SPAN-AMERICA MEDICAL SYSTEMS, INC.Post Office Box 5231

Greenville, South Carolina 29606-5231

____________________________________________________

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

February 10, 2005

____________________________________________________

TO THE SHAREHOLDERS OF SPAN-AMERICA MEDICAL SYSTEMS, INC.

Notice is hereby given that the Annual Meeting of Shareholders (the “Annual Meeting”) of Span-America Medical Systems, Inc. (the “Company”), will be held at the Company’s headquarters at 70 Commerce Center, Greenville, South Carolina, on February 10, 2005, at 9:00 a.m., for the purpose of considering and acting upon the following matters:

| (1) | the election of three directors; |

| (2) | a proposal to approve the 2005 Non-Employee Director Stock Plan authorizing the issuance of up to 60,000 shares of the Company’s common stock to the Company’s non-employee directors over a five year period; and |

| | (3) | the transaction of such other business as may properly come before the Annual Meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on December 22, 2004 as the record date for the determination of the shareholders entitled to notice and to vote at the Annual Meeting.

YOU ARE REQUESTED TO COMPLETE AND SIGN THE ACCOMPANYING PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING IN PERSON. THE PROXY WILL BE RETURNED TO ANY SHAREHOLDER WHO IS PRESENT IN PERSON AND REQUESTS SUCH RETURN.

By Order of the Board of Directors,

/s/ Richard C. Coggins

Richard C. Coggins

Secretary

January 7, 2005

Greenville, South Carolina

Please Return the Enclosed Proxy Immediately

SPAN-AMERICA MEDICAL SYSTEMS, INC.

Post Office Box 5231

Greenville, South Carolina 29606-5231

(864) 288-8877

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

February 10, 2005

Solicitation of Proxies

This Notice of Annual Meeting, Proxy Statement and Proxy (these “Proxy Materials”) are being furnished to shareholders in connection with the solicitation of proxies by the Board of Directors (the “Board”) of Span-America Medical Systems, Inc. (the “Company”), to be voted at the annual meeting of shareholders (the “Annual Meeting”) to be held at 9:00 a.m. on February 10, 2005 at the Company’s headquarters at 70 Commerce Center, Greenville, South Carolina. The approximate mailing date of these Proxy Materials is January 7, 2005.

Voting at the Annual Meeting

Shareholders of record at the close of business on December 22, 2004 (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. At the close of business on such record date, there were outstanding 2,593,768 shares of the Company’s no par value common stock (the “Common Stock”). The Common Stock is the only class of voting securities of the Company. Holders of shares of Common Stock are entitled to one vote for each share held on the Record Date on all matters presented for action by the shareholders. The presence, either in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock of the Company as of the Record Date is necessary to constitute a quorum at the Annual Meeting. All shares represented by valid proxies received prior to the Annual Meeting and not revoked before they are exercised will be voted in accordance with specifications thereon. If no contrary instructions are indicated, all shares represented by a proxy will be voted FOR the election to the Board of Directors of the nominees described herein, FOR approval of the 2005 Non-Employee Director Stock Plan, and in the discretion of the proxy holders as to all other matters that may properly come before the Annual Meeting or any adjournment thereof.

Shares will be tabulated by inspectors of election appointed by the Company, with the aid of the Company’s transfer agent. The inspectors will not be directors or nominees for director. The inspectors shall determine, among other things, the number of shares represented at the Annual Meeting, the existence of a quorum and the validity and effect of proxies, and shall receive votes, ballots or consents, hear and determine all challenges and questions arising in connection with the right to vote, determine the result, and do such acts as are proper to conduct the election and vote with fairness to all shareholders. Directors are elected by a plurality of votes. The 2005 Non-Employee Director Stock Plan will be approved if a quorum is present and the number of votes cast in favor of the plan is greater than the number of votes cast against the plan. Abstentions and broker non-votes are each included in the determination of the number of shares present and voting. In connection with the election of directors, abstentions and broker non-votes are not counted for purposes of determining the votes cast for directors. Abstentions and broker non-votes will have no effect the vote to approve the 2005 Non-Employee Director Stock Plan.

Revocation of Proxies

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by: (i) filing with the secretary of the Company, at or before the Annual Meeting, a written notice of revocation bearing a later date than the proxy; (ii) duly executing a subsequent proxy relating to the same shares and delivering it to the secretary of the Company at or before the Annual Meeting; or (iii) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy). Any written notice revoking a proxy should be sent to: Span-America Medical Systems, Inc., Post Office Box 5231, Greenville, South Carolina 29606-5231, Attention: Secretary.

ELECTION OF DIRECTORS

The number of the Company’s directors is currently set at nine persons in accordance with the Company’s Articles of Incorporation. As provided in the Company’s Articles of Incorporation, the Board is divided into three classes of directors, with each class being comprised of three persons who serve three-year terms. Accordingly, as set forth below, management has nominated Richard C. Coggins, Thomas F. Grady, Jr. and Peter S. Nyberg to serve as directors for terms that will expire at the earlier of the 2008 annual meeting of shareholders or when their successors are duly elected.

Unless authority to vote with respect to the election of one or more nominees is “WITHHELD,” it is the intention of the persons named in the accompanying proxy to vote such proxy for the election of the nominees set forth below. All nominees are United States citizens. In the event that any of the nominees for director should become unavailable to serve as director, which is not anticipated, the proxy holders named in the accompanying proxy will vote for other persons in their places in accordance with their best judgment. There are no family relationships among the directors and the executive officers of the Company.

Directors will be elected by a plurality of votes cast at the Annual Meeting. The Company’s Articles of Incorporation provide that cumulative voting is not available in the election of directors.

Information Regarding Nominees for Director and Current Directors

The following table sets forth the names and ages of the three nominees for director and the directors who are continuing in office, the positions and offices with the Company held by each such person, and the period that each such person has served as a director of the Company.

Name | | Age | | Position or Office with the Company | | DirectorSince | |

| | | | | | | | |

Nominees for Director with Terms Expiring in 2008 | |

| | | | | | | | |

| Richard C. Coggins | | | 47 | | | Director, Chief Financial Officer, VP - Finance and Secretary | | | 1993 | |

| Thomas F. Grady, Jr. * | | | 62 | | | Director | | | 1975 | |

| Peter S. Nyberg * | | | 40 | | | Director | | | 2004 | |

| | | | | | | | | | | |

Name | | Age | | Position or Office with the Company | | Director Since | |

| | | | | | | | |

Continuing Directors with Terms Expiring in 2006 | |

| Guy R. Guarch* | | | 64 | | | Director | | | 2003 | |

| Thomas D. Henrion* | | | 62 | | | Director | | | 1996 | |

| Douglas E. Kennemore, M.D.* | | | 72 | | | Director | | | 1975 | |

| | | | | | | | | | | |

Continuing Directors with Terms Expiring in 2007 |

| Robert H. Dick* | | | 61 | | | Director | | | 1999 | |

| James D. Ferguson | | | 47 | | | Director, President and Chief Executive Officer | | | 1998 | |

| Robert B. Johnston* | | | 39 | | | Director | | | 2004 | |

| * | Directors whom the Board has determined are “independent directors” within the meaning of the listing standards of the National Association of Securities Dealers (the “NASD”). A majority of the directors are “independent directors.” |

Business Experience of Nominees and Directors

Mr. Coggins joined the Company as Controller in 1986. He was elected Treasurer in January 1987, Vice President of Finance in January 1989, and Secretary and Chief Financial Officer in January 1990. He currently serves as the Company’s Chief Financial Officer, Vice President - Finance and Secretary. Mr. Coggins was previously employed by NCNB National Bank in Charlotte, North Carolina from 1984 to 1986, where he served as Commercial Banking Officer and Metropolitan Area Director.

Mr. Grady joined Federal Paper Board Company, Inc. in 1971, serving in various sales and marketing management positions. He served as Vice President of Sales for Federal from 1990 to 1996, when Federal was acquired by International Paper Company. Following the acquisition, Mr. Grady served as Vice President of Sales with International Paper from 1996 until September 2000, when he retired.

Mr. Nyberg is President of 21 CD, Inc. which he co-founded in July 2002. 21 CD, located in Durham, N.C., creates and supplies custom designed multimedia presentations on uniquely shaped CD-ROMs to enhance customers’ marketing and advertising initiatives. Prior to founding 21 CD, Mr. Nyberg worked from 1999 to 2002 in the health care industry for Promedix and Broadlane, Inc., serving various roles in strategic business development, sales and marketing. Mr. Nyberg also worked for Duke University Health System from 1992 to 1999 as administrative director and vice president of business development. He holds an MBA from Yale School of Management and a BA from Yale College.

Mr. Guarch retired in 2001 from C.R. Bard, Inc. where he spent 32 years in various sales, marketing, and management roles. Bard is a leading developer, manufacturer and marketer of health care products used for vascular, urological and oncological diagnosis and intervention. From 1993 to 2001, Mr. Guarch served as Regional Vice President Corporate Account Management for Bard’s Southeast Region. He worked as President of Bard Venture Division in Boston, MA from 1991 to 1993. From 1988 to 1991, Mr. Guarch worked in London, England, as Vice President Sales for the Bard Europe Division and Managing Director of Bard LTD, UK. Before 1988, Mr. Guarch worked in several sales and marketing roles for Bard’s USCI International Division in Boston, MA, which focused on the design, manufacture and sale of cardiac catheters, urological catheters, and artificial arteries.

Mr. Henrion is President and owner of Silver Thread Farms, LLC, a thoroughbred breeding farm in La Grange, Kentucky. Prior to his involvement with Silver Thread Farms, Mr. Henrion was Executive-in-Residence at b-Catalyst, Inc. from April of 2001 to May 2002. b-Catalyst is a venture capital firm in Louisville, Kentucky which specializes in providing financing and infrastructure support for start-up companies. From 1999 until March 2001, Mr. Henrion served as President of EquiSource, LLC. EquiSource provided group purchasing and e-commerce services to the equine industry in the United States. The company was purchased by the National Thoroughbred Racing Association (NTRA) in 2001 and was moved to Lexington, Kentucky. Mr. Henrion also served as a consultant to Unified Foodservice Purchasing Co-op, LLC from March 1999 to March 2001. From 1980 to 1999, Mr. Henrion was President, Chief Executive Officer, and Director of FoodService Purchasing Cooperative, Inc. ("FSPC") in Louisville, Kentucky. FSPC provided equipment, food, packaging items, and financial services to quick-service restaurant operators including KFC, Taco Bell, Dairy Queen, and Pizza Hut. In March 1999, FSPC merged with the purchasing organization of Tricon Global Restaurants, Inc. to form Unified Foodservice Purchasing Co-op. Mr. Henrion also serves as a director for Brinly-Hardy Company, Inc.

Dr. Kennemore retired in 1999 after 35 years in the private practice of neurosurgery in Greenville, South Carolina.

Mr. Dick has served since January 1998 as president of R. H. Dick & Company, an investment banking and management consulting firm currently based in Ocala, Florida. From 1996 to early 1998, Mr. Dick was a partner with Boles, Knop & Company, Inc., an investment banking firm in Middleburg, Virginia. Prior to that, Mr. Dick served as interim President, Chief Executive Officer and Chief Financial Officer of Biomagnetic Therapy Systems, Inc. (September 1995 - March 1996) and Pharmx, Inc. (May 1994 - April 1995). Both companies were clients of Boles, Knop & Company. From 1982 until 1994, Mr. Dick served in various executive roles with Codman & Shurtleff, Inc., a subsidiary of Johnson & Johnson and a manufacturer of surgical instruments, implants, equipment, and other surgical products. Mr. Dick’s positions with Codman included Director, Vice President - New Business Development, Vice President - U.S. Sales and Marketing, and Vice President - International. From 1978 to 1982, Mr. Dick was President and Chief Executive Officer of Applied Fiber Optics, Inc., which designed, manufactured and marketed fiber optic products for medical applications, defense and surgical microscopes. Mr. Dick also serves on the board and audit committee of Valley Forge Scientific Corporation, which designs and manufactures bipolar electro-surgery equipment.

Mr. Ferguson joined the Company as Materials Manager in 1990. He was promoted to Plant Manager of the Company’s contract packaging business in 1992, Director of Contract Packaging in 1994, and Vice President of Operations in 1995. Mr. Ferguson was named President and Chief Executive Officer of the Company in 1996. From 1981 to 1990, Mr. Ferguson worked for C.B. Fleet in Lynchburg, Virginia, where he served in various manufacturing management positions, ending as Director of Manufacturing.

Mr. Johnston is Vice President of Strategic Planning for The InterTech Group, Inc., in North Charleston, South Carolina. The InterTech Group is controlled by Mr. Jerry Zucker, the owner of approximately 8.7% of Span-America’s common stock. Mr. Johnston joined InterTech in 1998 as its Manager of Investor Relations. He has since held a number of positions of increasing responsibility with InterTech and its affiliates, rising to his current position as Vice President of Strategic Planning. Prior to joining InterTech, he was Senior Strategic Planner for Dominion Textile, Inc. in Montreal, Canada. Dominion Textile was a global manufacturer and marketer of textile products. Mr. Johnston holds an MBA degree from the John Molson School of Business at Concordia University in Montreal as well as a Master’s degree in Public Policy and Public Administration from Concordia University. Mr. Johnston has extensive experience in mergers, acquisitions, and corporate finance. He currently serves as a director of Circa Enterprises (TSX:CTO) as well as a number of closely held companies.

Mr. Johnston was nominated by the Company for election as a director at the Company’s 2004 annual meeting of shareholders pursuant to an agreement dated December 17, 2003 between Mr. Zucker, Mr. Johnston and the Company. This agreement required the Company to nominate Mr. Johnston to serve as a director for a full three-year term following the 2004 annual meeting in exchange for which Mr. Zucker and Mr. Johnston agreed not to, directly or indirectly (a) commence or engage in a tender offer for the Company’s stock, (b) make or participate in a solicitation of proxies to vote any shares of the Company’s stock or (c) take certain other actions that could affect control of the Company. The agreement will terminate thirty days after the later of (i) the date of the 2005 Annual Meeting or (ii) thirty days after Mr. Johnston’s resignation from the Board under any other circumstances. The Board by majority vote (excluding Mr. Johnston) could have required Mr. Johnston to resign any time before the six month anniversary of the 2004 annual meeting; however, the Board did not exercise this option. This agreement was filed as Exhibit 4.4 to the Company’s Annual Report on Form 10-K for the year ended September 27, 2003. The full text of the agreement is incorporated herein by reference, and the foregoing summary is qualified in its entirety by the full text of the agreement.

Meetings and Committees of the Board of Directors

During the 2004 fiscal year, the Board of Directors held seven meetings. All directors attended at least 75% of the aggregate of (i) total board meetings and (ii) total meetings of committees on which such director served. The Board has standing Audit, Compensation, Nominating and Executive Committees. The charters for the Audit, Compensation and Nominating Committees are posted on the Company’s web site atwww.spanamerica.com (select “About Us” then “Investor Relations” and then the desired committee charter).

Audit Committee. The Audit Committee is comprised of Messrs. Dick, Grady and Kennemore, all of whom are independent within the meaning of NASD listing standards and Rule 10A-3(b) under the Securities Exchange Act of 1934. The Board has determined that Mr. Dick is an “audit committee financial expert” within the meaning of Item 401(h) of Regulation S-K. The Audit Committee met four times during fiscal 2004. The Audit Committee was established by the Board for the purpose of overseeing the Company’s accounting and financial reporting processes and the audits of the Company’s financial statements and reviewing the financial reports and other financial information provided by the Company to any governmental body or the public and the Company’s systems of internal controls regarding finance, accounting, legal compliance, and ethics. Its primary duties and responsibilities are to: (i) serve as an independent and objective party to monitor the Company’s financial reporting process, audits of the Company’s financial statements, and the Company’s internal control system and (ii) appoint from time to time, evaluate, and, when appropriate, replace the registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company, determine the compensation of such “outside auditors” and the other terms of their engagement, and oversee the work of the outside auditors. The Company’s outside auditors report directly to the audit committee. The Audit Committee is also charged with establishing procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters.

Compensation Committee. The Compensation Committee is comprised of Messrs. Grady, Henrion, and Johnston, all of whom are independent within the meaning of the NASD listing standards. The Compensation Committee met two times during the 2004 fiscal year. The primary function of the Compensation Committee is to assist the Board in fulfilling its oversight responsibilities relating to officer and director compensation. Its primary duties and responsibilities are to: (i) oversee the development and implementation of the compensation policies, strategies, plans, and programs for the Company’s executive officers and outside directors; (ii) review and determine the compensation of the executive officers of the Company; and (iii) oversee the selection and performance of the Company’s executive officers and succession planning for key members of the Company’s management. The Compensation Committee’s report is included below under “Board Compensation Committee Report on Executive Compensation.”

Nominating Committee. The Nominating Committee is comprised of Messrs. Dick, Guarch, and Henrion, all of whom are independent within the meaning of the NASD listing standards. Prior to January 12, 2004, the Board did not have a standing nominating committee, and the functions of the nominating committee were performed by the outside directors. The Nominating Committee met four times during the 2004 fiscal year. The primary function of the Nominating Committee is to assist the Board in fulfilling its responsibilities with respect to Board and committee membership and shareholder proposals.Itsprimary duties and responsibilities are to: (i) establish criteria for Board and committee membership and recommend to the Board proposed nominees for election to the Board; and (ii) make recommendations regarding proposals and nominees for director submitted by shareholders of the Company.

Executive Committee. The Executive Committee is comprised of Messrs. Dick, Grady, and Henrion, all of whom are independent within the meaning of the NASD listing standards. It did not meet during fiscal year 2004. The Executive Committee serves in an advisory capacity to the senior management of the Company.

Directors Nominations

The nominating committee (described above) will consider director nominees recommended by shareholders. A shareholder who wishes to recommend a person or persons for consideration as a Company nominee for election to the Board of Directors must send a written noticeby mail to Secretary, Span-America Medical Systems, Inc., 70 Commerce Center, Greenville, South Carolina 29615, by fax to 864-288-8692, or by e-mail toboard@spanamerica.com that sets forth (i) the name of each person whom the shareholder recommends be considered as a nominee; (ii) a business address and telephone number for each nominee (an e-mail address may also be included) and (iii) biographical information regarding such person, including the person’s employment and other relevant experience. Shareholder recommendations will be considered only if received no later than the 120th calendar day before the first anniversary of the date of the Company’s proxy statement in connection with the previous year’s annual meeting (no later than September 9, 2005 with respect to recommendations for nominees to be considered at the 2006 Annual Meeting of Shareholders).Note: Shareholders may also make their own nominations directly (as opposed to recommending candidates for the Company to nominate) as described below under the heading “Shareholder Proposals.”

The Company’s nominating committee believes that a nominee recommended for a position on the Company’s Board of Directors must meet the following minimum qualifications:

| · | he or she must be over 21 years of age and under 72 years of age at the time of election (the Company’s bylaws provides that no person shall be elected to serve as a director for a term that will commence after such person’s 72nd birthday); |

| · | he or she must have experience in a position with a high degree of responsibility in a business or other organization; |

| · | he or she must be able to read and understand basic financial statements; |

| · | he or she must possess integrity and have high moral character; |

| · | he or she must be willing to apply sound, independent business judgment; and |

| · | he or she must have sufficient time to devote to the Company. |

In addition, the nominating committee believes that it is desirable that at least one of the Company’s directors serving on the Company’s audit committee possess such qualities and skills as are necessary for him or her to qualify as an audit committee financial expert, as defined in SEC rules and regulations.

The nominating committee identifies potential nominees for director, other than potential nominees who are current directors whose terms of office are expiring and who are standing for reelection, through business and other contacts. The nominating committee may in the future choose to retain a professional search firm to identify potential nominees for director. In addition, the nominating committee will consider potential nominees who are recommended by shareholders.

The Company’s nominating committee evaluates a potential nominee by considering whether the potential nominee meets the minimum qualifications described above, as well as by considering the following factors:

| · | whether the potential nominee has leadership, strategic, or policy setting experience in a complex organization, including any scientific, governmental, educational, or other non-profit organization; |

| · | whether the potential nominee has experience and expertise that is relevant to the Company’s business, including any specialized business experience, technical expertise, or other specialized skills, and whether the potential nominee has knowledge regarding issues affecting the Company; |

| · | whether the potential nominee is highly accomplished in his or her respective field; |

| · | in light of the relationship of the Company’s business to the medical science field, whether the potential nominee has received any awards or honors in the fields of medicine or the biological sciences and whether he or she is recognized as a leader in medicine or the biological sciences; |

| · | whether the addition of the potential nominee to the Board of Directors would assist the Board of Directors in achieving a mix of Board members that represents a diversity of background and experience, including diversity with respect to age, gender, national origin, race, and competencies; |

| · | whether the potential nominee has high ethical character and a reputation for honesty, integrity, and sound business judgment; |

| · | whether the potential nominee is independent, as defined by NASD listing standards, whether he or she is free of any conflict of interest or the appearance of any conflict of interest with the best interests of the Company and its shareholders, and whether he or she is willing and able to represent the interests of all shareholders of the Company; |

| · | whether the potential nominee is financially sophisticated, as defined by NASD listing standards, or qualifies as an audit committee financial expert, as defined by SEC rules and regulations; and |

| · | any factor affecting the ability or willingness of the potential nominee to devote sufficient time to Board activities and to enhance his or her understanding of the Company’s business. |

In addition, with respect to an incumbent director whom the nominating committee is considering as a potential nominee for re-election, the Company’s nominating committee reviews and considers the incumbent director’s service to the Company during his or her term, including the number of meetings attended, level of participation, and overall contribution to the Company. The manner in which the nominating committee evaluates a potential nominee will not differ based on whether the potential nominee is recommended by a shareholder or the Company.

Each of the nominees for director at the 2005 Annual Meeting of Shareholders is a current director standing for re-election. Mr. Nyberg was appointed to the board in July 2004 to fill the remaining term of James M. Shoemaker, Jr. who resigned from the board. Independent director Guy R. Guarch recommended Mr. Nyberg to the Board as a replacement for Mr. Shoemaker.

The Company did not pay any fee to any third party to identify or evaluate or assist in identifying or evaluating potential nominees for director at the 2005 Annual Meeting of Shareholders. The Company did not receive, by September 14, 2004 (the 120th calendar day before the first anniversary of the date of the Company’s 2004 proxy statement), any recommended nominee from a shareholder who beneficially owns more than 5% of the Company’s stock or from a group of shareholders who beneficially own, in the aggregate, more than 5% of the Company’s stock.

Communications Between Shareholders and Board of Directors

The Board provides a process for shareholders to send communications to the Board or any of the Directors. Shareholders may send written communications to the Board or any one or more of the individual Directors by mail to Secretary, Span-America Medical Systems, Inc., 70 Commerce Center, Greenville, South Carolina 29615, by fax to 864-288-8692, or by e-mail to board@spanamerica.com.Such communications will be reviewed by our Secretary, who shall remove communications relating to solicitations, junk mail, customer service concerns and the like. All other shareholder communications shall be promptly forwarded to the applicable member(s) of our board of directors or to the entire board of directors, as requested in the shareholder communication.

It is the Company's policy that all of the Company’s directors and nominees for election as directors at the Annual Meeting attend the Annual Meeting except in cases of extraordinary circumstances. All of the nominees for election at the 2004 Annual Meeting of Shareholders and all of the other directors attended the 2004 Annual Meeting of Shareholders, and the Company expects all nominees and directors to attend the 2005 Annual Meeting of Shareholders.

Code of Ethics

The Company has adopted a Code of Conduct that applies to all of the Company’s employees, including but not limited to the Company’s chief executive officer and principal financial and accounting officers and controller. The Company’s Code of Conduct is posted on the Company’s web site atwww.spanamerica.com (Select “About Us,” then “Investor Relations” and then “Corporate Code of Conduct”).

EXECUTIVE OFFICERS

The following table sets forth all of the current executive officers of the Company and their respective ages, company positions and offices, and periods during which they have served in such positions and offices. There are no persons who have been selected by the Company to serve as its executive officers who are not set forth in the following table.

Name | | Age | | Company Offices Currently Held | | Company

Officer Since | |

| | | | | | | | |

| James D. Ferguson | | | 47 | | | President and Chief Executive Officer | | | 1995 | |

| Robert E. Ackley | | | 50 | | | Vice President of Custom Products | | | 1995 | |

| Richard C. Coggins | | | 47 | | | Vice President of Finance, Secretary and Chief Financial Officer | | | 1987 | |

| Erick C. Herlong | | | 34 | | | Director of Operations | | | 2001 | |

| James R. O’Reagan | | | 52 | | | Vice President of R&D and Engineering | | | 2001 | |

| Clyde A. Shew | | | 47 | | | Vice President of Medical Sales and Marketing | | | 1996 | |

| Marie Sitter | | | 54 | | | Director of Human Resources | | | 2004 | |

| Wanda J. Totton | | | 49 | | | Vice President of Quality | | | 1995 | |

The Company’s executive officers are appointed by the Board of Directors and serve at the pleasure of the Board.

Business Experience of Executive Officers

Mr. Ferguson’s business experience is set forth above under “Business Experience of Nominees and Directors.”

Mr. Ackley joined the Company as Materials Manager in 1987. He was named Director of Consumer Sales in 1993, Vice President of Marketing in 1995, Vice President of Consumer Sales in 1996, Vice President of Operations in 1998, and Vice President of Custom Products in 2000. Prior to joining the Company, Mr. Ackley worked in various operations management roles for Almay Cosmetics in North Carolina and C.B. Fleet in Virginia.

Mr. Coggins’ business experience is set forth above under “Business Experience of Nominees and Directors.”

Mr. Herlong joined Span-America in 1995 as Packaging Engineer. He became Production Manager in 1998 and Plant Manager in 2000. He was named Director of Operations in May 2001. Before joining Span-America, Mr. Herlong worked for Dixie-Narco, a division of Maytag Corporation, for two years in the positions of Technical Services Representative and Materials Management Specialist. Mr. Herlong graduated from Clemson University in 1993 with a B.S. degree in Packaging Science.

Mr. O’Reagan joined the Company in August 2001 as Vice President of R&D and Engineering. From 1982 until 2001, Mr. O’Reagan worked for C.B. Fleet Company in Lynchburg, Virginia. While at Fleet, he served in various positions including Director of Engineering, Director of Operations, Director of Global Operations Planning and Engineering, and Director of Latin America and Global Manufacturing Planning. Mr. O’Reagan holds B.S. and M.S. degrees in Mechanical Engineering from the University of Virginia.

Mr. Shew joined the Company as Director of Corporate Accounts in May 1996. He was promoted to Vice President of Medical Sales in October 1996 and Vice President of Medical Sales and Marketing in February 1998. From 1984 to 1996, Mr. Shew worked in various sales and marketing roles for Professional Medical Products, Inc. in Greenwood, South Carolina. His final position there was Director of Corporate Accounts, where he was responsible for contracting with multi-facility health care organizations in the United States.

Ms. Sitter joined Span-America in 2000 as Human Resources Manager. She was promoted to Director of Human Resources in 2004 and was made a member of the Company’s senior management team. Prior to joining the Company, Ms. Sitter was employed as Director of Human Resources for CDS Ensembles, a privately held manufacturer of bedding products, where she worked from 1993 to 2000.

Ms. Totton joined the Company in 1987 as Quality Control Manager. She became Production Manager of the Company’s contract packaging business unit in 1990. She was promoted to Director of Quality in 1995 and was named Director of Quality / R&D in 1998. Ms. Totton now serves as Vice President of Quality, following the addition of a full time Director of R&D and Engineering in August 2001.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The information set forth below is furnished as of the Record Date, with respect to Common Stock owned beneficially or of record by persons known to the Company to be the beneficial owner of more than 5% of the Common Stock as of the Record Date, each of the directors and nominees individually, the named officers included in the compensation table, and all directors and executive officers as a group. Unless otherwise noted, each person has sole voting and investment power with respect to such person’s shares owned. All share amounts in the table include shares which are not outstanding but which are the subject of options exercisable in the 60 days following the Record Date. All percentages are calculated based on the total number of outstanding shares, plus the number of shares for the particular person or group which are not outstanding but which are the subject of options exercisable in the 60 days following the Record Date.

| | | Amount/Nature | | | |

Name and Address | | of Beneficial | | Percent | |

of Beneficial Owner | | Ownership | | of Class | |

| | | | | | |

Beneficial Owners of More Than 5% of the Company’s Common Stock | |

| | | | | | |

| Jerry Zucker | | | 226,800(1) | | | 8.7% | |

| 16 Buckingham Drive | | | | | | | |

| Charleston, SC 29407 | | | | | | | |

| | | | | | | | |

| Farnam Street Partners, L.P. | | | 224,791(2) | | | 8.7% | |

| 3033 Excelsior Boulevard, Suite 300 | | | | | | | |

| Minneapolis, MN 55426 | | | | | | | |

| | | | | | | | |

| Douglas E. Kennemore, M.D. | | | 211,876 | | | 8.2% | |

| 117 Rockingham Rd. | | | | | | | |

| Greenville, SC 29607 | | | | | | | |

| | | Amount/Nature | | | |

Name and Address | | of Beneficial | | Percent | |

of Beneficial Owner | | Ownership | | of Class | |

| | | | | | |

| Santa Monica Partners, LP | | | 150,432(3) | | | 5.8% | |

| 1865 Palmer Avenue | | | | | | | |

| Larchmont, NY 10538 | | | | | | | |

| | | | | | | | |

| Thomas D. Henrion | | | 136,008 | | | 5.2% | |

| 1309 Park Shore Road | | | | | | | |

| La Grange, KY 40031 | | | | | | | |

| | | | | | | | |

Directors and Nominees |

| | | | | | | | |

| Richard C. Coggins | | | 56,987(4) | | | 2.2% | |

| Robert H. Dick | | | 11,500 | | | * | |

| James D. Ferguson | | | 82,966(5) | | | 3.1% | |

| Thomas F. Grady, Jr. | | | 36,595 | | | 1.4% | |

| Guy R. Guarch | | | 3,000 | | | * | |

| Thomas D. Henrion | | | 136,008 | | | 5.2% | |

| Robert B. Johnston | | | 227,800 (6) | | | 8.8% | |

| Douglas E. Kennemore, M.D. | | | 211,876 | | | 8.2% | |

| Peter S. Nyberg | | | 0 | | | * | |

| | | | | | | | |

Named Officers |

| | | | | | | | |

| James D. Ferguson | | | 82,966(5) | | | 3.1% | |

| Robert E. Ackley | | | 37,038(7) | | | 1.4% | |

| Richard C. Coggins | | | 56,987(4) | | | 2.2% | |

| James R. O’Reagan | | | 11,625(8) | | | * | |

| Clyde A. Shew | | | 42,100(9) | | | 1.6% | |

| | | | | | | | |

Directors and Executive Officers as a Group |

| | | | | | | | |

| All Directors and Executive | | | 902,643(10) | | | 32.0% | |

| Officers of the Company as a | | | | | | | |

| Group (15 persons) | | | | | | | |

______________________

| (1) | The amount shown as beneficially owned by Jerry Zucker is based on his Schedule 13D/A filed on December 19, 2003. |

| (2) | The amount shown as beneficially owned by Farnam Street Partners is based on its Schedule 13D/A filed on December 2, 2002. |

| (3) | The amount shown as beneficially owned by Santa Monica Partners, LP is based on its Schedule 13D/A filed on July 17, 2002. |

| (4) | The amount shown as beneficially owned by Mr. Coggins includes 38,500 shares subject to options held by Mr. Coggins which are exercisable within 60 days of the Record Date. |

| (5) | The amount shown as beneficially owned by Mr. Ferguson includes 66,100 shares subject to options held by Mr. Ferguson which are exercisable within 60 days of the Record Date. |

| (6) | The amount shown as beneficially owned by Mr. Johnston consists of 1,000 shares owned directly by Mr. Johnston and 226,800 shares owned directly by Mr. Jerry Zucker. Mr. Johnston disclaims beneficial ownership with respect to the shares owned by Mr. Zucker. |

| (7) | The amount shown as beneficially owned by Mr. Ackley includes 31,000 shares subject to options held by Mr. Ackley which are exercisable within 60 days of the Record Date. |

| (8) | The amount shown as beneficially owned by Mr. O’Reagan includes 9,000 shares subject to options held by Mr. O’Reagan which are exercisable within 60 days of the Record Date. |

| (9) | The amount shown as beneficially owned by Mr. Shew includes 37,500 shares subject to options held by Mr. Shew which are exercisable within 60 days of the Record Date. |

| (10) | The amount shown as beneficially owned by all directors and executive officers as a group includes 225,300 shares subject to options held by such persons which are exercisable within 60 days of the Record Date. |

* Less than one percent.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Summary of Cash and Certain Other Compensation

The following table shows, for the 2004, 2003, and 2002 fiscal years, the cash compensation paid by the Company, as well as certain other compensation paid or accrued for those years, to the Company’s Chief Executive Officer and to each of the four other most highly compensated officers during fiscal year 2004 (the “Named Officers”).

Summary Compensation Table

| | | | | | | | | | | | | | |

| | | | | | | | | Long Term | | | |

| | | | | | | | | Long Term Compensation | | | |

| | | | | | | | | Awards | | | |

| | | | | Annual | | | | Securities | | | |

| | | | | Compensation (1) | | Restricted | | Underlying | | All Other | |

Name and Principal Position | | | | | | | | Stock | | Options | | Compensation | |

During Fiscal 2004 | | Year | | Salary ($) | | Bonus ($) | | Awards ($)(2) | | (#) | | ($) | |

| | | | | | | | | | | | | | | | | | | | |

| James D. Ferguson | | | 2004 | | | 210,000 | | | 95,550 | | | 8,055 (3 | ) | | 3,500 | | | 7,187 | (3) |

| President and CEO | | | 2003 | | | 201,667 | | | 58,880 | | | 9,520 (3 | ) | | 5,000 | | | 7,721 | |

| | | | 2002 | | | 179,401 | | | 64,645 | | | 8,342 (3 | ) | | 4,000 | | | 4,508 | |

| | | | | | | | | | | | | | | | | | | | |

| Robert E. Ackley | | | 2004 | | | 140,817 | | | 58,518 | | | — | | | 2,000 | | | 5,582 | (4) |

| VP of Custom Products | | | 2003 | | | 133,867 | | | 42,801 | | | — | | | 2,500 | | | 5,364 | |

| | | | 2002 | | | 127,500 | | | 41,031 | | | — | | | 2,000 | | | 3,513 | |

| | | | | | | | | | | | | | | | | | | | |

| Richard C. Coggins | | | 2004 | | | 146,932 | | | 64,199 | | | — | | | 2,000 | | | 5,683 | (5) |

| Chief Financial Officer | | | 2003 | | | 139,867 | | | 39,361 | | | — | | | 3,000 | | | 5,513 | |

| VP of Finance and Secretary | | | 2002 | | | 132,533 | | | 46,702 | | | — | | | 3,000 | | | 4,162 | |

| | | | | | | | | | | | | | | | | | | | |

| James R. O’Reagan | | | 2004 | | | 126,580 | | | 39,310 | | | 5,370 (6 | ) | | 2,000 | | | 5,884 | (6) |

| VP of R&D and Engineering | | | 2003 | | | 123,167 | | | 35,917 | | | 5,712 (6 | ) | | 2,500 | | | 5,897 | |

| | | | 2002 | | | 115,000 | | | 42,389 | | | — | | | — | | | 3,195 | |

| | | | | | | | | | | | | | | | | | | | |

| Clyde A. Shew | | | 2004 | | | 152,677 | | | 59,009 | | | — | | | 2,000 | | | 5,012 | (7) |

| VP of Medical Sales and Marketing | | | 2003 | | | 145,513 | | | 35,829 | | | — | | | 3,000 | | | 5,981 | |

| | | | 2002 | | | 137,250 | | | 45,119 | | | — | | | 3,000 | | | 4,646 | |

_________________

| (1) | Certain amounts may have been expended by the Company, which may have had value as a personal benefit to the Named Officers. However, the total value of such benefits did not exceed the lesser of $50,000 or 10% of the annual salary and bonus for each person. |

| (2) | Awards are made pursuant to the Company’s 2000 Restricted Stock Plan. As provided by the plan, the number of shares in each award equals half of the number of shares purchased by the recipient in the open market (excluding the exercise of stock options) during the plan year for that award. Each award vests at a rate of 25% of the restricted shares per year beginning with the end of the year to which the award pertains. Once shares vest, they are no longer restricted within the meaning of the plan. Dividends are not paid or accrued on non-vested shares. At the end of fiscal year 2004, a total of 2,279 restricted shares valued at $24,476 (calculated using the fair market value of the Company’s stock at fiscal year end 2004) held by all restricted stock holders in the aggregate were outstanding. |

| (3) | Mr. Ferguson was awarded 750, 1,000 and 1,234 shares of restricted stock in fiscal years 2004, 2003 and 2002, respectively. He had received a total of 3,984 shares of restricted stock at fiscal year end 2004, of which 2,615 shares were fully vested. The value of the stock, including vested and non-vested shares, was $42,788, calculated using the fair market value of the Company’s stock at fiscal year end 2004. The amount shown in “All Other Compensation” is comprised of (i) contributions of $6,002 to the Company’s 401(k) plan by the Company on behalf of Mr. Ferguson to match pre-tax deferral contributions, all of which is vested, and (ii) $1,185 in annual premiums paid by the Company on behalf of Mr. Ferguson for life insurance not generally available to all Company employees. |

| (4) | This amount is comprised of (i) contributions of $4,590 to the Company’s 401(k) plan by the Company on behalf of Mr. Ackley to match pre-tax deferral contributions, all of which is vested, and (ii) $992 in annual premiums paid by the Company on behalf of Mr. Ackley for life insurance not generally available to all Company employees. |

| (5) | This amount is comprised of (i) contributions of $4,834 to the Company’s 401(k) plan by the Company on behalf of Mr. Coggins to match pre-tax deferral contributions, all of which is vested, and (ii) $849 in annual premiums paid by the Company on behalf of Mr. Coggins for life insurance not generally available to all Company employees. |

| (6) | Mr. O’Reagan was awarded 500 and 600 shares of restricted stock in fiscal years 2004 and 2003, respectively. He had received a total of 1,100 shares of restricted stock at fiscal year end 2004, of which 425 shares were fully vested. The value of the stock, including vested and non-vested shares, was $11,814, calculated using the fair market value of the Company’s stock at fiscal year end 2004. The amount shown in “All Other Compensation” is comprised of (i) contributions of $4,126 to the Company’s 401(k) plan by the Company on behalf of Mr. O’Reagan to match pre-tax deferral contributions, all of which is vested, and (ii) $1,758 in annual premiums paid by the Company on behalf of Mr. O’Reagan for life insurance not generally available to all Company employees. |

| (7) | This amount is comprised of (i) contributions of $3,797 to the Company’s 401(k) plan by the Company on behalf of Mr. Shew to match pre-tax deferral contributions, all of which is vested, and (ii) $1,215 in annual premiums paid by the Company on behalf of Mr. Shew for life insurance not generally available to all Company employees. |

Option Grants in Fiscal Year 2004

| The following stock options were granted during fiscal year 2004 to the Named Officers. |

Option Grants in Last Fiscal Year

| | | Individual Grants | | | | | |

| | | | | Percent of | | | | | | | | | |

| | | Number of | | Total | | | | | | | | | |

| | | Securities | | Options | | Exercise | | | | Potential Realizable Value at | |

| | | Underlying | | Granted to | | or Base | | | | Assumed Rates of Stock Price | |

| | | Options | | Employees in | | Price | | Expiration | | Appreciation for Option Term | |

Name | | Granted (#) | | Fiscal Year | | ($/sh)(1) | | Date | | 5% ($) | | 10% ($) | |

| | | | | | | | | | | | | | | | | | | | |

| James D. Ferguson | | | 3,500 (2 | ) | | 15% | | | $13.58 | | | 02/11/14 | | | $29,891 | | | $75,751 | |

| | | | | | | | | | | | | | | | | | | | |

| Robert E. Ackley | | | 2,000 (2 | ) | | 8% | | | $13.58 | | | 02/11/14 | | | $17,081 | | | $43,286 | |

| | | | | | | | | | | | | | | | | | | | |

| Richard C. Coggins | | | 2,000 (2 | ) | | 8% | | | $13.58 | | | 02/11/14 | | | $17,081 | | | $43,286 | |

| | | | | | | | | | | | | | | | | | | | |

| James R. O’Reagan | | | 2,000 (2 | ) | | 8% | | | $13.58 | | | 02/11/14 | | | $17,081 | | | $43,286 | |

| | | | | | | | | | | | | | | | | | | | |

| Clyde A. Shew | | | 2,000 (2 | ) | | 8% | | | $13.58 | | | 02/11/14 | | | $17,081 | | | $43,286 | |

____________________

| (1) | The exercise price shown represents 100% of the fair market value of the underlying stock based on the average of the high and low sales price per share on the grant date, February 11, 2004. |

| (2) | The options shown become exercisable at the greater of 1,000 shares per year or 20% of the options granted per year, beginning July 1, 2004. In addition, the Plan contains certain standard conditions for the early expiration of the options. |

Option Exercises and Year-End Values

The following table sets forth information with respect to the Company’s Named Officers concerning the exercise of options during the 2004 fiscal year and unexercised options held as of the end of the 2004 fiscal year.

Aggregated Option Exercises in Last Fiscal Year and FY-End Option Values

| | | | | | | Number of Securities | | | |

| | | | | | | Underlying Unexercised | | Value of Unexercised | |

| | | Shares | | | | Options at Fiscal | | In-the-Money Options | |

| | | Acquired on | | Value | | Year-End (#) | | at Fiscal Year-End ($) (1) | |

Name | | Exercise (#) | | Realized ($)(1) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

| | | | | | | | | | | | | | | | | | | | |

| James D. Ferguson | | | 1,000 | | | $ 4,760 | | | 66,100 | | | 7,700 | | | $366,197 | | | $19,896 | |

| Robert E. Ackley | | | 10,000 | | | 75,490 | | | 31,000 | | | 1,500 | | | 158,801 | | | 1,385 | |

| Richard C. Coggins | | | 9,000 | | | 49,560 | | | 38,500 | | | 3,000 | | | 211,726 | | | 8,100 | |

| James R. O’Reagan | | | 0 | | | 0 | | | 9,000 | | | 5,500 | | | 40,520 | | | 24,705 | |

| Clyde A. Shew | | | 0 | | | 0 | | | 37,500 | | | 2,000 | | | 210,693 | | | 2,770 | |

_______________

| (1) | The “value realized” is determined by subtracting the amount paid upon exercise of the options from the market value of the underlying Common Stock as of the exercise date. The value of unexercised in-the-money options at fiscal year-end is determined by subtracting the exercise price from the market value of the underlying Common Stock as of fiscal year-end. |

BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

Notwithstanding any statement in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, incorporating future or past filings, including this Proxy Statement, in whole or in part, the following Board Compensation Committee Report on Executive Compensation below shall not be incorporated by reference into any such filing unless the incorporation specifically lists this report.

Decisions with respect to the compensation of the Company’s Named Officers are made by the three-member Compensation Committee of the Board comprised of Messrs. Grady, Henrion and Johnston. Each member of the Compensation Committee is a non-employee, independent director (within the meaning of NASD listing standards). The Compensation Committee’s charter is posted on the Company’s web site at www.spanamerica.com (select “About Us” then “Investor Relations” then “Compensation Committee Charter”). All decisions by the Compensation Committee relating to the compensation of the Company’s Named Officers are reviewed by the full Board. Set forth below is a report submitted by the Compensation Committee in its capacity as such addressing the Company’s compensation policies for fiscal 2004 with respect to the Named Officers of the Company.

Compensation Committee Report

General Compensation Policies with Respect to Named Officers

The Compensation Committee does not maintain formal, written executive compensation policies. However, in general, the Committee has structured officer compensation so as to provide competitive levels of compensation that integrate pay with the Company’s annual and long-term performance goals, reward above-average corporate performance, recognize individual initiative, responsibility and achievements, and assist the Company in attracting and retaining qualified executives. The Compensation Committee also endorses the position that stock ownership by management and stock-based performance compensation arrangements are beneficial in aligning management’s and shareholders’ interest in the enhancement of shareholder value.

The Named Officers’ overall compensation is intended to be consistent with the compensation paid to executives of companies similar in size and character to the Company, provided that the Company’s performance warrants the compensation being paid. In determining the appropriate compensation, the Compensation Committee has utilized a combination of salary, incentive cash compensation, Company stock ownership and benefits. The Compensation Committee has also attempted to maintain an appropriate relationship between the compensation among the Named Officers and their relative levels of responsibility within the Company.

Compensation paid to the Company’s Named Officers in fiscal year 2004, as reflected in the foregoing compensation tables, consisted of the following elements: base salary, bonus, restricted stock awards, option grants, matching contributions paid with respect to the Company’s 401(k) plan, and certain benefits. Payments under the Company’s 401(k) plan are made to all employees on a non-discriminatory basis.

Relationship of Performance to Executive Compensation

The Compensation Committee believes that a significant portion of the Named Officers’ compensation should be based on individual and corporate performance. The principal means through which the Company ties compensation to performance is through the Company’s Management Bonus Plan (the “Bonus Plan”). Participants in the Bonus Plan include officers and members of the Company’s senior management team, including all of the Named Officers. Pursuant to the Bonus Plan, prior to the beginning of each fiscal year the Board of Directors approves the Company’s operating plan which contains target earnings projections for the coming year. The target earnings projections must provide a reasonable increase over the prior year’s earnings and must be consistent with the Company’s long-term growth goals. Bonuses for Mr. Ferguson, Mr. Coggins, Ms. Totton and Ms. Sitter are based entirely on overall Company performance and are determined by the formula in the bonus plan approved by the Compensation Committee and the Board prior to the beginning of the fiscal year. The bonuses for each other participant are based approximately 60% on overall Company performance and approximately 40% on the achievement of individual targets pertinent to the participant’s business unit or area of operations, which are determined by the chief executive officer and reviewed by the Compensation Committee. The Bonus Plan is structured so that each participant has an opportunity to earn a bonus equal to approximately 25% of his or her base salary if the Company reaches 100% of its target earnings performance (and 100% of any applicable individual goal is met). The percentage of salary potentially earned by each participant under the Bonus Plan ranges from 0% if the Company earnings are less than approximately 80% of the target earnings (and less than 80% of any applicable individual target is achieved), to approximately 60% if the Company’s earnings exceed approximately 150% of target earnings (and any applicable individual target is exceeded by approximately 150%).

Options to purchase Company Common Stock are also granted periodically by the Compensation Committee to officers and members of the senior management team. The number of shares granted is based primarily on individual performance and, secondarily, on Company performance relative to the Company’s operating and strategic plans.

In order to encourage management employees to increase their ownership of the Company’s stock through their own investments, the Company’s 2000 Restricted Stock Plan provides that at the end of each year, the Company will award to each plan participant a number of shares of restricted stock equal to half the number of shares of Company stock the participant himself purchased during the year (excluding shares received on exercise of options) up to a maximum annual award of 5% of each participant’s annual salary. The restricted shares in each award vest at a rate of 25% per year beginning with the end of the year in which the purchases giving rise to the award occurred. All of the Named Officers are participants in the 2000 Restricted Stock Plan. The plan also permits the Compensation Committee to make additional restricted stock awards subject to such restrictions and conditions the committee may establish.

2004 Salaries, Cash Bonuses, Restricted Stock Awards, Stock Option Grants, and Incentive Payments

The 2004 salary levels of each of the Company’s Named Officers were determined on the anniversary date of the employee’s last performance review and were based generally on the criteria set forth above. Under the Company’s salary administration plan, each employee of the Company, including the Named Officers, is assigned a particular job grade level with an associated salary range. The job grade level is determined by a quantitative scoring system which considers various factors under the major categories of job demands, knowledge, job content, and level of responsibility. The associated salary range has been assigned to each job grade level based on input from independent consultants and the Company’s management. The independent consultants evaluated the base salary and incentive compensation of the Named Officers and selected jobs from each job grade level by comparing Company information to published compensation survey data from manufacturing companies in the non-durable goods industry with revenues in the range of $40 to $80 million. The survey data included information on job duties, base salary and total cash compensation at the 25th, 50th and 75th percentiles, adjusted where appropriate for the geographic differential in Greenville, South Carolina. Compensation was generally considered to be within the market competitive range if total cash compensation was within 90-110% of the market 50th percentile. The salary levels of the Named Officers were based primarily on individual performance, overall Company performance and achievement of specific individual and corporate goals for the prior fiscal year. The salary levels of the Named Officers must fall within the designated salary ranges for the appropriate job grade level, pursuant to the Company’s salary administration plan.

The Named Officers’ fiscal 2004 bonuses under the Bonus Plan were determined based on the Company’s achievement of operating profit targets in relation to the Company’s 2004 operating plan. Fiscal 2004 operating profit greatly exceeded the 2004 bonus plan targets generally resulting in relatively higher bonuses for fiscal 2004 compared to prior years. Mr. Ferguson and Mr. O’Reagan each purchased shares of Company common stock during fiscal 2004 and received the matching awards of restricted stock automatically provided for by the 2000 Restricted Stock Plan. No other awards were made to Named Officers under the 2000 Restricted Stock Plan in fiscal 2004. In order to reward past performance and encourage future growth and profitability of the Company, the Named Officers were awarded stock options under the Company’s 1997 Stock Option Plan as described above under the sub-heading “Option Grants in Fiscal Year 2004.”

Compensation of the Chief Executive Officer During Fiscal 2004

Mr. Ferguson’s compensation is determined by the Compensation Committee using the exact same factors as those applied to other Company officers as described above.

Other Compensation Plans

The Company has adopted certain broad-based employee benefit plans in which the chief executive officer and the other Named Officers have been permitted to participate. The Company has also adopted certain executive officer life and health insurance plans. The incremental cost to the Company of the chief executive officer’s and other Named Officers’ benefits provided under these plans (which are not set forth in any of the tables) totaled less than $50,000 and less than 10% of their cash compensation in fiscal year 2004. Benefits under these plans generally are not directly or indirectly tied to Company performance.

Submitted by the Compensation Committee

Thomas F. Grady, Jr.

Thomas D. Henrion

Robert B. Johnston

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board was comprised of Thomas F. Grady, Jr., Thomas D. Henrion and Robert B. Johnston. The Company is not aware of any compensation committee interlocks or insider participation in the Compensation Committee.

Compensation of Non-employee Directors

Each director of the Company who is not also an officer of the Company receives an annual fee of 1,000 shares of unregistered Common Stock plus a per diem fee of $1,000 for each Board meeting and committee meeting attended. In addition, each non-officer director receives a fee of $500 for participating in Board or committee meetings held by telephone conference call. The Chairman of the Board receives an additional 1,000 shares of unregistered Common Stock per year (for a total of 2,000 shares) plus the same per diem and conference call fees described above. The Chairman of the Audit Committee receives an additional 500 shares of unregistered Common Stock per year (for a total of 1,500 shares) plus the same per diem and conference call fees described above. Including the value on the date of receipt of the Common Stock received in March 2004, no director received more than $35,000 in fiscal 2004 for his services as a director. Directors who are also employees of the Company do not receive compensation for their services as directors.

Employment Agreements and Severance Protection Agreements

All Span-America employees, including the Named Officers, are employed at will by the Company and do not have employment agreements. In July 2002, the Company entered into severance protection agreements with each of the Named Officers at that date. In February 2004, the Company entered into a similar agreement with Ms. Totton after she was promoted to Vice President. The agreements provide for a lump sum severance payment of either 110% (for Messrs. Ackley, O’Reagan, Shew, and Ms. Totton) or 210% (for Messrs. Ferguson and Coggins) of each executive’s annual compensation if the executive’s employment is terminated without cause within one year following a change in control. Following such termination, the agreements also provide for vesting of the executives’ then outstanding options and restricted stock. The agreements have a rolling term of one year (except for Mr. Ferguson’s and Mr. Coggins’ agreements, which have two-year terms) that automatically extend each day for an additional day without any action by either party. Either party to an agreement may terminate the agreement by written notice to the other. Upon such notice, the agreement will cease to extend automatically, and will be terminated one year from the notice date (two years for Mr. Ferguson’s and Mr. Coggins’ agreements).

Under the severance agreements, “change in control” is generally defined as (i) the acquisition by any person of securities representing 35% or more of the combined voting power of the Company’s outstanding voting securities; (ii) during any period of up to two consecutive years, individuals who, at the beginning of such period, constitute the Board cease for any reason to constitute a majority of the Board; (iii) the stockholders of the Company approve a merger or consolidation of the Company with any corporation other than a merger or consolidation that would result in the voting securities of the Company outstanding immediately prior to the merger or consolidation continuing to represent at least 51% of the voting power of the surviving entity or a merger or consolidation effected to implement a recapitalization of the Company or a plan of complete liquidation of the Company or a sale of substantially all of the Company’s assets; or (iv) the occurrence of any other event that the Board determines affects control of the Company and with respect to which the Board adopts a resolution that such event constitutes a change in control for purposes of the severance agreements.

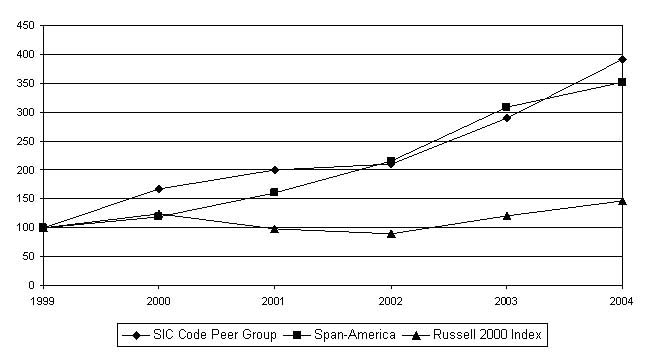

PERFORMANCE GRAPH

Notwithstanding any statement in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, incorporating future or past filings, including this Proxy Statement, in whole or in part, the following Performance Graph shall not be incorporated by reference into any such filing unless the incorporation specifically lists the following Performance Graph.

The following graph sets forth the performance of the Company’s Common Stock for the five-year period from October 2, 1999, through October 2, 2004, compared to the Russell 2000 Index and a peer group index. The peer group index was prepared by an unaffiliated third party and is comprised of all exchange-listed companies that had the standard industry classification code 3842 (which relates to medical products and supplies) at October 2, 2004. The companies included in the peer group index are shown below. All stock prices reflect the reinvestment of cash dividends.

COMPARISON OF CUMULATIVE TOTAL RETURN

AMONG SPAN-AMERICA MEDICAL SYSTEMS, INC.,

A PEER GROUP, AND THE RUSSELL 2000 INDEX

Assumes $100 invested on October 2, 1999.

Assumes dividends reinvested. Fiscal year ending October 2, 2004.

COMPANIES INCLUDED IN PEER GROUP INDEX

Standard Industry Classification Code 3842

at October 2, 2004

| American Medical Systems | Antares Pharma, Inc. | Armor Holdings, Inc. |

| ATS Medical, Inc. | Biomet, Inc. | Chad Therapeutics, Inc. |

| Closure Medical Corp. | CNS, Inc. | Cybex International, Inc. |

| DHB Industries, Inc. | DJ Orthopedics, Inc. | Encore Medical Corp. |

| Exactech, Inc. | Healthtronics, Inc. | Implant Sciences Corp. |

| Inamed Corp. | Integra Lifesciences Holdings | Invacare Corp. |

| Lakeland Industries | Langer, Inc. | Macropore Biosurgery, Inc. |

| Medical Action Industries | Microtek Medical Holdings | Mine Safety Appliance Co. |

| Miracor Diagnostics | Orthologic Corp. | Regeneration Technology Inc. |

| Sharps Compliance Corp. | Sharps Elimination Technologies, Inc. | Sonic Innovations, Inc. |

| Stryker Corporation | Synovis Life Technologies, Inc. | Theragenics Corporation |

| Tutogen Medical, Inc. | Vista Medical Technologies, Inc. | Wright Medical Group, Inc. |

| Zimmer Holdings, Inc. | | |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company is not aware of any relationships or related party transactions required to be disclosed in this Proxy Statement pursuant to Item 404 of Regulation S-K.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires the Company’s directors, executive officers, and persons who own more than 10% of a registered class of the Company’s equity securities to file with the Securities and Exchange Commission (the “SEC”) initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Executive officers, directors and greater than 10% shareholders are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms they file. Based solely on a review of the copies of such reports furnished to the Company and representations that no other reports were required during the 2004 fiscal year, the Company believes that all of its executive officers and directors filed the required reports on a timely basis under Section 16(a) except that Mr. Nyberg filed one late report on Form 3 with respect to his appointment to the board of directors to fill the unexpired term of Mr. Shoemaker who resigned from the board in July 2004.

2005 NON-EMPLOYEE DIRECTOR STOCK PLAN

(Item 2)

The board of directors recommends that the shareholders approve the adoption by our company of our 2005 Non-Employee Director Stock Plan (which will be referred to under this Item 2 simply as the “Stock Plan”), which is set forth inAppendix B. Our board adopted the Stock Plan, subject to shareholder approval, on January 7, 2005. If shareholders approve the Stock Plan, it will be effective as of January 7, 2005.

In September 1994, our board approved a resolution changing their annual director’s compensation from cash to stock. Currently, each non-employee director receives 1,000 shares of Company common stock per year in lieu of annual cash compensation. Our board chairman receives an additional 1,000 shares and our audit committee chairman receives an additional 500 shares of Company common stock per year as compensation for their additional duties as chairmen. Recent amendments to the NASD listed company corporate governance rules now generally require prior shareholder approval of most equity compensation for officers and directors of a listed company. The board of directors formulated the Stock Plan and recommends its approval because the Stock Plan will permit our company to continue to pay directors their compensation in company stock. The board believes stock compensation provides directors with additional incentives to promote the success of our company’s business and helps align the financial interests of directors with the interests of our company’s shareholders.

Summary of the Stock Plan

The Stock Plan provides that the board of directors will administer the Stock Plan unless the board elects to delegate administration to a committee of the board. We expect that the compensation committee of the board will administer the Stock Plan. The Stock Plan permits the grant of awards for up to an aggregate maximum of 60,000 shares of our company’s common stock, provided that during any fiscal year of the company, awards may not be granted providing for the issue of more than 12,000 shares in the aggregate or 3,000 to any individual director. Awards may be in the form of options or shares of stock. To the extent that an award is forfeited, any shares subject to the forfeited portion of the award will again become available for issue under the Stock Plan. As of December 22, 2004,2,593,768shares of our company’s common stock were issued and outstanding, and the closing price of the common stock on that date was $11.50 per share. Shares issued pursuant to the award of stock under the Stock Plan would be in addition to such outstanding shares. The shares subject to the Stock Plan and subject to grants made under the Stock Plan are subject to typical provisions preventing dilution in the event of any change in the characteristics of our company’s common stock. The extent and nature of any adjustments will be determined solely by the board of directors.

Directors who are not employees of our company or any of its subsidiaries are eligible to receive awards under the Stock Plan. Of the nine current directors, all except for James D. Ferguson, our President and Chief Executive Officer, and Richard C. Coggins, our Vice President and Chief Financial Officer, will be eligible to participate in the Stock Plan.

The board or administering committee will determine in its sole discretion which eligible individuals will be granted awards, the number of shares subject to each award, and any other terms and conditions of the awards not otherwise specified by the Stock Plan itself. In any fiscal year, awards may not be granted providing for the issue of more than 12,000 shares of common stock in the aggregate or 3,000 to any individual.

In general, upon the grant of an award (or upon vesting if an award is subject to vesting conditions) a participant will recognize ordinary income for federal income tax purposes in an amount equal to the fair market value, as of the grant (or vesting) date, of the shares (less the amount, if any, paid by the participant for the shares). Our company generally will be entitled for federal income tax purposes to a deduction in an amount equal to the amount of ordinary income recognized by the participant.

The board of directors may at any time amend or terminate the Stock Plan; provided that no amendment may, without approval of the shareholders of our company, change the class of individuals eligible to receive awards or (except for adjustments to prevent dilution) increase the 60,000, 12,000 and 3,000 limits on the total numbers of shares that may be issued under the Plan or under awards granted within the same fiscal year. In addition, no termination or amendment of the Stock Plan may adversely affect any award previously made to a participant under the Stock Plan without the consent of the participant.

The Stock Plan will only be effective if approved by the shareholders of our company. If not earlier terminated, the Stock Plan shall terminate on December 31, 2009. Termination of the Stock Plan will not affect in any manner any award previously made to a participant under the Stock Plan.

Grants Under the Stock Plan

As of the date of this proxy statement, no awards had been made under the Stock Plan, and no firm decisions have been made with respect to the allocation of awards under the Stock Plan. However, as stated above, the board of directors formulated the Stock Plan and recommends its approval so that our company can continue its historic practice of paying non-employee directors in company stock now that new NASD corporate governance rules generally require prior shareholder approval of such stock compensation. For their fiscal 2004 compensation, our company awarded each non-employee director 1,000 shares and an additional 1,000 and 500 shares, respectively, to the chairman of the board and chairman of the audit committee, for an aggregate of 8,500 shares valued at $114,750 (based on a price of $13.50 per share which was the closing price for the company’s common stock on the grant date of March 2, 2004). If the Stock Plan is approved by the shareholders, our board expects to award the same amounts for fiscal 2005 compensation (an aggregate of 8,500 shares currently worth approximately $97,750 for the seven currently eligible directors based on the December 22, 2004 closing price of $11.50 per share). The board has not determined grants for fiscal years beyond 2005; however, our company currently expects that each eligible director will continue to be awarded shares annually under the Stock Plan as such director’s compensation for service as a member of the Board and that such awards will not be subject to vesting or forfeiture conditions. While the plan permits awards in the form of options to acquire the Company’s common stock, the Company currently does not expect any awards to be made in the form of options.

Interest of Certain Persons in the Stock Plan; Effect on Existing Shareholders

As noted, our company currently expects that each eligible director annually will be awarded shares under the Stock Plan as part of such director’s compensation for service as a member of the Board. Current shareholders will experience dilution in their ownership of our company’s common stock to the extent shares are issued and, if applicable, vest under the Stock Plan.

Vote Required to Approve the Plan

The Stock Plan will be approved if (i) a quorum is present at the Annual Meeting and (ii) the number of votes cast in favor of the Stock Plan exceeds the number of votes cast against the Stock Plan. Abstentions and broker non-votes will count in determining whether a quorum is present but will not otherwise affect the vote to approve the Stock Plan.

The Stock Plan is being submitted to the shareholders of our company for approval because (a) the plan, by its terms, requires such approval to become effective and (b) the NASD listed company corporate governance rules require such approval for the shares covered by the plan to be listed. If the Stock Plan is not approved by the requisite shareholder vote (described above), it will not become effective and no shares will be granted under the plan.

Approval of the Stock Plan is not contingent on the approval of any other proposal described in this proxy statement.

THE BOARD OF DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU

VOTE TO APPROVE THE COMPANY’S 2005 NON-EMPLOYEE DIRECTOR STOCK PLAN.

AUDIT COMMITTEE REPORT

Notwithstanding any statement in any of the Company’s previous or future filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, incorporating future or past filings, including this Proxy Statement, in whole or in part, the following Audit Committee Report shall not be incorporated by reference into any such filing unless the incorporation specifically lists the following Audit Committee Report.

The Board of Directors first adopted a written Audit Committee Charter on June 7, 2000. The Charter was revised on February 11, 2004 to comply with new NASD and SEC requirements. A copy of the current Charter is included as Appendix A to this Proxy Statement and is posted on the Company’s web site atwww.spanamerica.com (select “About Us” then “Investor Relations” and then “Audit Committee Charter”). The Committee is comprised of three non-employee directors, all of whom are independent as defined in the current NASD listing standards. The Board has determined that Audit Committee Chairman Robert H. Dick is an audit committee financial expert with respect to the Company as defined by SEC regulations.

In carrying out its responsibilities, the Committee has done the following:

| · | Reviewed and discussed the audited financial statements for the year ended October 2, 2004 with the Company’s management and independent auditors. |

| · | Discussed with the independent auditors the matters required to be discussed by the Statement on Auditing Standards No. 61,Communication with Audit Committees. |

| · | Received from the independent auditors written disclosures regarding auditor independence and the letter required by Independence Standards Board Standard No. 1,Independence Discussion with Audit Committees, and discussed with the auditors their independence from the Company and its management. |

Based on the review and discussions described above, the Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended October 2, 2004, for filing with the Securities and Exchange Commission.

All members of the Audit Committee concur in this report.

Robert H. Dick (Chairman)

Thomas F. Grady, Jr.

Douglas E. Kennemore, M.D.

APPOINTMENT OF INDEPENDENT AUDITORS