SCHEDULE 14A

(Rule 14A-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement ¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12.

STAAR Surgical Company

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

STAAR SURGICAL COMPANY

1911 Walker Avenue

Monrovia, California 91016

April 26, 2002

To Our Stockholders

You are cordially invited to attend the Annual Meeting of Stockholders of STAAR Surgical Company (the “Company”). The Annual Meeting will be held on Thursday, May 30, 2002 at 10:00 a.m. at the Holiday Inn, located at 924 West Huntington Drive, Monrovia, California 91016.

The actions we expect to take at the Annual Meeting are described in detail in the attached Proxy Statement and Notice of Annual Meeting of Stockholders. Also included with this letter is the Company’s Annual Report.

Please use this opportunity to take part in the affairs of the Company by voting on the business to come before this meeting. If you are a record holder of the Company’s Common Stock on April 12, 2002, you are eligible to vote with respect to these matters, either personally at the meeting or by proxy. It is important that your shares be voted, whether or not you plan to attend the meeting, to ensure the presence of a quorum.Therefore, please complete, sign, date and return the accompanying proxy in the enclosed postage-paid envelope. Returning the proxy does NOT deprive you of your right to attend the meeting and vote your shares in person for the matters acted upon at the meeting.

We look forward to seeing you at the Annual Meeting.

| | Pre | sident and Chairman of the Board |

STAAR SURGICAL COMPANY

1911 Walker Avenue

Monrovia, California 91016

Notice of Annual Meeting of Stockholders

To Our Stockholders:

The Annual Meeting of Stockholders of STAAR Surgical Company will be held on Thursday, May 30, 2002, at 10:00 a.m., at the Holiday Inn, located at 924 West Huntington Drive, Monrovia, California 91016 for the following purposes:

| | (1) | | To elect one Class I director to a three year term; |

| | (2) | | To transact such other business as may properly come before the meeting or any adjournment or adjournments thereof. |

Stockholders of record at the close of business on April 12, 2002 will be entitled to notice of and to vote at the Annual Meeting and at any continuation or adjournment thereof.

All stockholders are cordially invited to attend the Annual Meeting in person. Your vote is important.Please fill in, date, sign and return the enclosed proxy in the return envelope as promptly as possible, whether or not you plan to attend the Annual Meeting. Your promptness in returning the proxy will assist in the expeditious and orderly processing of the proxies and will assist in ensuring that a quorum is present or represented. If you return your proxy, you may nevertheless attend the Annual Meeting and vote your shares in person if you wish. If you want to revoke your proxy at a later time for any reason, you may do so in the manner described in the attached Proxy Statement.

| | By | Order of the Board of Directors |

Monrovia, California

April 26, 2002

STAAR SURGICAL COMPANY

1911 Walker Avenue

Monrovia, California 91016

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 30, 2002

VOTING AND PROXY

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of STAAR Surgical Company, a Delaware corporation (referred to as the “Company”, “we”, “our” or “us”) for use at our Annual Meeting of Stockholders to be held at the Holiday Inn, located at 924 West Huntington Drive, Monrovia, California 91016 on Thursday, May 30, 2002, at 10:00 a.m. local time, and at any meeting following adjournment thereof. The Notice of Annual Meeting, this Proxy Statement and the accompanying proxy card are being mailed to stockholders on or about May 10, 2002.

Revocability of Proxy and Voting of Shares

Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. The proxy may be revoked by filing an instrument of revocation or a duly executed proxy bearing a later date with the Company’s Secretary at our principal executive offices located at 1911 Walker Avenue, Monrovia, California 91016. The proxy may also be revoked by attending the meeting and voting in person. If it is not revoked, the proxy will be voted at the meeting in accordance with the stockholder’s instructions indicated on the proxy card.If no instructions are indicated, the proxy will be voted FOR the approval of the proposal, and in accordance with the judgment of the proxy holders as to any other matter that may be properly brought before the meeting or any adjournments thereof.

Record Date, Voting Rights and Outstanding Shares

The Board of Directors has fixed April 12, 2002 as the record date (the “Record Date”) for determining holders of our Common Stock, $ .01 par value per share, who are entitled to vote at the meeting. As of the Record Date, we had 17,163,379 shares of Common Stock outstanding and entitled to vote. Each share of Common Stock entitles the record holder to one vote on each matter to be voted upon at the meeting. A majority of the shares of Common Stock issued and outstanding and entitled to vote at the meeting will constitute a quorum at the meeting. Votes withheld, abstentions and broker non-votes shall be counted for purposes of determining the presence or absence of a quorum for the transaction of business at the meeting.

When the proxy is properly executed, dated and returned, the shares it represents will be voted in accordance with any directions noted on it. Votes cast by proxy or in person at the Annual Meeting will be tabulated by the Inspectors of Election, in conjunction with information received from our transfer agent. The Inspectors of Election will also determine whether or not a quorum is present.

Directors are elected by a plurality of the votes cast in the election. Pursuant to Delaware law, abstentions will have the same effect as a negative vote, but will be counted as present for purposes of determining the existence of a quorum.If no specification is indicated, the shares will be voted “FOR” the election of the single director-nominee named on the proxy. Our Certificate of Incorporation and our Bylaws divide our Board of Directors into three classes, namely, Class I, Class II and Class III, with each class to be elected for a three-year term on a staggered basis. Proxies cannot be voted for a greater number of persons than the number of nominees named.

1

The affirmative vote of the holders of a majority of the shares of Common Stock present at the meeting in person or by proxy is required to approve all other proposals brought before the meeting. Shares which abstain from voting as to these matters, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to these matters (“broker non-votes”), will not be counted as votes in favor of such matters. For purposes of determining whether the affirmative vote of a majority of the shares present at the meeting and entitled to vote on a proposal has been obtained, abstentions will be included in, and broker non-votes will be excluded from, the number of shares present and entitled to vote. Accordingly, abstentions will have the effect of a vote “against” the matter and broker non-votes will have the effect of reducing the number of affirmative votes required to achieve the majority vote.

Solicitation

The cost of solicitation of proxies, including expenses in connection with preparing and mailing this Proxy Statement, will be borne by the Company. Copies of solicitation materials will be furnished to brokerage houses, nominees, fiduciaries and custodians to forward to beneficial owners of Common Stock held in their names. We will reimburse brokerage firms and other persons representing beneficial owners of stock for their reasonable expenses in forwarding solicitation materials to the owners. In addition to original solicitation of proxies by mail, our directors, officers and other employees may, without additional compensation, solicit proxies by telephone, facsimile and personal interviews.

PROPOSAL

This Proxy Statement includes one proposal requiring stockholder action.

One Class I director is to be elected to our Board of Directors at the Annual Meeting. This director will hold office for a three-year term. The Board of Directors has nominated Mr. David Bailey. We expect that this nominee will be available for election, but if he is not a candidate at the time the election occurs, it is intended that your proxy will be voted for the election of another nominee to be designated by the Board of Directors to fill any such vacancy.

No proxies are sought with respect to the election of the presently serving Class II directors (Dr. Peter J. Utrata and Dr. Volker D. Anhaeusser) or Class III directors (Mr. John Gilbert and Mr. David Morrison), as the terms of these directors do not expire until the Annual Meetings of Stockholders to be held in 2003 and 2004, respectively.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF MR. DAVID BAILEY AS THE CLASS I DIRECTOR.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table sets forth, as of April 12, 2002 (unless another date is indicated) each beneficial owner (other than directors and named executive officers) of more than 5% of our Common Stock.

Title of Class

| | Name and Address

| | Amount and

Nature of Beneficial Ownership(2)

| | Percent of Class(2)(3)

| |

| Common Stock | | J.P. Morgan Chase & Co. 270 Park Avenue New York, New York 10017 | | 2,107,328 | | 12.3 | % |

|

| Common Stock | | Wellington Management Co., LLP 75 State Street Boston, Massachusetts 02109 | | 1,478,000 | | 8.6 | % |

|

| Common Stock | | Dimensional Fund Advisors Inc. 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | | 979,750 | | 5.7 | % |

|

| Common Stock | | Safeco Asset Management Company 4333 Brooklyn Avenue N.E. Seattle, Washington 98185 | | 902,000 | | 5.3 | % |

The following table sets forth, as of April 12, 2002, information with respect to the shares of Common Stock beneficially owned by (i) each director and director nominee; (ii) each person (other than a person who is also a director and/or a director nominee) who is an executive officer named in the Summary Compensation Table below; and (iii) all executive officers and directors as a group. The term “executive officer” is defined as the President, Chief Financial Officer, any vice-president in charge of a principal business function (such as administration or finance), or any other person who performs similar policy making functions for the Company.

Title of Class

| | Name(1)

| | Amount and Nature of Beneficial Ownership(2)

| | Percent of Class(2)(3)

| |

| Common Stock | | David Bailey, Executive Officer and Director(4) | | 341,833 Shares/Direct Ownership | | 2.0 | % |

| Common Stock | | John Bily, Executive Officer | | N/A | | 0 | |

| Common Stock | | Richard Simmons, Executive Officer | | N/A | | 0 | |

| Common Stock | | John Santos, Executive Officer(5) | | 88,000 Shares/Direct and Indirect Ownership | | * | |

| Common Stock | | Helene Lamielle, Executive Officer | | N/A | | 0 | |

| Common Stock | | Volker Anhaeusser, Director(6) | | 74,425 Shares/Direct Ownership | | * | |

| Common Stock | | Peter Utrata, Director(7) | | 273,000 Shares/Direct Ownership | | 1.6 | % |

| Common Stock | | John R. Gilbert, Director(8) | | 40,000 Shares/Direct Ownership | | * | |

| Common Stock | | David Morrison, Director(9) | | 60,000 Shares/Direct Ownership | | * | |

| All Current Directors and Executive Officers as a Group | | | | 877,258(10) | | 5.1 | % |

3

| (1) | | The business address of each person named is c/o STAAR Surgical Company, 1911 Walker Avenue, Monrovia, California 91016. |

| (2) | | Calculated pursuant to Rule 13d-3(d)(1) of the Securities Exchange Act of 1934. Under Rule 13d-3(d)(1), shares not outstanding which are subject to options, warrants, rights or conversion privileges exercisable within 60 days are deemed outstanding for the purpose of calculating the number and percentage owned by such person, but not deemed outstanding for the purpose of calculating the percentage owned by each other person listed. The Company believes that each individual or entity named has sole investment and voting power with respect to shares of Common Stock indicated as beneficially owned by them, subject to community property laws, where applicable, except where otherwise noted. |

| (3) | | Based on 17,163,379 shares of Common Stock outstanding on the transfer records as of April 12, 2002. |

| (4) | | Includes 333,333 shares issuable upon exercise of an option granted to Mr. Bailey in connection with his current employment agreement. |

| (5) | | Includes 83,000 shares issuable upon the exercise of the following: (i) an option for the purchase of 18,000 shares granted under the 1996 Non-Qualified Stock Option Plan, (ii) an option for the purchase of 25,000 shares granted in conjunction with Mr. Santos’ current employment agreement, of which 16,667 shares are currently vested and 8,333 shares will vest on June 16, 2002, (iii) an option for the purchase of 25,000 shares granted on May 9, 2000 of which 8,333 shares are currently vested and 8,333 shares will vest on May 9, 2002, and (iv) an option for the purchase of 35,000 shares granted on May 31, 2000, of which 11,667 shares are currently vested and 11,667 shares will vest on May 31, 2002. |

| (6) | | Includes 60,000 shares that constitute options granted to Dr. Anhaeusser on May 9, 2000 (for 20,000 shares) and May 31, 2000 (for 40,000 shares) as director compensation. |

| (7) | | Includes 40,000 shares that constitute the remaining unexercised portion of 60,000 shares granted to Dr. Utrata as director compensation on May 31, 2000, of which 20,000 shares are currently vested and 20,000 shares will vest on May 31, 2002. |

| (8) | | Includes 40,000 shares that constitute 60,000 shares granted to Mr. Gilbert on May 25, 2001 as director compensation, of which 20,000 shares are currently vested and 20,000 shares will vest on May 25, 2002. |

| (9) | | Includes 60,000 shares issuable upon the exercise of: (i) an option to purchase 20,000 shares which were granted under the 1995 STAAR Surgical Company Consultant Stock Plan as part of a Consulting Agreement entered into between the Company and Mr. Morrison on March 1, 2001, and (ii) an option to purchase 60,000 shares granted to Mr. Morrison on May 25, 2001 as director compensation, of which 20,000 shares are currently vested and 20,000 shares will vest on May 25, 2002. |

| (10) | | Includes an aggregate of 616,333 shares issuable upon exercise of options held by directors and executive officers of the Company. |

4

IDENTIFICATION OF THE BOARD OF DIRECTORS

Our Certificate of Incorporation and our Bylaws divide our Board of Directors into three classes, namely, Class I, Class II and Class III, with the number of directors in each class to be as nearly equal as possible, and with each class to be elected for a three-year term on a staggered basis. Our Bylaws permit the Board of Directors to fix the number of its members so long as there are no less than three directors and no more than seven directors. At present, the Board of Directors consists of five members. One member serves as a Class I director, two members serve as Class II directors, and two members serve as Class III directors. Mr. David Bailey presently serves as our Class I director, and is subject to re-election at this Annual Meeting of Stockholders. Dr. Peter J. Utrata and Dr. Volker D. Anhaeusser presently serve as our Class II directors, and are subject to re-election at the Annual Meeting of Stockholders to be held in the year 2003. Messrs. John R. Gilbert and David Morrison serve as our Class III directors, and are subject to re-election at the Annual Meeting of Stockholders to be held in the year 2004. Information regarding the business experience of each nominee and director is provided below. There are no family relationships among our executive officers and directors.

David Bailey, Class I Director Nominee

Director since December 2000

Chairman of the Board of Directors since January 11, 2001

President and Chief Executive Officer

Age 45

Prior to joining us, Mr. Bailey served as Global President of CIBA Vision Corporation’s surgical business unit based in Atlanta, Georgia. As a member of that company’s senior executive committee, Mr. Bailey was involved in the management of a business with revenue in excess of $1 billion and employing over six thousand people. From April 1995 through May 1999, Mr. Bailey served on the global management boards of both Bausch & Lomb and ChironVision. In 1993, Mr. Bailey was the European Managing Director of Johnson & Johnson, Inc.’s European professional sector, with operating responsibility for the Iolab ophthalmic business, including both medical devices and pharmaceuticals. Mr. Bailey completed his formal education in the United Kingdom, obtaining a Master’s degree from Durham University, and a Bachelor of Arts degree with honors from York University.

Dr. Peter J. Utrata, Class II Director

Director since December 1987

Age 60

Dr. Utrata is an ophthalmic surgeon in Columbus, Ohio and has been the President of the Eye Surgery Center of Ohio, Inc. since May 1984. He is associated with the Grant Eye and Ear Hospital of Columbus, Ohio. From 1974 to May 1984, he was a physician and partner with Eye Surgery Consultants. Dr. Utrata received his undergraduate and medical degrees from Ohio State University where he is currently a Clinical Associate Professor.

Dr. Volker D. Anhaeusser, Class II Director

Director since April 2000

Age 46

Dr. Anhaeusser is a resident of Karlsruhe, Germany. He is a principal member and shareholder of the German law firm of Anhaeusser, Unger, & Bergien, whose specialty is corporate and business law. Dr. Anhaeusser received his Masters in Law degree in 1979 from Mainz University. Dr. Anhaeusser and other members of his firm affiliate with Pollet & Richardson, our legal counsel, on transactions that involve European business entities and laws of various European countries. Dr. Anhaeusser serves on the Board of Directors of several German based corporations, as well as serving on the Board of Directors of our subsidiary, Canon-STAAR Company, Inc.

5

John R. Gilbert, Class III Director

Director since February 2001

Age 65

Mr. Gilbert’s senior executive experience includes a 12 year career with Iolab Corporation and 18 years with Johnson & Johnson’s operating company, Ethicon, Inc. At Iolab, Mr. Gilbert was promoted from Vice President, Marketing to President and, in 1987, to Vice Chairman. While at Iolab Mr. Gilbert was responsible for that company’s franchise worldwide, while also serving as Vice President of Johnson & Johnson International. At Ethicon, Mr. Gilbert began as a sales representative and held a series of increasingly responsible positions, becoming Vice President, Sales and a member of the Management Board in 1976. He has had significant sales and general management experience in the areas of intraocular lenses, viscoelastic materials and other ophthalmic products. Mr. Gilbert is presently a Director of Rita Medical, a developer and marketer of a proprietary radio-frequency system for the treatment of cancerous and benign tumors. Mr. Gilbert is a veteran of the U.S. Army and a graduate of Texas A&M University with a Bachelor of Science degree in Industrial Technology.

David Morrison, Class III Director

Director since May 2001

Age 57

Mr. Morrison has 35 years experience in various executive positions, both within the United States and internationally. Since 1998, Mr. Morrison has been providing consulting services relating to marketing, with an emphasis in the field of surgical ophthalmology. Following the acquisition by Chiron Vision of Iolab in March 1995, Mr. Morrison was appointed President and Chief Operating Officer of the combined businesses, which were based in Claremont, California. Mr. Morrison began his career with Chiron Vision as President of International Operations in October 1994. Prior to joining Chiron Vision, Mr. Morrison was employed by the Gillette Company as Area Vice President for Europe. In 1981, Mr. Morrison joined Cooper Vision as its Area Vice President for Europe, Africa and the Middle East. When Mr. Morrison decided to end his career with Cooper Vision in 1989, he was President of International Operations and Co-Chief Operating Officer. Mr. Morrison began his career at Warner Lambert/Parke Davis in 1970, eventually attaining a senior marketing position. Mr. Morrison holds an Honors Degree in Economics and is a post-graduate in Business Administration.

COMPENSATION OF DIRECTORS

No cash fees were paid to directors for their service on the Board of Directors during the year 2001. Directors standing for election are granted options to purchase 60,000 shares of our Common Stock upon their election. (Directors are elected for three year terms.) The option exercise price is the closing price of the Common Stock on the date of grant. On May 25, 2001, the date of their election, Mr. John Gilbert and Mr. David Morrison were each granted options to purchase 60,000 shares of our Common Stock. The options were granted at a per share price of $3.49.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During fiscal year 2001, Dr. Volker Anhaeusser, Mr. John Gilbert and Mr. David Morrison served on our Compensation Committee. None of these individuals is employed by the Company, although Mr. Morrison is paid in excess of $60,000 per year as a consultant to the Company. Compensation issues were also brought before the full Board, which included Mr. David Bailey and Dr. Peter Utrata. Mr. Bailey is the Company’s President and Chief Executive Officer.

6

IDENTIFICATION OF EXECUTIVE OFFICERS

David Bailey, President and Chief Executive Officer

See discussion of business experience above.

John Bily, Chief Financial Officer

Age 54

Mr. Bily joined the Company in January 2002. Before joining the Company Mr. Bily spent 11 years with Allergan, Inc., most recently as Vice President Controller Worldwide Operations where he was responsible for the financial management of Allergan, Inc.’s global manufacturing and operations organization. Mr. Bily joined Allergan, Inc. in 1989 as Vice President Controller of Allergan Optical, the global contact lens and contact lens care division. Mr. Bily earned his Masters in Business Administration in Finance/Accounting from Arizona State University and his Bachelor of Arts degree in History from the University of Dallas. Mr. Bily also served in the United States Air Force.

Richard Simmons, Senior Vice President of Global Operations

Age 44

Mr. Simmons joined the Company as Senior Vice President of Global Operations in July 2001. Mr. Simmons was also named President and a member of the Board of Directors of STAAR Surgical AG, our wholly-owned Swiss subsidiary. Mr. Simmons brought to the Company both a broad international background and extensive experience across many operational areas. He previously worked in senior management levels with a number of ophthalmic medical device companies including Chiron Vision, Bausch & Lomb and most recently as a consultant helping to establish CIBA Vision’s surgical operations. Mr. Simmons attended courses to Masters in Business Administration standards at Manchester Business School and Loughborough University, England. He earned his Masters of Arts degree in Economics from Cambridge University, Queens’ College, England. Due to personal reasons, Mr. Simmons resigned his position in March 2002.

John Santos, Senior Vice President, Corporate Development

Age 46

Mr. Santos was our Chief Financial Officer from May 2000 until August 2001, at which time he was appointed Senior Vice President, Corporate Development. Mr. Santos continued to act as our Chief Financial Officer through December 2001. Prior to May 2000, Mr. Santos served as Vice President-Controller from April 1999 and Controller from October 1992. Prior to 1992, Mr. Santos was Corporate Controller of Calmar, Inc. and he held various management positions at Calmar, Inc. from 1984 to 1992. Mr. Santos received a Masters of Business Administration from Pepperdine University and a Bachelor of Arts degree in Business Administration with an emphasis in Accounting from California State University, Fullerton.

Helene Lamielle, Vice President of Scientific Affairs

Age 44

Dr. Lamielle, who joined us in January 2002, is an experienced medical and surgical ophthalmologist with 11 years of ophthalmic industry experience in pharmaceuticals and medical devices and across major subspecialties such as retina, cataract and refractive surgery. Before joining us, Dr. Lamielle was Vice President of Scientific Affairs, Implantable Products at Bausch & Lomb Surgical. Her responsibilities included management of research and development for surgical products for cataract and refractive indications and management of Clinical and Regulatory Affairs for all surgical products. Dr. Lamielle earned her medical degree from the University of Lyon, France.

7

SUMMARY COMPENSATION

The following table shows the compensation paid over the past three fiscal years with respect to: (i) the Company’s Chief Executive Officer as of the end of the 2001 fiscal year; (ii) the four other most highly compensated executive officers (in terms of salary and bonus) serving at the end of the 2001 fiscal year whose annual salary and bonus exceeded $100,000; and (iii) up to two additional individuals who would be in category (ii) but for the fact that the individual was not serving as an executive officer of the Company at the end of the last completed fiscal year (the “named executive officers”):

| | | | | | | | | | | Long Term Compensation

| |

| | | | | Annual Compensation

| | Awards

| | Payouts

| |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual Compen- sation ($)

| | Restricted Stock Awards ($)

| | Securities Underlying Options/SARs (1)

| | LTIP Payouts ($)

| | All Other Compen- sation ($)

| |

Chief Executive Officer | | | | | | | | | | | | | | | | | |

| David Bailey | | 2001 | | 350,000 | | 110,000 | | 8,000 | | — | | 150,000 | | — | | 164,446 | (2) |

| Director, CEO and | | 2000 | | 300,000 | | — | | 8,000 | | — | | 500,000 | | — | | — | |

| President | | 1999 | | — | | — | | — | | — | | — | | — | | — | |

Chief Financial Officer | | | | | | | | | | | | | | | | | |

| John Bily | | 2001 | | — | | — | | — | | — | | — | | — | | — | |

| Chief Financial | | 2000 | | — | | — | | — | | — | | — | | — | | — | |

| Officer | | 1999 | | — | | — | | — | | — | | — | | — | | — | |

| John Santos(3) | | 2001 | | 155,000 | | — | | — | | — | | — | | — | | 10,937 | |

| Chief Financial | | 2000 | | 155,000 | | 30,984 | | — | | — | | 60,000 | | — | | 5,679 | |

| Officer | | 1999 | | 125,000 | | 10,828 | | — | | — | | 25,000 | | — | | — | |

Other Executive Officers | | | | | | | | | | | | | | | | | |

| Richard Simmons(4) | | 2001 | | 180,000 | | — | | 41,000 | | — | | 100,000 | | — | | — | |

| Senior Vice | | 2000 | | — | | — | | — | | — | | — | | — | | — | |

| President, | | 1999 | | — | | — | | — | | — | | — | | — | | — | |

| Global Operations | | | | | | | | | | | | | | | | | |

| Helene Lamielle | | 2001 | | — | | — | | — | | — | | — | | — | | — | |

| Vice President | | 2000 | | — | | — | | — | | — | | — | | — | | — | |

| Scientific Affairs | | 1999 | | — | | — | | — | | — | | — | | — | | — | |

| Steven L. Ziemba(5) | | 2001 | | 170,000 | | — | | — | | — | | — | | — | | 4,590 | |

| Vice President | | 2000 | | 170,000 | | 46,429 | | — | | — | | 5,000 | | — | | 6,359 | |

| Regulatory Affairs | | 1999 | | 130,639 | | — | | — | | — | | 15,000 | | — | | — | |

| (1) | | No stock appreciation rights were granted in 1999, 2000 or 2001. |

| (2) | | The amount included for Mr. Bailey in the category “All Other Compensation” for 2001 consists of: $116,599 in relocation expenses, $28,675 in insurance premiums and $19,172 in miscellaneous moving expenses. |

| (3) | | Mr. Santos was re-assigned to Senior Vice President Corporate Development on August 1, 2001. |

| (4) | | Mr. Simmons resigned from his position effective March 15, 2002. |

| (5) | | Mr. Ziemba resigned from his position effective November 14, 2001. |

8

The following table provides certain information with respect to individual grants of stock options and/or stock appreciation rights in the 2001 fiscal year to each of the named executive officers:

| | | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (1)

|

Name

| | Number of Securities Underlying Options/ SARs Granted (2)

| | % of Total Options/SARs Granted to Employees in Fiscal Year (3)(4)

| | | Exercise or Base Price ($/Sh)

| | Expiration Date

| | 5% ($)

| | 10% ($)

|

| David Bailey | | 150,000 | | 36 | % | | 3.35 | | 08/08/11 | | 316,020 | | 800,856 |

| John Bily | | — | | — | | | — | | — | | — | | — |

| Richard Simmons | | 100,000 | | 24 | % | | 3.29 | | 06/30/06 | | 90,897 | | 200,858 |

| John Santos | | — | | — | | | — | | — | | — | | — |

| Helene Lamielle | | — | | — | | | — | | — | | — | | — |

| Steven L. Ziemba | | — | | — | | | — | | — | | — | | — |

| (1) | | The potential realizable dollar value of any given option is the difference between (i) the fair market value of the stock underlying such option as of the date of grant, adjusted to reflect hypothetical 5% and 10% annual growth rates {simple interest} from the date of grant of such option until the expiration date of such option, and (ii) the exercise price for such option. The 5% and 10% are hypothetical growth rates prescribed by the SEC for illustration purposes only and are not a forecast or prediction as to future stock prices. The actual amount that a named executive officer may realize will depend on various factors on the date the option is exercised, so there is no assurance that the value realized by a named executive officer will be at or near the value set forth above in the chart. |

| (2) | | All options were granted at fair market value on the date of grant. |

| (3) | | No SARs were granted to the named executive officers in the 2001 fiscal year. |

| (4) | | The numerator in calculating this percentage includes options granted to each named executive officer in his capacity both as an officer (employee) and, if applicable, as a director. The denominator in calculating this percentage is 419,145, which represents options granted to all of the employees of the Company, including the named executive officers, which includes, if applicable, grants of options attributable to them in their capacities as directors. |

The following table provides certain information with respect to the named executive officers concerning: (i) options exercised in fiscal year 2001; and (ii) the number and value of unexercised options as of the 2001 fiscal year end:

Name

| | Shares Acquired On Exercise (#)(1)

| | Value Realized ($)(2)

| | Number of Securities Underlying Unexercised Options/SARs at FY-End (#) Exercisable/ Unexercisable

| | Value of Unexercised In-The-Money Options/SARs at FY-End ($)(3) Exercisable/Unexercisable

|

| David Bailey | | — | | — | | 333,333/316,667 | | 0/64,500 |

| John Bily | | — | | — | | 0/0 | | 0/0 |

| Richard Simmons | | — | | — | | 0/100,000 | | 0/49,000 |

| John Santos | | — | | — | | 54,667/48,333 | | 0/0 |

| Helene Lamielle | | — | | — | | 0/0 | | 0/0 |

| Steven L. Ziemba | | — | | — | | 147,500/5,000 | | 28,900/0 |

| (1) | | No SARs were granted or exercised by any named executive officer in 2001, nor did any named executive officer hold any unexercised SARs at the end of the 2001 fiscal year. |

| (2) | | The dollar values are calculated by determining the difference between the fair market value of the securities underlying the options and the price of the options at exercise. |

9

| (3) | | The dollar value provided represents the cumulative difference in the fair market value of the Common Stock underlying all in-the-money options as of the last day of the 2001 fiscal year and the exercise prices for such options. Options are “in-the-money” if the fair market value of the underlying Common Stock as of the last day of the 2001 fiscal year exceeds the exercise price of such options. The fair market value of the Common Stock for purposes of this calculation is $3.78, based upon the closing price for the Company’s stock as quoted on the Nasdaq National Market on December 28, 2001, the last day of the Company’s 2001 fiscal year. |

EMPLOYMENT AGREEMENTS WITH NAMED EXECUTIVE OFFICERS

David Bailey, President, Chief Executive Officer and Chairman of the Board of Directors

On December 20, 2000 we entered into an employment agreement with Mr. David Bailey to act as our President and Chief Executive Officer. The agreement is for a term of three years. The agreement is automatically renewed upon expiration of the term, unless Mr. Bailey’s employment is terminated pursuant to the agreement’s provisions.

Until December 20, 2001, Mr. Bailey’s annual salary was $300,000. From and after that date, Mr. Bailey’s annual salary is $350,000. Each year during the term, Mr. Bailey is to meet with the Compensation Committee to establish performance goals. In any year in which Mr. Bailey meets or exceeds these goals, the Compensation Committee must award a bonus of up to 60% of Mr. Bailey’s annual salary. Mr. Bailey will also receive an annual cost of living adjustment to his salary.

In order to encourage Mr. Bailey to join the Company, we granted an option to purchase 500,000 shares of our Common Stock in conjunction with the execution of his employment agreement. Mr. Bailey is currently entitled to exercise the option to purchase two-thirds of the shares. His right to purchase the remaining one-third of the shares will vest on December 20, 2002. We also paid all bonuses forfeited by Mr. Bailey as a result of the termination of his prior employment. This amount totaled $110,000, and was paid in fiscal year 2001.

We paid all costs associated with securing for Mr. Bailey, who is a citizen of the United Kingdom, the right to work in the United States. We also paid re-location expenses, including moving expenses, the equity value of Mr. Bailey’s home in Atlanta, Georgia, maintenance charges (including the mortgage) of Mr. Bailey’s home in Atlanta, Georgia until its sale, and interim living expenses until his relocation to California was accomplished. We agreed to gross-up payment of these expenses to compensate Mr. Bailey for taxes incurred by him as a result of his re-location.

We pay Mr. Bailey an automobile allowance totaling $670 per month.

If Mr. Bailey’s employment is terminated as a result of a change of control, Mr. Bailey will receive, in addition to any compensation and bonus earned through the effective date of his termination, three years’ annual salary and the immediate vesting of any unvested option.

John Bily, Chief Financial Officer

On January 3, 2002 we entered into an employment agreement with Mr. John Bily to act as our Chief Financial Officer. The employment agreement has no set term. The employment relationship may be terminated for cause, for poor performance, upon Mr. Bily’s death, by Mr. Bily on 90 days written notice to the Company, by the Company due to a change of control or by the Company on 90 days written notice. If Mr. Bily’s employment is terminated by the Company due to a change of control, we shall be required to pay to him one year’s salary and any unvested options which he holds will vest on the date of his termination. If Mr. Bily’s employment is terminated by the Company without cause, on 90 days written notice, we shall be required to pay to him six months salary as severance.

10

We pay Mr. Bily a bi-weekly salary of $7,692.30.

Mr. Bily is also entitled to receive a bonus equal to 40% of his annual salary, subject to his achievement of certain milestones. Mr. Bily must be employed on January 3, 2003 in order to receive this bonus. This is not an annual bonus. Whether or not any future bonus will be paid to Mr. Bily will be within the discretion of the Compensation Committee.

In conjunction with the execution of his employment agreement, we granted to Mr. Bily an option to purchase 100,000 shares of our Common Stock. The option vests in equal increments over a period of three years, but the vesting schedule may be accelerated due to termination of Mr. Bily’s employment as a result of a change of control or upon his achievement of specific milestones. The exercise price per share is $3.29.

Richard Simmons, Senior Vice President of Global Operations

On June 30, 2001 Mr. Simmons signed a letter offering him employment as Senior Vice President of Global Operations. Mr. Simmons’ employment could be terminated on one month’s notice through the first 12 months of his employment. After the first year, Mr. Simmons’ employment can be terminated upon three months notice. After the first two years, Mr. Simmons’ employment can be terminated upon six months notice. If Mr. Bailey ceased to act as our President and Chief Executive Officer, Mr. Simmons’ employment can be terminated upon six months notice.

Mr. Simmons’ salary is $180,000 per year.

In conjunction with his execution of the offer letter, Mr. Simmons’ was granted an option to purchase 100,000 shares of our Common Stock. The exercise price per share is $4.83.

Due to personal reasons, Mr. Simmons resigned his position on March 15, 2002.

John Santos, Senior Vice President, Corporate Development

On April 28, 1999 we entered into an employment agreement with Mr. John Santos to act as our Controller. On May 31, 2000, Mr. Santos was promoted to the office of Chief Financial Officer. The agreement is for a term of three years, which is automatically renewed upon the expiration of each term unless otherwise re-negotiated or terminated pursuant to its terms. In August 2001, Mr. Santos was appointed as Senior Vice President, Corporate Development, with no change in his salary or benefits. Mr. Santos continued to act as Chief Financial Officer through December 2001.

Pursuant to his employment agreement, Mr. Santos receives an annual salary of $155,000 per year. This compensation may be increased at the discretion of the Board of Directors.

In conjunction with his agreement to continue providing services to us, Mr. Santos received an option to purchase 25,000 shares of our Common Stock. The option vests in equal increments over a period of three years. The first increment vested on June 16, 2000, the second increment vested on June 16, 2001, and the third increment will vest on June 16, 2002. The exercise price per share is $5.875.

If Mr. Santos’ employment is terminated as a result of a change of control, he will receive, in addition to any compensation earned through the effective date of his termination, one year’s annual salary, the immediate vesting of any unvested option, and the principal amount and all accrued interest of any loan made to him by the Company will be forgiven.

11

Helene Lamielle, Vice President, Scientific Affairs

On January 22, 2002 we entered into an employment agreement with Dr. Helene Lamielle to act as our Vice President, Scientific Affairs. The employment agreement has no set term. The employment relationship may be terminated for cause, for poor performance, upon Dr. Lamielle’s death, by Dr. Lamielle on 90 days written notice to the Company, by the Company due to a change of control or by the Company on 90 days written notice. If Dr. Lamielle’s employment is terminated by the Company due to a change of control, we shall be required to pay to her one year’s salary and any unvested options which she holds will vest on the date of her termination. If Dr. Lamielle’s employment is terminated by the Company without cause, on 90 days written notice, we shall be required to pay to her six months salary as severance.

We pay Dr. Lamielle a bi-weekly salary of $7,692.30.

Dr. Lamielle is also entitled to receive a bonus equal to 25% of her annual salary, subject to her achievement of certain milestones. Dr. Lamielle must be employed on the anniversary of her date of hire in order to receive this bonus. This is not an annual bonus. Whether or not any future bonus will be paid to Dr. Lamielle will be within the discretion of the Compensation Committee.

In conjunction with the execution of her employment agreement, we granted to Dr. Lamielle an option to purchase 75,000 shares of our Common Stock. The option vests in equal increments over a period of three years, but the vesting schedule may be accelerated due to termination of Dr. Lamielle’s employment as a result of a change of control or upon her achievement of specific milestones. The exercise price per share is $4.62.

12

REPORT OF THE COMPENSATION COMMITTEE

General. During the year 2001, the Compensation Committee was comprised of Mr. David Morrison, Mr. John Gilbert and Dr. Volker Anhaeusser. The Compensation Committee establishes specific awards under our equity plans, such as stock options, and determines the compensation for the Company’s executive officers. Executive compensation can include salary, bonus, and option grants as well as other perquisites that vary with the level of responsibility.

In determining the compensation for a particular executive officer, the Compensation Committee was guided in the year 2001 by the following objectives:

| | • | | attracting and retaining officers by maintaining competitive compensation packages; and |

| | • | | motivating officers to achieve and maintain superior performance levels. |

The Compensation Committee believes that total compensation for executive officers should be sufficiently competitive with compensation paid by companies of similar size and market place position.

Base Compensation. Base pay is baseline cash compensation and is determined by market forces. The Compensation Committee sets base pay based on what it believes is comparable to compensation paid by companies of similar size and market place position.

Annual Cash Bonuses. The Compensation Committee, in its sole discretion, approves the payment of bonuses from time to time to the Company’s employees, including its executive officers, as an incentive to influence employees to be productive over the course of each fiscal year. The determination of which executive officers should receive a bonus and what the amount of the bonus should be is based upon a subjective analysis of the executive’s level of responsibility, performance of duties and attainment of performance goals, and also takes into consideration other types and amounts of compensation paid to the executive, such as commissions.

Long-term Stock Ownership Plans. During the 2001 fiscal year the Company had one active stock plan in place, the 1998 STAAR Surgical Company Stock Plan. The stockholders of the Company have approved this plan. The plan affords the Company the ability to make stock grants and to grant incentive stock options, non-qualified stock options, and stock appreciation rights to, among others, the Company’s directors, officers and employees.

The Compensation Committee’s objective is to grant stock or options to purchase stock under its stock plans subject to vesting conditions based on continued employment. These vesting requirements are intended to create a more productive workforce by acting as an inducement for long-term employment with the Company, thereby lending stability to our employee base and encouraging more long-term productivity by our employees as they see their efforts translate into greater share value.

Compensation for Chief Executive Officer. Mr. Bailey’s compensation is described in the section of this Proxy Statement entitled “Employment Agreements with Named Executive Officers”. Besides competitive market forces, Mr. Bailey’s base compensation, which was $300,000 until December 20, 2001, when it was increased to $350,000, was based upon his extensive experience in the ophthalmic products industry and his successful management of the surgical division of CIBA Vision Corporation, a private company with over a $1 billion in revenues. During the 2001 fiscal year, the Compensation Committee recommended, and the Board of Directors approved, the grant of an option to Mr. Bailey allowing him to purchase 150,000 shares of the Company’s Common Stock at $3.35 (the fair market value of the Common Stock on the date of grant) so long as he achieved certain goals established by the Compensation Committee. These goals included attainment of positive cash flow, the launch of certain products in Europe and approval of certain products by the FDA. During the 2000 fiscal year, the Board of Directors approved the payment of a bonus to Mr. Bailey in the amount of $110,000.00, which was paid in 2001. This bonus had been negotiated prior to Mr. Bailey’s acceptance of

13

employment with us, and represented a bonus he earned but was required to forfeit because, at our request, he terminated his employment with his former employer before December 31, 2000.

Policy under §162(m) of the Internal Revenue Code. The Compensation Committee has not formulated a policy in qualifying compensation paid to executive officers for deductibility under Section 162(m) of the Internal Revenue Code, and does not foresee the necessity of doing so in the near future. Should limitations on the deductibility of compensation become a material issue, the Compensation Committee will, at such time, determine whether such a policy should be implemented, either in general or with respect to specific transactions.

The Compensation Committee

John Gilbert

Dr. Volker D. Anhaeusser

David Morrison

14

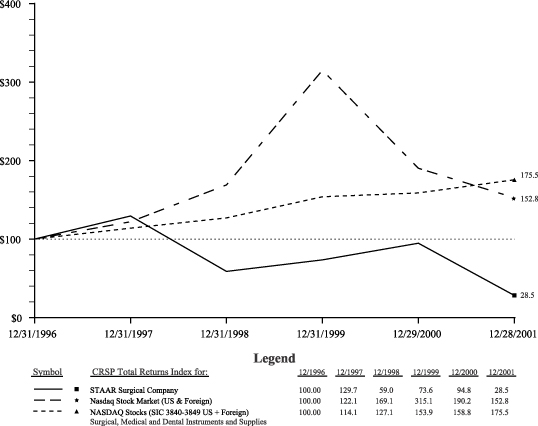

STOCK PERFORMANCE GRAPH

Set forth below is a line graph, assuming an initial investment of $100 on December 31, 1996, comparing the yearly percentage change in the cumulative total stockholder return for the last five fiscal years of the Common Stock relative to the cumulative total stockholder return for the same time period of: (i) United States and foreign companies listed on the Nasdaq Stock Market (the “Nasdaq Index”); and (ii) United States and foreign companies listed on the Nasdaq Stock Market (the “Peer Index”) which operate in the surgical, medical and dental instrument and supply industries (based upon Standard Industrial Classification {“SIC”} codes in the range of 3840 through 3849; the Company’s SIC code is 3845). The Nasdaq Index and the Peer Index were prepared by the Center for Research in Security Prices of the University of Chicago’s Graduate School of Business.

Comparison of Five-Year Cumulative Total Returns

Performance Graph for

STAAR Surgical Company

Produced on 03/29/2002 including data to 12/28/2001

Notes:

| | A. | | The lines represent monthly index levels derived from compounded daily returns that include all dividends. |

| | B. | | The indexes are reweighted daily using the market capitalization on the previous trading day. |

| | C. | | If the monthly interval, based on the fiscal year-end, is not a trading day, the preceding trading day is used. |

| | D. | | The index level for all series was set to $100.00 on 12/31/1996. |

15

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Indebtedness of Management

Peter J. Utrata

As of December 28, 2001, Dr. Peter J. Utrata, one of our directors, was indebted to us in the amount of $1,630,500. Excluding interest, this is the largest aggregate amount of indebtedness owed by Dr. Utrata during 2001. The following table sets forth the date on which each loan was made and the principal amount of the loan:

Date of Loan | | Amount of Loan |

| June 16, 1999 | | $1,258,000 |

| November 11, 1999 | | $ 100,000 |

| June 2, 2000 | | $ 272,500 |

We received full recourse promissory notes from Dr. Utrata memorializing these loans. The loans were used by Dr. Utrata to exercise options to purchase our Common Stock.

The promissory note in the amount of $1,258,000 is due to be paid in full on June 15, 2004 and bears interest at the lower of the lowest rate allowable by the Internal Revenue Service without the imputation of interest or 7%. Payment of the promissory note is secured with 120,000 shares of our Common Stock, pursuant to the terms of a Stock Pledge Agreement executed by Dr. Utrata. The Company is also in the process of taking a lien against certain real property owned by Dr. Utrata as additional security for repayment of this loan.

The promissory note in the amount of $100,000 is due to be paid in full on November 10, 2002 and bears interest at the lowest rate allowable by the Internal Revenue Service without the imputation of interest.

The promissory note in the amount of $272,500 is due to be paid in full on June 1, 2005 and bears interest at the lower of the lowest rate allowable by the Internal Revenue Service without the imputation of interest or 7%.

Consulting Agreement

David Morrison

On March 1, 2001, we entered into a Consulting Agreement with DRM Strategic Services Ltd., a private limited company wholly owned by our director, Mr. David Morrison. Pursuant to this Consulting Agreement, we pay DRM Strategic Services Ltd. the sum of $1,500 for each day Mr. Morrison performs duties as a Consultant, but in no month is DRM Strategic Services Ltd. paid for less than six days work. In conjunction with this Consulting Agreement, we issued to Mr. Morrison an option to purchase 20,000 shares of our Common Stock. The option exercise price is $3.99, the closing price on the date of grant. The duties that Mr. Morrison performs on behalf of DRM Strategic Services Ltd. include performing market research on behalf of the Company, assisting the Company in identifying licensing and co-marketing opportunities throughout the world and assisting the Company with identifying and building strategic relationships within the worldwide ophthalmic industry.

16

MEETINGS OF THE BOARD OF DIRECTORS

The Board of Directors held four meetings during the 2001 fiscal year and took action by consent eight times during the 2001 fiscal year. All directors attended all of the meetings of the Board.

REPORT ON COMMITTEES

The Board of Directors has three standing committees. Information regarding the functions of the Board’s committees, their present membership and the number of meetings held by each committee during the 2001 fiscal year is described below.

Audit Committee. The Audit Committee annually reviews and recommends to the Board of Directors the firm to be engaged as independent auditors for the Company for the next fiscal year, reviews with the independent auditors the plan and results of the audit engagement, reviews the scope and results of the Company’s procedures for internal auditing and inquires as to the adequacy of the Company’s internal accounting controls. The Report of the Audit Committee appears below. The current members of the Audit Committee are Mr. John R. Gilbert, Dr. Peter J. Utrata and Dr. Volker Anhaeusser. The Audit Committee met four times in the year 2001.

Compensation Committee. The Compensation Committee is authorized to fix the compensation of senior officers of the Company and to administer the Company’s various equity plans. During 2001, the members of the Compensation Committee included Mr. John Gilbert, Mr. David Morrison and Dr. Volker Anhaeusser. The Compensation Committee met once during the 2001 fiscal year and took action by consent four times.

Litigation Committee. The Litigation Committee was formed primarily for the purpose of managing the legal actions filed against the Company by Mr. John Wolf. When asked by the Board of Directors, the Litigation Committee also undertakes a review of potential disputes with third parties and determines a course of action for the resolution of them. The current members of the Litigation Committee are Mr. David Bailey, Mr. John R. Gilbert and Dr. Volker Anhaeusser. The Litigation Committee met twice during the 2001 fiscal year.

The Board of Directors does not have a Nominating Committee.

17

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Board of Directors is currently composed of three directors who are independent directors as defined under Rule 4200(a)(14) of the National Association of Securities Dealers’ Marketplace Rules. The Audit Committee operates under a written charter adopted by the Board of Directors.

The Audit Committee oversees the Company’s financial reporting process on behalf of the Board of Directors. Management is responsible for the Company’s financial statements and the financial reporting process, including the system of internal controls. The independent auditors are responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles. In fulfilling its oversight responsibilities, the Audit Committee has reviewed and discussed with management and the independent auditors the audited financial statements that have been included in our Annual Report on Form 10-K for the year ended December 28, 2001.

The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees, as amended. In addition, the Audit Committee has discussed with the independent auditors the auditors’ independence from the Company and its management including the matters in the written disclosures provided to the Audit Committee as required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees.

The Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, the inclusion of the audited financial statements in the Annual Report on Form 10-K for the 2001 fiscal year for filing with the Securities and Exchange Commission. The Audit Committee has not yet recommended the selection of our independent auditors for the fiscal year ending January 3, 2003.

| | Me | mbers of the Audit Committee |

18

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES ACT

Section 16(a) of the Securities Act requires our directors, executive officers and persons who own more than 10% of our Common Stock to file reports of ownership and changes in ownership of our Common Stock with the Securities and Exchange Commission. Directors, executive officers and persons who own more than 10% of our Common Stock are required by Securities and Exchange Commission regulations to furnish to us copies of all Section 16(a) forms they file. The Company has undertaken the responsibility of filing these forms for its directors and executive officers.

To our knowledge, based solely upon our actions in filing the reports and a review of the copies of such reports received or written representations from the reporting persons, we believe that during our 2001 fiscal year our directors, executive officers and persons who own more than 10% of our Common Stock complied with all Section 16(a) filing requirements with the exception of a form 4 that was not filed timely by the Company for David Bailey. This failure to file occurred during the transition of the filing responsibilities from an outside source to the Company.

INDEPENDENT PUBLIC ACCOUNTANTS

The Audit Committee has not yet recommended to the Board of Directors its selection of an auditor for the 2002 fiscal year, therefore the Company is not requesting approval of its choice of an auditor for the 2002 fiscal year.

Representatives of BDO Seidman, LLP, independent public auditors for the Company for the 2001 fiscal year, will be present at the Annual Meeting, will have an opportunity to make a statement, and will be available to respond to appropriate questions.

Audit Fees: The aggregate fees billed for professional services rendered for the audit of our annual financial statements for the most recent fiscal year and the reviews of the financial statements included in our Forms 10-Q for the most recent fiscal year totaled $208,000.

All Other Fees: Fees for services rendered totaled $194,000 which consisted of the following: $4,000 for preparation of and attendance at the annual shareholder meeting, $33,000 for work relating to our Swiss subsidiary, $35,000 for consulting, $55,000 for work relating to an IRS audit and $67,000 for tax work.

Financial Information Systems Design and Implementation. The Company paid no fees to BDO Seidman, LLP for professional services rendered in the design and implementation of financial information systems.

STOCKHOLDER PROPOSALS FOR 2003 ANNUAL MEETING

To be considered for inclusion in next year’s Proxy Statement, stockholder proposals must be received at our principal executive offices no later than the close of business on December 1, 2002.

Notice of intention to present a proposal at the 2003 Annual Meeting should be addressed to Corporate Secretary, STAAR Surgical Company, 1911 Walker Avenue, Monrovia, California 91016. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements.

19

TRANSACTION OF OTHER BUSINESS

Management does not know of any matters to be brought before the meeting other than those referred to in this Proxy Statement. If any matters which are not specifically set forth in the form of proxy and this Proxy Statement properly come before the meeting, the persons designated as proxies will vote thereon in accordance with their best judgment.

20

PROXY

STAAR SURGICAL COMPANY

This proxy is solicited on behalf of the Board of Directors

for the Annual Meeting on May 20, 2002

This proxy will be voted as specified by the stockholder. If no specification is made, all shares will be voted “FOR” the approval of the one proposal set forth in the proxy statement.

The stockholder(s) represented herein appoint(s) David Bailey and/or John Santos proxy with the power of substitution to vote all shares of Common Stock entitled to be voted by said stockholder(s) at the Annual Meeting of the Stockholders of STAAR Surgical Company to be held at the Holiday Inn, located at 924 West Huntington Drive, Monrovia, California 91016, on May 30, 2002 at 10:00 a.m., and in any adjournment or postponement thereof as specified in this proxy.

(Continued, and to be dated and signed on other side)

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE “FOR” THE NOMINEE LISTED BELOW.

| |

| | Date:

|

| Signature (Title, if any) | | Signature if held jointly | | |

Please sign exactly as name appears on the certificates representing shares to be voted by the proxy, as shown on the label above. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If a corporation, please sign full corporation name by president or other authorized officer. If a partnership, please sign in partnership name by authorized person(s).