description of Business

Industry Overview

Satellite technology is a key element in the worldwide infrastructure of communications and defense systems. Satellites enable communications service where there is no suitable alternative available (such as fiber-optic cables and microwave networks) or to supplement existing inadequate service. Unlike the cost of land-based networks, such as microwave and fiber cable, the cost to provide services via satellite does not increase with the distance between sending and receiving stations. Satellite networks allow for rapid installation, upgrades and allows for reconfigurations more quickly than land-based networks, which require rights-of-way and are generally more expensive and time consuming to install and upgrade than satellite networks.

3

Table of Contents

Satellite communication systems consist of two key sectors: satellites (the “space sector”); and ground-based transmission/reception systems (the “ground sector”). The space sector consists of a single satellite or a constellation of satellites in earth orbit, which typically provide continuous communications coverage over a wide geographic area. These satellites typically contain multiple transponders, each of which is capable of simultaneously receiving and transmitting one or more signals to or from multiple users. The satellite ground sector consists principally of one or more earth stations. An earth station is an integrated system consisting of antennae, radio signal transmitting and receiving equipment, amplifiers, satellite modems, frequency converters, redundancy switches and voice, data and/or video network interface equipment. Earth stations provide a communications link from the content originator (such as a broadcast studio or Internet service provider) to the end user either directly or through land-based networks.

Although we derive the majority of our revenue from the ground sector, the addition of AeroAstro signifies that we now obtain revenue from the space sector. Satellites in the space sector range in size up to 12,000 kilograms. However, the market for faster, smaller and more inexpensive microsatellites (less than 200 kilograms) is emerging as customers seek to enhance their abilities to launch mission specific inexpensive systems for imaging, communications, replenishment, repair and enhancement of existing space assets.

To shorten development time and minimize costs, microsatellite development has focused on designing and building space hardware that provides the bulk of the functionality of more expensive “large system” legacy componentry but at a fraction of the cost. Satellite builders employ components such as star trackers and sun sensors (used for navigation), miniature digital radios and spectrum analyzers in their microsatellites or other spacecraft.

Microsatellites are more inexpensive to build and deploy. The U.S. Air Force utilizes available capacity in existing launch missions to place small satellites into space at little incremental cost.

The ground sector consists of multiple applications in which we operate. The three principal categories of satellite communication applications are fixed satellite services, mobile satellite services and direct broadcast services.

Ø Fixed Satellite.Fixed satellite services provide point-to-point and point-to-multipoint satellite communication of voice, data and video between or among fixed ground-based earth stations. The introduction of high-power satellites has created new opportunities within the fixed satellite services sector by enabling the use of smaller, less costly earth stations for applications such as corporate data networks, Internet access and rural telephony.

Ø Mobile Satellite.Mobile satellite services operate between fixed earth stations and mobile earth stations, or terminals. These services provide mobile voice and data transmission capability on land, sea and air. Newly

developed mobile satellite services bring coverage that is more extensive and reliable for mobile telephone and data services to underserved populations throughout the world. Further, there is increased demand for “live” origination of broadcast television programming, such as live coverage of news, sports or cultural events that employ mobile satellite services for transmission from the venue to television studios.

The U.S. Department of Defense (DOD) has also increased its interest in supporting mobile military units that are deployable at short notice in a variety of geographic locations around the world. To support communications over a variety of locations and available communication networks, the DOD relies on mobile satellite ground stations that are flexible enough to operate across multiple satellite frequencies under challenging local conditions.

Ø Direct Broadcast.Direct broadcast services provide a direct transmission link from high-power satellites to customers over a wide geographic area. This includes direct-to-home television and radio services, distribution of television and radio programming to local affiliates direct broadcast data services and Internet access.

Industry Growth and Market Opportunity

We believe that demand for satellite system ground-based equipment has been and will continue to increase due to a number of factors, including:

Worldwide Demand for Communications Services.Factors contributing to the demand for communications services include worldwide economic development and the increasing globalization of commerce. Businesses have a need for higher bandwidth services to communicate with their customers and employees around the world and are increasingly reliant upon Internet and multimedia applications. We expect demand for these kinds of higher bandwidth services to continue to grow in both developed and developing countries.

Deregulation and Privatization.Many developing countries that had previously not committed significant resources to, or placed a high priority on, developing and upgrading their communications systems are now doing so, primarily through deregulation and privatization. A significant number of these countries lack the resources, or have large geographic areas or terrain that make it difficult, to install extensive land-based networks on a cost-effective basis. This provides an opportunity for satellite communications services systems to meet the growing demand for communications services in these countries.

Cost-Effectiveness of Satellite Communications.The relative cost-effectiveness of satellite communications services is a major factor driving the growth of satellite communications services in areas with rapidly growing telecommunications infrastructures. Large geographic areas, where significant distances separate population concentrations, require a technology whose cost and speed of implementation is relatively insensitive to distance. Unlike the cost of land-based networks, the cost to provide services via satellite does not increase with the distance between sending and receiving stations.

4

Table of Contents

Technological Advances.Technological advances continue to increase the capacity of a single satellite and reduce the overall cost of a system and the service it delivers. This increases the number of potential end-users for the services and expands the available market. We believe that recent technological developments, such as complex bandwidth efficient modulation schemes, turbo error correcting codes, bandwidth on demand, digital television compression technology and signal processing methods will continue to stimulate the demand for the use of satellite communication services.

Government and Military.Satellites allow the military to have instant secure communications when rapidly deploying around the world and further support the infrastructure necessary for military tactical deployments. The U.S. government provides a significant market opportunity for satellite equipment manufacturers as governmentpolicies encourage the use of commercial “off-the-shelf” components whenever feasible. This provides us with the opportunity to configure our standard products for a sizable customer that is likely to provide consistent business.

Because of current concerns with international terrorism, the militaries of many countries have increased requirements for communications as their forces deploy around the world. The U.S. government’s needs, such as maintaining communications with embassies and the U.S. military’s worldwide command and control requirements, continues to drive more demand for satellite communications.

U.S. military requirements in space continue to grow as international interest in space-based imaging and military control systems grows. Specific new and emerging areas of interest include operationally responsive space systems that can be adapted to specific missions at short notice and space situational awareness spacecraft that are designed to respond to other space hardware that is already in service.

Remote Asset Tracking and Monitoring.Increased interest on the part of businesses in just-in-time and other supply chain improvements requires improved and timelier data on the status of shipments and assets. Typically, this is achieved through GSM mobile phone or Radio Frequency Identification (RFID) technology. However, these approaches are not effective in remote areas such as the middle of the ocean or undeveloped portions of the world. Further, many companies, such as petroleum production firms, install and maintain assets in remote parts of the world that are distant from existing communication infrastructure. This results in increased opportunities to develop and install low cost satellite based systems that can provide timely information on location or asset status.

Television Video Distribution. Compressed HDTV digital video is a technology that has the potential to provide significant new market growth. The development of digital compression technology preserves the quality of TV signals and allows the transmission of television signals via satellite, point-to-point or fiber, in a smaller bandwidth than is currently possible through alternative technologies, the

most prevalent of which is over-the-air analog signals, which use much larger frequency spectrums than digital systems require. This advance in communications technology is enabling a wider application of satellite solutions for television and video broadcast services. The increased compression allows broadcasters to increase their channel offerings within a smaller, allocated spectrum. New HDTV content provides opportunities for additional network and local programming choices along with related revenue opportunities. Satellites provide television broadcasters with an efficient and economical method to distribute their programming to cable service providers and direct broadcast satellite operators. Direct broadcast services, in turn, use satellites to distribute digital television programming. Compressed video encoding and decoding make satellites available for less demanding video transmissions, including business teleconferencing, private business networks and telemedicine. The economics of compressed video allow the use of satellite transmission for long-distance teaching applications. Digital cinema distribution is a viable alternative to the physical distribution of feature length films and special media events.

Radio Broadcasts.Satellites are an ideal transmission medium for broadcast services, as a single satellite has the ability to communicate with ground locations spread across up to one-third of the surface of the earth. Radio network operators, financial news providers, merchandise retailers and others use satellite systems to provide financial data and other audio transmissions for a variety of applications, such as local radio programming, news wire services and supermarket in-store radio. In addition, direct radio broadcasters use satellites to broadcast multiple channels of programming directly to consumers.

Private Networks.As businesses and other organizations expand into regions of the world where the telecommunications infrastructure is inadequate for land-based networks, the need for alternative communications connections among multiple facilities becomes evident. A private network is a dedicated communications and/or data transmission network. Such a network may link employees of a multiple-location business with co-workers located throughout the world. Users can consolidate multiple applications over a single satellite network and receive the same quality of service at a lower overall cost. We believe the satellite communications industry is poised to gain a foothold in this market by offering reliable high-speed connectivity. Satellite systems can bypass the complexity of land-based networks, multiple carriers and varying price and billing schedules.

Internet Communications.The Internet has evolved into a global medium, allowing billions of individuals throughout the world to communicate, share information and engage in electronic commerce. Growth in this sector is expected to be driven by the large and growing number of personal computers installed in homes and offices, the declining prices of personal computers, improvements in network infrastructure, the availability of faster and more affordable Internet access and the increasing familiarity with and acceptance of the Internet by businesses and consumers. We also expect Internet usage to continue to grow rapidly due to unique characteristics that differentiate it from

5

Table of Contents

traditional media, such as real-time access to interactive content, real-time communication capabilities and the absence of geographic or temporal limitations.

We expect satellite communications to continue to offer a cost-effective augmentation capability for Internet service providers, particularly in markets where land-based networks are unlikely to be either cost-effective or abundant, such as remote rural areas.

Products

Satellite Electronics

We supply satellite modems, converters, switches, HDTV broadcast products as well as SDTV and digital encoders and decoders through our Radyne and Tiernan brands. The two principle product groups are:

| Ø | Satellite Electronics |

| Ø | Modems - Satellite modems transform user information, such as data, video and/or audio, into a signal that may receive further processing for transmission via satellite. We produce several varieties of satellite modems, which operate at different speeds using a variety of modulation techniques. Featured products include the DMD20 – Universal Satellite Modem, the DMD2050 – MIL-STD Compliant Universal Satellite Modem and the DMD20LBST – L-Band Satellite Modem and ODU Driver. |

| Ø | Troposcatter – In 2005, we introduced a new troposcatter product or “over-the-horizon” modem, in partnership with General Dynamics C4 Systems. The TM-20 modem has the ability to transmit and receive radio waves over the curvature of the earth by reflecting signals off irregularities in the troposphere, which is approximately 10Km above the Earth’s surface. The TM-20’s patented software is a major advance in troposcatter technology and we market this product to the U.S. military, which currently employs troposcatter systems throughout the world and to commercial interests. |

| Ø | Shared Bandwidth – In 2007, we introduced our new shared-bandwidth product, SkyWire™. Designed specifically for small to mid-sized networks, SkyWire™ is a scaleable, extremely efficient, easy to use, low cost TDMA network platform designed for IP network LAN-LAN connectivity. The SkyWire™ platform allows for a “True” full mesh configuration allowing for hub-less operation without the need for high stability clocking, complex Management and Control (M&C) or expensive central bandwidth allocation servers. SkyWire™ also fills the much needed sub-300 node hub and spoke network architecture by offering its users a low cost hub solution that allows smaller networks the ability to begin a hub and spoke network at a fraction of the cost of a |

conventional hub and spoke network. The MDX420 can also operate in single channel per carrier mode – all on the same platform. This functionality makes the MDX420 the world’s first “cross over” modem. |

| Ø | Broadcast Equipment |

| Ø | Standard and High Definition TV Encoders/Decoders – TV encoders convert analog signals to digital format and compress the signal to fit over available bandwidth. Decoders convert the compressed signal back into a form that allows for editing and viewing. Encoders, used in satellite, cable and terrestrial applications, convert the signal to a compressed form. Many U.S. broadcasters rely on encoders to provide news, live event gathering and direct to home service. We offer a complete product line of SDTV and HDTV encoders for professional applications. We offer both MPEG-2 and MPEG-4 video encoding capability and audio compression. The HDTV encoder features a monitor screen on its faceplate, which enables the technician to monitor actual unit performance in real time. Featured products include the HE4000 – High and Standard Definition Encoder, the SE4000 – DVB MPEG-2 Contribution Encoder, the HD4000 – High Definition Contribution Decoder and the TDR4022 – DVB Professional Integrated Receiver/Decoder. |

In early 2007, our Tiernan brand introduced a new standard definition encoder employing advance video codec, also known as MPEG-4. This encoder, known as the AVC-4000, is the first offering in a new family of products that employ this technology, which allows for further compression of video signals to levels that allow more efficiently use of available bandwidth when compared with MPEG-2 alternatives.

Satellite electronics products accounted for 44% of consolidated revenue for the year ended 2007.

Amplifiers

We provide a variety of high-powered amplifiers through our Amplifier segment under our Xicom brand.

Satellite amplifiers boost the strength of a signal prior to transmission to satellites, which are often more than 21,000 miles from the surface of the earth. Xicom’s Solid State Power Amplifiers (“SSPA”), Traveling Wave Tube Amplifiers (“TWTA”) and Klystron Tube Amplifiers (“KTA”) used in commercial and military satellite communications terminals throughout the world. These High Power Amplifiers (“HPA”) provide power levels vital to satellite communications in fixed, satellite newsgathering (“SNG”), flyaway, mobile, shipboard and airborne platforms. Applications include mobile SNG television trucks, fixed satellite ground stations and mobile platforms such as helicopters and ships. Featured products include antenna and rack-mount SSPAs, single-band (C-, X-, Ku-, Ka- and DBS) and multi-band TWTAs.

6

Table of Contents

Amplifiers accounted for 51% of consolidated revenue for the year ended 2007.

Microsatellites

We provide a variety of microsatellite components and buses through our Microsatellite segment under our AeroAstro brand. AeroAstro was the prime contractor for STPSat-1 responsible for spacecraft design and fabrication, integration of all experiments, space vehicle testing, launch integration support, launch and early orbit operations support as well as post-launch mission operations support. In addition to spacecraft equipment, AeroAstro developed and operates the Sensor Enabled Notification System (SENS), which provides cost effective satellite-based low data rate communications and asset tracking throughout the United States, North America, Europe, Australia, the Middle East, Asia and South America. SENS customers include government entities requiring reliable low data rate communications and businesses seeking to monitor vital assets.

Microsatellites accounted for 5% of consolidated revenue for the year ended 2007, even though we did not acquire the AeroAstro brand until August 1, 2007

Competition

We face significant competition in the satellite communications field. The major competitors in our Satellite electronics segment include companies such as Comtech EFData Corp., Paradise Datacom, Tandberg Television and Scopus. In our Amplifier segment, CPI (Communications & Power Industries) and Miteq Inc. are the principal competitors. Our main competitors in the Microsatellite segment are Surrey Satellite Technology, Ltd and MicroSat Systems, Inc. We maintain a sizable market share in each of these segments and anticipate further penetration with subsequent acquisition and organic growth.

We compete by deploying a direct sales effort in domestic and international markets and emphasizing our product features, quality and service. We believe that the quality, performance and capabilities of our products, our ability to customize certain network functions and the relatively lower overall cost of our products as compared to the cost of the competing products generally offered by our major competitors represent major factors in our ability to compete. However, our major competitors have the resources to develop products with features and functions that are competitive with or superior to our products. Competition from current competitors or future entrants in the markets in which we compete could cause us to lose orders or customers, or could force us to lower the prices we charge for our products.

We believe we have positioned ourselves to capitalize on the demand for both satellite ground and micro space systems and that our ability to leverage our competitive advantage allows for future success in this market, which include the following:

| Ø | An experienced management group, which has extensive technological and engineering expertise and excellent customer relationships. The members of our management team average over 20 years experience in the satellite communications industry. |

| Ø | A broad line of well-known, well-respected, off-the-shelf, state-of-the-art equipment that enables us to meet our customers’ requirements. |

| Ø | Our cutting edge expertise in micro space and small satellite components and systems. |

| Ø | Ongoing new product development and product introductions that address changing customer needs. |

| Ø | Our ability to custom design products for our customers’ special applications and to provide a one-stop shopping option to our customers. |

| Ø | Equipment that meets or exceeds all applicable military and government standards, including the first satellite modem to obtain Defense Information Systems Administration (“DISA”) certification, the DMD-20. |

| Ø | The ability to meet the complex satellite ground communications systems requirements of our customers in diverse political, economic and regulatory environments in various locations around the world. |

| Ø | Our worldwide sales and service organization with the expertise to successfully conduct business internationally through sales and service offices staffed by our employees in most of our major markets throughout the world, including Beijing, Singapore, London, Jakarta and Amsterdam. |

| Ø | The ability to offer a full line of satellite ground equipment with the mix of our different product lines. |

7

Table of Contents

Strategy

Our primary business goals are to expand market share in our businesses and improve profitability. We expect to achieve these goals through the following strategies:

Target Providers of Fixed, Mobile and Direct Broadcast Communications Services in Developing Markets.We plan to target developing markets that we believe will account for a significant portion of the demand for satellite-based systems. These markets typically lack terrestrial infrastructure adequate to support demand for domestic and international communications services. We believe that we offer a cost effective alternative to land based networks. We plan to target providers of mobile and rural telephony services and Internet service providers in developing markets because we believe they will rely extensively upon satellite communication solutions. In developed countries, we plan to target emerging satellite communications service providers such as those offering direct broadcast applications.

Pursue Military, Homeland Defense and Other U.S. Government Markets.Continued demand for technological solutions to national defense, homeland security and other government security requirements represents a key opportunity for our products. We plan to extend development of existing and new products in all of our lines of business to serve these needs. In addition to our satellite and space-based solutions, we continue to pursue opportunities to sell technology suited to restricted applications of the U.S. government.

Capitalize On Our Existing Technology Leadership.We believe that the global satellite communications services, equipment market and the digital television market present a number of attractive opportunities to apply our advanced technologies and capabilities. We plan to develop new products and enhance existing products by leveraging our technology to capture a share of these growth opportunities.

Develop New Products to Exploit New Market Opportunities.We plan to use our international sales force along with our research and development capabilities to identify new market opportunities and develop new products to exploit these opportunities. We intend to develop new products to penetrate and increase our presence in the markets for digital television, Internet communications, mobile and rural telephony for developing markets, high-speed satellite communications, government data equipment, cable television distribution and private networks for business and government.

Provide High-Margin Customized Products to Niche Markets.We design our products so we can adapt them to differing specifications with minimal engineering. We plan to design and produce customized products for niche markets, particularly military and government markets, which require customized technology.

Continual Emphasis on Operational Efficiency and Financial Performance.We have historically maintained a

strong emphasis on operational efficiency and financial performance. We believe that continued focus on our operational efficiencies is essential to future financial success while continuing to grow our business. As part of this continued emphasis, we plan to devote significant time and resources to key components of our business, such as our manufacturing processes, design systems and customer relationships.

Pursue Strategic Acquisitions.We intend to pursue strategic acquisitions of competitive or complementary companies in order to gain market share, increase our revenues, expand our product lines, improve our sales force and increase our profitability.

As discussed in detail elsewhere in this report, we are also exploring various strategic alternatives, including a possible sale of Radyne, although there can be no assurance that a transaction, whether a sale, recapitalization or other event, will take place. Please see Item 1A. – Risk Factors for further information.

Research and Development

We conduct an active and ongoing research and development program that focuses on advancing technology, developing improved design and manufacturing processes and improving the overall quality of the products we provide. Our goal is to provide our customers with new improved solutions that address their needs. Our research and development personnel concentrate on technology for the satellite and microwave communications, telecommunications and cable television industries. Our future growth depends on increasing the market share of our new products, adapting our existing products and technologies to new applications as well as introducing new communications products that will find market acceptance and benefit from our established international distribution channels. Accordingly, we are actively applying our communications technology expertise to improving the performance of our existing products and developing new products to serve existing and new markets.

We work closely with our customers and potential customers to assess their needs in order to facilitate our design and development of new products. We believe that this approach minimizes our developmental risk and improves the potential for market acceptance of our product introductions. Additionally, we use information obtained from our customers and our technological expertise to develop custom-designed products for our customers’ special applications.

We intend to use a significant portion of our cash flows from operations to fund our research into products for improved satellite communications, over-the-horizon (troposcatter) communications, new amplifier products, microsatellites, audio and HDTV encoders and other new telecommunications products. However, there is no assurance that we will continue to have access to sufficient capital to fund the necessary research and development or that such efforts, even if adequately

8

Table of Contents

funded, will ultimately prove successful. Refer toItem 7.- Management’s Discussion and Analysis of FinancialCondition and Results of Operationsfor research and development expense over a two-year period.

Sales and Marketing

We sell our products through an international direct sales force with sales and/or service offices in the United States (Phoenix, Arizona; San Diego and Santa Clara California; Ashburn Virginia; and Boca Raton, Florida); Singapore; China; Indonesia; the United Kingdom; and the Netherlands. Our direct sales force consists of 53 individuals supported by systems and applications engineers. We focus direct sales activities on expanding our international sales by identifying emerging markets and establishing new customer accounts. Additionally, we directly target certain major accounts that may provide entry into new markets or lead to subsequent distribution arrangements. International representatives, agents and systems integrators sell our products, supported by our sales and marketing personnel.

We supplement our direct sales force with distributors and local agents who help develop sales leads and provide ongoing support. Typically, a member of our direct sales staff then assists in completing the sale. Generally, our distributors do not carry inventory of our products.

We participate in approximately 20 trade shows each year. We also generate new sales leads through advertising in trade magazines, direct mail and our website. For further information on our products, please visitwww.radn.com. Information contained in our website is not a part of this report.

We maintain a warranty department that also includes customer service and support staff that support customers and agents and provide installation supervision, if needed. In certain instances, we use third-party companies to install and maintain our products at customer sites.

The revenues in the Microsatellite segment that we record from space systems typically result from our participation in competitive procurements of the U.S. government. We devote time to evaluating and responding to requests for proposal (RFPs) by government agencies within the Department of Defense and NASA. As needed we also employ the use of specialized consultants to develop our proposals and bids. In many instances, we will enter to alliances with other companies as a sub-contractor when we believe doing so will enhance our prospects for securing contracts.

Refer toItem 7. - Management’s Discussion and Analysis of Financial Condition and Results of Operationsfor selling, general and administrative expense over a two-year period.

Customers

Our customers generally include national and international telecommunications providers, digital television distributors (including broadcast and cable networks), Internet service providers, financial information providers, systems integrators, other corporate entities and the U.S. government.

Our direct sales into principal foreign markets for the periods indicated consisted of the following percentages of total sales.

| Region | 2007 | 2006 | 2005 | |||

Asia | 16% | 19% | 16% | |||

Africa/Middle East | 3% | 5% | 7% | |||

Americas | 3% | 2% | 3% | |||

Europe | 13% | 16% | 15% | |||

Total Foreign Sales | 35% | 42% | 41% | |||

Domestic | 65% | 58% | 59% | |||

| 100% | 100% | 100% | ||||

In addition to the sales above, we believe that substantial portions of our domestic sales ultimately are for products installed in foreign countries. We believe that foreign sales will continue to make up a major portion of our total sales in subsequent periods. We consider our ability to continue to sell our products in developing markets to be important to our future growth. We may or may not, succeed in our efforts to cultivate such markets due to political or other factors. Besides the USA, there is no other country that represents more than 10% of consolidated revenue for 2007. Seenote 13 – Significant Customers and Foreign and Domestic Salesfor significant customers with 10% or more of segment sales.

Manufacturing

We assemble and test certain products at our Phoenix, Arizona; San Diego and Santa Clara, California; and Ashburn, Virginia facilities using subsystems and circuit boards acquired from subcontractors. We obtain the remainder of our products, completely assembled and tested, from subcontractors. We believe that we maintain adequate inventory to minimize the procurement lead-time of components, never the less, our products use a number of specialized components or subassemblies produced by a limited number of suppliers. In the event that such suppliers were unable or unwilling to fulfill our requirements, we could experience interruptions in production while we develop alternative procurement sources. We maintain an inventory of certain chips, components and subassemblies to limit the exposure for such an interruption; and we believe that there are a number of alternative suppliers capable of providing replacements for the types of chips, customized components and subassemblies we use in production. However, there can be no assurance that this inventory is sufficient or that we may secure alternative suppliers quickly enough to prevent a significant interruption of our business.

9

Table of Contents

$ in thousands, except per share amounts

We seek to maintain an adequate supply of inventory based upon a master production schedule that management reviews on a regular basis. Although there is not a firm forecast, we take into account current market trends and historical data to supply their product.

As of December 31, 2007, we had backlog (orders to be shipped in future periods) of $10,737 in the Satellite Electronics segment, $27,180 for the Amplifier segment and $3,725 in the Microsatellite segment, all before eliminations.

Our Phoenix, San Diego and Santa Clara facilities have been awarded ISO 9001 certification, the international quality control standard for research and development, marketing, sales, manufacturing and distribution processes. Subsequently, we have continued to improve our processes and methods of operations, consistent with our goals and the certification requirements. This certification assists in increasing the acceptance of our products. As of December 31, 2007, our ISO 9001 certifications remained in effect.

Intellectual Property

We rely on our proprietary technology and intellectual property to maintain our competitive position. We protect a significant portion of our proprietary technology as trade secrets by relying on confidentiality agreements with our employees and certain suppliers. We also control access to and distribution of confidential information concerning our proprietary information.

We also have patents, which protect certain aspects of our proprietary technology. We have been cautious in seeking to obtain patent protection for our products, since patents often provide only narrow protection that may not prevent competitors from developing products that function in a manner similar to those covered by our patents. In addition, some of the foreign countries in which we sell our products do not provide the same level of protection to intellectual property as the laws of the United States. We will continue to seek patent protection for our proprietary technology in those cases where we think obtaining patents will provide us with a competitive advantage.

We also license proprietary technology from third parties under license agreements. Some of these agreements include royalty payments based on the number of units sold. These agreements allow us to produce sufficient numbers of units to assure availability of all of our products as required by market demands.

Employees

As of December 31, 2007, we had 412 full-time employees, including 4 executive officers, 214 manufacturing and operations personnel, 80 research and development personnel and 114 selling, general and administration personnel. These figures include employees based outside the United States. Labor unions do not represent any of our employees. We believe that our relationships with our employees are satisfactory and in good standing.

Available Information

Our website iswww.radn.com. We make available (free of charge), through our website, our annual, quarterly and current reports, in addition to any amendments to those reports as soon as practicable after electronically filing the reports with the Securities and Exchange Commission (the “SEC”). Also available at our website are corporate governance documents such as our Code of Ethics, our Stock Ownership and Insider Trading Policies and the charters of the committees of our Board of Directors. In addition, investors may read or obtain a copy of any materials we file with the SEC at the SEC’s Public Reference Room at 450 Fifth Street N.W., Washington, D.C. 20549. Investors may also obtain Information concerning the operation of the SEC’s Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website atwww.sec.gov where individuals can view and download copies of reports, proxy and information statements and other information filed electronically through the Electronic Data Gathering, Analysis and Retrieval (“EDGAR”) system. Information contained on our website is not a part of this report.

| Item 1A. | Risk Factors |

In addition to the factors affecting specific business operations identified in connection with the description of these operations contained elsewhere in this Form 10-K, the following risk factors merit consideration in evaluating our business. Our businesses’ financial condition, or results of operations, may have material adverse affects from any of these risks. Please note that additional risks not presently known or those we currently deem immaterial may also impair our business and operations.

We are in the process of examining various strategic alternatives to enhance shareholder value, but we cannot guarantee that we will pursue one or more alternatives or the alternatives will have the desired effect of enhancing shareholder value.

In the fourth quarter of 2007, our Board of Directors retained Needham & Company as its financial advisor to assist it in exploring strategic alternatives, including a possible sale of ourselves. Although an evaluation process is underway, including discussions with various interested parties, we had not set any time frame for conclusion of the process. There cannot be any assurance that a transaction, whether a sale, recapitalization or other event, will take place. Further, any such transaction or business arrangement may not ultimately lead to increased shareholder value. There are uncertainties and risks related to the exploration of strategic alternatives, including:

| Ø | The distraction of management and potential disruption of operations, which could have an adverse effect on our operating results; |

| Ø | The inability to successfully achieve the benefits of any strategic action undertaken by us; |

| Ø | The time dedicated to the process can be lengthy and there are inherent costs associated with such a process; |

10

Table of Contents

$ in thousands, except per share amounts

| Ø | Potential loss of other business opportunities as management focuses on the exploration of strategic alternatives; and |

| Ø | Perceived uncertainties as to our future direction, which can result in difficulties in recruiting and retaining personnel. |

In addition, the market price of our stock can be volatile as we explore strategic alternatives, which may continue or become more severe if and when a transaction or business arrangement is announced or we announce that we are no longer exploring strategic alternatives.

We have a history of inconsistent operating results and could suffer a reduction in profitability and even losses in the future.

Because of operating losses from time to time in prior years, we had an accumulated deficit of $9.5 million at December 31, 2003. While we have regained profitability and have continued to be profitable each year since 2003, during 2007, we experienced sales and margin erosion in our Satellite Electronics segment. We are in a highly competitive business and our profitability is dependent on growth in our markets, the continued introduction and market acceptance of our products and management of our expenses. There can be no assurance that we will be able to continue our earnings growth, maintain current earnings levels, or remain profitable at all. We anticipate that continued margin pressure may affect 2008 earnings.

Our quarterly operating results have fluctuated significantly in the past and we anticipate that they could do so in the future, which could adversely affect our stock price.

We may continue to experience significant quarter-to-quarter fluctuations in our operating results, which may result in volatility in the price of our common stock. These fluctuating operating results derive from a variety of factors, including the following:

| Ø | Quarter-to-quarter variability in demand for our products; |

| Ø | Introduction of new or enhanced products by us or our competitors; |

| Ø | Uneven growth of demand for products and services in developing countries; |

| Ø | Timing of significant marketing programs we may implement; |

| Ø | Extent and timing of hiring additional personnel; |

| Ø | Competitive conditions in our industry; and |

| Ø | General economic conditions in the United States and abroad. |

The factors described above are difficult to forecast and could harm our business, financial condition and results of operations. Furthermore, there have been recent years that have been challenging for the telecommunication and Internet industries. Our sales are somewhat seasonal, with the first quarter generally being the weakest and the fourth quarter generally the strongest. Accordingly, we may have difficulty in accurately forecasting our revenues for any future quarter.

We depend on international sales, which could cause our sales levels to be volatile.

A significant portion of our business depends on sales to customers outside the United States. We expect that international sales will continue to account for a significant portion of our revenues for the near future. For example, sales to foreign customers were approximately 35%, 42% and 41% for the years ended December 31, 2007, 2006 and 2005, respectively. The decrease in foreign sales reflects the addition of AeroAstro, whose sales tend to be mainly domestic. Nonetheless, we expect that our sales will continue to include a significant proportion of customers located outside the United States. Because of our dependence on foreign markets, the occurrence of any negative international political, economic or geographic events could result in significant revenue shortfalls. For example, during the fourth quarter of 2007, our Satellite Electronics segment experienced order cancellations in Pakistan due, at least in part, to political instability. These shortfalls could negatively influence our business, financial condition and results of operations. Some of the risks of doing business internationally include:

| Ø | Changing regulatory requirements; |

| Ø | Fluctuations in the exchange rate for the United States dollar; |

| Ø | The availability of export licenses; |

| Ø | Political and economic instability; |

| Ø | Difficulties in staffing and managing foreign operations, tariffs and other trade barriers; |

| Ø | Complex foreign laws and treaties; |

| Ø | Acts of terrorism; and |

| Ø | Difficulty of collecting foreign accounts receivable. |

We are subject to the Foreign Corrupt Practices Act, which prohibits us from making payments to government officials and others in order to influence the granting of contracts we may be seeking. In addition, we must comply with U.S. customs laws that forbid us to do business with certain countries. Our non-U.S. based competitors are not subject to these laws, which gives them a competitive advantage in those countries.

We depend on developing countries for sales, which could cause our sales levels to be volatile.

We believe a substantial portion of the growth in demand for our products will depend upon customers in developing countries. We cannot provide assurance that such increases in demand will occur or that prospective customers will accept our products. The degree to which we are able to penetrate potential markets in developing countries will be affected to a large extent by the speed with which other competing elements of the communications infrastructure, such as other satellite-delivered solutions, telephone lines, television cable and land-based solutions, are installed in these developing countries.

11

Table of Contents

$ in thousands, except per share amounts

A significant portion of our sales are to the U.S. government and government entities and changes in political priorities could reduce our revenue.

A significant portion of our consolidated net sales is directly to the U.S. government, or to entities reselling to these civilian agencies and the branches of the military. Demand for our products has been elevated due to the war on terrorism, natural disasters and general upgrades to infrastructures throughout the worlds’ military and police forces. These customers’ needs vary according to the priorities of each respective entity. Furthermore, upcoming national elections in the United States could bring a change in policies and priorities for the U.S. government. A change in control of any of the commercial, political or other related entities could result in reduced demand for our products and ultimately, lower sales and profits.

An increasing proportion of our revenues result from competitive and other procurements from the U.S. government that require that we skillfully bid and execute contracts.

With the acquisition of AeroAstro and increased direct U.S. government procurement revenues at Xicom, our ability to assure satisfactory and profitable performance of our obligations is dependent on our ability to accurately forecast, bid for and complete U.S. government contracts. These contracts may include cost plus fee arrangements where the fee to which we are entitled varies according to our performance or may include fixed fee arrangements where our profit is contingent on our ability to forecast and manage expenses. Successful completion of these contracts also depends on our ability to develop promised new technologies, recruit and retain appropriate personnel and deliver contract requirements in a timely fashion. Our performance in these regards may affect our ability to win additional or follow on work and could adversely affect revenues and profits.

The sales and implementation cycles for our products are long and continue to increase and we may incur substantial, non-recoverable expenses or devote significant resources to sales that may not occur when anticipated, if at all.

A customer’s decision to purchase our products involves a significant commitment of its resources and a lengthy evaluation and product qualification process. After a customer decides to purchase our products, the timing of its deployment and implementation depends on a variety of factors specific to each customer. Further, prospective customers may delay purchasing our products in order to evaluate new technologies, develop and implement new systems. Throughout the sales cycle, we spend considerable resources educating and providing information to prospective customers regarding the use and benefits of our products. While the early market acceptance of our new SkyWire™ shared bandwidth modems has exceeded our expectations, the length of this sales cycle suggests that we cannot assure that this product will enjoy expected market and financial success for 2008 despite the technological and marketing investments that we are making.

Our research and development efforts are costly and the results are uncertain, which may reduce our profitability and could result in losses.

The telecommunications industry, characterized by rapid change, includes the ground-based satellite communications systems business. Future technological advances in the telecommunications industry may result in the introduction of new products or services that compete with our products or render them obsolete. Our success depends in part on our ability to respond quickly to technological changes through the improvement of our current products and the development of new products. Accordingly, we are actively applying our communications expertise to design and develop new hardware and software products and enhance existing products. These efforts are costly. We expended $11,835, or 8.3% of our net sales, in fiscal 2007 on research and development activities. Additionally, our research and development programs may not produce successful results, which could have a material adverse effect on our business, financial condition and results of operations.

Continued growth through acquisition could prove unsuccessful, strain our personnel and systems and divert our resources.

We have pursued and will continue to pursue, growth opportunities through internal development and acquisition of complementary businesses, products and technologies. Over the past three-years, our operations have expanded significantly with our acquisitions of AeroAstro and Xicom. We are unable to predict whether or when we will complete any other prospective acquisitions. However, in order to pursue successfully, the opportunities presented by emerging satellite-delivered communications, we will be required to continue to expand our operations. This expansion could entail various risks, including the following:

| Ø | Difficulty of assimilating the operations and personnel of acquired businesses or products due to unforeseen circumstances; |

| Ø | The necessity to attract, train, motivate and manage a significantly larger number of employees; |

| Ø | The use of a disproportionate amount of our management’s attention or our resources; |

| Ø | Substantial cash expenditures, potentially dilutive issuances of equity securities, the incurrence of additional debt and contingent liabilities and amortization expenses related to intangible assets; |

| Ø | Potential disruption of our ongoing business; |

| Ø | Our inability, once integrated, to achieve comparable levels of revenues, profitability or productivity as our existing business or otherwise perform as expected; and |

| Ø | Our potential inability to obtain the desired financial and strategic benefits from the acquisition or investment. |

Moreover, we cannot assure that we will be able to successfully identify suitable acquisition candidates,

12

Table of Contents

$ in thousands, except per share amounts

complete acquisitions or expand into new markets. The occurrence of any of the risks described above or any failure to manage further growth in an efficient manner and at a pace consistent with our business could have a material adverse effect on our growth and our business, financial condition and results of operations.

The ownership change caused by the sale of all of the shares of our common stock held by our majority stockholders may limit the ability to use our net operating loss carryforwards.

We have net operating loss carryforwards that expire between the years 2007 and 2022. Because of the sale in 2004 by Stetsys Pte Ltd. and Stetsys US, Inc. of all of the shares of our common stock held by each company, we experienced an ownership change as defined by Section 382 of the U.S. Internal Revenue Code of 1986, as amended. With the ownership change, we will be limited in our ability to use the net operating losses from before the date of the ownership change to offset items of taxable income realized after that date. The annual limitation will also result in the expiration of some of the net operating losses before utilization. In addition, any future ownership change could further limit the availability of our net operating loss carryforwards to offset tax liabilities and viewed negatively by a prospective buyer of the stock.

Our competitive position relies heavily on our proprietary technology and intellectual property.

We rely on our proprietary technology and intellectual property to maintain our competitive position. Unauthorized parties could attempt to copy aspects of our technologies or to obtain information that we regard as proprietary. We may not be able to police unauthorized use of our intellectual property. Our failure to protect our proprietary technology and intellectual property could adversely affect our competitive position.

We generally rely on confidentiality agreements with our employees and some of our suppliers to protect our proprietary technology. We also control access to and distribution of confidential information concerning our proprietary technology. We cannot guarantee that the other parties to these agreements will not disclose or misappropriate the confidential information concerning our proprietary technology, which could have a material adverse effect on our business.

We rely on patents to protect certain aspects of our proprietary technology. Patents, however, often provide only narrow protection that may not prevent competitors from developing products that function in a manner similar to those covered by our patents. In addition, some foreign countries in which we sell our products do not provide the same level of protection to intellectual property as the laws of the United States provide. We cannot assure that any patents we currently own or control, or that we may acquire in the future, will prevent our competitors from independently developing products that are substantially similar or superior to ours.

We may find it necessary to take legal action in the future to enforce or protect our intellectual property rights. Litigation can be very expensive and can distract our management’s time and attention, which could adversely affect our business. In addition, we may not be able to obtain a favorable outcome in any intellectual property litigation.

We depend upon certain suppliers and subcontractors, the loss of which could cause an interruption in the production of our products.

We rely on subcontractors to assemble and test some of our products. Additionally, our products use a number of specialized chips and customized components or subassemblies produced by a limited number of suppliers. We maintain limited inventories of these products and do not have long-term supply contracts with our vendors. In the event our subcontractors or suppliers are unable or unwilling to fulfill our requirements, we could experience an interruption in product availability until we are able to secure alternative sources of supplies. We are also subject to price increases by suppliers that could increase the cost of our products or require us to develop alternative suppliers, which could interrupt our business. It may not be possible to obtain alternative sources at a reasonable cost. Supply interruptions could cause us to lose orders or customers, which would result in a material adverse impact on our business, financial condition and results of operations.

The inability to attract or retain additional technical personnel could impair our ability to conduct and expand our business.

Our continued ability to attract and retain highly skilled personnel also is critical to the operation and expansion of our business. The market for skilled engineers and other technical personnel is extremely competitive and recruitment and retention costs are high. Although we have been able to attract and retain the personnel necessary to operate our business, we may not be able to do so in the future, particularly as we continue to expand our business.

| Item 1B. | Unresolved Staff Comments |

None

| Item 2. | Properties |

We currently occupy approximately 40,000 square feet of building space in Phoenix, Arizona, 26,000 square feet in our San Diego, California facility, 72,000 square feet in our two Santa Clara, California facilities and 24,000 square feet in our Ashburn, Virginia facility. We use the Phoenix and San Diego facilities for our Satellite electronics segment. The Santa Clara facility is the base for the Amplifier segment and the Ashburn facility is the location of our Microsatellite segment. In addition, we sublease 16,000 square feet in Chandler, Arizona. The lease for our Phoenix facility expires

13

Table of Contents

$ in thousands, except per share amounts

in July 2018, subject to an option to renew for two consecutive terms of five years each. The lease for the Chandler facility expires in October 2008, subject to an option for a five-year renewal. The lease for the San Diego facility expires in June 2010, subject to an option to renew for two consecutive terms of five years each. We renewed the lease for the Santa Clara facility in 2006, for an additional five years and added additional space. The lease for the Ashburn facility expires in 2012. We also lease facilities for our regional sales and service offices in China, Singapore, the Netherlands and the United Kingdom. We believe that our facilities are adequate to meet current and reasonably anticipated needs in the immediate future.

| Item 3. | Legal Proceedings |

As previously disclosed, in April 2006, Comtech EF Data Corp. filed a complaint (Comtech EF Data Corporation v. Radyne Corporation Case No. 2:06cv01132) in the United States District Court for the District of Arizona alleging one count of patent infringement claiming that some of the our radio frequency converter products infringed on a patent held by Comtech EF Data Corp. The complaint seeks an injunction and unspecified monetary damages. We submitted our answer to the complaint on May 30, 2006. A special master, assigned by the court, issued a report and recommendation on patent claim construction to the court (i.e., on the scope of the patent claims) and recommended that the patent claims asserted against our down-converter products be found invalid, because the claims were too defective to be construed. The court has not yet made a determination as to whether it will adopt the recommendation of the special master. There have been no further developments during the quarter ended December 31, 2007 regarding this complaint. We believe all of Comtech EF Data Corp.’s claims are without merit and that we have substantial factual and legal defenses to the claims. We intend to defend our self vigorously in this lawsuit. However, there is no assurance that we will ultimately prevail in this proceeding.

From time to time, in addition to the claim identified above, we are subject to legal proceedings, claims, investigations and proceedings in the ordinary course of business, including commercial, employment and other matters. In accordance with U.S. generally accepted accounting principles, we make a provision for a liability when it is both probable that a liability has been incurred and management can reasonably estimate the amount of the loss. Management reviews these provisions at least quarterly and adjusts to reflect the impacts of negotiations, settlements, rulings, advice of legal counsel and other information and events pertaining to a particular case. Litigation is inherently unpredictable. It is possible, however, that our consolidated financial position, cash flows or results of operations could be affected by the resolution of one or more of such contingencies.

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Market for Common Stock

The NASDAQ Global Select Market quotes our common stock under the symbol “RADN”. The following table sets forth the range of high and low sales prices per share for our common stock as reported by the NASDAQ Global Select Market for the periods indicated.

| Sales Price | ||||||

| 2007 | High | Low | ||||

First quarter | $ | 11.13 | $ | 8.92 | ||

Second quarter | 10.68 | 8.61 | ||||

Third quarter | 11.41 | 10.19 | ||||

Fourth quarter | 11.06 | 8.54 | ||||

| 2006 | High | Low | ||||

First quarter | $ | 16.33 | $ | 12.59 | ||

Second quarter | 17.85 | 10.07 | ||||

Third quarter | 12.95 | 10.26 | ||||

Fourth quarter | 13.33 | 9.52 | ||||

Holders of Record

As of February 29, 2008, we had approximately 244 holders of record of our common stock. We estimate that we have another 5,501 holders of our common stock in street name.

Dividends

We have not paid dividends on our common stock since inception and we do not intend to pay any dividends to our stockholders in the near future. Our current credit facility prohibits us from paying dividends if we are, or will be, in default or noncompliance with one of the financial covenants contained in the credit agreement because of the payment of the dividend. We currently intend to reinvest earnings, if any, in the development and expansion of our business. The declaration of dividends in the future will be at the election of our Board of Directors and will depend upon our earnings, capital requirements and financial position, general economic conditions and other pertinent factors.

14

Table of Contents

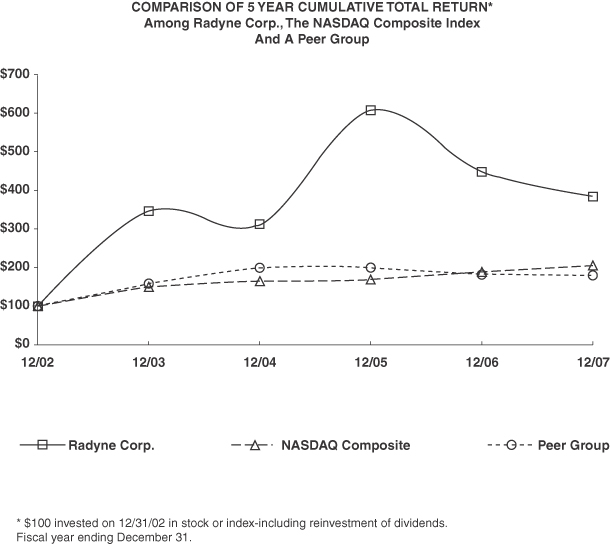

The following graph shows a comparison of cumulative total returns for our common stock, the NASDAQ Global Select Market and the Communication Equipment group assuming the investment of $100 in our common stock and each index on December 31, 2001 and the reinvestment of dividends, if any. Prior period performance is not indicative of future expected performance.

15

Table of Contents

$ in thousands, except per share amounts

Equity Compensation Plans

See Note 15 in the accompanying consolidated financial statements for a description of our equity compensation plans.

| Item 6. | Selected Financial Data |

The following selected consolidated statements of earnings data for the years ended December 31, 2007, 2006, 2005, 2004 and 2003 and the selected consolidated balance sheet data at those dates, are derived from our consolidated financial statements and notes thereto, audited by an independent registered public accounting firm, KPMG LLP. The following data is not necessarily indicative of results of future operations and we recommend reading in conjunction withItem 7. - Management’s Discussion and Analysis of Financial Condition and Results of Operations and the consolidated financial statements and notes thereto as of December 31, 2007 and 2006 and for the three years ended December 31, 2007, included elsewhere in this Annual Report on Form 10-K. The selected financial data below includes full year consolidation of Xicom during both 2007 and 2006. For 2005, the results of Xicom are from the date of acquisition, May 27, 2005, through December 31, 2005. The selected financial date also includes results for AeroAstro from the date of acquisition, August 1, 2007, through December 31, 2007.

Five Year Highlights

$ in thousands, except per share amounts

| Fiscal Year | 20071 | 2006 | 20052 | 2004 | 2003 | ||||||||||

Consolidated Statement of Earnings Data | |||||||||||||||

Net sales | $ | 142,054 | $ | 134,209 | $ | 103,263 | $ | 56,578 | $ | 57,991 | |||||

Operating income | 14,324 | 16,897 | 15,411 | 9,393 | 6,498 | ||||||||||

Net earnings | 10,212 | 11,865 | 10,686 | 13,500 | 4,125 | ||||||||||

Per Share Data | |||||||||||||||

Earnings (loss) per share: | |||||||||||||||

Basic | $ | 0.55 | $ | 0.66 | $ | 0.63 | $ | 0.83 | $ | 0.27 | |||||

Diluted | $ | 0.54 | $ | 0.63 | $ | 0.60 | $ | 0.79 | $ | 0.26 | |||||

Weighted average number of common shares outstanding: | |||||||||||||||

Basic | 18,526 | 18,026 | 16,838 | 16,357 | 15,488 | ||||||||||

Diluted | 19,028 | 18,845 | 17,700 | 17,136 | 15,718 | ||||||||||

Consolidated Balance Sheet Data | |||||||||||||||

Cash and cash equivalents | $ | 24,789 | $ | 27,540 | $ | 16,928 | $ | 39,300 | $ | 30,130 | |||||

Working capital | 63,010 | 62,272 | 41,167 | 53,432 | 41,642 | ||||||||||

Total assets | 139,888 | 120,004 | 100,626 | 65,416 | 50,609 | ||||||||||

Long-term obligations | 3,324 | 148 | 4,960 | 430 | 475 | ||||||||||

Total liabilities | 21,389 | 18,139 | 22,987 | 7,223 | 6,991 | ||||||||||

Stockholders’ equity | 118,499 | 101,865 | 77,639 | 58,193 | 43,618 | ||||||||||

Operating Statistics (unaudited) | |||||||||||||||

Gross profit rate | 39.6% | 42.1% | 44.6% | 53.3% | 45.4% | ||||||||||

Selling, general and administrative expense rate | 21.1% | 21.3% | 21.1% | 27.3% | 23.4% | ||||||||||

Research and development expense rate | 8.3% | 8.2% | 8.5% | 9.4% | 10.9% | ||||||||||

Operating income rate | 10.1% | 12.6% | 14.9% | 16.6% | 11.2% | ||||||||||

(1) Selected financial data above includes the results of AeroAstro from the date of acquisition, August 1, 2007, through December 31, 2007.

(2) Selected financial data above includes the results of Xicom from the date of acquisition, May 27, 2005, through December 31, 2005.

16

Table of Contents

$ in thousands, except per share amounts

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Introduction

The following should be read in conjunction with our consolidated financial statements and the related notes that appear in Item 8 of this Annual Report on Form 10-K. References to “Note” or “Notes” refer to the notes to our consolidated financial statements.

Overview

We design, manufacture and sell products and systems used for the transmission and reception of data and video over satellite, troposcatter, microwave and cable communication networks. Radyne, through its Tiernan subsidiary, manufactures HDTV and SDTV encoding and transmission equipment. Our Xicom subsidiary manufactures high power amplifiers for communications applications. Our AeroAstro subsidiary manufactures microsatellites. We maintain headquarters in Phoenix, Arizona and have sales and manufacturing facilities in Phoenix, Arizona; San Diego and Santa Clara, California; and Ashburn, Virginia. We also have sales or service centers located in Littleton, Colorado; Boca Raton, Florida; Singapore; China; Indonesia; the Netherlands; and the United Kingdom.

We employ 412 people throughout the USA, Europe and Asia. We serve customers in over 120 countries; including international telecommunications companies, Internet service providers, private communications networks, network and cable television companies and the United States government.

We have three reporting segments: 1) Satellite Electronics; represented by the Radyne and Tiernan products; 2) Amplifiers; represented by Xicom products; and 3) Microsatellites; represented by the AeroAstro brand.

During 2007, we had record sales of $142,054. The increase in sales was due, in part, to sales growth in our Amplifier segment and the addition of AeroAstro, which partially offset a decline in sales in our Satellite Electronics segment. Please refer to our discussion ofSales below for further detail.

For 2008, we will continue to pursue markets around the world where we believe we have positioned ourselves to offer cost effective technology solutions that are competitive with alternatives. Our approach remains to focus our efforts on well-defined hardware markets where we can rapidly develop and market communications products. We are committed to offering reliable products that compare well with those of our competition in order to achieve our goal of growing sales while maintaining strong gross margins. We continue to manage our operations with tight cost controls. At the same time, we are investing in new product research and development where we believe we either can achieve returns through new product sales or reduced cost of manufacturing.

In addition, we continue to evaluate opportunities to acquire new technologies or other businesses that complement our existing product lines and have a clear path to providing accretive returns.

Acquisitions

On August 1, 2007, we completed our acquisition of AeroAstro, Inc. AeroAstro is a leader in innovative microsatellite systems, components and advanced communications technologies. In addition to spacecraft equipment, AeroAstro developed and operates the SENS which provides cost effective satellite-based low data rate communications and asset tracking throughout the United States, North America, Europe, Australia, the Middle East, Asia and South America. SENS customers include government entities requiring reliable low data rate communications and businesses seeking to monitor vital assets. AeroAstro employs approximately 65 people and has principal offices in Ashburn, Virginia and Littleton, Colorado. Our financial reports include financial results for AeroAstro for the five-months ended December 31, 2007.